State, Local, Tribal Competitive

Uniform Grant Application for Non-Entitlement Discretionary Grants (COMPETITIVE; NON-COMPETITIVE and State Plans)

FFIG FY21 RFA Final

State, Local, Tribal Competitive

OMB: 0584-0512

OMB Control Number: 0584-0512

Expiration Date: xx/xx/xxxx

Supplemental Nutrition Assistance Program Fraud Framework Implementation Grant Program

Fiscal Year 20XX Request for Applications (RFA)

Catalog for Federal Domestic Assistance Number (CFDA): 10.535

Release Date: X X, 20XX

Application Due Date: 11:59 PM, Eastern Standard Time (EST), X X, 20XX Anticipated Award Date: X X, 20XX

OMB Burden Statement: The valid OMB control number for this information collection is 0584-0512. The estimated average time required to complete this information collection is 39 hours per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to: U.S. Department of Agriculture, Food and Nutrition Services, Office of Policy Support, 1320 Braddock Place, 5th Floor, Alexandria, VA 22314 ATTN: PRA (0584-0512). Do not return the completed form to this address.

A11

This Application Checklist provides applicants with a list of the required documents. However, FNS expects that applicants will read the entire RFA prior to the submission of their application and comply with all requirements outlined in the solicitation. The Application Checklist is for applicant use only and should not be submitted as part of the Application Package.

Complete the following at least four weeks prior to submission:

Obtain a Dun & Bradstreet Data Universal Numbering System (DUNS) number;

Register the DUNS number in the System for Award Management (SAM); and,

Register in Grants.gov.

When preparing your application, ensure:

1. Application format and narrative meet the requirements included in Section IV “Application and Submission Information.” This includes page limits, priorities outlined in Section I “Program Description”, and all necessary attachments.

When preparing your budget, ensure the following information is included:

All key staff proposed to be paid by this grant.

The percentage of time the Project Director will devote to the project in full-time equivalents (FTEs).

Your organization’s fringe benefit rate and amount, as well as the basis for the computation.

The type of fringe benefits to be covered with Federal funds.

Itemized travel expenses (including type of travel), travel justifications and basis for lodging estimates.

Types of equipment and supplies, justifications, and estimates, ensuring that the budget is in line with the project description.

Information for all contracts and justification for any sole-source contracts.

Justification, description and itemized list of all consultant services.

Indirect cost information (either a copy of a Negotiated Indirect Cost Rate Agreement (NICRA) or if no agreement exists and the applicant has never been approved for a NICRA, they may charge up to 10% de minimis). If applicant is requesting the de minimis rate or indirect costs are not requested, please indicate this in the budget narrative.

When submitting your application, ensure you have submitted the following:

SF-424 – Application for Federal Assistance (fillable PDF in Grants.gov)

SF-424A – Budget Information and Instruction Form (fillable PDF in Grants.gov)

SF-424B – Assurances for Non-Construction Programs (fillable PDF in Grants.gov)

SF-LLL – Disclosure of Lobbying Activities

FNS-906 – Grant Program Accounting System & Financial Capability Questionnaire (Appendix A)

Negotiated Indirect Cost Rate Agreement (PDF - Upload using the “Add Attachments” button under SF-424 item #15)

Application Checklist (continued)

When applicable, application packages are required to include the following documents:

AD-3030 – Representations Regarding Felony Conviction and Tax Delinquent Status for Corporate Applicants (fillable PDF in Grants.gov)

AD-1047 – Certification Regarding Debarment, Suspension, and Other Responsibility Matters Primary Covered Transactions

AD-1048 – Certification Regarding Department, Suspension, Ineligibility and Voluntary Exclusion Lower Tier Covered Transactions

AD-1049 – Certification Regarding Drug-Free Workplace Requirements (Grants) Alternative I

– For Grantees Other Than Individuals

AD-1052 – Certification Regarding Drug-Free Workplace State and State Agencies, Federal Fiscal Year

AD-3031 – Assurance Regarding Felony Conviction or Tax Delinquent Status For Corporate Applicants

Table of Contents

Application Checklist 2

PROGRAM DESCRIPTION & OBJECTIVES 6

FEDERAL AWARD INFORMATION 8

Cost Sharing or Matching Considerations 10

Pre-Award Screening Requirements 10

Acknowledgement of USDA Support 11

Address to Request Application Package 11

Content and Form of Application Submission 11

Preparing for Electronic Application Submission through Grants.gov 14

How to Submit an Application via Grants.gov 15

Grants.gov Receipt Requirements and Proof of Timely Submission 15

APPLICATION REVIEW INFORMATION 16

Evaluation of Grant Application Criteria 16

FEDERAL AWARD ADMINISTRATION INFORMATION 18

ADMINISTRATIVE AND NATIONAL POLICY REQUIREMENTS 19

Confidentiality of an Application 19

Conflict of Interest and Confidentiality of the Review Process 20

Code of Federal Regulations and Other Government Requirements 22

REPORTING REQUIREMENTS 22

Financial Reports 22

Performance Progress Report (PPR) 22

FEDERAL AWARDING AGENCY CONTACTS 22

OTHER INFORMATION 23

RFA Budget Narrative Checklist 24

FNS-908 Performance Progress Report (PPR) – For Reference Only 28

Introduction

The Food and Nutrition Service (FNS) administers the nutrition assistance programs of the U.S. Department of Agriculture, including the Supplemental Nutrition Assistance Program (SNAP). SNAP is the cornerstone of USDA's nutrition assistance programs. It began in its modern form in 1961 but has its origins in the Food Stamp Plan to help the needy in the 1930's. SNAP is the largest program in the domestic hunger safety net and provides nutrition assistance benefits via an Electronic Benefit Transfer (EBT) card to millions of low-income people. These benefits help supplement household food budgets so recipients can purchase more healthy food. FNS works in partnership with State agencies in the administration of SNAP.1

While the vast majority of recipients are eligible and use their benefits as intended, there are some who violate program rules. Program violations may include a number of activities, such as falsifying income or identity in order to be eligible for benefits they may not be entitled to, or by using benefits for anything other than their intended purpose. Program violations can result in severe penalties, such as criminal punishment and permanent disqualification from the program. SNAP has zero tolerance for fraud and continues to work with its State partners to implement measures to improve program integrity.

From 2014 to 2017, FNS partnered with 10 State agencies to pilot new strategies and improve the use of analytics to more effectively detect potential fraud, improve administration, and increase oversight. The lessons learned and ideas tested during these pilots led to the development of the SNAP Fraud Framework. The SNAP Fraud Framework is a collection of procedures, innovative ideas and promising practices to help State agencies improve fraud prevention, detection and investigation techniques and processes. This framework and its supporting documents are designed to support States as they develop new efforts or improve on existing ones to prevent, detect, and investigate fraud. There is no simple solution to combat fraud and each State may require a different approach to improve program integrity. The SNAP Fraud Framework acknowledges the need for State flexibility by offering a menu of options for States to implement as they work to improve program operations and efforts.

The SNAP Fraud Framework is intended to share best practices with personnel directly administering and enforcing the Food and Nutrition Act of 2008. It includes sensitive fraud detection and investigative techniques and therefore has not been shared beyond FNS and SNAP State agencies, the only eligible applicants for this grant opportunity. State agencies that do not have access to the SNAP Fraud Framework should contact their FNS Regional Office.

Program Description

The purpose of the SNAP Fraud Framework Implementation Grant Program is to support State agency efforts to improve and expand recipient fraud prevention, detection and investigation efforts using the procedures, ideas and practices outlined in the SNAP Fraud Framework. Successful applications will specifically incorporate one or more of these procedures, ideas and practices in their proposals. This grant opportunity is not intended to support retailer fraud-related projects.

Section 29(a) of the Food and Nutrition Act of 2008 (7 U.S.C. 2036) authorizes FNS to provide grants on a competitive basis to State agencies to strengthen program integrity activities in SNAP. Up to $X

1 Throughout this RFA, “State agencies” refers to the agencies that administer SNAP in the 50 States, the District of Columbia, the Virgin Islands, and Guam.

has been appropriated in FY 20XX for State agencies to implement practices described in the SNAP Fraud Framework.

Listed in the next section are some general examples of potential project ideas for each program objective, which can be found in the SNAP Fraud Framework. Applicants should identify projects that best fit the needs of the State and that the State can successfully implement. Additionally, we encourage applicants to consider foundational projects that the State agency can build on for future growth in the fraud control area, such as data quality improvement, strategic planning, or the development of a training program.

Key Objectives

Below is a list of the Program Objectives. As noted in the section below, within “Activities/Indicators Tracker”, proposed activities should be clearly aligned to these Objectives and their associated Activities and Indicators.

-

#

Objectives

1

Organizational Management: This objective aims to help States establish and communicate priorities, organize employees, and manage both large-scale and day-to-day processes.

Many of the concepts described in this component are the foundation for successful program integrity initiatives.

Examples of the types of projects that would fall under this objective include:

Establish a strategic plan that addresses recipient integrity

Improve documentation around recipient fraud processes and procedures that align with strategic priorities

Enhance data analysis skills within fraud unit

2

Performance Measurement: This objective offers recommendations encouraging States to consistently capture and analyze their own performance.

Examples of the types of projects that would fall under this objective include:

Assess the impact of current integrity efforts and initiatives through active monitoring of a defined set of metrics

Establish metrics, measures, and key performance indicators to track performance

Automate data gathering and calculations currently done manually

3

Recipient Integrity Education: This objective provides targeted integrity education initiatives to help ensure recipients have the necessary information and tools to use SNAP benefits as intended—preventing fraud before it occurs. When producing recipient integrity education material, States are encouraged to educate the public and applicants about SNAP fraud, rather than emphasizing the consequences as a deterrent to applying.

Examples of the types of projects that would fall under this objective include:

Improve client integrity education messaging through various channels, in multiple languages, and in plain language rather than in legal jargon.

Ensure SNAP recipients as well as the public understand what SNAP fraud is, and how to avoid committing program violations.

4

Fraud Detection: Here, the SNAP Fraud Framework stresses the importance of proactively detecting fraud from the application process and continuing throughout the recipient’s time in the Program.

Examples of the types of projects that would fall under this component include:

Strengthen efforts to detect potential fraud at the time of application

Improve the use of data analytics to monitor EBT card replacements and predict potential incidents of trafficking

Enhance internal controls to protect against employee fraud

5

Investigations and Dispositions: This objective aims to provide states with tools and suggestions to improve fraud case management from initial fraud referral through disposition.

Examples of the types of projects that would fall under this objective include:

Implement a data-driven process for prioritizing SNAP fraud investigations

Establish standardized procedures for developing effective evidence packages

Improve internal fraud referral and feedback processes

6

Analytics and Data Management: This objective details the necessary people, processes, and technology to launch and maintain an analytics capability. Data analytics can play a valuable role in preventing, detecting, and investigating SNAP fraud.

Examples of the types of projects that would fall under this objective include:

Clean up existing data to eliminate erroneous or duplicate values and improve usability

Improve data management processes (e.g., quality, storage, protection, security, standardization)

7

Learning and Development: The final objective contains recommendations for States to invest in training and professional development opportunities to promote employee engagement and to ensure employees are aware of new and emerging trends in fraud.

Examples of the types of projects that would fall under this objective include:

Establish a standardized training program for employees throughout the organization that focuses on their roles in recipient integrity activities

Create a mentoring or coaching program for professional development in support of recipient integrity efforts

The following information is intended to provide applicants with information to help applicants make informed decisions about proposal submissions.

Total amount of funding expected to award: $X

Anticipated number of awards: The number of grants awarded will be dependent on the quality and nature of the grants received.

Anticipated award announcement date: X, X 20XX

Expected amounts of individual Federal awards: FNS anticipates that funding per award will range from approximately $XXX,XXX to $XXX,XXX.

Anticipated start dates and period of performance: The period of performance begins on X X, 20XX and will not exceed two (X) years from the start date, or X X, 20XX.

Anticipated amounts and/or numbers of individual awards: X-X

Application due date: X X, 20XX

Please note:

Grant awards are subject to the availability of funding and/or appropriations of funds.

FNS reserves the right to use this solicitation and competition to award additional grants this year or the subsequent fiscal year, should additional funds become available.

Program Requirements

The goal of the SNAP Fraud Framework Implementation Grant is to help States implement promising practices contained in the SNAP Fraud Framework. The awards will support new projects that fall under any of the seven components of the SNAP Fraud Framework. The seven components can be found listed under the Program Goals heading of this RFA and fully described in the SNAP Fraud Framework document. Proposals should clearly describe the intent and scope of activities and their relation to any of the seven components of the SNAP Fraud Framework. State agencies that do not have access to the SNAP Fraud Framework should contact their FNS Regional Office.

Proposed projects must be sustainable. A significant part of the evaluation criteria will be dependent on how clear a proposal demonstrates the State agency’s ability to continue funding and implementing activities at the same level once the grant ends. This applies to all proposals, including those that propose hiring personnel to implement a part of the project.

Funds from this RFA are for new projects and shall not be used for the ongoing cost of carrying out an existing project. Additionally, funds may not be used to offset costs for existing personnel.

Recipients

of prior

SNAP recipient

integrity grant

awards are

eligible for

this opportunity

should they

choose to

apply; however,

proposals for

this grant

program must be

for new

projects. 11

Each project design should include quantifiable objectives, measures to assess progress toward meeting those objectives, project activities linked to meeting specific objectives, and a list of deliverables and/or milestones for the duration of the project. Applicants must also include a clear and reasonable timeline, and a narrative description of how the project will be staffed and managed, including a project organizational chart. Every grantee must assess and report on its progress each quarter by using performance measures tied to specific project objectives. These measures can include process measures, output measures, and outcome measures. The proposal should describe the process for collecting and reporting these data including the data source.

The proposal’s project description must capture a bona fide need. The budget and budget narrative must be in line with the proposed project description. FNS reserves the right to request information not clearly addressed.

We encourage potential applicants to carefully read and review the Evaluation of Grant Application Criteria listed in this RFA under Application Review Information (Section V). These criteria outline the qualities FNS expects successful proposals to have; they will also guide the reviewers’ evaluation of proposals.

Allowable Costs

Allowable Uses of Funds

Among other costs, budgets may include expenses related to personnel, contractors, equipment and supplies, meeting expenses, travel, and trainings.

Expenditures for both equipment (i.e., items of personal property having a useful life of more than one year and a cost of $5,000 or more) and supplies are allowable expenses

Funds from this RFA are for new projects and shall not be used for the ongoing cost of carrying out an existing project.

FNS does not intend for this grant program to fund compliance with existing statutory or regulatory program requirements, such as data matching. FNS will continue to fund all State agency activities through 50% Federal matching of administrative costs.

SNAP Fraud Framework Implementation Grant-funded projects may benefit other governmental programs; however, grant funds must only support SNAP’s share of the project costs.

Grantees may use grants funds to procure contracts for good or services.

Please note: Funds noted for an existing or ongoing project will be removed from the budget and may cause the budget score to be marked down.

Restrictions on Funding Use

Grant funds cannot be used for the ongoing cost of carrying out an existing project.

Pre-award costs will not be awarded for this grant project.

Type of Award

FNS will award SNAP Fraud Framework Implementation Grants in the form of a Federal grant. FNS will provide funding for approved grants through the Grant Award/Letter of Credit process, upon receipt of a properly executed Grant Agreement and subject to the availability of funding.

3. ELIGIBILITY INFORMATION

Eligible Applicants

This grant opportunity is open to the 53 State agencies that administer SNAP. State Agencies may submit applications on behalf of specific counties or districts. FNS will consider only one application per State agency.

Cost Sharing or Matching Considerations

There are no cost sharing or matching requirements for this program.

Other Eligibility Criteria

N/A

Pre-Award Screening Requirements

In reviewing applications in any discretionary grant competition, prior to making a Federal award, Federal awarding agencies, in accordance with 2 CFR 200.205, are required to review information available through any OMB-designated repositories of government-wide eligibility qualifications or financial integrity information. Additionally, Federal awarding agencies are required to have a framework in place for evaluating the risks posed by applicants before they receive Federal awards. The FNS review of risk posed by applicants will be based on the following:

SAM.gov, the System for Award Management, the Official U.S. Government system that consolidated the capabilities of CCR/FedReg, ORCA, and EPLS

FAPIIS, the Federal Awardee Performance and Integrity Information System that has been established to track contractor misconduct and performance

Dun & Bradstreet, the system where applicants establish a DUNS number that is used by the Federal government to better identify related organizations that are receiving funding under grants and cooperative agreements

U.S. Department of Agriculture, AD-3030, Representations Regarding Felony Conviction and Tax Delinquent Status for Corporate Applicants

FNS Risk Assessment Questionnaire; Applicants must complete and return the Grant Program Accounting System & Financial Capability Questionnaire that allows FNS to evaluate aspects of the applicant’s financial stability, quality of management systems, and history of performance, reports and findings from audits. The questionnaire contains a number of questions that may be an indicator of potential risk. The evaluation of the information obtained from the designated systems and the risk assessment questionnaire may result in FNS imposing special conditions or additional oversight requirements that correspond to the degree of risk assessed.

Acknowledgement of USDA Support

As outlined in 2 CFR 415.2, grant recipients shall include acknowledgement of USDA Food and Nutrition Service support on any publications written or published with grant support and, if feasible, on any publication reporting the results of, or describing, a grant-supported activity. Recipients shall include acknowledgement of USDA Food and Nutrition Service support on any audiovisual which is produced with grant support and which has a direct production cost of over $5,000.

When acknowledging USDA support, use the following language: "This material is based upon work that is supported by the Food and Nutrition Service, U.S. Department of Agriculture.” Grantees should follow the USDA Visual Standards Guide when using the USDA logo.

Grant recipients may be asked to host USDA officials for a site visit during the course of their grant award. All costs associated with the site visit will be paid for by USDA and are not expected to be included in grant budgets.

4. APPLICATION AND SUBMISSION INFORMATION

Address to Request Application Package

Applicants may request a paper copy of this solicitation and required forms by contacting the FNS Grants Officer at:

Dawn Addison; Grant Officer Grants and Fiscal Policy Division

U.S. Department of Agriculture, FNS 1320 Braddock Place, Room 620

Alexandria, VA 22314

E-mail: [email protected]

Content and Form of Application Submission

FNS strongly encourages eligible applicants interested in applying to this program to adhere to the following applicant format. The proposed project plan should be presented on 8 ½” x 11” white paper with at least 1-inch margins on the top and bottom. All pages should be single-spaced, in 12-point font. The project description with relevant information should be captured on no more than 25 pages, not including the cover sheet, table of contents, resumes, letter of commitment(s), endorsement letter(s), budget narrative(s), appendices, and required forms. All pages, excluding the form pages, must be numbered.

Special Instructions:

Late application submission will not be considered in this competition. FNS will not consider additions or revisions to applications unless they are submitted via Grants.gov by the deadline. No additions or revisions will be accepted after the deadline.

Applications submitted without the required supporting documents, forms, certification will not be considered.

Applications missing a written proposal or budget narrative will not be considered.

FNS reserves the right to request clarification on any application submitted in response to this solicitation.

Applications not submitted via Grants.gov will not be considered.

If multiple application packages are submitted through Grants.gov by the same applicant in response to this solicitation, FNS will accept the latest application package successfully submitted. All other packages submitted by the applicant will be removed from this competition.

Cover Sheet

The cover page should include, at a minimum:

Applicant’s name and mailing address

Primary contact’s name, job title, mailing address, phone number and e-mail address

Grant program title and subprogram title (if applicable)

Table of Contents

The Table of Contents should include relevant sections, subsections and associated page numbers.

Application Project Summary

The application should clearly describe the proposed project activities and anticipated outcomes that would result if the proposal were to be funded.

Project Narrative

The project narrative should clearly identify what the applicant is proposing and how it will address a solution, the expected results and/or benefits once the solution is achieved, and how it will meet the RFA program scope and objectives. The proposed project methodology should describe the project design, address program specific methodology needs, procedures, timetables, monitoring/oversight, and the organization’s project staffing.

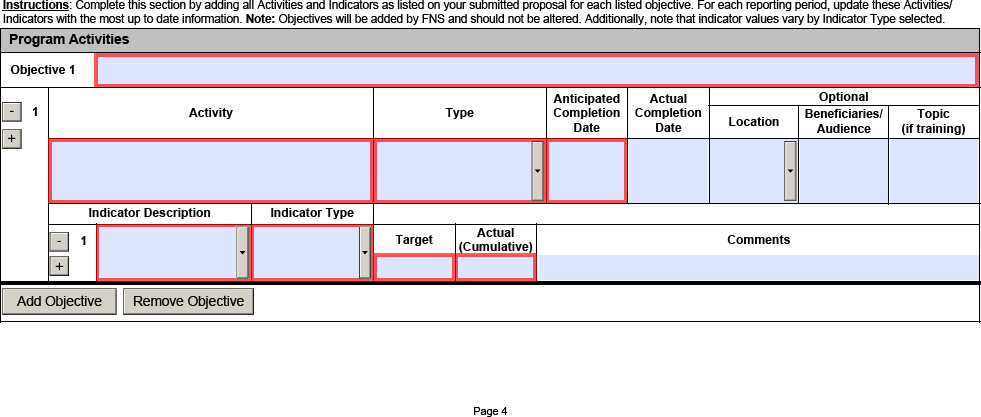

Activities/Indicators Tracker

Proposed Activities and indicators measuring success must be mapped to Program Objectives (as described in Section I – PROGRAM DESCRIPTION) in the below format (note that additional Activities/Indicators can be added as needed). Note: Indicators are defined as any metric you anticipate will be able to be tracked during the period of performance of the grant. Common examples include Number of People Attended, Number of People Impacted, Number of Conferences Delivered, Number of Materials Created, Number of Trainings, Number of People Trained.

(Example)

-

Objective #

1

Activity

Grant-funded activities or trainings

Indicator(s)

No. Trained

Activity

Measuring Students’ Nutrition Knowledge, Attitudes, and Behaviors

Indicator(s)

No. Impacted

--

-

Objective #

Activity

Indicator(s)

-

Objective #

Activity

Indicator(s)

Application Budget Narrative

The budget narrative should correspond with the proposed project narrative and application budget. The narrative must justify and support the bona fide needs of the budget’s direct cost. If the budget includes indirect costs, the applicant must provide a copy of its most recently approved Federal indirect cost rate agreement. All non-profit organizations must include their 501(c)(3) determination letter issued by the Internal Revenue Service (IRS). All funding requests must be in whole dollars.

Indirect Cost Rate

A current Negotiated Indirect Cost Rate Agreement (NICRA), negotiated with a Federal negotiating agency, should be used to charge indirect costs. Indirect costs may not exceed the negotiated rate. If a NICRA is used, the percentage and base should be indicated. If the applicant does not have, and has never been approved for, a NICRA, they may charge up to 10% de minimis. In this instance, the applicant must indicate they are requesting the de minimis rate. An applicant may elect not to charge indirect costs and, instead, use all grant funds for direct costs. If indirect costs are not charged, the phrase "none requested" should be stated in the budget narrative. For questions related to the indirect cost rate, please work with the Grant Officer as noted in Section VII of this RFA.

Required Grant Application Forms

Please refer to the Application Checklist for a list of required grant forms.

Submission Date

Complete grant applications must be uploaded to www.grants.gov by 11:59 PM EST on the due date listed on the cover page.

Applications must be submitted via Grants.gov. Mailed, e-mailed or hand-delivered application packages will not be accepted. For further instructions, go here.

Late or incomplete applications will not be considered.

FNS will not consider additions or revisions to applications unless they are submitted via Grants.gov by the deadline. No additions or revisions will be accepted after the deadline.

If multiple application packages are submitted through Grants.gov by the same applicant in response to this solicitation, FNS will accept the latest application package successfully. submitted. All other packages submitted by the applicant will be removed from this competition.

FNS strongly encourages applicants tobegin the registration process at least four weeks before the due date and to submit applications to Grants.gov at least one week before the deadline to allow time to troubleshoot any issues, should they arise. Please note that upon submission, Grants.gov may

send multiple confirmation notices; applicants should ensure receipt of confirmation that the application was accepted. Applicants experiencing difficulty submitting applications through the grants.gov web portal should contact the Grant Officer noted in the Agency Contacts (Section VII) of this RFA. FNS will evaluate submission issues on a case-by-case basis.

Preparing for Electronic Application Submission through Grants.gov

Applicants must register with Grants.gov, Dun and Bradstreet and Sam.gov in order to submit an application to FNS via Grants.gov, as required. FNS strongly encourages applicants to begin the registration process at least four weeks before the due date.

In order to submit an application, you must:

Obtain a DUNS number

If your organization does not have a DUNS number, or if you are unsure of your organization’s DUNS, contact Dun & Bradstreet at https://fedgov.dnb.com/webform or by calling 1-888-814-1435, Monday thru Friday, 8am-9pm ET. There is no fee associated with obtaining a DUNS number.

It may take 2-3 business days to obtain a DUNS number.

Register in the System for Award Management (SAM.gov)

SAM.gov combines Federal procurement systems and the Catalog of Federal Domestic Assistance into one system. For additional information regarding SAM.gov, see the following link: https://www.sam.gov/SAM

Must have your organization’s DUNS, entity’s Tax ID Number (TIN), and taxpayer name (as it appears on last tax return). It may take 3-5 business days to register in SAM.gov; however, in some instances the SAM process to complete the migration of permissions and/or the renewal of the entity record will require 5-7 days or more.

All applicants must have current SAM status at the time of application submission and throughout the duration of a Federal Award in accordance with two CFR Part 25.

We strongly encourage applicants to begin the process at least 3 weeks before the due date of the grant solicitation.

Create a Grants.gov Account:

The next step in the registration process is to create an account with Grants.gov. Applicants must know their organization's DUNS number to complete this process. Completing this process automatically triggers an email request for applicant roles to the organization's E-Business Point of Contact (EBiz POC) for review. The EBiz POC is a representative from your organization who is the contact listed for SAM.gov. To apply for grants on behalf of your organization, you will need the Authorized Organizational Representative (AOR) role.

For more detailed instructions about creating a profile on Grants.gov, refer to https://www.grants.gov/web/grants/grantors/grantor-registration.html

Authorize Grants.gov Roles:

After creating an account on Grants.gov, the EBiz POC receives an email notifying them of your registration and request for roles. The EBiz POC will then log in to Grants.gov and authorize the appropriate roles, which may include the AOR role, thereby giving you permission to complete and submit applications on behalf of the organization. You will be able to submit your application online any time after you have been approved as an AOR.

For more detailed instructions about creating a profile on Grants.gov, refer to https://www.grants.gov/web/grants/applicants/workspace-overview/workspace-roles.html

Track Role Status: To track your role request, refer to https://www.grants.gov/web/grants/applicants/workspace-overview/workspace-roles.html

Electronic Signature: When applications are submitted through Grants.gov, the name of the organization's AOR that submitted the application is inserted into the signature line of the application, serving as the electronic signature. The EBiz POC must authorize individuals who are able to make legally binding commitments on behalf of the organization as an AOR; this step is often missed and it is crucial for valid and timely submissions.

How to Submit an Application via Grants.gov

Grants.gov applicants can apply online using Workspace. Workspace is a shared, online environment where members of a grant team may simultaneously access and edit different web forms within an application. For each funding opportunity announcement (FOA) or RFA, you can create individual instances of a workspace.

For additional training resources, including video tutorials, refer to: https://www.grants.gov/web/grants/applicants/applicant-training.html

Applicant Support: Grants.gov provides applicants 24/7 support via the toll-free number 1-800-518- 4726 and email at [email protected]. If you are experiencing difficulties with your submission, it is best to call the Grants.gov Support Center and get a ticket number. The Support Center ticket number will assist the Center with tracking your issue and understanding background information on the issue.

For questions related to the specific grant opportunity, please contact the Grant Officer noted in the Agency Contacts (Section VII) of this RFA.

Grants.gov Receipt Requirements and Proof of Timely Submission

All applications must be received by 11:59 PM EST on the due date listed on the cover page, as detailed here. Proof of timely submission is automatically recorded by Grants.gov. An electronic date/time stamp is generated within the system when the application is successfully received by Grants.gov. The applicant AOR will receive an acknowledgement of receipt and a tracking number (GRANTXXXXXXXX) from Grants.gov with the successful transmission of their application.

Applicant AORs will also receive the official date/time stamp and Grants.gov Tracking number in an email serving as proof of their timely submission.

When FNS successfully retrieves the application from Grants.gov and acknowledges the download of submissions, Grants.gov will provide an electronic acknowledgment of receipt of the application to the email address of the applicant with the AOR role. Again, proof of timely submission shall be the official date and time that Grants.gov receives your application. Applications received by Grants.gov after the established due date for the program will be considered late and will not be considered for FNS funding.

Applicants using slow internet, such as dial-up connections, should be aware that transmission could take some time before Grants.gov receives your application. Again, Grants.gov will provide either an error or a successfully received transmission in the form of an email sent to the applicant with the AOR role. The Grants.gov Support Center reports that some applicants end the transmission because they think that nothing is occurring during the transmission process. Please be patient and give the system time to process the application.

Additional Information on Grants.gov and the Registration Process:

NOTICE: Special Characters and Naming Conventions

All applicants MUST follow Grants.gov guidance on file naming conventions. To avoid submission

issues, please follow the guidance provided by Grants.gov (per the Grants.gov Frequently Asked Questions (FAQ):

Are there restrictions on file names for any attachment I include with my application package?

File attachment names longer than approximately 50 characters can cause problems processing packages. Please limit file attachment names. Also, do not use any special characters (examples: & – *

% / # ’ -). This includes periods (.) and spacing followed by a dash in the file. To separate words in naming a file, use underscore, as in the following example: Attached_File.pdf.

Please note that if these guidelines are not followed, your application will be rejected. FNS will not accept any application rejected from www.grants.gov portal due to incorrect naming conventions.

Additional information and applicant resources are available at: https://www.grants.gov/web/grants/applicants/workspace-overview.html

Intergovernmental Review

This funding opportunity is subject to the requirements of EO 12372, “Intergovernmental Review of Federal Programs”. This Executive Order was issued with the desire to foster the intergovernmental partnership and strengthen federalism by relying on State and local processes for the coordination and review of proposed Federal financial assistance and direct Federal development. The Order allows each State to designate an entity to perform this function.

If you are located within a State that does not have a SPOC, you may send application materials directly to a Federal awarding agency.

Evaluation of Grant Application Criteria

Review criteria

FNS will pre-screen all applications to ensure the applicants are eligible entities and are in compliance with all Program regulations. FNS will not approve any waivers from Program regulations for any projects submitted in response to this solicitation.

Additionally, the review committee will evaluate proposals against the criteria below. The project narrative sections include a point value to indicate the importance of each section; however, reviewers will be evaluating proposals based on all sections regardless of whether point values are provided.

The following selection criteria will be used to evaluate applications for this RFA.

Soundness or Merit of Project Design (35 points)

Demonstrated Need: The proposal clearly describes the need to strengthen program integrity by focusing on at least one component of the SNAP Fraud Framework, and provides evidence that the proposed approach is well-suited to solve the identified issue.

Impact: The proposal clearly demonstrates:

A direct effect on the SNAP State agency process and provides evidence that the changes would help combat recipient fraud and benefit trafficking.

A clear progression from idea to practice in a State agency.

A clear description of the impact the project is expected to make. Impact can be described in terms of the degree to which the new or improved processes are expected to help the State agency’s expand its current efforts to eliminate recipient fraud.

Quality: The proposal shows thought, analysis, clarity, and the use of relevant facts and knowledge. This includes clear understanding of the SNAP Fraud Framework.

Application of the SNAP Fraud Framework: The proposed project integrates principles, procedures, ideas and/or practices outlined in the SNAP Fraud Framework.

Feasibility: The application proposes projects that are capable of being accomplished and likely to be implemented. The proposal demonstrates State agency readiness and leadership’s interest to implement activities. It should also demonstrate that the proposed project is appropriate given the current capacity of the agency. We encourage applicants to consider foundational projects that the State agency can build on for future growth in the fraud control area.

Implementation and Evaluation (15 points)

Timeline: The proposal includes a project timeline that outlines proposed tasks and demonstrates that sufficient time is allotted for each activity. Period of performance is commensurate with project scope.

Evaluation: The proposal describes a well-thought-out, organized review and evaluation process that will measure whether the goals of the project have been met. The evaluation should focus on measuring the impact the project seeks to make. Please be sure to include information on who will measure the goals of the project, how the goals will be measured, when the goals will be measured and what the organization will be measuring.

Sustainability (20 points)

The proposal shows that the project is very likely to be sustained after the grant period ends. The proposal should clearly demonstrate State agency’s ability to continue funding and implementing activities once the grant ends. This also applies personnel hired under this grant program, as applicable.

Budget Appropriateness and Economic Efficiency (20 points)

Budget: The proposal includes:

A line item budget – please refer to the Application Checklist on page III and Budget Narrative Checklist in Appendix B to assure each category is addressed in the budget.

A narrative that demonstrates how funds will be spent, by whom and for what purpose.

The narrative should provide enough detail for reviewers to easily understand how costs were determined and how they relate to the goals and objectives of the project. There should be adequate justification for budget costs based on current industry costs/standards. Information on costs should be obtained from applicable organizations or from online sources.

Additionally, a copy of the approved negotiated indirect cost rate agreement must be attached if indirect costs are shown as a budget expense to the project.

If applicable, the budget must show how the costs are allocated among the benefiting programs and demonstrate that this grant is only going to fund SNAP’s share.

Efficiency: The proposal is cost effective – it demonstrates that the anticipated results are commensurate with the cost of the project.

Contractual and Consultant Costs: Proposals who wish to hire a consultant or contract work out must provide the following information:

Consultant’s name and description of service

Itemized list of all direct costs and fees

Salaries must have the number of personnel including the position title

Specialty and specialized qualifications as appropriate to the salary

Number of estimated hours times hourly wages

All expenses and fees directly related to the proposed services to be rendered to the project

Applicants that are required to issue a bid should provide a narrative explaining the requirement and provide a reasonable estimate of Contractual and Consultant Costs.

NOTE: Proposal submissions that omit the required budget forms, budget narratives and/or line item descriptions will not receive the full point value for this criterion. Therefore, applicants should recognize that a well-written budget narrative that justifies the proposed project expenditures assists the reviewers during the review process.

Staff Capability and Management (10 points)

Oversight: The proposal demonstrates that effective and consistent oversight by qualified project managers will be implemented throughout the project.

Communication: The proposal demonstrates that effective communication will exist within the organization. The proposal includes an organizational chart of the proposed project.

Staff: The proposal identifies the project director or manager and other key staff. The proposal includes resumes that demonstrate that the proposed staff has the appropriate technical and experiential backgrounds for their proposed roles. If the applicant is unable to identify the project director or manager and key staff, it must include with the application package job descriptions for positions that must be assigned. Applicants should address their contingency or back-up plans in the event of key staff departures.

Time Commitment: The proposal outlines the amount of time and effort the project director or manager, key staff, and, if applicable, partnering organizations, will contribute to the project.

3. Review and Selection Process

Following the initial screening process, FNS will assemble a panel group to review and determine the technical merits of each application. The panel will evaluate the proposals based on how well they address the required application components and array the applications from highest to lowest score. The panel members will recommend applications for consideration for a grant award based on the evaluation scoring. The Selecting Official reserves the right to accept the panel’s recommendation or to select an application for funding out of order to meet agency priorities, program balance, geographical representation, or project diversity. If applicant is a previous SNAP Fraud Framework Implementation grantee, past performance will be evaluated and may impact the Selecting Official’s decision. FNS reserves the right to use this solicitation and competition to award additional grants in the next fiscal year should additional funds be made available.

NOTE: If a discrepancy exists between the total funding request (submitted on SF-424, SF-424A, and budget or budget narrative) within the application package in response to this solicitation, FNS will only consider and evaluate the estimated funding request contained on SF-424.

The Government is not obligated to make any award as a result of this RFA. Unless an applicant receives a signed award document with terms and conditions, any contact from a FNS Grants or Program Officer should not be considered as a notice of a grant award. No pre-award or pre- agreement costs incurred prior to the effective start date are allowed unless approved and stated on FNS’ signed award document (FNS-529). Only the recognized FNS authorized signature can bind the USDA, Food and Nutrition Service to the expenditure of funds related to an award’s approved budget.

ADMINISTRATIVE AND NATIONAL POLICY REQUIREMENTS Confidentiality of an Application

When an application results in an award, it becomes a part of the record of FNS transactions, available to the public upon specific request. Information that the Secretary determines to be of a confidential, privileged, or proprietary nature will be held in confidence to the extent permitted by law. Therefore, any information that the applicant wishes to have considered as confidential, privileged, or proprietary should be clearly marked within the application. Any application that does not result in an award will be not released to the public. An application may be withdrawn at any time prior to the final action thereon.

Safeguarding Personally Identifiable Information

Personally Identifiable Information (PII) is any information that can be used to distinguish or trace an individual’s identity, such as name, social security number, date and place of birth, mother’s maiden name, or biometric records, and any other information that is linked or linkable to an individual, such as medical, educational, financial, and employment information (National Institute of Standards and Technology (NIST) SP 800-122, Guide to Protecting the Confidentiality of Personally Identifiable information, April 2010).

Applicants submitting applications in response to this RFA must recognize that confidentiality of PII and other sensitive data is of paramount importance to the USDA Food and Nutrition Service. All federal and non-federal employees (e.g., contractors, affiliates, or partners) working for or on behalf of FNS are required to acknowledge understanding of their responsibilities and accountability for using and protecting FNS PII in accordance with the Privacy Act of 1974; Office of Management and Budget Memorandum M-06-15, Safeguarding Personally Identifiable Information; M-06-16, Protection of Sensitive Agency Information; M-07-16, Safeguarding Against and Responding to the Breach of Personally Identifiable Information; and the NIST Special Publication (SP) 800-122, Guide to Protecting the Confidentiality of Personally Identifiable Information.

By submitting an application in response to this RFA, applicants are assuring that all data exchanges conducted throughout the application submission and pre-award process (and during the performance of the grant, if awarded) will be conducted in a manner consistent with applicable Federal laws. By submitting a grant application, applicants agree to take all necessary steps to protect such confidentiality, including the following: (1) ensuring that PII and sensitive data developed, obtained or otherwise associated with UDSA FNS funded grants is securely transmitted. Transmission of applications through Grants.gov is secure; (2) ensuring that PII is not transmitted to unauthorized users, and that PII and other sensitive data is not submitted via email; and (3) Data transmitted via approved file sharing services (WatchDox, ShareFile, etc.), CDs, DVDs, thumb drives, etc., must be encrypted.

Conflict of Interest and Confidentiality of the Review Process

The agency requires all panel reviewers to sign a conflict of interest and confidentiality form to prevent any actual or perceived conflicts of interest that may affect the application review and evaluation process. Names of applicants, including States and tribal governments, submitting an application will be kept confidential, except to those involved in the review process, to the extent permitted by law. In addition, the identities of the reviewers will remain confidential throughout the entire process.

Therefore, the names of the reviewers will not be released to applicants.

Administrative Regulations

Federal Tax Liabilities Restrictions

None of the funds made available by this or any other Act may be used to enter into a contract, memorandum of understanding, or cooperative agreement with, make a grant to, or provide a loan or loan guarantee to, any corporation that has any unpaid Federal tax liability that has been assessed, for which all judicial and administrative remedies have been exhausted or have lapsed, and that is not being paid in a timely manner pursuant to an agreement with the authority responsible for collecting the tax liability, where the awarding agency is aware of the unpaid tax liability, unless a Federal agency has considered suspension or debarment of the corporation and has made a determination that this further action is not necessary to protect the interests of the Government.

Felony Crime Conviction Restrictions

None of the funds made available by this or any other Act may be used to enter into a contract, memorandum of understanding, or cooperative agreement with, make a grant to, or provide a loan or loan guarantee to, any corporation that was convicted of a felony criminal violation under any Federal law within the preceding 24 months, where the awarding agency is aware of the conviction, unless a Federal agency has considered suspension or debarment of the corporation and has made a determination that this further action is not necessary to protect the interests of the Government.

Debarment and Suspension 2 CFR Part 180 and 2 CFR Part 417

A recipient chosen for an award shall comply with the non-procurement debarment and suspension common rule implementing Executive Orders (E.O.) 12549 and 12669, “Debarment and Suspension,” codified at 2 CFR Part 180 and 2 CFR Part 417. This common rule restricts sub-awards and contracts with certain parties that are debarred, suspended or otherwise excluded from or ineligible for participation in Federal assistance programs or activities. The approved grant recipient will be required to ensure that all sub-contractors and sub-grantees are neither excluded nor disqualified under the suspension and debarment rules prior to approving a sub-grant award by checking the System for Award Management (SAM) at www.sam.gov.

Universal Identifier and Central Contractor Registration 2 CFR Part 25

Effective October 1, 2010, all grant applicants must obtain a Dun and Bradstreet (D&B) Data Universal Numbering System (DUNS) number as a universal identifier for Federal financial assistance. Active grant recipients and their direct sub-recipients of a sub-grant award also must obtain a DUNS number. To request a DUNS number visit: http://fedgov.dnb.com/webform.

The grant recipient must also register its DUNS number in SAM.gov. If you were registered in the CCR, your company’s information should be in SAM and you will need to set up a SAM account. To register in SAM you will need your entity’s DUNS and your entity’s Tax ID Number (TIN) and taxpayer name (as it appears on your last tax return). Registration should take 3-5 days. If you do not receive confirmation that your SAM registration is complete, please contact SAM.gov at https://www.fsd.gov/app/answers/list.

FNS may not make an award to an applicant until the applicant has complied with the requirements described in 2 CFR 25 to provide a valid DUNS number and maintain an active SAM registration with current information.

Reporting Sub-award and Executive Compensation Information 2 CFR Part 170

The Federal Funding Accountability and Transparency Act (FFATA) of 2006 (Public Law 109–282), as amended by Section 6202 of Public Law 110–252, requires primary grantees of Federal grants and cooperative agreements to report information on sub-grantee obligations and executive compensation. FFATA promotes open government by enhancing the Federal Government’s accountability for its stewardship of public resources. This is accomplished by making Government information, particularly information on Federal spending, accessible to the general public.

Primary grantees, including State agencies, are required to report actions taken on or after October 1, 2010, that obligates $25,000 or more in Federal grant funds to first- tier sub-grantees. This information must be reported in the Government-wide FFATA Sub-Award Reporting System (FSRS). In order to access FSRS a current SAM registration is required. A primary grantee and first-tier sub- grantees must also report total compensation for each of its five most-highly compensated executives. Every primary and first-tier grantee must obtain a DUNS number prior to being eligible to receive a grant or sub-grant award. Additional information will be provided to grant recipients upon award.

Duncan Hunter National Defense Authorization Act of Fiscal Year 2009, Public Law 110-417 Section 872 of this Act requires the development and maintenance of a Federal Government information system that contains specific information on the integrity and performance of covered

Federal agency contractors and grantees. The Federal Awardee Performance and Integrity Information System (FAPIIS) is designed to address these requirements. FAPIIS contains integrity and performance information from the Contractor Performance Assessment Reporting System, information from SAM.gov, and suspension and debarment information from the SAM. FNS will review and consider any information about the applicant reflected in FAPIIS when making a judgment about whether an applicant is qualified to receive an award.

Freedom of Information Act (FOIA) Requests

The Freedom of Information ACT (FOIA), 5 U.S.C. 552, provides individuals with a right to access records in the possession of the Federal Government. The Government may withhold information pursuant to the nine exemptions and the three exclusions contained in the Act.

Application packages submitted in response to this grant solicitation may be subject to FOIA by requests by interested parties. In response to these requests, FNS will comply with all applicable laws and regulations, including departmental regulations.

FNS will forward a Business Submitter Notice to the requested applicant’s point-of-contact. Applicants will need to review requested materials and submit and submit any recommendations within 10 days from the date of FNS notification. FNS will redact Personally Identifiable Information (PII).

For additional information on the Freedom of Information (FOIA) process, please contact Jennifer Weatherly, FNS Freedom of Information Act officer at [email protected].

Privacy Policy

The USDA Food and Nutrition Service does not collect any personal identifiable information without explicit consent. To view the Agency’s Privacy Policy, visit: https://www.usda.gov/privacy- policy. https://www.usda.gov/privacy-policy. https://www.usda.gov/privacy-policy.

Code of Federal Regulations and Other Government Requirements

This grant will be awarded and administered in accordance with the following regulations 2 Code of Federal Regulations (CFR), Subtitle A, Chapter II. Any Federal laws, regulations, or USDA directives released after this RFA is posted will be implemented as instructed.

Government-wide Regulations

2 CFR Part 25: “Universal Identifier and System for Award Management”

2 CFR Part 170: “Reporting Sub-award and Executive Compensation Information”

2 CFR Part 175: “Award Term for Trafficking in Persons”

2 CFR Part 180: “OMB Guidelines to Agencies on Government-wide Debarment and Suspension (Non-Procurement)”

2 CFR Part 200: “Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards”

2 CFR Part 400: USDA’s implementing regulation of 2 CFR Part 200 “Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards”

2 CFR Part 415: USDA “General Program Administrative Regulations”

2 CFR Part 416: USDA “General Program Administrative Regulations for Grants and Cooperative Agreements to State and Local Governments”

2 CFR Part 417: USDA “Non-Procurement Debarment and Suspension”

2 CFR Part 418 USDA “New Restrictions on Lobbying

2 CFR Part 421: USDA “Requirements for Drug-Free Workplace (Financial Assistance)”

7 CRR Part 16: “Equal Opportunity for Religious Organizations”

41 U.S.C. Section 22 “Interest of Member of Congress”

Freedom of Information Act (FOIA). Public access to Federal Financial Assistance records shall not be limited, except when such records must be kept confidential and would have been excepted from disclosure pursuant to the “Freedom of Information” regulation (5 U.S.C. 552)

General Terms and Conditions (T&Cs) of FNS grant awards may be obtained electronically in advance of an award. For a copy of T&Cs, please contact the Grant Officer noted in the Agency Contacts (Section VII) of this RFA.

3. REPORTING REQUIREMENTS Financial Reports

The award recipient will be required to enter the SF-425 (Financial Status Report) into the FNS Food Program Reporting System (FPRS) on a quarterly basis. In order to access FPRS, the grant recipient must obtain USDA e-authentication certification and access to FPRS. For additional information on FPRS, visit: www.fprs..usda.gov.

Performance Progress Report (PPR)

Grantees will be required to submit progress reports to FNS 30 days following the end of each quarterly period, using the FNS-908 PPR form that will be sent to grantees at the time of award. The reports should cover the preceding period of activity. A final report identifying the accomplishments and results of the project will be due 90 days after the end date of the award. For reference, sample of the PPR form can be found in the Appendix. Please note: the FNS-908 PPR form specific to this opportunity will be sent to grantees at the time of award. Use of the FNS-908 PPR form for progress reports is required.

For questions regarding this solicitation, please contact the Grant Officer at:

Dawn C. Addison

Grant Officer, Grants and Fiscal Policy Division

U.S. Department of Agriculture, FNS 1320 Braddock Place, Suite 620 Alexandra, VA 22314

E-mail: [email protected]

Debriefing Requests

Non-selected applicants may request a debriefing to discuss the strengths and weaknesses of submitted proposals. This information may be useful when preparing future grant proposals. Additional information on debriefing requests will be forwarded to non-selected applicants. FNS reserves the right to provide this debriefing orally or in written format.

APPENDIX

RFA Budget Narrative Checklist

FOR GRANT APPLICANT USE ONLY. DO NOT RETURN THIS FORM WITH THE APPLICATION.

This checklist will assist you in completing the budget narrative portion of the application. Please review the checklist to ensure the items below are addressed in the budget narrative.

NOTE: The budget and budget narrative, as well as forms SF-424 and SF-424A must be in line with the proposal project description (statement of work) bona fide need. FNS reserves the right to request information not clearly addressed. All funding requests must be in whole dollars.

-

ITEM

YES

NO

Personnel

Did you include all key employees paid for by this grant under this heading?

Are employees of the applicant’s organization identified by name and position title?

Did you reflect percentage of time the Project Director will devote to the project in full-time equivalents (FTE)?

Fringe Benefits

Did you include your organization’s fringe benefit amount along with the basis for the computation?

Did you list the type of fringe benefits to be covered with Federal funds?

Travel

Are travel expenses itemized? For example origination/destination points, number and purpose of trips, number of staff traveling, mode of transportation and cost of each trip.

Are the Attendee Objectives and travel justifications included in the narrative?

Is the basis for the lodging estimates identified in the budget? For example, include excerpt from travel regulations.

Equipment

Is the need for the equipment justified in the narrative?

Are the types of equipment, unit costs, and the number of items to be purchased listed in the budget?

Is the basis for the cost per item or other basis of computation stated in the budget?

ITEM

YES

NO

Supplies

Are the types of supplies, unit costs, and the number of items to be purchased reflected in the budget?

Is the basis for the costs per item or other basis of computation stated?

Contractual: (FNS reserves the right to request information on all contractual awards and associated costs after the contract is awarded.)

Has the bona fide need been clearly identified in the project description to justify the cost for a contract or sub-grant expense(s) shown on the budget?

A justification for all Sole-source contracts must be provided in the budget narrative prior to approving this identified cost.

Other

Consultant Services –

Has the bona fide need been clearly identified in the project description to justify the cost shown on the budget? The following information must be provided in the justification: description of service, the consultant’s name and an itemized list of all direct cost and fees, number of personnel including the position title (specialty and specialized qualifications as appropriate to the costs), number of estimated hours and hourly wages per hour, and all expenses and fees directly related to the proposed services to be rendered to the project.

For all other line items listed under the “Other” heading –

List all items to be covered within “Other” along with the methodology on how the applicant derived the costs to be charged to the program.

Indirect Costs

Has the applicant obtained a Negotiated Indirect Cost Rate Agreement (NICRA) from an Federal Agency? If yes, a copy of the most recent and signed negotiated rate agreement must be provided along with the application.

2 CFR 200 allows any non-Federal entity (NFE) that has never received a negotiated indirect cost rate to charge a de Minimis rate of 10% of modified total direct costs (MTDC), which the NFE may use indefinitely as a Federally- negotiated rate.

PURPOSE

Recipients of Federal funds must maintain adequate accounting systems that meet the criteria outlined in 2 CFR §200.302 Standards for Financial and Program Management. The responses to this questionnaire are used to assist in the Food and Nutrition Service Agency’s (FNS) evaluation of your accounting system to ensure the adequate, appropriate, and transparent use of Federal funds. Failure to comply with the criteria outlined in the regulations above may preclude your organization from receiving an award. This form applies to FNS’ competitive and noncompetitive grant programs.

Please submit this questionnaire along with your application package.

ORGANIZATION INFORMATION

Legal Organization Name:

DUNS Number:

FINANCIAL STABILITY AND QUALITY OF MANAGEMENT SYSTEMS

-

Requirement

Yes No

1. Has your organization received a Federal award within the past 3 years?

☐ ☐

2. Does your organization utilize accounting software to manage your financial records?

☐ ☐

3. Does your accounting system identify the receipt and expenditure of program funds separately for each grant?

☐ ☐

4. Does your organization have a dedicated individual responsible for monitoring organizational funds, such as an accountant or a finance manager?

☐ ☐

5. Does your organization separate the duties for staff handling the approval of transactions and the recording and payment of funds?

☐ ☐

6. Does your organization have the ability to specifically identify and allocate ☐ ☐

employee effort to an applicable program?

7. Does your organization have a property /inventory management system in ☐ ☐

place to track location and value of equipment purchased under the award?

-

AUDIT REPORTS AND FINDINGS

Requirement

Yes No

1. Has your organization been audited within the last 5 fiscal years? (If the answer is “Yes” and this report was issued under the Single Audit Act please note this in the box below marked “Additional Information” and if not issued under the “Single Audit Act”, please attach a copy or provide a link to the audit report in the Hyperlink space below).

☐ ☐

2. If your organization has been audited within the last 5 fiscal years, was there a “Qualified Opinion” or an “Adverse Opinion”?

☐ ☐

3. If your organization has been audited within the last 5 fiscal years, was there a “Material Weakness” disclosed?

☐ ☐

4. If your organization has been audited within the last 5 fiscal years, was there a “Significant Deficiency” disclosed?

☐ ☐

Hyperlink (if available):

Additional information including expanding on responses in previous sections:

APPLICANT CERTIFICATION

I certify that the above information is complete and correct to the best of my knowledge.

Signature of Authorized Representative Date

Name of Authorized

Representative:

Phone Number:

Email:

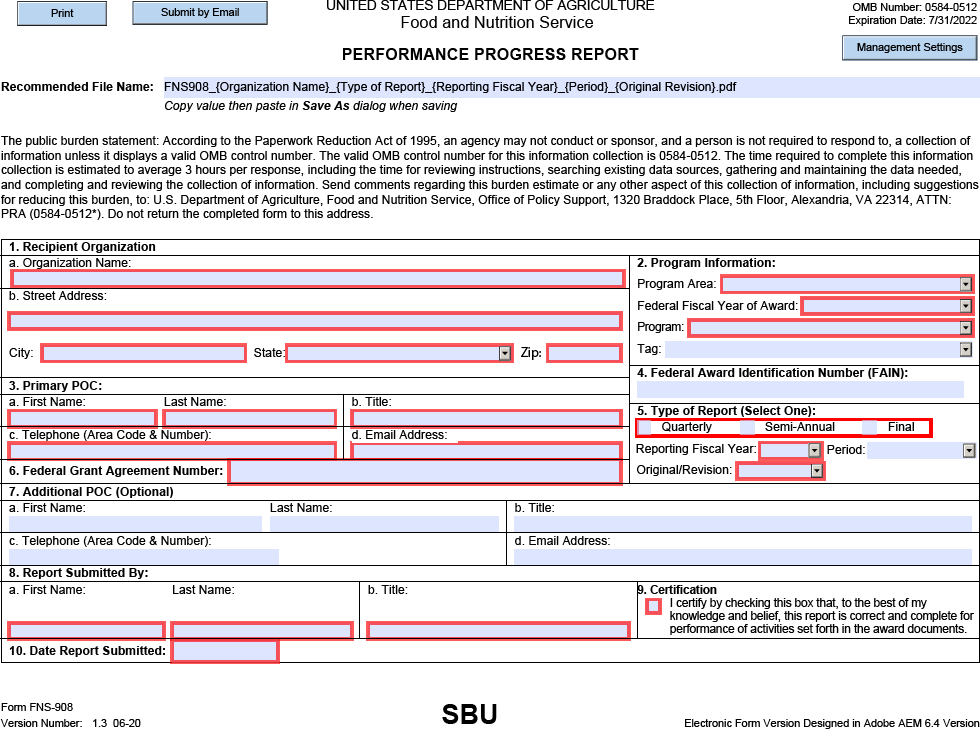

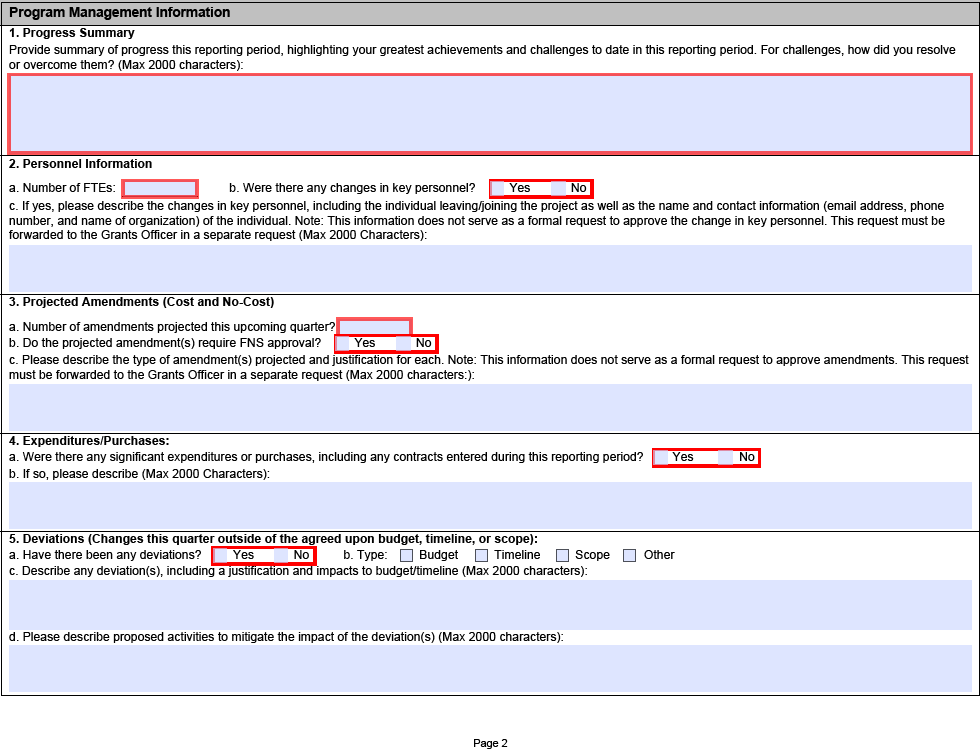

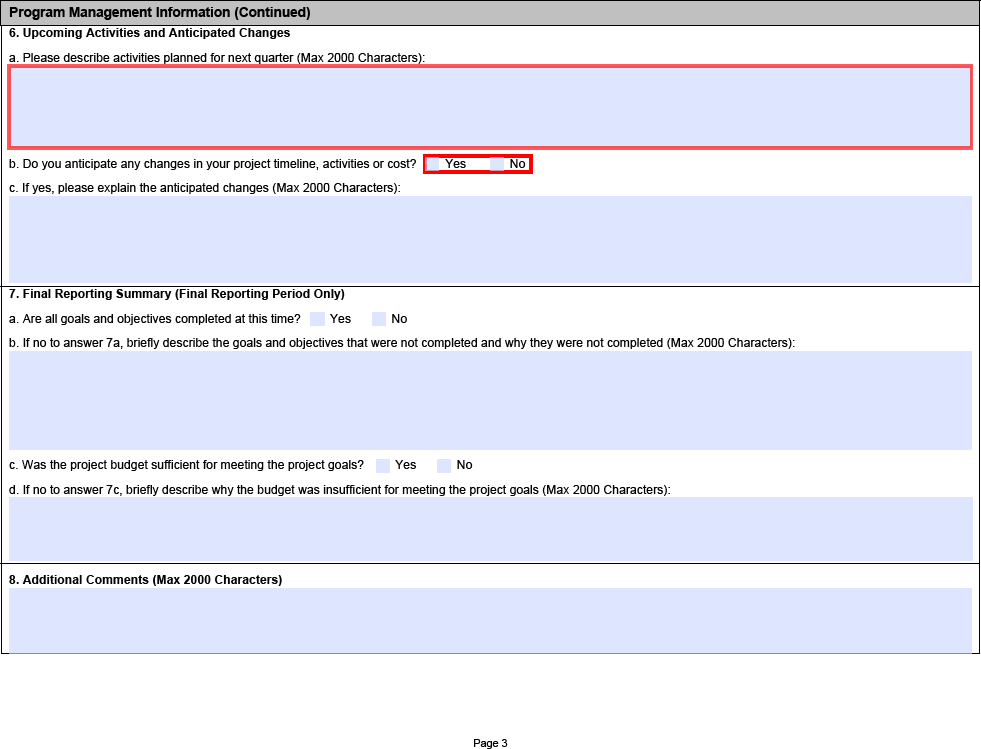

FNS-908 Performance Progress Report (PPR) – For Reference Only

The following pages contain screenshots of the PPR form that grantees are required to use for progress and final reports submitted to FNS. Upon award, a PPR form (Adobe PDF), customized for the specific FNS program, will be included in award packages.

FNS‐908 Performance Progress Report (PPR) – For Reference Only

FNS‐908 Performance Progress Report (PPR) – For Reference Only (Continued)

FNS‐908 Performance Progress Report (PPR) – For Reference Only (Continued)

Form

RFA

(01-21)

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy