ERA2 Quarterly Reports

Emergency Rental Assistance Program (ERA2)

ERA User Guide_v.0.4 - 7.9.2021-Clean

ERA2 Quarterly Reports

OMB: 1505-0270

![]()

User Guide: Treasury Portal for Recipient Reporting

Emergency Rental Assistance Program

July 9, 2021

DRAFT- For Discussion Purposes Only

Revision |

Date |

Description |

Version 0.2 |

7/7/2021 |

|

Version 0.3 |

7/8/2021 |

|

Version 0.4 |

7/9/2021 |

|

Table of Contents

II. Navigation & Logistics Error! Bookmark not defined.

IV. Quarterly Report Selection 9

V. Subaward/Expenditure Reporting 10

VI. Federal Financial Reporting – Form SF-425 15

VII. Project Overview and Performance Narrative 15

VIII. ERA Programmatic Reporting 18

IX. Household Payment Data File 22

X. Official Certification ………………………………………………………… 20

XI. Appendices……………………………………………………………………………….. XX

List of Figures

Figure 1 – Recipient Information 9

Figure 2 – Conditional Entry for SAM.gov Registration 9

Figure 3 – Award Detail Sub-Module 10

Figure 4 – Subrecipient Profile Sub-Module 12

Figure 5 – Subrecipient Profile Sub-Module Bulk Upload 12

Figure 6 – Subaward Reporting Sub-Module 13

Figure 7 – Subaward Reporting Sub-Module 13

Figure 8 – Subaward Reporting Sub-Module 13

Figure 9 – Data Entry for Expenditures > $30,000 14

Figure 10 – Bulk Upload for Expenditures > $30,000 15

Figure 11 – Data Entry for Aggregate Expenditures < $30,000 15

Figure 12 – Data Entry for Individual Payments < $30,000 15

Figure 13 – Form SF-425 Upload 16

Figure 14 – Project Overview Data Entry 17

Figure 15 - Project Description and System for Prioritizing Assistance 17

Figure 16 - Performance Narrative 18

Figure 17 – Effective Practices Narrative Entry 18

Figure 18 – Programmatic Reporting Bulk Upload 19

Figure 19 – Reporting on ERA Applicants 19

Figure 20 – Reporting on ERA Assistance Provided 20

Figure 21 – Reporting on ERA Protections to Vulnerable Communities 21

Figure 22 – Reporting on ERA Protections to Vulnerable Communities 22

Figure 23 – Reporting on Non-Expended Approved ERA Funds 23

The following color coding has been inserted to highlight sections that will change as new images, links, or features become available. This page will be removed once the information is inserted and final revisions are made.

Editing Color Coding

Image or link to be inserted

Transitional language, features that may/may not be present in final version

(ERA Screen Number)

Overview

This document is intended to be used as a companion to the Emergency Rental Assistance (ERA) Reporting Guidance. The ERA Reporting Guidance contains all relevant information and guidance on specific reporting requirements, while this ERA User Guide will assist you in navigating and reporting information in the Treasury Portal. You should refer to the Treasury ERA page for the latest guidance and updates on various reporting topics at https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/emergency-rental-assistance-program.

The ERA program makes funding available to assist households that are unable to pay rent or utilities. Two separate programs have been established:

ERA1 provides up to $25 billion under the Consolidated Appropriations Act, 2021, which was enacted on December 27, 2020.

ERA2 provides up to $21.55 billion under the American Rescue Plan Act of 2021, which was enacted on March 11, 2021.

The funds are provided directly to States, U.S. territories, local governments, referred to as “State, Local, and Territorial Recipients”, and Indian Tribes, Tribally Designated Housing Entities (TDHEs), as applicable, and the Department of Hawaiian Home Lands (DHHL), referred to as “Tribe, TDHE, and the DHHL Recipients”.

Each Recipient is required to submit regular reporting that covers all recipient, subrecipient, and contractor activities subject to ERA1 and ERA2. Each report must provide performance and financial information including background information about the ERA project that is the subject of the report; participant (household, beneficiary) data; and financial information with details about obligations, expenditures, direct payments, and subawards.

Additional information is located in the Reporting Guidance posted on the ERA website, as well in the ERA Frequently Asked Questions (FAQs) and fact sheets, which provide important information regarding ERA.

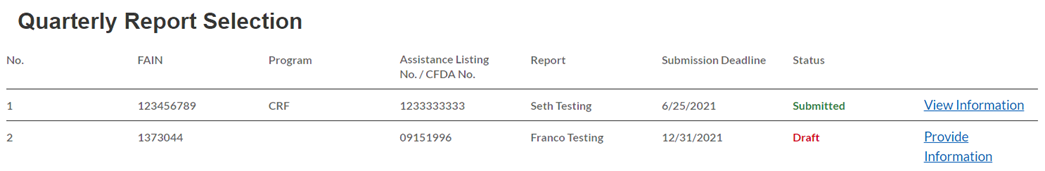

Quarterly Report Selection

In this module, you will select the Quarterly Report that you are required to complete

The landing page of the ERA application will list your ERA1 and ERA2 FAINs that the Recipient has received from Treasury along with current Quarter report indicated in “Draft”. You will be also be able to select and review previous Quarterly reports.

Note: Users will need to submit ERA1 and ERA2 data separately. Always be aware of a given report’s association with ERA1 or ERA2.

To navigate to a specific report, click on Provide Information to enter data for the specific ERA Award.

Recipient Profile

In this module, you will review and update your Organization’s information.

Recipient Profile

The majority of the information will be pre-populated as available through your ERA Application file. Enter your Recipient DUNS (+4) (if applicable) for your organization.

Notify the Treasury team immediately if any information is incorrect via the “functionality to be updated”

Figure 3 – Recipient Information

If you are not registered in SAM.gov, you can get registered by visiting [insert link/information here].

In the event that your organization is not registered with SAM.gov, update the following screens to provide executive compensation information.

Note: This information is required for Treasury to complete the FSRS.gov reporting on your behalf.

Figure 4 – Recipient Executive Compensation Reporting

Figure 5 - Conditional "No" Entry for Executive Compensation Reporting

Click the Save button to record progress and advance to the next module.

