1845-0001 2024-2025 FAFSA Supporting Statement FINAL post 30-day public comment filing 20231207

1845-0001 2024-2025 FAFSA Supporting Statement FINAL post 30-day public comment filing 20231207.docx

2024-2025 Free Application for Federal Student Aid (FAFSA)

OMB: 1845-0001

Tracking and OMB Number: (XX) 1845-0001 Revised: 12/7/2023

SUPPORTING STATEMENT

FOR PAPERWORK REDUCTION ACT SUBMISSION

2024-2025 Free Application for Federal Student Aid (FAFSA®)

Explain the circumstances that make the collection of information necessary. What is the purpose for this information collection? Identify any legal or administrative requirements that necessitate the collection. Include a citation that authorizes the collection of information. Specify the review type of the collection (new, revision, extension, reinstatement with change, reinstatement without change). If revised, briefly specify the changes. If a rulemaking is involved, list the sections with a brief description of the information collection requirement, and/or changes to sections, if applicable.

Section 483 of the Higher Education Act of 1965, as amended (HEA), mandates that the Secretary of Education “…shall produce, distribute, and process free of charge common financial reporting forms as described in this subsection to be used for application and reapplication to determine the need and eligibility of a student for financial assistance...”.

The determination of need and eligibility are for the following Title IV, HEA, federal student financial assistance programs: the Federal Pell Grant Program; the Campus-Based programs (Federal Supplemental Educational Opportunity Grant (FSEOG) and Federal Work-Study (FWS)); the William D. Ford Federal Direct Loan (Direct Loan) Program; the Teacher Education Assistance for College and Higher Education (TEACH) Grant; the Children of Fallen Heroes Scholarship and the Iraq and Afghanistan Service Grant.

Federal Student Aid (FSA), an office of the U.S. Department of Education (the Department), subsequently developed an application process to collect and process the data necessary to determine a student’s eligibility to receive Title IV, HEA program assistance. The application process involves an applicant’s submission of the Free Application for Federal Student Aid (FAFSA®). After submission and processing of the FAFSA form, an applicant receives a FAFSA Submission Summary (formerly known as the Student Aid Report or SAR), which is a summary of the processed data they submitted on the FAFSA form. The applicant reviews the summary, and, if necessary, will make corrections or updates to their submitted FAFSA data. Institutions of higher education listed by the applicant on the FAFSA form also receive a summary of processed data submitted on the FAFSA form, which is called the Institutional Student Information Record (ISIR).

The specific questions that applicants are asked to answer in the application process are described separately in the Data Elements and Justification document. The document identifies the data elements associated with each FAFSA question and provides the justification for including each question on the FAFSA form. In addition to the calculation of financial need for the various Title IV programs, the FAFSA form also collects data that allows for a determination of an applicant’s eligibility for state and institutional financial aid programs. If these data elements were not collected, the Department and institutions of higher education would be unable to make a determination of financial need and subsequently would be unable to award any Title IV, HEA program assistance, as mandated by the HEA. Many states would also be greatly hindered in their calculation of state aid to applicants.

This is a request for revisions of a current information collection, and important changes to the FAFSA form are described separately in the 2024-2025 Summary of Enhancements document.

Indicate how, by whom, and for what purpose the information is to be used. Except for a new collection, indicate the actual use the agency has made of the information received from the current collection.

The purpose of the application is to collect personal and financial data from current or prospective students in order to perform a need analysis as described in Part F of the HEA. The application is available in English and Spanish and the primary options for completing a FAFSA form include:

Electronic– Applicants can complete an electronic version of the FAFSA form which offers a customized experience, or

Paper – Applicants can complete and submit the PDF version of the FAFSA form. This version must be mailed to the Department for processing.

More specific application options are described in Question 12.

As required by Section 483 of the HEA, for applicants that have previously submitted a FAFSA form, there is a renewal FAFSA form that retains certain static data and the applicant only needs to update information that has changed since the previous FAFSA submission. The renewal FAFSA form is only available in the electronic version.

The information an applicant is required to provide on the FAFSA form varies based upon the need analysis formula that is being utilized. There are three need analysis formulas; the first is for dependent students (this formula also requires parental data), the second is for single independent students or married independent students without dependents other than a spouse, and the third formula is for independent students with dependents other than a spouse.

After the application is completed, the applicant submits the form to the Department and the data is processed by the Department’s FAFSA Processing System (FPS). The need analysis results in a student aid index (SAI), which is an index used by postsecondary educational institutions and states when determining the types and amounts of both federal and non-federal financial aid students may receive. The SAI is calculated in accordance with the statutory formula in Part F of the HEA and is intended to indicate a student’s ability (and for dependent applicants, their family's ability) to contribute toward the student's cost of attending a postsecondary educational institution. The following components are considered in the need analysis formula to determine the SAI:

The available income of (A) the independent student and (if married) the independent student’s spouse, or (B) the dependent student and dependent student’s parents; and

The available assets of (A) the independent student and (if married) the independent student’s spouse, or (B) the dependent student and the dependent student’s parents.

Once the FPS processes the applicant’s data using the appropriate need analysis formula, the Department sends an ISIR electronically to the postsecondary institutions the applicant listed on the FAFSA form. All information reported on the FAFSA form is included on the school’s ISIR, except for the student’s sex, race, ethnicity and list of colleges. An ISIR is also sent to the state grant agencies (based on the applicant’s state of legal residence, as well as the states where the institutions the applicant listed on his or her FAFSA form are located). With the exception of the student’s sex, race and ethnicity, the ISIR that states receive includes all information reported on the FAFSA form, including the list of colleges.

The Department notifies the applicant of the processing results by sending a FAFSA Submission Summary in the language the applicant used to submit the FAFSA form. Similar to the ISIR, the summary will contain the results of the processed application, including the student’s SAI, a transcript of the information that the student originally reported on the FAFSA form, and other relevant information (e.g., the applicant’s financial aid history from the Department’s National Student Loan Data System (NSLDS)). There are two versions of the summary that an applicant may receive; a paper summary, or an electronic summary.

