CBSV User Agreement with Non-Substantive Changes 0960-0760 (Final)

CBSV User Agreement Updated (Final) .docx

Consent-Based Social Security Number Verification Service (CBSV)

CBSV User Agreement with Non-Substantive Changes 0960-0760 (Final)

OMB: 0960-0760

OMB No. 0960-0760

______________________________________________________________________________

RACBSV23FXXX

User Agreement

Between

the Social Security Administration (SSA)

And

KRESS Employment Screening, Inc. d/b/a KRESS Employment Screening

for Consent Based Social Security Number

Verification (CBSV)

______________________________________________________________________________

Table of Contents

III. SSN Verification and Use 5

A. Requesting Party Responsibilities 6

A. Requesting Party Retains Form SSA-89 in Paper Format 11

B. Requesting Party Retains Form SSA-89 Electronically 12

VI. Technical and Business Process Requirements 12

VII. Protecting and Reporting the Loss of PII 13

A. The Requesting Party’s Responsibilities in Safeguarding PII 13

B. Reporting Lost, Compromised or Potentially Compromised PII 14

VIII. Referrals of Individuals to SSA 14

X. Duration of Agreement, Suspension of Services, and Annual Renewal 16

A. Duration and Termination of Agreement 16

A. Mandatory Compliance Review by Independent CPA 19

B. Initiating the Compliance Review 20

C. Requesting Party’s Cooperation with the Compliance Review 20

D. Responsibilities of the CPA 20

B. Requesting Party Contacts 23

XVIII. Authorizing Signatures and Dates 24

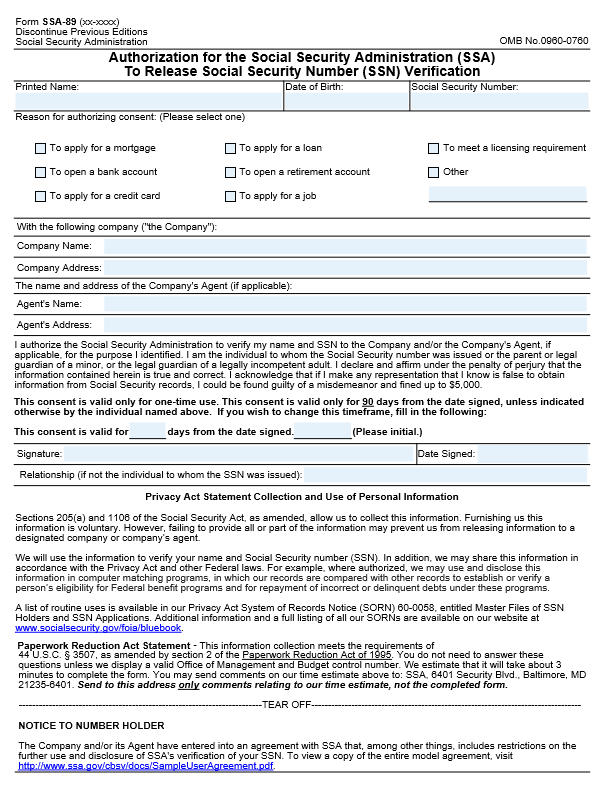

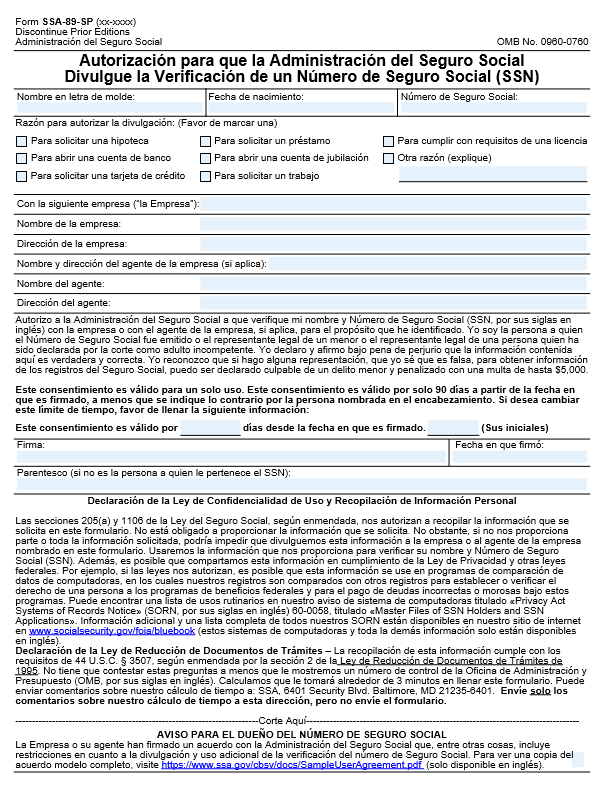

Attachment A - Form SSA-89 and Form SSA-89 SP 25

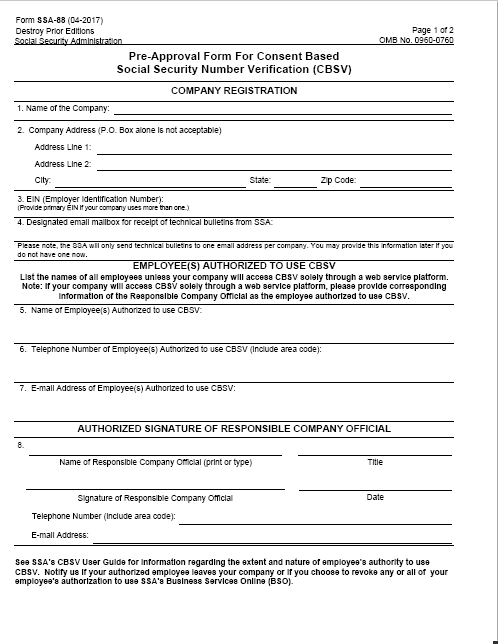

Attachment B – Form SSA-88 Pre-Approval Form for CBSV 27

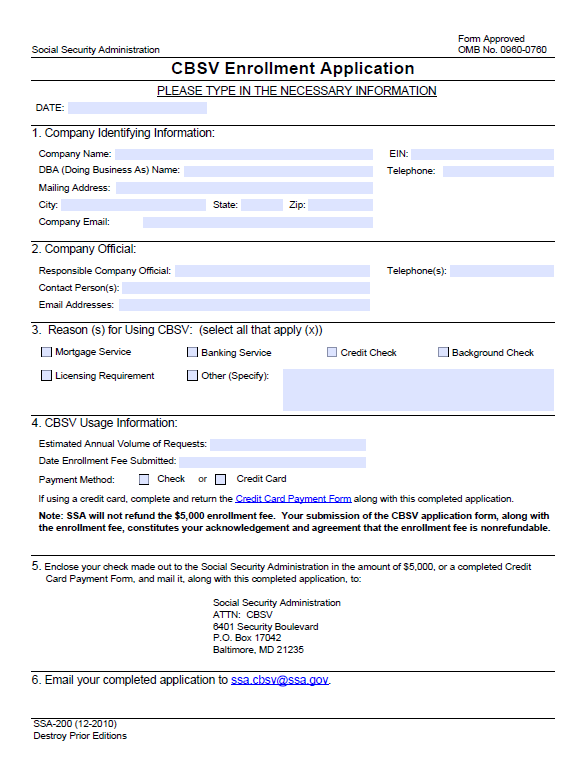

Attachment C - Form SSA-200 CBSV Enrollment Application 29

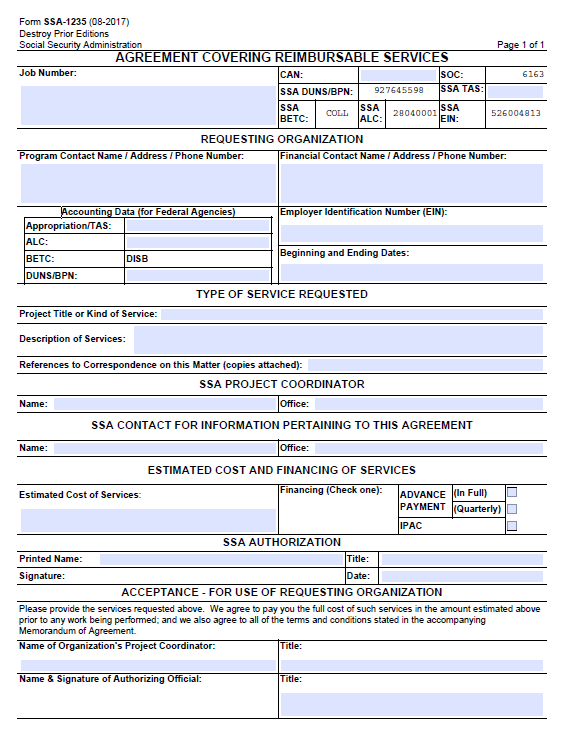

Attachment D - Form SSA-1235 Agreement Covering Reimbursable Services 30

Attachment E - Attestation Statement (COMPANY) 31

Attachment F - CBSV Attestation Requirements for CPA and Requesting Party Compliance Assertions 32

