Form CMS-10198 Creditable Coverage Disclosure to CMS

Creditable Coverage Disclosure to CMS OnLine Form and Instructions (CMS-10198)

CC Disclosure to CMS Instructions and Screen Shots

Federal - Creditable Coverage Disclosure to CMS OnLine Form and Instructions

OMB: 0938-1013

Form Approved OMB No. 0938-1013

Expires: TBD

CENTERS FOR MEDICARE & MEDICAID SERVICES

Creditable Coverage Disclosure to CMS Form

Instructions and Screen Shots

INTRODUCTION

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) added a prescription drug program to Medicare. Regulations to implement Medicare prescription drug coverage were published January 28, 2005 (70 Fed. Reg. 4193 (2005)). This guidance pertains to section 1860D-13 of the MMA, and the regulation at 42 CFR §423.56(e). Under those provisions, most entities that currently provide prescription drug coverage to Medicare Part D eligible individuals must disclose to the Centers for Medicare & Medicaid Services (CMS) whether the coverage is “creditable prescription drug coverage” (Disclosure to CMS Form). A Disclosure to CMS Form is required whether the entity’s coverage is primary or secondary to Medicare. Entities that must comply with these provisions are listed in the regulation at 42 CFR §423.56(b) and are also referenced on the creditable coverage homepage at http://www.cms.hhs.gov/creditablecoverage/. However, entities that contract with Medicare directly as a Part D plan or that contract with a Part D plan to provide qualified prescription drug coverage are exempt from the disclosure to CMS requirement. See 42 CFR §423.56(e).

If an entity does not offer prescription drug benefits to any Medicare Part D eligible individual on the beginning date of their plan year (renewal year, contract year, etc.), the entity is not required to complete the Disclosure to CMS Form for that plan year.

In addition, employers and unions that applied and were accepted for the Retiree Drug Subsidy (RDS) are exempt from filing the Disclosure to CMS Form only for the individuals and plan options for which they are claiming the RDS. If the employer or union offers prescription drug coverage to any other Medicare Part D eligible individual (active, disabled, COBRA or any retirees or dependents who are covered by the employer or union but are not being claimed under the RDS), they must provide a Disclosure to CMS Form for those plan options that cover those individuals and complete the requested information.

The regulation at 42 CFR §423.56(e) states that CMS will provide additional information concerning the required form and manner of disclosure to CMS. These instructions, in addition to the “Creditable Coverage Disclosure to CMS Guidance", provide such additional information concerning those rules, including the form, manner, and timing of providing a Disclosure to CMS Form.

CMS Form 10198-NC (Updated 07/2016)

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0938-1013. The time required to complete this information collection is estimated to average 8 hours per response initially, including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Attn: PRA Reports Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland 21244-1850.

OVERVIEW OF REGULATORY REQUIREMENTS Creditable Coverage Definition and Determination

As defined in the regulation at 42 CFR §423.56(a), drug coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard Medicare prescription drug coverage, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial guidelines. In general, this actuarial determination measures whether the expected amount of paid claims under the entity’s prescription drug coverage is at least as much as the expected amount of paid claims under the standard Medicare prescription drug benefit. See 70 FR 4225 (2005).

This determination is identical to the first step (the “gross test”) in calculating actuarial equivalence for purposes of 42 CFR §423.884, which applies when an employer or union applies for the RDS. The gross test does not take into account the extent to which the coverage is financed by the beneficiary or by the entity. See 42 CFR §423.884(d)(5)(ii)(A).

For plans that have multiple benefit options, the regulation requires that entities apply the gross test separately for each benefit option. See 42 CFR §423.884(d)(5) (iv). A benefit option is defined at 42 CFR §423.882 as a particular benefit design, category of benefits, or cost-sharing arrangement offered within a group health plan. Benefit option refers to the different categories of benefits and different plan design options under a given type of coverage (e.g., HMO, PPO, Indemnity). Benefit options are referenced on the Disclosure to CMS Form as “Options”.

The determination of creditable coverage status does not require an attestation by a qualified actuary except for a benefit option(s) under a group health plan for which an employer or union is electing the RDS. See the regulation at 42 CFR §423.884(d).

For purposes of the disclosure to CMS, a separate Disclosure to CMS Form is required for each type of coverage sponsored by an entity (e.g., Medicaid, SPAP, Employer Plan, Church Plan, Standardized Medigap Plan, Pre-standardized Medigap Plan).

Creditable Coverage Disclosure from Entity to CMS

The regulation at 42 CFR §423.56(e) requires all entities described in the regulation at 42

CFR §423.56(b) to disclose to CMS whether the prescription drug coverage that is offered to Medicare Part D eligible individuals is creditable or non-creditable.

Who Must Provide the Disclosure to CMS Form

The Disclosure to CMS Form is required to be provided to CMS by certain entities listed at 42 CFR

§423.56(b) that are not excluded at §423.56(e). The entities exempted under §423.56(e) include PDPs, MA-PDs, and PACE or cost-based HMOs or CMPs that provide “qualified Part D coverage” within the meaning of 42 CFR §423.100.

CMS Form 10198-NC (Updated 07/2016)

Entities that must provide a Disclosure to CMS Form include sponsors of:

Group health plans (offered by employers, union/Taft-Hartley plans, church, State and local government, and other group-sponsored plans) including the Federal Employees Health Benefits Program; and qualified retiree prescription drug plans as defined in section 1860D22(a)(2) of the Act;

Government sponsored plans, including Medicaid coverage under title XIX of the Act or under a waiver under section 1115 of the Act; State Pharmaceutical Assistance Programs (SPAPs) as defined at §423.454; and State High Risk Pools as defined under 42 CFR 146.113(a)(1)(vii);

Plans that provide coverage of prescription drugs for veterans, survivors and dependents under chapter 17 of title 38, U.S.C.;

Plans that provide Military Coverage under chapter 55 of title 10, U.S.C., including TRICARE;

Plans that provide individual health insurance coverage (as defined in section 2791(b)(5) of the Public Health Service Act) that includes coverage for outpatient prescription drugs and that does not meet the definition of an excepted benefit (as defined in section 2791(c) of the Public Health Service Act);

Coverage provided by the medical care program of the Indian Health Service, Tribe or other Tribal Organization, or Urban Indian Organization (I/T/U);

Plans that provide coverage under a Medicare supplemental policy (Medigap policy), as defined at 403.205, including standardized plans H, I or J; pre-standardized plans; waiver State plans; and plans with innovative benefits; and

Plans that provide other coverage as the Secretary may determine appropriate.

