ETA 8623-A ETA Handbook No. 336, 18th Edition

Unemployment Insurance State Quality Service Plan Planning and Reporting Guidelines

ETHandbook33618thEdChg5_SQSPPlannngReportingGuidelnes_11212023

OMB: 1205-0132

ET HANDBOOK NO. 336

18th Edition

UNEMPLOYMENT INSURANCE

STATE QUALITY SERVICE PLAN

PLANNING AND REPORTING GUIDELINES

INTRODUCTION

A. Background i

B. Relationship/Coordination with Other Plans iii

C. Partnership Principles iii

D. Planning Considerations iv

CHAPTER I ‑ PLANNING

INTRODUCTION

OVERVIEW OF PROCESS

Schedule I-1

Annual SQSP UIPL I-1

Financial Guidelines and Planning Targets I-2

Performance Measures I-2

Performance Assessment I-3

State Plan Preparation I-4

SQSP Review and Approval I-4

CONTENT AND SUBMITTAL OF SQSP

Content of the SQSP I-4

Submittal of the SQSP I-6

Submittal of the SQSP as part of the WIOA Combined Plan I-6

STATE PLAN NARRATIVE

A. Description I-7

B. Format and Instructions I-8

CORRECTIVE ACTIONS PLANS (CAPs)

A. Description I-8

B. CAP Format Completion I-9

UI PROGRAM INTEGRITY ACTION PLAN (IAP)

Description I-10

IAP Format Completion I-10

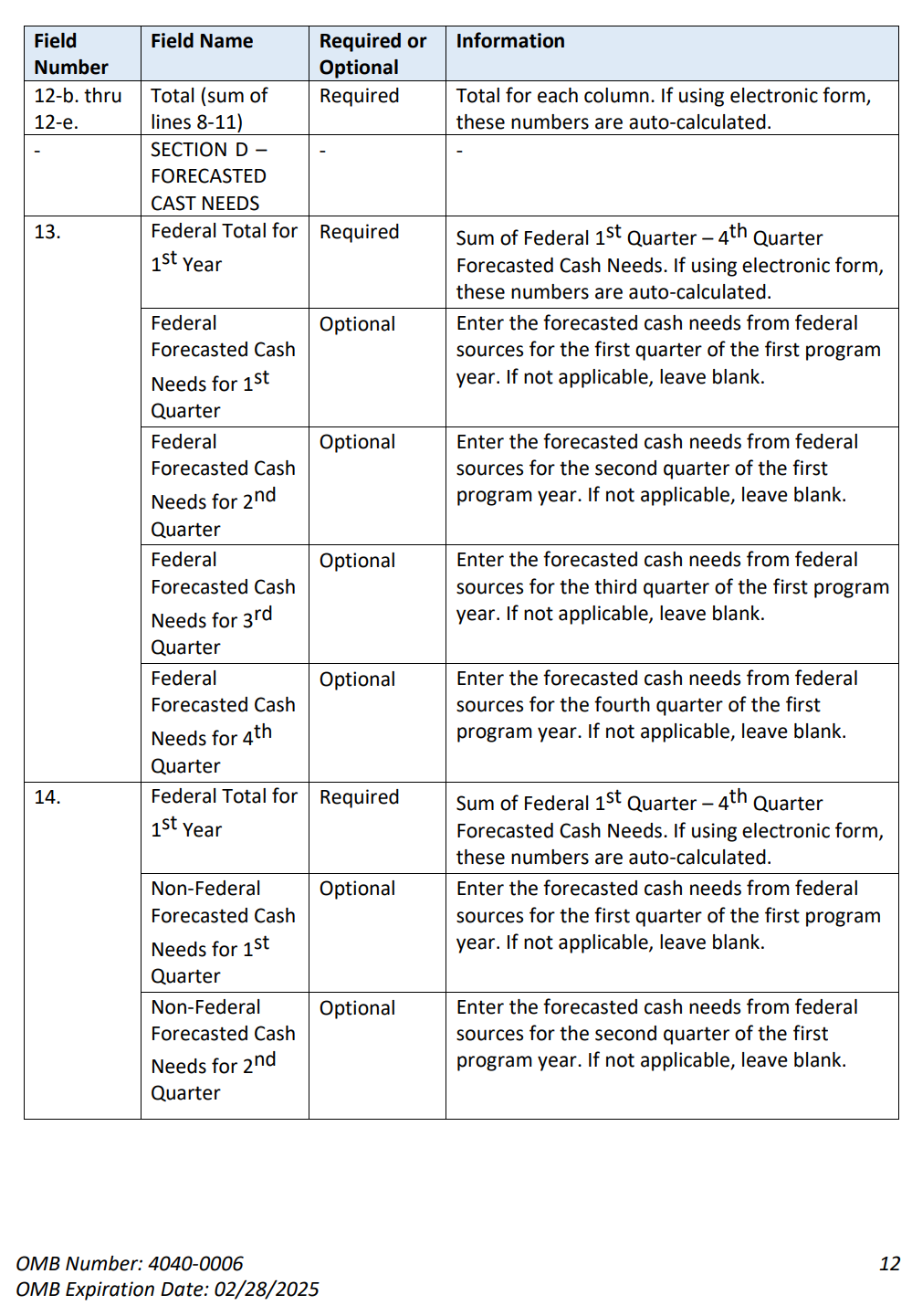

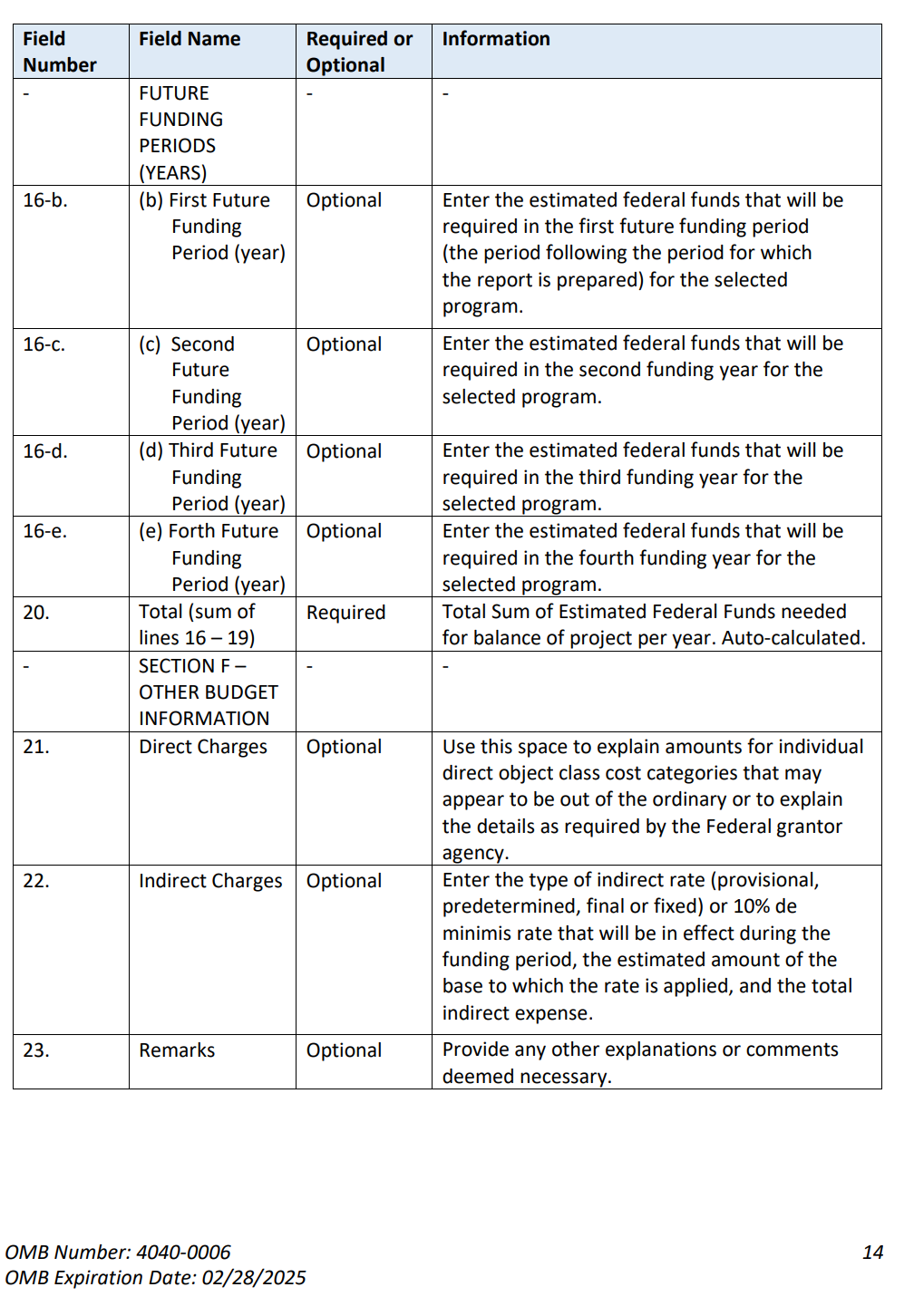

BUDGET WORKSHEETS AND INSTRUCTIONS

Worksheet UI-1, UI Staff I-10

SF 424, Application for Federal Assistance I-11

Supplemental Budget Requests (SBRs) I-11

VIII. ASSURANCES

Assurance of Equal Opportunity (EO) I-15

Assurance of Administrative Requirements and

Allowable Cost Standards I-16

Assurance of Management Systems, Reporting, and Record Keeping I-20

Assurance of Program Quality I-20

Assurance on Use of Unobligated Funds I-20

Assurance of Prohibition of Lobbying Costs I-21

Drug-Free Workplace I-21

Assurance of Contingency Planning I-21

Assurance of Conformity and Compliance I-22

Assurance of Automated Information Systems Security I-22

Assurance of Confidentiality I-23

Assurance of Disaster Unemployment Assistance I-23

IX. SQSP CONTENT CHECKLIST

CHAPTER II - REPORTING

I. INTRODUCTION

II. SUBMITTAL INSTRUCTIONS

A. Use of Computer Printouts in Lieu of Prescribed Forms. II-1

B. Electronic Submittal II-1

C. Due Dates II-1

D. Program Management Systems Document Numbers II-1

III. REPORTS

A. UI-3, Quarterly UI Above-base Report II-2

B. ETA 9130, Financial Status Report II-2

C. SF 270, Request for Advance or Reimbursement II-3

IV. DEFINITIONS

A. Expenditures II-3

B. Funding Period II-3

C. Obligations II-4

D. Unliquidated Obligations II-5

E. Automation Acquisition II-5

F. PMS Document Numbers II-6

G. Time Distribution Definitions II-6

APPENDIX I – UI Performance Measures and UI Programs

A. Core Measures Appendix I - 1

B. Secretary Standards in Regulation Appendix I - 2

C. UI Performs Management Information Measures Appendix I - 3

D. Unemployment Insurance Programs and Other Measures Appendix I - 5

APPENDIX II -- Planning Forms and Formats

A. Snapshot of CAP Form from the SQSP CAP and Quarterly Reporting

Workbook Appendix II - 1

B. UI Program Integrity Action Plan Format Appendix II - 2

C. State Plan Narrative Outline Appendix II - 3

D. SQSP Signature Page Appendix II - 5

E. Worksheet UI-1 Appendix II - 6

F. Instructions for the UI-1 Appendix II - 7

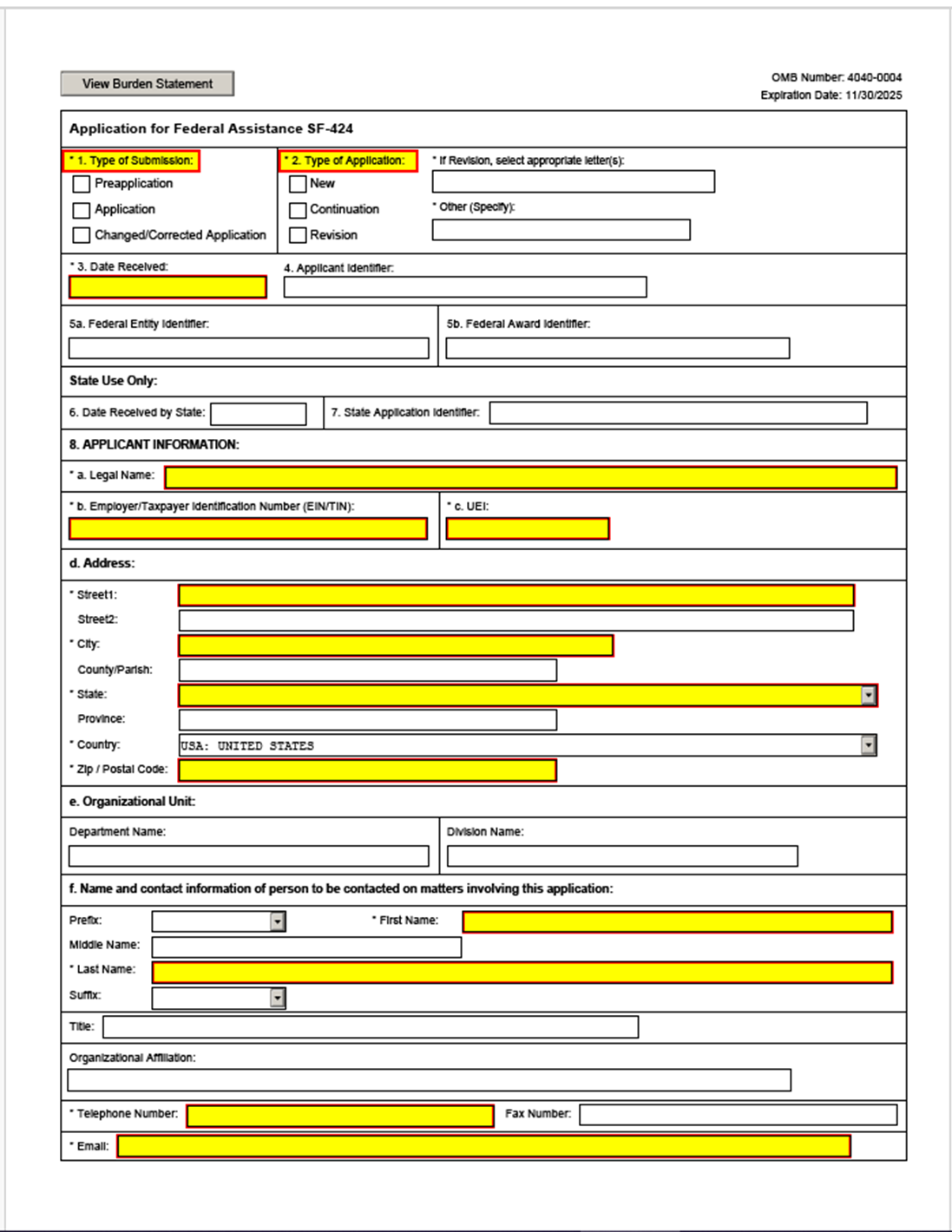

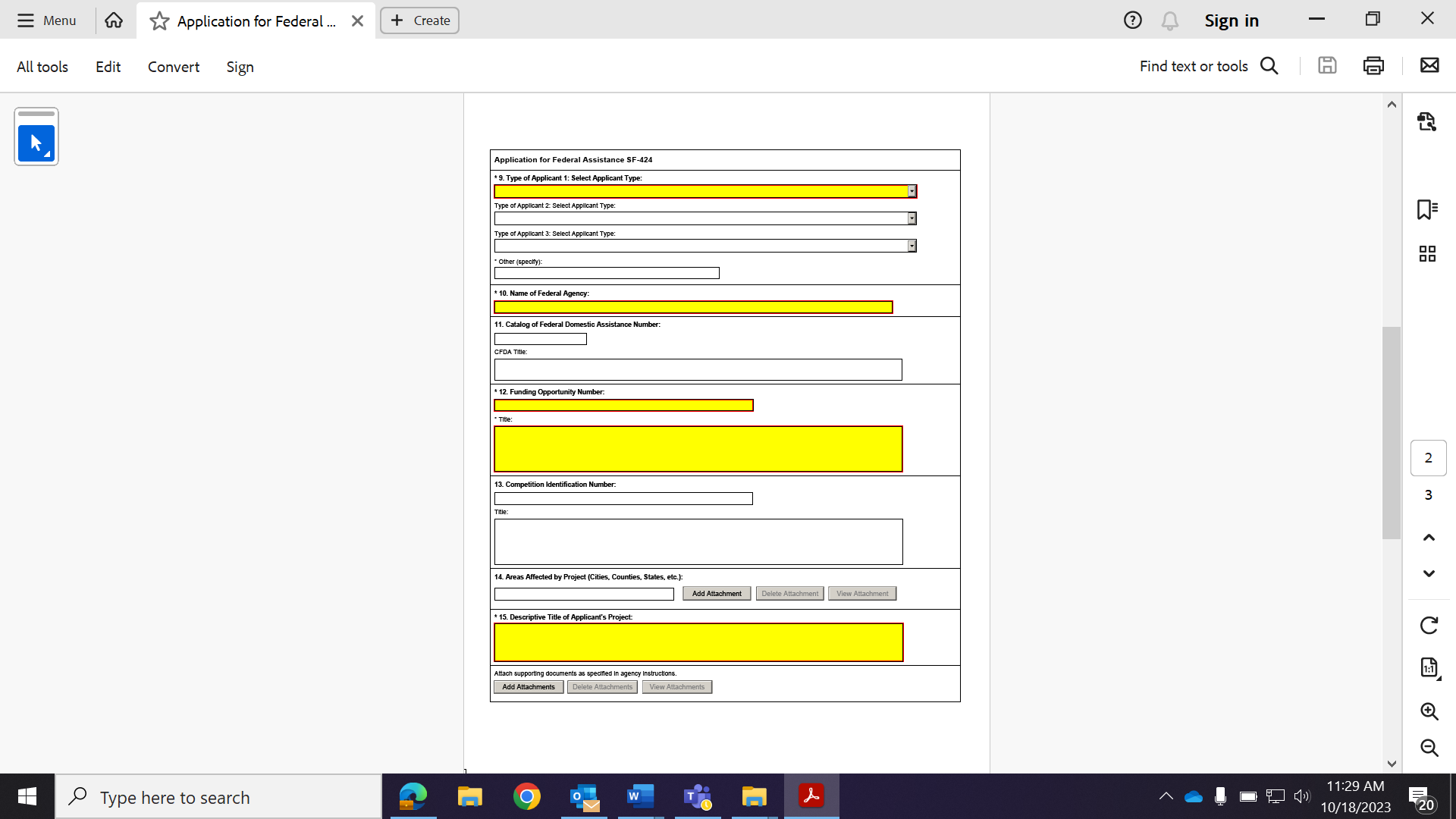

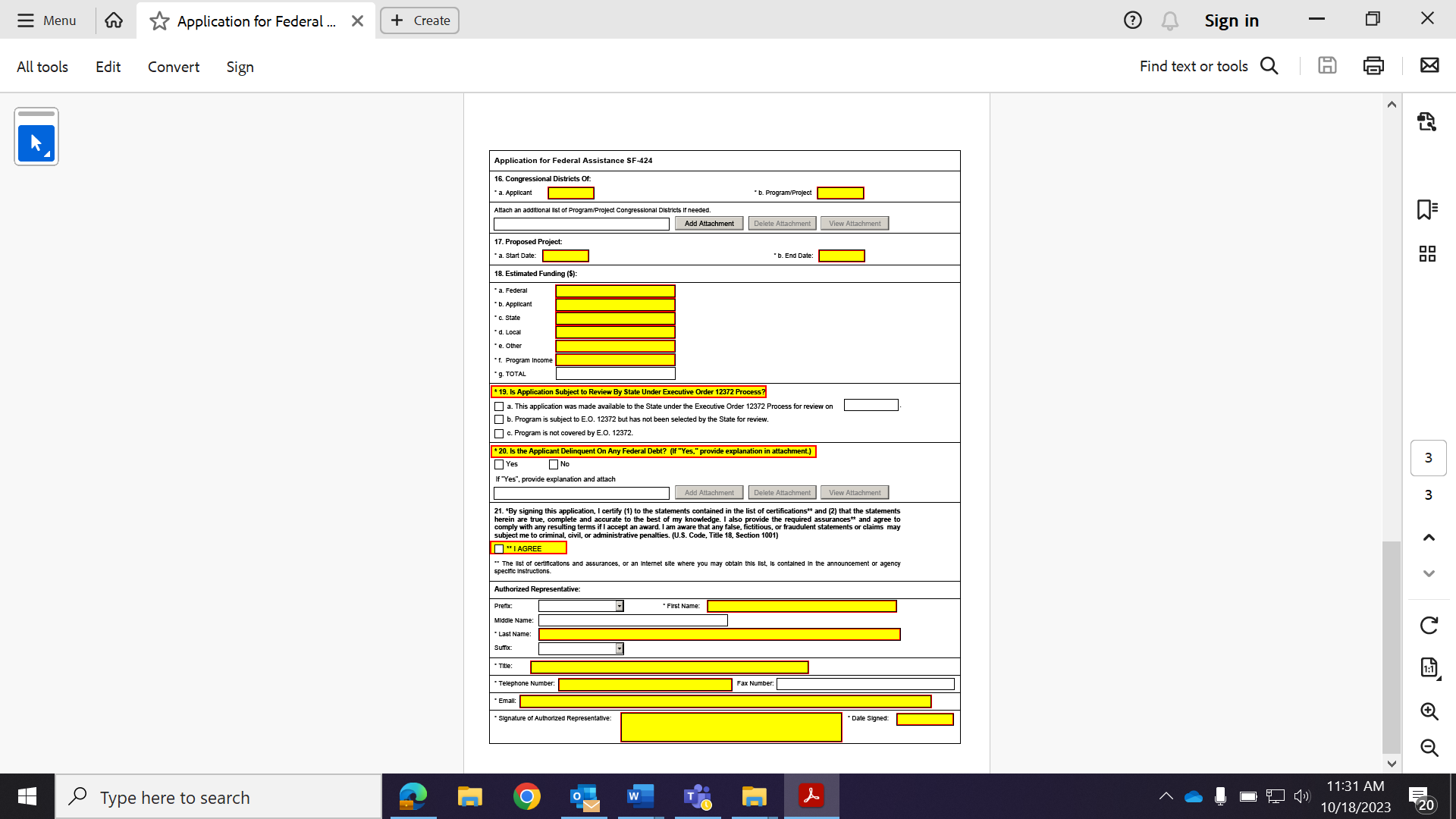

G. Application for Federal Assistance, SF-424 Appendix II - 8

H. Instructions for the SF-424 Appendix II- 11

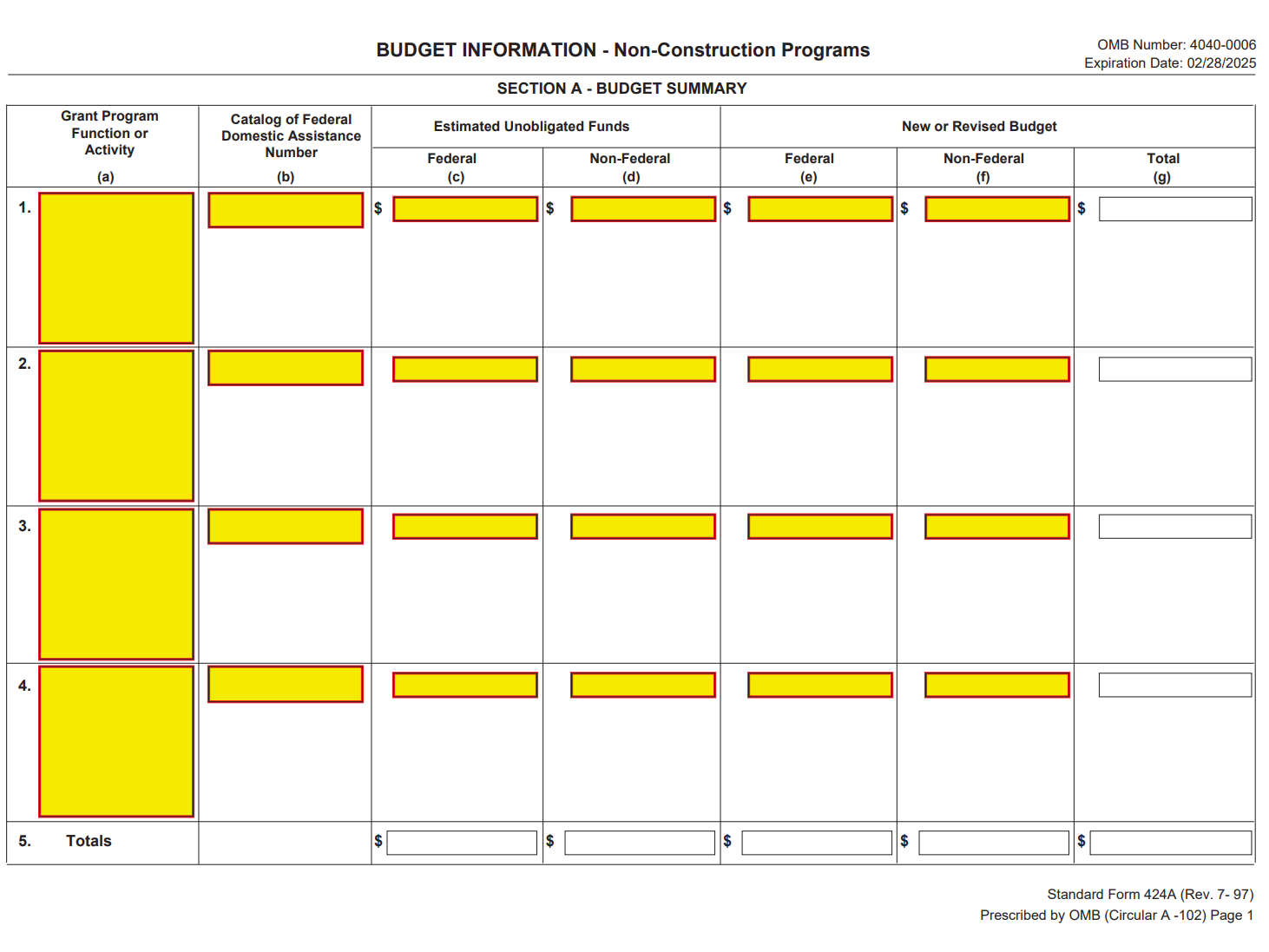

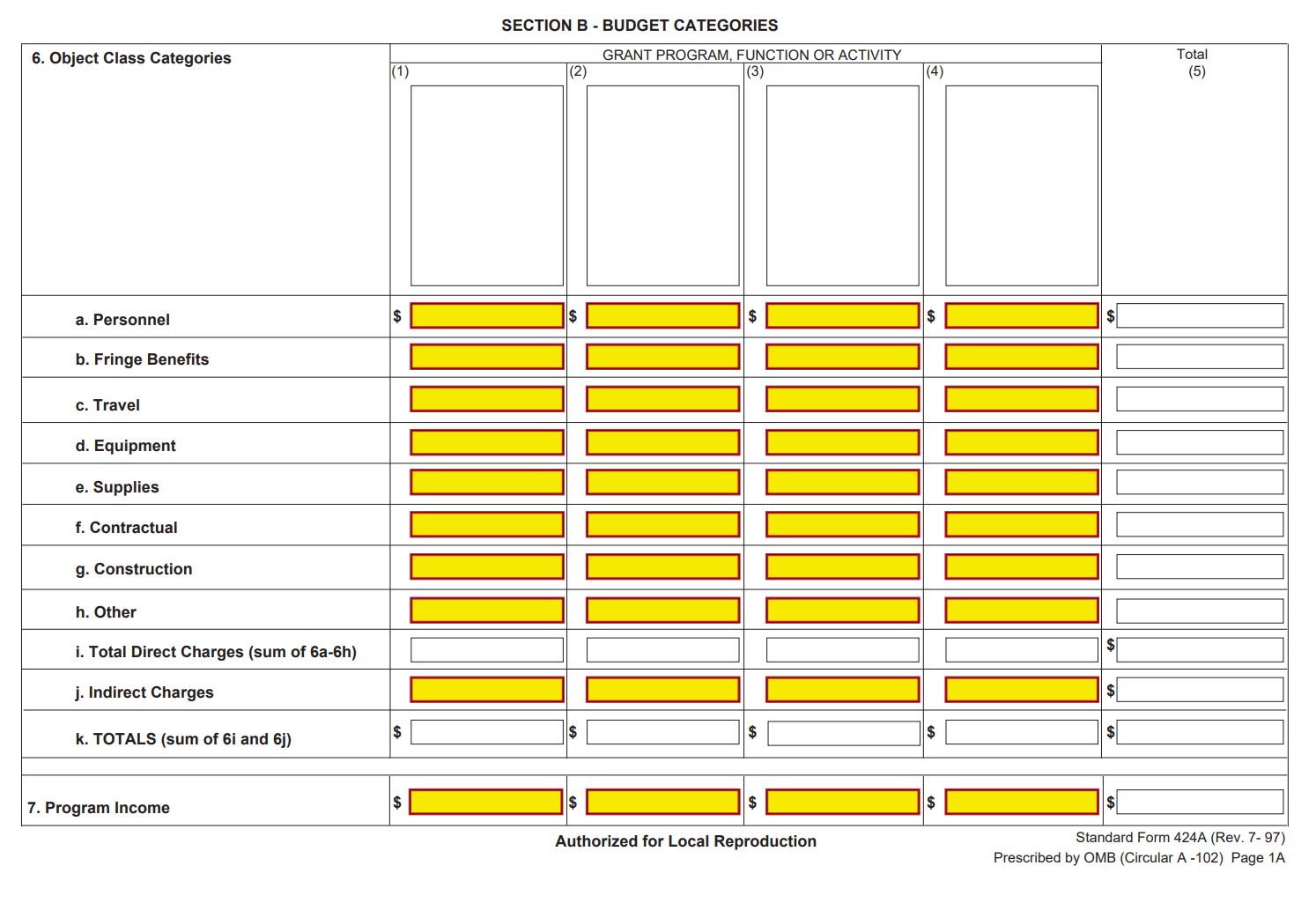

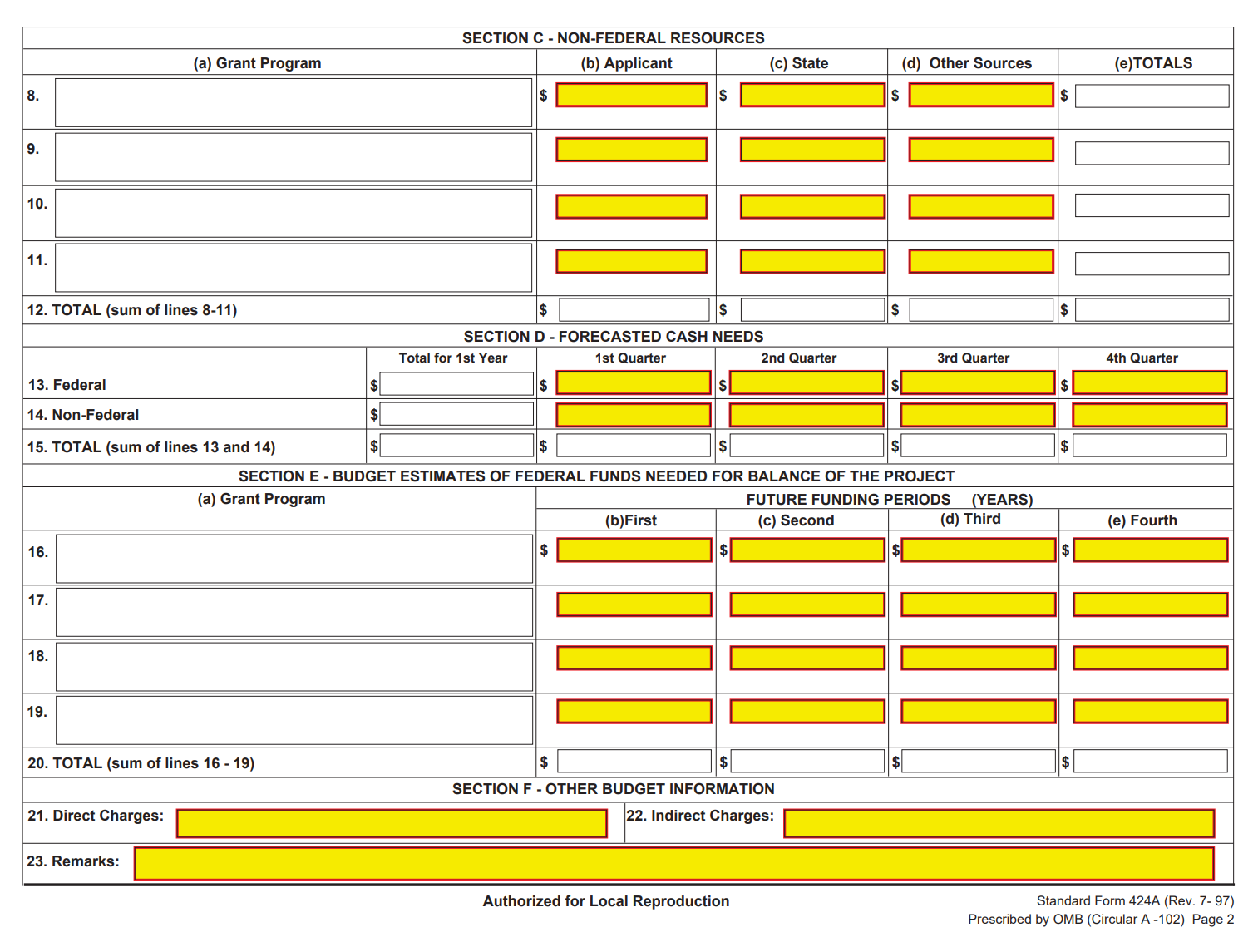

I Budget Information – Non-Construction Programs, SF-424A Appendix II- 19

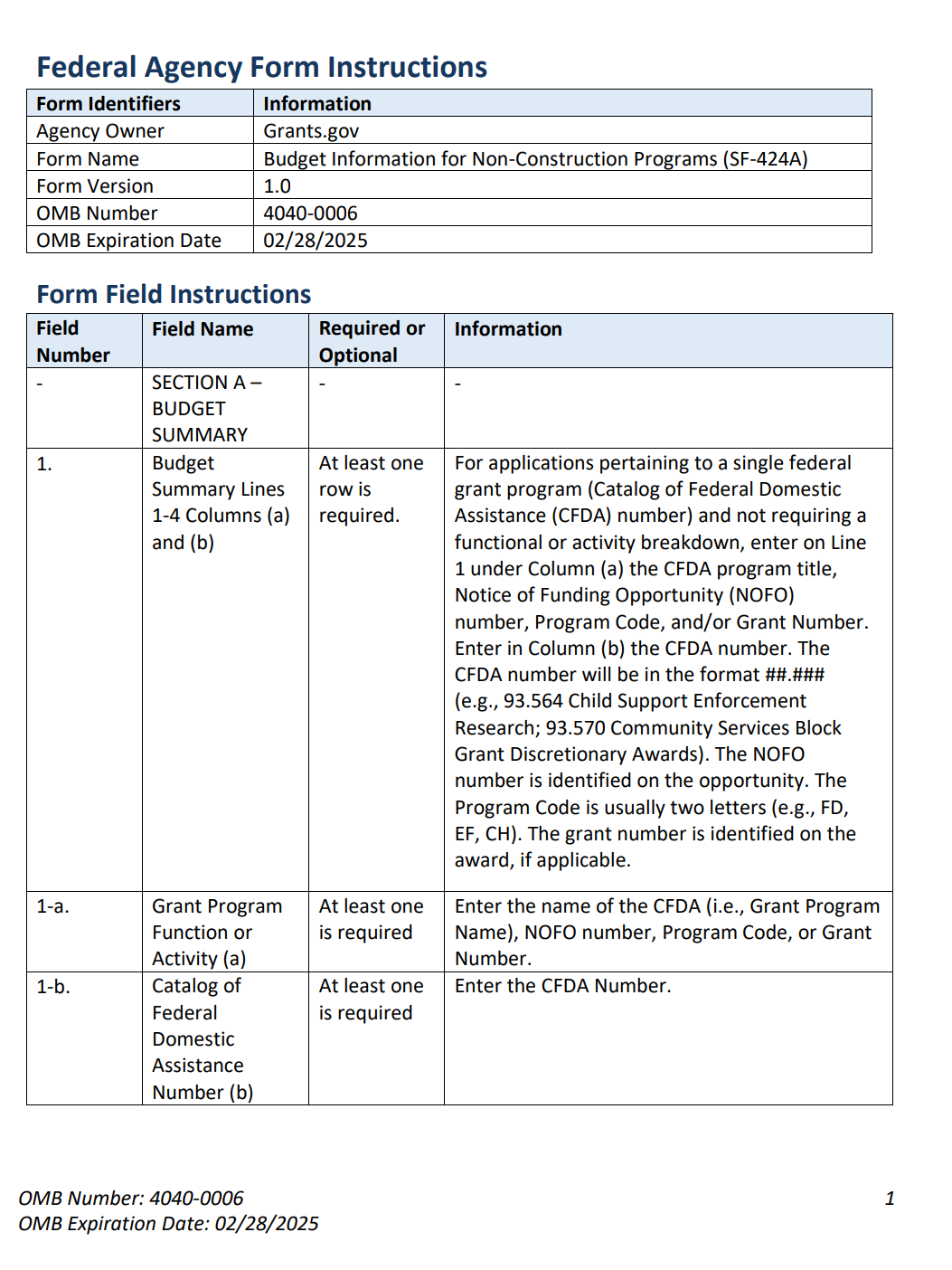

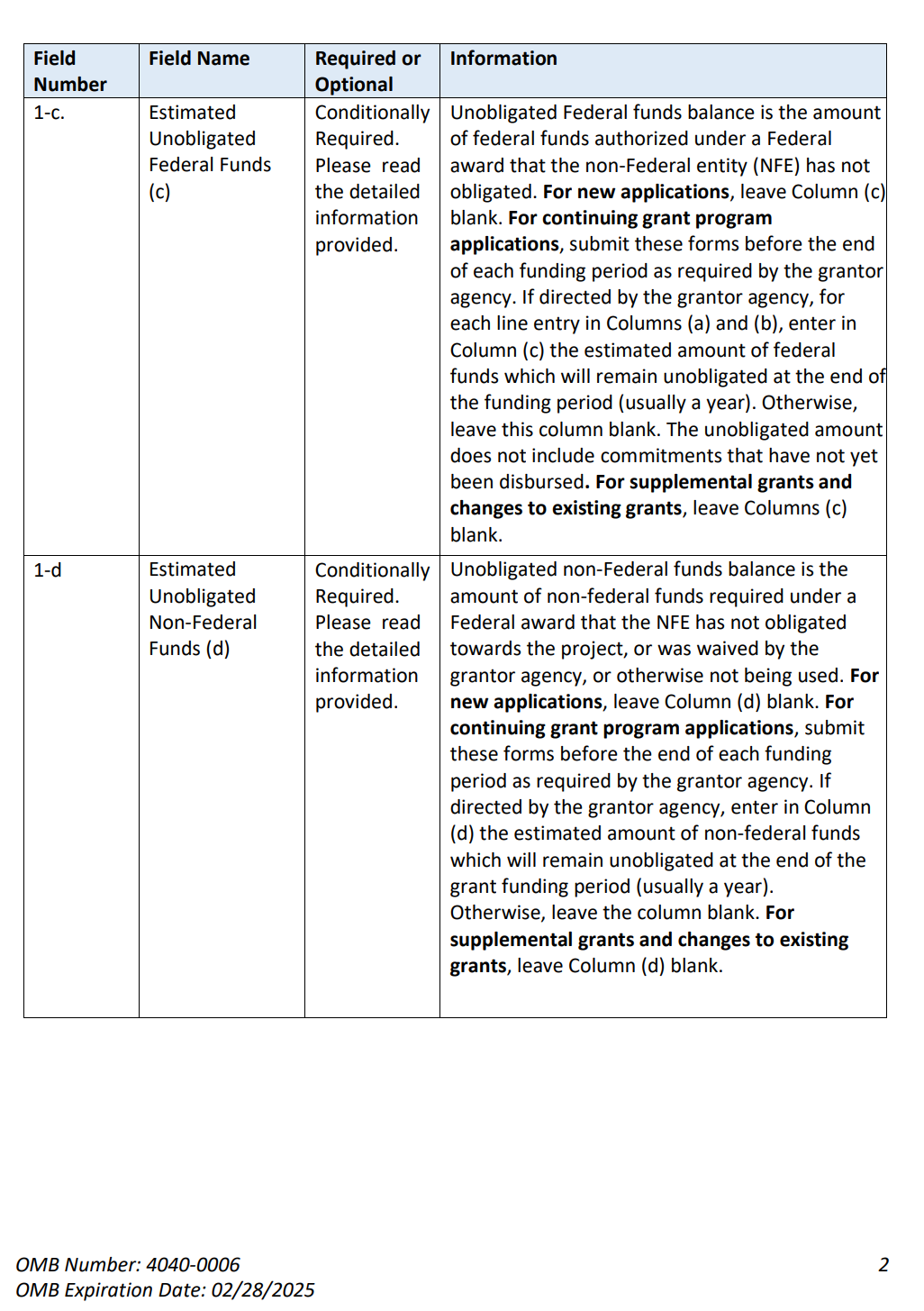

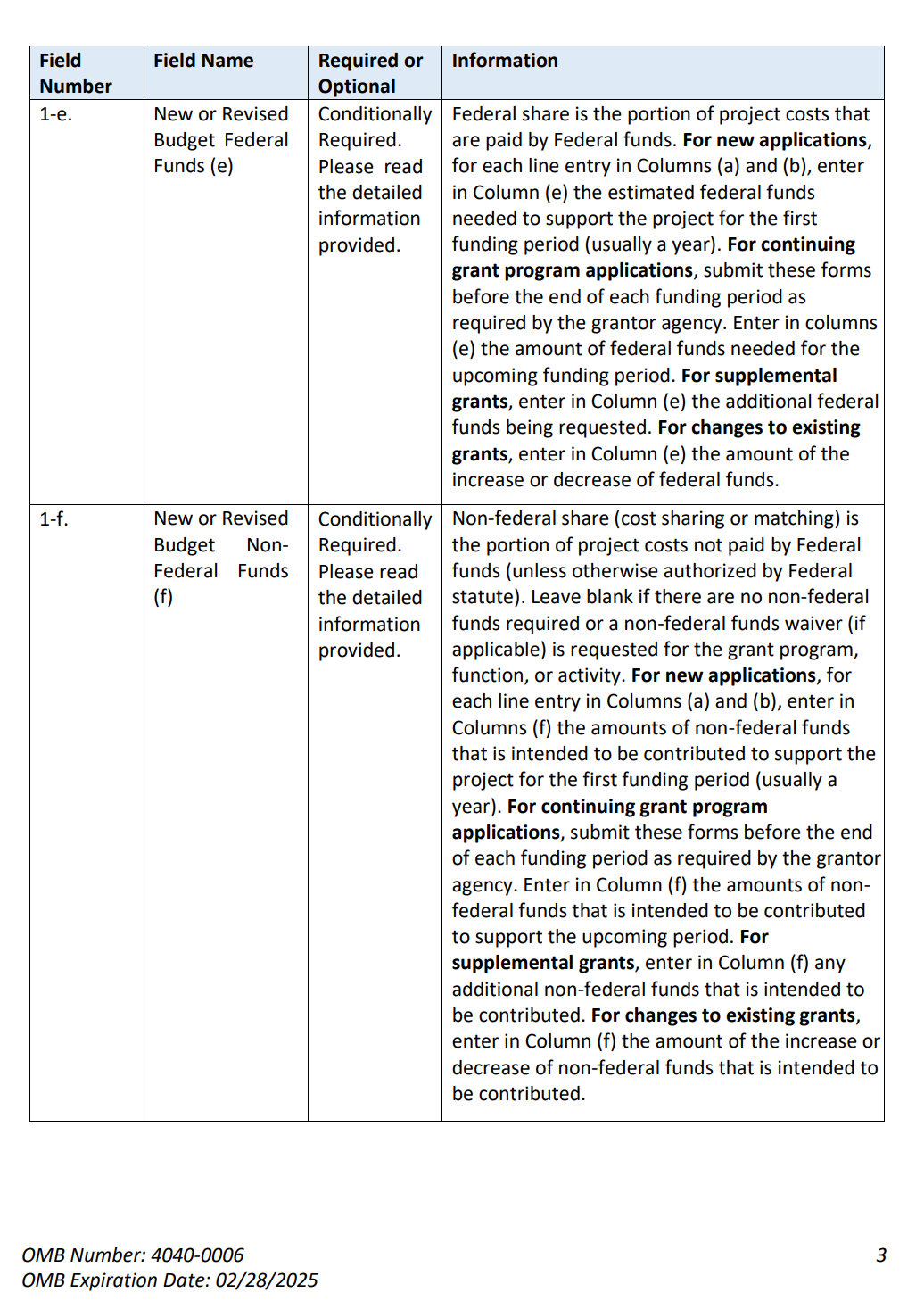

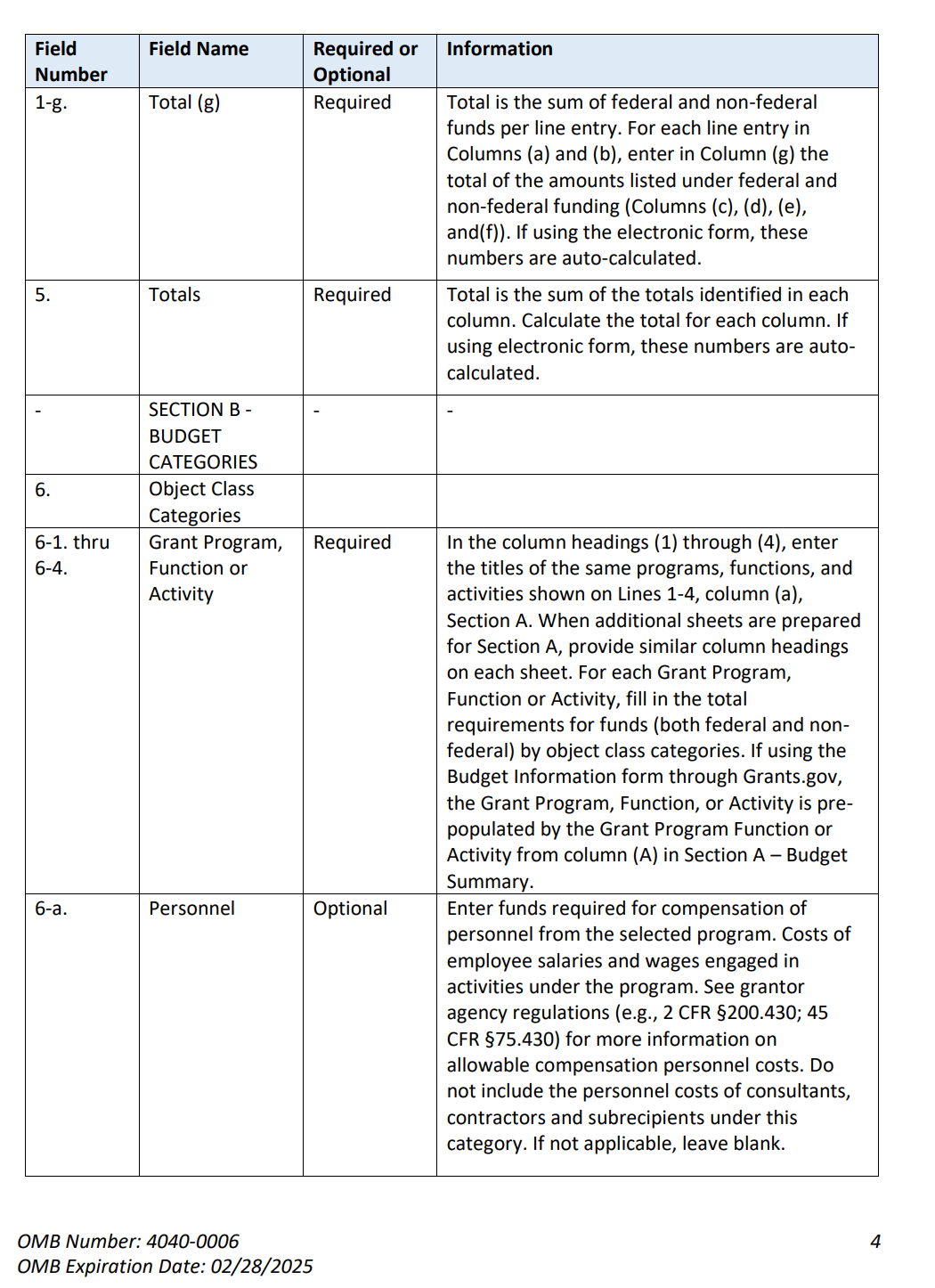

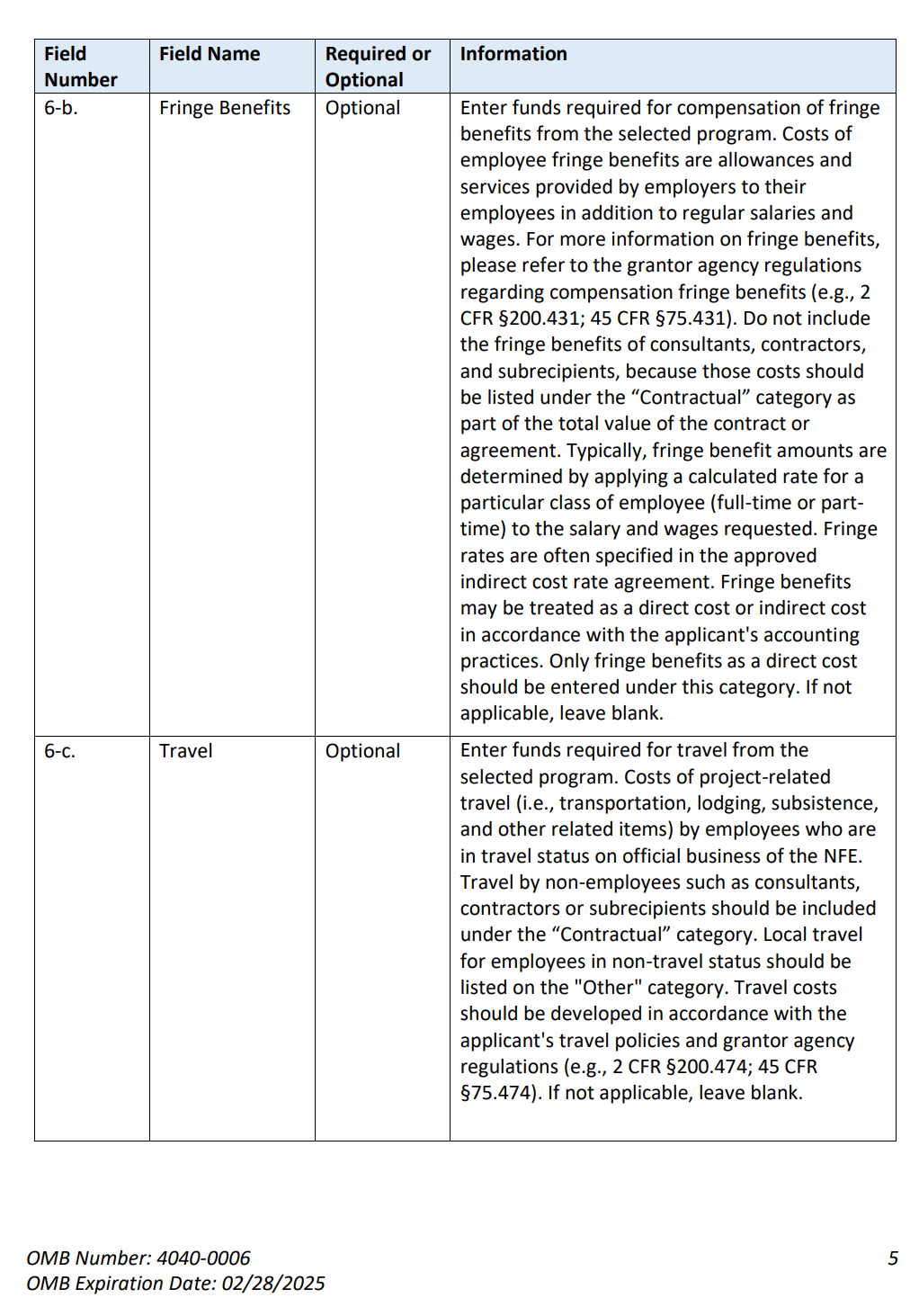

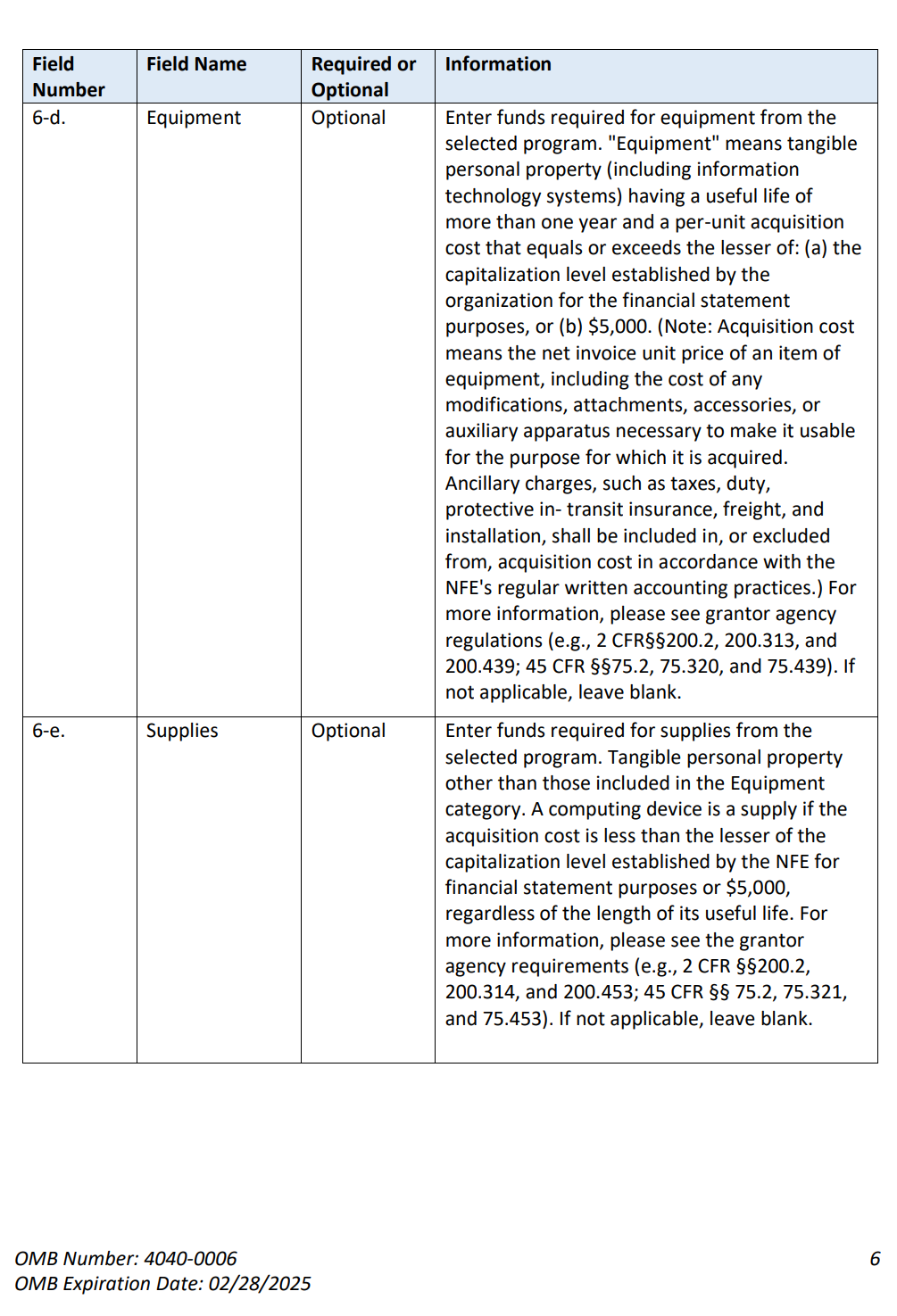

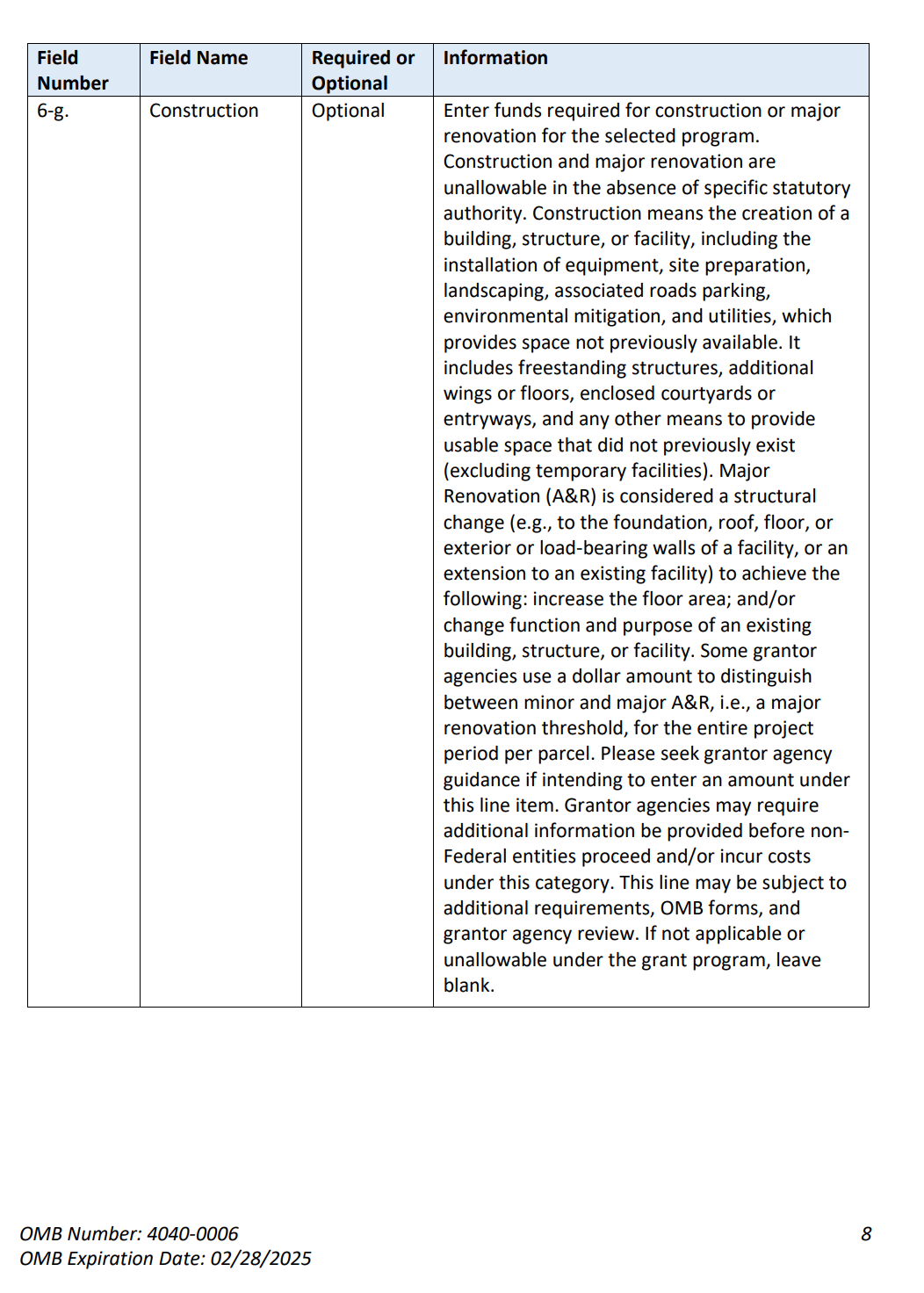

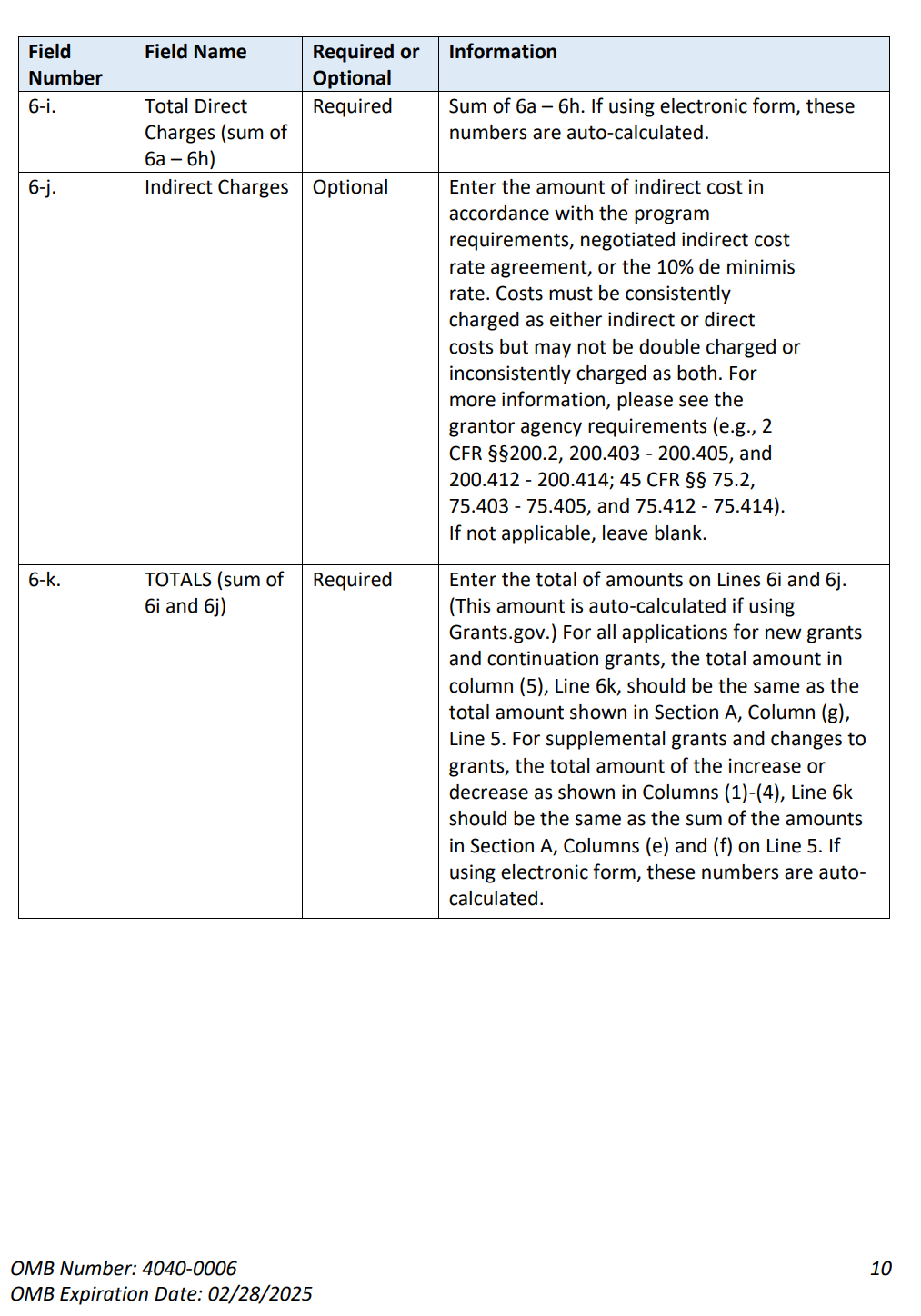

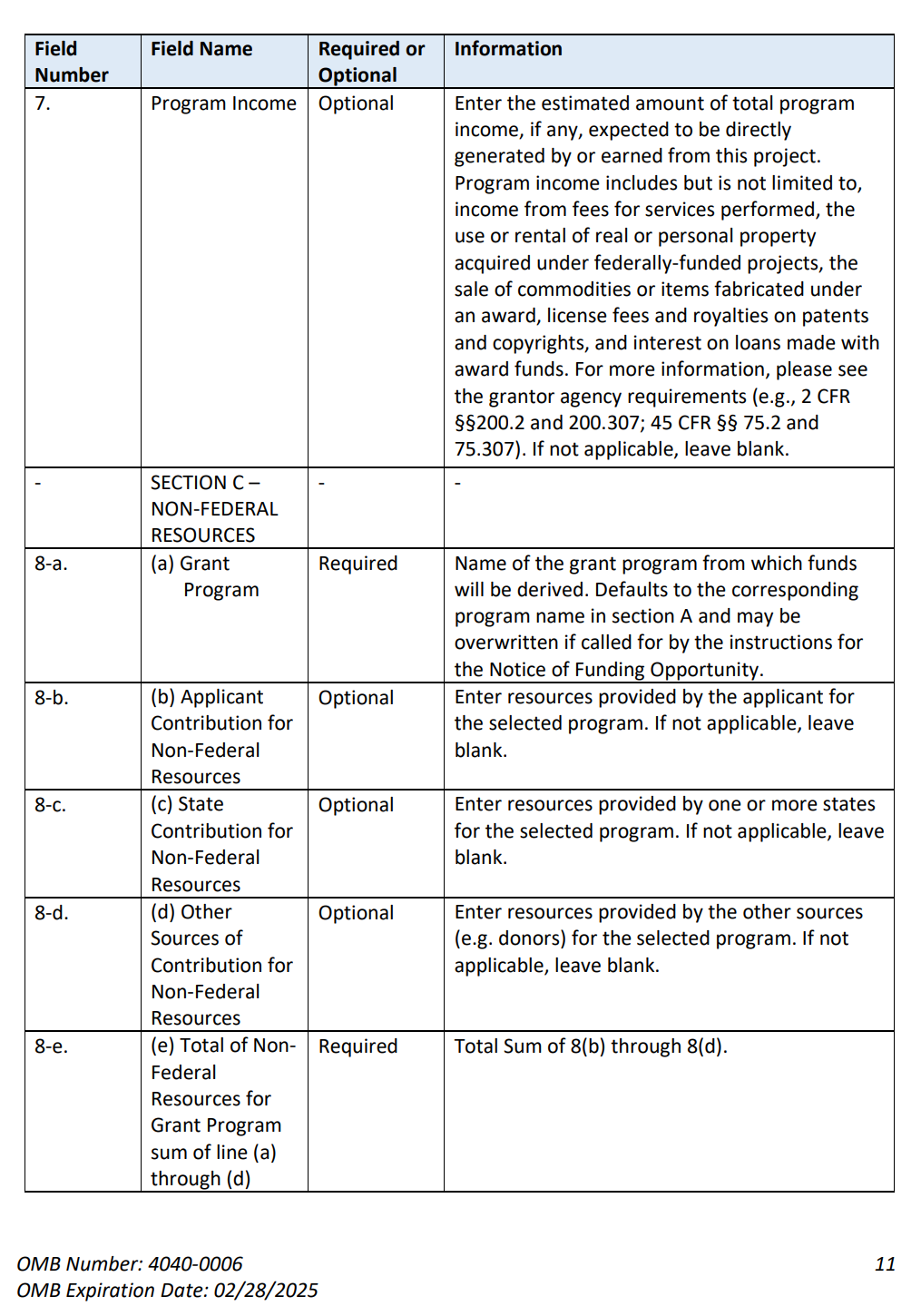

J. Instructions for the SF 424A Appendix II- 22

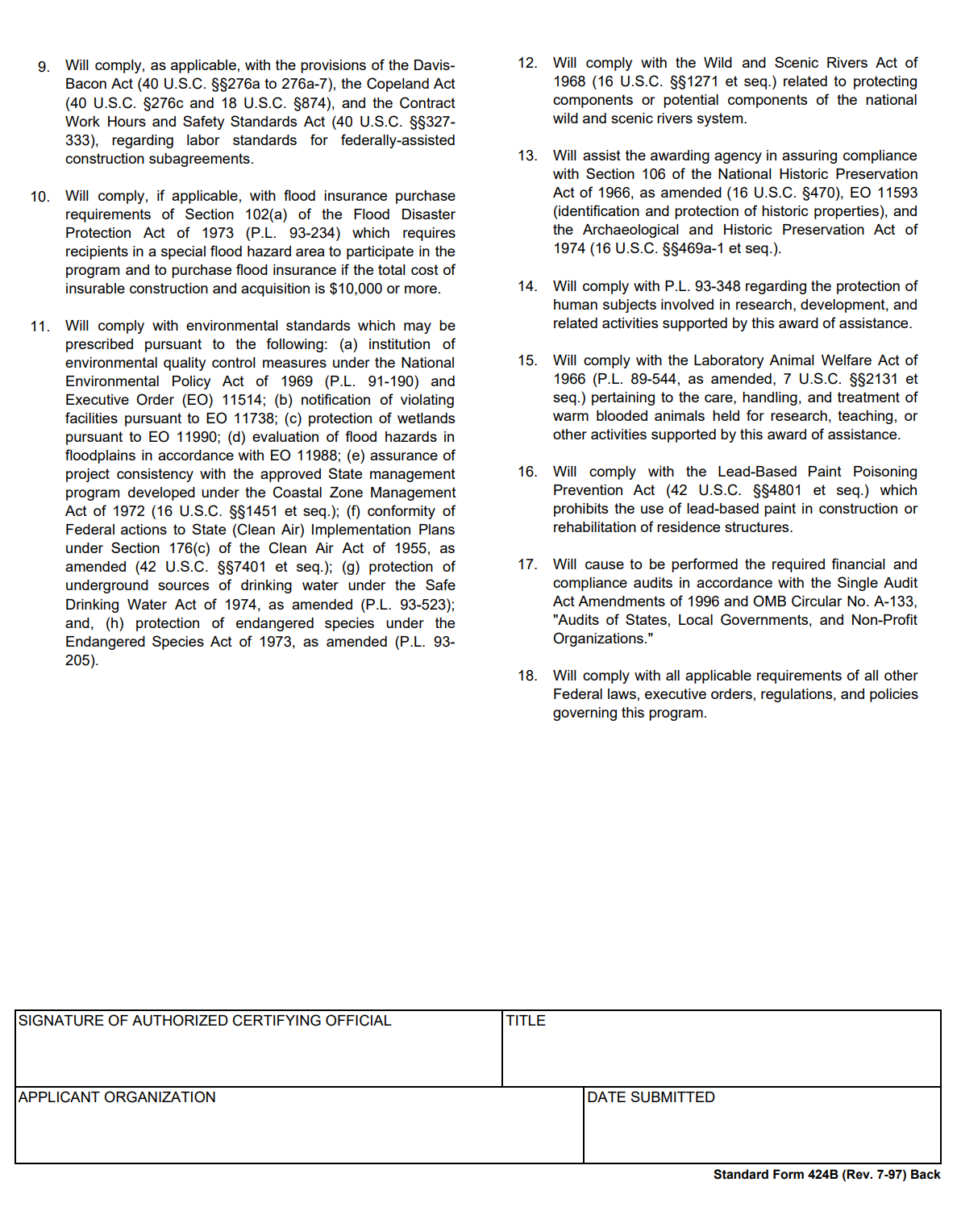

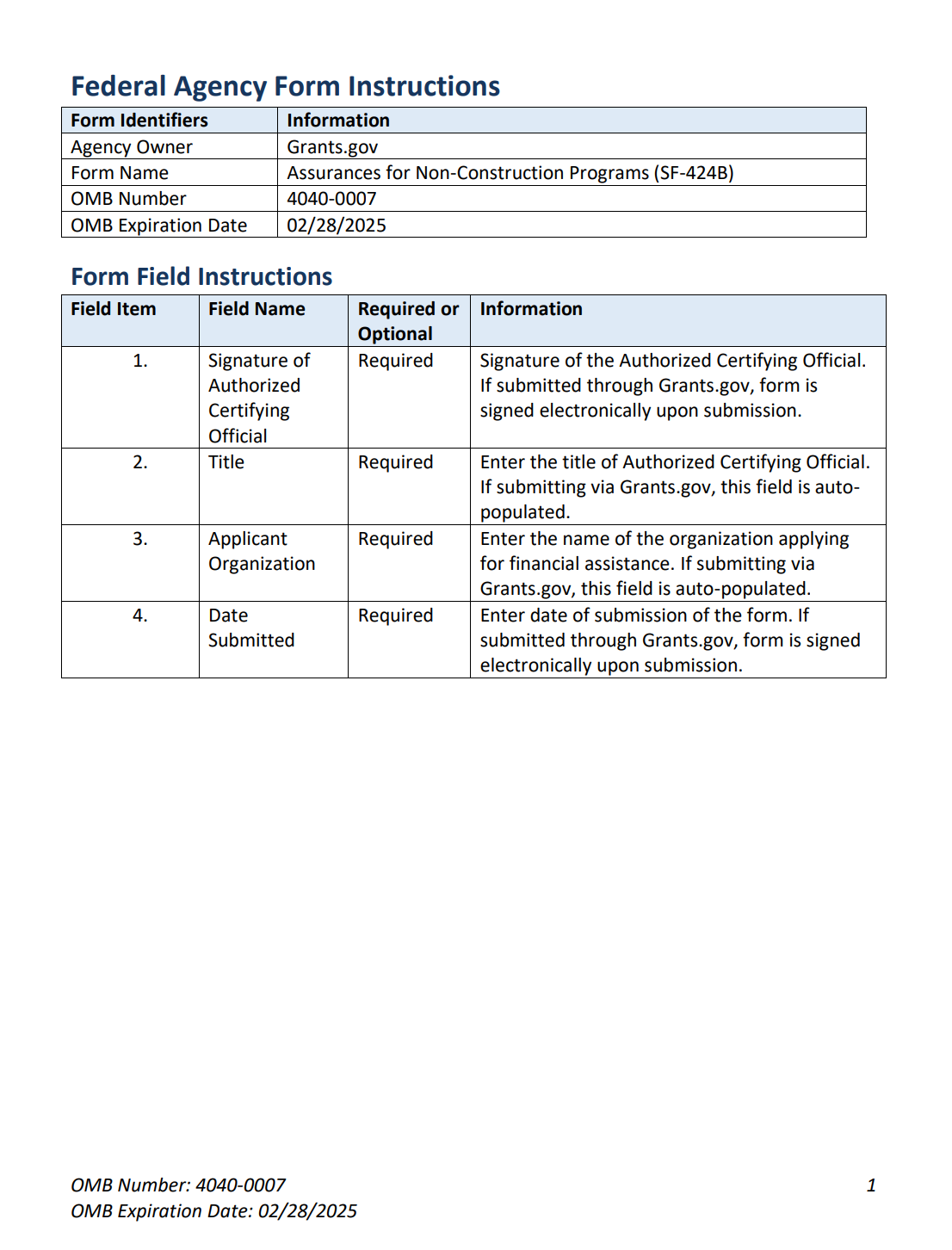

K. Assurances – Non-Construction Programs. SF-424B Appendix II- 37

L. Instructions for the SF-424B Appendix II- 40

APPENDIX III -- Reporting Forms and Formats

A. Worksheet UI-3 Appendix III - 1

B. Instructions for the UI-3 Appendix III - 3

C. US DOL ETA Financial Report, ETA 9130 Appendix III - 8

D. Financial Report Instructions, ETA 9130 Appendix III - 9

E. Request for Advance or Reimbursement, SF-270 Appendix III -20

F. Instructions for the SF-270 Appendix III -22

APPENDIX IV – Information Technology Security Guidelines

A. Contingency Planning Appendix IV- 1

B. Risk Management Appendix IV- 5

C. System Security Planning Appendix IV -11

D. Sample Plan Formats ...…………………………………..…… Appendix IV-18

APPENDIX V – UI Program Integrity Action Plan

A. Background and Instructions Appendix V - 1

ET HANDBOOK NO. 336

18th Edition

INTRODUCTION

This State Quality Service Plan (SQSP) Handbook provides guidelines for the completion and submittal of the State Quality Service Plan (referred to as the SQSP or the State Plan) for the Unemployment Insurance (UI) program, and the reports and data elements to be used for financial reporting of state UI program activities.

A. Background

The SQSP represents an approach to the UI performance management and planning process that allows for an exchange of information between the Federal and state partners to enhance the ability of the program to reflect their joint commitment to performance excellence and client-centered services. The statutory basis for the SQSP is Title III of the Social Security Act -- Section 302 authorizes the Secretary of Labor to provide funds to administer the UI program, and Sections 303(a)(8) and (a)(9) govern the expenditure of those funds. States submit budget worksheets and various assurances annually since funds for UI operations are appropriated each year. The Department of Labor’s (DOL’s) annual budget request for state UI operations contains workload assumptions for which the state must plan in order for the Secretary to carry out the responsibilities under Section 303(a)(1) of the Social Security Act, which requires that each state’s methods of administration insure full payment of unemployment compensation when due. DOL issues financial planning targets based on the budget request. States make plans based on such assumptions and targets via this mechanism.

As part of UI Performs, a comprehensive performance management system for the UI program, the SQSP is the principal vehicle that the state UI programs use to plan, record and manage improvement efforts as they strive for excellence in service. UI Performs was officially announced in August 1995. Unemployment Insurance Program Letter (UIPL) No. 41-95, dated August 24, 1995, outlined a construct for a comprehensive performance management system based on the following:

