Note to Reviewer of 1220-0164

Note to Reviewer for Payroll Deduction IRA (1220-0164).docx

National Compensation Survey

Note to Reviewer of 1220-0164

OMB: 1220-0164

May 5, 2011

MEMORANDUM FOR: REVIEWER of 1220-0164

FROM: Hilery Simpson

Chief, Division of Compensation Data Analysis and Planning

Office of Compensation and Working Conditions

Bureau of Labor Statistics

SUBJECT:

Nonsubstantive Change Request for the

National Compensation

Survey (NCS)

Clearance is being sought for the Bureau of Labor Statistics’ (BLS) National Compensation Survey (NCS) program to add one question on Payroll Deduction IRA benefits to the existing survey. OMB was informed of the necessity of this additional question in the most recent submission to OMB which was approved on April 7, 2011.

The Government Accountability Office (GAO) has asked BLS to collect more data on retirement benefits with no employer contributions, specifically Payroll Deduction IRAs, by 2012. With limited information available, the GAO turned to BLS to gather data on this subject.

NCS is proposing adding one “Yes, No, and Not Determinable” question on Payroll Deduction IRA benefits. This question will normally be asked of establishment payroll and personnel staff. Informal talks with a few current respondents; revealed that they knew whether their establishments offered a Payroll Deduction IRA or not. NCS must implement this change with the September 2010 NCS collection quarter (which starts July 31, 2011) in order to provide the GAO with incidence data for Payroll Deduction IRA benefits in 2012.

This question will only be asked of wage and benefits sample members who offer Cash or Deferred Arrangements (CODAs) retirement plans with no employer contribution. NCS will begin collecting employee access to Payroll Deduction IRA plans as a specific subset of CODAs with no employer contribution.

A Payroll Deduction IRA plan is an individual retirement plan that can be sponsored by an employer, but with no employer contribution. It can either be traditional (tax-deductible) or Roth (contributions are made after taxes but accumulate tax-free until retirement). While Roth IRA plans do not reduce an employee’s salary for tax purposes, they are in-scope for NCS collection as a CODA.

Currently in private industry CODA type benefits are offered to 24 percent of employees. In State and local governments CODA type benefits are offered to 55 percent of employees. NCS estimates that 20 seconds will be added to respondent burden per establishments who are asked this question. It will add approximately 12.6 hours annually to private industry sample respondent burden hours. For the government sample this question will add approximately 5.6 hours annually to government respondent burden hours. The new total annual respondent burden hours for the NCS survey is 37,138.2, an increase of 18.2 hours.

If you have any questions about this request, please contact Paul Carney at 202-691-5180 or e-mail at [email protected] or Hilery Simpson at 202-691-5184 or e-mail at [email protected].

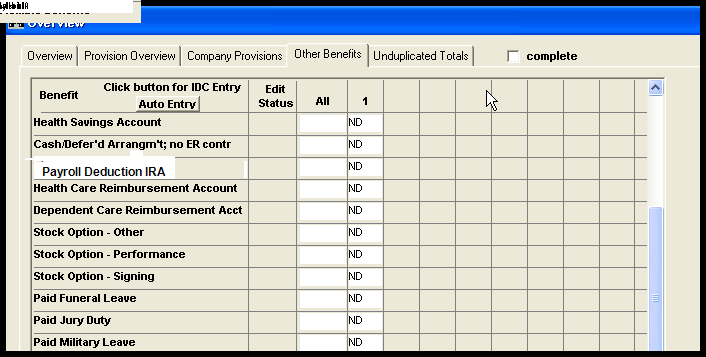

New question:

“Do you offer a (implied)” Payroll Deduction IRA? (Yes, No, and Not Determinable)

Example of question in the NCS data capture system:

Attachments

Updated 11-5P with “Payroll Deduction IRA” added on p. 27

Updated 11-5G with “Payroll Deduction IRA” added on p. 27

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Nonsubstantive Change Request |

| Subject | Payroll Deduction IRA |

| Author | Paul Carney |

| File Modified | 0000-00-00 |

| File Created | 2021-01-31 |

© 2026 OMB.report | Privacy Policy