43 CFR Part 3100

43 CFR Part 3100.doc

Onshore Oil and Gas Leasing, and Drainage Protection (43 CFR Parts 3100, 3120, and 3150, and Subpart 3162)

43 CFR Part 3100

OMB: 1004-0185

Title 43: Public Lands: Interior

PART 3100—OIL AND GAS LEASING

![]()

Section Contents

Subpart 3100—Onshore Oil and Gas Leasing: General

§ 3100.0-3 Authority.

§ 3100.0-5 Definitions.

§ 3100.0-9 Information

collection.

§ 3100.1 Helium.

§ 3100.2 Drainage.

§ 3100.2-1 Compensation

for drainage.

§ 3100.2-2 Drilling

and production or payment of compensatory

royalty.

§ 3100.3 Options.

§ 3100.3-1 Enforceability.

§ 3100.3-2 Effect

of option on acreage.

§ 3100.3-3 Option

statements.

§ 3100.4 Public

availability of information.

Subpart 3101—Issuance of Leases

§ 3101.1 Lease

terms and conditions.

§ 3101.1-1 Lease

form.

§ 3101.1-2 Surface

use rights.

§ 3101.1-3 Stipulations

and information notices.

§ 3101.1-4 Modification

or waiver of lease terms and stipulations.

§ 3101.2 Acreage

limitations.

§ 3101.2-1 Public

domain lands.

§ 3101.2-2 Acquired

lands.

§ 3101.2-3 Excepted

acreage.

§ 3101.2-4 Excess

acreage.

§ 3101.2-5 Computation.

§ 3101.2-6 Showing

required.

§ 3101.3 Leases

within unit areas.

§ 3101.3-1 Joinder

evidence required.

§ 3101.3-2 Separate

leases to issue.

§ 3101.4 Lands

covered by application to close lands to mineral

leasing.

§ 3101.5 National

Wildlife Refuge System lands.

§ 3101.5-1 Wildlife

refuge lands.

§ 3101.5-2 Coordination

lands.

§ 3101.5-3 Alaska

wildlife areas.

§ 3101.5-4 Stipulations.

§ 3101.6 Recreation

and public purposes lands.

§ 3101.7 Federal

lands administered by an agency outside of the Department of the

Interior.

§ 3101.7-1 General

requirements.

§ 3101.7-2 Action

by the Bureau of Land

Management.

§ 3101.7-3 Appeals.

§ 3101.8 State's

or charitable organization's ownership of surface overlying

Federally-owned minerals.

Subpart 3102—Qualifications of Lessees

§ 3102.1 Who

may hold

leases.

§ 3102.2 Aliens.

§ 3102.3 Minors.

§ 3102.4 Signature.

§ 3102.5 Compliance,

certification of compliance and

evidence.

§ 3102.5-1 Compliance.

§ 3102.5-2 Certification

of compliance.

§ 3102.5-3 Evidence

of compliance.

Subpart 3103—Fees, Rentals and Royalty

§ 3103.1 Payments.

§ 3103.1-1 Form

of remittance.

§ 3103.1-2 Where

submitted.

§ 3103.2 Rentals.

§ 3103.2-1 Rental

requirements.

§ 3103.2-2 Annual

rental payments.

§ 3103.3 Royalties.

§ 3103.3-1 Royalty

on production.

§ 3103.3-2 Minimum

royalties.

§ 3103.4 Production

incentives.

§ 3103.4-1 Royalty

reductions.

§ 3103.4-2 Stripper

well royalty reductions.

§ 3103.4-3 Heavy

oil royalty reductions.

§ 3103.4-4 Suspension

of operations and/or production.

§ 3104.1 Bond

obligations.

§ 3104.2 Lease

bond.

§ 3104.3 Statewide

and nationwide bonds.

§ 3104.4 Unit

operator's bond.

§ 3104.5 Increased

amount of bonds.

§ 3104.6 Where

filed and number of

copies.

§ 3104.7 Default.

§ 3104.8 Termination

of period of liability.

Subpart 3105—Cooperative Conservation Provisions

§ 3105.1 Cooperative

or unit agreement.

§ 3105.2 Communitization

or drilling agreements.

§ 3105.2-1 Where

filed.

§ 3105.2-2 Purpose.

§ 3105.2-3 Requirements.

§ 3105.3 Operating,

drilling or development contracts.

§ 3105.3-1 Where

filed.

§ 3105.3-2 Purpose.

§ 3105.3-3 Requirements.

§ 3105.4 Combination

for joint operations or for transportation of oil.

§ 3105.4-1 Where

filed.

§ 3105.4-2 Purpose.

§ 3105.4-3 Requirements.

§ 3105.4-4 Rights-of-way.

§ 3105.5 Subsurface

storage of oil and gas.

§ 3105.5-1 Where

filed.

§ 3105.5-2 Purpose.

§ 3105.5-3 Requirements.

§ 3105.5-4 Extension

of lease term.

§ 3105.6 Consolidation

of leases.

Subpart 3106—Transfers by Assignment, Sublease or Otherwise

§ 3106.1 Transfers,

general.

§ 3106.2 Qualifications

of

transferees.

§ 3106.3 Fees.

§ 3106.4 Forms.

§ 3106.4-1 Transfers

of record title and of operating rights

(subleases).

§ 3106.4-2 Transfers

of other interests, including royalty interests and production

payments.

§ 3106.4-3 Mass

transfers.

§ 3106.5 Description

of lands.

§ 3106.6 Bonds.

§ 3106.6-1 Lease

bond.

§ 3106.6-2 Statewide/nationwide

bond.

§ 3106.7 Approval

of transfer.

§ 3106.7-1 Failure

to qualify.

§ 3106.7-2 If

I transfer my lease, what is my continuing

obligation?

§ 3106.7-3 Lease

account status.

§ 3106.7-4 Effective

date of transfer.

§ 3106.7-5 Effect

of transfer.

§ 3106.7-6 If

I acquire a lease by an assignment or transfer, what obligations do I

agree to assume?

§ 3106.8 Other

types of transfers.

§ 3106.8-1 Heirs

and devisees.

§ 3106.8-2 Change

of name.

§ 3106.8-3 Corporate

merger.

Subpart 3107—Continuation, Extension or Renewal

§ 3107.1 Extension

by drilling.

§ 3107.2 Production.

§ 3107.2-1 Continuation

by production.

§ 3107.2-2 Cessation

of production.

§ 3107.2-3 Leases

capable of production.

§ 3107.3 Extension

for terms of cooperative or unit plan.

§ 3107.3-1 Leases

committed to plan.

§ 3107.3-2 Segregation

of leases committed in part.

§ 3107.3-3 20-year

lease or any renewal thereof.

§ 3107.4 Extension

by elimination.

§ 3107.5 Extension

of leases segregated by assignment.

§ 3107.5-1 Extension

after discovery on other segregated

portions.

§ 3107.5-2 Undeveloped

parts of leases in their extended term.

§ 3107.5-3 Undeveloped

parts of producing leases.

§ 3107.6 Extension

of reinstated leases.

§ 3107.7 Exchange

leases: 20-year term.

§ 3107.8 Renewal

leases.

§ 3107.8-1 Requirements.

§ 3107.8-2 Application.

§ 3107.8-3 Approval.

§ 3107.9 Other

types.

§ 3107.9-1 Payment

of compensatory royalty.

§ 3107.9-2 Subsurface

storage of oil and gas.

Subpart 3108—Relinquishment, Termination, Cancellation

§ 3108.1 As

a lessee, may I relinquish my lease?

§ 3108.2 Termination

by operation of law and reinstatement.

§ 3108.2-1 Automatic

termination.

§ 3108.2-2 Reinstatement

at existing rental and royalty rates: Class I

reinstatements.

§ 3108.2-3 Reinstatement

at higher rental and royalty rates: Class II

reinstatements.

§ 3108.2-4 Conversion

of unpatented oil placer mining claims: Class III

reinstatements.

§ 3108.3 Cancellation.

§ 3108.4

Bona

fide purchasers.

§ 3108.5 Waiver

or suspension of lease rights.

Subpart 3109—Leasing Under Special Acts

§ 3109.1 Rights-of-way.

§ 3109.1-1 Generally.

§ 3109.1-2 Application.

§ 3109.1-3 Notice.

