Attachment D EDAP-Experimental Design and Analysis Plan (EDAP)

Attachment D EDAP.docx

Conservation Auction Behavior: Effects of Default Offers and Score Updating

Attachment D EDAP-Experimental Design and Analysis Plan (EDAP)

OMB: 0536-0078

ERS Experiment Review

Gate 2: Experimental Design and Analysis Plan (EDAP)

Conservation Auction Behavior: Effects of Default Offers and Score Updating

February 10, 2022

[Note: This EDAP was reviewed by three experts in conservation auction experiments. Based on that reviews as well as USDA and OMB review, the following changes were made: removal of tests regarding the external validity of student populations for conservation auction experiments, an increase in the size of the sample size for farmers, minor modifications to payment levels and maximums, a reduction in the estimated time to complete the experiment and the expected response rate, and changes to the questions at the end of experiment that involve removing demographic questions and adding task comprehension and strategy questions.]

Objective:

USDA’s Conservation Reserve Program (CRP) enrolls environmentally sensitive cropland in long-term contracts. Enrolled landowners receive annual rental payments for establishing the approved conservation vegetative cover and not farming the land. Most land is enrolled through the CRP General Signup, a multi-unit, sealed-bid, reverse auction. Offers are ranked on both quality and price. Participants can increase the probability that their offer is accepted by agreeing to a higher quality conservation cover practice or lowering their asking price (annual payment). By encouraging better practices and lower payments, the auction design improves the cost effectiveness of the CRP.

To further encourage better practices and lower payments, USDA may be able to draw on insights from behavioral economics research about defaults (e.g.: starting points) and information provision. In many decision contexts, opt-out defaults have been shown to impact final decisions. When the decision environment is complex, final decisions can also be impacted by the timing of information that decision-makers receive. Both insights are relevant for the design of the software used in the CRP General Signup.

Using a stylized version of the enrollment software to create a simulated (artefactual) CRP auction, we will experimentally test the impacts on final practice and payment offers from two behavioral interventions: (i) a high-quality default starting offer; and (ii) live updates on the offer score at the point of offer selection.

Summary of Experimental Design

Setting |

Multi-unit reverse auction in which participants compete on price (requested rental payment) and quality (land characteristics and proposed conservation practices). Eligible cropland fields are subject to field-specific bid caps (maximum allowable rental payments). |

Outcomes |

Offer price: Percent reduction relative to field-specific bid cap (“bid down”) Offer quality: Conservation cover practice score |

Treatment arms |

T1 (Default offers): A starting position of the best conservation cover and high bid down, from which a participant can opt out and revise the offer. T2 (Score updating): Live updating of the offer score as cover and bid down choices are made. Control conditions: No default starting offer (active choice required) and full offer score only visible on final page of enrollment software. |

Treatment design (2x2) |

Control: 25% of the participants are assigned to each of four possible treatment combinations: control, T1 only, T2 only, or T1 and T2. |

Participants |

Farmers (former CRP participants): target usable observation size of 1,100

|

Research hypotheses |

H1 Default offers: When participants start with a high-scoring offer: H1A: the average score (reflecting both choices) will be higher; H1B: the average bid down will be larger; and H1C: higher quality practices will be more common. H2 Score updating: When scores are updated live in the software: H2A: the average bid down will be larger for lower endowment fields and smaller for higher endowment fields, reflecting a greater responsiveness to the underlying auction incentives; and H2B: lower endowment fields will be more likely and higher endowment fields will be less likely to offer higher quality practices.

|

Rounds |

4 rounds: 1 training round and 3 auction rounds. In each round, participants are endowed with a field-specific bid-cap and land quality conservation score. |

Incentives |

In each round, participants are endowed with field-specific bid cap and a land quality conservation score. Monetary payments to participants depend upon having an offer accepted and are lower if they bid down more or select a better practice. The average payment for farmers is $42: a $10 participation fee (minimum payment) plus $32 based on expected offer structure and acceptance rate. |

Sessions |

1 session per participant. |

Time to complete |

30 or fewer minutes to complete a session, including training materials and practice round. |

Background

CRP is a large reverse auction in which offers are ranked on quality and price.

Revisions in the enrollment software could lead to higher quality and lower price offers from participants.

