30D Comment Response Summary

1845-0001 2024-2025 30 day comment responses.docx

2024-2025 Free Application for Federal Student Aid (FAFSA)

30D Comment Response Summary

OMB: 1845-0001

2024-2025 Federal Student Aid Application Comments Tracking Summary

(30 Day final)

Package/docket ID number ICR 1845-0001

# |

Comment |

Formal Response |

|

1 |

Instructions for Question 5 in the "Personal Circumstances" section explaining veteran status, indicate that the student should indicate that they are a veteran if they "are not a veteran now but will be one by June 30, 2024." This appears to be a typo. In previous years, the student would answer "yes" if they would be a veteran by the end of the award year designated on the FAFSA. Following the logic of previous years' instructions, the student could be considered a veteran for the 2024-25 award year if they would be a veteran by June 30, 2025. However, 2024-25 instructions as they are currently written would mean that the student needs to be a veteran before the start of the award year. Further instructions indicate that a student should indicate "no" if they will "continue to serve through June 30, 2025" which would seem to indicate that if they will not serve through the end of the award year (i.e., will become a veteran), they should indicate "yes" to the question. |

This change will be made. |

|

2 |

The housing question should be added back to the FAFSA to help schools determine the most accurate Cost of Attendance to use for students. |

Thank you for your comment. The Department of Education is permitted only to ask questions that are required either (a) to aid in determining eligibility, (b) by the FAFSA Simplification Act, or (c) by the FUTURE Act. |

|

3 |

The Minnesota deadline continues to be listed incorrectly in each iteration of the DRAFT 24-25 FAFSA. Legislation in Minnesota from May, 2023 changed our deadline from the 30th day of the term to the last day of the fiscal year. So for 2024-2025, the deadline should be June 30, 2025. I submitted this info in May, August and now again in September via NASSGAP. |

This change will be made. |

|

4.a |

The 2024-2025 FAFSA is the first FAFSA to roll out under the FAFSA Simplification Act which created the intention to make the FAFSA more accessible and easier for students and their families to complete. I have comments regarding unnecessary questions that remain on the FAFSA that either no longer serve purposes or never did serve purposes in determining Federal Student Aid eligibility. In section 11 the student’s gender is still a question that is asked but I have trouble understanding why this is the case. With Selective Service registration no longer impacting eligibility for Federal Student Aid a student’s gender no longer has any value in determining eligibility for Federal Student Aid. |

Thank you for your comment. This question is required in accordance with the statutory or regulatory requirements defined by the FAFSA Simplification Act Section 483(a)(2)(B)(ii). |

|

4.b |

Section 12 requests students to verify information about their race and ethnicity, again, why? Colleges cannot utilize race and ethnicity information for admissions information, a student’s race and ethnicity also have no bearing in Federal Student Aid eligibility so why is this a question asked upon the FAFSA? I don’t see a logical reason for why this question is being asked besides for demographic purposes which is unduly creating additional steps to completing the FAFSA. |

Thank you for your comment. This question is required in accordance with the statutory or regulatory requirements defined by the FAFSA Simplification Act Section 483(a)(2)(B)(ii). |

|

4.c |

In section 15 why is the student’s parents’ grade level of completion asked? What importance does this play in determining Federal Student Aid eligibility? Simply put the answers to my questions is that none of these questions are necessary for FAFSA completion nor for determining Federal Student Aid eligibility for students. Truly simplify the FAFSA and eliminate unnecessary questions from the FAFSA as the Simplification Act intended to happen. Demographic and data gathering is not the purpose of the FAFSA, these questions can be obtained via other methods if the Department of Education wishes to document these questions for students and their families. |

Thank you for your comment. This question is required in accordance with the statutory or regulatory requirements defined by the FAFSA Simplification Act Section 483(a)(2)(B)(ii)(XIII). |

|

5.a |

The treatment of 529 college savings plans in the Notes on Page 22 under “Assets” needs further clarification. |

This change will be made. |

|

5.b |

Comment #60.a to the first FAFSA draft says: “1.Clarification: In the Note on page 21 of the FAFSA Form regarding “Investments do not include…” please add “Health Savings Accounts” and “education savings accounts owned by anyone other than the student or the student’s parent (such as a grandparent or other relative) regardless of whether the student is the beneficiary” for clarity.” The Formal Response says: 60.a) “Thank you for your comment. This change will be made” However, this change was not made in the most recent draft on page 22 “Assets” |

Further revisions were made to the instructions for clarity. |

|

5.c |

Furthermore, the instructions in this latest draft appear to contradict themselves. First it says, “Parents of dependent students should not report the value of educational savings accounts for other children.” But further on it says, “For a student who must report parental information, the accounts are reported as parental investments in question 40, including all accounts owned by the student and all accounts owned by the parents for any member of the household.” If accounts for other children are excluded as stated earlier, it seems that you perhaps mean “all accounts owned by the parent for any member of the household *who is not their child* |

Further revisions were made to the instructions for clarity. |

|

5.d |

Then it says “Investments do not include” …529 college savings plans if the student is the beneficiary”. I suspect that you mean “if the student is the beneficiary *and the account is not owned by the student or parents (such as grandparents)*” |

Further revisions were made to the instructions for clarity. |

|

6.a |

FAFSA states that corrections or additional information can be provided , unclear of that occurs in the review stage of online FAFSA or post-submission.

|

As in prior cycles, information provided on the online FAFSA form can be changed prior to submission, as well as after processing. It cannot be changed while the transaction is being processed. |

|

6.b |

"Pell can only be received at one college for same period of enrollment"; period of enrollment may be unclear as to whether or not Pell can be moved between schools.

|

No change. The Department of Education believes the instructions are clear. |

|

6.c |

Question 9,18 on paper FAFSA unclear that it can be skipped if student is independent. Is stated on page 4 what questions can be skipped, but independent status may be hard for applicants to determine on paper FAFSA. |

The “Can I Skip any questions?” notes on page 4 will be revised. |

|

6.d |

Will student spouse, parent spouse also be required to create FSA ID? |

If the student spouse or parent spouse is identified as a required contributor on the student’s FAFSA form, they must create an FSA ID to access and complete their section of the FAFSA form online. |

|

6.e |

Unclear on what circumstances student should provide parent spouse information. Example: parent was unmarried/single at time of filing 2022 tax return and has since married, but parent spouse did no contribute financially in any way until marriage from 2022 onward. If spouse had nothing to do with student before then, how would that affect providing information? |

Additional notes will be added to FAFSA question 38. |

|

7 |

Coming from a small school with not a lot of funding, I am asking that the housing question be added back to the FAFSA. This is our way packaging a student's financial aid. We use this as the student self-identifying that they will be living on, off or with their parents. The COA is also automatically calculated by this question on the FAFSA. Please add this question back to the 2024-2025 FAFSA. |

Thank you for your comment. The Department of Education is permitted only to ask questions that are required either (a) to aid in determining eligibility, (b) by the FAFSA Simplification Act, or (c) by the FUTURE Act. |

|

8 |

The 2024-25 (FY 2025) Texas State Financial Aid Priority deadline has been moved from January 15, 2024, to March 15, 2024. |

This change will be made. |

|

9 |

Question 11, 12: Why ask this? This is a financial aid application, not a demographics survey! The U.S. government conducts a census for this sort of data; including it on a financial aid application that does NOT consider the answers in eligibility calculations is just data collection for collection's sake. Let researchers conduct their OWN surveys. If the Department is bound & determined to collect needless data, child support PAID (not just received) might be a great place to start, but any question on the FAFSA that has an answer of "Prefer not to answer" should be in its own, separate section which is clearly labelled OPTIONAL QUESTIONS. |

Thank you for your comment. These questions are required in accordance with the statutory or regulatory requirements defined by the FAFSA Simplification Act Section 483(a)(2)(B)(ii). |

|

10 |

When Congress passed the FAFSA Simplification Act in 2020 they specifically authorized that small business and family farm value would be collected on the FAFSA and used to calculate the SAI. The draft 2024-25 FAFSA in questions 22 and 40 only asks for investment farm value. I believe this is contrary to Congressional intent. Additionally, it will be unfair to those who do provide family farm value vs. those that do not. Therefore, I encourage the word investment be removed from questions 22 and 40. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations.

|

|

11 |

Please reconsider the term "CONTRIBUTOR," referring to the people who provide information to the FAFSA. It could be intimidating to low-income parents who will be limited to providing the information requested by their children and might not read instructions thoroughly. What about a term in the line of INFORMATION-PROVIDER? |

Thank you for your comment. |

|

12 |

The Notes on p. 22 provide an explanation of what should be reported as Investments in questions 22 & 40. The 3rd paragraph of the Assets section (which begins "Investments also include qualified education benefits or educational savings accounts...") appears to include contradictory language. It states that "Investments include...529 college savings plans" if the student is not the beneficiary, but then goes on to state that "parents of dependent students should not report the value of educational savings accounts for other children." Later in the paragraph, it states that "[f]or a student who must report parental information, the accounts are reported as parental investments in question 40, including all accounts owned by the student and all accounts owned by the parents for any member of the household." This contradicts the earlier statement that parents "should not report the value of educational savings accounts for other children." This language is confusing - please simplify it and make it very clear when a 529 plan must be reported as an investment. |

Further revisions were made to the instructions for clarity. |

|

13 |

Documented students with undocumented parents could previously complete the FAFSA online without parent ID/SSN and mail in a signature page. The proposed new process requiring that all applicants and contributors have a user ID for the new 2024-25 form will mean that contributors without an SSN will have to do the entire process on paper, further complicating the process for those students, delaying processing of their application and thereby possibly reducing amount of aid. Please allow students with undocumented parents to complete process online and mail in signature page as previously done. |

FAFSA contributors without an SSN can obtain their own FSA ID beginning in December 2023 and use that FSA ID to complete their section of the student’s online FAFSA form. For this reason, there is no longer a need for a signature page. |

|

14 |

Perhaps I’m missing something, but it appears on the draft that the Investment Asset questions (#22 and #40) do not mention excluding retirement accounts. That would clearly cause confusion and overstatement of assets without that language clearly on the FAFSA. |

This is addressed in the “Assets” section of the notes. |

|

15.a |

Question #20 & 28, 38, & 45 – • The IRA rollover field had previously had a note pointing to Form 5498. This was not clear and now there are no instructions (on paper FAFSA or FAFSA prototype). The student/spouse/parents will need some guidance on where to gather this amount. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

15.b |

• Could the question about the Earned Income Tax Credit (EITC) refer to EIC instead of EITC since the tax return shows only EIC. Could there be instructions with a tax line number for this? (for example, Line 27 of the tax return, Description on tax return is Earned Income Credit (EIC)) |

This change will be made. |

|

15.c |

• For the grant/scholarship amount, why is the amount of grants/scholarships optional? |

FAFSA Simplification Act language states that this information must be collected if the student (or others as applicable) “elect” to report it. It will remain optional for that reason, but we will remove “(Optional)” from questions 20 and 38. |

|

15.d |

Why is this amount not on the spouse section? |

Both the student and parent are instructed in questions 20 and 38 to include the amount their spouse reported on their tax return if they are married. |

|

15.e |

Could the “reported as income to the IRS” be in bold letters as was done in 23-24? |

This change will be made. |

|

15.f |

• Each field from the tax return should refer to the 2022 tax year. |

No change. The FAFSA questions reference the 2022 tax return. |

|

16 |

Question #22 & 40 – Could the instructions for the investments state to NOT include retirement accounts? |

This is addressed in the “Assets” section of the notes. |

|

17 |

Question #42 – This section applies to the “parent spouse or partner” – will this be misinterpreted as “girlfriend or boyfriend” instead of a married spouse or partner? |

The instructions on page 3, which are referenced at the beginning of page 18, explain when to provide information about a parent spouse or partner. |

|

18 |

The date of student/parent marital status was helpful when determining family situations. Since this was removed, we are without this resource for problem solving. Is this something that can be included? |

Thank you for your comment. The Department of Education is permitted only to ask questions that are required either (a) to aid in determining eligibility, (b) by the FAFSA Simplification Act, or (c) by the FUTURE Act.

|

|

19.a |

The Honorable Miguel Cardona Secretary of Education U.S. Department of Education 400 Maryland Avenue S.W. Washington, D.C. 20202

October 13, 2023

The National College Attainment Network (NCAN) represents more than 650 organizations that provide access and success services to students from low-income communities, first generation college-goers, and students of color. We appreciate the opportunity to provide feedback on the final draft of the 2024-2025 FAFSA, as we have on previous drafts, and we are grateful to you for incorporating many of our comments into this version. In particular, we applaud Federal Student Aid (FSA) for removing the question asking applicants if they are transgender. This question would have created a lot of anxiety about who would be able to view applicants’ answers to the question and what would be done with this information. Here are our final comments on the form: FAFSA State Financial Aid Deadlines – We strongly encourage FSA to reach out to state agencies one last time to update state filing deadlines before the form is finalized. The current form has the wrong dates for California and Texas, two large states with thousands of FAFSA filers. The California deadline has been moved to April 2, 2024 and Texas’s has been moved to March 15, 2024. It’s critical that students have the best information available. |

Thank you for your comment. |

|

19.b |

|

The notes associated with ITIN will be updated. |

|

19.c |

|

No change. “For-profit agricultural operations” is clarifying text intended to help users answer the question. It is not meant to replace the wording in the associated questions. |

|

19.d |

We recommend selecting a consistent term and adding a note that applicants should not include the family home value when determining the net value of the farm. |

Further revisions were made to the instructions for clarity.

|

|

19.e |

Asset Instructions – In the instructions for the asset section, there are several pieces of conflicting information about how to report 529 plans. It is our understanding that, starting with the 2024-2025 FAFSA, for dependent students, the value of the 529 plan for the student whose FAFSA is being filed should be reported in the parent section (if they are required to report assets). It is our further understanding that the value of a 529 plan for any other siblings in the household should not be reported. If our assumptions are correct, there needs to be a major revision to the instructions to clarify who reports that asset and that the student’s plan is the only amount reported. If the student is independent, it needs to be made clear that the 529 plan is reported for the student only in the student section if they are required to report assets. |

Further revisions were made to the instructions for clarity.

|

|

19.f |

We thank you for your time and attention to these changes and look forward to seeing the final version of the form soon. |

Thank you for your comment. |

|

20.a |

Draft 2024-2025 FAFSA Comments Comments

Due: October 16, 2023 These comments are submitted by Mark Kantrowitz and David Levy. Online FAFSA The new online FAFSA asks the student to invite their parents or spouse to complete the FAFSA. Part of this invitation section of the FAFSA asks for the parent's or spouse’s date of birth and Social Security Number. These questions are stumbling blocks for some students, who don't have this information readily available about their parents. Some parents don’t have a Social Security number. Some parents may be resistant to sharing this information with their children. You may wish to make these questions optional, or omit them entirely. |

Thank you for your comment. This information is necessary to allow for matching of the parent contributor to the student's FAFSA form. Without the ability to match their identifiers with those entered by the student, the parent would be unable to enter their information (including their consent and approval) in the student’s FAFSA form and the student would be ineligible for federal student aid. |

|

20.b |

But, if you do continue to ask for the parent’s date of birth, you might want to add some simplistic edit checks, such as whether the parent is age 13 or under and therefore subject to COPPA. This scenario can happen when there is a digit transposition in the parent’s year of birth or the student’s parents are divorced and the biological/adoptive parent remarried someone who is younger than the student. |

Thank you for your comment. The Department of Education needs to further assess the impact of this recommendation in conjunction with pertinent stakeholders and ongoing departmental priorities. This recommendation will be considered as a potential future enhancement to the Free Application for Federal Student Aid (FAFSA®) form. |

|

20.c |

529 Plans as Investments The language of the draft paper/PDF FAFSA concerning investments was revised to reflect a change in section 480(f)(3)(B) of the Higher Education Act of 1965, due to the FAFSA Simplification Act. The definition of a qualified education benefit in the Higher Education Act was changed from “the parent if the student is a dependent student, regardless of whether the owner of the account is the student or the parent.” to “the parent if the student is a dependent student and the account is designated for the student, regardless of whether the owner of the account is the student or the parent.” The intention is to exclude 529 plans owned by a dependent student’s parents where the beneficiary is a sibling or parent, as opposed to the student. However, the FAFSA instructions appear to have an error that partially inverted this definition. Investments include real estate (do not include the home in which you live), rental property (includes a unit within a family home that has its own entrance, kitchen, and bath rented to someone other than a family member), trust funds, UGMA and UTMA accounts, money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds, other securities, installment and land sale contracts (including mortgages held), commodities, etc.

Investments also include qualified educational benefits or education savings accounts (e.g., Coverdell savings accounts and, if the student is not the beneficiary, 529 college savings plans and the refund value of 529 prepaid tuition plans). Parents of dependent students should not report the value of educational savings accounts for other children. For a student who does not report parental information, the accounts owned by the student (and/or the student’s spouse) are reported as student investments in question 22. For a student who must report parental information, the accounts are reported as parental investments in question 40, including all accounts owned by the student and all accounts owned by the parents for any member of the household.

Investments do not include the home you live in, the value of life insurance, ABLE accounts, 529 college savings plans if the student is the beneficiary, retirement plans (401[k] plans, pension funds, annuities, non-education IRAs, Keogh plans, etc.), or cash, savings, and checking accounts reported in the previous question.

Investments also do not include UGMA and UTMA accounts for which you are the custodian, but not the owner

|

Further revisions were made to the instructions for clarity. |

|

20.d |

Postage Most printer paper is 20 pounds per ream (500 sheets) of 17 x 22 sheet. Each 17 x 22 sheet contains four 8-1/2 x 11 pages, so the weight of a single 8-1/2 x 11 sheet is 20 pounds / (500 x 4) = 0.01 pounds. There are 16 ounces per pound, so the weight of a single sheet is 0.16 ounces. That means you can get 6.25 sheets per ounce. A standard #10 envelope weighs 0.2 ounces. Thus, five sheets and an envelope weighs one ounce. If you omit the instructions from the printed PDF FAFSA, and print the 14 pages double-sided, that will involve 7 sheets of paper, weighing 1.32 ounces with the envelope. If the applicant mails the full application and instructions, a total of 21 pages, that will add four pages if printed double-sided, yielding a total weight of 1.96 ounces with the envelope. If the applicant prints the application single-sided, it will weigh 2.44 ounces with the envelope. If the applicant prints the application and instructions, it will weigh 3.56 ounces, which is above the limit for a first class letter. These weights have been confirmed with actual printer paper. Current prices for first class stamps are $0.66 for the first ounce and $0.24 for each additional ounce. So, mailing a paper FAFSA printed double-sided will cost $0.90 instead of $0.66. Accordingly, the FAFSA instructions should advise the applicant that they will need additional postage to mail the FAFSA to the federal processor. |

Thank you for your comment. The instructions you’ve requested are on page 1 in the “Mail Your FAFSA Form” section. |

|

20.e |

Parent Education Status The updated draft FAFSA distinguishes between a parent who completed a college education and a parent who attended college but did not graduate. The intention is to identify first-generation college students, who are at risk of dropping out of college. Pages 20, 43 and 153-158 of the book, Who Graduates from College? Who Doesn’t?, demonstrates that an inflection point for college completion by first-generation college students occurs when the parents did and did not obtain at least a Bachelor’s degree. See especially Tables 196 and 200-203. This suggests that the term “college” in question 15 about parent education status should be defined as Bachelor’s degree attainment and not just attending college. Note that some states have different definitions of first-generation college student status, and using Bachelor’s degree attainment is the most general definition, that will enable the states to inform all students who may be eligible for additional financial aid. |

Thank you for your comment. The Department of Education believes the current instructions provide adequate guidance. |

|

20.f |

Need for Release of Draft Guidance We recommend that the U.S. Department of Education release a draft of the Application and Verification Guide (AVG), since the AVG provides insights into how applicants and contributors should complete the FAFSA. |

Thank you for your comment. This issue falls outside the scope of the 2024-25 FAFSA form clearance. Only the FAFSA PDF and the FAFSA Submission Summary are eligible for comments.

|

|

20.g |

Need for Release of FSA ID Screenshots The FSA ID is a key aspect of filing the FAFSA. However, to date the U.S. Department of Education has released screenshots of only the draft online FAFSA, not the online tools for creating and updating an FSA ID. |

Current FSA ID resources are accurate, as students and other contributors with an SSN can complete the FSA ID process at any time. Updated resources will become available in advance of FSA ID updates that reflect the added ability for contributors without an SSN to complete the FSA ID process. |

|

20.h |

Implement FSA ID prior to FAFSA The U.S. Department of Education intends to release the 2024-25 FAFSA sometime in December 2023. If possible, please release the tools for creating and updating an FSA ID sooner, so that applicants and contributors can get a head start on obtaining an FSA ID for the 2024-25 FAFSA. |

Students and other contributors with an SSN can complete the FSA ID process at any time. Additional functionality to allow contributors without an SSN to complete the FSA ID process will be available at the same time as the 2024-25 FAFSA form. |

|

20.i |

FAFSA Overview Videos The links in the FAFSA Overview video, such as studentaid.gov/eligibility, are not clickable. Also, the video mentions an October 1 start date, which doesn’t apply this year. |

The link referenced is to the current FAFSA Overview video. Videos and other resources related to the 2024-25 FAFSA form and process are currently being updated. |

|

21.a |

Draft 2024-2025 FAFSA Additional Comments Comments

Due: October 16, 2023 These comments are submitted by Mark Kantrowitz and David Levy. Parent Responsible for Completing the FAFSA The FAFSA Simplification Act at 20 USC 1087oo(f)(2) addresses a situation in which the student’s parents are divorced or separated. It specifies that the parent responsible for completing the FAFSA is the parent who provides more financial support to the student: (2) DIVORCED OR SEPARATED PARENTS.—Parental income and assets for a student whose parents are divorced or separated, but not remarried, is determined by including only the income and assets of the parent who provides the greater portion of the student’s financial support It does not, however, specify what happens when neither parent provides more support than the other. Page 4 of the 2023-09-01 version of the draft PDF/paper 2024-25 FAFSA reflects the statutory language, but does not address the situation when neither parent provides more support than the other. Which parent should include information? If the parents are divorced or separated, answer the questions about the parent who provides the greater portion of the student’s financial support, even if the student does not live with them. If this parent is remarried as of today, answer the questions about that parent and the stepparent. |

This change will be made. |

|

21.b |

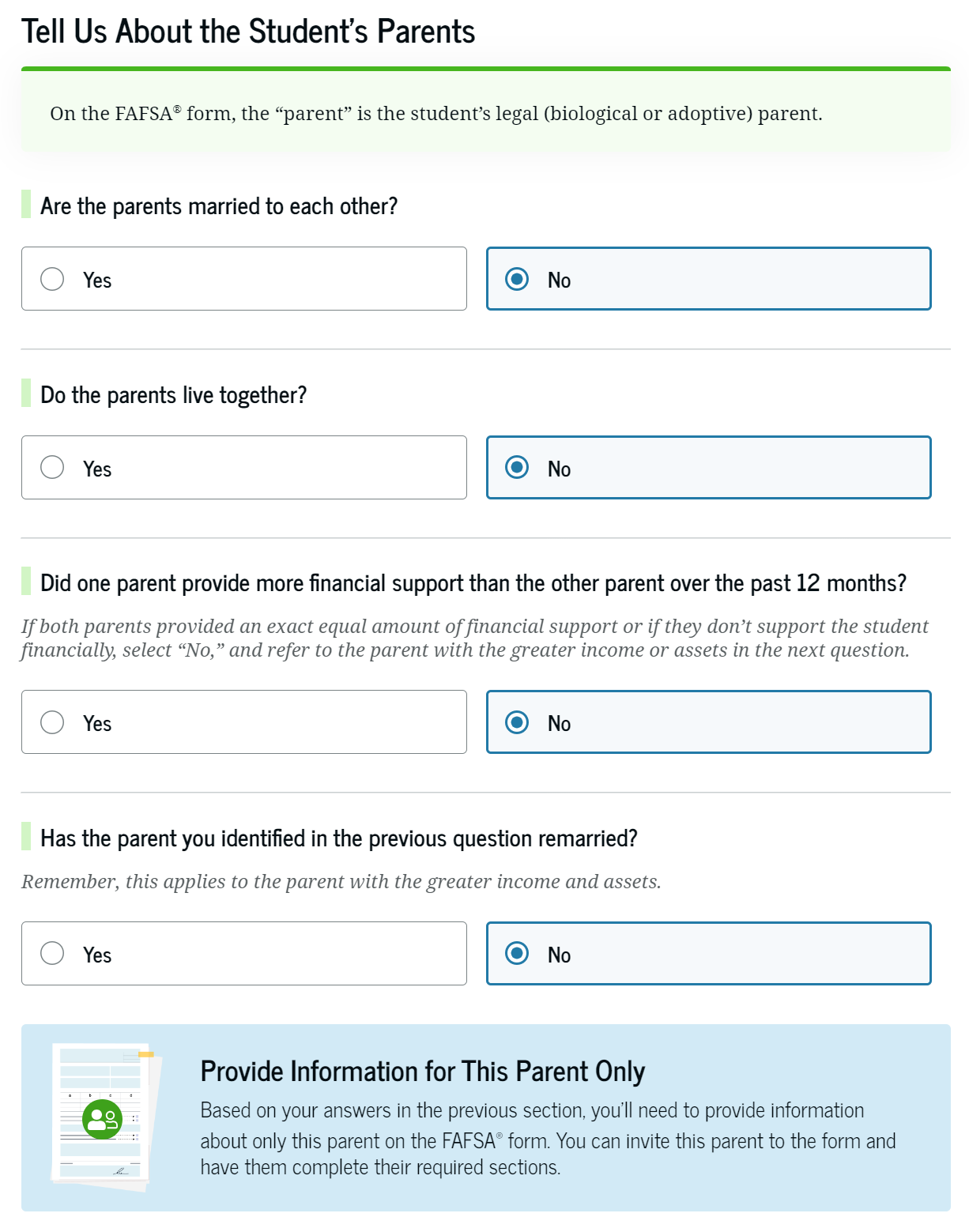

The 2024-25 FAFSA Prototype, however, provides conflicting and confusing instructions in this scenario. First, it tells the student to refer to the parent with the “greater income or assets.” Did one parent provide more financial support than the other parent over the past 12 months? If both parents provided an exact equal amount of financial support or if they don’t support the student financially, select “No,” and refer to the parent with the greater income or assets in the next question. Then, it tells the student to refer to the parent with the “greater income and assets.” Has the parent you identified in the previous question remarried? Remember, this applies to the parent with the greater income and assets. So, which one is it? Greater income or assets, or greater income and assets? |

This change will be made. |

|

21.c |

Also, how does the student decide which parent to identify when one parent has greater income and the other parent has greater assets? If you meant “plus” instead of “and” and “or”, that creates a false equivalency of income and assets. For example, the lower income parent could have received the house in the divorce. That doesn’t mean that they have greater financial strength, even if the other (much higher income) parent has no assets because they spend all of their income. (Remember, the FAFSA has not yet defined assets at this point to exclude the principal place of resident and qualified retirement plan accounts, nor has it defined it as the net worth of the assets after subtracting debt secured by the assets from the market value of the assets.) Students are going to get really confused by this. We recommend changing the language from “greater income or assets” and “greater income and assets” to just “greater income.” Alternatively, you could substitute “refer to the parent with greater income. If the parents have the same income, then refer to the parent with greater assets.” Here’s a screen snapshot that shows these conflicting questions.

|

This change will be made. |

|

22.a |

Comments on the proposed 2024-2025 Free Application for Federal Student Aid (FAFSA®) (Docket ID ED-2023-SCC-0053 ● In the Completing the FAFSA Form section: ○ In the “Which parent should include information?” section, ED instructs applicants, “If the parents are divorced or separated, answer the questions about the parent who provides the greater portion of the student’s financial support, even if the student does not live with them.” We believe this will lead to questions about a timeframe for when the greater portion of support was provided since that may vary for applicants. ED should be clearer in the instructions on the timeframe applicants should use. |

This change will be made. |

|

22.b |

○ In the online FAFSA demo in the Parent Wizard, ED instructs applicants whose divorced or separated parents provide an exact equal amount of financial support to the student to use the parent with the greater income or assets as the parent of record. The use of the word “or” is problematic because one parent could have a higher income and the other could have more assets. We recommend ED change the language to the “greater of income plus assets” to avoid confusion. |

This change will be made. |

|

22.c |

● The FAFSA Privacy Act Statement includes a new section headed “Opportunity to Contest or Amend Tax Information,” which instructs applicants to contact a financial aid administrator at their postsecondary institution if they have questions about or need to access their federal tax information. We fear applicants will mistakenly report postsecondary institutions to the Ombudsman Office when they are told they cannot contest or amend their FTI via the institution, resulting in confusion and wasted time for applicants, institutions, and the federal Ombudsman. The section should be renamed, “Opportunity to Access Your Federal Tax Information” to more accurately represent what students can expect from postsecondary institutions with respect to their FTI. |

This change will be made. |

|

22.d |

● The Federal Tax Information (FTI) Consent and Approval, as well as the Signatures section include new language, “By filling in the circle (accepting)…” This language is confusing because the applicable circles for each contributor do not appear until later in the form. We recommend adding language to read, “By filling the circle in Questions 24, 29, 41, and/or 46,” for clarity. |

This change will be made. |

|

22.e |

● Question 8: We recommend ED add clarifying text instructing applicants that “unusual circumstances” are listed in Question 7. We offer the suggested change: “Are the student’s parents unwilling to provide their information, but the student doesn’t have an unusual circumstance such as those listed in Question 7 that prevents them from contacting the parents or obtaining their information?” Unusual circumstances have a precise meaning for purposes of this question, and we believe students would be better able to answer Question 8 accurately if they were referred back to the description of unusual circumstances in Question 7. |

This change will be made. |

|

22.f |

● Questions 9 & 34 add a condition to the explanatory text for the student’s/parents’ other children who don’t live with the student/parent(s) stating they should be included in family size “...even if they live apart due to college enrollment. The new language appears to exclude from family size any dependents of the student or parent who do not live with them unless the reason they do not live with the student or parent is because of college enrollment. ○ We recommend that if ED retains the language referring to college enrollment, it is described as only one example of an instance where a family member is included in family size despite not living full-time with the family, and provide additional instructions as to whether and how temporary absences of any kind should be factored in. |

Thank you for your comment. The Department of Education believes the current instructions provide adequate guidance. |

|

22.g |

● Question 16 asks applicants if their parent or guardian was killed in the line of duty while (1) serving on active duty as a member of the armed forces on or after September 11, 2001, or (2) performing official duties as a public safety officer. However, the 2024–25 FAFSA® Specifications Guide, Volume 6, ISIR Guide includes separate indicators for Iraq and Afghanistan Service Grant (IASG) and Children of Fallen Heroes (CFH) eligibility. ○ With only a single FAFSA question to identify both statuses, it is not clear how the Federal Processing System can determine which indicator to set on the ISIR. ■ We recommend ED change the response options from “Yes” or “No” to “1” or “2” to describe which of the special rules for Pell Grant eligibility the student qualifies under and to set the appropriate ISIR indicator based on their response. |

Thank you for your comment. The Department of Education needs to further assess the impact of this recommendation in conjunction with pertinent stakeholders and ongoing departmental priorities. This recommendation will be considered as a potential future enhancement to the Free Application for Federal Student Aid (FAFSA®) form. |

|

22.h |

● Also in Question 16, we recommend that ED change “armed forces” to “U.S. armed forces” in accordance with the definition of armed forces in 10 U.S.C., §101(a)(4) as “the Army, Navy, Air Force, Marine Corps, Space Force, and Coast Guard.” |

This change will be made. |

|

22.i |

● Questions 18 and 36 ask students and parents about means-tested benefits receipt. There are several issues with how the question is asked and how instructions to skip questions are written. ○ The FAFSA Simplification Act specifies ED must request on the FAFSA information on means-tested benefits “the applicant receives or has received any of the following means-tested Federal benefits within the last two years.” ■ The corresponding FAFSA questions ask if the applicant or parent received means-tested benefits “...at any time during 2022 or 2023.” This does not address situations where the applicant or parent currently receives a means-tested benefit at the time they complete the FAFSA. |

With consideration of the 15-month open cycle of FAFSA applications, the specific timeline of what accounts for within the “last 2 years” is provided to maintain consistency in reporting across FAFSA data elements and FAFSA applicants within the 15-month open cycle. A school maintains the authority to consider a professional judgement to account for means-tested benefits after the year provided in the FAFSA text. |

|

22.j |

■ ED should update instructions to permit students who complete the paper FAFSA to skip asset questions if they received means-tested benefits that exempt them from having assets factored into their eligibility. |

This change will be made. |

|

22.k |

■ Finally, we urge ED to remove the free and reduced-price school lunch program from the list of means-tested benefits. During the pandemic, nearly all states moved their students into the free and reduced-price lunch program and today, many states are continuing to provide that benefit for their students. Therefore, this is no longer a suitable proxy for low-income status. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

22.l |

● ED should update IRS form line item references for all tax return questions, as many are inaccurate or missing. |

Further revisions will be made to align with input from the Internal Revenue Service(IRS). |

|

22.m |

● Questions 20 and 38 ask for “Amount of college grants, scholarships, or AmeriCorps benefits reported as income to the IRS (Optional).” Making it optional on the paper form seems to add little value and, in fact, could harm students who will skip the question, when completing it could result in additional eligibility for student aid. ED can still treat it as optional in processing without discouraging students from completing this question. |

This change will be made. |

|

22.n |

● Questions 21 and 39 instruct applicants and their parent to report child support received for the last complete calendar year. Given that applicants may be completing the FAFSA in any one of three different calendar years, the amount of child support for the last complete calendar year may be very different based only on whether the FAFSA was filed on December 31 or January 1. We recommend using the prior-prior year’s child support received for consistency. |

Thank you for your comment. This question is worded in accordance with the statutory or regulatory requirements defined by the FAFSA Simplification Act Section 483(a)(2)(B)(ii)(XIV)(aa). |

|

22.o |

● Question 37 and Question 44 have a new tax filing option: “Either the parent earned income in a foreign country but did not and will not file a foreign tax return or worked for an international organization and was not required to report income on any tax return. International organizations include, for example, the United Nations, World Bank, and International Monetary Fund.” but there are no instructions for how to answer Question 38 and Question 45 if that response is selected. We recommended in the 60-day comment period that ED add instructions for how to answer questions 38 and 45 when parents select this option in Questions 37 and 44, and we disagree with ED’s response that the current instructions provide adequate guidance. |

This change will be made. |

|

22.p |

● In the “Notes” section: ○ The changes ED made to the asset instructions with respect to when qualified education benefits are considered investments are still confusing despite changes made since the first FAFSA draft was issued, and also contain some inaccuracy. ■ We recommend ED change instructions to read, “Investments also include qualified educational benefits or education savings accounts (e.g., Coverdell savings accounts and, if the student is not the beneficiary, 529 college savings plans and the refund value of 529 prepaid tuition plans.) Such accounts should be reported as the asset of the owner of the account, unless the account owner is a dependent student, in which case the value of the account should be reported as a parent asset.” |

Further revisions were made to the instructions for clarity. |

|

22.q |

■ The language, “Parents of dependent students should not report the value of educational savings accounts for other children” should be removed since that is not correct. |

Further revisions were made to the instructions for clarity. |

|

22.r |

■ We also recommend removing the language, “Investments do not include… 529 college savings plans if the student is the beneficiary…” because this is not correct. |

Further revisions were made to the instructions for clarity. |

|

22.s |

○ The Business/Farm Instructions are identical to the 2023-24 instructions despite the significant change to include small businesses and family farms. Families need clear instructions on how to separate their residence and non-farm land from their farms. ■ There must be a clear way for families to establish whether their property is considered a farm for asset reporting purposes on the FAFSA. We recommend instructing families that if they own property for which they file an IRS Schedule E or F where they report any type of farm income, that the property in question is a farm since those schedules appear to capture all types of income or losses generated from farming. |

Further revisions were made to the instructions for clarity. |

|

22.t |

■ ED must also provide clear instructions about how to treat a primary residence that is on family farmland. Families that don’t own farms are able to exclude both the dwelling and the land it sits on from assets on the FAFSA under the primary residence exemption. We recommend ED use language such as “the land you/your family lives on that is not used for farming” to describe what can be excluded from asset reporting.enhancement |

Further revisions were made to the instructions for clarity. |

|

23 |

I recognize that the process of updating the FAFSA to reflect the FUTURE Act and the FAFSA Simplification Act has been long and challenging. I would like to thank the FSA team for doing an outstanding job of recognizing the potential unintended consequences of the changes, particularly as they potentially could impact lower-middle income families with multiple children attending college and/or coming from family farms. Between the guidance provided and the opportunity for impacted families to request professional judgment, I think the FSA team has done a great job of smoothing the pathway to college and to financial aid. Thanks to your diligent efforts, families won't have to choose which child gets to go to college - and rural students, who already face many challenges, including living in educational deserts, will still have access to the Pell grants that enable so many students to invest in their future and reach the middle class and beyond. |

Thank you for your comment. |

|

24.a |

Dear Ms. Mullan: Thank you for the opportunity to respectfully provide comment on the revised draft of the 2024-25 Free Application for Federal Student Aid (FAFSA®) (Docket ID ED-2023-SCC-0053). Please apply the below comments related to the paper FAFSA to the online form as well, since we do not have the benefit of previewing the online form at this time. 1. Page 3 – Where current terminology states “Parent Spouse or Parent Partner”, we think this will cause confusion. We can see a parent who lives with a “partner” who is not the biological parent of the student thinking they must list the “partner’s” information on the FAFSA. |

The instructions on page 3, which are referenced at the beginning of page 18, explain when to provide information about a parent spouse or partner. |

|

24.b |

2. Page 4 – In the “Which parent should include information?” section, applicants are instructed “If the parents are divorced or separated, answer the questions about the parent who provides the greater portion of the student’s financial support, even if the student does not live with them.” We expect this to lead to questions about the timeframe for when the greater portion of support was provided. If ED could be clearer in the instructions on the timeframe applicants should use, that will reduce confusion. |

This change will be made. |

|

24.c |

3. In the online FAFSA demo in the Parent Wizard, applicants with divorced or separated parents who provide an exact equal amount of financial support to the student are instructed to use the parent with the greater income or assets as the parent of record. The word “or” is a concern here because one parent could have a higher income and the other could have more assets. Changing this to the “greater of income plus assets” would alleviate this concern.

|

This change will be made. |

|

24.d |

4. Page 10 – Under Federal Benefits Received, clarification is needed with the question on receipt of Means tested benefits. If the entire school received free lunch, then the student/parent should know from the question if they can answer yes to this question or if the student/parent have to qualify for the free or reduced lunch based on income. Additional guidance needs to be provided.

|

Please refer to comment 22.k. |

|

24.e |

5. Page 11 and Page 17 – Questions 21 and 39 instruct applicants and their parent to report child support received for the last complete calendar year. Applicants may be completing the 2024-25 FAFSA in three different calendar years, leading to inequity in the timing of required data across applicants. Using the prior-prior year’s child support received would provide consistency among applicants.

|

Thank you for your comment. This question is worded in accordance with the statutory or regulatory requirements defined by the FAFSA Simplification Act Section 483(a)(2)(B)(ii)(XIV)(aa). |

|

24.f |

6. Page 22 – Investment farm is not adequately defined for families, who will have questions as to which business and farm assets must be reported. Many people engage in farming activities but do not consider their property to be a farm, while others receive income from farming but do not engage in farming themselves. Many families reside on their farms and will need clear instructions on how to separate their residence and non-farm land from their farm value. If the intention is for families that own property for which they file an IRS Schedule E or F and report farm income, then that should be indicated in the instructions. Additionally, instructions are needed for treatment of a primary residence that is on family farmland, similar to how families not on farms are able to exclude both the dwelling and the land it sits on from being reported as assets on the FAFSA. |

Further revisions were made to the instructions for clarity. |

|

24.g |

7. Page 22 – The last sentence of the directions regarding 529 under Investments on page 22 is confusing: “For a student who must report parental information, the accounts are reported as parental investments in question 40, including all accounts owned by the student and all accounts owned by the parents for any member of the household.” This does not match the sentence earlier in that paragraph, which states “Parents of dependent students should not report the value of educational savings accounts for other children.”

In closing, PHEAA would like to thank the U.S. Department of Education (ED) for the opportunity to provide feedback on the revised draft 2024-25 FAFSA. PHEAA, as the administrator of the nation’s fifth largest need-based state grant program, recognizes that this is the optimal application process for low-income students who benefit the most from Pennsylvania State Grant dollars. Please do not hesitate to contact me at [email protected] or at 717-720-1600 if you have any questions regarding these comments. Sincerely, Elizabeth K. McCloud Vice President PA State Grant & Special Programs |

Further revisions were made to the instructions for clarity. |

|

25.a |

This Draft FAFSA (as compared to prior years' PDF FAFSAs) has recast all of the questions in the third person rather than the second person, which is difficult to follow and unnecessarily wordy and complicated. In previous PDF FAFSAs, questions were asked of respondents in the second person. For example, on the 2023-2024 PDF FAFSA, question 26 reads “What will your college grade level be when you begin the 2023-2024 school year?” The 2024-2025 draft PDF FAFSA asks the same question in section 4 with less clear wording: “When the student begins the 2024–25 school year, what will their college grade level be?” The rationale for this shift is unclear—the third-person framing is strained, impersonal, bureaucratic, and confusing. |

Thank you for your comment. The use of third person is in response to preferences expressed by both students and parents during usability testing. |

|

25.b |

The “Student Spouse” wording is also confusing. It suggests that the contributors this section is a spouse who is also a student, rather than the applicant’s spouse. It would be clearer to call this section “Student’s Spouse” and include this apostrophized term in all subsequent references to the student’s spouse. Again, the questions be posed directly to the individual required to complete the section—i.e., with the 2nd person “you” phrasing instead of the unnecessarily stilted 3rd person phrasing. The “Parent Spouse or Partner” has the same word choice issues described above with regard to the student’s spouse. “Parent’s Spouse or Partner” is clearer and more precise. For both the "Parent" and "Parent's Spouse or Partner" sections, recasting the questions so they are posed directly to the person submitting the information (i.e., in the 2nd person) would improve clarity and simplicity. |

Thank you for your comment. The Department of Education considers this suggestion a stylistic preference. |

|

26 |

The FAFSA form still uses the heading Current Net Worth of Businesses and Investment Farms. It was my understanding that the law changed to require both family farmers and investment farmers to submit their net worth. The term investment farm refers to an agricultural business operation that is purchased and operated for financial gain. The intention of investing in a farm may be to generate a profit or to create a tax deduction for the owner. Investment farms are owned by institutional investors who generally don't live on the farm or take part in any of the day-to-day operations. As such, the investor generally hires farmhands and other employees to do the actual farming. A family farm, on the other hand, is a farm that is owned and operated by a family, especially one that has been handed down from one generation to another. The owners of the farm are completely at risk and do take part in the day-to-day operations. Investment farmers have traditionally had to report their net worth on the FAFSA. If the law change is to be properly clarified, the term 'investment' should be removed from the question. It should be updated to "Current Net Worth of Businesses and Farms" - unless the intention of the law is to only capture the value of investment farms - which would constitute no change to the way this question has been handled in the past. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

27.a |

I am most grateful to be permitted an opportunity to provide comments regarding the 2nd draft of the 2024-2025 FAFSA dated September 1, 2023. For more than three decades, I have been the author of The Princeton Review's "Paying for College" annually-updated guidebook. In the past, some of the suggested language I provided to employees of the Department have been implemented. Additionally, for one year’s form – at the time when millions of paper copies of the form were printed and mailed to schools and libraries - I detected an error with an IRS line reference in the early part of the print run and before any printed were shipped. The Department was most appreciative to me for pointing out the problem with the form, thereby avoiding a problem with erroneous information on the FAFSA. In my comments that follow, there are a number of items I wish to address: Item 1. Various problems with the ambiguous and confusing language in the Notes on page 22 of the second draft of the 2024-2025 FAFSA regarding the treatment of certain investments i.e. Coverdells, 529 plans, etc. Additionally, the text in the 2nd draft does not follow the law. I realize that in the prior 60 -day comment period for the first draft, the issue was raised about such accounts owned for the benefit of other individual (for example, siblings of the applicant) not being required to be reported as an asset. After the comment period ended, various employees of the Department in response to questions raised in webinars indicated that such accounts need not be reported. But now with this 2nd draft of the 2024-2025, the instructions on page 22 seems to be saying the opposite in some of the text. That is, include the value of such accounts for beneficiaries other than the applicant, but not the applicant. Though there is conflicting text in another sentence mentioning to include the value of accounts for all members of the household (which always includes the applicant.) I believe that both the earlier position of the Department over the summer as well as the wording on the 2nd draft of the FAFSA do not follow the law. The commenter for the 1st draft, the National Association of Financial Aid Administrators (“NASFAA”) was correct when citing there being a mention of the treatment of these accounts in Section 480 (f) (3) (B) of the legislation in their submitted comments. However I believe the flaw in NASFAA's interpretation of the law involves the language in Section 480 (f) (1) of the law. In that section of the law, the language states that "The term 'assets' means.....qualified education benefits (except as provided in paragraph (3))....". The key word in that part of the Section (f) (1) is the word "except". NASFAA's interpretation of the law in its comments would indeed have been correct if the wording was instead "...(as provided in paragraph (3))...". In that case, then Section 480 (f) (3) (B) would be the rule. Comment: Though if that were the wording (which it is not), then it follows there would have been no need for the law to mention qualified education benefits in Section 480 (f) (1) at all.

But the word "except" in Section 480 (f) (1) of the FAFSA Simplification legislation means that Section 480 (f) (1) is the general rule and that Section 480 (f) (3) (B) only covers one situation that overrides the general rule. As such due to the word "except" being including in Section 480 (f) (1): All qualified education benefits are to be reported if owned by an individual required to report information on the FAFSA (in which case they are to be considered as an investment of that individual regardless of the beneficiary) except that if a dependent student owns such a qualified education benefit, then such a student-owned qualified educational benefit is to be considered an investment of the parent (and not an investment of the student applying for aid). Therefore, the FAFSA Simplification legislation has not really changed anything in terms of how the value of such Coverdells and 529 plans are to be reported on the FAFSA when compared to the regulations in place for many prior years. The only change with Simplification relating to these qualified education benefits involves distributions in the PPY year from such plans owned by others not required to report financial information on the FAFSA (for example, an account owned by a grandparent) as such distributions will no longer be considered untaxed income of the applicant starting with the 2024-2025 version of the FAFSA. Unfortunately the new language on page 22 of the second draft of the FAFSA regarding what to include and what to exclude is ambiguous and contradictory. And that new language seems to draw distinctions between Coverdells Education Savings Accounts (ESAs), 529 prepaid plans and 529 savings plans in their treatment. This new language in the second draft of the FAFSA is all being promulgated even though the FAFSA Simplification legislation does not mention any of these carve-outs involving accounts to be excluded. For ease of reference: I have attached another PDF file with the relevant parts of page 22 of the FAFSA draft and the relevant part of the legislation involving the key parts of section 480 highlighted on both pages. |

Further revisions were made to the instructions for clarity. |

|

27.b |

The FAFSA instructions on page 22 regarding these accounts have other problems as well, that include: * The use of the abbreviation e.g. since e.g. is a Latin abbreviation for the words “exempli gratia” which mean “for example”. This abbreviation is used that widens the description of the item. That is, some examples are given but the list is not complete. So an applicant could assume there are other types of accounts covered, when the legislation is very specific when defining those accounts that are qualified tuition benefits. The Latin abbreviation i.e. is an abbreviation of “id est” which translates to mean “in other words”. I.e. narrows the description to better define only those items that meet the parameters of the term before the i.e. abbreviation. Therefore, i.e. should be used and only the types of the accounts mentioned in the law should be included after the abbreviation. |

This text will be revised. |

|

27.c |

* Mentioning accounts owned by the parents "for any member of the household" is another problem. Such wording means that accounts owned by a parent for someone not a member of the applicant's household are then to be excluded. The law does not provide for any such exclusion of these accounts for non-members of the household.

|

Further revisions were made to the instructions for clarity |

|

27.d |

* The wording about not including 529 plans if the student is the beneficiary makes no sense in the next paragraph covered the various assets not to include , given the text at the end of the prior paragraph on page 22 of the draft. If something is to be written in that paragraph about these accounts it would be to not include qualified education benefits if the student is the beneficiary of an account owned by someone not required to report their financial information on the FAFSA. underlined). And if such language is to be included in that paragraph regarding excluded assets, the text should be changed to refer to qualified education benefits (and not just 529 savings plans). |

Further revisions were made to the instructions for clarity |

|

27.e |

* Regarding Coverdell Education Savings Accounts (“ESAs”): the text on page 22 of the 2nd draft of the FAFSA is also problematic. The Coverdell ESAs are different than 529 plans in terms of ownership. That is, with a 529 the owner retains ownership unless an election is made to change the ownership at a later date (or the ownership changes due to the death of the owner). With Coverdells, generally a parent or grandparent is the owner while the beneficiary is a minor. But then things get complicated once the beneficiary reaches the age of majority in their state of residence . Unless an election was made for the initial owner to retain ownership of the Coverdell after the beneficiary reaches the age of majority (with such election needing to be made when the Coverdell was established), the ownership of the Coverdell ESAs will then automatically pass to the student when the student reaches that age of majority defined by their state . The FAFSA instructions to exclude "educational savings accounts for other children" does not follow the law if any other said child is still a minor. For a minor child, the Coverdell would still be the asset of the parent (if the parent is the owner). Perhaps the Department was not aware of this quirk with Coverdell ownership (which is not well known). And one has to also wonder what the words "education savings accounts" mean on page 22. Is it referring only to Coverdell Education Savings Accounts - given non-prepaid 529s are known as "savings plans" (and not "educational savings accounts" even though one's plan bears an account title e.g., Name of Owner FBO Name of Beneficiary. Or does the term "education savings accounts" include something else in addition to Coverdell ESA – though some other type of education savings account would not be a qualified education benefit. Note: The term in the law is “qualified education benefit”, so the word “educational” on page 22 of the draft is not the proper middle word to use. Because the text on page 22 regarding qualified education benefits is so problematic - and more important, does not follow the law - here is some suggested text that follows the letter of the law for you to consider using instead: Investments also include qualified education benefits [i.e. any Coverdell Education Savings Accounts (ESAs), 529 savings plans, 529 prepaid plans or other prepaid tuition plan offered by a State]. With one exception, the current value of any qualified education benefit owned by an individual required to report information on this application is to be reported as the asset of the current owner, regardless of the beneficiary. Exception: The value of any qualified education benefit owned by a dependent student required to report parent information on this form should be reported as a parental investment in questions 40 (and not reported in a student investment in question 22. |

Further revisions were made to the instructions for clarity |

|

27.f |

Item 2: An additional question to add. In the responses to the comments published by the Department in September 2023 “"60 Day Comment Response Summary", the Department’s response to the first comment cites “The Department is permitted to only ask questions that are required either a) aid in determining aid eligibility….” The question is am proposing to be added is therefore permitted under the law because it aids in determining aid eligibility for SEOG, federal Word-study, and a subsidized Direct Loan, and possibly the amount of the Pell Grant if the student will not receive the minimum or maximum Pell Grant. And indeed, the text in the middle of the left column on Page 3 in the section “How much student financial will I receive/” also clearly indicates that this question needs to be added as financial need is defined as the difference between the cost of attendance and one’s SAI. Then text in the first sentence alludes to the “information on the FAFSA> Given the financial aid administrator needs to know the proper cost of attendance, a question needs to be asked about the housing option. In this way, “information on the FAFSA” can be used by a college’s financial aid office to determine the proper Cost of Attendance and therefore the financial need of the student. There is no doubt this would fit the criteria to be permissible to be asked as it would “aid (the financial aid office) in determining aid eligibility” for federal aid programs. Page 3 of the draft also mentions the student’s college will be responsible for determining the amount of aid. Therefore, the aid office clearly needs this information on the student’s FAFSA. In summary, this question is permitted to be asked under the law and should be added. |

Thank you for your comment. |

|

27.g |

Item 3: The response oval with the pre-printed minus sign involving the tax return information for the student, the student’s spouse, the parent, and the parent’s spouse /partner for the identical question involving the “Foreign earned income exclusion”. Unlike other questions in the income tax return information sections that have this oval with a minus sign to the left of the response area for one to list the dollar amount in which a response can be a positive or a negative number (and so needs to be designated if it is a negative number by filling in the oval), the foreign earned income exclusion can only be a negative number on the tax return (which is why the IRS has printed parentheses for line 8d on Schedule 1. The oval with the minus sign is therefore unnecessary – and its inclusion will only add to confusion. To clarify this item, it would be beneficial to add text such as: “List as a positive number” after the IRS line reference text on the FAFSA.

|

Thank you for your comment. The Department of Education believes the current instructions provide adequate guidance. |

|

27.h |

Item 4: Other miscellaneous issues. * The text at the top of Page 1 regarding deadlines for the school having the information does not follow current Department policy in which the only requirement is for the FAFSA to be processed with an EFC appearing on the SAR. The information need not be correct, just true and complete to the best of one’s knowledge and the school need not be listed. The wording should be changed because of this. And the wording is also misleading because it implies one can drop of the completed aid form at the financial aid office of the school by the end of the enrollment period.

|

Thank you for your comment. The Department of Education believes the current instructions provide adequate guidance. |

|

27.i |

* In that same section, it would be better to add the comment about the online filing at the beginning of that text.

|

Thank you for your comment. The Department of Education believes the current instructions provide adequate guidance. |

|

28.a |

October 16, 2023 Kun Mullan, PRA Coordinator Strategic Collections and Clearance, Governance and Strategy Division, Office of Chief Data Officer, Office of Planning, Evaluation and Policy Development U.S. Department of Education 400 Maryland Ave. SW Washington, DC 20202 Re: 2024-2025 Free Application for Federal Student Aid (FAFSA), OMB Control Number 1845- 001, ICR Reference Number 202303-1845-006, Docket ID ED-2023-SCC-0053 Via: https://www.reginfo.gov/public/do/PRAViewICR?ref_nbr=202303-1845-006 Thank you for the opportunity to submit comments on the 2024-2025 FAFSA. SchoolHouse Connection has significant expertise in youth and young adult homelessness. We provide direct assistance to help these young people access financial aid and complete postsecondary education. We also provide training and development for professionals who serve them. We thank the U.S. Department of Education (“Department”) for its work to date to ensure that the homelessness-related provisions of the FAFSA Simplification Act are correctly implemented. However, there are a few remaining concerns that must be addressed in order for the FAFSA to comply with the statute and remove barriers to unaccompanied youth experiencing homelessness and unaccompanied youth who are self-supporting and at risk of homelessness (collectively, “UHY”). Homelessness Screen Text (after Question 6): In the most recent prototype of the 2024-2025 FAFSA, an applicant who answers “yes” to the homeless filtering question (Question 6) but then selects “none of these apply” to the subsequent question (indicating that they do not have documentation from one of the individuals who are authorized to make UHY determinations), is shown the following message: Provisionally Independent Student Based on your answer, you’re a provisionally independent student. This means you don’t need to answer questions about your parents to submit your application. To complete your application, you’ll need to contact your school’s financial aid office and provide documentation to verify your circumstances. 2 We won’t be able to calculate your Student Aid Index (SAI) until you confirm your circumstances with your financial aid office. Until then, we will only provide an estimate of your federal student aid eligibility as an independent student. This message conflicts with the Higher Education Act (HEA), as amended by the FAFSA Simplification Act. Under the statute, the question on homelessness on the FAFSA must be distinct from questions related to provisional independence [Sec. 483(2)(B)(v)], and the process of determinations for unaccompanied youth also must be distinct from determinations of provisional independence [Sec. 479D(a)(3)]. As currently constructed on the prototype, the resulting screen from the homelessness question is conflated with provisional independence, despite clear requirements that they be distinct and separate. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

28.b |

The message also states that the applicant must provide documentation to verify their circumstances. But under the FAFSA Simplification Act, if a youth cannot provide documentation from one of the authorized individuals specified in the law, the financial aid administrator must determine their status based on either a written statement from, or a documented interview with, the student. The youth is not required to provide any additional documentation; it is clearly the financial aid administrator’s responsibility to make the determination and document it. These statutory changes were specifically intended to relieve students of the burdens of filing additional paperwork and being subjected to intrusive questions about their circumstances. We are very concerned about the harmful consequences of this message, which states that UHY applicants are provisionally independent. The message will create anxiety and stress for youth who have already indicated that they are homeless and do not have documentation from a particular authorized individual or entity. As a result of the erroneous instructions conveyed in the message, these youth are likely to seek documentation that is difficult and/or impossible to obtain, and that re-traumatizes them – or, they may simply give up on financial aid and cease their pursuit of higher education. These are the very outcomes the FAFSA Simplification Act was designed to prevent. Counselors, advisors, and other college access professionals who see this message when they try to assist UHY applicants also may be confused and could incorrectly send youth down the path of provisional independence, which is a more complex and uncertain route to financial aid. Although we understand the Department’s position that UHY applicants who complete the FAFSA should still be treated in accordance with the statute by their financial aid office on the back end, we are very concerned that such applicants—having been sent down the provisionally-independent path and told that they must provide additional documentation—may not make it that far: Discouraged by the erroneous message, they may never complete the FAFSA. Thus, it is critical that the language on the FAFSA itself be corrected as well. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

28.c |

3 We recommend that the resulting screen text for an applicant who indicates that they are an unaccompanied homeless youth (or unaccompanied, self-supporting, and at risk), state as follows: Determination of Homelessness You have indicated that you are unaccompanied and either (1) experiencing homelessness or (2) self-supporting and at risk of experiencing homelessness. Your financial aid administrator is required to make a determination of your status based on a written statement from you, or a documented interview with you, in time for you to be able to receive financial aid. Please contact your school’s financial aid office to complete this process. This recommended text aligns with the requirements of the FAFSA Simplification Act and directs the student to follow up in the most effective and expeditious manner. If for this cycle, the Department is not able to have different screens for UHY applicants and applicants who are actually provisionally independent (via question 7), we would, at a minimum, suggest replacing the screen with text that acknowledges the differences between those two processes and avoids creating confusion. For example, the text could read: You Can Proceed Without Parent Information Based on your answers to the previous question, you can now proceed without answering questions about your parent(s). However, to fully complete your financial aid process, you will need to contact your school’s financial aid office. If you have indicated that you are unaccompanied and either (1) homeless or (2) selfsupporting and at risk of being homeless, your financial aid administrator is required to make a determination of your status based on a written statement from you, or a documented interview with you, in time for you to be able to receive financial aid. Please contact your school’s financial aid office to complete this process. If the previous paragraph does not apply to you, but you are not in contact with a parent, or contacting a parent would pose a risk to you, you will need to speak with the financial aid office to verify your circumstances. We won’t be able to calculate your Student Aid Index (SAI) until you confirm your financial aid office makes this determination. Until then, we will only provide an estimate of your federal student aid eligibility as an independent student. |

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

28.d |

Homelessness Pop-Up Help Text: In the current 2024-2025 FAFSA demonstration, there is no longer any pop-up text to help students answer the question about homelessness. Many students who are experiencing homelessness don’t know that they meet the definitions of 4 homelessness. For example, in a recent survey of the basic needs of community college students in California, 1 in 10 students self-identified as experiencing homelessness, but one in four exhibited living conditions that meet the definition of homelessness.1 We request that the relevant help text be added back to both the filtering question and to the list of determination sources to help students determine whether they meet the statutory definitions. |

Help text is a limitation stated in the “Functionality Limitations” section of the FAFSA prototype introduction. FAFSA question 6 will have an associated help topic when the online FAFSA is released. |

|

28.e |

Homelessness Filter Question Text (question 6): We urge the Department to modify the period referenced for when the student may have been experiencing homelessness, or at risk of homelessness. Specifically, we ask that the timeline state “during 2022 or 2023,” or “during the previous two years.” This is consistent with prior-prior year (or the previous two years), as used elsewhere throughout the FAFSA. Moreover, it will ensure that more students experiencing homelessness, or at risk of homelessness, can be identified and supported by their states and institutions. There was a sharp decline in unaccompanied homeless youth determinations during the pandemic. For example, between 2019-2020 and 2021-2022, the number of unaccompanied homeless youth determinations decreased by 23%. Over this same period, the requests for homeless determinations for the 2021-2022 application cycle increased by 28%.

|

The Department of Education is researching all available options and has referred this suggestion to the appropriate business unit to review recommendations. |

|

28.f |

We urge the Department to take every step to remove barriers to financial aid for these youth and young adults. Homelessness Question Label: The current label of the homelessness question – “Student Other Circumstances” – is too similar to other terms on the FAFSA and is likely to confuse students and the professionals who serve them. We therefore request that the label of this question be made clearer and more specific, such as “Experience with Homelessness” or “Youth and Young Adult Homelessness.” Changing the label of this question will help students, financial aid administrators, and support organizations refer to the correct portions of the FAFSA. |