Reporting Guidance Portal - Revision_3.29.23

Emergency Rental Assistance Program (ERA2)

ERA2 Reporting Guidance 3.29.23

OMB: 1505-0270

Emergency Rental Assistance Program (ERA2)

Reporting Guidance

March

29, 2023

v 1.0

Table of Contents

ERA2 Quarterly Compliance Reports effective as of Quarter 1 2023 7

Portal Tabs for ERA2 Quarterly Reports 7

Bulk Upload Templates and Instructions Tab 8

ERA2 Emergency Rental Assistance Project 10

ERA2 Affordable Rental Housing Project(s) 11

ERA2 Eviction Prevention Project(s) 13

Subrecipients, Contractors, and Direct Payees (Beneficiaries) Tab 15

Subawards, Contracts, and Direct Payments Tab 16

ERA2 Emergency Rental Assistance Project Data and Participant Demographics Tab 18

Performance & Financial Reporting Tab 24

Report Certification and Submission Tab 28

Appendix 1 – Quarterly Reporting Elements 29

Appendix 2 – ERA2 Program Terminology 32

Appendix 4 – Expenditure Categories and Payee Types 36

Appendix 5 – Administration and Compliance Information for ERA2 Award Recipients 37

Appendix 6 – Formerly Required ERA2 Monthly Reports 39

Appendix 7 – Applicable Limitations on Administrative Expenses 41

Appendix 8 – Background on Annual Civil Rights Compliance and Reporting 42

Appendix 9 -- Scenarios on Reporting 43

Appendix 10 – Reporting Aggregate Obligations and Expenditures 52

Appendix 11 – Reporting the Recipient’s Payments to Individuals 53

Introduction

This document provides reporting guidance for entities that received Emergency Rental Assistance (ERA2) awards directly from the U.S Department of the Treasury (Treasury). It addresses such topics as the reporting process, reporting periods, submission deadlines, required data, section-by-section guidance on completing the reports, and procedures for accessing Treasury’s online portal for reporting.

Please see the Treasury.gov Emergency Rental Assistance Program page for additional information, guidance, and tips.

Also see the User Guide – Treasury's Portal for Recipient Reporting for detailed instructions on using Treasury’s Portal for submitting required reports.

Contact Treasury’s Office of Recovery Programs Contact Center

via email at this address:

[email protected]

ERA2 Reporting Process

Figure 1

Steps in Preparing and

Submitting the Required ERA2 Reports

Step

1

– Throughout the reporting period, ERA2 Recipients gather and

maintain required information such as counts of applicants and

participants; amounts paid directly or indirectly to tenants,

landlords, and utility/home energy providers; amounts obligated to

subrecipients and contractors; and administrative expenses. This is

not meant to be an exhaustive list of required data. Please see

below for complete guidance on the required information.

Step

2

–Treasury will notify each Recipient’s designated ERA2

Points of Contact for Reporting when Treasury’s portal is

available for Recipients to begin preparing the reports.

Step

3

– Recipients should communicate with and gather required

information from their subrecipients and contractors, as

applicable.

Step

4 –

The Recipient’s designated ERA2 Point(s) of Contact for

Reporting and ERA2 Authorized Representatives for Reporting must

register with either ID.me or Login.gov before gaining access to

Treasury’s portal for submitting reports.

Step

5

– Recipient staff who are registered with either ID.me or

Login.gov will be able to access the portal and provide the

required information.

Step

6

– After manually entering or uploading the report

information, Recipients must review the information entered or

submitted to the online reporting forms for errors and

completeness. Following completion of the report in Treasury’s

portal, the Recipient’s designated ERA2 Authorized

Representative for Reporting must certify to the authenticity and

accuracy of the information provided and formally submit the report

to Treasury. Like other federal systems that facilitate bulk data

upload and/or manual data entry, certain data fields will be

controlled with validation rules that will trigger error or warning

notices requesting changes to entries.

Step

7

– Treasury staff will review the information submitted by the

Recipient for Treasury’s ongoing programmatic and financial

monitoring.

Step

8

–

Treasury will post select information from each Recipient’s

report on each of its ERA2 Project(s) on Treasury.gov.

Step

9 –

Each Recipient will continue to administer its ERA2 Project(s) and

continue gathering information for the next required report. Good

faith changes to prior submissions will generally be allowed with

some exceptions.

Each ERA2 Recipient

must submit cumulative quarterly and final reports. Figure 1 below

provides a recommended approach for preparing and submitting the

required ERA2 reports, and Table 1 below lists the ERA2 reporting

cycles, reporting periods and submission deadlines.

and

Submitting the Required ERA Reports

ep

1 – Recipients gather and

maintain required information such as counts of applicants and

participants; amounts paid directly or indirectly to tenants,

landlords, and utility/home energy providers; amounts paid to

subrecipients and contractors; and administrative expenses. This is

not meant to be an exhaustive list of required data. Please see

below for a complete guidance on the required information.

Step 2 – Approximately one week prior to the end of each reporting period, Treasury will distribute email notices to each Recipient’s designated Points of Contact for Reporting. The notices will alert the Recipients of the date that Treasury’s Portal will be made available for Recipient access and the report submission deadline.

Step 3 – Recipients will need to communicate with and gather required information from their subrecipients and contractors, if applicable.

Step 4 – The Recipient’s designated Point(s) of Contact for Reporting and Authorized Representatives for Reporting must register with ID.me before gaining access to Treasury’s Portal for submitting reports to further safeguard Recipient and beneficiary information.

Step 5 – Recipient staff access Treasury’s Portal and provide the required information.

Step 6 – After manually entering or uploading the report information, Recipients must review the information entered or submitted to the online reporting forms for any errors and completeness. Following completion of the report in in the portal, the Recipient’s designated Authorized Representative for Reporting must certify the authenticity and accuracy of the information provided and formally submit the report to Treasury. Like other federal systems that facilitate bulk data upload and/or manual data entry, certain data fields will be controlled with validation rules that will trigger error or warning notices requesting changes to entries.

Step 7 – Treasury staff will review the information submitted by the Recipient for Treasury’s ongoing programmatic and financial monitoring.

Step 8 – Treasury will post select information on each Recipient’s reporting on each of its ERA Project(s) (each ERA1 and ERA2 award) on Treasury.gov.

Quarterly and Final Reporting

ERA2 Recipients must certify and submit Quarterly and Final Compliance Reports.

Quarterly Reports require an array of cumulative programmatic and financial information covering the period from receipt of ERA2 award to the end of the current quarterly reporting period.

Final Reports require cumulative programmatic and financial information covering the entire award period of performance.

See Table 1 below for the quarterly and final reporting periods and submission deadlines.

Table 1 -- ERA2 Reports, Reporting Periods and Submission Deadlines

State, Local, and Territorial Recipients |

Cycle |

Calendar Quarter / Month and Year |

Reporting Period |

Submission Deadline |

Required |

Partial 1 |

Q2 2021 Partial |

Apr 1 – Jun 30, 2021 |

|

Required |

1 |

Q2 2021 |

Apr 1 – Jun 30, 2021 |

Oct 29, 2021 |

Required |

2 |

Q3 2021 |

Jul 1, 2021 – Sep 30, 2021 |

Oct 29, 2021 |

Required |

3 |

Q4 2021 |

Oct 1, 2021 – Dec 31, 2021 |

Feb 1, 2022 |

Required |

4 |

Q1 2022 |

Jan 1, 2022 – Mar 31, 2022 |

Apr 15, 2022 |

Required |

5 |

Q2 2022 |

Apr 1, 2022 – Jun 30, 2022 |

Jul 15, 2022 |

Required |

6 |

Q3 2022 |

Jul 1, 2022 – Sep 30, 2022 |

Oct 17, 2022 |

Required |

7 |

Q4 2022 |

Oct 1, 2022 – Dec 31, 2022 |

Jan 17, 2023 |

Required |

8 |

Q1 2023 |

Jan 1, 2023 – Mar 31, 2023 |

Apr 17, 2023 |

Required |

9 |

Q2 2023 |

Apr 1, 2023 – Jun 30, 2023 |

Jul 17, 2023 |

Required |

10 |

Q3 2023 |

Jul 1, 2023 – Sep 30, 2023 |

Oct 16, 2023 |

Required |

11 |

Q4 2023 |

Oct 1, 2023 – Dec 31, 2023 |

Jan 15, 2024 |

Required |

12 |

Q1 2024 |

Jan 1, 2024 – Mar 31, 2024 |

Apr 15, 2024 |

Required |

13 |

Q2 2024 |

Apr 1, 2024 – Jun 30, 2024 |

Jul 15, 2024 |

Required |

14 |

Q3 2024 |

Jul 1, 2024 – Sep 30, 2024 |

Oct 15, 2024 |

Required |

15 |

Q4 2024 |

Oct 1, 2024 – Dec 31, 2024 |

Jan 15, 2025 |

Required |

16 |

Q1 2025 |

Jan 1, 2025 – Mar 31, 2025 |

Apr 15, 2025 |

Required |

17 |

Q2 2025 |

Apr 1, 2025 – Jun 30, 2025 |

Jul 15, 2025 |

Required |

18 |

Q3 2025 |

Jul 1, 2025 – Sep 30, 2025 |

Oct 15, 2025 |

Required |

19 |

Final Report |

TBD |

|

ERA2 Quarterly Compliance Reports effective as of Quarter 1 2023

Effective with the Quarter 1 2023 reporting period, the ERA2 Quarterly compliance reports will consist of ten segments (tabs) on Treasury’s Portal as shown below. The following pages provide guidance on the information to be reported on each tab.

Portal Tabs for ERA2 Quarterly Reports

Reporting Guidance

Bulk Upload Templates and Instructions

Grantee Profile

Project Overview

Emergency Rental Assistance Project

Affordable Rental Housing Project(s)

Eviction Prevention Project(s)

Subrecipients, Contractors and Direct Payees (Beneficiaries)

Subawards, Contracts and Direct Payments

Expenditures

Emergency Rental Assistance Project Data and Participant Demographics

Performance and Financial Reporting

Report Certification and Submission

Reporting Guidance Tab

This tab displays helpful information on procedures for submitting the required report and hyperlinks to key guidance such as the ERA Reporting Guidance and the User Guide for Treasury’s Portal.

Bulk Upload Templates and Instructions Tab

This tab provides hyperlinks to downloadable templates for using the bulk upload function to submit information for the quarterly reports.

Grantee Profile Tab

The Grantee Profile tab displays the administrative information, the grantee’s points of contact for reporting, and the details of the grantee’s registration on SAM.gov as shown below. Recipients should verify the information as displayed on the portal.

Recipient Name, Address, and Identifying Information

Recipient Taxpayer Identification Number (TIN)

Recipient Legal Entity Name

Recipient Type

Recipient Street Address

Recipient City, State, and Zip Code

Grantee SAM.gov information

Points of Contact for Reporting

Each ERA2 Recipient must verify the names and contact information of staff who have been designated as the Recipient’s ERA2 Account Administrator, ERA2 Point(s) of Contact for Reporting and ERA2 Authorized Representative(s) for Reporting. This information will be pre-populated on the online ERA2 Quarterly Report form. Recipients may edit the information about current contacts and add new contacts.

Registration with System for Award Management System (SAM.gov)

Each ERA2 Recipient must declare its current SAM.gov registration status. If a Recipient is not registered with SAM.gov, the Recipient must provide the information listed below. The information will be carried forward to subsequent quarterly reports and is editable.

Whether in the preceding fiscal year, it received 80% or more of its annual gross revenue from federal funds.

Whether in the preceding fiscal year, it received $25 million in gross revenue from federal funds.

Whether the “total compensation” for the organization’s five highest paid officers is listed publicly or listed in SAM.gov; and,

If the “total compensation” of the highest paid officers is not publicly available, the Recipient must provide the names of its officers and their total compensation for the preceding completed fiscal year.

NOTICE ON SAM.GOV REGISTRATION: All ERA2

Recipients must to have an active SAM.gov registration. For general

information on the SAM.gov system and its requirements, got to

SAM.gov, and for registration details, go to

https://sam.gov/content/entity-registration.

NOTICE ON FSRS (Federal Subaward Reporting System) REPORTING: To assist in reducing ERA Recipients’ reporting burden, Treasury will provide the required information about the Recipient’s Subrecipients, Contractors and Direct Payees, as appropriate, to the FSRS.gov system on behalf of the Recipient in keeping with the $30,000 reporting threshold, timing, and data elements required by 2 CFR Part 170 and as discussed in this guidance. However, Recipients may choose to report the required information directly to FSRS.gov. A Recipient who reports the information directly to FSRS.gov should notify Treasury that it has done so.

Project Overview Tab

ERA2 Recipients use this tab to report on up to three categories of projects associated with their ERA2 award.

Beginning on October 1, 2022, ERA2 Recipients that have obligated at least 75 percent of their total ERA2 award for emergency rental assistance and related activities, may use the unobligated amounts of ERA2 award funds to support one or more of three categories of ERA2 projects described below. See FAQ 46 for more information on this topic.

ERA2 Recipients that continue to provide emergency rental assistance only will use this tab to report on those activities, even if they are not also providing affordable rental housing or eviction prevention services in accordance with FAQ 46.

The following pages provide detailed guidance on the required reporting for each category.

Three Categories of ERA2 Projects:

ERA2 Emergency Rental Assistance Project – this category consists of the grantee’s ongoing emergency rental and utility assistance activity as reported in the Q2 2021 through Q4 2022 quarterly compliance reports. These activities will be considered one project for purposes of ERA2 reporting.

ERA2 Affordable Rental Housing Project(s) – this project category consists of the ERA2 Recipient’s uses of ERA2 funds for the development of affordable rental housing per FAQ 46. Each housing development that is supported with ERA2 funds will be considered a separate project for ERA2 reporting. An ERA2 grantee may report on multiple ERA2-supported affordable rental housing projects in this category.

ERA2 Eviction Prevention Project(s) – this category consists of the ERA2 Recipient’s uses of ERA2 funds to support eviction prevention programs per FAQ 46. Each such eviction prevention program receiving ERA2 assistance is considered a separate project for ERA2 reporting. For example, an ERA2 grantee that establishes an eviction prevention effort that provides services to residents within a specific geography would report that effort as one ERA2 Eviction Prevention Project. If the ERA2 grantee establishes another effort covering a different geographic area or a separately funded effort covering distinctly different services, that effort would be reported under a separate ERA2 Eviction Prevention Project. An ERA2 grantee may report on multiple ERA2-supprted eviction prevention projects.

The following pages provide detailed information and guidance on the reporting requirements for each of the three categories of ERA2 Projects.

ERA2 Emergency Rental Assistance Project

Each ERA2 Recipient (“grantee”) must report the following information about its Emergency Rental Assistance Project, like what was required on previous ERA2 Quarterly Reports. One major difference starting with the Q1 2023 quarterly report is that grantees must now report cumulative information for several of the required data points (previously, grantees were required to report quarterly data). See below for more details on these requirements.

Required General Information

Project ID

Cumulative Obligations

Cumulative Expenditures

Current Period Obligations

Current Period Expenditures

Project Description

Status of Completion

ERA Project Website URL

Geographic Service Area

Description of the system for prioritizing assistance for the subject ERA2 emergency rental assistance project

Description of the Recipient’s use of fact-based proxies for determining eligibility for the subject ERA2 emergency rental assistance project

ERA2 grantees must also report additional detailed information about their Emergency Rental Assistance project on the “Emergency Rental Assistance Project and Participant Demographic Data” tab below.

ERA2 Affordable Rental Housing Project(s)

As discussed in FAQ 46, beginning on October 1, 2022, ERA2 Recipients that have obligated at least 75 percent of their total ERA2 award for emergency rental assistance and related activities, may use unobligated amounts of ERA2 award funds to support one or more ERA2 Affordable Rental Housing Projects. ERA2 grantees that opt to use the ERA2 funds for this purpose must report the following information about each such project. ERA2 grantees that do not administer Affordable Rental Housing Project(s) should leave this section blank.

All ERA2 Recipients that use ERA2 funds to administer Affordable Rental Housing Project(s) must provide the following:

Required General Information

Project Name

Project ID

Cumulative Obligations

Cumulative Expenditures

Current Period Obligations

Current Period Expenditures

Status of Completion

Project Narrative

Required Project Data

Obligations made in Q4 2022 related to this ERA2 Affordable Rental Housing Project(s)

Expenditures made in Q4 2022 related to this ERA2 Affordable Rental Housing Project(s)

Project Zip Code

Project Physical Address

Federal Program Alignment. The use of ERA2 funds for an affordable rental housing project must align with allowed uses of Federal funds under at least one of the following Federal programs. Please identify the primary Federal program from the list below.

Low-income Housing Tax Credit (Treasury)

HOME Investment Partnerships Program (U.S. Department of Housing and Urban Development (HUD))

HOME-ARP Program (HUD)

Housing Trust Fund Program (HUD)

Public Housing Capital Fund

(HUD)

Indian Housing Block Grant Program (HUD)

Section 202

Supportive Housing for the Elderly (HUD)

Section 811 Supportive

Housing for Persons with Disabilities (HUD)

Farm Labor Housing

Direct Loans and Grants (U.S. Department of Agriculture)

Multifamily

Preservation and Revitalization Program (USDA)

Besides ERA2, Additional Federal Program Funds Used for this Project, if any

Low-income Housing Tax Credit (Treasury)

HOME Investment Partnerships Program (U.S. Department of Housing and Urban Development (HUD))

HOME-ARP Program (HUD)

Housing Trust Fund Program (HUD)

Public Housing Capital Fund

(HUD)

Indian Housing Block Grant Program (HUD)

Section 202

Supportive Housing for the Elderly (HUD)

Section 811 Supportive

Housing for Persons with Disabilities (HUD)

Farm Labor Housing

Direct Loans and Grants (U.S. Department of Agriculture)

Multifamily

Preservation and Revitalization Program (USDA)

Other. If other, please explain

Is the grantee in compliance with the Federal program regulations and other requirements of the Federal program(s) selected in item #e above? (Yes/No)

In no, provide an explanationEstimated portion of the total cost of the affordable rental housing project that has been/will be paid with the ERA2 award

Estimated Start of Service of the Project

Date of First ERA2 Expenditure on the Project

Funding Mechanism(s) Used. Select the financial instrument(s) that are/will be utilized to provide ERA2 funds in support of the affordable rental housing project

Loan (including no-interest loans and deferred-payment loans)

Interest subsidy

Grant

Other financial arrangement. If other, please explain.

Are the ERA2 funds used as gap funding for an existing affordable rental housing project? (Yes/No/Other)

If Other, please explainType of Project. Select the category that most accurately describes the predominant objective of the project:

Rehabilitation

New Construction

Preservation

Operation

Number of Rental Units in the Project

Number of Rental Units Funded by ERA2

Number of Units Serving Very Low-Income Families

Description of Income Limitation on Rental Units Funded by ERA2

Development partners (if any)

Is the program limited to specific populations (e.g., elderly, domestic violence survivors, etc.)? Please describe.

Period of Legally Enforceable Income Limitation for ERA2 Funded Rental Units

Period of Legally Enforceable Income Limitation for any non-ERA2 Funded Rental Units

ERA2 Eviction Prevention Project(s)

As discussed in FAQ 46, beginning on October 1, 2022, ERA2 Recipients that have obligated at least 75 percent of their total ERA2 award for emergency rental assistance and related activities may use unobligated amounts of the ERA2 award funds to support one or more ERA2 Eviction Prevention Project.

The funding of ERA2 Eviction Prevention Project(s) is in addition to uses of ERA2 funds for housing stability services which may include eviction prevention services.

ERA2 grantees that opt to obligate ERA2 funds for Eviction Prevention Project(s) must report the following information about each such project. ERA2 grantees that do not administer ERA2 Eviction Prevention Project(s) should leave this section blank.

Required General Information

Project Name

Project ID

Cumulative Obligations

Cumulative Expenditures

Current Period Obligations

Current Period Expenditures

Project Narrative

Administrator of Project

Required Project Data and Demographics

Is the ERA2 Eviction Prevention Project an existing eviction prevention program previously funded under the housing stability services provision of ERA2? (Yes/No)

If yes, how are you ensuring that

the ERA2 Eviction Prevention Project services are being provided to

very low-income families?

Number of unique participant households that received their initial eviction prevention services under this project during the current reporting period.

Number of unique participant households that received any amount of eviction prevention services under this project cumulatively from award date through the end of the reporting period.

Cumulative number of unique participant households that received any amount of eviction prevention services under this project cumulative from award date through the end of the reporting period broken out by the recipient household income levels as follows:

- Less than 30% of area median income

- Between 30 and 50% of area median income

- Between 50 and 80% of area median income

Cumulative amount of ERA2 funds paid to or for participant households for eviction prevention services under this project.

Subrecipients, Contractors, and Direct Payees (Beneficiaries) Tab

This is the first of three reporting tabs where each ERA2 Recipient must report detailed cumulative information about its administration of the financial components of the subject ERA2 award. The information reported in the three tabs is required by the Treasury Office of Inspector General for its oversight. In addition, Treasury provides information reported in these tabs to the Pandemic Recovery Oversight Committee, in keeping with Federal Law.

Each ERA2 Recipient must report detailed information about each of its subrecipients, contractors, and direct payees (beneficiaries) to which it obligated a total of $30,000 or more of ERA2 funds since the date of receipt of the ERA2 award. (Note: “direct payees” includes ERA2 beneficiaries such as corporate landlords and utility providers, who are not individual tenants or unincorporated small landlords.) The required information about these entities, which Treasury uses for reporting to FSRS.gov and other purposes, is as follows:

UEI or TIN Number

Type of Entity (select from a picklist of entity types)

Legal Name

POC Email

Address

City

State

Zip and Zip+4

Whether the Subrecipient, Contractor or Direct Payee is Registered in SAM.gov (The information on SAM.gov registration is not required for individual tenants or unincorporated small landlords who received the direct payment of ERA funds as a beneficiary.)

As explained in the January 24, 2022, Special Guidance, ERA2 Recipients must create direct payee records for all businesses, corporations or non-profits that receive a total (cumulative) amount of ERA benefits valued at $30,000 or more. However, ERA2 Recipients are not required to create direct payee records for beneficiaries who are individuals (tenants) or unincorporated small landlords, regardless of the amount of the ERA2 benefit payment.

Please see Appendix 9, Scenarios on Reporting an ERA Recipient’s Allocations of ERA2 funds to Subrecipients, Contractors and Direct (Beneficiaries) for more information and examples that illustrate the requirements for ERA2 Recipient reporting on obligations and expenditures.

Subawards, Contracts, and Direct Payments Tab

This is the second of three reporting tabs where each ERA2 Recipient is required to report detailed information about its administration of the financial components of the ERA2 award.

Each ERA2 Recipient must report on all subawards, contracts and

direct payments for which it has obligated a total of $30,000 or

more in ERA2 funds since receipt of the ERA2 award.

This

includes reporting on all obligations of $30,000 or more for direct

payments made to beneficiaries that are businesses, corporations,

and non-profits. (This does not require reporting of obligations

made for direct payment to beneficiaries that are individuals

(tenants) or unincorporated small landlords.)

The required information includes:

Name of the entity to which the Subaward, Contract or Direct Payment is directed

Type of Entity for Payment

Place of performance address

Place of performance city

Place of performance state

Place of performance country

Place of performance zip and zip+4

Subaward, Contract or Direct Payment Number (to be provided by the ERA2 Recipient)

Type of Transaction (select from a picklist of types)

Amount obligated

Subaward Date

Performance start date

Performance end date

Narrative description of the subaward, contract or direct payment and the underlying use of ERA2 funds.

As explained in the January 24, 2022, Special Guidance, ERA2 Recipients are not required to create records for amounts obligated for its direct payments of ERA2 benefits awarded to individuals who are tenants or unincorporated small landlords, regardless of the amount of the ERA2 benefit payment. These payments would be reported in aggregate in the “Payments to Individuals” section.

However, ERA2 Recipients must create direct payment records for businesses, corporations, and non-profit entities to which the ERA2 Recipient awards ERA2 benefits totaling a cumulative amount of $30,000 or more.

Please see Appendix 9 for more information and several examples of the requirements for the ERA2 Recipient’s reporting on its obligations and expenditures and its subrecipient’s expenditures.

Expenditures Tab

This is the third of three reporting tabs where each ERA2 Recipient is required to report detailed information about its administration of the financial components of the ERA2 award.

Please see Appendix 9 for more information and several examples of the requirements for the ERA2 Recipient’s reporting on its obligations and expenditures and its subrecipient’s expenditures.

Expenditures Associated with the ERA2 Recipient’s Subawards, Contracts and Direct Payments with obligations valued at $30,000 or More

The ERA2 Recipient must report the following information for all expenditures associated with its subawards, contracts and direct payments for which it had obligated a cumulative amount of $30,000 or more. (These subawards, contracts are recorded via the Recipient Subawards, Contracts, and Direct Payments tab.)

Subaward, Contract or Direct Payment number (the ERA2 Recipient’s internal number reported in previous screens)

Name of Subrecipient, Contractor or Direct Payee receiving the Direct Payment (expenditure) (only beneficiaries that are businesses, corporations, or non-profit entities, not individuals (tenants) or unincorporated small landlords)

Expenditure Start and End date

Expenditure amount

Expenditure Category (allowed ERA2 Expenditure categories are listed here):

Financial Assistance: Rent

Financial Assistance: Rental arrears

Financial Assistance: Utility/home energy costs

Financial Assistance: Utility/home energy costs arrears

Other housing costs

Housing Stability Services Costs

Affordable Rental Housing Costs

Eviction Prevention Services Costs

Administrative Costs

Total of all Obligations and Total of all Expenditures Associated with the ERA2 Recipient’s Subawards, Contracts, and Direct Payments Valued at Less than $30,000

Each ERA2 Recipient must report the totals (aggregates) of all

obligations and of all expenditures recorded in the reporting period

which, individually, were in amounts less than $30,000.

Each ERA2 Recipient must categorize and report the above aggregate amounts (obligation and expenditure amounts) by combinations of the authorized ERA2 expenditure categories listed above and the three authorized transaction types.

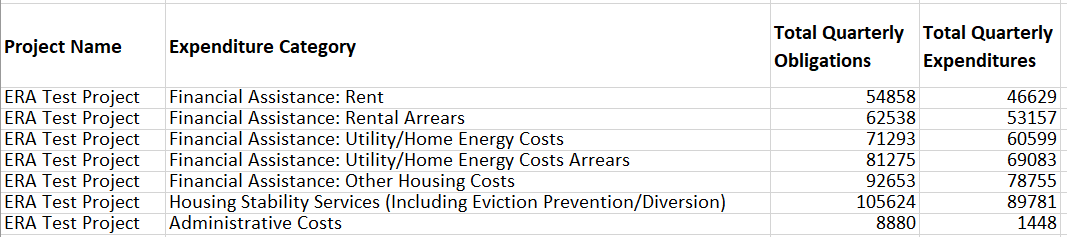

Treasury’s portal will display an on-screen summary of the reported obligations and expenditures in tabular format. Please see Appendix 10 for a sample of the table. The sample may be particularly helpful for ERA2 Recipients who manually key-in these data points.

ERA2 Recipient Obligations and Expenditures (Payments) to Individuals (Beneficiaries)

Each ERA2 Recipient must report the total (aggregate) amounts of all ERA2 funds that were obligated and expended (paid) to individuals (beneficiaries) for each of the allowable expenditure categories. The amounts to be reported include direct payments to beneficiaries who are individuals (tenants) and beneficiaries who are unincorporated small landlords.

Treasury’s portal will display an on-screen summary of the reported obligations and expenditures to individuals in tabular format. Please see Appendix 11 for a sample of the table. The sample may be particularly helpful for Recipients who manually key-in these data points.

ERA2 Emergency Rental Assistance Project Data and Participant Demographics Tab

Each ERA2 grantee must report the following information on its ERA2

Emergency Rental Assistance Project. The required data are the same

as was required for previous ERA2 quarterly compliance reports, with

the exception that grantees must now report cumulative information

rather than quarterly data. Grantees must continue to report certain

data elements by Race, Ethnicity and Gender of the participant

households’ primary applicant for assistance. See Appendix 3

for details on the required demographic categories.

Cumulative Number of Unique Households that Completed and Submitted an Application for ERA2 Assistance.

Definition: The cumulative number of unique households that submitted a complete application, as reasonably determined by the Recipient, for ERA assistance as of the end of the current reporting period. The phrase “unique households” means that each household applying for assistance should be counted only once, including where applicants applied multiple times over the program period. The Recipient must report the number of unique households for whom the ERA2 Recipient received a completed application between the date of receipt of the ERA2 award and the end of the current reporting period. The Recipient must also report the number broken out by the race, ethnicity, and gender of the primary applicant for assistance.

Cumulative Number of Unique Households that Received ERA2 Assistance

Definition: The cumulative number of unique participant households whose rent, rental arrears, utility/home energy payments, utility/home energy arrears, or other expenses related to housing were fully or partially paid under the subject ERA2 Project between the date of receipt of the ERA2 award and the end of the current reporting period.

The Recipient must report the cumulative number of unique households that received ERA2 assistance of any type and of any dollar amount under the subject ERA2 Project since receipt of the ERA2 award. The Recipient must also report the cumulative number broken out by race, ethnicity, and gender of the primary applicant for assistance.

Number of Unique Households that Received their Initial ERA2 Assistance in the Current Quarterly Reporting Period

Definition: The sum of the number of unique participant households whose rent, rental arrears, utility/home energy payments, utility/home energy arrears, or other expenses related to housing were fully or partially paid for the first time under the subject ERA2 Emergency Rental Assistance project during the quarterly reporting period.

The Recipient must report the number of unique households that received any ERA assistance of any type for the first time under the ERA2 Emergency Rental Assistance project in the quarterly reporting period. The Recipient must also report this number broken out by race, ethnicity, and gender of the primary applicant for assistance.

Each ERA2 Recipient must report the cumulative number of unique households that received any type of ERA2 Financial Assistance as listed below, between the date of receipt of the ERA2 award and the end of the current reporting period.

For each of the five types of ERA2 Financial Assistance listed below, Recipients will need to track and report the cumulative number of households receiving each type of assistance since receipt of the ERA2 award. Count each household only one time for a given type of assistance, regardless of whether the household had received that type of assistance multiple times. For example: where the ERA2 Project made a rent payment for a participant household and made a utility/home energy assistance payment for the same participant household, the grantee should report this as one household receiving rent assistance and one household receiving utility/home energy assistance. Similarly, where the ERA2 Project paid two utility/home energy payments to the same participant household, the Recipient should report this as one household receiving utility/home energy assistance.

Rent

Definition: The cumulative number of unique participant households that received (or whose landlord was paid) at least one rent payment of any dollar amount under the subject ERA2 Project between the date of receipt of the ERA2 award and the end of the current reporting period.

The Recipient must also report the numbers broken out by race, ethnicity, and gender of the primary applicants for assistance.

Rental Arrears

Definition: The cumulative number of unique participant households that received (or whose landlords were paid) a payment of any dollar amount for rental arrears under the subject ERA2 Project between the date of receipt of the ERA2 award and the end of the current reporting period.

The Recipient must also report the cumulative number broken out by the race, ethnicity, and gender of the primary applicants for assistance.

Utilities/Home Energy Costs

Definition: The cumulative number of unique participant households that received (or whose utility/home energy provider was paid) any dollar amount for any portion of at least one utility or home energy bill under the subject ERA2 Project between the date of receipt of the ERA2 award and the end of the current reporting period.

The Recipient must also report the number broken out by race, ethnicity, and gender of the primary applicants for assistance.

Utilities/Home Energy Arrears

Definition: The cumulative number of unique participant households that received (or whose utility/energy provider was paid) any dollar amount for utility/home energy arrears under the subject ERA2 Project between the date of receipt of the ERA2 award and the end of the current reporting period.

The Recipient must also report the cumulative number broken out by the race, ethnicity, and gender of the primary applicants for assistance.

Other Expenses Related to

Housing

Definition: The cumulative number of unique participant households that were paid any dollar amount for other approved housing expenses (Including eviction prevention/diversion assistance not provided under a separate ERA2 Eviction Prevention Project under the subject ERA2 Project (excluding rent, rental arrears, utility or home energy costs and home energy costs arrears) between the date of receipt of the ERA2 award and the end of the current reporting period. The Recipient must also report the cumulative number broken out by race, ethnicity, and gender of the primary applicants for assistance.

Housing Stability Services

Definition: The cumulative number of unique participant households that received housing stability services under the subject ERA2 Project between the date of receipt of the ERA2 award and the end of the current reporting period. This includes housing stability services provided directly by the Recipient or by any subrecipients or contractors.Cumulative Number of Unique Participant Households at Certain Income Levels

Each ERA2 Recipient must report the cumulative number of unique ERA2 participant households that were paid any dollar amount for at least one of the following: rent, rental arrears, utilities/home energy costs, utility/home energy arrears, or other expenses related to housing, between the date of receipt of the ERA2 award and the end of the current reporting period, by the following ranges of household income levels:

Less than 30% of area median income (#)

Between 30% and 50% of area median income (#)

Between 50% and 80% of area median income (#)

Total number of unique recipient households whose income eligibility was determined based on their eligibility for other federal benefit programs (#)

Total number unique of recipient households whose income eligibility was determined using a fact-based proxy (#)

The area median income for a household is the same as the income limits for families published in accordance with 42 U.S.C. 1437a(b)(2), available under the heading for “Access Individual Income Limits Areas” at https://www.huduser.gov/portal/datasets/il.html. Also see FAQ No. 4 in Treasury’s ERA Frequently Asked Questions (FAQs) available on the Emergency Rental Assistance Program page.

The numbers reported for group iv. and v. above should only include households for which the household income was determined to be eligible for other federal benefit programs or by a fact-based proxy and for whom there is not sufficient information in the self-certification to determine the correct AMI classification. The ERA2 Recipient should categorize participants into an AMI category wherever they have sufficient information to do so, even though the ERA2 Recipient used a proxy to determine income eligibility.

Each ERA2 Recipient must report cumulative numbers of unique participant households in each of the five income categories who received ERA2 assistance between the date of receipt of the ERA2 award and the end of the current reporting period. Each ERA2 Recipient must also report the cumulative numbers of unique participant households in each income category broken out race, ethnicity, and gender of the primary applicants for assistance.

Cumulative Amount of ERA2 Award Funds Paid to or for Participant Households

Definition: The cumulative dollar amount of ERA2 award paid under the ERA2 Project to or for participant households including payments for rent, rental arrears, utility/home energy costs, utility/home energy arrears, and other housing services and eligible expenses. This does not include funds paid for Housing Stability Services.

Each ERA2 Recipient must report the cumulative amount paid between the date of receipt of the ERA2 award and the end of the current reporting period. The Recipient must also report the cumulative number broken out by race, ethnicity, and gender of the primary applicants for assistance.

Average Number of Months of Rent, Rent Arrears, Utility/Home Energy Payments, and Utility/Home Energy Arrears Covered for Each Participant Household

Each ERA2 Recipient must calculate and report the following averages covering the period from the date of receipt of the ERA2 award to the end of the current reporting period:Average number of months of rent or utility/home energy payments covered for each participant household (provide cumulative participant demographic data).

Average number of months of prospective rent covered for each participant household over the award period of performance (provide cumulative participant demographic data).

Average number of months of rent arrears covered for each participant household over the award period of performance (provide cumulative participant demographic data).

Average number of months of prospective utility/home energy costs covered for each participant household over the award period of performance (provide cumulative participant demographic data).

Average number of months of utility/home energy cost arrears covered for each participant household over the award period of performance (provide cumulative participant demographic data).

Amounts Approved for Payment (Obligated) and Amounts Paid (Expended)

Each ERA2 Recipient must report the cumulative amount approved (obligated) and cumulative amount paid (expended) for assistance to households and for administrative expenses under the subject ERA2 Project. This includes all amounts obligated and expended by the ERA2 Recipient and its subrecipients and contractors, as applicable.

Cumulative Amount of ERA Award Funds Paid (Expended) for Administrative Expenses as of the end of the Reporting Period

Definition: The cumulative amount of the ERA2 award the ERA2 Recipient (and its subrecipients and contractors, as applicable) expended for administrative expenses between the date of receipt of the ERA2 award and the end of the current reporting period. This does not include amounts expended (paid) for housing stability services.

Note: For costs to have been incurred as defined, performance of the service or delivery of the good(s) must have occurred.Cumulative Amount of ERA2 Award Funds Approved (Obligated) for Administrative Expenses as of the end of the Reporting Period

Definition: The cumulative amount of the ERA2 award the ERA2 Recipient (and its subrecipients and contractors, as applicable) approved (obligated) for payment for administrative expenses between the date of receipt of the ERA2 award and the end of the current reporting period. This does not include amounts obligated for housing stability services. While ERA2 Recipients may use an equivalent definition contained in existing policies and procedures, the amount obligated should reflect the amount of administrative expense the ERA2 Recipient has agreed to pay during the same or a future period, as evidenced by a legally binding agreement or contract.Cumulative Amount of the ERA2 Award Funds Paid (Expended) for Housing Stability Services

Definition: Cumulative amount of the ERA2 award the ERA2 Recipient (and its subrecipients and contractors, as applicable) paid (expended) for housing stability services (including eviction prevention/diversion) between the date of receipt of the ERA2 award and the end of the current reporting period.

Note: For costs to have been incurred as defined, performance of the service or delivery of the good(s) must have occurred.

Cumulative Amount of the ERA2 Funds Approved (Obligated) for Housing Stability Services

Definition: Cumulative amount of the ERA2 award the ERA2 Recipient (and its subrecipients and contractors, as applicable) approved (obligated) for housing stability services (including eviction prevention/diversion) between the date of receipt of the ERA2 award and the end of the current reporting period.

Note: This amount is separate and distinct from the amounts of ERA2 funds the ERA2 Recipient obligated for a ERA2 Eviction Prevention Project as discussed in FAQ 46.

While ERA2 Recipients may use an equivalent definition contained in existing policies and procedures, the amount obligated should reflect the amount of assistance the Recipient has agreed to pay during the same or a future period, as evidenced by a legally binding agreement or contract.

Reminder: Obligations and Expenditures by Each Financial Assistance Type as Required Above Must be Less than or Equal to the Federal Award Amount --The amount an ERA2 Recipient reports as obligated or expended by ERA2 financial assistance type (for example, rent, rental arrears, etc.) and for administrative expenses must not exceed the total amount of the ERA2 award. This rule applies to amounts reported for a single reporting period and for cumulative reporting. Financial assistance and administrative obligations and expenditures should be a subtotal of total obligations and total expenditures.

Performance & Financial Reporting Tab

Treasury’s performance and financial reporting requirements are designed to ensure maximum transparency around use of ERA2 award funds for the public consistent with 2 CFR 200; to enable sufficient monitoring by Treasury and Treasury OIG, and to align with PRAC financial reporting requirements.

Performance Reporting

Current Performance Narrative

Each ERA2 Recipient must provide a brief narrative of 12,000 characters (2,000 words) or less describing the cumulative performance and accomplishments of the subject ERA2 Project. The narrative should support the performance and demographic data submitted and must include the following information:

Activities implemented and notable achievements to date

Planned activities

Notable challenges and status of each challenge

Details on compliance/non-compliance issues and mitigation plans

Requests for additional assistance or guidance from Treasury

Other information, as appropriate. Recipients do not need to repeat information provided in the Project Overview section above.

Narrative on Effective Practices

Each ERA2 Recipient may provide a brief narrative of 3,500 characters (500 words) or less describing effective practices for administering ERA2 programming to share with the ERA community.

Financial Reporting

Each ERA2 Recipient must provide the following financial data.

Total ERA2 award amount (pre-populated)

Cumulative amount of ERA2 Award Obligated as of the end of the Reporting Period

Cumulative amount of ERA2 Award Obligated but not Expended as of the end of the Reporting Period

Cumulative amount of ERA2 Award Expended as of the end of the Reporting Period

Amount of ERA2 Award Unobligated as of the end of the Reporting Period

Current Quarter Obligations

Current Quarter Expenditures

Reminder on Limitations on Administrative Costs – Recipients are limited in the amounts ERA2 used for administrative costs. See Appendix 8 for more information on uses of ERA funds for these costs. All recipients are permitted to charge both direct and indirect costs to their ERA2 awards. Recipients that elect to charge indirect costs to the ERA2 award must provide a copy of its current negotiated indirect cost rate agreement in the designated upload section of the online form. If a cost rate agreement does not exist, the Recipient must provide a written notification that it elected to use the de minimus indirect costs rate of ten percent of the modified total direct costs, per 2 CFR 200.414(f).

Reminder that Obligations and Expenditures Must Not Exceed the Federal Award Amount – Recipients should ensure that amounts reported as obligated or expended do not exceed the total amount of the recipient’s respective ERA2 award received from Treasury. Some recipients have reported obligations or expenditures that exceed the amount of funds awarded and paid by Treasury. While recipients may utilize other, non-Treasury ERA funds for their rental assistance programs, and are encouraged to do so within the guidelines set forth in Treasury’s ERA Frequently Asked Questions and related guidance from the Office of Management and Budget in M-21-20, Promoting Public Trust in the Federal Government through Effective Implementation of the American Rescue Plan Act and Stewardship of the Taxpayer Resources, Recipients should only report to Treasury in their ERA Quarterly Reports on expenditures and obligations related to their ERA2 award received from Treasury. Treasury encourages recipients to identify amounts and describe contributions from other federal, state, or local programs in a comment field in future quarterly and monthly submissions.

ERA2 Emergency Rental Assistance Project Participant Household Payment Data File (PHPDF)

The Participant Household Payment Data File (PHPDF) is a required component of each ERA quarterly report. Beginning with the Q1 2023 Report, ERA2 Recipient must submit a single cumulative PHPDF file containing information from the program inception through the current reporting period in each reporting period. Each quarterly submittal will replace all PHPDF data previously submitted. This will allow you to submit current period data and revisions to prior period data each reporting period. Please may do so with the file name PHPDF_ERA2-XXXX_Cumulative.csv.

ERA2 Recipients must use a Treasury template for providing the PHPDF. The template is available for download from the “Bulk Upload Templates and Instructions” tab of Treasury’s portal.

Treasury’s portal will enable ERA2 Recipients to securely upload the data file as part of each Quarterly Report. ERA2 Recipients should take care to never include beneficiary names or social security numbers in the file submission. ERA2 Recipients are reminded of the requirement to establish data privacy and security requirements for the information collected from all households, including protection of household personally identifiable information, and to provide confidentiality protections, as necessary, consistent with this requirement as set forth in the Consolidated Appropriations Act, 2021. Treasury’s eligibility and verification guidance remains unchanged.

Please see Figure 3 for information, guidance, and requirements for developing and submitting the PHPDF.

Any recipient that does not upload the PHPDF for submission with this quarterly report must provide an explanation in the comment box below with a timeframe for when the file will be submitted.

Figure 3

All ERA2 Recipients must provide a Participant Household Payment

Data File containing details on each payment made to each unique

participant household that receiving, either directly or

indirectly, a disbursement of ERA2 funds from the subject ERA2

Emergency Rental Assistance Project over the entire award period of

performance:

Physical address of the participant household that received the

payment (not P.O. Box)

Type of Payee to whom the payment was made (payee types are:

Tenant; Landlord or Owner; Utility/Home Energy Service Provider;

Other Housing Services and Eligible Expenses Provider)

Category of ERA2 Financial Assistance provided (Rent; Rental

Arrears; Utilities/Home Energy Costs; Utility/Home Energy Arrears;

and Other Housing Services and Eligible Expenses)

In situations where a payment is for multiple categories of

financial assistance, please report the predominant category for

the payment

Amount

of payment Date of

the payment

Start

and End Dates covered by the payment (as documented in the

participant household’s application / records, as

appropriate)

In

situations where the period of coverage is not known, please

provide a Start Date and leave the End Date field blank.

Required Participant Household Payment Data File

Elements

Each ERA2 Recipient should include the physical address of the participant household only. Do not provide the address of the landlord, the utility provider, or other entity that received the payment.

Recipients should not provide information about payments made to Housing Stability Service providers or about payments made for Administrative Costs.

To the extent that the ERA2 Recipient made multiple payments to assist tenants at the same address, the Recipient should include multiple data entries per household. See the following two scenarios for more information:

a) When an ERA2 Recipient makes a rental payment and a separate utility/home energy payment for the same household during the reporting period, the data file should include two separate entries (one entry for each payment).

b) When an ERA2 Recipient makes one payment to a landlord for the current rent due and an additional amount for the rental arrears, the data file should include two entries – one for the rent payment and one for the rental arrears payment.

Report Certification and Submission Tab

Treasury’s Portal will present the following statement that the Recipient’s Authorized Representative for Reporting must use to certifying that the information provided is complete and accurate:

I certify that the information provided is accurate and complete after reasonable inquiry of people, systems, and other information available to the ERA Recipient. The undersigned acknowledges that a materially false, fictitious, fraudulent statement or representation (or concealment or omission of a material fact) in this submission may be the subject of criminal prosecution under the False Statements Accountability Act of 1996, as amended, 18 U.S.C. § 1001, and also may subject me and the ERA Recipient to civil penalties, damages, and administrative remedies for false claims or otherwise (including under to 31 U.S.C. §§ 3729 et seq.). The undersigned is an authorized representative of the ERA Recipient with authority to make the above certifications and representations on behalf of the ERA Recipient.

The Recipient’s designated Authorized Representative for Reporting will be required to e-sign this certification before final submission of the quarterly report via the portal. Note that the certification will be the last step in the Recipients’ submission process for submitting a quarterly report.

In addition, to ensure that the individual currently logged-in to Treasury’s Portal is in fact authorized to certify and submit an ERA Quarterly Report the portal will display the name, title, phone, and email address of the currently person who is current logged-in to the system.

If the name shown above is not that of an authorized ERA2 Administrator or ERA2 Authorized Representative, the logged-in individual should save and log-off the portal, then have an authorized ERA2 Account Administrator or ERA2 Authorized Representative for Reporting sign in to officially certify and submit the quarterly report.

Appendices

Appendix 1 – Quarterly Reporting Elements

Table A-2

ERA2 Recipients

Required

Reporting Elements for ERA Quarterly Reports

effective with

the Q1 2023 Report

Guidance Section / Portal Tab |

Reporting Item |

Requirements all ERA2 Recipients |

Recipient Profile |

All components listed within section / portal tab |

Required |

Project Overview |

All components listed within section / portal tab |

Required |

Emergency Rental Assistance Project |

All components listed within section / portal tab |

Required |

Affordable Rental Assistance Project(s) |

All components listed within section / portal tab |

Required if the ERA2 administers an ERA2 Affordable Rental Housing Project |

Eviction Prevention Project(s) |

All components listed within section / portal tab |

Required if the ERA2 administers an ERA2 Eviction Prevention Project |

Project Data and Participant Demographics

|

Number of unique households that completed and submitted an application for ERA Assistance |

Required, including demographic data breakdown |

Number of unique households that received assistance of any kind |

Required, including demographic data breakdown |

|

Number of unique households that received their initial ERA assistance in the current reporting period |

Required, including demographic data breakdown |

|

Number of unique households that received ERA assistance by type – rent |

Required, including demographic data breakdown |

|

Number of unique households that received ERA assistance by type – rental arrears |

Required, including demographic data breakdown |

|

Number of unique households that received ERA assistance by type – utilities/home energy bills |

Required, including demographic data breakdown |

|

Number of unique households that received ERA assistance by type – utilities/home energy arrears |

Required, including demographic data breakdown |

|

Number of unique households that received ERA assistance by type – other expenses related to housing |

Required, including demographic data breakdown |

|

Number of unique households that received ERA assistance by type – housing stability services |

Required, do not provide demographic data breakdown |

|

Number of unique households at certain income levels: less than 30% of Area Median Income |

Required, including demographic data breakdown |

|

Number of unique households at certain income levels: between 30 and 50% of Area Median Income |

Required, including demographic data breakdown |

|

Number of unique households at certain income levels: between 50 and 80% of Area Median Income |

Required, including demographic data breakdown |

|

Total number of recipient households whose income eligibility was determined based on their eligibility for other federal benefit programs |

Required, including demographic data breakdown |

|

Total number of recipient households whose income eligibility was determined using a fact-based proxy |

Required, including demographic data breakdown |

|

Total amount of ERA award paid to or for participant households |

Required, including demographic data breakdown |

|

Average number of months of rent or utility/home energy payments covered for each participant household |

Required, including demographic data breakdown |

|

Amounts Paid (Expended) and Amounts Approved (Obligated for Payment) in the quarter (items j through n in this section) |

Required |

|

Performance and Financial Reporting |

Performance narrative |

Required |

Narrative on effective practices |

Required |

|

Data points as required on the SF-425:

|

Required |

|

Participant Household Payment Data File |

Required |

|

Report Certification and Submission |

Certify and Submit |

Required |

Appendix 2 – ERA2 Program Terminology

Who is a ERA2 Recipient / Grantee?

A Recipient (also referred to as a Prime Recipient) is an entity that received an ERA2 award directly from Treasury pursuant to section 3201 of the American Rescue Plan Act (ARPA):

Recipients / Grantees of ERA2 Awards:

All 50 States

Units of local government with more than 200,000 residents

The District of Columbia

U.S. Territories

What

is an ERA2 award?

Awards

issued by Treasury pursuant to section 3201 of the American Rescue

Plan Act.

What is a Subrecipient in the context of ERA2 Reporting?

For

the purposes of ERA reporting, a subrecipient is an entity or

individual to which an ERA recipient / grantee issues a subaward.

What is a Contractor?

Contractors are entities that receive a contract from the ERA Recipient / grantee for the purpose of obtaining goods and services to implement the ERA award.

What is a Beneficiary in the context of ERA2 reporting?

For

the purposes of ERA2 reporting, Beneficiaries are entities or

individuals that receive direct payments from the ERA2 Recipient /

grantee or its Subrecipient(s). Beneficiaries may be a

household/tenant, a landlord, a utility provider, or vendor for

other related housing expenses (e.g., for internet services and

hotel stays).

What

are ERA2 Financial Services in the context of ERA2 program

reporting?

Financial

Services are payments of ERA2 funds by an ERA2 Recipient / grantee

or its Subrecipient(s) for rent, rental arrears, utility/home energy

assistance or utility/home energy assistance arrears of the ERA

program participant households.

What are Housing Stability Services in the context of ERA2 program reporting?

Housing Stability Services are services for which the ERA2 Recipient / grantee or its Subrecipient(s) use(s) ERA2 funds to pay a third party that provides housing assistance services for a participant household.

What is a Fact-Based Proxy for Determining Participant Income Eligibility?

A Fact-Based Proxy as described in FAQ #4 dated May 7, 2021, is a written attestation from the applicant as to household income without further documentation of income. An ERA Recipient / grantee may rely on such an attestation from the applicant if the ERA2 Recipient / grantee also uses any reasonable fact-specific proxy for household income, such as reliance on data regarding average incomes in the household’s geographic area.

What is an obligation?

For purposes of ERA2 reporting, an obligation is a commitment to pay a third party with ERA2 award proceeds based on a contract, subaward, direct payment, or other arrangement.

What is an expenditure?

For purposes of ERA2 reporting, an expenditure is the amount that has been incurred as a liability of the entity (the service has been rendered or the good has been delivered to the entity).

What is a contract?

A contract is an obligation to an entity associated with an agreement to acquire goods or services.

What is a direct payment?

A direct payment is a disbursement by the ERA2 Recipient (with or without an existing obligation) to an entity or individual that is not associated with a contract or subaward. Examples of direct payments are a benefit payment the ERA2 Recipient makes to a household/tenant, a landlord, a utility provider, or a payment the ERA2 Recipient makes to a vendor for other related housing expenses (e.g., for internet services and hotel stays).

What is the primary place of performance for a contract or a subaward?

The primary place of performance is the address where the predominant performance of the contract or subaward will be accomplished.

What is the period of performance start date and end date for a contract or a subaward?

The period of performance start date is the date on which efforts begin or the contract or subaward is otherwise effective. The period of performance end date is the date on which all effort is completed, or the contract or subaward is otherwise ended.

What is the ERA2 Recipient’s / Grantee’s designated ERA2 Authorized Representative for Reporting?

The ERA2 Recipient’s designated Authorized Representative for Reporting is the individual designated by the ERA2 Recipient / Grantee as having authority to certifying and submit official reports on behalf of the Recipient (a governmental entity administering the specific ERA2 award).

What is the ERA2 Recipient’s / Grantee’s designated ERA2 Point of Contact for Reporting?

The ERA2 Recipient’s designated ERA2 Point of Contact for Reporting is the individual designated by the ERA2 Recipient / grantee who is responsible for receiving official Treasury notifications about program reporting including alerts about upcoming reporting, requirements, and deadlines. The ERA2 Point of Contact for Reporting is also responsible for completing the reports for the Recipient / grantee.

What is a Redirect of Award Funds?

A redirect of award funds occurs when a locality receives an ERA award and subsequently transfers 100% of the ERA award funds received from Treasury to its eligible State. In this situation, the redirect of award funds is finalized when the locality has submitted the relevant redirection documentation to Treasury and Treasury has provided confirmation of acceptance of such documentation. At that time, the locality’s ERA award is cancelled, and the locality has no further legal obligation to Treasury under the ERA award. The State’s ERA award is modified by the amount of the funds transferred by the local government and the State is responsible as the recipient for reporting on the use of the transferred award funds, as such funds are now subject to the requirements set forth in the ERA Award Terms and Conditions previously accepted by the State in connection with its ERA award.

Appendix 3 – Race, Ethnicity and Gender Categories for Reporting Disaggregated Counts of ERA2 Project Participants

State, Local and Territorial Recipients receiving ERA2 awards are required to report total (aggregate) counts of the number of ERA2 Project participants over several factors such as the number of applications received and approved and the number of participants receiving each type of authorized ERA2 assistance, so forth in each quarterly report. These ERA2 Recipients must also report the figures disaggregated by three demographic characteristics of the head of each participating household. The primary demographic characteristics – race, ethnicity, and gender – and each required subcategory are listed below.

Race

American Indian or Alaska Native

Asian

Black or African American

Mixed Race

Native Hawaiian or Other Pacific Islander

White

Declined to Answer

Data Not Collected

Ethnicity

Hispanic or Latino

Not Hispanic or Latino

Declined to Answer

Data Not Collected

Gender

Female

Male

Non-binary

Declined to Answer

Data Not Collected

Appendix 4 – Expenditure Categories and Payee Types

The following are several key terms helpful for ERA2 Recipient / Grantee data collection and reporting.

Allowed Expenditure Categories

Financial Assistance: Rent

Financial Assistance: Rental arrears

Financial Assistance: Utility/home energy costs

Financial Assistance: Utility/home energy costs arrears

Financial Assistance: Other housing costs

Housing Stability Services Costs

Affordable Rental Housing Costs

Eviction Prevention Services Costs

Payee Types

Tenant

Landlord or Owner

Utility / Home Energy Service Provider

Appendix 5 – Administration and Compliance Information for ERA2 Award Recipients

Background Information

Administration and Compliance

ERA2 Award Terms and Conditions which include important details for Recipients such as: Allowable uses of funds; Allowable administrative costs; Reporting; Maintenance of and Access to Records; Compliance with Applicable Laws and Regulations and other topics (this list of topics is only illustrative of topics covered in the Award Terms and Conditions).

ERA2 award terms with detailed information on such topics as allowable uses of funds.

Regulatory Requirements under the Uniform Guidance (2 CRF Part 200): The ERA2 awards are generally subject to the requirements set forth in the Uniform Guidance. In all instances, Recipients should review the Uniform Guidance requirements applicable to its use of ERA2 award funds. Recipients should consider how and whether certain aspects of the Uniform Guidance apply.

Single Audit Requirements: Recipients and Subrecipients that expend more than $750,000 in Federal awards during their fiscal year will be subject to an audit under the Single Audit Act and its implementing regulation at 2 CFR Part 200, Subpart F regarding audit requirements. Recipients and subrecipients may also refer to the implementing guidance on OMB’s website, the OMB Compliance Supplements for audits of federal funds, and related guidance at, and the Federal Audit Clearinghouse to see examples and single audit submissions.

Civil Rights Compliance: Unless exempted, recipients of Federal financial assistance from the Treasury are required to meet legal requirements relating to nondiscrimination and nondiscriminatory use of Federal funds. Those requirements include ensuring that entities receiving Federal financial assistance from the Treasury do not deny benefits or services, or otherwise discriminate on the basis of race, color, national origin (including limited English proficiency), disability, age, or sex (including sexual orientation and gender identity), in accordance with the following authorities: Title VI of the Civil Rights Act of 1964 (Title VI) 42 U.S.C. §§ 2000d et seq., and Treasury's implementing regulations, 31 CFR Part 22; Section 504 of the Rehabilitation Act of 1973 (Section 504), Public Law 93-112, as amended by Public Law 93-516, 29 U.S.C. § 794; Title IX of the Education Amendments of 1972 (Title IX), 20 U.S.C. §§1681 et seq., and the Department's implementing regulations, 31 CFR Part 28; Age Discrimination Act of 1975, Public Law 94-135, 42 U.S.C. §§ 6101 et seq., and Treasury’s implementing regulations at 31 CFR Part 23. In order to carry out its enforcement responsibilities, under Title VI of the Civil Rights Act, Treasury will collect and review information from recipients to ascertain their compliance with the applicable requirements before and after providing financial assistance. Treasury’s implementing regulations, 31 CFR Part 22, and the Department of Justice (DOJ) regulations, Coordination of Non-discrimination in Federally Assisted Programs, 28 CFR Part 42, provide for the collection of data and information from recipients (see 28 CFR § 42.406). Treasury will request recipients to submit data for post-award compliance reviews, including information such as a narrative describing their Title VI compliance status.

Additional Helpful Information

Emergency Rental Assistance Program Federal Assistance Listing (CFDA Number 21.023) as posted on SAM.gov. The assistance listing includes helpful information including program purpose, statutory authority, eligibility requirements, and compliance requirements for recipients. The Assistance Listing Number (ALN) is the unique 5-digit number assigned to identify a federal assistance listing and can be used to search for federal assistance program information, including funding opportunities, spending on USASpending.gov, or audit results through the Federal Audit Clearinghouse.

Appendix 6 – Formerly Required ERA2 Monthly Reports

ERA2 Recipients were required to submit brief monthly reports through June 30, 2022. This requirement is subject to change and Treasury may require submission of additional Monthly Reports.

The required monthly consist of two data elements as described below. Recipients must submit the monthly reports via the Treasury portal by the 15th day of the month following the reporting period.

Required ERA2 Monthly Reporting Data Elements and Definitions |

||

Equivalent on Quarterly Report |

Element |

Definition |

See “Project Data and Participant Demographics” Tab |

Number of Unique Households that Received ERA2 Assistance of Any Kind in the Reporting Period |

The number of unique participant

households whose rent, rental arrears, utility/home energy

payments, utility/home energy arrears, or other expenses related

to housing were fully or partially paid under the subject ERA2

award in the reporting period. This number should capture

all previously-approved applicants receiving assistance from

[month day 1 – month day 30, 20XX], as well as new

applicants approved in the month with assistance received and/or

paid in from [month day 1 – month day 30, 20XX]. |

See “Project Data and Participant Demographics” Tab |

Total Amount of ERA2 Award Funds Paid to or for Participant Households in the Reporting Period

|

The total dollar amount of ERA2 award funds paid under the ERA2 Project to or for participant households including payments for rent, rental arrears, utility/home energy costs, utility/home energy cost arrears, and other housing services and eligible expenses in the [month day 1 – month day 30, 20XX] reporting period. This does not include funds paid for Housing Stability Services. Please enter “0” if the grantee has not experienced any new activity on this data element during reporting period. |

Appendix 7 – Applicable Limitations on Administrative Expenses

The following Treasury FAQ addresses the applicable limitation on uses of ERA2 award funds for administrative expenses.

Under ERA2, not more than 15 percent of the amount paid to a grantee may be used for administrative costs attributable to providing financial assistance, housing stability services, and other affordable rental housing and eviction prevention activities.

For ERA2, any direct and indirect administrative costs must be allocated by the grantee accordingly for the provision of financial assistance, housing stability services, and other affordable rental housing and eviction prevention activities. As required by the applicable statutes, not more than 10 percent of funds received by a grantee may be used to provide eligible households with housing stability services (discussed in FAQ 23). To the extent administrative costs are not readily allocable to one or the other of these categories, the grantee may assume an allocation of the relevant costs of 90 percent to financial assistance and 10 percent to housing stability services.

Grantees may apply their negotiated indirect cost rate to the award, but only to the extent that the total of the amount charged pursuant to that rate and the amount of direct costs charged to the award does not exceed 15 percent of the amount of the award for ERA2.

Please see Treasury’s ERA Frequently Asked Questions (FAQs) under the Guidance section on the Emergency Rental Assistance Program page for more information on administrative expenses and other important topics.

Appendix 8 – Background on Annual Civil Rights Compliance and Reporting

Treasury will request information on each Recipients’ compliance with Title VI of the Civil Rights Act of 1964 (Title VI) on an annual basis. This information may include a narrative describing the Recipient’s compliance with Title VI, along with other questions and assurances. Treasury currently plans to require this additional information as part of one the scheduled quarterly reports. Treasury will provide additional instructions and guidance on requirements for the Civil Rights reporting as it become available. This collection does not apply to Tribal Governments.