Debt Collection Data Requirements for GAs - October 2022

DCIA Aging and Compliance Data Requirements for Guaranty Agencies

Debt Collection Data Requirements for GAs - October 2022

OMB: 1845-0160

![]()

DCIA Aging and Compliance Data Requirements

for Guaranty Agencies

October 2022

Financial Management Group

Financial Reporting and Analysis Division

[This page intentionally left blank.]

Table of Contents

Aging Specifications

Data Set Specifications

Appendixes…………………………………………………………………………………………………………….50

Appendix A – Sample GAFR / ED Form 2000 A

Appendix B – Presentation of MR-32 & MR-41 Loan Ending Balance Disposition Data Set in Microsoft Excel Format B

Appendix C – Mapping GA TOP Referral Business Rules to MR-32 & MR-41 Loan Ending Balance Disposition Data Set Lines C

Appendix D – Guaranty Agency List D

Appendix E – Glossary of Acronyms E

Version Control |

|||

Version |

Author |

Date |

Changes |

1.0 |

C. Alsop |

10/02/2019 |

Approved by FSA and released for PRA clearance |

1.1 |

C. Alsop |

1/13/2020 |

Updated planned implementation date, Date Acquired Aging Methodology table, Title IV claim types table, and glossary |

1.2 |

C. Carleton |

10/5/2022 |

Minor edits; updated GA and FSA contacts |

Federal Student Aid (FSA) uses data supplied by its loan servicers to satisfy mandatory and ad- hoc debt collection reporting requirements related to receivables due from the public. FSA is required to submit receivable information to the United States Department of the Treasury (Treasury), the Office of Management and Budget (OMB), and the Chief Financial Officers’ Council (CFOC).

Treasury, OMB, and the CFOC use receivable financial data to:

monitor the effectiveness of government-wide receivable management processes via performance metrics;

improve data transparency by publicly releasing agency receivable data on a quarterly basis; and

inform the United States Congress (Congress) annually of agency debt collection regulation compliance as required by the Debt Collection Improvement Act of 1996, as amended (DCIA).

Purpose

The purpose of this document is to:

communicate debt aging requirements per DCIA;

capture detailed information pertaining to the status and collection of Federal Family Education Loan (FFEL) Program loans authorized by the Higher Education Act of 1965, as amended (HEA) and defined by Title IV of the HEA (Title IV) that is not currently available via the Guaranty Agency Financial Report (GAFR) (also known as the ED Form 2000);

enable FSA to report complete and accurate data to Treasury, as required; and

permit FSA to monitor Guaranty Agency (GA) compliance with DCIA.

This specification document requires the GAs prepare three individual Data Sets, collectively called the DCIA Aging and Compliance Data Set (DCIA Compliance Data Set). To prepare the DCIA Compliance Data Set, this document references accounting transactions and GA-specific operational requirements (i.e., the GAFR, Internal Revenue Service (IRS) Form 1099-C reporting, etc.). Any references are solely intended to facilitate the GA’s efforts to prepare a compliant DCIA Data Set and are not intended to provide requirements beyond the scope of preparing the DCIA Compliance Data Set.

Post-implementation, please submit any technical questions about these requirements via email to the following email addresses:

To: [email protected] CC: [email protected]

To facilitate identification, please enter “DCIA Compliance Technical Question” in the email subject line.

Scope

The scope of this requirements document is the DCIA-specific aging and compliance data requirements. The scope of each of the three Data Sets is discussed later in this document. The three Data Sets are:

MR-24 Collection Terminations Write-Off Data Set

MR-32 Loan Ending Balance Aging Data Set

MR-32 & MR-41 Loan Ending Balance Disposition Data Set

The guidance contained in this document is based upon FSA’s policies and business processes as of the date of this document, unless otherwise noted. Any future revision to FSA’s policies and/or business processes may require FSA to update and reissue these requirements.

GAs must prepare and submit the individual Data Sets on a monthly or annual basis as follows:

Table 1.3 Data Set Frequency

-

Data Set

Frequency

MR-24 Collection Terminations Write-Off Data Set (Write-Off Data)

Annually

MR-32 Loan Ending Balance Aging Data Set (Aging Data)

Monthly

MR-32 & MR-41 Loan Ending Balance Disposition Data Set (Disposition Data)

Monthly

This document is organized into the following sections:

Table 1.4 Organization of Requirements Document

-

Section

Section Description

1.0

Introduction: This section provides an overview of the purpose, scope, and frequency requirement for the reports listed in this document.

Aging Specifications

2.0

DCIA Aging Requirements: This section summarizes the DCIA- compliant aging methodologies applicable to Title IV debt held by GAs.

Data Set Specifications

3.0

Preparation of the Data Sets: This section provides important information necessary to prepare the DCIA Compliance Data Set.

4.0 through 6.0

DCIA Compliance Data Set Specifications: These sections provide details regarding each Data Set’s purpose, scope, frequency, and layout. Line-by-line instructions and a presentation view of the Data Set are also included in each section.

7.0

Submission to FSA: This section explains how to package the files for submission to FSA.

Appendixes

A

This appendix presents an example of an approved GAFR.

B

This appendix presents an example of the Disposition Data Set when uploaded to Microsoft Excel.

C

This appendix provides a mapping of GA TOP Referral Business Rules to the Disposition Data Set lines.

D

This appendix lists active GAs by their GA codes.

E

This appendix lists commonly used acronyms referenced throughout this document.

[This page intentionally left blank.]

This section describes the compliant methodologies for aging Title IV loan debt for DCIA purposes1. This section also explains how to determine a loan’s eligibility for referral to the Treasury Offset Program (TOP) based upon the loan’s age of delinquency (i.e., greater than 120 days delinquent). This section also explains how to age DCIA-aged debt in accordance with the United States Department of Education (the Department) and Treasury’s Office of General Counsel (OGC) guidance. The methodology described in this section is independent of the methodologies followed to age debt for other purposes including for Title IV. As such, this guidance is not intended to revise or replace any of other aging methodologies the GAs are required to follow.

Listed below are key DCIA-related terms used later in this section and throughout this document. To facilitate identifying these terms, all key terms are capitalized.

DCIA Aging Methodology for Title IV Loan Debt: The methodology to age Title IV loan debt for DCIA purposes including determining a debt’s eligibility for referral to TOP based upon its age. Section 2.3 of this document includes a full description of the DCIA Aging Methodologies including: 1) criteria for identifying debt to apply the methodology, 2) methodology for determining debt age in number of days, 3) methodology for calculating dollar amount to report, and 4) criteria for transitioning to another aging methodology.

Title IV Default: Per Title IV, a loan enters default if the loan exceeds 270 days of delinquency. 2 Based upon existing business processes, all Title IV debt held and serviced by a GA is in Title IV Default.

1 The aging methodology to follow and consequently how to age GA-held debt is independently determined for each individual debt.

Title IV Claim Types: Per Title IV, a GA can request reimbursement from FSA for Defaults and other FFEL Program claims it paid to lenders. Claims paid to lenders and included in the federal receivable3 are aged. Claims paid to lenders and not included in the federal receivable are not aged and, as a result, neither of the two GA-applicable DCIA Aging Methodologies are applicable.

Per DCIA, there are two distinct aging methodologies applicable to GAs. The appropriate methodology is determined by the Title IV Claim Type of the debt (i.e., Defaults, Exempt/LLR are included in the federal receivable and aged; all other claim types are not included in the federal receivable nor aged).

The remainder of this section describes each of the two DCIA aging methodologies in more detail. Note, per DCIA, there are only two possible DCIA Delinquency Statuses – Current or Delinquent. Based upon existing business processes, debt held by a GA is always “delinquent” for DCIA purposes.

3 The federal receivable is defined as the amount reported on MR-32 Ending Balance of Defaulted Loans. The amount reported on MR-32 is reported on FSA’s financial statements.

4 Disability claims are also called Total and Permanent Disability Discharge (TPD Discharge) claims.

5 Other discharges include Teacher Loan Forgiveness Program discharges and partial discharges of consolidation loans.

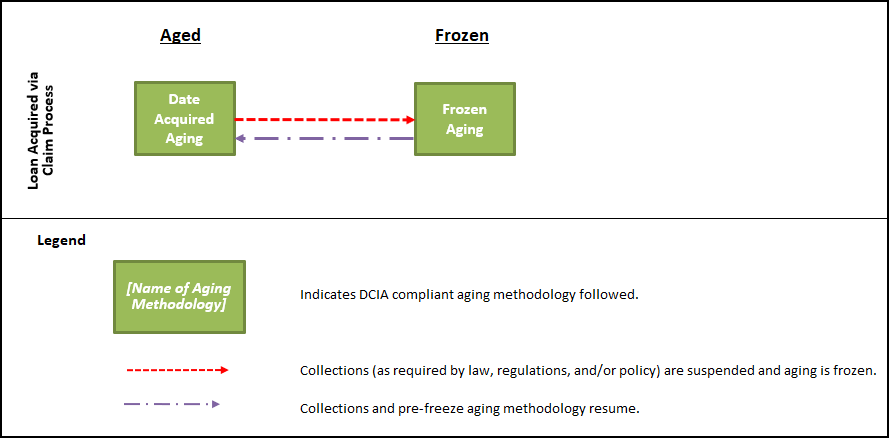

Figure 1 - Relationship between DCIA Aging Methodologies for Debt Held by GAs

For DCIA purposes, a debt in the Default Title IV Loan Status should be aged using the Date Acquired Aging Methodology unless the Frozen Aging Methodology is triggered.

The following table describes the Date Acquired Aging Methodology.

Table

2.3.1

Date

Acquired

Aging

Methodology

Table

2.3.1

Date

Acquired

Aging

Methodology

Date Acquired Aging Methodology |

Applicability and Criteria |

|

Applicable for Title IV Claim Types |

|

|

Criteria to Start Aging Methodology: |

|

|

Methodology |

||

Determining Age |

collection efforts.) |

|

Valid DCIA Delinquency Status(es) |

|

|

Determining Dollar Value of Delinquency |

|

|

Transition to Another DCIA Aging Methodology |

||

Aging Methodology and Criteria for Switching: |

|

|

6 “Delinquent” is the only valid DCIA Delinquency Status for this aging methodology because based upon existing business processes, all Title IV debt held by GAs is delinquent.

For DCIA purposes, a debt in the Default Title IV Loan Status should be aged using the Frozen Aging Methodology unless the Date Acquired Aging Methodology is triggered. This methodology should be followed for the duration of the event that triggered the suspension of collection efforts and froze the age of the debt.

The following table describes the Frozen Aging methodology.

Table

2.3.2

Frozen

Aging

Methodology

Table

2.3.2

Frozen

Aging

Methodology

Frozen Aging Methodology |

Applicability and Criteria |

|

Applicable for Title IV Claim Types |

|

|

Criteria to Start Aging Methodology: |

|

|

Methodology |

||

Determining Age: |

|

|

Valid DCIA Delinquency Status(es): |

|

|

Determining Dollar Value of Delinquency: |

|

|

Transition to Another DCIA Aging Methodology |

||

Aging Methodology and Criteria for Switching: |

|

|

7 Events that may warrant suspended collections include a defaulted debt meeting the criteria for the military deployment benefit, pending discharge due to death, pending discharge due to TPD, and bankruptcy stay/hold.

8 Delinquent” is the only valid DCIA Delinquency Status for this aging methodology because based upon existing business processes, all Title IV debt held by GAs is delinquent.

[This page intentionally left blank.]

Sections 4.0–6.0 provide line-by-line instructions explaining the specific information required for each Data Set requirement. Appendixes B and C contain supplemental information which should be used when developing and preparing the Disposition Data.

The collective DCIA Compliance Data Set must comply with the requirements listed below.

Table 3.1.1 Common Requirements for the DCIA Compliance Data Set

-

Common Requirements

1.

Report “Number” as the quantity of debts (i.e., number of loans).

2.

Report “Dollars” as the sum of all amount types (i.e., principal, interest, and other fees9, if applicable) that result in activity or a balance.

3.

Sum all activity and balances for a line. If the total results in a debit balance, report the amount as positive. If the total results in a credit balance, report the amount as negative.

4.

Do not use commas for amounts that have four or more digits. For example,

$2,758.39 should be entered as 2758.39; 1,078 debts should be entered as 1078.

5.

Enter all dollar amounts rounded to the nearest cent/penny. Enter all debt quantities as whole numbers without cents/pennies.

6.

Enter a debt number of “0” and dollar amount of “0.00”, unless otherwise stated, if there are no debts that meet the reporting requirements for a given line.

7.

Do not password protect report files unless required to by FSA or your agency’s data protection policies (i.e., because the files contain personally identifiable information or sensitive data).

8.

Submit each data requirement as a Comma-Separated Value [Comma Delimited] (CSV) file and follow the layout specified.

9 Examples of possible other fees include late charges, collection costs, and attorney’s fees.

Each Data Set requirement section follows a consistent outline or format. Specifically, each requirement contains the following sections:

Purpose

Scope

Frequency

A high-level overview/summary of the Data Set requirement

Line-by-line instructions

A presentation of the Data Set in Microsoft (MS) Excel format.

Each Data Set requirement references the following file layout terms:

-

File Layout Term

Description

Data Element Name

Required field (or “column”) name

Line Name

Required line (or “row”) name

Portfolio Data

Loan data that meets the criteria for each Line Name (i.e., Number and Dollars values reflected in the GA’s system of record)

Identifier Data

GA Code and Reporting Period information required for each line

The specific requirements for each report’s Data Element Names, Line Names, Portfolio Data, and Identifier Data are described in the following sections. GAs should follow the file layout requirement presented for each Data Set requirement as it will ensure that FSA will be able to consolidate data received from multiple GAs across multiple periods of time.

The remainder of this document and the examples presented will focus on a fictitious GA (i.e., GA 999) and its DCIA Compliance Data Set submission for the month-ending March 31, fiscal year (FY) 2020.

The MR-24 Collections Terminations Write-Off Data Set (Write-Off Data) is required in order to monitor GA compliance with IRS Form 1099-C reporting.

The scope of the data is debt reported on GAFR line MR-24 Collection Terminations during the previous calendar year (CY) (i.e., January through December).

Table

4.2

Reporting

Period

Scope

of

Collection

Terminations

Table

4.2

Reporting

Period

Scope

of

Collection

Terminations

Current Reporting Period |

|

Reporting Period Scope of Collection Terminations to Report (I.E., Previous Calendar Year) |

|||

FY |

Quarter |

Reporting Cycle Calendar Month/Year |

|

||

FY 2023 |

Q1 |

October |

2022 |

|

Collection terminations reported during the previous CY (i.e., 2021). |

November |

2022 |

= |

|||

December |

2022 |

|

|||

Q2 |

January |

2023 |

|

Collection terminations reported during the previous CY (i.e., 2022)*. |

|

February |

2023 |

|

|||

March |

2023 |

|

|||

Q3 |

April |

2023 |

|

||

May |

2023 |

= |

|||

June |

2023 |

|

|||

Q4 |

July |

2023 |

|

||

August |

2023 |

|

|||

September |

2023 |

|

|||

* Per IRS requirements, if filing electronically, reporting entities must submit Form 1099-C to the IRS by the end of March immediately following the end of the CY being reported (i.e., Form 1099-Cs for collection terminations reported during calendar 2022 should be submitted to the IRS by March 2023).

Each GA must prepare Write-Off Data annually. Per IRS requirements, electronically filed Form 1099-Cs are due by the end of March immediately following the end of the CY being reported. Therefore, in accordance with the IRS’ March 31st deadline for electronically filed Form 1099-Cs, Write-Off Data is due to FSA in the following month (i.e., in April of each year).

The Write-Off Data Set captures information related to activity reported on MR-24 during the previous CY and allocates it by disposition type (i.e., reported to the IRS, not reported to the IRS because the amount was less than $600, and not reported to the IRS for other reasons). The Write-Off Data is reported to FSA via the following Data Elements:

Disposition status (i.e., line name)

Number

Dollars

GA code

Calendar year.

Line 1 - Data Element Names

Report the five required Data Element Names as shown in the table below.

-

Data Element

Data Element Name

1

DISPOSITION_OF_COLLECTION_TERMINATIONS

2

NUMBER

3

DOLLARS

4

GA_CODE

5

CALENDAR_YEAR

Line 1 should display as follows:

![]()

Line 2 - Collection Terminations Reported During the Previous Calendar Year

Report the total collection terminations reported on MR-24 during the previous CY.

The table below lists the Data Elements and criteria to report.

-

Data Element

Criteria

Example

DISPOSITION_ OF

_COLLECTION

_TERMINATIONS

Line Name

Report “Collection Terminations Reported During the Previous Calendar Year”.

NUMBER

Number (i.e., quantity of debts) that meets the scope of the line.

If 5,478 loans meet the criteria for this line, report the value as “5478”.

DOLLARS

Dollar (i.e., debt/loan amount) value that meets the scope of the line.

If $879,652.15 meets the criteria for this line, report the value as “879652.15”.

GA_CODE

3-digit GA Code

Report “999”.

CALENDAR_YEAR

4-digit CY

Report “2019”.

-

Note About Line 2 Collection Terminations Reported During the Previous Calendar Year

Line 2 serves as a control and must agree to the sum of principal, interest and other amounts for the preceding 12-month CY as reported on GAFR line MR-24. If a GA submits this Data Set and Row 2 does not agree to the preceding 12-month CY MR-24 total, FSA will reject the GA’s submission and return it for correction.

Line 2 should display as follows:

![]()

Line 3 - Reported to IRS on Form 1099-C

Report the amount of total collection terminations reported on MR-24 during the previous CY (i.e., reported on Line 2) and reported to the IRS via Form 1099-C.

The table below lists the Data Elements and criteria to report.

-

Data Element

Criteria

Example

DISPOSITION_ OF

_COLLECTION

_TERMINATIONS

Line Name

Report “Reported to IRS on Form 1099-C”.

NUMBER

Number (i.e., quantity of debts) that meets the scope of the line.

If 72 loans meet the criteria for this line, report the value as “72”.

DOLLARS

Dollar (i.e., debt/loan amount) value that meets the scope of the line.

If $24,893.54 meets the criteria for this line, report the value as “24893.54”.

GA_CODE

3-digit GA Code

Report “999”.

CALENDAR_YEAR

4-digit CY

Report “2022”.

Line 3 should display as follows:

![]()

Line 4 - Not Reported and Eligible for 1099-C but Not Required (Less than $600)

Report the amount of total collection terminations reported on MR-24 during the previous CY (i.e., reported on Line 2) that were eligible for 1099-C reporting but were not reported to the IRS via Form 1099-C.

The table below lists the Data Elements and criteria to report.

-

Data Element

Criteria

Example

DISPOSITION_ OF

_COLLECTION

_TERMINATIONS

Line Name

Report “Not Reported and Eligible for 1099-C but Not Required (Less than $600)”.

NUMBER

Number (i.e., quantity of debts) that meets the scope of the line.

If 10 loans meet the criteria for this line, report the value as "10”.

DOLLARS

Dollar (i.e., debt/loan amount) value that meets the scope of the line.

If $5,789.87 meets the criteria for this line, report the value as “5789.87”.

GA_CODE

3-digit GA Code

Report “999”.

CALENDAR_YEAR

4-digit CY

Report “2022”.

Line 4 should display as follows:

![]()

Line 5 - Not Reported to IRS on Form 1099-C (Must Footnote)

Subtract Line 3 and Line 4 from Line 2.

The table below lists the Data Elements and criteria to report.

-

Data Element

Criteria

Example

DISPOSITION_ OF

_COLLECTION

_TERMINATIONS

Line Name

Report “Not Reported to IRS on Form 1099-C (Must Footnote)”.

NUMBER

The balance remaining after subtracting the Number value of Line 3 and Line 4 from Line 2.

Report the Numbers result of subtracting Line 3 and Line 4

from Line 2 (i.e., 5,396) as

“5396”.

DOLLARS

The balance remaining after subtracting the Dollars amount of Line 3 and Line 4 from Line 2.

Report the Dollars result of subtracting Line 3 and Line 4 from Line 2 (i.e., $84,8968.74) as “848968.74”.

GA_CODE

3-digit GA Code

Report “999”.

CALENDAR_YEAR

4-digit CY

Report “2022”.

Note About

Line 5

Not

Reported

to IRS

on Form

1099-C

Line 5 should represent collection terminations from the prior CY

that were not reported to the IRS on Form 1099-C due to reasons

other than being less the $600. The reason(s) for not reporting to

the IRS debt included on this line must be explained in a separate

footnote. The explanation can be included in the body of the

submission email or added as a separate MS Word file attachment. See

Section 7.0 Submission to FSA for more information.

Line 5 should display as follows:

![]()

The GAs should use the following file naming configuration.

Table 4.6 Write-Off Data File Naming Configuration

Required File Naming Configuration |

Example |

yyyymm-WOFF-ccc Where

|

GA 999 will name the CSV or text file for Write-Off Data as of March 31, 2023 as follows:

|

If the Write-Off Data Set is prepared correctly, when uploaded to MS Excel or MS Access, the Data Set will display as shown:

Note About

Abnormal

Balances

The expected sign for all debt quantities and dollar amounts for

this Data Set is positive. Any abnormal balances must be researched

and explained. The

explanation can be included in the body of the submission email or

added as a separate MS Word file attachment.

See Section 7.0 Submission to FSA for more information.

[This page intentionally left blank.]

The MR-32 Loan Ending Balance Aging Data Set (Aging Data) is required in order to age debt per DCIA and to facilitate determining a debt’s eligibility for TOP referral.

The scope of the data is debt reported on GAFR line MR-32 Ending Balance of Defaulted Loans as of fiscal month-end.

Each GA must prepare the Aging Data as of each fiscal month-end for which it also prepares a GAFR report (i.e., monthly).

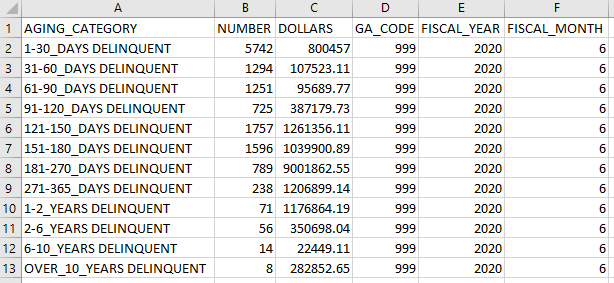

The Aging Data captures additional information related to the ending balance of defaulted debt reported on MR-32. The debt is aged per the applicable DCIA aging methodologies (see Section 2.0) and grouped into categories based on the number of days the debt is delinquent. The Aging Data is reported to FSA via the following Data Elements:

Aging category (i.e., days delinquent)

Number

Dollars

GA code,

Fiscal year

Fiscal month

Line 1 - Data Element Names

Report the six required Data Element Names as shown in the table below.

-

Data Element

Data Element Name

1

AGING_CATEGORY

2

NUMBER

3

DOLLARS

-

Data Element

Data Element Name

4

GA_CODE

5

FISCAL_YEAR

6

FISCAL_MONTH

Line 1 should display as follows:

![]()

Line 2–13 - Debt by Age of Delinquency

Report the quantity of debts and loan ending balance by the age category10.

The required Line Names are the aging categories listed in the table below. The categories are listed by line number.

-

Line

AGING_CATEGORY

2

1–30 Days Delinquent

3

31–60 Days Delinquent

4

61–90 Days Delinquent

5

91–120 Days Delinquent

6

121–150 Days Delinquent

7

151–180 Days Delinquent

8

181–270 Days Delinquent

9

271–365 Days Delinquent

10

1–2 Years Delinquent

11

2–6 Years Delinquent

12

6–10 Years Delinquent

13

Over 10 Years Delinquent

10 The loan ending balance is derived from the GA’s system of record and corresponds to the balance the GA reported on GAFR line MR-32 as of the month-end reporting date.

-

Note About Aging Categories

FSA customized the age categories for the Aging Data Set to reflect unique requirements of HEA Title IV debt. Specifically, FSA segregated the age categories into 30-day increments to allow breaks at 120, 180, and 270 days delinquent.

As an example, the table below lists the Data Elements and criteria to report for Line 2, 1–30 Days Delinquent. Note: Lines 3–13 would follow the same format.

Data Element |

Criteria |

Example |

AGING_CATEGORY |

Debt that is 1 to 30 days delinquent. |

Report “1-30_DAYS_DELINQUENT”. |

NUMBER |

Number (i.e., quantity of debts) that meets the scope of the line. |

If 5,742 loans meet the criteria for this line, report the value as “5742”. |

DOLLARS |

Dollar (i.e., debt/loan amount) value that meets the scope of the line. |

If $800,457.00 meets the criteria for this line, report the value as “800457.00”. |

GA_CODE |

3-digit GA Code |

Report “999”. |

FISCAL_YEAR |

4-digit FY |

Report “2020”. |

FISCAL_MONTH |

2-digit fiscal month |

Report “06”. |

Line 2 should display as follows:

![]()

-

Note About Lines 2–13

The sum of the total Dollars value of Lines 2–13 must equal the Dollars value reported on MR-32 of the GAFR. If a GA submits this Data Set and the total of these lines does not equal MR-32, FSA will reject the GA’s submission and return it for correction.

The GAs should use the following file naming configuration.

Table 5.6 Aging Data File Naming Configuration

Required File Naming Configuration |

Example |

yyyymm-AGNG-ccc Where

|

GA 999 will name the CSV for Aging Data as of March 31, 2023 as follows:

|

If the Aging Data Set is prepared correctly, when uploaded to MS Excel or MS Access, the data will display as shown:

Note About

Abnormal

Balances

The expected sign for all debt quantities and dollar amounts for

this Data Set is positive. Any abnormal balances must be researched

and explained. The

explanation can be included in the body of the submission email or

added as a separate MS Word file attachment.

See Section 7.0 Submission to FSA for more information.

The MR-32 & MR-41 Loan Ending Balance Disposition Data Set (Disposition Data) is needed to monitor GA compliance with DCIA TOP Referral reporting.

The scope of the data is debt reported on GAFR lines MR-32 Ending Balance of Defaulted Loans and MR-41 Ending Balance on Bankruptcies as of the fiscal month-end.

Each GA must prepare the Disposition Data as of each fiscal month-end for which it also prepares a GAFR report (i.e., monthly).

The Disposition Data captures the combined debt quantities and loan ending balances from the GA’s system of record that correspond to the balances the GA reported on GAFR lines MR-32 and MR-41 as of the same month-end. It summarizes and reports amounts according to the disposition of these debts in the most recent (weekly) TOP referral process executed by the GA before month-end (TOP Referral Process Disposition) and further classifies them by Delinquency Group.

The Disposition Data is reported to FSA via the following ten Data Elements:

Line Name

Line prefix

Line suffix

BizOps number

Line short name

Delinquency group

Portfolio Data

Number

Dollars

Identifier Data

GA code

Fiscal year

Fiscal month

Each debt is mapped to the Disposition Data based on its TOP Referral Process Disposition as identified by the most recent (weekly) TOP referral process executed prior to month-end for the reporting period and is reported on one line only. Data Elements 1–4 collectively identify each

unique TOP Referral Process Disposition reportable as of month-end, while Data Element 5 further classifies the identified debt quantities and dollar amounts into one of three delinquency groups (1-120 days delinquent, 121-180 days, or > 180 days delinquent) using the DCIA Aging methodology described in Section 2.0 of this document. As a result, each TOP Referral Process Disposition is mapped to three consecutive lines ordered by delinquency group. The unique set of values on each line in Data Elements 1–5 comprise the Line Name and provide the reporting scope criteria for the Portfolio Data elements NUMBER and DOLLARS as of the reporting date.

Value

Definition

Purpose

a

Certified

AND

Active

Identifies the disposition

of debts (within scope as of the

reporting

date)

in the most

recent (weekly) GA TOP Referral Process.

b

Not

Subject

to TOP

c

Due

Process

Pending

Completion

d

Excluded/Inactivated via

DCIA

Compliant

Exclusion

e

Excluded/Inactivated

via

FSA business

rule exception

f

Debt

Rejected

by

Treasury and

temporarily excluded

g

Debt excluded via FSA

Temporary

Generic

Hold11

h

Debt excluded via FSA’s

Unenforceable Debt Discharge

business

process12

i

Debt

not

referred/inactivated

that did not meet the requirements

to

report

in

any prior

category

Identifies debts within

scope

as

of the

reporting

date, not

previously reported.

Data Element |

Data Element Name |

Data Element Definition |

1 |

LINE_PREFIX |

1-character code (“a” through “i”) assigned by FSA to group reported portfolio data into one of nine categories as follows: |

11 Category not applicable to GAs

12 This policy exemption is tracked as a separate category in DMCS; in the GA Disposition Data it is included in section “e” with all the other identified TOP referral business rule exemptions.

Data Element |

Data Element Name |

Data Element Definition |

2 |

LINE_SUFFIX |

3-digit code (“000”–“999”)13 assigned by FSA to identify the reporting sequence of each reporting line short name within each “LINE_PREFIX” report category. |

3 |

BIZOPS_NO |

3-digit code (“001”–“999” or “N/A” (Not Applicable)) assigned by FSA to identify the TOP Referral Exclusion/ Exception/Instruction business rule and definition per Appendix C that defines the debt to be reported on the line, based on debt’s disposition in the most recent weekly TOP referral. Appendix C maps each FSA TOP Referral business rule to the corresponding Disposition Data line number. Leading zeros are added to the FSA TOP Referral BizOps Number to produce the corresponding three-digit BIZOPS_NO code. E.g., “1” becomes “001”, “10” becomes “010”, etc. If debt was not excluded from TOP referral based on an FSA business rule (e.g., because debt WAS referred, or debt was not in portfolio at time of last TOP referral, etc.) then no business rule is applicable and “N/A” is entered in this field. |

4 |

LINE_SHORT_NAME |

Text required by FSA that briefly describes the disposition post-TOP referral of debt to be reported on the line. |

13 The Disposition Data Set format is designed to facilitate FSA’s consolidation of data received from GAs and DMCS into one data set for analysis. The DMCS-only reporting categories in the Data Elements BIZOPS_NO, LINE_PREFIX, and LINE_SUFFIX have been omitted, resulting in gaps in the sequence numbers

Permitted

value

Definition

1–120_DAYS

At

least

one*,

but

no

more

than

120 days

delinquent

121–180_DAYS

At

least

121,

but

no

more

than

180 days

delinquent

OVER_180_DAYS

More than

180

days

delinquent

Data Element |

Data Element Name |

Data Element Definition |

5 |

DELINQUENCY_GROUP |

One of three delinquency categories that describe, as of the reporting month-end date, the number of days the debt reported on the line is delinquent, per DCIA- compliant aging (as described in Section 2.0 of this document).

*If a debt is acquired via a FFEL default claim on the month- end reporting date, then its calculated age will be zero days delinquent. However, since ALL debts acquired via a default claim are considered delinquent from the moment of acquisition, such debts must be reported in the “1-120_DAYS” delinquency group.

Note: The aging methodology used for the Disposition Data is identical to that used for the Aging Data, except that for the Disposition Data all debts are aggregated into one of only three delinquency groups. |

6 |

NUMBER |

Number (i.e., quantity of debts) that meets the scope of the line as defined by the Line Name, as of the reporting date. |

7 |

DOLLARS |

Dollar (i.e., debt/loan amount) value that meets the scope of the line as defined by the Line Name. |

8 |

GA_CODE |

3-digit GA Code |

9 |

FISCAL_YEAR |

4-digit FY |

10 |

FISCAL_MONTH |

2-digit fiscal month |

Line 1 - Data Element Names

Report the ten required Data Element Names as shown in the table below.

-

Data Element

Data Element Name

1

LINE_PREFIX

2

LINE_SUFFIX

3

BIZOPS_NO

4

LINE_SHORT_NAME

5

DELINQUENCY_GROUP

6

NUMBER

7

DOLLARS

8

GA_CODE

9

FISCAL_YEAR

10

FISCAL_MONTH

Line 1 should display as follows:

![]()

For the Disposition Data lines 2–124, the Identifier Data elements will have identical values on every line for each GA in any given reporting period. If GA 999 prepared Disposition Data as of March 31, 2023, it would report the following values on every line:

-

Identifier Data Element

Criteria

Example

GA_CODE

3-digit GA Code

Report “999”.

FISCAL_YEAR

4-digit FY

Report “2023”.

FISCAL_MONTH

2-digit FY month

Report “06”.

Therefore, the remainder of this section omits the above-mentioned Data Elements from the tables presented.

Note About the Disposition Data Line Name Values

The Disposition Data format is designed to facilitate FSA’s consolidation of data received from GAs and DMCS into one data set for analysis. The DMCS-only reporting categories for the Data Elements BIZOPS_NO, LINE_PREFIX, and LINE_SUFFIX, have been omitted, resulting in gaps in the sequence numbers.

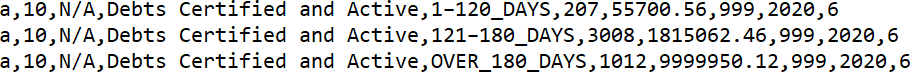

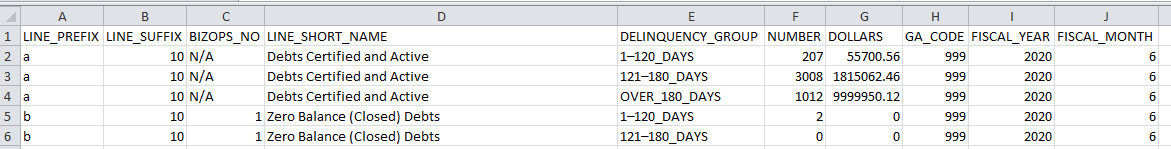

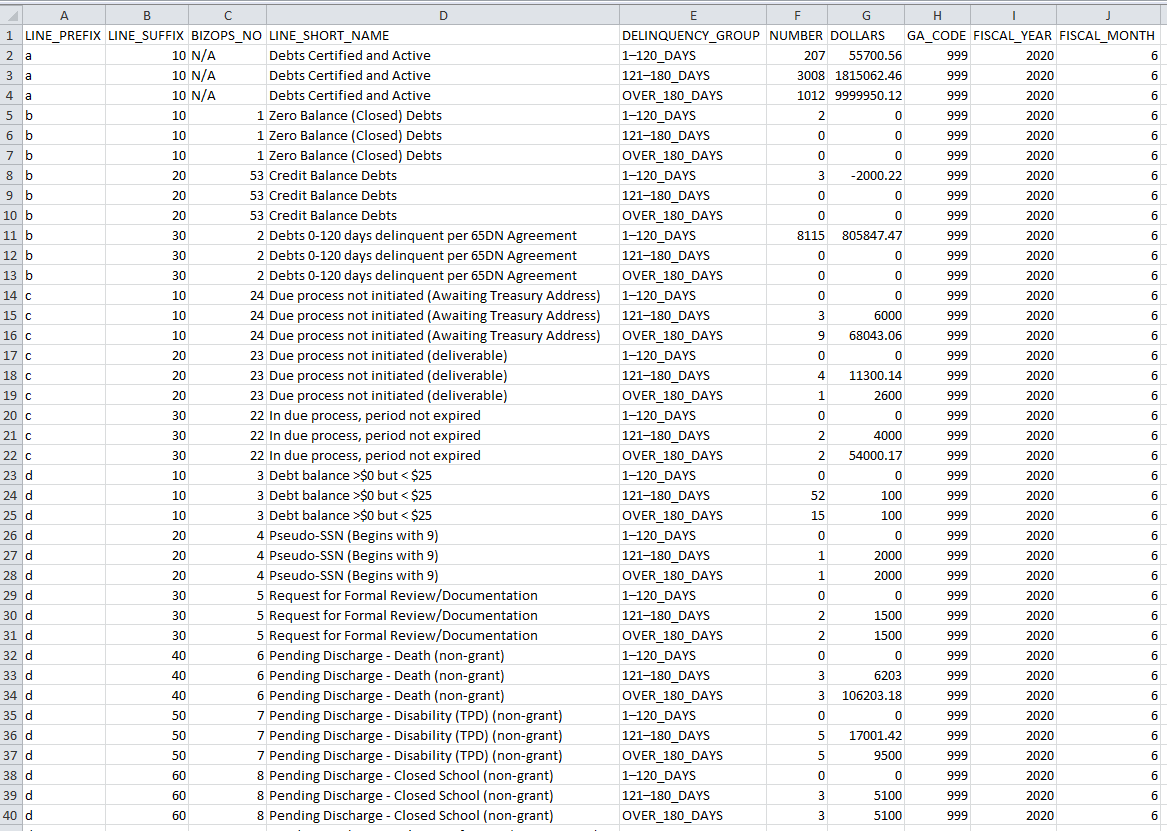

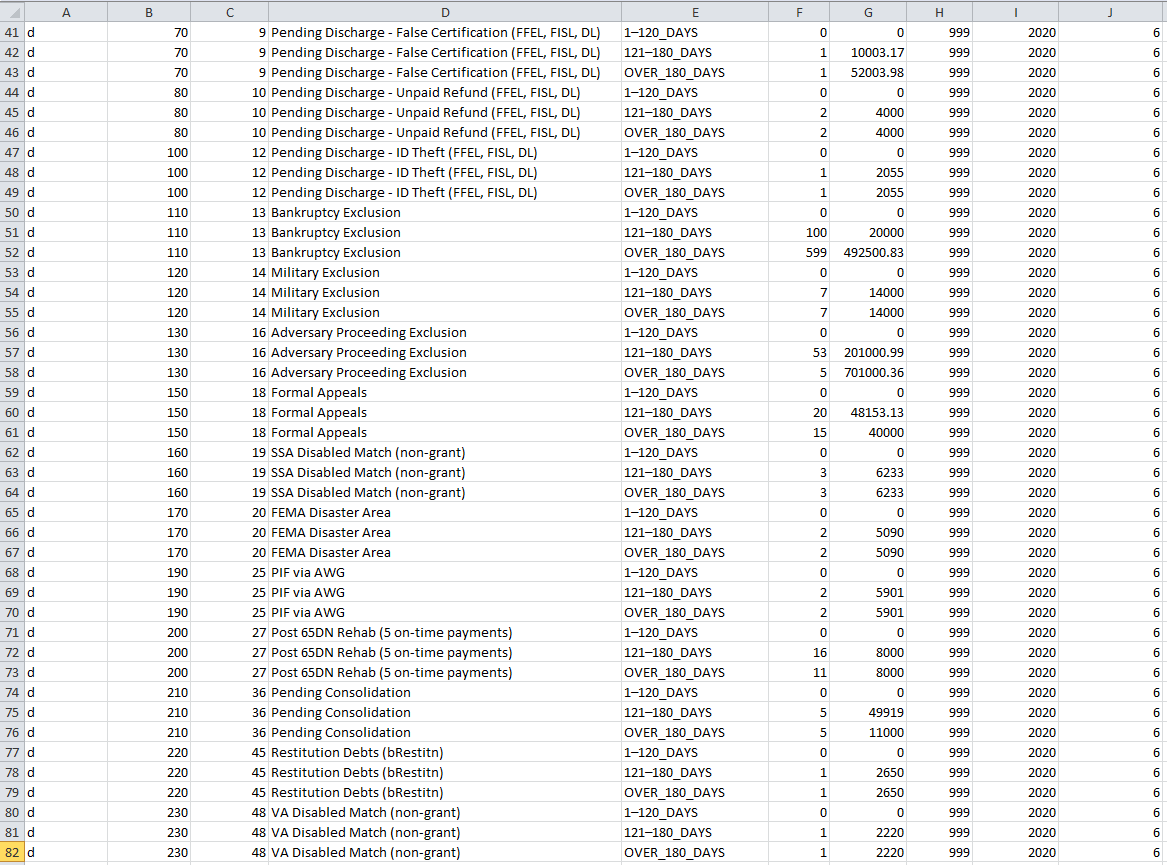

Lines 2–4: Debt Certified and Active

Report on each line (as Number and Dollars respectively) the combined debt quantities and loan ending balances from the GA’s system of record that correspond to the balances the GA reported on GAFR lines MR-32 and MR-41 as of the month-end reporting date that, based on the most recent weekly TOP Referral prior to the reporting month-end, have a TOP Referral Process Disposition “Debt Certified and Active” AND meet the line’s DELINQUENCY_GROUP criteria. If GA 999 identified the following debt:

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Certified and Active” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

2 |

a |

10 |

N/A |

Debts Certified and Active |

1-120 _DAYS |

207 |

55,700.56 |

3 |

a |

10 |

N/A |

Debts Certified and Active |

121-180 _DAYS |

3,008 |

1,815,062.46 |

4 |

a |

10 |

N/A |

Debts Certified and Active |

OVER_180 _DAYS |

1,012 |

9,999,950.12 |

Based on the criteria above, the sample Lines 2–4 would display as follows:

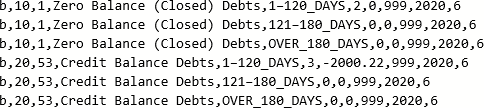

Lines 5–118: Debt Not Certified/Inactivated Based on TOP Referral Business Rule

Report on each line (as Number and Dollars respectively) the combined debt quantities and loan ending balances from the GA’s system of record that correspond to the balances the GA reported on GAFR lines MR-32 and MR-41 as of the month-end reporting date for any debts NOT “Certified and Active” (or, if previously certified, inactivated) because, based on the most recent weekly TOP Referral prior to the reporting month-end, they have a TOP Referral Process Disposition that meets the requirements of the FSA TOP Referral business rule in Appendix C that maps to the line’s required BIZOPS_NO value AND meet the line’s DELINQUENCY_GROUP criteria. If GA 999 identified the following debt:

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

5 |

b |

10 |

1 |

Zero Balance (Closed) Debts |

1-120 _DAYS |

2 |

- |

6 |

b |

10 |

1 |

Zero Balance (Closed) Debts |

121-180 _DAYS |

- |

- |

7 |

b |

10 |

1 |

Zero Balance (Closed) Debts |

OVER_180 _DAYS |

- |

- |

8 |

b |

20 |

53 |

Credit Balance Debts |

1-120 _DAYS |

3 |

(2,000.22) |

9 |

b |

20 |

53 |

Credit Balance Debts |

121-180 _DAYS |

- |

- |

10 |

b |

20 |

53 |

Credit Balance Debts |

OVER_180 _DAYS |

- |

- |

11 |

b |

30 |

2 |

Debts 0-120 days delinquent per 65DN Agreement |

1-120 _DAYS |

8,115 |

805,847.47 |

12 |

b |

30 |

2 |

Debts 0-120 days delinquent per 65DN Agreement |

121-180 _DAYS |

- |

- |

13 |

b |

30 |

2 |

Debts 0-120 days delinquent per 65DN Agreement |

OVER_180 _DAYS |

- |

- |

14 |

c |

10 |

24 |

Due process not initiated (Awaiting Treasury Address) |

1-120 _DAYS |

- |

- |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

15 |

c |

10 |

24 |

Due process not initiated (Awaiting Treasury Address) |

121-180 _DAYS |

3 |

6,000.00 |

16 |

c |

10 |

24 |

Due process not initiated (Awaiting Treasury Address) |

OVER_180 _DAYS |

9 |

68,043.06 |

17 |

c |

20 |

23 |

Due process not initiated (deliverable) |

1-120 _DAYS |

- |

- |

18 |

c |

20 |

23 |

Due process not initiated (deliverable) |

121-180 _DAYS |

4 |

11,300.14 |

19 |

c |

20 |

23 |

Due process not initiated (deliverable) |

OVER_180 _DAYS |

1 |

2,600.00 |

20 |

c |

30 |

22 |

In due process, period not expired |

1-120 _DAYS |

- |

- |

21 |

c |

30 |

22 |

In due process, period not expired |

121-180 _DAYS |

2 |

4,000.00 |

22 |

c |

30 |

22 |

In due process, period not expired |

OVER_180 _DAYS |

2 |

54,000.17 |

23 |

d |

10 |

3 |

Debt balance >$0 but < $25 |

1-120 _DAYS |

- |

- |

24 |

d |

10 |

3 |

Debt balance >$0 but < $25 |

121-180 _DAYS |

52 |

100.00 |

25 |

d |

10 |

3 |

Debt balance >$0 but < $25 |

OVER_180 _DAYS |

15 |

100.00 |

26 |

d |

20 |

4 |

Pseudo-SSN (Begins with 9) |

1-120 _DAYS |

- |

- |

27 |

d |

20 |

4 |

Pseudo-SSN (Begins with 9) |

121-180 _DAYS |

1 |

2,000.00 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

28 |

d |

20 |

4 |

Pseudo-SSN (Begins with 9) |

OVER_180 _DAYS |

1 |

2,000.00 |

29 |

d |

30 |

5 |

Request for Formal Review/Document ation |

1-120 _DAYS |

- |

- |

30 |

d |

30 |

5 |

Request for Formal Review/Document ation |

121-180 _DAYS |

2 |

1,500.00 |

31 |

d |

30 |

5 |

Request for Formal Review/Document ation |

OVER_180 _DAYS |

2 |

1,500.00 |

32 |

d |

40 |

6 |

Pending Discharge - Death (non-grant) |

1-120 _DAYS |

- |

- |

33 |

d |

40 |

6 |

Pending Discharge - Death (non-grant) |

121-180 _DAYS |

3 |

6,203.00 |

34 |

d |

40 |

6 |

Pending Discharge - Death (non-grant) |

OVER_180 _DAYS |

3 |

106,203.18 |

35 |

d |

50 |

7 |

Pending Discharge - Disability (TPD) (non-grant) |

1-120 _DAYS |

- |

- |

36 |

d |

50 |

7 |

Pending Discharge - Disability (TPD) (non-grant) |

121-180 _DAYS |

5 |

17,001.42 |

37 |

d |

50 |

7 |

Pending Discharge - Disability (TPD) (non-grant) |

OVER_180 _DAYS |

5 |

9,500.00 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

38 |

d |

60 |

8 |

Pending Discharge - Closed School (non-grant) |

1-120 _DAYS |

- |

- |

39 |

d |

60 |

8 |

Pending Discharge - Closed School (non-grant) |

121-180 _DAYS |

3 |

5,100.00 |

40 |

d |

60 |

8 |

Pending Discharge - Closed School (non-grant) |

OVER_180 _DAYS |

3 |

5,100.00 |

41 |

d |

70 |

9 |

Pending Discharge - False Certification (FFEL, FISL, DL) |

1-120 _DAYS |

- |

- |

42 |

d |

70 |

9 |

Pending Discharge - False Certification (FFEL, FISL, DL) |

121-180 _DAYS |

1 |

10,003.17 |

43 |

d |

70 |

9 |

Pending Discharge - False Certification (FFEL, FISL, DL) |

OVER_180 _DAYS |

1 |

52,003.98 |

44 |

d |

80 |

10 |

Pending Discharge - Unpaid Refund (FFEL, FISL, DL) |

1-120 _DAYS |

- |

- |

45 |

d |

80 |

10 |

Pending Discharge - Unpaid Refund (FFEL, FISL, DL) |

121-180 _DAYS |

2 |

4,000.00 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

46 |

d |

80 |

10 |

Pending Discharge - Unpaid Refund (FFEL, FISL, DL) |

OVER_180 _DAYS |

2 |

4,000.00 |

47 |

d |

100 |

12 |

Pending Discharge - ID Theft (FFEL, FISL, DL) |

1-120 _DAYS |

- |

- |

48 |

d |

100 |

12 |

Pending Discharge - ID Theft (FFEL, FISL, DL) |

121-180 _DAYS |

1 |

2,055.00 |

49 |

d |

100 |

12 |

Pending Discharge - ID Theft (FFEL, FISL, DL) |

OVER_180 _DAYS |

1 |

2,055.00 |

50 |

d |

110 |

13 |

Bankruptcy Exclusion |

1-120 _DAYS |

- |

- |

51 |

d |

110 |

13 |

Bankruptcy Exclusion |

121-180 _DAYS |

100 |

20,000.00 |

52 |

d |

110 |

13 |

Bankruptcy Exclusion |

OVER_180 _DAYS |

599 |

492,500.83 |

53 |

d |

120 |

14 |

Military Exclusion |

1-120 _DAYS |

- |

- |

54 |

d |

120 |

14 |

Military Exclusion |

121-180 _DAYS |

7 |

14,000.00 |

55 |

d |

120 |

14 |

Military Exclusion |

OVER_180 _DAYS |

7 |

14,000.00 |

56 |

d |

130 |

16 |

Adversary Proceeding Exclusion |

1-120 _DAYS |

- |

- |

57 |

d |

130 |

16 |

Adversary Proceeding Exclusion |

121-180 _DAYS |

53 |

201,000.99 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

58 |

d |

130 |

16 |

Adversary Proceeding Exclusion |

OVER_180 _DAYS |

5 |

701,000.36 |

59 |

d |

150 |

18 |

Formal Appeals |

1-120 _DAYS |

- |

- |

60 |

d |

150 |

18 |

Formal Appeals |

121-180 _DAYS |

20 |

48,153.13 |

61 |

d |

150 |

18 |

Formal Appeals |

OVER_180 _DAYS |

15 |

40,000.00 |

62 |

d |

160 |

19 |

SSA Disabled Match (non-grant) |

1-120 _DAYS |

- |

- |

63 |

d |

160 |

19 |

SSA Disabled Match (non-grant) |

121-180 _DAYS |

3 |

6,233.00 |

64 |

d |

160 |

19 |

SSA Disabled Match (non-grant) |

OVER_180 _DAYS |

3 |

6,233.00 |

65 |

d |

170 |

20 |

FEMA Disaster Area |

1-120 _DAYS |

- |

- |

66 |

d |

170 |

20 |

FEMA Disaster Area |

121-180 _DAYS |

2 |

5,090.00 |

67 |

d |

170 |

20 |

FEMA Disaster Area |

OVER_180 _DAYS |

2 |

5,090.00 |

68 |

d |

190 |

25 |

PIF via AWG |

1-120 _DAYS |

- |

- |

69 |

d |

190 |

25 |

PIF via AWG |

121-180 _DAYS |

2 |

5,901.00 |

70 |

d |

190 |

25 |

PIF via AWG |

OVER_180 _DAYS |

2 |

5,901.00 |

71 |

d |

200 |

27 |

Post 65DN Rehab (5 on-time payments) |

1-120 _DAYS |

- |

- |

72 |

d |

200 |

27 |

Post 65DN Rehab (5 on-time payments) |

121-180 _DAYS |

16 |

8,000.00 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

73 |

d |

200 |

27 |

Post 65DN Rehab (5 on-time payments) |

OVER_180 _DAYS |

11 |

8,000.00 |

74 |

d |

210 |

36 |

Pending Consolidation |

1-120 _DAYS |

- |

- |

75 |

d |

210 |

36 |

Pending Consolidation |

121-180 _DAYS |

5 |

49,919.00 |

76 |

d |

210 |

36 |

Pending Consolidation |

OVER_180 _DAYS |

5 |

11,000.00 |

77 |

d |

220 |

45 |

Restitution Debts (bRestitn) |

1-120 _DAYS |

- |

- |

78 |

d |

220 |

45 |

Restitution Debts (bRestitn) |

121-180 _DAYS |

1 |

2,650.00 |

79 |

d |

220 |

45 |

Restitution Debts (bRestitn) |

OVER_180 _DAYS |

1 |

2,650.00 |

80 |

d |

230 |

48 |

VA Disabled Match (non-grant) |

1-120 _DAYS |

- |

- |

81 |

d |

230 |

48 |

VA Disabled Match (non-grant) |

121-180 _DAYS |

1 |

2,220.00 |

82 |

d |

230 |

48 |

VA Disabled Match (non-grant) |

OVER_180 _DAYS |

1 |

2,220.00 |

83 |

d |

240 |

47 |

Hardship |

1-120 _DAYS |

- |

- |

84 |

d |

240 |

47 |

Hardship |

121-180 _DAYS |

11 |

7,500.15 |

85 |

d |

240 |

47 |

Hardship |

OVER_180 _DAYS |

1 |

3,500.00 |

86 |

d |

250 |

50 |

Court-Ordered Settlement |

1-120 _DAYS |

- |

- |

87 |

d |

250 |

50 |

Court-Ordered Settlement |

121-180 _DAYS |

1 |

2,100.00 |

88 |

d |

250 |

50 |

Court-Ordered Settlement |

OVER_180 _DAYS |

32 |

2,100.00 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

89 |

d |

260 |

51 |

Litigation Hold |

1-120 _DAYS |

- |

- |

90 |

d |

260 |

51 |

Litigation Hold |

121-180 _DAYS |

1 |

3,500.00 |

91 |

d |

260 |

51 |

Litigation Hold |

OVER_180 _DAYS |

1 |

73,598.44 |

92 |

e |

10 |

26 |

SSN Change |

1-120 _DAYS |

- |

- |

93 |

e |

10 |

26 |

SSN Change |

121-180 _DAYS |

1 |

1,950.00 |

94 |

e |

10 |

26 |

SSN Change |

OVER_180 _DAYS |

1 |

1,950.00 |

95 |

e |

70 |

33 |

Pending Discharge - 9/11 Survivors (Grants, FFEL, FISL) |

1-120 _DAYS |

- |

- |

96 |

e |

70 |

33 |

Pending Discharge - 9/11 Survivors (Grants, FFEL, FISL) |

121-180 _DAYS |

1 |

3,750.00 |

97 |

e |

70 |

33 |

Pending Discharge - 9/11 Survivors (Grants, FFEL, FISL) |

OVER_180 _DAYS |

1 |

3,750.00 |

98 |

e |

100 |

40 |

Borrower Defense (FFEL, Perkins) |

1-120 _DAYS |

- |

- |

99 |

e |

100 |

40 |

Borrower Defense (FFEL, Perkins) |

121-180 _DAYS |

1 |

2,670.00 |

100 |

e |

100 |

40 |

Borrower Defense (FFEL, Perkins) |

OVER_180 _DAYS |

1 |

9,541.60 |

101 |

e |

120 |

15 |

Unenforceable Debt Discharge Process |

1-120 _DAYS |

- |

- |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

102 |

e |

120 |

15 |

Unenforceable Debt Discharge Process |

121-180 _DAYS |

2 |

4,259.00 |

103 |

e |

120 |

15 |

Unenforceable Debt Discharge Process |

OVER_180 _DAYS |

1 |

2,000.00 |

104 |

e |

130 |

46 |

Pending Subrogation |

1-120 _DAYS |

- |

- |

105 |

e |

130 |

46 |

Pending Subrogation |

121-180 _DAYS |

20 |

18,000.54 |

106 |

e |

130 |

46 |

Pending Subrogation |

OVER_180 _DAYS |

5 |

812,000.77 |

107 |

e |

140 |

44 |

Mixed (Debit/Credit) Balance Debts |

1-120 _DAYS |

- |

- |

108 |

e |

140 |

44 |

Mixed (Debit/Credit) Balance Debts |

121-180 _DAYS |

1 |

4,500.00 |

109 |

e |

140 |

44 |

Mixed (Debit/Credit) Balance Debts |

OVER_180 _DAYS |

1 |

4,500.00 |

110 |

e |

150 |

52 |

Closed debt with debit balance |

1-120 _DAYS |

- |

- |

111 |

e |

150 |

52 |

Closed debt with debit balance |

121-180 _DAYS |

1 |

1,900.00 |

112 |

e |

150 |

52 |

Closed debt with debit balance |

OVER_180 _DAYS |

1 |

1,900.00 |

113 |

e |

160 |

54 |

Unrelated EIN matches borrower SSN |

1-120 _DAYS |

- |

- |

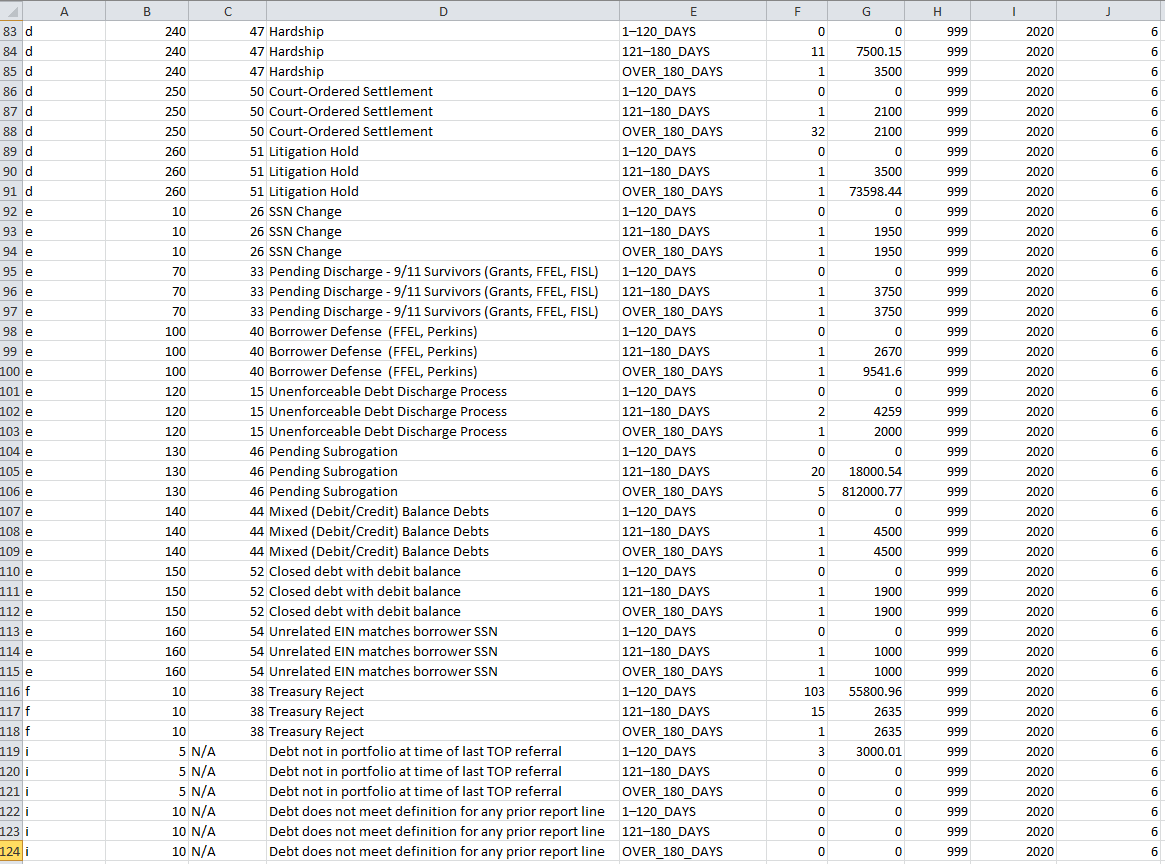

114 |

e |

160 |

54 |

Unrelated EIN matches borrower SSN |

121-180 _DAYS |

1 |

1,000.00 |

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Certified/Inactivated Based on TOP Referral Business Rule” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

115 |

e |

160 |

54 |

Unrelated EIN matches borrower SSN |

OVER_180 _DAYS |

1 |

1,000.00 |

116 |

f |

10 |

38 |

Treasury Reject |

1-120 _DAYS |

103 |

55,800.96 |

117 |

f |

10 |

38 |

Treasury Reject |

121-180 _DAYS |

15 |

2,635.00 |

118 |

f |

10 |

38 |

Treasury Reject |

OVER_180 _DAYS |

1 |

2,635.00 |

Based on the criteria above, sample Lines 5–10 would display as follows:

Note About

Disposition

Data Lines

8, 9

and 10

Disposition Data

Lines 8,

9 and

10 report debts

with a

credit balance. Enter

the debt

quantity (NUMBER) as a positive number but the amount

(DOLLAR) as a negative amount.

These are the only data lines where a negative dollar amount

will be reported, unless the net amount meeting the reporting

criteria for any other line is abnormal.

Lines 119–121: Debt Not Tested

Report on each line (as Number and Dollar respectively) the combined debt quantities and loan ending balances from the GA’s system of record that correspond to the balances the GA reported on GAFR lines MR-32 and MR-41 as of the month-end reporting date for debts that were not tested for TOP Referral Disposition because they were not in scope at the time of the last (weekly) TOP referral before month-end AND also meet the line’s DELINQUENCY_GROUP criteria. If GA 999 identified the following debt:

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Tested” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

119 |

i |

5 |

N/A |

Debt not in portfolio at time of last TOP referral |

1-120 _DAYS |

3 |

3,000.01 |

120 |

i |

5 |

N/A |

Debt not in portfolio at time of last TOP referral |

121-180 _DAYS |

- |

- |

121 |

i |

5 |

N/A |

Debt not in portfolio at time of last TOP referral |

OVER_18 0 _DAYS |

- |

- |

Based on the criteria above, sample Lines 119–121 would display as follows:

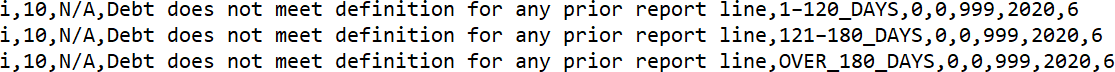

Lines 122–124: Debt Not Otherwise Classified

Report on each line (as Number and Dollar respectively) the combined debt quantities and loan ending balances from the GA’s system of record that correspond to the balances the GA reported on GAFR lines MR-32 and MR-41 as of the month-end reporting date for debts that did not meet the reporting criteria for any prior line (i.e., Lines 2–121) AND also meet the line’s DELINQUENCY_GROUP criteria. If GA 999 identified the following debt:

Line |

Debt in Scope on Reporting Date with TOP Referral Process Disposition: “Debt Not Otherwise Classified” |

||||||

Line Name |

Portfolio Data |

||||||

LINE_ PREFIX |

LINE_ SUFFIX |

BIZOPS _NO |

LINE_ SHORT_NAME |

DELINQ- UENCY_ GROUP |

NUMBER |

DOLLAR |

|

122 |

i |

10 |

N/A |

Debt does not meet definition for any prior report line |

1-120 _DAYS |

- |

- |

123 |

i |

10 |

N/A |

Debt does not meet definition for any prior report line |

121-180 _DAYS |

- |

- |

124 |

i |

10 |

N/A |

Debt does not meet definition for any prior report line |

OVER_180 _DAYS |

- |

- |

Based on the criteria above, sample lines 122–124 would display as follows:

-

Note About Disposition Data Lines 122–124 Debt Not Otherwise Classified

Since the TOP referral process is designed to identify the appropriate disposition of every debt within the GA portfolio that meets the scope definition on the date the TOP referral process is executed, no dollar amount or debt quantity is expected to be reported on these lines. Any valid dollar amount and debt quantity reported represents either debt that was incorrectly mapped or debt with characteristics that the referral or reporting process did not identify. The GA must fully research any such debt quantity or dollar amount reported and provide a detailed written explanation when the Disposition Data Set is submitted, either included in the body of the submission email or attached as a separate MS Word file.

Note About Validation of Data Before Submission |

It is FSA’s expectation that GAs will carefully review the Disposition Data Set each month prior to submission to ensure on-going compliance with the Disposition Data requirements. The review should include, but is not limited to, the following Data Validation Tests. FSA will reject the Disposition Data submitted if it does not comply with requirements or if a required explanation is not provided. |

Validation Test 1 – Validate Number of Disposition Data Lines Against Requirement

The Disposition Data Requirements detailed in Section 6.5 above explicitly require that each GA submit Disposition Data that includes 124 lines (including the Data Element Names in Line 1).

FSA will reject the Disposition Data if the total number of lines is not equal to 124.

-

Note About Disposition Data Validation Test 1

Validation Test 1 serves as a control for the Disposition Data and must result in a calculated line number variance of zero. If a GA submits Disposition Data where this test results in a variance other than zero, FSA will reject the GA’s submission and return it for correction.

Validation Test 2 – Validate Disposition Data Against Control Total

The Disposition Data requirements described in Section 6.5 above are designed to capture the combined debt quantities and loan ending balances from the GA’s system of record that correspond to the balances the GA reported on GAFR lines MR-32 and MR-41 as of the month- end reporting date. FSA will validate the Disposition Data submitted by each GA against the sum of the MR-32 and MR-41 GAFR lines the GA submitted for the same reporting period. For example, assume GA 999 submitted a GAFR and Disposition Data with the following data as of March 31, 2023:

-

Validation - Debt in Scope on Reporting Date

Data Source

Dollar Amount

GAFR Line MR–32

15,169,908.06

GAFR Line MR–41

563,824.23

Subtotal: Disposition Data Control Total

15,733,732.29

Total Dollar amount reported in Disposition Data Element “Dollars”, Lines 2–124

15,733,732.29

Control Difference:

0.00

Since the Control Difference is zero, the Disposition Data would PASS Validation Test

-

Note About Disposition Data Validation Test 2

Validation Test 2 serves as a control for the Disposition Data and must result in a calculated Control Difference value of zero. If a GA submits Disposition Data where this test results in a Control Difference value other than zero, FSA will reject the GA’s submission and return it for correction.

The GAs should use the following file naming configuration.

Table 6.7 Disposition Data File Naming Configuration

Required File Naming Configuration |

Example |

yyyymm- DISP-ccc Where

|

GA 999 will name the Disposition Data as of March 31, 2023 as follows:

|

If the Disposition Data Set is prepared correctly, when uploaded to MS Excel or MS Access, the data will display as shown:

The above image shows only the first few lines of the Disposition Data. For a complete example, please refer to Appendix B.

Note About Abnormal Balances

Except for Lines 8–10, the expected sign for all debt quantities and dollar amounts in this Data Set is positive. Any abnormal balances must be researched and explained. The explanation can be included in the body of the submission email or added as a separate MS Word file attachment. See Section 7.0 Submission to FSA for more information.

[This page intentionally left blank.]

Note About Validation of Data Before Submission |

To ensure on-going compliance with the DCIA Compliance Data Set requirements, FSA will perform a quality control review of the GA’s submission package for each reporting period. This review will include confirming that the GA’s submission agrees with the related GAFR MR lines and that variance explanations have been provided when required. FSA will reject the submission if it does not reconcile to the highlighted MR lines or if a required explanation is not provided. GAs must therefore review their submissions carefully prior to delivery. |

GAs can prepare the DCIA Compliance Data Set in Excel; however, the files must be saved and submitted to FSA as individual CSV files. For example, if a GA submits a GAFR for a reporting period that has FFEL Program activity or balances, then the GA must also submit separate CSV files - one for each of the required Data Sets.

GAs must submit the following as appropriate:

The applicable individual Data Set files,

The Disposition Data explanation (i.e., for “Debt Not Otherwise Classified”), if necessary,

The required Write-Off Data explanation, if necessary and

Any abnormal activity or balance explanations, if necessary.

Explanations can be included in the body of the submission email or added as a separate MS Word file attachment. Additionally, submitted files should not be password protected unless required by the GA’s or FSA’s data protection policies (i.e., because the files contain personally identifiable information or sensitive data).

GAs should prepare an email with the contents of the submission package attached and send it to the following FSA email addresses:

To: [email protected] CC: [email protected]

Please indicate the reporting month and FY in the subject line of the email as follows:

Table 7.2 Submission Email Subject Line

Subject Line |

Example |

DCIA Compliance Data Set mm–yyyy

Where

|

For the reporting period ending March 31, 2023, the subject line should be as follows:

|

GAs must submit the DCIA Compliance Data Set no later than close of business (COB) on the due date specified below.

Table 7.3 DCIA Compliance Data Set Due Dates

FY Reporting Period End Date |

Applicable to the Following Months |

Due Date |

Number of Data Sets Required to Be Submitted |

If month-end… |

Oct, Nov, Jan, Feb, April, May, Jul, and Aug |

COB 12th business day of the following month. |

2 Data Sets* |

If quarter-end… |

Mar |

COB 8th business day of the following month. |

3 Data Sets** |

If quarter-end… |

Dec, Jun, and Sep |

COB 8th business day of the following month. |

2 Data Sets* |

* Write-Off Data Set isn’t required

** Write-Off Data Set is required

Business day is based upon the Federal government calendar. COB is 5 p.m. Eastern time.

Appendixes

[This page left intentionally blank.]

Appendix A – Sample GAFR / ED Form 2000

Appendix A – Sample GAFR / ED Form 2000

Note: The sample GAFR presented below is for example purposes only. Its purpose is to highlight the relationship between specific GAFR MR lines and the DCIA Compliance Data Set.

[This page intentionally left blank.]

Appendix B – Presentation of MR-32 & MR-41 Loan Ending Balance Disposition Data Set in Microsoft Excel Format

MR-32C

&

MR-41

Loan

Ending

Balance

Disposition

Data

Set

(Disposition

Data)

MR-32C

&

MR-41

Loan

Ending

Balance

Disposition

Data

Set

(Disposition

Data)

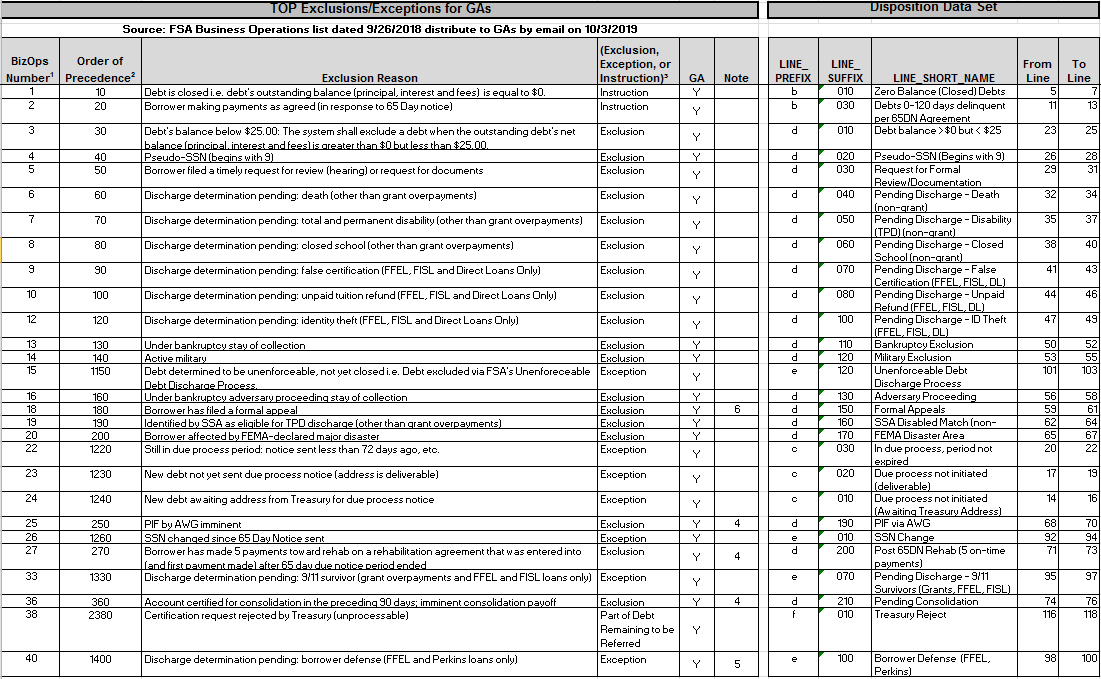

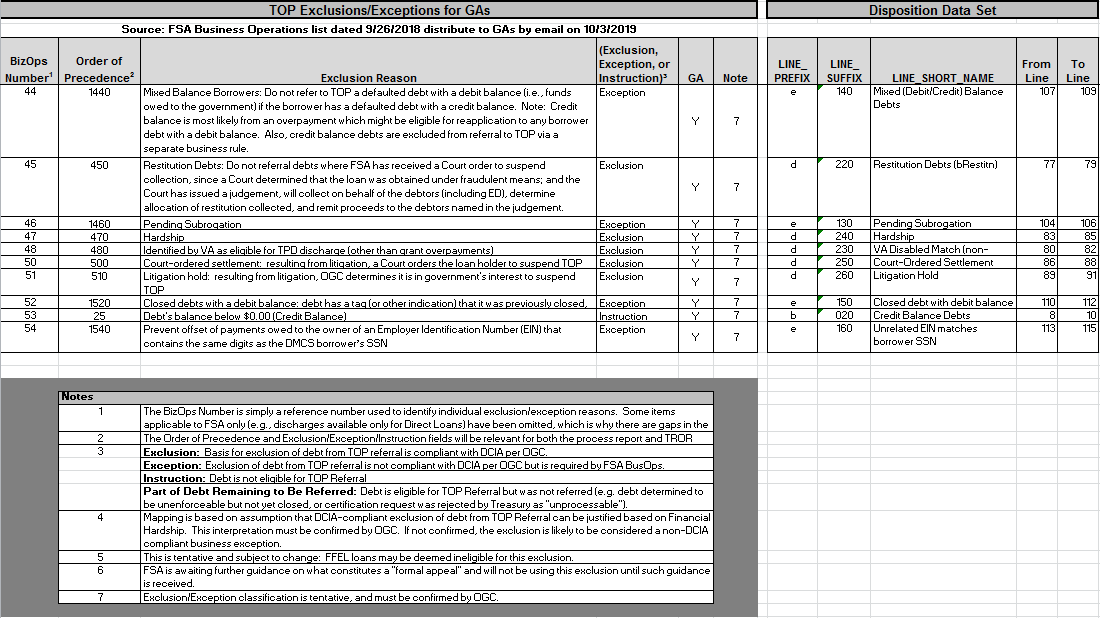

Appendix C – Mapping GA TOP Referral Business Rules to MR-32 & MR-41 Loan Ending Balance Disposition Data Set Lines

Mapping of FSA GA TOP Referral Business Rules to Disposition Data Line Numbers

Note About Top Exclusions/Exceptions for GAs |

The TOP Referral Exclusion/Exception Business Rules for GAs are the responsibility of Program Operations. Questions concerning the TOP referral business process are outside the scope of this document and should be addressed to Program Operations accordingly. |

[This page intentionally left blank.]

Appendix D – Guaranty Agency List

Appendix D – Guaranty Agency List

GA Code |

GA State |

GA Name |

708 |

Colorado |

Colorado Student Loan Program dba College Assist |

712 |

Florida |

Florida Department of Education, Office of Student Financial Assistance (OSFA) |

721 |

Kentucky |

Kentucky Higher Education Assistance Authority (KHEAA) |

722 |

Louisiana |

Louisiana Office of Student Financial Assistance (LOSFA) |

725 |

Massachusetts |

American Student Assistance dba Massachusetts Higher Education Assistance Corporation (MHEAC) |

726 |

Michigan |

Michigan Guaranty Agency (MGA) |

731 |

Nebraska |

Nebraska or National Student Loan Program (NSLP) |

733 |

New Hampshire |

New Hampshire Higher Education Assistance Foundation |

735 |

New Mexico |

New Mexico Student Loan Guarantee Corporation |

736 |

New York |

Higher Education Services Corporation (HESC) |

737 |

North Carolina |

North Carolina State Education Assistance Authority (NCSEAA) |

740 |

Oklahoma |

Oklahoma College Assistance Program (OCAP) |

742 |

Pennsylvania |

Pennsylvania Higher Education Assistance Agency (PHEAA) |

748 |

Texas |

Texas Guaranteed Student Loan Corporation |

749 |

Utah |

Utah Higher Education Assistance Authority (UHEAA) |

750 |

Vermont |

Vermont Student Assistance Corporation (VSAC) |

755 |

Wisconsin |

Ascendium Education Solutions |

927 |

Minnesota |

Educational Credit Management Corporation I |

951 |

Minnesota |

Educational Credit Management Corporation II |

Appendix E – Glossary of Acronyms

Appendix E – Glossary of Acronyms

Acronym / Term |

Description |

65-Day Notice Period |

Required period of notification to the borrower that delinquent Title IV debt will be sent to TOP for administrative offset unless the borrower enters into a Rehabilitation Agreement or Repayment Agreement prior to the end of the 65-day notice period or responds with a timely Request for Review or Request for Documents. The 65-Day Notice sent during this period satisfies the requirement to complete TOP due process before referring a debt to TOP. |

Aging Data |

MR-32 Loan Ending Balance Aging Data Set |

CFOC |

Chief Financial Officers’ Council |

Claim Date |

The date a Guaranty Agency pays a lender’s claim. |

COB |

Close of Business |

Congress |

The United States Congress |

CSV |

Comma-Separated Value (Comma Delimited) |

CY |

Calendar Year |

DCIA |

Debt Collection Improvement Act of 1996, as amended |

DCIA Compliance Data Set |

DCIA Aging and Compliance Data Set (i.e., the three Data Set requirements, collectively) |

Department |

United States Department of Education |

Disposition Data |

MR-32 & MR-41 Loan Ending Balance Disposition Data Set |

Exception |

A set of criteria, not authorized by DCIA, that when met FSA excludes a debt from referral to TOP or inactivates a debt already at TOP. This set of criteria is based upon FSA policy. An example of excepted debt is debt determined to be unenforceable but not yet closed out. |

Exclusion |

A set of criteria that is compliant with DCIA, that when met, FSA may exclude a debt from referral to TOP or inactivate a debt already at TOP as authorized by DCIA. Examples of excluded debt include debt less than $25 dollars, debt in bankruptcy, etc. |

FFEL |

Federal Family Education Loan Program |

Form 1099-C |

IRS Form 1099-C, Cancellation of Debt |

FSA |

Federal Student Aid |

FY |

Fiscal Year |

GA |

Guaranty Agency |

Acronym / Term |

Description |

GAFR |

Guaranty Agency Financial Report (ED Form 2000) |

HEA |

Higher Education Act of 1965, as amended |

IRS |

Internal Revenue Service |

LLR |

Lender-of-Last Resort |

MR |

Monthly Report |

MR-24 |

Collection Terminations (GAFR Line Reference) |

MR-32 |

Ending Balance of Defaulted Loans (GAFR Line Reference) |

MR-41 |

Ending Balance on Bankruptcies (GAFR Line Reference) |

MS |

Microsoft |

OGC |

Office of General Counsel |

OMB |

Office of Management and Budget |

Rehabilitation Agreement |

Default resolution agreement available to qualified defaulted Title IV borrowers under the terms of which if the borrower makes nine on-time payments (i.e., pays within 20 days of the due date) during a period of ten consecutive months, the debt will be considered “rehabilitated.” The rehabilitated loan is repurchased by a lender or assigned to FSA, clearing the default and resetting the delinquency age to zero (i.e., “current” ). |

Reinsurance Date |

The date the Department reimburses a GA for a previously paid claim. |

Repayment Agreement |

For the DCIA aging, the term Repayment Agreement is reserved to refer to any non-rehabilitation repayment agreement entered into by the borrower after the default of their Title IV debt. |

Title IV |

Title IV of the Higher Education Act of 1965, as amended |

TOP |

Treasury Offset Program |

TPD |

Total and Permanent Disability |

Treasury |

United States Department of Treasury |

Write-Off Data |

MR-24 Collection Terminations Write-Off Data Set |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | [email protected];[email protected] |

| File Modified | 0000-00-00 |

| File Created | 2023-08-29 |

© 2026 OMB.report | Privacy Policy