2019 Business Compliance (Post-Filing) Burden Survey -2

IRS Taxpayer Burden Surveys

2019 Business Compliance (Post-Filing) Burden Survey -2

OMB: 1545-2212

Business Compliance Burden Survey

Frequently Asked Questions

What is the Business Compliance Burden Survey?

This survey is about the time and out-of-pocket costs your business spent in Calendar Year 2019 on post-filing activities associated with already-filed federal income tax returns.

Post-filing activities include:

Resolving an issue with an already-filed return after receiving a notice from the IRS

Amending an already-filed federal income tax return

You will not be asked about income or other financial details of your business’s tax return.

Who should complete this survey?

The person(s) most responsible for performing or supervising your business’s efforts to resolve the post-filing issue should complete this survey. Feel free to consult with others, but please do not forward this survey to your external service provider.

How was I selected for this survey?

You were randomly selected from all taxpayers who engaged in post-filing activities in Calendar Year 2019.

If your organization has multiple business entities that file separately for federal income tax purposes, please review the address label of the mailing to see which entity was randomly selected for this survey.

How will my answers be used?

Please be assured that your responses will be used for research and aggregate reporting purposes only and will not be used for other non-statistical or non-research purposes such as direct enforcement activities.

Why should I participate?

While participation is voluntary, information about your business’s post-filing tax return compliance experience will help the IRS reduce taxpayer burden for all taxpayers. We encourage you to take a few minutes of your time to participate. By doing so, you will make sure businesses like yours are represented.

How long will this survey take?

This survey should take 10 to 15 minutes to complete.

Who can I contact with questions?

If you have questions about the content of this

survey, please call Victoria Hoverman at Westat at 855-315-3923 or email [email protected]. If you would like to contact someone at the IRS, please email Clara Gant at [email protected].

To read the official IRS announcement regarding this survey, please visit the following URL on the IRS website: https://www.irs.gov/statistics/B19-business-compliance-burden-survey

NOTE to taxpayers in the Compliance Assurance Process (CAP): IRS understands that most issues with your business’s federal income tax returns are resolved prior to filing. When responding to this survey, please consider only the activities your business undertook to amend returns or resolve issues after the returns were filed.

Form 14714-A (OS) (8-2019) Catalog Number 72199E

TIME

SPENT ON POST-FILING ACTIVITIES

This survey refers to federal income tax return post-filing activities conducted in Calendar Year 2019.

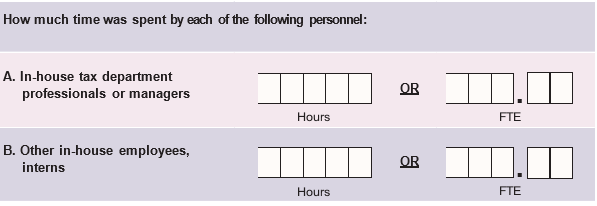

Think about the time spent by your business’s owners and employees on post-filing activities in Calendar Year 2019.

Please include time spent: Please do NOT include time spent:

Working on federal income tax return post-filing activities, such as:

Amending a federal income tax return

Responding to an IRS notice about an already-filed federal income tax return

Resolving an issue with an already-filed federal income tax return

Interacting with the IRS, including “active waiting” time such as being placed on hold during a phone call or waiting to meet with IRS personnel

By an external service provider, because those costs will be considered in Question 3

Waiting on the IRS or an external service provider to respond to you

Filing federal income tax returns not required to resolve your post-filing activities

Filing any state income tax return(s) or resolving issues with any state return(s)

Conducting post-filing activities in any calendar year other than 2019

If you’re not sure how much time was spent, please provide your best estimate.

You may answer the question in number of hours OR full-time equivalents (FTE).

FTE = total hours/2080 hours.

What was the average annual salary in Calendar Year 2019 for the in-house

tax professionals or managers (i.e., Question 1, Category A) who conducted activities related to your business’s federal income tax post-filing activities? Please do not include benefits or overhead.

If you’re not sure what the average salary was, please provide your best estimate.

-

$

.

Not Applicable

Dollars

Cents

COSTS

ASSOCIATED WITH POST-FILING ACTIVITIES

This survey refers to federal income tax return post-filing activities conducted in Calendar Year 2019.

Think about the money spent by your business on post-filing activities in Calendar Year 2019. Costs associated with resolving post-filing activities are a very important part of assessing burden. If you’re not sure how much money was spent, please provide your best estimate.

Do not include the amount of tax, penalties, and/or interest payments related to your post-filing activities.

How

much money

was spent on…

How

much money

was spent on…

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State

and Local Income Tax Returns

How many state and local income tax returns did your business file in Calendar Year 2019?

If you’re not sure, please provide your best estimate.

Number of returns

How many state and local income tax returns from any year did your business amend as a result of the federal income tax return post-filing activities conducted in Calendar Year 2019?

If you’re not sure, please provide your best estimate.

Number of returns

IMPROVING

THE BUSINESS COMPLIANCE BURDEN PROCESS

6. What do businesses like yours find to be the most difficult part of amending or resolving issues with an already-filed federal income tax return?

7. Please describe below any suggestions you have for how the IRS could improve taxpayer services or reduce the compliance burden associated with amending or resolving issues with an already-filed return.

Thank you for completing our survey.

Privacy and Paperwork Reduction Act Notice for Business Compliance Burden Data Collection

The Privacy Act of 1974 states that when we ask you for information, we must first tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if you do not provide it and whether or not you must respond under the law.

Our legal right to ask for this information is 5 U.S.C. 301.

The primary purpose for requesting the information is to analyze the role of taxpayer burden in tax administration. We will also use the information to fulfill the IRS’ statutory obligations to the Office of Management and Budget and Congress for information required by the Paperwork Reduction Act, and to provide tax policy analysis support to the

Office of Tax Analysis at the Department of the Treasury. We will also use the information provided to better understand taxpayer needs and burden reduction opportunities.

Tax information may be disclosed only as provided by 26 U.S.C. 6103. Providing the information is voluntary. Not providing all or part of the information requested may reduce our ability to address taxpayer concerns regarding paperwork reduction.

OMB

No: 1545-2212. This report is authorized under the Paperwork

Reduction Act. Data collected will be shared with IRS staff, but

your responses will be used for research and aggregate reporting

purposes only and will not be used for other non-statistical or

non-research purposes such as direct enforcement activities. The

information that you provide will be protected to the fullest extent

allowable under the Freedom of Information Act (FOIA). Public

reporting burden for this collection of information is estimated to

average 10 to 15 minutes, including the time for reviewing

instructions, searching existing data sources, gathering and

maintaining the data needed, and completing and reviewing the

collection of information. Send comments regarding this burden

estimate or any other aspect of this collection of information,

including suggestions for reducing this burden, to Special Services

Section, SE:W:CAR:MP:T:M:S, Room 6129, 1111 Constitution Ave. NW,

Washington, DC 20224.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Gant Clara |

| File Modified | 0000-00-00 |

| File Created | 2023-08-26 |

© 2026 OMB.report | Privacy Policy