CS-12-352 ACS Automated Survey and CS-12-353 CSCO Mail Survey

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

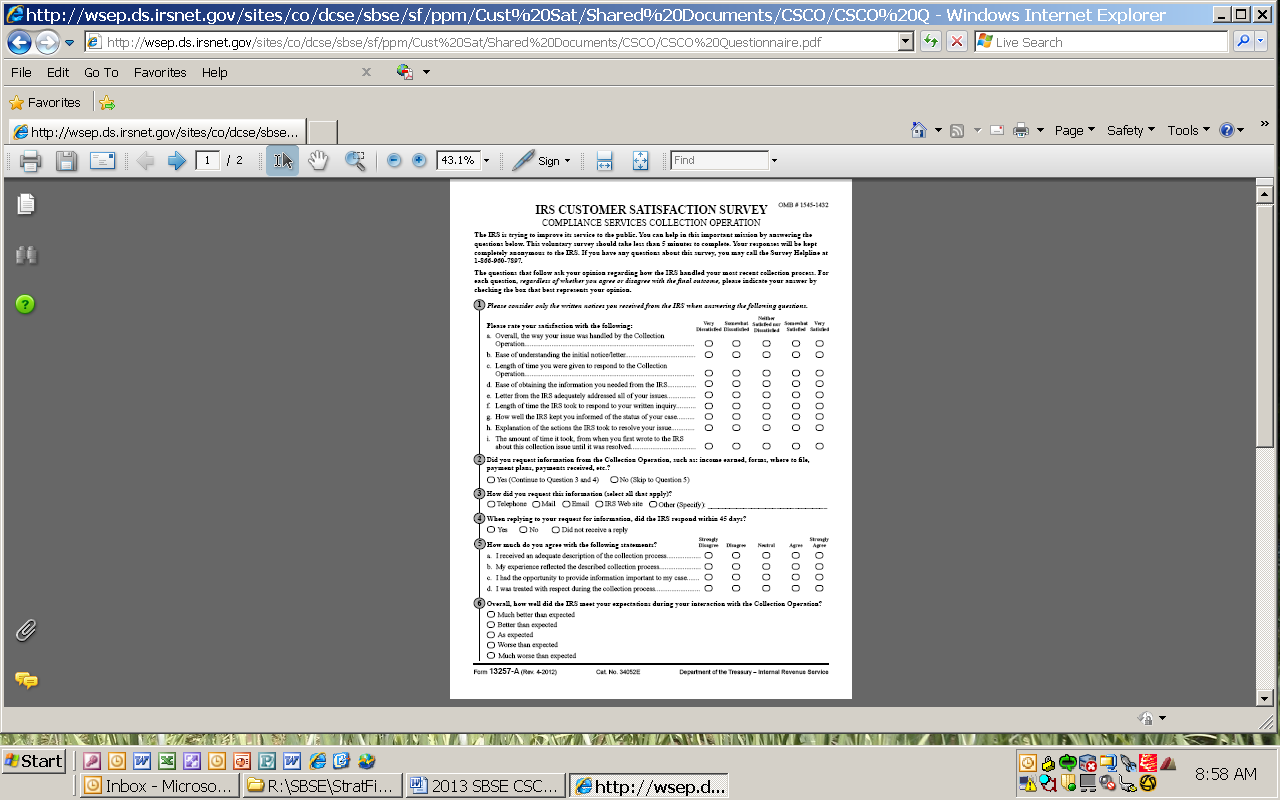

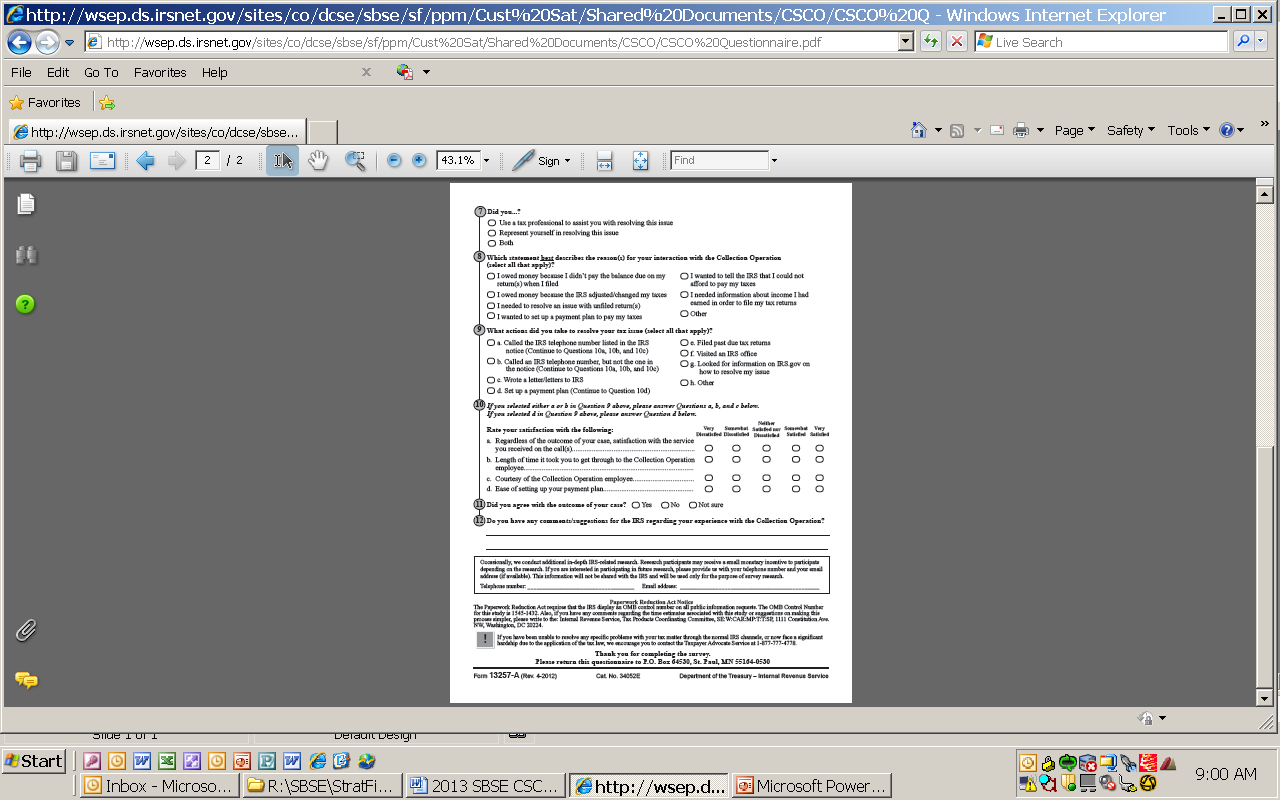

CS-12-353 2013 SBSE CSCO mail OMB Survey Instruments

CS-12-352 ACS Automated Survey and CS-12-353 CSCO Mail Survey

OMB: 1545-1432

SB/SE CSCO Prenotification Letter

Dear

I need your help with an important initiative I am undertaking to improve our service to America’s taxpayers. I want to get feedback from taxpayers like you who have recently received a notice informing you of a balance due or return delinquency on your tax return.

In a few days, you will receive a questionnaire asking your opinions about the collection process with the IRS. Please direct it to the person who had the most contact with the IRS on this matter. The questionnaire should take less than 5 minutes to complete. Your answers will be combined with others to give us an evaluation of customer satisfaction with IRS service.

To keep all replies anonymous to the IRS, we have asked an independent research company to administer the survey. Pacific Consulting Group/Scantron employees will process the questionnaires and report only statistical totals to us.

I am committed to improving IRS service to every taxpayer. Please help me in this effort by completing and returning the questionnaire as soon as possible. If you do not receive a questionnaire, please contact the Survey Helpline at 1-800-960-7897.

Sincerely,

Denice D. Vaughan

Director, Campus Compliance Services

L1_13257-A

Dear

A few days ago, you received a letter from Denice D. Vaughan, Director, Campus Compliance Services, asking for your help with an important research project.

We are administering a nationwide survey of people who have had contact with the Internal Revenue Service (IRS). We want to know your opinions about the collection process you went through which began with a notice informing you of a balance due or a return delinquency. Your responses are critical to the accuracy of this research.

We are sending questionnaires to a random sample of taxpayers who have gone through the collection process on a recent tax return. All responses will be anonymous to the IRS, and your participation is voluntary. We will group your responses with others, so that no individual reply can be traced back to any one person.

The questionnaire is quite brief and should take less than 5 minutes to complete. Please use the postage-paid reply envelope to return your completed questionnaire. If you have any questions about this survey, please feel free to call the Survey Helpline at 1-866-960-7897.

To verify the authenticity of this survey, please visit IRS.gov and enter the search term “customer surveys.” The IRS Customer Satisfaction Survey page contains a list of valid, current and unexpired, IRS surveys and as of this issuance should provide a reference to SB/SE Compliance Services Collection Operation.

The IRS is committed to improving its performance and service to the American public. A first step in this process is to gather reliable information from those who have had contact with IRS services and employees. Your honest opinions will help bring about this improvement.

Sincerely,

Dr. Peter Webb

Project Director

Pacific Consulting Group

L2_13257-A

Do We Have Your Input Yet?

Recently, you received a questionnaire asking your opinions about the service you received from the IRS in a recent contact. If you have already completed and returned the questionnaire, please accept our sincere thanks. If not, please take a few minutes to complete it and return it today. We want to be sure we have your opinions and suggestions.

If you did not receive the questionnaire, or it got misplaced, please call us at 1-866-960-7897.

Dr. Peter Webb

Project Director

Pacific Consulting Group

L3_13257-A

Dear

A few days ago, you received a survey from Denice D. Vaughan, Director, Campus Compliance Services, asking for your help with an important research project. If you have already completed the survey, thank you. If you have not already done so, please take a few minutes to fill in your responses.

We are administering a nationwide survey among people who have had contact with the Internal Revenue Service (IRS). We want to know your opinions about the collection process you went through which began with a notice informing you of a balance due or a return delinquency. Your responses are critical to the accuracy of this research.

We are sending questionnaires to a random sample of taxpayers who have gone through the collection process on a recent tax return. All responses will be anonymous to the IRS, and your participation is voluntary. We will group your responses with others, so that no individual reply can be traced back to any one person.

The questionnaire is quite brief and should take less than 5 minutes to complete. Please use the postage-paid reply envelope to return your completed questionnaire. If you have any questions about this survey, please feel free to call the Survey Helpline at 1-866-960-7897.

To verify the authenticity of this survey, please visit IRS.gov and enter the search term “customer surveys.” The IRS Customer Satisfaction Survey page contains a list of valid, current and unexpired, IRS surveys and as of this issuance should provide a reference to SB/SE Compliance Services Collection Operation.

The IRS is committed to improving its performance and service to the American public. A first step in this process is to gather reliable information from those who have had contact with IRS services and employees. Your honest opinions will help bring about this improvement.

Thank you in advance for your cooperation.

Sincerely,

Project Director

Pacific Consulting Group

L4_13257-A

| File Type | application/msword |

| File Title | DOCUMENTATION FOR THE GENERIC CLEARANCE |

| Author | 558022 |

| Last Modified By | pbzlb |

| File Modified | 2012-07-11 |

| File Created | 2012-07-11 |

© 2026 OMB.report | Privacy Policy