WISPR Public Comments and ETA Responses

SS Attachment E - Summary of Public Comments-Departmental Responses.doc

Workforce Investment Streamlined Performance Reporting (WISPR) System

WISPR Public Comments and ETA Responses

OMB: 1205-0469

ATTACHMENT E

Summary of Public Comments/Departmental Responses

The Department of Labor (DOL or the Department) published a pre-clearance consultation notice in the July 16, 2004 Federal Register (Vol. 69, No. 136, Pages 42777 through 42779) http://www.doleta.gov/performance/EMILE/FED_REG.pdf to provide the general public and Federal agencies with an opportunity to comment on its Information Collection Request (ICR) for the proposed EMILE performance reporting system.

We received 161 letters and e-mail messages in response to the Federal Register notice: 56 were submitted by Native American/tribal organizations; 43 responses were submitted by state workforce agencies; 38 were submitted by local workforce agencies, Workforce Investment Boards, One-Stop Career Centers, and State Associations of Workforce Investment Boards; 10 were submitted by disability-related groups; 9 were submitted by national associations, public interest groups and research organizations; 2 were submitted by agencies/programs serving farm workers; 1 was submitted by a federal agency, 1 was submitted by an organization serving ex-offenders, and 1 was submitted by a private citizen. A summary of the comments received and the Department’s responses can be found below.

Introduction:

The proposed reporting system is designed to ensure nationwide comparability of performance data for employment and training programs such as Workforce Investment Act (WIA) Title IB, Trade Adjustment Assistance Act, Jobs for Veterans Act and Wagner-Peyser Act. One of the comments DOL received mentioned that consolidation of programs and funding streams is better addressed through legislative channels. The idea of consolidation of most employment and training activities is indeed addressed in the Administration’s proposal on WIA reauthorization and in the President’s Fiscal Year 2007 budget for the Employment and Training Administration.

The proposed reporting system does not consolidate employment and training programs. Rather, the Department is interested in standardizing customer data collection to improve the validity and comparability of performance results across programs and to reduce stakeholder confusion about performance results. Further, integrating program reporting into a single, streamlined reporting structure using the common measures across will enhance the Department’s ability to assess the effectiveness and impact of the workforce investment system, and help ensure reliability and integrity of performance data and system integrity.

DOL would like to note that there were comments received that were not specifically related to the reporting package but related to the lack of input and the timing of costly changes to the system without WIA reauthorization. The Department did conduct a feasibility study with the four states of California, New York, Tennessee, and Illinois to determine startup and maintenance costs as well as timelines for implementation. DOL also participated in a number of conferences and workshops to present the proposal and obtain feedback. DOL believes that the changes made now to streamline performance reporting systems across programs will continue to be beneficial when and if WIA is reauthorized. The importance of having accurate, more frequent information is the primary concern to be able to better describe the results achieved by the workforce system.

DOL would also like to address the many comments received from the Indian and Native American community. These comments were considered and the INA program reporting has been removed from the EMILE reporting package; therefore, all specific comments were not included in this response.

The following comment summary is organized into the six areas (comments that did not address one of the six areas have been summarized in this introduction) as requested in the Federal Register notice:

1. Evaluate whether the proposed collection of information is necessary for the proper performance of the functions of the agency, including whether the information will have practical utility.

Issue: Seventeen commenters expressed concern over the burden for employers related to collecting data required to complete the Employer record. Most of these commenters felt that the number of data elements that employers were being asked to provide was excessive and suggested streamlining the employer record to eliminate excessive reporting requirements. Some commenters felt that the burden and costs of data collection placed on employers’ outweighed benefits for employers, job seekers, and workforce development agencies. A number of commenters indicated that excessive reporting requirements would result in some employers not listing job orders with the Employment Service and/or driving employers away from using other services available through the workforce development system (such as those available through the One-Stop Career Center System).

Response: Most of the information that is being reported has been significantly reduced in the revised reporting system. In fact, the collection of individual service records for employer/businesses is no longer a part of the revised reporting system—the basics from the employer are name of company, location and size of establishment. In the aggregate it will capture the count of the number of unique businesses who receive services, the category of services provided, and the number of job orders and openings listed with the workforce investment system by Occupational Network (O*NET) and North American Industrial Classification System (NAICS) codes. These data will be used to provide information on the number and types of businesses served and the state’s level of business involvement.

Issue: Twelve commenters expressed concerns related to obtaining Federal Employer Identification Numbers (FEIN) as a unique common employer identifier. Some commenters made suggestions regarding employer confidentiality and protecting employer identities.

Response: The revised proposal eliminates the mandatory collection of FEIN; however, we believe that DOL should connect this to the “normal line of business” that should be going on with employers—collecting a unique identifier is a good practice to help workforce system staff track their job seeker and business customers.

Issue: Five commenters indicated that state workforce agencies lacked resources to design, develop, and implement the Employer Standardized Individual Record. Most of these commenters inquired about the availability of additional funding to offset these implementation costs.

Response: Unfortunately, there is no new funding to defray the cost of data system changes for states although most states have mechanisms in place through job order systems, etc. already. A portion of each state’s formula allotment for Wagner-Peyser, WIA, and other funding sources can be used to maintain, enhance, or to build data collection and reporting systems necessary to carry out the state’s program responsibilities. In addition, DOL will provide free technical assistance and training, and data element and reporting validation specifications to assist states to comply with the reporting requirements. DOL will continue to enhance data element and report validation software at no cost to the states as well. Many states have utilized this software in the past as the state’s outcome reporting tool, which reduced the pressure on states to utilize precious administrative funds to purchase or create validation software. We will continue to encourage more states to take advantage of these tools. Finally, large portions of the new reporting requirements build on the current reporting requirements and, therefore, a major portion of the work states will have to do to comply with the new requirements has already been addressed under previous OMB approved information collection requests.

Issue: Three commenters suggested that reporting burden and costs associated with the employer record would be reduced by allowing states to submit a quarterly or annual aggregate employer report (and dropping the requirement for states to submit quarterly individual employer records and job listings).

Response: DOL has looked at these concerns, which also came to light as part of the feasibility study conducted on the proposed reporting system. Based on system input, DOL has determined that the aggregate reporting approach will be used in the revised reporting system.

Issue: Two commenters expressed concern about the potential for undercounting of actual services provided to businesses – for example, one commenter noted that the workforce system provided much in the way of information services either by staff directly or via the Internet that would not likely be documented under EMILE; a second noted that documenting only the date of the most recent date a type of employer service was received would likely result in an undercount of the actual services being provided by local workforce agencies.

Response: The intent of employer/business service reporting is to secure basic information on the number of unique employers or businesses that receive service from the workforce investment system and the category of services being provided, not to capture a count of business transactions. From the information collected under the proposed information collection, states and DOL will be able to assess the impact of the services provided by reviewing the volume of job orders and openings employers or businesses list, and the employment, retention, and earnings outcomes job seekers achieved. Service transaction counts are not necessary and represent an unnecessary reporting burden on the system.

Issue: Twelve commenters stated that self-help customers might be reluctant to provide their Social Security Numbers (SSN). Social Security information is voluntary and is not a condition of receiving services, so there is no compelling reason for an individual who may be concerned about identity theft or government intrusion to offer this number. In addition, there may be customers who are using fraudulent or fake numbers and would fear the consequences of entering that SSN’s for the customers would mean that they would be included in the counts for registration but they could not be included in any assessment of services provided as it would be impossible to track wage gains through the Unemployment Insurance system, so it would appear that they had no wages in the post-program period. A number of commenters suggested that registrants not providing SSN’s be included in a total count of users of the self-help or resource room services but be excluded from performance calculations. The majority of comments on this subject were received from state agencies (8). Other commenters were from an association, a union, and a workforce investment board.

Response: The Department respects the fact that state workforce agencies, as well as program participants, may question the reason(s) behind a request for personally identifying information, or have concerns about how such information is to be used. The provision of personally identifying information, such as the SSN or equal opportunity information, is indeed voluntary, to be self-identified and--as one or more commenters noted-- is not a condition for receipt of employment and training services funded by the Wagner-Peyser Act, WIA, and other DOL employment and training programs.

The SSN and employment status elements are the minimum participant data needed to track service outcomes under the common measures through the Unemployment Insurance wage record match (per TEGL 17-05, UI wage records serve as the primary data source to track outcomes under common measures). Although the Department’s preference is for states to have procedures in place that help the participant understand the uses of the SSN, for individuals unwilling to provide the SSN, states may generate a pseudo identification number for the purpose of inclusion in total participant counts and service transactions; these individuals will, however, be excluded from performance calculations. The SSN thus enables the Department to provide a fuller picture of the system’s impact in assisting individuals to achieve their employment goals via an array of service interventions, including self-help services online or in One-Stop resource room, staff-assisted core and intensive services and training.

Self-help customers and individuals receiving staff assistance should be made aware that the SSN (and other personally identifiable information such as gender, age, race/ethnicity, disability status) assist the state workforce agency and the Department in evaluating and improving efforts to provide services that are effective in helping customers become reemployed more quickly or obtain the necessary training for employment opportunities in more high growth, high demand jobs.

Issue: Four commenters questioned whether there were adequate safeguards in place to maintain confidentiality of records. Specifically, there were two questions regarding security of data transmission and two regarding the general lack of trust in government by the population served.

Response: It is the responsibility of state information technology (IT) staffs to have these protections in place as collecting confidential information is not new. The information submitted to the federal government by the states does not have attached to it an SSN. Instead, an individual identifier is created at the state. When DOL provides information to the public, it is usually in aggregate form, built from the individual records, and when individual records are made available to the public, the file is cleaned to hide individuals’ birth dates and groups of records from areas with too few exiter records. We plan to follow these same procedures with the WISPR records.

Issue: Nineteen other confidentiality issues were raised in comments received. Two commenters raised the issue of collecting confidential information when the individuals collecting the information might be the neighbors of the individuals providing the information. A general concern raised by several commenters was the rationale for collecting individual level data at the national level. “The state would recommend that the DOL reach out to citizen and business groups to disclose the detail of information to be gathered nationally in a machine-readable format. We expect these groups would be interested to know the purpose for this detailed information and would like the opportunity to respond. Reporting on participants who use non-staff assisted facilities should be limited to summary information, if reported at all.”

Response: The information collected at the federal level is not identifiable; SSN’s are not submitted to the federal level. Instead, each participant is given a unique identification number at the state level before the information is transferred and that is what identifies the data at the federal level.

Issue: Ten commenters raised the issue of unavailable data. Six were concerned over access to wage data from the Unemployment Insurance system; three reported that medical information might not be available to them; one mentioned that restrictions were in place that would prohibit access to some educational information; and one mentioned that self-employment data would probably not be available through state revenue departments.

One local government stated that they were encouraged that the “Department will support grantee access to UI wage records.” The single state that commented on wage data sharing was concerned over their inability to legally provide this data to grantees.

One state cited the Family Educational Rights and Privacy Act (FERPA) as having been “a constant obstacle to its ability to provide customers with a true consumer report on service providers identified in the eligible training provider list.”

Self-Employment data is collected by state tax revenue agencies, but that information is almost never available to other agencies.

Response: The use of Unemployment Insurance (UI) wage records for outcomes verifications is the standard, and supplemental data is allowable only when there is not access to these records. Generally, DOL does not believe the measures discourages self-employment because supplemental data is allowed for 2 of 3 measures, and the earnings measure would not be a positive or negative for self-employed individuals.

Issue: Four commenters mentioned that it would be necessary to negotiate agreements among the partner organizations regarding data sharing, and three commenters mentioned the need to clarify who would be responsible for coordinating data collection and submission. The issue with negotiating agreements is time. Several commenters suggested that DOL notify participating agencies that data sharing is expected and notify other federal agencies of the data needs anticipated as part of EMILE.

Several commenters raised the issue of coordination, pointing out that not all data is collected by one organization; thus, compiling the data for submission will be a problem. The question is which organization will have this responsibility. One commenter mentioned the need to ensure that summary data reported in EMILE comply with the Wage Record Interchange System (WRIS) agreements regarding the suppression of restricted data. This is certainly a critical technical issue.

Response: We believe that data sharing is already or should already be a part of a variety of Memoranda of Understanding (MOU’s) that exist for One-Stop Career Centers and/or among state agencies. DOL will facilitate, as appropriate, efforts to establish national data sharing agreements, as well as to share best practices learned on data sharing agreements in various states and local areas. The kind of information being requested is not new and states have proven their ability to report.

Issue: Several comments were received regarding the need to develop software in order to populate the data bases envisioned in EMILE. This is especially important because, in most states, no one agency operates all the affected programs.

Response: There are no databases envisioned- EMILE is not a case management system and we are not proposing to create one. They exist within the states and across local areas, and elements in the existing systems are what gets transferred into the WISPR record and then aggregated for reports. State and local existing MOU’s and operating agreements are key.

2. Evaluate the accuracy of the agency’s estimate of the burden of the proposed collection of information, including the validity of the methodology and assumptions used.

Issue: Thirty-six commenters indicated that the burden estimates for implementing EMILE were unclear and do not accurately reflect the level of effort required to transition from current reporting systems to the proposed EMILE reporting system. The comments ranged from general statements alleging that the estimates were understated to a few detailed analyses of the cost of transitioning to the EMILE system at the local and state level. Commenters also noted that the burden estimates do not account for the costs necessary to replace systems developed by the local workforce investment boards for the purpose of tracking client services and provider performance. Several other commenters highlighted the fact that reprogramming would be a significantly larger cost than anticipated in the estimates because of the need to add as many as 100 new screens and an additional 55 to 100 data elements. In addition to the programming requirements, many of the commenters mentioned additional costs and burdens associated with the development of new policy and procedural guidance for all those working in the affected program areas.

Response: Many of the ETA common measures data collection and reporting goals were implemented in the WIA, Wagner-Peyser/VETS, and TAA reporting requirements that were approved by OMB and made effective July 1, 2005. These goals include the use of common data elements and report items, with identical report calculations, across the three programs. Therefore, the transition from the current reporting requirements to the WISPR System will focus on the creation of a consolidated participant record as well as consolidated participant and employer reporting. This focus requires states to provide ETA with integrated systems output (in the form of participant records and reports), but it does not require states to integrate data collection input. Furthermore, the integration of systems’ output can happen gradually over the first three years of WISPR implementation.

By contrast, the proposed EMILE system had a broader scope than the WISPR; EMILE would have required state-run programs to collect approximately 50% more data elements than WISPR proposes to collect, and full implementation would be required in the first year of EMILE. Nevertheless, as detailed in A.15 of the WISPR supporting statement, the annual WISPR burden estimate is 30 percent higher than the annual EMILE estimate for comparable data collection and reporting activities, assuming none of the states have integrated data collection and reporting. The WISPR startup estimate is more than twice as high as the EMILE startup estimate for comparable startup activities. The WISPR estimates are on par with current annual burden estimates for the state-run programs and are 50 percent higher than the current startup estimates for comparable startup activities. (The WISPR burden estimate assumes that the data collection burden will decrease from the current programs; this is in part a function of a lower, more accurate count of program participants.) It should also be noted that, as directed by OMB, the burden estimates exclude normal and customary costs for program operations, and the burden for complying with EEO recordkeeping and reporting requirements.

Issue: Three commenters noted that the burden estimate failed to include the costs to maintain duplicate systems during any transition period and to ensure that legislative changes are made to allow EMILE to replace other program reporting systems. Several commenters believed that the costs and time associated with developing forms, policy and procedural manuals were also left out of the estimates. Because of the increased data collection, commenters also pointed out the need to plan for additional data storage and to develop and maintain validation systems.

Response: As indicated above, the proposed WISPR System requires integrated output for the state-run programs but it does not require integrated input. The WISPR System therefore does not require the creation of completely new systems, or the maintenance of duplicate systems. In addition, since many of the key goals of ETA's common measures initiative have already been implemented through existing WIA, Wagner-Peyser Act, and TAA reporting systems, it is anticipated that the burden associated with developing state level forms, policy, and procedural manuals is minimized. Finally, there is no data storage issue under the proposed WISPR System because unlike EMILE, WISPR does not involve an increase in data collection compared to current requirements.

Issue: A total of thirty-eight commenters expressed concerns over the costs of making changes to existing data systems to meet EMILE reporting requirements that were not factored into the agency’s burden estimate. Some commenters noted that legacy data systems would need to be overhauled and this would be very costly, particularly in terms of staff time. In addition, there would be additional costs because of the need to bring together information from other data systems, such as the Unemployment Insurance wage record data. Several commenters noted that the proposed EMILE reporting system will require states and local programs to either combine several of their management information systems or develop new consolidated information system structures. One commenter noted that because EMILE spans a number of workforce programs, the state will have to modify its various management information systems and combine the data on a quarterly basis. A second commenter expressed similar concerns and estimated that the extra information system work would require about 750 hours per year.

Response: Comments regarding systems changes are addressed in areas 1 and 2 above. Comments regarding EMILE's UI wage record data requirements were likely based on the proposed EMILE requirement that grantee run programs would need to access wage record data. Grantee run programs are not included in the proposed WISPR System, so this issue is no longer relevant. The state run programs included in the WISPR System have long used wage record data in reporting. It should be noted that the WISPR burden estimate assumes that states will need on average more than 15,000 hours per year to comply with the WISPR reporting requirements.

Issue: Nineteen commenters identified training costs associated with roll-out and effective implementation of EMILE as a significant transition cost item that was not factored into the agency’s burden estimate. For example, one state commenter noted: “The changes to the automated system will require extensive and expensive staff training at the state and local levels. All state and service providers who work with customers, plus staff involved in validation and reporting will need initial and ongoing training to comply with EMILE. These costs are not included in the burden estimates.” Several of these commenters emphasized the importance of training to ensure that EMILE data were valid and reliable.

Response: As indicated in the previous responses, the proposed WISPR System builds on the current WIA, Wagner-Peyser/VETS, and TAA data collection and reporting systems. This means that the transition from current systems to the WISPR will be less burdensome than the transition to EMILE would have been. In addition, the transition is gradual--states do not need to fully implement the WISPR integrated reporting requirements until Program Year 2009. The federal government burden estimate in A.14 of the Supporting Statement includes the cost of updating the Data Reporting and Validation Software (DRVS) to incorporate the WISPR report formats and calculations. The DRVS is provided to states free of charge to help reduce their reporting and validation burden. Finally, some amount of state-level training would likely be necessary due to staff turnover regardless of a change in reporting requirements; this would fall under normal and customary activities that are not assigned a burden.

Issue: Ninety-eight organizations provided 136 comments about the burden they would face due to the new data collection and transmission requirements. Some of the commenters focused on specific reporting concerns, while others made general comments about the excessive amount of data required. The state commenters were mostly concerned about having to collect and transmit individual records for each person utilizing the resource room or self-help facilities in local One-Stop Career Centers. Eleven commenters expressed specific concerns of increased ongoing costs related to the number of data items collected in EMILE for job seekers as well as to the staff time that it would take to collect additional data.

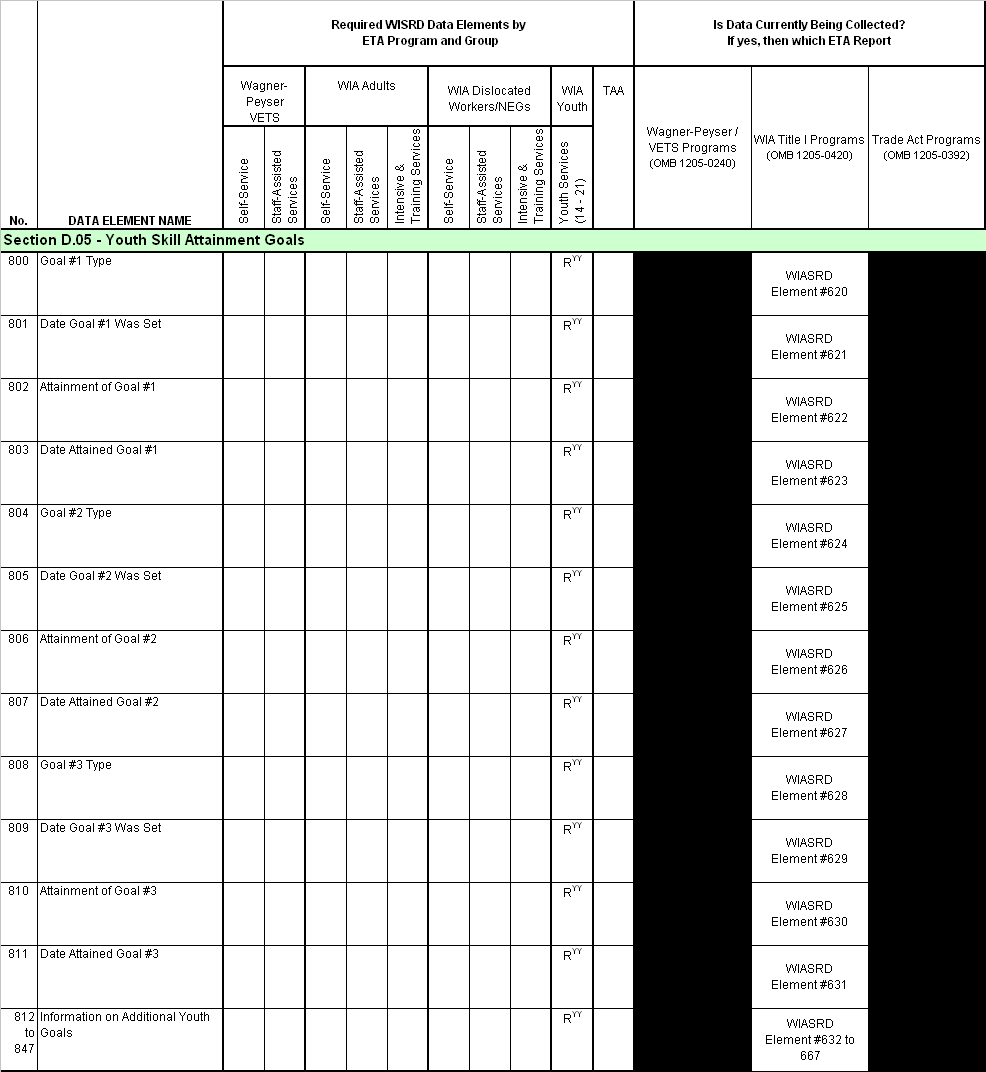

Response: The Department appreciates and understands the concerns expressed by the commenters, and has made two important modifications to this ICR. First, to address the burden issues related to the submission of individual records, the Department has eliminated the original EMILE requirement for states to submit quarterly records on participants and exiters and replaced it with a requirement for states to submit quarterly records on exiters only. The only exception to this general rule includes those WIA Youth program participants who have achieved a reportable outcome on either the Skill Attainment Rate or Literacy and Numeracy Gains measures. This modification substantially reduces the amount of data to be reported to the Department, and minimizes the burden on states to continuously update and submit “real-time” participant demographics, service, and related assistance information. Once states submit an initial exiter record to the Department, the only information that should include updates is data related to the tracking of performance outcomes and other required indicators of program performance. This approach is consistent with current state reporting activities where they prepare individual records with updated information on performance outcomes to support the production of quarterly reports.

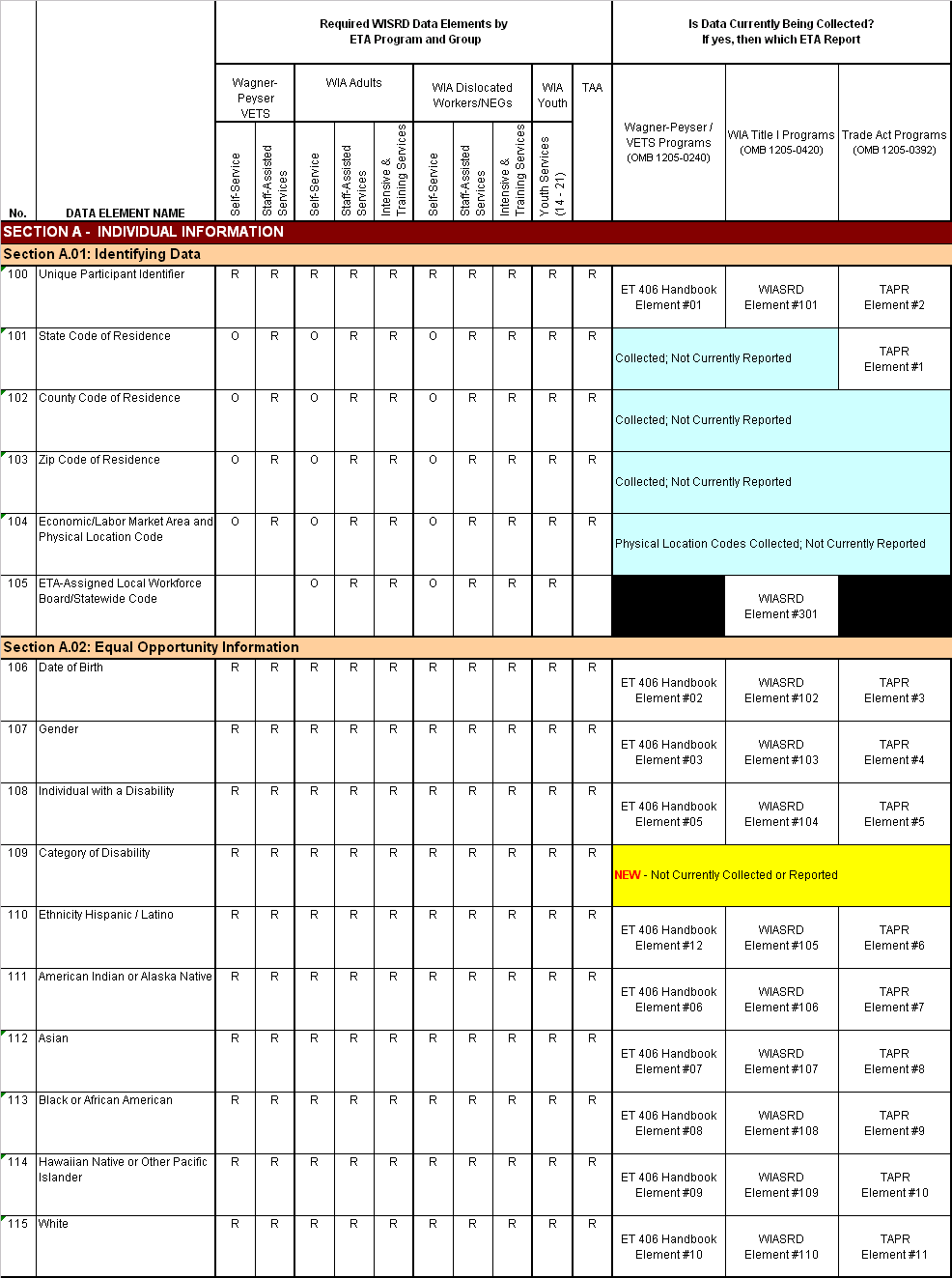

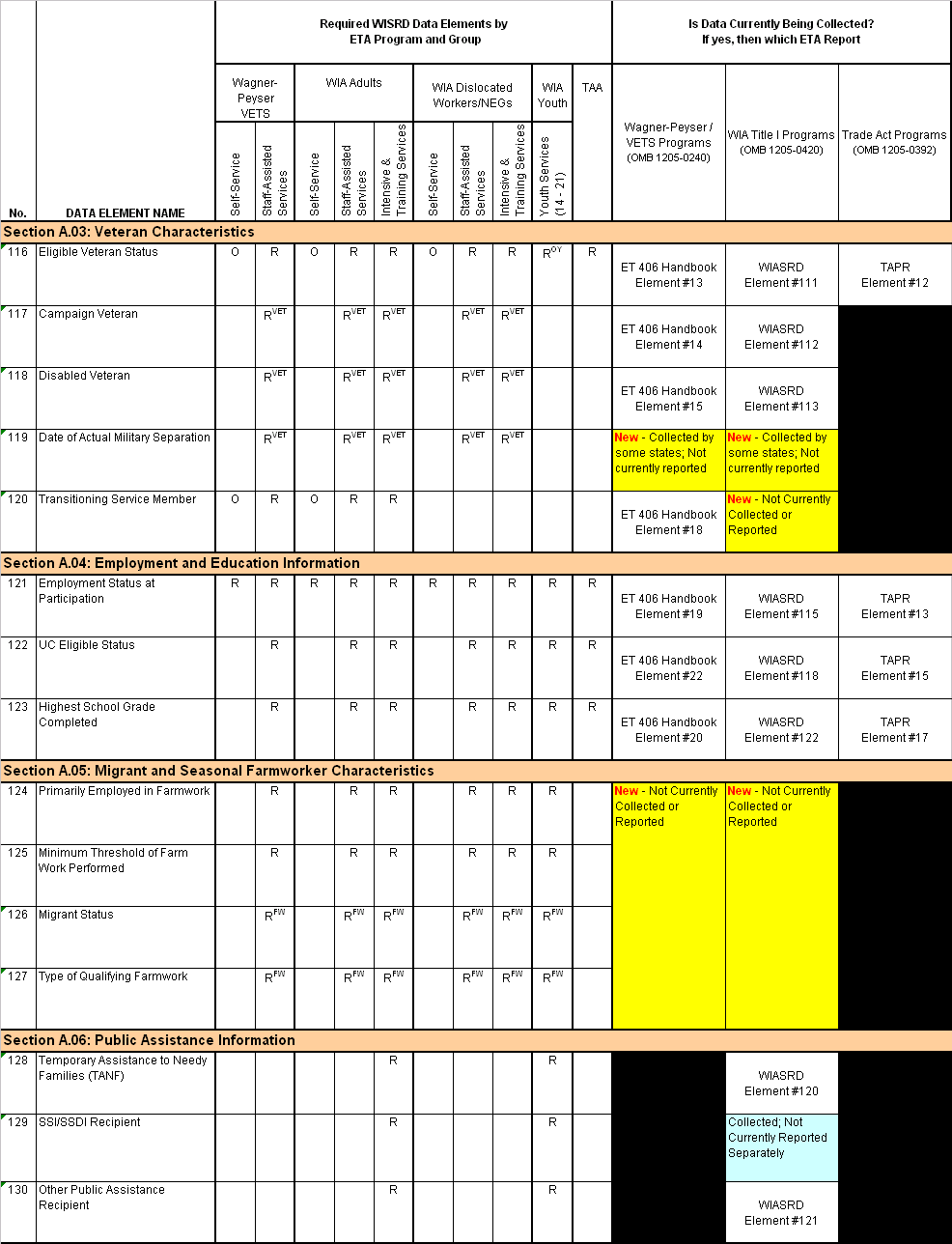

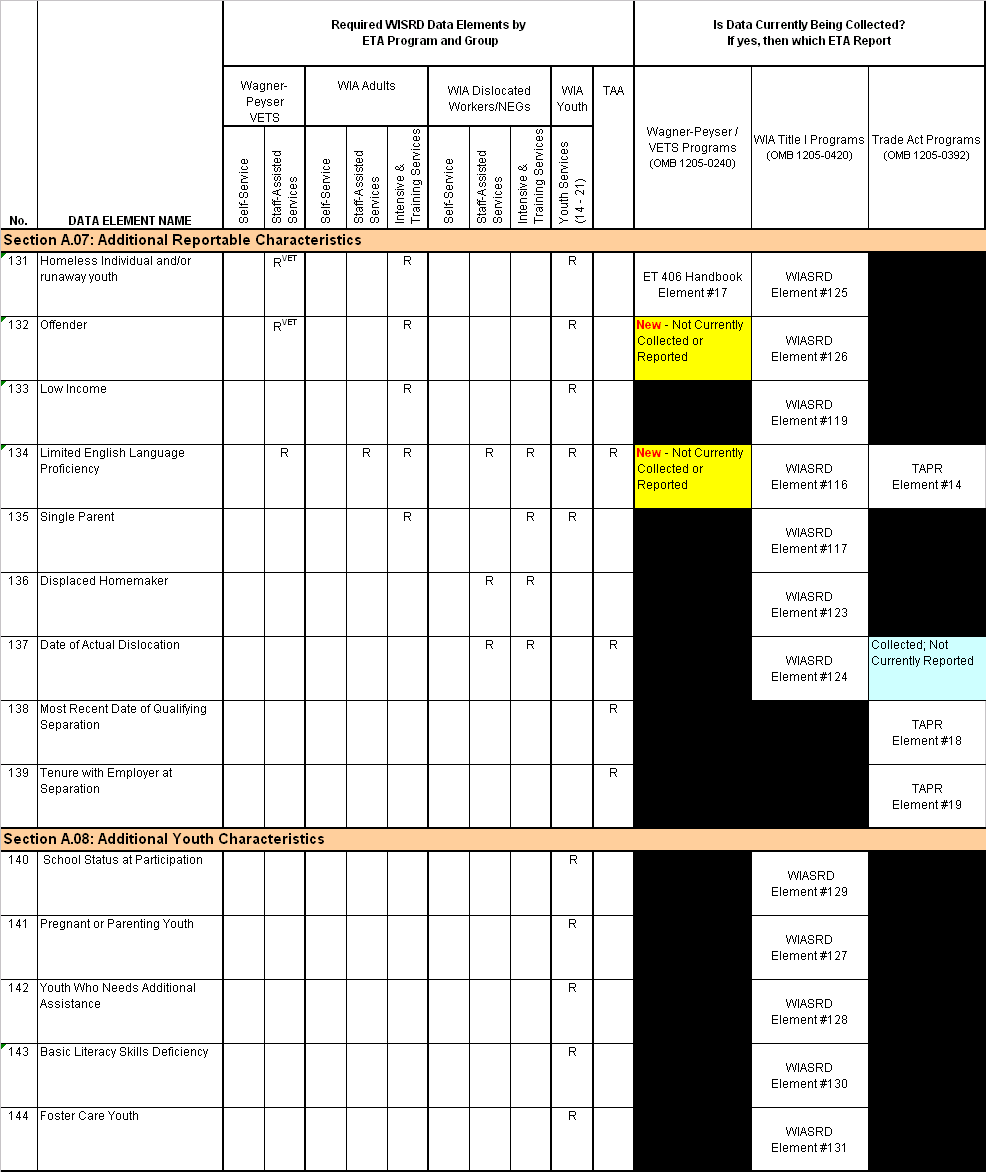

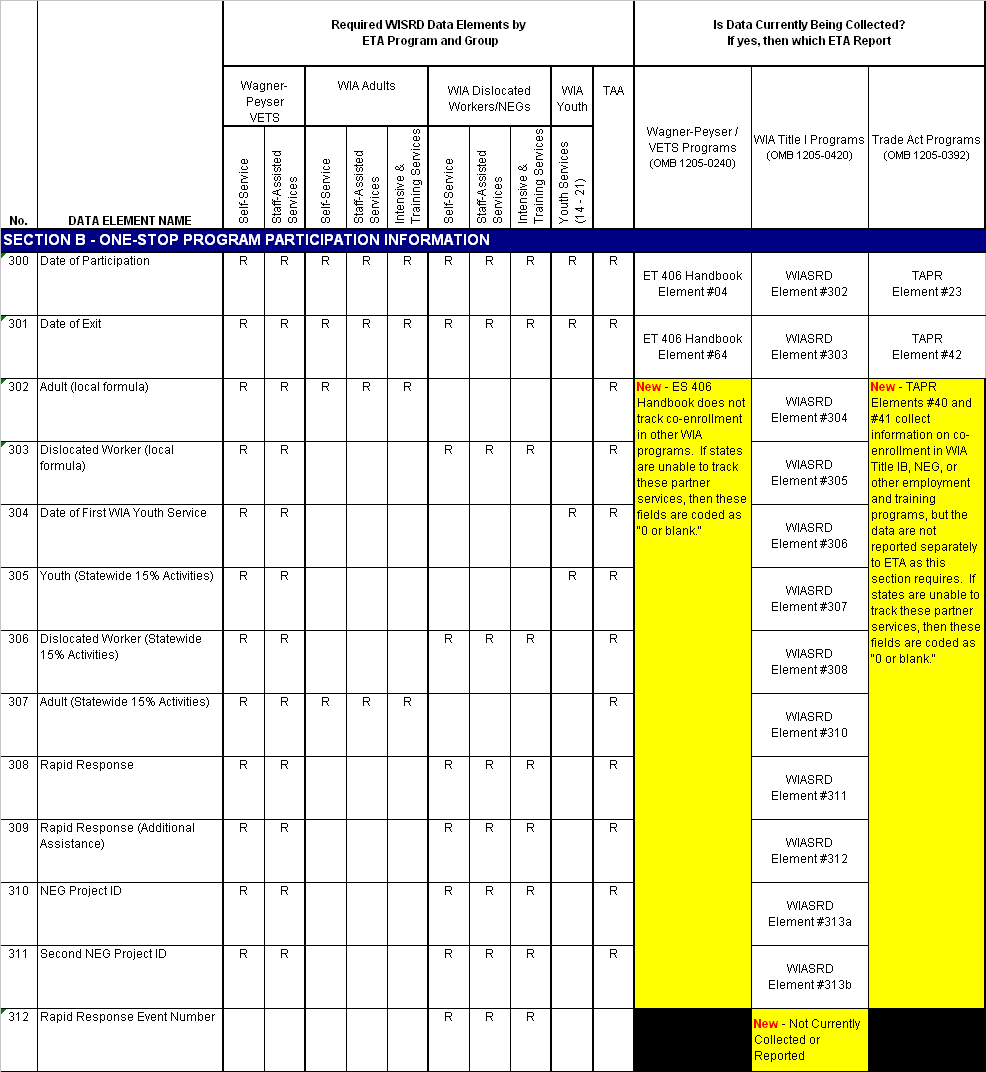

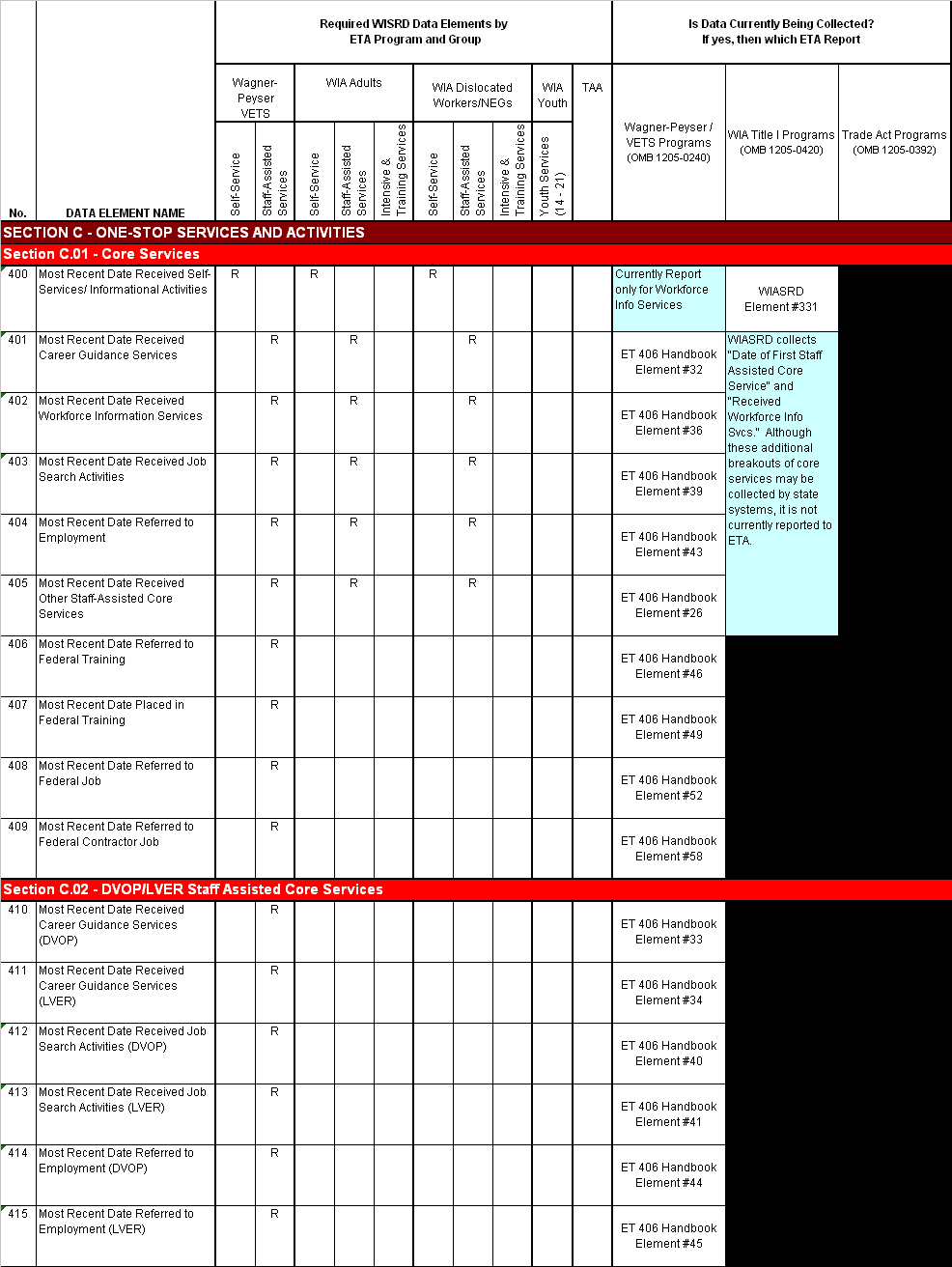

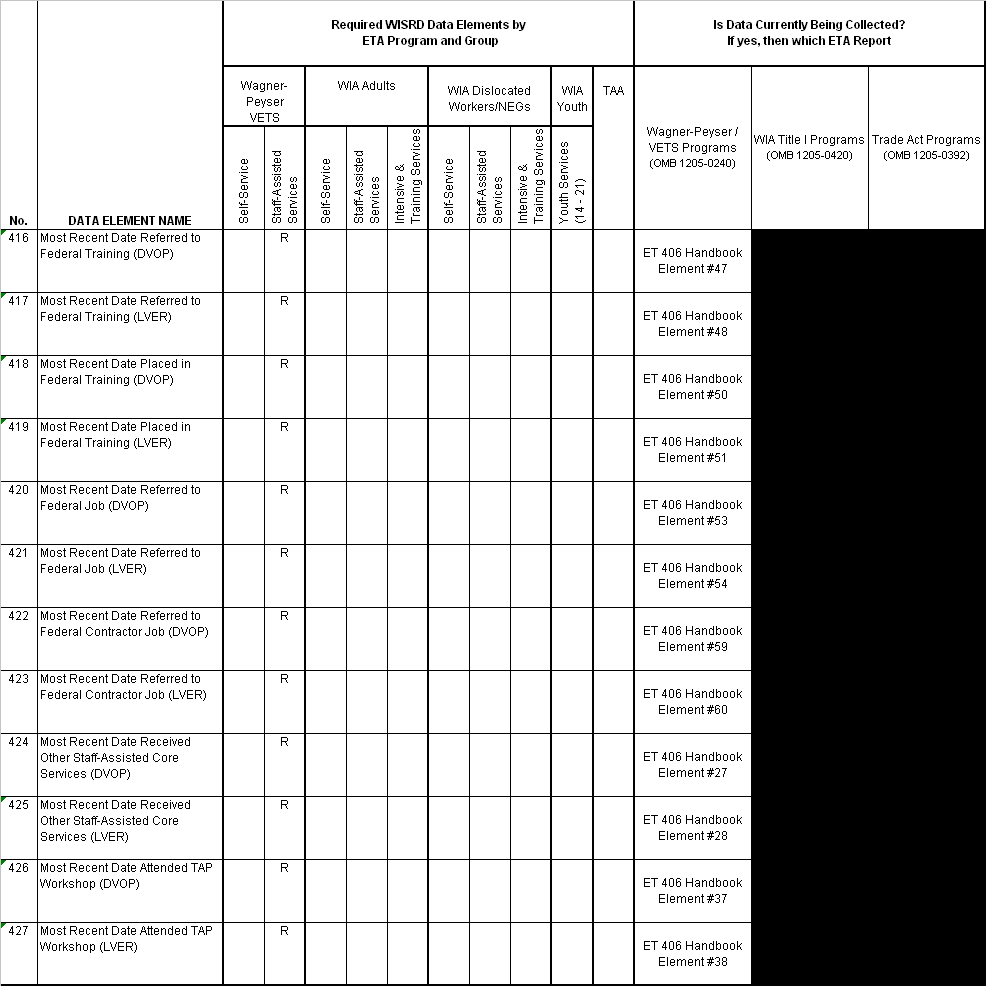

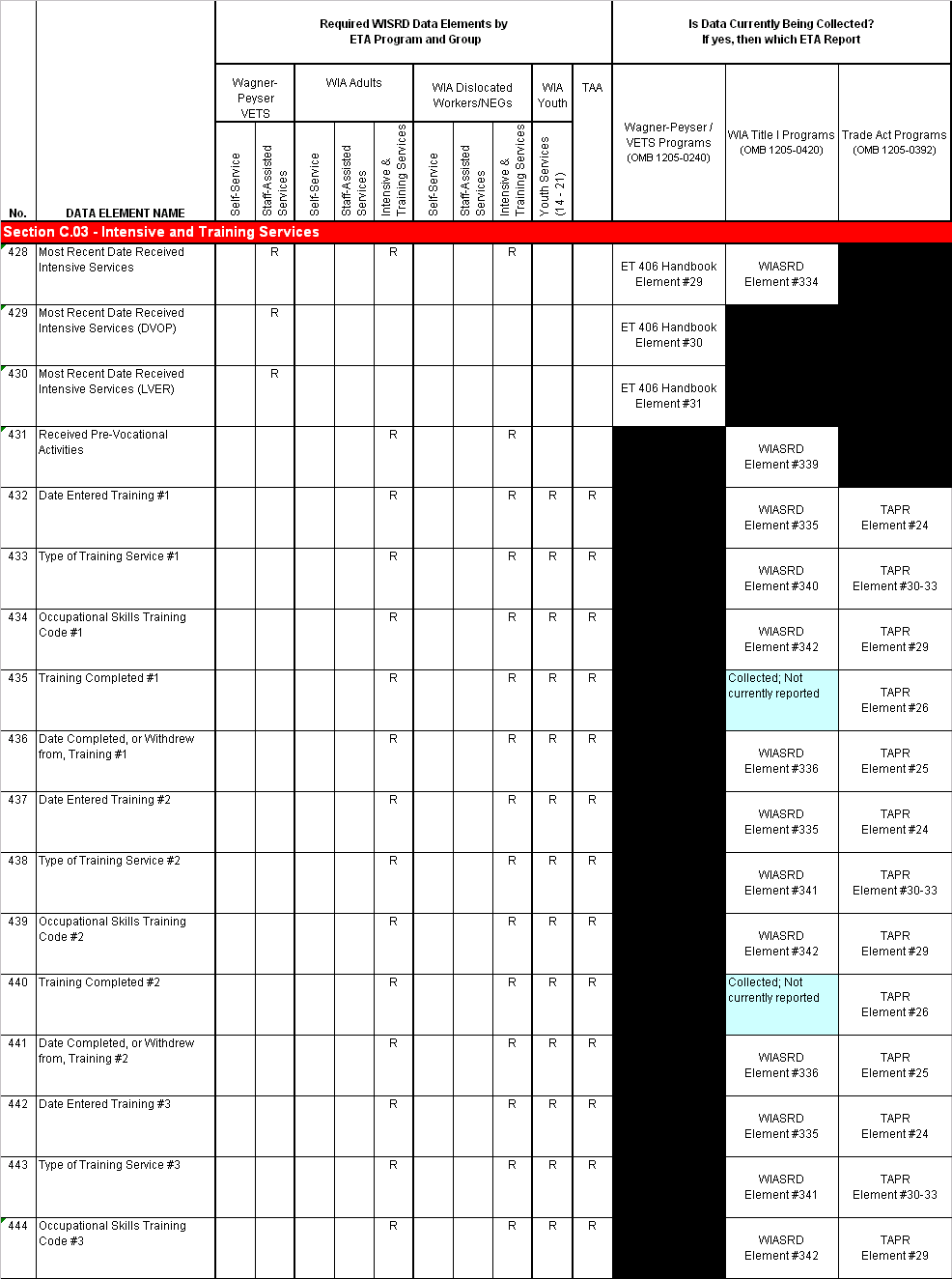

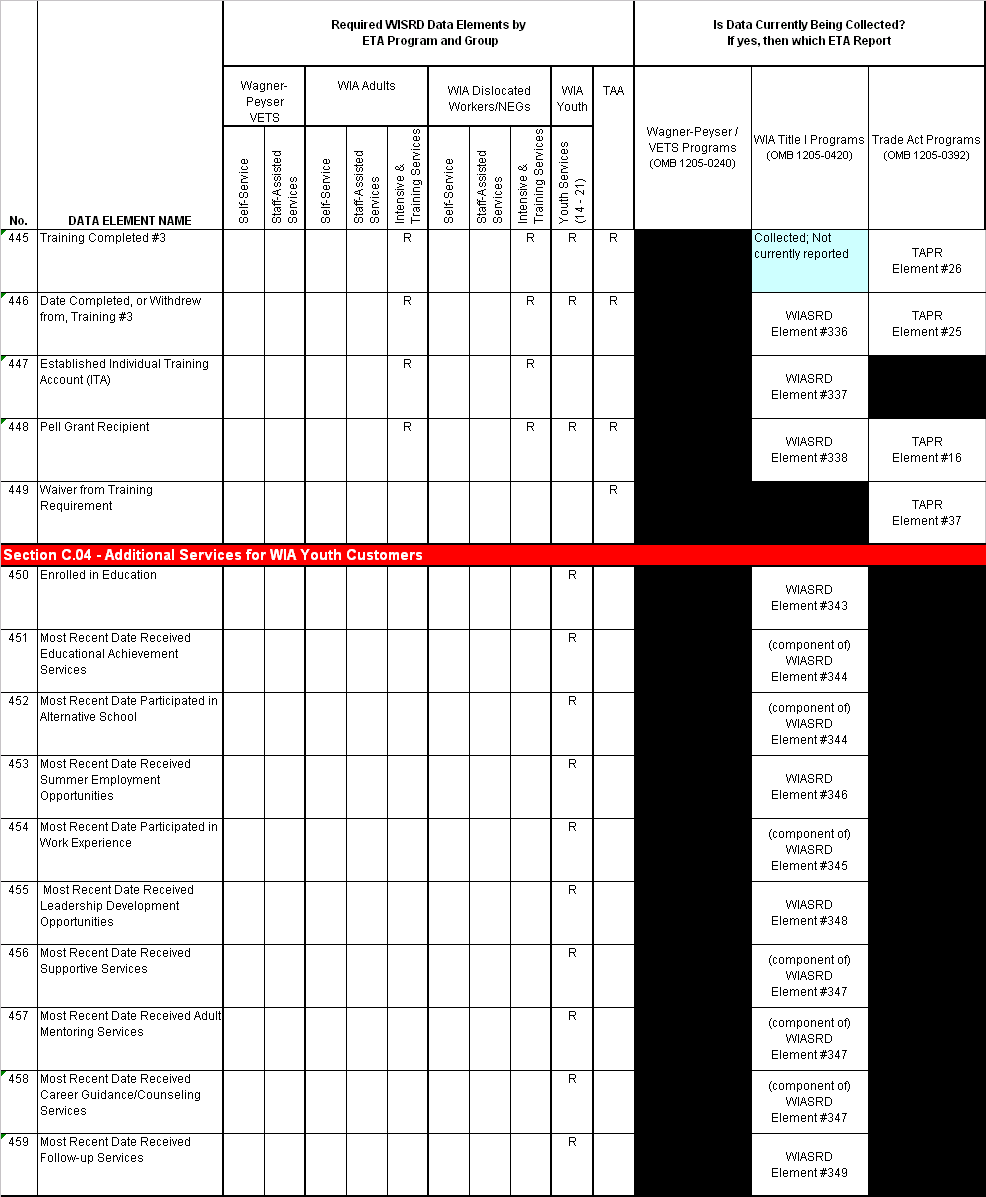

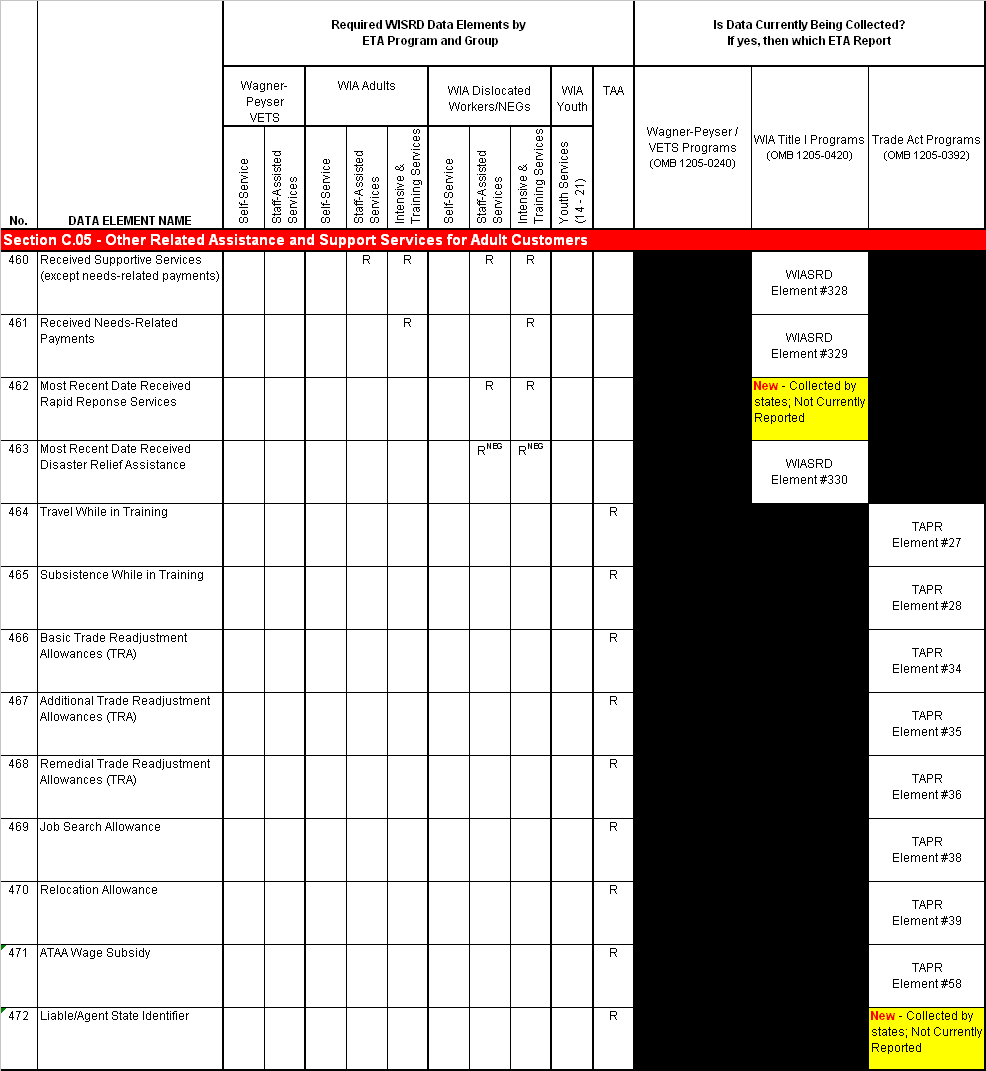

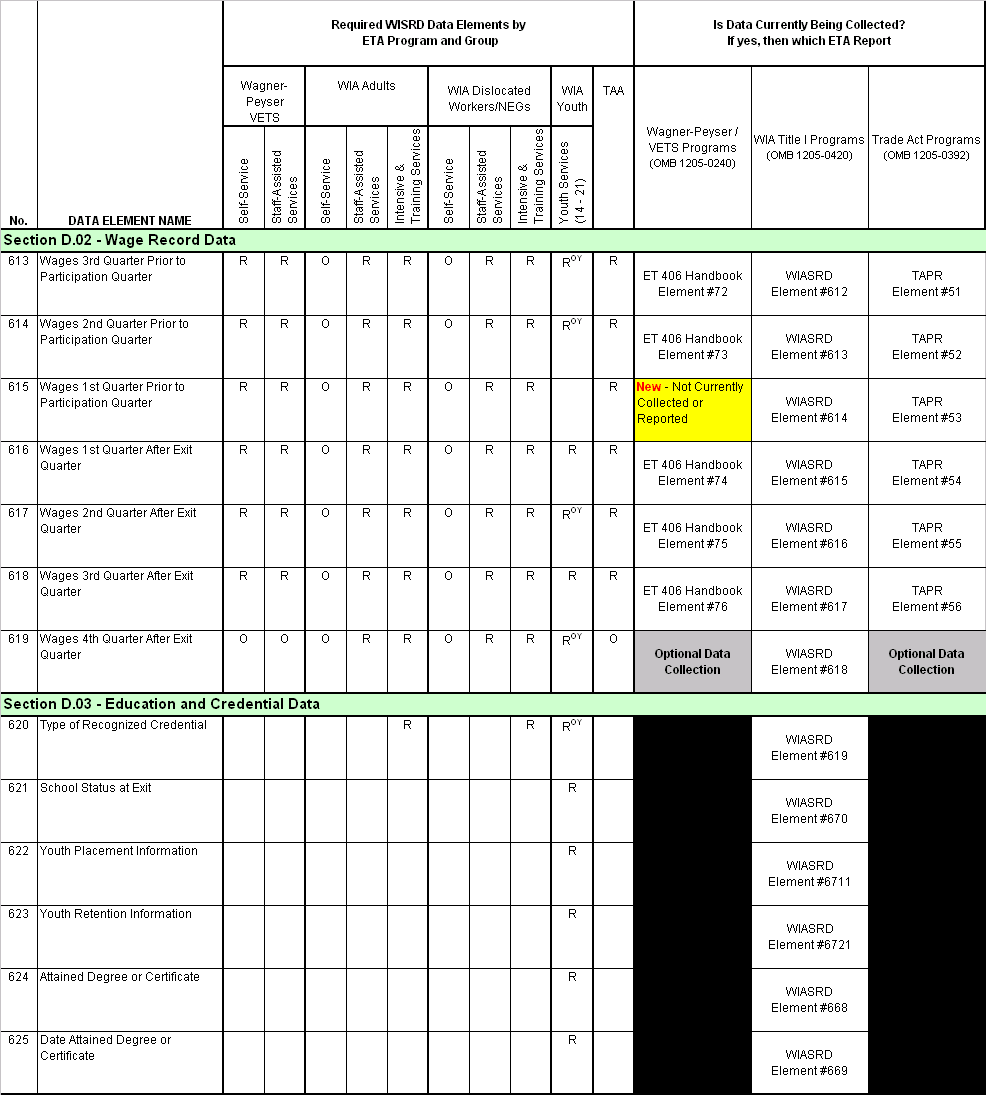

Second, with regard to concerns about the amount of data collection required for job seekers, the Department thoroughly reviewed each data element in the original EMILE proposal and then made appropriate reductions. In fact, the Department eliminated approximately 123 data elements that were originally proposed for collection by the state formula programs in the EMILE reporting system. Of equal importance, the Department made every effort to ensure that the information collection in the WISPR System was closely aligned with recent revisions approved by OMB in early 2006 for these programs. The Department performed an analysis of the proposed Workforce Investment Standardized Record Data (WISRD) in Attachment D of the WISPR System Handbook in relation to what is currently authorized for collection through OMB in each of these programs (see Appendix A). When compared to current OMB approved collections, the proposed WISRD specifications will require only 18 new data elements for the Wagner-Peyser/VETS programs, 6 new data elements for the WIA/NEG programs, and 14 new data elements for the TAA program. For the purpose of this analysis, new data elements mean information that is not currently collected by the state and not currently reported to the Department. It is important to note that standardizing the collection of co-enrollment data through the proposed WISRD (i.e., tracking whether the individual received services from partner programs) accounts for 11 of the 18 new data elements for the Wagner-Peyser/VETS programs and 12 of the 14 new data elements for the TAA program. For each of these co-enrollment fields, the Department has also provided instructions that if the states are unable to track these partner services, then each of these fields should be coded as “0” or left “blank.” The Department believes that these two major modifications, as reflected in the proposed WISPR System, address the public comments on this issue.

Issue: Six commenters were concerned about increased ongoing costs related to the collection of additional data on employers. Although most of the comments were general in nature, one state did comment specifically that “It appears that EMILE requires [the state] to distinguish when services to employers are provided by WIA Title IB funds and when Wagner-Peyser or VETS funds those services. As we have embarked down a path of seamless service to our business customers, separating out who provides these services to our customers for the sake of reporting would impose an unnecessary cost on our systems.”

Response: As noted earlier, the Department has modified the original EMILE reporting system proposal by replacing the requirement for states to submit quarterly individual records on employer served with a quarterly report of aggregate data (see ETA Form 9131). Similar to the data collection approach for program participants receiving self-service and informational activities, the Department has made every effort to establish a minimum level of employer data collection in order to meet the reporting requirements of ETA Form 9131. In fact, states are only required to collect the following information directly from the employer customer in order to generate the appropriate aggregate counts on the ETA Form 9131: Unique Identifier, Industry Type, Size of Employer Establishment, and Federal Contractor Status. All other information necessary to complete the ETA Form 9131 is either collected by One-Stop staff in their management information system during the course of providing a direct employer service or electronically when the employer utilizes a self-service system (e.g., posting a job order, self-service applicant referral).

With regard to concerns over determining the program funding source for the employer services, the Department is giving states the option of submitting a single integrated quarterly report on services to employers across programs or separate reports for each program. This option minimizes the reporting burden on those states that have more seamless service delivery systems. The one exception to this general rule, as outlined in the WISPR System Data Preparation and Reporting Handbook, is that all states are required to submit a separate ETA Form 9131 that reflects staff-assisted services provided by the Local Veterans Employment Representative (LVER) Program. Since states already have in place systems that collect service information at the staff level for veterans’ programs, such as the LVER Program, the Department does not believe that this additional aggregate report on LVER staff-assisted services is overly burdensome to the respondents.

Issue: Twelve commenters mentioned that requiring individuals to provide personal data in order to use the self-help resource rooms of the various service providers would be sufficient to drive many customers away. Six commenters were specifically concerned about increased ongoing costs related to the collection of additional data on self-service customers. Comments in this area noted that there is little data currently collected on self-service customers and that there are a great number of self-service customers, so the additional data items in EMILE for these customers can generate significant ongoing costs. The commenters generally pointed out that the extra costs would result in decreased services to customers. Several commenters thought that questions regarding disabilities and migrant and seasonal farm work background might be perceived as discriminatory and would either not be answered or would cause clients to be sufficiently uncomfortable as to avoid returning for help.

Response: The Department understands the concerns expressed by the commenters in this area, and agrees that only a very minimal amount of data should be collected from self-service customers. The Department has made every effort to address the public comments in this area, and minimized the reporting burden in the proposed WISPR System by establishing data collection requirements that are commensurate with the level of resources expended and services received for each program. A very limited number of items are required to be collected directly from customers using self-services and informational activities. More data collection items, however, are expected for those receiving intensive, training, and other needs-related services from the WIA and TAA programs. For individuals who participate in the WIA Youth Program, state data collection is based on the age in which the individual enters the WIA Youth Program.

As noted in Appendix D: Workforce Investment Standardized Record Data (WISRD) of the WISPR System Data Preparation and Reporting Handbook, the only data items that are required to be collected directly from self-service customers are the following: Unique Identifier, Equal Opportunity Information (Date of Birth, Gender, Disability Status, Ethnicity, and Racial Categories), and Employment Status. All other data elements that need to be collected directly from the customer are either listed as “optional” or not applicable in the proposed WISPR System. Information related to migrant and seasonal farm worker status is required for participants who receive more than self-services; not those who receive self-services only.

It is important to emphasize that equal opportunity information, including disability status, is required to be presented to and, where self-disclosed, collected from all individuals who disclose personally identifiable information (e.g., social security number, name, or address) in accordance with applicable Federal laws, regulations, and policy guidance. The employment status item is required because that information is needed in order to determine whether the participant should be included in the appropriate program performance measures (e.g., adult entered employment rate). The Department believes that the proposed data collection burden, as outlined in the WISPR System, strikes the appropriate balance between addressing Federal reporting and recordkeeping requirements while ensuring that self-service customers are not overly burdened by the data collection requirements.

Issue: A total of twenty-three commenters noted that there was a lack of financial resources at the state and local levels to fund transition costs. Some of these commenters inquired about the potential availability of funds from the Department to offset transition costs. For example, one state observed that “the costs of movement of multiple USDOL programs from legacy systems to standard reporting using common measures and EMILE should not be underestimated. States and local workforce investment areas will need financial support from USDOL beyond formula funds to make the required adjustments in a timely, efficient and effective way.”

Response: DOL acknowledges that some states may experience more costs than others depending on how far along they are in the transition to a more consolidated reporting system across those programs covered by the proposed WISPR System. It is important to note that many of the steps needed to move toward standardized data collection and reporting across programs, which is a key feature of the WISPR System, have already begun at the state and local levels based on recent OMB approved revisions to each program reporting system (see latest OMB notices of action on No. 1205-0420, dated 02/22/2006; No. 1205-0240, dated 02/15/2006); and No. 1205-0392, dated 01/22/2006). Although the funds allocated to the states for each of the programs include resources for developing and maintaining management information systems, the Department is committed to using existing resources for providing staff training and technical assistance to the states on the approved reporting specifications, and upgrading standardized reporting and validation software and instructional handbooks to support state implementation of the WISPR System.

The Department believes these transition activities will contribute to a more valuable and effective system in the future, that is more flexible to any changes in laws/regulations, reduces confusion caused by different systems for different programs, and facilitates partnership across funding streams, and will be cost-saving over time.

Issue: Three commenters stated that the proposed EMILE reporting system would require states and local areas to track customers for more time to obtain pre-program and post-program wage information and that these activities would generate costs on an ongoing basis that were not included in the burden estimate. One state commented “EMILE doubles the states’ collection of additional pre- and post-[program] wage data beyond what is necessary for reporting program performance….EMILE broadens collection to one year pre and one year post, but requires the pre- and post based on a “system-wide” timeframe rather than individual program timeframes. Our access to unemployment insurance wage records and WRIS, and our storage of wage data for reports will be significantly increased.”

Response: The Department understands the concerns expressed by the commenters, but does not agree that the proposed collection significantly increases respondent costs for data matching and storage. When compared to supplemental data collection, it is widely recognized that the costs for accessing and storing wage record data are very minimal, and the states have maintained infrastructures for years that retain such data in physically secure locations and process such data to meet Federal reporting and record keeping requirements. Although this ICR has been modified to eliminate the requirement for states to report wages in the 4th quarter prior to participation and provide states with the option of collecting pre- and post-program wages for WIA self-service customers, the Department believes that all other wage data are necessary for calculating the common measures as well as other statutorily-defined indicators of program performance, and providing management information for use in Federal program administration and oversight, including grant-specific participation, service, and outcome summaries.

3. Discuss how to enhance the quality, utility, and clarity of the information to be collected.

It is important to note that the Department received numerous public comments in this area related to the underlying policies and methodologies for implementing the common performance measures as outlined in Training and Employment Guidance Letter (TEGL) 15-03. Many respondents provided specific comments on how to improve the methodologies of the common performance measures, and expressed concerns regarding access to and timely use of state Unemployment Insurance (UI) wage records for accurately calculating the employment-based measures.

Although public comments based on official policies are largely outside the scope of the reporting and record keeping system, the Department took these comments seriously, consulted with states and grantees during calendar year 2005, and issued revised policy guidance on the common measures in February 2006 (TEGL 17-05). TEGL 17-05 rescinds and replaces all previous guidance letters with a single, unified policy document on the common measures and WIA section 136 performance accountability systems. The proposed WISPR System reflects the revisions in Departmental policies contained in TEGL 17-05, and a copy of the guidance letter can be obtained by going to http://www.doleta.gov/performance; then click on “TEGLs/TENs.”

Issue: Thirty-five respondents provided comments that some of the data element definitions specified in the proposed EMILE reporting system was either unclear or too narrow to produce information of any practical utility. The comments ranged from general observations that data elements definitions needed to be reviewed for clarity to very specific questions about one or more data elements to be collected.

Response: The Department reviewed each data element contained in the proposed WISPR System to ensure that all definitions, reporting instructions, and coding values are clear and consistent with existing statutory and regulatory authorities. In response to public comments on specific data elements originally proposed under the EMILE reporting system, the Department made the following revisions:

Employer Data Collection

Based on public comments received, the Department has eliminated the requirement for states to report individual records on services to employers. Instead, states will be required to submit ETA Form 9131, which is a quarterly report containing aggregate data on the number of employer establishments served and types of services provided. The Department has provided definitions and, where appropriate, specific examples of services that should be reported in each service category on the quarterly report (see section III.3 of the WISPR Data Preparation and Reporting Handbook).

Job Seeker Data Collection

Homeless or Runaway Youth: The Department merged these two elements, as originally proposed, into a single data element that is currently being implemented by the states;

TANF Recipient/SSDI/Other Public Assistance Data: The Department has more precisely defined the collection of these elements to include receipt of cash assistance or other support services from the appropriate source of public assistance in the “last six months prior to participation in the program”. The Department has also merged the “Supplemental Security Income (SSI-SSA Title XVI) and Social Security Disability Insurance (SSDI)” fields into a single data element and normalized the set of coding values for the states to implement;

Category of Disability: The Department has added a data element (#109) to collect information on the type of impairment an individual has, whether the impairment is primarily physical, mental, or both. This element will be asked only of those individuals who affirmatively identified themselves as having a disability for item #108;

Tenure with Employer at Separation: The Department has modified this collection item to include up to 3-digits (000) instead of 2-digits as originally proposed;

Occupational Code: The Department is standardizing the reporting of all occupational codes to align with the O*NET Classification System. States may use crosswalk tables published at http://online.onetcenter.org/ in cases where the case management system is collecting codes based on a different classification system. However, the Department expects all states to convert to the O*NET Classification System in preparation for implementing this ICR;

Established ITA: The Department is maintaining the “Yes/No” coding values for this data collection item. Although states and local areas have flexibility to define additional codes for program management purposes, the state must have procedures in place to crosswalk or “map” to the OMB approved coding values;

Offender: The Department will not be expanding the collection of this element to all individuals receiving staff-assisted core services from the Wagner-Peyser and WIA Title IB programs in order to minimize the collection burden on One-Stop customers. One commenter also noted that the definition should be limited to only those who have been convicted of a felony. Since the definition for this element is defined by the Federal Workforce Investment Act of 1998 at section 101 (27), the Department will not be altering the definition based on this comment;

School Status At Participation: The Department has modified coding value #4 to be “Not Attending School or School Dropout” in order to accommodate persons who may have dropped out in the 6th grade and never even attended high school;

Waiver from Training Requirement: The Department has added coding value “7 = Reason Unknown/Served Prior to 2002 Amendments” and instructed states to record “0” if the individual did not receive a training waiver or the data element does not apply to the participant;

Ethnicity/Race Data: The Department has modified the collection of this information to eliminate the “Other Race” and “Information Not Voluntarily Reported” elements. States are instructed to record a “0” or leave “blank” those fields that the individual decides to not self-disclosure. The Department has also provided appropriate guidance on the collection of ethnicity/race information to include a specific reference that “individuals must be offered the option of selecting one or more racial designations” (see section V.4 of the WISPR Data Preparation and Reporting Handbook);

Trade Readjustment Assistance (TRA) Payments: The Department has modified the collection of this information to include only 3 “Yes/No” elements to indicate whether the individual received “Basic” and/or “Additional” and/or “Remedial” TRA. In order to reduce respondent burden, this modification resulted in the elimination of 6 fields that proposed to also collect the “Total Weeks Paid” and “Total Amount Paid” in each TRA category;

Date of Military Separation: The Department has clarified that this data collection item can be left "blank" if it does not apply to the participant or the date of military separation has not yet occurred;

Occupational Code of Employment: The Department has clarified the instructions of this element to be reported, where available, and that this information can be based on any job held after exit. In addition, the element applies only to adults, dislocated workers and older youth who entered employment in the quarter after the exit quarter. If all 8 digits of the occupational skills code are not collected, record as many digits as are available. States are also instructed that to use the occupational code for the most recent job held in situations where the individual had multiple jobs;

Reason for Exit: The Department has streamlined the coding values for this element and clarified that, with the exception of coding value “98=retirement,” this field is used to indicate whether the participant exited the program for a reason that would exclude him/her from performance measurement calculations. States have the flexibility to define additional codes beyond the ones approved by OMB, but use of those codes will not exclude the participant from the measure calculations;

UC Eligible Status/WPRS: The Department merged these two elements, as originally proposed, into a single data element that is currently being implemented by the states;

Residence Codes (state, county, zip): The Department has clarified the appropriate reporting instructions for these fields to indicate that states may record “0” or leave “blank” the permanent residence code fields in situations where they are not known (e.g., self-service customers, homeless individuals, runaway youth);

Number of School Years Completed/Highest Degree Achieved: The Department merged these two elements, as originally proposed, into a single data element that is currently being implemented by the states;

Most Recent Date of Qualifying Separation or Dislocation: The Department has split this single element into two data collection items based on public comments that they may be two distinct dates in the customer’s work experience and, therefore, should be collected and stored separately; and

Literacy and Numeracy (ABE/ESL): The Department has merged these two separate sections of data collection in the original proposal into a single consolidated set of data elements. This resulted in the elimination of 42 unique data elements in this section of the proposal. The Department has also aligned the types of ABE/ESL assessment tests and functional areas with recent changes announced by the U.S. Department of Education. For more information on changes to ESL descriptors for PY2006, please go to the National Reporting System website at http://www.nrsweb.org/.

There were also a number of data elements that applied to state administered programs (WIA, Wagner-Peyser/VETS, TAA) where the Department received both general and specific public comments related to clarifying definitions or reporting instructions, questioning the practical utility of the information to be collected, or the increased burden to implement the proposed data element(s) at the local level. In response to these comments, the following data elements, as originally proposed under EMILE, have been thoroughly reviewed by the Department and are being proposed for elimination through the revised WISPR System (beyond the data elements that have already been modified or eliminated as noted above):

SECTION A: INDIVIDUAL INFORMATION

Date Record Created, Individual Education Plan, Chronic Unemployment or Underemployment, Dependent of Eligible Farmworker, Total Number of Individuals in Family, Substance Abuse (youth only), Lacks Transportation (youth only), and In Military Service at Participation

SECTION B: ONE-STOP PARTICIPATION DATA

Program Source (DVOP/LVER), NEG Project ID Participation Date, Second NEG Participation Date, Third NEG Participation Date, Third NEG Project ID, Incumbent Worker 15% Statewide Activities Participation Date, Other 15% Statewide Activities Participation Date, ETA-Assigned WIA Title IB Code #2, Trade Adjustment Assistance (TAA) Application Date, TAA Program Type, ATAA Program Participation Date, H-1B Participation Date, and Participation Status

It is also important to note that all required co-enrollment fields in this section have been revised to collect a “Yes/No” or “Yes/0 or blank,” rather than the exact date of first service, to minimize the reporting burden on respondents. The Department made slight modifications to the optional co-enrollment fields, but those do not factor into the overall burden calculations.

SECTION C: ONE-STOP SERVICES AND ACTIVITIES

Section C.01: Most Recent Date Utilized Career Resource Room, Most Recent Date Received Orientation to One-Stop Services, and Most Recent Date Received Job Search Services

Section C.02: Most Recent Date Received Assessment Services, Most Recent Date Received Assessment Services (DVOP), Most Recent Date Received Assessment Services (LVER), Most Recent Date Referred to Support Services, Most Recent Date Referred to Support Services (DVOP), Most Recent Date Referred to Support Services (LVER), Most Recent Job Development Contact, and Interstate

Section C.03: Most Recent Date Received Case Management Services, Most Recent Date Received Case Management Services (DVOP), Most Recent Date Received Case Management Services (LVER), Most Recent Date Placed in FCJL Job, Most Recent Date Placed in FCJL Job (DVOP), and Most Recent Date Placed in FCJL Job (LVER)

Section C.04: Date Individual Service Plan Created, Most Recent Date Received Comprehensive and Specialized Assessment, Most Recent Date Received Counseling and Career Planning Services, Most Recent Date Participated in Adult Education, Basic Skills, and/or Literacy Activities, and Most Recent Date Participated in Work Experience (paid or unpaid)

Section C.05, C.06, and C.07: In order to reduce respondent burden, the Department has restructured the data collection in section C.05 by collecting only three sequences of training services, as opposed to the five sequences originally proposed, and eliminated follow-up requirements on each training service to capture attainment of degrees, diplomas, or certificates. This modification has reduced the amount of data collection in this section by approximately 22 data elements. Under sections C.06 and C.07, the “Date Individual Service Strategy (ISS) Created” and “Received Training Waiver” fields have been eliminated, respectively.

SECTION D: PROGRAM OUTCOMES INFORMATION

Date Entered Employment, Self-Employed, Industry Code of Employment 1st Quarter After Exit, Method Used to Determine Training-Related Employment, Date Found Employed 2nd Quarter, Date Found Employed 3rd Quarter, Date Employed 4th Quarter, Wages 4th Quarter Prior to Participation Quarter, Attained Diploma, GED, or Certificate #2, and Date Attained Degree or Certificate #2

Issue: Sixteen respondents commented that there will be data quality problems associated with reporting records with missing or invalid identification numbers. Voluntary reporting of SSN’s and Federal FEIN’s at the grantee level will result in service reporting errors for both job seeker and employer customers, respectively. Without a valid and unique identification number, it will be difficult to compile individual service information from multiple programs into a single consolidated record as originally proposed under the EMILE reporting system. Similar problems exist for employers who do not know or wish to disclose their FEIN’s as a condition of posting a job order or receiving other employer services. Because employers may change FEIN’s as a result of mergers, there must be a method identified to accommodate the transition of FEIN’s for reporting purposes and data accuracy. These respondents also advocated for greater flexibility in reporting services to employer establishments with the same FEIN and who are located in the same geographical location.

Response: The Department agrees with the concerns expressed by a majority of the respondents that the confidentiality and safeguarding of personally-identifiable client information is of paramount importance and must be observed at all times to the extent permitted by applicable state or federal laws. Further, the Department wants to re-emphasize that the proposed WISPR System is not requesting OMB clearance on the disclosure of individual SSN’s and FEIN’s at the Federal level.

For program participants, the Department notes that the states must make every effort to collect an accurate SSN as this is essential for matching client records to wage record databases maintained by the states and other Federal agencies in support of implementing the common performance measures and other reporting requirements approved by OMB. States have maintained such data collection and matching procedures for a number of years and, as outlined in section 7.A of TEGL 17-05, “to the extent it is consistent with state law, Unemployment Insurance (UI) wage records will be the primary data source for tracking the adult entered employment, retention, and earnings measures and the employment portion of the youth placement in employment or education measure.” TEGL 17-05 further specifies that states can exclude from the outcome measures those records where the state has determined that an individual disclosed an invalid or missing SSN. This policy was designed to improve the quality of outcomes being reported to the Department and hold states harmless for disclosures of invalid SSN’s by their clients. We believe this policy substantially addresses the concerns raised by the commenters.

It is also important to note that when records are prepared for submission to the Department on individuals who exit the program(s), the very first field in each WISRD file must be an individual identifier, created by the state, to conceal the actual identity of the person whose data are being reported to the Department. The states are responsible for ensuring that appropriate edits are applied to the SSN’s being collected and that unique individual identifiers are created in such a way that the state can identify that same individual in every period of participation and in every local area and statewide program.

For employer customers, the Department is proposing to eliminate the requirement for states to submit individual employer records that contain FEIN’s. Instead, states will have the flexibility to create identifiers for each unique employer establishment that receives services from the program(s). These unique employer establishment records will be used to generate aggregate quarterly performance data on the ETA Form 9131. The Department believes that the revised proposal to require a quarterly report of aggregate data on services to employers substantially addresses the public comments in this area. The proposed revision provides greater flexibility to the states in terms of creating and managing unique identifiers for employers, particularly where employer establishments have the same FEIN and/or are located in the same geographical location, and facilitates more accurate reporting on the actual number of employers served and types of services provided.

Issue: Sixteen respondents noted the requirement that all job seeker and employer information be submitted through a single consolidated record will present significant data integrity problems. In some cases, the workforce programs covered by the proposed reporting system are managed by multiple state agencies where the data reside in separate physical locations, making the implementation of a single consolidated record exceedingly difficult and burdensome. Many of the respondents also noted that there would be no way of attributing the job seeker or employer services provided to a specific workforce program.

Response: The Department appreciates the concerns expressed by the commenters on this issue and finds the arguments compelling enough to make a revision to the original reporting requirement. The Department agrees that some, but not all, states would have difficulty in consolidating performance information across programs, particularly in situations where the data covered by the proposed reporting system reside in separate state agencies. On the other hand, the Department is strongly committed to improving the integration of services at the local level and removing barriers to cooperation among programs by implementing a set of common performance measures and achieving greater standardization in the collection and reporting of customer data from the states to the Federal level. More importantly, the Department wants to recognize those states that have maintained integrated case management systems for years to support customer relations management across programs, and provide them with the opportunity to streamline and simplify the submission of performance information to the Department.

The Department believes that the proposed WISPR System strikes an appropriate balance on this issue. Section II.4 of the WISPR Data Preparation and Reporting Handbook provides information on the submission procedures for each of the approved reports and records. On the ETA Form 9131 and 9132, the states will be provided with two options during the first two years of WISPR System implementation for submitting quarterly reports; either a single consolidated report across programs or separate reports for each program funding source depending on how the state administers the workforce programs covered by the report. The Department will be prepared to accept a variety of report submissions based on the unique administrative configurations of the states.

In a few instances, the states will be provided with only one submission option. For example, the ETA 9131 Form requires all states to submit a quarterly report that reflects services provided to employers by staff funded through the Local Veterans Employment Representative (LVER) Program. On the ETA 9133 Form, all states are required to submit two quarterly reports on services to eligible veterans and transitioning service members. The detail on these two quarterly reports are needed to comply with reporting requirements outlined in the Jobs for Veterans Act (P.L. 107-288 (38 U.S.C. 4215(a))). We believe this approach to reporting provides the maximum amount of flexibility to the states while addressing the Department’s goals to facilitate better integration of services at the local level and reduce state reporting burden by streamlining and simplifying the submission of quarterly reports and records across programs.

In response to concerns that the proposed reporting system will not be able to attribute services to a specific workforce program, the Department would like to point out that the current program reporting and recordkeeping systems cannot attribute services provided to an exact funding source. For example, the WIA reporting system includes participant-level information on individuals who receive training services while participating in one or more WIA Title IB programs. The current Workforce Investment Act Standardized Record Data (WIASRD) file does not attribute the funding of the training services, whether wholly or in part, to one or more specific program funding sources. In fact, the individual may have received a Pell Grant to support the receipt of training services while participating in a WIA Title IB program, rather than formula WIA Adult and/or Dislocated Worker funds.

The Department believes it is too difficult to design a reporting system that tracks all customer services by program funding source without imposing a significant burden on the states to implement. In the case of services provided by Disabled Veterans Outreach Program (DVOP) or LVER staff, the Department is proposing to track whether receipt of a particular staff-assisted core service (e.g., referral to employment, referral to federal training) or intensive service (e.g., comprehensive assessment, individual employment plan) was provided by a DVOP and/or LVER funded staff person. However, this detail is necessary to comply with reporting requirements outlined in the Jobs for Veterans Act (P.L. 107-288 (38 U.S.C. 4215(a))).

Issue: A majority of respondents in this area commented that the implementation of the proposed reporting system will be a large and difficult undertaking of revising both data collection systems and operational processes for the programs at the local level. For the data to be valid and meaningful, these respondents noted that significant “lead time” or a transition period be outlined by the Department so that states and grantees can make adequate adjustments in their information systems and provide appropriate training to local staff on the reporting changes.

Response: The Department agrees with the commenters that implementation of a more comprehensive and streamlined reporting system across programs will require time and resources in order to effectuate a successful transition to the proposed WISPR System. In fact, the Department acknowledged the importance of a transition period in its initial Federal Register (July 2004) on the proposed EMILE reporting system stating that “the Department will work closely with the grantees to establish a transition plan for each program, to phase out prior reporting requirements to be replaced by EMILE once these new reporting requirements have been approved by OMB.” The Department remains committed to a transition period for the states to implement the proposed reporting system.

Following approval from OMB, the Department expects to begin implementation of the WISPR System during PY 2007, providing the states with a one-year transition period to the new reporting requirements. In order to address more significant concerns expressed by the commenters regarding the “lead time” needed to submit consolidated information across programs, the Department is providing the states with two options for submitting quarterly performance reports under the WISPR System. For those states that are ready, the Department will be prepared to accept the submission of consolidated performance reports and records immediately in PY 2007. For states that need more time, the Department will allow those respondents to submit separate performance reports and records for each program in the first two years of implementation of the approved WISPR System (PY 2007 and PY 2008). However, the Department expects all states to begin submitting consolidated quarterly performance reports and records in the third year (PY 2009) of WISPR System implementation.

Issue: A few respondents asked for clarification regarding whether individuals who receive rapid response services are included in the proposed reporting system.

Response: Currently, states are required to report performance information for only those WIA participants who receive rapid response services funded under WIA section 134(a)(2)(A)(ii). This section of the statute refers only to “additional assistance” to local areas that experience disasters, mass layoffs or plant closings, or other events that precipitate substantial increases in the number of unemployed individuals. The current reporting requirement has resulted in an undercount of the total number of individuals who receive rapid response services provided by the state. Therefore, the Department has modified the proposed ICR package to clearly indicate that individuals who receive services financially assisted by WIA section 134(a)(1)(A) are to be included in the reporting and recordkeeping requirements.

4. Suggest how to minimize the burden of the collection of information on those who are to respond, including through the use of appropriate automated, electronic, mechanical, or other technological collection.

Issue: The Department received both general and specific comments from nearly all respondents regarding the anticipated burden and cost to collect data on job seekers and employers under the proposed EMILE reporting system. In particular, many respondents suggested that the Department eliminate those data elements that are outside the scope of meeting existing statutory and regulatory reporting requirements, and that the reporting burden for reporting services to employers would be significantly reduced by allowing respondents to submit a quarterly or annual report containing aggregate data.

Response: As noted earlier, the Department has thoroughly reviewed each data element originally proposed under the EMILE reporting system and is recommending that more than 123 elements for job seeker customers be eliminated from the original EMILE reporting system. To further reduce respondent burden, the Department is proposing to replace the requirement for states to submit individual records on active participants each quarter with two standardized quarterly report formats (ETA Forms 9132 and 9133) that contain aggregate data on active participants, eligible veterans, and transitioning service members. And finally, the Department is proposing to replace the requirement for states to report individual records on services to employers with a quarterly report (ETA Form 9131) of aggregate data on the number of employer establishments served and types of services provided.

With these substantial revisions in mind, the Department is continuing to seek OMB approval on the collection of information that states are already reporting and is necessary to comply with Equal Opportunity requirements, hold states and grantees appropriately accountable for the Federal funds they receive, allow the Department and Congress to fulfill its oversight and management responsibilities, and communicate the impact of the workforce system to the Administration, Congress, and the general public. When compared to the original EMILE reporting system proposal, the WISPR System is more closely aligned with information that is already approved by OMB and being collected by the states in order to satisfy reporting requirements to DOL as well as to run their day-to-day operations of the programs. The Department has substantially addressed the public comments in this area, and believes the WISPR System proposal is much less burdensome to the states and less intrusive on the delivery of customer services than the original EMILE reporting system proposal.

Issue: One commenter suggested that with the availability of terabyte database services, the agency should use clustered servers in one location for all data. The agency should define a file structure, similar to the current OMB approved WIASRD layout, and utilize a web-based application to facilitate easier uploading of the data. Several commenters noted that the use of an automated, electronic process for transmitting all quarterly reports and records to the agency would be preferable.

Response: The Department agrees with the commenters and, as noted in the supporting statement for this ICR, the Department will continue to utilize a web-based submission process for all state reports and records. This report submission process, formally called the Enterprise Business Support System (EBSS), has been in place for several years and will be upgraded to meet the state submission requirements under the WISPR System. In its Federal Register notice (July 2004) on the proposed EMILE reporting system, the Department acknowledged the importance of maintaining this electronic submission capability by “enhancing its current electronic reporting system and technology infrastructure to accommodate the new reporting specifications.”

EBSS enhancements will be designed to support all OMB approved specifications, manual as well as electronic file upload capabilities for all quarterly reports and records, customized submission process based on a reporting profile chosen by the state (i.e., submitting integrated reports across programs vs. reports for each program in the first two years), and data download capabilities for states and internal Departmental staff. EBSS uses Secure Socket Layer (SSL) technology that allows the application to remain secure in a web-based environment. Although individual SSNs are not being submitted as part of this ICR, any data exports to states or other internal staff analysts will be implemented via SSL or using another industry-accepted encryption technology.

Issue: Several commenters suggested that the agency provide the necessary technical support for the proposed reporting requirements, including validation software that is capable of generating all quarterly reports and records that can be electronically uploaded to the agency’s on-line reporting system.

Response: The Department agrees with the commenters that the burden and cost of reporting performance information under the proposed WISPR System would be greatly reduced if a standardized reporting and validation software package were developed to support the OMB approved reporting requirements. In fact, the Department acknowledged the importance of such technical support in its initial Federal Register (July 2004) on the proposed EMILE reporting system stating that “to reduce start-up costs related to implementing EMILE, the Department is planning to update standardized reporting and validation software and instructional handbooks, which may be used by the grantees in calculating and electronically submitting the quarterly summary performance report and individual records.” The Department remains committed to this form of technical support for the states to implement the proposed reporting system. Following OMB approval of the WISPR System, the Department will begin modifying the separate existing program reporting and validation software packages for WIA, Wagner-Peyser/VETS, and TAA programs into a single integrated package for the states. All instructional handbooks and user guides associated with the software will be updated, and state level training on the modified software will be delivered to end users.

Issue: Several commenters suggested that the reporting of job seeker and employer customer satisfaction surveys be eliminated from the proposed reporting system. These commenters noted that the three required questions on the American Customer Satisfaction Index (ACSI) survey form provide little useful data gauge program performance at the state level. In addition, the cost and administrative burden of conducting the surveys is significant.

Response: The Department agrees with the commenters and has removed the requirement for states to report job seeker and employer customer satisfaction data on a quarterly basis. OMB approved the elimination of this quarterly information when the Department revised the WIA (OMB No. 1205-0420) and Wagner-Peyser Act/VETS (OMB No. 1205-0240) reporting systems during 2005 to incorporate data collection for the common measures. However, the Department must point out that the reporting of customer satisfaction information is a statutory requirement of the WIA section 136. Therefore, unless states have an approved WIA waiver from the Department to not report on customer satisfaction, the state must continue to follow all OMB approved guidelines for collecting and reporting job seeker and employer customer satisfaction results on the WIA Annual Report.

5. Practical Utility of Collecting Nine Categories of Disabilities

Issue: Comments from thirty-four respondents were received relating to the collection of additional information on the types of disability of people being served in the One-Stop. The Department received comments from approximately twenty-three state workforce agencies, nine non-profit and advocacy-related organizations, and three national associations. Nearly all state workforce agencies offered substantive comments against the collection of the recommended disability categories. While there are several organizations that offered support for the collection on types of disability data, this support was often conditional and followed by suggestions in regards to how the data should be collected and stored, and that intensive staff development and guidance would be needed at the local level to effectively implement the new information collection.

Public Comments in Favor of Collecting Types of Disability: Four respondents provided comments supporting the collection of additional information on persons with disabilities. These respondents noted that the collection of this information is critical to focusing more attention on the program’s responsibility to serve people with disabilities and essential to evaluating the program’s effectiveness in this area. Two respondents urged the Department to collect this information, but that clear and concise definitions are established to ensure that the information has practical utility. As a practical suggestion, one respondent suggested that the list of disability categories be consistent with the data collected by the Rehabilitation Services Administration (RSA) Form 911, asserting that consistency would facilitate data comparisons between the two programs and that the RSA listing is “easier for individuals to understand and complete due to its long-term development and use.” One other respondent suggested that a “data module” be added to the proposed reporting system to collect information on the provision of specialized services which are used by people with disabilities, including: vocational rehabilitation services, extended employment supports, customized employment services and assistive technology.

Public Comments Against Collecting Types of Disability: Fifteen respondents commented that if the data on type of disability was a voluntary data element, that the data collected would lack validity and reliability. The consensus among these commentators was that there would be an undercount of both the total number of individuals with disabilities and the number in each of the categories of disability collected. Several reasons were identified for inaccurate and undercounting of disabilities among those served. First, some individuals may not know they have a particular disability or if they do, may not view it as a disability affecting their ability to work. For example, as one commenter observed: “Perception of ‘having a disability’ tends to be only partially an objective defined fact and often a function of perceptions as well as cultural norms, especially when it comes to non-apparent disability labels (such as mental illness, learning disabilities, substance abuse, etc.)”. Second, some participants may not wish to disclose that they have a disability and the type of disability because (1) they fear discrimination (e.g., in terms of service delivery or within the job market), (2) it is overly intrusive or an invasion of privacy, or (3) they feel that it is irrelevant to the services they need.