C4C Rule Draft

C4CRuleDraft072109OMB.doc

Survey of Consumer Response to CARS Initiative

C4C Rule Draft

OMB: 2127-0659

DRAFT

DEPARTMENT OF TRANSPORTATION

National Highway Traffic Safety Administration

49 CFR Parts 512 and 599

[ Docket No. NHTSA-2009-0120 ]

RIN 2127-AK53

Requirements and Procedures for Consumer Assistance to Recycle and Save Program

AGENCY: National Highway Traffic Safety Administration (NHTSA), Department of Transportation (DOT)

ACTION: Final rule

SUMMARY: This final rule sets forth requirements and procedures for the voluntary vehicle trade-in and purchase/lease program under the Consumer Assistance to Recycle and Save Act of 2009. This program helps consumers pay for a new, more fuel efficient car or truck from a participating dealer when they trade in a less fuel efficient car or truck. The rule establishes a process by which dealers can register in order to participate in the program and establishes the criteria this agency will use to determine which disposal facilities to list as eligible to receive and either crush or shred the trade-in vehicles. It also sets forth the criteria that trade-in vehicles and new vehicles must meet in order for purchases and leases to qualify for assistance under this program and establishes the requirements that must be met by consumers, dealers, disposal facilities and others. Finally, the rule sets forth enforcement procedures and provisions for punishing fraud and other violations of the program requirements.

DATES: This final rule is effective [Insert the date of publication in the FEDERAL REGISTER.] Petitions: If you wish to petition for reconsideration of this rule, your petition must be received by [Insert the date 45 days after date of publication of this document in the Federal Register.]

ADDRESSES: If you submit a petition for reconsideration of this rule, you should refer in your petition to the docket number of this document and submit your petition to: Administrator, National Highway Traffic Safety Administration, 1200 New Jersey Avenue, S.E., West Building, Washington, DC 20590.

The petition will be placed in the public docket. Anyone is able to search the electronic form of all documents received into any of our dockets by the name of the individual submitting the document (or signing the document, if submitted on behalf of an association, business, labor union, etc.). You may review the complete User Notice and Privacy Notice for Regulations.gov at http://www.regulations.gov/search/footer/privacyanduse.jsp.

FOR FURTHER INFORMATION CONTACT: You may contact the CARS Hotline at (866)-CAR-7891. For non-legal issues, you may call, Frank Borris, NHTSA Office of Enforcement, telephone 202-366-8089. For legal issues, you may call David Bonelli, NHTSA Office of Chief Counsel, telephone 202-366-5834. You may send mail to these officials at the National Highway Traffic Safety Administration, 1200 New Jersey Avenue, SE, West Building, Washington, DC 20590.

SUPPLEMENTARY INFORMATION:

Table of Contents

I. Background

II. Questions and Comments from the Public about the CARS Program

III. Public Outreach and Consultation

IV. The Regulation

a. Definitions (§ 599.102)

b. Registration of Dealers (§ 599.200)

c. Identification of Disposal Facilities (§ 599.201)

d. Determining Eligibility of Trade-In Vehicles and New Vehicles (§ 599.300)

1. Vehicle Definitions

2. Eligibility of Trade-in Vehicles

3. Eligibility of New Vehicles

e. Requirements for Qualifying Transactions (§§ 599.300 and 301)

1. Vehicle Categories and Credit Amounts

2. Special Requirements for Trade-in Vehicles

3. Restrictions and Limitations on Transactions

f. Requirements for Dealer Reimbursement (§ 599.302-304)

g. Disposal of Trade-In Vehicles (§ 599.400-403)

h. Enforcement (§ 599.500-517)

1. Prevention of Fraud

2. Civil Penalties and Other Sanctions

V. Confidential Information and Privacy

a. Determinations of the Confidentiality of CARS Data Based on FOIA Exemptions 4, 6 and the Privacy Act

b. Approach -- Class Determinations vs. Individual Assessments

c. Class Determinations Based on FOIA Exemption 4

d. Data Submitted to NHTSA for the CARS Program

1. Manufacturer Data

2. Dealer Information and Transaction Data

3. Disposal Facility and Destruction Data

e. CARS Data Class Determinations Based on FOIA Exemption 4

1. Manufacturer Assigned Dealer Identification

2. Dealer Bank Name, ABA Routing Number, Bank Account Number

3. CARS Dealer ID and CARS Authorization Codes

f. Class Determination Based on FOIA Exemption 6

VI. Costs and Benefits

VII. Statutory Basis for This Action

VIII. Effective Date

IX. Regulatory Analyses and Notices

I. Background

On June 24, 2009, the President signed into law the Consumer Assistance to Recycle and Save Act of 2009 (the CARS Act or the Act) (Pub. L. No. 111-32). The Act establishes, within the National Highway Traffic Safety Administration (NHTSA or the agency), a temporary program under which an owner of a motor vehicle meeting statutorily specified criteria may trade in the vehicle and receive a monetary credit from the dealer toward the purchase or lease of a new motor vehicle meeting statutorily specified criteria.

Generally, the trade-in vehicle must have a combined fuel economy, as determined by the Environmental Protection Agency (EPA), below a specified value and the new vehicle must have an EPA combined fuel economy above a higher specified value. (Combined fuel economy is an EPA calculation representing the weighted average of a vehicle’s city and highway fuel economy as determined according to the method described in EPA regulations at 40 CFR 600.210-08(c).) The program covers qualifying transactions that occur between July 1, 2009 and November 1, 2009, so long as funds appropriated by Congress are not exhausted. If all of the conditions of eligibility are met and the dealer provides NHTSA with sufficient documentation relating to the transaction, NHTSA will make an electronic payment to the dealer equal to the amount of the credit extended by the dealer to the consumer, not exceeding the statutorily authorized amount. The dealer must agree to transfer the trade-in vehicle to a disposal facility that will crush or shred it so that it will never be returned to the road, although parts of the vehicle, other than the engine block and drive train (unless the drive train is sold in separate parts), may be sold prior to disposal.

The CARS Act requires the Secretary of Transportation, acting through NHTSA, to issue final regulations within 30 days after enactment (i.e., by July 24, 2009), “notwithstanding” the notice and comment requirements of the Administrative Procedure Act (5 U.S.C. §553). The regulations must, among other things: (1) provide for a means of registering dealers for participation in the program; (2) establish procedures for reimbursement of dealers participating in the program; (3) require that dealers use the credit in addition to any other rebate or discount advertised by the dealer or offered by the manufacturer and prohibit the dealer from using the credit to offset any such other rebate or discount; (4) require that dealers disclose to the person trading in an eligible vehicle the best estimate of the scrappage value of such vehicle and permit dealers to retain $50 of the amount paid for the scrappage value as payment for any administrative costs of participation in the program; (5) establish requirements and procedures for the disposal of eligible trade-in vehicles; and (6) provide for the enforcement of penalties for violations of the program requirements.

Separate from the rulemaking requirement, the CARS Act directs the agency to establish a website to convey information about the program, including instructions on how to determine if a vehicle is an eligible trade-in vehicle, how to participate in the program and how to determining if a dealer is participating in the program. The agency established this website at http://www.cars.gov. Among other things, the website contains an interactive tool for determining eligible vehicles, a list of participating dealers and disposal facilities, responses to frequently asked questions, and information on how to determine the EPA combined fuel economy of trade-in vehicles and of new vehicles. In addition, NHTSA set up a hotline ((866)-227-7891) to answer questions about the program and, on July 2, 2009, published a document in the Federal Register (74 FR 31812) providing additional useful information, in advance of issuance of this final rule.

The Act provides that the program covers eligible transactions beginning on July 1, 2009, prior to today’s final rule. NHTSA advised the public through the July 2 Federal Register document, the website, and the hotline that it was prudent to wait until the details of the program were specified in today’s final rule. Nevertheless, if transactions occurring on or after July 1, 2009, but before today’s final rule, meet all of the requirements identified in this final rule, registered dealers may follow the application procedures of the rule and apply for reimbursement for those transactions. To expedite processing, the rule relies, wherever possible, on electronic submissions through secure agency websites.

In order to implement this new program, NHTSA has had to quickly create a new organization. NHTSA has established the Office of the Car Allowance Rebate System (CARS) within the Office of Enforcement. The agency has decided also to use this name for the program on its new website, www.cars.gov. The new office will consist of three divisions. The Transaction Oversight Division will work closely with the contractor NHTSA has retained to review incoming requests for payment from dealers to ensure that those requests are reviewed correctly and in a timely way. The Data Analysis and Reporting Division will review data generated in connection with the program to help ensure the system’s efficiency and detect problems with the process or indications of potential compliance issues. That division will also produce reports on all aspects of the system. The Compliance Division will work to detect and deter possible noncompliance related to the program and coordinate closely with NHTSA’s Office of Chief Counsel when possible violations are found. That division will also coordinate closely with the DOT’s Office of Inspector General on issues related to possible fraud in connection with the program.

The use of the term “rebate” in the name NHTSA has chosen for the program is not intended to have any effect on how CARS transactions are treated under State or federal tax laws. The CARS Act provides that the credit is not income to the purchaser, but does not address any other possible tax issues. NHTSA lacks expertise and authority in tax matters and makes no attempt here to provide any guidance on those matters.

II. Questions and Comments from the Public about the CARS Program

During the period between enactment of the CARS Act and publication of today’s rule, the agency received numerous questions and comments about various provisions of the Act. The final rule seeks to address these comments and questions, and details appear later in this document. However, the agency provides here a brief summary discussion of some of the issues raised. As noted earlier, NHTSA’s website for the CARS program contains responses to frequently asked questions by members of the public.

The CARS program assists consumers who trade in their older, less fuel efficient vehicles for new, more fuel efficient vehicles. The program is designed to remove these older, less fuel efficient vehicles from the road, by requiring the trade-in vehicle to be scrapped. Some consumers were unaware that their trade-in vehicle must be destroyed as a statutory condition of participating in this program. Because of that condition, consumers purchasing or leasing a new vehicle under this program should not expect to receive the full trade-in value of their old vehicle when negotiating with a dealer.

As detailed below, the program has different requirements for different types of trade-in vehicles (e.g., passenger cars, SUVs and vans, pickups, and trucks) because these vehicles have varying levels of EPA combined fuel economy. In general, passenger cars have the highest combined fuel economy. Therefore, even though a passenger car may be quite old and/or in poor condition, it may not be an eligible trade-in vehicle under the program because its combined fuel economy at the time of its manufacture (as measured by the EPA) exceeds statutory limits. Some consumers have expressed surprise at this result. However, the agency must follow the requirements of the statute. Larger, older pickup trucks and SUVs, on the other hand, do not typically have very high fuel economy. The statutory requirements for trading in these vehicles are less strict than for trading in passenger cars. Consumers may find that more of the vehicles in these categories are eligible as trade-in vehicles under the program.

Questions have arisen as to which persons are eligible to participate in the program and whether a person can trade in a vehicle owned by someone else, such as a family member. The agency has concluded that individuals as well as legal entities, such as corporations and partnerships, may participate in the program. However, a person may not trade in a vehicle owned by someone else under the program. The Act’s one-year insurance requirement is satisfied so long as the trade-in vehicle is insured, irrespective of the identity of the person holding the insurance policy. The specifics of these requirements are explained later in this document.

The agency has received questions regarding the value and disposition of the trade-in vehicle. The CARS Act specifies that while many parts of the trade-in vehicle are permitted to be removed and sold, in the end the residual vehicle, including the engine block, must be crushed or shredded. Therefore, the trade-in value of the vehicle is not likely to exceed its scrap value. Purchasers should not expect to receive the same trade-in value as they might if the vehicle were to remain on the road. The Act also requires dealers to disclose to purchasers the scrap value of the trade-in vehicle at the time of the trade-in and allows dealers to retain up to $50 of the scrap value of the vehicle for their administrative costs of participation in the program.

Some consumers have expressed concern that the combined fuel economy value of their vehicles, as determined on the fueleconomy.gov website of the EPA, is not an accurate measure of the actual fuel economy they experience. EPA determines these values for each make, model, and model year with regard to each vehicle at the time of its manufacture. These consumers contend that if another means were used to calculate combined fuel economy, their vehicle would be an eligible trade-in vehicle under the program. The CARS Act is prescriptive in this regard, and requires NHTSA to use the EPA calculation, and not any other calculation, to determine whether a trade-in vehicle is eligible under the program.

Some consumers have asked whether they may participate in more than one reimbursed transaction, either singly or as joint-registered owners of a vehicle. The CARS Act specifies that each person may receive only one credit and that only one credit may be issued to the joint-registered owners of a single trade-in vehicle under the program. Consequently, a person may participate in a transaction that receives a credit under this program only once.

The CARS Act is specific as to the characteristics of the vehicle that may be traded in and the characteristics of the new vehicle that may be purchased or leased, and these two requirements are interdependent (i.e., whether a new vehicle is eligible under the program depends, in part, on the characteristics of the trade-in vehicle). For example, the trade-in requirements for a large work truck differ from those of passenger cars under the program. Similarly, some vehicles—notably motorcycles—simply are not eligible under the CARS Act, either as trade-in vehicles or for purchase or lease, even though consumers have noted that transactions involving those vehicles might reduce fuel use and improve the environment.

III. Public Outreach and Consultation

The extremely short time afforded by the Act to develop and complete this rulemaking precluded publishing a proposed rule for notice and comment. Therefore, the agency took a variety of steps to obtain public input as it moved forward to develop this rule. It established a website that invited public inquiries. As it received inquiries, it posted a steadily growing list of questions and answers, which in turn led to additional inquiries. It hosted a “webinar” that elicited hundreds of inquiries. In addition, it met with representatives of a wide variety of environmental interest groups.

The agency also directly consulted with organizations representing original equipment manufacturers (OEMs), including the Alliance of Automobile Manufacturers and the Association of International Automobile Manufacturers, to obtain information on franchised dealerships. The agency involved the OEMs because they possess comprehensive and readily available lists of new vehicle dealers licensed under State law. As detailed below, the agency is using lists of franchised dealers provided by the OEMs to aid in the process of registering dealers under the program.

NHTSA met with automobile dealers and dealer organizations, including the National Automobile Dealers Association and the American International Automobile Dealers Association, to better understand the typical vehicle trade-in and purchase/lease transaction. The agency consulted with groups representing disposal facilities, salvage auctions, and reporting entities, including the American Salvage Pool Association, the Automotive Recyclers Association, CoPart, Mannheim, Insurance Auto Auctions, the Institute of Scrap Recycling Industries, Inc., and the National Salvage Vehicle Reporting Program, to learn about the processes involved in recycling and scrapping old vehicles. The information learned by the agency from dealer and disposal facility organizations was critical to an informed rulemaking process.

The agency also consulted with officials from Texas, California and Germany. These officials provided valuable information to the agency, based on their experience administering and enforcing similar vehicle purchase and trade-in programs. Each of these officials cautioned NHTSA that it would need to be vigilant to guard against fraud.

Finally, as required under the CARS Act, the agency coordinated with appropriate Federal agencies. With respect to the National Motor Vehicle Title Information System (NMVTIS), the agency met with the Department of Justice and its NMVTIS program administrator, the American Association of Motor Vehicle Administrators, to develop procedures for updating the NMVTIS to reflect the crushing or shredding of trade-in vehicles under the program. The agency consulted with the EPA on the listing of categories of eligible vehicles and on the listing of disposal facilities and requirements and procedures for the proper disposal of refrigerants, antifreeze and other substances prior to crushing or shredding the trade-in vehicle. The agency also consulted with EPA concerning a method to disable the engines of the vehicles that are traded in.

Memoranda providing the dates and summaries of meetings with these organizations and various other groups are included in the docket for this rule.

IV. The Regulation

As directed by the CARS Act, today’s final rule sets forth requirements and procedures for registering participating dealers and listing participating disposal facilities, reimbursing dealers for qualifying transactions, disposing of trade-in vehicles, and enforcing penalties for program violations.

The rule is being issued without first providing a notice and an opportunity for public comment. As noted above, the Act provides that the rule shall be issued within 30 days after enactment, “notwithstanding” the requirements of 5 U.S.C. § 553, the Federal law requiring notice and comment. Further, given that schedule and the necessity of quickly beginning to implement this 4-month program with a statutorily fixed end date, the agency finds for good cause that providing notice and comment is impracticable and contrary to the public interest. Drafting and issuing a proposed rule, providing a period for public comment, and addressing those comments in the final rule would have been highly impracticable in the time available and would have substantially delayed issuance of this final rule beyond the legislatively mandated issuance date of July 24. We think the public interest is best served by issuing this rule on the mandated date so that its requirements are known and can be followed by all participants. This is especially true because transactions since July 1 have been potentially eligible for credits under this program.

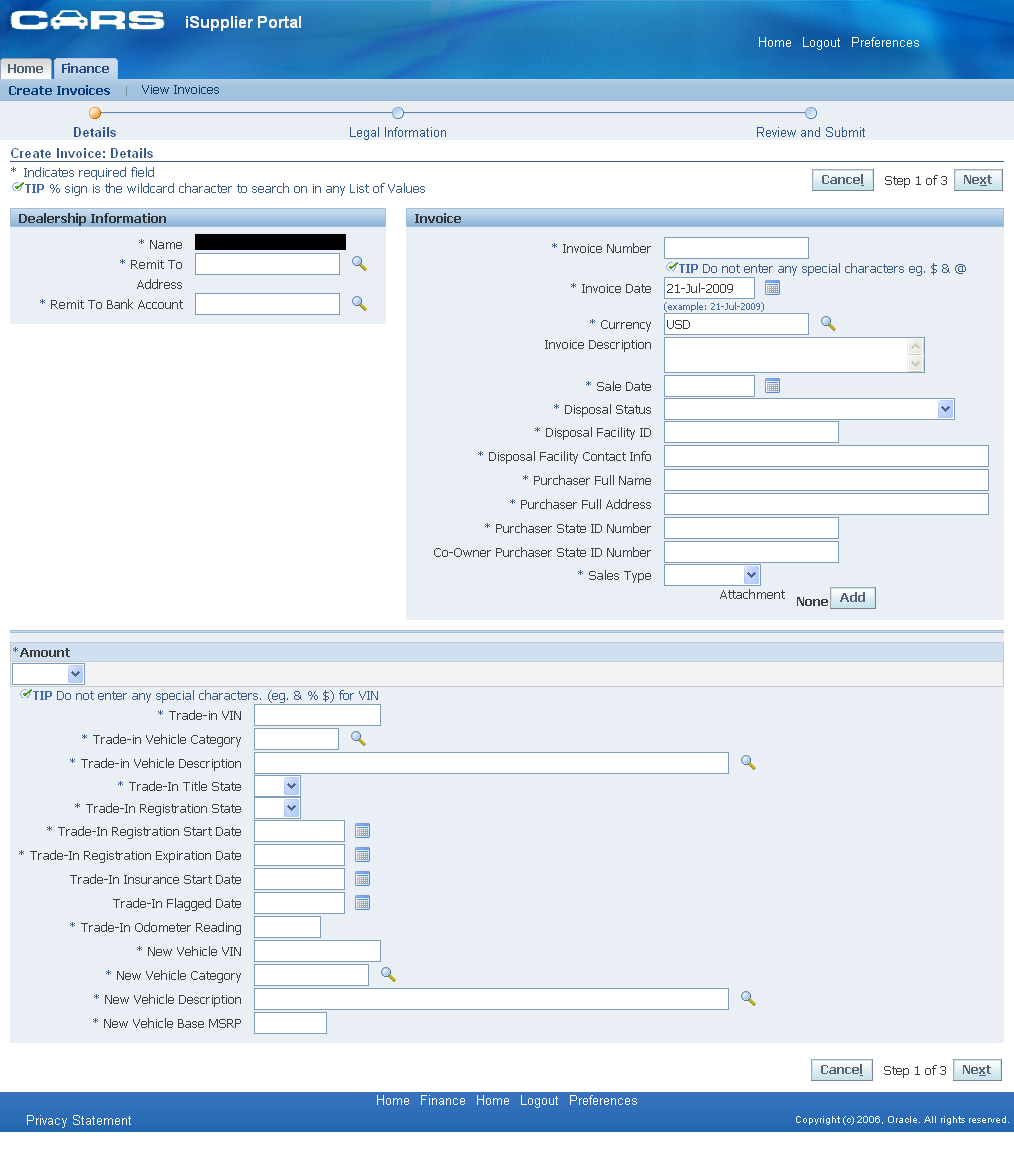

The CARS Act prescribes a rulemaking period of just 30 days before the program is to be fully implemented and capable of accommodating a potentially very large number of transactions. Mindful of this requirement, the agency placed significant emphasis on efficient transaction processes and data exchange. To that end, most of the transactional requirements imposed by today’s rule are met through electronic online submissions. Where this is so, the rule identifies the particular data or information required in the electronic submission and, in one case, refers to an appendix with a facsimile of the electronic form for easy reference.

The Act requires the agency to develop certain lists to assist consumers and dealers (e.g., a comprehensive list of new fuel efficient vehicles meeting the program requirements, a list of disposal entities to which dealers may transfer eligible trade-in vehicles). Here, the rule makes use of appendices or references to the CARS website for convenient reference to these helpful lists.

Much of the CARS Act is specific and directive. However, where a statutory term or provision is not clear or gives the agency discretion, the rule generally strikes the balance in favor of an interpretation that promotes smooth and expeditious completion of transactions or one that decreases opportunities for fraud.

Definitions (§ 599.102)

The CARS Act defines a dealer as a person licensed by a “State” and identifies an eligible trade-in vehicle in terms of its insurance and registration status under “State” law. Read together, these statutory provisions restrict the transactions that are eligible for a credit under the CARS program. More specifically, a dealer must be a United States dealer and a trade-in vehicle must be insured and registered in the United States. However, nothing in the Act excludes U.S. territories from the reach of the program. Consequently, in §599.102, the agency has defined “State” to include the 50 United States, the District of Columbia, Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands.

The CARS Act uses the term “person” to describe those eligible to purchase or lease a new vehicle under the Program. See §§1302(c-d). In the absence of a definition of this term in the CARS Act, the agency relies on the universal definition that appears in 1 U.S.C. §1, which includes corporations, companies, associations, firms, partnerships, societies, and joint stock companies, as well as individuals. The agency adopts this definition for the term “person” in §599.102, and also defines a “purchaser” in that section as a person purchasing or leasing a new vehicle under the CARS program. Of course, each person is subject to the statutory restriction that precludes participation by any person in this program more than once.

b. Registration of Dealers (§ 599.200)

The Act requires the agency to provide for a means of registering dealers for participation in the Program. (§1302(d)(1)). A dealer is defined under the Act as a person licensed by a State who engages in the sale of new automobiles to ultimate purchasers (§1302(i)(6)), a definition we have restated in § 599.102. After consultation with dealer and OEM organizations, the agency is implementing the dealer registration requirement through a several step process. First, on June 30, 2009, the agency requested and later received a list of franchised dealers from their respective OEMs, including each dealer’s legal business name, doing-business-as name, mailing address, point of contact, and OEM franchise identifier.1 OEM franchised dealers, as a group, satisfy the requirement for State licensing. The agency has learned that, without an active OEM franchise agreement, a dealer is unable to offer manufacturer purchasing incentives and may not be able, in some cases, to extend the full manufacturer warranty to the new vehicles it sells. For this reason, the agency includes the requirement for a currently active OEM franchise agreement as part of the dealer registration process. (The OEMs have agreed to update this list weekly, to add newly franchised dealerships and remove dealerships that are no longer under franchise agreement.) The agency then contacted all listed dealers by mail, providing instructions on how to register under the program. Dealers received separate letters and were instructed to register separately for each make of vehicle they sell. Section 599.200(b) identifies the required dealer qualifications for registration, which flow from the statutory requirement for State licensing and from the need to perform transactions electronically. OEM franchised dealers should easily satisfy these requirements.

As set forth in section 599.200(c), dealers that have been contacted by mail by the agency and that wish to participate must register to do so electronically, using the authorization code and following the instructions provided in the mailing, and fill out an electronic screen providing, among other things, name and contact information and bank account and routing data for receiving payment under the program.2 The agency will review this information to ensure completeness, and verify that the dealer has a still active franchise agreement (based on the continuously updated list provided by OEMs). Section 599.200(d) sets forth the procedures for approving and disapproving registration applications. Section 599.200(d)(1) provides that, where an application for registration is approved, the agency will notify the dealer of approval by email, providing a user identification and password with which to conduct transactions, and add the dealer to the list of registered dealers on its website at http://www.cars.gov. Consumers may consult this list to identify registered dealers in their locality. Section 599.200(d)(2) provides that, where an application for registration is rejected, the agency will notify the dealer by email, and provide the reasons for rejection. The agency anticipates that, unless rejected, confirmation of registration and addition to the list should occur within 2 to 4 business days after a dealer submits the required information.

Section 599.200(e)(1) provides that the agency may automatically revoke a registration as a matter of course for termination or discontinuance of a franchise but the dealer’s registration may be reinstated upon a dealer’s showing of proper and adequate license to sell new vehicles to ultimate purchasers. Section 599.200(e)(2) states that the agency may suspend or revoke a dealer’s registration under the procedures in § 599.504. Section 599.200(f) requires a registered dealer to immediately notify the agency of any change in the registration information it submitted or any change in the status of its State license or franchise. Finally, Section 599.200(g) accommodates transactions that occurred after July 1, 2009, but prior to the publication of today’s final rule, by permitting registration after a qualifying sale or lease transaction has occurred.3

The agency believes that this process is the most efficient and appropriate method to register dealers consistent with the requirements of the CARS Act. The Act requires that a dealer be licensed under State law, and the list provided by OEMs ensures that this is so. Using this list also allows the agency to verify dealer registration information in a timely manner. Since the OEMs have agreed to provide weekly updated lists, this process also will allow for registration of newly franchised dealers as they come into existence and the discontinuance of registrations for dealers that are no longer franchised. Newly franchised dealers will be contacted by mail with an authorization code, as the agency becomes aware of them from the weekly updated lists. A dealer whose franchise has been discontinued will be removed from the agency’s list, and will no longer be eligible to receive credits for transactions under the program.

c. Identification of Disposal Facilities (§ 599.201)

Under the Act, the agency is required to provide a list of entities to which dealers may transfer eligible trade-in vehicles for disposal. (§ 1302(d)(6)). The Act also requires the Secretary to coordinate with the Attorney General to ensure that the National Motor Vehicle Title Information System (NMVTIS) is timely updated to reflect the crushing or shredding of trade-in vehicles and appropriate reclassification of their titles. (§ 1302(c)(2)(C)).

The agency met with groups representing auto recyclers and other disposal facilities and salvage auctions, as well as officials from AAMVA and the Department of Justice responsible for administering the NMVTIS, to get an understanding of the vehicle salvage and disposal process. From those meetings, the agency learned that there is a wide range of entities involved in various aspects of the vehicle salvage and disposal business. The agency also consulted with the EPA about the CARS program and the requirement to produce a list of disposal facilities for disposition of the trade-in vehicles. Mindful of environmental issues, NHTSA sought to identify a universe of disposal facilities that was attentive to these concerns, while achieving the objectives of the CARS program.

In the course of these consultations and based on advice from EPA, the agency identified the National Vehicle Mercury Switch Recovery Program (NVMSRP) as a comprehensive source of disposal facilities generally committed to meeting State and Federal environmental laws. The NVMSRP was established in 2006 under a memorandum of understanding (MOU) among the EPA, environmental groups, manufacturers and disposal facilities, to recover and recycle mercury switches from end-of-life vehicles before they are scrapped, crushed or shredded. This purpose is in alignment with the CARS Act’s requirement for proper vehicle disposition, including the removal of mercury switches. The MOU authorizes the End of Life Vehicle Solutions (ELVS), a corporation established by vehicle manufacturers to carry out responsibilities of the NVMSRP, including establishing a process for participants to enroll in the program and maintaining a database of participants who recover and submit mercury switches.

Information about ELVS can be found on its website at http://www.elvsolutions.org. Participants may enroll in the program by registering with ELVS. See the ELVS website at http://www.elvsolutions.org/contact.html for more information on joining ELVS. The list of ELVS participants by State can be found on the website of the Environmental Quality company at http://www.eqonline.com/services/ELVS-Mercury-Switch-Recovery-Program.asp. Currently, approximately 7,700 disposal facilities are participants, and EPA estimates that approximately 1,500 of these facilities actively turn in the switches. The agency has determined that disposal facilities that are participants on the ELVS list present the best assurance of compliance with State and Federal environmental laws.

With this in mind, NHTSA has identified disposal facilities that are ELVS participants for listing as approved disposal facilities under this program, and these disposal facilities are listed on the agency’s website at www.cars.gov/disposal. However, some entities on this list may dispose of mercury switches as part of their business (for example, auto repair businesses) but do not actually engage in dismantling or recycling of vehicles. Therefore, the fact that an entity is on the list does not automatically ensure that it is equipped to dispose of vehicles properly. To be eligible for participation in the CARS Program, an entity on the ELVS list must be able to crush or shred motor vehicles, either with its own equipment or by use of a mobile crusher. NHTSA was not able to obtain accurate lists of all entities that have this capacity within the time allowed, but is informed that many of the entities on the ELVS list are capable of at least obtaining the services of a mobile crusher. Dealers will have to inquire of specific entities concerning their capacity to crush or shred the vehicle. Any entity that does participate will have to certify that it has that capacity to crush or shred and will dispose of the vehicle through crushing or shredding.

These facilities must additionally agree to turn in mercury switches in accordance with the NVMSRP from any CARS trade-in vehicles they accept (to the extent the vehicles have such switches), by certifying that they will do so. In addition, because the CARS Act directs the agency to ensure that pollutants are removed from vehicles and properly disposed of, that vehicles are crushed or shredded, and that NMVITS is updated to reflect the disposition of the vehicle, as a condition of participation in the Program, the listed participants must also agree to remove pollutants from the CARS trade-in vehicles in compliance with State and Federal law, crush or shred the vehicle, update NMVTIS to reflect the disposition of the vehicle, and certify to having done so. The certification requires the disposal facility to certify that it will dispose of refrigerants, antifreeze, lead products, mercury switches, and such other toxic or hazardous vehicle components prior to crushing or shredding in accordance with applicable Federal and State requirements. The rule does not impose additional requirements; for example, it does not require removal of all lead products such as lead solder connections that are ordinarily not removed during the shredding process.

NHTSA is aware, from consultations with EPA, that the State of Maine and the U.S. territories (American Samoa, Guam, the Northern Mariana Islands and the Virgin Islands) are not participants in the NVMSRP and that the ELVS list contains no disposal facilities in these areas. Maine has its own program for recycling mercury switches, which is comparable to the NVMSRP. Under Maine law, a vehicle may not be crushed without first removing and properly disposing of mercury switches, and disposal facilities are covered by that law. NHTSA obtained a list of disposal facilities in Maine from the State Bureau of Motor Vehicles, and this list is included along with the ELVS facilities in other states, on the agency’s website at www.cars.gov/disposal. As a condition of participating, these Maine facilities must make the same certifications as required of the ELVS facilities.

In the case of the U. S. Territories, the agency is informed that participation in ELVS is currently impracticable for cost reasons related to sending mercury switches to the Continental United States. Therefore, the rule does not include disposal facilities on the list for the Territories, but allows dealers to select disposal facilities within the territories that are able to make the same certifications required of the ELVS and Maine facilities.

The agency plans to update this disposal facility list periodically, to add entities that become ELVS participants and to remove entities that are no longer ELVS participants or for other reasons discussed elsewhere in this document. The rule requires dealers to consult this list on the CARS website at the time of the transfer of the trade-in vehicle, as an entity that does not appear on the list on that date is not eligible to receive the vehicle for crushing or shredding.4

One issue that has arisen is the participation of entities that shred vehicles in the CARS process. Shredders turn crushed vehicles into materials useful in various industrial processes. Shredders are relatively few in number, with less than 300 shredding machines distributed nationwide. Disposal facilities with shredders may be ELVS participants and, if they are, they can participate fully in the CARS program. To the extent these facilities are not ELVS participants, they may still play a role in the ultimate disposition of the vehicle. The final rule places no restrictions on a trade-in vehicle, once crushed. Once crushed, the agency assumes the vehicle will be transferred to a shredder so that its materials can be recycled. The rule does not require any tracking of this ultimate shredding of a crushed vehicle, so the entity receiving the crushed vehicle for shredding does not have to submit a CARS certification form.

Because of the requirement, discussed later in this document, that dealers must disable the trade-in vehicle’s engine prior to transferring the vehicle to a disposal facility, the agency believes that the statutory interest in ensuring that the vehicle is not returned to use on the road in this or any other country is largely met before it leaves the dealer’s possession. Prior engine disablement reduces the likelihood that a trade-in vehicle will be returned to use as an on-road automobile. With the extra assurance provided by engine disablement, the smooth operation of the program is better served if limitations on participation in the disposal stream are kept to a minimum, ensuring a reasonable geographic distribution of entities that may receive trade-in vehicles from dealers under the program.

With these points in mind, the agency consulted with representatives of the salvage auction industry. The agency believes it is practicable to provide for the participation of salvage auctions in the transfer of trade-in vehicles to disposal facilities under the CARS Program, in order to broaden the avenues of disposal available to dealers. Therefore, salvage auctions may receive a CARS trade-in vehicle, provided that, as a condition of participation, these entities agree to limit their auction sales of CARS trade-in vehicles to the disposal facilities described above that appear on the agency’s list. We believe that including listed disposal facilities, and requiring salvage auctions to sell at auction the scrap trade-in vehicles only to approved disposal facilities strikes the appropriate balance between program and environmental accountability, on the one hand, and geographic distribution and dealer access, on the other. NHTSA was unable to develop a comprehensive list of salvage auctions within the time allowed. Although we heard from representatives of some of the largest auctions and their associations (including CoPart, Mannheim, the Insurance Auto Auctions, and the Automotive Salvage Pool Association), we concluded that simply listing their members, absent more would not be appropriate. However, we understand from representatives of those organizations and companies that they and their members are willing to restrict the sale of CARS trade-in vehicles to just those entities on the CARS program disposal facility list and make the necessary certifications about the disposal of those vehicles. Any other salvage auctions willing to abide by these restrictions and submit the necessary forms and certifications under penalty of law may participate in the CARS program. All participants must understand the specific requirements of this rule and the substantial penalties they may incur if they violate it or submit false information in connection with the program. Also, all who participate must understand that their records, premises, and CARS vehicles in their possession are subject to inspection by NHTSA and the DOT Office of Inspector General.

d. Determining Eligibility of Trade-in Vehicles and New Vehicles (§ 599.300)

The CARS Act prescribes detailed requirements concerning eligible trade-in vehicles and eligible new vehicles for qualifying transactions under the Program. This final rule implements these requirements in close adherence to the statutory language.

1. Vehicle Definitions

The CARS Act divides eligible trade-in vehicles and new vehicles into four groups: passenger automobiles; category 1 trucks; category 2 trucks; and category 3 trucks.5 The term “passenger automobile” and its definition are taken from the agency’s fuel economy statute. The definition excludes vehicles that NHTSA has determined are 1) not manufactured primarily for transporting persons and 2) vehicles that are capable of off-highway operation. Vehicles not manufactured primarily for transporting persons include pickup trucks and certain vehicles that permit expanded use of the vehicle for cargo-carrying purposes, including vehicles which are designed to transport more than 10 persons; provide temporary living quarters, transport property on an open bed, provide greater cargo-carrying than passenger-carrying volume, or permit expanded use of the automobile for cargo-carrying purposes or other nonpassenger-carrying purposes. (See 49 CFR 523.5(a)).

Vehicles that are capable of off highway operation include three groups of vehicles. (See 49 CFR 523.5(b)). The first includes vehicles that have 4-wheel drive and have at least four out of five specified physical characteristics relating to ground clearance.6 The second includes vehicles that are rated at more than 6,000 pounds gross vehicle weight and have at least four out of five specified physical characteristics relating to ground clearance, but do not have 4-wheel drive. The third includes 2-wheel drive SUVs (regardless of GVWR) which came in a 4-wheel drive version that met four of five specified physical characteristics related to ground clearance. Beginning with the 2011 model year, NHTSA will reclassify this third group of vehicles as passenger cars. See Average Fuel Economy Standards - Passenger Cars and Light Trucks - Model Year 2011, Section XI (Vehicle Classification); 74 FR 14419, March 30, 2009. Although neither specified nor prohibited in the CARS Act, the agency has concluded that it is most appropriate to define passenger cars using the NHTSA regulations and policy which are applicable to 2010 and earlier model year vehicles. Therefore, the third group of vehicles will continue to be classified as trucks for CARS purposes (and will be excluded from the definition of a passenger automobile).

A “category 1 truck” is a non-passenger automobile. This category includes sport utility vehicles (SUVs), medium-duty passenger vehicles,7 small and medium pickup trucks, minivans, and small and medium passenger and cargo vans. It does not include vehicles that are defined as category 2 trucks.8

A “category 2 truck” is a large van or a large pickup truck, based upon the length of the wheelbase (more than 115 inches for pickup trucks and more than 124 inches for vans). If the vehicle nameplate contains a variety of wheelbases, the size classification is determined by considering only the shortest wheelbase produced. In addition, some pickup trucks and cargo vans which exceed these thresholds are treated as category 3 trucks instead of category 2 trucks.

A “category 3 truck” is a work truck and is rated between 8,500 and 10,000 pounds gross vehicle weight. This category includes very large pickup trucks (those with cargo beds 72 inches or more in length) and very large cargo vans.

As previously stated, for category 1 and 2 trucks with a variety of wheelbases, the size classification is determined by considering only the shortest wheelbase produced. If a secondary manufacturer modifies and introduces into commerce a vehicle with only a limited portion of the wheelbases offered by the original equipment manufacturer (OEM), the size classification for the secondary manufacturer will be determined by (and consistent with) the size classification determined for the OEM. For example, if General Motors produces 2008 model year Chevrolet Colorado pickup trucks with wheelbases of 111, 119 and 126 inches, Colorado pickup trucks would be classified as category 1 trucks for CARS purposes (because the shortest wheelbase Colorado pickup truck was less than or equal to 115 inches). If a secondary manufacturer introduces into commerce 2008 model year Colorado ZZZ vehicles (high performance Colorado pickups with 126 inch wheelbase only), Colorado ZZZ models would also be classified as a category 1 pickup trucks.

The rule defines these four groups of vehicles in § 599.102 and makes use of these categories throughout §§ 599.300(e) and 599.300(f).

2. Eligibility of Trade-in Vehicles

The CARS Act establishes four criteria for an eligible trade-in vehicle. The trade-in vehicle must:

(1) be in drivable condition;

(2) have been continuously insured, in accordance with State law, and registered in the same owner’s name for the one-year period immediately prior to the trade-in;

(3) have been manufactured not earlier than 25 years before the date of trade- in9 and, in the case of a category 3 vehicle, also be from a model year not later than model year 2001; and

(4) have a combined fuel economy value of 18 miles per gallon or less,10 if it is a passenger automobile, a category 1 truck, or a category 2 truck.11

The agency must have a means of evaluating these criteria as it determines whether a transaction qualifies under this program.

(i) “Drivable Condition”

The agency intends that “drivable condition” be demonstrated by several means. First, it must be confirmed by the trade-in vehicle being operated, under its own power, by the dealer on public roads on the date the vehicle is traded in. The dealer must then certify to the operation of the vehicle when it submits its request for reimbursement. Separately, the person trading in the vehicle must certify that it is in drivable condition. This latter certification also must be submitted by the dealer with its application requesting reimbursement. This approach is adopted in § 599.300(b)(1) of the final rule, and the required certifications appear in Appendix A.

(ii) Insurance

In addressing the requirement that the trade-in vehicle be “continuously insured consistent with the applicable State law” for a period of not less than one year prior to the transaction, the agency notes the complication that not all States require vehicle owners to purchase automobile insurance coverage. Several States provide vehicle owners with the option, for example, to post a surety bond, leave a cash deposit or self-insure in lieu of purchasing automobile insurance. Two States have little or no insurance requirements.

The agency recognizes that insurance requirements differ throughout the country. However, the agency believes that the Act requires the continuous one-year insurance condition to be met as a threshold matter, with respect to any trade-in vehicle under the program. In a State where the conditions and requirements of insurance are specified in law (e.g., liability minimums, deductible requirements), the insurance coverage would then need to be in accordance with those conditions and requirements. To qualify under this requirement, a purchaser must provide proof of insurance covering the trade-in vehicle for a period of at least one year prior to the date of the trade-in.

The agency is aware that, in some cases, consumers may have insurance cards that state clearly the period of insurance coverage, while in other cases, an insurance card is unavailable or does not convey the period-of-coverage information. To provide for an alternative, the agency consulted with several insurance associations, including the Insurance Information Institute, American Insurance Association, National Association of Mutual Insurance Companies, and Property Casualty Insurers Association of America. These entities agreed to assist the agency through their member insurance companies. They indicated that purchasers could contact their insurers to obtain proof of insurance in a form that provides the details needed to identify the insured vehicle and the one year period of coverage required under the Program.

To implement this process, the agency is requiring the owner of the trade-in vehicle to provide proof, at the time the vehicle is traded in, that the trade-in vehicle has been insured continuously for one year prior to the trade-in. This proof may take one of three forms. The proof may consist of one or more insurance cards containing the make, model, model year, and vehicle identification number (VIN) of the insured vehicle, but only if, taken together, the cards display on their face a continuous one-year period of insurance coverage. The proof may also consist of insurance policy documents (e.g., declarations pages) showing the same information. Finally, the proof may consist of a signed letter, on insurance company letterhead, identifying the same vehicle identification information (i.e., make, model, model year, and VIN) of the insured vehicle and the period of continuous coverage, which must be for at least one year prior to the date of the trade-in. In addition, the consumer must certify that the trade-in vehicle has been continuously insured for the requisite period. This proof of insurance, along with the consumer certification, must be submitted by the dealer in its application to the agency requesting reimbursement. Section 599.300(b)(2) and Appendix C implement these requirements.

(iii) Registration

The requirement that the trade-in vehicle be registered to the same owner for a continuous period of one year prior to the transaction requires clarification. The agency interprets this provision as requiring the trade-in vehicle to be registered to and owned by the person purchasing or leasing the new vehicle under the program. In a transaction involving more than one person, the trade-in vehicle must have been registered to and owned by at least one of the persons purchasing or leasing the vehicle under the program.12 This requirement avoids ownership and title issues that could delay transactions because of the introduction of a third party who is not the owner of the trade-in vehicle into the transaction. The requirement also avoids the creation of a market for buying and selling trade-in vehicles for use in transactions under the program. Finally, it is a necessary result in order to ensure that the consumer purchasing or leasing an eligible new vehicle is able to make, from first-hand knowledge, the certifications about the trade-in vehicle required in Appendix A.

To qualify under this requirement, the purchaser will need to provide proof of registration covering the trade-in vehicle for a period of at least one year prior to the date of the trade-in. The agency recognizes that this proof of registration presents complications for purchasers. In several States, registration cards or documents do not indicate a period of coverage of more than one year. In some of these States, purchasers have a difficult time obtaining prior registration information from the State. Seeking a less burdensome alternative, the agency evaluated the capabilities of commercial vehicle information services, including Polk and Experian, to determine the type of vehicle information that is readily available to consumers. The agency discovered that purchasers may obtain a history of vehicle registration information from these services.

To implement this process, the agency has determined that proof of registration may be demonstrated by any of the following: a current State registration document or series of registration documents in the name of the purchaser evidencing registration for a period of not less than one year immediately prior to the trade-in; a current State registration document showing registration in the name of the purchaser and a document of title that confers title on the purchaser not less than one year immediately prior to the trade-in; or a current State registration document showing registration in the name of the purchaser and a document from a commercially available vehicle history provider evidencing registration for a period of not less than one year immediately prior to the trade-in. Changes in ownership during this period to delete a co-owner due to death or divorce do not interrupt the continuity of the registration, so long as the purchaser has been shown as an owner on the registration for the entire period. In addition, the consumer must certify that the trade-in vehicle was continuously registered for the requisite period. This proof of registration, along with the consumer certification, must be submitted by the dealer in its application to the agency requesting reimbursement. Section 599.300(b)(3) and Appendix C implements these requirements.

(iv) Manufacture Date

The requirement that the trade-in vehicle be manufactured not earlier than 25 years before the date of trade-in is straightforward, and is implemented in Section 599.300(b)(4). Ordinarily, the model year of the vehicle, which appears on the title, will serve to satisfy this requirement. Where that information is inconclusive (e.g., certain model year 1984 and 1985 vehicles), the month and year of manufacture may be retrieved from the safety standard certification label that appears on the frame or edge of the driver’s door in most vehicles. The rule allows the 25-year period to be satisfied provided it falls any time within the month that the vehicle is traded in. Section 599.300(e) implements the additional requirement, in the case of a category 3 vehicle, that the trade-in vehicle be manufactured not later than model year 2001. The dealer must certify that the trade-in vehicle meets this manufacturing date requirement. (Appendix A).

(v) Combined Fuel Economy

The specified combined fuel economy rating of 18 mpg or less for the trade-in vehicle (excepting category 3 vehicles) is implemented throughout §§599.300(e) and 599.300(f).13 Under the Act, combined fuel economy for an eligible trade-in vehicle is defined as the number posted under the words “Estimated New EPA MPG” and above the word “Combined” for vehicles of model year 1984 through 2007, or posted under the words “New EPA MPG” and above the word “Combined” for vehicles of model year 2008 or later on the fueleconomy.gov website of the Environmental Protection Agency for the make, model, and year of such vehicle. (§1302(i)(5)(B)). The agency adopts this definition in §599.102, but includes language limiting its application to combined fuel economy based on gasoline. This treatment of trade-in vehicles is consistent with the CARS Act requirements for defining the combined fuel economy of new vehicles.14

EPA changed the way it calculated fuel economy ratings starting in Model Year 2008, and has estimated the revised ratings for Model Years 1985-2007. Therefore, as described above, eligibility is determined by the revised ratings rather than the original EPA sticker on the vehicle. Since the revised ratings reflect a lower fuel economy, vehicles that would not be eligible under their original EPA rating may qualify for trade-in.

3. Eligibility of New Vehicles

The Act specifies that a new vehicle must be a passenger automobile, a category 1 truck, a category 2 truck, or a category 3 truck. The characteristics of these vehicles were described earlier under Section c.1, “Vehicle Definitions,” and they are defined in §599.102. To further assist consumers in determining the eligibility of new vehicles, the CARS website, at http://www.cars.gov, contains an interactive tool. Consumers may identify their trade-in vehicle, select a new vehicle, and determine whether the transaction qualifies for a credit (and the amount of the credit) under the program.

In addition to the definitional categories, the new vehicle purchased or leased under the program must achieve a minimum combined fuel economy level. For new passenger automobiles the combined fuel economy must be at least 22 miles per gallon, for category 1 trucks it must be at least 18 miles per gallon, and for category 2 trucks it must be at least 15 miles per gallon. Category 3 trucks have no minimum fuel economy requirement. Under the Act, combined fuel economy for new vehicles is defined as the number, expressed in miles per gallon, centered below the words “Combined Fuel Economy” on the label required to be affixed or caused to be affixed on a new automobile pursuant to subpart D of part 600 of title 40 Code of Federal Regulations. (§1302(i)(5)(A)). The agency adopts this definition, without change, in § 599.102.

The new vehicle must also have a manufacturer’s suggested retail price (MSRP) of $45,000 or less to be eligible for purchase or lease under the program. The agency interprets this requirement to be the base MSRP—the price on the Monroney label affixed to the vehicle before any dealer accessories, optional equipment, taxes or destination charges are added to the price. This interpretation is consistent with the Automobile Information Disclosure Act, which identifies the retail price separately from the retail delivered price with optional equipment. See 15 U.S.C. § 1232(f)(1). To implement this approach, we have added a definition of the term MSRP in § 599.102 and stated the limitation in § 599.300(c)(3).

The CARS Act allows the new vehicle to be either purchased or leased. In the case of a lease, the Act requires the lease to be for a period of not less than 5 years. The agency has added a definition of “lease” in § 599.102, specifying its minimum duration and making clear that a lease that incorporates a balloon payment at any time prior to five years does not meet the statutory requirement.

e. Requirements for Qualifying Transactions (§§ 599.300 and 301)

1. Vehicle Categories and Credit Amounts

The preceding section described eligibility requirements for the trade-in vehicle and for the purchased or leased new vehicle. Under the CARS Act, a transaction does not qualify for a credit unless the trade-in vehicle and the new vehicle, considered together, satisfy all requirements. In addition, the amount of the credit (either $3,500 or $4,500) is dependent on the category and fuel economy of the two vehicles making up the transaction.

For example, in a transaction involving a trade-in vehicle that is a passenger automobile, a category 1 truck, or a category 2 truck and a new vehicle that is a passenger automobile, each meeting the eligibility criteria discussed in the last section, if the new vehicle has a combined fuel economy that is 4 to 9 miles per gallon higher than the trade-in vehicle, the credit is $3,500. If the new vehicle has a combined fuel economy that is at least 10 miles per gallon higher than the trade-in vehicle, the credit is $4,500.

If the transaction involves a trade-in vehicle that is a passenger automobile, a category 1 truck, or a category 2 truck and a new vehicle that is a category 1 truck each meeting the eligibility criteria, a gain of 2 to 4 miles per gallon results in a credit of $3,500; a gain of at least 5 miles per gallon results in a credit of $4,500.

In the case of a new category 2 or category 3 truck, the trade-in vehicle categories are different. For a new category 2 truck, the trade-in vehicle must be a category 2 or a category 3 truck. If the transaction involves two category 2 trucks each meeting the eligibility criteria, a gain of 1 mile per gallon results in a credit of $3,500; a gain of at least 2 miles per gallon results in a credit of $4,500. A category 3 truck that is traded in for a new category 2 truck is entitled to a $3,500 credit, without fuel economy restriction. (Category 3 trucks are not rated for fuel economy by EPA.) A category 3 truck that is traded in for another category 3 truck is entitled to a $3,500 credit if the new vehicle is “smaller or similar in size.” In view of the fact that Congress has not spoken directly to the precise meaning of this term, consistent with available information, NHTSA has incorporated this statutory requirement as satisfied if the gross vehicle weight rating of the new category 3 truck is no greater than that of the trade-in category 3 truck.

The full universe of qualifying transactions, together with the corresponding amount of the credit, is set forth in §§ 599.300(e) and 599.300(f).

The CARS Act limits the amount of funds that can be used to provide credits for purchases or leases of work trucks (category 3 trucks) to 7.5 percent of the funds appropriated for the program. Once that limit is reached, NHTSA will stop making payments for these transactions. The total amount available for the program is $1 billion, with $50 million available to the agency to administer the program. NHTSA intends to provide ongoing information about the balance of funds remaining available for these and all other categories of transactions under the program.15

2. Special Requirements for Trade-in Vehicles

The CARS Act requires dealers to disclose to purchasers trading in an eligible vehicle the best estimate of the scrap value of the vehicle, and permits the dealer to retain $50 of any amount paid to the dealer for scrappage of the vehicle as payment for the administrative costs of participation in the program. The agency has restated this requirement in §599.300(d) and in the dealer certifications in Appendix A.

The CARS Act addresses the disposition of trade-in vehicles. The Act requires a dealer that receives an eligible trade-in vehicle under the program to certify to the Secretary of Transportation, as prescribed by rule, that the dealer will transfer the vehicle (including the engine block), “in such manner as the Secretary prescribes,” to an entity that will ensure that the vehicle will be crushed or shredded, and will not be sold leased or exchanged. While Congress authorized the agency to promulgate a rule, it did not define “manner” or otherwise speak directly to its meaning. NHTSA interprets “manner”16 to include the methods applied by the dealer and the condition of the vehicle transferred by the dealer. Specifically, the agency is prescribing in today’s rule that the dealer is to transfer the trade-in vehicle with its engine permanently disabled, as detailed below.

In enacting the CARS Act, the Congress was concerned about fraud. See § 1302(a)(4). The agency is aware of the significant disparity in value that exists between a vehicle that is in “drivable condition,” as the trade-in vehicle must be under this program, and a vehicle that is scrapped and ultimately destroyed, which is the required disposition for that trade-in vehicle. A substantial opportunity exists for fraudulent diversion of the trade-in vehicle, largely because its still-functioning engine makes it attractive to return the vehicle to the road rather than relegate it to the scrap yard.17 Moreover, continued use of the trade-in vehicle completely defeats the environmental purpose of the CARS Act, which is to remove these vehicles from the road permanently.

The CARS Act contains an explicit Congressional instruction to take measures to prevent fraud and the statute’s clear environmental objective is to ensure that the fuel inefficient parts of the vehicle are never again used on the highway. Taking the above considerations into account, including the Secretary’s authority to prescribe the manner in which the trade-in vehicle, including its engine block, is transferred to a disposal facility, the agency has determined that the prudent course of action, consistent with Congressional concerns about crushing or shredding, resale and fraud, is to require permanent disablement of the trade-in vehicle’s engine block as a part of the qualifying transaction under this program.

In this context, we interpret “engine block” to mean the part of the engine containing the cylinders and typically incorporating water cooling jackets or, in the case of a rotary engine, the rotor housing, and also including the crank, rods, pistons, and heads. In light of the statute’s purpose of removing fuel inefficient vehicles from the nation’s highways, the agency believes it is reasonable to read the word “block” in a way that includes engine parts traditionally considered part of the “long block.” [NCC: note that I have dropped in an expanded definition of “block” here and in the text. If we don’t address how to read the word, it will become an issue on which we will receive no deference. The problem is that if we do define it this way, the statute then prohibits them from selling the long block, which may be more than we want.]

The agency has determined that a quick, inexpensive, and environmentally safe process exists to disable the engine of the trade-in vehicle while in the dealer’s possession. Removing the engine oil from the crankcase, replacing it with a 40 percent solution of sodium silicate (a substance used in similar concentrations in many common vehicle applications, including patching mufflers and radiators), and running the engine for a short period of time renders the engine inoperable. Generally, this will require just two quarts of the sodium silicate solution. The retail price for two quarts of this solution (enough to disable the largest engine under the program) is under $7, and the time involved should not substantially exceed that of a typical oil change. The agency has tested this method at its Vehicle Research and Test Center and found it safe, quick, and effective. As with many materials used in the vehicle service area of a dealership, certain common precautions need to be taken when using sodium silicate. The same is true with regard to workers who may come in contact with the substance during the crushing or shredding of the engine block. We have discussed the matter with the EPA and the Occupational Safety and Health Administration (OSHA) and are aware of no detrimental effects related to the disposal of the engine block with this material in it.

The agency considered several possible methods of rendering the engine inoperable. The agency was looking for a method that was safe for workers involved, completely effective, environmentally sound, and relatively inexpensive for a dealer to use. NHTSA’s Vehicle Research and Test Center (VRTC) tested various methods and prepared a report (placed in the docket) summarizing the tests. VRTC evaluated four options: (1) the use of sodium silicate solution in the manner the agency has now adopted; (2) destroying the oil filter sealing land and threaded fastener boss; (3) drilling a hole in the engine block; and (4) running the engine without oil. VRTC concluded that the sodium silicate method was the best option. The other methods all had significant problems related to their effectiveness, practical limitations based on vehicle variations, and/or safety risks for workers involved.

The agency reviewed available information about sodium silicate and its properties, including material safety data sheets and a toxicology report that are available in the docket. Sodium silicate is a commonly used substance found in a wide range of products, including even dishwasher detergent. The Food and Drug Administration lists it as a GRAS (Generally Regarded as Safe) substance. It is used to treat hazardous wastes, and is frequently used in the automotive industry as a rust inhibitor in cooling systems, and to seal leaks in cooling systems, head gaskets, and exhaust systems. Neither our review of available information nor our discussions with other agencies (EPA and OSHA) gave the agency reason to be concerned about the use of sodium silicate as a significant health or environmental issue.

It is important to note that there are many varieties of sodium silicates, which are differentiated by weight ratio (the ratio of the silicon dioxide and sodium oxide that make up the compound). The weight ratios range from 1.0 to 3.5, with the higher ratio formulations being less irritating for humans and less corrosive in an engine environment. The material that dealers will be required to use under this rule is at the higher end of the range - 3.2 - which means that it is far less of a potential health or environmental issue than other lower range formulations of these products.

Like many household and workplace products, sodium silicate solution can be harmful if swallowed or inhaled and can cause irritation to the eyes or respiratory tract if used improperly. Employers whose employees may come in contact with the material need to provide them with adequate warning of these risk and appropriate protection. Because sodium silicate has been used in automotive repair for decades, it has long been present both in repair shops and in vehicles at various stages of recycling. It is reasonable to assume, therefore, that dealerships, scrap yards, and shredder facilities are well equipped to take appropriate measures to protect their workers.

Nor did we find reason to have significant concerns about the environmental effects of sodium silicate in this application. The EPA does not regulate it as a hazardous substance. Given the high weight ratio of the formulation that will be used to disable the engines, the risk of reactivity with metals is very low.

The agency has decided to implement this process in the rule, requiring a dealer that receives an eligible trade-in vehicle under the CARS program to disable that vehicle’s engine prior to transferring the vehicle to a disposal facility, and to provide a certification to the agency that it has done so at the time the dealer submits its request for reimbursement Section 599.300(d) specifies the requirement for the dealer to disable the engine, Appendix B sets forth, in a simple and precise manner, the procedures that the dealer must follow to disable the engine and the workplace precautions that should be taken, and Appendix A contains the required dealer certification.

The rule contains one exception to the general requirement that the dealer disable the engine prior to transferring the vehicle to the disposal facility. With regard to transactions that occurred prior to the effective date of this rule, the dealer may have already transferred the vehicle to a disposal facility, whether or not using a salvage auction to transfer the vehicle. In that case, the rule permits the dealer to locate the vehicle at the disposal facility and either go there and disable the engine at that location or, if the engine block has already been crushed or shredded, to obtain proof from the disposal facility that the crushing or shredding has occurred. The agency is making this allowance only to accommodate purchasers and dealers who, rather than waiting for the final rule to be issued as the agency had advised, proceeded to conduct transactions that were otherwise completely in accordance with this final rule.

Although there was not time to provide notice and an opportunity to comment prior to issuance of this final rule, NHTSA did engage in extensive outreach prior to its issuance with representatives of those entities most knowledgeable about the subject matter. In those discussions, the method NHTSA has now chosen for disabling the engine block was identified as an option NHTSA might adopt. Several of the organizations that participated in the discussions wrote to NHTSA concerning that methodology. (These letters are in the docket.)

In its letter of July 21, 2009, NADA contends that Congress did not assign the task of making the engine inoperable to the dealers, and that if required to accomplish this task the dealers should be compensated. As discussed above, the agency interprets the CARS Act as giving NHTSA substantial discretion in determining the manner in which the vehicle, including the engine block, is to be transferred for ultimate disposal. We believe that having the engine permanently disabled at the dealer greatly reduces the risk of fraud and helps ensure that the statute’s environmental objectives will be achieved. We believe that the dealers can disable the engine using the prescribed method at very low cost, which we estimate to be no greater than [fill in what FRIA now says]. It is possible that the total of the cost of performing this task and the dealer’s other costs related to the program may exceed the $50 the dealer is allowed to retain from the trade-in’s scrappage value to cover its administrative costs. Nevertheless, we think the importance of having this task performed by the dealer is sufficient reason to require dealers to perform it. The CARS Act does not preclude NHTSA from imposing costs necessary to the proper implementation of the program.

The Automotive Recyclers Association (ARA), which represents more than 4,500 scrap and junk yards, wrote to NHTSA on July 20. ARA argues that the use of sodium silicate will damage more than the engine block and jeopardize the resale of parts such as pistons, cams, and cylinder heads. ARA apparently believes that “block” has only one meaning, i.e., the so-called “short block,” which generally refers only to the cast iron or aluminum casting. As discussed above, NHTSA has defined “engine block” in a way that includes the engine parts that ARA contends are not part of the block. NHTSA’s definition is a reasonable reading of the term “block,” and is consistent with a Congressional purpose to prevent these fuel inefficient engines from ever being operated again. Moreover, even if ARA’s more restrictive reading of “block” were to prevail, the statute merely permits the disposal facility to sell parts that are not part of the block; it does not preclude NHTSA from requiring measures that might affect some of those parts. ARA also contends that use of sodium silicate would contaminate the recycling of motor oil. ARA seems not to understand that, under the procedure set out in this rule, the dealer would drain the oil and recycle it as it would normally do.

The Institute of Scrap Recycling Industries (ISRI) represents, among others, companies that shred vehicles that have previously been crushed, either at their facility or at another disposal facility that lacks a shredder. ISRI wrote to NHTSA on July 20. ISRI contends, based on the judgment of its own director of environmental management, that the use of sodium silicate could pose hazards to workers at shredders and could cause certain metals to corrode, which could lead to excess metal ions in stormwater runoff, which could make stormwater compliance more challenging. ISRI’s contentions appear to be based on an incorrect assumption as to the quantity of sodium silicate that would be in each CARS trade-in vehicle; the procedure in [most cases] will require no more than two quarts, while ISRI assumes three to four quarts. ISRI assumes that a substantial portion of the material will remain unreacted after the procedure, which is not the case. [Brian, Claude: stop me if I’m wrong on this point.] ISRI also assumes that two such vehicles would be run consecutively through a shredder, which would not be [necessary.]

As discussed previously, NHTSA has no reason to believe that the use of sodium silicate will expose any workers, including those at shredders, to unreasonable risks. Those who manage the shredders will simply need to require their employees to take the precautions necessary to protect themselves from exposure to sodium silicate. Presumably those who work at shredders are appropriately trained and equipped to deal with hazards that may be related to the materials with which they are working. More importantly, sodium silicate has been present in motor vehicles for decades because of its common use in the repair of mufflers, radiators—and engines. We assume that shredders have taken note of the presence of the material before now. The use of dust respirators would be advisable.

With regard to the potential environmental risks, ISRI has not made an effective case, and NHTSA has no reason to believe that any such risk exists with regard to sodium silicate. The heart of ISRI’s argument is that the unreacted portion of the sodium silicate could cause corrosion of metals during the shredding process. As noted above, the formulation of sodium silicate used in the engine disablement procedure is among those least likely to have a severe corrosive effect. In fact, sodium silicate is used in vehicle cooling systems to inhibit corrosion and is used in metal pipes to help prevent corrosion that could increase lead levels in drinking water. In any event, the agency has no reason to believe that the untoward environmental effects that ISRI suggests may occur are a realistic possibility.

The rule also requires that, prior to submitting a copy of the title along with its request for reimbursement, the dealer clearly mark the title on both sides with the words, “Junk Automobile, CARS.gov.” The marking must be placed so as not to obscure the vehicle owner’s name, VIN, or other writing. Having this special label or brand on the title will inform all who subsequently handle it that the vehicle is a trade-in under this program and should not be registered or titled for further use as an automobile. State registration officials should pay special attention to this marking on a title because it indicates that the vehicle has been traded in under the CARS program with the understanding that it would never again be used as an automobile in this or any other country and is suitable only to be used for scrap or parts.

3. Restrictions and Limitations on Transactions