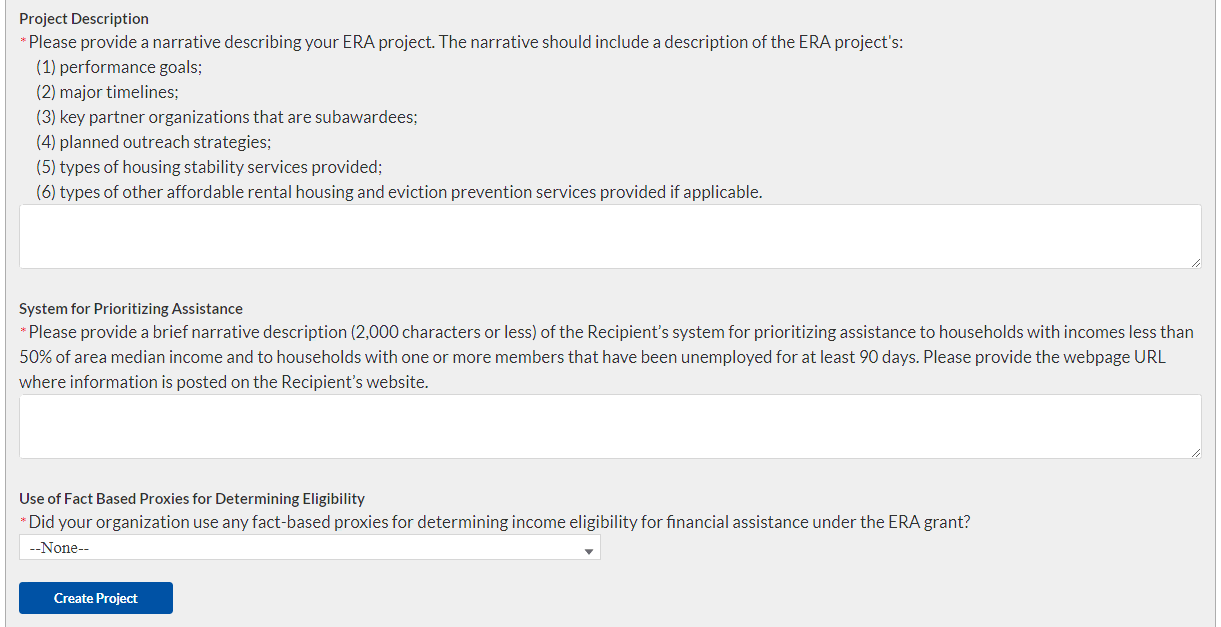

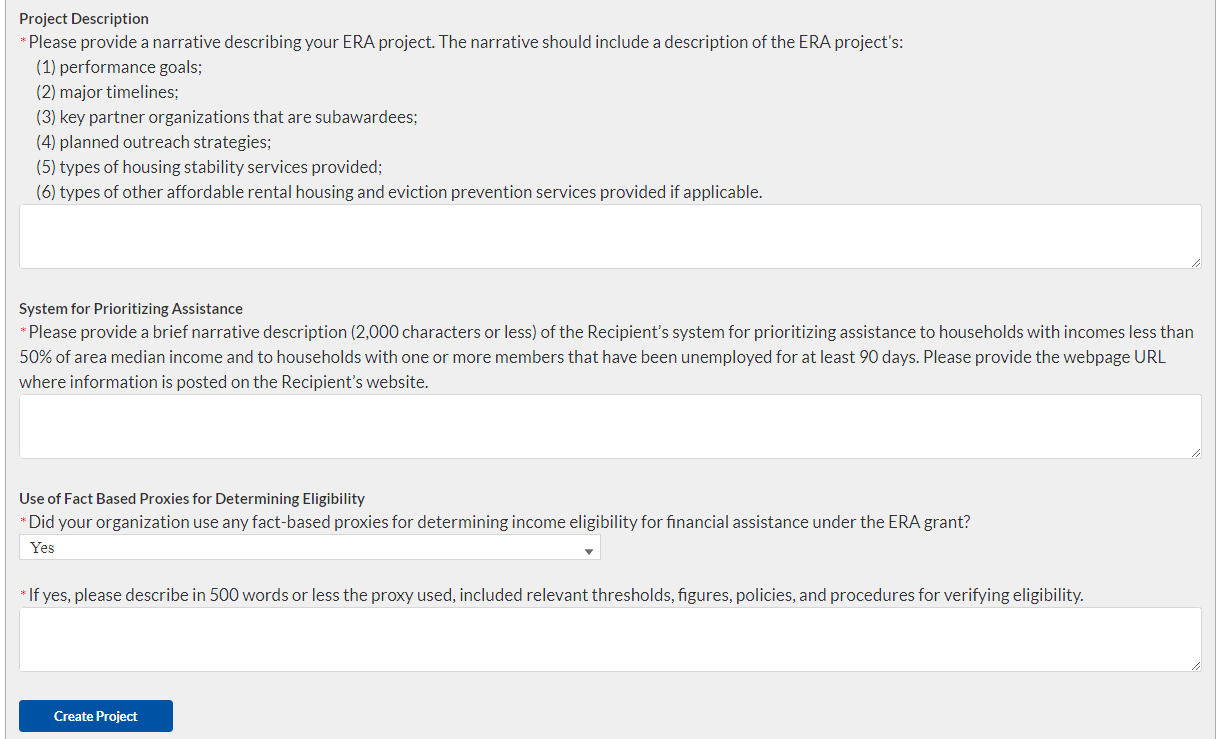

In this module, you will provide an overview of the ERA Project.

Project Overview Sub-Module

In this Sub-Module, you will provide additional information pertaining to the project and provide a description of the project’s intentions, goals, and accomplishments.

Manually enter a unique Project ID and Project Name .

Manually enter the ERA Project Website URL and indicate the Geographic Service Areas served by the project.

Note: Tribe, TDHE, and the DHHL Recipients are not required to submit the Geographic Service Areas.

Figure 6 – Project Overview Data Entry

Utilize the Project Description text box to provide a narrative description on the project. You should include major timelines, key partner organizations, planned outreach strategies, other housing services provided, housing stability services provided, and other affordable rental housing and eviction prevention services provided, if applicable.

Utilize the System for Prioritizing Assistance text box to provide a narrative description on the Recipient’s system of prioritizing assistance to participant households of certain incomes.

Figure 7 - Project Description and System for Prioritizing Assistance

Select “yes” or “no” from the dropdown menu depending on if your organization used any fact-based proxies when determining income eligibility.

If you used fact-based proxies, then provide a narrative description of the proxies used and known procedures.

Figure 8 - Project Description and System for Prioritizing Assistance, "Yes"

At the bottom of the page, click the Create Project icon to advance to the next screen.

Projects List

On the Projects screen, click on the project for which you want to provide Subaward reporting information.

The link will launch into the Subaward Reporting screen.

Subaward Reporting

Subawards

The Subaward Reporting Submodule will allow you to enter information regarding Subawards received by the Subrecipient. Detailed information regarding the Subawards will be required.

You will have the ability to utilize a bulk-upload feature or individually enter records. For bulk-upload instructions specific to this submodule, see XX page number OR appendix link here. If you choose to individually enter records, then follow the instructions below.

Review and verify the pre-populated fields pertaining to the Subawards

Manually enter the following fields pertaining to the Subawards: Subaward Number, Subaward Obligation, Subaward Date, Period of Performance Start, Period of Performance End, Place of Performance Address, City, State, Zip+4, Country, and Congressional District.

Select the Subaward Type, and Subrecipient from the drop-down picklist.

Use the open textbox to provide a brief description on the Subaward’s underlying eligible use

Figure 9 – Subaward Reporting Sub-Module

Figure 10 – Subaward Reporting Sub-Module

Once you have filled in the information, click Create Subaward to finalize the data entry.

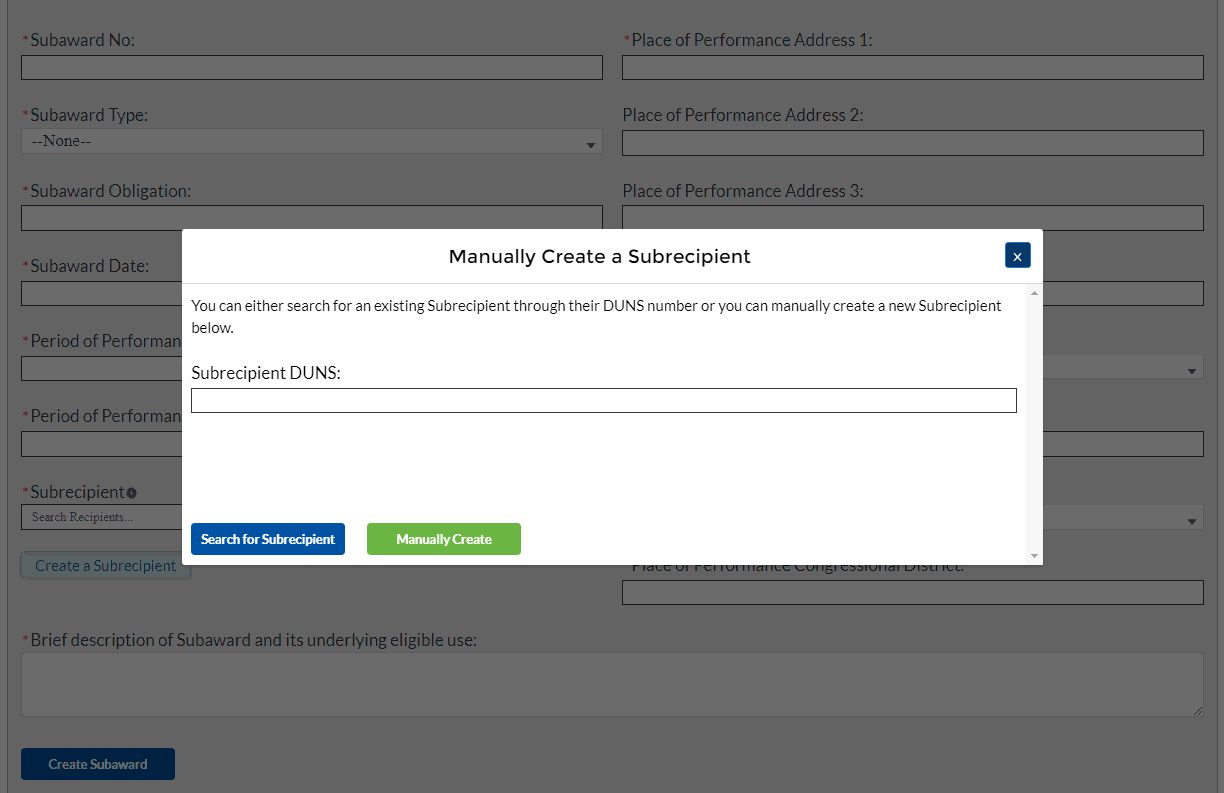

Manually Create a Subrecipient

After completing the Subaward Reporting, the Subrecipient Profile Submodule will document the information of Subrecipients that received federal funding from the ERA program. You can enter each Subrecipient record individually or utilize a bulk-upload feature.

You will have the ability to utilize a bulk-upload feature or individually enter records. For bulk-upload instructions specific to this submodule, see XX page number OR appendix link here. If you choose to individually enter records, then follow the instructions below.

First, manually enter the Subrecipient DUNS.

You can either search for the Subrecipient if you have already created it, or click Manually Create if it is your first time entering the DUNS.

Figure 11 - Manually Create a Subrecipient

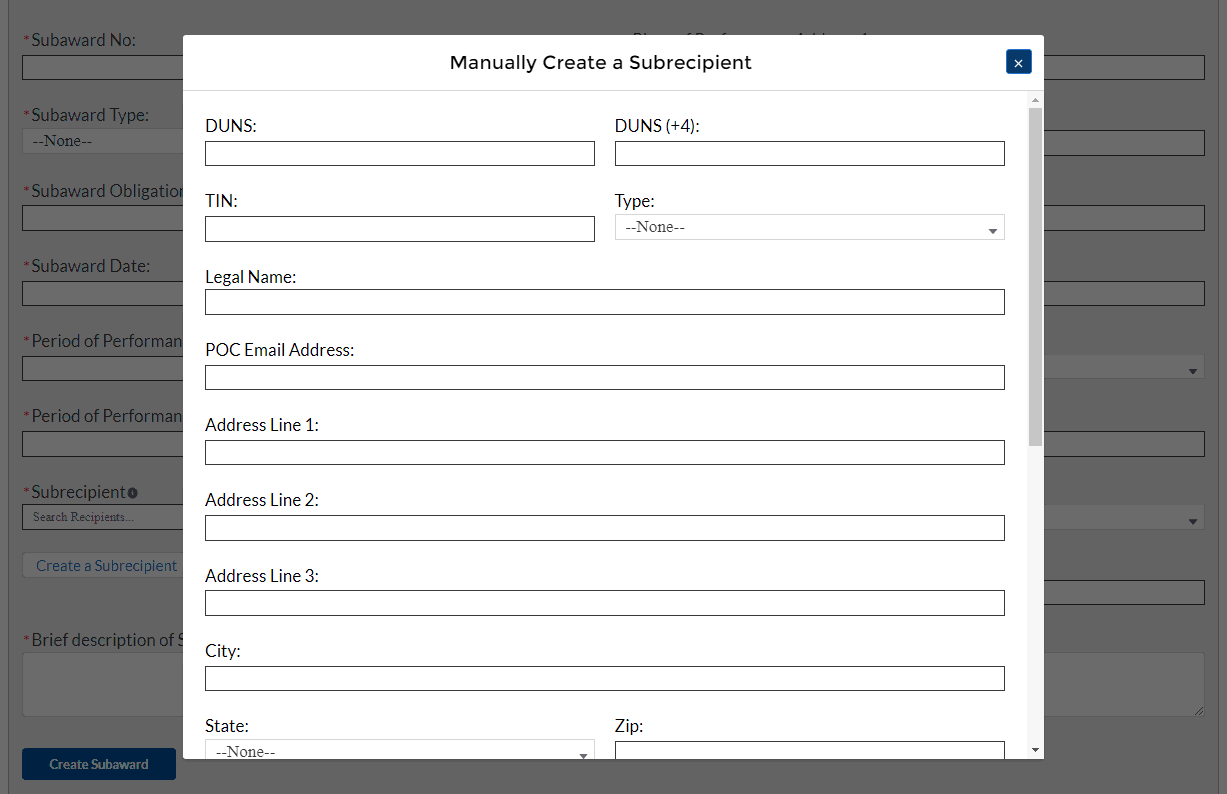

Enter the relevant Subrecipient information below in each of the required fields.

Figure 12 - Manually Create a Subrecipient, Info 1

Answer “yes” or “no” in the drop-down picklist to the three questions provided below.

Figure 13 - Manually Create a Subrecipient, Info 2

If your organization’s five highest paid officers is not publicly listed or otherwise listed in SAM.gov, enter the name and total compensation of each officer in the table shown below.

Figure 14 - Manually Create a Subrecipient, Info 3

At the bottom of the page, click the Create Subrecipient icon to advance to the next screen.

Subaward Expenditure Reporting

Once Subaward data is entered, you will need to provide information regarding the expenditure of Subawards. The expenditures will be categorized into three groups: (1) Expenditures greater than or equal to $30K, (2) Aggregated Expenditures less than $30K, (3) Aggregated Expenditures to individuals less than $30K.

You will have the ability to utilize a bulk-upload feature or individually enter records. For bulk-upload instructions specific to this submodule, see XX page number OR appendix link here. If you choose to individually enter records, then follow the instructions below.

Expenditures greater than or equal to $30,000

Review and verify the pre-populated fields pertaining to the Subaward expenditures greater than or equal to $30,000.

Select the Subaward Name and Subaward Type from the picklist. Verify the Subrecipient’s compliance with the conditions of the grant through a drop-down picklist

Manually enter the Expenditure Start, Expenditure End, and Expenditure Amount.

Select the Expenditure Category from the drop-down picklist.

Answer Yes or No in the drop-down picklist if for Is the Subrecipient complying with the terms and conditions of the grant? If the Subrecipient is not in compliance, then manual entry of a brief explanation will be required

You will have the ability to individually enter expenditures or utilize a Subaward Expenditure Bulk Upload feature.

Figure 15 – Expenditures > $30,000

Figure 16 – Data Entry for Expenditures > $30,000

At the bottom of the page, click the Next icon to advance to the next screen.

Aggregate Expenditures for less than $30,000

Manually enter the Total Quarterly Expenditure Amount, Cumulative Expenditures, and Cumulative Obligations.

Select the Expenditure Category and Subaward Type from the drop-down picklist.

Figure 17 – Data Entry for Aggregate Expenditures < $30,000

At the bottom of the page, click the Next icon to advance to the next screen.

Aggregate Expenditures to Individuals for less than $30,000

Manually enter the Total Quarterly Expenditure Amount, Cumulative Expenditures, and Cumulative Obligations.

Select the Expenditure Category from the drop-down picklist.

Figure 18 – Data Entry for Individual Payments < $30,000

At the bottom of the page, click the Next icon to advance to the next screen.

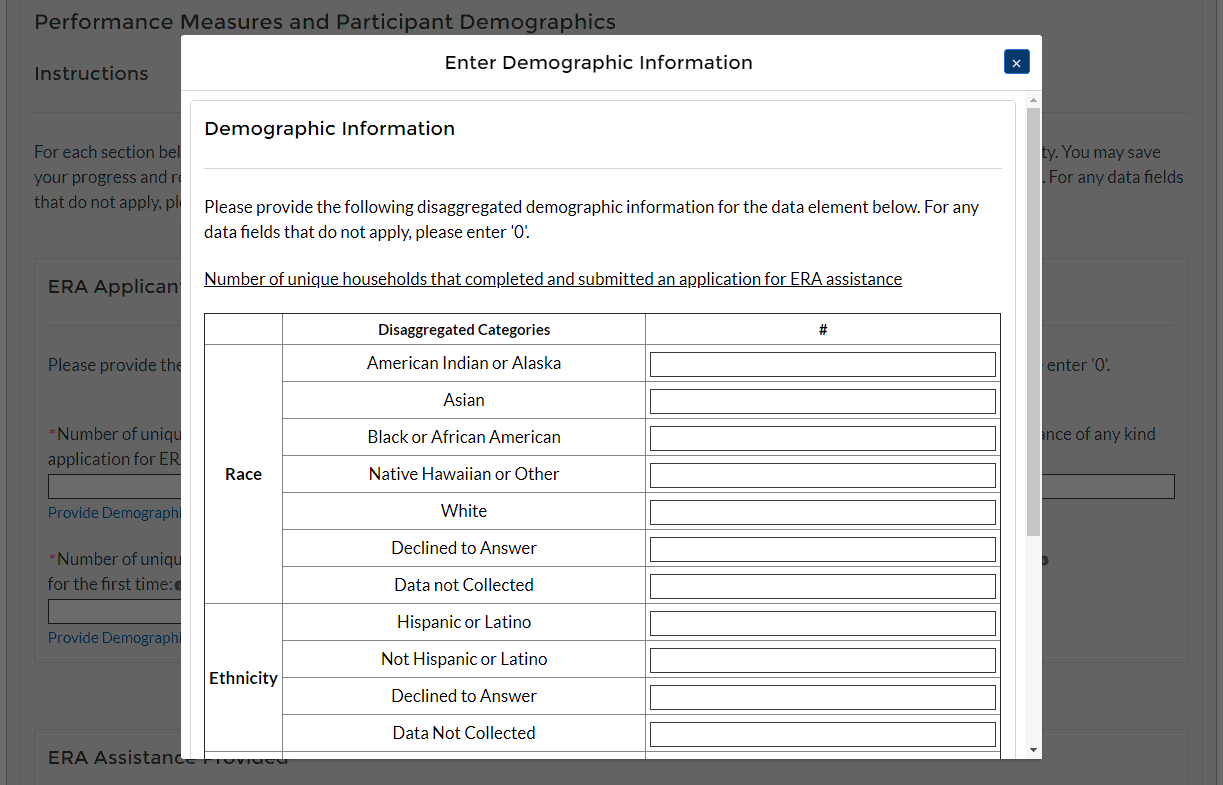

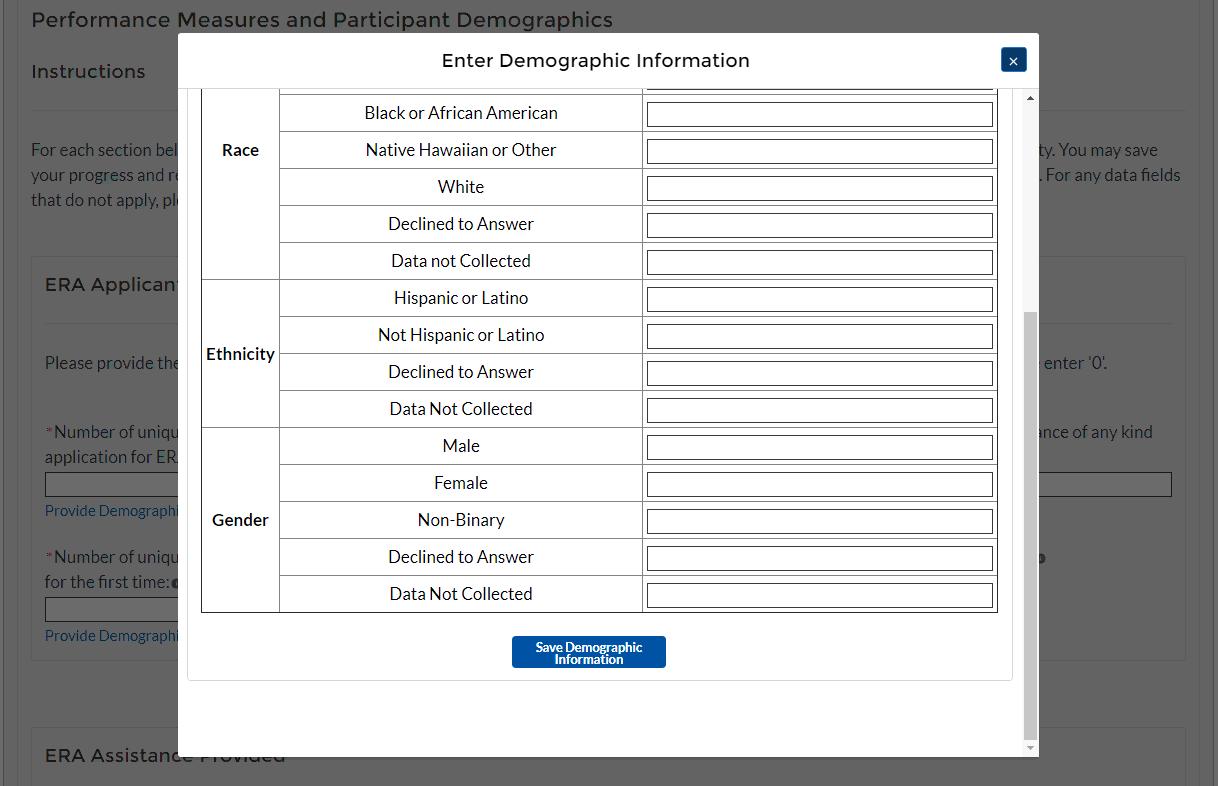

Demographic Reporting

In this module, you will provide detailed information on the status of the subject ERA1 or ERA2 Project using performance data and participant demographic information. All fields will need to be manually entered as no fields are pre-populated. For each measure and data element listed below, Recipients must report progress achieved over the reporting period. State, Local and Territorial Recipients must also report certain data elements by race, ethnicity and gender of the primary applicant for assistance in the household.

Figure 19 – ERA Demographic Reporting

You will have the ability to utilize a bulk-upload feature or individually enter records. For bulk-upload instructions specific to this submodule, see XX page number OR appendix link here. If you choose to individually enter records, then follow the instructions below.

Under the ERA Applicants section, enter the number of unique households that:

Completed and submitted an application for ERA assistance

Received assistance of any kind under the ERA program

Received ERA assistance for the first time

Note: Tribe, TDHE, and the DHHL Recipients must report this entire element, with no requirement to report the information broken out by race, ethnicity, and gender of the primary applicants for assistance.

Figure 21 – Reporting on ERA Applicants

Note: When you see the “Provide Demographic Information” icon in blue (circled in red above), you will click it and enter relevant demographic information into the chart seen below.

Under the ERA Assistance Provided Section, you will manually enter:

The number of unique households that received ERA assistance for Rent, Rental Arrears, Utilities/Home Energy Bills, Utilities/Home Energy Costs Arrears, Other Expenses Related to Housing, and Housing Stability Services.

Note: Tribe, TDHE, and the DHHL Recipients must report on each of the five ERA Financial Assistance Types listed, with no requirement to report the information broken out by race, ethnicity, and gender of the primary applicant for assistance.

Figure 22 – Reporting on ERA Assistance Provided

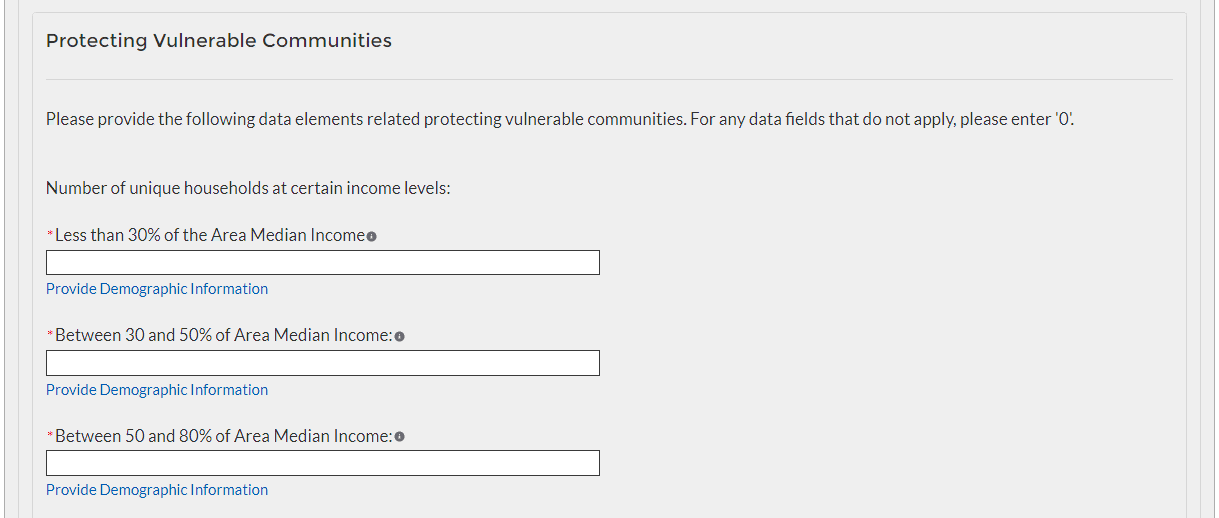

Under the Protecting Vulnerable Communities Section enter:

The number of unique households that reside at less than 30% of area median income, between 30% and 50% of area median income, and between 50% and 80% of area median income

Note: Not applicable for Tribe, TDHE, and the DHHL Recipients.

