Cafe-ghg_nprm

2127_0655_MY 2012-2016 CAFE-GHG NPRM[1].doc

49 CFR Parts 531 and 533 Passenger Car Average Fuel Economy Standards -- Model Years 2008-2020; Light Truck Average Fuel Economy Standards Model Years 2008-2020; Production Plan Data.

CAFE-GHG_NPRM

OMB: 2127-0655

ENVIRONMENTAL PROTECTION AGENCY

40 CFR Parts 86 and 600

DEPARTMENT OF Transportation

National Highway Traffic Safety Administration

49 CFR Parts 531, 533, and 537

[EPA–HQ–OAR–2009–0472; FRL_XXXX-X; NHTSA-2009-0059]

RIN 2060-AP58; RIN 2127-AK50

Proposed Rulemaking to Establish Light-Duty Vehicle Greenhouse Gas Emission Standards and Corporate Average Fuel Economy Standards

AGENCIES: Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration (NHTSA).

ACTION: Proposed Rule.

SUMMARY: EPA and NHTSA are issuing this joint proposal to establish a National Program consisting of new standards for light-duty vehicles that will reduce greenhouse gas emissions and improve fuel economy. This joint proposed rulemaking is consistent with the National Fuel Efficiency Policy announced by President Obama on May 19, 2009, responding to the country’s critical need to address global climate change and to reduce oil consumption. EPA is proposing greenhouse gas emissions standards under the Clean Air Act, and NHTSA is proposing Corporate Average Fuel Economy standards under the Energy Policy and Conservation Act, as amended. These standards apply to passenger cars, light-duty trucks, and medium-duty passenger vehicles, covering model years 2012 through 2016, and represent a harmonized and consistent National Program. Under the National Program, automobile manufacturers would be able to build a single light-duty national fleet that satisfies all requirements under both programs while ensuring that consumers still have a full range of vehicle choices.

DATES: Comments: Comments must be received on or before [Insert date 60 days after publication in the Federal Register], sixty days after date of publication in the Federal Register. Under the Paperwork Reduction Act, comments on the information collection provisions must be received by the Office of Management and Budget (OMB) on or before [Insert date 30 days after publication in the Federal Register], thirty days after date of publication in the Federal Register. See the SUPPLEMENTARY INFORMATION section on “Public Participation” for more information about written comments.

Hearings: NHTSA and EPA will jointly hold two public hearings on the following dates: [Insert Date], in Detroit, Michigan, and [Insert Date], in Sacramento, California The hearings will start at 9 a.m. local time and continue until everyone has had a chance to speak. See the SUPPLEMENTARY INFORMATION section on “Public Participation.” for more information about the public hearings.

ADDRESSES: Submit your comments, identified by Docket ID No. EPA-HQ-OAR-2009-0472 and/or NHTSA-2009-0059, by one of the following methods:

www.regulations.gov: Follow the on-line instructions for submitting comments.

Email: [email protected]

Fax: EPA: (202) 566–1741; NHTSA: (202) 493-2251.

Mail:

EPA: Environmental Protection Agency, EPA Docket Center (EPA/DC), Air and Radiation Docket, Mail Code 2822T, 1200 Pennsylvania Avenue, NW., Washington, DC 20460, Attention Docket ID No. EPA-HQ-OAR-2009-0472. In addition, please mail a copy of your comments on the information collection provisions to the Office of Information and Regulatory Affairs, Office of Management and Budget (OMB), Attn: Desk Officer for EPA, 725 17th St., NW., Washington, DC 20503.

NHTSA: Docket Management Facility, M-30, U.S. Department of Transportation, West Building, Ground Floor, Rm. W12-140, 1200 New Jersey Avenue, SE, Washington, DC 20590.

Hand Delivery:

EPA: Docket Center, (EPA/DC) EPA West, Room B102, 1301 Constitution Ave., NW., Washington, DC, Attention Docket ID No. EPA-HQ-OAR-2009-0472. Such deliveries are only accepted during the Docket’s normal hours of operation, and special arrangements should be made for deliveries of boxed information.

NHTSA: West Building, Ground Floor, Rm. W12-140, 1200 New Jersey Avenue, SE, Washington, DC 20590, between 9 a.m. and 5 p.m. Eastern Time, Monday through Friday, except Federal Holidays.

Instructions: Direct your comments to Docket ID No. EPA-HQ-OAR-2009-0472 and/or NHTSA-2009-0059. See the SUPPLEMENTARY INFORMATION section on “Public Participation” for more information about submitting written comments.

Public Hearing: NHTSA and EPA will jointly hold two public hearings at the following locations: [Insert Date, Location, & Address], Detroit, Michigan; and [Insert Date, Location, & Address], Sacramento, California. See the SUPPLEMENTARY INFORMATION section on “Public Participation” for more information about the public hearings.

Docket: All documents in the dockets are listed in the www.regulations.gov index. Although listed in the index, some information is not publicly available, e.g., confidential business information (CBI) or other information whose disclosure is restricted by statute. Certain other material, such as copyrighted material, will be publicly available only in hard copy. Publicly available docket materials are available either electronically in www.regulations.gov or in hard copy at the following locations: EPA: EPA Docket Center, EPA/DC, EPA West, Room 3334, 1301 Constitution Ave., NW., Washington, DC. The Public Reading Room is open from 8:30 a.m. to 4:30 p.m., Monday through Friday, excluding legal holidays. The telephone number for the Public Reading Room is (202) 566–1744. NHTSA: Docket Management Facility, M-30, U.S. Department of Transportation, West Building, Ground Floor, Rm. W12-140, 1200 New Jersey Avenue, SE, Washington, DC 20590. The Docket Management Facility is open between 9 a.m. and 5 p.m. Eastern Time, Monday through Friday, except Federal holidays.

FOR FURTHER INFORMATION CONTACT: EPA: Tad Wysor, Office of Transportation and Air Quality, Assessment and Standards Division, Environmental Protection Agency, 2000 Traverwood Drive, Ann Arbor MI 48105; telephone number: 734-214-4332; fax number: 734-214-4816; email address: [email protected], or Assessment and Standards Division Hotline; telephone number (734) 214-4636; e-mail address [email protected]. NHTSA: Rebecca Yoon, Office of Chief Counsel, National Highway Traffic Safety Administration, 1200 New Jersey Avenue, SE, Washington, DC 20590. Telephone: (202) 366-2992.

SUPPLEMENTARY INFORMATION:

A. Does this Action Apply to Me?

This action affects companies that manufacture or sell new light-duty vehicles, light-duty trucks, and medium-duty passenger vehicles, as defined under EPA’s CAA regulations,1 and passenger automobiles (passenger cars) and non-passenger automobiles (light trucks) as defined under NHTSA’s CAFE regulations.2 Regulated categories and entities include:

Category |

NAICS CodesA |

Examples of Potentially Regulated Entities |

Industry |

336111 336112 |

Motor vehicle manufacturers. |

Industry |

811112 811198 541514 |

Commercial Importers of Vehicles and Vehicle Components. |

A North American Industry Classification System (NAICS)

This list is not intended to be exhaustive, but rather provides a guide regarding entities likely to be regulated by this action. To determine whether particular activities may be regulated by this action, you should carefully examine the regulations. You may direct questions regarding the applicability of this action to the person listed in FOR FURTHER INFORMATION CONTACT.

B. Public Participation

NHTSA and EPA request comment on all aspects of this joint proposed rule. This section describes how you can participate in this process.

How Do I Prepare and Submit Comments?

In this joint proposal, there are many issues common to both EPA’s and NHTSA’s proposals. For the convenience of all parties, comments submitted to the EPA docket will be considered comments submitted to the NHTSA docket, and vice versa. An exception is that comments submitted to the NHTSA docket on the Draft Environmental Impact Statement will not be considered submitted to the EPA docket. Therefore, the public only needs to submit comments to either one of the two agency dockets. Comments that are submitted for consideration by one agency should be identified as such, and comments that are submitted for consideration by both agencies should be identified as such. Absent such identification, each agency will exercise its best judgment to determine whether a comment is submitted on its proposal.

Further instructions for submitting comments to either the EPA or NHTSA docket are described below.

