NHTSA Label and Advertising Research

NHTSA Label and Advertising Research.docx

Monroney Label Consumer Focus Groups

NHTSA Label and Advertising Research

OMB: 2127-0686

NHTSA

Monroney Sticker / NCAP Advertising

Focus Group Report

June 9, 2009

one thomas circle nw tenth floor washington, dc 20005

tel: 202.289.2001 fax: 202.289.1327 www.stratacomm.net

Offices in Washington, DC and Detroit

Table of Contents

OBJECTIVES AND METHODOLOGY 3

KEY FINDINGS 4

Detailed Findings 9

The Car Buying Process 9

The Role of Safety and the Government 5-Star Safety Ratings 11

Reaction to the Government New 5-Star Safety Ratings Label 13

Communicating Label Changes 16

Transition Period Implications 18

NCAP Ad and Tagline Reactions 20

OBJECTIVES AND METHODOLOGY

NHTSA is currently developing communications materials to educate consumers on the new Government 5-star Safety Ratings System effective for model 2011 vehicles. The new testing program will provide consumers with tougher vehicle-to-vehicle comparisons, summary ratings, and detailed information about available crash avoidance technologies. The new program will result in a new 5-star crash test ratings label to be displayed on all vehicles tested beginning in model year 2011.

The goals of the research are to:

Better understand consumers’ new vehicle purchase decision-making process and the role safety plays in that process

Explore reactions to the new Government 5-Star Rating System

Measure feedback related to the effectiveness of the communication materials used to convey new crash test rating information (label, ad, tagline/logo)

Gauge consumer preferences for different possible education and communication efforts surrounding the new Government 5-Star Rating System

The results of this work will be used to help maximize consumer understanding of the new system and communication materials as well as to help consumers make the best vehicle purchase decisions specific to safety.

Two focus groups were conducted in each of the following three locations, Los Angeles, CA, Boston, MA, and Atlanta, GA. Participants were screened to ensure they were sole or shared decision-makers regarding vehicle purchase decisions, likely to purchase a new vehicle in the next two years, and that they were at least somewhat concerned about vehicle safety. Participants were recruited to represent a mixture of gender, age, education, income, and family size (children in the household under the age of 18).

In addition to general discussion about car buying and vehicle safety, in each group, 8-9 participants were engaged in a discussion to assess the effectiveness of new collateral materials meant to educate the public on the new Government 5-Star Rating System: the Monroney sticker, online advertising, and possible messaging for the campaign.

This report presents the results of the feedback from 51 participants total.

A Note on Qualitative Research

In reviewing these findings, it is important to remember that qualitative research, by design, is not meant to be projectable within accurate statistical ranges. Focus groups allow for the understanding and investigation of group consensus, not individual reactions. Qualitative research offers insight into the thematic and directional information of the participants.

KEY FINDINGS

Car Buying Process

Consumers consider themselves somewhat to very knowledgeable when it comes to purchasing a new vehicle, but still feel the process is difficult primarily because of the stress associated with negotiating the price and financing arrangements with dealers and the amount of time car shopping and research consumes.

Research is a step included in all consumers’ decision-making process, and while consumers research many different vehicle attributes, word of mouth (family, friends, neighbors, mechanics) and the Internet are the most commonly leveraged resources.

Consumer Reports, Edmunds, Kelly Blue Book, AutoTrader and CarFax are among the most frequently mentioned resources by name.

Notably, consumers report specifically avoiding a dealer as the sole information resource because of negative perceptions that a dealer will say anything to make the sale.

Safety is one of several frequently mentioned attributes consumers research before purchasing a new vehicle.

Price, resale value, fuel efficiency, and style/features information are also heavily researched and play a key role in the decision-making process. Price of a vehicle being the key feature.

Once a consumer has made up their mind to purchase a new vehicle, the amount of time spent on research and the shopping process varies dramatically. Some enjoy a spontaneous purchase while others need upwards of 9 months to gather all the information needed to make a decision.

Most consumers research a new vehicle between 1-6 months.

Consumers do agree on the best timing for purchasing a new vehicle; they wait for the end of the month or the year—calendar and model—to capitalize on better deals and incentives designed to help dealerships meet their quotas.

