Justification for No Material or Nonsubstantive Change to Approved Collection

Justification Nonmaterial Change 4010 instructions.v6.docx

Annual Financial and Actuarial Information Reporting (29 CFR Part 4010)

Justification for No Material or Nonsubstantive Change to Approved Collection

OMB: 1212-0049

Justification for No Material or Nonsubstantive Change to Approved Collection

AGENCY: Pension Benefit Guaranty Corporation (PBGC)

TITLE: Annual Financial and Actuarial Information Reporting (29 CFR part 4010)

STATUS: OMB control number 1212‑0049; expires 02/28/2026

CONTACT: Karen Levin (202-229-3559)

The Pension Benefit Guaranty Corporation (PBGC) is making changes to the approved instructions, dated February 28, 2024, for plans to submit financial and actuarial information to PBGC, as a non-material/non-substantive change request under OMB Control Number 1212-0049, which is scheduled to expire on February 28, 2026.

Section 4010 of the Employee Retirement Income Security Act of 1974 (ERISA) and PBGC’s regulation on Annual Financial and Actuarial Information Reporting (29 CFR Part 4010) require a contributing sponsor of certain underfunded single-employer plans and members of the contributing sponsor’s controlled group to report identifying, financial and actuarial information to PBGC. In general, this reporting is required if one or more plans sponsored by a member of the controlled group has a funding target attainment percentage below 80%. The 4010 regulation specifies the items that filers must submit under section 4010 of ERISA, through PBGC’s e-filing portal.

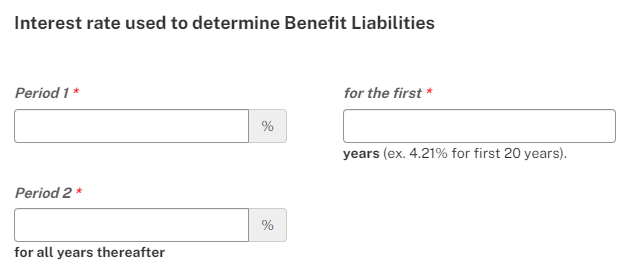

One of the required items is plan liability determined using ERISA 4044 assumptions. The ERISA 4044 interest rate assumptions vary based on the measurement date. That interest assumption currently uses a “select and ultimate” structure (e.g., 4.0% for the first 20 years and 3.8% thereafter). To confirm that the reported liability was determined using the correct interest assumptions, filers are required to report the select rate, the time period for which the select rate applies, and the ultimate rate. The e-filing portal application is set up for the user to enter those three data items. See screen shot below:

PBGC’s final rule on Valuation Assumptions and Methods restructures the 4044 interest assumption as a yield curve, to more closely replicate the actual yields on the investments backing group annuities, and better reflect today's actuarial practice. The final rule is effective July 8, 2024 and will apply to calculations where the valuation date is on or after July 31, 2024.

PBGC is modifying the instructions for the interest rate questions 4010 filing to reflect the 4044 final rule and conform to the yield curve approach. The changes to the information in the box are shown in red font. Note, green highlighted words will link to the final rule while yellow highlighted words will link to the PBGC’s ERISA 4044 interest rate webpage.

The change will apply to certain 4010 filings due beginning mid-November 2024. Reporting using the new methodology will not change the estimated burden for 4010 reporting.

Changes to the instructions for Schedule P, Section II — Funded status information (§4044 basis), number 4

4. Interest rate used to determine benefit liabilities

Enter the select and ultimate interest rates to determine benefit liabilities reported above and number of years in the “select” period for which that interest rate is used.

Enter rates as percentages. For example, if the applicable rate for the first 20 years is 4.21%, enter 4.21, not .0421 for the rate and 20 for number of years.

Note – the required interest assumption is provided § 4044.52(a) and published quarterly on www.pbgc.gov.

-

Note re:

proposedchange to 4044 interest assumptionstructureOn

August 18, 2023,June 6, 2024, PBGC issued aproposedfinal rulethat would changechanging the structure of the ERISA 4044 interest assumption for valuation dates on or after July 31, 2024 from a “select and ultimate” approach to a yield curve approach. Ifthat proposal is finalized as proposed andyou are completing a Schedule P for a plan where benefit liabilities are measured on a date for which the new approach applies (i.e., a plan year ending on or after July 31, 2024):lLeave the interest rate questions blank., andEnter the date of the applicable yield curve in the Schedule P comments section (e.g., “July 31, 2024 ERISA 4044 yield curve”, “September 30, 2024 yield curve”).

The ERISA 4044 yield curves are available on PBGC’s website and updated monthly.

Note that the final rule also modifies the ERISA 4044 mortality assumption and expense load for valuation dates on or after July 31, 2024. For details, see the final rule.

PBGC anticipates modifying these instructions, as appropriate when the rule is finalized.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Murphy Deborah |

| File Modified | 0000-00-00 |

| File Created | 2024-07-22 |

© 2026 OMB.report | Privacy Policy