§ 3109.1-4 Award

of lease or compensatory royalty agreement.

§ 3109.1-5 Compensatory

royalty agreement or lease.

§ 3109.2 Units

of the National Park System.

§ 3109.2-1 Authority

to lease. [Reserved]

§ 3109.2-2 Area

subject to lease. [Reserved]

§ 3109.3 Shasta

and Trinity Units of the Whiskeytown-Shasta-Trinity National

Recreation Area.

![]()

Authority: 30 U.S.C. 189 and 359; 43 U.S.C. 1732(b), 1733, and 1740; and the Energy Policy Act of 2005 (Pub. L. 109–58).

Source: 48 FR 33662, July 22, 1983, unless otherwise noted.

Subpart 3100—Onshore Oil and Gas Leasing: General

§ 3100.0-3 Authority.

(a) Public domain. (1) Oil and gas in public domain lands and lands returned to the public domain under section 2370 of this title are subject to lease under the Mineral Leasing Act of 1920, as amended and supplemented (30 U.S.C. 181 et seq. ), by acts, including, but not limited to, section 1009 of the Alaska National Interest Lands Conservation Act (16 U.S.C. 3148).

(2) Exceptions. (i) Units of the National Park System, including lands withdrawn by section 206 of the Alaska National Interest Lands Conservation Act, except as provided in paragraph (g)(4) of this section;

(ii) Indian reservations;

(iii) Incorporated cities, towns and villages;

(iv) Naval petroleum and oil shale reserves and the National Petroleum Reserve—Alaska.

(v) Lands north of 68 degrees north latitude and east of the western boundary of the National Petroleum Reserve—Alaska;

(vi) Arctic National Wildlife Refuge in Alaska.

(vii) Lands recommended for wilderness allocation by the surface managing agency:

(viii) Lands within Bureau of Land Management wilderness study areas;

(ix) Lands designated by Congress as wilderness study areas, except where oil and gas leasing is specifically allowed to continue by the statute designating the study area;

(x) Lands within areas allocated for wilderness or further planning in Executive Communication 1504, Ninety-Sixth Congress (House Document numbered 96–119), unless such lands are allocated to uses other than wilderness by a land and resource management plan or have been released to uses other than wilderness by an Act of Congress; and

(xi) Lands within the National Wilderness Preservation System, subject to valid existing rights under section 4(d)(3) of the Wilderness Act established before midnight, December 31, 1983, unless otherwise provided by law.

(b) Acquired lands. (1) Oil and gas in acquired lands are subject to lease under the Mineral Leasing Act for Acquired Lands of August 7, 1947, as amended (30 U.S.C. 351–359).

(2) Exceptions. (i) Units of the National Park System, except as provided in paragraph (g)(4) of this section;

(ii) Incorporated cities, towns and villages;

(iii) Naval petroleum and oil shale reserves and the National Petroleum Reserve—Alaska;

(iv) Tidelands or submerged coastal lands within the continental shelf adjacent or littoral to lands within the jurisdiction of the United States;

(v) Lands acquired by the United States for development of helium, fissionable material deposits or other minerals essential to the defense of the country, except oil, gas and other minerals subject to leasing under the Act;

(vi) Lands reported as excess under the Federal Property and Administrative Services Act of 1949;

(vii) Lands acquired by the United States by foreclosure or otherwise for resale.

(viii) Lands recommended for wilderness allocation by the surface managing agency;

(ix) Lands within Bureau of Land Management wilderness study areas;

(x) Lands designated by Congress as wilderness study areas, except where oil and gas leasing is specifically allowed to continue by the statute designating the study area;

(xi) Lands within areas allocated for wilderness or further planning in Executive Communication 1504, Ninety-Sixth Congress (House Document numbered 96–119), unless such lands are allocated to uses other than wilderness by a land and resource management plan or have been released to uses other than wilderness by an Act of Congress; and

(xii) Lands within the National Wilderness Preservation System, subject to valid existing rights under section 4(d)(3) of the Wilderness Act established before midnight, December 31, 1983, unless otherwise provided by law.

(c) National Petroleum Reserve—Alaska is subject to lease under the Department of the Interior Appropriations Act, Fiscal Year 1981 (42 U.S.C. 6508).

(d) Where oil or gas is being drained from lands otherwise unavailable for leasing, there is implied authority in the agency having jurisdiction of those lands to grant authority to the Bureau of Land Management to lease such lands (see 43 U.S.C. 1457; also Attorney General's Opinion of April 2, 1941 (Vol. 40 Op. Atty. Gen. 41)).

(e) Where lands previously withdrawn or reserved from the public domain are no longer needed by the agency for which the lands were withdrawn or reserved and such lands are retained by the General Services Administration, or where acquired lands are declared as excess to or surplus by the General Services Administration, authority to lease such lands may be transferred to the Department in accordance with the Federal Property and Administrative Services Act of 1949 and the Mineral Leasing Act for Acquired Lands, as amended.

(f) The Act of May 21, 1930 (30 U.S.C. 301–306), authorizes the leasing of oil and gas deposits under certain rights-of-way to the owner of the right-of-way or any assignee.

(g)(1)The Act of May 9, 1942 (56 Stat. 273), as amended by the Act of October 25, 1949 (63 Stat. 886), authorizes leasing on certain lands in Nevada.

(2) The Act of March 3, 1933 (47 Stat. 1487), as amended by the Act of June 5, 1936 (49 Stat. 1482) and the Act of June 29, 1936 (49 Stat. 2026), authorizes leasing on certain lands patented to the State of California.

(3) The Act of June 30, 1950 (16 U.S.C. 508(b)) authorizes leasing on certain National Forest Service Lands in Minnesota.

(4) Units of the National Park System. The Secretary is authorized to permit mineral leasing in the following units of the National Park System if he/she finds that such disposition would not have significant adverse effects on the administration of the area and if lease operations can be conducted in a manner that will preserve the scenic, scientific and historic features contributing to public enjoyment of the area, pursuant to the following authorities:

(i) Lake Mead National Recreation Area —The Act of October 8, 1964 (16 U.S.C. 460n et seq. ).

(ii) Whiskeytown Unit of the Whiskeytown-Shasta-Trinity National Recreation Area —The Act of November 8, 1965 (79 Stat. 1295; 16 U.S.C. 460q et seq. ).

(iii) Ross Lake and Lake Chelan National Recreation Areas —The Act of October 2, 1968 (82 Stat. 926; 16 U.S.C. 90 et seq. ).

(iv) Glen Canyon National Recreation Area —The Act of October 27, 1972 (86 Stat. 1311; 16 U.S.C. 460dd et seq. ).

(5) Shasta and Trinity Units of the Whiskeytown-Shasta-Trinity National Recreation Area. Section 6 of the Act of November 8, 1965 (Pub. L. 89–336; 79 Stat. 1295), authorizes the Secretary of the Interior to permit the removal of leasable minerals from lands (or interest in lands) within the recreation area under the jurisdiction of the Secretary of Agriculture in accordance with the Mineral Leasing Act of February 25, 1920, as amended (30 U.S.C. 181 et seq. ), or the Acquired Lands Mineral Leasing Act of August 7, 1947 (30 U.S.C. 351–359), if he finds that such disposition would not have significant adverse effects on the purpose of the Central Valley project or the administration of the recreation area.

[48 FR 33662, July 22, 1983, as amended at 49 FR 2113, Jan. 18, 1984; 53 FR 17351, 17352, May 16, 1988; 53 FR 22835, June 17, 1988; 53 FR 31958, Aug. 22, 1988]

As used in this part, the term:

(a) Operator means any person or entity, including, but not limited to, the lessee or operating rights owner, who has stated in writing to the authorized officer that it is responsible under the terms and conditions of the lease for the operations conducted on the leased lands or a portion thereof.

(b) Unit operator means the person authorized under the agreement approved by the Department of the Interior to conduct operations within the unit.

(c) Record title means a lessee's interest in a lease which includes the obligation to pay rent, and the rights to assign and relinquish the lease. Overriding royalty and operating rights are severable from record title interests.

(d) Operating right (working interest) means the interest created out of a lease authorizing the holder of that right to enter upon the leased lands to conduct drilling and related operations, including production of oil or gas from such lands in accordance with the terms of the lease.

(e) Transfer means any conveyance of an interest in a lease by assignment, sublease or otherwise. This definition includes the terms: Assignment which means a transfer of all or a portion of the lessee's record title interest in a lease; and sublease which means a transfer of a non-record title interest in a lease, i.e., a transfer of operating rights is normally a sublease and a sublease also is a subsidiary arrangement between the lessee (sublessor) and the sublessee, but a sublease does not include a transfer of a purely financial interest, such as overriding royalty interest or payment out of production, nor does it affect the relationship imposed by a lease between the lessee(s) and the United States.

(f) National Wildlife Refuge System Lands means lands and water, or interests therein, administered by the Secretary as wildlife refuges, areas for the protection and conservation of fish and wildlife that are threatened with extinction, wildlife management areas or waterfowl production areas.

(g) Actual drilling operations includes not only the physical drilling of a well, but the testing, completing or equipping of such well for production.

(h)(1) Primary term of lease subject to section 4(d) of the Act prior to the revision of 1960 (30 U.S.C. 226–1(d)) means all periods of the life of the lease prior to its extension by reason of production of oil and gas in paying quantities; and

(2) Primary term of all other leases means the initial term of the lease. For competitive leases, except those within the National Petroleum Reserve—Alaska, this means 5 years and for noncompetitive leases this means 10 years.

(i) Lessee means a person or entity holding record title in a lease issued by the United States.

(j) Operating rights owner means a person or entity holding operating rights in a lease issued by the United States. A lessee also may be an operating rights owner if the operating rights in a lease or portion thereof have not been severed from record title.

(k) Bid means an amount of remittance offered as partial compensation for a lease equal to or in excess of the national minimum acceptable bonus bid set by statute or by the Secretary, submitted by a person or entity for a lease parcel in a competitive lease sale.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17352, May 16, 1988; 53 FR 22836, June 17, 1988]

§ 3100.0-9 Information collection.

(a)(1) The collections of information contained in §3103.4–1(b) have been approved by the Office of Management and Budget under 44 U.S.C. 3501 et seq. and are among the collections assigned clearance number 1004–0145. The information will be used to determine whether an oil and gas operator or owner may obtain a reduction in the royalty rate. Response is required to obtain a benefit in accordance with 30 U.S.C. 181, et seq., and 30 U.S.C. 351–359.

(2) Public reporting burden for the information collections assigned clearance number 1004–0145 is estimated to average 1 hour per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing the burden, to the Information Collection Clearance Officer (783), Bureau of Land Management, Washington, DC 20240, and the Office of Management and Budget, Paperwork Reduction Project, 1004–0145, Washington, DC 20503.

(b)(1) The collections of information contained in §3103.4–1(c) and (d) have been approved by the Office of Management and Budget under 44 U.S.C. 3501 et seq. and assigned clearance number 1010–0090. The information will be used to determine whether an oil and gas lessee may obtain a reduction in the royalty rate. Response is required to obtain a benefit in accordance with 30 U.S.C. 181, et seq., and 30 U.S.C. 351–359.

(2) Public reporting burden for this information is estimated to average1/2hour per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing the burden, to the Information Collection Clearance Officer, Minerals Management Service (Mail Stop 2300), 381 Elden Street, Herndon, VA 22070–4817, and the Office of Management and Budget, Paperwork Reduction Project, 1010–0090, Washington, DC 20503.

[57 FR 35973, Aug. 11, 1992]

The ownership of and the right to extract helium from all gas produced from lands leased or otherwise disposed of under the Act have been reserved to the United States.

§ 3100.2-1 Compensation for drainage.

Upon a determination by the authorized officer that lands owned by the United States are being drained of oil or gas by wells drilled on adjacent lands, the authorized officer may execute agreements with the owners of adjacent lands whereby the United States and its lessees shall be compensated for such drainage. Such agreements shall be made with the consent of any lessee affected by an agreement. Such lands may also be offered for lease in accordance with part 3120 of this title.

§ 3100.2-2 Drilling and production or payment of compensatory royalty.

Where lands in any leases are being drained of their oil or gas content by wells either on a Federal lease issued at a lower rate of royalty or on non-Federal lands, the lessee shall both drill and produce all wells necessary to protect the leased lands from drainage. In lieu of drilling necessary wells, the lessee may, with the consent of the authorized officer, pay compensatory royalty in the amount determined in accordance with §3162.2(a) of this title.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17352, May 16, 1988]

§ 3100.3-1 Enforceability.

(a) No option to acquire any interest in a lease shall be enforceable if entered into for a period of more than 3 years (including any renewal period that may be provided for in the option) without the approval of the Secretary.

(b) No option or renewal thereof shall be enforceable until a signed copy or notice of option has been filed in the proper BLM office. Each such signed copy or notice shall include:

(1) The names and addresses of the parties thereto;

(2) The serial number of the lease to which the option is applicable;

(3) A statement of the number of acres covered by the option and of the interests and obligations of the parties to the option, including the date and expiration date of the option; and

(4) The interest to be conveyed and retained in exercise of the option. Such notice shall be signed by all parties to the option or their duly authorized agents. The signed copy or notice of option required by this paragraph shall contain or be accompanied by a signed statement by the holder of the option that he/she is the sole party in interest in the option; if not, he/she shall set forth the names and provide a description of the interest therein of the other interested parties, and provide a description of the agreement between them, if oral, and a copy of such agreement, if written.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17352, May 16, 1988. Redesignated at 53 FR 22836, June 17, 1988]

§ 3100.3-2 Effect of option on acreage.

The acreage to which the option is applicable shall be charged both to the grantor of the option and the option holder. The acreage covered by an unexercised option remains charged during its term until notice of its relinquishment or surrender has been filed in the proper BLM office.

[48 FR 33662, July 22, 1983. Redesignated at 53 FR 22836, June 17, 1988]

Each option holder shall file in the proper BLM office within 90 days after June 30 and December 31 of each year a statement showing as of the prior June 30 and December 31, respectively:

(a) Any changes to the statements submitted under §3100.3–1(b) of this title, and

(b) The number of acres covered by each option and the total acreage of all options held in each State.

[53 FR 17352, May 16, 1988. Redesignated and amended at 53 FR 22836, June 17, 1988]

§ 3100.4 Public availability of information.

(a) All data and information concerning Federal and Indian minerals submitted under this part 3100 and parts 3110 through 3190 of this chapter are subject to part 2 of this title, except as provided in paragraph (c) of this section. Part 2 of this title includes the regulations of the Department of the Interior covering the public disclosure of data and information contained in Department of the Interior records. Certain mineral information not protected from public disclosure under part 2 of this title may be made available for inspection without a Freedom of Information Act (FOIA) (5 U.S.C. 552) request.

(b) When you submit data and information under this part 3100 and parts 3110 through 3190 of this chapter that you believe to be exempt from disclosure to the public, you must clearly mark each page that you believe includes confidential information. BLM will keep all such data and information confidential to the extent allowed by §2.13(c) of this title.

(c) Under the Indian Mineral Development Act of 1982 (IMDA) (25 U.S.C. 2101 et seq. ), the Department of the Interior will hold as privileged proprietary information of the affected Indian or Indian tribe—

(1) All findings forming the basis of the Secretary's intent to approve or disapprove any Minerals Agreement under IMDA; and

(2) All projections, studies, data, or other information concerning a Minerals Agreement under IMDA, regardless of the date received, related to—

(i) The terms, conditions, or financial return to the Indian parties;

(ii) The extent, nature, value, or disposition of the Indian mineral resources; or

(iii) The production, products, or proceeds thereof.

(d) For information concerning Indian minerals not covered by paragraph (c) of this section—

(1) BLM will withhold such records as may be withheld under an exemption to FOIA when it receives a request for information related to tribal or Indian minerals held in trust or subject to restrictions on alienation;

(2) BLM will notify the Indian mineral owner(s) identified in the records of the Bureau of Indian Affairs (BIA), and BIA, and give them a reasonable period of time to state objections to disclosure, using the standards and procedures of §2.15(d) of this title, before making a decision about the applicability of FOIA exemption 4 to:

(i) Information obtained from a person outside the United States Government; when

(ii) Following consultation with a submitter under §2.15(d) of this title, BLM determines that the submitter does not have an interest in withholding the records that can be protected under FOIA; but

(iii) BLM has reason to believe that disclosure of the information may result in commercial or financial injury to the Indian mineral owner(s), but is uncertain that such is the case.

[63 FR 52952, Oct. 1, 1998]

Subpart 3101—Issuance of Leases

§ 3101.1 Lease terms and conditions.

§ 3101.1-1 Lease form.

A lease shall be issued only on the standard form approved by the Director.

[53 FR 17352, May 16, 1988]

§ 3101.1-2 Surface use rights.

A lessee shall have the right to use so much of the leased lands as is necessary to explore for, drill for, mine, extract, remove and dispose of all the leased resource in a leasehold subject to: Stipulations attached to the lease; restrictions deriving from specific, nondiscretionary statutes; and such reasonable measures as may be required by the authorized officer to minimize adverse impacts to other resource values, land uses or users not addressed in the lease stipulations at the time operations are proposed. To the extent consistent with lease rights granted, such reasonable measures may include, but are not limited to, modification to siting or design of facilities, timing of operations, and specification of interim and final reclamation measures. At a minimum, measures shall be deemed consistent with lease rights granted provided that they do not: require relocation of proposed operations by more than 200 meters; require that operations be sited off the leasehold; or prohibit new surface disturbing operations for a period in excess of 60 days in any lease year.

[53 FR 17352, May 16, 1988]

§ 3101.1-3 Stipulations and information notices.

The authorized officer may require stipulations as conditions of lease issuance. Stipulations shall become part of the lease and shall supersede inconsistent provisions of the standard lease form. Any party submitting a bid under subpart 3120 of this title, or an offer under §3110.1(b) of this title during the period when use of the parcel number is required pursuant to §3110.5–1 of this title, shall be deemed to have agreed to stipulations applicable to the specific parcel as indicated in the List of Lands Available for Competitive Nominations or the Notice of Competitive Lease Sale available from the proper BLM office. A party filing a noncompetitive offer in accordance with §3110.1(a) of this title shall be deemed to have agreed to stipulations applicable to the specific parcel as indicated in the List of Lands Available for Competitive Nominations or the Notice of Competitive Lease Sale, unless the offer is withdrawn in accordance with §3110.6 of this title. An information notice has no legal consequences, except to give notice of existing requirements, and may be attached to a lease by the authorized officer at the time of lease issuance to convey certain operational, procedural or administrative requirements relative to lease management within the terms and conditions of the standard lease form. Information notices shall not be a basis for denial of lease operations.

[53 FR 17352, May 16, 1988, as amended at 53 FR 22836, June 17, 1988]

§ 3101.1-4 Modification or waiver of lease terms and stipulations.

A stipulation included in an oil and gas lease shall be subject to modification or waiver only if the authorized officer determines that the factors leading to its inclusion in the lease have changed sufficiently to make the protection provided by the stipulation no longer justified or if proposed operations would not cause unacceptable impacts. If the authorized officer has determined, prior to lease issuance, that a stipulation involves an issue of major concern to the public, modification or waiver of the stipulation shall be subject to public review for at least a 30-day period. In such cases, the stipulation shall indicate that public review is required before modification or waiver. If subsequent to lease issuance the authorized officer determines that a modification or waiver of a lease term or stipulation is substantial, the modification or waiver shall be subject to public review for at least a 30-day period.

[53 FR 22836, June 17, 1988; 53 FR 31958, Aug. 22, 1988]

§ 3101.2-1 Public domain lands.

(a) No person or entity shall take, hold, own or control more than 246,080 acres of Federal oil and gas leases in any one State at any one time. No more than 200,000 acres of such acres may be held under option.

(b) In Alaska, the acreage that can be taken, held, owned or controlled is limited to 300,000 acres in the northern leasing district and 300,000 acres in the southern leasing district, of which no more than 200,000 acres may be held under option in each of the 2 leasing districts. The boundary between the 2 leasing districts in Alaska begins at the northeast corner of the Tetlin National Wildlife Refuge as established on December 2, 1980 (16 U.S.C. 3101), at a point on the boundary between the United States and Canada, then northwesterly along the northern boundary of the refuge to the left limit of the Tanana River (63°9'38" north latitude, 142°20'52" west longitude), then westerly along the left limit to the confluence of the Tanana and Yukon Rivers, and then along the left limit of the Yukon River from said confluence to its principal southern mouth.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17352, May 16, 1988]

An acreage limitation separate from, but equal to the acreage limitation for public domain lands described in §3101.2–1 of this title, applies to acquired lands. Where the United States owns only a fractional interest in the mineral resources of the lands involved in a lease, only that part owned by the United States shall be charged as acreage holdings. The acreage embraced in a future interest lease shall not be charged as acreage holdings until the lease for the future interest becomes effective.

(a) The following acreage shall not be included in computing accountable acreage:

(1) Acreage under any lease any portion of which is committed to any Federally approved unit or cooperative plan or communitization agreement;

(2) Acreage under any lease for which royalty (including compensatory royalty or royalty in-kind) was paid in the preceding calendar year; and

(3) Acreage under leases subject to an operating, drilling or development contract approved by the Secretary.

(b) Acreage subject to offers to lease, overriding royalties and payments out of production shall not be included in computing accountable acreage.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17352, May 16, 1988; 71 FR 14823, Mar. 24, 2006]

(a) Where, as the result of the termination or contraction of a unit or cooperative plan, the elimination of a lease from an operating, drilling or development contract a party holds or controls excess accountable acreage, said party shall have 90 days from that date to reduce the holdings to the prescribed limitation and to file proof of the reduction in the proper BLM office. Where as a result of a merger or the purchase of the controlling interest in a corporation, acreage in excess of the amount permitted is acquired, the party holding the excess acreage shall have 180 days from the date of the merger or purchase to divest the excess acreage. If additional time is required to complete the divestiture of the excess acreage, a petition requesting additional time, along with a full justification for the additional time, may be filed with the authorized officer prior to the termination of the 180-day period provided herein.

(b) If any person or entity is found to hold accountable acreage in violation of the provisions of these regulations, lease(s) or interests therein shall be subject to cancellation or forfeiture in their entirety, until sufficient acreage has been eliminated to comply with the acreage limitation. Excess acreage or interest shall be cancelled in the inverse order of acquisition.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17353, May 16, 1988]

The accountable acreage of a party owning an undivided interest in a lease shall be the party's proportionate part of the total lease acreage. The accountable acreage of a party who is the beneficial owner of more than 10 percent of the stock of a corporation which holds Federal oil and gas leases shall be the party's proportionate part of the corporation's accountable acreage. Parties to a contract for development of leased lands and co-parties, except those operating, drilling or development contracts subject to §3101.2–3 of this title, shall be charged with their proportionate interests in the lease. No holding of acreage in common by the same persons in excess of the maximum acreage specified in the laws for any one party shall be permitted.

[48 FR 33662, July 22, 1983, as amended at 49 FR 2113, Jan. 18, 1984; 53 FR 17353, May 16, 1988]

At any time the authorized officer may require any lessee or operator to file with the Bureau of Land Management a statement showing as of specified date the serial number and the date of each lease in which he/she has any interest, in the particular State, setting forth the acreage covered thereby.

§ 3101.3 Leases within unit areas.

§ 3101.3-1 Joinder evidence required.

Before issuance of a lease for lands within an approved unit, the lease offeror shall file evidence with the proper BLM office of having joined in the unit agreement and unit operating agreement or a statement giving satisfactory reasons for the failure to enter into such agreement. If such statement is acceptable to the authorized officer the operator shall be permitted to operate independently but shall be required to conform to the terms and provisions of the unit agreement with respect to such operations.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17353, May 16, 1988]

§ 3101.3-2 Separate leases to issue.

A lease offer for lands partly within and partly outside the boundary of a unit shall result in separate leases, one for the lands within the unit, and one for the lands outside the unit.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17353, May 16, 1988]

§ 3101.4 Lands covered by application to close lands to mineral leasing.

Offers filed on lands within a pending application to close lands to mineral leasing shall be suspended until the segregative effect of the application is final.

§ 3101.5 National Wildlife Refuge System lands.

§ 3101.5-1 Wildlife refuge lands.

(a) Wildlife refuge lands are those lands embraced in a withdrawal of public domain and acquired lands of the United States for the protection of all species of wildlife within a particular area. Sole and complete jurisdiction over such lands for wildlife conservation purposes is vested in the Fish and Wildlife Service even though such lands may be subject to prior rights for other public purposes or, by the terms of the withdrawal order, may be subject to mineral leasing.

(b) No offers for oil and gas leases covering wildlife refuge lands shall be accepted and no leases covering such lands shall be issued except as provided in §3100.2 of this title. There shall be no drilling or prospecting under any lease heretofore or hereafter issued on lands within a wildlife refuge except with the consent and approval of the Secretary with the concurrence of the Fish and Wildlife Service as to the time, place and nature of such operations in order to give complete protection to wildlife populations and wildlife habitat on the areas leased, and all such operations shall be conducted in accordance with the stipulations of the Bureau on a form approved by the Director.

§ 3101.5-2 Coordination lands.

(a) Coordination lands are those lands withdrawn or acquired by the United States and made available to the States by cooperative agreements entered into between the Fish and Wildlife Service and the game commissions of the various States, in accordance with the Act of March 10, 1934 (48 Stat. 401), as amended by the Act of August 14, 1946 (60 Stat. 1080), or by long-term leases or agreements between the Department of Agriculture and the game commissions of the various States pursuant to the Bankhead-Jones Farm Tenant Act (50 Stat. 525), as amended, where such lands were subsequently transferred to the Department of the Interior, with the Fish and Wildlife Service as the custodial agency of the United States.

(b) Representatives of the Bureau and the Fish and Wildlife Service shall, in cooperation with the authorized members of the various State game commissions, confer for the purpose of determining by agreement those coordination lands which shall not be subject to oil and gas leasing. Coordination lands not closed to oil and gas leasing shall be subject to leasing on the imposition of such stipulations as are agreed upon by the State Game Commission, the Fish and Wildlife Service and the Bureau.

§ 3101.5-3 Alaska wildlife areas.

No lands within a refuge in Alaska open to leasing shall be available until the Fish and Wildlife Service has first completed compatability determinations.

Leases shall be issued subject to stipulations prescribed by the Fish and Wildlife Service as to the time, place, nature and condition of such operations in order to minimize impacts to fish and wildlife populations and habitat and other refuge resources on the areas leased. The specific conduct of lease activities on any refuge lands shall be subject to site-specific stipulations prescribed by the Fish and Wildlife Service.

§ 3101.6 Recreation and public purposes lands.

Under the Recreation and Public Purposes Act, as amended (43 U.S.C. 869 et seq. ), all lands within Recreation and Public Purposes leases and patents are subject to lease under the provisions of this part, subject to such conditions as the Secretary deems appropriate.

§ 3101.7 Federal lands administered by an agency outside of the Department of the Interior.

§ 3101.7-1 General requirements.

(a) Acquired lands shall be leased only with the consent of the surface managing agency, which upon receipt of a description of the lands from the authorized officer, shall report to the authorized officer that it consents to leasing with stipulations, if any, or withholds consent or objects to leasing.

(b) Public domain lands shall be leased only after the Bureau has consulted with the surface managing agency and has provided it with a description of the lands, and the surface managing agency has reported its recommendation to lease with stipulations, if any, or not to lease to the authorized officer. If consent or lack of objection of the surface managing agency is required by statute to lease public domain lands, the procedure in paragraph (a) of this section shall apply.

(c) National Forest System lands whether acquired or reserved from the public domain shall not be leased over the objection of the Forest Service. The provisions of paragraph (a) of this section shall apply to such National Forest System lands.

[53 FR 22836, June 17, 1988]

§ 3101.7-2 Action by the Bureau of Land Management.

(a) Where the surface managing agency has consented to leasing with required stipulations, and the Secretary decides to issue a lease, the authorized officer shall incorporate the stipulations into any lease which it may issue. The authorized officer may add additional stipulations.

(b) The authorized officer shall not issue a lease and shall reject any lease offer on lands to which the surface managing agency objects or withholds consent required by statute. In all other instances, the Secretary has the final authority and discretion to decide to issue a lease.

(c) The authorized officer shall review all recommendations and shall accept all reasonable recommendations of the surface managing agency.

[48 FR 33662, July 22, 1983. Redesignated and amended at 53 FR 22836, June 17, 1988]

(a) The decision of the authorized officer to reject an offer to lease or to issue a lease with stipulations recommended by the surface managing agency may be appealed to the Interior Board of Land Appeals under part 4 of this title.

(b) Where, as provided by statute, the surface managing agency has required that certain stipulations be included in a lease or has consented, or objected or refused to consent to leasing, any appeal by an affected lease offeror shall be pursuant to the administrative remedies provided by the particular surface managing agency.

[53 FR 22837, June 17, 1988]

§ 3101.8 State's or charitable organization's ownership of surface overlying Federally-owned minerals.

Where the United States has conveyed title to, or otherwise transferred the control of the surface of lands to any State or political subdivision, agency, or instrumentality thereof, or a college or any other educational corporation or association, or a charitable or religious corporation or association, with reservation of the oil and gas rights to the United States, such party shall be given an opportunity to suggest any lease stipulations deemed necessary for the protection of existing surface improvements or uses, to set forth the facts supporting the necessity of the stipulations and also to file any objections it may have to the issuance of a lease. Where a party controlling the surface opposes the issuance of a lease or wishes to place such restrictive stipulations upon the lease that it could not be operated upon or become part of a drilling unit and hence is without mineral value, the facts submitted in support of the opposition or request for restrictive stipulations shall be given consideration and each case decided on its merits. The opposition to lease or necessity for restrictive stipulations expressed by the party controlling the surface affords no legal basis or authority to refuse to issue the lease or to issue the lease with the requested restrictive stipulations for the reserved minerals in the lands; in such case, the final determination whether to issue and with what stipulations, or not to issue the lease depends upon whether or not the interests of the United States would best be served by the issuance of the lease.

[48 FR 33662, July 22, 1983, as amended at 49 FR 2113, Jan. 18, 1984; 53 FR 22837, June 17, 1988]

Subpart 3102—Qualifications of Lessees

§ 3102.1 Who may hold leases.

Leases or interests therein may be acquired and held only by citizens of the United States; associations (including partnerships and trusts) of such citizens; corporations organized under the laws of the United States or of any State or Territory thereof; and municipalities.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17353, May 16, 1988]

Leases or interests therein may be acquired and held by aliens only through stock ownership, holding or control in a present or potential lessee that is incorporated under the laws of the United States or of any State or territory thereof, and only if the laws, customs or regulations of their country do not deny similar or like privileges to citizens or corporations of the United States. If it is determined that a country has denied similar or like privileges to citizens or corporations of the United States, it would be placed on a list available from any Bureau of Land Management State office.

[53 FR 17353, May 16, 1988]

Leases shall not be acquired or held by one considered a minor under the laws of the State in which the lands are located, but leases may be acquired and held by legal guardians or trustees of minors in their behalf. Such legal guardians or trustees shall be citizens of the United States or otherwise meet the provisions of §3102.1 of this title.

[48 FR 33662, July 22, 1983, as amended at 53 FR 17353, May 16, 1988]

(a) The original of an offer or bid shall be signed in ink and dated by the present or potential lessee or by anyone authorized to sign on behalf of the present or potential lessee.

(b) Three copies of a transfer of record title or of operating rights (sublease), as required by section 30a of the act, shall be originally signed and dated by the transferor or anyone authorized to sign on behalf of the transferor. However, a transferee, or anyone authorized to sign on his or her behalf, shall be required to sign and date only 1 original request for approval of a transfer.

(c) Documents signed by any party other than the present or potential lessee shall be rendered in a manner to reveal the name of the present or potential lessee, the name of the signatory and their relationship. A signatory who is a member of the organization that constitutes the present or potential lessee (e.g., officer of a corporation, partner of a partnership, etc.) may be requested by the authorized officer to clarify his/her relationship, when the relationship is not shown on the documents filed.

(d) Submission of a qualification number does not meet the requirements of paragraph (c) of this section.

[53 FR 17353, May 16, 1988]

§ 3102.5 Compliance, certification of compliance and evidence.

§ 3102.5-1 Compliance.

In order to actually or potentially own, hold, or control an interest in a lease or prospective lease, all parties, including corporations, and all members of associations, including partnerships of all types, shall, without exception, be qualified and in compliance with the act. Compliance means that the lessee, potential lessee, and all such parties (as defined in §3000.0–5(k)) are:

(a) Citizens of the United States (see §3102.1) or alien stockholders in a corporation organized under State or Federal law (see §3102.2);

(b) In compliance with the Federal acreage limitations (see §3101.2);

(c) Not minors (see §3102.3);

(d) Except for an assignment or transfer under subpart 3106 of this title, in compliance with section 2(a)(2)(A) of the Act, in which case the signature on an offer or lease constitutes evidence of compliance. A lease issued to any entity in violation of this paragraph (d) shall be subject to the cancellation provisions of §3108.3 of this title. The term entity is defined at §3400.0–5(rr) of this title.

(e) Not in violation of the provisions of section 41 of the Act; and

(f) In compliance with section 17(g) of the Act, in which case the signature on an offer, lease, assignment, transfer, constitutes evidence of compliance that the signatory and any subsidiary, affiliate, or person, association, or corporation controlled by or under common control with the signatory, as defined in §3400.0–5(rr) of this title, has not failed or refused to comply with reclamation requirements with respect to all leases and operations thereon in which such person or entity has an interest. Noncompliance with section 17(g) of the Act begins on the effective date of the imposition of a civil penalty by the authorized officer under §3163.2 of this title, or when the bond is attached by the authorized officer for reclamation purposes, whichever comes first. A lease issued, or an assignment or transfer approved, to any such person or entity in violation of this paragraph (f) shall be subject to the cancellation provisions of §3108.3 of this title, notwithstanding any administrative or judicial appeals that may be pending with respect to violations or penalties assessed for failure to comply with the prescribed reclamation standards on any lease holdings. Noncompliance shall end upon a determination by the authorized officer that all required reclamation has been completed and that the United States has been fully reimbursed for any costs incurred due to the required reclamation.

(g) In compliance with §3106.1(b) of this title and section 30A of the Act. The authorized officer may accept the signature on a request for approval of an assignment of less than 640 acres outside of Alaska (2,560 acres within Alaska) as acceptable certification that the assignment would further the development of oil and gas, or the authorized officer may apply the provisions of §3102.5–3 of this title.

[53 FR 22837, June 17, 1988]

§ 3102.5-2 Certification of compliance.

Any party(s) seeking to obtain an interest in a lease shall certify it is in compliance with the act as set forth in §3102.5–1 of this title. A party(s) that is a corporation or publicly traded association, including a publicly traded partnership, shall certify that constituent members of the corporation, association or partnership holding or controlling more than 10 percent of the instruments of ownership of the corporation, association or partnership are in compliance with the act. Execution and submission of an offer, competitive bid form, or request for approval of a transfer of record title or of operating rights (sublease), constitutes certification of compliance.

[53 FR 17353, May 16, 1988; 53 FR 22837, June 17, 1988]

§ 3102.5-3 Evidence of compliance.

The authorized officer may request at any time further evidence of compliance and qualification from any party holding or seeking to hold an interest in a lease. Failure to comply with the request of the authorized officer shall result in adjudication of the action based on the incomplete submission.

[53 FR 17353, May 16, 1988]

Subpart 3103—Fees, Rentals and Royalty

§ 3103.1 Payments.

§ 3103.1-1 Form of remittance.

All remittances shall be by personal check, cashier's check, certified check, or money order, and shall be made payable to the Department of the Interior—Bureau of Land Management or the Department of the Interior—Minerals Management Service, as appropriate. Payments made to the Bureau may be made by other arrangements such as by electronic funds transfer or credit card when specifically authorized by the Bureau. In the case of payments made to the Service, such payments may also be made by electronic funds transfer.

[53 FR 22837, June 17, 1988]

(a)(1) All fees for lease applications or offers or for requests for approval of a transfer and all first-year rentals and bonuses for leases issued under Group 3100 of this title shall be paid to the proper BLM office.

(2) All second-year and subsequent rentals, except for leases specified in paragraph (b) of this section, shall be paid to the Service at the following address: Minerals Management Service, Royalty Management Program/BRASS, Box 5640 T.A., Denver, CO 80217.

(b) All rentals and royalties on producing leases, communitized leases in producing well units, unitized leases in producing unit areas, leases on which compensatory royalty is payable and all payments under subsurface storage agreements and easements for directional drilling shall be paid to the Service.

[48 FR 33662, July 22, 1983, as amended at 49 FR 11637, Mar. 27, 1984; 49 FR 39330, Oct. 5, 1984; 53 FR 17353, May 16, 1988; 72 FR 50887, Sept. 5, 2007]

§ 3103.2-1 Rental requirements.

(a) Each competitive bid or competitive nomination submitted in response to a List of Lands Available for Competitive Nominations or Notice of Competitive Lease Sale, and each noncompetitive lease offer shall be accompanied by full payment of the first year's rental based on the total acreage, if known, and, if not known, shall be based on 40 acres for each smallest legal subdivision. An offer deficient in the first year's rental by not more than 10 percent or $200, whichever is less, shall be accepted by the authorized officer provided all other requirements are met. Rental submitted shall be determined based on the total amount remitted less all required fees. The additional rental shall be paid within 30 days from notice of the deficiency under penalty of cancellation of the lease.

(b) If the acreage is incorrectly indicated in a List of Lands Available for Competitive Nominations or a Notice of Competitive Lease Sale, payment of the rental based on the error is curable within 15 calendar days of receipt of notice from the authorized officer of the error.

(c) Rental shall not be prorated for any lands in which the United States owns an undivided fractional interest but shall be payable for the full acreage in such lands.

[48 FR 33662, July 22, 1983, as amended at 49 FR 26920, June 29, 1984, 53 FR 22837, June 17, 1988; 53 FR 31958, Aug. 22, 1988]

§ 3103.2-2 Annual rental payments.

Rentals shall be paid on or before the lease anniversary date. A full year's rental shall be submitted even when less than a full year remains in the lease term, except as provided in §3103.4–4(d) of this title. Failure to make timely payment shall cause a lease to terminate automatically by operation of law. If the designated Service office is not open on the anniversary date, payment received on the next day the designated Service office is open to the public shall be deemed to be timely made. Payments made to an improper BLM or Service office shall be returned and shall not be forwarded to the designated Service office. Rental shall be payable at the following rates:

(a) The annual rental for all leases issued subsequent to December 22, 1987, shall be $1.50 per acre or fraction thereof for the first 5 years of the lease term and $2 per acre or fraction for any subsequent year, except as provided in paragraph (b) of this section;

(b) The annual rental for all leases issued on or before December 22, 1987, or issued pursuant to an application or offer to lease filed prior to that date shall be as stated in the lease or in regulations in effect on December 22, 1987, except:

(1) Leases issued under former subpart 3112 of this title on or after February 19, 1982, shall be subject after February 1, 1989, to annual rental in the sixth and subsequent lease years of $2 per acre or fraction thereof;

(2) The rental rate of any lease determined after December 22, 1987, to be in a known geological structure outside of Alaska or in a favorable petroleum geological province within Alaska shall not be increased because of such determination;

(3) Exchange and renewal leases shall be subject to rental of $2 per acre or fraction thereof upon exchange or renewal;

(c) Rental shall not be due on acreage for which royalty or minimum royalty is being paid, except on nonproducing leases when compensatory royalty has been assessed in which case annual rental as established in the lease shall be due in addition to compensatory royalty;

(d) On terminated leases that were originally issued noncompetitively and are reinstated under §3108.2–3 of this title, and on noncompetitive leases that were originally issued under §3108.2–4 of this title, the annual rental shall be $5 per acre or fraction thereof beginning with the termination date upon the filing, on or after the effective date of this regulation, of a petition to reinstate a lease or convert an abandoned, unpatented oil placer mining claim;

(e) On terminated leases that were originally issued competitively, the annual rental shall be $10 per acre or fraction thereof beginning with the termination date upon the filing, on or after the effective date of this regulation, of a petition to reinstate a lease under §3108.2–3 of this title; and

(f) Each succeeding time a specific lease is reinstated under §3108.2–3 of this title, the annual rental on that lease shall increase by an additional $5 per acre or fraction thereof for leases that were originally issued noncompetitively and by an additional $10 per acre or fraction thereof for leases that were originally issued competitively.

[53 FR 17353, May 16, 1988 and 53 FR 22837, June 17, 1988, as amended at 61 FR 4750, Feb. 8, 1996]

§ 3103.3-1 Royalty on production.

(a) Royalty on production shall be payable only on the mineral interest owned by the United States. Royalty shall be paid in amount or value of the production removed or sold as follows:

(1) 121/2percent on all leases, including exchange and renewal leases and leases issued in lieu of unpatented oil placer mining claims under §3108.2–4 of this title, issued after December 22, 1987, except:

(i) Leases issued after December 22, 1987, resulting from offers to lease or bids filed on or before December 22, 1987, which are subject to the rates in effect on December 22, 1987; and

(ii) Leases issued on or before December 22, 1987, which are subject to the rates contained in the lease or in regulations at the time of issuance;

(2) 162/3percent on noncompetitive leases reinstated under §3108.2–3 of this title plus an additional 2 percentage-point increase added for each succeeding reinstatement;

(3) Not less than 4 percentage points above the rate used for royalty determination contained in the lease that is reinstated or in force at the time of issuance of the lease that is reinstated for competitive leases, plus an additional 2 percentage-point increase added for each succeeding reinstatement.

(b) Leases that qualify under specific provisions of the Act of August 8, 1946 (30 U.S.C. 226c) may apply for a limitation of a 121/2percent royalty rate.

(c) The average production per well per day for oil and gas shall be determined pursuant to 43 CFR 3162.7–4.

(d) Payment of a royalty on the helium component of gas shall not convey the right to extract the helium. Applications for the right to extract helium shall be made under part 16 of this title.

[53 FR 22838, June 17, 1988]

(a) A minimum royalty shall be payable at the expiration of each lease year beginning on or after a discovery of oil or gas in paying quantities on the lands leased, except that on unitized leases the minimum royalty shall be payable only on the participating acreage, at the following rates:

(1) On leases issued on or after August 8, 1946, and on those issued prior thereto if the lessee files an election under section 15 of the Act of August 8, 1946, a minimum royalty of $1 per acre or fraction thereof in lieu of rental, except as provided in paragraph (a)(2) of this section; and

(2) On leases issued from offers filed after December 22, 1987, and on competitive leases issued from successful bids placed at oral auctions conducted after December 22, 1987, a minimum royalty in lieu of rental of not less than the amount of rental which otherwise would be required for that lease year.

(b) Minimum royalties shall not be prorated for any lands in which the United States owns a fractional interest but shall be payable on the full acreage of the lease.

(c) Minimum royalties and rentals on non-participating acreage shall be payable to the Service.

(d) The minimum royalty provisions of this section shall be applicable to leases reinstated under §3108.2–3 of this title and leases issued under §3108.2–4 of this title.

[48 FR 33662, July 22, 1983, as amended at 49 FR 11637, Mar. 27, 1984; 49 FR 30448, July 30, 1984; 53 FR 22838, June 17, 1988]

§ 3103.4 Production incentives.

§ 3103.4-1 Royalty reductions.

(a) In order to encourage the greatest ultimate recovery of oil or gas and in the interest of conservation, the Secretary, upon a determination that it is necessary to promote development or that the leases cannot be successfully operated under the terms provided therein, may waive, suspend or reduce the rental or minimum royalty or reduce the royalty on an entire leasehold, or any portion thereof.

(b)(1) An application for the benefits under paragraph (a) of this section on other than stripper oil well leases or heavy oil properties must be filed by the operator/payor in the proper BLM office. (Royalty reductions specifically for stripper oil well leases or heavy oil properties are discussed in §3103.4–2 and §3103.4–3 respectively.) The application must contain the serial number of the leases, the names of the record title holders, operating rights owners (sublessees), and operators for each lease, the description of lands by legal subdivision and a description of the relief requested.

(2) Each application shall show the number, location and status of each well drilled, a tabulated statement for each month covering a period of not less than 6 months prior to the date of filing the application of the aggregate amount of oil or gas subject to royalty, the number of wells counted as producing each month and the average production per well per day.

(3) Every application shall contain a detailed statement of expenses and costs of operating the entire lease, the income from the sale of any production and all facts tending to show whether the wells can be successfully operated upon the fixed royalty or rental. Where the application is for a reduction in royalty, full information shall be furnished as to whether overriding royalties, payments out of production, or similar interests are paid to others than the United States, the amounts so paid and efforts made to reduce them. The applicant shall also file agreements of the holders to a reduction of all other royalties or similar payments from the leasehold to an aggregate not in excess of one-half the royalties due the United States.

(c) Petition may be made for reduction of royalty under §3108.2–3(f) for leases reinstated under §3108.2–3 of this title and under §3108.2–4(i) for noncompetitive leases issued under §3108.2–4 of this title. Petitions to waive, suspend or reduce rental or minimum royalty for leases reinstated under §3108.2–3 of this title or for leases issued under §3108.2–4 of this title may be made under this section.

[48 FR 33662, July 22, 1983; 48 FR 39225, Aug. 30, 1983, as amended at 49 FR 30448, July 30, 1984; 53 FR 17354, May 16, 1988; 57 FR 35973, Aug. 11, 1992; 61 FR 4750, Feb. 8, 1996]

§ 3103.4-2 Stripper well royalty reductions.

(a)(1) A stripper well property is any Federal lease or portion thereof segregated for royalty purposes, a communitization agreement, or a participating area of a unit agreement, operated by the same operator, that produces an average of less than 15 barrels of oil per eligible well per well-day for the qualifying period.

(2) An eligible well is an oil well that produces or an injection well that injects and is integral to production for any period of time during the qualifying or subsequent 12-month period.

(3) An oil completion is a completion from which the energy equivalent of the oil produced exceeds the energy equivalent of the gas produced (including the entrained liquid hydrocarbons) or any completion producing oil and less than 60 MCF of gas per day.

(4) An injection well is a well that injects a fluid for secondary or enhanced oil recovery, including reservoir pressure maintenance operations.

(b) Stripper oil well property royalty rate reduction shall be administered according to the following requirements and procedures.

(1) An application for the benefits under paragraph (a) of this section for stripper oil well properties is not required.

(2) Total oil production (regardless of disposition) for the subject period from the eligible wells on the property is totaled and then divided by the total number of well days or portions of days, both producing and injection days, as reported on Form MMS–3160 or MMS–4054 for the eligible wells to determine the property average daily production rate. For those properties in communitization agreements and participating areas of unit agreements that have allocated (not actual) production, the production rate for all eligible well(s) in that specific communitization agreement or participating area is determined and shall be assigned to that allocated property in that communitization agreement or participating area.

(3) Procedures to be used by operator:

(i) Qualifying determination.

(A) Calculate an average daily production rate for the property in order to verify that the property qualifies as a stripper property.

(B) The initial qualifying period for producing properties is the period August 1, 1990, through July 31, 1991. For the properties that were shut-in for 12 consecutive months or longer, the qualifying period is the 12-month production period immediately prior to the shut-in. If the property does not qualify during the initial qualifying period, it may later qualify due to production decline. In those cases, the 12-month qualifying period will be the first consecutive 12-month period beginning after August 31, 1990, during which the property qualifies.

(ii) Qualifying royalty rate calculation. If the property qualifies, use the production rate rounded down to the next whole number (e.g., 6.7 becomes 6) for the qualifying period, and apply the following formula to determine the maximum royalty rate for oil production from the Federal leases for the life of the program.

Royalty Rate (%) = 0.5 + (0.8 × the average daily production rate)

The formula-calculated royalty rate shall apply to all oil production (except condensate) from the property for the first 12 months. The rate shall be effective the first day of the production month after the Minerals Management Service (MMS) receives notification. If the production rate is 15 barrels or greater, the royalty rate will be the rate in the lease terms.

(iii) Outyears royalty rate calculations.

(A) At the end of each 12-month period, the property average daily production rate shall be determined for that period. A royalty rate shall then be calculated using the formula in paragraph (b)(3)(ii) of this section.

(B) The new calculated royalty rate shall be compared to the qualifying period royalty rate. The lower of the two rates shall be used for the current period provided that the operator notifies the MMS of the new royalty rate. The new royalty rate shall not become effective until the first day of the month after the MMS receives notification. Notification shall be received on Form MMS–4377 and mailed to Minerals Management Service, P.O. Box 17110, Denver, CO 80217. If the operator does not notify the MMS of the new royalty rate within 60 days after the end of the subject 12-month period, the royalty rate for the property shall revert back to the royalty rate established as the qualifying period royalty rate, effective at the beginning of the current 12-month period.

(C) The royalty rate shall never exceed the calculated qualifying royalty rate for the life of this program.

(iv) Prohibition. For the qualifying period and any subsequent 12-month period, the production rate shall be the result of routine operational and economic factors for that period and for that property and not the result of production manipulation for the purpose of obtaining a lower royalty rate. A production rate that is determined to have resulted from production manipulation will not receive the benefit of a royalty rate reduction.

(v) Certification. The applicable royalty rate shall be used by the operator/payor when submitting the required royalty reports/payments to MSS. By submitting royalty reports/payments using the royalty rate reduction benefits of this program, the operator certifies that the production rate for the qualifying and subsequent 12-month period was not subject to manipulation for the purpose of obtaining the benefit of a royalty rate reduction, and the royalty rate was calculated in accordance with the instructions and procedures in these regulations.

(vi) Record retention. For seven years after production on which the operator claims a royalty rate reduction for stripper well properties, the operator must retain and make available to BLM for inspection all documents on which the calculation of the applicable royalty rate under this section relies.

(vii) Agency action. If a royalty rate is improperly calculated, the MMS will calculate the correct rate and inform the operator/payors. Any additional royalties due are payable immediately upon notification. Late payment or underpayment charges will be assessed in accordance with 30 CFR 218.102. The BLM may terminate a royalty rate reduction if it is determined that the production rate was manipulated by the operator for the purpose of receiving a royalty rate reduction. Terminations of royalty rate reductions will be effective on the effective date of the royalty rate reduction resulting from the manipulated production rate (i.e., the termination will be retroactive to the effective date of the improper reduction). The operator/payor shall pay the difference in royalty resulting from the retroactive application of the unmanipulated rate. Late payment or underpayment charges will be assessed in accordance with 30 CFR 218.102.

(4) The royalty rate reduction provision for stripper well properties shall be effective as of October 1, 1992. If the oil price, adjusted for inflation by BLM and MMS, using the implicit price deflator for gross national product with 1991 as the base year, remains on average above $28 per barrel, based on West Texas Intermediate crude average posted price for a period of 6 consecutive months, the benefits of the royalty rate reduction under this section may be terminated upon 6 months' notice, published in theFederal Register.

(5) The Secretary will evaluate the effectiveness of the stripper well royalty reduction program and may at any time after September 10, 1997, terminate any or all royalty reductions granted under this section upon 6 months notice.

(6) The stripper well property royalty rate reduction benefits shall apply to all oil produced from the property.

(7) The royalty for gas production (including liquids produced in association with gas) for oil completions shall be calculated separately using the lease royalty rate.

(8) If the lease royalty rate is lower than the benefits provided in this stripper oil property royalty rate reduction program, the lease rate prevails.

(9) The minimum royalty provisions of §3103.3–2 apply.

(10) Examples.

Explanation, Example 1

1. Property production rate per well for qualifying period (August 1, 1990–July 31, 1991) is 10 barrels of oil per day (BOPD).

2. Using the formula, the royalty rate for the first year is calculated to be 8.5 percent. This rate is also the maximum royalty rate for the life of the program.

8.5%=0.5+(0.8×10)

3. Production rate for the first year is 8 BOPD.

4. Using the formula, the royalty rate is calculated at 6.9 percent. Since 6.9 percent is less than the first year rate of 8.5 percent, 6.9 percent is the applicable royalty rate for the second year.

6.9%=0.5+(0.8×8)

5. Production rate for the second year is 12 BOPD.

6. Using the formula, the royalty rate is calculated at 10.1 percent. Since the 8.5 percent first year royalty rate is less than 10.1 percent, the applicable royalty rate for third year is 8.5 percent.

10.1%=0.5+(0.8×12)

7. Production rate for the third year is 23 BOPD.

8. Since the production rate of 23 BOPD is greater than the 15 BOPD threshold for the program, the calculated royalty rate would be the property royalty rate. However, since the 8.5 percent first year royalty rate is less than the property rate, the royalty rate for the fourth year is 8.5 percent.

9. Production rate for the fourth year is 15 BOPD.

10. Since the production is at the 15 BOPD threshold, the royalty rate would be the property royalty rate. However, since the 8.5 percent first year royalty rate is less than the lease rate, the royalty rate for the fifth year is 8.5 percent.

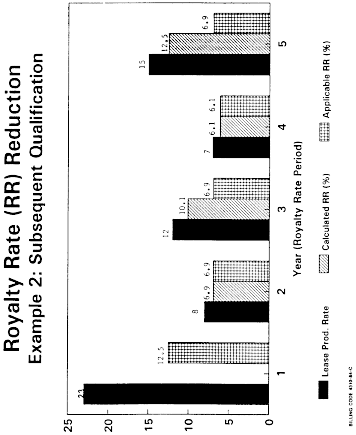

Explanation, Example 2

1. Property production rate of 23 BOPD per well (for the August 1, 1990–July 31, 1991, qualifying period prior to the effective date of the program) is greater than the 15 BOPD which qualifies a property for a royalty rate reduction. Therefore, the property is not entitled to a royalty rate reduction for the first year of the program.

2. Property royalty rate for the first year is the rate as stated in the lease.

3. Production rate for the first year is 8 BOPD.

4. Using the formula, the royalty rate is calculated to be 6.9 percent for the second year. This rate is also the maximum royalty rate for the life of the program.

6.9%=0.5+(0.8×8)

5. Production rate for the second year is 12 BOPD.

6. Using the formula, the royalty rate is calculated at 10.1 percent. Since the 6.9 percent second year royalty rate is less than 10.1 percent, the applicable royalty rate for third year is 6.9 percent.

10.1%=0.5+(0.8×12)

7. Production rate third year is 7 BOPD.

8. Using the formula, the royalty rate is calculated at 6.1 percent. Since the 6.1 percent third year royalty rate is less than the qualifying (maximum) rate of 6.9 percent, the royalty rate for the fourth year is 6.1 percent.

6.1%=0.5+(0.8×7)

9. Production rate for the fourth year is 15 BOPD.

10. Since the production is at the 15 BOPD threshold, the royalty rate would be the lease royalty rate. However, since the 6.9 percent second year royalty rate is less than the lease rate, the royalty rate for the fifth year is 6.9 percent.

Appendix

[48 FR 33662, July 22, 1983; 48 FR 39225, Aug. 30, 1983, as amended at 49 FR 30448, July 30, 1984; 53 FR 17354, May 16, 1988; 57 FR 35973, Aug. 11, 1992. Redesignated at 61 FR 4750, Feb. 8, 1996; 70 FR 53074, Sept. 7, 2005]

§ 3103.4-3 Heavy oil royalty reductions.

(a)(1) A heavy oil well property is any Federal lease or portion thereof segregated for royalty purposes, a communitization area, or a unit participating area, operated by the same operator, that produces crude oil with a weighted average gravity of less than 20 degrees as measured on the American Petroleum Institute (API) scale.

(2) An oil completion is a completion from which the energy equivalent of the oil produced exceeds the energy equivalent of the gas produced (including the entrained liquefiable hydrocarbons) or any completion producing oil and less than 60 MCF of gas per day.

(b) Heavy oil well property royalty rate reductions will be administered according to the following requirements and procedures:

(1) The Bureau of Land Management requires no specific application form for the benefits under paragraph (a) of this section for heavy oil well properties. However, the operator/payor must notify, in writing, the proper BLM office that it is seeking a heavy oil royalty rate reduction. The letter must contain the serial number of the affected leases (or, as appropriate, the communitization agreement number or the unit agreement name); the names of the operators for each lease; the calculated new royalty rate as determined under paragraph (b)(2) of this section; and copies of the Purchaser's Statements (sales receipts) to document the weighted average API gravity for a property.

(2) The operator must determine the weighted average API gravity for a property by averaging (adjusted to rate of production) the API gravities reported on the operator's Purchaser's Statement for the last 3 calendar months preceding the operator's written notice of intent to seek a royalty rate reduction, during each of which at least one sale was held. This is shown in the following 3 illustrations:

(i) If a property has oil sales every month prior to requesting the royalty rate reduction in October of 1996, the operator must submit Purchaser's Statements for July, August, and September of 1996;