Justification Statement for 1513-0016 Non-significant Change

1513-0016 (F 5120.24) Non-significant Justification Statement.docx

Drawback on Wines Exported

Justification Statement for 1513-0016 Non-significant Change

OMB: 1513-0016

August 11, 2025

Non-substantive Change Justification Statement for

OMB Control Number 1513–0016, Drawback on Wines Exported

In general, the Internal Revenue Code of 1986 (IRC) at 26 U.S.C. 5041 imposes Federal excise tax on wine produced or imported into the United States, while section 5362(c) allows domestic wine to be exported without payment of that tax. In addition, for taxpaid or tax-determined domestic wine that is subsequently exported, the IRC at 26 U.S.C. 5062(b) provides that the exporter may claim drawback (refund) of the tax paid or determined on such wine, subject to the regulations prescribed by the Secretary of the Treasury.

Among other provisions, the Alcohol and Tobacco Tax and Trade Bureau (TTB) administers chapter 51 (distilled spirits, wines, and beer) of the IRC pursuant to section 1111(d) of the Homeland Security Act of 2002, as codified at 6 U.S.C. 531(d). In addition, the Secretary of the Treasury has delegated certain IRC administrative and enforcement authorities to TTB through Treasury Order 120–01.

The TTB regulations governing drawback on exported taxpaid or tax-determined wine are found in 27 CFR Part 28, Exportation of Alcohol, Subpart K, Exportation of Wine with Benefit of Drawback, which includes §§ 28.211 through 28.220a. Specifically, § 28.211 allows for drawback on taxpaid or tax-determined domestic wine that was subsequently exported, laden for use on certain vessels or aircraft, or transferred to a foreign trade-zone for exportation or storage pending exportation. Section 28.212 provides that wholesale liquor dealers, and proprietors of distilled spirits plants, bonded wine cellars, or taxpaid wine bottling houses who are also registered as wholesale liquor dealers under 27 CFR part 31, are authorized to remove wine and receive drawback under subpart K. As required by § 28.214, and specific to this information collection, approved under OMB control number 1513–0016, such exporters file such drawback claims using form TTB F 5120.24, Drawback on Wines Exported.

On March 25, 2025, the President issued an Executive Order, “Modernizing Payments To and From America’s Bank Account,” which was published in the Federal Register as E.O. 14247 on March 28, 2025, at 90 FR 14001. As a cost-saving and theft-prevention measure, the Executive Order requires, in general, that the Secretary of the Treasury cease issuing paper checks for all Federal disbursements, benefit payments, vendor payments, and tax refunds, and to make such payments via direct deposit or other electronic methods, effective September 30, 2025.

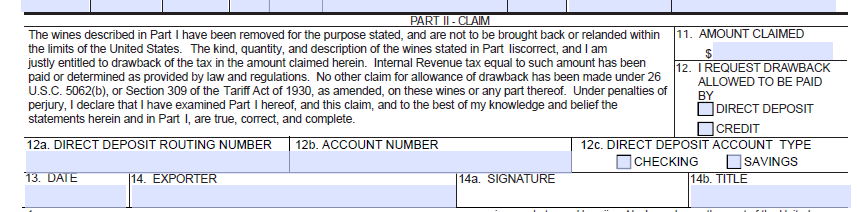

Previously on TTB F 5120.24, in Item 12, the respondent could select to receive their excise tax drawback as a payment made by check or as a credit on their next alcohol excise return. In response to E.O. 14247, TTB is revising form TTB F 5120.24 to eliminate the respondent’s option to receive a paper check. Item 12 on the revised form will now allow the claimant to choose to receive their excise tax drawback as a payment made by direct deposit or as a credit to be taken on their alcohol excise tax return. In addition, if the claimant selects the direct deposit option, TTB has added Items 12a, 12b, and 12c to the form to allow the claimant to supply their direct deposit routing and bank account numbers, and to state if the account is a checking or savings account.

TTB believes that these minor changes to TTB F 5120.24 made in response to E.O. 14247 do not affect this information collection’s per-respondent or total annual burden. The revision of Item 12 and the addition of Items 12a, 12b, and 12c merely require information that is already known by and immediately available to the respondent. These changes do not introduce new concepts and entail no burden other than that necessary to identify the respondent’s bank routing and account numbers to allow for direct deposit of an alcohol spirits excise tax refund, should the respondent select the direct deposit option. As such, TTB believes that these changes are non-substantive in nature, and we request OMB approval of the described changes to this information collection on that basis.

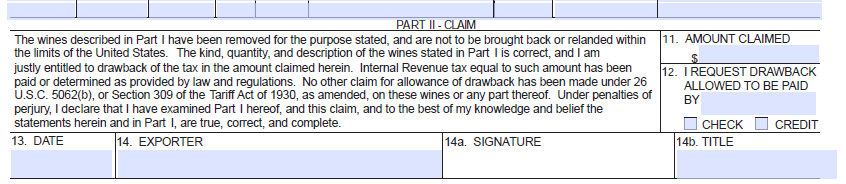

The figure below shows the previous version of Item 12 on TTB F 5120.24, Drawback on Wines Exported, which allowed the respondent to select drawback of wine excise tax as a payment made by paper check or as a credit on their alcohol excise tax return:

The figure below shows the new version of Item 12 on TTB F 5120.24, Drawback on Wines Exported, allowing the respondent to select drawback of wine excise tax as a payment made via direct deposit or as a credit on their alcohol excise tax return. If the respondent selects payment by direct deposit, they then provide their direct deposit routing number, bank account number, and type of account (checking or savings) in Items 12a, 12b, and 12c, respectively:

[END]

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 2025-09-19 |

© 2026 OMB.report | Privacy Policy