The annual budget for CRP is about $2 billion. The 22 million acres currently enrolled in the program entered or re-enrolled within the past fifteen years. This research will examine the CRP General Signup, a large reverse auction that is the system through which most land is enrolled in the program. In the March 2020 General Signup, USDA accepted 51,610 offers. Since these offers will become 10-year contracts with over $185 million in annual payments and cost-share payments to establish conservation cover, this single signup represents over $2.5 billion in federal procurement of environmental services.

Given the General Signup’s financial scale, the auction is designed with cost effectiveness as an important program goal. The average annual rental payment in the 2016 signup for accepted offers was about $63 per acre per year (FSA SU 49 book). In contrast, the national cropland cash rental rate for non-irrigated land was $125 per acre (NASS, October 2016). Three aspects of the program design are responsible for the lower average rental payment on CRP land: (a) the eligibility criteria, which favor more environmentally sensitive land that happens to also be more economically marginal; (b) field-specific bid caps, which are upper limits on rental payments; and (c) a cost factor in the offer ranking, which favors offers with lower rental payments.

In addition to assessing offers based on their price, the auction also ranks offers based on quality using both characteristics of the land (e.g., soil erodibility) and the type of cover practice chosen. Price and quality measures are combined in a score known as the Environmental Benefits Index (EBI). The EBI rewards offers with lower rental payments and with better conservation covers. Improved covers are also incentivized through cost-share payments that reduce the marginal cost to the participants of upgrading to better conservation covers. To explore ways to complement or enhance the current incentives for improved practices and lower payments, this study applies insights from behavioral economics to study the potential impact of changes within the enrollment software.

Research Design and Implementation Team:

The study is being designed and implemented by Steven Wallander (USDA Economic Research Service), Kent Messer (University of Delaware, CBEAR), Paul Ferraro (Johns Hopkins University, CBEAR), Richard Iovanna (USDA FPAC-BC), and Laura Paul (University of Delaware, CBEAR). In September 2017, ERS and CBEAR entered into a cooperative agreement to conduct the initial design phase for this research.

Collaborators:

This experiment is being developed and implemented with input from USDA’s Farm Service Agency (FSA) and the FPAC Business Center (FPAC-BC).

Experimental Structure

Treatments will be tested within an online auction using real payments.

This study will use an artefactual field experiment, which involves a set of choices in a context that closely resembles real world decisions and involves actual financial payouts to participants based on their decisions (Harrison and List, 2004). In comparison to laboratory experiments, artefactual experiments have better external validity for the purpose of informing the design of the CRP General Signup. The experimental treatments will be implemented similarly to how they could be implemented in the General Signup software. The auction outcome, in terms of annual payment and cover practice selection, will also be structured to mimic the outcomes and incentives of the CRP auction. The participants will make offers in multiple rounds of an artefactual auction using software developed by CBEAR and accessed online in a web browser. To reduce hypothetical bias, which can occur when experimental subjects do not internalize the incentives of their task, we will provide payments to participants based on their success in getting offers accepted.

Population

Since CRP is a voluntary program tailored toward the enrollment of environmentally sensitive cropland, we would like to draw from a population of farmers or owners of eligible cropland. This study will draw a simple random sample of 11,000 farmers from the sampling frame of the, approximately, 70,000 farmers who made offers in the 2020 and 2021 General Signups.

Recruitment Details

Participants will be recruited through mailings directing them to a webpage where the experiment will be run. Participants will be notified that they are being asked to participate in an auction to study alternatives to the CRP General Signup structure. Based on the power analysis (discussed below) and the project budget, we will recruit about 1,100 participants from the prior CRP participant pool. Assuming a participation rate of 10%, we will send invitations to about 11,000 randomly chosen members of the sample frame. The sampling method for each wave will be a simple random sample without replacement. Given the uncertainty of actual participation rates for each group, we will divide the recruitment into multiple waves, and each wave will close as a separate auction. The first wave will invite participation from 4,000 individuals. Then size of the second wave of recruitment will be based on the observed participation rate from the first wave, with goal of arriving at a final sample size of 1,100 participants. An analysis of the administrative data from the prior General Signup will be used to summarize the potential for selection bias among farmers.

Measured Outcomes

In the CRP-style conservation auction, participants will be asked to make a series of enrollment offers for hypothetical fields across several independent auction rounds. For each offer, we will record two outcomes:

the cover practice selected (basic, good, better, best); and

the asking price ($/acre).

We will have participants make offers in four auction rounds, each representing an independent auction sign-up. In each round, the assigned field characteristics will be different. Since the first round will be for training, the following three rounds will generate a total of 3,300 total offers for the farmer participants.

At the conclusion of the auction, participants will be asked a small set of questions about task comprehension and strategy.

Treatments

We will randomly assign two treatments:

a default high-scoring offer (an “opt-out” default);

score updating (“live” provision of the final score during offer selection).

We will assign treatments in a 2-by-2 design

This design ensure even assignment of each treatment and no correlation in the assignment of those treatments.

The default treatment is hypothesize to shift the average offers for both asking price (rental payment) and cover practice to endowment field scores.

The score updating treatment is hypothesized to reduce attenuation in the responsiveness to endowment field scores.

Since the treatment effects are hypothesized to have different types of effects, the study does not estimate the interaction effect of the treatments. The treatments were selected in part on the basis of this difference since interaction effects can greatly increase the number of estimated treatment effects, which reduces statistical power..

Treatment 1: Default Starting Offer

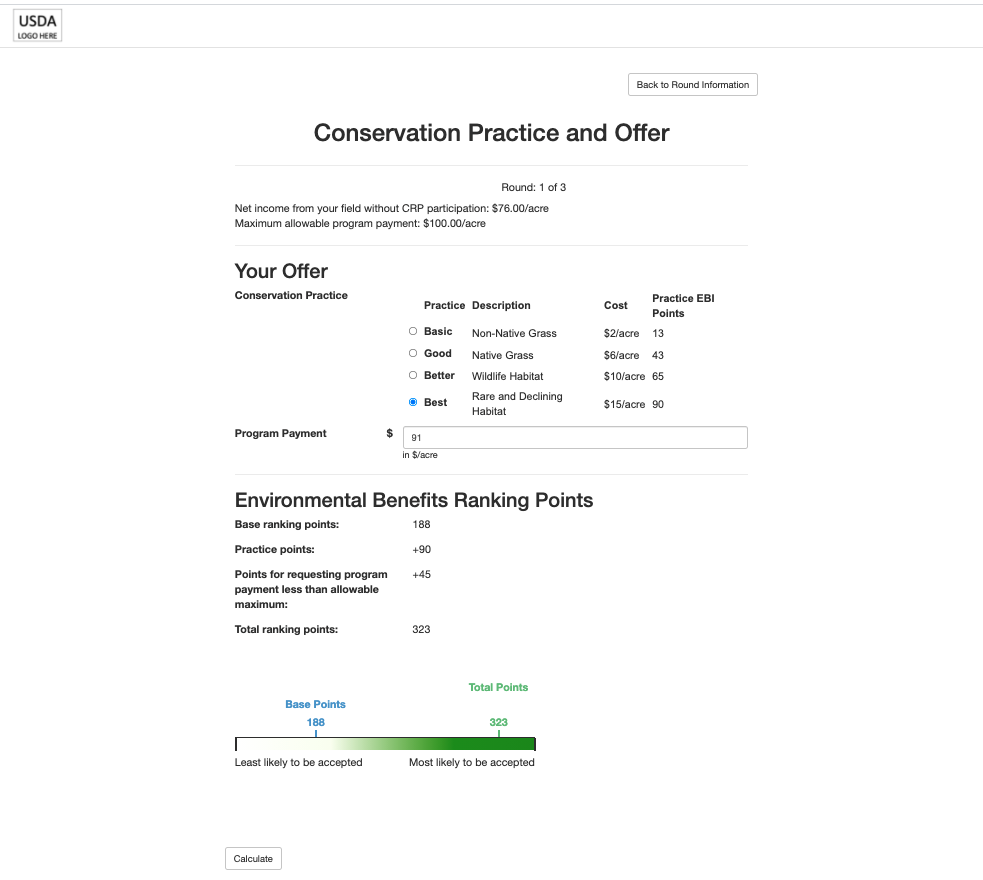

Participants will be randomly assigned to either an “active choice” condition (the status quo control group) or a “default offer” condition (the treatment group). In the “active choice” condition, which is based on the current CRP enrollment software, auction participants start with no preselected option for cover choice or annual rental payment. In the “default offer” condition, participants will start with an offer consisting of a high quality cover and high bid down for the annual rental payment, which they can change (i.e., an opt-out default, see Figure 1). The assigned condition will remain constant across rounds for each participant.

Treatment 2: Score Updating

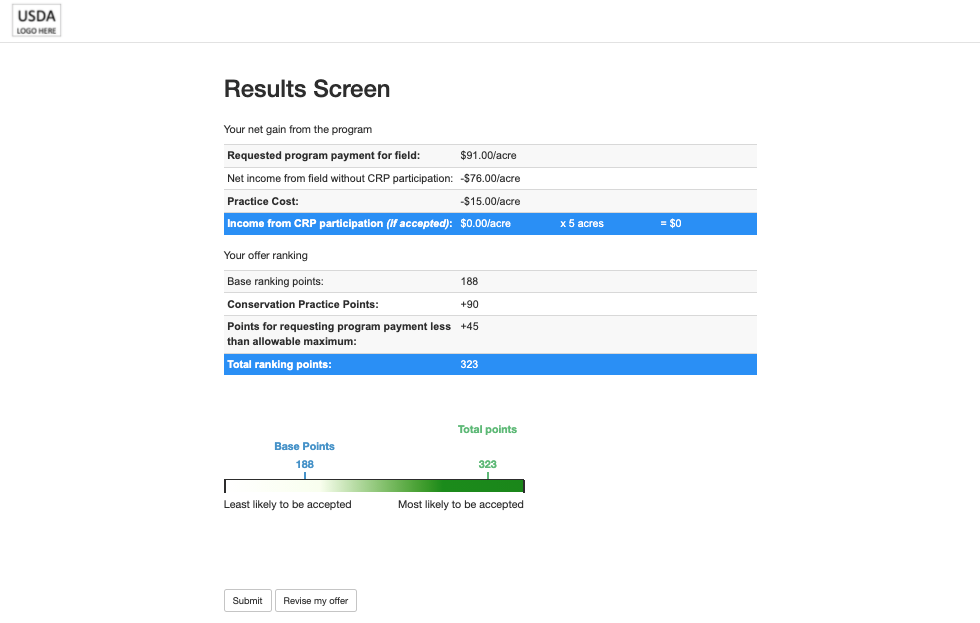

Participants will also be randomly assigned to a “score updating” condition (treatment) or a “post-decision information” condition (the status quo control). In the “post-decision information condition,” which is how the current CRP signup software functions, participants only see their ranking score on the final offer submissions screen, after having made their cover practice and annual rental rate choices (figure 2). In the “score updating” condition, participants will see their score updated immediately as they change their choices on the offer selection screen (figure 1). This score will also be repeated on the final offer submission screen. As in the current software, all participants will have an option to navigate back to the earlier offer selection screen to revise their choices. The assigned condition will remain constant across rounds for each participant.

Figure 1: Default offer and score updating treatments in the offer selection screen.

Note: Sample screen shot for a field with a $100/acre bid cap, 188 starting EBI points, and a reserve rate of $76/acre. The opt-out default treatment pre-selects the best conservation cover practice and nine percent bid down. This screen also shows a score updating treatment, which consists of the live updated EBI points at the bottom of the screen.

Figure 2: Final information screen

Induced Values

We designed the reverse auction to induce offer choices that resemble the observed outcomes in past CRP auctions.

We use four types of parameters to induce variation in offers:

field parameters: starting EBI score and maximum net return for nine different field types;

auction parameters: the ranking points and costs for improved quality practices and lower asking prices (annual payments);

real money payouts: assigned net returns and field size; and

expectations about the minimum acceptable ranking score: information to all participants on a range of “cutoff EBI” scores.

We use an empirical model to demonstrate that for our parameterization there is a Nash equilibrium of offer structures (practices and asking prices) given a program budget that is conditioned on the participation rate (e.g., $46,200 per 1,100 participants).

Field Parameters

The optimal enrollment offer will vary by participant and round. That variation is induced by the interaction of the auction rules with the different assigned field characteristics. Participants cannot affect these values; they are randomly assigned to them each round. There are three field characteristics:

Endowment of the “Land EBI”: higher starting EBI points fields;

Bid cap: upper limit on the asking price and related EBI points for “cost factor”;

Reserve rate: the “outside option” return on the land; participant payments calculated relative to this rate; provides “room” under the bid cap for participants to bid down their asking price.

The three different bid caps and three different environmental scores combine to generate nine possible fields (Table 1). These values are based on the 25th, 50th, and 75th percentiles in bid caps (“Bid Cap EBI”) and environmental scores based on land characteristics (“Land EBI”) from the past five General Signups, adjusted to achieve a Nash equilibrium of offer behavior given other parameters. Participants will randomly be assigned to a sequence of three different fields over their three actual rounds. (See section below for details on the treatment and field parameter assignment methodology.) It also ensures that we will have within-participant variation in bidding incentives, which will allow for estimation of the score updating treatment effect as explained in the analysis section below.

Table 1: Total Starting EBI

|

|

Land EBI |

||

|

|

Low |

Average |

High |

Bid cap |

Bid Cap EBI |

88 |

120 |

171 |

$50/acre |

97 |

185 |

217 |

268 |

$100/acre |

68 |

156 |

188 |

239 |

$150/acre |

40 |

128 |

160 |

211 |

Note: The land EBI in the actual CRP auction is the sum of six different EBI subfactors, which reflect physical characteristics such as soil erodibility. In this experiment, there is no underlying calculation, and the values are based on historical CRP offer data. The bid cap EBI in the actual signup is calculated by the formula a*((b-bidcap)/b) with coefficients that are determined after the auction has closed. While this means that the bid cap EBI is technically not known to participants during the signup, the actual values have historically remained nearly constant. For this experiment, bid cap EBI values are drawn from recent auctions.

Auction Parameters

In addition to the field characteristics, participants need to know how their offer scores can be increased through improved cover practices, or higher bid down, or both.

Within the CRP General Signup, participants can choose between more than a dozen possible cover practices and can chose combinations by adopting some practices on only a portion of acreage. For this study, we collapse the cover practice choice set into four options that reflect the most common choices in the actual program.

Basic: Non-native perennial grass mixture (CP1)

Good: Native perennial grass and forbs mixture (CP2)

Better: Wildlife habitat (CP4d)

Best: Rare and declining habitat (CP25).

For these four cover practices, we assign points and costs similar to the actual program (with establishment costs annualized) adjusted to produce a consistent Nash equilibrium in offer structure (Table 2). The points and prices are revealed in the selection menu in the software.

Table 2: Available practice EBI points

Practice Name |

Points |

Cost |

Basic (non-native grass) |

13 |

$2 |

Good (native grass) |

43 |

$6 |

Better (wildlife habitat) |

65 |

$10 |

Best (rare and declining habitat) |

90 |

$15 |

Note: These practice types, points, and total are based on analysis of actual offer data and EBI rules.

Participants also get additional points through the EBI for offering a lower asking price (i.e.: “bidding down”). In the actual program this includes points proportional to the absolute annual payment level set national and points proportional to the field-level bid cap. The combination means that fields with higher bid caps get more points per percent of bid down. We provide a simplified version of the actual (non-linear) ranking score: 3, 5, and 7 points per percent bid down for low, medium, and high bid cap fields, respectively.

Real Money Payouts

Actual payments to participants are based on the “gain” they receive if their offer is accepted:

acres x ( asking price – alternative rental payment – practice cost )

Payments for the participants, based on a field size of five acres, are strictly bounded between $10 (the participation fee) and $142.50 (the return to the highest value field with zero bid down and the lowest cost practice plus the participation fee).

At the Nash equilibrium, the average payment for the participants would be $42; four out of the nine field types would be rejected and get the $10 participation fee; five out of nine field types would be accepted and get payments from $70 to $103, which includes the participation fee and the gains from their accepted offers.

Participants with an accepted offer in the auction will receive a payment based on the difference between their asking price and their reserve rate minus the (annualized) cost of the practice. An alternative rental rate is the per-acre payment that they would receive in rent for the hypothetical field on the cash grain rental market. For all participants and all fields, the reserve rate is 9 percent plus $15 dollars below the bid cap, which gives all participants an equal amount of “room” to bid down conditional on adopting the best practice, which will cost $15 per acre. This gives reserve rates of $30.50, $76.00, and $121.50.

All participants are making offers to enroll five-acre fields, so payments based on these reserve rates and asking price will be multiplied by a factor of five. As an example of how this would translate into actual payments, if a field with a $100/acre bid cap bids down to $95 (a 5% bid down), selects a practice that costs $5/acre, and gets accepted, that participant would get $14 per acre, the $19 difference between the asking price ($95) and the reserve rate ($76) minus the $5 cost of the practice. The final payment would be $80, which is the $70 payment for the accepted five-acre field and the $10 participation fee. Participants who make an offer that is not accepted would only get the $10 participation fee. Participants with the same field characteristics who offer a lower rental rate or selected an even better practice and are accepted would receive less than $80.

Expected EBI cutoff:

For reference, the minimum acceptable EBI scores in the past five signups ranged from 200 to 292 (see appendix). This range reflects variation in participation levels and in the amount of acreage that could be accepted into the program. In our experiment, participants do not have an option of withholding a given field from a round of the auction, so total participation is close to fixed at about 1,000 fields per round when combining waves of recruitment. The variation around that level is limited. In addition, our experiment faces a budget constraint rather than an acreage constraint. To allow this auction to clear within rounds and recruitment waves in which the total number of participants may vary (e.g.: we might get 300 or 500 or some other number of participants in the first wave), we impose a budget conditional on the participation level. This is similar to having a pre-determined acceptance rate (say of 4 out of 9 offers) but allows for the financial budget to be binding. The actual acceptance rate and cutoff EBI will vary depending upon how much offer improvement occurs. To estimate the most likely EBI cutoff, we estimate an empirical Nash equilibrium for the nine field types subject to our budget constraint. Under the equilibrium solution, the final payout ranges from $10 (the participation payment) on five fields that are not accepted, to $103 (table 3). The selection of practices at the equilibrium includes all four practice types.

Table 3: Final Payouts

|

|

|

|

||||||||||||||||||||||||

We will use the range of cutoffs in prior auctions to convey information about expected EBI cutoffs in the artefactual experiment. All participants will be given the same information about expected cutoffs. Due to the experimental design, the expected cutoffs are fixed across rounds and auctions.

Assignment of treatment and field parameters

The four possible treatments are assigned at the participant level, and the assignment remains constant across all four rounds (including the practice round).

There are nine possible fields. Field characteristics vary across rounds for each participant. There are 729 possible sequences of the nine fields across the three experimental rounds (9^3). However, to ensure that each round is balanced across field types and that each participant has a low, medium, and high endowment round, we assign field parameters in two stages. First we assign one of six possible sequences of broad starting EBI categories (low medium and high):

L – M – H

L – H – M

M – L – H

M – H – L

H – L – M

H – M – L

Then, within rounds, we randomly select one of the three EBI scores and associated bid cap within each category (table 4).

Table 4: Low, Medium and High Grouping of EBI Endowments

|

|

Land EBI |

||

|

|

Low |

Average |

High |

Bid cap |

Bid Cap EBI |

88 |

120 |

171 |

$50/acre |

97 |

185 |

217 |

268 |

$100/acre |

68 |

156 |

188 |

239 |

$150/acre |

40 |

128 |

160 |

211 |

Note: Low (green), Medium (red), High (blue)

For assignment of treatment, we want the four treatments equally balanced within each of the six sequences. We accomplish this by assigning treatment and sequence jointly at the beginning of the experiment, which means that there are 24 possible assignments.

Analysis Plan: Modeling/hypothesis Testing Strategy

For the analysis of this experiment, there are ten different measures of average treatment effect of the treated (table 5). These are estimated separately for the farmer and student populations. There are also ten tests of the differences in the treatment effects between the populations. Nine of the estimates arise from the interaction of three outcomes (total exogenous EBI points, the bid down decision, and the cover practice choice) and the treatment effects. The default treatment has a single estimate for each outcome because it is expected to shift the average decisions. The score updating treatment has two estimates for each outcome, which we refer to as the primary and the secondary treatment effects. The primary treatment effect is estimated from the interaction of the starting EBI score and the treatment dummy variable, because the theoretical prediction is that the reduced uncertainty with the treatment will rotate (steepen) the response to the starting EBI for both practice choice and bid down. The secondary treatment effect is estimated with a simple treatment dummy to allow for a shift in addition to a rotation in the offer responses. The tenth test is a simple effect of the score updating treatment on the average propensity to navigate backwards from the final offer screen in order to revise the offer.

Even though there are ten treatment effect estimates, adjustments for multiple hypothesis testing is more limited for two reasons. First, the primary treatment effect for the score updating timing treatment is the true test of the research hypothesis, and so we do not adjust for the secondary treatment effects. Second, the bid down and cover choice outcomes are nested within the exogenous EBI test, meaning that the testing findings are likely to be highly correlated. Given those considerations, we do not plan to adjust for multiple hypothesis testing.

Table 5: Treatment effect estimates

Dependent Variable |

Default offer effect |

Score updating primary effect |

Score updating secondary effect |

Population Difference |

Starting EBI |

|

|

|

e.g.:

|

Bid down (%) |

|

|

|

e.g.:

|

Cover (1/2/3/4) |

|

|

|

e.g.:

|

Backtrack (0/1) |

|

|

|

|

We will estimate the treatment effect in a regression framework. The default treatment effect will be captured through the coefficient on the treatment indicator variable D1. The primary score updating effect will be captured by the interaction between the EBI endowment and the treatment indicator variable D2. The hypothesis in this case is that the treatment will reduce attenuation in the effect of the EBI endowment, making the average response steeper. The secondary treatment effect of the score updating effect will be the coefficient on the treatment indicator variable D2 itself.

The additional EBI gained from offer improvement (+EBI) outcome will be estimated using Tobit model given censoring at the lower end (13 points). (Note that the censoring on EBI improvement points is similar in this situation and in actual CRP program data to the censoring and use of Tobit model show in figure A1 of the appendix.) While there is also possible censoring at the upper end, we do not expect to observe a binding constraint there. The model of individual supply of upgrade EBI points conditional on the treatments is given by the following equation where “i" denotes a participant.

The bid down decision will be estimated using a Tobit model given censoring at zero. As noted in the pre-analysis, there is typically considerable censoring, with about half of offers making no bid down.

The cover decision is a discrete choice and so will modeled using an ordered probit with the treatment effects included in the latent variable construction.

As a test of whether knowledge of the final score is truly constrained in the control condition for the score updating treatment, we will collect data on whether participants use the “back” buttons to navigate to earlier screens and revise their offers prior to finalizing their offer structure. If control group participants use the “back” button more frequently than the treatment group, who will receive live updated of scoring earlier in the software, then this will indicate that the information available under the control is not as constrained as expected.

Power Analysis

For the opt-out default treatment effect on bid down, we conducted a simple power analysis of a difference in two means around the average bid down of 4.2%. For our proposed sample size of 1,100, the minimum detectable effect at 80 percent power is 0.17 percentage points, or an increase to from 4.2 to 4.37% bid down (figure 3). In other words, if the default increases bid down from 4.2% to 4.37%, then four out of five runs of the experiment would successfully reject the null hypothesis of no effect on bid down at the Type 1 error rate (alpha) of 0.02. We use the smaller alpha to correct for the use of multiple hypotheses. A smaller sample size of 500 would be underpowered at this effect size. For context, a 0.2 percentage point increase in bid down given a budget of $2 billion per year would result in a program savings of $40 million per year. We conduct the power analysis as a two-tailed test because it is possible that the default could induce practice improvements that are offset by reductions in bid down. Note that additional power could be gained through explicitly modeling the censoring (with a Tobit model), using all 3,300 offer data points (though clustering would occur at the participant level), and using additional covariates, such as average bid down in actual prior signups.

Figure 3: Power chart for alternative sample sizes and effect sizes on bid down.

[Stata code: power twomeans 4.2 (3.5 (0.005) 5.0), n(500 1000 1500 2000) graph(x(m2))]

For the power analysis of practice adoption, we do a test of two proportions for the best practice. In terms of practice adoption, this gives us power to detect of difference of about 40 to 50 percent (from, say 20% to 27.5% or from 10% to 15.5%) in practice adoption. Additional power could be gained by modeling the treatment effect of all four proportions using an ordered probit model.

[Stata code: power twoproportions 0.1, diff(0.03 0.04 0.05 0.06 0.07 0.08)]

Limitations

One limitation of our approach is the use of an artefactual experiment rather than a field experiment built into the CRP software during an actual General Signup. Research on default effects in a lab or artefactual setting often shows smaller effect sizes in comparison to default experiments in a field setting. Nonetheless, the current research approach will be useful for determining whether it would be worthwhile to conduct a similar field experiment within CRP at some point in the future.

Another limitation of our approach is simplification of both the conservation practice improvement options and the ranking mechanism. These are meaningful departures from the actual program design. However, we feel that these simplifications are needed to reduce respondent burden and to ensure adequate statistical power. Having too many choices and too complex of a ranking mechanism would likely reduce the signal to noise ratio on any treatment effect.

Appendix

Nash Equilibrium.

To calibrate our model, we calculate an empirical Nash equilibrium. Each of the nine fields faces a payoff matrix over the four possible practice choices and sixteen possible bid down levels (from zero to 15 percent in one-percent increments) (Table A1).

Table A1: Expected payoff matrix for $50/acre bid cap field at Nash equilibrium

In addition, all nine fields face an expected probability of acceptance that is defined by a logistic cumulative distribution function, shared beliefs (mean and standard deviation) for a “cut-off” EBI score, and a final EBI score that is the additive combination of their starting EBI and the additional EBI from the offer selection. The Nash equilibrium consists of an EBI cutoff that is consistent with optimal bids for each of the nine-fields and the auction clearing criteria in terms of budget per number of participants. Under the current specification as described in the main text of this document, the auction clears with a cutoff EBI of 260 points, which is similar to the average EBI cut off over the past six sign ups.

Under the Nash equilibrium, cover practice selection is similar to the distribution observed in recent signups (table A2). Four out of the nine fields offer the maximum asking price at the Nash equilibrium (zero bid down) which is also within the range of recent signups. Average bid down, conditional on any bid down, is about 3 percent, which is slightly lower than in recent sign ups (table A3).

Table A2: Cover practice selection in recent signups and Nash equilibrium.

Year |

Signup |

Basic |

Good |

Better |

Best |

2010 |

41 |

10.6% |

58.3% |

8.2% |

15.6% |

2011 |

43 |

15.8% |

56.9% |

9.2% |

12.5% |

2012 |

45 |

14.8% |

58.2% |

11.1% |

10.4% |

2016 |

49 |

5.7% |

62.8% |

7.8% |

19.4% |

|

|

|

|

|

|

Nash |

|

11.1% |

33.3% |

33.3% |

22.2% |

Note: the analysis looks only at practice choice on new acres, not re-enrolled acres, and excludes offers with tree practices.

Table A3: Average bid down

Year |

Signup |

Offers |

% with Biddown |

Average Biddown |

Average biddown incl. 0’s |

2009 |

39 |

50,094 |

52.1% |

11.6% |

6.0% |

2010 |

41 |

37,715 |

41.9% |

11.4% |

4.8% |

2011 |

43 |

47,949 |

40.6% |

11.6% |

4.7% |

2012 |

45 |

27,281 |

34.2% |

11.4% |

3.9% |

2016 |

49 |

26,157 |

37.7% |

11.1% |

4.2% |

Similarity to field parameters and offer structure response in actual CRP auctions

Acres: Over the past five signups, the median field offered to CRP is about 40 acres, while the mean field is about 80 acres.

Soil rental rate (bid cap): Over the two most recent signups, the median soil rental rate (bid cap) is about $93/acre and the mean is about $110/acre. Fifty percent of offers are between $48/acre and $160/acre. (We only use the two most recent signups (45 and 49) for rental rate because of a strong upward trend from 2009 to 2012.)

Starting EBI points: As noted above, the starting EBI points associated with bid caps are between 97 points (at $50/acre) and 40 points (at $150/acre). For the points based on land characteristics, the 25th percentile over the past five signups is between 84 and 96 points, and the 75th percentile is between 162 and 177 points.

Relationship between exogenous EBI points, bid down, and practice choice: A regression analysis of expected bid down in actual offer data reveals that, as predicted, offers with higher endowments of EBI points bid down less (figure A1). Similarly, offers with higher endowments are less likely to select improved conservation practices on average. This is consistent with the predictions of our Nash equilibrium model.

Figure A1: Predicted bid down by signup conditional on EBI endowment

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Wallander, Steve - ERS |

| File Modified | 0000-00-00 |

| File Created | 2022-06-22 |

© 2026 OMB.report | Privacy Policy