The paper summary is a full synopsis that is mailed to applicants who filed a paper FAFSA form and who did not provide an e-mail address.

The electronic summary is available in fafsa.gov to all applicants who log in with Federal Student Aid electronic credentials (FSA ID). Notifications for the electronic summary are sent to students who provided a valid e-mail address on their electronic or paper application. These notifications are sent by e-mail and include a hyperlink that takes the user to fafsa.gov.

Applicants are expected to review the information on their summary and, if necessary, correct errors in the reported information, verify the responses if so requested, and supply any missing information. Specifically, there are several ways that an applicant can correct, update, or provide additional information:

Fafsa.gov – Any applicant who has an FSA ID – regardless of how they originally applied – may correct any of the data they provided manually on the FAFSA form on fafsa.gov;

Paper FAFSA Submission Summary – Applicants who receive or request a paper summary can make hand-written corrections or additions directly on the paper summary and mail it back to the Department. Applicants for whom FTI was obtained from the IRS will be unable to correct their FTI on a paper FAFSA Submission Summary. Corrections to the applicant’s SSN can be made using the paper summary. Although the paper summary can be used to make changes, the electronic summary cannot be used for corrections;

FAFSA Partner Portal (formerly known as FAA Access) - With the applicant’s permission, an institution can use the FAFSA Partner Portal to correct the FAFSA form;

Electronic Other – With the applicant’s permission, corrections can be made via the postsecondary institution’s third-party servicer, a postsecondary institution’s mainframe computer, or a postsecondary institution’s proprietary software for the student; and

Federal Student Aid Information Center (FSAIC) – FSAIC has the ability to assist applicants and contributors with a limited amount of changes. With the Data Release Number (DRN), applicants and contributors can make changes to their basic demographic information such as address, phone number and email address by calling FSAIC. Additionally, applicants can use their DRN to change the postsecondary institutions listed on their FAFSA form by calling FSAIC.

An applicant who corrects and/or updates (as defined in 34 CFR 668.55) their FAFSA form resubmits the information to the Department. The Department, in turn, processes the changed information and sends the applicant an updated FAFSA Submission Summary. For most applicants the application process is now concluded, as the Department has processed the most accurate and complete information for use in the need analysis formula and the postsecondary institution is able to determine eligibility and award aid.

Regulations, however, establish a verification process (as defined in 34 CFR 668, Subpart E) that requires some applicants to provide documentation to the postsecondary institution to confirm the information reported on the FAFSA form. These procedures “...govern the verification by institutions of information submitted by applicants for student financial assistance under the subsidized student financial assistance programs.”

Applications are selected for verification either by the FPS or by the postsecondary institution. A postsecondary institution must verify all applications the FPS selects for verification. Prior to receiving any federal subsidized aid, students selected for verification must complete the verification process with the postsecondary institution, and the institution must submit any final changes to the FPS for processing.

In conclusion, the above narrative provides an overview of the application process that exists to determine an applicant’s eligibility for Title IV, HEA program assistance. Since Title IV, HEA funds should only be disbursed to eligible students and the amounts disbursed should reflect the actual need of the applicant and family, the awarding of aid by the financial aid office at the postsecondary institution does not occur until the applicant has completed the entire application process – initial submission, review, corrections and/or verification, if necessary. The entire application process allows the Department to capture the most complete and accurate information for use in the need analysis formula and reduces the possibility that an applicant could receive Title IV, HEA funds they are not eligible to receive.

Describe whether, and to what extent, the collection of information involves the use of automated, electronic, mechanical, or other technological collection techniques or forms of information technology, e.g. permitting electronic submission of responses, and the basis for the decision of adopting this means of collection. Please identify systems or websites used to electronically collect this information. Also describe any consideration given to using technology to reduce burden. If there is an increase or decrease in burden related to using technology (e.g. using an electronic form, system or website from paper), please explain in number 12.

Over time, the Department has made several process improvements that have utilized technological advancements. The following describes some components of the application process that have incorporated such advancements.

Fafsa.gov

483(a)(3) of the HEA mandates that, “The Secretary shall produce, distribute, and process forms in electronic format….” Subsequently, the Department developed the fafsa.gov website in 1998. Fafsa.gov has grown to be the primary entry point for tens of millions of students who apply for federal, state, and institutional financial aid. The Department endeavors to continually improve fafsa.gov to further simplify the application experience for students and families. The following describes the benefits of using fafsa.gov:

Applications submitted through fafsa.gov are processed much faster than the PDF version of the FAFSA form

Applicants who have previously applied for aid benefit by completing the renewal FAFSA form, which retains certain static data

Applicants who need to correct or provide missing information can do so easily by returning to fafsa.gov

Fafsa.gov creates a customized, smart application experience based on an applicant’s personal data and previous answers

In addition to computers, fafsa.gov is accessible from mobile and/or tablet devices, allowing customers to submit applications from the device of their choice

Applicants who use fafsa.gov benefit from web edits that ensure all required fields are completed and all data conflicts are resolved prior to application submission, which makes for a reduced application rejection rate during processing

Fafsa.gov is a safe and secure web site that uses standard commercial encryption protocols that determine the highest encryption level the browser will support

In compliance with the Americans with Disabilities Act, fafsa.gov is 508-compliant and accessible to visually impaired applicants.

Electronic Signature and FSA ID

The FSA ID, which consists of a user-created username and password, can be used as an electronic signature for the FAFSA form. Since the submission of the FAFSA form requires signatures from all contributors to the form, the FSA ID facilitates a simpler application experience by eliminating the need for a paper signature submission. Beginning with the 2024-25 FAFSA processing cycle, users who don’t have social security numbers (SSNs) will be allowed to obtain an FSA ID, allowing for that population subset to have the same simplified electronic signature process. In addition, the FSA ID can be used each year to access the renewal FAFSA form and to access processed FAFSA data to make corrections or updates.

Customer Service – Federal Student Aid Information Center (FSAIC)

In addition to the assistance handling inquiries about the financial aid process, the application, and the FSA ID, FSAIC offers technological features that have simplified the application experience for many applicants.

Chat – live web chat capability with a customer service representative

Email – email communications with a customer service representative

Automated phone self-service – The interactive voice response unit (IVRU) menus offer self-service functionality for some of the most common customer inquiries including a FAFSA application status check and answers to frequently asked questions. These features are available to customer 24 hours a day, 7 days a week and require no agent assistance.

Expanded call center hours – hours of operation include regular weekend hours throughout the year to provide better assistance during the weekend.

Image and Data Capture (IDC)

The Department has maintained the IDC document management system. The system scans images, captures data, and sends the data for processing to the FPS. The IDC utilizes optical character recognition (OCR) to electronically recognize and capture typed or hand-written data from the printed FAFSA PDF and paper FAFSA Submission Summary. Use of this technology results in the automation of data entry tasks, thus reducing the processing time for applicants.

Describe efforts to identify duplication. Show specifically why any similar information already available cannot be used or modified for use for the purposes described in Item 2 above.

The FAFSA collection requirements do not contain any duplication of data elements. Because legislation requires that the FAFSA form be completed annually by applicants, returning applicants encounter similar questions in subsequent years. To reduce that burden, the renewal FAFSA form is available electronically and reuses much of the data previously submitted. Required responses on the renewal FAFSA form are limited to income and asset questions likely to change from year to year.

Beginning with the 2024-25 cycle, there are certain instances in which data being provided elsewhere will be used in the FAFSA form. For example, because applicants and contributors filing electronically will be required to log in to StudentAid.gov with their FSA ID, data that is associated with their FSA ID will be pre-populated into the FAFSA form. Additionally, if someone is a contributor on multiple FAFSA forms, data that is used on the first form they complete will be used to pre-populate subsequent applications for the same processing cycle.

The review and corrections segment of the application process does not duplicate the process of initial data collection. Reviewing and correcting the application is also fundamental to the application experience because it creates an opportunity to obtain the most accurate applicant information.

If the collection of information impacts small businesses or other small entities, describe any methods used to minimize burden. A small entity may be (1) a small business which is deemed to be one that is independently owned and operated and that is not dominant in its field of operation; (2) a small organization that is any not-for-profit enterprise that is independently owned and operated and is not dominant in its field; or (3) a small government jurisdiction, which is a government of a city, county, town, township, school district, or special district with a population of less than 50,000.

The collection of eligibility information for the awarding of student aid does not impact small businesses.

Describe the consequences to Federal program or policy activities if the collection is not conducted or is conducted less frequently, as well as any technical or legal obstacles to reducing burden.

If the application process was not completed and data elements not collected, the Department would be unable to make an accurate determination of financial need necessary to award any Title IV, HEA program assistance, as mandated. In addition, the HEA requires annual determination of the applicant’s need for Title IV, HEA program assistance. If the data were collected less frequently, the Department would be in violation of the law. Although an applicant must reapply and receive a new need analysis for every year that student aid is requested, use of the renewal FAFSA form, as described previously, reduces the amount of new data that a student must provide.

As a part of the annual application process, the corrections component provides an opportunity for the applicant to make corrections. The corrections component is crucial for assuring that comprehensive, accurate data is used to calculate the applicant’s SAI and overall financial aid eligibility. If the Department were unable to request verification or correction of submitted data, the SAI could be calculated using questionable or erroneous data. In addition, errors discovered as a result of multiple federal database matches (e.g., Social Security Administration (SSA), Department of Homeland Security (DHS), Veteran Affairs, etc.) could not be corrected. The result would be countless incomplete or inaccurate FAFSA forms and, potentially, millions of incorrect eligibility determinations resulting in the loss of taxpayer dollars by awarding Title IV, HEA program assistance based on erroneous applicant data.

Explain any special circumstances that would cause an information collection to be conducted in a manner:

requiring respondents to report information to the agency more often than quarterly;

requiring respondents to prepare a written response to a collection of information in fewer than 30 days after receipt of it;

requiring respondents to submit more than an original and two copies of any document;

requiring respondents to retain records, other than health, medical, government contract, grant-in-aid, or tax records for more than three years;

in connection with a statistical survey, that is not designed to produce valid and reliable results than can be generalized to the universe of study;

requiring the use of a statistical data classification that has not been reviewed and approved by OMB;

that includes a pledge of confidentiality that is not supported by authority established in statute or regulation, that is not supported by disclosure and data security policies that are consistent with the pledge, or that unnecessarily impedes sharing of data with other agencies for compatible confidential use; or

requiring respondents to submit proprietary trade secrets, or other confidential information unless the agency can demonstrate that it has instituted procedures to protect the information’s confidentiality to the extent permitted by law.

The application does not invoke special circumstances, as described.

As applicable, state that the Department has published the 60 and 30 Federal Register notices as required by 5 CFR 1320.8(d), soliciting comments on the information collection prior to submission to OMB.

Include a citation for the 60 day comment period (e.g. Vol. 84 FR ##### and the date of publication). Summarize public comments received in response to the 60 day notice and describe actions taken by the agency in response to these comments. Specifically address comments received on cost and hour burden. If only non-substantive comments are provided, please provide a statement to that effect and that it did not relate or warrant any changes to this information collection request. In your comments, please also indicate the number of public comments received.

For the 30 day notice, indicate that a notice will be published.

Describe efforts to consult with persons outside the agency to obtain their views on the availability of data, frequency of collection, the clarity of instruction and record keeping, disclosure, or reporting format (if any), and on the data elements to be recorded, disclosed, or reported.

Consultation with representatives of those from whom information is to be obtained or those who must compile records should occur at least once every 3 years – even if the collection of information activity is the same as in prior periods. There may be circumstances that may preclude consultation in a specific situation. These circumstances should be explained.

On March 23, 2023 a Federal Register notice (Vol. 88, No 56, pages 17560-17562) was published inviting public comment on the information collection. The comment period closed May 23, 2023 and generated207 public comments. The attached table includes responses to those comments. Changes have been made to the forms based on public comment, internal Department discussions, and for increased clarity of question and instruction. There has been no change to the estimated number of respondents, responses, or burden hours.

The Department is now requesting publication of a 30-day Federal Register notice inviting public comment.

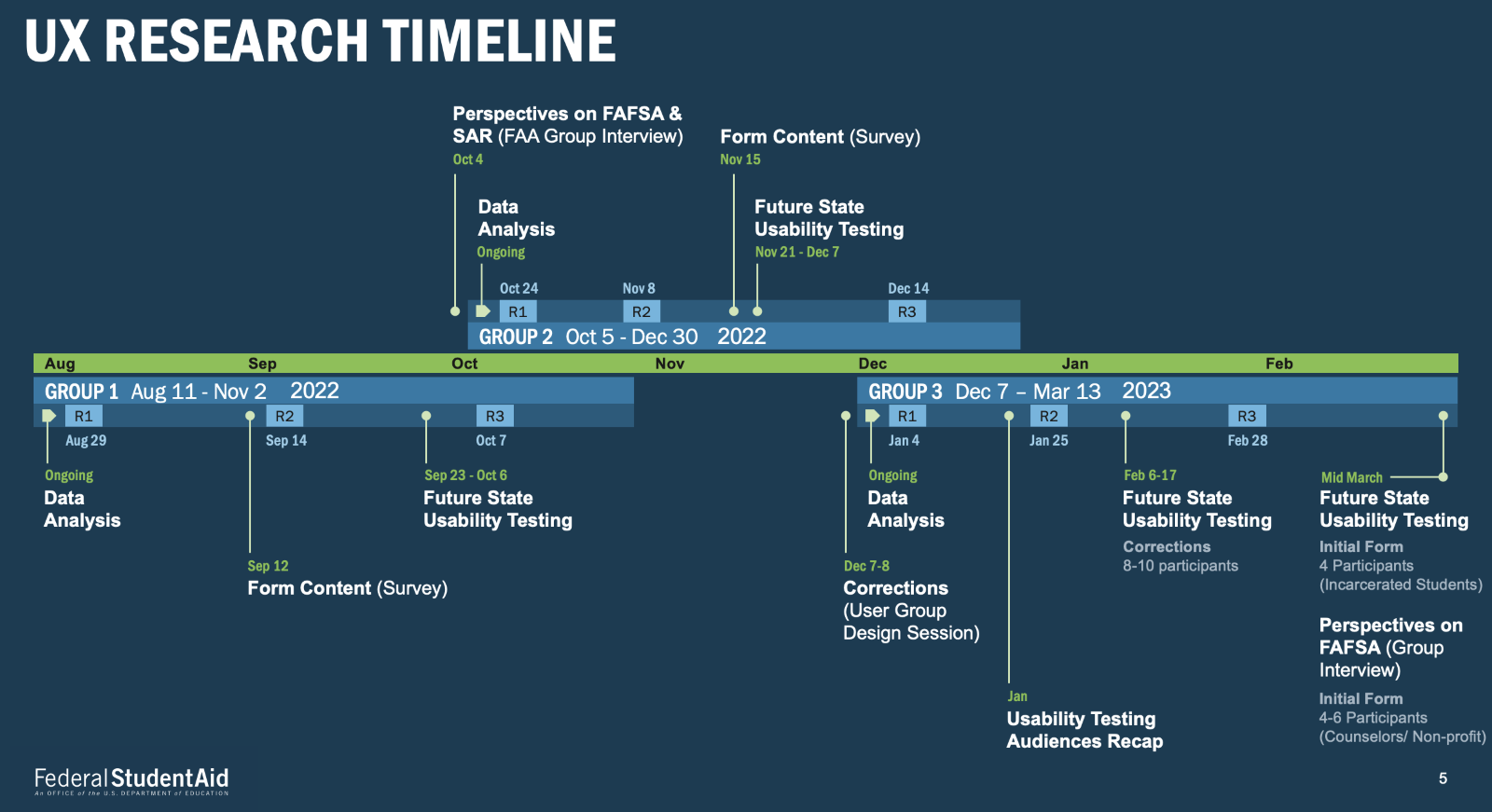

Additionally, students and parents participate in usability studies on existing functions of the application and/or proposed enhancements. FAFSA-centered future state testing, optimization testing, and other formative research activities began November 2021 and extended through March 2023. They included over 197 participants, over 120 hours of group and 1-on-1 interviews, and 14 research studies. Validation testing in the production environment will also occur after the form goes live, with planned usability testing in production with at least 16 participants. Figure 1 below provides a summary of testing and research activities.

Figure 1. User Experience Research Timeline for the 24-25 FAFSA

A satisfaction survey is also available to applicants that complete the FAFSA form. The quantitative and qualitative data gathered from the survey is monitored and reported on a quarterly basis. Consideration of the views expressed by these groups is part of the annual development process of the application. The survey is approved under information collection 1845-0045.

Explain any decision to provide any payment or gift to respondents, other than remuneration of contractors or grantees with meaningful justification.

There are no payments or gifts for the completion and/or submission of the application.

Describe any assurance of confidentiality provided to respondents and the basis for the assurance in statute, regulation, or agency policy. If personally identifiable information (PII) is being collected, a Privacy Act statement should be included on the instrument. Please provide a citation for the Systems of Record Notice and the date a Privacy Impact Assessment was completed as indicated on the IC Data Form. A confidentiality statement with a legal citation that authorizes the pledge of confidentiality should be provided.1 If the collection is subject to the Privacy Act, the Privacy Act statement is deemed sufficient with respect to confidentiality. If there is no expectation of confidentiality, simply state that the Department makes no pledge about the confidentiality of the data. If no PII will be collected, state that no assurance of confidentiality is provided to respondents. If the Paperwork Burden Statement is not included physically on a form, you may include it here. Please ensure that your response per respondent matches the estimate provided in number 12.

The confidentiality of the data collected is discussed in the Routine Uses section of the System of Records Notice for the Federal Student Aid Application File (18-11-01), published in 64 FR 30159–30161 (June 4, 1999), as amended by, 64 FR 72407 (December 27, 1999), as amended by, 65 FR 11294 (March 2, 2000), as amended by 66 FR 18758 (April 11, 2001), as amended by, 74 FR 68802-68808 (December 29, 2009), as amended by 76 FR 46774-46781 (August 3, 2011), and as amended by 84 FR 57856-57863 (October 29, 2019).

A section on Privacy, printed on page three of the FAFSA PDF and linked from the homepage of fafsa.gov, informs the applicant that the postsecondary educational institutions identified by the student will also have access to the data, and that the grant agencies in the applicant’s state of legal residence will receive the data even if the student does not provide consent pursuant to section 483(a)(3)(iii) of the HEA. The Department of Education allows state grant agencies to disclose certain limited “FAFSA Filing Status Information” to certain entities (secondary schools, local education agencies (LEAs), and other designated entities), so those certain entities can help facilitate students’ completion of the FAFSA form. The limited FAFSA completion information includes the date the FAFSA form was submitted, the date the FAFSA form was processed, whether the applicant was chosen for verification, and the completion status of the FAFSA form.

Privacy Act information is available on the paper FAFSA Submission Summary and accessible at all times from fafsa.gov. In addition, agencies such as law enforcement agencies, the Office of Management and Budget (OMB), the Department of Justice (DOJ), the Government Accountability Office (GAO), Congress, and other entities have access to the data. No other individuals have access to this information without the express written consent of the applicant or as authorized by the Secretary consistent with the provisions of Section 483(a)(3)(C).

Provide additional justification for any questions of a sensitive nature, such as sexual behavior and attitudes, religious beliefs, and other matters that are commonly considered private. The justification should include the reasons why the agency considers the questions necessary, the specific uses to be made of the information, the explanation to be given to persons from whom the information is requested, and any steps to be taken to obtain their consent.

As required in Section 483(a)(2)(ii) of the HEA, the FAFSA form asks students to provide their sex, race, and ethnicity. The Department of Education plans to use this information only for statistical purposes. On the page within the form where these questions are presented, messaging displays instructing students that answers to the questions will not affect their eligibility for federal student aid and will not be used in any aid calculations. Students are provided an opportunity to decline to answer any of the sex, race, or ethnicity questions.

Provide estimates of the hour burden for this current information collection request. The statement should:

Provide an explanation of how the burden was estimated, including identification of burden type: recordkeeping, reporting or third party disclosure. Address changes in burden due to the use of technology (if applicable). Generally, estimates should not include burden hours for customary and usual business practices.

Please do not include increases in burden and respondents numerically in this table. Explain these changes in number 15.

Indicate the number of respondents by affected public type (federal government, individuals or households, private sector – businesses or other for-profit, private sector – not-for-profit institutions, farms, state, local or tribal governments), frequency of response, annual hour burden. Unless directed to do so, agencies should not conduct special surveys to obtain information on which to base hour burden estimates. Consultation with a sample (fewer than 10) of potential respondents is desirable.

If this request for approval covers more than one form, provide separate hour burden estimates for each form and aggregate the hour burden in the table below.

Provide estimates of annualized cost to respondents of the hour burdens for collections of information, identifying and using appropriate wage rate categories. Use this site to research the appropriate wage rate. The cost of contracting out or paying outside parties for information collection activities should not be included here. Instead, this cost should be included in Item 14. If there is no cost to respondents, indicate by entering 0 in the chart below and/or provide a statement.

Provide a descriptive narrative here in addition to completing the table below with burden hour estimates.

For the 2024-2025 FAFSA form, the Department continues to utilize the applicant burden model (ABM) which was approved by the OMB beginning with the 2016-2017 application cycle.

The estimates included are the result of the Department’s efforts to determine the public’s burden as it relates to the application process for federal student aid. The ABM measures applicant burden through an assessment of the activities each applicant conducts in conjunction with other applicant characteristics and in terms of burden, the average applicant’s experience. Key determinants of the ABM include:

The total number of applicants that will potentially apply for federal student aid;

How the applicant chooses to complete and submit the FAFSA form (e.g., by paper or electronically);

How the applicant chooses to submit any corrections and/or updates;

The type of FAFSA Submission Summary document the applicant receives (electronic or paper);

The average amount of time involved in preparing to complete the application.

For the 2024-2025 FAFSA cycle, the Department is estimating 1.88% fewer FAFSA forms will be submitted compared to the number of students projected to be enrolled in 2024. The Projections of Education Statistics prepared by the U.S. Department of Education, National Center for Education Statistics (NCES), Integrated Postsecondary Education Data System provides estimates of the total enrollment in all degree-granting institutions.

Table 1. Enrollment projections from NCES Projections of Education Statistics

-

Year

Enrollment Projections

2023

20,040,000

2024

20,107,000

Based on these factors, the Department estimates that 19,728,988 FAFSA forms will be submitted for 2024-2025.

Once the applicant volume is projected, we determine the total estimated burden and cost by examining each FAFSA completion method. The completion method reflects how applicants choose to complete and submit the FAFSA form. Each completion method is assigned an individual burden estimate to reflect the average time an applicant will spend to prepare, complete and submit a FAFSA form and/or correction. For 2024-2025 estimates, we determined that the 2021-2022 cycle offers a complete data set to help baseline the estimated population. It should also be noted that the Department determined that recordkeeping would not be documented as a component of the burden estimate. Since the Department retains, for the applicant, summaries of the data submitted and a history of their changes, the need for an applicant to retain a set of records is optional.

The components that were included in the individual burden estimate include information from the central processing system and user data from surveys and this allowed us to estimate the individual burden for each completion method. The individual burden estimate includes the following:

Preparation – Average time it takes to review instructions and gather the documents necessary to complete the FAFSA form (e.g., FAFSA PDF, student/spouse and/or parent’s federal income tax returns, bank statements);

Completion – Average time it takes for data entry (paper or electronic), referencing instructions, or accessing on-line help or calling customer service; and

Submission – Average time it takes to review the Certification Statement, apply signatures, make copies of paper forms or print electronic outputs, and if necessary, obtain postage and mail.

As a result, Table 2 details the initial submission behavior (completion method) and provides the total burden for submission of the FAFSA form; along with associated costs by type of application. Information Collection instruments FAFSA (IC 1) and FAFSA Renewal (IC 2) include aggregate projections of fafsa.gov submissions. Note that FAFSA – EZ (IC 3), FAFSA-EZ Renewal (IC 4), and the entire school entry section have been removed as they are no longer applicable beginning with the 2024-25 FAFSA processing cycle.

Table 3 details the corrections behavior by type of corrections submitted and allows us to calculate the burden associated with each correction method; associated costs by type of correction are also provided.

Table 4 shows the total number of FAFSA Submission Summaries distributed as a result of the initial submission of the FAFSA form and any corrections made. Table 4 also identifies the type of FAFSA Submission Summaries distributed and provides associated cost for each.

Lastly, Table 5 summarizes the overall total annual responses, overall total annual burden and overall total costs for the 2024-2025 Federal Student Aid application. Total annual responses for the 2024-2025 Federal Student Aid application are estimated to be 34,328,439. The total estimated burden for the 2024-2025 Federal Student Aid application is 22,417,460 hours, a decrease of 427,252 hours from the prior cycle year projection of 22,844,712. The decrease is attributed to a more customized user experience combined with lower than anticipated FAFSA volume. FAFSA volume is consistently lower than projected enrollment and fluctuates based on economic conditions. Table 5 also summarizes the annual cost burden to complete the application process, which is $63,712.73, an increase of $7,660.93 from the prior projection. The increase in costs is mainly attributed to the increase in postal stamps from 58 to 63 cents. The annual cost burden is comprised of the individual postage cost of 63 cents that would be required of applicants who choose to submit a printed FAFSA PDF (Table 2) or correct a paper FAFSA Submission Summary (Table 3).

Table 2. Initial submission of FAFSA® forms

Initial Submission of FAFSA (Part 1 of Application Process) |

|||||||

Type of Application Filed |

Type

of FAFSA Applicant |

Percent |

Estimated

Number of Applicants |

Estimated

Individual Applicant Burden |

Estimated

Individual Applicant Cost |

Total

Burden for All Applicants |

Total Cost for All Applicants (Dollars) |

Student Entry- Electronic |

|

|

|

|

|

|

|

FAFSA (IC 1) |

Overall Usage |

|

47.87% |

|

|

|

|

The electronic version of the FAFSA completed by applicants. |

Dependent |

44% |

4,155,477 |

1.53 |

$ - |

6,369,024 |

$ - |

Independent |

56% |

5,288,789 |

0.77 |

$ - |

4,057,618 |

$ - |

|

Subtotals |

|

9,444,267 |

|

|

10,426,642 |

$ - |

|

FAFSA - Renewal (IC 2) |

Overall Usage |

|

51.98% |

|

|

|

|

The electronic version of the FAFSA completed by applicants who have previously completed the FAFSA. |

Dependent |

51% |

5,230,115 |

1.14 |

$ - |

5,940,341 |

$ - |

Independent |

49% |

5,025,013 |

0.63 |

$ - |

3,171,798 |

$ - |

|

Subtotals |

|

10,255,128 |

|

|

9,112,139 |

$ - |

|

Paper Submissions |

|

|

|

|

|

|

|

Printed FAFSA (IC 3) |

Overall Usage |

|

0.15% |

|

|

|

|

The printed version of the FAFSA provided for applicants who are unable to access the Internet or complete the electronic form. |

Dependent |

21% |

6,215 |

1.83 |

$ 0.63 |

11,399 |

$ 3,915.45 |

Independent |

79% |

23,379 |

1.20 |

$ 0.63 |

28,036 |

$ 14,728.77 |

|

Subtotals |

|

29,593 |

|

|

39,435 |

$ 18,644.22 |

|

Total Applicants |

19,728,988 |

||||||

Burden for Applicants |

19,578,216 |

||||||

Cost for Applicants |

$18,644.22 |

||||||

Table 3. Correcting submitted FAFSA® information

Correcting Submitted FAFSA Information (Part 3 of Application Process) |

|||||||

Type of Correction |

Type

of FAFSA Respondent by Filing Option |

|

Estimated

Number of Corrections Received |

Estimated

Individual Burden |

Estimated

Individual Applicant Cost |

Total

Burden for All Respondents |

Total Cost for All Applicants (Dollars) |

Fafsa.gov |

Overall Usage |

|

40.36% |

|

|

|

|

Any applicant who has an FSA ID – regardless of how they originally applied – may correct using fafsa.gov Corrections. |

Dependent |

59% |

3,476,480 |

0.18 |

$ - |

625,766 |

$ - |

Independent |

41% |

2,415,859 |

0.12 |

$ - |

289,903 |

$ - |

|

|

Subtotals |

|

5,892,338 |

|

|

915,669 |

|

Electronic Other - Corrections |

Overall Usage |

|

15.33% |

|

|

|

|

With the applicant's permission, corrections can be made via: a school’s third party servicer, a school’s mainframe computer, FPP or a school’s proprietary software. |

Dependents & Independents |

|

2,238,096 |

0.05 |

$ - |

111,905 |

$ - |

Paper FAFSA Submission Summary |

Overall Usage |

|

0.49% |

|

|

|

|

Applicants can write corrections directly on the paper FAFSA Submission Summary and mail for processing. |

Dependents & Independents |

|

71,537 |

0.18 |

$ 0.63 |

12,877 |

$ 45,068.51 |

FPP - Corrections |

Overall Usage |

|

3.83% |

|

|

|

|

With the FAFSA filer’s permission, an institution can use FPP to correct the FAFSA form. |

Dependents & Independents |

|

559,159 |

0.05 |

$ - |

27,958 |

$ - |

Internal Department Corrections |

Overall Usage |

|

39.59% |

|

|

|

|

The Department will submit an applicant's record for system generated corrections. There is no burden to the applicants under this correction type. |

Dependents & Independents |

|

5,779,923 |

0.00 |

$ - |

0 |

$ - |

FSAIC Corrections |

Overall Usage |

|

0.40% |

|

|

|

|

Any applicant, who has their Data Release Number (DRN), can make changes to the postsecondary institutions listed on their FAFSA or change their address by calling FSAIC. |

Dependents & Independents |

|

58,398 |

0.05 |

$ - |

2,920 |

$ - |

Total Corrections |

14,599,451 |

||||||

Burden for Applicants |

1,071,329 |

||||||

Cost for Applicants |

$42,922.39 |

||||||

Table 4. Reviewing FAFSA® information – FAFSA Submission Summary distribution

Reviewing Processed FAFSA Information (Part 2 of Application Process) |

|

|

|

|

|||

Type of FAFSA Submission Summary Sent |

Type

of FAFSA Respondent by Filing Option |

|

Documents

Sent |

Estimated

Individual Burden |

Estimated

Individual Applicant Cost |

Total

Burden for All Applicants |

Total Cost for All Applicants (Dollars) |

Electronic FAFSA Submission Summary |

Distribution |

|

97.0% |

|

|

|

|

PDF version of the FAFSA Submission Summary for applicants who applied electronically or by paper and provided an e-mail address. |

Dependents & Independents |

|

33,298,586 |

0.05 |

$ - |

1,664,929 |

$ - |

Paper FAFSA Submission Summary |

Distribution |

|

3.0% |

|

|

|

|

Full paper summary that is mailed to paper applicants who did not provide an e-mail address. |

Dependents & Independents |

|

1,029,853 |

0.10 |

$ - |

102,985 |

$ - |

Total FAFSA Submission Summaries Sent to All Applicants |

34,328,439 |

||||||

Burden for Applicants |

1,767,915 |

||||||

Cost for Applicants |

$0.00 |

||||||

Table 5. Total burden and total costs for 2024-2025 FAFSA® form

Application Process Summary |

Responses |

Burden (Hours) |

Cost (Dollars) |

Initial Submission |

19,728,988 |

19,578,216 |

$18,644.22 |

Corrections |

14,599,451 |

1,071,329 |

$45,068.51 |

FAFSA Submission Summary Review |

0 |

1,767,915 |

$0.00 |

Total Annual Responses |

34,328,439 |

|

|

Total Burden for All Applicants |

|

22,417,460 |

|

Total Cost for All Applicants |

|

|

$63,712.73 |

Provide an estimate of the total annual cost burden to respondents or record keepers resulting from the collection of information. (Do not include the cost of any hour burden shown in Items 12 and 14.)

The cost estimate should be split into two components: (a) a total capital and start-up cost component (annualized over its expected useful life); and (b) a total operation and maintenance and purchase of services component. The estimates should take into account costs associated with generating, maintaining, and disclosing or providing the information. Include descriptions of methods used to estimate major cost factors including system and technology acquisition, expected useful life of capital equipment, the discount rate(s), and the time period over which costs will be incurred. Capital and start-up costs include, among other items, preparations for collecting information such as purchasing computers and software; monitoring, sampling, drilling and testing equipment; and acquiring and maintaining record storage facilities.

If cost estimates are expected to vary widely, agencies should present ranges of cost burdens and explain the reasons for the variance. The cost of contracting out information collection services should be a part of this cost burden estimate. In developing cost burden estimates, agencies may consult with a sample of respondents (fewer than 10), utilize the 60-day pre-OMB submission public comment process and use existing economic or regulatory impact analysis associated with the rulemaking containing the information collection, as appropriate.

Generally, estimates should not include purchases of equipment or services, or portions thereof, made: (1) prior to October 1, 1995, (2) to achieve regulatory compliance with requirements not associated with the information collection, (3) for reasons other than to provide information or keep records for the government or (4) as part of customary and usual business or private practices. Also, these estimates should not include the hourly costs (i.e., the monetization of the hours) captured above in Item 12.

Total Annualized Capital/Startup Cost : N/A

Total Annual Costs (O&M) : N/A

Total Annualized Costs Requested : N/A

Provide estimates of annualized cost to the Federal government. Also, provide a description of the method used to estimate cost, which should include quantification of hours, operational expenses (such as equipment, overhead, printing, and support staff), and any other expense that would not have been incurred without this collection of information. Agencies also may aggregate cost estimates from Items 12, 13, and 14 in a single table.

The projected cost to create the application, related applicant products or instructional materials for 2024-2025 is $38,706,260. The projections also include the cost associated with the operations and maintenance of the Department’s processing system mainframe software and systems and other costs like printing, mailing, and customer service.

Table 6. Annual Costs

-

Projected Costs

2024-2025

Category 1 – AEDS & DCC Operations and Maintenance Services:

$ 19,341,741

Front end: This category is the primary delivery area performed under the DCC contract. It consists of system development and maintenance of Information Technology (IT) products and the primary operational programs: FAFSA web services, status reports, ongoing support of existing software and hardware, Business Process Optimization enablement (call center), management of volume peaks, design services, usability tests, and statistical analysis support.

Back end: This category is the primary delivery area performed under the AEDS and AED contracts. It consists of system development and maintenance of Information Technology (IT) products and the primary operational programs: processing system mainframe software and systems, develop the paper application and other paper products related to eligibility, status reports, ongoing support of existing software and hardware, management of volume peaks, managing printing of FPS mailing, editorial services, CPS/FPS/Student Aid Information Gateway (SAIG) help desk & customer communications, Image and Data Capture (IDC), e-mail, print, and other operational services including conference support, Participation Management (PM) Operations, form support (FAFSA forms and PM Enrollment Forms), FAFSA Partner Portal and EDExpress support, postage and mailing of FAFSA Submission Summaries, and statistical analysis support.

$ 19,364,519

Total Projected Annual Cost

$ 38,706,260

Explain the reasons for any program changes or adjustments. Generally, adjustments in burden result from re-estimating burden and/or from economic phenomenon outside of an agency’s control (e.g., correcting a burden estimate or an organic increase in the size of the reporting universe). Program changes result from a deliberate action that materially changes a collection of information and generally are result of new statute or an agency action (e.g., changing a form, revising regulations, redefining the respondent universe, etc.). Burden changes should be disaggregated by type of change (i.e., adjustment, program change due to new statute, and/or program change due to agency discretion), type of collection (new, revision, extension, reinstatement with change, reinstatement without change) and include totals for changes in burden hours, responses and costs (if applicable).

Provide a descriptive narrative for the reasons of any change in addition to completing the table with the burden hour change(s) here.

The Department adjusted the data set used to calculate the burden projections. For 2024-2025 estimates, we utilized the 2021-2022 application cycle results, which offered a complete data set, to forecast individual burden. The Department believes this more accurately reflects and depicts our respondent universe.

The Department is projecting an increase of 366,129 responses but a decrease of 427,252 burden hours compared to the 2023-2024 projections. The burden decrease is attributed, in part, to the implementation of the FAFSA Simplification Act and FUTURE Act provisions which has allowed the department to provide an enhanced and optimized FAFSA experience from start to finish. With the IRS direct data exchange, the department is able to directly transfer the FAFSA contributor’s federal tax information, with their express permission, into the application and eliminated the need for the user to link, authenticate and transfer their tax information from the IRS web site using the IRS Data Retrieval tool process.

Table 7. Estimated Annual Applicant Burden and Cost

-

Comparison of Current 2024-2025 and Prior 2023-2024 Estimated FAFSA Submissions

Application Cycle Projections

Applicants

Corrections

Responses

Burden Hours

2023-2024

19,861,000

14,101,310

33,962,310

22,844,712

2024-2025

19,728,988

14,599,451

34,328,439

22,417,460

Difference

-132,012

498,141

366,129

-427,252

Percentage Change

-0.66%

3.53%

1.07%

-1.87%

-

Program Change Due to New Statute

Program Change Due to Agency Discretion

Change Due to Adjustment in Agency Estimate

Total Burden

-427,252

Total Responses

366,129

Total Costs (if applicable)

We also attribute part of the burden decrease to the unequal amount of estimated time it takes for applicants to complete the various aspects of the application as seen in Tables 2, 3, and 4 in item 12 of this supporting statement. While each applicant will review the FAFSA Submission Summary, which is the output document to their application input, that review does not require as much time to perform. That is also true for any applicant who wishes to make a correction to data provided on the initial application. And lastly, the department continues to apply customer-centric design principles to deliver a more interactive and intuitive FAFSA preparation, completion and submission experience.

-

Activity

Old FAFSA Electronic

(2023-2024)

New FAFSA Electronic

(2024-2025)

Old FAFSA Paper

(2023-2024)

New FAFSA Paper

(2024-2025)

Initial Application

Dependent average of 1.39 hours per application; Independent average of .68 hours per application

Dependent average of 1.53 hours per application; Independent average of .77 hours per application

Dependent average of 1.74 hours per application; Independent average of 1.13 hours per application

Dependent average of 1.83 hours per application; Independent average of 1.20 hours per application

Correction

Dependent and Independent average of .08 hours per application

Dependent and Independent average of .07 hours per application

Dependent and Independent average of .12 hours per application

Dependent and Independent average of .18 hours per application

Renewal

Dependent average of 1.05 hours; Independent average of .56 hours per application

Dependent average of 1.14 hours; Independent average of .63 hours per application

For collections of information whose results will be published, outline plans for tabulation and publication. Address any complex analytical techniques that will be used. Provide the time schedule for the entire project, including beginning and ending dates of the collection of information, completion of report, publication dates, and other actions.

The results of the collected information will not be published for tabulation or publication.

If seeking approval to not display the expiration date for OMB approval of the information collection, explain the reasons that display would be inappropriate.

The expiration date for OMB approval will not be included on the 2024-2025 FAFSA PDF and FAFSA Submission Summary for design reasons, although the OMB control number is displayed.

Explain each exception to the certification statement identified in the Certification of Paperwork Reduction Act.

Exceptions to the certification requirement are not requested for this information collection.

1 Requests for this information are in accordance with the following ED and OMB policies: Privacy Act of 1974, OMB Circular A-108 – Privacy Act Implementation – Guidelines and Responsibilities, OMB Circular A-130 Appendix I – Federal Agency Responsibilities for Maintaining Records About Individuals, OMB M-03-22 – OMB Guidance for Implementing the Privacy Provisions of the E-Government Act of 2002, OMB M-06-15 – Safeguarding Personally Identifiable Information, OM:6-104 – Privacy Act of 1974 (Collection, Use and Protection of Personally Identifiable Information)

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy