CS-07-069- IRS Large & Mid-Size Business Division; CS-07-070 - SB/SE FIELD EXAM TAX CUSTOMERS; CS-07-071 - TE/GE Stay Exempt Training; CS-07-072-W&I TAX PROFESSIONALS SURVEY

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-07-069 Survey

CS-07-069- IRS Large & Mid-Size Business Division; CS-07-070 - SB/SE FIELD EXAM TAX CUSTOMERS; CS-07-071 - TE/GE Stay Exempt Training; CS-07-072-W&I TAX PROFESSIONALS SURVEY

OMB: 1545-1432

OMB # 1545-1432

LARGE & MID-SIZE BUSINESS

CUSTOMER SATISFACTION SURVEY

INTERNATIONAL FOREIGN RESIDENT COMPLIANCE

The

IRS is trying to improve its service to the public. You can help in

this important mission by answering the

questions

below. This voluntary survey takes about ten minutes to complete.

When completing this survey, please

mark your responses with an

‘x’ using a blue or black pen like this example .

Do not mark outside of the response

area like this example . Your responses will be kept completely confidential. If you have any questions about this

survey, you may call the survey administrator at 000-000-0000.

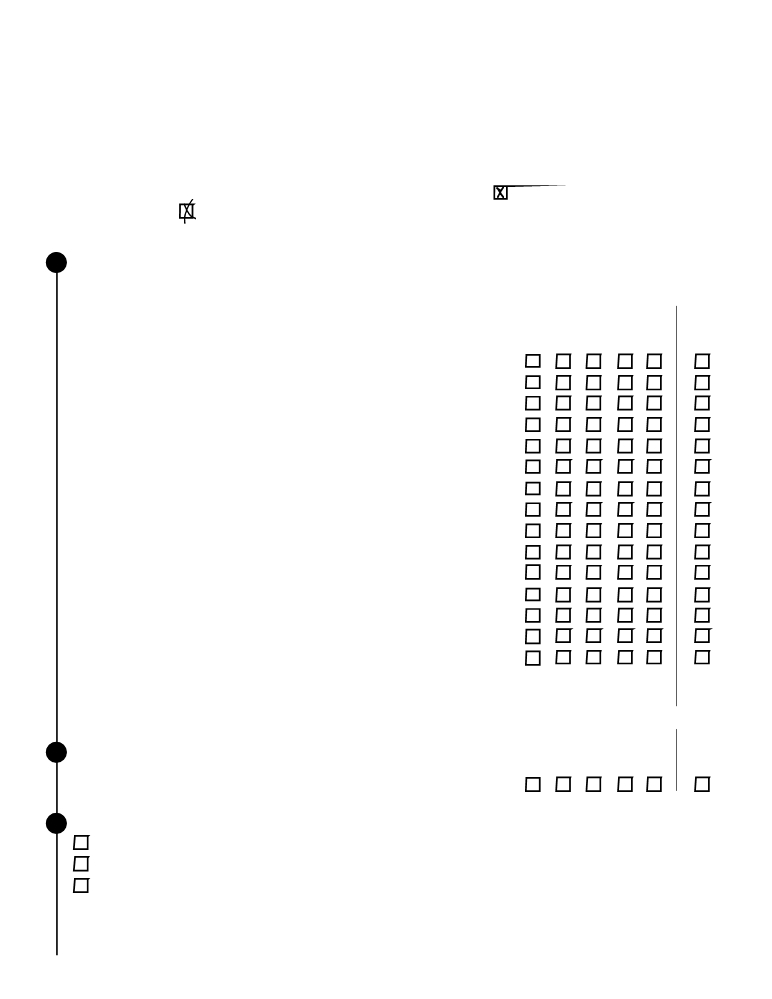

1 The questions that follow ask your opinion regarding how the IRS

handled

your most recent examination. For each question,

regardless of whether you agree or disagree with the final

outcome,

please

indicate your opinion by choosing a number from 1 to 5,

where

1 means “Very Dissatisfied” and 5 means “Very

Satisfied.”

a. Explanation of why you were being examined.

b. Explanation of the exam process.

c. Ease of understanding the notice regarding your initial appointment.

d. Time given you to provide requested information to the IRS

e. Time the IRS took to respond to you.

f. Flexibility of auditor in scheduling meetings.

g. Reasonableness of the information you were asked to provide.

h. Explanation of why records were required after initial appointment.

i. Business knowledge of your examiner.

j. Tax knowledge of your examiner.

k. Courtesy of your examiner.

l. Consideration given to the information you submitted.

m. Length of the exam process from start to finish.

n. Amount of time you had to spend on the examination.

o. Understanding that you have payment options.

p. Explanation of why adjustments were made.

q. Fairness of treatment by the IRS.

2 Regardless of whether you agree or disagree with the final outcome,

how would you rate your overall satisfaction with the way your examination was handled? ...

3 Are you…?

The taxpayer

A tax professional who represented the taxpayer

Someone else who represented the taxpayer

Very Very Don’t

Dissatisfied Satisfied know/Not

1 2 3 4 5 applicable

▼ ▼ ▼ ▼ ▼ ▼

.

Very Very Don’t

Dissatisfied Satisfied know/Not

1 2 3 4 5 applicable

▼ ▼ ▼ ▼ ▼ ▼

.

Please continue on back

If you have been unable to resolve any specific problems with your tax matter through the normal IRS channels, or now face a significant hardship due to the application of the tax law, we encourage you to contact the Taxpayer Advocate Service at 1-000-000-0000.

4 Use this space for comments, or suggestions for improvement.

Paperwork Reduction Act Notice

The Paperwork Reduction Act requires IRS to display an OMB Control Number on all approved information requests. The OBM Control # for this study is xxx-xxx. Also, if you have comments regarding the estimated time associated with this voluntary study, or suggestions on making this process simpler, please write to the: IRS, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224

Thank you for completing the survey.

Please return the questionnaire by mail, using the enclosed business return envelope.

| File Type | application/msword |

| Last Modified By | mdsloa00 |

| File Modified | 2007-11-29 |

| File Created | 2007-11-09 |

© 2026 OMB.report | Privacy Policy