ACRSI - Supporting Statement ROCIS - 12-17-24 ROCIS

ACRSI - Supporting Statement ROCIS - 12-17-24 ROCIS.docx

Acreage/Crop Reporting Streamling Initiative (ACRSI)

OMB: 0563-0084

UNITED STATES DEPARTMENT OF AGRICULTURE

Acreage/Crop Reporting Streamlining Initiative

OMB NUMBER: 0563-0084

A. Justification

1. Explain the circumstances that make the collection of information necessary. Identify any legal or administrative requirements that necessitate the collection. Attach a copy of the appropriate section of each statute and regulation mandating or authorizing the collection of information.

This is an extension of a currently approved information collection request. This is a 3-year renewal for both Farm Service Agency (FSA) and Risk Management Agency (RMA). The Acreage/Crop Reporting Streamlining Initiative (ACRSI) is an initiative to improve and streamline the existing information collection activities currently approved by OMB by eliminating or minimizing the duplication of information collected. The improvements and streamlining continue to reduce the overall burden on the public, USDA employees, and Approved Insurance Providers (AIPs) by eliminating the need for farmers and ranchers to report the same information multiple times and eliminate the need for USDA employees, AIPs and insurance agents to input the same data multiple times, thus reducing USDA administrative and operating costs.

The following statutory and regulatory mandates require the collection of acreage and production information from producers who wish to participate in certain USDA programs.

Section 508(f)(3) of the Federal Crop Insurance Act (7 U.S.C. §1515) requires producers to provide (1) annual records regarding crop acreage, acreage yields, and production for each agricultural commodity insured; and (2) report acreage planted and prevented from being planted by the designated acreage reporting date for the crop and location as established by the Federal Crop Insurance Corporation (FCIC). The Risk Management Agency administers these requirements for FCIC. (Please note that this is not an FSA requirement.)

7 U.S.C. 7333 (b)(3) specifically requires, for crops and commodities covered by the Noninsured Crop Disaster Assistance Program (NAP), annual reports of acreage planted and prevented from being planted must be reported, as required by the Secretary, by the designated acreage reporting date for the crop and location as established by the Secretary.

The Common Crop Insurance Policy Basic Provisions at 7 CFR 457.8 provide that insured producers must submit an annual acreage for each insured crop in the county on or before the acreage reporting date contained in the Special Provisions, or other date as specified.

7 CFR 1437.7(d) requires that reports of acreage planted or intended but prevented from being planted must be provided to Commodity Credit Corporation (CCC) at the administrative FSA office for the acreage no later than the date specified by CCC for each crop and location.

Sections 1614 and 11020 of the Agricultural Act of 2014 specify the Secretary shall reduce administrative burdens and cost to producers by streamlining and reducing paperwork, forms and other administrative requirements, including through implementation of the Acreage Crop Reporting Streamlining Initiative.

2. Indicate how, by whom, and for what purpose the information is to be used. Except for a new collection, indicate the actual use the agency has made of the information received from the current collection.

The purpose of this collection request is to ensure statutory criteria are met for Federal crop insurance, FSA, and Commodity Credit Corporation programs, the collection of commodity, acreage, and production information is necessary. The information collected will be the same information currently collected and will be used in the same manner it is currently used.

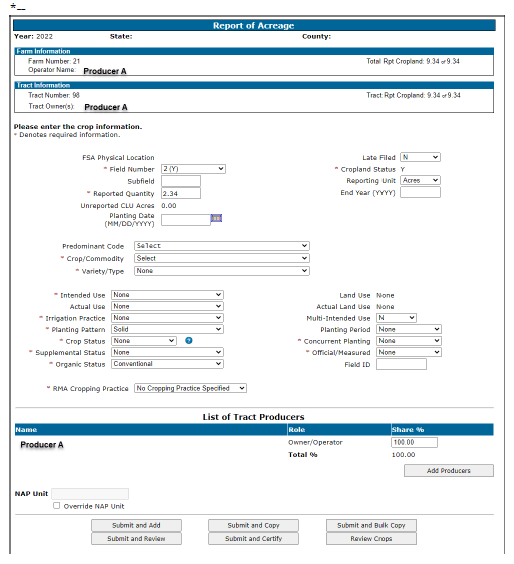

Figure 1 - Screenshot of FSA CARS showing acreage report data entry.

P roducers

report required information to both their FSA County Office and crop

insurance agent. Currently, to report this information, a producer

must provide the physical location of the crop, commonly by filling

out a map (provided by FSA, crop insurance agent, or bringing their

own generated map with all required information), of planting

locations, crops, dates, producer share, etc. at their local FSA

County Office, which then gets loaded in FSA’s Crop Acreage

Reporting System (CARS) to create an FSA-578. Additionally, the

producer must file similar information with their AIP via their agent

by using a copy of the FSA-578, by using the insurance companies own

form/e-form, or via precision ag data. The ACRSI initiative

identified the subset of information required to be reported to both

RMA and FSA, established department standards for the collection of

that information, and developed systems to allow that common

information to flow from the point where it is first reported to the

department to others who require the same information (e.g. from the

FSA County Office to the AIP for use by the producers insurance

agent). System and process enhancements are inherent to the ACRSI

lifecycle with work underway to improve how producers’

precision-ag systems and farm management information systems share

information with USDA and how USDA uses that information. This can

include optimization to federal crop insurance, USDA published

statistics, and general improvements to the acreage reporting process

within the USDA. FSA is currently working to implement the

Geospatially Enhanced Acreage Reporting (GEAR) system for reporting

acreage.

roducers

report required information to both their FSA County Office and crop

insurance agent. Currently, to report this information, a producer

must provide the physical location of the crop, commonly by filling

out a map (provided by FSA, crop insurance agent, or bringing their

own generated map with all required information), of planting

locations, crops, dates, producer share, etc. at their local FSA

County Office, which then gets loaded in FSA’s Crop Acreage

Reporting System (CARS) to create an FSA-578. Additionally, the

producer must file similar information with their AIP via their agent

by using a copy of the FSA-578, by using the insurance companies own

form/e-form, or via precision ag data. The ACRSI initiative

identified the subset of information required to be reported to both

RMA and FSA, established department standards for the collection of

that information, and developed systems to allow that common

information to flow from the point where it is first reported to the

department to others who require the same information (e.g. from the

FSA County Office to the AIP for use by the producers insurance

agent). System and process enhancements are inherent to the ACRSI

lifecycle with work underway to improve how producers’

precision-ag systems and farm management information systems share

information with USDA and how USDA uses that information. This can

include optimization to federal crop insurance, USDA published

statistics, and general improvements to the acreage reporting process

within the USDA. FSA is currently working to implement the

Geospatially Enhanced Acreage Reporting (GEAR) system for reporting

acreage.

FSA and RMA continues to enhance the ACRSI process. The effectiveness and lessons learned from each phase informed changes and expansions in subsequent phases, as discussed below. The first phase was initiated in the fall of 2011 in Dickenson, Marion, McPherson and Saline Counties in Kansas, and only for the collection of information from producers regarding winter wheat. The second phase was implemented in the spring of 2015 in 30 counties of Illinois and Iowa covering 9 crops. The third phase was implemented in the fall of 2015 in all counties of 15 states covering 9 crops. The fourth phase was implemented in the spring of 2016 in all counties nationwide covering 13 crops and about 90 percent of reported acreage. The fifth phase was implemented in the fall of 2016 expanding nationwide coverage to 16 crops and about 93 percent of reported acreage. The sixth phase was implemented in the fall of 2017 expanding nationwide coverage to 25 crops and about 94 percent of reported acreage. Since that time, ACRSI has continuously added more crops and types that now covers over 97 percent of insurable acreage. The program will continue to add crops and types over time to stay current; however, there are no crops left to cross walk that have major acreage impacts.

RMA and FSA additionally piloted a process to allow external providers to submit required data from precision agriculture or farm management information systems. This 2018 Pilot used planting data from Nebraska producers that was disseminated to the Agencies through the ACRSI Clearinghouse process. Beginning in 2024, FSA now processes geospatial data (planting boundaries) from third parties or AIPs with the Geospatial Review Application (GRA). This allows FSA staff to review and process more efficiently the submitted geospatial data and reduce the time and effort spent by producers when reporting detailed precision data to FSA.

Given the many differences in missions between RMA and FSA, producers must still complete, review, and sign both an FSA acreage report (form FSA-578) and a crop insurance acreage report. The ACRSI process allows for the majority of the required common information (e.g., crop name/type, land location, planting date, etc.) to be reported once and shared with the other Agency to reduce duplicate reporting. The data provided through the ACRSI process can also be prepopulated and available for review by producers when they arrive to the individual office to complete their reporting requirements. This ACRSI process improvement assures the same subset of common producer and acreage data is reported to all department agencies and reduces the amount of time required of the producer to satisfy department reporting requirements. Once collected, information may also be shared with the Natural Resources Conservation Service and the National Agricultural Statistics Service, as needed.

3. Describe whether, and to what extent, the collection of information involves the use of automated, electronic, mechanical, or other technological collection techniques or other forms of information technology, e.g. permitting electronic submission of responses, and the basis for the decision for adopting this means of collection. Also describe any consideration of using information technology to reduce burden.

RMA and FSA makes every effort to comply with the E-Government Act, 2002 (E-Gov) and to provide alternative submission of information collections. Producers are required to annually report certain information to both their FSA County Office and crop insurance agent using FSA CARS (e.g., Box and OneSpan technologies) or crop insurance information systems (each insurance provider has their own system and capabilities as covered by OMB Number 0563-0053 and 0563-0083). Over time, farm management information systems have evolved to provide producers practical options to automate the collection, organization, and preparation of information about their farming operations. Increasingly, producers use these systems to generate tabular reports and electronic files to satisfy a range of business needs including department reporting requirements.

Under ACRSI, the department has established data standards for common producer and acreage information reported to FSA and RMA. These data standards provide the foundation for leveraging technology to collect and share this information. As ACRSI functionality is further expanded and adopted, producers will be increasingly able to leverage their technology investments to report increasing amounts of information electronically or through a third party, and have that information shared between Agencies.

4. Describe efforts to identify duplication. Show specifically why any similar information already available cannot be used or modified for use for the purposes described in Item 2 above.

Every effort has been made to avoid duplication. There is similar data collected; however, those do not meet the agency’s needs.

FSA and RMA share many common customers. Currently, many of those customers are required to report some of the same commodity and acreage information for use by both agencies. ACSRI’s core purpose is to reduce the burden spent on these common elements by electronically sharing that data with the other agency prior to a second reporting event.

5. If the collection of information impacts small businesses or other small entities, describe any methods used to minimize burden.

FSA and RMA has determined that the requirements for this information collection do not adversely impact small businesses or other small entities. Information being requested or required has been held to the minimum required for the intended use. There is no additional reporting requirements created specifically for small businesses to meet the requirements.

6. Describe the consequence to Federal program or policy activities if the collection is not conducted or is conducted less frequently, as well as any technical or legal obstacles to reducing burden.

The information collected is mandatory as we would not be able to administer their respective programs in accordance with the applicable statutory/regulatory mandates without collection of the applicable information. In addition, failure to collect the applicable information could result in unearned Federal benefits being issued or producers being denied eligibility to program benefits. This is an ongoing information collection request.

7. Explain any special circumstances that would cause an information collection to be conducted in a manner:

requiring respondents to report information to the agency more often than quarterly;

requiring respondents to prepare a written response to a collection of information in fewer than 30 days after receipt of it;

requiring respondents to submit more than an original and two copies of any document;

requiring respondents to retain records, other than health, medical, government contract, grant-in-aid, or tax records for more than three years;

in connection with a statistical survey, that is not designed to produce valid and reliable results that can be generalized to the universe of study;

requiring the use of a statistical data classification that has not been reviewed and approved by OMB;

that includes a pledge of confidentiality that is not supported by authority established in statute or regulation, that is not supported by disclosure and data security policies that are consistent with the pledge, or which unnecessarily impedes sharing of data with other agencies for compatible confidential use; or

requiring respondents to submit proprietary trade secret, or other confidential information unless the agency can demonstrate that it has instituted procedures to protect the information's confidentiality to the extent permitted by law.

The collection of information is conducted in a manner consistent with the guidelines in 5 CFR 1320.5.

8. If applicable, provide a copy and identify the date and page number of publication in the Federal Register of the agency's notice, required by 5 CFR 1320.8 (d), soliciting comments on the information collection prior to submission to OMB. Summarize public comments received in response to that notice and describe actions taken by the agency in response to these comments. Specifically address comments received on cost and hour burden.

The 60-day notice was published on August 23, 2024, at 89FR 68125-68127. No comments were received.

Listed below are the System of Records that were amended and published in the federal register on December 11, 2007, Volume 72 Number 237, page 70290-70293. USDA/FCIC-2, Compliance Review Cases; USDA/FCIC-8, List of Ineligible Producers; USDA/FCIC-9, Agent; USDA/FCIC-10, Policyholder; and USDA/FCIC-11, Loss Adjuster.

We reached out to numerous people (including Scott U, Mark K., and Dean H. were contacted the week of December 9th, 2024) asking them to provide feedback and no one was willing to participate.

9. Explain any decision to provide any payment or gift to respondents, other than remuneration of contractors or grantees.

There are no payments or gifts provided to respondents.

10. Describe any assurance of confidentiality provided to respondents and the basis for the assurance in statute, regulation, or agency policy.

The data that is collected and handled in accordance with the established FCIC procedures for implementing the Privacy and Freedom of Information Act (FOIA). The information collection complies with the Privacy Act of 1974 and OMB Circular A-130, Responsibilities for the Maintenance of Records About Individuals by Federal Agencies.

Also, in Appendix I, Procurement Integrity;

“I.b. During this Agreement, no FCIC official shall knowingly:

Disclose any proprietary or source selection information regarding the agreement directly or indirectly to any person other than a person authorized by FCIC to receive such information.”

The Senior Government Information Specialist, Samantha Jones, reviewed and approved this package on December 11, 2024.

11. Provide additional justification for any questions of a sensitive nature, such as sexual behavior or attitudes, religious beliefs, and other matters that are commonly considered private. This justification should include the reasons why the agency considers the questions necessary, the specific uses to be made of the information, the explanation to be given to persons from whom the information is requested, and any steps to be taken to obtain their consent.

No data is collected that may be considered sensitive or personal in nature.

12. Provide estimates of the hour burden of the collection of information. Indicate the number of respondents, frequency of response, annual hour burden, and an explanation of how the burden was estimated.

Based on RMA policyholder data, around 500,000 policyholders file acreage reports each crop year. Since we know that virtually all RMA policyholders also report to FSA, RMA estimates that these 500,000 policyholders proceeded to complete and verify their acreage reports with the FSA County office or a crop insurance agent. The estimated average time spent at the second channel is 15 minutes. We also know that roughly half of these policyholders file both a spring and a fall acreage report thus we use a factor of 1.5 for the estimated number of responses per respondent. As indicated in the burden grid, this activity results in an estimated total burden of 187,500 hours per year.

FSA and RMA estimates that continued expansion of the ACRSI process would further encourage respondents to report their information via the Clearinghouse by directly using their precision ag or farm management information systems.

The estimated annualized cost to respondents for providing this information is:

$7,550,625.00

Calculated by:

187,500 x 40.27

187,500 Estimated Annual Burden Hours

$ 40.27 Median Hourly Wage for Farmers, Ranchers, and Other Ag Managers

Bureau of Labor Statistics, My 2023 National Industry-Specific Occupation Employment and Wage Estimates (https://www.bls.gov/oes/current/oessrci.htm); there is no recordkeeping or third party disclosure.

13. Provide estimates of the total annual cost burden to respondents or record keepers resulting from the collection of information, (do not include the cost of any hour burden shown in items 12 and 14). The cost estimates should be split into two components: (a) a total capital and start-up cost component annualized over its expected useful life; and (b) a total operation and maintenance and purchase of services component.

There is no start-up/capital or operation/maintenance costs associated with this program.

14. Provide estimates of annualized cost to the Federal government. Provide a description of the method used to estimate cost and any other expense that would not have been incurred without this collection of information.

RMA and FSA does not produce or distribute forms; therefore, there is no cost of producing or distributing forms for RMA. There is also no cost to RMA for the collection of the information from the producer because it is collected by the AIPs through their representatives and agents and covered by the existing Standard Reinsurance Agreement. However, the form of FSA-578 is available in an electronic form to be completed by producers at the County office for Noninsured Crop Disaster Assistance Program (NAP)

The recurring maintenance costs for ACRSI Clearinghouse technology components is estimated to be minimal, less than $10,000 per year. This is based on recent expenses for RMA IT contracting costs over the last 3 years. However, future development costs would be incurred depending on technology enhancements for the intake, distribution, and display of producer data.

15. Explain the reasons for any program changes or adjustments reported in Items 13 or 14 of the OMB Form 83-1.

There are no changes in this collection. This is an extension of a currently approved information collection. There are an estimated 500,000 respondents, with an estimated 750,000 total annual responses for an estimated 187,500 annual burden hours.

16. For collections of information whose results are planned to be published, outline plans for tabulation and publication.

Neither FSA nor RMA currently intends to publish the information collection. NASS may make available data obtained through ACRSI in its annual reports.

17. If seeking approval to not display the expiration date for OMB approval of the information collection, explain the reasons that display would be inappropriate.

No approval is being sought to not display OMB approval.

18. Explain each exception to the certification statement identified in Item 19 of the 83-I.

This information collection meets the certification requirements of SF-83-I, Item 19.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Risk Management Agency |

| File Modified | 0000-00-00 |

| File Created | 2025-01-03 |

© 2026 OMB.report | Privacy Policy