EPA: Direct your comments to Docket ID No EPA-HQ-OAR-2009-0472. EPA’s policy is that all comments received will be included in the public docket without change and may be made available online at www.regulations.gov, including any personal information provided, unless the comment includes information claimed to be Confidential Business Information (CBI) or other information whose disclosure is restricted by statute. Do not submit information that you consider to be CBI or otherwise protected through www.regulations.gov or e-mail. The www.regulations.gov Web site is an ‘‘anonymous access’’ system, which means EPA will not know your identity or contact information unless you provide it in the body of your comment. If you send an e-mail comment directly to EPA without going through www.regulations.gov your e-mail address will be automatically captured and included as part of the comment that is placed in the public docket and made available on the Internet. If you submit an electronic comment, EPA recommends that you include your name and other contact information in the body of your comment and with any disk or CD–ROM you submit. If EPA cannot read your comment due to technical difficulties and cannot contact you for clarification, EPA may not be able to consider your comment. Electronic files should avoid the use of special characters, any form of encryption, and be free of any defects or viruses. For additional information about EPA’s public docket visit the EPA Docket Center homepage at http:// www.epa.gov/epahome/dockets.htm.

NHTSA: Your comments must be written and in English. To ensure that your comments are correctly filed in the Docket, please include the Docket number NHTSA-2009-0059 in your comments. Your comments must not be more than 15 pages long.3 NHTSA established this limit to encourage you to write your primary comments in a concise fashion. However, you may attach necessary additional documents to your comments. There is no limit on the length of the attachments. If you are submitting comments electronically as a PDF (Adobe) file, we ask that the documents submitted be scanned using the Optical Character Recognition (OCR) process, thus allowing the agencies to search and copy certain portions of your submissions.4 Please note that pursuant to the Data Quality Act, in order for the substantive data to be relied upon and used by the agencies, it must meet the information quality standards set forth in the OMB and Department of Transportation (DOT) Data Quality Act guidelines. Accordingly, we encourage you to consult the guidelines in preparing your comments. OMB’s guidelines may be accessed at http://www.whitehouse.gov/omb/fedreg/reproducible.html. DOT’s guidelines may be accessed at http://www.dot.gov/dataquality.htm.

Tips for Preparing Your Comments

When submitting comments, remember to:

Identify the rulemaking by docket number and other identifying information (subject heading, Federal Register date and page number).

Follow directions - The agency may ask you to respond to specific questions or organize comments by referencing a Code of Federal Regulations (CFR) part or section number.

Explain why you agree or disagree, suggest alternatives, and substitute language for your requested changes.

Describe any assumptions and provide any technical information and/or data that you used.

If you estimate potential costs or burdens, explain how you arrived at your estimate in sufficient detail to allow for it to be reproduced.

Provide specific examples to illustrate your concerns, and suggest alternatives.

Explain your views as clearly as possible, avoiding the use of profanity or personal threats.

Make sure to submit your comments by the comment period deadline identified in the DATES section above.

How Can I be Sure That My Comments Were Received?

NHTSA: If you submit your comments by mail and wish Docket Management to notify you upon its receipt of your comments, enclose a self-addressed, stamped postcard in the envelope containing your comments. Upon receiving your comments, Docket Management will return the postcard by mail.

How Do I Submit Confidential Business Information?

Any confidential business information (CBI) submitted to one of the agencies will also be available to the other agency. However, as with all public comments, any CBI information only needs to be submitted to either one of the agencies’ dockets and it will be available to the other. Following are specific instructions for submitting CBI to either agency.

EPA: Do not submit CBI to EPA through www.regulations.gov or e-mail. Clearly mark the part or all of the information that you claim to be CBI. For CBI information in a disk or CD ROM that you mail to EPA, mark the outside of the disk or CD ROM as CBI and then identify electronically within the disk or CD ROM the specific information that is claimed as CBI. In addition to one complete version of the comment that includes information claimed as CBI, a copy of the comment that does not contain the information claimed as CBI must be submitted for inclusion in the public docket. Information so marked will not be disclosed except in accordance with procedures set forth in 40 CFR Part 2.

NHTSA: If you wish to submit any information under a claim of confidentiality, you should submit three copies of your complete submission, including the information you claim to be confidential business information, to the Chief Counsel, NHTSA, at the address given above under FOR FURTHER INFORMATION CONTACT. When you send a comment containing confidential business information, you should include a cover letter setting forth the information specified in our confidential business information regulation.5

In addition, you should submit a copy from which you have deleted the claimed confidential business information to the Docket by one of the methods set forth above.

Will the Agencies Consider Late Comments?

NHTSA and EPA will consider all comments received before the close of business on the comment closing date indicated above under DATES. To the extent practicable, we will also consider comments received after that date. If interested persons believe that any new information the agency places in the docket affects their comments, they may submit comments after the closing date concerning how the agency should consider that information for the final rule. However, the agencies’ ability to consider any such late comments in this rulemaking will be limited due to the time frame for issuing a final rule.

If a comment is received too late for us to practicably consider in developing a final rule, we will consider that comment as an informal suggestion for future rulemaking action.

How Can I Read the Comments Submitted By Other People?

You may read the materials placed in the docket for this document (e.g., the comments submitted in response to this document by other interested persons) at any time by going to http://www.regulations.gov. Follow the online instructions for accessing the dockets. You may also read the materials at the EPA Docket Center or NHTSA Docket Management Facility by going to the street addresses given above under ADDRESSES.

How do I participate in the public hearings?

NHTSA and EPA will jointly host two public hearings on the dates and locations described in the DATES and ADDRESSES sections above.

If you would like to present testimony at the public hearings, we ask that you notify the EPA and NHTSA contact persons listed under FOR FURTHER INFORMATION CONTACT at least ten days before the hearing. Once EPA and NHTSA learn how many people have registered to speak at the public hearing, we will allocate an appropriate amount of time to each participant, allowing time for lunch and necessary breaks throughout the day. For planning purposes, each speaker should anticipate speaking for approximately ten minutes, although we may need to adjust the time for each speaker if there is a large turnout. We suggest that you bring copies of your statement or other material for the EPA and NHTSA panels and the audience. It would also be helpful if you send us a copy of your statement or other materials before the hearing. To accommodate as many speakers as possible, we prefer that speakers not use technological aids (e.g., audio-visuals, computer slideshows). However, if you plan to do so, you must notify the contact persons in the FOR FURTHER INFORMATION CONTACT section above. You also must make arrangements to provide your presentation or any other aids to NHTSA and EPA in advance of the hearing in order to facilitate set-up. In addition, we will reserve a block of time for anyone else in the audience who wants to give testimony.

The hearing will be held at a site accessible to individuals with disabilities. Individuals who require accommodations such as sign language interpreters should contact the persons listed under FOR FURTHER INFORMATION CONTACT section above no later than ten days before the date of the hearing.

NHTSA and EPA will conduct the hearing informally, and technical rules of evidence will not apply. We will arrange for a written transcript of the hearing and keep the official record of the hearing open for 30 days to allow you to submit supplementary information. You may make arrangements for copies of the transcript directly with the court reporter.

Table of Contents

I. Overview of Joint EPA/NHTSA National Program

A. Introduction

1. Building Blocks of the National Program

2. Joint Proposal for a National Program

B. Summary of the Joint Proposal

C. Background and Comparison of NHTSA and EPA Statutory Authority

1. NHTSA Statutory Authority

2. EPA Statutory Authority

3. Comparing the Agencies’ Authority

D. Summary of the Proposed Standards for the National Program

1. Joint Analytical Approach

2. Level of the Standards

3. Form of the Standards

E. Summary of Costs and Benefits for the Joint Proposal

1. Summary of Costs and Benefits of Proposed NHTSA CAFE

Standards

2. Summary of Costs and Benefits of Proposed EPA GHG

Standards

F. Program Flexibilities for Achieving Compliance

1. CO2/CAFE Credits Generated Based on Fleet Average Performance

2. Air Conditioning Credits

3. Flex-fuel and Alternative Fuel Vehicle Credits

4. Temporary Lead-time Allowance Alternative Standards

5. Additional Credit Opportunities under the CAA

G. Coordinated Compliance

H. Conclusion

II. Joint Technical Work Completed for This Proposal

A. Introduction

B. How did NHTSA and EPA Develop the Baseline Market Forecast?

1. Why do the Agencies Establish a Baseline Vehicle Fleet?

2. How do the Agencies Develop the Baseline Vehicle Fleet?

3. How is the Development of the Baseline Fleet for this Proposal

Different from NHTSA’s Historical approach, and Why is this Approach Preferable?

4. How Does Manufacturer Product Plan Data Factor into the Baseline Used in this Proposal?

C. Development of Attribute-Based Curve Shapes

D. Relative Car-Truck Stringency

E. Joint Vehicle Technology Assumptions

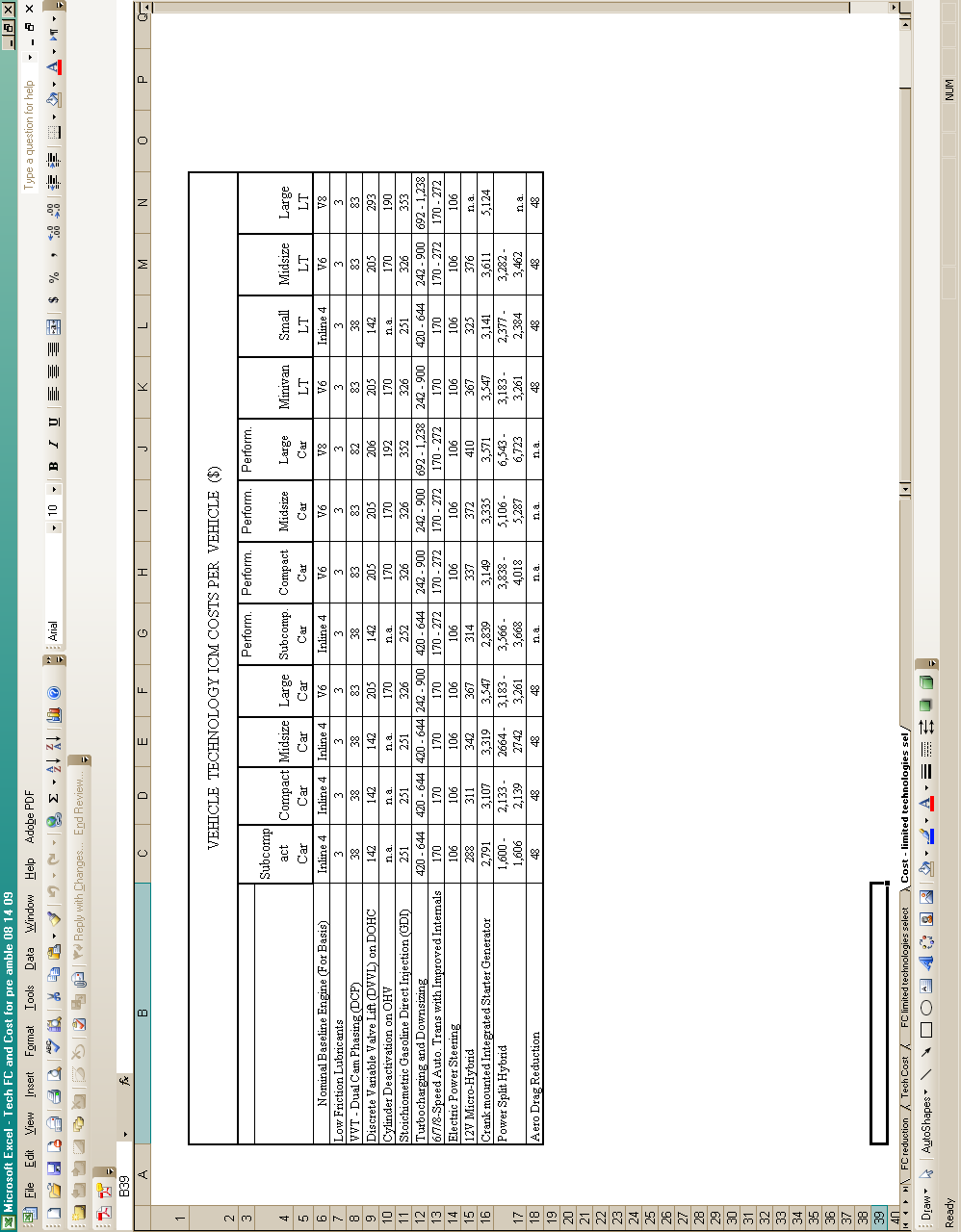

1. What Technologies do the Agencies Consider?

2. How did the Agencies Determine the Costs and Effectiveness of Each of these Technologies?

F. Joint Economic Assumptions

III. EPA Proposal for Greenhouse Gas Vehicle Standards

A. Executive Overview of EPA Proposal

1. Introduction

2. Why is EPA Proposing this Rule?

3. What is EPA Proposing?

4. Basis for the Proposed GHG Standards under Section 202(a)

B. Proposed GHG Standards for Light-duty Vehicles, Light-duty Trucks, and Medium duty Passenger Vehicles

1. What Fleet-wide Emissions Levels Correspond to the CO2 Standards?

2. What Are the CO2 Attribute-based Standards?

3. Overview of How EPA’s Proposed CO2 Standards Would Be Implemented for Individual Manufacturers

4. Averaging, Banking, and Trading Provisions for CO2 Standards

5. CO2 Temporary Lead-time Allowance Alternative Standards

6. Proposed Nitrous Oxide and Methane Standards

7. Small Entity Deferment

C. Additional Credit Opportunities for CO2 Fleet Average Program

1. Air Conditioning Related Credits

2. Flex Fuel and Alternative Fuel Vehicle Credits

3. Advanced Technology Vehicle Credits for Electric Vehicles, Plug- in Hybrids, and Fuel Cells

4. Off-cycle Technology Credits

5. Early Credit Options

D. Feasibility of the Proposed CO2 Standards

1. How Did EPA Develop a Reference Vehicle Fleet for Evaluating Further CO2 Reductions?

2. What are the Effectiveness and Costs of CO2-reducing Technologies?

3. How can Technologies be Combined into “Packages” and What is the Cost and Effectiveness of Packages?

4. Manufacturer’s Application of Technology

5. How is EPA Projecting that a Manufacturer Would Decide Between Options to Improve CO2 Performance to Meet a Fleet Average Standard?

6. Why are the Proposed CO2 Standards Feasible?

7. What Other Fleet-Wide CO2 Levels Were Considered?

E. Certification, Compliance, and Enforcement

1. Compliance Program Overview

2. Compliance with Fleet-Average CO2 Standards

3. Vehicle Certification

4. Useful Life Compliance

5. Credit Program Implementation

6. Enforcement

7. Prohibited Acts in the CAA

8. Other Certification Issues

9. Miscellaneous Revisions to Existing Regulations

10. Warranty, Defect Reporting, and Other Emission-related Components Provisions

11. Light Vehicles and Fuel Economy Labeling

F. How Would This Proposal Reduce GHG Emissions and Their Associated Effects?

1. Impact on GHG Emissions

2. Overview of Climate Change Impacts from GHG Emissions

3. Changes in Global Mean Temperature and Sea-level Rise Associated with the Proposal’s GHG Emissions Reductions

4. Weight Reduction and Potential Safety Impacts

G. How Would the Proposal Impact Non-GHG Emissions and Their Associated Effects?

1. Upstream Impacts of Program

2. Downstream Impacts of Program

3. Health Effects of Non-GHG Pollutants

4. Environmental Effects of Non-GHG Pollutants

5. Air Quality Impacts of Non-GHG Pollutants

H. What are the Estimated Cost, Economic, and Other Impacts of the Proposal?

1. Conceptual Framework for Evaluating Consumer Impacts

2. Costs Associated with the Vehicle Program

3. Cost per Ton of Emissions Reduced

4. Reduction in Fuel Consumption and its Impacts

5. Impacts on U.S. Vehicle Sales and Payback Period

6. Benefits of Reducing GHG Emissions

7. Non-Greenhouse Gas Health and Environmental Impacts

8. Energy Security Impacts

9. Other Impacts

10. Summary of Costs and Benefits

I. Statutory and Executive Order Reviews

1. Executive Order 12866: Regulatory Planning and Review

2. Paperwork Reduction Act

3. Regulatory Flexibility Act

4. Unfunded Mandates Reform Act

5. Executive Order 13132 (Federalism)

6. Executive Order 13175 (Consultation and Coordination with Indian Tribal Governments)

7. Executive Order 13045: “Protection of Children from Environmental Health Risks and Safety Risks”

8. Executive Order 13211 (Energy Effects)

9. National Technology Transfer Advancement Act

10. Executive Order 12898: Federal Actions to Address Environmental Justice in Minority Populations and Low-Income Populations

J. Statutory Provisions and Legal Authority

IV. NHTSA Proposal for Passenger Car and Light Truck CAFE Standards for MYs 2012-2016

A. Executive Overview of NHTSA Proposal

1. Introduction

2. Role of Fuel Economy Improvements in Promoting Energy Independence, Energy Security, and a Low Carbon Economy

3. The National Program

4. Review of CAFE Standard Setting Methodology Per the President’s January 26, 2009 Memorandum on CAFE Standards for MYs 2011 and Beyond

5. Summary of the Proposed MY 2012-2016 CAFE Standards

B. Background

1. Chronology of Events Since the National Academy of Sciences Called for Reforming and Increasing CAFE Standards

2. NHTSA Issues Final Rule Establishing Attribute-Based CAFE Standards for MY 2008-2011 Light Trucks (March 2006)

3. Ninth Circuit Issues Decision re Final Rule for MY 2008-2011 Light Trucks (November 2007)

4. Congress Enacts Energy Security and Independence Act of 2007 (December 2007)

5. NHTSA Proposes CAFE Standards for MYs 2011-2015 (April 2008)

6. Ninth Circuit Revises its Decision re Final Rule for MY 2008-2011 Light Trucks (August 2008)

7. NHTSA Releases Final Environmental Impact Statement (October 2008)

8. Department of Transportation Decides not to Issue MY 2011-2015 final Rule (January 2009)

9. The President Requests NHTSA to Issue Final Rule for MY 2011 Only (January 2009)

10. NHTSA Issues Final Rule for MY 2011 (March 2009)

11. Energy Policy and Conservation Act, as Amended by the Energy Independence and Security Act

C. Development and Feasibility of the Proposed Standards

1. How Was the Baseline Vehicle Fleet Developed?

2. How were the Technology Inputs Developed?

3. How Did NHTSA Develop the Economic Assumption Inputs?

4. How Does NHTSA Use the Assumptions in its Modeling Analysis?

5. How Did NHTSA Develop the Shape of the Target Curves for the Proposed Standards?

D. Statutory Requirements

1. EPCA, as Amended by EISA

2. Administrative Procedure Act

3. National Environmental Policy Act

E. What are the Proposed CAFE Standards?

1. Form of the Standards

2. Passenger Car Standards for MYs 2012-2016

3. Minimum Domestic Passenger Car standards

4. Light Truck Standards

F. How Do the Proposed Standards Fulfill NHTSA’s Statutory Obligations?

G. Impacts of the Proposed CAFE Standards

1. How Would These Proposed Standards Improve Fuel Economy and Reduce GHG Emissions for MY 2012-2016 Vehicles?

2. How Would These Proposed Standards Improve Fleet-wide Fuel Economy and Reduce GHG Emissions Beyond MY 2016?

3. How Would These Proposed standards Impact Non-GHG emissions and Their Associated Effects?

4. What are the Estimated Costs and Benefits of These Proposed

Standards?

5. How Would These Proposed Standards Impact Vehicle Sales?

6. What are the Consumer Welfare Impacts of These Proposed Standards?

7. What are the Estimated Safety Impacts of These Proposed Standards?

8. What Other Impacts (Quantitative and Unquantifiable) will These Proposed Standards Have?

H. Vehicle Classification

I. Compliance and Enforcement

1. Overview

2. How Does NHTSA Determine Compliance?

3. What Compliance Flexibilities Are Available under the CAFE Program and How Do Manufacturers Use Them?

4. Other CAFE Enforcement Issues—Variations in Footprint

J. Other Near-Term Rulemakings Mandated by EISA

1. Commercial Medium- and Heavy-Duty On-Highway Vehicles and Work Trucks

2. Consumer Information

K. Regulatory Notices and Analyses

1. Executive Order 12866 and DOT Regulatory Policies and

Procedures

2. National Environmental Policy Act

3. Regulatory Flexibility Act

4. Executive Order 13132 (Federalism)

5. Executive Order 12988 (Civil Justice Reform)

6. Unfunded Mandates Reform Act

7. Paperwork Reduction Act

8. Regulation Identifier Number

9. Executive Order 13045

10. National Technology Transfer and Advancement Act

11. Executive Order 13211

12. Department of Energy Review

13. Plain Language

14. Privacy Act

I. Overview of Joint EPA/NHTSA National Program

A. Introduction

The National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA) are each announcing proposed rules whose benefits would address the urgent and closely intertwined challenges of energy independence and security and global warming. These proposed rules call for a strong and coordinated federal greenhouse gas and fuel economy program for passenger cars, light-duty-trucks, and medium-duty passenger vehicles (hereafter light-duty vehicles), referred to as the National Program. The proposed rules can achieve substantial reductions of greenhouse gas (GHG) emissions and improvements in fuel economy from the light-duty vehicle part of the transportation sector, based on technology that is already being commercially applied in most cases and that can be incorporated at a reasonable cost.

This joint notice is consistent with the President’s announcement on May 19, 2009 of a National Fuel Efficiency Policy of establishing consistent, harmonized, and streamlined requirements that would reduce greenhouse gas emissions and improve fuel economy for all new cars and light-duty trucks sold in the United States 6 The National Program holds out the promise of delivering additional environmental and energy benefits, cost savings, and administrative efficiencies on a nationwide basis that might not be available under a less coordinated approach. The proposed National Program also offers the prospect of regulatory convergence by making it possible for the standards of two different federal agencies and the standards of California and other states to act in a unified fashion in providing these benefits. This would allow automakers to produce and sell a single fleet nationally. Thus, it may also help to mitigate the additional costs that manufacturers would otherwise face in having to comply with multiple sets of federal and state standards. This joint notice is also consistent with the Notice of Upcoming Joint Rulemaking issued by DOT and EPA on May 197 and responds to the President’s January 26, 2009 memorandum on CAFE standards for model years 2011 and beyond,8 the details of which can be found in Section IV of this joint notice.

1. Building Blocks of the National Program

The National Program is both needed and possible because the relationship between improving fuel economy and reducing CO2 tailpipe emissions is a very direct and close one. The amount of those CO2 emissions is essentially constant per gallon combusted of a given type of fuel. Thus, the more fuel efficient a vehicle is, the less fuel it burns to travel a given distance. The less fuel it burns, the less CO2 it emits in traveling that distance.9 While there are emission control technologies that reduce the pollutants (e.g., carbon monoxide) produced by imperfect combustion of fuel by capturing or destroying them, there is no such technology for CO2. Further, while some of those pollutants can also be reduced by achieving a more complete combustion of fuel, doing so only increases the tailpipe emissions of CO2. Thus, there is a single pool of technologies for addressing these twin problems, i.e., those that reduce fuel consumption and thereby reduce CO2 emissions as well.

a. DOT’s CAFE Program

In 1975, Congress enacted the Energy Policy and Conservation Act (EPCA), mandating that NHTSA establish and implement a regulatory program for motor vehicle fuel economy to meet the various facets of the need to conserve energy, including ones having energy independence and security, environmental and foreign policy implications. Fuel economy gains since 1975, due both to the standards and market factors, have resulted in saving billions of barrels of oil and avoiding billions of metric tons of CO2 emissions. In December 2007, Congress enacted the Energy Independence and Securities Act (EISA), amending EPCA to require substantial, continuing increases in fuel economy standards.

The CAFE standards address most, but not all, of the real world CO2 emissions because EPCA requires the use of 1975 passenger car test procedures under which vehicle air conditioners are not turned on during fuel economy testing.10 Fuel economy is determined by measuring the amount of CO2 and other carbon compounds emitted from the tailpipe, not by attempting to measure directly the amount of fuel consumed during a vehicle test, a difficult task to accomplish with precision. The carbon content of the test fuel11 is then used to calculate the amount of fuel that had to be consumed per mile in order to produce that amount of CO2. Finally, that fuel consumption figure is converted into a miles-per-gallon figure. CAFE standards also do not address the 5-8 percent of GHG emissions that are not CO2, i.e., nitrous oxide (N2O), and methane (CH4) as well as emissions of CO2 and hydrofluorocarbons (HFCs) related to operation of the air conditioning system.

b. EPA’s Greenhouse Gas Standards for Light-duty Vehicles

Under the Clean Air Act EPA is responsible for addressing air pollutants from motor vehicles. On April 2, 2007, the U.S. Supreme Court issued its opinion in Massachusetts v. EPA,12 a case involving a 2003 order of the Environmental Protection Agency (EPA) denying a petition for rulemaking to regulate greenhouse gas emissions from motor vehicles under section 202(a) of the Clean Air Act (CAA).13 The Court held that greenhouse gases were air pollutants for purposes of the Clean Air Act and further held that the Administrator must determine whether or not emissions from new motor vehicles cause or contribute to air pollution which may reasonably be anticipated to endanger public health or welfare, or whether the science is too uncertain to make a reasoned decision. The Court further ruled that, in making these decisions, the EPA Administrator is required to follow the language of section 202(a) of the CAA. The Court rejected the argument that EPA cannot regulate CO2 from motor vehicles because to do so would de facto tighten fuel economy standards, authority over which has been assigned by Congress to DOT. The Court stated that “[b]ut that DOT sets mileage standards in no way licenses EPA to shirk its environmental responsibilities. EPA has been charged with protecting the public‘s ‘health’ and ‘welfare’, a statutory obligation wholly independent of DOT’s mandate to promote energy efficiency.” The Court concluded that “[t]he two obligations may overlap, but there is no reason to think the two agencies cannot both administer their obligations and yet avoid inconsistency.” 14 The Court remanded the case back to the Agency for reconsideration in light of its findings. 15

EPA has since proposed to find that emissions of GHGs from new motor vehicles and motor vehicle engines cause or contribute to air pollution that may reasonably be anticipated to endanger public health and welfare.16 This proposal represents the second phase of EPA’s response to the Supreme Court’s decision.

c. California Air Resources Board Greenhouse Gas Program

In 2004, the California Air Resources Board approved standards for new light-duty vehicles, which regulate the emission of not only CO2, but also other GHGs. Since then, thirteen states and the District of Columbia, comprising approximately 40 percent of the light-duty vehicle market, have adopted California’s standards. These standards apply to model years 2009 through 2016 and require CO2 emissions for passenger cars and the smallest light trucks of 323 g/mi in 2009 and 205 g/mi in 2016, and for the remaining light trucks of 439 g/mi in 2009 and 332 g/mi in 2016. On June 30, 2009, EPA granted California’s request for a waiver of preemption under the CAA.17 The granting of the waiver permits California and the other states to proceed with implementing the California emission standards.

2. Joint Proposal for a National Program

On May 19, 2009, the Department of Transportation and the Environmental Protection Agency issued a Notice of Upcoming Joint Rulemaking to propose a strong and coordinated fuel economy and greenhouse gas National Program for Model Year (MY) 2012-2016 light duty vehicles.

B. Summary of the Joint Proposal

In this joint rulemaking, EPA is proposing GHG emissions standards under the Clean Air Act (CAA), and NHTSA is proposing Corporate Average Fuel Economy (CAFE) standards under the Energy Policy and Conservation Action of 1975 (EPCA), as amended by the Energy Independence and Security Act of 2007 (EISA). The intention of this joint rulemaking proposal is to set forth a carefully coordinated and harmonized approach to implementing these two statutes, in accordance with all substantive and procedural requirements imposed by law.

Climate change is widely viewed as the most significant long-term threat to the global environment. According to the Intergovernmental Panel on Climate Change, anthropogenic emissions of greenhouse gases are very likely (90 to 99 percent probability) the cause of most of the observed global warming over the last 50 years. The primary GHGs of concern are carbon dioxide (CO2), methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride. Mobile sources emitted 31.5 percent of all U.S. GHG in 2006, and have been the fastest-growing source of U.S. GHG since 1990. Light-duty vehicles emit four GHGs--CO2, methane, nitrous oxide, and hydrofluorocarbons--and are responsible for nearly 60 percent of all mobile source GHGs. For light-duty vehicles, CO2 emissions represent about 95 percent of all greenhouse emissions, and the CO2 emissions measured over the EPA tests used for fuel economy compliance represent over 90 percent of total light-duty vehicle greenhouse gas emissions.

Improving energy security by reducing our dependence on foreign oil has been a national objective since the first oil price shocks in the 1970s. Net petroleum imports now account for approximately 60 percent of U.S. petroleum consumption. World crude oil production is highly concentrated, exacerbating the risks of supply disruptions and price shocks. Tight global oil markets led to prices over $100 per barrel in 2008, with gasoline reaching as high as $4 per gallon in many parts of the U.S., causing financial hardship for many families. The export of U.S. assets for oil imports continues to be an important component of the U.S.’ historically unprecedented trade deficits. Transportation accounts for about two-thirds of U.S. petroleum consumption. Light-duty vehicles account for about 60 percent of transportation oil use, which means that they alone account for about 40 percent of all U.S. oil consumption.

NHTSA and EPA have coordinated closely and worked jointly in developing their respective proposals. This is reflected in many aspects of this joint proposal. For example, the agencies have developed a comprehensive joint Technical Support Document (TSD) that provides a solid technical underpinning for each agency’s modeling and analysis used to support their proposed standards. Also, to the extent allowed by law, the agencies have harmonized many elements of program design, such as the form of the standard (the footprint-based attribute curves), and the definitions used for cars and trucks. They have developed the same or similar compliance flexibilities, to the extent allowed and appropriate under their respective statutes, such as averaging, banking, and trading of credits, and have harmonized the compliance testing and test protocols used for purposes of the fleet average standards each agency is proposing. Finally, as discussed in Section I.C., under their respective statutes each agency is called upon to exercise its judgment and determine standards that are an appropriate balance of various relevant statutory factors. Given the common technical issues before each agency, the similarity of the factors each agency is to consider and balance, and the authority of each agency to take into consideration the standards of the other agency, both EPA and NHTSA are proposing standards that result in a harmonized National Program.

This joint proposal covers passenger cars, light-duty-trucks, and medium-duty passenger vehicles built in model years 2012 through 2016. These vehicle categories are responsible for almost 60 percent of all U.S. transportation-related GHG emissions. EPA and NHTSA expect that automobile manufacturers will meet these proposed standards by utilizing technologies that will reduce vehicle GHG emissions and improve fuel economy. Although many of these technologies are available today, the emissions reductions and fuel economy improvements proposed would involve more widespread use of these technologies across the light-duty vehicle fleet. These include improvements to engines, transmissions, and tires, increased use of start-stop technology, improvements in air conditioning systems (to the extent currently allowed by law), increased use of hybrid and other advanced technologies, and the initial commercialization of electric vehicles and plug-in hybrids.

The proposed National Program would result in approximately 950 million metric tons of total carbon dioxide equivalent emissions reductions and approximately 1.8 billion barrels of oil savings over the lifetime of vehicles sold in model years 2012 through 2016. In total, the combined EPA and NHTSA 2012-2016 standards would reduce GHG emissions from the U.S. light-duty fleet by approximately 21 percent by 2030 over the level that would occur in the absence of the National Program. These proposals also provide important energy security benefits, as light-duty vehicles are about 95 percent dependent on oil-based fuels. The benefits of the proposed National Program would total about $250 billion at a 3% discount rate, or $195 billion at a 7% discount rate. In the discussion that follows in Section III and IV, each agency explains the related benefits for their individual standards.

Together, EPA and NHTSA estimate that the average cost increase for a model year 2016 vehicle due to the proposed National Program is less than $1,100. U.S. consumers who purchase their vehicle outright would save enough in lower fuel costs over the first three years to offset these higher vehicle costs. However, most U.S. consumers purchase a new vehicle using credit rather than paying cash and the typical car loan today is a five year, 60 month loan. These consumers would see immediate savings due to their vehicle’s lower fuel consumption in the form of reduced monthly costs of $12-$14 per month throughout the duration of the loan (that is, the fuel savings outweigh the increase in loan payments by $12-$14 per month). Whether a consumer takes out a loan or purchases a new vehicle outright, over the lifetime of a model year 2016 vehicle, consumers would save more than $3,000 due to fuel savings. The average 2016 MY vehicle will emit 16 fewer metric tons of CO2 emissions during its lifetime.

This joint proposal also offers the prospect of important regulatory convergence and certainty to automobile companies. Absent this proposal, there would be three separate federal and state regimes independently regulating light-duty vehicles to reduce fuel consumption and GHG emissions: NHTSA’s CAFE standards, EPA’s GHG standards, and the GHG standards applicable in California and other states adopting the California standards. This joint proposal would allow automakers to meet both the NHTSA and EPA requirements with a single national fleet, greatly simplifying the industry's technology, investment and compliance strategies. In addition, in a letter dated May 18, 2009, California stated that it “recognizes the benefit for the country and California of a National Program to address greenhouse gases and fuel economy and the historic announcement of United States Environmental Protection Agency (EPA) and National Highway Transportation Safety Administration's (NHTSA) intent to jointly propose a rule to set standards for both. California fully supports proposal and adoption of such a National Program.” To promote the National Program, California announced its commitment to take several actions, including revising its program for MYs 2012-2016 such that compliance with the federal GHG standards would be deemed to be compliance with California's GHG standards. This would allow the single national fleet used by automakers to meet the two Federal requirements and to meet California requirements as well. This commitment was conditioned on several points, including EPA GHG standards that are substantially similar to those described in the May 19, 2009 Notice of Upcoming Joint Rulemaking. Many automakers and trade associations also announced their support for the National Program announced that day.18 The manufacturers conditioned their support on EPA and NHTSA standards substantially similar to those described in that Notice. NHTSA and EPA met with many vehicle manufacturers to discuss the feasibility of the National Program. EPA and NHTSA are confident that these proposed GHG and CAFE standards, if finalized, would successfully harmonize both the federal and state programs for MYs 2012-2016 and would allow our country to achieve the increased benefits of a single, nationwide program to reduce light-duty vehicle GHG emissions and reduce the country’s dependence on fossil fuels by improving these vehicles’ fuel economy.

A successful and sustainable automotive industry depends upon, among other things, continuous technology innovation in general, and low greenhouse gas emissions and high fuel economy vehicles in particular. In this respect, this proposal would help spark the investment in technology innovation necessary for automakers to successfully compete in both domestic and export markets, and thereby continue to support a strong economy.

While this proposal covers MYs 2012-2016, EPA and NHTSA anticipate the importance of seeking a strong, coordinated national program for light-duty vehicles in model years beyond 2016 in a future rulemaking.

Key elements of the proposal for a harmonized and coordinated program are the level and form of the GHG and CAFE standards, the available compliance mechanisms, and general implementation elements. These elements are outlined in the following sections.

C. Background and Comparison of NHTSA and EPA Statutory Authority

This section provides the agencies’ respective statutory authorities under which CAFE and GHG standards are established.

1. NHTSA Statutory Authority

NHTSA establishes CAFE standards for passenger cars and light trucks for each model year under EPCA, as amended by EISA. EPCA mandates a motor vehicle fuel economy regulatory program to meet the various facets of the need to conserve energy, including ones having environmental and foreign policy implications. EPCA allocates the responsibility for implementing the program between NHTSA and EPA as follows: NHTSA sets CAFE standards for passenger cars and light trucks; EPA establishes the procedures for testing, tests vehicles, collects and analyzes manufacturers’ data, and calculates the average fuel economy of each manufacturer’s passenger cars and light trucks; and NHTSA enforces the standards based on EPA’s calculations.

a. Standard Setting

We have summarized below the most important aspects of standard setting under EPCA, as amended by EISA.

For each future model year, EPCA requires that NHTSA establish standards at “the maximum feasible average fuel economy level that it decides the manufacturers can achieve in that model year,” based on the agency’s consideration of four statutory factors: technological feasibility, economic practicability, the effect of other standards of the Government on fuel economy, and the need of the nation to conserve energy. EPCA does not define these terms or specify what weight to give each concern in balancing them; thus, NHTSA defines them and determines the appropriate weighting based on the circumstances in each CAFE standard rulemaking.19

For MYs 2011-2020, EPCA further requires that separate standards for passenger cars and for light trucks be set at levels high enough to ensure that the CAFE of the industry-wide combined fleet of new passenger cars and light trucks reaches at least 35 mpg not later than MY 2020.

i. Factors That Must be Considered in Deciding the Appropriate Stringency of CAFE Standards

(1) Technological feasibility

“Technological feasibility” refers to whether a particular method of improving fuel economy can be available for commercial application in the model year for which a standard is being established. Thus, the agency is not limited in determining the level of new standards to technology that is already being commercially applied at the time of the rulemaking. NHTSA has historically considered all types of technologies that improve real-world fuel economy, except those whose effects are not reflected in fuel economy testing. Principal among them are technologies that improve air conditioner efficiency because the air conditioners are not turned on during testing under existing test procedures.

(2) Economic practicability

“Economic practicability” refers to whether a standard is one “within the financial capability of the industry, but not so stringent as to” lead to “adverse economic consequences, such as a significant loss of jobs or the unreasonable elimination of consumer choice.”20 This factor is especially important in the context of current events, where the automobile industry is facing significantly adverse economic conditions, as well as significant loss of jobs. In an attempt to ensure the economic practicability of attribute-based standards, NHTSA considers a variety of factors, including the annual rate at which manufacturers can increase the percentage of its fleet that employs a particular type of fuel-saving technology, and cost to consumers. Consumer acceptability is also an element of economic practicability, one which is particularly difficult to gauge during times of frequently-changing fuel prices. NHTSA believes this approach is reasonable for the MY 2012-2016 standards in view of the facts before it at this time. NHTSA is aware, however, that facts relating to a variety of key issues in CAFE rulemaking are steadily evolving and seeks comments on the balancing of these factors in light of the facts available during the comment period.

At the same time, the law does not preclude a CAFE standard that poses considerable challenges to any individual manufacturer. The Conference Report for EPCA, as enacted in 1975, makes clear, and the case law affirms, “a determination of maximum feasible average fuel economy should not be keyed to the single manufacturer which might have the most difficulty achieving a given level of average fuel economy.”21 Instead, NHTSA is compelled “to weigh the benefits to the nation of a higher fuel economy standard against the difficulties of individual automobile manufacturers.” Id. The law permits CAFE standards exceeding the projected capability of any particular manufacturer as long as the standard is economically practicable for the industry as a whole. Thus, while a particular CAFE standard may pose difficulties for one manufacturer, it may also present opportunities for another. The CAFE program is not necessarily intended to maintain the competitive positioning of each particular company. Rather, it is intended to enhance fuel economy of the vehicle fleet on American roads, while protecting motor vehicle safety and being mindful of the risk of harm to the overall United States economy.

(3) The effect of other motor vehicle standards of the Government on fuel economy

“The effect of other motor vehicle standards of the Government on fuel economy,” involves an analysis of the effects of compliance with emission,22 safety, noise, or damageability standards on fuel economy capability and thus on average fuel economy. In previous CAFE rulemakings, the agency has said that pursuant to this provision, it considers the adverse effects of other motor vehicle standards on fuel economy. It said so because, from the CAFE program’s earliest years23 until present, the effects of such compliance on fuel economy capability over the history of the CAFE program have been negative ones. For example, safety standards that have the effect of increasing vehicle weight lower vehicle fuel economy capability and thus decrease the level of average fuel economy that the agency can determine to be feasible.

In the wake of Massachusetts v. EPA and of EPA’s proposed endangerment finding, granting of a waiver to California for its motor vehicle GHG standards, and its own proposal of GHG standards, NHTSA is confronted with the issue of how to treat those standards under the “other motor vehicle standards” provision. To the extent the GHG standards result in increases in fuel economy, they would do so almost exclusively as a result of inducing manufacturers to install the same types of technologies used by manufacturers in complying with the CAFE standards. The primary exception would involve increases in the efficiency of air conditioners.

Comment is requested on whether and in what way the effects of the California and EPA standards should be considered under the “other motor vehicle standards” provision or other provisions of EPCA in 49 U.S.C. 32902, consistent with NHTSA’s independent obligation under EPCA/EISA to issue CAFE standards. The agency has already considered EPA’s proposal and the harmonization benefits of the National Program in developing its own proposal.

(4) The need of the United States to conserve energy

“The need of the United States to conserve energy” means “the consumer cost, national balance of payments, environmental, and foreign policy implications of our need for large quantities of petroleum, especially imported petroleum.”24 Environmental implications principally include reductions in emissions of criteria pollutants and carbon dioxide. Prime examples of foreign policy implications are energy independence and security concerns.

(a) Fuel prices and the value of saving fuel

Projected future fuel prices are a critical input into the preliminary economic analysis of alternative CAFE standards, because they determine the value of fuel savings both to new vehicle buyers and to society. In this rule, NHTSA relies on fuel price projections from the U.S. Energy Information Administration’s (EIA) Annual Energy Outlook (AEO) for this analysis. Federal government agencies generally use EIA’s projections in their assessments of future energy-related policies.

(b) Petroleum consumption and import externalities

U.S. consumption and imports of petroleum products impose costs on the domestic economy that are not reflected in the market price for crude petroleum, or in the prices paid by consumers of petroleum products such as gasoline. These costs include (1) higher prices for petroleum products resulting from the effect of U.S. oil import demand on the world oil price; (2) the risk of disruptions to the U.S. economy caused by sudden reductions in the supply of imported oil to the U.S.; and (3) expenses for maintaining a U.S. military presence to secure imported oil supplies from unstable regions, and for maintaining the strategic petroleum reserve (SPR) to provide a response option should a disruption in commercial oil supplies threaten the U.S. economy, to allow the United States to meet part of its International Energy Agency obligation to maintain emergency oil stocks, and to provide a national defense fuel reserve. Higher U.S. imports of crude oil or refined petroleum products increase the magnitude of these external economic costs, thus increasing the true economic cost of supplying transportation fuels above the resource costs of producing them. Conversely, reducing U.S. imports of crude petroleum or refined fuels or reducing fuel consumption can reduce these external costs.

(c) Air pollutant emissions

While reductions in domestic fuel refining and distribution that result from lower fuel consumption will reduce U.S. emissions of various pollutants, additional vehicle use associated with the rebound effect25 from higher fuel economy will increase emissions of these pollutants. Thus, the net effect of stricter CAFE standards on emissions of each pollutant depends on the relative magnitudes of its reduced emissions in fuel refining and distribution, and increases in its emissions from vehicle use.

Fuel savings from stricter CAFE standards also result in lower emissions of CO2, the main greenhouse gas emitted as a result of refining, distribution, and use of transportation fuels. Lower fuel consumption reduces carbon dioxide emissions directly, because the primary source of transportation-related CO2 emissions is fuel combustion in internal combustion engines.

NHTSA has considered environmental issues, both within the context of EPCA and the National Environmental Policy Act, in making decisions about the setting of standards from the earliest days of the CAFE program. As courts of appeal have noted in three decisions stretching over the last 20 years,26 NHTSA defined the “need of the Nation to conserve energy” in the late 1970s as including “the consumer cost, national balance of payments, environmental, and foreign policy implications of our need for large quantities of petroleum, especially imported petroleum.”27 Pursuant to that view, NHTSA declined in the past to include diesel engines in determining the appropriate level of standards for passenger cars and for light trucks because particulate emissions from diesels were then both a source of concern and unregulated.28 In 1988, NHTSA included climate change concepts in its CAFE notices and prepared its first environmental assessment addressing that subject.29 It cited concerns about climate change as one of its reasons for limiting the extent of its reduction of the CAFE standard for MY 1989 passenger cars.30 Since then, NHTSA has considered the benefits of reducing tailpipe carbon dioxide emissions in its fuel economy rulemakings pursuant to the statutory requirement to consider the nation’s need to conserve energy by reducing fuel consumption.

ii. Other Factors Considered by NHTSA

NHTSA considers the potential for adverse safety consequences when in establishing CAFE standards. This practice is recognized approvingly in case law.31 Under the universal or “flat” CAFE standards that NHTSA was previously authorized to establish, the primary risk to safety came from the possibility that manufacturers would respond to higher standards by building smaller, less safe vehicles in order to “balance out” the larger, safer vehicles that the public generally preferred to buy. Under the attribute-based standards being proposed in this action, that risk is reduced because building smaller vehicles tends to raise a manufacturer’s overall CAFE obligation, rather than only raising its fleet average CAFE. However, even under attribute-based standards, there is still risk that manufacturers will rely on downweighting to improve their fuel economy (for a given vehicle at a given footprint target) in ways that may reduce safety.

In addition, the agency considers consumer demand in establishing new standards and in assessing whether already established standards remained feasible. In the 1980’s, the agency relied in part on the unexpected drop in fuel prices and the resulting unexpected failure of consumer demand for small cars to develop in explaining the need to reduce CAFE standards for a several year period in order to give manufacturers time to develop alternative technology-based strategies for improving fuel economy.

iii. Factors that NHTSA is Statutorily Prohibited from Considering in Setting Standards

EPCA provides that in determining the level at which it should set CAFE standards for a particular model year, NHTSA may not consider the ability of manufacturers to take advantage of several EPCA provisions that facilitate compliance with the CAFE standards and thereby reduce the costs of compliance.32 As noted below in Section IV, manufacturers can earn compliance credits by exceeding the CAFE standards and then use those credits to achieve compliance in years in which their measured average fuel economy falls below the standards. Manufacturers can also increase their CAFE levels through MY 2019 by producing alternative fuel vehicles. EPCA provides an incentive for producing these vehicles by specifying that their fuel economy is to be determined using a special calculation procedure that results in those vehicles being assigned a high fuel economy level.

iv. Weighing and Balancing of Factors

NHTSA has broad discretion in balancing the above factors in determining the average fuel economy level that the manufacturers can achieve. Congress “specifically delegated the process of setting … fuel economy standards with broad guidelines concerning the factors that the agency must consider. The breadth of those guidelines, the absence of any statutorily prescribed formula for balancing the factors, the fact that the relative weight to be given to the various factors may change from rulemaking to rulemaking as the underlying facts change, and the fact that the factors may often be conflicting with respect to whether they militate toward higher or lower standards give NHTSA discretion to decide what weight to give each of the competing policies and concerns and then determine how to balance them-as long as NHTSA's balancing does not undermine the fundamental purpose of the EPCA: energy conservation, and as long as that balancing reasonably accommodates “conflicting policies that were committed to the agency's care by the statute.’”

Thus, EPCA does not mandate that any particular number be adopted when NHTSA determines the level of CAFE standards. Rather, any number within a zone of reasonableness may be, in NHTSA’s assessment, the level of stringency that manufacturers can achieve. See, e.g., Hercules Inc. v. EPA, 598 F. 2d 91, 106 (D.C. Cir. 1978) (“In reviewing a numerical standard we must ask whether the agency’s numbers are within a zone of reasonableness, not whether its numbers are precisely right”).

v. Other Requirements Related to Standard Setting

The standards for passenger cars and those for light trucks must increase ratably each year. This statutory requirement is interpreted, in combination with the requirement to set the standards for each model year at the level determined to be the maximum feasible level that manufacturers can achieve for that model year, to mean that the annual increases should not be disproportionately large or small in relation to each other.

The standards for passenger cars and light trucks must be based on one or more vehicle attributes, like size or weight, that correlate with fuel economy and must be expressed in terms of a mathematical function. Fuel economy targets are set for individual vehicles and increase as the attribute decreases and vice versa. For example, size-based (i.e., size-indexed) standards assign higher fuel economy targets to smaller (and generally, but not necessarily, lighter) vehicles and lower ones to larger (and generally, but not necessarily, heavier) vehicles. The fleet-wide average fuel economy that a particular manufacturer is required to achieve depends on the size mix of its fleet, i.e., the proportion of the fleet that is small-, medium- or large-sized.

This approach can be used to require virtually all manufacturers to increase significantly the fuel economy of a broad range of both passenger cars and light trucks, i.e., the manufacturer must improve the fuel economy of all the vehicles in its fleet. Further, this approach can do so without creating an incentive for manufacturers to make small vehicles smaller or large vehicles larger, with attendant implications for safety.

b. Test Procedures for Measuring Fuel Economy

EPCA provides EPA with the responsibility for establishing CAFE test procedures. Current test procedures measure the effects of nearly all fuel saving technologies. The principal exception is improvements in air conditioning efficiency. By statutory law in the case of passenger cars and by administrative regulation in the case of light trucks, air conditioners are not turned on during fuel economy testing. See Section I.C.2 for details.

The fuel economy test procedures for light trucks could be amended through rulemaking to provide for air conditioner operation during testing and to take other steps for improving the accuracy and representativeness of fuel economy measurements. Comment is sought by the agencies regarding implementing such amendments beginning in MY 2017 and also on the more immediate interim alternative step of providing CAFE program credits under the authority of 49 U.S.C. 32904(c) for light trucks equipped with relatively efficient air conditioners for MYs 2012-2016. These CAFE credits would be earned by manufacturers on the same terms and under the same conditions as EPA is proposing to provide them under the CAA, and additional detail is on this request for comment for early CAFE credits is contained in Section IV of this preamble. Modernizing the passenger car test procedures, or even providing similar credits, would not be possible under EPCA as currently written.

c. Enforcement and Compliance Flexibility

EPA is responsible for measuring automobile manufacturers’ CAFE so that NHTSA can determine compliance with the CAFE standards. When NHTSA finds that a manufacturer is not in compliance, it notifies the manufacturer. Surplus credits generated from the five previous years can be used to make up the deficit. The amount of credit earned is determined by multiplying the number of tenths of a mpg by which a manufacturer exceeds a standard for a particular category of automobiles by the total volume of automobiles of that category manufactured by the manufacturer for a given model year. If there are no (or not enough) credits available, then the manufacturer can either pay the fine, or submit a carry back plan to NHTSA. A carry back plan describes what the manufacturer plans to do in the following three model years to earn enough credits to make up for the deficit. NHTSA must examine and determine whether to approve the plan.

In the event that a manufacturer does not comply with a CAFE standard, even after the consideration of credits, EPCA provides for the assessing of civil penalties, unless, as provided below, the manufacturer has earned credits for exceeding a standard in an earlier year or expects to earn credits in a later year.33 The Act specifies a precise formula for determining the amount of civil penalties for such a noncompliance. The penalty, as adjusted for inflation by law, is $5.50 for each tenth of a mpg that a manufacturer’s average fuel economy falls short of the standard for a given model year multiplied by the total volume of those vehicles in the affected fleet (i.e., import or domestic passenger car, or light truck), manufactured for that model year. The amount of the penalty may not be reduced except under the unusual or extreme circumstances specified in the statute.

Unlike the National Traffic and Motor Vehicle Safety Act, EPCA does not provide for recall and remedy in the event of a noncompliance. The presence of recall and remedy provisions34 in the Safety Act and their absence in EPCA is believed to arise from the difference in the application of the safety standards and CAFE standards. A safety standard applies to individual vehicles; that is, each vehicle must possess the requisite equipment or feature that must provide the requisite type and level of performance. If a vehicle does not, it is noncompliant. Typically, a vehicle does not entirely lack an item or equipment or feature. Instead, the equipment or features fails to perform adequately. Recalling the vehicle to repair or replace the noncompliant equipment or feature can usually be readily accomplished.

In contrast, a CAFE standard applies to a manufacturer’s entire fleet for a model year. It does not require that a particular individual vehicle be equipped with any particular equipment or feature or meet a particular level of fuel economy. It does require that the manufacturer’s fleet, as a whole, comply. Further, although under the attribute-based approach to setting CAFE standards fuel economy targets are established for individual vehicles based on their footprints, the vehicles are not required to comply with those targets. However, as a practical matter, if a manufacturer chooses to design some vehicles that fall below their target levels of fuel economy, it will need to design other vehicles that exceed their targets if the manufacturer’s overall fleet average is to meet the applicable standard.

Thus, under EPCA, there is no such thing as a noncompliant vehicle, only a noncompliant fleet. No particular vehicle in a noncompliant fleet is any more, or less, noncompliant than any other vehicle in the fleet.

2. EPA Statutory Authority

Title II of the Clean Air Act (CAA) provides for comprehensive regulation of mobile sources, authorizing EPA to regulate emissions of air pollutants from all mobile source categories. Pursuant to these sweeping grants of authority, EPA considers such issues as technology effectiveness, its cost (both per vehicle, per manufacturer, and per consumer), the lead time necessary to implement the technology, and based on this the feasibility and practicability of potential standards; the impacts of potential standards on emissions reductions of both GHGs and non-GHGs; the impacts of standards on oil conservation and energy security; the impacts of standards on fuel savings by consumers; the impacts of standards on the auto industry; other energy impacts; as well as other relevant factors such as impacts on safety.

This proposal implements a specific provision from Title II, section 202(a).35 Section 202 (a) (1) of the Clean Air Act (CAA) states that “the Administrator shall by regulation prescribe (and from time to time revise)…standards applicable to the emission of any air pollutant from any class or classes of new motor vehicles …, which in his judgment cause, or contribute to, air pollution which may reasonably be anticipated to endanger public health or welfare.” If EPA makes the appropriate endangerment and cause or contribute findings, then section 202(a) authorizes EPA to issue standards applicable to emissions of those pollutants.

Any standards under CAA section 202(a)(1) “shall be applicable to such vehicles … for their useful life.” Emission standards set by the EPA under CAA section 202(a)(1) are technology-based, as the levels chosen must be premised on a finding of technological feasibility. Thus, standards promulgated under CAA section 202(a) are to take effect only “after providing such period as the Administrator finds necessary to permit the development and application of the requisite technology, giving appropriate consideration to the cost of compliance within such period” (section 202 (a)(2); see also NRDC v. EPA, 655 F. 2d 318, 322 (D.C. Cir. 1981)). EPA is afforded considerable discretion under section 202(a) when assessing issues of technical feasibility and availability of lead time to implement new technology. Such determinations are “subject to the restraints of reasonableness”, which “does not open the door to ‘crystal ball’ inquiry.” NRDC, 655 F. 2d at 328, quoting International Harvester Co. v. Ruckelshaus, 478 F. 2d 615, 629 (D.C. Cir. 1973). However, “EPA is not obliged to provide detailed solutions to every engineering problem posed in the perfection of the trap-oxidizer. In the absence of theoretical objections to the technology, the agency need only identify the major steps necessary for development of the device, and give plausible reasons for its belief that the industry will be able to solve those problems in the time remaining. The EPA is not required to rebut all speculation that unspecified factors may hinder ‘real world’ emission control.” NRDC, 655 F. 2d at 333-34. In developing such technology-based standards, EPA has the discretion to consider different standards for appropriate groupings of vehicles (“class or classes of new motor vehicles”), or a single standard for a larger grouping of motor vehicles (NRDC, 655 F. 2d at 338).

Although standards under CAA section 202(a)(1) are technology-based, they are not based exclusively on technological capability. EPA has the discretion to consider and weigh various factors along with technological feasibility, such as the cost of compliance (see section 202(a) (2)), lead time necessary for compliance (section 202(a)(2)), safety (see NRDC, 655 F. 2d at 336 n. 31) and other impacts on consumers, and energy impacts associated with use of the technology. See George E. Warren Corp. v. EPA, 159 F.3d 616, 623-624 (D.C. Cir. 1998) (ordinarily permissible for EPA to consider factors not specifically enumerated in the Act). See also Entergy Corp. v. Riverkeeper, Inc., 129 S.Ct. 1498, 1508-09 (2009) (congressional silence did not bar EPA from employing cost-benefit analysis under Clean Water Act absent some other clear indication that such analysis was prohibited; rather, silence indicated discretion to use or not use such an approach as the agency deems appropriate).

In addition, EPA has clear authority to set standards under CAA section 202(a) that are technology forcing when EPA considers that to be appropriate, but is not required to do so (as compared to standards set under provisions such as section 202(a)(3) and section 213(a)(3)). EPA has interpreted a similar statutory provision, CAA section 231, as follows:

While the statutory language of section 231 is not identical to other provisions in title II of the CAA that direct EPA to establish technology-based standards for various types of engines, EPA interprets its authority under section 231 to be somewhat similar to those provisions that require us to identify a reasonable balance of specified emissions reduction, cost, safety, noise, and other factors. See, e.g., Husqvarna AB v. EPA, 254 F.3d 195 (DC Cir. 2001) (upholding EPA’s promulgation of technology-based standards for small non-road engines under section 213(a)(3) of the CAA). However, EPA is not compelled under section 231 to obtain the ‘‘greatest degree of emission reduction achievable’’ as per sections 213 and 202 of the CAA, and so EPA does not interpret the Act as requiring the agency to give subordinate status to factors such as cost, safety, and noise in determining what standards are reasonable for aircraft engines. Rather, EPA has greater flexibility under section 231 in determining what standard is most reasonable for aircraft engines, and is not required to achieve a ‘‘technology forcing’’ result.36

This interpretation was upheld as reasonable in NACAA v. EPA, (489 F.3d 1221, 1230 (D.C. Cir. 2007)). CAA section 202(a) does not specify the degree of weight to apply to each factor, and EPA accordingly has discretion in choosing an appropriate balance among factors. See Sierra Club v. EPA, 325 F.3d 374, 378 (D.C. Cir. 2003) (even where a provision is technology-forcing, the provision “does not resolve how the Administrator should weigh all [the statutory] factors in the process of finding the 'greatest emission reduction achievable’”). Also see Husqvarna AB v. EPA, 254 F. 3d 195, 200 (D.C. Cir. 2001) (great discretion to balance statutory factors in considering level of technology-based standard, and statutory requirement “to [give appropriate] consideration to the cost of applying … technology” does not mandate a specific method of cost analysis); see also Hercules Inc. v. EPA, 598 F. 2d 91, 106 (D.C. Cir. 1978) (“In reviewing a numerical standard we must ask whether the agency’s numbers are within a zone of reasonableness, not whether its numbers are precisely right”); Permian Basin Area Rate Cases, 390 U.S. 747, 797 (1968) (same); Federal Power Commission v. Conway Corp., 426 U.S. 271, 278 (1976) (same); Exxon Mobil Gas Marketing Co. v. FERC, 297 F. 3d 1071, 1084 (D.C. Cir. 2002) (same).

a. EPA’s Testing Authority

Under section 203 of the CAA, sales of vehicles are prohibited unless the vehicle is covered by a certificate of conformity. EPA issues certificates of conformity pursuant to section 206 of the Act, based on (necessarily) pre-sale testing conducted either by EPA or by the manufacturer. The Federal Test Procedure (FTP or ‘‘city’’ test) and the Highway Fuel Economy Test (HFET or ‘‘highway’’ test) are used for this purpose. Compliance with standards is required not only at certification but throughout a vehicle’s useful life, so that testing requirements may continue post-certification. Useful life standards may apply an adjustment factor to account for vehicle emission control deterioration or variability in use (section 206(a)).

Pursuant to EPCA, EPA is required to measure fuel economy for each model and to calculate each manufacturer’s average fuel economy.37 EPA uses the same tests – the FTP and HFET – for fuel economy testing. EPA established the FTP for emissions measurement in the early 1970s. In 1976, in response to the Energy Policy and Conservation Act (EPCA) statute, EPA extended the use of the FTP to fuel economy measurement and added the HFET.38 The provisions in the 1976 regulation, effective with the 1977 model year, established procedures to calculate fuel economy values both for labeling and for CAFE purposes. Under EPCA, EPA is required to use these procedures (or procedures which yield comparable results) for measuring fuel economy for cars for CAFE purposes, but not for labeling purposes.39 EPCA does not pose this restriction on CAFE test procedures for light trucks, but EPA does use the FTP and HFET for this purpose. EPA determines fuel economy by measuring the amount of CO2 and all other carbon compounds (e.g. total hydrocarbons (THC) and carbon monoxide (CO)), and then, by mass balance, calculating the amount of fuel consumed.

b. EPA Enforcement Authority