I. Attestation Requirements: 32

II. Requesting Party Compliance Assertions: 33

III. Compliance/Noncompliance Standards 35

APPENDIX A – External Testing Environment (ETE) – (For Web Service Users Only) 40

III. Technical Specifications and Systems Security & Related Business Process Requirements 41

A. General Participation Requirements 42

B. Environment and Platform 42

C. Web Service Specific Expertise 42

D. Ability to meet SSA’s Schedule 42

A. Requesting Party’s Responsibilities: 43

B. Requesting Party Acknowledgements: 43

V. Duration of Agreement and Suspension of Services 44

The purpose of this User Agreement is to establish the conditions, terms, and safeguards under which the Social Security Administration (SSA or Agency) will provide the Requesting Party with verification of Social Security Numbers (SSNs).

Agency – The Social Security Administration (SSA or Agency).

Assertion – The Requesting Party’s claims to the completeness and accuracy of all transactions.

Attestation – Declaration by the Certified Public Accountant (CPA) that the Assertions of the Requesting Party are accurate.

Authorized User – An employee of the Requesting Party whom the Requesting Party has authorized to submit SSN verification requests and has successfully registered to use the Consent Based Social Security Number Verification (CBSV) system.

BSO – Business Services Online.

Client – SSN holder who authorizes the Requesting Party to verify his/her SSN through SSA by completing the Form SSA-89, Consent Form (Attachment A). Under SSA disclosure regulations, the parent or legal guardian of a minor or legal guardian of a legally incompetent adult may also authorize disclosure for the subject of the record if he/she is acting on the individual’s behalf and provides proof of the relationship, such as a birth certificate or court document.

CBSV – Consent Based Social Security Number Verification

CBSV transaction Fee – the per-SSN verification fee. The Requesting Party must make an advance payment for estimated annual usage. The transaction fee can change at any time.

Compliance Review – The annual audit performed by the SSA-chosen CPA firm.

Consent Form – Form SSA-89 (Authorization for SSA to Release SSN Verification & Form-SSA 89 SP Authorization for SSA to Release SSN Verification – Spanish – Attachment A). Any mention hereafter of the Form SSA-89 includes the Form SSA-89 SP.

Initial Enrollment Fee – a one-time, non-refundable payment to the Social Security Administration to enroll in CBSV. The initial enrollment fee must be paid by credit card or check. The initial enrollment fee is currently $5,000 but it can change at any time.

Personally Identifiable Information (PII) – PII is personally identifiable information, or any information about an individual maintained by a Requesting Party or Principal, including: (1) any information that can be used to distinguish or trace an individual‘s identity, such as name, SSN, date and place of birth, mother‘s maiden name, or biometric records; and (2) any other information that is linked or linkable to an individual, such as medical, educational, financial, and employment information.

Principal – Business organization or institution that is the original requesting source for the SSN verification that enters into a contractual relationship with the Requesting Party to secure SSN verifications from SSA. The Principal may or may not be the Requesting Party but is the end-user entity to which the Requesting Party ultimately discloses the SSN verification result.

Requesting Party – Party signing this User Agreement with SSA, including any and all of its employees, officers, directors, agents, servants, subsidiaries, personal and legal representatives, affiliates, successors, assigns, and contractors. The Requesting Party is also known as the Agent.

Responsible Company Official – The officer or employee of the Requesting Party with authority to make legally binding commitments on behalf of the Requesting Party.

SSN Verification –The response the agency provides to the Requesting Party after conducting a verification of the Client’s Fraud Protection Data. With the consent of the Client, CBSV can verify if the Client’s name, date of birth, and SSN match SSA’s records. CBSV returns a match verification of “yes” or “no.” If our records show that the Client is deceased, CBSV returns a death indicator. CBSV does not verify an individual’s identity.

Legal Authority

The legal authority for providing SSN verifications to the Requesting Party or Principal with the Client’s Written Consent is the Privacy Act (5 U.S.C. § 552a(b)), section 1106 of the Social Security Act (42 U.S.C. § 1306), and SSA regulation (20 C.F.R. § 401.100).

SSA will verify SSNs solely for the purposes specified on the individual Form SSA-89 Consent Forms (Form SSA-89, Authorization for SSA to Release SSN Verification – Attachment A) associated with the verification request. The Requesting Party must use the verified SSN only for the purpose(s) specified and authorized by the Client. Exceeding the scope of the consent as specified in the signed Consent Form violates state and Federal law and subjects the Requesting Party to civil and criminal liability. SSA recognizes that the Requesting Party may seek verification of the Client’s SSN on behalf of a Principal pursuant to the terms of the Client’s Consent Form. In this case, the Requesting Party must ensure that the Principal agrees in writing to use the verification only for the purpose stated in the Consent Form, and make no further use or re-disclosure of the verified SSN. The Requesting Party’s relationship with the Principal is subject to the contractual obligations as specified in this document. The Requesting Party must ensure that the Principal complies with those contractual obligations.

The information obtained from records maintained by SSA is protected by Federal statutes and regulations, including 5 U.S.C. § 552a(i)(3) of the Privacy Act. Under this section, any person who knowingly and willfully requests or obtains any record concerning an individual from an agency under false pretenses will be guilty of a misdemeanor and fined not more than $5,000.

SSA’s verification of an SSN does not provide proof or confirmation of identity. CBSV is designed to provide the Requesting Party with only a “yes” or “no” verification of whether the SSA’s records verified the SSN. If SSA’s records show that the Client is deceased, CBSV returns a death indicator. CBSV does not verify employment eligibility, nor does it interface with the Department of Homeland Security’s (DHS) verification system, and it does not satisfy DHS’s I-9 requirements.

The Requesting Party’s failure to follow these rules may result in suspension from the program or a disruption of service.

User Agreement & Attestation of RCO

The Requesting Party must designate a Responsible Company Official (RCO) to sign the Attestation Statement (Attachment E) indicating understanding of the Privacy Act restrictions relating to the use of this service on behalf of the Requesting Party.

The Requesting Party must submit the signed and dated Attestation Statement (Attachment E) to SSA with the signed User Agreement. The RCO will email the completed forms to [email protected].

If the RCO signing the original Attestation Statement subsequently leaves the company or no longer has authority to make legally binding commitments on behalf of the company, the Requesting Party will designate a new RCO and have the new RCO submit a new signed Attestation Statement within 30 calendar days of the original RCO no longer being able to act in that capacity. A company may only have one RCO.

Annually, the RCO will complete and sign the Attestation Statement, which advises them of their obligations to establish effective internal controls for compliance with CBSV requirements.

If the Requesting Party wants the Agency to recognize the Requesting Party’s successor in interest to this User Agreement, the Requesting Party must submit written notification to the CBSV Project Manager at least 30 days prior to the change. The Requesting Party must provide supporting documentation, including the new company name and EIN, if applicable, with each submission.

This Agreement is not transferable; any successor in interest must complete a Form SSA-200 (CBSV Enrollment Application – Attachment C) and sign a new User Agreement with the Agency.

If the Requesting Party wants the Agency to recognize: (a) name change; (b) Employer Identification Number (EIN) change; or (c) or name change and EIN change, the Requesting Party must:

Provide written notification to [email protected] to the CBSV Project Manager within 30 calendar days of change;

Provide supporting documentation with each submission;

Complete a new SSA-200 enrollment form; and

Sign a new User Agreement.

Please Note: Any change resulting in a new agreement may result in a disruption in service.

Form SSA-88 (Pre-Approval Form for CBSV – Attachment B)

The Requesting Party must complete the Form SSA-88 (Pre-Approval Form for CBSV – Attachment B) with requested information for each Authorized User. The Requesting Party must use one Form SSA-88 to provide information for multiple Authorized Users. The Requesting Party may attach a separate document listing additional users if the entire list of Authorized Users cannot fit on one Form SSA-88.

Please Note: A Requesting Party that utilizes both the web service and online service must submit a separate Form SSA-88 for each service.

The Requesting Party must ensure that the Form SSA-88 (Attachment B) identifies the total number of the Requesting Party’s Authorized Users.

Please Note: SSA will grant the Authorized User online access unless the Form SSA-88 indicates that the use is for web services. If online access is granted in error, the Requesting Party must correct the form and wait for a new activation code before gaining web service access.

Authorized Users

The Requesting Party must notify SSA within 14 business days if any change occurs to the employment status (including, but not limited to, long-term absence, termination of employment, or change of duties related to CBSV) of any Authorized User or if the Requesting Party revokes any Authorized User’s authorization to use CBSV. The RCO must email such updates to [email protected].

Service Channels

For a real-time response, the Requesting Party may submit requests for verifications either (1) online or (2) through a web services platform that conforms to SSA’s data configuration as described in the specifications document provided at https://www.ssa.gov/cbsv/webservice. All requests must specify the name, date of birth, and SSN of each Client the Requesting Party seeks to verify.

SSA may change its method of receiving verification requests and providing verification results to the Requesting Party at any time. If SSA decides to change its method of receiving SSN verification requests or providing verification results, the Requesting Party must bear its own costs incurred to accommodate such changes.

Annual Mandatory Compliance Review

A CPA designated by SSA will conduct a compliance review of the Requesting Party at least annually. The Requesting Party must allow the CPA to come onsite and conduct the compliance review. SSA factors the cost of the compliance review into the transaction fee. The CPA’s report will provide an opinion to SSA on the Requesting Party’s Assertion that it complied with the CBSV User Agreement requirements (see Attachment F). If SSA does not deem the results of the compliance review satisfactory, SSA reserves the right to come onsite and perform its own inspection. SSA reserves the right to access all company books and records associated with the CBSV program at any time.

Fees

The Requesting Party must pay the one-time $5,000 initial enrollment fee in advance and make advance payment of estimated transaction fees for the current fiscal year prior to submitting any request for verification under this User Agreement. The Requesting Party must pay in full any remaining balance due for verifications from the previous fiscal year obligations before it uses CBSV for the following fiscal year. The Requesting Party may submit a request to SSA to make quarterly installments of advance payments. The Requesting Party must email the request, along with its agreement number, to [email protected].

Actions and Responsibilities

The Requesting Party must ensure that its RCO carries out the following actions and responsibilities:

As part of the registration process for the Online Service, SSA will mail a one-time activation code to the RCO. SSA mails the activation code to the RCO whose name appears on Form SSA-88. The RCO must provide the activation code to the Authorized Users named in the letter in order to complete the registration process and to activate access to CBSV services. Each Authorized User must login to BSO and enter the activation code in order to activate online services, and follow the pre-registration process described in the CBSV User Guide.

As part of the registration process for Web Services, SSA will mail a one-time activation code to the RCO. The RCO must provide his or another Authorized User’s information on Form SSA-88. The RCO will be the representative Authorized User for the Requesting Party when using the Web Service and must follow the registration process described in the CBSV User Guide.

The RCO, jointly and on behalf of the Requesting Party, must be responsible for all access requests made through the Requesting Party’s Web Service. The Requesting Party must maintain an audit trail to track all CBSV activities of each Authorized User and the RCO must be responsible for the Requesting Party’s compliance with the requirement to maintain this audit trail.

Each Authorized User is responsible for maintaining his or her account and password. Online passwords expire every 90 days; web service passwords expire after 1 calendar year. SSA does not send out reminders to update passwords.

The Requesting Party must ensure that any Principal to whom the Requesting Party discloses verification results acknowledges and agrees to comply with all of the requirements, as applicable, under this User Agreement via a contractual relationship the Requesting Party establishes with the Principal as outlined in Attachment F.

The Requesting Party must inform all authorized personnel with access to the verification results of the confidential nature of the information and the administrative, technical and physical safeguards required to protect the information from improper disclosure. All confidential information must be stored in an area that is physically safe from unauthorized access at all times. Confidential information includes access to the CBSV service, forms and passwords.

The Requesting Party must obtain, at its own expense, the hardware, software, or other equipment necessary to establish connection to CBSV either through the online service or the web service.

Each Authorized User must certify to SSA that: (i) he or she must submit verification requests to SSA only when he or she has information, knowledge, or a reasonable belief that the requests are supported by the requisite Consent Forms; and (ii) he or she is aware that any verification request submitted to SSA without the requisite Consent Form is subject to legal penalties and could lead to termination of this User Agreement.

The Requesting Party must use the External Testing Environment to test verifications through the web service channel. SSA does not offer a test environment for the online service channel.

With respect to advertising, the Requesting Party acknowledges the following

Section 1140 of the Social Security Act authorizes SSA to impose civil monetary penalties on any person who uses the words “Social Security” or other program-related words, acronyms, emblems and symbols in connection with an advertisement, solicitation or other communication, “in a manner which such person knows or should know would convey, or in a manner which reasonably could be interpreted or construed as conveying, the false impression that such item is approved, endorsed, or authorized by the Social Security Administration . . . .” 42 U.S.C. § 1320b-10(a).

The Requesting Party or any of its Principals is specifically prohibited from using the words “Social Security” or other CBSV program-related words, acronyms, emblems and symbols in connection with an advertisement for “identity verification.”

The Requesting Party or any of its Principals is specifically prohibited from advertising that an SSN verification provides or serves as identity verification.

SSA will compare the information provided in the Requesting Party’s verification request with the information in SSA’s Master File of SSN Holders and provide verification results in an appropriate format and method.

SSA will review CBSV verification requests and verification results, conduct audits, generate reports, and conduct site visits of the Requesting Party as needed to ensure proper use to deter fraud and misuse. SSA, in its sole discretion, will determine the need for audits, reports, or site visits upon its review of the Requesting Party’s submissions, verification results, or CPA audit reports.

SSA will send low balance reminders to the Requesting Party.

SSA will make every attempt to provide advanced notification of planned outages. These notices will be posted on the CBSV website and the CBSV staff will send an email to the Requesting Party contact listed in this agreement.

SSA will provide an External Testing Environment for use during web service development and troubleshooting technical issues. SSA does not offer a testing environment for online service users.

Please Note: Requesting Parties must not conduct web services or online testing in the CBSV production environment. Testing in the production environment may lead to suspension of CBSV services.

SSA will make onsite inspections of the Requesting Party’s site, including a systems review, to ensure that the Requesting Party has taken the required precautions to protect the Consent Forms and the information contained therein and to assess overall system security.

At any time, SSA may complete unscheduled reviews of Consent Forms by requiring the Requesting Party to produce a random sample of Consent Forms connected with verification requests submitted by the Requesting Party.

A standardized Form SSA-89, Authorization for SSA to Release SSN Verification, is included as Attachment A to this User Agreement. The Form SSA-89 is an Office of Management and Budget (OMB) approved form; therefore, the Requesting Party must not alter this form. Please Note: Facsimile (fax) date/time stamps, barcodes, quick response (QR) codes, and tracking numbers may be added to the margins of the front of the Form SSA-89. These are the only acceptable alterations to the Form SSA-89.

The Requesting Party must obtain a signed Form SSA-89 from each Client for whom the SSN verification is requested before submitting a verification request. If the request is for a minor child (under age 18), a parent or legal guardian must sign the Form SSA-89. If the request is for a legally incompetent adult, a legal guardian must sign the Form SSA-89. If the parent or legal guardian signs the Form SSA-89, the Requesting Party must retain proof of the relationship, e.g., a copy of the birth certificate or court documentation proving the relationship. A third party (e.g., a spouse, an appointed representative, an attorney, a third party with a power of attorney) is not authorized to execute the Form SSA-89 on the Client’s behalf. Please Note: SSA does not recognize Power of Attorney for consent purposes.

The original Form SSA-89 must be completed and contain a hand-written “wet” signature and must include the date of birth of the Client. The Requesting Party must not accept digital or electronic signatures.

The Client may change the period during which the consent will be valid. The Client must annotate and initial this change in the space provided on the Form SSA-89. The Requesting Party or Principal must not request the SSN verification from SSA prior to receiving physical possession of a signed Form SSA-89 from the Client. SSA will receive the request for SSN verification within the period specified on the Form SSA-89 or within 90 days, from the date the Client signed the Form SSA-89 if the Client did not establish an alternate timeframe on the Form SSA-89.

The Requesting Party must retain the signed Form SSA-89s for a period of five (5) years from the date the request signed by the client, either in paper format or electronically. The Requesting Party must protect the confidentiality of completed Form SSA-89s and the information therein, as well as the associated verification result. The Requesting Party must also protect the Form SSA-89s from loss or destruction by taking the measures below. (See Section VI in this User Agreement for Technical Specifications and System Security and Related Business Process Requirements and Section VII in this User Agreement for instructions on Protecting and Reporting the Loss of PII.)

If the Requesting Party chooses to retain the Form SSA-89s in paper format, the Requesting Party must store the Form SSA-89s in a locked, fireproof, and waterproof storage receptacle. The Requesting Party must restrict access to all confidential information to the minimum number of employees and officials who need it to perform the process associated with this User Agreement. The stored data must not be reused. The Requesting Party cannot reuse a Written Consent to submit another SSN Verification request or for different purposes. However, the Requesting Party can mark its own records as “verified” or “unverified” for future reference.

If the Requesting Party chooses to retain the Form SSA-89 electronically or store them on removable electronic media (such as CDs), the Requesting Party must: (1) password protect any electronic files used for storage; (2) restrict access to the files to the RCO and/or his or her designee; and (3) put in place and follow adequate disaster recovery procedures.

When using either of the electronic storage means, the Requesting Party must destroy via shredding the original paper Form SSA-89 immediately after converting the paper Form SSA-89 to electronic media.

A. Technical

The Requesting Party will not have direct access to SSA’s databases. The Requesting Party must encrypt verification requests per the instructions provided in the CBSV Interface Specification document located here: https://www.ssa.gov/cbsv/webservice.html.

All testing must be done using CBSV’s free External Testing Environment (ETE).

The Requesting Party must obtain, at its own expense, the hardware, software, or other equipment necessary to establish connection to CBSV either through the online service or the web service.

The Requesting Party must obtain, at its own expense, Internet service in order to access the CBSV portion of the online service.

The Requesting Party must bear all costs it incurs for site preparation, connection, operating costs, and any other miscellaneous costs to participate in CBSV.

The Requesting Party must provide SSA with a valid e-mail address for communications. SSA reserves the right to conduct on-site visits to review the Requesting Party’s documentation and in-house procedures for protection of and security arrangements for confidential information and adherence to terms of this User Agreement

The Requesting Party may use either method of CBSV service delivery (online or web service); however, due to the unique nature of SSA’s authentication, an Authorized User may only have one access role – either online or web services.

If the Requesting Party chooses to use both online and web service, it must assign two different Authorized Users.

The Requesting Party is responsible for the one-time initial enrollment fee and annual advance payments for estimated transactions, regardless of the number of methods of service it uses.

The Requesting Party and its Principals must follow the detailed requirements and procedures for using and testing CBSV that are set forth in this User Agreement and User Guide. SSA’s User Guide and sample User Agreement are available online at https://www.ssa.gov/cbsv. SSA may amend the User Agreement, User Guide, and Interface Specifications at any time, at its discretion.

If the Requesting Party and its Principals access CBSV through the web service platform client application, the Requesting Party must maintain an automated audit trail record identifying either the individual User or the system process that initiated a request for verification results from SSA.

Every verification request must be traceable to the individual Authorized User or the system process that initiated the transaction. At a minimum, individual audit trail records must contain the data needed to associate each verification request to its initiator and the relevant business purpose (e.g., the Principal for whom SSA verification results were requested), and each verification request must be time and date stamped. Each verification request must be stored in the audit trail record as a separate record, not overlaid by subsequent verification requests.

If the Requesting Party retains in its system any verification results from SSA, or if certain data elements within the Requesting Party’s system indicate that the information has been verified by SSA, the Requesting Party must restrict access to the files to the RCO and/or his or her designee and ensure that its system also captures an audit trail record, with the same requirements as for the web service platform client application, of any user who views the SSA-verified information stored within the Requesting Party’s system.

The Requesting Party must process all verification results under the immediate supervision and control of authorized personnel in a manner that will protect the confidentiality of the verification results; prevent the unauthorized use of the verification results; and prevent access to the verification results by unauthorized persons.

The Requesting Party must establish, maintain, and follow its own policy and procedures to protect PII, including policies and procedures for reporting lost or compromised, or potentially lost or compromised, PII. The Requesting Party must inform its Authorized Users who handle PII of their individual responsibility to safeguard such information. In addition, the Requesting Party must, within reason, take appropriate and necessary action to: (1) educate Authorized Users on the proper procedures designed to protect PII; and (2) enforce their compliance with the policy and procedures prescribed.

All Requesting Parties, Principals, and Authorized Users must properly safeguard PII from loss, theft, or inadvertent disclosure. Each Authorized User is responsible for safeguarding this information at all times, regardless of whether or not the user is at his or her regular duty station.

When the Requesting Party, including the Principal it services, or its Authorized User becomes aware or suspects that PII has been lost, compromised, or potentially compromised the Requesting Party, in accordance with its incident reporting process, must provide immediate notification of the incident to the primary SSA contact within 1 hour of the PII loss. If the primary SSA contact is not readily available, the Requesting Party must immediately notify the SSA alternate, if names of alternates have been provided. (See Section XVII of the User Agreement for the phone numbers of the designated primary and alternate SSA contacts.) The Requesting Party must act to ensure that each Authorized User has been given information as to whom the primary and alternate SSA contacts are and how to contact them.

The Requesting Party must provide the primary SSA contact or the alternate, as applicable, with updates on the status of the reported PII loss or compromise as they become available but must not delay the initial report.

The Requesting Party must provide complete and accurate information about the details of the possible PII loss to assist the SSA contact/alternate, including the following information:

Contact information;

A description of the loss, compromise, or potential compromise (i.e., nature of loss/compromise/potential compromise, scope, number of files or records, type of equipment or media, etc.) including the approximate time and location of the loss;

A description of safeguards used, where applicable (e.g., locked briefcase, redacted personal information, password protection, encryption, etc.);

Name of SSA employee contacted;

Whether the Requesting Party or the Authorized User has contacted or been contacted by any external organizations (i.e., other agencies, law enforcement, press, etc.);

Whether the Requesting Party or the Authorized User has filed any other reports (i.e., Federal Protective Service, local police, and SSA reports); and

Any other pertinent information.

If the Requesting Party experiences a loss or breach of data, the Requesting Party must provide appropriate notice to the affected individuals and take any additional remediation actions.

If SSA returns a “no-match” result (See Section 6.0 of the CBSV User Guide) to the Requesting Party, the Requesting Party must take the following actions before making any referrals to SSA Field Offices for resolution:

The Requesting Party must determine whether the data submitted to SSA matches the data contained on the Form SSA-89. If it does not match, the Requesting Party must re-submit the corrected data to SSA for verification. The Requesting Party must bear the cost for the resubmission.

If the data on the Form SSA-89 matches the data submitted to SSA, the Requesting Party must contact the Client to verify the original data provided. If the Client corrects the original data by completing and signing a new Form SSA-89 with the corrected information, the Requesting Party must submit the corrected data to SSA for verification. The Requesting Party must bear the cost for the resubmission.

If the Requesting Party cannot resolve the data discrepancy, the Requesting Party must refer the Client to an SSA Field Office to determine the nature of the problem. If corrections are required, the Requesting Party must submit the correct data to SSA for verification. The Requesting Party must bear the cost for the resubmission.

Some SSN records will not be verifiable by CBSV services. In those cases, follow the instructions in the CBSV User Guide. Do not refer unverifiable SSN records to the CBSV staff. The CBSV staff will not manually validate SSNs for the Requesting Party.

The Requesting Party must provide SSA with advance payment for the full annual cost of all services rendered under this User Agreement.

The Requesting Party must deposit with SSA, either by company check or company credit card, a one–time, nonrefundable enrollment fee of five thousand dollars ($5,000), which will be applied to SSA’s total CBSV operating costs to reduce the actual transaction fees charged to all users.

The Requesting Party must submit payment for transaction fees with a completed and signed Form SSA-1235 (Agreement Covering Reimbursable Services—Attachment D). Prior to the start of each new federal fiscal year, the Requesting Party must submit a new, signed Form SSA-1235, accompanied by the full payment of transaction fees for estimated requests for that federal fiscal year. The federal fiscal year begins on October 1 and ends on September 30.

SSA will credit the account of the Requesting Party and decrement from the advanced payment as services are rendered. SSA will provide services only if there are sufficient funds in the Requesting Party’s account. In cases when estimated costs have changed, the Requesting Party must remain in active status as long as its account balance is positive. No interest will accrue to the advance payment.

At least annually, SSA will review its costs related to providing the CBSV services, recalculate the transaction fee necessary for SSA to recover full costs, and adjust the transaction fee accordingly. SSA will notify the Requesting Party before any change to the transaction fee goes into effect.

If the recalculation of costs results in an increase or decrease in the transaction fee, the Requesting Party must sign and submit an amended Form SSA-1235 and may need to submit additional advance payments to continue receiving CBSV services.

This User Agreement is effective upon signature of both parties, including a signed Form SSA-1235 and payment in full of all fees due and payable under such Form SSA-1235, and will remain in effect until terminated or cancelled as follows:

The Requesting Party may terminate this User Agreement by sending 30-days advance written notice to [email protected] of its intent to terminate this User Agreement and cancel its participation in the CBSV service. This User Agreement will be terminated effective 30 calendar days after SSA receives such notice or at a later date specified in the notice;

SSA and the Requesting Party may mutually agree in writing to terminate this User Agreement, in which case the termination will be effective on the date specified in such termination agreement;

SSA may terminate this User Agreement upon determination, in its sole discretion, that the Requesting Party has failed to comply with its responsibilities under this User Agreement. This includes without limitation its obligation to make advance payment, its requirement to use the Form SSA-89 without modification and in accordance with this User Agreement, and its responsibilities under Section XI, Compliance Reviews, including correcting its non-compliance within 30 calendar days of SSA’s notice of such non-compliance;

In the event this User Agreement or the CBSV service is prohibited by any applicable law or regulation, this User Agreement will be null and void as of the effective date specified in such law or regulation;

SSA may terminate this User Agreement and the CBSV program at its sole discretion. In case of such cancellation of the CBSV program, SSA will provide all participants in the CBSV program with advance written notice of SSA’s decision; or

If the Requesting Party is dissolved as a corporate entity, this User Agreement is no longer valid. Any new corporate entity purporting to acquire the Requesting Party’s interest in this User Agreement must sign a new User Agreement. The rights and obligations under this User Agreement cannot be assigned whether through purchase, acquisition, or corporate reorganization.

The Requesting Party specifically waives any right to judicial review of SSA’s decision to cancel the provision of CBSV services or terminate this User Agreement.

After the close of the fiscal year in which this User Agreement is terminated, SSA will refund to the Requesting Party any remaining advance payment of transaction fees. If the User Agreement is terminated early in the fiscal year, SSA reserves the right to refund the balance of advance payment prior to the close of the fiscal year. No interest will accrue during this time. Notwithstanding the foregoing, the one-time enrollment fee is not refundable for any reason.

Suspension is a temporary action imposed by SSA on a Requesting Party for a designated period until the Requesting Party meets certain requirements or rectifies certain conditions. Suspension is immediate upon notice by SSA to the Requesting Party and remains in effect until lifted by SSA.

Noncompliance with this User Agreement, including Assertions set forth in Attachment F – CBSV Attestation Requirements & Requesting Party Compliance Assertions of this User Agreement, is grounds for suspension of CBSV services at the sole discretion of SSA.

Suspension will be effective immediately upon SSA’s notice. The notice will specify the reason for the suspension, be sent via e-mail to the Requesting Party’s RCO, and remain in effect until SSA’s further determination.

If the Requesting Party disputes SSA’s decision to suspend its access, the Requesting Party may elect to write a letter to SSA specifying the reasons for contesting the suspension. Such letters may be sent via e-mail and must be received by SSA within 30 calendar days from the date that SSA transmitted the notice of suspension to the RCO. The Requesting Party must send the dispute to [email protected] email address.

After reviewing the Requesting Party’s letter, SSA may make the final determination to: 1) lift the suspension; 2) continue the suspension; or 3) terminate this User Agreement. SSA will provide the Requesting Party with written notice of its final decision. SSA’s decision is final and non-reviewable.

The Requesting Party specifically waives any right to judicial review of SSA’s decision to suspend or terminate this User Agreement.

SSA may suspend the Requesting Party's use of the CBSV system for any of the following reasons:

Non-Payment,

Violation of User Agreement Terms, or

Temporary Fix for an Active Record.

The following are the three types of noncompliance and their resulting penalties.

Type |

Noncompliance |

Penalty |

Type I |

Type I noncompliance consists of multiple infractions that significantly place PII at risk or have resulted in unauthorized disclosure of PII and are systemic in nature and includes, but is not limited to the following examples:

|

Suspension of CBSV user privileges for 90 days or termination |

Type II

|

Type II noncompliance consists of an infraction that could result in an unauthorized verification being submitted to SSA or a failure to comply with the consent requirements or a failure to comply with securing data containing PII. A Type II noncompliance may also be a failure that might prevent the completion of the Compliance Review. Type II noncompliance includes, but is not limited to, the following examples:

|

Suspension of CBSV user privileges for 60 days |

Type III

|

Type III noncompliance consists of failures that are only minor in nature. Type III noncompliance would not result in either unauthorized disclosure of PII or unauthorized SSN verification requests being submitted to SSA. Examples of Type III noncompliance includes, but is not limited to, the following examples:

|

Suspension of CBSV user privileges for 30 days |

This User Agreement does not authorize SSA to incur obligations through the performance of the services described herein. Performance of such services is authorized only by execution of Form SSA-1235 (Agreement Covering Reimbursable Services – Attachment D). Moreover, SSA may incur obligations by performing services under this User Agreement only on a fiscal year basis. Accordingly, attached to, and made a part of, this User Agreement, is a Form SSA-1235 that provides the authorization for SSA to perform services under this User Agreement during fiscal year 2024.

Because SSA’s performance under this User Agreement spans multiple fiscal years, SSA and the Requesting Party will prepare a new Form SSA-1235 at the beginning of each succeeding fiscal year during which SSA will incur obligations through the performance of the services described in this User Agreement. The parties will sign the Form SSA-1235 by September 15 before the beginning of the Federal fiscal year (October 1st). SSA’s ability to perform work for fiscal years beyond the current fiscal year is subject to the availability of funds.

SSA will refund to the Requesting Party any excess funds remaining in the Requesting Party’s account after the close of the federal fiscal year. The remaining balance from one fiscal year does not carry over to the following fiscal year. The Requesting Party must sign a new Form SSA-1235 and submit an advance payment prior to the beginning of each fiscal year in a transaction separate from any refund due from SSA from the previous fiscal year.

The RCO(s) for the Requesting Party must complete an annual Attestation Statement, which advises them of their obligations to establish effective internal controls for compliance with CBSV requirements.

The Requesting Party and any of its Principals and subsidiaries using CBSV must submit to a mandatory annual compliance review.

SSA will determine if additional reviews are required. SSA will determine the actual date of the compliance reviews in consultation with the reviewing CPA.

An SSA-appointed CPA firm will perform an annual compliance review to determine whether all authorized transactions are complete and accurate.

The CPA firm will perform the Compliance review in accordance with the standards established by the American Institute of Certified Public Accountants and contained in the Generally Accepted Government Audit Standards (GAGAS).

SSA will email a notice to the Requesting Party identifying the name of the retained CPA firm and its designated contact.

SSA will provide to the CPA a statistically valid random sample of the Requesting Party’s verifications identified by name, SSN and date of birth along with the verification results provided to the Requesting Party.

SSA will use the U.S. Government Accountability Office (GAO) President’s Council on Integrity and Efficiency’s (PCIE) Financial Audit Manual (FAM), Section 460, Compliance Tests in determining the sample size.

The Requesting Party must:

Provide to the reviewing CPA a copy of this signed User Agreement and all applicable attachments in their entirety; the Requesting Party must maintain its own copies for the CPA; and

Inform all of its Principals of the requirement to produce supporting documentation upon the CPA’s request for purposes of compliance reviews.

In performance of the Compliance review under this User Agreement, the CPA must use the review Assertions specified in Attachment F, CBSV Attestation Requirements & Requesting Party Compliance Assertions (Audit).

In addition, the CPA will:

Follow standards established by the American Institute of Certified Public Accountants (AICPA) and contained in GAGAS.

Provide a report containing the results of the Compliance review to the designated SSA contact within 30 calendar days after completing the Compliance review.

Provide the Requesting Party with a copy of the report containing the results of the compliance review within 30 calendar days after the report is provided to SSA, unless SSA informs the CPA otherwise.

If the results of the CPA’s review indicate that the Requesting Party has not complied with any term or condition of this User Agreement, SSA may:

Perform its own onsite inspection, audit, or compliance review,

Refer the report to its Office of the Inspector General for appropriate action, including referral to the Department of Justice for criminal prosecution,

Suspend CBSV services,

Terminate this User Agreement; and/or,

Take any other action SSA deems appropriate.

See Attachment F for a list of compliance and non-compliance Assertions.

SSA reserves the unilateral right to amend this User Agreement at any time to implement the following:

Minor administrative changes, such as changes to SSA contact information; or

Procedural changes, such as method of transmitting requests and results and limits on the number of verification requests.

SSA will notify the Requesting Party via email of any unilateral amendments under this section. If the Requesting Party does not agree to be bound by any such unilateral amendment, the Requesting Party may terminate this User Agreement with 30 calendar days’ written notice.

Notwithstanding any other provision of this User Agreement, the Requesting Party must indemnify and hold SSA harmless from all claims, actions, causes of action, suits, debts, dues, controversies, restitutions, damages, losses, costs, fees, judgments, and any other liabilities caused by, arising out of, associated with, or resulting directly or indirectly from, any acts or omissions of the Requesting Party, including but not limited to the disclosure or use of information by the Requesting Party or its Principal, or any errors in information provided to the Requesting Party under this User Agreement.

SSA is not responsible for any financial or other loss incurred by the Requesting Party, whether directly or indirectly, through the use of any data provided pursuant to this User Agreement. SSA is not responsible for reimbursing the Requesting Party for any costs the Requesting Party incurs pursuant to this User Agreement.

SSA is not liable for any damages or loss resulting from errors in information provided to the Requesting Party under this User Agreement. Furthermore, SSA is not liable for damages or loss resulting from the destruction of any materials or data provided by the Requesting Party. All information furnished to the Requesting Party will be subject to the limitations and qualifications, if any, transmitted with such information. If, because of any such error, loss, or destruction attributable to SSA, SSA will re-perform the services under this User Agreement, the additional cost thereof will be treated as a part of the full costs incurred in compiling and providing the information and the Requesting Party must pay these costs.

SSA’s performance of services under this User Agreement is authorized only to the extent that they are consistent with performance of the official duties and obligations of SSA. If for any reason SSA delays or fails to provide the services, or discontinues all or any part of the services, SSA is not liable for any damages or loss resulting from such delay, failure, or discontinuance.

Nothing in this User Agreement is intended to make any person or entity who is not a signatory to this User Agreement a third-party beneficiary of any right created by this User Agreement or by operation of law.

This User Agreement and the accompanying Form SSA-1235 constitute the entire agreement of the parties with respect to its subject matter. There have been no representations, warranties or promises made outside of this User Agreement. This User Agreement must take precedence over any other documents that may be in conflict with it.

In the event of a disagreement between the parties to this User Agreement, the parties will meet and confer to attempt to negotiate a resolution. If the parties cannot agree on a resolution, the parties will submit the dispute in writing to the Deputy Commissioner, Office of Budget, Finance and Management, of SSA, who will render a final determination binding on both parties.

CBSV Project Team

Email: [email protected]

Call: 866-395-8801

Billing and Payment Issues

Physical address via U.S. Postal Service or overnight carrier

ATTN CBSV Mailstop 2-O-2 ELR DRAC IABT

Social Security Administration

6401 Security Blvd

Baltimore, MD 21235

866-395-8801

Email: [email protected]

PO Box Address

ATTN CBSV

Social Security Administration

PO Box 17042

Baltimore, MD 21235

Please Note: Advance payment (company credit card via Pay.gov) is required.

Advance payment is required before work begins. Upon the receipt of the signed SSA-1235, we will create an eBill and an email will be sent from Pay.gov to you that the eBill is ready for payment.

Reporting Lost, Compromised or Potentially Compromised PII

Office of Data Exchange, Policy Publications, and International Negotiations

Project Manager: *Vivian Adebayo 410-966-4663

Alternate Contact: *Antoinette Ford 410-966-4422

CBSV Technical & Web Services Support

Reminder: Report changes to SSA within 30 calendar days.

Company Name: _________________________________________

Responsible Company Official:_________________________________________

Title: _________________________________________

Address: __________________________________________

__________________________________________

__________________________________________

Telephone: __________________________________________

Fax: __________________________________________

Email: __________________________________________

The signatories below warrant and represent that they have the competent authority on behalf of their respective entities to enter into the obligations set forth in this User Agreement.

For Social Security Administration:

________________________________________ Date __________

(Signature)

Printed Name: Christopher McDermott

Acting Associate Commissioner, Office of Data Exchange, Policy Publications, and International Negotiations

For Requesting Party:

_________________________________________ Date ___________

(Signature)

Printed Name: ______________________________

Title: _____________________________________

Company Name: ____________________________

Attachment A - Form SSA-89 and Form SSA-89 SP

Attachment B – Form SSA-88 Pre-Approval Form for CBSV

Attachment C - Form SSA-200 CBSV Enrollment Application

Attachment D - Form SSA-1235 Agreement Covering Reimbursable Services

Attachment

E - Attestation Statement (COMPANY)

Attachment

E - Attestation Statement (COMPANY)

ATTESTATION STATEMENT FOR

USING THE SSN VERIFICATION PROCESS

(Signature required annually)

Name and address of company requesting services:

______________________________________________________________________ ______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

The Requesting Party understands that the Social Security Administration (SSA) will verify Social Security Numbers (SSN) solely to ensure that the records of my Clients or my Principal’s Clients are correct for the purpose(s) indicated on the Form SSA-89 (Authorization for SSA to Release SSN Verification – Attachment A), obtained from the Clients.

The information received from records maintained by SSA is protected by Federal statutes and regulations, including 5 U.S.C. § 552a(i)(3) of the Privacy Act. Under this section, any person who knowingly and willfully requests or obtains any record concerning an individual from an agency under false pretenses must be guilty of a misdemeanor and fined not more than $5,000.

The Requesting Party must inform all authorized personnel with access to confidential information of the confidential nature of the information and the administrative, technical and physical safeguards required to protect the information from improper disclosure. All confidential information must at all times be stored in an area that is physically safe from unauthorized access.

The Requesting Party must restrict access to all confidential information to the minimum number of employees and officials who need it to perform the process.

[Please clearly print or type your Responsible Company Official's name, title, and phone number and have him/her sign and date below.]

Name_________________________________________________________________ Title__________________________________________________________________ Phone Number__________________________________________________________

Signature__________________________________________Date_________________

Attachment F - CBSV Attestation Requirements for CPA and Requesting Party Compliance Assertions

The Compliance review must be performed in accordance with standards applicable to attestation engagements contained in Generally Accepted Government Auditing Standards (GAGAS) issued by the Comptroller General of the United States. These standards also incorporate by reference attestation standards established by the American Institute of Certified Public Accountants. The period of the compliance review will be the Federal fiscal year. These standards incorporate independence requirements that the Certified Public Accountant (CPA) must meet in order to perform the compliance review.

The CPA must agree in its letter of engagement with the Requesting Party to make its compliance review work papers available for review by SSA or its designee.

Any questions regarding the compliance review as well as the final report on this engagement must be directed to:

Office of Data Exchange, Policy Publications, and International Negotiations

Social Security Administration

4700 Annex Building

6401 Security Blvd

Baltimore MD 21235-6401

Name, Email and Telephone: (will be provided when agreement is signed)

The Requesting Party must provide a copy of its current CBSV User Agreement in its entirety to the reviewing CPA engaged to perform the compliance review.

SSA will provide to the CPA a random sample of verifications submitted by the Requesting Party identified by name, Social Security number and date of birth along with the verification results provided to the Requesting Party.

The CPA must send confirmation requests either by mail or e-mail to Social Security number holders for the random sample of verifications to provide information about the validity of submitted requests. The CPA must follow up confirmation non-replies in writing, via mail or by phone. The CPA must provide results of the confirmation process in a schedule to the compliance report submitted to SSA. The CPA must include all instances of confirmations indicating that a verification was not authorized in an addendum to the compliance report. The confirmation process including follow up of non-replies is a required procedure.

Terms that have a special meaning are defined in Section I.C of the CBSV User Agreement.

A signed Form SSA-89 (Attachment A) was used to obtain consent for all verification requests submitted to SSA.

The signed Form SSA-89 used to obtain consent for Social Security Number (SSN) verification contains wet “pen and ink” signatures of the identified individuals.

The signed Form SSA-89 used to obtain consent contains all wording as prescribed in Attachment A of the CBSV User Agreement and no additional wording has been added.

The signed Form SSA-89 used to obtain consent was completed in its entirety, without alterations, including name, date of birth, social security number, stated reason, Principal’s name and complete address, Agent’s (Requesting Party) name and complete address, signature and date signed for the Client (social security number holder). The Form SSA-89 must also include the relationship if the individual signing the form is not the individual to whom the SSN was issued (for minors or legally incompetent adults).

The Agent (Requesting Party) identified on all Form SSA-89s accepted by the company is a listed party (d/b/a) in the company’s CBSV User Agreement.

Regarding the purpose stated on the Form SSA-89:

The SSN verification was used only for the purpose stated on the consent form, and

The consent form identifies a specific purpose (e.g., “mortgage application” or “verification for employment”) and is not a general purpose (e.g., “identity verification” or “identity proof or confirmation”).

The date SSN verifications were submitted to SSA was after the date the Form SSA-89s were signed and dated.

The submission date for the SSN verification was not more than 90 days after the Form SSA-89 was signed and dated unless the authorizing individual specified an alternate timeframe. If an alternate timeframe was specified, the submission date was within the alternate timeframe.

The company retains all consent forms for five (5) years from the date the SSN verification was submitted to SSA.

For Requesting Parties that are not Principals, the company has:

Correctly relayed to the Principal (client) the information regarding the SSN verification received from SSA.

The Requesting Party’s record retention policy has the following elements, if applicable:

Paper Form SSA-89s are stored in a locked fireproof and waterproof container and access is limited to Authorized Users.

Electronic - The consent forms retained electronically are password protected, encrypted, and only authorized personnel identified on the Form SSA-88 (Attachment B) have access to these files. Passwords issued to personnel who no longer work for the company or no longer work in the capacity to have access to the files are voided. Paper consent forms converted to electronic media are destroyed. Disaster recovery procedures are in place and are being followed.

Removable Electronic Media (e.g. CD, DVD, flash drive) - All data has been encrypted and all removable electronic media is stored in a locked, fireproof, and waterproof storage receptacle. Only Authorized Users have access to this media. Paper consent forms have been properly destroyed after being stored electronically.

The Attestation Statement (Attachment E) is current. The Requesting Party submitted the attestation statement to SSA within 30 days of the beginning of the fiscal year (October 1 to September 30). For new companies, the Requesting Party submitted the Attestation Statement with the signed User Agreement. The signer’s authority includes the right to financially bind the company and bear responsibility for CBSV.

Form SSA-88 (Attachment B) is current. The Requesting Party filed a new Form SSA-88 with SSA within 14 days of a relevant personnel change (such as removing any employee previously listed on the SSA-88 as an Authorized User, or adding a new employee that requires access to CBSV). All employees identified on the Form SSA-88 are still employed by the company, are performing CBSV duties, and are associated with the correct CBSV service channel (e.g. Online Service or Web Service).

For Requesting Parties that are not Principals, the agreements between the company and its Principals (clients) include the following acknowledgements:

The Principal agrees that it must use the verification only for the purpose stated in the Consent Form, and must make no further use or re-disclosure of the verification; and

The agreements acknowledge that Section 1140 of the Social Security Act authorizes SSA to impose civil monetary penalties on any person who uses the words "Social Security" or other program-related words, acronyms, emblems and symbols in connection with an advertisement, solicitation or other communication, "in a manner which such person knows or should know would convey, or in a manner which reasonably could be interpreted or construed as conveying, the false impression that such item is approved, endorsed, or authorized by the Social Security Administration..." 42 U.S.C. § 1320b-10(a); and

The agreements acknowledge that the company and its Principals are specifically prohibited from using the words "Social Security" or other program-related words, acronyms, emblems and symbols in connection with an advertisement for “identity verification”; and

The agreements further acknowledge that the company and its Principals are specifically prohibited from advertising that SSN verification provides or serves as identity verification; and

The agreements acknowledge that SSA has the right of access to all company books and records associated with the CBSV program at any time; and

The Principal agrees to receipt the completed Form SSA-89 (Attachment A) prior to submitting verifications; and

The Principal agrees to follow the same requirements for safeguarding and reporting the loss of PII as outlined in Section V (B) of the User Agreement.

The Requesting Party’s audit trail and activity logs can track the activity of Authorized Users who request information or view SSA-supplied information within the Requesting Party’s system, including viewing Form SSA-89s stored electronically.

The following are the compliance and noncompliance standards for use in required CBSV compliance reviews.

Compliance Assertion |

Compliance |

Noncompliance |

1 |

Signed Form SSA-89 (Attachment A) provided. |

Type II: Signed Form SSA-89 was not provided to auditor. |

2 |

Written (pen and ink) and original signature on the Form SSA-89. |

Type II: Signature on the Form SSA-89 is printed electronically. The number holder confirms that Form SSA-89 does not represent his/her authorization of verification. |

3 |

Form SSA-89 approved by OMB is not altered in any way and includes the Privacy Act and Paperwork Reduction Act. |

Type II: Form SSA-89 is altered from Attachment A of the CBSV User Agreement by either added wording or deleted wording, and/or does not include the Privacy Act and Paperwork Reduction Act. |

4

|

Form SSA-89 includes name, date of birth, social security number, stated purpose, Principal’s name and complete address, agent (Requesting Party) name and complete address, signature and date signed for the authorizing individual. Form SSA-89 must include the signer’s relationship if he or she is not the individual to whom the SSN was issued. |

Type II: Form SSA-89 is missing any of following: name, date of birth, social security number, stated purpose, Principal’s name, Principal’s complete address, agent’s (Requesting Party) name, agent’s complete address, signature and date signed, relationship (if required). |

4a |

The Form SSA-89 contains the signature of a parent or legal guardian if the request is for a minor child (under age 18), or of a legal guardian if the request is for a legally incompetent adult. The parent or legal guardian signed the consent and the Company retained proof of the relationship, (e.g. a copy of the birth certificate or court documentation proving the relationship). The relationship field must be completed. SSA does not recognize Power of Attorney for CBSV purposes.

|

Form SSA-89 does not contain the signature of a parent or legal guardian and the request is for a minor child (under age 18), or it does not contain the signature of a legal guardian and the request is for a legally incompetent adult. The parent or legal guardian signed the consent and the Company did not retain proof of the relationship (e.g. a copy of the birth certificate or court documentation proving the relationship). The relationship field is not completed.

|

5 |

The Agent (Requesting Party) identified on all Form SSA-89s accepted by the company is a listed party (or d/b/a) in the company’s CBSV User Agreement. |

Type II: The Agent (Requesting Party) identified on all Form SSA-89s accepted by the company does not match the name (or d/b/a) in the company’s CBSV User Agreement. |

6 |

The purpose stated on the Form SSA-89 is consistent with the business of the Principal and is specific. Examples of a specific purpose include mortgage loan application, verification for employment, credit card application, or seeking credit with lender. |

Type II: Purpose stated on the Form SSA-89 is not specific. Examples of non-specific purpose include verify identity, confirmation, proof identity, and application. Type III: The purpose stated on the Form SSA-89 is not consistent with the business of the Principal. |

7 |

The date the SSN verification request was submitted to SSA was on or after the signature date on Form SSA-89. When the date and time the manually signed Form SSA-89 was received by the Requesting Party is available, the determination of compliance should consider time as well as date. |

Type II: The submission date for the SSN verification was before the signature date on Form SSA-89. |

8 |

The date the SSN verification request was submitted to SSA was within 90 days of the signature date on the Form SSA-89 or was within the alternate timeframe if specified by authorizing individual and submission date was within alternate timeframe. |

Type II: The submission date was more than 90 days after the signature date or was after the specified alternate timeframe specified by the authorizing individual. |

9 |

Form SSA-89s are available either in paper or electronic format from Requesting Party’s records five (5) years from verification date of the SSN. |

Type II: Requesting Party cannot provide Form SSA-89, which authorizes a specific verification, five (5) years from verification date of the SSN. Form SSA-89s that are obtained from the Principal for purposes of establishing compliance with this requirement are indicative of non-compliance with this requirement. |

10 |

The Requesting Party correctly informed the Principal of the results of SSN verification. The results were not altered in any way. |

Type II: The Requesting Party did not correctly inform the Principal of the results of SSN verification. The Requesting Party altered the results prior to sending them to the Principal. |

11 |

The Form SSA-89s retained electronically are password protected, encrypted, and only accessible by personnel identified on Form SSA-88. Passwords are deactivated when employees separate from the company. If stored electronically, paper Form SSA-89s are destroyed. Disaster recovery procedures are in place and being followed. Removable electronic media and or paper forms are safeguarded in a locked, fireproof and waterproof storage receptacle and only authorized personnel have access. |

Type II: The Form SSA-89s retained electronically are not password protected, not encrypted, or are accessible by unauthorized personnel. Passwords are not deactivated when employees separate from the company. If stored electronically, paper Form SSA-89s are not destroyed. Disaster recovery procedures are not in place or not being followed. Removable electronic media is not safeguarded in a locked, fireproof and waterproof storage receptacle or unauthorized personnel have access. |

12 |

The Attestation Statement was submitted to SSA within 30 days of the beginning of the federal fiscal year (October 1 to September 30) or for new users, the Attestation Statement was submitted with the signed User Agreement; AND the signatory has authority to financially bind the company and bear responsibility.

|

Type II: The Attestation Statement was not submitted within 30 days of the beginning of the federal fiscal year or for new users, the Attestation Statement was not submitted with the signed User Agreement; OR the signatory does not have the authority to financially bind the company or bear responsibility.

|

13 |

During the timeframe under review, the Form SSA-88 was current. The most recent SSA-88 filed with SSA included all Authorized Users for the appropriate service channel (Web Service or Online Service). All Authorized Users listed on the Form SSA-88 were employees of the Requesting Party. All Authorized Users listed on the Form SSA-88 were still performing duties relating to the CBSV system. |

During the timeframe under review, the SSA-88 was not current. The most recent Form SSA-88 filed with SSA did not include all Authorized Users for appropriate service channel (Web Service or Online Service). An employee listed on the Form SSA-88 was not an employee of the Requesting Party. An employee listed on the form was no longer performing duties related to the CBSV system. Please Note: It is not considered non-compliance if the Requesting Party files a new Form SSA-88 within 14 days of the termination of employment of any employee listed as an Authorized User on the Form SSA-88. |

14 |

Agreements with Principals include:

|

Type II: Agreements with Principals missing any of the following:

Reference to provisions of the Requesting Party’s User Agreement with SSA rather than specific language regarding each item listed above is considered non-compliance. |

15 |

The Requesting Party or Principal can provide an activity log that tracks the activity of employees who request information or view SSA-supplied information in the company’s system, including the Form SSA-89s stored electronically. |

Type I: Failure to maintain the ability to track access to CBSV data and results, which prevents the completion of a compliance review as required by the User Agreement. Type II: The Requesting Party or Principal cannot track the activity of employees who request information or view SSA-supplied information in the company’s system, including the Form SSA-89s stored electronically. |

Suspension will be lifted after the applicable penalty periods only if the Requesting Party has provided evidence and SSA has determined that the noncompliance at issue has been resolved to SSA’s satisfaction. The Requesting Party must submit a corrective action plan within 30 days of the beginning of the suspension period.

OMB #0960-0760

APPENDIX A – External Testing Environment (ETE) – (For Web Service Users Only)

______________________________________________________________________

CBSV User Agreement

Between the Social Security Administration (SSA)

And

External-to-SSA Developers

For External Testing Environment (ETE)

______________________________________________________________________

The External Testing Environment (ETE) provides a dedicated test environment to be used by external-to-the Social Security Administration (SSA) developers for Consent Based Social Security Number Verification (CBSV) web services to test their software independent of SSA’s development activities. The ETE gives the external developers the flexibility to test on an “as needed” basis to make sure their software remains up-to-date and continues to provide accurate data on behalf of the public to SSA systems.

The purpose of this User Agreement is to establish the conditions, terms, and safeguards under which SSA will provide access to external-to-SSA developers for testing within the ETE.

-

Name

Description

SSA

Social Security Administration

External to SSA Developer (ETSSAD)

Employee designated by Requesting Party to process submissions.

Requesting Party

Company desiring to access and use the ETE as represented by an Officer or Employee of Company possessing authority to make legally binding commitments on behalf of the Company.

Application Sponsor

Owner of SSA application with authority to approve ETSSAD request

ETE Administrator

Employee responsible for the management of the External Testing Environment

Credentials

Personal Identification Number (PIN) and Password to access SSA systems.

The Requesting Party must secure, at its own expense, the necessary hardware, software, etc. to establish connection to the ETE. The Requesting Party must have, and must provide at its own expense, Internet access in order to access the ETE. The Requesting Party must provide SSA with a valid e-mail address for its representative so that SSA may communicate with the Requesting Party via email.

All Requesting Party site preparation, connection, and operating costs, as well as any other miscellaneous costs incurred by the Requesting Party to enable its participation in the ETE, are the responsibility of the Requesting Party.

SSA will give access to ETE documentation to the Requesting Party, which SSA may amend from time to time at its discretion without amendment to this User Agreement. The requirements for submitting files, checking status, and retrieving results are set forth in the User Guide.

In order to meet general expectations for participation, the ETSSAD will need to:

Execute test scenarios over a stated period on a repetitive basis to ensure connectivity to SSA systems.

Interpret test results and accurately report issues encountered during Web service testing in enough detail that they can be reproduced.

Provide feedback to SSA regarding the application’s reliability, stability, and user experience.

Provide feedback to SSA regarding product enhancements, documentation, and help systems.

Be able to react to SSA’s software changes.

Have technical team members available to work with the SSA technical team to troubleshoot and resolve any connectivity or compatibility challenges incurred during the testing process.

In order to meet the environment requirements the ETSSAD must:

Have a Web service development environment that supports development using a .NET and/or Java-based industry standard technologies.

Have a test environment that can be setup to connect to SSA’s testing environment. If necessary, the ETSSAD test environment should be configured to use digital certificates generated by SSA for testing purposes.

The Requesting Party must have the following technical expertise in developing Web service clients for external Web services that have the following characteristics:

Conformance to the World Wide Web Consortium (W3C) Web service standards (Simple Object Access Protocol (SOAP), Web Service Definition Language (WSDL), Web Service Security [WS-Security]).

A transport layer security using Hypertext Transfer Protocol Secure (HTTPS), using Secure Socket Layer (SSL) Certificates signed by well-known Certification Authorities (CAs).

Protected Web services that require the following authentication mechanisms:

Client Authentication using the Personal Identification Number (PIN)/Password as a part of the WS-Security SOAP header, and;

Strong Authentication (using X.509 Client Certificates), which authenticates the ETSSAD based on a digital signature over the SOAP body and timestamp element.

Experience in successful Web service testing.

The ETSSAD must work within SSA’s schedule constraints. The applicant therefore must be able to:

Perform testing during the agreed-upon time frame with help support available on weekdays between 9 A.M. and 5 P.M. Eastern Standard Time (EST),

Support a flexible test schedule, and

Participate in pre-scheduled technical status conference calls for the duration of testing.

The Requesting Party agrees to create electronic file(s) to be used to test an SSA developed web service. The Requesting Party may be asked to process SSA generated test data when required.

All requests will conform to the submission requirements outlined in the ETE documentation which the Requesting Party will have access to upon successful registration for access to the ETE.

The Requesting Party agrees to provide the name, phone number, email address, and timeframe for testing. Further, the Requesting Party agrees to notify SSA if there is any change to employment status (including but not limited to, for example, long-term absence, termination of employment, change of duties relevant to ETE) for any ETSSAD authorized to use ETE. The Requesting Party must also notify SSA if they wish to revoke any employee’s authorization to use SSA’s ETE. SSA will complete the registration process by issuing a unique access code by SSA to the Requesting Party. The Requesting Party must to provide this code to the ETSSAD as authentication of the employee’s relationship to the Requesting Party as well as proof of being authorized by the Requesting Party to submit such requests.

SSA may change its method of receiving verification requests and providing the results to the Requesting Party at any time. The Requesting Party must be responsible for any costs generated by SSA's decision to change its method of using the ETE.

The Requesting Party acknowledges that Section 1140 of the Social Security Act authorizes SSA to impose civil monetary penalties on any person who uses the words "Social Security" or other program-related words, acronyms, emblems and symbols in connection with an advertisement, solicitation or other communication, "in a manner which such person knows or should know would convey, or in a manner which reasonably could be interpreted or construed as conveying, the false impression that such item is approved, endorsed, or authorized by the Social Security Administration . . . ." 42 U.S.C. § 1320b-10(a); and