If an entity does not offer outpatient prescription drug benefits to any Medicare Part D eligible individuals on the beginning date of their plan year (renewal year, contract year, etc.), the entity is not required to complete the Disclosure to CMS Form for that plan year.

The regulation at 42 CFR §423.884(c)(2)(iv) requires that a plan sponsor provide an attestation that its prescription drug coverage is at least actuarially equivalent to the standard prescription drug coverage under Part D as part of the application for the RDS. Therefore, because the actuarial equivalence standard includes the creditable coverage standard, a sponsor that has been approved for the RDS is exempt from filing the Disclosure to CMS Form only with respect to those qualified covered retirees for which the Sponsor is claiming the RDS. The sponsor’s RDS application serves as its disclosure to CMS under 42 CFR §423.56(e).

CMS Form 10198-NC (Updated 07/2016)

Timing of Creditable Coverage Disclosure from Entity to CMS

As outlined under 42 CFR 423.56(e) and (f), and the Creditable Coverage Disclosure to CMS Guidance Creditable Coverage to CMS Guidance , a Disclosure to CMS Form must be submitted to CMS on an annual basis and upon any change that affects whether the drug coverage is creditable.

At a minimum, disclosure to CMS must be made at the following times:

For plan years that ended in 2006, Creditable Coverage Disclosure to CMS Form must have been provided no later than March 31, 2006;

For plan years that end in 2007 and beyond, the Creditable Coverage Disclosure to CMS Form must be provided within 60 days after the beginning date of the plan year for which the entity is submitting the disclosure (e.g., the disclosure is for CY 2014, therefore the plan must submit the Creditable Coverage Disclosure to CMS Form within 60 days of January 1, 2014) ;

Within 30 days after the termination of the prescription drug plan; and

Within 30 days after any change in the creditable coverage status of the prescription drug plan.

INSTRUCTIONS FOR PROVIDING DISCLOSURE TO CMS Form and Manner of Disclosure from Entity to CMS

An entity is required to provide a disclosure to CMS through completion of the online Creditable Coverage Disclosure to CMS Form (CMS-10198) available at:

http://www.cms.gov/Medicare/Prescription-Drug-Coverage/CreditableCoverage/index.html. This method of transmission is convenient and will take minimal time to complete, and is the sole method for compliance with the requirement.

NOTE: The Creditable Coverage Disclosure to CMS Form is required to be submitted online and not in hard copy. Only sections relevant to the plan sponsor will be displayed online. To assist you in completing the Creditable Coverage Disclosure to CMS Form, additional information and screen shots regarding each section of the online form can be found in these instructions.

CMS Form 10198-NC (Updated 07/2016)

CONTENT OF THE CREDITABLE COVERAGE DISCLOSURE TO CMS FORM

The disclosure submission process is composed of the following steps to complete the online Creditable Coverage Disclosure to CMS Form:

• Step 1 -Enter the Disclosure Information • Step 2 -Verify and Submit Disclosure Information, and • Step 3 -Receive Submission Confirmation

All fields are required unless otherwise indicated.

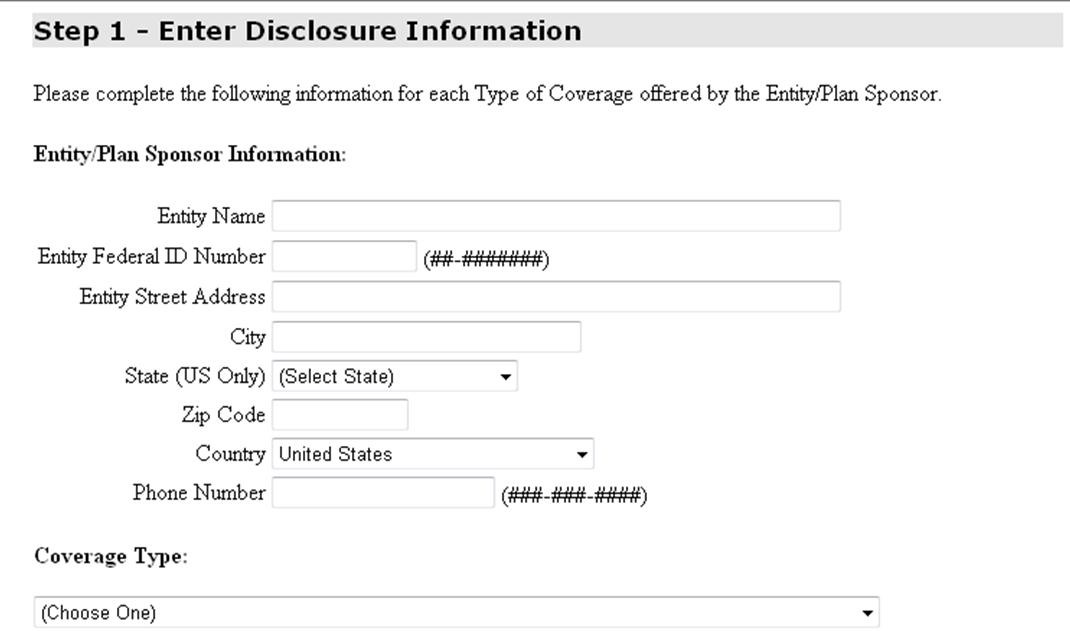

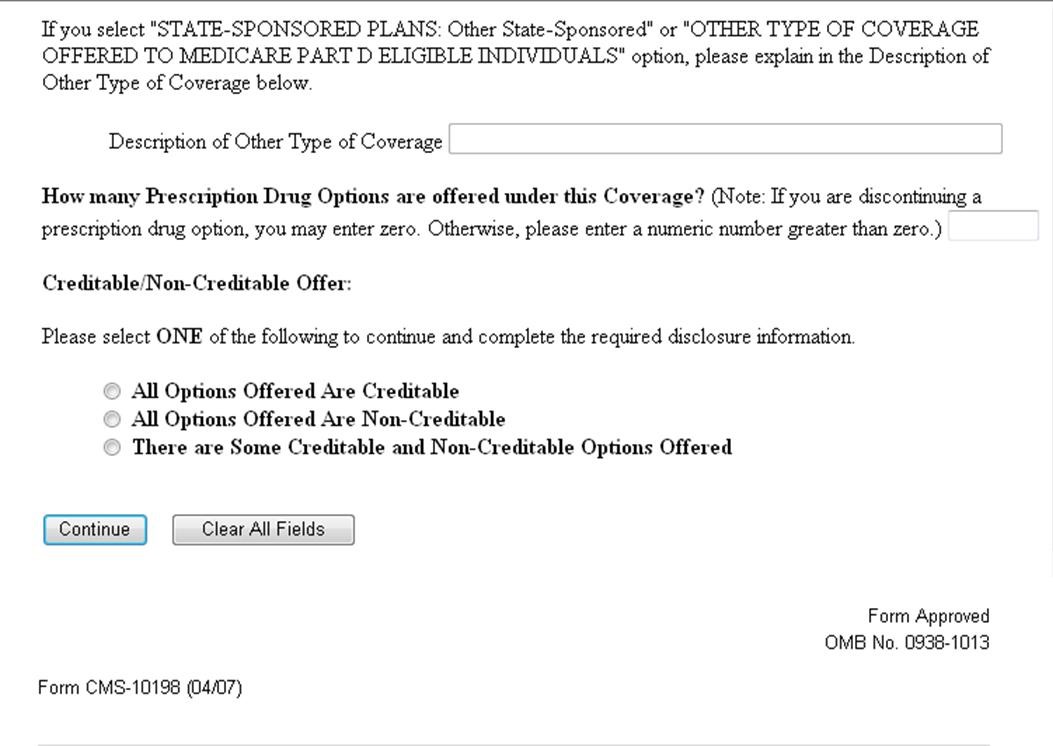

STEP 1- ENTER DISCLOSURE INFORMATION

All entities must complete Section A of Step 1 of the online Creditable Coverage Disclosure to CMS Form.

If all options offered by your plan are creditable, you must complete additional information in Section B of the Creditable Coverage Disclosure to CMS Form.

If all options offered by your plan are non-creditable, you must complete additional information in Section C of the Creditable Coverage Disclosure to CMS Form.

If there are some creditable and non-creditable options offered by your plan, you must complete additional information in Section D of the Creditable Coverage Disclosure to CMS Form.

Section A

Listed below are the required data fields in the online Creditable Coverage Disclosure to CMS Form that must be populated. For entities with subsidiaries (division, line of business, operating unit, control group, etc.), one Creditable Coverage Disclosure to CMS Form can be submitted to CMS for the entire entity if the plan year is the same for all subsidiaries/divisions, or an additional form can be submitted for each subsidiary (division, line of business, operating unit, control group, etc.) with the subsidiaryspecific information.

NOTE: As you answer the questions in Step 1, you must choose “Continue” after you have chosen the correct “Creditable/Non-Creditable Options” to enter the additional required disclosure information outlined in Sections B, C or D.

CMS Form 10198-NC (Updated 07/2016)

Note: the items listed below are numbered, however the actual online form does not contain numbers next to each of the fields. Please see the screen shots for a representation of the actual online form fields.

Name of Entity Offering Coverage. This is the name of the entity that is providing or sponsoring the plan of benefits to Medicare eligible individuals such as an employer, a union, the United States Department of Veterans Affairs (VA) or a health insurance issuer. It is not the name of any carrier that the entity may have contracted with for insurance coverage or for administration of its benefit plan. For example, an employer contracts with a plan to provide benefits. The employer would submit their name, not the name of the plan providing the benefits on behalf of the employer.

Federal Tax Identification Number of the Entity. For entities that have multiple subsidiaries (divisions, lines of business, operating units, control groups, etc.) that are all covered under the same type of coverage, the Federal Tax Identification Number (also known as the Employer Identification Number, or EIN) for the parent company may be used when completing the entity’s EIN information for the entire company. If the form is completed separately for individual subsidiaries (divisions, lines of business, operating units, control groups, etc.), the EIN for each subsidiary should be provided.

Street Address, including the City, State, Zip Code and Country of the Entity. For entities that have many subsidiaries (divisions, lines of business, operating units, control groups, etc.) under the same type of coverage, the street address for the parent company may be used when completing the entity’s information.

Phone Number of the Entity. For entities with many subsidiaries (divisions, lines of business, operating units, control groups, etc.) that have the same type of coverage, the phone number for the Parent Company may be used when completing the entity’s information.

5a. Type of Coverage. The types of coverage (e.g., Medicaid, VA, SPAP) that must provide the Creditable Coverage Disclosure to CMS Form are those entities listed under the regulation at 42 CFR §423.56(b) and are not excluded under 42 CFR §423.56(e).

5b. Description of “Other” Type of Coverage: If you selected “State Sponsored Plan: Other StateSponsored” or “other Type of Coverage Offered to Medicare Part D Eligible Individuals,” provide a description of the coverage you are reporting.

Number of Prescription Drug Options offered by the Entity. This is the total number of benefit options as defined under 42 CFR §423.882 that the entity is offering to Medicare eligible individuals, not being claimed for RDS. This is a numeric field and must be filled in with a number.

For example, an employer plan may offer an HMO option, a PPO option and an indemnity option.

Creditable Coverage Status of Options offered by the Entity. If the options offered by the entity are either all creditable or all non-creditable, the entities/plan sponsors may provide aggregated data in the Creditable Coverage Disclosure to CMS Form for all options under the Plan. If some of the options offered are creditable and some are not creditable, entities/plan sponsors may combine the data for options that are creditable and combine the data for those options that are not creditable in the disclosure. Once the entity selects “All Options Offered Are Creditable”, “All Options Offered Are Non-Creditable” or “There are some Creditable and Non-Creditable Options Offered” on the Disclosure to CMS Form, and clicks on the “Continue” button, they will then see the appropriate section (Section B, C or D) that needs to be completed.

Click “Continue” to submit and continue entering the additional required data elements. Choose “Clear All Fields” to clear the Creditable Coverage Disclosure to CMS Form in order to restart the submission.

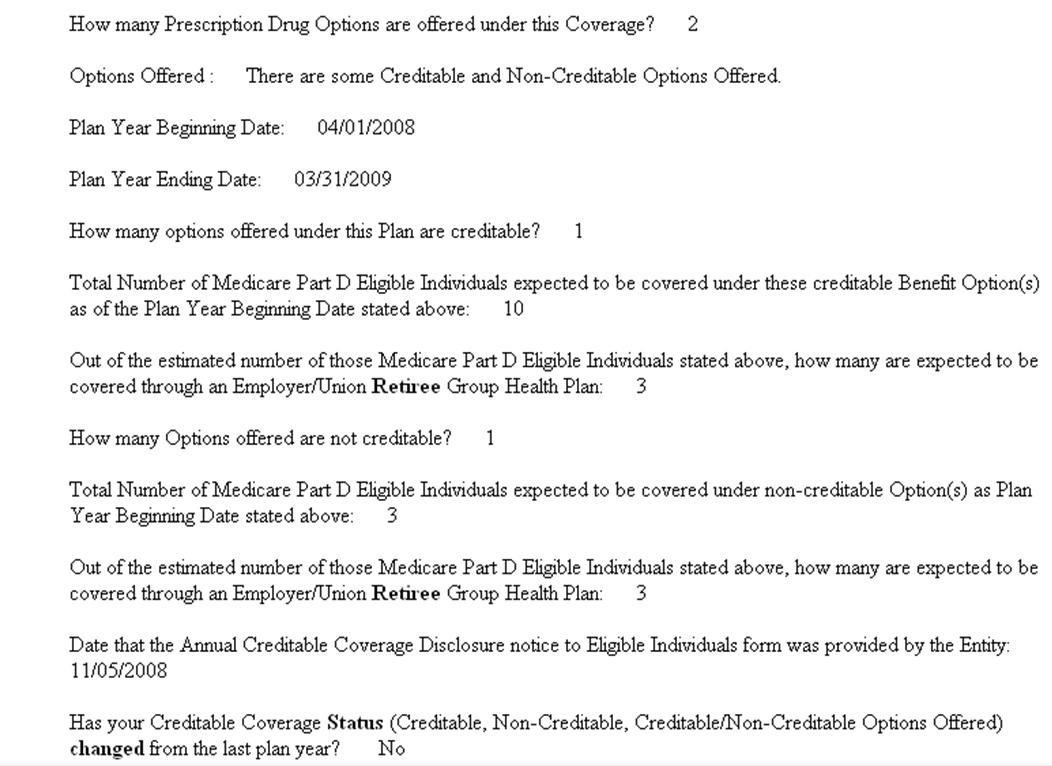

SECTIONS B, C & D

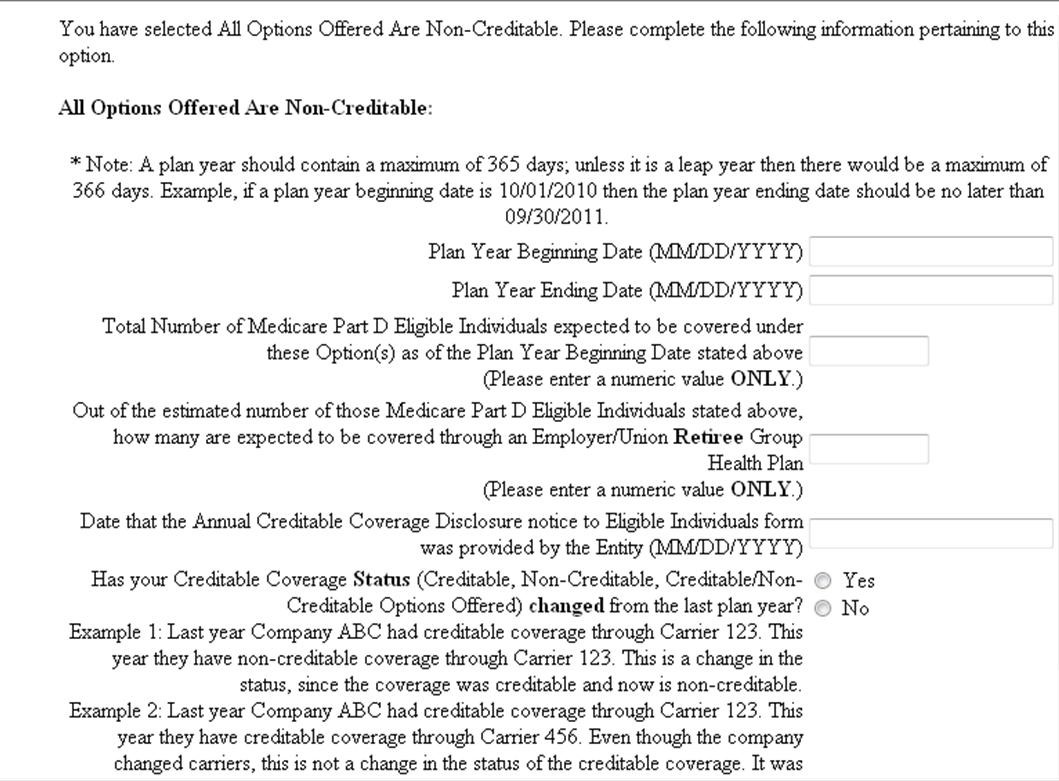

9a - 9b. Period covered by Creditable Coverage Disclosure to CMS Form. An entity is required to provide the disclosure on an annual basis and upon a change to the status of their creditable coverage. Each entity must provide the beginning and ending calendar date(s) of the plan year for which such entity is providing the information.

For purposes of the Creditable Coverage Disclosure to CMS Form, CMS defines “Plan Year” as the beginning and ending date of the entity’s annual renewal or contract period.

These dates must be entered using two (2) digits for the month, two (2) digits for the day, and four (4) digits for the year, and the date field must be entered using the forward slash (/) between the month and day and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

The plan year ending date cannot be more than 365 days (366 in a leap year) past the plan year beginning date. For example, June 30 would be the plan year ending date when the plan year beginning date is July 1.

9c - 9d. Only pertain to entities who answered ‘There are Some Creditable and Non-Creditable Options.’

9c. How Many Options Offered under this Plan are Creditable. This is the total number of benefit options as defined under 42 CFR §423.882 that the entity is offering to Medicare eligible individuals that are creditable. For example, an employer plan may offer an HMO option, a PPO option, and an indemnity option, and a health insurance issuer may offer multiple individual health insurance policies that include prescription drug coverage. This is a numeric field and must be filled in with a number.

9d. How Many Options Offered under this Plan are Not Creditable. This is the total number of benefit options as defined under 42 CFR §423.882 that the entity is offering to Medicare eligible individuals that are not creditable. For example, an employer plan may offer an HMO option, a PPO option, and an indemnity option, and a Medigap issuer may offer multiple Medigap policies that include prescription drug coverage. This is a numeric field and must be filled in with a number.

10. Number of Part D Eligible Individuals expected to be covered under these Plan(s) as of the Beginning Date of the Plan Year. While CMS recognizes that many entities will not be able to provide an exact number of Part D eligible individuals, entities should estimate the number of covered Part D eligible individuals under the options offered under the type of coverage for which they are providing the Creditable Coverage Disclosure to CMS Form. This estimate should be the total number of Medicare eligible individuals, less any Medicare eligible individual(s) being claimed under the RDS program, that are expected to be covered under the entity’s prescription drug plan options (this includes active, disabled, individuals on COBRA and retired individuals). For purposes of this disclosure question, a “Medicare eligible individual being claimed under the RDS program” is any qualified covered retiree for which the entity is expected to collect the retiree drug subsidy. This is a numeric field and must be filled in with a number.

Entities should work with their current vendors (Insurance carrier, TPA, PBM, Consultant, etc.) to verify whether the prescription drug plan(s) offered by the entity covers any Medicare eligible individuals (including active, retired, disabled individuals and their dependents or any individuals on COBRA) at the start of each plan year.

If the entity has a plan participant that will be or becomes eligible for Part D coverage during the plan year, the entity should not include these individuals on their Creditable Coverage Disclosure to CMS Form if they were not effective on the beginning date of the plan year. These individual(s) should be included on their annual disclosure at the beginning date of the next plan year. Entities are required however, to provide a disclosure of creditable coverage status to the individual prior to when they become Medicare eligible as outlined in the Creditable Coverage Disclosure to CMS

Guidance located at https://www.cms.gov/Medicare/Prescription-Drug-

Coverage/CreditableCoverage/CCDisclosureForm.html

11. Out of the estimated number of those Medicare Part D Eligible individuals stated above, how many are expected to be covered through an Employer/Union Retiree group health plan.

(Applicable to Entities sponsoring Group Health Plans only. All other entities offering other types of coverage should indicate a zero (0) in this field.)

Entities sponsoring a group health plan should estimate the number of Part D eligible individuals covered under retiree plans for which they are providing the Creditable Coverage Disclosure to CMS Form. This estimate should be the total number of Medicare eligible individuals, less any Medicare eligible individual(s) being claimed under the RDS program, that are expected to be covered under the entity’s RDS prescription drug plan options on the beginning date of the plan year. For purposes of this disclosure question, a “Medicare eligible individual being claimed under the RDS program” is any qualifying covered retiree for which the entity is expected to collect the retiree drug subsidy. This number is a subset of question 10 and cannot be any larger than the number stated in question 10. This is a numeric field and must be filled in with a number.

Entities should work with their current vendors (Insurance carrier, TPA, PBM, Consultant, etc.) to verify whether the retiree prescription drug plan option(s) offered by the entity covers any Medicare eligible individuals at the start of each plan year.

If the entity has a retired plan participant that will be or becomes eligible for Part D coverage during the plan year, the entity should not include these retired individuals on their Creditable Coverage Disclosure to CMS Form if they were not effective on the beginning date of the plan year. These retired individual(s) should be included on their annual disclosure at the beginning date of the next plan year. Entities are required; however, to provide a disclosure of creditable coverage status to the individual prior to when they become Medicare eligible as outlined in the Creditable Coverage Disclosure to CMS Guidance located at https://www.cms.gov/Medicare/Prescription-Drug-

Coverage/CreditableCoverage/CCDisclosureForm.html

12. Date of Notice of Creditable Coverage provided to Part D Eligible Individuals. An entity must disclose to CMS the latest calendar date on which it provided the required creditable coverage or non-creditable coverage disclosure notices to Part D eligible individuals of creditable or non-creditable coverage (i.e., mailed, personally distributed to Part D eligible individuals, etc.) as required under 42 CFR §423.56 (c), (d) & (f).

CMS Form 10198-NC (Updated

This date must be entered using two (2) digits for the month, two (2) digits for the day, and four (4) digits for the year, and the date field must be entered using the forward slash (/) between the month and day and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

13a - c. Reporting Changes in Creditable Coverage Status

13.a Change in previously disclosed Creditable Coverage Status information to CMS. Entities also must provide a Creditable Coverage Disclosure to CMS Form if the creditable coverage status of a type of coverage or any of the options previously disclosed to CMS changes. (Example: An option was creditable and now is non-creditable or an option was non-creditable and is now creditable.) This includes terminating a creditable coverage plan or option. (See below for more information.)

Select “Yes” or “No” in the fields to report if a change in the creditable coverage status has occurred since the last plan year disclosure or after the disclosure to CMS has been submitted for a plan year.

13b. YES - Change in Status of Creditable Coverage; Effective date of the change in status. If you selected “Yes,” enter the date the change in status occurred. This date must be entered using two (2) digits for the month, two (2) digits for the day, and four (4) digits for the year, and the date field must be entered using the forward slash (/) between the month and day and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

13c. YES – Date Entity Disclosed to Medicare Part D Eligibles. If you selected “Yes,” disclose to CMS the date on which it provided the required creditable coverage or non-creditable coverage disclosure notices to Part D eligible individuals of the change in creditable or non-creditable coverage status (i.e., mailed, personally distributed to Part D eligible individuals, etc.) as required under 42 CFR §423.56(f)(2). This date must be entered using two (2) digits for the month, two (2) digits for the day and four (4) digits for the year and the date field must be entered using the forward slash (/) between the month and day and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

Termination of a Plan or Option

Option Termination: If the entity terminates a creditable coverage option after the Creditable Coverage Disclosure to CMS Form has been submitted for a plan year, the entity must complete a new form. The new submission needs to indicate the new number of options being offered by the entity and the new estimated number of Medicare eligible individuals and retirees that are covered

CMS Form 10198-NC (Updated

under the plan as of the date of the change. The entity should indicate “Yes” to the question “Has your Creditable Coverage Status (Creditable, Non-Creditable, Creditable/Non-Creditable Options Offered) changed from the last plan year?”, and the entity must disclose to CMS the date in which the change in creditable coverage status occurred and the date in which it provided the required disclosure notices to Part D eligible individuals of the change in creditable coverage status (i.e., mailed, personally distributed to Part D eligible individuals, etc.) as required under 42 CFR §423.56(f)(2). This date must be entered using two (2) digits for the month, two (2) digits for the day, and four (4) digits for the year, and the date field must be entered using the forward slash (/) between the month and day and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

Plan Termination: If the entity is terminating the creditable coverage plan after the Creaitable Coverage Disclosure to CMS Form has been submitted for a given plan year, the entity must complete a new form. The new submission needs to indicate that there are zero (0) options being offered, that the plan is non-creditable, and that there are now zero (0) estimated Medicare eligible individuals and retirees covered under the plan. The entity should indicated “Yes” to the question “Has your Creditable Coverage Status (Creditable, Non-Creditable, Creditable/Non-Creditable Options Offered) changed from the last plan year?”, and the entity must disclose to CMS the date in which the change in creditable coverage status occurred and the date in which it provided the required disclosure notices to Part D eligible individuals of the change in creditable coverage status (i.e., mailed, personally distributed to Part D eligible individuals, etc.) as required under 42 CFR §423.56(f)(2). This date must be entered using two (2) digits for the month, two (2) digits for the day, and four (4) digits for the year, and the date field must be entered using the forward slash (/) between the month and day and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

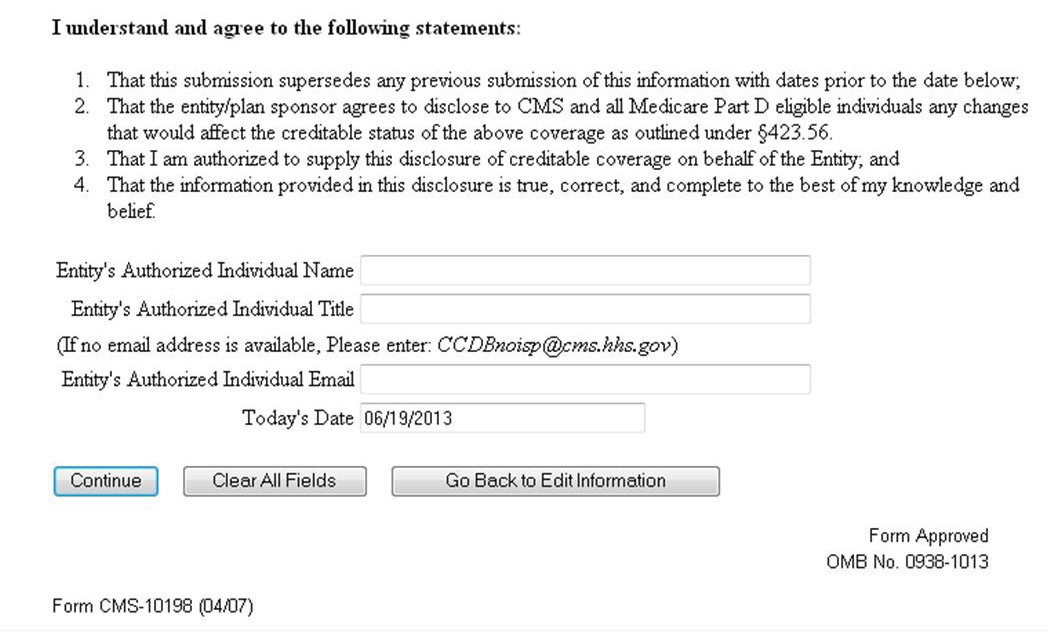

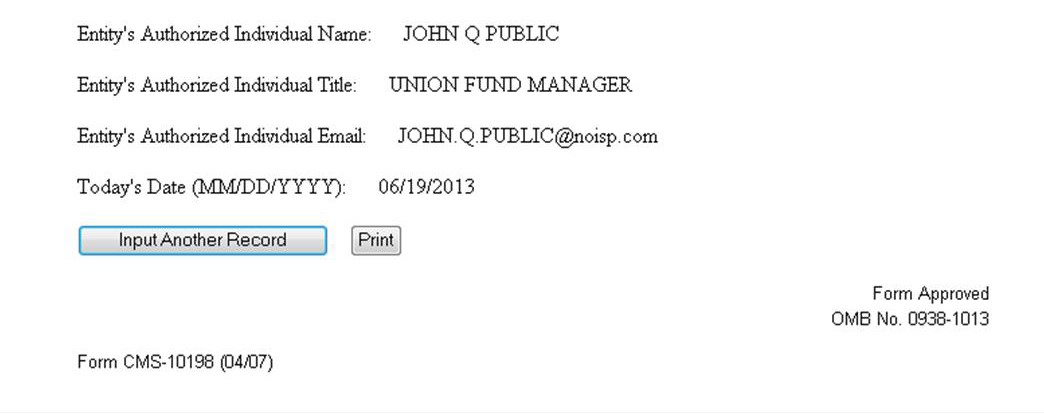

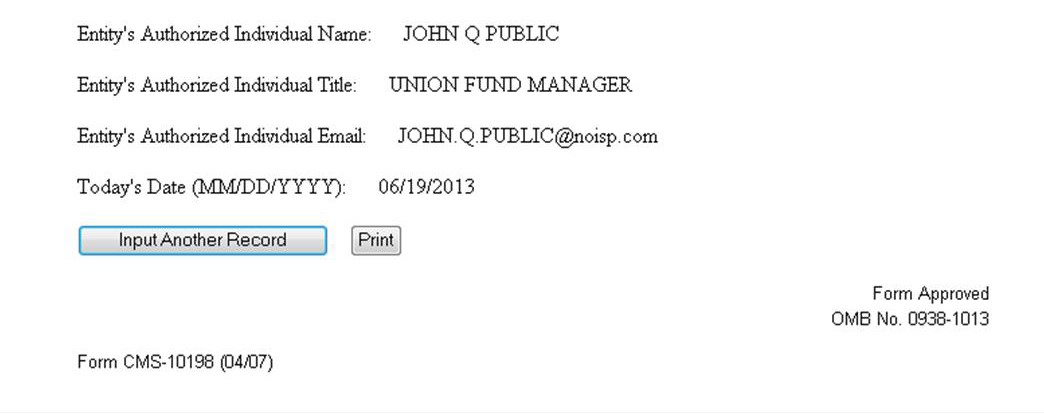

14a – 14d. Name, Title, Email of the Entity’s Authorized Individual and Date.

14a- 14c. Entity’s Authorized Individual Name, Title and Email. An “Authorized Individual” is the person completing the Creditable Coverage Disclosure to CMS Form who is either: a) employed by the entity; or b) contracted with the entity as an Authorized Individual to complete the Creditable Coverage Disclosure to CMS Form on behalf of the entity. The Authorized Individual must provide his or her name, title and email address. If the Authorized Individual does not have an email account, follow the example on the form and enter [email protected].

14d. Today’s Date. The entity’s authorized individual must provide the date on which he or she is submitting the Creditable Coverage Disclosure to CMS Form. This date must be entered using two (2) digits for the month, two (2) digits for the day, and four (4) digits for the year, and the date field must be entered using the forward slash (/) between the month and day

and between the day and year (MM/DD/YYYY). Failure to enter the date in this manner will result in an error message when submitting the information.

15. Choose “Continue” to move to Step 2 – Verify and Submit Disclosure Information.

Choose “Go Back to Edit Information” if you have made an error and need to make a correction to the data elements entered. Choose “Clear All Fields” to restart the submission.

NOTE: If you have made an error while entering your disclosure elements, you will get a pop up error message with an indication of where the error has been made, such as an error in your date entry or failure to complete a required field. You will be required to make the correction to each data field that has an error indicator next to it and then choose “Continue” to move to Step 2.

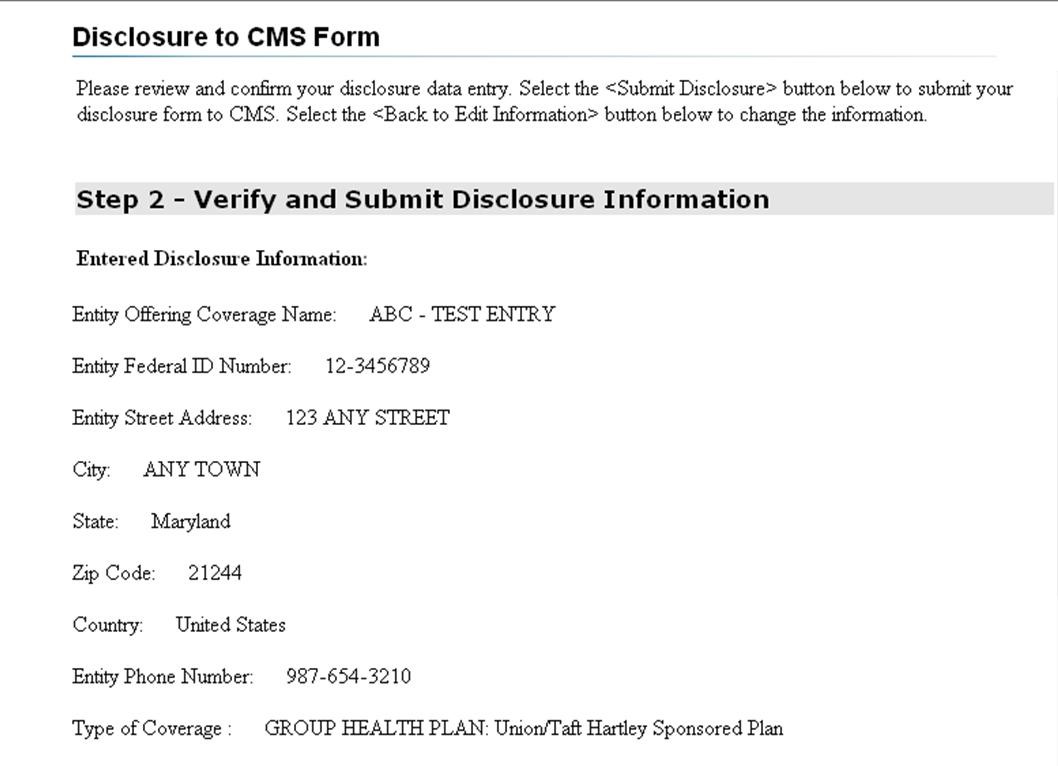

STEP 2 – VERIFY AND SUBMIT DISCLOSURE INFORMATION

Review and confirm your disclosure data entry. Select the “Submit Disclosure” button below to submit your Creditable Coverage Disclosure to CMS Form. Select the “Go Back to Edit Information” button below to change the information.

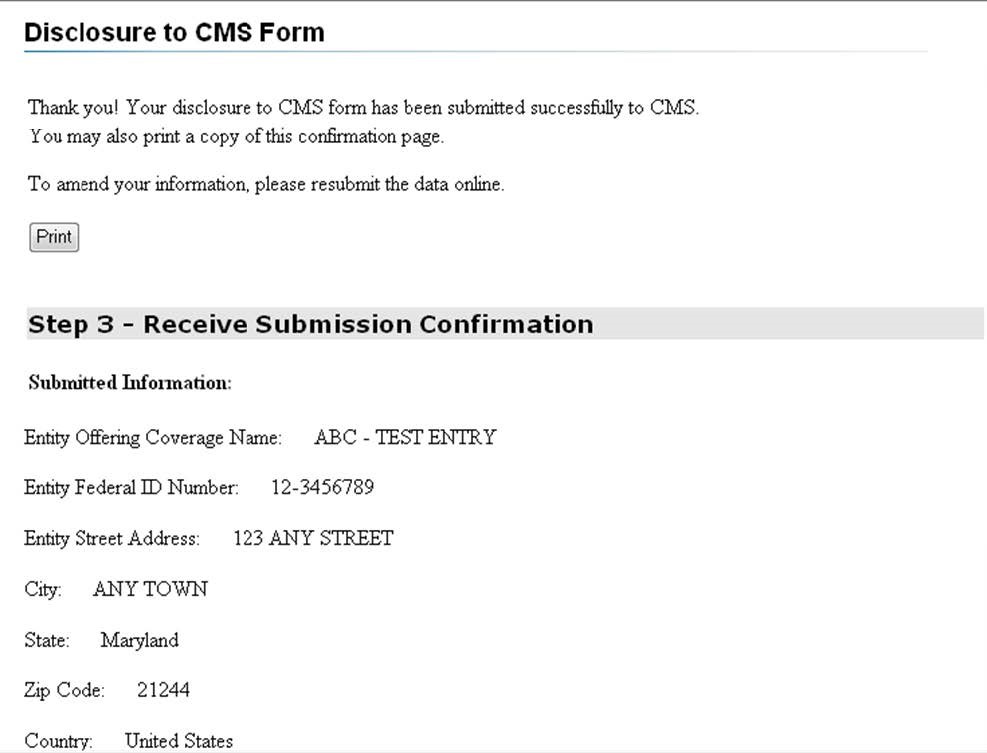

STEP 3 – RECEIVE SUBMISSION CONFIRMATION

Once you have clicked the “Submit” button on the online Creditable Coverage Disclosure to CMS Form, and if you have completed the form correctly, then you will receive the following confirmation message: “Thank you! Your Disclosure to CMS form has been submitted successfully to CMS. You will receive a confirmation email for your records. Please print a copy of this confirmation page for your records.”

This means that your Creditable Coverage Disclosure to CMS Form has been submitted successfully to CMS. You should print a copy of this page for your records. If you receive an error message after clicking the “Submit” button, go back and check your answers and correct the error that was indicated in the error message. If you are unable to submit the form successfully, or if there is a technical issue or an error message (that you are not able to correct) when submitting the online form, contact the Disclosure to CMS Technical Help line at 1-877-243-1285. Input Another Record Button

If the entity has another Creditable Coverage Disclosure to CMS Form to enter, click on the “Input Another Record” button and a new online form will appear for the entity to complete. This feature is available so that entities will not have to log out of the online form tool and log back in if they have more than one benefit option and they were not able to combine their benefit options due to a different plan year, or if the entity offers different types of coverage. For instance a State Government entity

CMS Form 10198-NC (Updated 07/2016)

may have numerous types of coverage to disclose to CMS (i.e.: their employee benefit plan, their Medicaid program, a state high risk pool plan and/or a State Pharmaceutical Assistance Program).

CONTACT FOR FURTHER INFORMATION

Visit the CMS website link related to Creditable Coverage issues at: http://www.cms.gov/Medicare/Prescription-Drug-Coverage/CreditableCoverage/index.html

CMS may release Question and Answers relating to Creditable Coverage issues from time to time on the CMS website under the Questions and Issues Database website which can be found at: https://questions.cms.gov

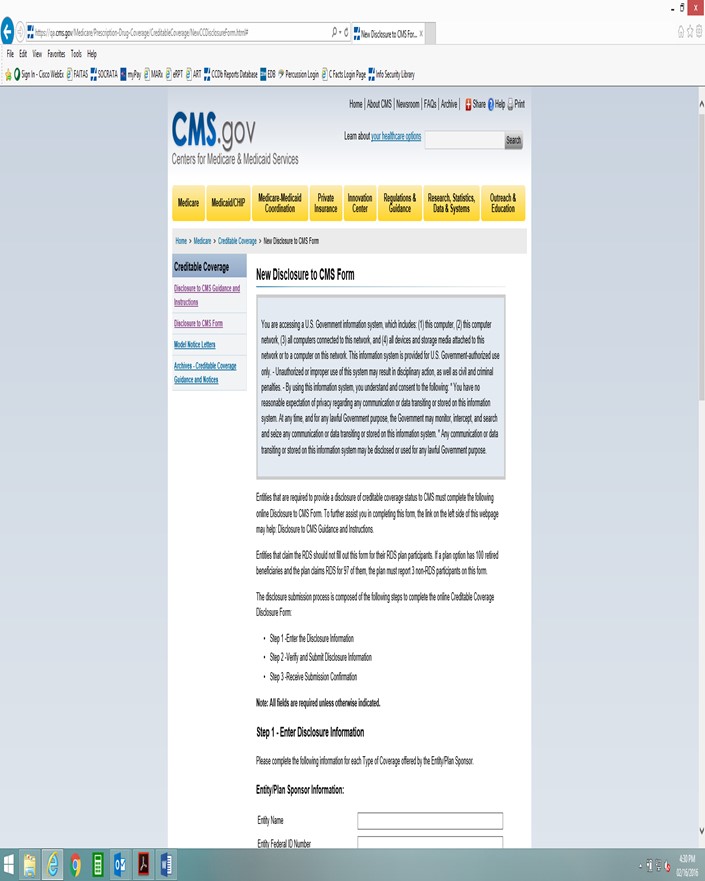

DISCLOSURE TO CMS FORM SCREEN SHOTS

These screen shots of the Creditable Coverage Disclosure to CMS Form accompany the instructions provided within this document. The Creditable Coverage Disclosure to CMS Form must be completed online at http://www.cms.hhs.gov/CreditableCoverage.

The screen shots of the Creditable Coverage Disclosure to CMS Form included in this document are not valid for submission to CMS.

(Screen Shot 1: Introductory Language/Disclaimer)

STEP 1- ENTER THE DISCLOSURE INFORMATION

Section A

SAMPLE DISCLOSURE FORM – NOT FOR SUBMISSION TO CMS

(Screen Shot 1: Step 1)

(Listing of Drop Down Items)

GROUP HEALTH PLAN: Employer Sponsored Plan

GROUP HEALTH PLAN: Union/Taft Hartley Sponsored Plan GROUP HEALTH PLAN: Church

GROUP HEALTH PLAN: Federal Government

GROUP HEALTH PLAN: State Government

GROUP HEALTH PLAN: Local Government

GROUP HEALTH PLAN: Other Entity

STATE-SPONSORED PLANS: Medicaid

STATE-SPONSORED PLANS: State Pharmacy Assistance Program (SPAP) STATE-SPONSORED PLANS: State High Risk Pool

STATE-SPONSORED PLANS: Other State-Sponsored

MEDIGAP (Medicare Supplement) PLAN (as defined under §403.205): Standardized Plan (H,I, J)

MEDIGAP (Medicare Supplement) PLAN (as defined under §403.205): Pre-standardized Plan MEDIGAP (Medicare Supplement) PLAN (as defined under §403.205): Waiver State Plan

MEDIGAP (Medicare Supplement) PLAN (as defined under §403.205): Innovative Benefit Rider

INDIVIDUAL HEALTH INSURANCE (Non-Medigap Plans)

VETERANS COVERAGE (under Chapter 17 of Title 38 U.S.C.)

MILITARY COVERAGE (under Chapter 55 of Title 10, U.S.C., including TRICARE)

INDIAN HEALTH SERVICE

TRIBE OR TRIBAL ORGANIZATION

URBAN INDIAN ORGANIZATION

OTHER TYPE OF COVERAGE OFFERED TO MEDICARE PART D ELIGIBLE INDIVIDUALS

Section B – All Options Offered Are Creditable

SAMPLE DISCLOSURE FORM – NOT FOR SUBMISSION TO CMS

(Screen Shot 2)

Section C – If All Options Offered Are Non-Creditable SAMPLE DISCLOSURE FORM – NOT FOR SUBMISSION TO CMS

(continued)

Section D – There are Some Creditable and Some Non-Creditable Options Offered SAMPLE DISCLOSURE FORM – NOT FOR SUBMISSION TO CMS

STEP 2- VERIFY AND SUBMIT DISCLOSURE INFORMATION

SAMPLE DISCLOSURE FORM – NOT FOR SUBMISSION TO CMS

CMS Form 10198-NC (Updated

STEP 3 – Print and Submit

SAMPLE DISCLOSURE FORM – NOT FOR SUBMISSION TO CMS

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Creditable Coverage Disclosure to CMS Form Instructions and Screen Shots |

| Author | CMS |

| File Modified | 0000-00-00 |

| File Created | 2025-07-17 |

© 2026 OMB.report | Privacy Policy