CMS-10725 - Appendix C - QHP PBM Instructions

Pharmacy Benefit Manager Transparency (CMS-10725)

CMS-10725 - Appendix C - QHP PBM Instructions

OMB: 0938-1394

OMB

Control Number:

0938-1394 Expiration

Date: XX/XX/20XX

OMB

Control Number:

0938-1394 Expiration

Date: XX/XX/20XX

Qualified Health Plan Pharmacy Benefit Manager (PBM) Drug Data, Pricing, and Rebate Review (QHP PBM DPR2) Template Instructions

Centers for Medicare & Medicaid Services

Center for Consumer Information and Insurance Oversight

08/02/2023

CCIIO/MPMG/OG

Department of Health & Human Services Centers for Medicare & Medicaid Services

Center for Consumer Information and Insurance Oversight 200 Independence Avenue SW

Washington, DC 20201

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0938-1394. This information collection requires QHP issuers and Pharmacy Benefit Managers, that do not contract with a Pharmacy Benefit Manager, to administer the prescription drug benefit and report issuer and plan level prescription drug benefit information to CMS on an annual basis. The time required to complete this information collection is estimated to average 122 hours per response, including the time to review instructions, search existing data resources, gather the data needed, and to review and complete the information collection. Pursuant to 45 CFR 156.295(a) and 184.50(a), this information collection is mandatory for PBMs to report prescription drug benefit information related to QHP issuers. HHS will use this information to understand the cost of prescription drugs and the role that PBMs play in the health care delivery process. All information collected will be kept private in accordance with regulations at 45 C.F.R. 155.260, Privacy and Security of Personally Identifiable Information. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Mail Stop C4-26-05, Baltimore, Maryland 21244-1850, Attention: Information Collections Clearance Officer or email LeAnn Brodhead at [email protected].

Table of Contents

Allocation Methodology for Detailed Data Template File 14

The Patient Protection and Affordable Care Act (P.L. 111–148) and the Health Care and Education Reconciliation Act of 2010 (P.L. 111–-152) (collectively, the Patient Protection and Affordable Care Act [ACA]) were signed into law in 2010. The ACA established competitive private health insurance markets, called Marketplaces or Exchanges, giving millions of Americans and small businesses access to qualified health plans (QHPs), including stand-alone dental plans (SADPs).

Additionally, the ACA added section 1150A of the Social Security Act, requiring, among other entities, QHPs and pharmacy benefit managers (PBMs) that serve QHPs to report information on prescription drug benefits to the U.S. Department of Health and Human Services (HHS). CMS finalized regulations for this reporting at 45 CFR 156.295 and

184.50. This reporting is called the Qualified Health Plan Pharmacy Benefit Manager Drug, Data, Pricing, and Rebate Review (QHP PBM DPR2).

Each year, PBMs that serve QHPs and QHP issuers that do not contract with a PBM—hereafter referred to as “submitters”—will use a web form and template to submit required information related to prescription benefits via the Health Insurance Oversight System (HIOS) PBM Module. Submitters will use an attestation form to confirm the accuracy, completeness, and truthfulness of the submitted data, based on their best knowledge, information, and belief.

Submitters must provide the completed web form, template, and attestation form in the prescribed electronic format.

This document provides guidance and instructions for PBMs that contract with QHP issuers and for QHP issuers that administer their own prescription drug plans on how to submit prescription drug, rebate, and spread pricing data as well as an attestation form to comply with the QHP PBM DPR2 requirements.

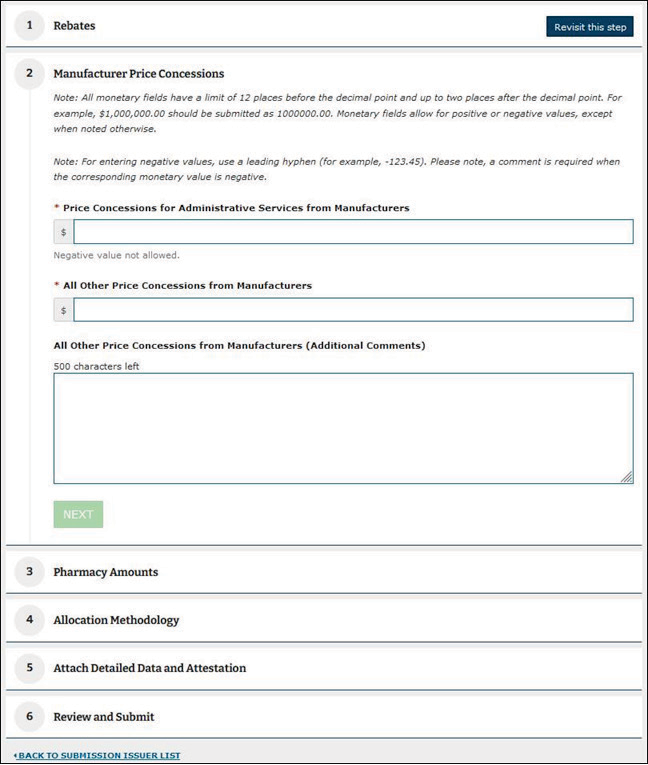

Submitters will use the web form (Figure 2.1) and template (Figure 2.2) to submit required prescription information for each issuer. Table 2.1 provides the input requirements for each field on the web form. All fields are required unless designated with an asterisk (*) in Figure 2.1.

