NCUA Call Report

NCUA Call Report

Call Report Instructions 2023-Q3 Proposed

NCUA Call Report

OMB: 3133-0004

CALL REPORT FORM 5300 INSTRUCTIONS

effective

June 30, 2023 Until Superseded

Call Report Instruction Revisions

The following Call Report Instruction enhancements were made:

Statement of Financial Condition, Assets, Item 8 (Account AS0067):

Changed:

“Report the total amount of investment in debt securities that your credit union has classified as available for sale at fair value prior to any valuation adjustment for estimated credit losses. Estimated credit losses are reported separately in Account AS0041. The amount reported in Account AS0067 less the amount reported in Account AS0041 attributable to AFS debt securities represents fair value of all AFS debt securities and must equal the fair value amount reported on Schedule B, Section 1, in Account NV0084. Refer to Accounting Standards Codification (ASC) 320, Investments – Debt Securities.”

to:

“Report the total amount of investment in debt securities that your credit union has classified as available for sale at fair value. The allowance for credit losses is reported in Account AS0042. The amount reported in Account AS0067 represents fair value of all AFS debt securities and must equal the fair value amount reported on Schedule B, Section 1, in Account NV0084. Refer to Accounting Standards Codification (ASC) 320, Investments – Debt Securities.”

“Report the allowance for credit losses on available-for-sale debt securities. This is reported for disclosure purposes only and will not be included in Total Investment Securities (Account AS0013).”

Statement of Financial Condition, Assets, Item 11 (Account AS0041):

Changed:

“Report the allowance for credit losses on investment securities.

to:

“Report the allowance for credit losses on held-to-maturity debt securities.”

Table of Contents

ASC Topic 326 Financial Instruments – Credit Losses (CECL) Check Box (Account AS0010) 20

2. Cash on Deposit (Amounts Deposited in Financial Institutions) 20

4. All other deposits (Account AS0008) 21

6. Equity Securities (Account AS0055) 21

7. Trading Debt Securities (Account AS0061) 22

8. Available-for-Sale Debt Securities (Account AS0067) 22

9. (Allowance for Credit Losses on Available-for-Sale Debt Securities) (Account AS0042) 22

10. Held-to-Maturity Debt Securities (Account AS0073) 22

11. Allowance for Credit Losses on Held-to-Maturity Debt Securities (Account AS0041) 22

14. Total Other Investments (Sum of Accounts 769A, 769B, and AS0016 ) (Account AS0017) 23

15. Loans Held for Sale (Account 003) 24

16. Total Loans & Leases (Accounts 025A and 025B) 24

17. Allowance for Loan & Lease Losses (Account 719) 24

18. Allowance for Credit Losses on Loans & Leases (Account AS0048) 24

19. Foreclosed and Repossessed Assets 25

20. Land and Building (Account 007) 26

21. Other Fixed Assets (Account 008) 26

22. NCUA Share Insurance Capitalization Deposit (Account 794) 26

24. Total Assets (Account 010) 27

1. Accounts Payable, Accrued Interest on Borrowings, and Other Liabilities (Account 825) 28

2. Accrued Dividends/Interest Payable on Shares/Deposits (Account 820A) 28

3. Allowance for Credit Losses on Off-Balance Sheet Credit Exposure (Account LI0003) 28

4. Borrowings (Account 860C) 28

5. Member Shares of All Types (Account 013) 28

6. Nonmember Deposits (Account 880) 28

7. Total Shares and Deposits (Account 018) 29

8. Total Liabilities (Account LI0069) 29

9. Undivided Earnings (Account 940) 29

10. Other Reserves (Account 658) 29

11. Appropriation for Non-Conforming Investments (State Credit Union ONLY) (Account 668) 29

12. Equity Acquired in Merger (Account 658A) 29

13. Noncontrolling Interest in Consolidated Subsidiaries (Account 996) 29

14. Accumulated Unrealized Net Gains (Losses) on Cash Flow Hedges (Account 945A) 29

16. Accumulated Unrealized Gains (Losses) on Available for Sale Debt Securities (Account EQ0009) 30

17. Other Comprehensive Income (Account 945B) 30

18. Net Income (Account 602) 31

19. TOTAL LIABILITIES, SHARES AND EQUITY (Account 014) 31

Statement of Income and Expense 32

Interest Income Year-to-Date 32

1. Interest on Loans and Leases (Account 110) 32

2. Interest Refunded (Account 119) 32

4. Other Interest Income (Account IS0005) 32

5. Total Interest Income (Account 115) 32

Interest Expense Year-to-Date 33

6. Dividends on Shares (Account 380) 33

8. Interest on Borrowed Money (Account 340) 33

9. Total Interest Expense (Account 350) 33

10. Net Interest Income (Account 116) 33

11. Provision for Loan & Lease Losses (Account 300) 33

Statement of Income and Expense 35

Non-Interest Income Year-to-Date 35

13. Fee Income (Account 131) 35

14. Other Income (Includes unconsolidated CUSO Income) (Account IS0020) 35

17. Gain (Loss) on Derivatives (Account 421) 35

18. Gain (Loss) on Disposition of Fixed Assets (Account 430) 36

19. Gain (Loss) on Sales of Loans and Leases (Account IS0029) 36

20. Gain (Loss) on Sales of Other Real Estate Owned (Account IS0030) 36

21. Gain from Bargain Purchase (Merger) (Account 431) 36

22. Other Non-Interest Income (Account 440) 36

23. TOTAL NON-INTEREST INCOME (Account 117) 36

Non-Interest Expense Year-to-Date 36

24. Total Employee Compensation and Benefits (Account 210) 36

25. Travel and Conference Expense (Account 230) 36

26. Office Occupancy Expense (Account 250) 36

27. Office Operations Expense (Account 260) 36

28. Educational and Promotional Expense (Account 270) 37

29. Loan Servicing Expense (Account 280) 37

30. Professional and Outside Services (Account 290) 37

31. Member Insurance (Account 310) 37

32. Operating Fees (Examination and/or supervision fees) (Account 320) 37

33. Miscellaneous Non-Interest Expense (Account 360) 37

34. Total Non-Interest Expense (Account 671) 37

35. Net Income (Loss) (Account 661A) 37

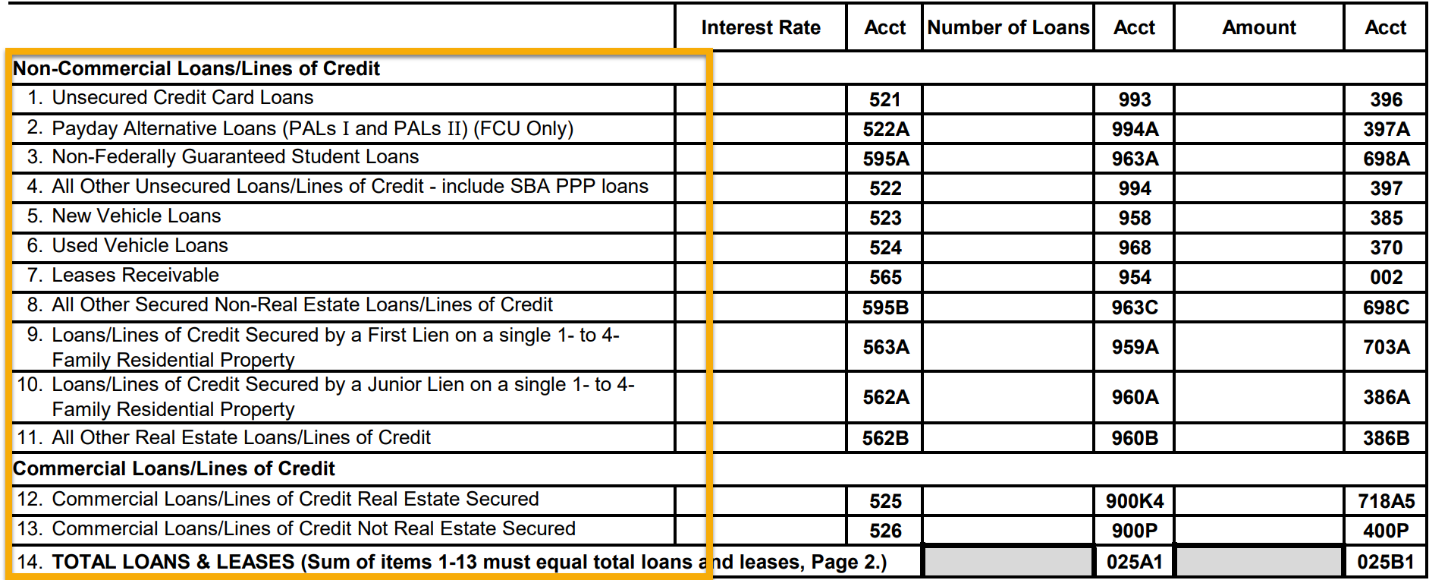

Schedule A, Section 1 – Loans & Leases 38

Non-Commercial Loans/Lines of Credit 39

1. Unsecured Credit Card Loans (Accounts 521, 993, and 396) 39

2. Payday Alternative Loans (PALs I and II) (FCUs Only)(Accounts 522A, 994A, and 397A) 39

3. Non-Federally Guaranteed Student Loans (Accounts 595A, 963A, and 698A) 40

4. All Other Unsecured Loans/Lines of Credit (Accounts 522, 994, and 397) 40

5. New Vehicle Loans (Accounts 523, 958, and 385) 40

6. Used Vehicle Loans (Accounts 524, 968, and 370) 40

7. Leases Receivable (Accounts 565, 954, and 002) 41

8. All other Secured Non-Real Estate Loans/Lines of Credit (Accounts 595B, 963C, and 698C) 41

11. All Other Real Estate Loans/Lines of Credit (Accounts 562B, 960B, and 386B) 42

Commercial Loans/Lines of Credit 42

12. Commercial Loans/Lines of Credit Real Estate Secured (Accounts 525, 900K4, and 718A5) 42

13. Commercial Loans/Lines of Credit Not Real Estate Secured (Accounts 526, 900P, and 400P) 43

15. Loans Granted Year-to-Date (Accounts 031A and 031B) 43

Government Guaranteed Loans 44

16. Non-Commercial Loans (contained in items 1 – 11 above) 44

a.1. Small Business Administration (Accounts LN0050, LN0051, and LN0052) 44

a.2. Paycheck Protection Program loans (Accounts LN0056 and LN0057) 44

b. Other Government Guaranteed (Accounts LN0053, LN0054, and LN0055) 44

17. Commercial Loans (contained in items 12 – 13 above) 44

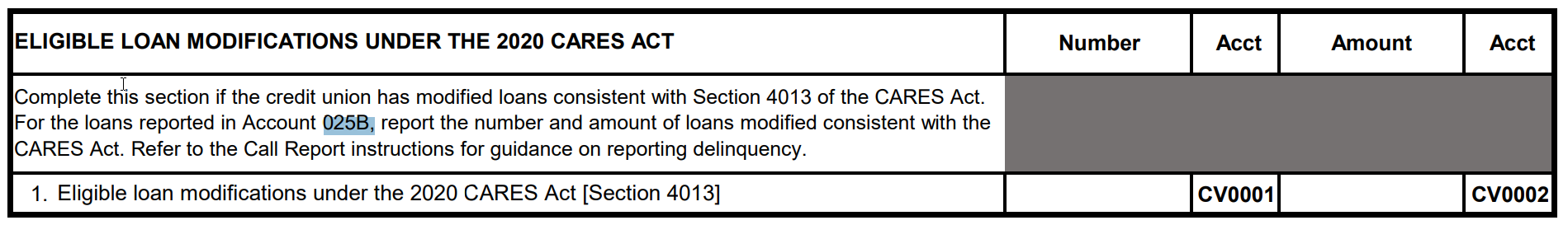

Eligible Loan Modifications Under the 2020 CARES Act 46

18. Eligible loan modifications under the 2020 CARES Act [§ 4013] (Accounts CV0001 and CV0002) 47

Schedule A, Section 2 – Delinquent Loans & Leases 49

Non-Commercial Loans/Lines of Credit 50

1. Unsecured Credit Card Loans (Accounts 024B, DL0002, 026B, 027B, 028B, 045B, and 045A) 50

5. New Vehicle Loans (Accounts 020C1, DL0030, 021C1, 022C1, 023C1, 041C1, and 035E1) 50

6. Used Vehicle Loans (Accounts 020C2, DL0037, 021C2, 022C2, 023C2, 041C2, and 035E2) 50

7. Leases Receivable (Accounts 020D, DL0044, 021D, 022D, 023D, 041D, and 034E) 50

Commercial Loans/Lines of Credit 51

13. Secured by Farmland (Accounts DL0085, DL0086, DL0087, DL0088, DL0089, DL0090, and DL0091) 51

14. Secured by Multifamily (Accounts DL0092, DL0093, DL0094, DL0095, DL0096, DL0097, and DL0098) 51

19. Unsecured Commercial (Accounts DL0127, DL0128, DL0129, DL0130, DL0131, DL0132, and DL0133) 52

21. Total Delinquent Loans and Leases (Accounts 020B, DL0141, 021B, 022B, 023B, 041B, and 041A) 52

Schedule A, Section 2 – Delinquent Loans & Leases (continued) 53

a. Participation Loans Purchased Under 701.22 (Account DL0142) 53

b. Indirect Loans (Account 041E) 53

c. Whole or Partial Loans Purchased under 701.23 (Account DL0144) 53

23. Amount of Non-Commercial Loans in Nonaccrual Status (Account DL0145) 53

24. Amount of Commercial Loans in Non-Accrual Status (Account DL0146) 53

25. Total outstanding loan balances subject to bankruptcies (Account 971) 53

Schedule A, Section 3 – Loan Charge Offs & Recoveries 54

Non-Commercial Loans/Lines of Credit 54

1. Unsecured Credit Card Loans (Accounts 680 and 681) 54

2. Payday Alternative Loans (PALs I and II) (FCU Only) (Accounts 136 and 137) 54

3. Non-Federally Guaranteed Student Loans (Account 550T and 551T) 54

4. All Other Unsecured Loans/Lines of Credit (Accounts CH0007 and CH0008) 54

5. New Vehicle Loans (Accounts 550C1 and 551C1) 55

6. Used Vehicle Loans (Accounts 550C2 and 551C2) 55

7. Leases Receivable (Accounts 550D and 551D) 55

8. All Other Secured Non-Real Estate Loans/Lines of Credit (Accounts CH0015 and CH0016) 55

11. All Other (Non-Commercial) Real Estate Loans/Lines of Credit (Accounts CH0021 and CH0022) 55

Commercial Loans/Lines of Credit 55

12. Construction and Development Loans (Accounts CH0023 and CH0024) 55

13. Secured by Farmland (Accounts CH0025 and CH0026) 56

14. Secured by Multifamily (Accounts CH0027 and CH0028) 56

15. Secured by Owner Occupied, Non-Farm, Non-Residential Property (Accounts CH0029 and CH0030) 56

18. Commercial and Industrial Loans (Accounts CH0035 and CH0036) 56

19. Unsecured Commercial Loans (Account CH0037 and CH0038) 56

20. Unsecured Revolving Lines of Credit for Commercial Purposes (Account CH0039 and CH0040) 56

21. Total Charge Offs and Recoveries (Accounts 550 and 551) 57

a. Participation Loans Purchased Under 701.22 (Accounts 550F and 551F 57

Schedule A, Section 4 – Other Loan Information 58

Loans to Credit Union Officials 58

1. Loans Outstanding to Credit Union Officials and Senior Executive Staff (Accounts 995 and 956) 58

Federal Credit Union Interest Rate Ceiling Report 58

2. Federal Credit Union Interest Rate Ceiling (FCU ONLY) 58

Purchased Credit Impaired Loans (PCILS) 58

3. Total Purchased Credit Impaired Loans (PCILs) Outstanding (Accounts PC0001 and PC0002) 59

Purchased Financial Assets with Credit Deterioration (PCD) 59

4. PCD Loans Outstanding (Accounts PC0003, PC0004, PC0005, and PC0006) 59

5. PCD Debt Securities Outstanding (Account PC0007, PC0008, PC0009, and PC0010) 60

1. New and Used Vehicle Loans (Accounts IN0001 and IN0002) 61

2. First Lien and Junior Lien Residential Loans (Accounts IN0003 and IN0004) 61

3. Commercial Loans (Accounts IN0005 and IN0006) 61

4. All Other Loans (Accounts IN0007 and IN0008) 61

5. Total Outstanding Indirect Loans (Accounts 617A and 618A) 61

Section 6 – Loans Purchased and Sold Under Sections 701.22 and 701.23 62

2. Loans Purchased from Other Sources (Accounts SL0012 and SL0013, SL0020, and SL0021) 62

3. Loans Sold, Year-to-date (Accounts SL0022 and SL0023) 62

4. First Mortgage Loans Sold on the Secondary Market (Account SL0024 and 736) 63

6. Real Estate Loans Sold With Servicing Retained (Account SL0028, SL0029, SL0030 and 779A) 63

7. All Other Loans Sold with Servicing Retained (Account SL0032, SL0033, SL0034, and SL0035) 63

8. Vehicle – Non-commercial (Accounts SL0036, SL0037, SL0038, and SL0039) 64

9. Non-Federally Guaranteed Student Loans (Accounts 691L7, SL0041, 691N7, and SL0043) 64

10. 1- to 4-Family Residential Property (Accounts 691L2, SL0045, 691N2, and SL0047) 64

11. Commercial Loans excluding C&D (Accounts 691L8, SL0049, 691N8, and SL0051) 64

12. Commercial Construction & Development (Accounts 691L9, SL0053, 691N9, and SL0055) 64

13. All Other (Accounts SL0056, SL0057, SL0058, and SL0059) 64

14. Total (Accounts 691L, 690, 691N, and 691) 64

1- to 4-Family Residential Property Loans/Lines of Credit Secured by 1ST Lien 65

3. Adjustable Rate (Accounts RL0013, RL0014, and RL0015) 66

1- to 4-Family Residential Property Loans/Lines of Credit Secured by Junior Lien 66

All Other (Non-Commercial) Real Estate 67

12. Balance Outstanding of 1- to 4-Family Residential Construction Loans (Account 704A2) 68

Schedule A, Section 8 – Commercial Lending 70

Section 8 – Commercial Lending 70

Commercial Loan Definition Examples 72

a. Construction and Development Loans (Accounts 143A3, 143B3, 143C3, and 143D3) 73

b. Secured by Farmland (Accounts 961A5, 042A5, 099A5, and 463A5) 74

c. Secured by Multifamily Residential Property (Accounts 900M, 400M, 090M, and 475M) 74

f. Total Real Estate Secured (Accounts 900K2, 718A3, 090K2, and 475K2) 75

h. Commercial and industrial loans (Accounts 900L2, 400L2, 090L2, and 475L2) 75

i. Unsecured Commercial Loans (Accounts 900C5, 400C5, 090C5, and 475C5) 75

k. Total Commercial Loans to Members (Accounts 900A1, 400A1, 090A1, and 475A1) 76

2. Purchased commercial loans or participation interests to nonmembers 76

a. Construction and Development Loans (Accounts 143A4, 143B4, 143C4, and 143D4) 76

b. Secured by Farmland (Accounts 961A7, 042A7, 099A7, and 463A7) 76

c. Secured by Multifamily Residential Property (Accounts 900M1, 400M1, 090M1, and 475M1) 77

f. Total Real Estate Secured (Accounts 900K3, 718A4, 090K3, and 475K3) 78

h. Commercial and industrial loans (Accounts 900L3, 400L3, 090L3, and 475L3) 78

i. Unsecured Commercial Loans (Accounts 900C7, 400C7, 090C7, and 475C7) 78

k. Total Commercial Loans to Nonmembers (Accounts 900B1, 400B1, 090B1, and 475B1) 79

Total Commercial Loans (Accounts 900T1 and 400T1) 79

Miscellaneous Commercial Loan Information 79

Regulatory Reporting – Part 723 – Member Business Loans 80

8. Net Member Business Loan Balance (NMBLB) (Account 400A) 80

Schedule B, Section 1 – Held-to-Maturity and Available-for-Sale Debt Securities 81

1. US Government Obligations (Accounts NV0001, NV0002, NV0003, and NV0004) 81

2. Federal Agency Securities – Guaranteed. 81

3. Federal Agency Securities – Non-Guaranteed. 81

4. Non-Federal Agency Asset-Backed Securities – Senior Tranches. 82

5. Non-Federal Agency Asset-Backed Securities – Subordinated Tranches. 82

9. Total HTM or AFS Investment Securities. (Accounts NV0081, 801, NV0083, and NV0084) 83

Schedule B, Section 2 – Trading Debt and Equity Securities 84

1. US Government Obligations. (Account NV0087) 84

2. Federal Agency Securities – Guaranteed. 84

3. Federal Agency Securities – Non-Guaranteed. 84

4. Non-Federal Agency Asset-Backed Securities – Senior Tranches. 84

5. Non-Federal Agency Asset-Backed Securities – Subordinated Tranches. 85

6. Securities Issued by States and Political Subdivisions in the U.S. (Account NV0102) 85

7. Debt Securities Issued by Depositories, Banks, and Credit Unions (Account NV0103) 85

8. All Other Trading Investments. (Account NV0104) 86

9. Total Trading Debt Securities. (Account NV0105) 86

11. Total Trading Debt and Equity Securities (Account NV0110) 86

Schedule B, Section 3 – Investments Maturity Distribution 87

Section 3 – Investment Maturity Distribution 87

1. Time Deposits (Accounts NV0111, NV0112, NV0113, NV0114, NV0115, and NV0116) 88

2. Equity Securities (Accounts AS0050, AS0051, AS0052, AS0053, AS0054, and NV0122) 88

3. Trading Debt Securities (Accounts AS0056, AS0057, AS0058, AS0059, AS0060, and NV0128) 88

5. Held-to-Maturity Debt Securities (Accounts AS0068, AS0069, AS0070, AS0071, AS0072, and NV0140) 89

6. Other Investments (Accounts NV0141, NV0142, NV0143, NV0144, NV0145 and NV0146) 89

7. Total (Sum items 1 –6) (Accounts NV0153, NV0154, NV0155, NV0156, NV0157, and NV0158) 89

Schedule B, Section 4 – Investments, Memoranda 90

1. Non-Conforming Investments (SCU Only) (Account 784A) 90

2. Outstanding balance of brokered certificates of deposit and share certificates (Account 788) 90

Realized Investment Gains (Losses) 90

3. Realized Gains (Losses) on Held-to-Maturity Debt Securities (Account NV0159) 90

4. Realized Gains (Losses) on Available-for-Sale Debt Securities (Account NV0160) 90

6. Gain (Loss) on Investments (Account NV0162) 90

7. Total Other-Than-Temporary Impairment (OTTI) Losses (Account 420A) 90

8. Less: Portion OTTI Losses in Other Comprehensive Income (Account 420B) 91

9. OTTI Losses Recognized in Earnings (Account 420C) 91

Assets used to fund employee benefit or deferred compensation plans 91

Charitable Donation Accounts 92

Schedule C, Section 1 and Section 2 93

Section 1 – Unfunded Committments 93

1. Unfunded Commitments for Commercial Loans (Account 814K) 93

2. Unfunded Commitments for All Remaining Loans (Non-Commercial Loans) 93

3. Total Unfunded Commitments for all loan types (Account 816A) 93

Section 2 – Off-Balance Sheet Exposures 94

1. Total Uncondtionally Cancelable Unfunded Commitments for All loan Types (Account LQ0013) 94

2. Conditionally Cancelable Unfunded Commitments 94

4. Loans Transferred under the FHLB MPF program (Account LQ0021) 94

5. Financial Standby Letters of Credit (Account LQ0022) 95

6. Forward Agreements that are not derivative contracts (Account LQ0023) 95

8. Off-balance-Sheet Securitization Exposures (Account LQ0027) 96

9. Securities Borrowing or Lending transactions (Account LQ0028) 96

10. Off-balance sheet exposure of repurchase transactions (Account LQ0029) 96

Schedule C, Sections 3, 4, and 5 97

Section 3 – Contingent Liabilities 97

1. Other Contingent Liabilities (Account 818A) 97

Section 4 – Borrowing Arrangements 97

2. Amount of Borrowing Callable by Lender (Account 865A) 99

Section 5 – Borrowing Maturity Distribution 99

1. Draws Against Borrowing Capacity (Accounts 883A, 883B1, 883B2, and 883C) 99

2. Borrowings from Repurchase Transactions (Accounts 058A, 058B1, 058B2, and 058C) 99

3. Subordinated Debt (Accounts 867A, 867B1, 867B2, and 867C) 99

4. TOTAL BORROWINGS (Accounts 860A, 860B1, 860B2, and LQ0860) 99

Schedule D – Shares, Supplemental Information 100

Section 1 - Number of Members 100

1. Number of Current Members (Account 083) 100

2. Number of Potential Members (Account 084) 100

Section 2 - Shares/Deposits Maturity Distribution 100

1. Share Drafts (Accounts 452, 902A, and 902) 100

2. Regular Shares (Accounts 454, 657A, and 657) 100

3. Money Market Shares (Accounts 458, 911A and 911) 100

4. Share Certificates (Accounts 451, 908A, 908B1, 908B2, and 908C) 101

5. IRA/KEOGH Accounts (Accounts 453, 906A, 906B1, 906B2, and 906C) 101

6. All Other Shares and Deposits (Accounts 455, 630A, 630B1, 630B2, and 630) 101

7. TOTAL SHARES (Accounts 966, 013A, 013B1, 013B2, and SH0013) 101

8. Nonmember Deposits (Accounts 457, 880A, 880B1, 880B2, and SH0880) 101

9. TOTAL SHARES AND DEPOSITS (Accounts 460, 018A, 018B1, 018B2, and SH0018) 101

Additional Information on Shares/Deposits 101

10. Accounts Held by Member Public Units (Account 631) 101

11. Accounts Held by Nonmember Public Units (Account 632) 101

12. Non-dollar Denominated Shares and Deposits (Account 636) 101

13. Dollar Amount of Share Certificates equal to or greater than $100,000 (Account 638) 102

14. Dollar Amount of IRA/Keogh Accounts equal to or greater than $100,000 (Account 639) 102

16. Dollar Amount of Commercial Share Accounts (Account 643) 103

Section 3 - NCUA Insured Savings Computation 103

1. Uninsured Member Shares and Deposits (Account 065A4) 104

2. Uninsured Nonmember Shares and Deposits (Account 067A2) 104

3. Total Uninsured Shares and Deposits (Account 068A) 104

4. Total Insured Shares and Deposits (Account 069A) 104

Additional Share Insurance 104

5. Does your credit union maintain share/deposit insurance other than the NCUSIF (Account 875) 104

b. Dollar amount of shares and/or deposits insured by the company named above (Account 877 104

Schedule E – Supplemental Information 105

Section 2 – Credit Union Employees 105

1. Number of Credit Union Employees who are: 105

Section 3 – Credit Union Branches 105

Section 4 – International Remittances 105

1. Number of International Remittances Originated Year-to-Date (Account 928) 105

Section 5 – Credit Union Service Organization (CUSO) 106

1. Total Value of Investments in CUSOs(Account 851) 106

2. Total Amount Loaned to CUSOs (Account 852) 107

3. Total Aggregate Cash Outlay in CUSOs (Account 853) 107

Section 6 - Money Services Businesses 107

1. Total Money Services Businesses (Accounts 1050 and 1050A) 108

Schedule F – Derivative Transactions Report 110

Total Derivative Transactions Outstanding 110

1. Interest Rate Derivatives 110

i. Purchased Options (Accounts DT0001 and DT0002) 110

ii. Written Options (Accounts DT0003 and DT0004) 110

2. Loan Pipeline Management Derivatives (Accounts DT0011 and DT0012) 111

3. European Equity Call Options (Accounts DT0013 and DT0014) 111

4. All Other Derivatives (Accounts DT0015 and DT0016) 111

5. Total Derivatives (Accounts 1030 and 1030C) 111

Schedule G - Capital Adequacy Worksheet 112

Section 2 - Net Worth Calculation 114

1. Undivided Earnings (Account 940) 114

2. Appropriation for Non-Conforming Investments (State Credit Union ONLY) (Account 668) 114

3. Other Reserves (Appropriations of Undivided Earnings) (Account 658) 114

4. Net Income (unless this amount is already included in Undivided Earnings) (Account 602) 114

5. CECL Transition Provision (as determined under 702.703(c)) (Account NW0004) 114

6. Subordinated Debt or Grandfathered Secondary Capital included in Net Worth (Account 925A) 114

7. Adjusted Retained Earnings acquired through Business Combinations 114

8. Total Net Worth (Account 997) 115

Section 3 - Total Assets Calculation 115

1. Average of Daily Assets over the calendar quarter (Account 010A) 116

2. Average of the three month-end balances over the calendar quarter (Account 010B) 116

3. The average of the current and three preceding calendar quarter-end balances (Account 010C) 116

Section 4 - Net Worth Ratio, Risk-Based Capital Ratio, and Net Worth Classification 116

1. Net Worth Ratio (Account 998) 116

2. Risk-Based Capital Ratio (Account RB0172) 117

3. Net Worth Classification if credit union is not new (Account 700) 117

4. Net Worth Classification if credit union is new (Account 701) 117

Schedule H – Complex Credit Union Leverage Ratio Calculation 118

3. Total Assets (Credit unions with total assets greater than $500,000,000) (Account 010) 119

Qualifying Criteria (See Instructions) 119

4. CCULR (Net Worth Ratio) (Credit unions with a net worth ratio of 9% or greater) (account 998) 119

Schedule I – Risk-Based Capital Ratio Calculation 121

1. Undivided earnings. (Account 940) 122

2. Appropriations for non-conforming investments. (Account 668) 122

3. Other reserves. (Account 658) 122

4. Equity acquired in merger. (Account 658A) 122

5. Net income. (account 602) 122

6. Total Equity. (Account RB0001) 122

7. Allowance for Credit Losses. (Account RB0002) 122

8. Subordinated Debt in accordance with §702.407 or §702.414. (Account RB0003) 122

9. Section 208 Assistance included in net worth as defined in §702.2. (Account RB0004) 122

10. Total Additions. (Account RB0005) 122

11. NCUSIF capitalization deposit. (Account 794) 123

12. Goodwill. (Account 009D2) 123

13. Other intangible assets. (Account AS0032) 123

14. Identified losses not reflected in the risk-based capital numerator. (Account RB0008) 123

15. Total Deductions. (Account RB0009) 123

16. Total Risk-Based Capital Before Mortgage Servicing Assets Deduction. (Account RB0010) 123

17. Total Risk-Based Capital Numerator. (Account RB0012) 124

NCUA Form 5300 – Pages 25 and 26 125

Schedule I – Risk-Based Capital Ratio Calculation 125

23. Junior-lien residential real estate loans. (Accounts RB0056, RB0057, RB0058, and RB0059) 130

25. Commercial loans. (Accounts RB0068, RB0069, RB0070, RB0071, RB0072, RB0073, and RB0074) 132

26. Loans Held for Sale. (Account RB0075) 133

27. Less: Allowance for Credit Losses (Loans). (Accounts RB0177, RB0076, RB0077, and RB0078) 133

NCUA Form 5300 – Pages 27 and 28 136

Schedule I – Risk-Based Capital Ratio Calculation 136

OFF-BALANCE SHEET AND DERIVATIVE EXPOSURES 136

32. Unfunded Commitment – Commercial Loans. (Accounts RB0123 and RB0124) 136

34. Unfunded Commitment – Consumer Loans – Unsecured. (Accounts RB0129 and RB0130) 137

35. Federal Home Loan Bank under the MPF Program. (Accounts RB0131 and RB0132) 137

38. Centrally cleared derivatives. (Accounts RB0148, RB0149, RB0150, RB0151, and RB0152) 139

42. Total Risk-Weighted Assets. (Account RB0171) 140

NCUA Form 5300 – Page 1

Assets

Complete this row if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL)

ASC Topic 326 Financial Instruments – Credit Losses (CECL) Check Box (Account AS0010)

Indicate if the credit union has adopted ASC Topic 326 Financial Instruments – Credit Losses (CECL).

Cash

Report cash on hand as either Coin and Currency or Cash Items in Process of Collection.

Coin and Currency (Account AS0004)

Report coin and currency owned and held in all branches of the credit union. Include coin and currency in transit to a Federal Reserve Bank or to any other depository institution for which the credit union has not yet received credit as well as coin and currency in transit from a Federal Reserve Bank or from any other depository institution for which the credit union’s account has already been charged. Include cash items, coins, and currency in automated teller machines, teller cash dispensers, or similar machines.

Cash Items in Process of Collection (Account AS0005)

Report cash items in process of collection (CIPC).

Total Cash on Hand (Account 730A)

This line does not require input and will automatically populate when the Call Report is submitted with the sum of amounts reported in Items 1a and 1b.

Report cash on deposit (for example, overnight accounts, money market accounts, checking accounts, and corporate credit union daily accounts) at corporate credit unions, a Federal Reserve Bank, and other financial institutions. Report time deposits in Account AS0007.

Cash on Deposit in Corporate Credit Unions (Account 730B1)

Report deposits in transit to and balances on deposit in corporate credit unions. These amounts may or may not be subject to withdrawal by check and may or may not bear interest.

Cash on Deposit in a Federal Reserve Bank (Account AS0003)

Report deposits in transit to and balances on deposit in a Federal Reserve Bank. These amounts may or may not be subject to withdrawal by check, and may or may not bear interest. Include reserve balances at Federal Reserve Banks.

Cash on Deposit in Other Financial Institutions (Account 730B2)

Report deposits in transit to and balances on deposit in financial institutions other than corporate credit unions or a Federal Reserve Bank. These amounts may or may not be subject to withdrawal by check, and may or may not bear interest.

Total Cash on Deposit (Amounts Deposited in Financial Institutions) (Account 730B)

This line does not require input and will automatically populate when the Call Report is submitted with the sum of amounts reported in Items 2a through 2c.

Time deposits in commercial banks, S&Ls, savings banks, natural person credit unions or corporate credit unions (Account AS0007)

Report the amount of time deposits in commercial banks, savings and loans institutions, savings banks, natural person credit unions or corporate credit unions. Do not include short-term investments that are reported in Account 730B as Cash on Deposit, or negotiable certificates of deposit reported in Accounts AS0061, AS0067, or AS0073 as securities.

Complete Schedule B, Section 3 – Investment Maturity Distribution.

Report all other deposits.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 730A, 730B, AS0007, and AS0008.

Investment Securities

Complete Schedule B, Section 3 – Investment Maturity Distribution for all investment securities reported below.

Report the total amount of investment in equity securities, including all mutual funds (even those that only invest in U.S. Government debt securities) at fair value. Refer to Accounting Standards Codification (ASC) 321, Investments – Equity Securities.

Complete Schedule B, Section 2 – Trading Debt and Equity Securities as appropriate.

Report the total amount of investment in debt securities that were bought and are held principally for the purpose of selling in the near term. This account should reflect frequent buying and selling. Report these investments at fair value. Refer to Accounting Standards Codification (ASC) 320, Investments – Debt Securities.

Complete Schedule B, Section 2 – Trading Debt and Equity Securities as appropriate.

Report the total amount of investment in debt securities that your credit union has classified as available for sale at fair value. The allowance for credit loss is reported in Account AS0042. The amount reported in Account AS0067 represents fair value of all AFS debt securities and must equal the fair value amount reported on Schedule B, Section 1, in Account NV0084. Refer to Accounting Standards Codification (ASC) 320, Investments – Debt Securities.

Complete Schedule B, Section 1 – Held-to-Maturity and Available-for-Sale Debt Securities as appropriate.

Complete this row if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL)

Report the allowance for credit losses on available-for-sale debt securities. This is reported for disclosure purposes only.

Report the amount of investment in debt securities that your credit union has classified as held to maturity. Report these investments at amortized cost. Refer to Accounting Standards Codification (ASC) 320, Investments – Debt Securities.

Complete Schedule B, Section 1 – Held-to-Maturity and Available-for-Sale Debt Securities as appropriate.

Complete this row if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL)

Report the allowance for credit losses on held-to-maturity debt securities.

TOTAL INVESTMENT SECURITIES (Sum of Accounts AS0055, AS0061, AS0067, and AS0073 less AS0041) (Account AS0013)

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts AS0055, AS0061, AS0067, and AS0073 less AS0041.

Other Investments

Complete Schedule B, Section 3 – Investment Maturity Distribution for other investments reported below.

Report the total Nonperpetual Capital Accounts (NCA) at corporate credit unions as defined in §704.2 of the NCUA regulations.

Report the total of Perpetual Contributed Capital (PCC) at corporate credit unions as defined in §704.2 of the NCUA regulations.

Report the amount of all other investments not included in lines 12a and b. Include the outstanding balance all investments in credit unions other than corporate credit unions. Include CLF stock, FHLB stock, Federal Reserve stock, and common trust investments. Do not include short-term investments that are reported in Account 730B as Cash on Deposit or negotiable certificates of deposit reported in Accounts AS0061, AS0067, or AS0073 as securities.

Report any other investments not listed above at their remaining maturities. Do not include loans to and investments in CUSOs. Report loans to and investments in CUSOs on Schedule C - Credit Union Service Organization (CUSO) Information and as “All Other Assets” on the Statement of Financial Condition.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of amounts reported in Accounts 769A, 769B, and AS0016.

NCUA Form 5300 - Page 2

Assets—Continued

Loans Held for Sale

Report the amount of outstanding loans either identified for sale at origination or for which there has subsequently been a decision to sell. Loans Held for Sale should not be included in the amounts reported under the Loan & Leases section.

If your credit union originated any real estate loans year-to-date classified as Loans Held for Sale, complete the loans granted year-to-date information on Schedule A – Specialized Lending, Section 7 – 1- to 4-Family Residential Property and all Other Non-Commercial Real Estate Loans and Lines of Credit.

If your credit union originated any commercial loans year-to-date classified as Loans Held for Sale, complete the loans granted year-to-date information on Schedule A – Specialized Lending, Section 8 – Commercial Lending.

Loans and leases

Report the total number and outstanding balance of loans and leases. The total number and outstanding balance of loans must equal the total number (Account 025A1) and outstanding balance (Account 025B1) of loans reported on Schedule A, Section 1 - Loans and Leases, which contains the detailed schedule of loans by type. Include loans to other credit unions. See the instructions for the Loans and Leases Schedule for further details.

If you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL), report the number and amortized cost of loans and leases. The total number and amortized cost of loans and leases must equal the total number (Account 025A1) and amortized cost (Account 025B1) of loans and leases reported on Schedule A, Section 1 - Loans and Leases, which contains the detailed schedule of loans by type.

Report the amount set aside to absorb possible losses on loans and leases.

Complete this row if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL)

Report the allowance for credit losses as determined in accordance with ASC Topic 326: Financial Instruments – Credit Losses (CECL).

Other Assets

Report long-lived assets intended for sale and acquired through, or in lieu of, foreclosure or repossession (meaning the credit union has taken possession) in the applicable category (either Commercial, Consumer Real Estate, Consumer Vehicle, or Consumer Other).

At Foreclosure

Initially record the assets at fair value (less costs to sell) at the date of foreclosure or repossession. This fair value (less cost to sell) becomes the “cost”, or carrying amount, of the foreclosed or repossessed asset. The amount, if any, by which the recorded amount of the loan exceeds the fair value (less costs to sell) of the asset is a loss, which must be charged off to the allowance at the time of the foreclosure or repossession.

Subsequent to Foreclosure

Re-value the assets periodically to the lower of carrying amount or fair value (less costs to sell) through a separate valuation account, not the allowance. Changes in the valuation allowance are included in net expenses from foreclosed and repossessed assets.

If a repossessed or foreclosed long-lived asset is not sold shortly after it is received, any declines in value after foreclosure and any gain or loss from the sale or disposition of the asset shall not be reported as a loan loss or recovery and shall not be debited or credited to the allowance account for loans and leases. Adjustments to maintain held for sale foreclosed and repossessed assets at fair value, less costs to sell, should be reported as Miscellaneous Operating Expenses. Any gain or loss upon the disposition of fixed assets should be reported as Gain (Loss) on Disposition of Fixed Assets.

Regardless of the valuation, foreclosed and repossessed property the credit union intends to sell should be transferred to Foreclosed and Repossessed Property and reported on this line.

Commercial (Account AS0022)

Report the amount of foreclosed or repossessed commercial assets.

Consumer Real Estate (AccountAS0023)

Report the amount of foreclosed or repossessed consumer real estate assets.

Consumer Vehicle (AccountAS0024)

Report the amount of foreclosed or repossessed consumer vehicles.

Consumer Other (Account AS0025)

Report the amount of foreclosed or repossessed other consumer assets.

Total Foreclosed and Repossessed Assets (Account 798A)

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts AS0022, AS0023, AS0024, and AS0025.

Report the book value of land and buildings, less depreciation on buildings.

Report all other fixed assets, such as furniture and fixtures and leasehold improvements, less related depreciation. With the adoption of ASC Topic 842, include right-of-use assets. This includes both operating and financing leases (credit union is lessee), less accumulated amortization.

Report the amount of the National Credit Union Share Insurance Fund capitalization deposit.

Report all other assets not previously reported in the appropriate account.

Report the amount of goodwill acquired in a business combination (i.e., merger).

Mortgage servicing assets (Account 779)

Report the dollar amount of Mortgage Servicing Assets. A Mortgage Servicing Asset is a contract to service loans under which the estimated “benefits of servicing” (revenues from contractually specified servicing fees, late charges, and other ancillary sources including “float”) are expected to more than adequately compensate the servicer for performing the servicing. A servicing contract is either (a) undertaken in conjunction with selling or securitizing the loan being serviced or (b) purchased or assumed separately. Not all servicing contracts result in a servicing asset.

Other Intangible Assets (Account AS0032)

Report the amount of other intangible assets. Include identifiable intangible assets obtained through a merger or other business combination.

If your credit union has more than $10 million in assets and you report loans greater than $0, then report the amount of accrued interest income on loans and leases here.

Accrued Interest on Investments (Account 009B)

If your credit union has more than $10 million in assets and you report investments greater than $0, then report the amount of accrued interest income on investments here.

All Other Assets (Account 009C)

Report assets not previously identified here. Other assets include:

prepaid expenses,

accounts receivable,

loans to and investments in CUSOs,

purchased participations not qualifying for true sales accounting under GAAP (e.g., participations purchased with substantial recourse),

life insurance held for the purpose of funding employee benefit or deferred compensation plans,

private insurance capitalization deposits,

derivative asset amounts, exclusive or inclusive of accrued interest, and

any other assets not previously identified.

If this amount includes loan or investments for funding split dollar life insurance, you must also complete Schedule B, Section 4 – Investments, Memoranda.

If this amount includes loans to or investments in CUSOs, you must also complete Schedule E, Section 5 – Credit Union Service Organizations (CUSOs). If your credit union wholly owns the CUSO or owns a controlling interest in the CUSO, the CUSO should not be reported as an asset. Instead, the CUSO’s books and records should be consolidated with your credit union’s books and records in accordance with generally accepted accounting principles. Complete Schedule E, Section 5 - Credit Union Service Organizations (CUSOs) regardless of the ownership interest.

If this amount includes derivatives, you must also complete Schedule D – Derivatives Transaction Report.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 009D2, 779, AS0032, 009A, 009B, and 009C.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of amounts reported in Accounts AS0009, AS0013. AS0017, 003, 025B less 719 and AS0048, 798A, 007, 008, 794, and AS0036. This must also equal the sum of LIABILITIES, SHARES, AND EQUITY.

NCUA Form 5300 - Page 3

Liabilities and Equity

Liabilities

Report the amount of accounts payable, accrued interest on borrowings, and other liabilities including, but not limited to, taxes payable, undistributed payroll deductions, draft clearings, unposted suspense items, and derivative liability amounts, exclusive or inclusive of accrued interest. Also, report lease liabilities (lease liability equals the present value of unpaid lease payments) if your credit union has adopted ASC Topic 842.

If this amount includes derivatives, you must also complete Schedule F – Derivatives Transactions Report.

Report the amount of accrued dividends and interest declared but not distributed.

Complete this row if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL)

Report the amount set aside to absorb possible losses on off-balance sheet credit exposures if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL).

Report the amount of total borrowings, including subordinated debt and grandfathered secondary capital, and complete Schedule C, Sections 4 and 5.

Shares/Deposits

All credit unions must also complete Schedule D.

Report the total amount of member shares. The amount reported here must equal the Total Shares reported in Account SH0013 in Schedule D – Shares/Deposits Maturity Distribution.

Report the total amount of nonmember deposits.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of amounts reported in Accounts 013 and 880. This must also equal the Total Shares and Deposits reported in Account SH0018 in Schedule D – Shares/Deposits Maturity Distribution.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 825, 820A, LI0003, 860C, and 018.

Equity

Report post-closing undivided earnings. Amounts reported as Regular Reserves in previous Call Reports should be reported in Undivided Earnings, Account 940.

Report any reserves that originate from undivided earnings not reported elsewhere. Amounts reported here must have been closed into Undivided Earnings from Net Income first.

Report the amount of reserves set aside from Undivided Earnings to cover the excess of Book Value over Fair Value for investments not authorized by the NCUA. These reserves are required by the NCUA regulations §741.3(a)(2). This account is only necessary for reporting reserves for non-ASC 320 investments and ASC 320 investments classified as Held to Maturity.

Report the acquisition date fair value of equity interests acquired in the acquisition(s) of another credit union(s) as measured consistent with GAAP.

Report the portion of equity of all consolidated subsidiaries of the reporting credit union held by parties other than the reporting credit union. A noncontrolling interest, sometimes called a minority interest, is the portion of equity in a credit union's subsidiary not attributable, directly or indirectly, to the credit union.

Report the effective portion of the accumulated change in fair value (gain or loss) on derivatives designated and qualifying as cash flow hedges in accordance with ASC 815, Derivatives and Hedging.

Report the cumulative amount of the total remaining unrealized losses for Other-Than-Temporary-Impairment (OTTI) due to other market factors on HTM debt securities. Such amounts must be appropriately displayed (disclosure only, not an actual expense entry on the Income Statement) through either a previous or the current period's OTTI Information on Schedule B, Section 4.

Skip line 15 if you have adopted ASC Topic 326 Financial Instruments – Credit Losses (CECL).

Report the amount of accumulated unrealized gains (losses) on available for sale debt securities.

Report any items of other comprehensive income that are not already included in Accounts EQ0009, 945A, or 945C. An example of an Other Comprehensive Income item is other comprehensive income amounts related to single-employer defined benefit postretirement plans, such as a pension plan or health care plan.

A credit union that sponsors a single-employer defined benefit postretirement plan, such as a pension plan or health care plan, must recognize the funded status of each such plan on its balance sheet (an over-funded plan is recognized as an asset while an under-funded plan is recognized as a liability).

Initially, the postretirement plan amounts recognized on the credit union’s balance sheet before applying the standard must be adjusted to recognize gains or losses, prior service costs or credits, and transition assets or obligations that have not yet been included in the net periodic benefit cost of its plans. These adjustment amounts are recognized directly in equity as components of other comprehensive income. Thereafter, a credit union must recognize certain gains and losses and prior service costs or credits that arise during each reporting period as a component of other comprehensive income (OCI).

Postretirement plan amounts carried in OCI are adjusted as they are subsequently recognized in earnings as components of the plan’s net periodic benefit cost. Credit unions should consult their independent accountant for further guidance in applying this accounting standard.

These examples are not all inclusive. Items required by accounting standards to be reported as direct adjustments to paid-in capital, retained earnings, or other non-income equity accounts are not to be included as components of comprehensive income.

Report net income that has not been closed to Undivided Earnings.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Items 8 and 9 through 18. This must equal Total Assets, Account 010.

If the credit union has any unfunded commitments, complete Schedule C, Section 1 – Unfunded Commitments.

NCUA Form 5300 - Page 4

Statement of Income and Expense

Interest Income Year-to-Date

Report income earned from interest on loans and leases, including loans held for sale, and recognition of deferred loan fees and costs. Do not reduce the amount reported by the amount of interest refunds authorized by the credit union board as allowed by §113(9) of the Federal Credit Union Act (See 12 U.S.C. §1761b).

As stated in the Loan Nonaccrual Policy in Appendix B to part 741, credit unions may not accrue interest on any loan in default for 90 days or more. When a loan is in nonaccrual status, the reversal of previously accrued but uncollected interest must be handled in accordance with GAAP. Specifically, acceptable accounting treatment includes a reversal of all previously accrued, but uncollected, interest on loans placed in a nonaccrual status against appropriate income and balance sheet accounts.

Report loan interest income refunded or authorized to be refunded to members by the credit union board.

Income from Investments (Includes Interest and Dividends, exclude changes in fair value and realized gains/losses from Equity and Trading Debt securities) (Account 120)

Report interest and dividend income earned from all investments. Include income earned on Cash on Deposit and Cash Equivalents reported on the Statement of Financial Condition. Do not include any realized or unrealized gains/losses from trading securities, gains or losses resulting from the sale of investments, fair value gains or losses resulting from derivative activity, or unconsolidated CUSO income.

Report interest income from sources other than loans, leases, and investments.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Account 110 less Account 119 plus Account 120 and IS0005.

Interest Expense Year-to-Date

Report dividend expense incurred for all classes of shares year-to-date.

Interest on Deposits (Total interest expense for deposit accounts) (State Credit Union ONLY) (Account 381)

Report interest on all deposits year-to-date.

Interest cost for borrowed money from all sources including certificates of indebtedness. For leases under ASC Topic 842, report the interest paid (using the effective interest method) on finance lease payments. Interest costs associated with the issuance of Grandfathered Secondary Capital or Subordinated Debt should be reported here.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 380, 381, and 340.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Account 115 less Accounts 350.

Expense recorded to maintain the Allowance for Loan & Lease Losses account.

Skip to Item 12 if you have adopted ASC Topic 326 Financial Instruments – Credit Losses (CECL).

Complete Item 12 if you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL).

Report the amount of credit loss expense (provision for credit losses) associated with each financial asset below.

Loans & Leases (Account IS0011)

Report the amount of credit loss expense for loans and leases.

AFS Debt Securities (Account IS0012)

Report the amount of credit loss expense related to available for sale debt securities.

HTM Debt Securities (Account IS0013)

Report the amount of credit loss expense related to held to maturity securities.

Off-Balance Sheet Credit Exposures (Account IS0016)

Report the amount of credit loss expense related to off-balance sheet credit exposures.

Total Credit Loss Expense (Account IS0017)

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts IS0011, IS0012, IS0013, and IS0016.

NCUA Form 5300 - Page 5

Statement of Income and Expense

Non-Interest Income Year-to-Date

Report the amount of fee income from services. Fee income from services includes overdraft fees, ATM fees, credit card fees, wire fees, account research fees, late fees, statement production fees, dormant account fees, transaction service fees, safekeeping fees, others. Fee income should only be reported net of expenses and credits associated with providing such fee related services to members if it meets the GAAP requirement.

Report income other than the types reported in Accounts 110, 119, 120, and 131. Include dividends from the NCUSIF, interchange income, interest income earned on purchased participations not qualifying for true sales accounting under GAAP, and unconsolidated CUSO income.

Gain (Loss) on Equity and Trading Debt Securities (includes changes in fair value and realized gains/losses from Equity and Trading Debt securities) (Account IS0046)

Report the resulting gain (loss) from the sale or disposition of all equity and trading debt securities.

Gain (Loss) on all other Investments or change in fair value of hedged items(not Equity or Trading Debt Securities) (Account IS0047)

Report the resulting gain (loss) from the sale or disposition of all investments except equity or trading debt securities reported in Account IS0046. Complete Schedule B, Section 4. Report changes in the fair value of a hedged item in a Fair Value Hedge relationship (the derivative hedge is reported in Account 421, line 17). Report losses on Nonperpetual Capital Accounts and Perpetual Contributed Capital at corporate credit unions on this line. In addition, use this account to report declines in fair value that are Other-Than-Temporary-Impairments (OTTI) for securities classified as either available for sale or held-to-maturity. However, report only the credit loss portion of the OTTI on this line. All other losses related to OTTI must be reported on the Statement of Financial Condition – Equity, under Accumulated Unrealized Gain (Losses) on Available for Sale Securities (Account EQ0009) or Accumulated Unrealized Losses for OTTI (Due to Other Factors) on HTM Securities (Account 945C).

Report the gains or losses associated with derivatives activities exclusive of interest and premium amortization. Gains and losses will be the change in fair value for the period and any other Derivative Gain (Loss).

Report the amount of income or expense resulting from the sale or other disposition of fixed assets. Include gains or losses on the sale of foreclosed and repossessed assets except other real estate owned on this line. Report the gains or losses on other real estate owned in Account IS0030.

Report the amount of income or expense resulting from the sale or other disposition of loans and leases including income or loss derived from selling real estate loans on the secondary market.

Report the amount of income or expense resulting from the sale or other disposition of other real estate owned.

Report any applicable gain as the result of a bargain purchase of another credit union.

Record all miscellaneous non-interest income or expense items, including such items as gifts and donations received. Also, include contribution income such as grants.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 131, IS0020, IS0046, IS0047, 421, 430, IS0029, IS0030, 431, and 440.

Non-Interest Expense Year-to-Date

Report the amount of salaries, benefits, pension plan costs, employer’s taxes, and reimbursement to sponsor when credit union employees are on the sponsor’s payroll.

Report authorized expenses incurred by officers, directors, and employees for travel, attendance at conferences, and other meetings.

Report the amount of expenses related to occupying an office including office rent, utilities (gas, electric, etc.), building depreciation, real estate taxes, building maintenance, and amortization of leasehold improvements.

Report expenses related to the operation of an office including communications, stationery and supplies, liability insurance, bond insurance, furniture and equipment rental and/or maintenance and depreciation, bank charges, in-house electronic data processing (EDP) cost, etc. Also, include the amortization expense on finance lease payments under ASC Topic 842.

Advertising, publicity, and promotions.

Collection expenses, recording fees, credit reports, credit card program expenses, loan servicing fees.

Legal fees, audit fees, accounting services, consulting fees, and outside EDP servicing.

Report National Credit Union Share Insurance Fund (NCUSIF) premium assessments, life savings, borrower’s protection, share insurance, and other member insurance.

Annual operating/supervision fee assessed by the NCUA or the State Supervisory Authority.

Report non-interest expenses that were not previously reported in items 22 through 30, including cash over and short, annual meeting expenses, association dues, adjustments to maintain held for sale foreclosed and repossessed assets at fair value, etc.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 210, 230, 250, 260, 270, 280, 290, 310, 320, and 360.

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts IS0010 less 300 and IS0017 plus Account 117 less Account 671.

NCUA Form 5300 - Page 6

Schedule A, Section 1 – Loans & Leases

Report the interest rate, number, and outstanding balance of loans and leases. If you have adopted ASC Topic 326 – Financial Instruments, Credit Losses (CECL), report the interest rate, number, and amortized cost of loans and leases. The Number of Loans (Account 025A1) and Amount (Account 025B1) reported on Item 14 must equal the number (Account 025A) and Amount (Account 025B) reported on Page 2, Item 15.

Please complete Schedule A – Sections 2 through 8, if your credit union has any delinquent loans, loan losses, indirect loans, real estate loans, participation loans, commercial loans, member business loans, troubled debt restructured, or purchased credit impaired loans outstanding; or purchased or sold whole loans or parts of loans year-to-date; or if the credit union originated any real estate, commercial, or member business loans during the reporting period.

Loans should be reported in Schedule A without regard for the channel (direct or indirect, purchased or participation) used to obtain the loan. It is possible for a single loan to be reported in multiple sections of Schedule A.

Collateral Codes. Report loans by collateral code. For example, if a new or used vehicle is secured by real estate (for example a home equity loan), include it with real estate loans. Report loans or groups of loans purchased in whole or in part and the portion of any loan participation that remains on the credit union’s balance sheet according to the applicable collateral code.

Interest Rates. Report loan interest rates being offered as of the reporting period for each loan category. Report the actual rate (report 6.5 for 6.5%). If more than one rate applies, report the most common rate in each loan category.

For each loan category, report only those loans that have an outstanding balance. Report the outstanding balance adjusted for any unamortized premium or discount and for any unamortized loan fees or costs. Also, the outstanding balance should subtract any amount previously charged off.

Loan origination fees or costs are recognized over the life of the related loan as an adjustment of yield. Loan fees, certain direct loan origination costs, and purchase premiums and discounts on loans are recognized as an adjustment of yield, generally by the interest method, based on the contractual terms of the loan.

Loans as hedged items. If loans are part of a hedge accounting designation, the carrying value of the respective loans should be adjusted in accordance with ASC Topic 815.

Loan purchases. Report the number of whole or partial loans purchased under § 701.23 (if an FCU) or similar state provisions (if an SCU). Also, report the number of individual loans (whole or partial) in each group of loans purchased under § 701.23 (if an FCU) or similar state provisions (if an SCU). It is not necessary to report the number of groups.

Participation Loans. Report the number of participation loans purchased under § 701.22 (if an FCU) or similar state provisions (if an SCU). Also, report the number of individual loans in each pool of loans purchased under § 701.22 (for FCU) or similar state provisions (if SCU). It is not necessary to report the number of pools.

Do not report purchased participation loans that do not qualify for true sales accounting under GAAP (for example, participation loans purchased with substantial recourse), as these loans will still be reflected on the seller’s balance sheet. The purchasing credit union should report participations not qualifying for true sales accounting as Other Assets.

Commercial Loans. Loans that would be considered commercial loans except for the loan amounts to associated borrowers being under $50,000 should be reported as a non-commercial loan by definition and reported according to the underlying collateral.

Loan secured by more than one 1- to 4-family residential properties. A single loan to a borrower or associated borrowers that is secured by more than one 1- to 4-family residential properties and the aggregate net member business loan balance or the outstanding balances plus unfunded commitments less any portion secured by shares in the credit union is equal to or greater than $50,000, should be reported as a member business loan AND commercial loan except loans to non-members should only be reported as a commercial loan.

Non-Commercial Loans/Lines of Credit

Include the rate, number, and outstanding balance or amortized cost of credit card loans. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section of the Liquidity, Commitments and Sources page.

Federal Credit Unions will report the interest rate, and aggregate number and dollar amount of all PALs I and PALs II loans granted under §701.21(c)(7)(iii) and (iv) of the NCUA regulations. Do not include these loans with All Other Unsecured Loans/Lines of Credit. State-Chartered credit unions will report similar loans with All Other Unsecured Loans/Lines of Credit.

NCUA amended its general lending rule to enable FCUs to offer short-term, small amount loans as a viable alternative to predatory payday loans. This amendment permits FCUs to charge a higher interest rate for a PALs loan than is permitted under the general lending rule, but imposes limitations on the permissible term, amount, and fees associated with PALs I and II loans.

Report the rate, number, and dollar amount of non-federally guaranteed, or private, student loans. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section of the Liquidity, Commitments and Sources page.

Report guaranteed student loans such as Stafford, Perkins, PLUS, and Consolidation loans, granted prior to July 1, 2010, as All Other Secured Non-Real Estate Loans/Lines of Credit (Accounts 595B, 963C, and 698C).

Also report government guaranteed student loans on the line labeled Government Guaranteed Non-Commercial Loans (Accounts LN0053, LN0054, and LN0055).

Report the rate, number, and dollar amount of outstanding unsecured loans and lines of credit, other than credit card loans that are not defined as commercial loans. Typically, this includes signature loans. Include all Small Business Administration Paycheck Protection Program loans reported on lines 16.a.1 and 16.a.2 below. Also, report overdrawn share accounts of all types, other than commercial share accounts that qualify as a commercial loan, regardless of the existence of an overdraft protection program for share draft accounts. Overdrawn commercial share accounts that qualify as a commercial loan are reported in Accounts 526, 900P, and 400P. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section of the Liquidity, Commitments and Sources page.

Report the rate, number, and dollar amount of new vehicle loans, where a new vehicle is pledged as security and manufactured for household use per NCUA regulations §723.2. Loans secured by ATVs, RVs, motorcycles, and boats should not be reported on this line, but included in the All Other Secured Non-real Estate Loans/Lines of Credit (Accounts 595B, 963C, and 698C) item of the Loans & Leases section of the call report.

Include the rate, number, and dollar amount of used vehicle loans, where a used vehicle is pledged as security and manufactured for household use per NCUA regulations §723.2. Loans secured by ATVs, RVs, motorcycles, and boats should not be reported on this line, but included in the All Other Secured Non-real Estate Loans/Lines of Credit line of the Loans & Leases section of the call report.

Include the rate, number, and dollar amount of outstanding direct financing leases as defined by GAAP (credit union is lessor) including leases acquired through an indirect leasing arrangement. Credit unions that lease personal property such as vehicles to members make direct financing leases. Types of leases other than direct lease are rare in credit unions.

An indirect lease where the credit union is not the lessor is considered a leveraged lease and should be reported in the appropriate loan category.

Include the rate, number, and dollar amount of all non-commercial loans secured by anything other than real estate and not reported elsewhere in Schedule A, Section 1. This may include the following:

fully share-secured loans;

loans financing the disposal of non-real estate credit union property to nonmembers; and,

secured commercial purpose loans which do not meet the definition of commercial loan per NCUA regulations §723.2 and are not secured by real estate. The common reason a commercial purpose loan would not qualify as a commercial loan is because the loans outstanding to associated borrowers are less than $50,000.

Unfunded loan commitments must be reported in Schedule C, Section 1.

Loans/lines of credit secured by a first lien on a single 1- to 4-family residential property. (Accounts 563A, 959A, and 703A)

Include the rate, number, and dollar amount of member and non-member loans secured by a lien in first position on a single 1- to 4-family residential property. Residential property means a house, condominium unit, cooperative unit, manufactured home, or the construction thereof, and unimproved land zoned for one-to-four family residential use. Residential property excludes boats or motor homes, even if used as a primary residence, or timeshares. Report lien position at the time of origination. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section of the Liquidity, Commitments and Sources page. To be considered 1- to 4-family residential property the property secured by the loan must be considered real property within the jurisdiction of the collateral. Residential property is a type of real estate and should also be reported in Schedule A, Section 7 - 1- to 4-Family Residential Property and all other Non-Commercial Real Estate Loans and Lines of Credit.

Loans/lines of credit secured by a junior lien on a single 1- to 4-family residential property. (Accounts 562A, 960A, and 386A)

Include the rate, number, and dollar amount of member and non-member loans secured by a lien in junior position on a single 1- to 4-family residential property. Residential property means a house, condominium unit, cooperative unit, manufactured home, or the construction thereof, and unimproved land zoned for one-to-four family residential use. Residential property excludes boats or motor homes, even if used as a primary residence, or timeshare. Report lien position at the time of origination. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section of the Liquidity, Commitments and Sources page. To be considered 1- to 4-family residential property the property secured by the loan must be considered real property within the jurisdiction of the collateral. Residential property is a type of real estate and should also be reported in Schedule A, Section 7 - 1- to 4-Family Residential Property and all other Non-Commercial Real Estate Loans and Lines of Credit .

Include the rate, number, and dollar amount of member and non-member loans secured by a lien on any real estate regardless of lien position not reported elsewhere on this page.

Commercial Loans/Lines of Credit

Include the rate, number, and outstanding balance of all commercial loans defined in §723.2 and secured by real estate. Commercial loan means any loan, line of credit, or letter of credit and any interest a credit union obtains in such loans made by another lender, to individuals, sole proprietorships, partnerships, corporations, or other business enterprises for commercial, industrial, agricultural, or professional purposes, but not for personal expenditure purposes. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section of the Liquidity, Commitments and Sources page.

Excluded from this definition per §723.2 are covered loans issued under the Small Business Administration's Paycheck Protection Program, 15 U.S.C. 636(a)(36), and loans:

made by a corporate credit union;

made by a federally insured credit union to another federally insured credit union;

made by a federally insured credit union to a credit union service organization; (Reported on Schedule C Credit Union Service Organization Information)

secured by a single 1- to 4-family residential property whether or not it is the borrower’s primary residence; (Reported elsewhere on the Loans & Leases schedule as secured by a single 1- to 4-family residential property.)

fully secured by shares in the credit union making the extension of credit or deposits in other financial institutions; (Reported as All Other Secured Non-Real Estate Loans/Lines of Credit on the Loans & Leases schedule)

secured by a vehicle manufactured for household use; (Reported as new or used vehicle loans on the Loans & Leases schedule)

that would otherwise meet the definition of commercial loan and which, when the aggregate outstanding balances plus unfunded commitments less any portion secured by shares in the credit union to a borrower or an associated borrower, are equal to less than $50,000. In this case, the loan should be reported on the Loan & Lease schedule according to the underlying collateral.

Include the rate, number, and outstanding balance of all commercial loans defined in §723.2 and not secured by real estate. Unused loan commitments must be reported in the Off-Balance Sheet Commitments section.

Excluded from this definition per §723.2 are covered loans issued under the Small Business Administration's Paycheck Protection Program, 15 U.S.C. 636(a)(36), as well as loans:

made by a corporate credit union;

made by a federally insured credit union to another federally insured credit union; (Reported on the Statement of Financial Condition as an investment)

made by a federally insured credit union to a credit union service organization; (Reported on Schedule C Credit Union Service Organization Information)

secured by a single 1- to 4-family residential property whether or not it is the borrower’s primary residence; (Reported elsewhere on the Loans & Leases schedule as secured by a single 1- to 4-family residential property.)

fully secured by shares in the credit union making the extension of credit or deposits in other financial institutions; (Reported as All Other Secured Non-Real Estate Loans/Lines of Credit on the Loans & Leases schedule)

secured by a vehicle manufactured for household use; (Reported as new or used vehicle loans on the Loans & Leases schedule)

that would otherwise meet the definition of commercial loan and which, when the aggregate outstanding balances plus unfunded commitments less any portion secured by shares in the credit union to a borrower or an associated borrower, are equal to less than $50,000. In this case, the loan should be reported on the Loan & Lease schedule according to the underlying collateral.

Total Loans & Leases (Sum of items 1-13 must equal total loans and leases (Account 025B)) (Accounts 025A1 and 025B1)

This line does not require input and will automatically populate when the Call Report is submitted with the sum of Accounts 025A1 and 025B1.

Loans Granted

For number and amount granted or purchased year-to-date, include the total number and amount plus unfunded commitments at the time of purchase or origination. Include all loans of all types granted including real estate loans sold on the secondary market, loans held for sale, and participation loans, in which you are participating. For number and amount granted or purchased year-to-date, include the total number and amount plus unfunded commitments at the time of purchase or origination. Lines of credit and credit card loans should only be counted as a new loan in the period they are granted or renewed, not each subsequent draw on the open line of credit. Credit decisions to increase a line of credit should be treated as a new loan for the entire amount, not just the incremental increase.

Payday Alternative Loans (PALs I and II) Granted Year-to-Date (also include amount in item 15) (Federal credit union ONLY) (Accounts 031C and 031D)

Report the number and dollar amount of PALs I and PALs II loans granted year-to-date.

Government Guaranteed Loans

Report government guaranteed loans in this section. Government guarantee means a guarantee provided by the U.S. Government, FDIC, NCUA or other U.S. Government agency, or a public sector entity. Public sector entity means, a state, local authority, or other governmental subdivision of the United States below the sovereign level.

a.1. Small Business Administration (Accounts LN0050, LN0051, and LN0052)

Report the number, total outstanding balance including the guaranteed portion, and the guaranteed portion of Small Business Administration loans that do not meet the definition of a commercial loan. Include all Small Business Administration Paycheck Protection Program loans (Small Business Administration Paycheck Protection Program loans are by definition not commercial loans, see the NCUA regulation §723.2, Definitions, for the Commercial Loan definition). Any loan reported on this line should have already been reported elsewhere in the Loans & Leases section of the call report, lines 1 - 11.

a.2. Paycheck Protection Program loans (Accounts LN0056 and LN0057)

Report the number and total outstanding balance of Small Business Administration Paycheck Protection Program loans. Any loan reported on this line should have already been reported on line 16a.1. above.

b. Other Government Guaranteed (Accounts LN0053, LN0054, and LN0055)

Report the number, total outstanding balance including the guaranteed portion, and only the guaranteed portion of government guaranteed loans, other than Small Business Administration loans reported in Accounts LN0050, LN0051, and LN0052, that do not meet the definition of a commercial loan. Any loan reported on this line should have already been reported elsewhere in the Loans & Leases section of the call report, lines 1 - 11.

Small Business Administration (Accounts 691B1, 691C1, and 691C2)

Report the total number and total outstanding balance (including the guaranteed portion) of any loan granted (originated) under a Small Business Administration (SBA) loan program. Any loan reported on this line should have already been reported elsewhere in the Loans & Leases section of the call report, lines 12 - 13.

Include in this section any loan granted in conjunction with the SBA or similar agency even if the agency does not provide a guarantee but provides a favorable junior lien such as the SBA 504 program without which the financial institution is unlikely to provide financing (for a loan of this type the guaranteed portion should be reported as $0).

Include SBA 7(a) Guaranteed Interest Certificates but do not include or SBA 7(a) Guaranteed Loan Pool Certificates or similarly structured products with guaranteed payment in this line item.

Report the unconditionally US government guaranteed (for example SBA 7(a) Guaranteed Interest Certificate), USDA Business and Industry and FSA Farm Ownership & Operating participation loans or similar purchased in the secondary market as commercial loans on the Loans & Leases schedule of the call report and in this line.

Report SBA 7(a) Loan Pool Certificate securities and similar products from other agencies as Agency/GSE Debt Instruments (not backed by mortgages) in the Investment subsection of the Statement of Financial Condition and as Agency/GSE Debt Instruments (not backed by mortgages) in Schedule B Investments, Supplemental Information schedule.

Other Government Guaranteed (Accounts 691P, 691P1, and 691P2)

Report the total number and total outstanding balance (including the guaranteed portion) of any loan granted (originated) under a government guaranteed program. Any loan reported on this line should have already been reported elsewhere in the Loans & Leases section of the call report, lines 12 - 13.

Include in this section any loan granted in conjunction with agencies similar to the SBA even if the agency does not provide a guarantee but provides a favorable junior lien such as the SBA 504 program without which the financial institution is unlikely to provide financing (for a loan of this type the guaranteed portion should be reported as $0).

Report the unconditionally US government guaranteed USDA Business and Industry and FSA Farm Ownership & Operating participation loans or similar loans purchased in the secondary market as commercial loans on the Loans & Leases schedule of the call report and on this line.

Report products from other agencies that are similar to SBA 7(a) Loan Pool Certificate securities as Agency/GSE Debt Instruments (not backed by mortgages) in the Investment subsection of the Statement of Financial Condition and as Agency/GSE Debt Instruments (not backed by mortgages) in Schedule B Investments, Supplemental Information schedule.

Eligible Loan Modifications Under the 2020 CARES Act

Section 4013 of the CARES Act suspended the GAAP standards to eliminate the burden of tracking and reporting Troubled Debt Restructured (TDR) loans.

For a loan to be modified under § 4013 of the CARES Act, all these requirements must be true:

The loan had to exist prior to December 31, 2019