|

Version Control Number |

11.7.2017 |

Application Overview |

|

|

|

|

|

|

|

|

|

|

|

|

Unit Schedule |

|

|

|

|

|

|

|

|

|

|

|

Rates |

|

|

|

|

Private Pay Comparables |

|

|

|

|

|

|

|

|

|

Occupancy and Census Comparables |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Forecast |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expense History |

|

|

|

|

|

|

|

|

|

|

Expense Comparables |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Comparison Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Appraisal Sockets U.S. Department of Housing and Urban Development OMB Approval No. 2502-0605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data Input - Not a Required Input |

|

|

|

|

|

|

|

|

Supplemental Data Input- Not a Required Input |

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

|

9 |

|

10 |

|

11 |

|

12 |

|

13 |

|

14 |

|

15 |

|

|

|

|

|

|

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Section 232 Office of Residential Care Facilities (exp. 11/30/2022) |

|

Project Name |

|

|

Select |

What is the property's Investment Grade |

Indicate the historical financial data periods reported. Note: If 4 periods of income data are not available leave the oldest slots blank, not the newest. If supplemental data is added (not required), direct input the dates.

|

|

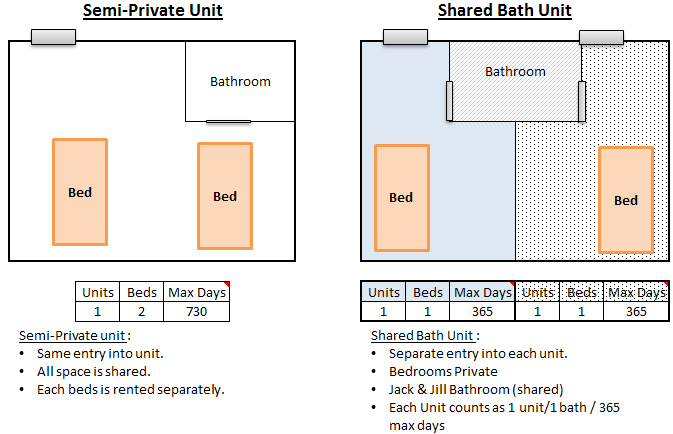

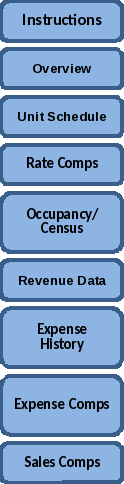

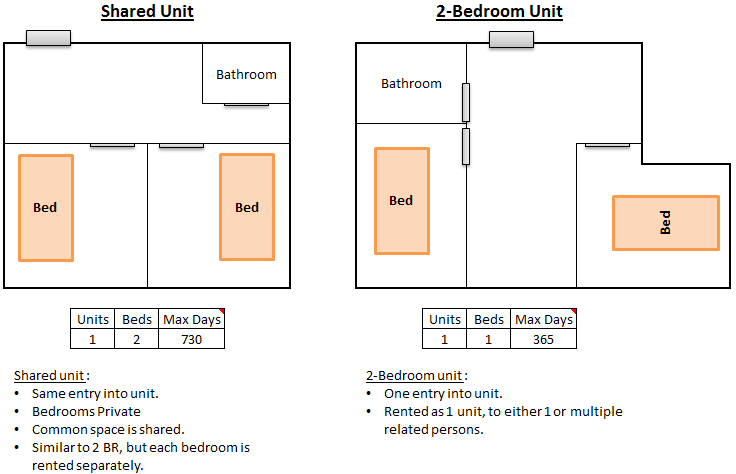

Project Unit Type |

Care Type |

Room Type |

# of Units |

# of Beds |

Baths |

Unit Sq. Ft. |

Current Rent |

Appraisal Rent |

Rental Rate Bed or Unit |

Notes |

|

Medicare Rates: |

|

|

|

|

Project Unit Type |

Rent Comparable Name |

Care Type |

Room Type |

Beds or Units |

Unadjusted Rate |

Adjusted Rate |

Gross Total Adjustments |

Notes |

|

Care Type |

Occupancy and Census Comparable Name |

Occupancy Rate |

Occupancy / Census Survey Time Period |

Private Pay |

Medicare |

Medicaid |

Veterans Admin |

HMO (Insurance) |

Other |

Total |

|

|

Period |

FY 1900 |

FY 1900 |

FY 1900 |

FY 1900 |

Appraisal (Market) |

Lender (for DSCR) |

Enter Period |

Enter Period |

Enter Period |

|

Expense Categories |

FY 1900 |

FY 1900 |

FY 1900 |

FY 1900 |

Appraisal (Market) |

Lender's DSC |

Enter Period |

Enter Period |

Enter Period |

|

Expense Comparable Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit Types |

Sale Comparable Name |

City |

State |

Sale Date |

Bulk Sale |

Sales Price |

Year Built |

# of Units |

# of Beds |

Private Pay % |

Medicare % |

Medicaid % |

Other % |

Occ. % |

Sales Data Info Source |

Date of NOI |

Sale Income Growth |

Cap Rate |

Unit of Comparison |

Unadjusted Price |

Adjusted Price |

Gross Adjustment % |

EGIM |

Expense Ratio |

Comments/Important Factors |

|

|

Project Street Address |

|

|

Select |

Is the subject operated as a non-profit? |

|

|

Historical Average RUG Rate: |

|

Time Period: |

|

|

|

|

|

Income Source |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

Total $ |

# of Days |

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public reporting burden for this collection of information is estimated to average 0.5 hours per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. The information is being collected to obtain the supportive documentation that must be submitted to HUD for approval, and is necessary to ensure that viable projects are developed and maintained. The Department will use this information to determine if properties meet HUD requirements with respect to development, operation and/or asset management, as well as ensuring the continued marketability of the properties. Response to this request for information is required in order to receive the benefits to be derived from the National Housing Act Section 232 Healthcare Facility Insurance Program. This agency may not collect this information, and you are not required to complete this form unless it displays a currently valid OMB control number. While no assurance of confidentiality is pledged to respondents, HUD generally discloses this data only in response to a Freedom of Information Act request.

Warning: Anyone who knowingly submits a false claim or makes a false statement is subject to criminal and/or civil penalties, including confinement for up to 5 years, fines, and civil and administrative penalties. (18 U.S.C. §§ 287, 1001, 1010, 1012; 31 U.S.C. §3729, 3802). |

|

City |

|

|

Select |

Is there or will there be a ground lease? |

|

A |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

|

|

|

SN-Private-pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. General & Administrative |

|

|

|

|

|

|

|

|

|

|

State |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

State |

|

|

Select |

Will the project have any encumbrances such as rent, occupancy or private restrictions? |

|

|

|

|

|

|

|

|

B |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

Medicaid Rates |

|

|

|

|

|

|

|

SN-Medicaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Payroll Taxes and Benefits |

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

FHA Number |

|

|

Select |

Does the underwritten income include any commercial income? |

|

Begin Date |

End Date |

Period Type |

|

|

Headers |

|

C |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

Published Rate: |

|

Rate Date: |

|

|

|

|

|

SN-Medicare (Part A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Resident Care |

|

|

|

|

|

|

|

|

|

|

Gross Square Footage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Lender (Firm) |

|

|

|

Not A Required Question |

Oldest Period ˃ |

|

|

Fiscal Year (FY) |

0 |

days |

FY 1900 |

|

D |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

|

As a percentage of the census mix. |

|

|

SN-HMO/Ins/Medicare (Part C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Food Services |

|

|

|

|

|

|

|

|

|

|

Occupancy |

|

|

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Lender (UW Name) |

|

|

|

Not A Required Question |

|

|

|

Fiscal Year (FY) |

0 |

days |

FY 1900 |

|

E |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

SN-Veterans Admin (VA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Activities |

|

|

|

|

|

|

|

|

|

|

Unit Count by Mix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Mortgage Amount |

|

|

Select |

Are the real estate taxes based upon an abatement or special tax consideration? |

|

|

|

Fiscal Year (FY) |

0 |

days |

FY 1900 |

|

F |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e. g. SNF-Other Payers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Housekeeping & Laundry |

|

|

|

|

|

|

|

|

|

|

Skilled Nursing beds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Mortgage Term (in months) |

|

|

Select |

Does the underwritten income include adult day care income? |

Most Recent ˃ |

|

|

Fiscal Year (FY) |

0 |

days |

FY 1900 |

|

G |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

ALF-Private-pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Maintenance |

|

|

|

|

|

|

|

|

|

|

Assisted Living beds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Mortgage Interest Rate |

|

|

|

Not A Required Question |

|

|

|

|

|

|

|

|

H |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

ALF-Medicaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Utilities |

|

|

|

|

|

|

|

|

|

|

Memory Care beds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

Mortgage Ins. Premium (MIP) |

|

|

|

Not A Required Question |

|

|

The appraisal analyzed the project's financial data through what date? |

|

|

|

|

I |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

ALF-Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Insurance (property & liability) |

|

|

|

|

|

|

|

|

|

|

Independent Living units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

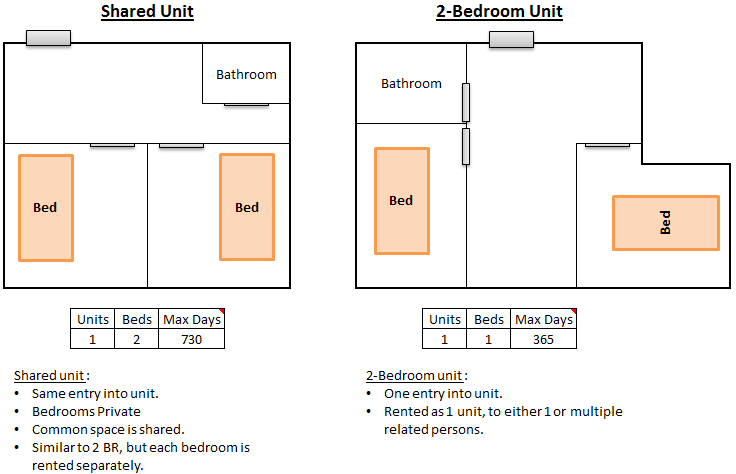

| 1. This workbook is to be filled out and accompany each appraisal submitted to ORCF for the 232/223(f) refinance program. Other programs that involve new construction will not use this form. The data may be entered by the appraiser or by the lender. It is however the lender's responsibility to ensure the entries are correct. |

|

|

|

|

Select |

Is the building's footprint changing? |

|

|

|

|

|

|

J |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

MC-Private-pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Marketing and Promotion |

|

|

|

|

|

|

|

|

|

|

Total |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Appraisal Firm |

|

|

Select |

Has the property sold (or pending) within 3 years of the appraisal date? |

|

|

|

|

|

|

K |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

MC-Medicaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Ground Rent |

|

|

|

|

|

|

|

|

|

|

Payor Mix (enter as % of resident days) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Appraiser Name |

|

|

Select |

Not A Required Question |

|

|

|

|

|

|

|

|

L |

Select |

Select |

|

- |

Select |

|

|

|

Select |

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

MC-Other Payers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Bad Debt |

|

|

|

|

|

|

|

|

|

|

Private Pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

Date of Valuation |

|

|

|

Not A Required Question |

|

|

|

|

|

|

|

|

Total |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

IL-Private-pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

Medicare |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

| 2. Input information into cells that are shaded this color green. |

|

Appraised Value |

|

|

|

Not A Required Question |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

IL-Other Payers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

Medicaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

| Optional Information can be added to cells with this color yellow. |

|

Underwritten Value |

|

|

|

|

|

|

|

|

|

|

|

Other Unit Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

Residential Revenue Achieved |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

| The data entered calculates to a number that exceeds the parameters for that data i.e. occupancy in excess of 100% |

|

Cost Approach Conclusion (if utilized) |

|

|

Market |

|

|

|

|

|

|

|

a. |

|

d. |

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

Medicare Part B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

Total |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

Income Capitalization Conclusion |

|

|

Select |

Is the project's market population, target population, real estate values, or employment base declining? |

|

|

|

|

|

|

|

b. |

|

e. |

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e.g. Therapy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-total |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

| 3. Cells displaying the word "Select" contain predetermined drop-down for you to select from. Only use the responses in the drop down list. |

|

Appraiser's Capitalization Rate |

|

|

|

|

|

|

|

|

|

|

c. |

|

f. |

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e.g. Level of Care Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate (Property) Taxes |

|

|

|

|

|

|

|

|

|

|

Effective Gross Income (per year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

Sales Comparison Conclusion |

|

|

Select |

Are there any negative market influences that require special consideration? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e.g. Second Occupant Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management Fees |

|

|

|

|

|

|

|

|

|

|

Expense Categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

| 4. Some cells (see below) include instructional aids to complete the responses. The pop-up can easily be moved to a different location on the sheet by left clicking on the pop-up. |

|

Year Built |

|

|

Select |

Will the project be impacted by a current/projected oversupply of competitive units? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e.g. Misc./Assessment Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Replacement Reserves |

|

|

|

|

|

|

|

|

|

|

e.g. General & Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

Remaining Economic Life (in years) |

|

|

Select |

Have new units/beds been approved for construction, completed construction within the past year, or are currently in lease-up within the PMA? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e.g. Commercial Space |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

e.g. Payroll Taxes and Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

Lender Proposed Repair Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

e.g. Day Care |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Resident Care |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Appraisal Indicated Repair Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

FY 1900 |

FY 1900 |

FY 1900 |

FY 1900 |

|

|

Enter Period |

Enter Period |

Enter Period |

|

e.g. Food Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Land Square Size (Sq.Ft.) |

|

|

Appraisal |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Building Size (Sq.Ft.) |

|

|

Select |

Hypothetical Conditions: Other than assuming that the critical and non-critical repairs have been made, does the appraisal make other hypothetical assumptions? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

Other Revenue Achieved |

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

|

Total Revenue from Financial Statement |

|

|

|

|

|

|

|

|

|

|

e.g. Housekeeping & Laundry |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Star Rating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

Effective Gross Income |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

$0 |

0 |

|

Effective Gross Income Reported in Appraisal |

$0 |

$0 |

$0 |

$0 |

|

|

$0 |

$0 |

$0 |

|

e.g. Maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Undepreciated Cost New |

|

|

Select |

Extraordinary Assumptions: Does the appraisal make any extraordinary assumptions? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Difference |

$0 |

$0 |

$0 |

$0 |

|

|

$0 |

$0 |

$0 |

|

e.g. Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

|

Does the application propose reduced debt seasoning (less than 2 years) pursuant to Healthcare Mortgage Insurance Program Handbook (4232.1) Ch. 3.13D? |

|

|

Select |

Jurisdictional Exceptions: Does the appraisal invoke any jurisdictional exceptions? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

Select |

|

|

Select |

|

|

|

|

|

|

0.0% |

|

|

Potential Days |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

Net Income from Financial Statement |

|

|

|

|

|

|

|

|

|

|

e.g. Insurance (property & liability) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

|

|

|

Select |

Functional Obsolescence: Does the appraisal identify any functional obsolescence? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOI Reported in Appraisal |

$0 |

$0 |

$0 |

$0 |

|

|

$0 |

$0 |

$0 |

|

e.g. Marketing and Promotion |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

6. Each input cell is named. When the cell is selected the name appears in the name box to the left of the formula bar (see Illustration below). Users are welcome to integrate this workbook's names into their worksheets but this workbook's assigned names must not change. To migrate the Sockets tab into another Excel workbook without losing the cell names, first open both this worksheet and the destination workbook, then right-click the "Sockets" tab, select “move or copy”, under “To Book” select the destination workbook (which you opened) from the list, then finish by clicking “OK”. Prior to submitting this document to ORCF make sure any external links are broken. |

|

|

|

Select |

External Obsolescence: Does the appraisal identify any external obsolescence? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Difference |

$0 |

$0 |

$0 |

$0 |

|

|

$0 |

$0 |

$0 |

|

e.g. Ground Rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

Select |

|

Select |

|

|

|

|

|

|

|

|

|

Select |

Select |

Select |

|

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconcile Items |

|

|

|

|

|

|

|

|

|

|

e.g. Bad Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Fundraising Income |

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Fundraising Expense |

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Depreciation |

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Amortization |

|

|

|

|

|

|

|

|

|

|

Other [delineate] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Unusual Administration |

|

|

|

|

|

|

|

|

|

|

Sub-total |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Unique Employees |

|

|

|

|

|

|

|

|

|

|

Real Estate Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Major single-item capital exp. |

|

|

|

|

|

|

|

|

|

|

Management Fees (Actual) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Facility Lease |

|

|

|

|

|

|

|

|

|

|

Replacement Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Expenses |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Operating Income |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Do not delete or add rows as this will impact other tables that share the same row. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year of Expense Information |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

e.g. Jul-12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance |

$0 |

$0 |

$0 |

$0 |

|

|

$0 |

$0 |

$0 |

|

Net adjust. amount applied for date |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. The inputs typically call for data to be reported on a per resident day (PRD) basis. Please do not alter this formatting as it is the format HUD will use in data collecting. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. General & Administrative |

|

|

|

|

|

|

|

|

|

|

e.g. General & Administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. The data fields are intended to stay static but if ORCF requires changes patch notes will be circulated for version control. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Payroll Taxes and Benefits |

|

|

|

|

|

|

|

|

|

|

e.g. Payroll Taxes and Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Resident Care |

|

|

|

|

|

|

|

|

|

|

e.g. Resident Care |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

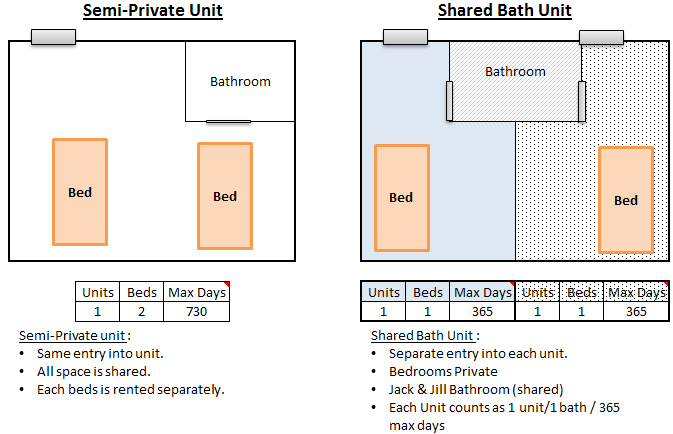

11. The navigation bar to the left provides quick links to the various worksheet sections. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select |

|

Select |

Select |

Select |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.g. Food Services |

|

|

|

|

|

|

|

|

|

|

e.g. Food Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A bulk sale is the combined sale of more than one property.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|