Figure 23 – Reporting on ERA Protections to Vulnerable Communities

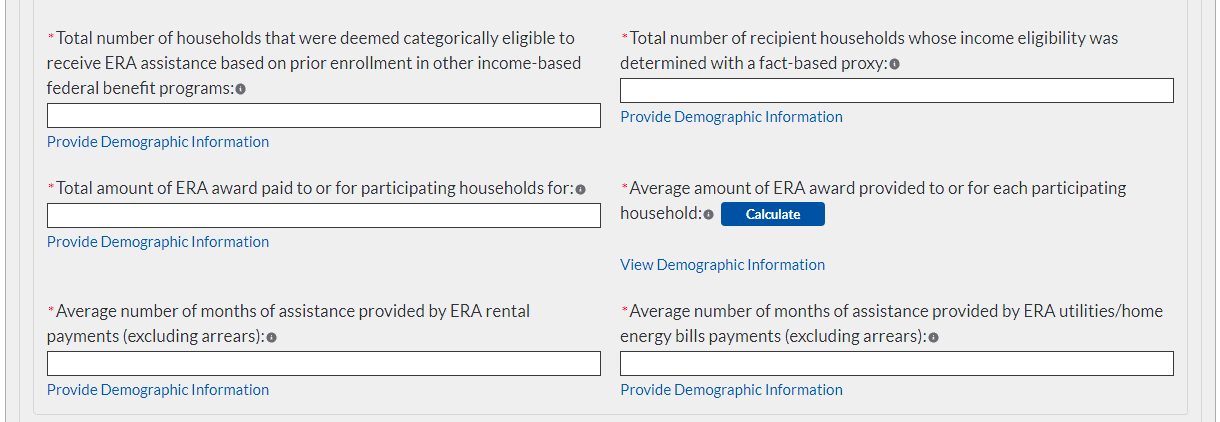

Number of households that were deemed categorically eligible to receive ERA assistance based on prior enrollment in other income-based federal benefit programs

Note: Not applicable for Tribe, TDHE, and the DHHL Recipients.

Number of recipient households whose eligibility was determined with a fact-based proxy

Note: Not applicable for Tribe, TDHE, and the DHHL Recipients.

Total amount of ERA award paid to or for participating households

Note: Tribe, TDHE, and the DHHL Recipients must report this data point, with no requirement to report the information broken out by race, ethnicity, and gender of the primary applicants for assistance.

Average amount of ERA award provided to or for each participating household

Note: Tribe, TDHE, and the DHHL Recipients must report this data point, with no requirement to report the information broken out by race, ethnicity, and gender of the primary applicants for assistance.

Average number of months of assistance provided by ERA rental payments (excluding arrears)

Note: Tribe, TDHE, and the DHHL Recipients must report this data point, with no requirement to report the information broken out by race, ethnicity, and gender of the primary applicants for assistance.

Average number of months of assistance provided by ERA utilities/home energy bills payments (excluding arrears)

Note: Not applicable for Tribe, TDHE, and the DHHL Recipients.

Figure 24 – Reporting on ERA Protections to Vulnerable Communities

Under the ERA Funds Approved but Not Expended section you will manually enter:

Total Dollar Amount of ERA Award Funds Approved (Obligated) to or for Participant Households

Total Amount of ERA Award Fund Paid (Expended) for Administrative Expenses

Total Amount of ERA Award Funds Approved (Obligated) for Administrative Expenses

Total Dollar Amount of the ERA Award Funds Paid (Expended) for Housing Stability Services

Total Dollar Amount of the ERA Funds Approved (Obligated) for Housing Stability Service Costs

Note: Entire section not applicable for Tribe, TDHE, and the DHHL Recipients.

Figure 25 – Reporting on Non-Expended Approved ERA Funds

At the bottom of the page, click the Next icon to advance to the next screen.

Report Overview

Quarterly Performance Narrative Sub-Module

In this Sub-Module, you will provide additional information on how the project performed against the outlined ERA goals and outcomes for the current reporting Quarter.

Provide a narrative that discusses how the project performed relative to the goals outlined by the ERA program. Be sure to address all the listed relevant points.

Figure 26 - Performance Narrative

At the bottom of the page, click the Next icon to advance to the next screen.

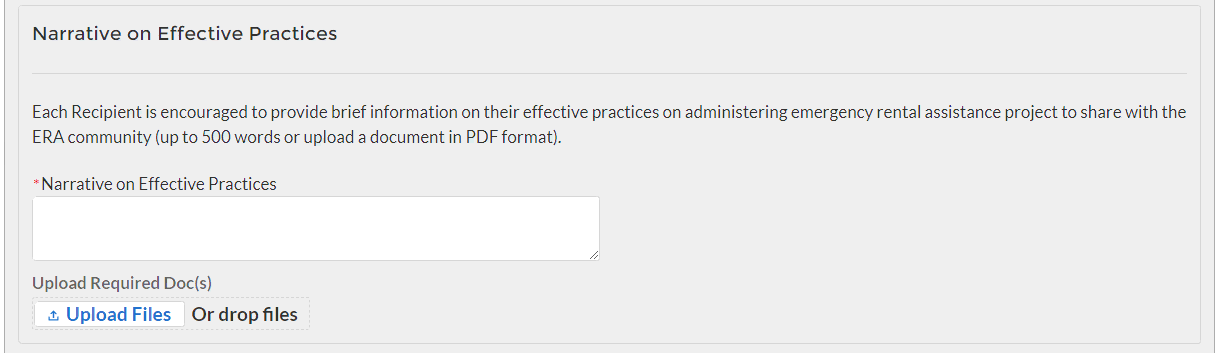

Quarterly Narrative on Effective Practices Sub-Module

In this Sub-Module, you will provide additional information on the effective practices that were used by your organization

Provide a brief explanation on the effective practices used by your organization used when administering the ERA project.

Figure 27 – Effective Practices Narrative Entry

At the bottom of the page, click the Next icon to advance to the next screen.

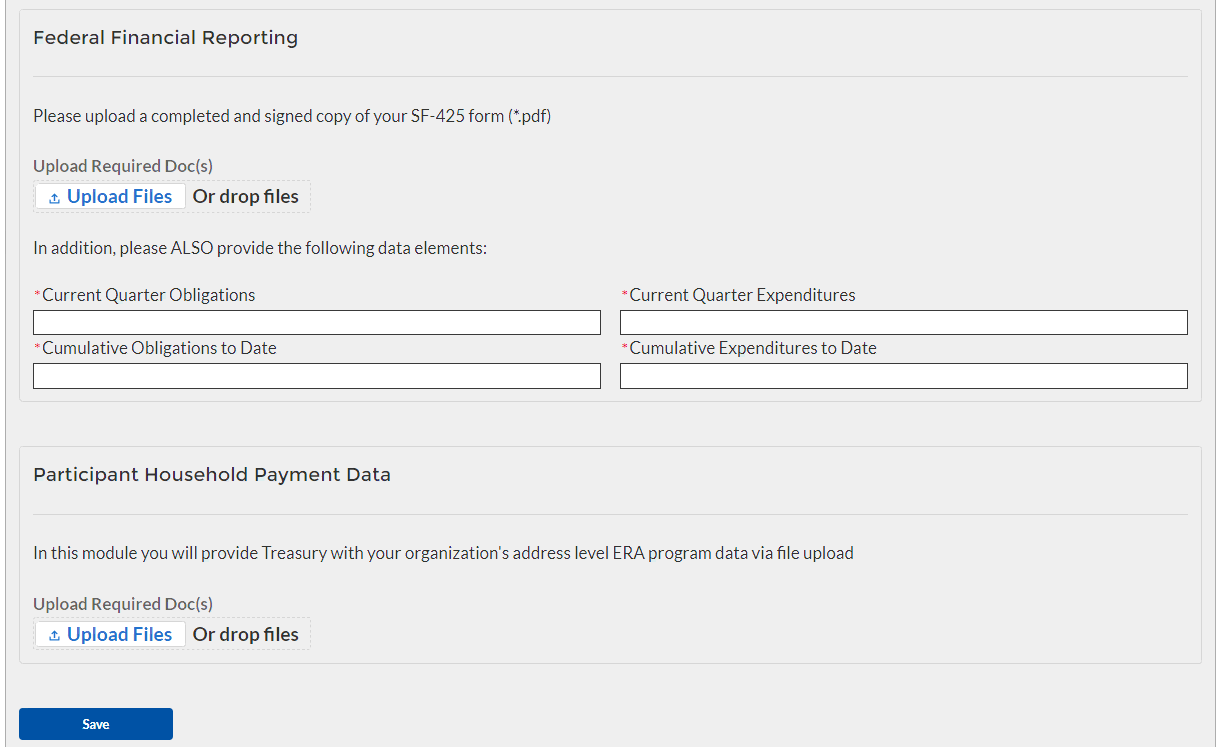

In this section, you must upload a completed and signed copy of your SF-425 form (*.pdf format only) and your organization’s address-level ERA program data

Click the first Upload Files button to submit your completed and signed Quarterly SF-425 document.

Manually enter the Current Quarter Obligations, Current Quarter Expenditures, Cumulative Obligations to date, and Cumulative Expenditures to date data.

Click the second Upload Files button to and attach your necessary Participant Household Payment Data File.

Note: Tribe, TDHE, and the DHHL Recipients are not required to submit Participant Household Payment Data Files

Figure 31 – Form SF-425 Upload

At the bottom of the page, click the Save button to advance to the next screen.

Figure 33 – Form Submission Certification

Appendices

Bulk Upload Overview

Purpose

Award Recipients are required to submit quarterly reports to include performance and financial information including background information about the ERA Project that is the subject of the report; participant data; and financial information with details about obligations, expenditures, direct payments, and Subawards. This document provides guidance on how to upload reports to the Treasury portal. Award recipients will have the ability to upload performance and financial data reports for the following reporting modules:

Subrecipient Profile

Subaward Reporting

Subaward Expenditure Reporting > $30,000

Subaward Expenditure Reporting < $30,000

Subaward Expenditure Reporting < $30,000 to Individuals

ERA Programmatic Reporting

Participant Household Payment Data

Upload Process

The upload process includes the following steps:

Identify the reporting module to upload

Create a Comma-Separated Values (CSV) file following the specification described in this document

Follow the “How to Upload Files” section

Upload reporting module files

Reconcile data upload error messages

Receive successful upload confirmation

Support Options – How to Get Help

<Add how-to get help, help desk email, phone number, etc. >

Technical Guidance

CSV File Format - All information is submitted a CSV files, see details description of the CSV format at:

https://en.wikipedia.org/wiki/Comma-separated_values

Specific CSV characteristics:

Each column header is in double quotes. Examples:

“firstName”,”lastName”

The Data format is: mm/dd/yyyy with double quotes. Example:

“06/22/2021”

The naming convention for the uploaded files:

xxxx

All String and Date values are in double quotes

Numeric values do not require double quotes. Numeric values could be an integer or decimal

The column length specifies the type of number expected

Numeric values with decimals are specified for each case

All currency values are numeric. It is not required to add “,” for thousand or millions

Upload Template Description

Each data element and/or column in the CSV files is described below:

Index No: Reference number for the data element. For internal use only

Defined term: Column Short description

Definition: Column long description or definition

CSV Column Name: The column header name that must be used in the CSV file

Required: Indicates if the column is required or not required.

List Value: The content of the column is from a list of predefined values. This is valid for some of the columns. The list is provided for all cases. Most of the cases is N/A which means that the type is ether String or Numeric

Data type: Specify the data type of the column. The options are: Numeric, Text, Date and Pick List.

Max Length: Indicates the maximum length in characters that is allowed for each column.

File Name Naming Convention

<Specify the naming convention here >

Subrecipient Profile

This module provides identifying information for each Subrecipient that received federal funding from this program. Where possible, you should provide the Subrecipient's DUNS number to pre-populate several segments of the record. In addition, you will also need to provide information about the Subrecipient's 2 CFR 170.330 Total Compensation reporting, if applicable.

CSV Format details

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

Subrecipient DUNS |

The DUNS unique identification number for the Subrecipient Organization of the Recipient's ERA funds. |

sub_recipient_duns |

Required |

n/a |

Numeric |

9 |

Subrecipient DUNS (+4) |

A 4-character suffix that may be assigned by a business concern and appended to its DUNS. |

sub_recipient_duns_sufix |

Optional |

n/a |

String |

4 |

Subrecipient TIN |

The Subrecipient's Internal Revenue Service (IRS) Taxpayer Identification Number |

sub_recipient_tin |

Required |

n/a |

Numeric |

9 |

Subrecipient Type |

A collection of indicators of different types of Subrecipient types that receive ERA funds. |

sub_recipient_type |

Required |

|-

Tenant |

Picklist (see permissible values in previous column) |

82 |

Subrecipient Name |

The name of the Subrecipient. |

sub_recipient_name |

Required |

n/a |

String |

120 |

POC Email Address |

The email address of the primary point-of-contact for the Subrecipient. |

sub_recipient_email |

Required |

n/a |

String |

40 |

Address Line 1 |

First line of the Subrecipient's address. |

sub_recipient_address_1 |

Required |

n/a |

String |

150 |

Address Line 2 |

Second line of the Subrecipient's address. |

sub_recipient_address_2 |

Optional |

n/a |

String |

150 |

Address Line 3 |

Third line of the Subrecipient's address. |

sub_recipient_address_3 |

Optional |

n/a |

String |

150 |

City Name |

Name of the city in which the Subrecipient is located. |

sub_recipient_city |

Required |

n/a |

String |

40 |

State Code |

United States Postal Service (USPS) two-letter abbreviation for the state or territory in which the Subrecipient is located. |

sub_recipient_zip5 |

Required |

n/a |

String |

2 |

Zip5 |

United States ZIP code (five digits) associated with the Subrecipient's address. |

sub_recipient_zip5 |

Required |

n/a |

String |

5 |

Zip4 |

Zip Plus4 (four digits) associated with the Subrecipient’s address. |

sub_recipient_zip4 |

Required |

n/a |

String |

4 |

Subrecipient SAM.gov Registration |

Confirmation that the Subrecipient is registered in SAM.gov |

sub_recipient_is_sam_register |

Required |

Yes/No |

Picklist (see permissible values in previous column) |

n/a |

Federal Funding-to-Annual Gross Revenue (preceding fiscal year) Proportional Threshold for Top 5 Executive Compensation Reporting |

Confirmation that the proportion of the Subrecipient's federal funding-to-total annual gross revenue for the preceding fiscal year is at least 80% |

sub_recipient_is_funding_to_total_80 |

Required |

Yes/No |

Picklist (see permissible values in previous column) |

n/a |

Federal Funding of Annual Gross Revenue (preceding fiscal year) Threshold for Top 5 Executive Compensation Reporting |

Confirmation that the Subrecipient's total annual gross revenue from federal funding across all programs for the preceding fiscal year is greater than $25 million. |

sub_recipient_is_preceding_fiscal_25m |

Required |

Yes/No |

Picklist (see permissible values in previous column) |

n/a |

Confirmation of 2 CFR 170 Total Compensation Information |

Confirmation that qualifying Subrecipient's publicly identify their top five highest compensated executives or have it listed in their SAM.gov profile |

sub_recipient_is_five_excs |

Required |

Yes/No |

Picklist (see permissible values in previous column) |

n/a |

Executive Name |

The legal name belonging to one of the five highest paid executives, officers, or employees of the Subrecipient. |

sub_recipient_executive_name_n

Please provide 5 executive names, replace n with 1,2,..5 |

Required |

n/a |

String |

100 |

Total Compensation |

The Total Compensation, as defined in 2 CFR part 170.330, earned by the five highest paid executives, officers, or employees of the Subrecipient. |

sub_recipient_executive_total_compensation_n

Please provide 5 executive names, replace n with 1,2,..5 |

Required |

n/a |

Numeric |

12,2 |

Subaward Reporting

This module provides general information for each Subaward of federal funding provided under this program. The module includes detailed information on the amount, date, period and place of performance, and a brief description of the Subaward and its underlying eligible use. In addition, associate the Subaward with the relevant Project /FAIN and Subrecipient.

CSV Format details

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

Subaward No. |

Recipient's internal account number for the grant, contract, transfer, or direct payment. This can be the account number or any other unique identifying number assigned by the Recipient to the award. This number is strictly for the Recipient's recordkeeping. |

sub_award_no |

Required |

n/a |

String |

20 |

Subrecipient Name |

Subrecipient Name - Assigned to the Subaward. Name must match valid sub-recipient name either uploaded in the Subrecipient bulk upload or a entered in the system. |

sub_recipient_name |

Required |

n/a |

String |

120 |

Subaward Type |

The type of Subaward. |

sub_award_type |

Required |

-

Contract: Purchase Order |

Picklist (see permissible values in previous column) |

30 |

Subaward Amount (Obligation) |

Total amount of ERA funds obligated by the Recipient to a Subrecipient under a given Subaward. |

sub_award_amount |

Required |

n/a |

Numeric |

12,2 |

Subaward Date |

The date the Recipient obligated funds to a Subrecipient. |

sub_award_date |

Required |

n/a |

Date |

8 |

Period of Performance Start |

The date on which efforts begin or the Subaward is otherwise effective. |

sub_award_period_start |

Required |

n/a |

Date |

8 |

Period of Performance End |

The date on which all effort is completed or the Subaward is otherwise ended. |

sub_award_period_end |

Required |

n/a |

Date |

8 |

Place of Performance Address 1 |

First line of the address where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_address1 |

Required |

n/a |

String |

120 |

Place of Performance Address 2 |

Second line of the address where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_address2 |

Optional |

n/a |

String |

120 |

Place of Performance Address 3 |

Third line of the address where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_address3 |

Optional |

n/a |

String |

120 |

Place of Performance City |

The name of the city where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_city |

Required |

n/a |

String |

40 |

Place of Performance State Code |

United States Postal Service (USPS) two-letter abbreviation for the state or territory indicating where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_country |

Required |

n/a |

String |

2 |

Place of Performance Zip5 |

United States ZIP code (five digits) identifying where the predominant performance of the subaward will be accomplished.

|

sub_award_perf_zip5 |

Required |

n/a |

String |

4 |

Place of Performance Zip+4 |

United States ZIP code (five digits) appended to the ZIP code +4 (four digits) identifying where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_zip5 |

Required |

n/a |

String |

5 |

Place of Performance Country |

Name of the country where the predominant performance of the Subaward will be accomplished. |

sub_award_perf_county |

Required |

n/a |

String |

100 |

Place of Performance Congressional District |

A territorial division within a state from which members of the U.S. House of Representatives are elected. This information is associated with the Subaward's Place of Performance. |

sub_award_perf_dictrict |

Required |

n/a |

String |

5 |

Subaward Description |

A description of the overall purpose and expected outputs and outcomes or results of the funded subaward, including significant deliverables and, if appropriate, associated units of measure. The purpose and outcomes or results should be stated in terms that allow an understanding that the subaward constitutes an eligible use of funds. |

sub_award_description |

Required |

n/a |

String |

750 |

Subaward Expenditure – Greater than $30,000

This module provides details for each expenditure of program funds. The module associates each expenditure with a Project, Subaward, and Subrecipient record created in Step 1a, 1b, and 1c. In addition, identify the relevant Expenditure Category, provide the amount of the expenditure(s) and relevant dates. In addition, grantees and creditors receiving federal program funds will also have to answer some additional, Subaward specific questions.

CSV Format Details

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

Expenditure Project Label |

A drop-down list of Project Names that allows the Recipient to associate Expenditure records to Project records. |

sub_award_project_label |

Required |

… |

Label |

100 |

Expenditure Subaward Label |

A drop-down list of Subaward IDs that allows the Recipient to associate Expenditure records to Subaward records. |

sub_award_expenditure_lebel |

Required |

… |

Label |

100 |

Expenditure Subrecipient Label |

A pre-populated label - tied to the Subaward record - associated to Expenditure records. |

sub_award_sub_recipient_label |

Required |

… |

Label |

100 |

Expenditure Start Date |

Start date for the range of time when the expenditure(s) occurred. |

sub_award_expenditure_srart_date |

Required |

n/a |

Date |

8 |

Expenditure End Date |

End date for the range of time when the expenditure(s) occurred |

sub_award_expenditure_end_date |

Required |

n/a |

Date |

8 |

Expenditure Amount |

Total amount of Emergency Rental Assistance dollars on the Subaward. |

sub_award_expenditure_amount |

Required |

n/a |

Numeric |

12,2 |

Expenditure Category |

The category to which the purpose of the expenditure most closely relates to when created. |

sub_award_expenditure_category |

Required |

-

Financial Assistance: Rent; |

Picklist (see permissible values in previous column) |

100 |

Grant Compliance Check |

Confirmation that the Subrecipient is in compliance with the Subaward as defined by the Recipient. |

sub_award_grant_compliance_check |

Required |

Yes/No |

Picklist (see permissible values in previous column) |

n/a |

Noncompliance Explanation |

Written description of noncompliance identified in the Grant Compliance Check. |

sub_award_noncompliance_explanation |

Required |

n/a |

String |

250 |

Subaward Expenditure – Less than $30,000

For disbursements less than $30,000, please provide the aggregate expenditures and obligations for the current reporting period and total to date.

CSV Format Details

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

Subaward Type (Aggregates) |

The Subaward Type that had obligation or expenditure/payment activity during the reporting period. |

sub_award_type |

Required |

- Aggregate of Contracts Awarded for <$50,000; - Aggregate of Grants Awarded for <$50,000 - Aggregate of Loans Issued for <$50,000; - Aggregate of Transfers <$50,000; - Aggregate of Direct Payments <$50,000 |

Picklist (see permissible values in previous column) |

30 |

Total Quarterly Expenditure Amount (Aggregates) |

Sum of Expenditures or Payments during the most recent quarter for this Subaward Type (Aggregates). |

sub_award_total_qt_expenditure_amount |

Required |

n/a |

Numeric |

12,2 |

Total Quarterly Obligation Amount (Aggregates) |

Sum of Subaward amounts/obligations during the most recent quarter for this Subaward Type (Aggregates). |

sub_award_total_qt_obligation_amount |

Required |

n/a |

Numeric |

12,2 |

Cumulative Expenditures (Aggregates) |

Sum of expenditures across all reporting quarters for this Subaward Type (Aggregates). |

sub_award_cummulative_expenditures |

Required |

n/a |

Numeric |

12,2 |

Cumulative Obligations (Aggregates) |

Sum of Subaward amounts/obligations across all reporting quarters for this Subaward Type (Aggregates). |

sub_award_cummulative_obligations |

Required |

n/a |

Numeric |

12,2 |

Subaward Expenditure – Less than $30,000 to individuals

For disbursements less than $30,000, please provide the aggregate expenditures and obligations for the current reporting period and total to date.

CSV Format Details

Index |

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

SA30 |

Total Quarterly Expenditure Amount (Individuals) |

Sum of Expenditures or Payments during the most recent quarter for this Subaward Type (Individuals). |

sub_award_total_qt_expenditure_amount |

Required |

n/a |

Numeric |

12,2 |

SA31 |

Total Quarterly Obligation Amount (Individuals) |

Sum of Subaward Amounts/Obligations during the most recent quarter for this Subaward Type (Individuals). |

sub_award_expenditure_reporting |

Required |

n/a |

Numeric |

12,2 |

SA32 |

Cumulative Expenditures (Individuals) |

Sum of Expenditures or Payments during the most recent quarter for this Subaward Type (Individuals). |

sub_award_comulative_expenditure |

Required |

n/a |

Numeric |

12,2 |

SA33 |

Cumulative Obligations (Individuals) |

Sum of Subaward Amounts/Obligations during the most recent quarter for this Subaward Type (Individuals). |

sub_award_cumulative_obligations |

Required |

n/a |

Numeric |

12,2 |

ERA Programmatic Reporting

In this module, provide Treasury with your organization's address-level data and ERA program data. If your organization does not utilize the bulk upload feature for program data, you will need to manually enter all required data elements including disaggregated data points.

CSV Format Details

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

Number of unique households that completed and submitted an application for ERA assistance - Current Period |

The

number of unique households that submitted a complete application,

as reasonably determined by the Recipient, for ERA assistance in

the reporting period. |

era_number_of_unique_households_sumitted |

Required |

n/a |

Numeric |

9 |

Number of unique households that received ERA assistance of any kind - Current Period |

The

number of unique households whose rent and/or utility/home energy

payments were fully or partially paid by the ERA Recipient under

the federal ERA program plus the number of households that

received housing stability services administered by the ERA

Recipient in the reporting period. |

era_number_of_unique_households_receive_assistance |

Required |

n/a |

Numeric |

9 |

Number of unique households that received their initial ERA assistance in the current reporting period |

The sum of the number of unique participant households whose rent and/or utility/ home energy payments were fully or partially paid for the first time under the subject ERA award during the reporting period plus the number that only received housing stability services for the first time during the current reporting period. |

era_unique_housholds_received_current |

Required |

n/a |

Numeric |

10 |

Acceptance rate of applications for ERA assistance - Current Quarter |

The

quarterly ratio of new applications to initial payments –

i.e., the total number of new unique households receiving

assistance divided by the total number of new, unique, and

complete application submissions in a given quarter. |

era_acceptance_rate_current_qt |

Required |

n/a |

Percentage |

2,2 |

Number of unique households that received ERA assistance by type - Current Period |

The

non-mutually exclusive number of unique households that received

each type of assistance under the ERA program. |

|

Required |

n/a |

Numeric |

9 |

Number of unique households that received any ERA assistance and has a household income level that is between 50 – 80% AMI - Current Period |

The

number of households that received ERA program assistance in the

reporting period and whose income was more than 50% but less than

80% of the area median income as defined by the US Department of

Housing and Urban Development. |

era_income_range_current_period |

Required |

n/a |

Numeric |

9 |

Number of unique households that received any ERA assistance and has a household income level that is between 30 – 50% AMI - Current Period |

The

number of households with incomes of at least 30% but not greater

than 50% of the area median income as defined by the US Department

of Housing and Urban Development that received ERA program

assistance in the reporting period and whose |

era_received_any_range_current_perior |

Required |

n/a |

Numeric |

9 |

Number of unique households that received any ERA assistance and has a household income level that is less than 30% AMI - Current Period |

The

number of households with incomes was less than 30% of the area

median income as defined by the US Department of Housing and Urban

Development that received ERA program assistance in the reporting

period. |

era_received_income_less_range |

Required |

n/a |

Numeric |

9 |

Total number of recipient households whose income eligibility was determined based on their eligibility for other federal benefit programs - Current Period |

Total

number of households that were deemed categorically eligible to

receive ERA assistance based on prior enrollment in other

income-based federal benefit programs during the reportig

period. |

era_num_determ_elegibility_federal_current |

Required |

n/a |

Numeric |

9 |

Total number of recipient households whose income eligibility was determined with a fact-based proxy - Current Quarter |

Total

number of recipient households whose income eligibility was

determined with one of the fact-based proxies described in the

Program Overview during the reporting period. |

era_num_determ_elegibility_proxy_current |

Required |

n/a |

Numeric |

9 |

Total amount of ERA award paid to or for participating households - Current Quarter |

The

total dollar amount of ERA award funds paid under the ERA award to

or for participating households during the reporting period

including payments for Financial Assistance, such as rent, rental

arrears, utility and home energy costs, utility and home energy

cost arrears, other housing services and eligible expenses, and

Housing Stability Services (including eviction prevention

services). |

era_amount_paid_participants_qt |

Required |

n/a |

Numeric |

12,2 |

Average amount of ERA award provided to or for each participant household - Current Quarter |

The

average dollar amount of ERA award funds paid under the ERA award

to or for participating households during the reporting period

including payments for Financial Assistance, such as rent, rental

arrears, utility and home energy costs, utility and home energy

cost arrears, other housing services and eligible expenses, and

Housing Stability Services (including eviction prevention

services). |

era_avr_award_current_qt |

Required |

n/a |

Numeric |

12,2 |

Average number of months of assistance provided by ERA rental payments (excluding arrears) - Current Quarter |

The

total number of rental payments paid by the ERA Recipient to or

for participating households during the reporting period. Count

each month’s payment to the same household individually. Do

not count payments for rental arrears. |

era_avr_months_rental_current_qt |

Required |

n/a |

Numeric |

2,2 |

Average number of months of assistance provide by ERA utilities/home energy bills payments (excluding arrears) - Current Quarter |

The

total number of utility/ home energy bill payments paid by the ERA

Recipient to or for participating households during the reporting

period. Count each month’s payment to the same household

individually. Do not count payments for utility or home energy

bill arrears. |

era_avr_bills_current_qt |

Required |

n/a |

Numeric |

2,2 |

Total dollar value of ERA Financial Assistance paid (expended) to or for participating households - Current Quarter |

The

total dollar amount of ERA Financial Assistance, as defined in the

ERA1 and ERA2 statutes, paid (expended) to or for participating

households during the reporting period. The figure includes

payments for rent; rental arrears; utility and home energy costs;

utility and home energy cost arrears; and other housing expenses.

|

era_paid_participats_current_qt |

Required |

n/a |

Numeric |

12,2 |

Total dollar value of approved but unpaid (obligated) ERA Financial Assistance - Current Quarter |

The

total dollar amount of ERA Financial Assistance, as defined in the

ERA1 and ERA2 statutes, approved but unpaid (obligated) to or for

households during the reporting period. This figure includes

payments for rent, rent arrears, utility and home energy bills,

utility and home energy arrears, and other housing expenses.

|

era_approved_unpaid_current_qt |

Required |

n/a |

Numeric |

12,2 |

Total dollar value of ERA Administrative Expenses paid (expended) to or for participating households - Current Quarter |

The

total dollar amount of ERA Administrative Expenses, as defined in

the ERA1 and ERA2 statutes, paid (expended) to or for

participating households during the reporting period. The figure

includes payments for rent; rental arrears; utility and home

energy costs; utility and home energy cost arrears; and other

housing expenses. |

era_paid_admin_expenses_current_qt |

Required |

n/a |

Numeric |

12,2 |

Total dollar value of approved but unpaid (obligated) ERA Administrative Expenses - Current Quarter |

The

total dollar amount of ERA Administrative Expenses, as defined in

the ERA1 and ERA2 statutes, approved but unpaid (obligated) to or

for households during the reporting period. This figure includes

payments for rent, rent arrears, utility and home energy bills,

utility and home energy arrears, and other housing expenses.

|

era_approved_unpaid_admin_expenses_current_qt |

Required |

n/a |

Numeric |

12,2 |

Total dollar value of ERA Housing Stability Services paid (expended) to or for participating households - Current Quarter |

The

total dollar amount of ERA Housing Stability Services, as defined

in the ERA1 and ERA2 statutes, paid (expended) to or for

participating households for the reporting period. The figure

includes payments for rent; rental arrears; utility and home

energy costs; utility and home energy cost arrears; and other

housing expenses. |

era_paid_stability_servicecurrent_qt |

Required |

n/a |

Numeric |

12,2 |

Total dollar value of approved but unpaid (obligated) ERA Housing Stability Services - Current Quarter |

The

total dollar amount of ERA Housing Stability Services, as defined

in the ERA1 and ERA2 statutes, approved but unpaid (obligated) to

or for households during the reporting period. This figure

includes payments for rent, rent arrears, utility and home energy

bills, utility and home energy arrears, and other housing

expenses. |

era_approved_unpaid_stability_services_current_qt |

Required |

n/a |

Numeric |

12,2 |

Participant Household Payment Data

In this Module, each State, Local and Territorial Recipient must submit a data file containing the household-level information described below for each ERA assistance payment made to or on behalf of each participant household during the reporting period. The Financial Assistance expenditure category includes payments made by State, Local or Territorial Recipients and by all subrecipients and contractors for rent, rental arrears, utility/home energy services, utility/home energy services arrears, and other housing services and eligible expenses.

CSV Format

Defined Term |

Definition |

CSV Column Name |

Required |

List Values |

Data Type |

Max

|

Payee Address 1 |

First line of the Payee’s address |

participant_household_payment_data_payee_address1 |

Required |

n/a |

String |

120 |

Payee Address 2 |

Second line of the Payee’s address |

participant_household_payment_data _payee_address2 |

Optional |

n/a |

String |

120 |

Payee Address 3 |

Third line of the Payee’s address |

participant_household_payment_data _payee_address3 |

Optional |

n/a |

String |

120 |

Payee City |

The name of the city where the Payee’s physical address is located |

participant_household_payment_data_perf_city |

Required |

n/a |

String |

40 |

Payee State Code |

United States Postal Service (USPS) two-letter abbreviation for the state or territory indicating the Payee state |

participant_household_payment_data_perf_state |

Required |

n/a |

String |

2 |

Payee Zip+4 |

United States ZIP code (five digits) appended to the ZIP code +4 (four digits) identifying the Payee address. |

participant_household_payment_data_payee_zip4 |

Required |

n/a |

String |

5 |

Payee Type |

A collection of indicators of different types of payees |

participant_household_payment_data_payee_type |

Required |

n/a |

Drop Down Menu |

120 |

Amount of Payment |

Total amount of ERA funds disbursed to the payee |

participant_household_payment_data_amount_payment |

Required |

n/a |

Dollar Numeric |

12,2 |

Date of Payment |

The date the payment was disbursed to the payee |

participant_household_payment_data_payment_date |

Required |

n/a |

Date Numeric |

8 |

Type of Assistance Covered by Payment |

A collection of indicators of different types assistance |

participant_household_payment_data_types_assistance |

Required |

n/a |

Drop Down Menu |

120 |

Start Date Covered by the Payment |

Start date the Financial Assistance covers for a particular household |

participant_household_payment_data_start_date_coverage |

Required |

n/a |

Date Numeric |

8 |

End Date Covered by the Payment |

End date the Financial Assistance covers for a particular household |

participant_household_payment_data_end_date_coverage |

Required |

n/a |

Date Numeric |

8 |

DRAFT- PRE-DECISIONAL / CONFIDENTIAL / NOT FOR DISTRIBUTION

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Ben Donat |

| File Modified | 0000-00-00 |

| File Created | 2022-08-08 |

© 2026 OMB.report | Privacy Policy