Form SBA Form 2181 SBA Form 2181 SBIC Program Application Instructions

SBIC Management Assessment Questionnaire & License Application; Exhibits to SBIC License App./Mgmt. Assessment Questionnaire

3245-0062 SBA Form 2181 SBIC Program Application Instructions 8-8-2023

SBIC Management Assessment Questionnaire & License Application; Exhibits to SBIC License App./Mgmt. Assessement Questionnaire

OMB: 3245-0062

409 3rd Street, SW • Washington, DC 20416 • (202) 205-6510

SBIC Program

Application Instructions – A 3-Step Process

Short Form 2181, Long Form 2181, Subsequent Fund Form 2181, Form 2181 Exhibits and Payments

As of August 7, 2023

Pre-Screen Form 2181 (Short):

MAQ Form 2181 (Long):

MAQ Form 2181 (Subsequent Fund):

MAQ Form 2181 Exhibits:

|

Format: Excel Excel Excel Excel

Excel Excel Excel Excel Excel Excel Multiple Excel Excel Excel Excel Excel Excel

Excel Excel Excel Excel Excel Excel Excel Multiple Excel Excel Excel

Excel/PDF Excel/PDF Excel/PDF Excel/PDF Excel/PDF Excel/PDF |

|

|

Table of Contents

Table of Contents 2

The SBIC Application Process 4

Pre-Screening 4

Management Assessment Questionnaire 5

License Application 6

Submitting Your Application 7

Pre-Screening 7

Management Assessment Questionnaire (MAQ) Application 7

License Application 8

Saving your Files for Submission 9

MAQ Application Instructions 10

General Instructions 10

Forms in Microsoft Excel 11

Form 2181: Info Release 11

Form 2181: Fund Overview 12

Form 2181: Investment Track Record 12

Form 2181: Small Business Impact 16

Form 2181: Covenant Defaults 17

Form 2181: Historical Cash Flows 18

Form 2181: Principal Bios 19

Form 2181: Applicant Economics and Time 20

Form 2181: Firm and Service Providers 20

Form 2181: Applicant Principals 21

Form 2181: References 21

Form 2181: Exhibit A Activities and Relationships 23

Form 2181: Exhibit B Individual Declarations 24

Form 2181: Exhibit C Significant Investor Declarations 24

Form 2181: Exhibit D Individual Legal Questionnaire 24

Final License Application Instructions 25

Form 2181: Exhibit E Legal Document Certification 25

Form 2181: Exhibit F Capital Certificate 25

Form 2181: Exhibit G Transferors Liability Contract 26

Fingerprinting 26

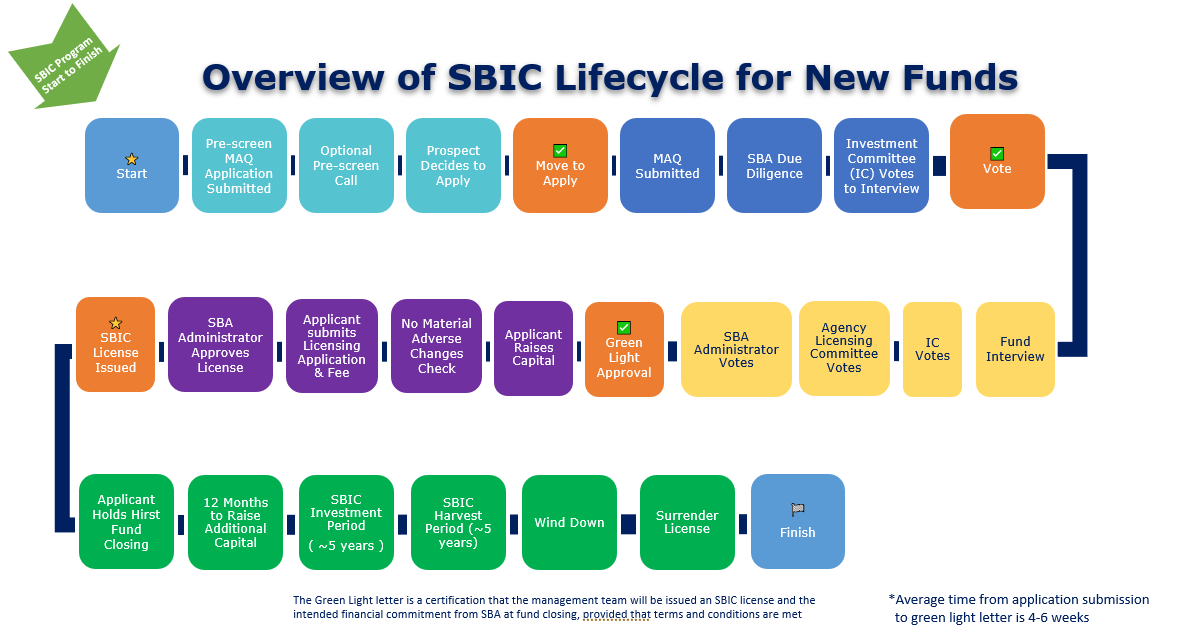

The SBIC Application Process

Applying for an SBIC license is a three-part process that consists of (1) a Pre-Screening review (“Short Form 2181”), (2) the submission of the Management Assessment Questionnaire (“MAQ”) (Long Form 2181 or Subsequent Fund Form 2181 and Form 2181 Exhibits) and MAQ fee and (3) the submission of the Final License Application and Licensing fee.

Privacy Act Statement

The Small Business Investment Act of 1958, as amended, 15 U.S.C. 661, et seq., authorizes the SBA to collect the information on this form, including personal, business, and financial background information by identifying number or other personal identifiers. Furnishing the information is voluntary. However, failing to provide all or part of the information may prevent SBA from making a determination of eligibility for participation in the SBIC program. The information collected may be released to appropriate Federal, State, and Local Agencies, credit bureaus, and Servicing agents when relevant to civil, criminal, or regulatory verification procedures. The information in this system is used on a routine basis exclusively by authorized officials. While the records are routinely used only for the purpose of analysis of information that supports the SBA’s risk management for the SBIC program, additional uses may be made in accordance with SBA 40, System of Records Notice, 2019-19153.pdf (govinfo.gov).

Pre-Screening

SBA provides an optional Pre-screen that prospective applicants may consider completing and submitting to SBA. This an optional step, but one that is highly recommended for first-time applicants to the SBIC Program. Prospective applicants are invited to submit a Pre-screen Form 2181 and receive feedback. The feedback is informal and non-binding, but it helps prospective applicants better understand SBA’s underwriting criteria and reassess their own fit with the program.

The Pre-screen 2181 contains a subset of forms contained in the full MAQ. Specifically the Short Form 2181 contains the following:

The Overview

Narrative

Investment Track Record

Principal Biographies

Completing this form can help prospective applicants prepare for the Management Assessment Questionnaire (MAQ) without incurring the cost of the MAQ Application Fee. This information gives background context to aid SBA in providing informal feedback.

Management Assessment Questionnaire

Once you have decided to move forward with the application process, the next step is to prepare and submit the MAQ, which consists of the following:

Form 2181 (Long Form or Subsequent Fund Form)

Form 2181 Exhibits A - D

Attachments/Supplemental Materials

Payment of Initial Licensing Fee / “MAQ Fee”),

After receipt of your MAQ (including payment of the Initial Licensing Fee / “MAQ Fee”), a Licensing Investment Analyst and SBA Legal Counsel will be assigned to review your application.

Please carefully note all forms, exhibits and other documents required for submission as part of the MAQ Application as a Resubmission Penalty Fee of $10,000 (see 13 CFR § 107.300) can be assessed to an applicant that has previously withdrawn or is otherwise not approved for a license that must be paid, in addition to the Initial and Final Licensing Fees at the time that such applicant resubmits its application. SBA, in its discretion, may waive this fee in extraordinary circumstances.

After the interview, the Investment Committee will again consider whether your management team has the experience and skills necessary to manage an SBIC. If they vote affirmatively, your application will be reviewed by the SBA Agency Licensing Committee for approval. If the SBA Agency Licensing Committee votes affirmatively, the SBA Administrator will vote on your application. If approved by both Committees and the SBA Administrator, your application will be approved for a “Green Light” letter inviting you to submit a final License Application once sufficient capital has been raised to hold an initial closing. The “Green Light” letter will also contain information regarding SBA’s “Total Intended Leverage Commitment” as a dollar amount and ratio of private capital to SBA leverage to the Applicant based on the Applicant’s stated target fund size. If the target fund size is not reached, SBA’s Total Intended Leverage Commitment dollar amount will be calculated based on the ratio outlined in the “Green Light” letter.

An Applicant may hold multiple closings within 12 months of its initial closing based on the date of formal SBA license approval. A final close must be held within 12 months of receipt of formal SBA license approval. A fund may not accept additional capital commitments 12 months after the date of formal SBA license approval.

Subsequent Funds

Applicants who meet all eligibility criteria under 13 CFR § 107.305 for Expedited Subsequent Funds Licensing, may apply using the Subsequent Funds Form 2181 which is comprised of a subset of the forms required in the Long Form 2181.

License Application

The License Application builds upon the previously submitted MAQ and includes additional forms and documentation. The entire package includes the following:

Form 2181 (UPDATED to include any changes since the Green Light Letter)

Form 2181 Exhibits A - D (UPDATED to include any changes since the Green Light Letter)

Form 2181 Exhibits E - G

Copies of all final legal documents + redlined copies detailing any and all changes to previously submitted legal documents

Payment of all application and Final Licensing Fee and other fees which may at that time be due (e.g., the Resubmission Penalty Fee, if applicable and if not already paid)

Upon receipt of the License Application and full payment all Licensing Fees, a Licensing Investment Analyst and SBA Legal Counsel will review the materials and recommend whether the SBA’s Agency Licensing Committee and SBA Administrator vote stands or whether there is evidence of material adverse changes which would trigger a revote. If no material adverse changes are identified, the License Application will be submitted to the SBA Administrator for formal final approval.

Throughout this process, from Pre-Screening through Licensing, you will be working closely with the analysts and managers of SBA’s Office of Investment and Innovation. At various times, you may receive both informal questions and formal SBA Comment Letters. Prompt and courteous replies will minimize delays in licensure.

Submitting Your Application

Pre-Screening

Once the Pre-screen (Short Form 2181) is completed, prospective applicants may submit the Pre-screen (Short Form 2181) via e-mail to [email protected] with the subject line “Pre-screen: MM/DD/YYYY: Name of Prospective Applicant”. If considering the SBIC Critical Technologies (SBICCT) Initiative the subject line should state “SBICCT Pre-screen: MM/DD/YYYY: Name of Prospective Applicant”.

You will be notified of the receipt of your Pre-screen form via e-mail within 2-4 working days, and SBA may follow up to offer the opportunity to share informal and non-binding feedback related to SBA’s underwriting criteria and program considerations.

Management Assessment Questionnaire (MAQ) Application

Once the applicant has compiled and completed all forms, documents, exhibits, and attachments that are required as part of the MAQ, the applicant must follow the steps below to properly submit the MAQ. Please note that your MAQ should be submitted electronically. Hard copies will not be accepted. For the MAQ application to be considered complete and ready for review, all elements and attachments listed in the Management Assessment Questionnaire (MAQ) and related exhibits must be submitted, and the requisite application fee must be paid. SBA requires all license application fees be remitted via the Pay.Gov website.

Compress your MAQ files into a single or multiple “ZIP” files and e-mail them to [email protected] using the subject line “MAQ: MM/DD/YYYY: Name of Applicant”. Please be aware that any single e-mail exceeding 10 MB will be rejected by SBA’s e-mail network due to size restrictions. If necessary, submit your files in a series of e-mails, identifying each part in the subject line as follows: “MAQ: MM/DD/YYYY: Name of Applicant (Part # of #)”

Each principal should sign and date the certification and declaration Exhibits of the Form 2181. Submit approved digitally signed PDF versions of the certification and declarations along with Excel versions.

Pay the MAQ “Initial Licensing Fee” via the Pay.Gov website: https://www.pay.gov/public/home. Select "Small Business Administration" under Agencies, then click on "SBIC Fees" and fill out the pop-up form. You will be notified of the receipt of your application via e-mail within 2-4 working days. Initial Licensing Fees are as specified in 13 C.F.R. § 107.300. Initial Licensing Fees as of the publish date of this document are as follows:

Fund Sequence |

Initial Licensing Fee |

Fund I |

$5,000 |

Fund II |

$10,000 |

Fund III |

$15,000 |

Fund IV+ |

$20,000 |

License Application

Follow the steps below to properly submit your License Application (Final Licensing Fee, Form 2181, remaining exhibits and legal documents):

Update your MAQ Form 2181 and 2181 Exhibit submissions as necessary, prefacing any changes you make using red font. Summarizing all changes in the body of the email submission will also assist in helping the Licensing Investment Analyst and SBA Legal Counsel in quickly identify areas in need of review.

Compress your License Application files into a single or multiple “ZIP” files and e-mail them to [email protected] using the subject line “License Application: MM/DD/YYYY: Name of Applicant”. Please be aware that any e-mail exceeding 10 MB will be rejected by SBA’s e-mail network. If necessary, submit your files using a series of e-mails in order to bypass the size restriction.

Pay the required License application fees via the Pay.Gov website: https://www.pay.gov/public/home. Select “Small Business Administration” under “See All Agencies”, then click on “SBIC Fees” and fill out the pop-up form. You will be contacted by SBA within 2 business days once your fee payment has cleared. Your License Application submission date is based on receiving Final Form 2181, Form 2181 Exhibits, legal documents, and the date of fee payment on Pay.gov. If documents are submitted but fees have not been paid, the License application will not be considered “submitted.” All fees must be paid at the time of document submission.

Final Licensing Fees are as specified in 13 C.F.R. § 107.300. As of the publish date of this document, the Final Licensing Fee is calculated as the “Final Licensing Base Fee” plus 1.25 basis points multiplied by the Leverage dollar amount being requested by the applicant and conditionally approved by SBA, communicated as the “Total Intended Leverage Commitment.” As the fee is based on the amount being requested, the Applicant will multiple the Total Intended Leverage Commitment dollar amount provided at the time of Green Light approval by 1.25 basis points and add this amount to the Final Licensing Base Fee, where the Final Licensing Base Fee is based on the applicant’s Fund Sequence as follows:

Fund Sequence |

Final Licensing Base Fee |

Fund I |

$10,000 |

Fund II |

$15,000 |

Fund III |

$25,000 |

Fund IV+ |

$30,000 |

Saving your Files for Submission

The list below provides guidance on how you should name each of the files included in your application. Using these file naming conventions will help your SBA analysts quickly identify the materials in your application. The text in bold should be replaced with your information:

Form 2181:

Form 2181 –(Applicant Name).xls

Exhibit “X” –(Applicant Name).xls or .docx

For the attachments requested in of the checklist of Form 2181, please use the following file naming convention:

Form 2181 Attachment – (Applicant Name) _ (Title of Document).xxx

MAQ Application Instructions

General Instructions

Before you begin compiling completing the MAQ application, SBA recommends reading these general instructions. For assistance with any questions during the preparation of your responses, send an e-mail with your question to [email protected] and include your name, the name of your firm, investment strategy, and a phone number at which you can be reached.

The completion of the SBIC Application Materials requires the following two computer software programs:

Microsoft Word (version 2010 or later)

Microsoft Excel (version 2010 or later)

The instructions that follow provide guidance on how to complete the forms using these two programs. If you do not have access to Word or Excel, please contact SBA via e-mail at [email protected] for guidance.

Defined Terms

The MAQ application contains terms that carry special meaning within the context of the SBIC Program:

Use of the term “SBIC:” This term refers to a proposed SBIC if you are submitting a MAQ application or a final License application.

Use of the term “principal:” This refers to any individual who engages or proposes to engage in the management of the applicant, and customarily includes officers and directors of a corporation, general partners of a partnership and managers of a limited liability company. However, it may also include other individuals, especially if they have either a vote or a veto in any investment decision. Whether one qualifies as a principal is based upon authority, responsibility and actions. Title is not determinative, and, in its sole discretion, SBA may determine that a person with a relationship to the SBIC is a principal.

Regulatory Terminology: When the application refers to specific sections of SBA regulations, you should read those particular sections of the regulations before composing your response. Where you find words capitalized that are normally not capitalized in ordinary usage, it indicates that this is a defined term with a specific meaning within SBA regulations. See 13 C.F.R. § 107.50. For example, you may find the term Associates used in some questions. This term, which describes certain categories of related parties, is defined in 13 C.F.R. § 107.50 and should be read carefully.

Forms in Microsoft Excel

With the exception of Exhibit G and attachments, the entire SBIC Application should be prepared using Microsoft Excel.

Applicants are encouraged to draw from existing materials in preparing their SBIC application. The content you have already prepared for your Private Placement Memorandum or Limited Partner (LP) “pitch decks” may be useful in completing the application. However, you must ensure that your responses are direct, complete, and concise. Failure to provide any requested information or the use of unnecessarily long responses may delay the review of your application.

The forms make use of checkboxes, dropdown lists, and auto-population of data values based on prior entries. Where you see a series of boxes and dropdown lists, click on the appropriate response.

DO NOT edit the section headings or add values to predefined dropdown lists used in the application document.

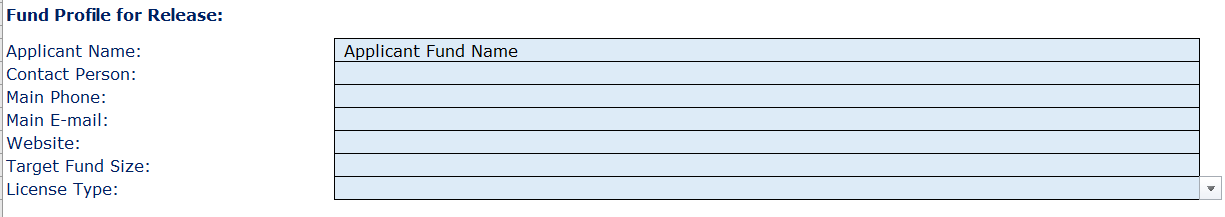

Form 2181: Info Release

On the worksheet labeled “Info Release,” please enter the name of the SBIC Applicant and the name of the contact person at the SBIC application.

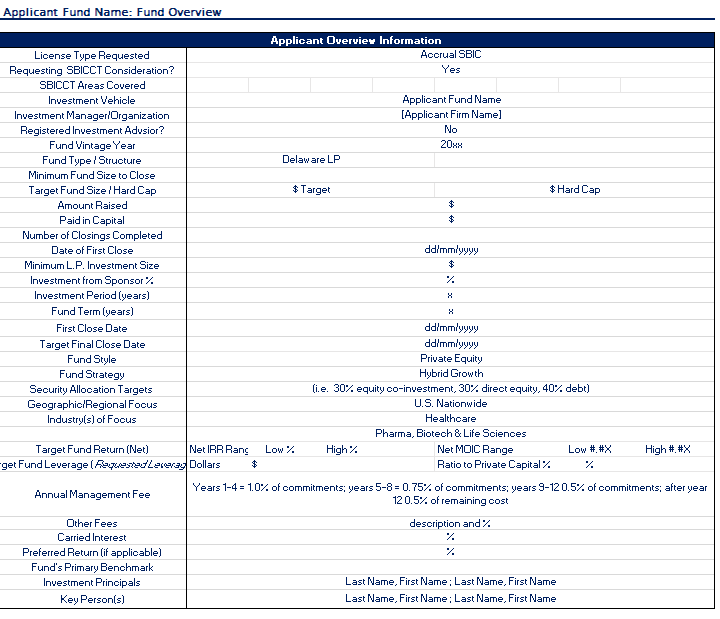

Form 2181: Fund Overview

On the worksheet labeled “Fund Overview,” please enter all information available at the time of MAQ submission. SBA is aware that information is likely to change between MAQ application submission and final License application submission, particularly related to close dates, amount raised and target fund size.

Form 2181: Investment Track Record

Assessing the Investment Track Record is critical to the analysis of your team’s qualifications for an SBIC application and should be completed with care. SBA will treat your investment track record submission as a representation of your complete investment experience. The investment track record should be used to present experience that meets the SBIC program regulations under section § 107.305 outlined below and should align to the investment strategy of the proposed Applicant fund:

§ 107.305 Evaluation of license applicants.

(a) Management Qualifications. Management qualifications, including demonstrated investment skills and experience as a principal investor, or a combination of investment skill and relevant industry operational experience; business reputation; adherence to legal and ethical standards; record of active involvement in making and monitoring investments and assisting portfolio companies; managing a regulated business, if applicable; successful history of working as a team; and experience in developing appropriate processes for evaluating investments and implementing best practices for investment firms.

(b) Demonstrated Investment Acumen. Performance of proposed investment team’s prior relevant industry investments as well as any supporting operating experience, including investment returns measured both in percentage terms and in comparison to appropriate industry benchmarks; the extent to which investments have been realized as a result of sales, repayments, or other exit mechanisms; evidence of previous investment or operational experience contributing to U.S. domestic job creation and, when applicable, demonstrated past adherence to statutory and regulatory SBIC program requirements.

Investment Track Record Eligibility

Prepare an Investment Track Record for all funds or individual investments in which your decision-making role meets the following criteria:

You were a voting member of the investment or credit committee responsible for approving the investment, or

You were the “deal lead,” responsible for conducting the due diligence, structuring the investment, presenting the opportunity to the investment committee, and monitoring the transaction post-close.

If the principals of the Applicant do not have investments for which they held responsibilities as a voting member or deal lead, clearly indicate the role each principal had relative to the investments listed on the “Track Record” tab.

Financial Analysis/Market Research

Lead Structuring

Lead Due Diligence

Made Investment Recommendation to Investment or Credit Committee

Member of Investment or Credit Committee

Negotiation of Deal Terms

Member of Board of Directors of the Portfolio Company

Officer of the Portfolio Company

Board Observer of the Portfolio Company Board

Managed the Exit Process

While SBA places the greatest weight on investment experience gained as a principal in a traditional fund environment, we recognize that other types of experience may be relevant based on the investment strategy of the Applicant. If you have made investments on a “one-off” basis, but your track record lends itself to being viewed as if it were an actual fund, you may present a “synthesis” of those transactions. A Synthetic track record should include all qualifying investments currently held or which were terminated within the last ten years. You may include investments made:

Individually with your personal funds.

Through an entity for which you had discretionary voting authority, such as a trust of which you were the trustee.

Through an entity (such as a limited partnership or LLC) that was formed for the specific purpose of making the investment, where you had decision-making authority over all aspects of the investment as general partner or managing member and were primarily responsible for raising the entity’s capital from investors.

The dollar amount listed for your investment should be limited to amounts over which you or your organization held discretion or authority. For investments made as part of a club or syndicate, do not include investment dollar amounts other than your own.

Use the “Notes” section to explain the criteria you used to select the investments included in the exhibit.

General Data Entry Guidelines

Where necessary, you may add rows to the Investment Track Record tab. To ensure the formulas work correctly, always add rows above the last row in the table. To do so, select the last row in the table, right-click, and then select “Insert Row” from the menu that appears.

Any numbers you input should be rounded to the nearest dollar.

Definition of Key Terms

Portfolio Company |

Lists the name of the portfolio company |

Debt or Equity |

Indicate whether the security purchased is a ‘Debt’ security or an ‘Equity’ security. |

Type of Security |

Specify the type of security purchased. A drop-down menu has been provided as a guide, but you may enter your own description of the security. Examples include subordinated debt, subordinated debt with warrants, common equity, preferred equity, etc. |

Percentage Ownership (fully diluted) |

Indicate the ownership percentage, on a fully diluted basis, associated with the security. If the security does not include any ownership stake in the company, please leave the cell blank. |

Current Pay Component (CP/”Blank”) |

Indicate whether the security was structured with a current pay component at issuance. Current pay includes cash payments only, such as periodic interest payments or dividends. It does not include PIK, accrued interest, accrued dividends or other types of capitalized proceeds. Select “CP” if the security was structured with current pay at issuance. Leave the cell blank if it was not structured with current pay. |

Senior Leverage Multiple (Senior Debt/EBITDA) |

This multiple should be calculated based on the company’s balance sheet at transaction close. To calculate this multiple, divide the total amount of senior debt on the company’s balance sheet by the company’s Last Twelve Months (LTM) EBITDA as of the transaction close. |

Total Leverage Multiple (Debt/EBITDA) |

To calculate this multiple, divide the total amount of debt capital on the company’s balance sheet (on a post-close basis) by the company’s LTM EBITDA as of the transaction close. |

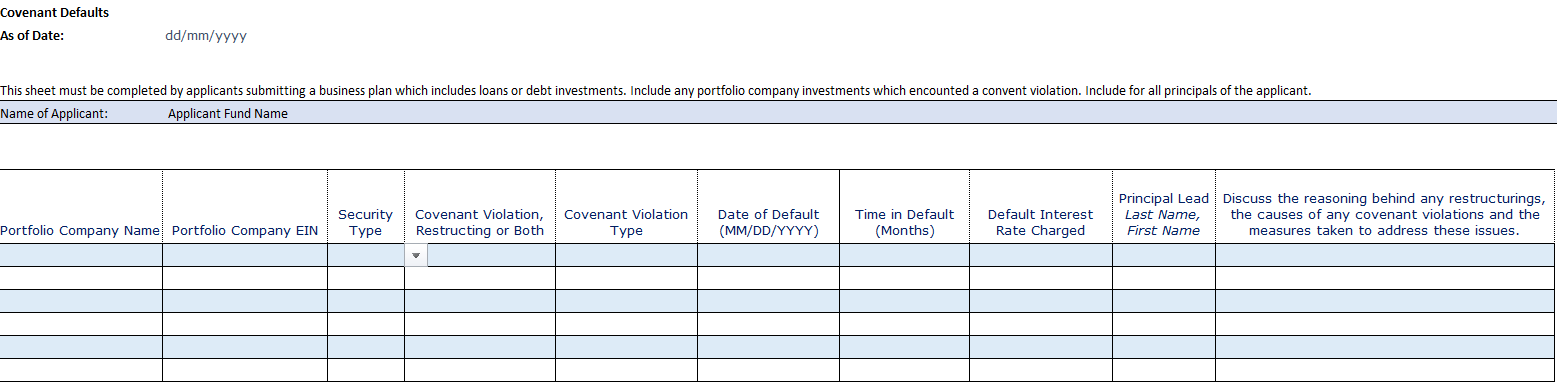

DEBT ONLY: Covenant Violations (CV), Restructuring (RS) or both |

This information should be provided only for debt securities. Indicate whether at any time in the life of this security the company (i) violated a covenant (CV), (ii) the security was restructured (RS), or (iii) experienced both. Please note that if you indicate the company violated a covenant or the security was restructured, you will be asked for provide a brief explanation in worksheet ‘E1-D. Covenant Default’ |