a significantly improved data collection infrastructure that provides more management information more frequently;

performance measures that include National core criterioned measures and a menu of non-criterioned measures for states to use in measuring and improving their program performance;

a dynamic planning process that is state focused; and

a goal of continuous improvement with responsibility shared by both state and Federal partners.

UIPL No. 14-05, Changes to UI Performs, and its changes 1, 2, and 3, outline changes to UI Performs as a result of a review of the system. The changes streamlined UI Performs by:

reducing the number of measures for which performance criteria are set to a few core measures;

recognizing remaining measures as management information with no set performance criteria; and

streamlining the SQSP narrative.

The focus of this Handbook is to provide specific guidance regarding the SQSP, which is the implementing document for the performance management system described above. The State Plan is an integral part of UI Performs. It is, therefore, critical to understand the broader context in which the State Plan is developed.

1. The Continuous Improvement Cycle. UI Performs embraces the continuous improvement cycle advocated by quality practitioners which is commonly known as the “Plan-Do-Check-Act” cycle. It also is referred to as a “closed loop” continuous improvement cycle. It incorporates a strategic planning process of identifying priorities; ongoing collection and monitoring of valid data to measure performance; identification of areas of potential improvement; and development of specific action steps to improve performance, followed by use of available data to determine whether the action steps are successful. The cycle continues indefinitely with the opportunity at any point to reassess priorities, performance, and action that can improve performance.

2. The Performance Measurement System. The system includes Core Measures, Secretary’s Standards, Management Information Measures, and UI Programs as listed in Appendix I. The Core Measures and Secretary’s Standards are indicators of how well State Workforce Agencies (SWAs) perform critical activities. Management Information Measures provide additional insight into UI program operations.

3. The Planning Process. UI Performs emphasizes joint responsibility between states and the Employment and Training Administration (ETA) for setting priorities and responding to performance information on an ongoing basis. The relationship between the states and ETA will include the following shared responsibilities:

continued tracking and analysis of performance data;

identification of Federal and state priorities;

development of planning directions;

negotiation to determine improvement levels; and

development and implementation of strategies to maintain acceptable performance.

Accomplishing these ongoing responsibilities requires an interactive and consultative process between states and ETA.

4. The State Quality Service Plan. The State Plan is intended to be a dynamic document that states can use as a management tool - much like a business plan - not only to ensure strong program performance, but also to guide key management decisions, such as where to focus resources. It should focus the states’ efforts to ensure well-balanced performance across the range of UI activities. The State Plan also is designed to be flexible to accommodate, among other things, multi-year planning and significant changes in circumstances during the planning cycle. Although it is developed in cooperation with the Federal partner, the State Plan is state-focused. The Federal role in the process is designed to be constructive and supportive.

Operationally, the State Plan also serves as the programmatic plan portion of the grant document through which states receive Federal UI administrative funding. To serve this purpose, states are required to submit budget worksheets and various assurances, as required in the UI grant agreement.

The State Plan is designed to provide the structure for recording the following kinds of information:

responses Federally-identified priorities;

performance assessment information;

short and long term strategies for achieving performance targets;

corrective action plans (CAPs) for failure to meet core performance criteria; and

state strategies for evaluating customer satisfaction and gaining customer input to promote performance excellence.

States are required to submit the SQSP electronically and should contact the Regional Office (RO) SQSP Coordinator prior to submittal to coordinate specific details.

B. Relationship/Coordination with Other Plans

The UI program does not stand alone. It is the wage replacement component of an overarching effort to return a worker to suitable work. As such, the SQSP should be developed in concert with other plans which also address the same customer (such as plans under the Wagner-Peyser Act and the Workforce Innovation and Opportunity Act (WIOA)) to ensure a coordinated effort and minimal obstacles for the client in moving from program to program. This coordination will most likely be apparent in the State Plan Narrative portion of the SQSP.

C. Partnership Principles

The three following principles form the basis for carrying out Federal and state responsibilities under UI Performs and the SQSP planning process:

Basing the federal-state relationship on mutual trust and respect will improve the UI system and its service to the American public;

Working as equal partners with complementary roles will improve the UI system's quality of service and its integrity; and

By setting high standards and goals and working together as a team, the system will be strengthened, and the entire nation will benefit.

The following are examples of the actions and attitudes which are consistent with these principles:

Fostering a win-win relationship; advocating for and supporting one another.

Sharing credit, celebrating successes;

Being willing to acknowledge the existence of problems, and focus on fixing them instead of placing blame;

Mutually accepting responsibility for resolving problems and overcoming deficiencies;

Where there are differences between partners—

Trying to resolve disputes equitably and fairly, being willing to compromise to achieve consensus; and

Seeking early, informal resolution;

Fostering open, personal communication;

Clearly defining partner roles, rights and responsibilities;

Engaging in joint planning and influencing one another's priorities;

Promoting innovation and creativity;

Jointly seeking input from customers;

Sharing information and resources;

Recognizing the role and importance of other players at the state and national levels;

Asserting positive and friendly influence on partners to improve performance; and

Periodically reviewing the principles and roles.

D. Planning Considerations

This section provides information for states to use in developing their SQSPs.

1. State Agency Resource Planning Targets for UI.

Financial Guidelines. States will prepare all SQSPs according to financial guidelines transmitted with target funding levels provided by the ROs.

Final Allocations. Final allocations may contain increases or decreases from the target funding level, which may require some revisions to submitted or approved State Plans.

2. State Flexibility. States have the flexibility to use the total dollars approved by ETA among the various UI program categories as it deems appropriate. However, for purposes of determining certification of above-base funding for workload above the base, the base staff year levels for claims activities, as allocated by ETA, will be used. Note that this flexibility does not include special allocations which are identified on a case-by-case basis.

3. State Financial Reporting System. ETA does not prescribe the use of any specific accounting and reporting system by the states. States are free to use any accounting system that meets the standards for state grantee financial management systems prescribed by Federal Regulations at 22 CFR 200.302. However, states must be able to report UI financial information in the form and detail described in Chapter II of this Handbook.

E. OMB Approval

OMB No.: 1205-0132 OMB Expiration Date: 02/29/2024 Estimated Average Response Time: 3.41 hours

OMB Burden Statement: Public reporting burden for this collection will vary from state to state, depending on the number of reports required, but will average 3.41 hours per response. These reporting instructions have been approved under the Paperwork reduction Act of 1995. Persons are not required to respond to this collection of information unless it displays a valid OMB control number. Public reporting burden for this collection of information includes the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Submission is required to obtain or retain benefits under Section 303(a)(6) of the Social Security Act. Persons responding to this collection have no expectation of confidentiality. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Office of Unemployment Insurance, Room S-4519, 200 Constitution Ave., NW, Washington, DC, 20210, [email protected].

ET HANDBOOK NO. 336

18th Edition

CHAPTER I - PLANNING

INTRODUCTION

Chapter I of the SQSP Handbook provides guidelines for the completion and submittal of the SQSP for the UI program and instructions for the SBR process for extraordinary funding.

OVERVIEW OF PROCESS

While the SQSP process is ongoing throughout the year, the Formal (biennial) plan submittal occurs once every two years. Since funds for UI operations are appropriated each year, an Alternate year submittal is required in the off year. Each submittal occurs in conjunction with the funding cycle and utilizes the following process:

Schedule. The significant activities and dates relating to the submittal and subsequent approval of the SQSP are estimated to be:

-

Activity

Approximate Date

National Office (NO) issues Annual UIPL

May/June

NO send financial guidelines and planning targets to states

States submit SF 424, 424A (as necessary)

Late June

At RO request or at the time of the SQSP submittal, at the latest

ROs notify states of SQSP approval

Late September

ROs notify NO of approved SQSPs

No later than September 25

Execution of UI Annual Funding Agreement with first funding increment

Early October

States submit UI-1 (UI Staff Hours)

October 1

States electronically submit the required SQSP documents to ROs.

August/September per RO requirement

Annual SQSP UIPL. Each year, the SQSP submittal will be initiated with the SQSP UIPL. States should carefully review the annual UIPL. This letter will specify the dates relevant to the SQSP process for the approaching fiscal year; summarize National Priorities and Federal Program Emphasis for the year; and identify any special planning requirements in effect for the fiscal year. It also will explain opportunities for increased, targeted funding made available on an annual basis in the President’s budget if such opportunities exist.

National Priorities and Federal Program Emphasis. The National Priorities and Federal Program Emphasis summarizes the primary areas in which the Federal partner will focus attention and resources for the planning cycle. The DOL Strategic Plan and the annual DOL Performance Budget form the basis for the Federal Program Emphasis. Required by Congress under the Government Performance and Results Act (GPRA), the Federal plans are an integral part of the Federal budget process. They establish program performance goals and outcomes and identify strategies and performance objectives to attain them. Accordingly, states will want to review the current versions of these planning documents before developing their SQSPs. These documents may be found on the DOL webpage, About Us | U.S. Department of Labor (dol.gov).

Special Planning Requirements. Any special planning considerations or requirements for the planning year will be identified in the SQSP UIPL.

Financial Guidelines and Planning Targets. Each year the NO provides preliminary allocations, any special financial instructions for the year, and submission deadlines.

Performance Measures. UI Performs incorporates two types of performance measures (Core and Management Information). States are encouraged to routinely monitor performance data on both Core and Management Information Measures, and to achieve continuous improvement in overall unemployment compensation performance by establishing improvement targets for as many measures as possible.

Core (Criterioned) Measures. Core Measures are those measures that are considered to be critical indicators of the overall performance of the program. If acceptable levels of performance (ALPs) for them are not met, it signals fundamental impairment in program operations, and triggers corrective action planning. Core Measures are comparable among SWAs and have ALP criteria assigned to them. SWAs are expected to submit CAPs if performance falls below the ALPs. See Appendix I, Performance Measures, for a list of the Core Measures and associated criteria.

Management Information (Non-Criterioned) Measures. Management Information Measures, like Core Measures, are routinely reported by the state using Federal definitions found in ETA Handbook 401, but, with the exception of the Secretary’s Standards0, have no established performance criteria assigned to them. Some Management Information Measures are subsets or components of data included in Core Measures, such as timeliness of Unemployment Compensation for ex-Service Members (UCX) benefit payments, those claiming benefits on an interstate basis, or the individual Tax Performance System (TPS) components of the tax quality measure. These data alert state and Federal managers to performance issues that could result in lower performance on Core Measures and are useful for performance analysis. However, as provided in Federal UI law, the Secretary of Labor retains full authority to address cases of poor performance in a state that does not substantially comply with Federal law requirements.

Performance Assessment

Continuous Assessment. In the SQSP process, both the Federal partner and the state will routinely access performance data to monitor program performance and initiate corrective action when warranted. CAPs are plans developed in response to data showing state performance below the ALPs established for Core Measures and criteria established for other measures and UI programs. Also, if a state’s performance in one or more Management Information Measures is so poor that a state’s substantial compliance with Federal law requirements is in question, DOL may request corrective action. Although performance may be viewed at specific points in time (e.g., monthly, quarterly, annually), each assessment reviews performance over time and focuses not only on performance for the period in question, but also on the trend of performance over the period reviewed (e.g., was performance declining or improving, sustained or erratic).

States that have CAPs in place must submit quarterly status updates to their RO by the date the Region has specified. The status update must include the progress of each CAP milestone or activity scheduled to be completed by the end of the quarter. Quarterly updates are to be recorded using the CAP and Quarterly Reporting Workbook (Appendix II).

Annual Assessment. An annual assessment will augment the ongoing continuous improvement process and will form the basis for corrective action planning for the SQSP. This annual assessment will utilize the most recent 12 months of performance data. For data reported monthly or quarterly, the assessment will include the 12 months ending March 31 of each year. For data reported annually, the assessment will be based on data reported for the most recent complete calendar year (or other full 12-month period, per reporting requirements).

ETA will make all relevant data available to the states for SQSP purposes, but states have continuous direct access to the data resident on the state SUN computer system, or through the Office of Unemployment Insurance website at

https://oui.doleta.gov/unemploy/performance1.asp. Subsequent performance data that become available during the plan development period (e.g., April, May, June data) should be utilized to refine plans before final submission and approval.

State/Regional Negotiations. Before the SQSP is signed, states and regional administrators must agree on the specific areas for which the state will submit and/or revise CAPs and Narratives in the SQSP. These negotiations encompass performance below the established criteria for Core Measures, Secretary’s Standards, and UI Programs. CAPs are expected to be submitted if performance is unsatisfactory and an effective plan is not already in place.

State Plan Preparation. States must prepare and transmit an SQSP in accordance with the instructions in this Handbook and in the annual SQSP UIPL. The SQSP, with its CAPs and Narratives, is the state’s formal plan and schedule for improving performance. An acceptable SQSP must have state management approval and must authorize the resources necessary to conduct the actions planned.

SQSP Review and Approval. ROs shall review SQSPs for completeness, and to ensure that they are in accordance with the instructions and that they reflect negotiated agreements. This review may result in the RO initiating additional discussion or obtaining clarification. A plan that the regional administrator deems unsatisfactory, i.e., failing to meet the requirements identified in this Handbook, shall be returned to the state for revision without approval.

CONTENT AND SUBMITTAL OF SQSP

Content of the SQSP. The SQSP process provides a 24-month window for states to adequately plan and implement performance improvement efforts. The process provides for two types of submittals: a Formal (biennial) submittal and an Alternate Year submittal.

Formal SQSP. Every two years, the Formal or Biennial SQSP submittal must contain a complete SQSP package, including: a transmittal letter; the State Plan Narrative, including required Assurance information; CAPs; the IAP; budget worksheets/forms; organizational charts; other required administrative documents as requested; and the SQSP Signature Page.

Alternate Year SQSP. The Alternate Year submittal consists of items included in the state’s request for Federal UI administrative funding, as well as modifications to the Formal SQSP. It must contain at least: a transmittal letter; modifications to the State Plan Narrative, including updated Assurance information; CAPs for new performance deficiencies; required modifications to existing CAPs; the IAP; budget worksheets/forms; updated organizational charts; and the SQSP Signature Page.

Each element/document is described below.

Transmittal Letter. State administrators must prepare and send a cover letter to the appropriate RO transmitting all the required SQSP documents.

Budget Worksheets. States must complete required budget forms and plan for administration based on projected allocations received from the Federal partner.

All states must complete Worksheet UI-1 and required SF 424s. States must complete the SF 424A only if they vary the quarterly distribution of base claims activity staff years.

States must submit the Worksheets UI-1 by October 1 of each year separately from the SQSP submittal. States must submit the SF 424 and SF 424A (if necessary) via www.Grants.gov.

Completion instructions and facsimiles of these forms are in Appendix II.

The State Plan Narrative. The State Plan Narrative is a vital element of the SQSP that provides a vehicle for sharing with the Federal partner state-specific efforts that affect the administration of the UI Program. The State Plan Narrative allows the state to describe in a single narrative: a) state priorities; b) performance assessments; c) coordination with other plans; d) state performance in comparison to the GPRA goals; e) actions planned to correct deficiencies regarding UI programs, UI program reviews, and reporting requirements; and f) results of customer satisfaction surveys (optional). Section IV, State Plan Narrative, provides a detailed description and instructions for the format and content of the Narrative. A sample outline of the State Plan Narrative is contained in Appendix II.

Corrective Action Plans. CAPs are expected as a part of the SQSP when a state’s annual performance does not meet the criteria, specifically:

Performance that did not meet ALPs for Core Measures for the annual measurement period and remains uncorrected prior to the preparation of the SQSP;

Performance that did not meet the criteria for Secretary’s Standards for the annual measurement period and remain uncorrected prior to the preparation of the SQSP;

UI program deficiencies identified by the NO in the annual SQSP UIPL;

UI program integrity; and

Failure to meet the requirements for the Assurance of Contingency Planning.

CAPs will not be expected based on Management Information Measures in most circumstances. However, if a state’s performance in one or more Management Information Measures is so poor that a state’s compliance with Federal law requirements is in question, a CAP may be expected.

A sample of the required CAP format is in Appendix II.

UI Program Integrity Action Plan (IAP). All states are required to complete the IAP, outlining the strategies the state will undertake during the planning period regarding the prevention, reduction, and recovery of UI improper payments. SWAs will use the IAP template in Appendix II to describe planned activities to prevent, detect, reduce, and recover improper UI payments. The description of the plan is in Appendix V.

Organizational Chart. The state must submit an organizational chart. This organization chart must conform to the requirement for delivery of service through public employment offices, or such other designated providers as the Secretary may authorize; show the state's configuration from the Governor of the state down to the point of Employment Service and UI customer service delivery; and provide sufficient detail to show each organizational unit involved and the title of the unit manager.

SQSP Signature Page. State administrators must sign and date the SQSP Signature Page located in Appendix II. By signing the Signature Page, the state administrator certifies that the state will comply with all the assurances and activities contained in the SQSP guidelines.

Submittal of the SQSP. States must submit the SQSP to the RO by the date the Region has specified. The SQSP Content Checklist (Checklist) located at the end of this chapter shows all the documents that comprise the entire SQSP. States should use the Checklist when preparing the SQSP to ensure that those documents appropriate to its plan are submitted, and to minimize the potential for a delay in the approval and funding process. Electronic transmittal of the SQSP is required in a format specified by the RO. States must provide the RO with an original SQSP Signature Page; however, states may submit the Signature Page electronically, if state law permits.

Submittal of the SQSP as part of the WIOA Combined State Plan. WIOA provides the option for states to include program plans for mandatory one-stop partners and other programs to submit a Combined State Plan. Given that the UI program is a mandatory one-stop partner under WIOA, states have the option of including the UI program as part of the Combined State Plan. However, each state must participate in the UI Performs SQSP process whether or not the state decides to include the UI program as part of its Combined State Plan. The SQSP State Plan Narrative must provide a discussion of the plan coordination with other WIOA Combined Plan programs to ensure a coordinated effort and integrated service delivery.

States that elect to include UI in the Combined State Plan must submit the most recently approved complete SQSP package through the Combined State Plan process via the online WIOA State Plan Portal at https://wioaplans.ed.gov/.

STATE PLAN NARRATIVE

Of necessity, states engage in a planning process and set priorities for the coming two years. The State Plan Narrative (Narrative) provides a vehicle for sharing the results of that process with the Federal partner. In addition, it provides an opportunity to report on the integration and coordination with other internal and external plans which serve the same client.

Description. The Narrative consists of a description of major planning elements the state plans to focus on during the 2-year planning cycle. The Narrative should be concise, as a more detailed discussion with RO staff already may have occurred or may occur as a follow-up. However, in order to develop RO and NO support for its objectives, the state needs to provide a minimum amount of information relative to the categories defined in a format that allows for follow-up and tracking.

Below are the components to be included in the Narrative. These components should be addressed in a manner that best describes the state’s direction and plans for two consecutive fiscal years:

The strategic direction the state has adopted to ensure continuous program improvement, including the basis for the state’s choice of areas to emphasize in the planning cycle, and the actions planned to support performance improvement during the two years;

Assessment of program performance in prior program years;

A discussion of the coordination with other plans, including the WIOA Combined Plan;

Responses to the Secretary of Labor’s areas of program emphasis;

State performance in comparison to the GPRA goals for the U.S. Department of Labor;

Actions planned to correct the following types of deficiencies regarding UI programs and reporting requirements including:

Program Review Deficiencies. Causes for failures to conduct required program reviews.

Program Deficiencies. Uncorrected deficiencies identified during program reviews conducted by the state, or ETA.

Reporting Deficiencies.

Missing reports: Failure to submit any Federally-required report.

Late reports: Failure to timely or accurately submit any Federally-required reports. This includes monthly and quarterly reports submitted late more than 50 percent of the time (7 of 12 months for monthly reports; 3 of 4 quarters for quarterly reports); and annual reports submitted late 3 consecutive years.

Information on the state strategy for evaluating customer satisfaction and including customer input to promote continuous improvement; (optional)

State’s specific requests for technical assistance from the Federal partner; and

Information on the state’s approach to maintaining solvency of the state’s unemployment fund.

Format and Instructions. A sample of the Narrative outline is in Appendix II. The format is intended to provide states flexibility in conveying the overall direction and emphasis of the Narrative, while providing for electronic transmittal. States are requested to address each area of the outline, including entering N/A (Not Applicable) where appropriate.

CORRECTIVE ACTIONS PLANS

Description. CAPs are the state’s formal plan and schedule for improving performance. States are to complete each component of the CAP, including the CAP summary, milestones, and completion dates. CAPs are to be completed and submitted using the format(s) in Appendix II.

States are expected to complete and submit CAPs for the following:

Performance Deficiencies. Performance that did not meet criteria established for Secretary’s Standards, Core Measures, and UI Programs for the annual measurement period and remains uncorrected prior to the preparation of the SQSP is considered deficient. CAPs for Secretary’s Standards, Core Measures, and UI Programs must be titled as listed in Appendix I.

In many instances, performance deficiencies will have been identified prior to the annual assessment with a CAP already in existence to remedy the problem. Accordingly, the SQSP will not, in many instances, result in the development of a new CAP unless progress on an existing plan is not on target or does not adequately address milestones for the plan cycle. Such CAPs (i.e., adequate, existing CAPs) will be incorporated into the SQSP submission along with revised CAPs and CAPs addressing newly identified deficiencies.

UI Program Deficiencies. ETA will issue additional guidance to address UI program deficiencies in the annual SQSP UIPL.

Single Audits. Each state is subject to a Single Audit for the regulations outlined in 2 CFR Part 200, Subpart F. Any unresolved program compliance or performance deficiencies identified by a single audit must be addressed in a CAP. However, if a state is developing a CAP for a performance measure associated with the unresolved program compliance or performance deficiencies from the single audit, the corrective actions for both items may be addressed in a single CAP. Information on the program and audit objectives for the UI program is available as part of the FY 2023 Compliance Supplement at: 2023 Compliance Supplement – 2 CFR Part 200 Appendix XI (whitehouse.gov). (Note: The Compliance Supplement and link is updated annually.)

Poor Performance on Management Information Measures. If a state’s performance in one or more Management Information Measures is so poor that a state’s substantial compliance with Federal law requirements is in question, corrective action may be required.

CAP Format Completion. When developing a CAP for deficient performance, states must complete all data elements in the prescribed formats. Each of the prescribed formats includes the data elements listed below.

State.

Federal Fiscal Year.

Measure/Program Area. Measures are listed in Appendix I.

Performance Level. The state must indicate the target performance level they anticipate will result from the completion of the planned corrective actions plan and milestones for each quarter of the planning cycle. The quarterly targets are represented as a percentage reflecting 12-months of cumulative performance data for each quarter ending date.

Corrective Action Plan Summary. The summary must address each deficient performance measure as described in ET Handbook 336, Chapter I, in the space provided. It must explain the reason for the deficiency, provide a description of the specific actions/activities planned to improve performance, and a plan for monitoring and assessing accomplishments of planned actions for each CAP.

If the desired improvement will not be accomplished by the end of the two consecutive fiscal years for which the plan is submitted, the state should provide a multi-year plan which must include: (1) an estimate of where performance will be at the end of the 2-year planning cycle; (2) major actions remaining to be taken in subsequent fiscal years; and (3) a projection as to when the performance goal will be achieved.

Milestones and Completion Dates. The state must list both specific milestones (key corrective action or improvement activities) and the completion date for each milestone in the space provided. Milestones must be established for each element of the state’s CAP and be of sufficient number and frequency to facilitate state and regional plan oversight and assessment during the 2-year cycle. It is anticipated that one or more milestones for each quarter would permit such progress tracking and assessment during the planning cycle through state and regional follow‑up schedules.

NOTE.

Milestones should be concise and should specify key actions to be

accomplished throughout the planning cycle to implement the state's

proposals for achieving its corrective action goals. States also

may wish to identify performance milestones that reflect the

performance level they anticipate will result from completion of

planned activities.

Quarterly Updates. States must provide a quarterly update for each milestone. The update should describe if the milestone was completed as scheduled. If the milestone was not completed as scheduled, states should explain why and provide a new completion date.

An Excel Workbook will be used by states for developing SQSP submissions and for reporting updates to the specific milestones and performance each quarter. The Excel Workbook will be provided to states at the beginning of each SQSP planning cycle. A snapshot of the required format is contained in Appendix II.

UI Program Integrity Action Plan (IAP).

Description. IAPs must include root causes of UI improper payments, person(s) accountable for reducing UI improper payments, strategies to address root causes and recovery of improper payments, and a timeline. IAPs should be completed and submitted according to the format in Appendix II.

IAP Format Completion. When developing an IAP, states must provide all required information as discussed in this Handbook and in the annual SQSP UIPL. A recommended template for the IAP is included in Appendix II of this Handbook.

Instructions for completion on the IAP are in Appendix V.

BUDGET WORKSHEETS AND INSTRUCTIONS

This section contains instructions states will need to follow to prepare resource requests for administering the UI program during the fiscal year. Budget worksheets are in Appendix II. Only two UI program operation worksheets (UI‑1 and SF 424) are required. State agencies must prepare and submit the UI‑1 (via Unemployment Insurance Required Reports (UIRR)) for staff hour estimates, and the SF 424 (via grants.gov) for base level planning and supplemental grant requests.

Worksheet UI‑1, UI Staff Hours. A facsimile of Worksheet UI-1 and associated form completion instructions are found in Appendix II. These data are required for the development of annual base planning targets. The UI-1 worksheet is due by submission via the UIRR to the NO (Attn.: Office of Unemployment Insurance, Division of Fiscal and Actuarial Services) by October 1 of each year.

SF 424, Application for Federal Assistance. The regulation at 22 CFR 200.207 requires the use of forms approved by OMB under the Paperwork Reduction Act of 1995, as amended, for an application for grant funds by state grantees; OMB Standard Form (SF) 424, Application for Federal Assistance is the approved form. ETA requires that states use the SF 424 for submitting applications for UI base grants and SBRs. The SF 424 must be completed according to its instructions.

Procedures for Submission. States must submit a separate SF 424for each request for base funding and each SBR. A separate SF 424A also may be required as described in sub-paragraph 2.b. below. In addition, states which submit SBRs must provide supporting justification and documentation. SF 424s are due as requested, or with the SQSP at the latest, for base grants and throughout the year as necessary for SBRs.

Form Completion Instructions. States must follow the standard instructions in completing SFs 424 and 424A; however, states are not required to complete all items on the SF 424 and 424A. A facsimile of these forms and completion instructions are found in Appendix II. The following are specific guidelines for completing SFs 424 and 424A.

a. SF 424. States are not required to complete Items 3, 4, 6, 9, 13, and 14 for base grants and SBRs. States must complete the remaining items. In Item 2, all SBRs are considered to be revisions. In Item 12, the title of the project must refer to either the base grant or SBR title and number. SBRs must be numbered sequentially within the fiscal year, e.g., 00-1, 00-2, etc.

b. SF 424A. States must complete Items 1, 6, and 16 for SBRs. States are not required to complete this form for base grants, unless the number of base claims activity staff years paid by quarter vary; states that do so must show the quarterly distribution in Item 23 (Remarks).

Supplemental Budget Requests (SBRs). ETA provides supplemental funding related to expenditures due to state law changes enacted after the base allocation is provided. In addition, ETA may on occasion award supplemental funds for specific items not funded in the base allocations. States may submit SBRs for these specific solicitations from ETA.

Allowable/Unallowable Costs

Allowable Costs. States may submit SBRs only for one-time costs that are not a part of base or above-base funding. SBR funds may be used only for the purposes identified in the SBR and/or any modifications to the original agreement approved by the grant officer.

Unallowable Costs. SBR funds may not be used for ongoing costs, such as maintenance of software and hardware, or ongoing communications costs. In addition, SBRs may not be used to pay for salary increases, even when these increases are caused by a law change.

Guidelines for Preparing SBR Supporting Documentation. ETA will evaluate and approve all SBRs on the basis of supporting documentation and the justification provided. Insufficient justification may delay processing and result in partial or total disapproval of the SBR.

Supporting Documentation. SBRs may address a variety of projects whose scope cannot be fully anticipated. At a minimum, the SBR supporting documentation must contain the following five elements; however, these guidelines will not perfectly fit every SBR. States should use them as a starting point.

1) Summary. For larger projects, the SBR should contain a summary (1-2 paragraphs) that explains what the funds will accomplish. It should identify major capital expenditures, including hardware, software, and telecommunications equipment; state staff; contract staff; and other purchases. It should also state what the final product or results will be when the funds have been expended.

2) Commitment to Complete Project. ETA cannot assure the availability of future Federal supplemental funds. By applying for these individual projects, the state is agreeing that the projects will be completed with no additional Federal SBR funding. Applicants must agree to continue efforts to complete the SBR project, and to supply any additional funds necessary to complete the project in a timely manner. This assurance is necessary to ensure that projects begun with Federal funds are not abandoned due to a lack of additional Federal funding.

3) Schedule. If the project activities have not been completed, the SBR must include a projected schedule. The schedule should provide the projected dates for significant activities from start to completion.

4) Amount of Funding Requested. The total dollar amount of the SBR must be included. The costs of specific program modules or tasks must also be listed.

5) Description of the Proposed Fund Usage. The SBR must contain a full description of how the funds are to be used and why the proposed expenditures represent the best use of funds for the state. For each specific program module or task, the SBR must include costs for:

(a) Staff. The request must identify both one-time state staff needs, and contract staff needs. Staff needs must include the type of position (e.g., program analysts), the expected number of staff hours, and the projected hourly cost per position.

(1) State Staff. Staff costs are allowable, but all personal services (PS) and personal benefit (PB) expenses and time worked for the project must be appropriately charged to the SBR.

(2) Contractor Staff. For contract staff, the state must supply documentation including the estimated positions and hours, and the anticipated costs. States electing to negotiate with the Information Technology Support Center (ITSC) or other available sources for technical assistance must supply the same information normally requested for all contract staff, including the type of position, the expected staff hours, and the costs.

(b) Non-Personal Services (NPS). States may identify itemized one-time state NPS needs or may calculate staff-related NPS costs by formula. If not itemized in the SBR, staff-related NPS costs (excluding data processing and other needs) must be based on the rates approved for the current year's base allocation.

(1) Hardware, Software, and Telecommunications Equipment. This section must include any hardware, software, and/or telecommunications equipment purchases that are a part of the request. Descriptions must show that the sizing and capabilities of the proposed purchases are appropriate for the state. States that receive SBR funds for specific items, and subsequently determine that other items are more suitable, may substitute those items if they submit an amendment to the SBR documenting the appropriateness of the purchase, and ETA approves the substitution. Substitutions must be in line with the overall goals of the project.

SBRs sometimes include requests for items covered under the definition of automation acquisition in Chapter II. The obligation and expenditure periods for these funds are longer than the periods for regular UI base and above base funds. States must clearly identify automation acquisition items in the SBR.

(2) Travel. The request may include NPS travel costs; however, PS and PB costs for staff while on travel are not allowable.

(3) Other. The request may include one-time costs for other activities, not identified above, and anticipated to be obtained from vendors, such as telephone companies, Internet service providers, and telecommunications providers.

Additional Required Items for Law Change SBRs. SBRs for law changes must contain the following information:

1) The specific bill number of enactment, and effective date of law change.

2) Relevant provisions as an attachment.

3) Costs per legislative provision and a narrative explaining why costs were or will be incurred for each provision, e.g., implementing tax rate changes; increasing the maximum benefit amount; or creating an alternative base period.

4) If a legislative provision benefits both UI and non-UI activities, the SBR must contain a statement certifying that the request is consistent with the state’s approved cost allocation plan and is only for costs which, under Federal law, may be funded from UI grants.

Supplementary Items. Some SBRs are for large-scale, complex projects that may be accomplished over a period of years. The following items are not required, but would be helpful in the SBR evaluation process:

Use of Technology. If applicable, the request should describe how the state will use technology in this project, including the technical appropriateness of the hardware, software, and/or telecommunications equipment for integration with the state's current operating systems.

Strategic Design. The SBR should include a description of the strategic design of the project as evidence of a well-thought-out analysis of operations.

Measurable Improvements Expected in UI Operations. The request should identify the areas in which services could be improved through implementation of the proposed project. Measurable improvements may include accomplishing necessary work using fewer steps, doing work more quickly, incorporating work steps which are not currently accomplished, or reducing the amount of error which presently occurs in the work product.

Supporting Materials. States may attach any additional materials which they believe will enhance the content of the SBR.

ASSURANCES

The State administrator, by signing the SQSP Signature Page, certifies that the state will comply with the following assurances, and that the state will institute plans or measures to comply with the following requirements. A facsimile of the Signature Page appears in Appendix II. The assurances are identified and explained in Paragraphs A. through K. below.

Assurance of Equal Opportunity (EO). As a condition to the award of financial assistance from ETA, the state must assure that the operation of its program, and all agreements or arrangements to carry out the programs for which assistance is awarded, will comply with the following laws:

Section 188 of the Workforce Innovation and Opportunity Act (WIOA);

Title VI of the Civil Rights Act of 1964, as amended;

Sections 504 of the Rehabilitation Act of 1973, as amended;

Age Discrimination Act (ADA) of 1975, as amended; and

Workforce Innovation and Opportunity Act (WIOA)Title IX of the Education Amendments of 1972, as amended;

Title II Subpart A of the Americans with Disabilities Act of 1990, as amended; and

Equal Pay Act of 1963, as amended.

Further, the state must assure that it will establish and adhere to Methods of Administration that give a reasonable guarantee of compliance with the above equal opportunity and nondiscrimination laws and regulations regarding the program services it provides and in its employment practices. These Methods of Administration must, at a minimum, include the following:

Designation of an Equal Opportunity Officer. The state must designate a senior-level individual to coordinate its EO responsibilities. The person designated must report to the top official on equal opportunity and nondiscrimination matters and be assigned sufficient staff and resources to ensure the capability to fulfill the agency’s equal opportunity and nondiscrimination obligations.

Equal Opportunity Notice and Communication. The state must take affirmative steps to prominently display the Equal Opportunity is the Law Notice in all of its facilities and inform applicants/registrants for programs, participants, applicants for employment, and employees:

a. that the state does not discriminate in admission, access, treatment, or employment; and

b. of their right to file a complaint and how to do so.

Other than the Equal Opportunity is the Law Notice, methods of notification of this information may include placement of notices in offices and publication of notices in newsletters, newspapers, or magazines.

Assurances. The state must develop and implement procedures for transferring nondiscrimination and EO obligations in sub-contracts and sub-agreements.

Universal Access. The state must take appropriate steps to ensure it is that it is providing universal access to its programs. These steps should include reasonable efforts to the various racial and ethnic groups; members of both sexes; individuals with disabilities; individuals address possible disparities in different access based on, possibly among other things, race, ethnicity, sex, disability status, age groups; and individuals with different, and language needs.

Compliance with Section 504. The state must take the necessary measures to ensure access to its programs and facilities for persons with disabilities, as well as make certain communication with persons with disabilities is as effective as that with others.

Data Collection and Recordkeeping. The state must collect such data and maintain such records in accordance with procedures prescribed by the Director of the U.S. Department of Labor’s Civil Rights Center. These characteristics data (e.g., race, sex, national origin, age, disability) are utilized to determine whether the state and its local office are in compliance with Federal nondiscrimination and equal opportunity statutes and regulations.

Monitoring. The state must establish a system for periodically monitoring the delivery of program services for compliance.

Discrimination Complaint Procedures. The state must develop and follow procedures for handling complaints of discrimination covering all of the regulations applicable to it as a recipient of Federal financial assistance.

Corrective Actions and Sanctions. The state must establish procedures for taking prompt corrective action regarding any noncompliance finding relating to the administration, management, and operation of its programs and activities.

Assurance of Administrative Requirements and Allowable Cost Standards. The State must comply with administrative requirements and cost principles applicable to grants and cooperative agreements as specified in 2 CFR 200 (Office of Management and Budget’s Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards) and 2 CFR part 2900 (U.S. Department of Labor’s Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards). The state must assure that state staff will attend mandatory meetings and training sessions or return unused funds.

States that have subawards to organizations covered by audit requirements of 2 CFR 200, Subpart F (Audit Requirements) must (1) ensure that such subrecipients meet the requirements of that circular, as applicable, and (2) resolve audit findings, if any, resulting from such audits, relating to the UI program.

The state also must assure that it will substantially comply with the following specific administrative requirements:

1. Administrative Requirements

a. Program Income. Program income is defined in 2 CFR 200.11 as gross income earned by the non-Federal entity that is directly generated by a grant supported activity or earned as a result of the Federal award during the period of performance. States may deduct costs incidental to the generation of UI program income from gross income to determine net UI program income. UI program income shall be added to the funds committed to the grant by ETA. The program income must be used only as necessary for the proper and efficient administration of the UI program. Any rental income or user fees obtained from real property or equipment acquired with grant funds from prior awards shall be treated as program income under this grant.

b. Budget Changes. Except as specified by terms of the specific grant award, ETA, in accordance with regulations, waives the requirements in 2 CFR 308(f) that states obtain prior written approval for certain types of budget changes.

c. Real Property Acquired with Reed Act Funds. The requirements for real property under ETA-funded grants are TEGL July detailed in regulations and multiple guidance. The OMB regulation in 2 CFR 200.311 governs real property obtained with Federal funds. Training and Employment Guidance Letter (TEGL) No. 3-19, dated July 15, 2019, addresses real property under ETA-funded grants. TEGL No. 3-07, dated August 1, 2007, addresses Transfers of Federal Equity in State Real Property to the States. TEGL No. 7-04, dated October 20, 2004, addresses Issues Related to Real Property used for ETA Program purposes. UIPL No. 39-97, dated September 12, 1997, governs the use of Reed Act funds, which, as explained in section 2.c. below, are funds distributed under specified authorities in Section 903 of the Social Security Act.

d. Equipment Acquired with Reed Act Funds. The requirements for equipment acquired with Reed Act or other non‑Federal funds and amortized with UI grants are in UIPL No. 39-97, and UIPL No. 39-97 Changes 1 and 2, and in 22 CFR 200.313.

e. Real Property, Equipment, and Supplies

1) Real property, equipment, and supplies acquired under prior awards are transferred to this award and are subject to the relevant regulations at 22 CFR 200.

2) For computer systems and all associated components which were installed in states for the purpose of Regular Reports, Benefit Accuracy Measurement (BAM), and other UI Activities, the requirements of 22 CFR 200 apply. The NO reserves the right to transfer title and issue disposition instructions in accordance with Federal regulations at 22 CFR 200.313(e). States also will certify an inventory list of system components which will be distributed annually by ETA.

2. Exceptions and Expansions to Cost Principles. The following exceptions or expansions to the cost principles of 2 CFR 200 Subpart E are applicable to states:

Employee Fringe Benefits. Regarding personnel benefit costs incurred on behalf of state employees who are members of fringe benefit plans which do not meet the requirements of 22 CFR 200.431, the costs of employer contributions or expenses incurred for state fringe benefit plans are allowable, provided that:

For retirement plans, all covered employees joined the plan before October 1, 1983; the plan is authorized by state law; the plan was previously approved by the Secretary; the plan is insured by a private insurance carrier which is licensed to operate this type of plan in the applicable state; and any dividends or similar credits because of participation in the plan are credited against the next premium falling due under the contract.

For all state fringe benefit plans other than retirement plans, if the Secretary granted a time extension after October 1, 1983, to the existing approval of such a plan, costs of the plan are allowable until such time as the plan is comparable in cost and benefits to fringe benefit plans available to other similarly employed state employees. At such time as the cost and benefits of an approved fringe benefit plan are equivalent to the cost and benefits of plans available to other similarly employed state employees, the time extension will cease, and the cited requirements of 2 CFR 200 Subpart E will apply.

For retirement plans and all other fringe benefit plans covered in (1) and (2) of this paragraph, any additional costs resulting from improvements to the plans made after October 1, 1983, are not chargeable to UI grant funds.

UI Claimant's Court Appeals Costs. To the extent authorized by state law, funds may be expended for reasonable counsel fees and necessary court costs, as fixed by the court, incurred by the claimant on appeals to the courts in the following cases:

Any court appeal from an administrative or judicial decision favorable in whole or in part for the claimant;

Any court appeal by a claimant from a decision which reverses a prior decision in his/her favor;

Any court appeal by a claimant from a decision denying or reducing benefits awarded under a prior administrative or judicial decision;

Any court appeal as a result of which the claimant is awarded benefits;

Any court appeal by a claimant from a decision by a tribunal, board of review, or court which was not unanimous;

Any court appeal by a claimant where the court finds that a reasonable basis exists for the appeal.

Reed Act Distributions (1956-58, 1998). A state may wish to make payment from the state's UI grant allocations into a state's unemployment fund in the Unemployment Trust Fund for the purpose of reducing charges against Reed Act funds. The use of UI grant allocations to restore Reed Act funds under Section 903(c)(2) of the Social Security Act, 42 U.S.C. 1103(c)(2), is limited to the Reed Act distributions made under Sections 903(a) and (b) of the Social Security Act.

These include the 1956-58 and 1998 Reed Act distributions. The use of UI grant allocations to restore Reed Act funds made under other distributions is not permitted.

In addition, the use of UI grant allocations to restore Reed Act funds is permitted only if the charges against the grant are allowable costs under 2 CFR 200 Subpart E and

The charges against Reed Act funds were for amounts appropriated, obligated, and expended for the acquisition of automated data processing installations or for the acquisition or major renovation of state-owned buildings, but not land; and

Regarding each acquisition or improvement of property, the payments are accounted for as credit against equivalent amounts of Reed Act funds previously withdrawn under the respective appropriation.

Prior Approval of Equipment Purchases. As provided for in 2 CFR 200.313, the requirement that grant recipients obtain prior approval from the Federal grantor agency for all purchases of equipment (as defined in 2 CFR 200.11) is waived and approval authority is delegated to the state administrator.

Assurance of Management Systems, Reporting, and Record Keeping. The state must assure that:

Financial systems, including records documenting compliance with Federal statutes, regulations, and the terms and conditions of the Federal award, must be sufficient to permit the preparation of reports required by general and program-specific terms and conditions;; and the tracing of funds to a level of expenditures adequate to establish that such funds have been used according to the Federal statutes, regulations, and the terms and conditions of the Federal award. (2 CFR 200.302).

The financial management system and the program information system provide federally-required reports and records that are uniform in definition, accessible to authorized Federal and state staff, and verifiable for monitoring, reporting, audit, and evaluation purposes.

It will submit reports to ETA as required in instructions issued by ETA and in the format ETA prescribes.

It will retain all financial and programmatic records, supporting documents, and other required records at least three years as specified in 2 CFR 200.334.

The financial management system provides for methods to ensure compliance with the requirements applicable to procurement and grants as specified in 2 CFR 200.214Suspensio214 (suspension and debarment), and for obtaining the required certifications under 2 CFR 180 regarding debarment, suspension, ineligibility, and voluntary exclusions for lower tier covered transactions.

Assurance of Program Quality. The state must assure that it will administer the UI program in a manner that ensures proper and efficient administration. "Proper and efficient administration" includes performance measured by ETA through Core measures, Management Information Measures (including Secretary’s Standards), program reviews, and the administration of the UI program requirements.

Assurance on Use of Unobligated Funds. The state must assure that non-automation funds will be obligated by December 31 of the following fiscal year, and liquidated within 90 days thereafter, or as otherwise specified in annual DOL Appropriation Acts. ETA may extend the liquidation date upon written request. Automation funds must be obligated by end of the 3rd fiscal year, and liquidated within 90 days thereafter, or as otherwise specified in annual DOL Appropriation Acts. ETA may extend the liquidation date upon written request. Failure to substantially comply with this assurance may result in disallowed costs from audits or review findings.

Note. Travel costs for state agency personnel are considered obligated when the travel is actually performed.

Assurance of Prohibition of Lobbying Costs. The state must assure and certify that, in accordance with the annual DOL Appropriations Acts, no UI grant funds will be used to pay salaries or expenses related to any activity designed to influence legislation or appropriations pending before the Congress of the United States. (2 CFR 200.450)

Drug-Free Workplace. The state must assure and certify that it will comply with the requirements at this part. (The Drug-Free Workplace Act of 1988, 41 U.S.C. 702 et seq., and 2 CFR 182)

Assurance of Contingency Planning. The state must establish, effectively implement, and maintain plans for emergency response, backup operations, and post-disaster recovery for the UI systems to ensure the availability of critical information resources and continuity of operations in emergency situations.

The state must assure that, at a minimum, the following formally written and tested procedures of Contingency Planning are in place:

procedures for sustaining essential business operations while recovering from a significant disruption.

procedures and capabilities for recovering information technology (IT) system, such as a major application or general support system.

procedures to facilitate recovery of capabilities at an alternate site.

procedures and capabilities to sustain an organization’s essential, strategic functions at an alternate site for up to 30 days.

procedures for recovering business operations immediately following a disaster.

procedures for disseminating status reports to personnel and the public.

strategies to detect, respond to, and limit consequences of malicious cyber incident.

procedures for minimizing loss of life or injury and protecting property damage in response to a physical threat.

The National Institute of Standards and Technology (NIST) provide guidelines for IT Contingency Planning. An overview of these guidelines is provided in Appendix IV. It is recommended that the state follow state or departmental guidelines for business related procedures, such as business continuity, continuity of operations, or business recovery after a disaster.

In the State Plan Narrative, Section H, Assurances, states are expected to provide the dates that their Information Technology (IT) Contingency Plan, System Security Plan, and Risk Assessment were implemented, tested, and reviewed/updated.

If a state does not have an IT Contingency Plan, System Security Plan, and Risk Assessment procedures in place or if these documents are incomplete, then the state is expected to address the actions it plans to take to meet these requirements in a CAP.

Assurance of Conformity and Compliance. The state must assure that the state law will conform to, and its administrative practice will substantially comply with, all Federal UI law requirements, and that it will adhere to DOL directives.

Assurance of Automated Information Systems Security. The state must establish and implement an information security program. The state must ensure that it is providing adequate IT security and that it is commensurate to the level of risk associated with the UI program and the UI IT environment. The state must ensure that appropriate safeguards are put in place to protect both tangible and intangible resources and employees.

The state should develop, disseminate, and periodically review/update: (1) formal, documented policies for Risk Assessment and System Security Planning that address purpose, scope, roles, responsibilities, management commitment, coordination among all entities, and compliance; and (2) formal, documented procedures to facilitate the implementation of these policies and associated controls.

The state assures that it has the following Risk Assessment controls for UI systems in place:

Risk Assessments of the UI systems to assess the risk and magnitude of harm that could result from the unauthorized access, use, disclosure, disruption, modification, or destruction of information and other systems that support the operations and assets of the state.

Updates to the Risk Assessment at least once every three years or whenever there are significant changes to any of the UI systems, facilities where they reside, or other conditions that may affect the security status of the system.

Scans for vulnerabilities in the UI systems as deemed necessary or when significant new vulnerabilities potentially affecting the system are identified and reported.

The state assures that it has the following System Security Planning controls for UI systems in place:

A System Security Plan for the UI systems that provides an overview of the security requirements for the systems and a description of the security controls in place or planned for meeting those requirements. The plan should be approved by the officials designated by the state.

An annual review of the system security plan for the UI systems. Revisions to the plan should address system/organizational changes or problems identified during plan implementation and/or security control assessments.

A set of rules that describes users’ responsibilities and expected behavior with regard to UI information and information system usage. A signed acknowledgement (Rules of Behavior) from users indicating that they have read, understood, and agreed to abide by a set of Rules of Behavior, before authorizing access to the information system and its resident information.

An overview of Risk Management and System Security Planning for an information system is provided in Appendix IV.

Assurance of Confidentiality. The state will keep confidential any business information, as defined at 20 CFR Part 603618.100, and any successor provision(s), it obtains or receives in the course of administering the Trade Adjustment Assistance for Workers (TAA), Alternative Trade Adjustment Assistance (ATAA), and Reemployment Trade Adjustment Assistance (RTAA) programs under this Agreement. The state also shall adhere as applicable to the requirements in 20 CFR Part 603. The state shall not disclose such information to any person, organization, or other entity except as authorized by applicable state and Federal laws.

Assurance of Disaster Unemployment Assistance (DUA). The state must assure that it will conduct annual training for its DUA staff and developing and maintain a standard operating procedures manual.

Assurances for Non-Construction Programs. The state must agree to Non-Construction Program assurances as detailed in Standard Form 424B, as applicable.

SQSP CONTENT CHECKLIST

The SQSP Content Checklist shows all the documents which comprise the entire SQSP listed by submittal and in order of assembly. Each state must ensure that those documents appropriate to its plan are submitted to minimize the potential for a delay in the approval and funding process.

Formal SQSP Submittal (Biennial submittal)

AUGUST/SEPTEMBER SUBMITTAL (Main)

Transmittal Letter

The State Plan Narrative

A. Overview

B. Federal Emphasis (GPRA goals), if required

C. Program Review Deficiencies

D. Program Deficiencies

E. Reporting Requirements

F. Customer Service Surveys (optional)

G. Other

H. Assurances

Corrective Action Plans

Deficient Core Performance

Deficient Secretary’s Standards

UI Program Deficiencies

BAM Requirement Deficiencies

Organization

Authority

3) Written Procedures

4) Forms

Sample Selection

Investigation Procedures

7) Case Completion Timeliness

TPS Requirement Deficiencies

Poor Performance of Management Information Measures

Single Audits

UI Program Integrity Action Plan

Budget Worksheets/Forms

SF 424, SF 424 (A) - Application for Federal Assistance (as necessary)

Organization Chart

Signature Page

OCTOBER SUBMITTAL

UI-1 - UI Staff Hours

B. Alternate year SQSP

AUGUST/SEPTEMBER SUBMITTAL (Main)

Transmittal Letter

State Plan Narrative with required updates

CAPs:

New CAPs for:

On-site reviews that identify a need for corrective action

New performance deficiencies identified during the most recent performance year.

Other performance deficiencies identified in the annual SQSP UIPL.

Modifications to existing CAPs for:

Missed milestones

Other

UI Program Integrity Action Plan

5. Budget Worksheets/Forms

SF 424, SF 424 (A) - Application for Federal Assistance (as necessary)

6. Organization Chart

7. Signature Page

OCTOBER SUBMITTAL

UI-1 - UI Staff Hours

SBR SUBMITTAL (Only when solicited by DOL)

1. Transmittal Letter

2. Budget Worksheets/Forms

SF 424 and SF 424 (A) - Application For Federal Assistance

3. Supporting Documentation

Summary

Commitment to Complete Project

Schedule

Description of Proposed Fund Usage

Amount of Funding Requested

Expenditures

4. Additional SBR Documentation (Law Change SBRs only)

Bill Number and Effective Date

Relevant Provisions

Costs & Narrative by Legislative Provision

UI only Statement

5. Optional Supplementary Items (Large-scale, Complex Projects)

Technical Approach

Strategic Design

Measurable Improvements Expected

Supporting Materials

ET HANDBOOK NO. 336

18th Edition

CHAPTER II - REPORTING

INTRODUCTION

Chapter II of the SQSP Handbook provides guidelines for the reports and data elements to be used for financial reporting of state UI program activities.

SUBMITTAL INSTRUCTIONS

Use of Prescribed Forms. States may submit financial report information on the ETA 9130, SF 270, and SF 424.

Electronic Submittal. States submit the UI-3 and the UI-1 worksheet through UIRR. This ensures that the reported data are consistent. UIRR makes output reports available for review and correction before electronic transmission to the NO. In addition, electronic submittal is available for the ETA 9130 via the Enterprise Business Support System.

States submit the SF 424s via www.Grants.gov. All other required standard forms must be submitted to the appropriate ETA regional office (RO); however, SBR information is submitted directly to the NO. The NO electronically receives UIRR and ETA 9130 reports, which the ROs also may access.

Due Dates. The UI-3 worksheet is due within 30 days after the end of the reporting quarter. The ETA 9130 is due 45 days after the end of the reporting quarter. The request form, SF 270, is a voluntary report.

Program Management Systems (PMS) Document Numbers. The following is an example of a list of PMS Document Numbers that the NO will use to issue obligational authority and that states will use for the ETA 9130 and when drawing cash. Additional line items may be necessary depending on the funding being directed to the state agency. Definitions of program categories on the UI-3 are provided in Section IV, Paragraph H, Time Distribution Definitions.

-

PROGRAM

PMS DOCUMENT NO.

UI State Administration

UIxxxxxxx

UI National Activities

UIxxxxxxx

Disaster Unemployment Assistance (DUA) Administration

UIxxxxxxx

Disaster Unemployment Assistance (DUA) Benefits

UIxxxxxxx

NOTE. ETA code numbers are assigned to each separate DUA disaster when funds are provided to the states.

REPORTS

Facsimiles of the forms and completion instructions can be found in Appendix III. Additionally, standard forms may be downloaded from https://www.grants.gov/web/grants/forms/sf-424-family.html and the ETA 9130 form and instructions may be downloaded from https://www.doleta.gov/grants/financial_reporting.cfm#ETA-9130_Forms_and_Instructions.

UI-3, Quarterly UI Above-base Report

Purpose. This report provides information to ETA on the number of staff years worked and paid for various UI program categories and provides the basis for determining above-base entitlements.

Reporting Instructions. States are required to report the number of quarterly staff years worked and paid and the number of year-to-date staff years paid. ETA does not prescribe the type of time distribution reporting system used by states to generate the required data. However, the system used must be capable of providing data in the required detail, and the data must fairly and accurately represent the utilization of staff years. Data must be traceable to supporting documentation, e.g., time distribution and cost reports. States using sampling, allocation, and estimating techniques to spread actual hours to the UI programs must have documentation describing the techniques and procedures being used.