The Role of Safety and Government 5-Star Safety Ratings

Vehicle safety is very important to consumers. However, many admit to taking vehicle safety for granted because of the belief that manufacturers are making cars much safer than ever before to sell more cars and avoid lawsuits. Some attribute this improvement in car safety to the Government 5-Star Ratings System which has led to major safety improvements.

Consumers pay close attention to the news and news magazine reports (such as 20/20 or 60 minutes) for any safety red flags associated with a car brand or style.

Proactive research into a vehicle’s safety record is most frequently conducted online using Edmunds, Consumer Reports, CarFax or simply a Google search.

The Government 5-star Safety Ratings system and the crash test dummies are recognized by a large majority of consumers, but very few accurately credit NHTSA with creating and carrying out the testing. Many believe insurance companies or the car’s manufacturers execute the crash tests.

Once informed of the source of the Government 5-star Safety Ratings system, consumers overwhelmingly agree that it is a credible and valuable tool for consumers to make informed purchasing decisions, and motivates manufacturers to make safer vehicles.

In fact, many credit this crash testing process with enhancing vehicle safety over the past thirty years.

Interestingly, most consumers do not realize that the Government 5-Star Safety Ratings are displayed on the window sticker of new vehicles. Rather, many believe that dealers control what is displayed on a new car and that a Government 5-Star rating would be displayed only when it is a positive selling point to promote.

Most consumers would turn to the internet to find the Government 5-star Safety Rating ratings, specifically to insurance companies, manufacturers, or government web sites.

Again, consumers express a hesitation about getting accurate crash test rating information from a dealer—some are hesitant because they think the dealer simply won’t know, while others are hesitant because they do not trust dealers.

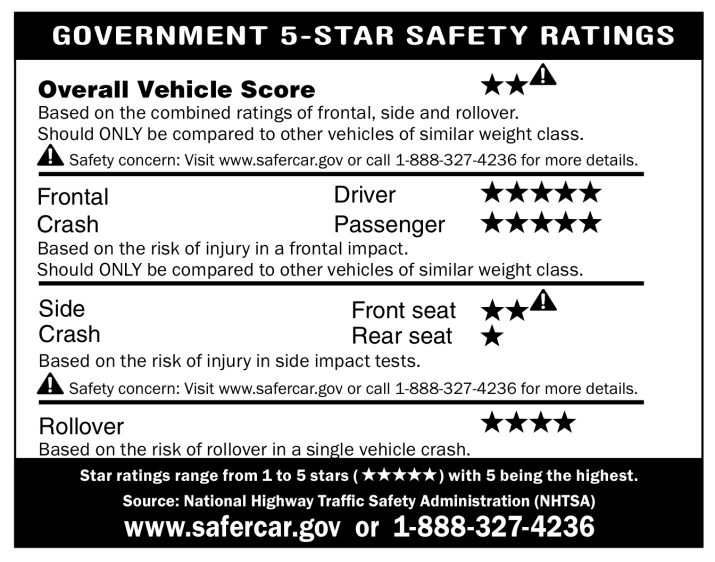

Reaction to the New Government 5-Star Safety Rating Label

All consumers support the notion of a new, more stringent crash test rating system. They feel there is always room for improvement and understand that technology has come so far it’s time to raise the bar.

With few exceptions, consumers have positive reactions to the new label:

They appreciate the addition of an overall vehicle rating.

The label is clear and easy to understand.

It gets their attention.

They appreciate the website and telephone resources listed for more information.

They are more confident they are making a good purchase decision after reviewing the label.

The exclamation point warning symbol catches attention and communicates there is concern relating to the testing and that consumers should call the number or go to the website to learn the nature of the concern.

Whether there is just one warning in the overall rating or a separate warning in one of the relevant crash rating categories, the response would be the same—a high level of caution and a strong need to look it up to learn the nature of the concern.

Overall there are three key points of confusion:

The exclamation point. While consumers understand that this is a symbol that denotes a warning or concern, they express some frustration with not knowing exactly what that concern is or what it might mean. Additionally, they report the exclamation point would be especially confusing if it was displayed next to a 4 or 5-star rating (displayed next to a 2 star rating in the focus groups).

Most participants said that the safety warning would keep them from purchasing a vehicle if it was next to a two star rating, If it was displayed next to a five star rating it would push them to inquire about the seeming incongruity.

Nevertheless, respondents report that the warning would serve its purpose to direct people to the web or to call the number to find out more about the safety concern.

The overall rating: Consumers want to know how the overall rating is calculated. In the example used, many were confused as to how a car with a 5-star frontal crash and 4-star rollover rating earns only 2 stars overall.

Side crash classification: A handful of consumers in each group expressed some confusion and frustration in not knowing if the side crash ratings were specific to the driver or passenger sides of the vehicle.

Communicating Label Changes

Many consumers express a strong desire to be educated on exactly what is/was changed or added to the new Government 5-Star Safety Ratings system. Additionally, they want to know what constitutes 5 stars vs. 4 stars, vs. 3 stars, etc. They are interested in understanding how a rating in the old system would compare to a rating for the same vehicle in the new system.

In general, TV and online sources are deemed the best mediums for communicating these changes. Specifically, TV news magazine shows such as 20/20 or 60 Minutes or other earned media outlets. However, consumers also indicate it is important that they get this information from many different sources:

Online (specific web site for crash testing and online ads in vehicle purchasing relevant sites)

Radio

Newspapers (earned media, in particular is highly valued)

Dealer/Manufacturers’ websites

PSAs

Insurance companies

Car dealers’ websites

Brochures or fact sheets in dealerships

Gas stations or auto repair shops

Aside from car dealers and manufacturers, consumers focus on auto industry businesses and media as potential partners to help NHTSA distribute information on the new crash test rating process and resulting label. Specific mentions include:

AAA

DMV

Highway Patrol

Insurance companies

Car & Driver magazine

AARP magazine

Motor Trend

Online sites like KBB, Edmunds, AutoTrader, etc.

The group consensus is that education and communication efforts regarding any change should begin about one year prior to the effective date of the change—especially because so many consumers will spend several months researching and shopping for a new vehicle before making a purchase decision.

Transition Period Implications

Consumers understand and appreciate that there will be a transition period when the new crash test rating system goes into effect. However, some were surprised to learn that even under the current system, not all vehicles are tested every year.

There is going to be considerable confusion during the transition period. While the majority of consumers want the old rating information to be displayed during this transition period, they also understand that it could cause confusion because of inconsistent rating systems.

If a car were not yet rated under the new system, most would like to see a label stating that the vehicle has not been rated under the new system.

Nevertheless, for most, some safety information is better than no information and they would like to see how it rated under the old system or know where they could find out.

Many respondents report their feeling that cars not rated under the new Government 5-Star Ratings system will have a significant marketplace disadvantage for consumers comparing vehicles on the lot.

Awareness levels of other crash test rating providers is low overall, and many consumers indicate they will continue to rely on their primary sources of information during this transition period—word of mouth and the internet.

NCAP Ad and Tagline Reactions

Overall the ad was considered informative, to the point, memorable, and would motivate most to go to the website to look up their current vehicle or a vehicle they may purchase.

A few were not satisfied with the animation quality of the ad, but most thought its simplicity helped and was appropriate for the web.

Participants like to see movement in an ad so it catches their eye.

They would like to see the starts move or pop out at them to grab their attention.

They need large, bolded font so messages are easy to read.

They like colors to pop, again to catch their eye.

Consumers are much more likely to watch the ad online if it is displayed on websites relevant to new vehicle purchases. In fact, some report they would proactively click on the ad to view it if they saw the tagline/logo displayed because the URL clearly indicates that the ad is not selling anything (because of the .gov) and contains content about something very important to them personally: safety.

TV and radio are also believed to be appropriate mediums for this message. TV is recommended as the transition date approaches, or when new data is available, because of its broad audience; and radio is recommended because people are most often in the car when listening to the radio, which would make the message more relevant and memorable.

They understand that Safercar.gov will have additional information explaining how the ratings have changed and how they have been made more rigorous.

On their own, consumers come up with words like “new,” “tougher,” “stronger,” and “stricter” to describe the fact that the new crash test ratings system is based on more stringent standards.

When presented with the tagline and logo options, “New, Tougher…” has a slight edge over the other options.

“Introducing” paired with the tagline conveyed the message that ratings were new and/or updated.

“New” on its own gives the impression to some that there were no standards or ratings being done before

“Updated” and “Improved” are seen by some as vague and give the impression that something was wrong or inadequate about the old system.

If possible, it might be worth segmenting the tagline to different audiences. Some males preferred “New Generation” as a good alternative.

Participants suggested the use of bolded text to best communicate the key message, and also stressed brevity for any taglines.

Advice for NHTSA

Consumers are generally unfamiliar with the National Highway Traffic Safety Administration and its mission. They recommend, and would find it useful and valuable, to have advertising and promotion to build awareness and familiarity with the new Government 5-Star Rating System.

Communication and education efforts surrounding the new rating system should begin by January 2010 and should utilize numerous media outlets to distribute the message.

These efforts should not only focus on the fact that there is a new Government 5-Star Ratings System, but also highlight the differences between the new and old systems.

Detailed Findings

The Car Buying Process

Overall, consumers consider themselves somewhat to very knowledgeable when it comes to purchasing a new vehicle—especially in Boston and Atlanta, where half of consumers consider themselves very knowledgeable. Despite feeling knowledgeable, many consumers still report a high level of difficulty and stress associated with the car buying process. The following summarizes the aspects of the car buying process consumers find especially easy or difficult:

Easy/Enjoyable:

Knowing what you want

Test driving

Picking features

Difficult/Uncomfortable:

Time consuming

Negotiating price/financing

Making a big decision

Comprehensive comparison shopping

Paperwork

Interacting with the car dealers

Part

of the reason so many consumers consider themselves knowledgeable

when it comes to purchasing a new vehicle is likely because research

is such a fundamental step in consumers’ decision-making

process. While consumers research a broad range of vehicle

attributes, most of their research is completed before they ever

step foot on a dealership parking lot.

Part

of the reason so many consumers consider themselves knowledgeable

when it comes to purchasing a new vehicle is likely because research

is such a fundamental step in consumers’ decision-making

process. While consumers research a broad range of vehicle

attributes, most of their research is completed before they ever

step foot on a dealership parking lot.

Sales / incentives Financing options Test Drive

Price / financing

options Safety information Performance ratings Resale value Fuel efficiency Style/feature options Operation/maintenance costs Insurance costs Life time of vehicle Warranties Read reviews/talk to current

owners

Top 3 factors in purchase decision overall: Price Style / features Safety

Consumers

tend to collect the vast majority of their information from one of

two sources: the Internet or word-of-mouth.

Consumers

tend to collect the vast majority of their information from one of

two sources: the Internet or word-of-mouth.

“I take a lot of feedback from my friends and family and co-workers. I may not know the exact make or model I want, but I would go to my friends that are in the same boat as I with young children and see how they like the particular make and model of their vehicle.”

However, many consumers also report that they are more sensitive to TV and radio commercials about new vehicles once they are in the market for one. Car & Driver magazine is mentioned when specifically probed for print resources.

In Boston, consumers were specifically asked if they used any government information in their research process to which more than half reported yes—to learn more about either recall status or safety ratings.

Interestingly, consumers specifically report avoiding a dealer as an information resource because of negative perceptions that a dealer will say anything to make the sale.

Once a consumer has made up their mind to purchase a new vehicle, the amount of time spent on research and the shopping process varies dramatically. Some enjoy a spontaneous purchase while others require upwards of 9 months to gather all the information needed to make a decision. Overall, most consumers report the research process occurs between 1 and 6 months in advance of making a final purchase decision.

While consumers spend very different amounts of time researching their new vehicle, they are commonly motivated by financial drivers when it comes to the best timing for making the actual purchase. The end of the month or year (calendar and model) is widely believed to give the consumer an advantage at the dealership among dealers feeling pressure to meet quotas. Notably, some consumers will plan the purchase of a new vehicle around the expiration of their current vehicle’s inspection or other tags; while others report they can be influenced on the spur of the moment by holiday sales or special incentives advertised on TV, newspapers or radio.

The Role of Safety and the Government 5-Star Safety Ratings

Safety is very important to consumers. Consumers think of vehicle safety in the context of impact performance (airbags, reinforced doors) and crash avoidance (antilock brakes, all wheel drive); they want to feel secure that they—or their family, friends—will not only survive, but walk away from a crash.

“When I think of safety it’s the ability to be able to walk away from an accident.”

“Seatbelts, airbags, you know, I want to make sure they have the proper airbags. I mean, I’ve heard of kids being killed with the airbags just hitting them too hard. Or even the side bag, that they get hit and just fall apart.”

“Not getting hurt in a crash.”

Yet, consumers overall tend to give more weight to the price and style (make, model, color) of a vehicle than safety when making a final purchase decision. In fact, many consumers openly admit to taking safety for granted because of the belief that manufacturers are making cars much safer than ever before.

The majority of consumers view the high safety performance of today’s vehicles as a natural progression of safety based on increasing consumer expectations, marketplace competition, technological advancement, and the desire to avoid negative attention such as lawsuits, or recalls.

“I’ve watched safety improve in vehicles over the years and I mean unless you’re buying one of those little SmartCars that I can probably move myself out of a parking space, there’s a lot of safety that’s built in. Now whether it’s the four star or the five star crash rating at that point in time if you’re in an accident fate might have a little bit of a role too. I think that car safety has come a long way where I remember when only the driver side had the airbag.”

“There’s a lot of people that are interested in [safety], so the manufacturers are going to have features that they can brag about that are improving safety.”

Consumers tend to rely heavily on news and news magazine specials—such as 20/20 and 60 Minutes—to highlight any major brand or vehicle safety concerns. However, they do leverage their primary resources (internet and word of mouth) to find specific safety information as they get more serious about a vehicle purchase.

“Like when they’ll say there’s going to be a news segment coming on about the safety of a new car, I’ll watch that.”

While most consumers agree, you can never have too much information when it comes to your safety; they also report that there is enough information available to help them make good decisions about which vehicle to buy.

The 5-star safety ratings system and the crash test dummies are recognized by a large majority of consumers, but very few accurately credit NHTSA with creating and carrying out the testing. Most believe insurance companies or the car’s manufacturers execute the crash tests.

H

Valuable Credible Helpful Important Objective Builds consumer confidence

owever, few consumers are well informed on what the test

entails—including multiple crash scenarios (front, side,

rollover) at multiple rates of speed, and performance of safety

features (brakes, seatbelts, airbags). In general, the Government

5-star Safety Ratings system is widely viewed as a good thing for

both consumers and manufacturers and is commonly credited with

helping to make cars safer over the past thirty years.

“The most useful thing about the ratings is they allow you to compare apples to apples in certain classes. Obviously you can’t compare a H2 to a Camry. But if you’re comparing midsize sedans across all makes and models, three star to a two star, you’re comparing apples to apples and that’s not necessarily true with the other rating agencies. If you look at Consumer Reports, a two star in Consumer Reports can’t be compared to a three star government rating. The one thing I really like about the government system is that the same exact test apples to apples. And it allows you to compare in weight classes of different makes and models.”

“It’s important because people like myself who don’t know a lot about cars or what to look for – it gives you an idea of what to look for.”

Despite being aware of its existence, understanding how is it created, and feeling it would bolster confidence in purchase decisions, very few consumers report researching the Government 5-star Safety Ratings of the last vehicle they purchased. For many this traces back to the common practice of taking vehicle safety for granted. Notably, consumers indicate a strong likelihood to research these ratings on their next vehicle purchase.

Interestingly, there is very low awareness that the Government 5-star Safety Ratings currently appears on every new vehicle. Rather, many believe that dealers control what is displayed on a new car and that only a 5-star rating would be displayed because it is another positive selling point to promote. Some consumers express hesitation about getting accurate crash test rating information from a dealer at all—some are hesitant because they think the dealer simply won’t know, while others are hesitant because they do not trust dealers. On the other hand, some consumers also feel that it is the dealers’ responsibility to be knowledgeable about the product he/she is selling and recommend that the dealer have brochures or other third-party certified materials to educate consumers while also mitigating any possible trust concerns.

“If a rating is at a dealership, it’s only the good ones because the manufacturers will want to brag and it will help the dealership sell the car.”

“I don’t know, I don’t trust them. That’s why you need to do your own research before you go to the dealer.”

“They should have some responsibility I think. As someone who sells or handles anything, you should know the positives and negatives of what the product is.”

“I’d like to be able to find out as much information as I can at the car dealership without having to talk to a salesperson

Generally, consumers are highly confident that they can easily find this information online using Google.

Reaction to the Government New 5-Star Safety Ratings Label

All consumers support the notion of a new, more stringent crash test rating system. They feel there is always room for improvement and understand that technology has come so far that it is time to raise the bar. There is also a clear connection in consumers’ minds between raising vehicle safety performance expectations and manufacturers continuing the natural progression of vehicle safety.

After reviewing an example of the new safety label, consumers have positive reactions to the new label:

They appreciate the addition of an overall vehicle rating.

The label is clear and easy to understand.

It gets their attention.

They appreciate the online and telephone resources listed for more information.

They are more confident they are making a good purchase decision.

Los Angeles

Boston

Atlanta

The exclamation point warning symbol catches attention and communicates there is concern relating to the testing. It effectively stimulates consumer interest to call the number or go to the website to learn the nature of the concern.

The symbol jumps out at consumers and grabs their attention. Some consumers report they would drop a vehicle from consideration without going to the website to read about the reason behind the warning if the star ratings were low and there was a safety warning.

Regardless whether there were just one warning in the overall rating or a separate warning in one of the relevant crash rating categories, the response would be the same—a high level of caution and a strong need to look it up to learn the nature of the concern.

“[The symbol means] “Warning! Stay away!” “Caution.” “Look out.” “Be careful.” “Like a red flag.”

“For me it’s something huge that you should know about because if it has that triangle there it’s telling me “Okay. Watch out.” You need to know something about this car before you buy it.”

“It catches your eye. Compares similar cars which is helpful.”

“It’s idiot proof to be honest. It’s so simple.”

“I better go on www.safecar.gov and see what happened and what’s wrong with it.”

“Helps you rule out cars that aren’t measuring up.”

A single warning in the overall rating (with no rating in the relevant categories) will stimulate consumers to go to the website and check out the reason for the concern. When there is a warning by the overall score and a warning in one of the categories, it is not clear they refer to the same issue. It is very likely that consumers with an interest in a vehicle will check out any warning and will be able to determine more clearly the impact of the concern on the vehicle overall or the specific crash test category.

With regard to the labels overall, there are three key points of confusion:

The exclamation point. While consumers understand that this is a warning or concern, they express some frustration with not knowing exactly what that concern is or what it might mean. Additionally, they report the exclamation point would be especially confusing if it was displayed next to a 4 or 5-star rating.

“They have a reason. For me it’s something huge that you should know about because if it has that triangle there it’s telling me “Okay. Watch out.” You need to know something about this car before you buy it.”

“I want to know on this label what is the safety concern. I don’t want to have to go somewhere else. Presuming this is on the car I want to know right then and there all the information.”

“If something has a five star, it shouldn’t have an exclamation.”

“It’s contradictory [warning by a rating of 5 stars].”

“I would definitely have that in bold print. That’s the most important thing to me on the entire thing is what is the concern so I want that to jump out at me.

Nevertheless, respondents report that the warning would serve its purpose to direct people to the web or call the number to find out more about the concern—especially if it is on a car that they really like.

“When I saw this had two concerns… I want to know on this label what the safety concern is. I don’t want to have to go somewhere else. Presuming this is on the car, I want to know right then and there all the information.”

“I better go on “www.safecar.gov and see what happened and what’s wrong with it.”

“I’d be confused. Why would you get five stars and a warning?”

“[Exclamation point] could be something major, it could be something little. How do you know?”

The overall rating. Consumers want to know how the overall rating is calculated. Many are confused as to how a car with a 5-star frontal crash and 4-star rollover rating earns only 2 stars overall.

“It’s a little confusing on how you get the overall vehicle score. The two, the five; how does that add up to two?”

“Mathematically it wouldn’t make sense to have the two if you had 5, 5, 2, 1, and 4 [stars].”

Side crash classification. A handful of consumers in each group expressed some confusion and frustration in not knowing if the side crash ratings were specific to the driver or passenger sides of the vehicle.

“I want to know which is the driver? Does front seat mean the passenger seat?”

“On the side crash test front seat has two stars, but is it the front driver’s seat or the front passenger’s seat? Because it’s broken down by driver and passenger above.”

Other suggestions to improve the label or enhance its clarity include:

Adjusting the text to read left to right. Some consumers read the middle section of the label “Frontal driver” and “Crash passenger” instead of “Frontal Crash” and “Driver/Passenger.”

Splash of color. Some consumers note that color would help the label stand out among all the other information posted on new vehicles. Specifically, consumers recommend making the exclamation point red—though all report noticing the exclamation point without any problem as is.

Have only one exclamation point legend. Consumers feel that showing the exclamation point legend and number/URL directive once would free up space on the label to allow for larger font, which would be more attention getting.

Communicating Label Changes

When thinking about the current crash test safety ratings, most consumers report that they have been only one of many considerations when purchasing past vehicles. In fact some view the crash test ratings as only an elimination tool during the decision making process—not an attribute that alone could add a vehicle to their consideration set.

|

Los Angeles |

Boston |

Atlanta |

Extremely Influential – I make my vehicle purchasing decisions based primarily on the crash test rating. |

3 |

1 |

1 |

Very Influential – I make my vehicle purchasing decisions based on a few key things, including crash test ratings. |

6 |

4 |

2 |

Somewhat Influential – I make my vehicle purchasing decisions based on many things, crash test ratings being one of them |

9 |

10 |

11 |

Not too influential – I rarely think about crash test ratings when purchasing a vehicle. |

-- |

2 |

2 |

Not at all influential – I have never thought about crash test ratings when purchasing a vehicle. |

-- |

-- |

-- |

However, some consumers believe the crash test ratings will be more influential on their next vehicle purchase because they now know that the sticker is displayed right on the new vehicle and they will be looking for it.

“Because the sticker is on the car it’s very influential. If the rating just existed somewhere then not too influential.”

Consumers suggest that TV is the best medium through which to communicate this change—specifically, TV news magazine shows such as 20/20 or 60 Minutes. For many, the recent coverage of the digital TV conversion serves as an appropriate model to follow. However, consumers also indicate it is important that they get this information from many different sources:

When asked specifically about appropriate partners for NHTSA, to help communicate this change, respondents like the idea and offer an array of possibilities:

AAA

DMV

Insurance companies

Gas stations

Highway Patrol

CarFax

Car & Driver

Motor Trend

Dealerships

Though consumers feel strongly that any partner should have relevant business ties to the auto industry (for example, Target is not considered appropriate), there are a few exceptions:

News media

AARP magazine

Parenting magazines

Telling consumers that the safety ratings have changed is not enough; educating consumers on exactly what has changed is critical. Specifically, consumers want to know, what is different, what is new altogether, and why the system changed in the first place. And the sooner education efforts begin the better. Some consumers feel that education efforts should begin as soon as a change is certain, though the majority think that 6 months to a year is adequate lead time—allowing consumers ample time to complete their research before a new vehicle purchase effected by this change. Because the new Government 5-star Crash Test Rating will be rolled out for the 2011 model year, January 1, 2010 is believed to be the most appropriate launch date for NHTSA’s communication efforts.

Following the digital TV conversion model, many respondents encourage NHTSA to publicize the effective date of change—fostering a countdown of sorts to the new system.

Notably, a handful of consumers suggest that talking about the change too early could cause some people to question their current vehicle’s safety rating, while others fear this news would suppress an already suffering auto market as consumers wait for the new models tested under the updated system.

Transition Period Implications

Consumers understand and appreciate that there will be a transition period when this new crash test rating system goes into effect. However, they were surprised to learn that even under the current system, not all vehicles are tested every year. Further, most respondents inaccurately assume that the old safety rating label would remain on new vehicles until they were tested under the new system. Yet, once told that the old label would not be put on new vehicles, consumers understand that comparing two vehicles with ratings based on two different systems could cause considerable confusion.

“Use the old rating. It should be on the car already, so leave it.”

“I don’t know, it can be misleading because people will still want to compare it to the new rating.”

Ultimately, consumers report that some safety information is better than none and as such would be comfortable with a label simply indicating that the vehicle has not yet been rated, but directed consumers on where to find old ratings.

Notably, a few consumers are skeptical about the selection process of which new models are tested and which are not—they believe that cars that do not get new rating stickers will be at a disadvantage.

“I’d want to see a sticker that said ‘this new car has not been tested against new 2011 standards. According to the previous standards, this was a 4-star.”

“Want a sticker saying that the car hasn’t been tested, but would also want to know why some were selected and others weren’t—how were the tested cars selected?”

A little political of who is selected to be tested, why should some be penalized by not being tested?”

Consumer discussion of transition period implications underscores the need for comprehensive education efforts on the Government 5-star Safety Ratings System changes. New vehicles that are not tested the first year are believed to be at a disadvantage to those that have been tested—making it important to educate consumers on the selection process. Further, because most consumers will research a past safety rating in the absence of a new one—it is essential that consumers understand the difference between the new and old crash test safety systems. Interestingly, some consumers suggest publishing a crash test schedule to help consumers plan for and research the specific types of new vehicles they are interested in.

Consumer Reports is the only other source mentioned by name that does its own crash testing—though consumers expect manufacturers and dealerships to have this information available on their websites. In the end, consumers indicate (again) that they would rely on the Internet and word of mouth to get information on a vehicle they were seriously considering even if it did not have a label.

NCAP Ad and Tagline Reactions

Consumers were shown an advertisement and asked for feedback. The ad was shown in the context of an online webpage to elicit the most authentic audience response—as the ad was developed for online media.

Overall

the ad was considered informative, to the point, memorable, and

would motivate most to go to the website to look up their current

vehicle or a vehicle they may purchase.

Overall

the ad was considered informative, to the point, memorable, and

would motivate most to go to the website to look up their current

vehicle or a vehicle they may purchase.

The majority of consumers point to the fact that the woman survived the crash as the main message—and that the government safety ratings (safecar.gov) can allow you to walk away from a crash too.

“The woman survived the crash, so the government helped her survive.”

“Promoting the website, where to get information.”

“You can walk away from the accident if you get the information.”

“Crash ratings are available at safecar.gov.”

Specific feedback includes:

Likes:

The words at the end were strong and clear

The music was not distracting

Simple, easy to remember the website

Caught attention immediately with the crash

Short and to the point

Dislikes:

Animation quality

The fact that it was animation and not real people

While a few consumers were not satisfied with the animation quality of the ad, most thought its simplicity helped keep focus on the message and was appropriate for the web. Notably, consumers are much more likely to watch the ad online if it is displayed on websites relevant to new vehicle purchases. In fact, some report they would proactively click on the ad to view it if they saw the tagline/logo displayed because the URL clearly indicates that the ad is not selling anything (because of the .gov) and contains content about something very important to them personally: safety.

T

Los Angeles V and

radio are also believed to be appropriate mediums for this message.

TV is recommended as the effective transition date approaches

because of it’s broad audience; and radio is recommended

because people are most often in the car when listening to the

radio, which would make the message more relevant and memorable.

V and

radio are also believed to be appropriate mediums for this message.

TV is recommended as the effective transition date approaches

because of it’s broad audience; and radio is recommended

because people are most often in the car when listening to the

radio, which would make the message more relevant and memorable.

Boston

Atlanta

Before they are even shown possible taglines and logos for the new Government 5-star Safety Ratings System, consumers come up with words like “new,” “tougher,” “stronger,” and “stricter” on their own to describe the fact that the new crash test rating system is based on more stringent standards.

When presented with the tagline and logo options, “New, Tougher…” gets a slight edge over the others. While selected frequently as a favorite, “New” on its own gives the impression that there were no standards or ratings being done before to some consumers. “Next Generation” also received high marks—especially considering only two groups viewed this tagline/logo—however, some consumers felt that this phrase was too closely associated with Star Trek and could be a turn off, especially to females.

Additionally, “Updated” and “Improved” are seen as vague and give the impression that something was wrong or inadequate about the old system.

Note: four new tagline/logos were added in the Boston and Atlanta groups based on feedback received in Los Angeles. Data for these four tagline/logos is displayed in white columns below:

TOTAL |

|

|

|

|

1st Choice |

11 |

7 |

7 |

7 |

Los Angeles |

|

|

|

1st Choice |

5 |

4 |

3 |

Boston |

|

|

|

1st Choice |

5 |

3 |

2 |

Atlanta |

|

|

1st Choice |

4 |

3 |

Other suggestions include:

Introducing

Stricter

Raising the bar

Did you know

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | GRETCHEN COMEY |

| File Modified | 0000-00-00 |

| File Created | 2021-01-31 |

© 2026 OMB.report | Privacy Policy