Exit Type |

This information is requested for realized/liquidated securities only. Use the drop-down menu to select the type of exit used to liquidate this security. If none of the options provided are appropriate, please enter your own 1–2-word term identifying the type of exit. |

Date of Initial Investment |

Provide the month and year the security was issued. You may enter the precise day (DD/MM/YYYY), but the spreadsheet will only display the month and year. |

Date of Exit (if realized) |

This information is requested for realized/liquidated securities only. Leave this cell blank for unrealized financings. Provide the month and year the security was liquidated. You may enter the precise day (DD/MM/YYYY), but the spreadsheet will only display the month and year. |

Realized/Unrealized |

Please indicate whether the security has been realized, including any warrants (R) or remains unrealized (U). A security has been “realized” if the following has occurred:

|

Total Financing Amount |

Enter the total, cumulative dollar amount of financings made using this type of security. Please be precise as this information will be used in calculating the fund’s performance metrics. Round the amount to the nearest dollar. For example, $50,350,200 should be entered as ‘50350200’ and NOT as 50.4 or $50.35M |

Form 2181: Small Business Impact

This worksheet requests data specific to each company included in the portfolio. Please begin the list with those companies in which your investments have been fully exited, followed by those in which you have exited one security but still hold another, then finish with those companies in which none of your investments have been fully exited.

Definition of Key Terms

Portfolio Company |

Enter the name of the portfolio company. Please note, this is the only worksheet in which you will be able to provide the names of your portfolio companies. These names will be carried through the remainder of the spreadsheet to ensure consistency. |

Industry |

Select the company’s industry from the drop-down. If none of the options are appropriate, please type-in your own industry classification. |

Description of products/services |

Use 4-5 words to describe the product or service this company provides. |

Deal Source |

Use the drop-down menu to select the source of this transaction. If none of the options provided are appropriate, please enter your own 1–2-word term identifying the source of the deal. |

Co-Creditors (if applicable) |

Enter the names of the company’s creditors during the period in which you were an investor in this company. Separate multiple names with a comma. |

Equity Investors (if applicable) |

Enter the names of any equity sponsors or other major equity holders present during the period in which you were an investor in this company. Separate multiple names with a comma. |

Form 2181: Covenant Defaults

The securities you indicated had covenant violations or which were restructured will automatically appear in the first column of this worksheet. Please complete the information requested.

Definition of Key Terms

Covenant Violation Type |

This information is requested only for those securities that experienced covenant violations. Identify the covenant(s) that were violated. |

Time in Default (Months) |

This information is requested only for those securities that experienced covenant violations. Indicate the number of months in which the company was in default on its covenant(s). |

Default Interest Rate Charged |

This information is requested only for those securities that experienced covenant violations. If the company was charged a default rate of interest, please indicate what rate it was charged. |

Principal Lead |

Please indicate which principal(s) within your firm took the lead in addressing the covenant violations with company management and co-investors or leading a restructuring. If responsibility for these activities was handled primarily by co-investors, leave blank. |

Discuss the reasoning… |

As explained in the exhibit, please discuss the reasons why the company defaulted on its covenants, what caused it to miss payments or why the security was restructured. Further, describe any measures taken to resolve the issues that caused the default or restructuring. These explanations should be brief. The SBA analyst assigned to review your application will request additional information if necessary. |

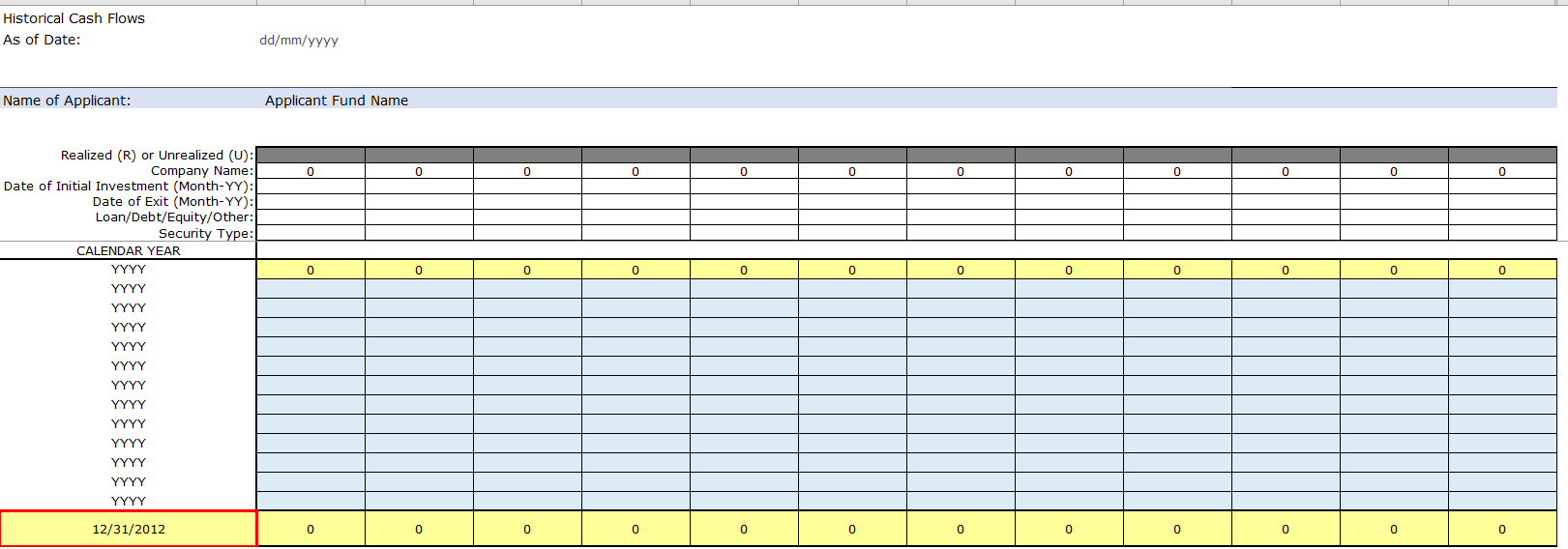

Form 2181: Historical Cash Flows

SBA Licensing Investment Analysts use the ‘Historical Cash Flows’ tab to assess the historical performance of your portfolio. To complete this tab in the workbook, please follow the steps outlined below:

Verify Prior Entries: To avoid errors and frustration, please ensure that you have properly completed all prior worksheets contained in Form 2181.

Enter Valuation Date: Enter the last day of the Valuation Quarter using the format MM/DD/YYYY (Q1: 03/31/YYYY, Q2: 06/30/YYYY, Q3: 09/30/YYYY, Q4: 12/31/YYYY).

The Valuation Quarter is the last day of the quarter in which the unrealized positions in your track record were valued.

Once you enter the Valuation Quarter, all prior dates will adjust automatically.

Enter Cash Flows: Each investment security you identified is included in this worksheet and has a column dedicated to its historical cash flow schedule. Based on the investment and exit dates you provided, the cells corresponding with each investment’s hold period should be highlighted in yellow.

Beginning with the quarter in which the security was initially issued, enter the net annual cash flows associated with the investment security. Net cash outflows should be entered as negative numbers and cash inflows should be entered as positive numbers. You should only include cash flows associated with the investment security itself. Consulting fees, investment banking fees, board fees or any other service fees charged to portfolio companies should not be included in these schedules.

Enter Residual Values: Once all the net cash flows have been recorded through the Valuation Quarter, you should next enter the value of all unrealized positions. Enter the full “residual value” of each unrealized investment security as of the Valuation Quarter.

For debt securities structured with warrants, include the value of any outstanding warrants in the full “residual value”, but also indicate the value of the warrants alone.

Review: Verify the data presented below the cash flow schedules for each security, as well as the fund level performance information presented in the bottom right corner of the worksheet. Ensure these numbers are consistent with your own estimates. If there are inconsistencies, consider the following:

The IRR calculation used in this worksheet annualizes the results of Excel’s IRR function. It does not use Excel’s XIRR function, which employs the exact dates on which each cash flow occurred. The difference in method may be a source of discrepancy.

The “Multiple of Invested Capital” is a cash-on-cash calculation that uses the “Investment Amount” you entered as the denominator. If you failed to enter the exact, cumulative amount invested in each security type, the multiple may not be accurate.

For other problems, you are encouraged to contact SBA for guidance. Reach out to your Licensing Investment Analyst or send an e-mail with your name, the name of your firm and your phone number to [email protected].

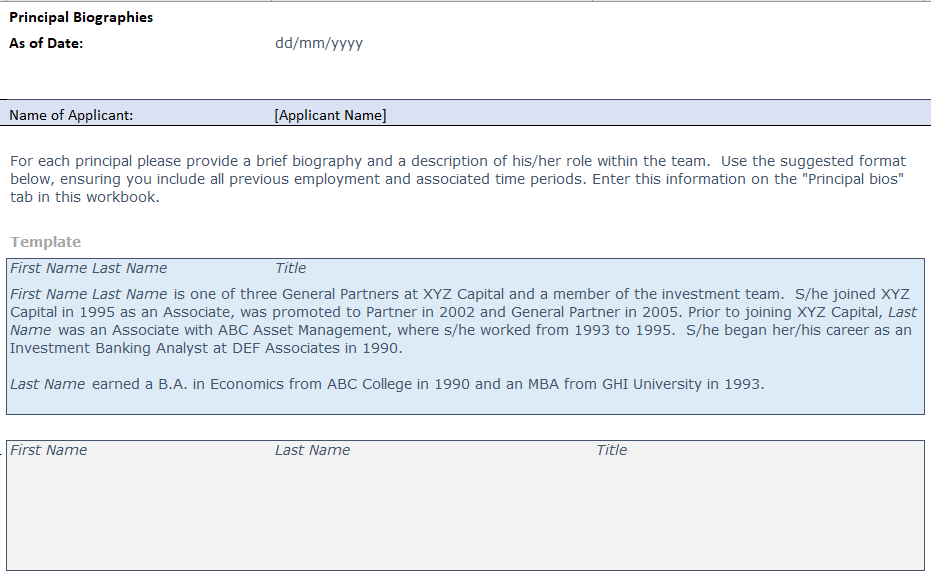

Form 2181: Principal Bios

Provide a biography following the template provided for each Principal of the Applicant.

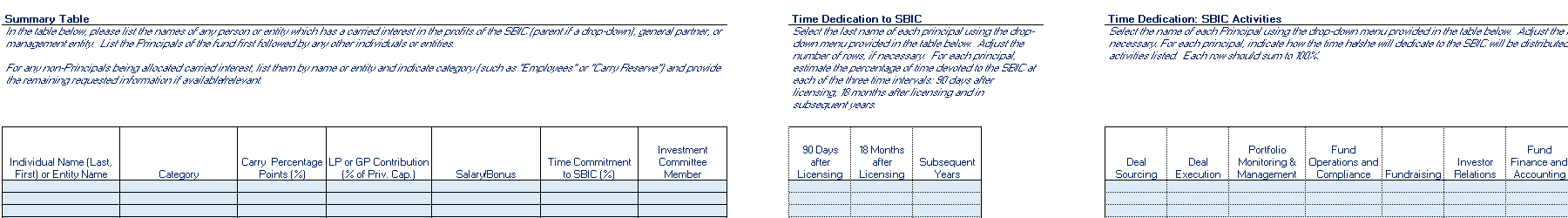

Form 2181: Applicant Economics and Time

For all individuals and entity participating in the carry economics of the Applicant, list names and complete the requested fields with respect to category of the participant, carry percentage points, contribution to the limited partnership or general partnership and complete all other fields to the extent applicable.

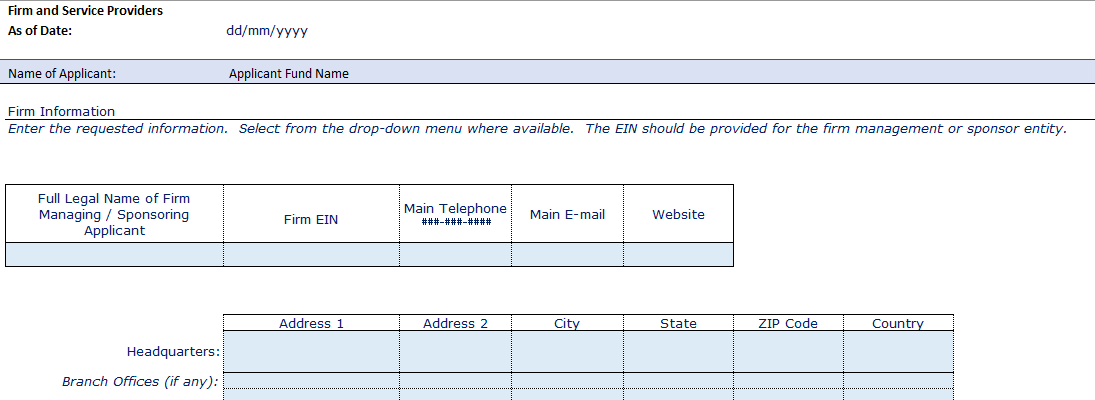

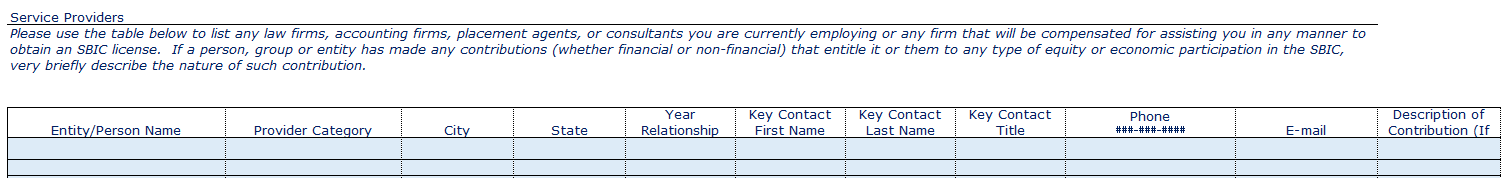

Form 2181: Firm and Service Providers

Provide requested information regarding the firm managing or sponsoring the Applicant. List the service providers the Applicant is working with. Not necessary, but to the extent possible, list service providers the Applicant intends to work with upon Licensing.

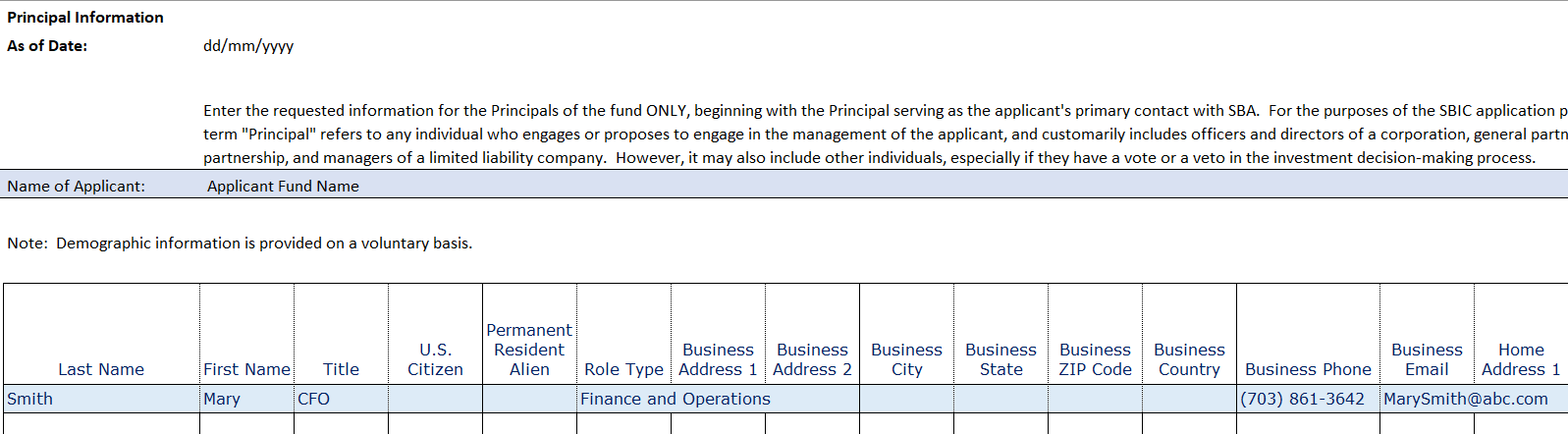

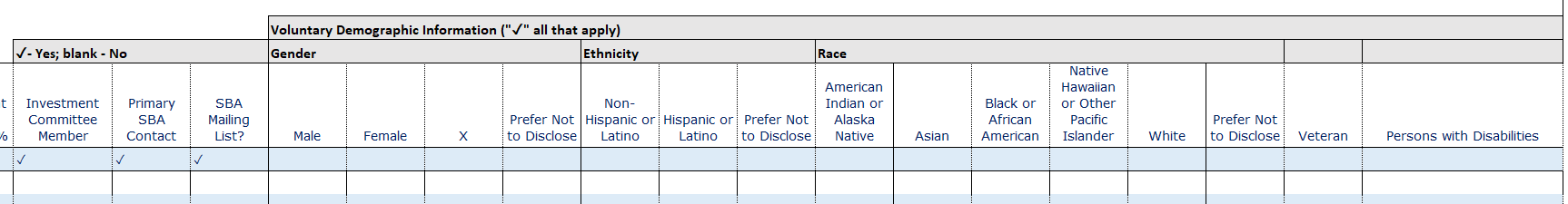

Form 2181: Applicant Principals

List the name, title, role, contact details, citizenship, and demographic information (voluntary) of the Applicant Principals. Note: all demographic information is entirely voluntary, and this information is not a factor or condition of Green Light Approval or Licensing.

Form 2181: References

The due diligence process is a key component of SBA’s underwriting process and involves confidential calls to references familiar with your qualifications and background. Use the guidance below to compile a list of references for each of the principals included in your SBIC application. Avoid overlapping references. If a person can serve as a reference for two or more principals, simply associate him/her with one principal and include a note in the “Notes” column. You should consolidate each principal’s references and submit only ONE file for the entire team. DO NOT submit separate files for each principal.

Each principal should include five (5) references from the following categories:

Supervisors/Partners

Associates/Peers/Subordinates

Portfolio Company Co-Investors (Co-lenders, Deal sponsors)

Fund Investors

Limited Partners

Each principal or team should also provide the following:

A full roster of portfolio company CEOs or CFOs for each of the companies included in the Track Record spreadsheet. These references should be the primary individuals with whom you or your team dealt during the period of your investment. Provide the most recent contact information you have available and associate the relevant principal with each CEO/CFO.

Provide the contact information for any employees of the SBIC applicant’s firm that have departed within the last five (5) years.

Please Note: SBA’s due diligence process involves reference calls to both "on-list" references you have included as well as to "off list" references SBA Licensing Analysts themselves identify.

While SBA Licensing Analysts will generally contact you before making reference calls, this may not always be the case. Please be aware that the reference calling process may begin immediately upon SBA's receipt of your application. If you have any special concerns about SBA contacting current employers, current partners, or any other on- or off-list references, please notify SBA in advance of submitting your application.

References Worksheet:

Definition of Key Terms

Principal: |

From the drop-down list, select the principal with whom the reference is associated. |

Firm/Organization: |

Enter the name of the Firm or Organization the reference individual was associated with at the time of the reference period. |

First Name: |

Enter the first name of the reference. |

Last Name: |

Enter the last name of the reference. |

Title: |

Enter the current title of the reference. |

Current Firm: |

Enter the name of the firm at which the reference is currently employed. If the reference is not employed, please indicate “retired,” “unemployed” or another relevant term. |

Reference Type: |

From the drop-down list, select the reference type. If the reference does not fit within one of the categories provided, type-in your own category. |

Associated Fund/Company: |

Enter the name of the fund or company at which the Principal was employed when he/she worked with the reference. For example, if the reference was a co-investor in a deal the principal completed while working for “SBIC Investors I, LP,” you would enter in this cell “SBIC Investors I, LP” |

Associated Portfolio Company: |

If the relationship between the principal and the reference involved a particular portfolio company included in Exhibit E1 or E2, please enter the name of the portfolio company. For example, if the reference was the CEO of a company in which the principal’s firm was an investor, you would enter the name of that company in this cell. |

Start Year of Relationship: |

Enter the year in which the relationship with the reference effectively began. |

End Year of Relationship: |

Enter the year in which the relationship with the reference effectively ended. |

Notes: |

Briefly explain the context of the relationship and any other notes that may be relevant. |

Form 2181: Exhibit A Activities and Relationships

This certification of Activities and Relationships form is to be completed by each of the principals and control persons of the applicant, signed with the submission of an SBIC MAQ, and resubmitted in the event of material changes at the time of final License Application. If any new principals (as defined in the application instructions) or Control Persons (as defined in 13 CFR §107.50) are added to the firm after submitting the MAQ, a certification signed by the new principal or Control Person must be submitted to SBA. If a new principal or new Control Person is to be added to the SBIC after it is licensed, a certification signed by the new principal or Control Person must be submitted to SBA. Submit the Excel version of the file and save and submit a version in PDF format including an approved digital signature.

Form 2181: Exhibit B Individual Declarations

This declaration is to be completed by each of the principals (as defined in the application instructions) and Control Persons (as defined in 13 CFR §107.50) of the applicant, signed with the submission of an SBIC MAQ, and resubmitted in the event of material changes at the time of final License Application. If any new principals or Control Persons) are added to the applicant after submitting the MAQ, a declaration signed by the new principal or Control Person must be submitted to SBA as soon as possible in order to reduce licensing delays. If a new principal or new Control Person is to be added to the SBIC after it is licensed, a declaration signed by the new principal or Control Person must be submitted to SBA as soon as possible. Submit the Excel version of the file and save and submit a version in PDF format including an approved digital signature.

Form 2181: Exhibit C Significant Investor Declarations

This declaration must be signed by each investor of 50% or more of the ownership interests of the applicant (“Significant Investors”) if that investor is not required to sign the "Principal and Control Person Declarations."

SBA anticipates many Applicants may not have Significant Investors ready to commit at the time of MAQ Application submission. However, if the Applicant has a letter of intent to commit from an investor in the Applicant of 50% or more at the time of MAQ submission, Exhibit C should be completed and submitted with the MAQ Application.

Submit the Excel version of the file and save and submit a version in PDF format including an approved digital signature.

Form 2181: Exhibit D Individual Legal Questionnaire

Submit this exhibit for each Principal, ensuring that each Principal has answered all questions set forth in this Exhibit D. If the answer to any question is “yes”, you should furnish complete details and provide any necessary attachments. Include all pertinent information, including, name(s) under which charged, dates, locations, titles of proceedings, docket numbers, fines, and penalties (paid and unpaid), sentences, type of offense (misdemeanor or felony), dates of parole/probation, names of mediators, arbitrators or other alternative dispute resolution professionals, and relevant documents. For the purposes of this exhibit, a “substantial ownership interest” in an organization is considered to be an interest, direct or indirect, of 20% or more in equity interests, voting interests, or profit interests. The term “senior management” generally refers to meaningful participation in budget or investment decisions, including participation as a member of the board of directors. If you have questions about whether or not you would have been considered part of senior management, discuss the issue with SBA. This exhibit must be signed when submitted as part of either a MAQ Application and/or a Final License Application. Any changes in the responses between the MAQ Application and the Final License Application should be noted and explained.

Submit the Excel version of the file and save and submit a version in PDF format including an approved digital signature.

Final License Application Instructions

Once the Applicant has:

Sufficient private capital raised to hold a first close to satisfy the requirements of 13 CFR 107.200 and 107.210,

Completed updates to forms, exhibits, and attachments previously submitted as part of the MAQ,

Compiled all new investor agreements and legal documents, and

Completed Exhibits E, F & G,

then the Applicant is ready to submit the Final License Application and pay the Final Licensing Fee. The Final License Application must include:

Final updates to Form 2181, Exhibits and all prior document submissions including redlines of all changes

All Investor and Owner Agreements (including all side letters)

Offering Memoranda and Other Documents

Organizational Documents of the Applicant

Opinions of Counsel

Management Services and Other Agreements

Bank Letters and Third-Party Debt Agreements

Legal Document Certification (Exhibit E)

Capital Certificate (Exhibit F)

Any Guaranty Agreements

Transferors Liability Contract (Exhibit G)

Fingerprint Cards

Final Licensing Fee payment

Form 2181: Exhibit E Legal Document Certification

Exhibit E Legal Document Certification concerning the Applicant’s legal documents and certification of no material adverse changes must be completed and signed by either a principal of the Applicant or (with respect to the Legal Document Certification) the Applicant’s legal counsel and submitted with the Applicant’s final, fully-executed legal documents prior to SBA’s approval of the Applicant’s Final License Application.

Submit the Excel version of the file and save and submit a version in PDF format including an approved digital signature.

Form 2181: Exhibit F Capital Certificate

You must submit a signed Capital Certificate with your license application showing that the minimum Regulatory Capital and Leverageable Capital requirements has been met.

Follow the instructions as outlined on the “instructions” section and the “reps and warranties” section in Exhibit F. Submit the Excel version of the file and save and submit a version in PDF format including an approved digital signature under the reps and warranties section.

Form 2181: Exhibit G Transferors Liability Contract

This Transferor’s Liability Contract is to be executed by (i) each principal of the SBIC, in his/her individual capacity, (ii) each person, in his/her individual capacity, who will own or control, directly or indirectly, 50% or more of the Private Capital of the SBIC (as defined in 13 CFR §107.230), (iii) each entity that will own or control, directly or indirectly, 50% or more of the Private Capital of the SBIC, (iv) each person, in his/her individual capacity, who will own or control, directly or indirectly, 10% or more of the Private Capital of the SBIC and will participate in investment decisions of the SBIC (e.g., participation on the SBIC’s Investment Committee), and (v) each entity that will own or control, directly or indirectly, 10% or more of the Private Capital of the SBIC and will have a nominee who participates in investment decisions of the SBIC.

Fingerprinting

All Principals of an SBIC Applicant are required to submit fingerprints to the SBA as part of an SBIC license application. Principals can register by accessing the SBA fingerprinting website: https://www.applicantservices.com/sba/. Once on this page, select “SBA SBIC” and follow the registration steps.

This website will use the individual’s address to provide nearby locations where the individual can schedule an appointment to have electronic fingerprints taken. Once fingerprints are scanned, they will automatically be submitted to the SBA, without any further action by the individual.

For individuals who do not live near an electronic fingerprinting provider, the SBA will continue to permit paper-and-ink fingerprints. If, following registration, the website determines that local electronic fingerprinting is not available to an individual, it will provide additional information and forms to help that individual submit paper-and-ink fingerprints.

Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | JFinkel |

| File Modified | 0000-00-00 |

| File Created | 2023-08-18 |

© 2026 OMB.report | Privacy Policy