Form Revision_2022 CDFI Transaction Level Report Form

Annual Certification and Data Collection Report Form

OMB# 1559-0046 CDFI Transaction Level Report Form

Annual Certification and Data Collection Report Form - ACR

OMB: 1559-0046

Abbreviated CDFI Transaction Level Report Form for CDFI Certification Applicants and Certified CDFIs that are not current Financial Assistance (FA) Recipients Form & Data Point Guidance

Table of Contents

II. Abbreviated Transaction Level Report (TLR) 3

III. TLR for Financial Services 7

V: Non-substantive Changes to the Full-Length CDFI TLR 14

VI. Target Market Policies Affecting Abbreviated TLR Data Entry 27

Appendix A: Abbreviated TLR Requirements 31

Appendix B: CDFI TLR Address 45

Appendix C: Consumer Loans/Investments Originated Table 53

Appendix D: Certifying CDFI TLRs 65

Abbreviated CDFI Transaction Level Report Form for CDFI Certification Applicants and Certified CDFIs that are not current Financial Assistance (FA) Recipients & Data Point Guidance1

December 2022

I. Overview

In May 2020, the Certification Transaction Level Report (CTLR) was a proposed requirement for CDFI Certification Applicants, and for those Certified CDFIs that are not current Financial Assistance (FA) recipients and therefore do not submit a full Transaction Level Report (TLR) (OMB control number 1559-0027) to the CDFI Fund. As an administrative efficiency, the CTLR data collection was submitted for public comment under the Annual Certification and Data Collection Report (ACR) OMB control number 1559-0046. The CTLR was intended to support both the revised Certification Application (see related OMB 1559-0028) and the ACR. The CTLR would be submitted using the CDFI Fund’s Awards Management and Information System (AMIS).

As of October 2022, in response to public comments, the CDFI Fund has eliminated the separate CTLR. CDFI Certification Applicants and those Certified CDFIs that are non-recipients will submit a subset of the full TLR to the CDFI Fund, the abbreviated TLR. The subset of data fields is modeled on the 11 data fields proposed in the CTLR, with the addition of other TLR data fields necessary to conform to existing TLR validations and allow for Target Market (TM) activity assessment. The abbreviated TLR provides a method to evaluate the extent to which Certified CDFIs serve qualified Investment Areas and Targeted Populations.

For Certified CDFIs that are current active FA recipients, the Fund is making a few non-substantive changes to the TLR in order to better measure TM activity, as well as align new tables originally proposed as part of the CTLR. First, the TLR’s Consumer Loan Report (CLR) will now require entities to report counts and dollar amounts for individual Other Targeted Population (OTP) categories instead of the current overall OTP category. Credit Unions and Banks will continue to report consumer loans aggregated to the census tract level. Second, the TLR will now include the Financial Services Table and Loan Purchases Table originally proposed for the CTLR. The same eligibility requirements for their use applies. Third, several existing data fields will include additional answer choices in their pull-down menus. For example, the “Purpose” data field will now include “Climate-Centered Finance” as an answer choice to align with answer choices in the ACR. The full-length CDFI TLR has its PRA approval set to expire at the end of July 2023; so it will go out for renewal in the first half of calendar year 2023.

Section II provides a synopsis of the abbreviated TLR, including the designated TLR data fields and the data entry and submission process. Section III discusses the new Financial Services table and Section IV discusses the new Loan Purchases table. Both of these tables were originally proposed as part of the CTLR and are now incorporated into the TLR for every organization to complete if applicable. Section V describes the non-substantive changes being made to the TLR so that it better aligns with the new Certification Application and the ACR. Section VI describes the policies from the Certification Application that are relevant to measuring and reporting Target Market activity and thus impact how the transaction level data should be reported in the abbreviated TLR, as well as how many TLRs will need to be submitted in order to assess whether an entity is meeting the Target Market activity thresholds. The Appendices provide more detail on the abbreviated TLR’s technical requirements, as well as current versions of the instructional guidance for geocoding TLR addresses, certifying TLR records and completing the Consumer Loans/Investments Originated Table. These documents will be updated once the abbreviated TLR and its components are fully built out in AMIS. All capitalized terms used throughout the document are defined in the CDFI statute, regulations and related guidance.

II. Abbreviated Transaction Level Report (TLR)

CDFI Certification Applicants and Certified CDFIs that are not current active FA recipients will report on new originations closed during the most recently completed fiscal year in the abbreviated TLR. CDFI Certification Applicants are required to submit their complete abbreviated TLR ahead of their CDFI Certification Application submission, which is considered the pre-certification process. Certified CDFIs that are not current active FA recipients are required to submit their complete abbreviated TLR ahead of their ACR submission. To ensure coordination between TLR TM activity results and ACR TM activity requirements, ACR submissions will be due 180 days after the reporting entity’s most recently completed fiscal year. Certified CDFIs will no longer have a “gap” fiscal year between their date of certification and their first ACR submission.

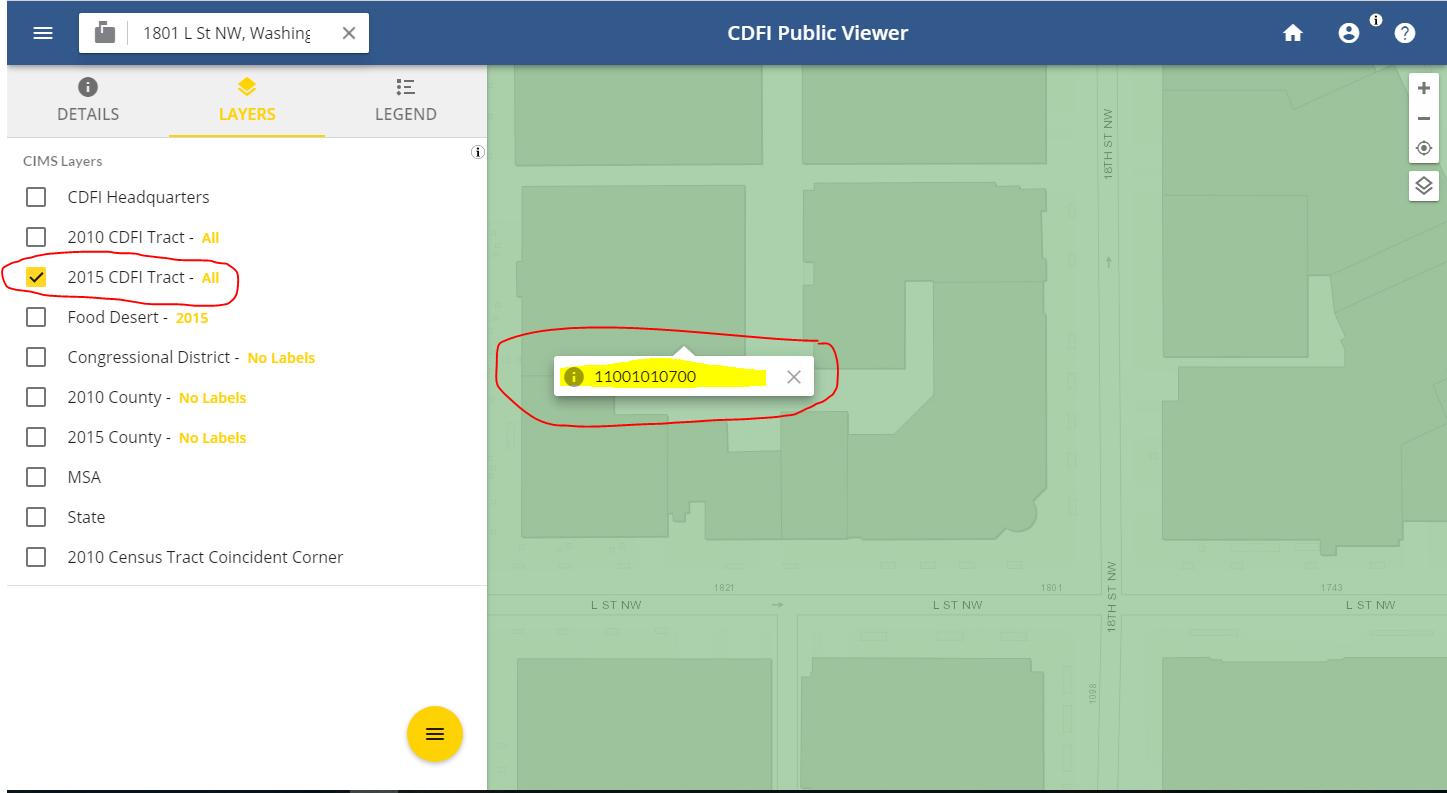

The existing CDFI TLR Address Report will be used to enter location information for each transaction. Depending on the number of originations to report on, an organization may enter information on each origination directly through the user interface in AMIS or they can submit through a bulk upload using a spreadsheet file. Organizations will use the existing TLR reporting and pre-certification process, which allows reporting organizations to validate and check their TLR and associated reports for errors before submitting their final reports. The precertification process will also allow organizations to stage their data in batches and to avail themselves of the geocoding functionality for determining whether transactions are located in qualified Investment Areas (IAs). When organizations upload their reports into the precertification process, the system will check for errors. Once all of the transactions are correct and validated by the system, an organization can submit the final report. An organization should retain all supporting documentation for a minimum of 10 years after submission of the TLR to the Fund for compliance record keeping, just in case it is subject to a random desk review based on the guidelines stated in the Certification Agreement.

Once an organization has submitted its final report, AMIS will then generate a display for each Applicant or certified CDFI that provides an overall tabulation of the proportion of its new originations that serve qualified Investment Areas and/or Targeted Populations based on the Applicant’s or CDFI’s proposed or approved Target Market(s). This information will automatically be populated into either the CDFI Certification Application or ACR to assess whether the organization meets the minimum Target Market activity thresholds required for obtaining or maintaining its CDFI Certification.

Table 1 below provides the existing CDFI TLR data points collected through AMIS and used in conjunction with the CDFI Information Mapping System (CIMS) for the CDFI TLR that all CDFI Certification Applicants and certified, non-FA award recipient CDFIs must complete.

Table 1: CDFI TLR Data Fields to be completed by CDFI Certification Applicants and certified, non-FA award recipient CDFIs

Existing CDFI TLR Column Letter |

TLR Data Point |

Description |

Data Type |

C |

TLR Submission Year |

TLR Submission Year is the year of the report, NOT the year when the report is submitted. |

Drop down of year |

D |

Date Originated |

Report the date that a legally binding note was signed by the borrower/investee in favor of the lender/investor. |

Response must be mm/dd/yyyy |

E |

Original Loan/Investment Amount |

Report the amount of the loan original investment. |

Response must be numeric and non-negative |

F |

Purpose |

Choose one of the pre-defined values below and identify the primary purpose of the financial note. |

Drop down of purpose |

G |

Transaction Type |

Choose one of the pre-defined values below and report the type of transaction for the financial note. |

Drop down of type |

H |

Loan Status |

Choose one of the pre-defined values below and report the status of the loan or investment at the reporting period end. |

Drop down of status |

B |

Originator Transaction ID |

The reporting entity should assign a unique identifier to each loan or investment. |

Response must be text - up to 20 characters |

I |

Interest Rate |

Report the interest rate charged to the borrower at origination. |

Response must be in numeric format up to 3 decimal places |

Q |

Forgivable Loan |

Report whether the loan or investment agreement stipulates that some or all of the outstanding balance of the loan or the equity may be converted to a grant upon meeting specified conditions. |

Drop down of responses |

N |

Equity-Like Features |

Choose one of the pre-defined values below and report the type of equity-like feature. |

Drop down of responses |

S |

Client ID |

The reporting entity should create and report a unique identifier to help distinguish which clients/projects (investees, borrowers, or projects) are associated with which loans or investments. |

Response must be text up to 20 characters |

T |

Investee/Borrower Type |

Choose one of the pre-defined values below and report whether the transaction is a loan or investment in an individual, a business or a CDFI certified by the CDFI Fund. |

Drop down of type |

W |

Entity Structure |

Choose one of the pre-defined values below and report the investee’s/borrower’s business or government structure. |

Drop down of type |

X |

Minority Owned or Controlled |

Report whether the investee/borrower is more than 50% owned or controlled by one or more minorities. |

Drop down of responses |

Y |

Women Owned or Controlled |

Report whether the investee/borrower is more than 50% owned or controlled by one or more women. |

Drop down of responses |

Z |

Low-Income Owned or Controlled |

Report whether the investee/borrower is more than 50% owned or controlled by one or more low-income persons. |

Drop down of responses |

AC |

Race |

Choose one of the pre-defined values below and report the race of the investee or borrower. |

Drop down of race |

AD |

Hispanic Origin |

Choose one of the pre-defined values below and report whether the investee or borrower is Hispanic. |

Drop down of Hispanic origin |

AI |

Low-Income Status |

Choose one of the pre-defined values below and report the income status of the investee or borrower. |

Drop down of income status |

AJ |

Other Targeted Populations |

Choose one of the pre-defined values below and report whether the transaction serves an Other Targeted Population (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. |

Drop down of OTP type |

AK |

Description of Other Approved OTP |

If “Other Approved OTP” was selected above, report the description of that Other Targeted Population. |

Text |

AO |

IA End Users |

Choose one of the pre-defined values below and report whether the transaction serves Investment Area (IA) End Users. |

Drop down of IA |

AL |

LITP End Users |

Choose one of the pre-defined values below and report whether the transaction serves Low-Income Targeted Population (LITP) End Users as defined in the CDFI Fund’s Target Market Assessment Methodologies document. |

Drop down of LITP |

AM |

OTP End Users |

Choose one of the pre-defined values below and report whether the transaction serves Other Targeted Population (OTP) End Users as defined in the CDFI Fund’s Target Market Assessment Methodologies document. |

Drop down of OTP type |

AN |

Description of Other Approved OTP-End Users |

If “Other Approved OTP” was selected above, report the description of that Other Targeted Population. |

Text |

III. TLR for Financial Services

Depository Institutions seeking to obtain or maintain CDFI Certification are able to document the provision of qualified Financial Services to meet the Target Market test if the dollar volume of their qualified Financial Product transactions falls below the 60 percent threshold, but still represents at least 50% of the total dollar volume of its transactions. In such cases, a Depository Institution may meet the test by demonstrating that at least 60 percent of the total number of its Financial Products are directed to one or more eligible Target Market(s) and at least 60 percent its total unique depository account holders are members of one or more eligible Target Market(s), as of the end of the reporting fiscal year.

To provide for such cases, the TLR has a separate template and/or AMIS user interface, the TLR Financial Services object, where reporting entities will provide information on their unique depository account holders as of the last day of the most recently completed fiscal year. Depending on the number of unique depository account holders, the reporting entity may be required to enter information directly into AMIS through the user interface or use the template for bulk record uploading. Reporting entities will use the CDFI TLR Address object to geocode the location of each unique depository account holder by the census tract FIPS code. The results from geocoding allow AMIS to determine which unique depository account holders are located in Investment Areas. Using the CDFI Fund’s Target Market Assessment Methodologies, a reporting entity can identify unique depository account holders who are members of an approved Targeted Population. It is important to remember that a unique depository account holder may qualify for an Investment Area as well as a Targeted Population(s), but for purposes of calculating Target Market activity percentages, a unique depository account holder can only be counted once, i.e. it is either IA or LITP or OTP, but not more than one.

Please note that as part of the geocoding process, the CDFI Information Mapping System (CIMS) will NOT save any addresses and will return a file with only valid FIPS codes and identify transactions that serve Investment Areas. This approach protects confidential information.

Table 2: Data Fields for the TLR Financial Services Object

Data Point |

Description |

Data Type |

Financial Services Submission Year |

Financial Services Submission Year is the year of the report, NOT the year in which the report is submitted. |

Drop down of year |

Depository Account Holder ID |

An ID number unique to each depository account holder at the financial institution as of the last day of the most recently completed fiscal year. |

Alpha-numeric |

Other Targeted Populations (OTP) |

Select from drop down the Other Targeted Population(s) associated with the depository account holder. |

Drop down of OTP type |

Account FIPS Code |

11-digit census tract FIPS code generated by geocoding the depository account holder address to indicate the depository account holder’s location. |

Text format |

Account Latitude |

X coordinate location (latitude) of the depository account holder. |

Numeric |

Account Longitude |

Y coordinate location (longitude) of the depository account holder. |

Numeric |

Investment Area (IA) |

Binary response derived from the “Account FIPS Code” data field indicating whether the depository account holder lives in an eligible Investment Area. |

FIPS Code Qualified (Yes/No) |

Low-Income Targeted Population (LITP) |

Select from drop down the binary response indicating whether the depository account holder is a member of a Low-Income Targeted Population. |

Drop down of Yes or No |

Org ID |

AMIS ORG ID. |

Auto-populated |

Organization Name |

Full name of the reporting entity |

Auto-populated |

Institution Type |

Financial institution type (should align with Organizational Profile option selected). |

Auto-populated |

Submission Date |

Date on which the template/table was submitted by the financial institution. |

Auto-generated date by AMIS (mm/dd/yyyy) |

IV. TLR for Loan Purchases

CDFI Certification applicants or Certified CDFIs can document how their purchase of loans from certified CDFIs or non-Certified CDFIs serve to meet the Financing Entity, and/or the Target Market test. The CDFI Fund counts Loan Purchases from CDFIs and Target Market loans purchased from non-Certified CDFIs as Financial Products. Loan Purchases should be presented for review in connection with the Target Market requirements as follows:

Loan Purchases from Certified CDFIs, whether purchased individually or in bundle, are recognized as Financial Products directed to an OTP – Certified CDFIs Target Market. Each bundled Loan Purchase from a CDFI will count as a single Financial Product transaction.

Target Market loans purchased from non-Certified CDFIs are recognized as Financial Products directed to the Target Market(s) of the original borrowers. Applicants that purchase Target Market loans from non-Certified CDFIs in bundle may count each of the purchased loans as a single Financial Product transaction.

Table 3 below presents the data fields that comprise the TLR’s Loan Purchases object. The TLR will provide a separate template to geocode the location of loans purchased from a CDFI or non-Certified CDFIs only if address information is available for each transaction. All loans purchased from a certified CDFI should be coded as “Other Targeted Population – Certified CDFIs” by the reporting entity. For loans purchased from a non-certified CDFI, the reporting entity can classify them as IA, LITP or OTP depending on their eligibility. Based on the FIPS code assigned to each loan purchased in the TLR, AMIS will assess whether it is located in an IA. Reporting entities should refer to the CDFI Fund’s Target Market Assessment Methodologies document for guidelines on how to classify a loan purchased as LITP or OTP.

To conduct a Loan Purchases analysis, please select the Loan Purchases template. Please note that CIMS will NOT save any addresses and will return a file with only valid FIPS codes for each transaction that is identified as serving either a distressed area or Targeted Population. This approach protects confidential information.

Once both the Loan Purchases and all other TLR coding is completed and validated in the organization’s pre-certification account and submitted, the system will report the percentage of all valid Target Market transactions as a share of all Loan Purchases and other Financial Products. This applies to both the Certification Application and the ACR.

Table 3. Data Fields for the Loan Purchases Object

QUESTION NUMBER |

REPORT ITEM |

INSTRUCTIONS |

LP1 |

TLR Loan Purchase Submission Year |

Select from drop down list of years NOTE: TLR Loan Purchase Submission Year is the year of the report, NOT the year when the report is submitted. |

LP2 |

Was this loan/loan bundle purchased from a Certified CDFI? |

Select from the following answers: Yes No If answer is “Yes” then proceed to Question LP3. If answer is “No” then proceed to Question LP22.

NOTE: “Certified” status pertains to the time of purchase for the individual loan or loan bundle. If the CDFI from which the individual loan or loan bundle was purchased was not Certified at the time of purchase, but later became Certified, then the reporting entity should respond “No” to this question. If the CDFI from which the individual loan or loan bundle was purchased was Certified at the time of purchase, but later became not Certified, then the reporting entity should respond “Yes” to this question. |

If Yes, provide the following information on each individual loan or loan bundle. Do not disaggregate loan bundles. (Use multiple rows if necessary): |

||

LP3 |

Purchase Number |

System assigned value. |

LP4 |

Purchase Date |

For each row, enter the month, day, and year of the loan purchase event. |

LP5 |

Total $ Paid |

For each row, enter the Total Amount Paid for the loan purchase. |

LP6 |

Total # Loans |

For each row, enter the Total Number of Loans for the purchase. |

LP7 |

Presale Book Value |

For each row, enter the Presale Book Value for the loans purchased. |

LP8 |

Name of Certified CDFI that Loan/Loan Bundle was Purchased From |

For each row, enter the name of the Certified CDFI from which the individual loan or loan bundle was purchased. |

LP8A |

City location for the Certified CDFI from which the Loan/Loan Bundle was Purchased |

For each row, enter the name of the city. |

LP8B |

State location for the Certified CDFI from which the Loan/Loan Bundle was Purchased |

For each row, enter the name of the state. |

LP9 |

Business Loans_Amount |

For each row, enter the Dollar Amount of loan purchases in this category. NOTE: This category includes microenterprise loans. |

LP10 |

Business Loans_Number |

For each row, enter the Number of loan purchases in this category. |

LP11 |

Consumer Loans_Amount |

For each row, enter the Dollar Amount of loan purchases in this category. |

LP12 |

Consumer Loans_Number |

For each row, enter the Number of loan purchases in this category. |

LP13 |

Commercial Real Estate Loans_Amount |

For each row, enter the Dollar Amount of loan purchases in this category. |

LP14 |

Commercial Real Estate Loans_Number |

For each row, enter the Number of loan purchases in this category. |

LP15 |

Residential Real Estate Loans_Amount |

For each row, enter the Dollar Amount of loan purchases in this category. |

LP16 |

Residential Real Estate Loans_Number |

For each row, enter the Number of loan purchases in this category. |

LP17 |

Mortgage Loans_Amount |

For each row, enter the Dollar Amount of loan purchases in this category. |

LP18 |

Mortgage Loans_Number |

For each row, enter the Number of loan purchases in this category. |

LP19 |

Other/Unknown Loans_Amount |

For each row, enter the Dollar Amount of loan purchases in this category. |

LP20 |

Other/Unknown Loans_Number |

For each row, enter the Number of loan purchases in this category. |

LP21 |

Other Targeted Populations (OTP) |

Systems should fill this in as “Other Targeted Population – Certified CDFIs.” |

If No, provide the following information on each individual loan, regardless of whether it is a single loan purchase or a loan bundle purchase. All loan bundles should be disaggregated to the individual loan level. (Use multiple rows if necessary): |

||

LP22 |

Purchase Number |

Number identifying the loan bundle to which individual loans belong if they were purchased in a bundle. NOTE: Loans purchased together in a bundle should have the same number value for this data field. |

LP23 |

Loan ID |

Unique identifier for each loan in a purchased bundle or individual loans purchased separately. |

LP24 |

Name of Entity Loan was Purchased From |

For each row, enter the name of the entity from which the loan(s) was purchased. |

LP25 |

Purchase Date |

For each row, enter the month, day, and year of the loan purchase event. |

LP26 |

Loan Amount |

For each row, enter the Dollar Amount of loan purchased. |

LP27 |

Loan Interest Rate |

For each row, enter the interest rate of loan purchased. |

LP28 |

Loan Status |

For each row, select the option below that describes the status of the loan purchased at the end of the most recently completed fiscal year. Active Closed Sold Charged-off Refinanced Restructured |

LP29 |

Purpose |

For each row, select the option below that describes the purpose of the loan purchased. Consumer Non-Real Estate Business Non-Real Estate Microenterprise Home Purchase Home Improvement Real Estate – Construction/Permanent/Acquisition w/o Rehab – Commercial Real Estate – Construction–Housing-Multi Family Real Estate – Construction–Housing-Single Family Real Estate–Rehabilitation–Commercial Real Estate – Rehabilitation – Housing – Multi Family Real Estate – Rehabilitation – Housing – Single Family Climate Other |

LP30 |

Project FIPS Code |

Report the project’s 11-digit FIPS Code. |

LP31 |

Project Latitude |

Report the Project Latitude (Y-Coordinate). NOTE: It should be a negative number. |

LP32 |

Project Longitude |

Report the Project Longitude (X-Coordinate) NOTE: It should be a positive number. |

LP33 |

Investment Area (IA) |

For each row, value of (Yes or No) will by Populated by AMIS based on the submission of the CDFI TLR Address template into CIMS. |

LP34 |

Other Targeted Populations (OTP) |

For each row, select the option below and report whether the loan purchased serves an Other Targeted Population (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document.

Native American Native Alaskan residing in Alaska African American Native Hawaiian residing in Hawaii Other Pacific Islander residing in Other Pacific Islands Persons with Disabilities Hispanic Other Approved OTP NA |

LP35 |

Desc of Other Approved OTP |

If “Other Approved OTP” was selected in LP34, provide a description of the approved Targeted Population. |

LP36 |

Low-Income Targeted Population (LITP) |

For each row, choose one of the predefined values below and report whether the transaction serves a Low-Income Targeted Population.

Yes No

NOTE: An entity may code loans as LITP through its own loan processing system. Such coding should be based on the collection of income data per the CDFI Fund’s Regulations and the CDFI Fund’s Target Market Assessment Methodologies document. For cases where the CDFI Fund has approved an entity’s method to determine LITP End-Users, that method can be used to designate transactions as long as there is supporting documentation. The transaction file should be validated and saved in the organization’s pre-certified account. |

LP37 |

IA End Users |

For each row, choose one of the predefined values below and report whether the transaction serves Investment Area (IA) End Users.

Yes No NA NOTE: Consult the “CDFI Program 2011-2015 ACS Eligible Investment Areas” table for identifying eligible investment areas (IA) census tracts -- https://www.cdfifund.gov/research-data/Pages/default.aspx. |

LP38 |

LITP End Users |

For each row, choose one of the pre-defined values below and report whether the transaction serves Low-Income Targeted Population (LITP) End Users as defined in the CDFI Fund’s Target Market Assessment Methodologies document.

Yes No NA

NOTE: Individuals qualify as members of the Low-Income Targeted Population (LITP) if their family income is:

|

LP39 |

OTP End Users |

For each row, select the option below and report whether the loan purchased serves an Other Targeted Population (OTP) End User as defined in the CDFI Fund’s Target Market Assessment Methodologies document.

Native American Native Alaskan residing in Alaska African American Native Hawaiian residing in Hawaii Other Pacific Islander residing in Other Pacific Islands Persons with Disabilities Hispanic Other Approved OTP NA |

LP40 |

Desc of Other Approved OTP-End Users |

If “Other Approved OTP” was selected in LP38, provide a description of the Other Targeted Population. |

V: Non-substantive Changes to the Full-Length CDFI TLR

In an effort to better align the existing CDFI TLR data collection instrument (OMB Control Number 1559-0027) with the new Certification Application and new ACR, the Fund will make the following changes:

(1) Add “Climate-Centered” Finance as an answer choice for the “Purpose” data field

Purpose (Column F) Choose one of the pre-defined values below and identify the primary purpose of the financial note. If there are multiple purposes (for example, a loan funding both the purchase of a fixed asset and a facility improvement), select the purpose with the largest share of the transaction. |

|

Validations:

Please select one of the following: |

|

CONSUMER |

Consumer: Loan is a personal (secured or unsecured) loan to one or more individuals for health, education, emergency, credit repair, debt consolidation, or other consumer purposes. Personal loans for business purposes should be identified as Business loans and personal loans for home improvement or repair should be identified as Housing loans. Note: Banks and Credit Unions will receive a validation error if they select Consumer as the Purpose and will be directed to fill out the Consumer Loans/Investments Originated table instead. |

BUSINESS |

Non-Real Estate Business: Financing to for-profit and nonprofit businesses with more than five employees or in an amount greater than $50,000 for a purpose that is not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate. |

MICRO |

Non- Real Estate Microenterprise: Financing to a for-profit or non-profit enterprise that has five or fewer employees (including the proprietor) with an amount no more than $50,000 for a purpose that is not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate. |

CLIMATE |

Climate-Centered Finance: Financing projects related to climate resilience; response to or preparation for extreme weather; reduction of emissions; sustainability; energy, water, or location efficiency; or clean energy projects, including Solar (NAICS 221114), Wind power (NAICS 221115), Geothermal power (NAICS 221116), Biomass (NAICS 221117), as well as other terms such as “LEED”, “recycling”, “waste processing”, “Biofuel”, “brownfield”, “renewable energy” or “green lending. |

HOMEPURCH |

Home Purchase: Loan is for the purchase of a primary residence. |

HOMEIMP |

Home Improvement: Loan is for the renovation or other improvement of an owner-occupied home. |

RECOCOM |

Real Estate – Construction/Permanent/Acquisition w/o Rehab – Commercial: Financial Note is for predevelopment financing, construction or permanent financing, or acquisition without rehabilitation of office, retail, manufacturing, or community facility space. Include mixed-use real estate that combines both commercial and residential use. |

RECOMULTI |

Real Estate – Construction–Housing-Multi Family: Financial Notes is for predevelopment financing, or construction of multifamily housing. |

RECOSINGLE |

Real Estate – Construction–Housing-Single Family: Financial Note is for predevelopment financing, or construction of single family housing. |

RERHCOM |

Real Estate–Rehabilitation–Commercial: Financing is to

rehabilitate office, retail, |

RERHMULTI |

Real Estate – Rehabilitation – Housing – Multi Family: Financing is to rehabilitate or acquire multifamily housing. |

RERHSINGLE |

Real Estate – Rehabilitation – Housing – Single Family: Financing is to rehabilitate or acquire single family housing. |

OTHER |

None of the Above: Financial note purpose does not match any of the purposes defined above. Loans or Investments to other CDFIs should be reported as “Other”. |

(2) Add “Credit Cards” as a stand-alone answer choice for the “Transaction Type” data field, so it is no longer part of the “Lines of Credit” answer choice

Transaction Type (Column G) Choose one of the pre-defined values below and report the type of transaction for the financial note. For Loan Guarantee, CDFI recipient is a guarantor of this loan. For Loan Loss Reserve, CDFI recipient is using the FA award to provide loan loss reserve for this loan. For Capital Reserve, CDFI recipient is using the FA award to leverage this loan. |

|

Validations:

Please select one of the following: |

|

TERM |

Term Loan: A term loan is a loan from the CDFI for a specific amount that has a specified repayment schedule and a fixed or floating interest rate. |

EQTYINV |

Equity Investment: An equity investment is money that is invested in a company by the CDFI in exchange for the ownership shares of that company. |

CREDITCARD |

Credit Card: A payment mechanism that facilitates both consumer and commercial business transactions, including purchases and cash advances where the borrower is required to pay at least part of the card’s outstanding balance each billing cycle, depending on the terms as set forth in the cardholder agreement. As the debt reduces, the available credit increases for accounts in good standing. |

LOC |

Line of Credit (LOC): An LOC is an arrangement between the CDFI and a customer that establishes the maximum loan amount the customer can borrow excluding credit cards. |

DEBTEQTY |

Debt with Equity: The loan agreement that stipulates a loan may be converted to an equity upon meeting specified conditions. |

LNGUARANTEE |

Loan Guarantee: A loan agreement where the CDFI is a guarantor. |

LNLSRESERVE |

Loan Loss Reserve: CDFI is using the FA award to provide loan loss reserve for this loan |

CAPRESERVE |

Capital Reserve: CDFI is using the FA award to leverage this loan. |

OTHER |

None of the Above |

(3) Add “Certified CDFI(s)” as an answer choice for the “Other Targeted Populations (OTP)” data field and rename some of the existing answer choices to reflect OTP language used in the new Certification Application and the Target Market Assessment Methodologies document.

Other Targeted Populations (Column AJ) Choose one of the pre-defined values below and report whether the transaction serves an Other Targeted Population (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. |

|

Validations:

Please select one of the following: |

|

Native American |

Native American (with maintained tribal affiliation or community connection) |

Native Alaskan |

Native Alaskan residing in Alaska (with maintained tribal affiliation or community connection) |

African American |

African American |

Native Hawaiian |

Native Hawaiian residing in Hawaii |

Other Pacific Islander |

Other Pacific Islander residing in Other Pacific Islands |

Persons with Disabilities |

Persons with Disabilities |

Hispanic |

Hispanic |

Certified CDFIs |

Certified Community Development Financial Institutions (CDFIs) |

Other Approved OTP |

Other Approved OTP |

NA |

Not Applicable |

(4) In order to allow forgivable loan products to be included as allowable Financial Products for TM activity tests, the answer choices for the “Forgivable Loan” data field need to be modified. The CDFI Fund will allow a forgivable loan that has at least 1 payment in a 12 months period to be counted as a Financial Product.

Forgivable Loan (Column Q) Report whether the loan or investment agreement stipulates that some or all of the outstanding balance of the loan or the equity may be converted to a grant upon meeting specified conditions. Enter “Do Not Know” if the information is either unknown or not applicable. Only forgivable loans with at least one payment within 12 months of the loan closing date can be counted as a Financial Product for Target Market activity. |

|

Validations:

|

|

Yes |

The loan or the equity may be converted to a grant. |

YesTM |

The loan or the equity may be converted to a grant and there has been at least one payment within 12 months of the loan closing date. |

No |

The loan or the equity may not be converted to a grant. |

Do Not Know |

The information is either unknown to the lender or not applicable. |

(5) For the TLR’s Consumer Loans/Investments Originated Table (CLR), the Fund will add mandatory data fields that capture the dollar amount and number of loans for each OTP category in order to better assess TM activity to approved TMs, as well as change the existing LITP and OTP data fields from optional to mandatory.

Existing Data Fields

LITP Amount (Column G) Of the Total Originated Amount, enter the amount of loans serving a Low-Income Targeted Population (LITP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

LITP Number (Column H) Of the Total Originated Number, enter the number of loans serving a Low-Income Targeted Population (LITP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount (Column I) Of the Total Originated Amount, enter the amount of loans serving an Other Targeted Population (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number (Column J) Of the Total Originated Number, enter the number of loans serving an Other Targeted Population (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

New Data Fields

OTP Amount Native American (Column#) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Native American (with maintained tribal affiliation or community connection) (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Native American (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population – Native American (with maintained tribal affiliation or community connection) (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount Native Alaskan (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Native Alaskan residing in Alaska (with maintained tribal affiliation or community connection) (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Native Alaskan (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population – Native Alaskan residing in Alaska (with maintained tribal affiliation or community connection) (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount African American (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population –African American (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number African American (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population – African American (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount Native Hawaiian (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Native Hawaiian residing in Hawaii (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Native Hawaiian (Column #) Of the Total Originated Number, enter the number of loans serving an approved Other Targeted Population – Native Hawaiian residing in Hawaii (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount Other Pacific Islander (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Native Pacific Islander residing in Other Pacific Islands (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Other Pacific Islander (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population – Native Pacific Islander residing in Other Pacific Islands (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount Persons with Disabilities (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Persons with Disabilities (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Persons with Disabilities (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population – Persons with Disabilities (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount Hispanic (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Hispanic (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Hispanic (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population –Hispanic (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Amount Other Approved OTP (Column #) Of the Total Originated Amount, enter the amount of loans serving Other Targeted Population – Other Approved OTP (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total amount of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

OTP Number Other Approved OTP (Column #) Of the Total Originated Number, enter the number of loans serving Other Targeted Population – Other Approved OTP (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. The reporting entity needs to aggregate the total number of loans per the census tract, per fiscal year. A loan can only be characterized as LITP or OTP, but not both. |

Validations:

|

Response must be numeric |

VI. Target Market Policies Affecting Abbreviated TLR Data Entry

TARGET MARKET ACTIVITY BENCHMARKS

New CDFI Applicants must meet the applicable Target Market percentage benchmarks over its most recently completed fiscal year prior to submission of the Application. To maintain Certification, Certified CDFIs must demonstrate compliance with the Target Market percentage benchmarks based on an annual basis using the number and dollar amount of Financial Product originations during a reporting entity’s most recently completed fiscal year. A Certified CDFI that fails to meet the Target Market benchmark over its most recently completed fiscal year may maintain its Certification by demonstrating that it met the benchmark over a three-year period through the last day of its most recently completed fiscal year.2 To confirm activity to the Target Market, transaction level data will be submitted annually through the TLR.

CDFI CERTIFICATION APPLICATION

All Applicants must complete and submit an abbreviated TLR before beginning an Application for CDFI Certification. Data provided through the TLR will be used to determine the share of an entity’s Financial Products and/or Financial Services that are deployed to the entity’s proposed Target Market(s). Entities will upload transactional data to the TLR that supports the proposed Target Market and Accountability criteria using the eligible American Community Survey (ACS) dataset approved by the CDFI Fund.

Applicant and relevant Affiliate(s) data, presented by Financial Product category, will be collected in the TLR. The data must include all Financial Product transactions, by number and dollar that were closed during the Applicant’s most recently completed fiscal year. Transactions provided to the proposed Target Market components must be identified in the TLR in order to count towards the Target Market requirements. In order to be approved for each Target Market component identified in the TLR, the Applicant will need to demonstrate the appropriate level of accountable board members using appropriate sources of accountability.

Depository Institutions selecting the option to use Financial Services to meet the Target Market test because their Target Market Financial Product dollar volume is between 50% - 59%, must also enter the data for all relevant, unique depository account holders as of the fiscal year end in the TLR.

COMPILING TARGET MARKET DATA

Data on Financial Product activity presented for review in connection with the Target Market requirements must be submitted in the TLR based on the date the Financial Product transactions were closed or, in the case of active, outstanding Loan Purchases, on the date the bundle of loans were purchased.

Even if related funds were not disbursed on that date or were not eventually fully disbursed, the transaction amounts must be the total amount of financing approved.

The CDFI Fund counts credit card products and lines of credit as Financial Products. Credit card and lines of credit product activity should be presented for review in connection with the Target Market requirements as follows:

Each new account opened and issued will count as one Financial Product transaction.

The date an account was opened and issued will be considered the date the Financial Product transaction was closed; not each time the credit is used, nor each year the credit is used.

The credit limit approved when the account was first opened will constitute the transaction amount, not individual charges or draws or the outstanding balance.

The CDFI Fund counts Loan Purchases from CDFIs and Target Market loans purchased from non-Certified CDFIs as Financial Products. Loan Purchases should be presented for review in connection with the Target Market requirements as follows:

Loan Purchases from Certified CDFIs, whether purchased individually or in bundle, are recognized as Financial Products directed to an “OTP – Certified CDFIs” Target Market. Each bundled Loan Purchase from a Certified CDFI will count as a single Financial Product transaction.

Target Market loans purchased from non-Certified CDFIs are recognized as Financial Products directed to the Target Market(s) of the original borrowers. Applicants that purchase Target Market loans from non-Certified CDFIs in bundle may count each of the purchased loans as a single Financial Product transaction.

Target Market Provisions for Different Entity Types

COLLECTIVE REVIEW FOR DEPOSITORY INSTITUION HOLDING COMPANIES (DIHCs), AFFILIATES OF DIHCS, OR SUBSIDIARIES OF IDIs

For a DIHC, an Affiliate of a DIHC, or a Subsidiary of an IDI to be certified as a CDFI, it must meet the Target Market requirements both:

Individually, based on the Applicant’s own Financial Product and, if elected, Financial Services activity; and

Collectively, based on the aggregate Financial Product and, if elected, Financial Services activity of the Applicant and any Affiliate in its family of entities.

ALTERNATIVE PROVISIONS BY ENTITY TYPE

Depository Institution Holding Companies (DIHCs)

DIHCs that do not directly provide Financial Products or Financial Services, may rely on the activity of all relevant Affiliates, subject to the statutory CDFI Certification collective review process. If a DIHC Applicant’s Affiliates have also applied for CDFI Certification, the DIHC will present only the aggregate Financial Product and, if elected, Financial Services activity of all relevant Affiliates for review.

Entities participating in the CDFI Fund’s Bond Guarantee Program (BG Program)

Entities applying for Certification solely for participation as Eligible CDFIs in the CDFI Fund’s BG Program may meet CDFI Certification Target Market requirements using Financial Product activity that is not arm’s-length, provided that the activity is by and between such entities and their Controlling Certified CDFIs. Such activity must be pursuant to operating agreements that include management and ownership provisions and that are in a form and substance acceptable to the CDFI Fund (see 12 CFR 1805.201(b)(2)(C)(iii)).

Spinoffs

If an entity is eligible for the CDFI Certification provision for Spinoffs (as described in the Financing Entity section of the Application), it must include the following Financial Product and Financial Services activity data for review in connection with the Target Market requirements:

Any Financial Product transactions it closed during its most recently completed full fiscal year, including any Financial Product transactions received as part of a spun-off Financial Product portfolio that were closed by the original entity during its most recently completed fiscal year and that remain on the Spinoff’s balance sheet as of the end of that fiscal year; and

Any depository accounts held by the Spinoff entity that were still open as of the end of the entity’s most recently completed fiscal year.

An entity spun off from a CDFI is not eligible for this provision.

Appendix A: Abbreviated TLR Requirements

The TLR captures information on all loans and investments that the organization originated during the reporting period, as determined by its Certification Application or, for Certified CDFIs, by its Fiscal Year End. The abbreviated version of the TLR is only required for new Certification Applicants and currently Certified CDFIs that are not current Financial Assistance (FA) award recipients and therefore do not have to file the full-length TLR completed by award recipients.

For Certified CDFIs without an FA award, such as CDFI/NACA or RRP, your organization’s ACR will enable the abbreviated TLR. For those CDFI Fund award recipients, your Award Assistance Agreement will enable the full-length TLR. Please note, if you have multiple FA awards, you are only required to submit one TLR per fiscal year.

If your organization does not agree with the award and reporting status displayed in the ACR (for example a status of “Submitted,” or a due date of 12/31/2023), please review your Certification Agreement and/or Assistance Agreement with the CDFI Fund to ascertain which reports are designated in the Agreements. If you believe that your organization status is incorrect, please submit a service request in AMIS requesting a review of your award and reporting status.

Explanation of the Data Points for the abbreviated TLR to be completed by new CDFI Certification Applicants and Certified CDFIs that are not current Financial Assistance (FA) Recipients

TLR Submission Year (Column C) Choose one of the pre-defined values. TLR Submission Year is the year of the report, NOT the year when the report is submitted. For example, if this is your 2020 CDFI TLR, you should set the TLR Submission Year to “2020” for all records in that report even though the report is submitted in 2021. |

Validations:

|

|

Date Originated (Column D) Report the date that a legally binding note was signed by the borrower/investee in favor of the lender/investor. |

Validations:

|

Response must be mm/dd/yyyy |

Original Loan/Investment Amount (Column E) Report the amount of the original loan investment. The amount should be a non-zero positive whole number. For LOC and credit cards, report the credit limit amount. If the credit limit amount is unknown, enter “1”. |

Validations:

|

Response must be numeric |

Purpose (Column F) Choose one of the pre-defined values below and identify the primary purpose of the financial note. If there are multiple purposes (for example, a loan funding both the purchase of a fixed asset and a facility improvement), select the purpose with the largest share of the transaction. |

|

Validations:

Please select one of the following: |

|

CONSUMER |

Consumer: Loan is a personal (secured or unsecured) loan to one or more individuals for health, education, emergency, credit repair, debt consolidation, or other consumer purposes. Personal loans for business purposes should be identified as Business loans and personal loans for home improvement or repair should be identified as Housing loans. Note: Banks and Credit Unions will receive a validation error if they select Consumer as the Purpose and will be directed to fill out the Consumer Loans/Investments Originated table instead. |

BUSINESS |

Non-Real Estate Business: Financing to for-profit and nonprofit businesses with more than five employees or in an amount greater than $50,000 for a purpose that is not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate. |

MICRO |

Non- Real Estate Microenterprise: Financing to a for-profit or non-profit enterprise that has five or fewer employees (including the proprietor) with an amount no more than $50,000 for a purpose that is not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate. |

CLIMATE |

Climate-Centered Finance: Financing projects related to climate resilience; response to or preparation for extreme weather; reduction of emissions; sustainability; energy, water, or location efficiency; or clean energy projects, including Solar (NAICS 221114), Wind power (NAICS 221115), Geothermal power (NAICS 221116), Biomass (NAICS 221117), as well as other terms such as “LEED”, “recycling”, “waste processing”, “Biofuel”, “brownfield”, “renewable energy” or “green lending. |

HOMEPURCH |

Home Purchase: Loan is for the purchase of a primary residence. |

HOMEIMP |

Home Improvement: Loan is for the renovation or other improvement of an owner-occupied home. |

RECOCOM |

Real Estate – Construction/Permanent/Acquisition w/o Rehab – Commercial: Financial Note is for predevelopment financing, construction or permanent financing, or acquisition without rehabilitation of office, retail, manufacturing, or community facility space. Include mixed-use real estate that combines both commercial and residential use. |

RECOMULTI |

Real Estate – Construction–Housing-Multi Family: Financial Notes is for predevelopment financing, or construction of multifamily housing. |

RECOSINGLE |

Real Estate – Construction–Housing-Single Family: Financial Note is for predevelopment financing, or construction of single family housing. |

RERHCOM |

Real Estate–Rehabilitation–Commercial: Financing is to

rehabilitate office, retail, |

RERHMULTI |

Real Estate – Rehabilitation – Housing – Multi Family: Financing is to rehabilitate or acquire multifamily housing. |

RERHSINGLE |

Real Estate – Rehabilitation – Housing – Single Family: Financing is to rehabilitate or acquire single family housing. |

OTHER |

None of the Above: Financial note purpose does not match any of the purposes defined above. Loans or Investments to other CDFIs should be reported as “Other”. |

Transaction Type (Column G) Choose one of the pre-defined values below and report the type of transaction for the financial note. For Loan Guarantee, CDFI Certification Applicant or currently Certified CDFI is a guarantor of this loan. For Loan Loss Reserve, CDFI Certification Applicant or currently Certified CDFI is using its assets to provide Loan Loss Reserve for this loan. For Capital Reserve, CDFI Certification Applicant or currently Certified CDFI is using its assets to leverage this loan. |

|

Validations:

Please select one of the following: |

|

TERM |

Term Loan: A term loan is a loan from the CDFI for a specific amount that has a specified repayment schedule and a fixed or floating interest rate. |

EQTYINV |

Equity Investment: An equity investment is money that is invested in a company by the CDFI in exchange for the ownership shares of that company. |

CREDITCARD |

Credit Card: A payment mechanism that facilitates both consumer and commercial business transactions, including purchases and cash advances where the borrower is required to pay at least part of the card’s outstanding balance each billing cycle, depending on the terms as set forth in the cardholder agreement. As the debt reduces, the available credit increases for accounts in good standing. |

LOC |

Line of Credit (LOC): An LOC is an arrangement between the CDFI and a customer that establishes the maximum loan amount the customer can borrow. |

DEBTEQTY |

Debt with Equity: The loan agreement that stipulates a loan may be converted to an equity upon meeting specified conditions. |

LNGUARANTEE |

Loan Guarantee: A loan agreement where the CDFI is a guarantor. |

LNLSRESERVE |

Loan Loss Reserve: CDFI is using the FA award to provide Loan Loss Reserve for this loan. |

CAPRESERVE |

Capital Reserve: CDFI is using the FA award to leverage this loan. |

OTHER |

None of the Above |

Loan Status (Column H) Choose one of the pre-defined values below and report the status of the loan or investment at the reporting period end. |

|

Validations:

Please select one of the following: |

|

ACTIVE |

A loan or investment was open, on-the-books at the reporting period end. |

CLOSED |

A loan or line of credit that was paid in full (not refinanced) or an equity investment that has been exited at the reporting period end. |

SOLD |

A financial note was off-the-books, but not paid in full at the reporting period end. It was done due to a transfer to another entity. |

CHARGEDOFF |

A financial note was off-the-books, but not paid in full at the reporting period end. It was done due to delinquency of borrower. |

REFIN |

A financial note was off-the-books, but not paid in full at the reporting period end. It was done due to changes of loan features such as interest rate or loan term. |

RESTRUCT |

A financial note was open, on-the-books at the reporting period end. It was done in response to or to prevent a loan default. |

Originator Transaction ID (Column B) The reporting entity should assign a unique identifier to each loan or investment. The identifier can be a combination of both letters and numbers and should start with a letter. It should not contain any special characters such as, but not limited to, commas and exclamation points. Do not use names, social security numbers or any other personally identifying information in creating Originator Transaction ID. |

Validations:

|

Response must be text - up to 20 characters |

Interest Rate (Column I) Report the interest rate charged to the borrower at origination. Enter the percentage as a whole number (e.g., if the Interest Rate is 2.5%, enter 2.5). If the interest rate is unknown or not applicable, enter “99”. |

Validations:

|

Response must be in numeric format up to 3 decimal places |

Equity-Like Features (Column N) Choose one of the pre-defined values below and report the type of equity-like feature. If a loan has more than one equity-like feature, choose the one appearing first in the loan agreement. |

|

Validations:

Please select one of the following: |

|

CONVDEBT |

Convertible Debt: Loan agreement specifies an option to convert all or part of the loan amount to equity |

PERFINT |

Performance Based Interest Rate: Loan’s interest rate adjusts based on the borrower’s performance. |

ROYALTIES |

Royalties: Loan has a royalty participation that gives the investor the right to a percentage of the borrower’s sales or profits. |

WARRANTS |

Warrants: Loan agreement gives the investor the right to purchase the portfolio company’s stock at a later date at a pre-negotiated price. |

OTHER |

None of the Above: Loan Agreement specifies an equity-like feature not described above. |

Forgivable Loan (Column Q) Report whether the loan or investment agreement stipulates that some or all of the outstanding balance of the loan or the equity may be converted to a grant upon meeting specified conditions. Enter “Do Not Know” if the information is either unknown or not applicable. Only forgivable loans with at least one payment within 12 months of the loan closing date can be counted as a Financial Product for Target Market activity. |

|

Validations:

|

|

Yes |

The loan or the equity may be converted to a grant. |

YesTM |

The loan or the equity may be converted to a grant and there has been at least one payment within 12 months of the loan closing date. |

No |

The loan or the equity may not be converted to a grant. |

Do Not Know |

The information is either unknown to the lender or not applicable. |

Client ID (Column S) The reporting entity should create and report a unique identifier to help distinguish which clients/projects (investees, borrowers, or projects) are associated with which loans or investments. A client/project ID can be associated with one or more loans/investments. The identifier can be a combination of both letters and numbers and should start with a letter. It should not contain any special characters such as, but not limited to, commas and exclamation points. Do not use names, social security numbers, or any other personal identifying information in creating Client ID. |

Validations:

|

Response must be text up to 20 characters |

Investee/Borrower Type (Column T) Choose one of the pre-defined values below and report whether the transaction is a loan or investment in an individual, a business or a CDFI certified by the CDFI Fund. Loans or investments in nonprofit entities or non-certified CDFIs should be reported as “BUS.” |

|

Validations:

Please select one of the following: |

|

IND |

Individual: A loan is issued by CDFI to a borrower, who is an individual. |

BUS |

Business: A loan is issued by CDFI to a borrower, who is a business entity. |

CDFI |

CDFI: A loan is issued by CDFI to a borrower, who is a CDFI certified by the CDFI Fund. |

Minority Owned or Controlled (Column X) Report whether the investee/borrower is more than 50% owned or controlled by one or more minorities. If the business is a for-profit entity, report whether more than 50% of the owners are minorities. If the business is a nonprofit entity, report whether more than 50% of its Board of Directors are minorities. Enter “Do Not Know” if the information is either unknown or not applicable. |

|

Validations:

Please select one of the following: |

|

Yes |

The business is owned or controlled by minorities. |

No |

The business is not owned or controlled by minorities. |

Do Not Know |

The information is either unknown to the lender or not applicable. |

Low-Income Owned or Controlled (Column Z) Report whether the investee/borrower is more than 50% owned or controlled by one or more Low-Income persons. If the business is a for-profit entity, report whether more than 50% of the owners are Low-Income persons. If the business is a nonprofit entity, report whether more than 50% of its Board of Directors are Low-Income persons. “Low-Income” is defined as having family income is equal or less than 80 percent of the Area Median Family Income. Enter “Do Not Know” if the information is either unknown or not applicable. |

|

Validations:

Please select one of the following: |

|

Yes |

The business is owned or controlled by Low-Income persons. |

No |

The business is not owned or controlled by Low-Income persons. |

Do Not Know |

The information is either unknown to the lender or not applicable. |

Race (Column AC) Choose one of the pre-defined values below and report the race of the investee or borrower. If the investee or borrower is of mixed race, select “OTHER.” Enter “Do Not Know” if the information is either unknown or not applicable. |

|

Validations:

Please select one of the following: |

|

AMIND |

Native American |

ALASKAN |

Alaskan Native |

ASIAN |

Asian |

BLACK |

African American |

HAWAIIAN |

Native Hawaiian |

PACIFIC |

Other Pacific Islander |

WHITE |

White |

OTHER |

None of the Above |

Do Not Know |

The information is either unknown to the lender or not applicable |

Hispanic Origin (Column AD) Choose one of the pre-defined values below and report whether the investee or borrower is Hispanic. Enter “Do Not Know” if the information is either unknown or not applicable. |

|

Validations:

Please select one of the following: |

|

Yes |

The borrower is Hispanic |

No |

The borrower is not Hispanic |

Do Not Know |

The information is either unknown to the lender or not applicable |

Low-Income Status (Column AI) Compliance Check Choose one of the pre-defined values below and report the income status of the investee or borrower. Area Median Family Income (AMFI) for an investee or borrower depends on the Metropolitan/Non-Metropolitan designation of the county where the investee or borrower resides. If the investee or borrower lives in a Metropolitan county, then use the greater of either the Metropolitan or national Metropolitan AMFI. If the investee or borrower lives in a Non-Metropolitan county, then use the greater of either the statewide or national Non-Metropolitan AMFI. Enter “Do Not Know” if the information is either unknown or not applicable. |

|

Validations:

Please select one of the following: |

|

Extremely Low-Income |

Select this option if investee/borrower’s family income is less than 30 percent of the Area Median Family Income. |

Very Low-Income |

Select this option if investee/borrower’s family income is equal or greater than 30 percent and less than 50 percent of the Area Median Family Income. |

Low-Income |

Select this option if investee/borrower’s family income is equal or greater than 50 percent and equal or less than 80 percent of the Area Median Family Income. |

Middle-Income |

Select this option if investee/borrower’s family income is greater than 80 percent and less than 120 percent of the Area Median Family Income. |

Upper-Income |

Select this option if investee/borrower’s family income is equal or greater than 120 percent of the Area Median Family Income. |

Do Not Know |

The information is either unknown to the lender or not applicable |

Other Targeted Populations (Column AJ) Choose one of the pre-defined values below and report whether the transaction serves an Other Targeted Population (OTP) as defined in the CDFI Fund’s Target Market Assessment Methodologies document. |

|

Validations:

Please select one of the following: |

|

Native American |

Native American (with maintained tribal affiliation or community connection) |

Native Alaskan |

Native Alaskan residing in Alaska (with maintained tribal affiliation or community connection) |

African American |

African American |

Native Hawaiian |

Native Hawaiian residing in Hawaii |

Other Pacific Islander |

Other Pacific Islander residing in other Pacific Islands |

Persons with Disabilities |

Persons with Disabilities |

Hispanic |

Hispanic |

Certified CDFIs |

Certified Community Development Financial Institutions (CDFIs) |

Other Approved OTP |

Other Approved OTP |

NA |

Not Applicable |

Description of Other Approved OTP (Column AK) Desc. Of Other Approved OTP If “Other Approved OTP” was selected above, report the description of that Targeted Population. |

Validations:

|

Response must be text |

End Users: Loans to businesses: End

users are third party entities. For example, CDFI X (first party)

makes a loan to Business Y (second party), then Business Y (second

party) hires Entities Z (third party). If the majority of the

Entities Z (the third party) are Low-Income (as defined in the

Low-Income Status section), then select “YES” for LITP

End Users. If the majority of the Entities Z (the third party)

belong to an Other Targeted Population, then select “YES”

for OTP End Users. If the majority of the Entities Z (the third

party) live in Investment Areas, as defined by the CDFI Fund, then

select “YES” for IA End Users. Loans for Facilities and

Multi-family Housing: Reporting End Users for OTP, LITP, or IA

designated loans to fund facilities or multi-family housing or

apartments should reflect the majority of the demographic or

socioeconomic characteristics of the beneficiary population.

LITP End Users (Column AL) Compliance Check Choose one of the pre-defined values below and report whether the transaction primarily serves a Low-Income Targeted Population (LITP) End Users as defined in the CDFI Fund’s Target Market Assessment Methodologies document. “Low-Income” is defined as having family income is equal or less than 80 percent of the Area Median Family Income. |

|

Validations:

Please select one of the following: |

|

YES |

The transaction serves Low-Income Targeted Population (LITP) End Users |

NO |

The transaction does not serve Low-Income Targeted Population (LITP) End Users |

NA |

Not Applicable |

OTP End Users (Column AM) Choose one of the pre-defined values below and report whether the transaction serves an Other Targeted Population (OTP) End Users as defined in the CDFI Fund’s Target Market Assessment Methodologies document. |

|

Validations:

Please select one of the following: |

|

Native American |

Native American (with maintained tribal affiliation or community connection) |

Native Alaskan |

Native Alaskan residing in Alaska (with maintained tribal affiliation or community connection) |

African American |

African American |

Native Hawaiian |

Native Hawaiian residing in Hawaii |

Other Pacific Islander |

Other Pacific Islander residing in other Pacific Islands |

Persons with Disabilities |

Persons with Disabilities |

Hispanic |

Hispanic |

Other Approved OTP |

Other Approved OTP |

NA |

Not Applicable |

Description of Other Approved OTP-End Users (Column AN) Desc. Of Other Approved OTP-End Users If “Other Approved OTP” was selected above, report the description of that Targeted Population. |

Validations:

|

Response must be text |

IA End Users (Column AO) Compliance Check Choose one of the pre-defined values below and report whether the transaction serves Investment Area (IA) End Users. Consult the “CDFI Program 2011-2015 ACS Eligible Investment Areas” table for identifying eligible investment areas (IA) census tracts -- https://www.cdfifund.gov/research-data/Pages/default.aspx. |

|

Validations:

Please select one of the following: |

|

YES |

The transaction serves Investment Area (IA) End Users |

NO |

The transaction does not serve Investment Area (IA) End Users |

NA |

Not Applicable |

Appendix B: CDFI TLR Address

Manual Entry:

To add a CDFI TLR Address, simply locate the “CDFI TLR Address” related list on the CDFI TLR and click “New CDFI TLR Address.” If another address needs to be recorded in the case of multiple address transactions, repeat the aforementioned step. CDFI TLR Project report and CDFI TLR Address report go together. In other words, if the reporting entity includes a loan in the CDFI TLR Project report, then the reporting entity needs to include its address(es) in the CDFI TLR Address report.

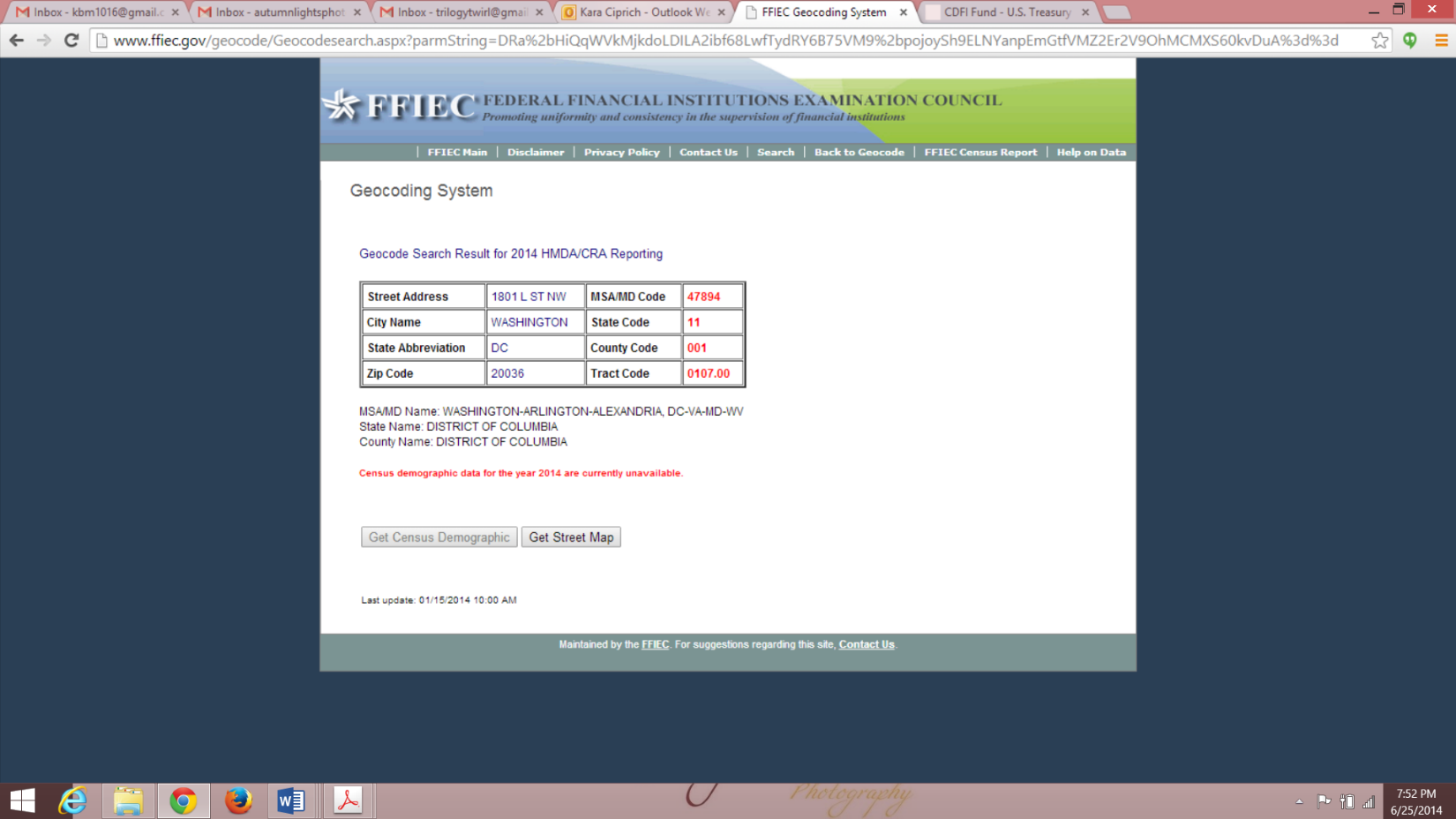

The reporting entity will be directed to the following page to enter information for the CDFI TLR Address:

Note: If Investee Type = IND only provide the FIPS Code. Address and X-Y Coordinate will not be accepted.

The following data points will be collected in the UI, XML, and CSV:

Project Street Address Line (Column C) Compliance Check Report the location of the business or other real estate project for which the loan or investment is being used. Only enter the address number and street name, nothing else. For example, “357 Bluff Rd”. P.O. Box addresses are not accepted. Unit/Suite # can only be entered on “Project Street Address Line 2” below. |

Validations:

|

Response must be text |

Project Street Address Line 2 (Column D) Report the second line of the project’s street address such as Unit/Suite #, if necessary. |

Validations:

|

Response must be text |

Project City (Column E) Compliance Check Report the project’s city. |

Validations:

|

Response must be text |

Project State (Column F) Compliance Check Report the two-letter state abbreviation. |

Validations:

|

Response must be text |

Project Zip Code 5 (Column G) Compliance Check Report the five-digit zip code. |

Validations: