SBC Disclosure

Summary of Benefits and Coverage and Uniform Glossary (CMS-10407)

Pennsylvania Dutch_Uniform Glossary_Final_11.01.24 (clean)

SBC Disclosure

OMB: 0938-1146

Glossary vun Health Coverage un Medical Terms

Die Glossary dutt en latt commoni Wadde un Phrases eckschpleene, awwer sie is net en vollschtendiche List. Die Glossary Wadde und Definitions sin gezaehlt yuscht fer dich helfe un mechde velleicht differnt sei vun dei Plan odder Health Insurance Policy. Deel vun die Wadde mechde aa net die seem exact Meening hawwe wie sie gyuust wadde in dei Policy adder Plan, un in ennicher Case, was in die Policy adder der Plan schteht is was mer gehe muss debei. (Guck dei En katzer Description vun Sache as du grigscht un wie du gecovered bischt [Summary of Benefits and Coverage] fer Information uff wie mer ein Copy vun dei Policy odder Plan Document griege kann.)

Ennich eppes as underlined kann mer finne in die Glossary.

Guck Page 6 fer en Example weise wie Deductibles, Coinsurance un Out-of-Pocket Limits zamme schaffe in en waahri Situation.

Allowed Amount

Des is's menscht as der Plan bezaahle zellt fer en gecovereder Health Care Service. Es mecht velleicht aa en “eligible expense,” “payment allowance,” adder “negotiated rate” gheese sei.

Appeal

Wann du froogscht as dei Health Insurer adder dei Plan widder considere deet der en Benefit gewwe adder en Payment mache fer eppes was sie partly adder gans nunner gedreht ghadde hen.

Balance Billing

Wann en Provider dich en Bill schickt fer die Koschte as dei Plan net covere dutt. Des is der Difference gschwischich was gebilled wadde is un die Allowed Amount. Fer en Example, wann der Provider $200 an tschaertsche is un die Allowed Amount is $110, mecht der Provoder dich bille fer die $90 as iwwerich sin. Des haeppent oftzeide wann du en Out-of- Network Provider (Non-Preferred Provider) sehnscht. En Network Provider (Preferred Provider) mecht dich net balance bille fer annri gecoveredi Services.

Claim

Wann

du

odder

dei

Provider

froogt

dei

Health

Insurer

adder

dei Plan

fer en Benefit (sell include aa fer

zrickbezaahlt warre fer en Health Care Expense) fer eppes as du

meenscht as gecovered sei sett.

Coinsurance

Dei Schier

vun die

Koschte vun

en gecovereder

Health Care

Service, gfiggert as en Percentage

(so wie

20%) vun der

Allowed

Amount

fer daer

Service. Gweenlich bezaahlscht du

Coinsurance un

aa ennichi Deductibles

as du eegenscht. (Fer en

Example, wann der

Allowed Amount vun der Health Insurance adder Plan fer en Office Visit is $100 un hoscht schunt dei Deductible bezaahlt, waer dei Coinsurance Payment vun 20% $20. Die Health Insurance adder der Plan bezaahlt was iwwerich ist vun der Allowed Amount.)

Complications of Pregnancy

Des is ennicher Sitution as uffkummt wann en Fraa an eckschpeckte adder in Labor is adder wann's Baby kummt wann's notwendich is fer die Maem adder's Baby protecte. Morning Sickness un en non- emergency C-Section sin net considered as Complications of Pregnancy.

Copayment

En gfixter Amount (so wie $15) as du bezaahlscht fer en gecovereder Health Care Service, gweehnlich an die Zeit wann du seller Service grigscht (des watt alsemol en “copay” gheese). Des kann varye depending uff was fer Health Care Service du grigscht.

Cost Sharing

Dei Schier vun die Koschte fer Services as en Plan covert as du aus dei Sack bezaahle musscht (des watt alsemol “out-of-pocket costs” gheese). Deel Examples vun Cost Sharing sin Copayments, Deductibles, un Coinsurance. Family Cost Sharing is der Schier vun Koscht fer Deductibles un out-of-pocket Koschte as du un dei Fraa/Mann un/adder Kind/Kinner selwert bezaahle misse. Annri Koschte, so wie dei Premiums, Penalties as du possibly bezaahle misscht, adder die Koscht vun Care as en Plan net covert sin gweehnlich net considered as Cost Sharing.

Cost-sharing Reductions

Discounts as mer grigt fer certaini Services as gecovered sin bei en Plan as du kaafscht deich der Marketplace. Du mechscht en Discount griege wann dei Income nidder is, un du grigscht en Silver-level Health Plan, adder wann du en Member bischt vun en federally-recognized Tribe, sell include aa en Shareholder sei in en Alaska Native Claims Settlement Act Corporation.

Deductible

En Amount as du eegne kenntscht deich en Coverage Period (gweenlich ee Yaahr) fer gecoveredi Health Care Services eb dei Plan schtaert bezaahle. En Overall Deductible dutt applye zu alli adder yuscht ebaut alli gecoveredi Dinger un Services.

En Plan mit en Overall Deductible mecht velleicht aa separati Deductibles hawwe as applye zu specifici Services odder Groups vun Services. En Plan mecht aa yuscht separati Deductibles hawwe. (Fer en Example, wann dei Deductible $1000 is zellt dei Plan nix bezaahle bis du $1000 bezaahlscht fer gecoveredi Health Care Services as unnich der Deductible sin.)

Tests fer ausfiggere was letz is

Tests fer ausfiggere was letz is mit dei Gsundheet. Fer en Example, en X-ray kennt en Test sei fer sehne eb du en Gnoche verbroche hoscht.

Durable Medical Equipment (DME)

Equipment un Supplies as gordered sin bei en Health Care Provider fer alli Daag yuuse adder fer en lengeri Zeit.

DME mecht includ-e: Oxygen Equipment, Redderschtiehl, un Gricke.

Emergency Medical Condition

Wann du grank adder wehgeduh bischt adder en Symptom hoscht (so wie grossi Schmatze) adder en Condition hoscht as schlimm genung is as wann du addlich in Gfaahr waerscht wann du net graad Medical Attention griege deetscht. Wann du net graad Medical Attention grigt hoscht, is's addlich likely as eppes wie des haeppene kennt: 1) Dei Gsundheet waer addlich in Gfaahr; adder 2) Du hettscht grossi Druwwel mit dei Bodily Functions; adder 3) Du deetscht addlich Damage griege zu en Organ adder en Part vun dei Body.

Emergency Medical Transportation

Getransport sei mit en Ambulance fer en Emergency Medical Condition. Des kennt differnti Sadde Transportation sei, so wie in die Luft, uffs Land, adder uffs Wasser. Dei Plan mecht velleicht net alli Sadde Emergency Medical Transportation covere, oder es mecht velleicht wennicher bezaahle fer certaini Sadde.

Emergency Schtubb Care

Services fer checke fer en Emergency Medical Condition un dich treate fer en Emergency Medical Condition verhalde vun schlimmer warre. Du mechscht velleicht die Services griege in die Emergency Schtubb vun en glicenseder Hospital adder en annrer Blatz as Care gebt fer Emergency Medical Conditions.

Services as Exclude Sin

Health Care Services as dei Plan net bezaahlt adder net covere dutt.

Formulary

En List vun Drugs as dei Plan covere dutt. En Formulary mecht velleicht saage was dei Schier is vun die Koscht fer alli Drug. Dei Plan mecht velleicht Drugs in differnti cost-sharing Levels adder Tiers. Fer en Example, en Formulary mecht velleicht differnti Tiers hawwe fer Generic Drugs und Brand-Naame Drugs, noh zelle differnti cost-sharing Amounts apply zu alli Tier.

Grievance

En Complaint as du gebscht zu dei Health Insurer adder dei Plan.

Habilitation Services

Health Care Services as epper helft sei Skills fer lewe alli Daag halde, lanne, adder verbessere. Examples sin Therapy fer en Kind as net an laafe adder schwetze is wie mer eckschpeckte deet fer sei Elt. Die Services mechte includ-e Physical un Occupational Therapy, Speech-Language Pathology, un annri Services fer disabledi Leit in en latt differnti Inpatient adder Outpatient Settings.

Health Insurance

Des is en Contract wu en Health Insurer gezaehlt is deel adder all die Koschte fer dei Health Care wann du regler en Premium bezaahlscht. En Health Insurance Contract watt alsemol en “policy” adder en “Plan” gheese.

Home Health Care

Health Care Services un Supplies as du grigscht in dei Heemet unnich dei Dockter sei Orders. Du kenntscht Services griege vun Nurses, Therapists, Social Workers, odder annri glicensedi Health Care Providers. Home Health Care is gweenlich yuscht fer medical Schtofft, un net fer Sache wie koche, butze, adder faahre.

Hospice Services

Des sin Services fer Comfort un Support gewwe zu Leit as en terminal Grankhet hen en aa zu ihre Families.

Hospitalization

Des is Care as mer grigt nochdem as mer in en Hospital admit watt und gweenlich iwwer Nacht bleiwe muss. Deel Plans mechte considere as en Overnight Stay fer Observation waer Outpatient Care un net Inpatient Care.

Hospital Outpatient Care

Des is Care as mer grigt in en Hospital awwer mer muss net iwwer Nacht bleiwe.

In-network Coinsurance

Dei Schier (so wie 20%) vun der Allowed Amount fer gecoveredi Health Care Services. Dei Schier is gweenlich wennicher fer in-network gecoveredi Services.

In-network

Copayment En

gfixter Amount (so wie $15) as du bezaahlscht fer gecoveredi

Health

Care

Services

zu

Providers

as

contracte mit dei Health

Insurance adder

Plan.

In-network Copayments sin gweenlich wennicher as out-of-network

Copayments.

Marketplace

En Marrik fer Health Insurance wu Leit, Families un glenni Businesses lanne kenne wege ihre Plan Options; Plans compar-e gebased uff Koschte, Benefits, un annri Sache; applye fer financial Hilf un sie griege mit Premiums un Cost Sharing gebased uff Income; un en Plan choos-e un uffsigne fer Coverage. Mer heest des aa en “Exchange.” Der Marketplace watt gschprengt bei der Schteet in deel Schteets un bei der Federal Government in annri. In deel Schteets dutt der Marketplace aa Leit es eligible sin fer enrolle in annri Programs, so wie Medicaid und der Children's Health Insurance Program (CHIP). Des is available online, uff die Phone, un in person.

Maximum

Out-of-pocket

Limit

Des is der yearly Amount as der Federal

Government setzt as's menscht as epper adder en Family bezaahle

muss in Cost

Sharing

deich's

Plan

Yaahr

fer

gecoveredi,

in-network Services.

Es

dutt

applye

zu

menscht

Sadde

Health

Plans

un Insurance. Der Amount mecht

heecher sei as die Out-of-

pocket Limits

in dei Plan.

Medically Necessary

Health Care Services adder Supllied as notwendich sin fer en Grankhet, Injury, Condition, Disease, adder ihre Symptoms prevente, diagnos-e, adder treate, aa Habilitation; die do misse approved sei bei Medical Providers.

Minimum

Essential

Coverage

Minimum Essential Coverage dutt gweenlich

includ-e Plans,

Health Insurance

as mer griege kann deich die

Marketplace

adder annri specifici Marrik Policies,

Medicare, Medicaid, CHIP, TRICARE, un certaini annri Coverage. Wann

du eligible bischt der certaini Sadde Minimum

Essential

Coverage,

kennt's

sei

as

du

net

eligible

bischt fer der Premium

Tax Credit.

Minimum Value Standard

En basicer Standard fer messe der Percent vun erlaubti Koschte as der plan covere dutt. Wann du en Employer Plan griege kenntscht as bezaahlt fer 60% adder meh vun die Total Allowed Koschte, dutt der Plan Minimum Value offere un du mechscht net eligible sei fer Premium Tax Credits un Cost-Sharing Reductions fer en Plan kaafe vun der Marketplace.

Network

Die Bletz, Providers un Suppliers as dei Health Insurer adder Plan gecontract hot fer Health Care Services provid-e.

Network Provider (Preferred Provider)

En Provider as en Contract hot mit dei Health Insurer adder Plan as agreed hot fer Services provid-e zu Members vun en Plan. Du zellscht wennicher bezaahle wann du en Provider sehnscht as in die Network is. Des watt aa “preferred provider” adder “participating provider” gheese.

Orthotics and Prosthetics

Braces fer Bee, Aerm, Buckel, un Hals, falschi Bee, Aerm, un Aage, un falschi Brischt nooch en Mastectomy. Die Services includ-e: Adjustments, Repairs, un Replacements as notwendich sin wann eppes verbroche geht, auswaert, adder verlore geht, adder wann der Patient sei Condition gechanged hot.

Out-of-network Coinsurance

Dei Schier (so wie 40%) vun der Allowed Amount fer gecoveredi Health Care Services zu Providers as net contracte mit dei Health Insurance adder Plan. Out-of- network Coinsurance dutt gweenlich meh koschte as In- network Coinsurance.

Out-of-network Copayment

En gfixter Amount (so wie $30) as du bezaahlscht fer gecoveredi Health Care Services zu Providers as contracte mit dei Health Insurance adder Plan. In-network Copayments sin gweenlich wennicher as Out-of-network Copayments.

Out-of-network Provider (Non-Preferred Provider)

En Provider as ken Contract hot mit dei Plan fer Services provid-e. Wann dei Plan Out-of-network Services covere dutt, zellscht du gweenlich meh bezaahle fer en Out-of- network Provider sehne as en Preferred Provider. Dei Policy legt aus was selli Koschte sei zelle. Des kennt aa “non-preferred” adder “non-participating” gheese sei in Blatx vun “out-of-network provider.”

Out-of-pocket Limit

S'menscht as du bezaahle kenntsch deich en Coverage Period (gweenlich ee Yaahr) fer dei Schier vun die Koschte vun gecoveredi Services. Nochdem as du daer Limit gedroffe hoscht zellt der plan gweenlich 100% bezaahle vun der allowed amount. Daer Limit helft dich Plans

mache fer bezaahle fer Health Care. Daer Limit dutt selewe net dei Premium, Balance-Billed Charges fer Health Care includ-e as dei Plan net covere dutt. Deel Plans zaehle net all dei Copayments, Deductibles, Coinsurance Payments, Out-of-network Payments, adder annri Expenses geeich daer Limit.

Physician Services

Health Care Services as en glicenseder Medical Dockter, so wie en M.D. (Medical Doctor) adder D.O. (Doctor of Osteopathic Medicine) provid-e adder coordinat-e dutt.

Plan

Health Coverage as du directly grigscht (individual plan) adder deich en Employer, Union, adder en annrer Group Sponsor (employer group plan) as certaini Health Care Koschte covert. Es watt aa gheese “health insurance plan.” “policy,” “health insurance policy,” adder “Health Insurance.”

Preauthorization

En Decision bei dei Health Insurer adder plan as en Health Care Service, Treatment Plan, Prescription Drug adder Durable Medical Equipment (DME) is medically necessary. Alsemol watt des “prior authorization,” “prior approval,” adder “precertification” gheese. Dei Health Insurance adder Plan mecht preauthorization requir-e fer certaini Services eb du sie grigscht, except fer in en Emergency. Preauthorization is ken Verschpreche as dei Health Insurance adder Plan die Koscht covere zellt.

Premium

Der Amount as bezaahlt warre muss fer dei Health Insurance adder Plan. Du adder dei Employer dutt des gweenlich alli Muunet, Quarter, adder Yaahr bezaahle.

Premium Tax Credits

Financial Hilf as dei Taxe runner nemmt fer dich un dei Family helfe private Health Insurance bezaahle. Du kannscht die Hilf griege wann du Health Insurance grigscht deich der Marketplace un dei Income is unnich en certainer Level. Advance Payments vun der Tax Credit darf mer yuuse graadeweck fer dei monthly Premium Koschte runner griege.

Prescription Drug Coverage

Coverage unnich en Plan as helft fer Prescription Drugs bezaahle. Wann die Formulary vun der Plan “tiers” (levels) yuuse dutt, warre Prescription Drugs zamme gegrouped bei Sadd adder Koscht. Was du bezaahlscht in cost sharing zellt differnt sei fer alli “tier” vun gecoveredi Prescription Drugs.

Prescription Drugs

Drugs un Medications as mer en Prescription hawwe muss defoor bei Law.

Preventive Care (Preventive Service)

Routine Health Care, so wie screenings, Check-Ups, un Patient Counseling, fer prevente adder finne Grankete, Disease, adder annri Heath Druwwle.

Primary Care Physician (Family Dockter)

En Dockter, so wie en M.D. (Medical Doctor) adder

D.O. (Doctor of Osteopathic Medicine) as en latt differnti Health Care Services provid-e adder coordinat-e dutt fer dich.

Primary Care Provider

En Dockter, so wie en M.D. (Medical Doctor) adder

D.O. (Doctor of Osteopathic Medicine), Nurse Practitioner, Clinical Nurse Specialist, adder Physician Assistant, as erlaubt unnich State Law un die Terms vun der Plan as en latt differnti Health Care Services provid-e adder coordinat-e dutt fer dich, adder helft dich selli finne.

Provider

En Person adder en Blatz as Health Care Services provid-e dutt. Deel Examples vun en Provider sin en Dockter, Nurse, Chiropractor, Physician Assistant, Hospital, Surgical Center, Skilled Nursing Facility, un Rehabilitation Center. Der Plan mecht requir-e as der Provider glicensed, certified, adder accredited so wie es schteht in State Law.

Reconstructive Surgery

Surgery un Follow-up Treatment as notwendich is fer fixe adder improv-e en Part vun der Body because vun Birth Defects, Injuries, adder Medical Conditions.

Referral

En gschriwwener Order vun dei Primary Care Provider fer dich lesse en Specialist sehne adder fer certaini Health Care Services griege. In en latt Health Maintenance Organizations (HMOs) musscht du en Referral griege eb du Health Care Services griege kannscht vun ennich epper except dei Primary Care Provider. Wann du net en Referral s'erscht grigscht, mecht der Plan net bezaahle fer die Services.

Rehabilitation

Services Health

Care

Services

as

epper

helft

Skills

un Functioning fer daily Lewe

halde, zrick griege, adder improv-e, wann epper selli verlore hot

weil as er grank, weh geduh, adder gegrippelt

waar.

Die

Services

mechte

includ-e

Physical

un Occupational Therapy,

Speech-Language Pathology, un annri Services fer disabledi Leit in

en latt differnti Inpatient adder Outpatient Settings.

Screening

En Sadd Preventive Care as include Tests adder Exams fer eppes finne; des watt gweenlich geduh wann mer ken Symptoms, Signs, adder History vun en Disease adder Condition.

Skilled

Nursing

Care

Services as geduh warre adder supervised

warre in dei Heemet adder in en Nursing Home. Skilled Nursing Care

is

net

der

same

as

“skilled

care

services”;

selli

sin

Services

as geduh warre bei Therapists

adder Technicians (net rechti Nurses) in dei Heemet adder in en

Nursing Home.

Specialist

En Provider as focuse dutt uff en specificer Area vun Medicine adder en Group vun Patients fer certaini Sadde Symptoms un Conditions diagnos-e, manag-e, prevente, adder treate.

Specialty

Drug

En Sadd Prescription

Drug as

gweenlich special ghandled warre muss adder constantly monitored un

assessed sei muss bei

en Health

Care Professional; es

kennt

aa hatt fer dispens-e

sei.

Gweenlich

sin

Specialty

Drugs

die

deierschti

Drugs uff en Formulary.

UCR (Usual, Customary and Reasonable)

Der Amount as mer bezaahlt fer en Medical Service in en certainer Region gebased uff was providers in der Region gweenlich tschaertsche fer en Medical Service as s'seem adder neegscht seem is. Der UCR Amount watt alsemol gyuust fer der Allowed Amount ausfiggere.

Urgent Care

Care fer en Illness, Injury, adder Condition as serious genung is as en commoner Person graadeweck Care suche deet, awwer net so schlimm as mer Emergency Room Care griege deet.

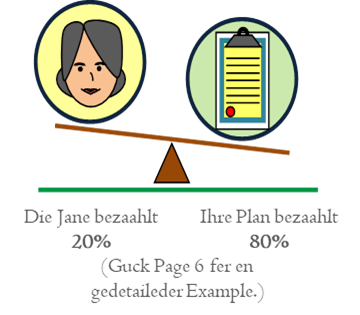

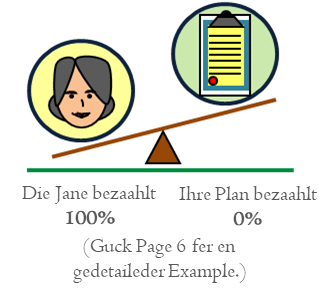

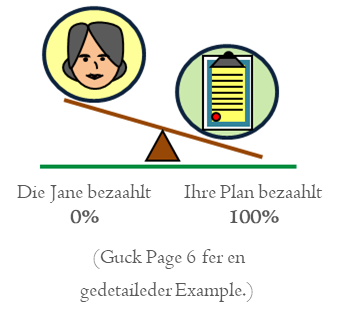

Wie Du un Dei Insurer Koschte Deele – Example

Die Jane Ihre Plan Deductible: $1,500 |

Coinsurance: 20% |

January 1st Schtaert vun der Coverage Period |

December 31st |

Die

Jane bezaahlt 100%

Ihre

Plan

bezaahlt 0%

Die Jane is noch net zu ihre $1,500 Deductible kumme

Ihre Plan bezaahlt nix

Office Visit Koschte: $125 Die Jane bezaahlt: $125 Ihre Plan bezaahlt: $0

Die

Jane bezaahlt 20%

Ihre

Plan

bezaahlt 80%

Die Jane is nau zu ihre $1,500 Deductible kumme un Coinsurance schtaert

Die Jane hot etlichi Mole en Dockter gsehne un hot $1,500 alles zamme bezaahlt, un nau is sie zu ihre Deductible kumme. Des meent, ihre Plan bezaahlt deel vun die Koschte fer ihre negschter Visit.

Office Visit Koschte: $125

Die Jane bezaahlt 20% vun $125 = $25

Ihre Plan bezaahlt: 80% vun $125 = $100

Die Jane bezaahlt

0%

Ihre Plan bezaahlt

100%

Die Jane is nuff zu ihre

$5,000 Out-of-Pocket Limit

kumme

Die Jane hot der Dockter oft gsehne un hot $5,000 bezaahlt alles zamme. Ihre Plan dutt noh die iwweriche vun ihre Koschte bezaahle fer der Rest vun's Yaahr.

Office Visit Koschte: $125

Die Jane bezaahlt: $0

Ihre Plan bezaahlt: $125

PRA Disclosure Statement: According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0938-1146. The time required to complete this information collection is estimated to average 0.02 hours per response, including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Attn: PRA Reports Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland 21244-1850.

(OMB

control

number:

0938-1146/Expiration

date:

05/31/2026)

Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Glossary vun Health Coverage un Medical Terms |

| Author | Centers for Medicare & Medicaid Services (CMS) |

| File Modified | 0000-00-00 |

| File Created | 2024-12-22 |

© 2026 OMB.report | Privacy Policy