Final Report

Emergency Rental Assistance Program (ERA1)

1027 Addendum Guidance ERA1 Final Report 2022-11-02

Final Report

OMB: 1505-0266

P re-Decisional

- DRAFT

re-Decisional

- DRAFT

Addendum to ERA

Reporting Guidance -- ERA1 Final Report

Page

DRAFT

Addendum

to ERA Reporting Guidance

ERA1 Final Report

Table of Contents

Tab: Expenditures in Closeout Period 6

Closeout Expenditures Associated with the Grantee’s Obligations Less than $30,000 6

Closeout Period Expenditures (Payments) made to Individuals 7

Tab: Subrecipients, Contractors, and Direct Payees (Obligations of $30,000 or More) 8

Tab: Subawards, Contracts and Direct Payments (Obligations of $30,000 or more) 9

Tab: Expenditures Made Over the Period of Performance 10

Obligations and Expenditures (Payments) to Individuals 14

Tab: Summary (Cumulative) Amounts of Expenditures 15

Tab: Participants and Services Provided 16

Participant Household Payment Data File 18

Tab: Report Certification and Submittal 19

Optional Customer Service Survey 19

Introduction

This document outlines the requirements for submitting ERA1 Final Reports.

The ERA1 Final Report requires grantees to provide summary and cumulative information for all activities, achievements and uses of ERA1 award funds over the entire ERA1 project period of performance. The ERA1 Final Report structure is very similar to ERA1 quarterly reports. In general, the final report requires grantees to:

Review and verify certain information from previously submitted quarterly reports, and make revisions, if needed. This requirement applies to previously submitted information on subrecipients, subawards and expenditures;

Report cumulative amounts for the key programmatic outputs (also reported on the quarterly reports, such as numbers of participants served, number of participants receiving rental assistance, and so forth);

Report cumulative financial information;

Submit a cumulative Participant Household Payment Data File.

Grantees must submit the ERA1 Final Reports through Treasury’s Portal for Reporting using id.me or login.gov.

Please see the following documents for additional guidance on ERA1 reporting:

ERA1 Final Report worksheet ((link))

ERA Reporting Guidance ((link))

User Guide for Using Treasury’s Portal ((link))

ERA1 Closeout Documentation ((link))

Due Dates

The ERA1 Final report due date depends on whether the grantee received reallocated funds.

No ERA1 Reallocated Funds Received: January 30, 2023 – Due Date to certify and submit ERA1 Final Report: grantee award period of performance ended on September 30, 2022.

ERA1 Reallocated Funds Received: April 28, 2023 – Due Date to certify and submit ERA1 Final Report: grantee received an extended period of performance through December 29, 2022.

ERA1 Final

Report Contents

The

following pages provide details on the ERA1 Final Report

requirements. The information is organized by the Final Report’s

tabs/sections as noted below.

Tab: Grantee Profile

The

contents of this tab mirror the contents of the quarterly report

Profile tab. Data in this tab will be prepopulated with information

the grantee provided in its most recent quarterly report.

Task: Grantees should review the prepopulated information, verify it, and, if needed, input updated information. Simply manually type over the pre-populated data to provide the updates.

Grantee Profile

The prepopulated data points on this section are:

Grantee name, address and identifying information

Grantee UEI number

Grantee Taxpayer Identifying Number (TIN)

Grantee legal name

Grantee type (select from pick list)

Grantee street address

Grantee city, State and Zip Code

Official Points of Contact for the ERA award

Task: Grantees must review the prepopulated names and contact information of staff who were designed as the Grantee’s ERA Account Administrator for Reporting, ERA Point(s) of Contact for Reporting and ERA Authorized Representative for Reporting. Verify the accuracy of the prepopulated information and, if needed, input updated information.

It is important

to verify and update the designee names to ensure the portal will

accept the Final Report when it is certified and submitted. It is

important to ensure contact correct information for contacts as

Treasury will use this information if we have questions or additional

guidance on closeout or related issues in the future. You may

designate additional staff for each role to ensure Treasury is able

to contact the grantee in the future, if needed.

The Grantee’s Registration with SAM.gov (the Federal System for Award Management)

Task: Grantees should review the prepopulated information, verify it, and, if needed, input updated information. Manually type over the prepopulated data to provide the updates.

Tab: ERA1 Project Overview

The

contents on the Project Overview tab aligns with questions required

on the quarterly report, with a few changes as discussed below.

In the first two sections on this tab, the portal will prepopulate and display information the grantee provided in the most recent quarterly report.

Task: Grantees should review, verify, and if necessary, update the information prepopulated in the following sections.

ERA1 Project Information

Recipient (Grantee) Project ID. (This is the ID the grantee submitted previously.)

Name of the ERA1 Project.

ERA1 Website URL

Geographic Service Area for the ERA1 project

Narrative Descriptions of Three Features

Description of the Grantee’s System for Prioritizing Assistance for the ERA1 project and URL where the information is/was available for the public. If there is no website, the grantee must upload an electronic copy of publicly available information about the prioritization.

Description of the Grantee’s use of Fact-based Proxies for determining eligibility for the ERA1 project. If the grantee indicated “Yes,” review and update the previously submitted narrative description of the grantee’s process for utilizing the proxies.

Brief description(s) of the Grantee’s effective practices for sharing with the ERA community. (This is an optional item.) Please review and update any previously submitted items, and please do provide information on other effective practices that may be helpful for other rental assistance providers.

ERA1 Project Final Summary Narrative

Task: Grantees should provide a narrative statement as described below.

Grantees must provide a new narrative summary description of its ERA1 project overall. Grantees can either cut and paste the narrative into the on-screen text box or upload a narrative in a document in Word format. Please address the following topics in the summary description:

Accomplishments

Application Process

Project governance and management structure

Key participating organizations

Outreach strategies used

Services provided

Housing stability services provided

Other affordable rental housing and eviction prevention services provided

Plans for future action in extending the impact of the ERA project

Lessons learned for implementing emergency rent and utility payment projects generally and in the context of a disaster, and so forth.

Challenges faced

Other information you would like to highlight

Tab: Expenditures in Closeout Period

Grantees

must report payments (expenditures) made in the closeout period for

administrative costs.

Reminder: Recipients may expend ERA1 funds during the closeout period only for administrative costs incurred in the closeout period, which is the 120-day period from October 1, 2022, through January 30, 2023 for recipients that did not receive reallocated funds (closeout period is December 30, 2022 through April 28, 2023 if reallocated funds received). Grantees must have obligated award funds spent on administrative expenses during the closeout period before the end of their ERA1 award period of performance (September 30, 2022 or December 29, 2022).

Task: Grantees must categorize and report each of its closeout administrative cost expenditures and provide the associated information.

The process of reporting these expenditures is the same as required in the quarterly reports. Please see the User Guide (Section VII, pp. xx) for guidance on reporting expenditures.

We recommend grantees first categorize closeout administrative expenditures using the three standard expenditure categories listed below (as used in the quarterly reports). When ready, click on the appropriate links to navigate to the reporting section.

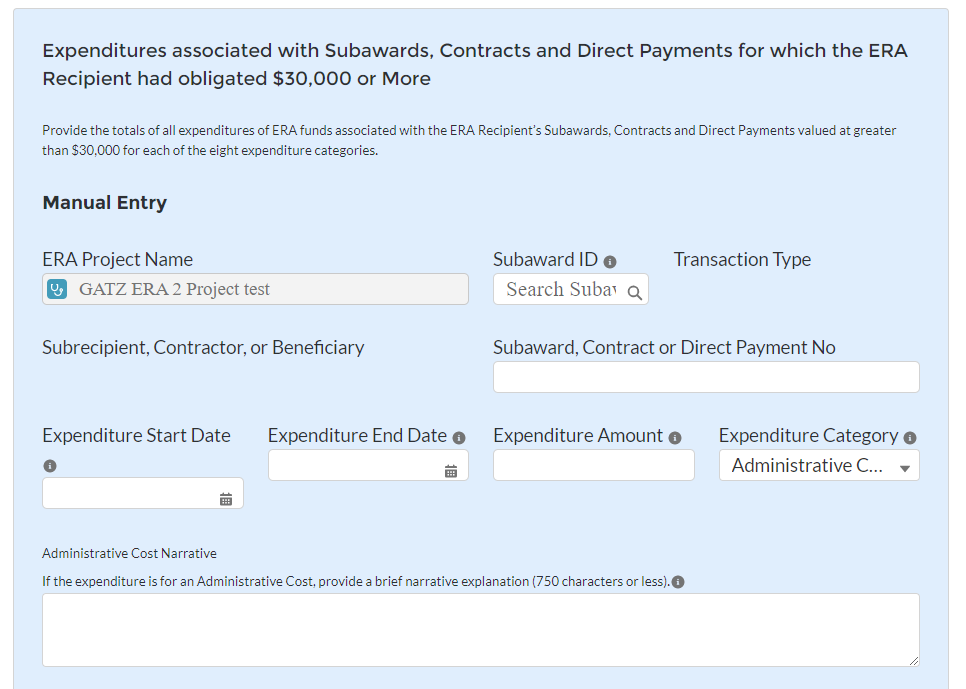

Closeout Expenditures Associated with the Grantee’s Subawards, Contracts or Direct Payments for which the Grantee had Obligated $30,000 or more

Required datapoints:

ERA Project Name (will be prepopulated)

Subaward ID (the ID of the subaward, contract or direct payment)

Transaction type

Name of Subrecipient, Contractor, or Direct Payee

Subaward, Contract, or Direct Payment Number

Expenditure Start Date

Expenditure End Date

Expenditure Amount

Expenditure Category (will be set to Administrative Costs)

Administrative Cost Narrative (text box for a brief explanation of the cost)

Closeout Expenditures Associated with the Grantee’s Obligations Less than $30,000

Required datapoints:

ERA Project Name (will be prepopulated)

Expenditure Category (will be limited to administrative cost category only)

Transaction Type (Subaward, Contract, Direct Payment)

Total amount of expenditures of this category for administrative costs in the closeout period

Administrative Cost Narrative (text box for a brief statement with information on the administrative costs included in this category)

Closeout Period Expenditures (Payments) made to Individuals

Required datapoints:

Project name (prepopulated)

Expenditure Category (will be limited to administrative costs category only)

Total amount of expenditures (payments) made to individuals for administrative costs in the closeout period.

Administrative Cost Narrative (text box for a brief statement with information on the administrative costs included in this category)

Three-Tab

Sequence on Reporting the Grantee’s Obligations and

Expenditures Over the Entire ERA1 Period of Performance

As part of the ERA1 Final Report, the grantee must review (and revise, if needed) previously reported obligations and expenditures covering the entire period of performance. The portal includes a sequence of three tabs for reviewing and revising the information (this sequence of tabs is the same as in the quarterly reports).

Tab 1: Subrecipients, Contractors, and Direct Payees

Tab 2: Subawards, Contracts and Direct Payments

Tab 3: Expenditures

The general function of each of the three tabs is described below.

When the grantee opens the tab, the portal will display an on-screen table displaying information the grantee reported in quarterly reports over the entire award period of performance. The grantee can choose either to:

Review and, if needed, revise previously reported information on-screen; or

Download the information in Excel format and review and make revisions in Excel. Those who choose to review the information in Excel format can upload the revised data to the portal database.

The following provides detailed guidance on each of the tabs in the sequence.

Tab: Subrecipients, Contractors, and Direct Payees (Associated

with Obligations of $30,000 or More)

Task: Grantees must review and make revisions, as appropriate, to previously submitted Subrecipient, Contractor and Direct Payee records.

Use this tab to review and make revisions, as appropriate, to records on the grantee’s subrecipients, contractors and direct payees to whom the grantee obligated a total of $30,000 or more in the project period as reported in quarterly reports.

Grantees may review the information either in Excel Format or on-screen.

Review in Excel Format

Grantees can choose to download a copy of these records to review the submitted information and make any needed revisions. Once complete, the grantee can use the portal’s bulk upload function to submit the file. The bulk upload function is the same as used for quarterly reports. See the User Guide for detailed instructions.

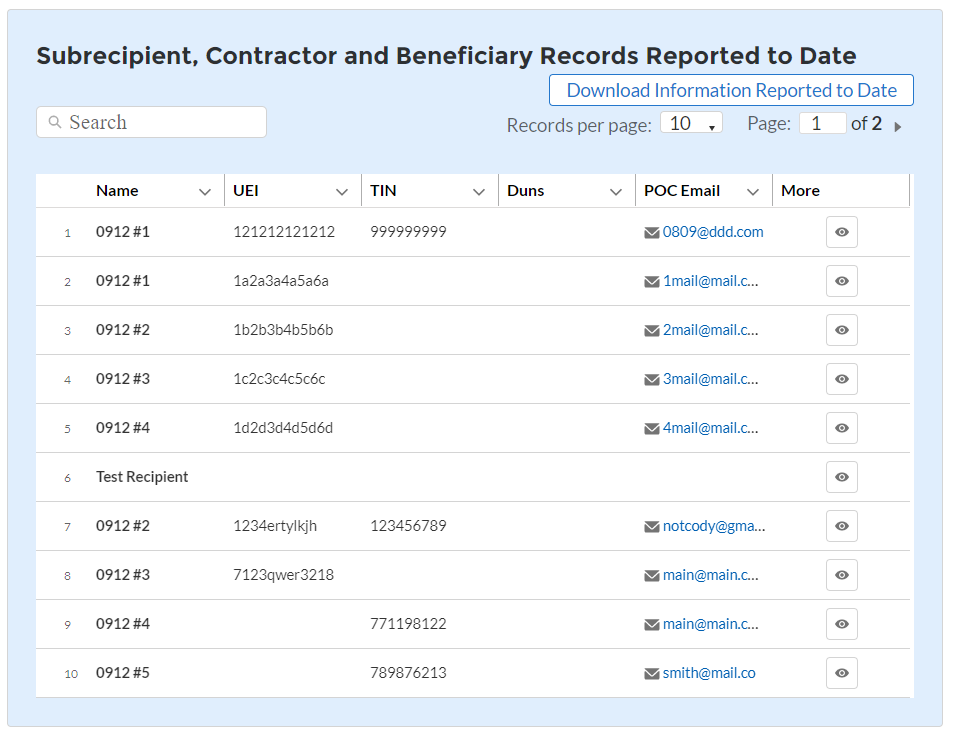

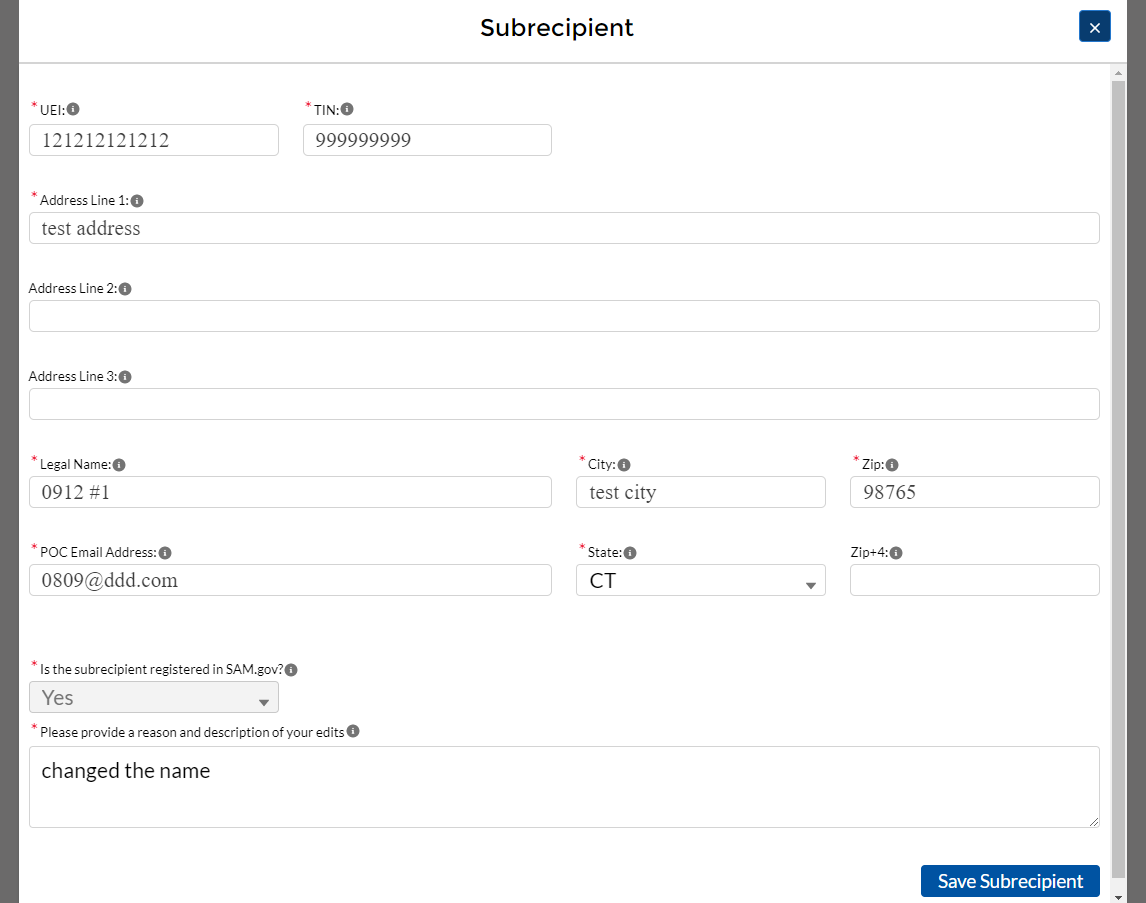

Review On-Screen

The portal will display an on-screen table listing information that the grantee had previously reported about its subrecipients, contractors and direct payees. The table will display basic information such as the name, address, and EUI and TIN numbers.

Grantees can review each record individually on-screen by clicking on the “eye” icon to open a detailed view. Grantees can revise the records, if needed, using the detailed view. Grantees are required to provide a narrative explanation for any revision they make. Figure 1 below depicts a sample on-screen table and the “eye” icon, and Figure 2 is a display of the detailed view of an individual record. The process for making revisions on-screen is the same used for the quarterly reports. Grantees must provide a narrative explanation for any revisions they make. See the User Guide for detailed instructions.

F igure

1 – Mock-Up of List of Subrecipient, Contract, and Direct Pay

Records

igure

1 – Mock-Up of List of Subrecipient, Contract, and Direct Pay

Records

Figure 2 – Mock-up of Details of Subrecipient, Contractor and Direct Payee Records for Making Revisions On-Screen

Tab: Subawards, Contracts and Direct Payments (Associated with Obligations of $30,000 or more)

Task: Grantees

must review and make revisions, as appropriate, to previously

submitted subaward, contract and direct payment records.

Use this tab to review information about the grantee’s Subawards, Contracts and Direct Payments (for which the Grantee obligated $30,000 or more over the award period of performance) as reported in quarterly reports.

The functionality of this tab is the same as the tab above. Grantees may review the information either in Excel Format or on-screen.

Review in Excel Format

Grantees may download a copy of these records to review and make any needed revisions. Once complete, the grantee can use the portal’s bulk upload function to submit the updated file. The bulk upload function is the same as used for quarterly reports. See the User Guide for detailed instructions.

Review On-Screen

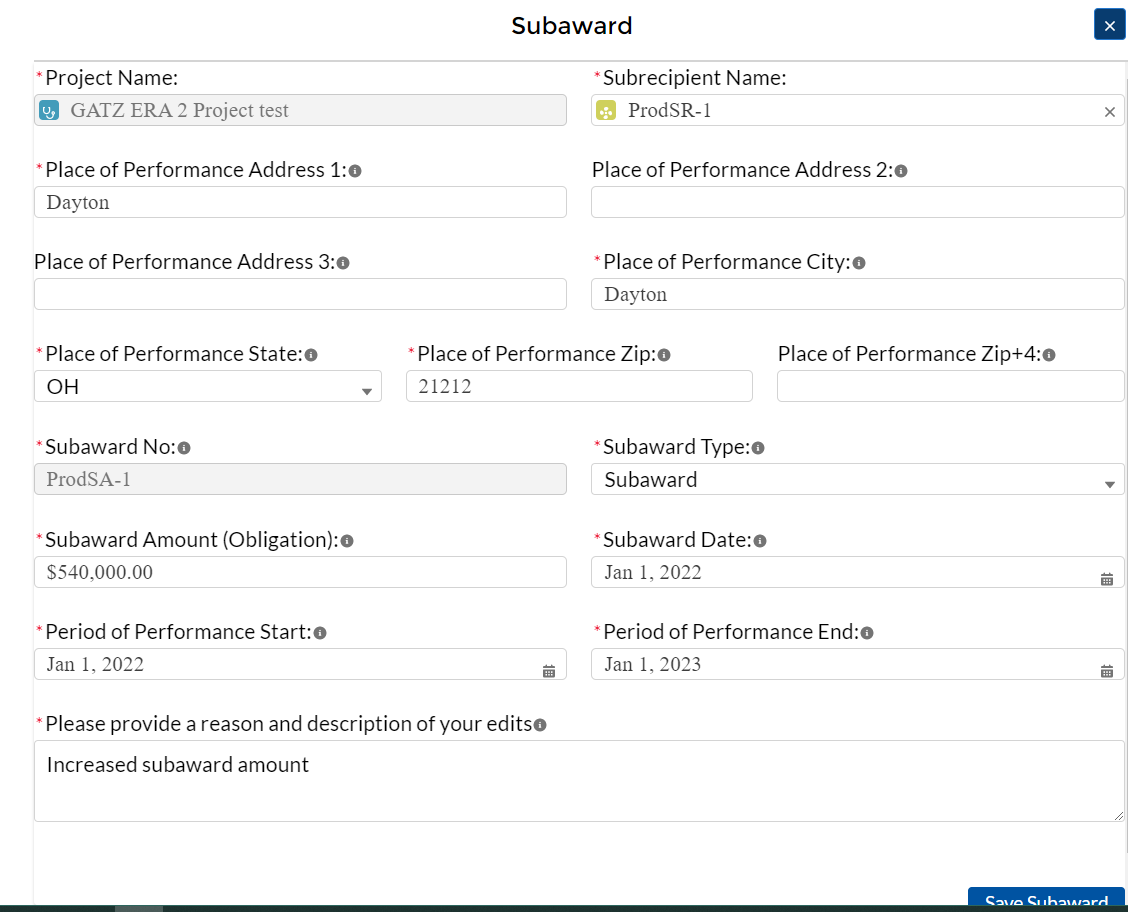

The portal will display an on-screen table of previously reported information on each of the Grantee’s subawards, contracts and direct payments set-up over the period of performance that involved obligations of $30,000 or more.

Information provided includes the name of the associated Subrecipient, Contractor or Direct Payee; the obligation amount(s); the type of transaction; the date of the transaction; and the start and end dates. Figure 3 displays an example. Grantees can review each record individually on-screen. Clicking on the “eye” icon will open a detailed view.

Grantees can revise records, if needed, by using the detailed view. Figure 4 depicts a sample of the detailed view for an individual record. The process for making revisions on-screen is the same as in the quarterly reports. Grantees must provide a narrative explanation for any revisions. See the User Guide for detailed instructions.

Figure 3 – Mock-Up of List of Subrecipient, Contract, and Direct Payment Records

Figure 4 – Mock-Up of Display Details of Subawards, Contracts or Direct Payment Records for Making Revisions On-Screen

Tab 3: Expenditures (Covering Full Period of Performance)

Task: Grantees must review and make revisions, as appropriate, to previously submitted expenditure records.

Grantees must review and make revisions, as appropriate, to expenditure records submitted with quarterly reports for each of the following three categories of expenditures:

Expenditures associated with the grantee’s obligations of $30,000 or more for subawards, contracts or direct payments

Expenditures associated with the grantee’s subawards, contracts, or direct payments valued at less than $30,000

Obligations and Expenditures to Individuals

The functionality for reviewing each category of expenditures is outlined below.

Expenditures Associated with the Grantee’s Obligations of $30,000 or more for Subawards, Contacts, or Direct Payments

Review in Excel Format

Grantees may download a copy of expenditure records to review and make any needed revisions. Once complete, the grantee can use the portal’s bulk upload function to submit the updated file. The bulk upload function is the same as used for quarterly reports. See the User Guide for detailed instructions.

Review On-Screen

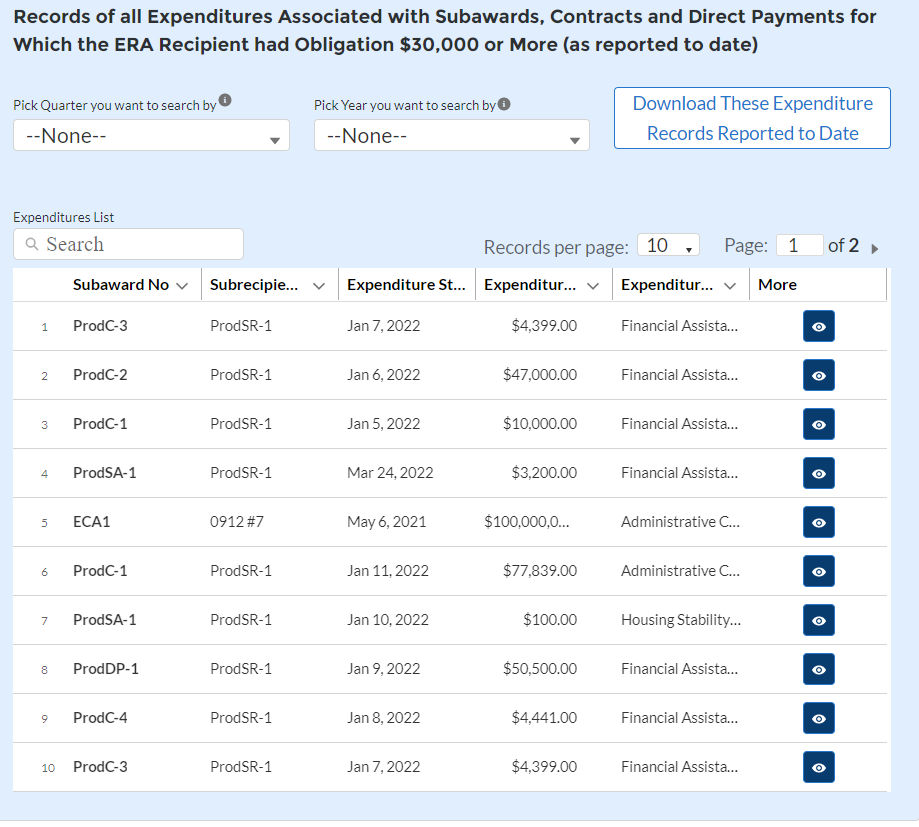

The portal will display an on-screen table of expenditures in this category previously reported by the grantee. Information provided includes the name of the subrecipient, contractor or direct payee that received the payment; the expenditure amount(s); the expenditure category; the transaction number; and the start and end dates. Figure 5 provides an example.

Figure 5 – Mock-up of List of Expenditure Records

Grantees can revise the records, if needed, by using the detailed view. Figure 4 depicts a sample of the detailed view of an individual record. The process for making revisions on-screen is the same used for the quarterly reports. Grantees must provide a narrative explanation for any revisions they make. See the User Guide for detailed instructions. Figure 6 displays a mock-up of the screen for revisioning these expenditure records.

Figure 6 – Mock-Up of Display of Details of these Expenditure Records for Making Revisions On-Screen

Expenditures Associated with the Grantee’s Subawards, Contracts and Direct Payment Valued at Less than $30,000

Grantees must

review and make revisions, where needed, to aggregate expenditures

associated with obligations of less than $30,000. These

expenditures are reported in the aggregate for each expenditure

category.

Review in Excel Format

Grantees may download a copy of the expenditure records to review and make any needed revisions. Once complete, the grantee can use the portal’s bulk upload function to submit the updated file. The bulk upload function is the same as used for quarterly reports. See the User Guide for detailed instructions.

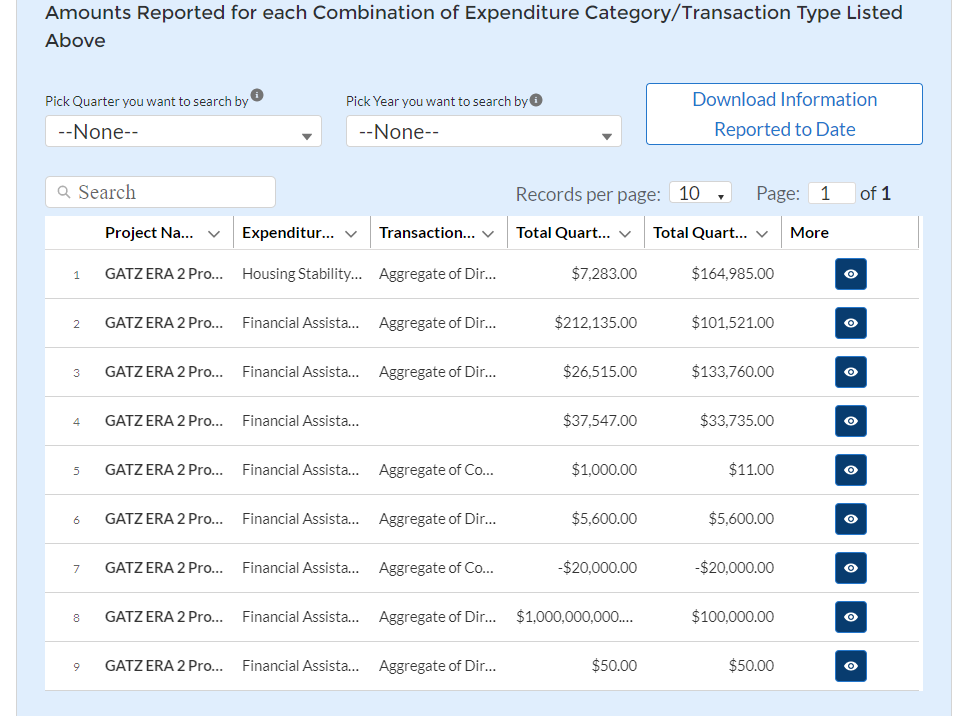

Review On-Screen

The portal will display an on-screen table of the aggregated expenditures in this category previously reported by the grantee. Information provided includes expenditure category; transaction type; obligation amount; expenditure amount(s); and administrative cost narrative. Figure 7 provides an example.

Figure 7 – Mock-up of Aggregated Expenditures Associated with Obligations Valued at Less than $30,000

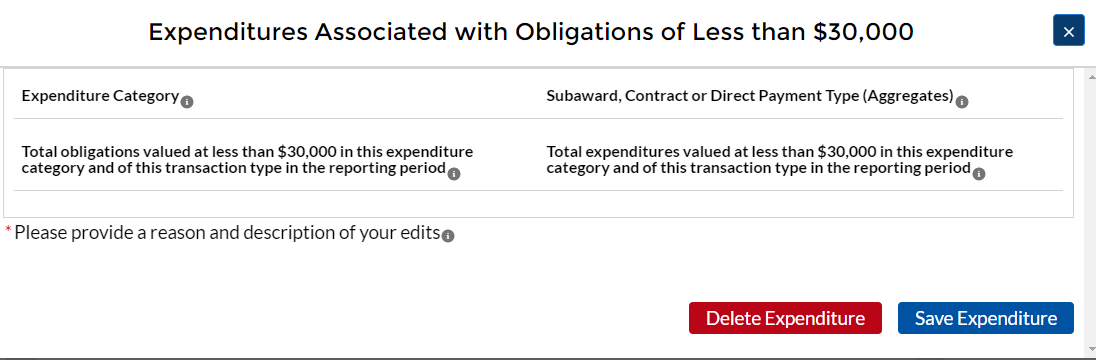

Grantees can revise the aggregated information, if needed, by using the detailed view, as depicted in Figure 8. The process for making revisions on-screen is the same used for the quarterly reports. Grantees must provide a narrative explanation for any revisions they make. See the User Guide for detailed instructions.

Figure 8 – Mock-Up of Display of Details of Aggregated Expenditures Associated with Obligations of Less than $30,000 for Making Revisions On-Screen

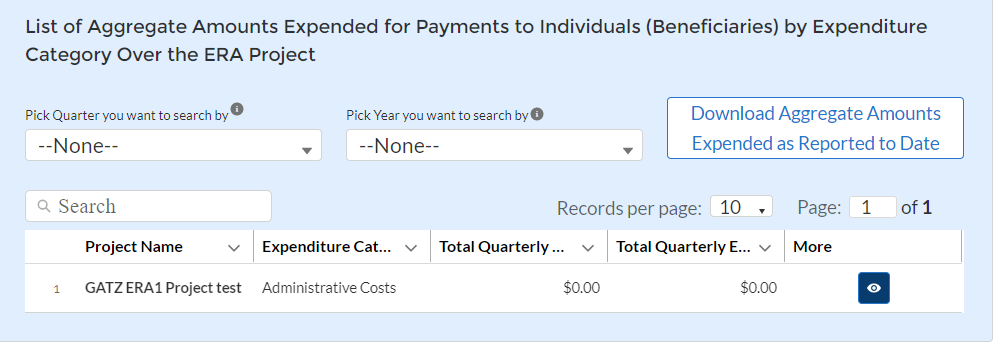

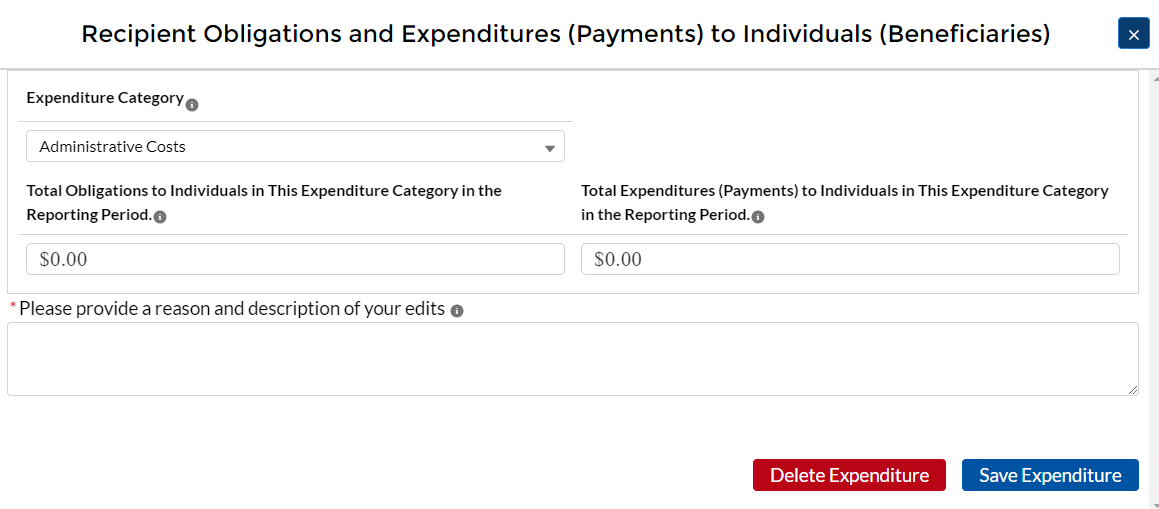

Obligations and Expenditures (Payments) to Individuals

Grantees must review and make revisions, where needed, to records of its aggregated expenditures (payments) made to individuals. These expenditures are reported in the aggregate for each expenditure category.

Review in Excel Format

Grantees may download a copy of the expenditure records as reported on quarterly reports for review and for making any needed revisions. Once completed, the grantee can use the portal’s bulk upload function to submit the updated file of expenditure records. The bulk upload function is the same as used for quarterly reports. See the User Guide for detailed instructions.

Review On-Screen

The portal will display an on-screen table of aggregated expenditures paid to individuals as previously reported by the grantee. Information provided includes expenditure category; obligation amount; expenditure amount(s); and administrative cost narrative. Figure 8 provides an example.

Figure 8 – Mock-up of List of Aggregated Expenditures (Payments) to Individuals

Figure 9 – Mock-up of Display of Details of Expenditures (Payment) to Individuals by Expenditure Category for Making Revisions On-Screen

Tab: Summary (Cumulative) Amounts of Expenditures

The

ERA1 Final Report will include a new tab where grantees are required

to provide cumulative totals of all expenditures made over the entire

award period of performance (ERA1 Award date through September 30,

2022 or December 29, 2022). The required totals are list below.

Total amount of ERA1 funds expended in the award period of performance

Total amount of ERA1 funds expended in the award period of performance categorized by each of the following expenditure categories:

Rent

Rent arrears

Utility/Home Energy Costs

Utility/Home Energy Costs Arrears

Other Housing Costs (related to COVID-19)

Housing Stability Services

Administrative Costs

Total ERA1 expenditures associated with the Grantee’s subawards, contracts and direct payments (valued at $30,000 or more).

Total ERA1 funds expended over the award period of performance that were associated with the Grantees’ subawards, contracts and direct payments (valued at $30,000 or more) over the award period of performance, categorized by the following expenditure categories:

Rent

Rental Arrears

Utility/Home Energy Costs

Utility/Home Energy Costs Arrears

Other Housing Costs (related to COVID-19)

Housing Stability Services

Administrative Costs

Total ERA1 expenditures associated with the Grantee’s subawards, contracts and direct payments (valued at less than $30,000).

Total of all ERA1 expenditures associated subawards, contracts and direct payments (valued at less than $30,000), categorized by the following expenditure categories:

Rent

Rent Arrears

Utility/Home Energy Costs

Utility/Home Energy Costs Arrears

Other Housing Costs (related to COVID-19)

Housing Stability Services

Administrative Costs

Total amount of ERA1 funds paid to individuals (regardless of size of payment).

Total amount of ERA1 funds paid to individuals (regardless of size of payment), categorized by the following expenditure categories.

Rent

Rent Arrears

Utility/Home Energy Costs

Utility/Home Energy Costs Arrears

Other Housing Costs (related to COVID-19)

Housing Stability Services

Administrative Costs

Tab:

Participants and Services Provided

Grantees

must provide cumulative counts or amounts for each of the following

data elements, all of which are the same as required on the “Project

Data and Participant Demographics” section of the quarterly

reports, with two exceptions as noted below.

Grantees must also provide cumulative participant demographic information where noted.1

Please see the ERA Reporting Guidance for detailed information, including definitions, of each required element.

Number of unique households that completed and submitted an application for ERA assistance over the award period of performance. Provide associated cumulative demographic information.

Number of unique submitted applications accepted over the award period of performance. Provide associated cumulative demographic information.

Acceptance rate of all applications submitted over the award period of performance. Provide associated cumulative demographic information.

Number of unique participant households that received ERA1 assistance of any kind over the award period of performance. Provide associated cumulative demographic information.

Number of unique participant households that received ERA1 assistance over the award period of performance by type of assistance. Provide associated cumulative demographic information for each type of assistance.

Rent

Rent arrears

Utilities/home energy costs

Utilities/home energy costs arrears

Other expenses related to housing (related to COVID-19)

Housing stability services

Number of unique participant households that received ERA1 assistance over the award period of performance categorized by income categories listed below. Include cumulative demographic information for each income category.

Less than 30% of area median income

Between 30% and 50% of area median income

Between 50% and 80% of area median income

Number of unique participant households whose income eligibility was determined based on their eligibility for other federal benefit programs. Provide associated cumulative demographic information.

Number of unique participant households whose income eligibility was determined based on a fact-based proxy. Provide associated cumulative demographic information.

Total amount of ERA1 funds paid to or for participant households over the award period of performance.

Average amount of ERA1 funds provided to or for participant households over the award period of performance.

Average number of months of rent or utility/home energy payment covered for each participant household. Provide associated cumulative demographic information.

Average number of months of prospective rent covered for each participant household. Provide associated cumulative demographic information. (NEW)

Average number of months of rent arrears covered for each participant household. Provide cumulative demographic information. (NEW)

Average number of months of prospective utility/home energy costs covered for each participant household. Provide cumulative demographic information. (NEW)

Average number of months of utility/home energy cost arrears covered for each participant household. Provide cumulative demographic information. (NEW)

Total amount of ERA1 funds expended for administrative expenses over the award period of performance.

Total amount of ERA1 funds expended for housing stability services over the award period of performance.

Tab: Financial Reporting

Grantees

must provide the following financial data covering the period between

the date of award and date of Final Report certification and

submittal. The required data elements, as shown below, are from the

Federal Standard Form SF-425. Please see the SF-425 guidance for

additional information, if needed.

Federal Cash

Cash Receipts (SF-425 Item 10a)

Cash Disbursements (SF-425 Item 10b)

Cash on Hand (SF-425 10c)

Federal Expenditures and Unobligated Balances

Total Federal funds authorized (SF-425 Item 10d

Federal share of expenditures (SF-425 Item 10e)

Federal share of unliquidated obligations (SF-425 Item 10f)

Total Federal Share (Sum of SF-425 items 10e and 10f)

Unobligated balance of Federal Funds (SF-425 Item 10d minus 10g)

Participant Household Payment Data File

Grantees are required to submit a cumulative Participant Household Payment Data File (PHPDF). The format for the PHPDF and the process for providing the file is the same as for the quarterly reports.

The cumulative PHPDF file must include data on every ERA1 assistance payment made during the ERA1 project period by the Recipient and any Subrecipient(s) to or for participant households for the following purposes: Rent; Rental arrears; Utility/Home energy costs; Utility/Home energy cost arrears; Other expenses related to housing; and Housing stability services.

Comments

Grantees may provide additional information or comments on any data submitted as part of the Final Report. The Grantees should either manually type or cut and paste the comments in a text box that will be displayed on the portal screen.

Tab: Report Certification and Submittal

The ERA1 grantee’s designated Account Administrator or Authorized Representative for ERA Reporting will be required to e-sign an official certification before final submission of the ERA1 Final Report. The certification and the process for submitting the Final Report are the same as for the quarterly reports. Please see Section X of the User Guide for more information.

Optional Customer Service Survey

Immediately after the grantee certifies and submits the ERA1 Final Report, the portal will invite them to participate in an optional Customer Service Survey. The survey includes the following five questions, all of which are optional. Each question asks the Grantee to provide a rating and includes a text box where the Grantee can provide comments.

Overall, how effective is the Emergency Rental Assistance (ERA) Program?

How satisfied are you with Treasury’s administration of the ERA Program?

What can we do to improve Treasury’s administration of the ERA Program?

Rate your overall experience using Treasury’s Portal for ERA Reporting.

Do you have any additional suggestions of feedback?

1 Tribes, DHHL, and TDHEs are not required to submit demographic information.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 2023-08-26 |

© 2026 OMB.report | Privacy Policy