![]()

![]()

Figure 2.1. QHP PBM DPR2 Web Form

![]() Home KnowJedge

center Help

O

Home KnowJedge

center Help

O

Table 2.1. Summary QHP PBM DPR2 Reporting Requirements

Field Name |

Field Descriptions and Exclusions |

Field Character Limits |

PBM Retained Rebates |

Enter all manufacturer rebates retained by the PBM and not passed through to the QHP issuer. For issuer submitters that do not contract with a PBM, enter all manufacturer rebates received. Exclusions: Do not include any rebates that are expected but not yet received in this row; those must be reported in the “Rebates Expected but Not Yet Received” field. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. |

PBM Retained Rebates (Additional Comments) |

This field is required when the “PBM Retained Rebates” field is negative. Enter additional comments explaining why a negative amount was reported. |

This field is limited to 500 alphanumeric characters. |

Rebates Expected But Not Yet Received |

Include in this row good faith estimates of the sum of all rebate amounts that are expected by the submitter for the applicable year but have not yet been received from a drug manufacturer, if applicable. For PBM submitters, all rebate guarantee amounts expected, but not yet received from manufacturers, must also be reported in this row (see the “All Other Rebates” field for a definition of PBM rebate guarantee amounts). Similarly, all rebate amounts received by the PBM that are expected to be passed on to the QHP issuer, but as of the compilation of this report have not yet been passed to the QHP issuer, must be reported in this row. Exclusions:

|

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. |

PBM Incentive Payments |

Include in this row any incentive or bonus payments paid by the QHP issuer to the PBM for performing administrative services for its QHPs, such as negotiating rebates and drug prices as well as increasing generic utilization. For QHP issuer submitters that do not contract with a PBM, zero is acceptable. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. |

Field Name Field Descriptions and Exclusions Field Character Limits |

||

All Other Rebates |

Include in this row the sum of the following rebate information. Issuers that do not contract with a PBM are only required to enter a value in this row as described under “For all Issuers.” Zero is acceptable if not applicable. For PBM submitters only: Include all manufacturer rebates actually received from a manufacturer by the PBM and passed through to the QHP. In addition, include any rebate guarantee amounts received from PBMs in connection with the QHP issuer. Rebate guarantee amounts generally are payments received by QHP issuers from PBMs to account for the difference between the rebate amount guaranteed by a PBM, as likely delineated in the contract between the two parties, and the actual rebate amount received from a drug manufacturer. For all submitters: Include in this row estimated rebates at the point of sale (POS). The actual manufacturer rebate amounts received for rebates that were estimated and applied to the negotiated price at the POS are also reported in this row. Exclusions: Do not include any manufacturer rebates reported in the “PBM Retained Rebates” or “Rebates Expected But Not Yet Received” fields. Do not include rebate guarantee amounts that are expected but not yet received; such amounts must be reported under the “Rebates Expected But Not Yet Received” field. Do not include any other types of remuneration from any other sources. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. The value reported in this field may be negative. |

All Other Rebates (Additional Comments) |

Additional comments explaining why a negative amount was reported are required when the “All Other Rebates” field is negative. |

This field is limited to 500 alphanumeric characters. |

Price Concessions for Administrative Services From Manufacturers |

Include in this row all price concessions received by a submitter from drug manufacturers for administrative services. Price concessions that are reported here are received when the manufacturer provides administrative services to the submitter at a cost below market value. Also reported in this row are grants from pharmaceutical manufacturers for services and programs such as utilization management and medical education. Applicable price concessions for administrative services that are not associated with a specific drug must be reported in full in this row. Exclusions: Do not include any rebate administration fees collected by the QHP issuer or the PBM, which are reported as “Bona Fide Service Fees”; these fees are not covered by the QHP PBM DPR2 collection and should not be reported anywhere in the web form or the detailed data template. Do not include any pharmacy payments, fees, or adjustments, which are to be reported in the fields “Amounts Received From Pharmacies” and “Amounts Paid to Pharmacies” instead. Do not include any other types of price concessions. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. |

Field Name Field Descriptions and Exclusions Field Character Limits |

||

All Other Price Concessions From Manufacturers |

All price concessions received by a submitter from pharmaceutical manufacturers for reasons not already captured by the previous rows are reported here. Include any amounts received and retained by submitters. If all price concessions received from manufacturers are captured in the prior rows, the value reported here will be zero. Exclusions: Do not include any price concessions accounted for in the following fields: “PBM Retained Rebates,” “Rebates Expected But Not Yet Received,” “All Other Rebates.” Do not include price concessions from pharmacies, which are reported in the following fields: “Amounts Received From Pharmacies,” “Amounts Paid to Pharmacies.” |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. |

All Other Price Concessions From Manufacturers (Additional Comments) |

Additional comments are required when the field “All Other Price Concessions From Manufacturers” is a non-zero value. Describe the nature of all other price concessions reported in the “All Other Price Concessions From Manufacturers” field. |

This field is limited to 500 alphanumeric characters. |

Amounts Received From Pharmacies |

Reported in this row is any sum received by a submitter from a pharmacy after the POS that is not otherwise required to be included in the negotiated price. Include any amounts received and retained by PBMs if applicable (i.e., those not passed through to the QHP issuer). Specifically, if a submitter pays a pharmacy a specified amount for a prescription event but recoups some of the payment after the event (if, for instance, the pharmacy has failed to meet performance standards set under a performance-based payment arrangement), the amount recouped by the submitter must be reported in this row if it is not otherwise included in the negotiated price, as it reduces the drug costs of the submitter. Examples of adjustments to be reported in this field include any reconciliation amount that accounts for differences between the contracted rate and the higher adjudicated rate received by the pharmacy at the POS and contingent incentive fees related to, for instance, generic dispensing rates, audit performance/error rates, refill rates, preferred dispensing rates, and/or other performance metrics, including qualitative measures. Such adjustments must only be reported in this row if they reduce the submitter’s costs and are not otherwise included in the negotiated price. This row must also include per-claim administrative fees collected, not paid, by the submitter from pharmacies after the POS that are not included in the negotiated price. Examples of such fees include, but are not limited to, preferred pharmacy fees, fees related to extended supply rates, etc. Exclusions: any pharmacy payment adjustments applied at the POS and all post-POS incentive payments to pharmacies and positive adjustments to pharmacy payments, which must be reported in the “Amounts Paid to Pharmacy” field. Do not include other types of remuneration. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. |

Field Name Field Descriptions and Exclusions Field Character Limits |

||

Amounts Received From Pharmacies (Additional Comments) |

This field is required when the field “Amounts Received From Pharmacies” is a non-zero value. Describe the types of pharmacy price concessions reported in the “Amounts Received From Pharmacies” field and detail the metrics by which pharmacy performance was assessed, if relevant to the price concession calculation. |

This field is limited to 500 alphanumeric characters. |

Amounts Paid to Pharmacies |

Report any sum paid by a submitter to a pharmacy after the POS that is not otherwise required to be included in the negotiated price in this row. Specifically, if a submitter pays a pharmacy a bonus payment after the POS, the amount paid by the submitter must be reported in this row as a negative amount, if it is not otherwise included in the negotiated price, as it serves to increase the drug costs of the submitter. Examples of adjustments to be reported in this field include any reconciliation amount that accounts for differences between the contracted rate and the lower adjudicated rate achieved by the pharmacy at the POS and contingent incentive payments related to, for instance, generic dispensing rates, audit performance/error rates, refill rates, preferred dispensing rates, and/or other performance metrics, including qualitative measures. Such adjustments must only be reported in this row if they increase the PBM’s costs and are not otherwise included in the negotiated price. Exclusions: Do not include any payments to entities other than pharmacies. Exclude any remuneration received from pharmacies (which is reported in the “Amounts Received From Pharmacies” field). Do not include other types of data. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. The value reported in this field must be negative or zero. |

Amounts Paid to Pharmacies (Additional Comments) |

Additional comments are required when the “Amounts Paid to Pharmacies” field is a non-zero value. Describe the types of pharmacy incentive payments reported in the “Amounts Paid to Pharmacies” field. Please detail the metrics by which pharmacy performance was assessed, if relevant to the incentive payment calculation. |

This field is limited to 500 alphanumeric characters. |

PBM Spread Amounts for Retail Pharmacies |

PBMs must report aggregate values for all PBM spread amounts, not the PBM spread for each retail pharmacy. The value reported here must be for all covered drugs. For issuers that do not contract with a PBM, zero is acceptable. The aggregate amount of the difference between the amount paid by the QHP issuer to the PBM and the amount the PBM pays retail pharmacies, sometimes referred to as “PBM spread” or “risk premium,” must be reported in this row. If issuers use pass-through pricing to pay PBMs, this value must be zero. Issuers that use lock-in pricing to pay PBMs must report in this row the difference between the lock-in price and the price that the pharmacy ultimately paid. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. For a negative value, enter a minus sign and the value for the field. |

Field Name Field Descriptions and Exclusions Field Character Limits |

||

PBM Spread Amounts for Mail Order Pharmacies |

The aggregate amount of the difference between the amount paid to the PBM and the amount the PBM pays mail-order pharmacies, sometimes referred to as “PBM spread” or “risk premium,” must be reported in this row. PBMs must report aggregate values for all PBM spread amounts, not the PBM spread for each mail-order pharmacy. For issuers that do not contract with a PBM, zero is acceptable. The value reported here must be for all covered drug costs. If issuers use pass-through pricing to pay PBMs, this value must be zero. PBMs must report in this row the difference between the lock-in price and the price ultimately received by the pharmacy for issuers that use lock-in pricing to pay PBMs. |

Numeric dollar amount. This field may have up to 12 digits before the decimal and two digits after the decimal. For a negative value, enter a minus sign and the value for the field. |

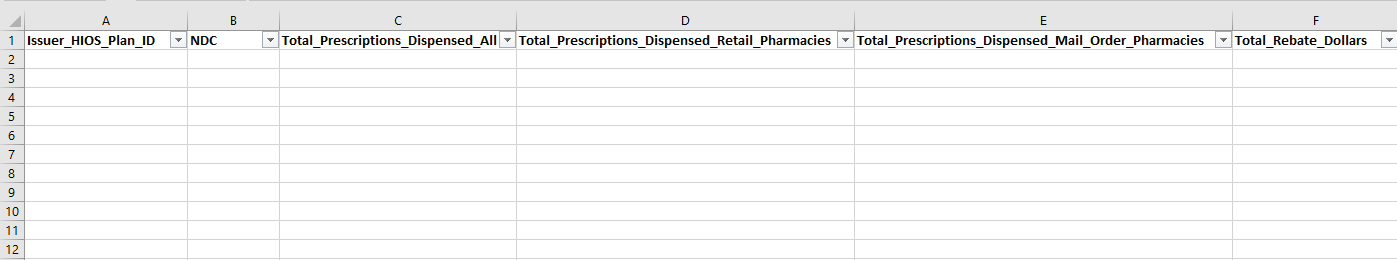

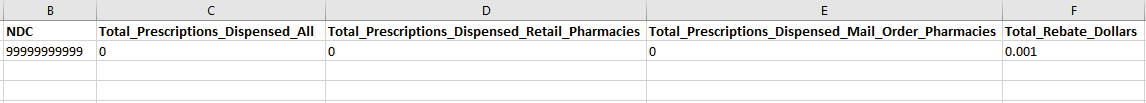

Submitters must submit data at the HIOS Plan ID level for all fields included in Table 2.2. This includes counts of prescriptions dispensed at the 11-digit NDC level using the National Drug Code Directory. Data must be formatted as a pipe delimited comma-separated value (CSV or .csv) file and submitted in the Pharmacy Benefit Manager HIOS Module. A blank copy of the detailed data template is available in the HIOS Knowledge Center (see Section 3 for additional information on the HIOS Knowledge Center) within the PBM Module item.

Figure 2.2 Detailed QHP PBM DPR2 Template

Table 2.2. Detailed PBM DPR2 Tab Reporting Requirements

Field name |

Field descriptions and exclusions |

Field character limits |

Issuer_HIOS_Plan ID |

The QHP issuer’s 14-digit HIOS Plan ID. This number must be entered as exactly 14 digits and letters with no dashes (e.g., 11111MD0002222). |

14-character numeric characters |

NDC |

Submitters will enter the 11-digit NDC in this column. This number must be entered as exactly 11 digits with no dashes (e.g., 55555000102). NDC codes must align with the current code definitions found at the National Drug Code Directory. Ten-digit NDCs must be converted to the 11-digit format. Please include both generic and brand-name NDCs in the detailed data file. Please exclude from submission any NDCs representing compounded drugs. Note that when converting from an .xls or .xlsx file type to a .csv file type, leading zeros may be removed. To ensure successful data submission, review the detailed data template following file conversion to ensure that any NDC codes beginning with one or more zero(s) have retained those digits and appear exactly as 11-digit values. |

11-digit NDC (without dashes) numeric characters |

Total_Prescription s_Dispensed_All |

Submitters will provide the total number of prescriptions dispensed for the associated NDC. This field should equal the sum of the following two fields: “Total Prescription Drugs Dispensed Retail Pharmacies” and “Total Prescription Drugs Dispensed Mail Order Pharmacies.” |

Numeric |

Total_Prescription s_Dispensed_Ret ail_Pharmacies |

Submitters will provide the total number of prescription drugs dispensed through retail pharmacies. |

Numeric |

Total_Prescription s_Dispensed_Mail _Order_Pharmaci es |

Submitters will provide the total number of prescription drugs dispensed through mail-order pharmacies. |

Numeric |

Total_Rebate_Doll ars |

Submitters will provide the total rebate amount received. This field should be inclusive of all rebates entered on the summary webform—including PBM-retained rebates, rebates expected but not yet received, PBM incentive payments, and all other rebates—at the NDC level. |

Numeric dollar amount |

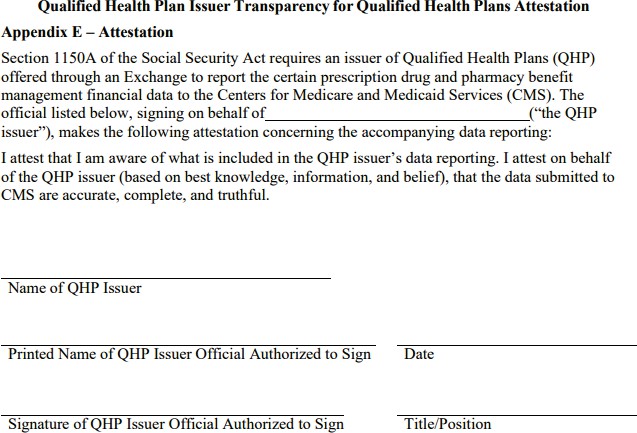

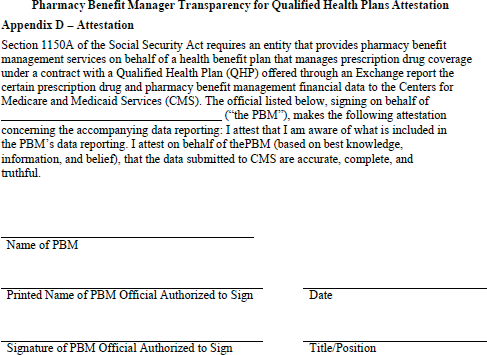

Submitters will use either the QHP Issuer attestation form (Figure 2.3) or the PBM attestation form (Figure 2.4) to confirm the accuracy, completeness, and truthfulness of the submitted data, based on their best knowledge, information, and belief. Blank copies of each attestation form can be located in the HIOS Knowledge Center (see Section 3 for additional information on the HIOS Knowledge Center) within the PBM Module item.

Figure

2.3.

QHP

PBM

DPR2

Attestation

Form

(QHP

Issuers

Who Do

Not Contract With a PBM)

Figure

2.4.

QHP

PBM

DPR2

Attestation

Form

(PBMs

Reporting

on Behalf of an QHP Issuer)

Submitters must provide the completed web form, template, and attestation form in an electronic format. The following section provides instructions for completing the data submission process and guidelines for complying with the data collection requirements.

In addition to these instructions CMS expects that submitters will refer to the materials contained within the HIOS Knowledge Center as they prepare their submission. Once on the HIOS homepage the PBM Module Knowledge Center items can be accessed by navigating to “Knowledge Center” >> “Browse by Module” >> “Pharmacy Benefit Manager”.

Available resources in the Knowledge Center include the following:

The HIOS PBM User Manual: This manual provides further technical guidance and troubleshooting support for submitters.

The PBM Attestation Form: This document allows submitters that are PBMs to attest to their submitted data.

The QHP Issuer Attestation Form: This document allows submitters that are QHP Issuers to attest to their submitted data.

The QHP PBM DPR2 data template: This Microsoft Excel file is a blank version of the template that submitters will provide to CMS. Note that this file will need to be converted from an .xlsx to a .csv format, and from “comma- delimited” to “tab-delimited” format before submitting. For further guidance on converting to a “tab-delimited” format, please see page 13 of this document.

Submitters must establish an account within the HIOS Pharmacy Benefit Manager Module and designate a single point of contact to grant other users within their company access to perform prescription drug benefit management functions in HIOS.

A PBM submitter must first be a registered user in HIOS to access the Pharmacy Benefit Manager Module. Instructions for registering are available via the HIOS Production User Quick Reference Guide.

Before the submission window opens CMS hosts a mandatory pre-submission period, during which submitters (i.e., PBMs or QHP issuers) must inform CMS of the issuers for whom they intend to submit data. The purpose of the pre-submission window is to confirm which submitting entity (QHP issuer or PBM) intends to submit for each Issuer ID that CMS anticipates receiving data for. Submitters will complete pre-submission through the pre-submission window found on the PBM Module home page in HIOS. There must be a single pre-submission issuer list per submitter (i.e., per Federal Employer Identification Number) that all authorized individuals submitting for that company can access and manage.

Instructions for adding issuers to the pre-submission list are available via the HIOS Production User Quick Reference Guide. Pre-submission must be completed before the submission period begins and requires the information found in Table 3.1 to complete.

Table 3.1 Data Required to Complete Pre-submission Requirements

Field Name |

Field Descriptions and Exclusions |

Field Character Limits |

Plan Year |

Enter the plan year for which the submitter is submitting data. Submissions in Calendar Year 2023 will be for Plan Year 2022. |

Four-character numeric |

Organization Name |

Enter the name of the PBM. “N/A” is acceptable for issuer submitters that do not contract with a PBM to administer prescription drug benefits. |

Alphanumeric |

Organization FEIN |

Enter the organization’s federal EIN/TIN. |

Nine-character numeric |

Issuer Name |

Enter the name of the health insurance issuer offering qualified health plans (QHP issuer) for which the submitter is submitting data. |

Alphanumeric |

Issuer State |

Enter the state where the QHP issuer’s plans are sold. |

Two-character alphanumeric |

Issuer HIOS ID |

Enter the QHP issuer’s five-digit Health Insurance Oversight System (HIOS) ID. |

Five-character numeric |

Submitters will compile a set of QHP PBM DPR2 data per plan year and per issuer if the submitter is a contracted PBM. A “set” of data includes the content shown in Table 3.2.

Table 3.2. QHP PBM DPR2 Data Set Contents

-

Content

Submission Method

Issuer-Level Aggregate Data

HIOS web form

Detailed Data (data submitted is at the Plan ID [SCID] and National Drug Code [NDC] levels)

Attachment submitted via HIOS. Must be a ZIP file containing one or more pipe-delimited CSV files.

Attestation Form

Attachment submitted via HIOS. Must be a PDF.

If you are submitting data for an issuer that had zero pharmacy claims during the reporting year (e.g., an issuer offered one or more on-Exchange QHP(s) in the reporting year but did not enroll any consumers during the reporting year) you

will still need to submit a detailed data template. In this case, after listing the 14-digit plan ID, you may complete the template data fields as depicted in Figure 3.1.

Figure 3.1. Detailed QHP PBM DPR2 Template Completed for Zero Claims to Report

Allocation Methodology

Submitters are required to report financial and prescription data at the QHP issuer and 11-digit NDC levels. However, CMS is aware that some submitters may receive and/or record data at the product or plan level. To satisfy the reporting requirements, submitters must allocate data to the QHP issuer and 11-digit NDC levels using reasonable allocation methodologies. A description of all allocation methodologies used to report data at the issuer and/or 11-digit NDC level must be submitted by the submitter in HIOS as part of the PBM DPR2 reporting. Please see the Appendix for more information on allocation methodologies.

Detailed Data Template File Submission Format

Once the submitter has fully populated the required data elements within the detailed data template, the template must be converted to one or more pipe-delimited .csv file(s) which must then be grouped into one ZIP file for submission. There is no required file-naming convention for the .csv file(s) or the final ZIP file. Instructions for converting from a comma- delimited .csv file to a pipe-delimited .csv file are as follows.

Browse to your .csv comma-delimited file.

Right-click the file, click Open with, then click Notepad.

Press Ctrl + H on your keyboard to open the Replace window in Notepad. You can also open this window by clicking Edit at the top of the window, then clicking Replace.

Type a “,” into the Find what field, type a “|” into the Replace with field, then click the Replace All button. The “|” key on your keyboard is above the “Enter” key.

Close the Replace window, then save the edited file. Be sure to append the .csv file extension to the end of the file name when saving it, as Notepad may try to save the file as a .txt file.

The following steps can then be used to create a ZIP folder containing multiple .csv files in Windows:

Place all .csv files within a single folder. This folder should only include files intended for submission.

Right-click on the folder, select “Send to,” then select “Compressed (zipped) folder.”

A new zipped folder with the same name is created in the same location.

Submitters can create a submission in the HIOS PBM Module for a given issuer once they have prepared the detailed data file and signed the attestation form for the issuer. To begin, submitters must enter the issuer-level aggregate data in a web form. Submitters must then attach the corresponding detailed data template and attestation form to the submission.

Upon submission of the web form and detailed data file, the HIOS system will automatically perform several initial data verifications. This process may take up to a few minutes and will result in either a “successful data verification” or a “failed data verification” result. If the former, no further action is needed; if the latter, the detailed data file will need to be corrected and reuploaded. The HIOS system will generate an email providing further guidance about how to rectify any verification issues; this e-mail should arrive by the end of the day on which submission was initially completed. The following table outlines potential causes of failed data verification, which will be further detailed via email.

Table 3.3. QHP PBM DPR2 Failed Data Verification Causes

-

Warning/Issue Description

Explanation of Issue Feedback

Sample First Warning/Issue Instance

Column header did not match the required column layout. See the ICD for the file layout specifications.

HIOS will indicate the file(s) containing an incorrect column header and will note the specific column heading(s) in need of adjustment.

File Name: File_1.csv

Expected Column Header: NDC Received Column Header: NDC11

Expected data rows were not found in the data file or data file was blank.

HIOS will indicate which (if any) specific data rows are missing.

N/A

Issuer_HIOS_Plan_ID format is invalid.

HIOS will indicate which reported Issuer ID(s) will need correction.

Issuer_HIOS_Plan_ID: 80316MN0010002-01

The NDC must be exactly 11-digits with no hyphens.

HIOS will indicate which reported NDC(s) will need correction.

NDC: 10000-0000-3

The Issuer_HIOS_Plan_ID's Issuer ID and State do not match compared to the summary data for the submission.

HIOS will indicate which reported Issuer ID(s) do not match submitted summary data.

Issuer_HIOS_Plan_ID: 12345VA0010002

Multiple rows with the same Issuer_HIOS_Plan_ID and NDC combination are not allowed.

HIOS will indicate which Issuer ID and NDC combination(s) are reported more than once.

Issuer_HIOS_Plan_ID: 80316MN0010002 NDC: 10000000004

The value for the prescription dispensed fields (All, Retail, Mail Order) must be non-negative integers (whole numbers greater than or equal to zero).

HIOS will indicate the plan ID(s) for which invalid prescription- dispensed data were reported and will indicate the invalid prescription value.

Issuer_HIOS_Plan_ID: 80316MN0010002 NDC: 10000000004

Total_Prescriptions_Dispensed_All: - 30000004

The Total_Rebate_Dollars value must be a numeric value with up to 12 places before the decimal point and up to three places after the decimal point.

HIOS will indicate the plan ID(s) for which invalid rebate data were reported and will indicate the invalid rebate value.

Issuer_HIOS_Plan_ID: 80316MN0010002 NDC: 10000000007

Total_Rebate_Dollars: 123456789012.1486

The Product ID portion of the Issuer_HIOS_Plan_ID (the first 10 characters) does not exist in HIOS.

HIOS will indicate the plan ID(s) for which corresponding product ID(s) were not found.

Issuer_HIOS_Plan_ID: 80316MN0010002

If a failed data verification explanation email has not arrived within 24 hours of initial submission, please submit a help desk ticket to [email protected] with the subject “QHP PBM DPR2 Failed Data Verification” and request that your issue be routed to the HIOS Technical group for assistance. For further technical guidance related to submission specifications and troubleshooting, please reference the HIOS PBM User Manual, available in the HIOS Knowledge Center (see Section 3 for additional information on the HIOS Knowledge Center).

Appendix

This appendix contains additional information on the allocation methodology for completing the PBM DPR2 detailed data template.

Allocation Methodology for Detailed Data Template File

CMS has identified several reasonable allocation methodologies (see below) and requires submitters to select the applicable option from a drop-down menu when reporting the allocation methodology used. Submitters must make one selection from a drop-down menu specifying an allocation methodology for reporting data at the issuer level and one selection from a drop-down menu specifying an allocation methodology for reporting data at the 11-digit NDC level. If data already were received from the manufacturers at the issuer and/or 11-digit NDC level, submitters should make the “No allocation method needed” selection from the drop-down menu.

In the event a submitter uses different allocation methodologies for different types of data, they must select the “Other” option and describe in a comment the allocation methodologies used and the data category for which each methodology was used. CMS may need to follow up with submitters to better understand allocation methodologies. Submitters should keep internal documentation of all allocation methodologies used in anticipation of explaining them to CMS. Submitters are strongly encouraged to use one of the allocation methodologies provided.

The options included in each drop-down menu are as follows:

Allocation Methodology to the QHP Issuer Level

No allocation method needed at the QHP issuer level. Manufacturer data received at the QHP issuer level.

Allocation to the QHP issuer level based on Actual Drug Utilization.

Allocation to the QHP issuer level based on issuer’s Total Drug Spend.

Allocation to the QHP issuer level based on issuer’s Brand Drug Spend.

Allocation to the QHP issuer level based on Total Drug Spend for Drugs in Preferred Brand Tier.

Allocation to the QHP issuer level based on Billed Rebate Amounts.

Other allocation to the QHP issuer level (comments are required).

Allocation Methodology to the 11-digit NDC Level

No allocation method needed at the 11-digit NDC level. Manufacturer data received at the 11-digit NDC level.

Allocation to the 11-digit NDC level based on Actual Drug Utilization.

Allocation to the 11-digit NDC level based on Plan’s Total Drug Spend.

Allocation to the 11-digit NDC level based on Plan’s Brand Drug Spend.

Allocation to the 11-digit NDC level based on Total Drug Spend for Drugs in Preferred Brand Tier.

Allocation to the 11-digit level based on Billed Rebate Amounts.

Other allocation to the 11-digit NDC level (comments are required).

Table A-1 provides examples of the allocation methodologies listed above and indicates whether they are considered reasonable for allocating manufacturer rebate amounts to the QHP issuer and 11-digit NDC levels. Please note that the determination of the reasonableness of the various allocation methodologies presented in Table A-1 is specific to the allocation of manufacturer rebates, and some of the methodologies determined to be unreasonable for rebate allocation may in fact be reasonable for allocating other categories of data to a QHP issuer or 11-digit NDC. For instance, allocation based on the number of claims, while unreasonable for use with manufacturer rebates, could be appropriate for use with per-claim administrative fees charged to pharmacies.

Submitters, when able, should allocate rebates for a specific drug to the QHP issuer and 11-digit NDC levels based on the actual utilization of that specific drug. Other allocation methodologies may be subject to additional validation. When selecting among the options allowed, submitters should consider the accuracy with which an allocation methodology applies rebate dollars to the applicable QHP issuer or 11-digit NDC.

Submitters selecting “Other allocation to the QHP issuer level” or “Other allocation to the 11-digit NDC level” must provide comments, which must identify the entity responsible for applying the allocation methodology and include a clear explanation of the methodology, as well as a specification of each category of data for which the methodology was used. The response “Not Applicable” or any of its variations is not an acceptable explanation and will be rejected.

Table A-1. Examples of Methodologies for Allocating Rebates to the QHP Issuer Level and 11-Digit NDC Levels

Allocation Methodology |

Description |

Considered Reasonable for the Allocation of Manufacturer Rebates? |

Explanation |

Based on Actual Drug Utilization |

Rebate amounts received for a specific drug are allocated to a QHP issuer and 11-digit NDC based on the number of units of the specific drug that were purchased under the QHP issuer as a percentage of the total number of units purchased by the PBM. |

Yes |

Appropriately accounts for differences in a specific drug’s utilization across QHP issuers. |

Based on Plan’s Total Drug Spend |

Rebate amounts received for multiple drugs are allocated to a QHP issuer based on the total drug spend under the QHP issuer as a percentage of the total drug spend under all of a PBM’s QHP issuers, and further to an 11-digit NDC based on the NDC- specific total drug spend under the QHP issuer as a percentage of the total drug spending under the QHP issuer. |

Yes |

Approximates differences in utilization and spending on rebate-eligible drugs across QHP issuers. |

Based on Plan’s Brand Drug Spend |

Rebate amounts received for multiple drugs are allocated to a QHP issuer based on the total drug spend for drugs under the QHP issuer as a percentage of the total drug spend for brand drugs under all of the PBM’s QHP issuers, and further to an 11-digit NDC based on the NDC-specific total drug spend under the QHP issuer as a percentage of the total drug spend for brand drugs under the QHP issuer. |

Yes, but only if the PBM receives rebates only for brand drugs. |

Accounts for differences in utilization and spending on rebate-eligible drugs across QHP issuers. |

Based on Total Drug Spend for Drugs in Preferred Brand Tier |

Rebates received for multiple drugs are allocated to a QHP issuer based on the total drug spend for drugs in the QHP issuer’s preferred brand tier as a percentage of the total drug spend for drugs in the preferred brand tier of all of the PBM’s QHP issuers, and further to an 11-digit NDC based on the NDC-specific total drug spend under the QHP issuer as a percentage of the total drug spend for drugs in the preferred brand tier under the QHP issuer. |

Yes, but only if the PBM receives rebates only for drugs in the preferred brand tier. |

Accounts for differences in utilization and spending on rebate-eligible drugs across QHP issuers. |

Based on Billed Rebate Amounts |

Rebates received for a specific drug are allocated to a QHP issuer and 11-digit NDC based on the rebate amounts billed to the pharmaceutical manufacturer for the specific QHP issuer and drug as a percentage of the total rebate amount billed to the pharmaceutical manufacturer for all of the PBM’s QHP issuers. |

Yes |

Appropriately accounts for differences in a specific drug’s utilization across QHP issuers. |

Allocation Methodology |

Description |

Considered Reasonable for the Allocation of Manufacturer Rebates? |

Explanation |

Based on Enrollment |

Rebates received for multiple drugs are allocated to a QHP issuer or 11-digit NDC based on the number of beneficiaries enrolled in the QHP issuer as a percentage of the total number of beneficiaries enrolled in all of the PBM’s QHP issuers. |

No |

Does not sufficiently approximate differences in utilization and spending on rebate-eligible drugs across QHP issuers. |

Based on Advanced Premium Tax Credit (APTC) Subsidy Enrollment |

Rebates received for multiple drugs are allocated to a QHP issuer or 11-digit NDC based on the number of low-income subsidy (LIS) beneficiaries enrolled in the QHP issuer as a percentage of the total number of LIS beneficiaries enrolled in all of the PBM’s QHP issuers. |

No |

Does not sufficiently approximate differences in utilization and spending on rebate-eligible drugs across QHP issuers. |

Based on Number of Claims |

Rebates received for multiple drugs are allocated to a QHP issuer or 11-digit NDC based on the number of claims under the QHP issuer as a percentage of the total number of claims received under all of the PBM’s QHP issuers. Thus, allocation is based on the total number of claims for all of the drugs rather than the number of claims received for each drug. |

No |

Does not sufficiently approximate differences in utilization and spending on rebate-eligible drugs across QHP issuers. |

CMS will evaluate the appropriateness of an allocation methodology that has not already been identified as appropriate on a case-by-case basis using the information that submitters provide on the methodology in the comment field.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Qualified Health Plan Pharmacy Benefit Manager (PBM) Drug Data, Pricing, and Rebate Review (QHP PBM DPR2) Template Instructions |

| Subject | Qualified Health Plan Pharmacy Benefit Manager (PBM) Drug Data, Pricing, and Rebate Review (QHP PBM DPR2) Template Instructions; |

| Author | Centers for Medicare & Medicaid Services |

| File Modified | 0000-00-00 |

| File Created | 2024-11-21 |

© 2026 OMB.report | Privacy Policy