MT CGF Disburement Approval Request Submission

EIB 12-02 CGF Disbursement Request.docx

Credit Guarantee Facility Disbursement Approval Request

MT CGF Disburement Approval Request Submission

OMB: 3048-0046

EIB 12-02 MT CGF Disbursement Approval Request

Disbursement Request Submission Screenshots (CGF)

February 5, 2013

Table of Contents

II. Disbursement Request Forms - Workflow 7

B. Data displayed with each disbursement request form 8

III. Sample Disbursement Request Forms 10

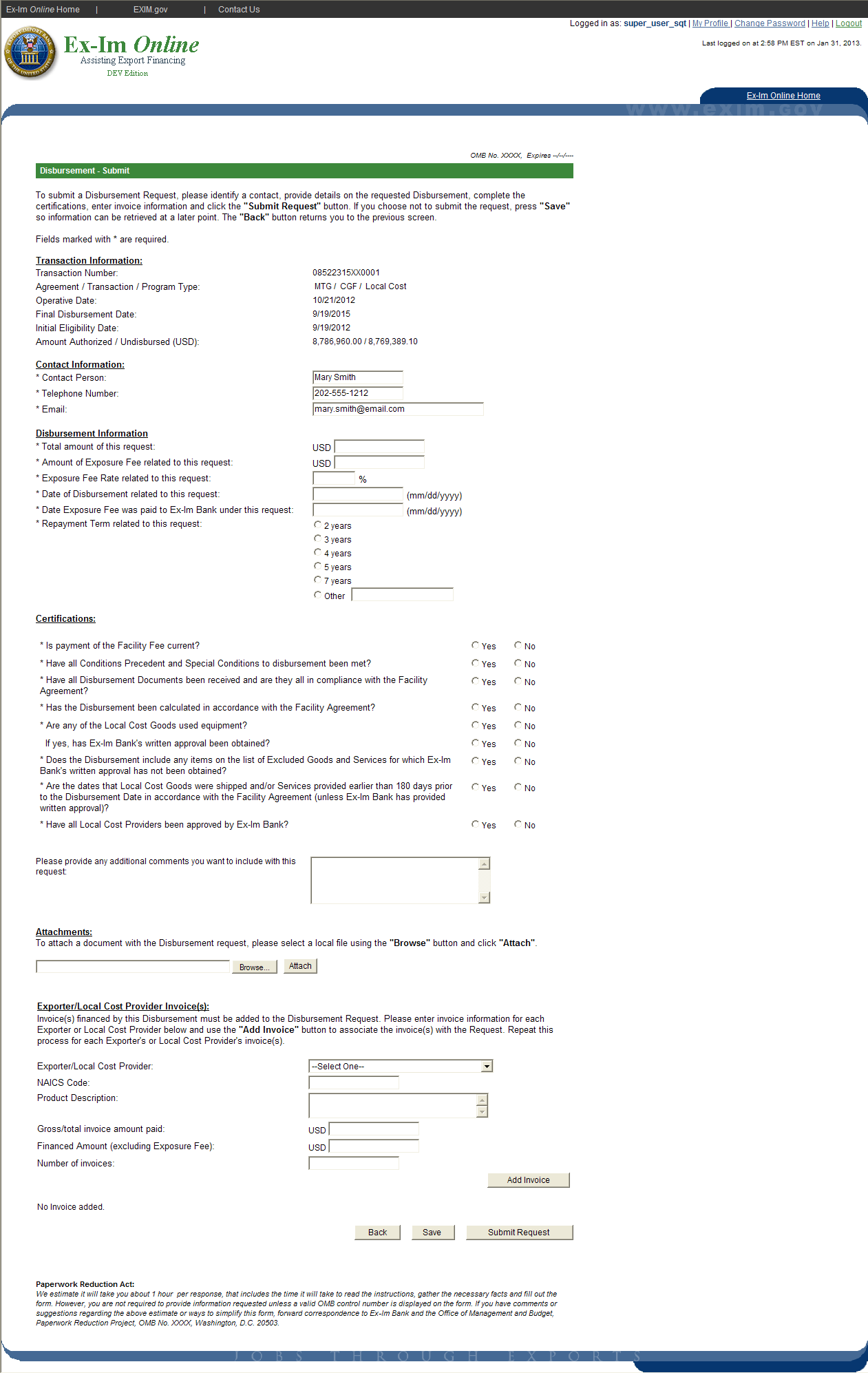

A. Disbursement Request Form – CGF (US Cost) 10

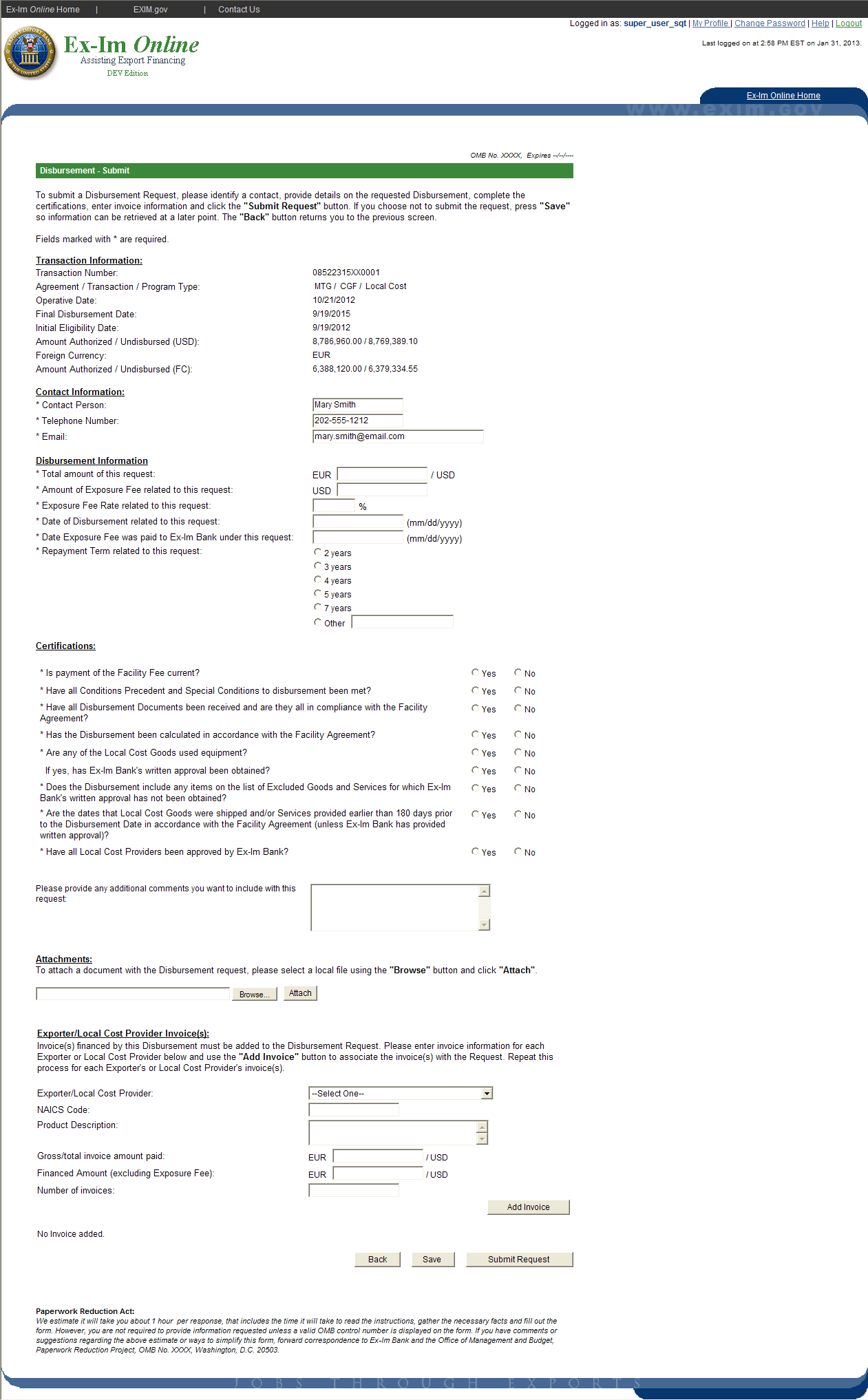

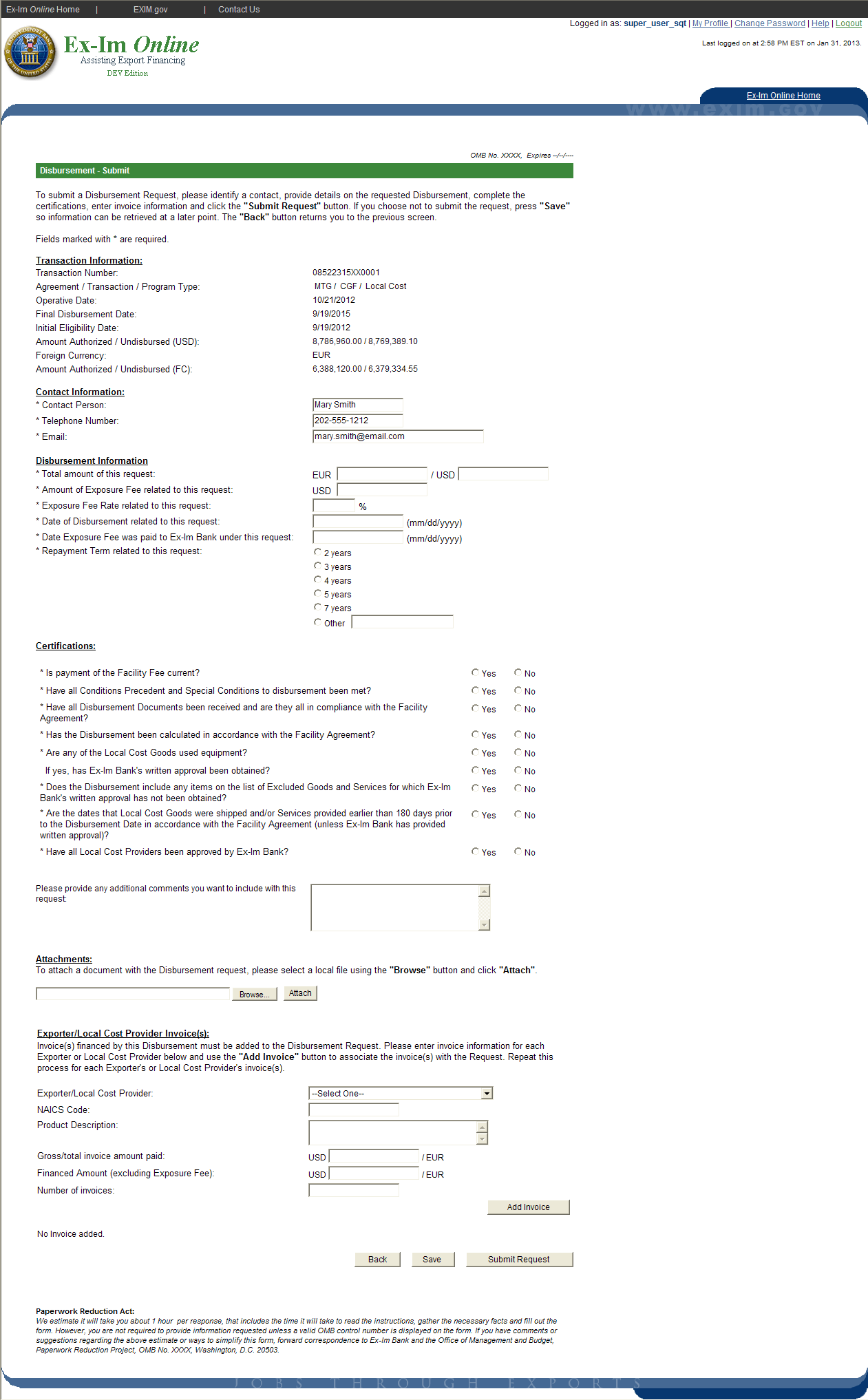

B. Disbursement Request Form – CGF (Local Cost) 11

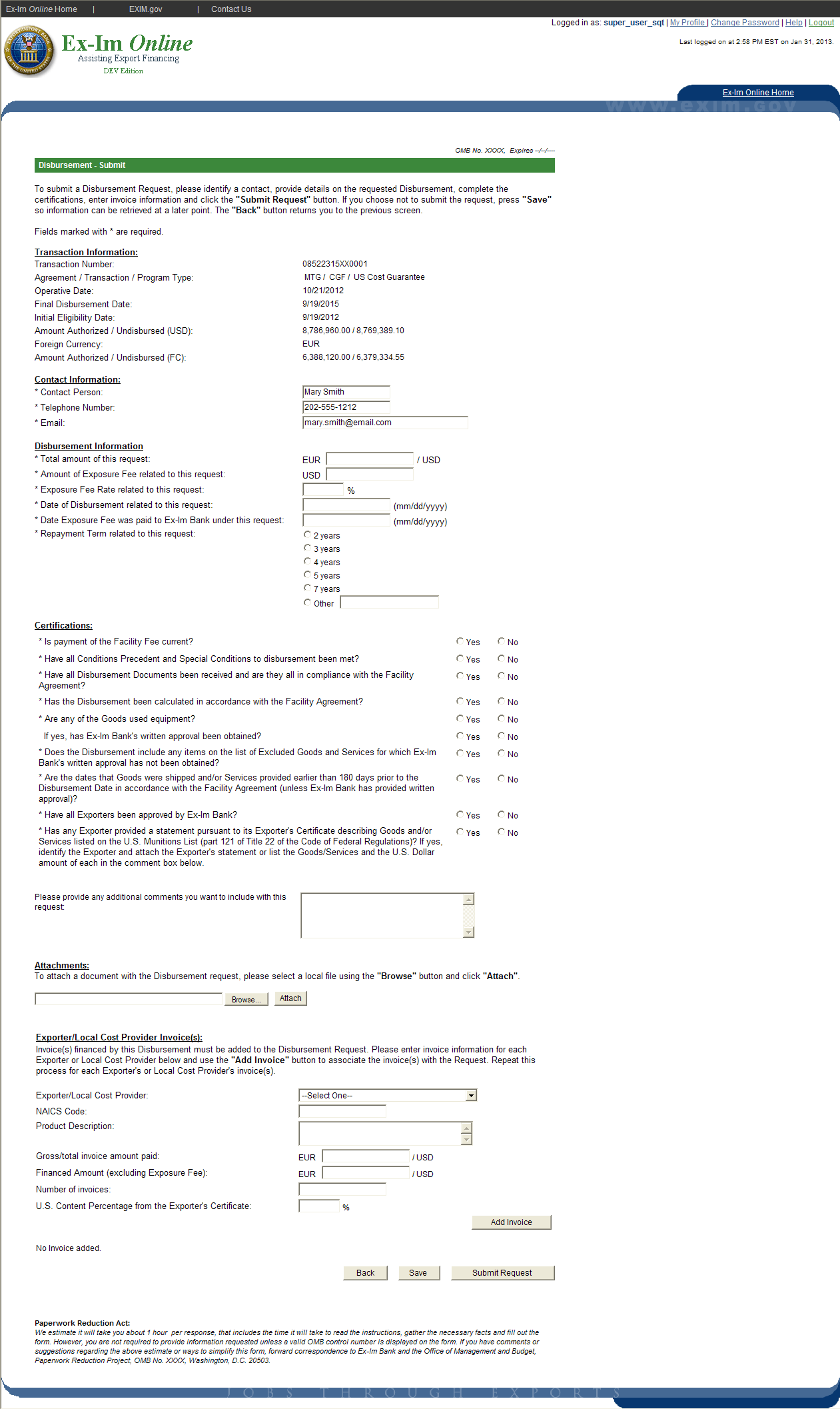

C. Disbursement Request Form – CGF (US Cost Foreign Currency - Fixed) 12

D. Disbursement Request Form – CGF (Local Cost Foreign Currency – Fixed) 13

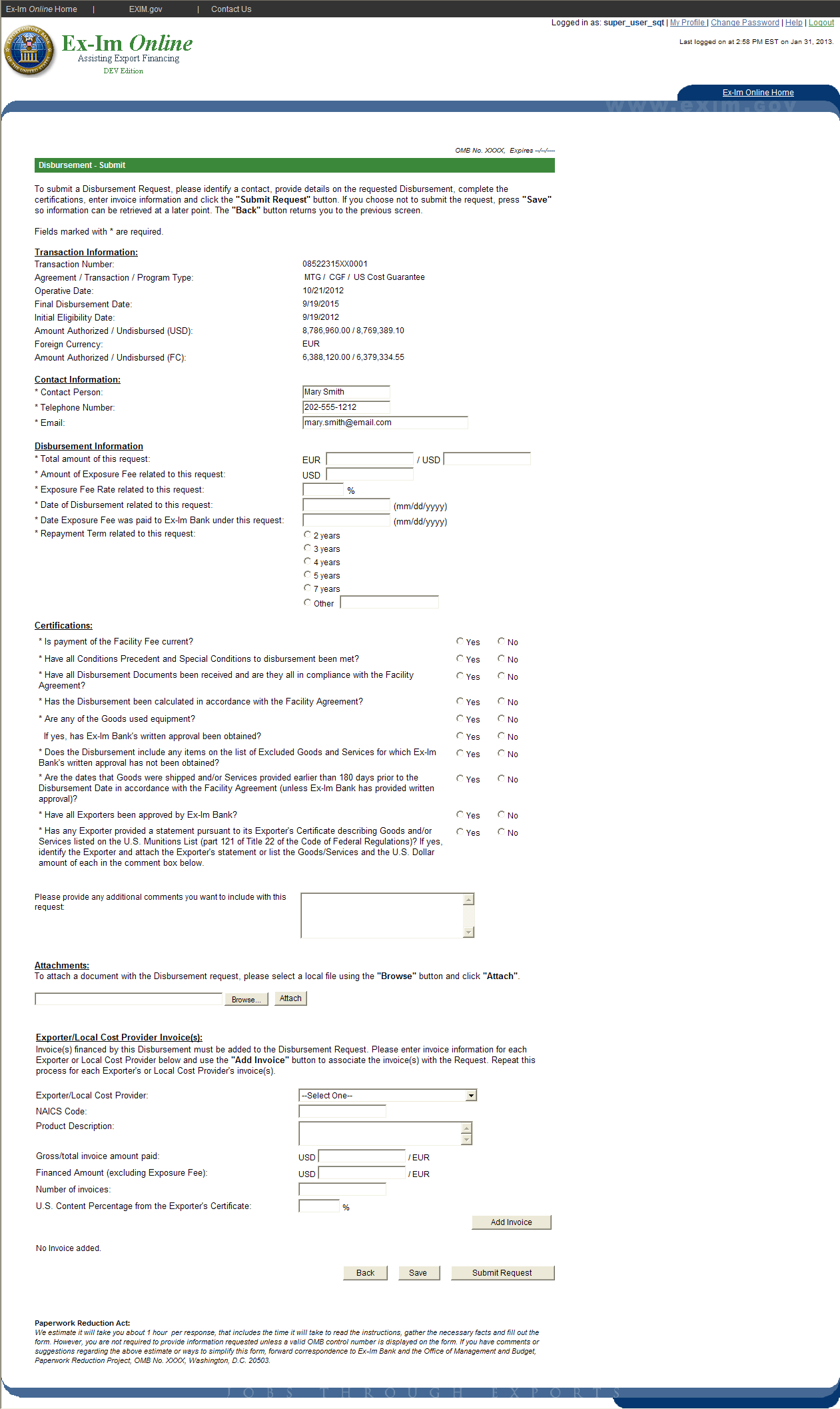

E. Disbursement Request Form – CGF (US Cost Foreign Currency – Floating) 14

F. Disbursement Request Form – CGF (Local Cost Foreign Currency - Floating) 15

Ex-Im Bank has developed an electronic disbursement approval processing system for guaranteed lenders with Credit Guarantee Facilities. After a Credit Guarantee Facility (CGF) has been authorized by Ex-Im Bank and legal documentation has been completed, the Lender will obtain and review the required disbursement documents (e.g. invoices, bills of lading, Exporter’s Certificates, etc.) and will disburse the proceeds of the loan for eligible goods and services. The Lender will access and complete an electronic questionnaire through ExIm Online inputting key data and requesting approval of the disbursement. Ex-Im Bank’s action (approved or declined) will be posted on the Lender’s history page.

Eligible costs in the following categories may be authorized by Ex-Im Bank and the electronic disbursement approval request will have variations depending on the type of cost selected:

U.S. goods and services

Local cost goods and services

CGFs denominated in a foreign currency may be authorized. Disbursements under these transactions have special foreign exchange conversion rules depending on whether the U.S. exporter receives payment in U.S. dollars or a foreign currency under the terms of its supply contract. There are slight variations in the request which reflect the foreign exchange conversion approach:

Fixed (the U.S. Exporter is paid in foreign currency): The Lender is required to enter all financial data in foreign currency values and the System will convert the information to U.S. dollars based on a pre-approved fixed exchange rate associated to the transaction.

Floating (the U.S. Exporter is paid in U.S. dollars): The Lender is required to enter the total amount of the request in both U.S. dollars and foreign currency values so that a conversion rate can be established with the remaining financial data entered only in U.S. dollars.

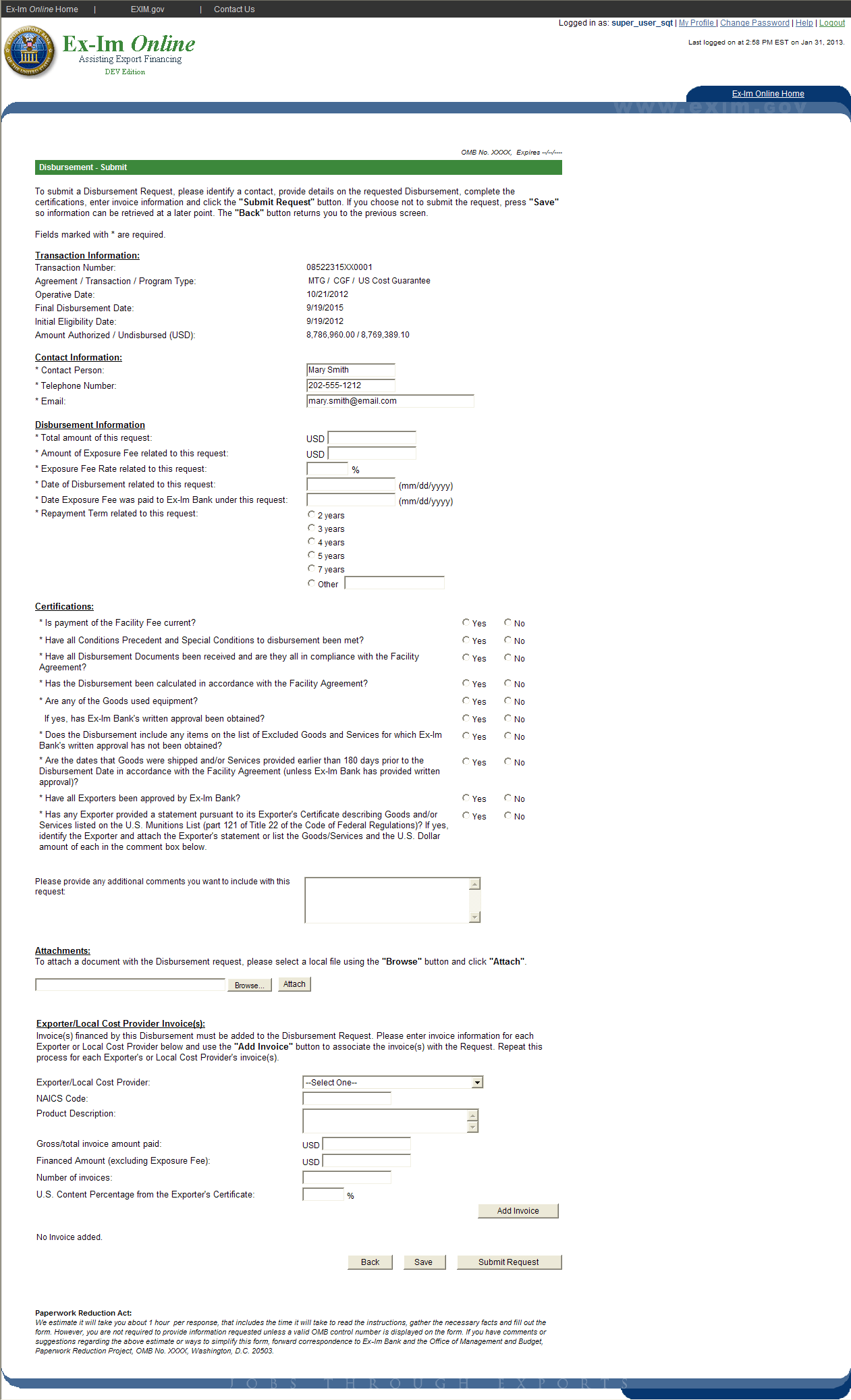

The

remainder of this document will provide screenshots of the sample

Disbursement Request Forms that can be submitted by a Lender through

the Ex-Im Online System. These forms are only available in

electronic format and therefore all Lenders are required to submit

for approval “on-line.” The on-line process helps to

confirm that all necessary data is collected up-front by enforcing

data validations upon submission as well as ensuring the integrity of

the data, meaning what was entered by the Lender, is what is received

by Ex-Im Bank. As mentioned earlier, the

decision to approve or decline a disbursement request is recorded on

the history page and, in addition, is communicated via email to the

individual assigned as the contact person on the disbursement request

form. Depending on certain

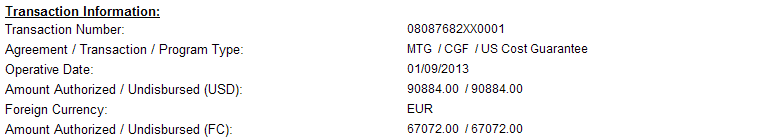

attributes of the transaction, the System will dynamically display

the appropriate request form (i.e., if the transaction is a foreign

currency deal, if the transaction contains local cost, etc.). In

addition, the System will automatically display certain fields that

are “view-only.” This is data that Ex-Im Bank is able to

pre-populate based on transaction details stored in our transaction

processing systems. These fields are included in the Transaction

Information Section.

The

System will default the Contact Information fields based on the

contact information submitted with the disbursement request and

provide the option for the Lender to update this information. The

contact person will receive all email correspondence distributed by

the System in reference to the disbursement request submitted.

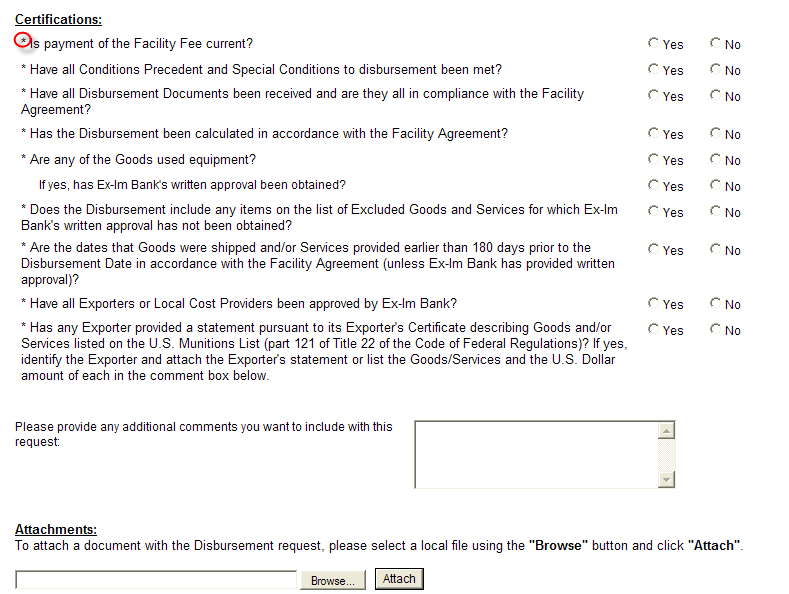

Lastly, the System will require at least one invoice entry to be included with a disbursement request as well as any required field will be designed with an asterisk (*). For transactions where the Exposure Fee was paid up front and not financed, the System will not require the Lender to input the Exposure Fee amount and Date Exposure Fee paid. This information is known by the System because it is data that is collected prior to disbursement and subsequently stored in Ex-Im Online.

To better understand what is being communicated in the following pages, see below for a list of acronyms and their corresponding definition:

CGF – Credit Guarantee Facility

FC – Foreign Currency

USD – US Dollar

EOL – Ex-Im Online

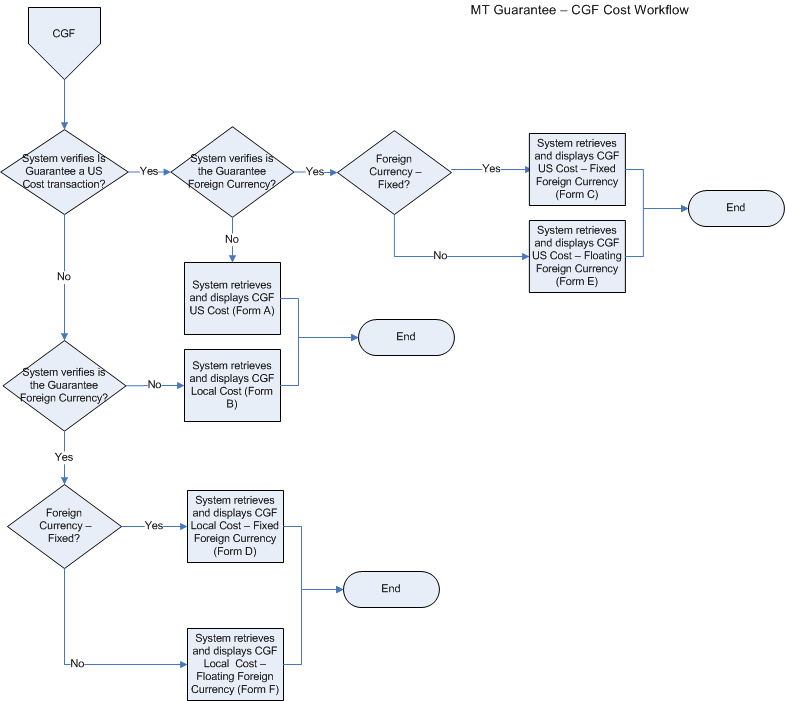

The following section provides workflow diagrams, which define the process that will lead the System to determine which form should be presented to the Lender. In order to better illustrate the data collected for each form, a matrix has been included to show the data elements captured for each variation of the disbursement request form. In addition, Section III includes sample screenshots of each request form with the appropriate reference to a particular workflow process (i.e. A. Disbursement Request Form – CGF Guarantee (US Cost) corresponds to CGF Guarantee – US Cost Workflow “Form A reference” and “Form A” on the matrix).

The workflow diagrams illustrate the System processes that occur when identifying which disbursement request form to display to the Lender. Section III provides sample screenshots which correspond to an “end state” outlined through the workflow as well as a column in the data matrix outlining the specific elements displayed on a particular form (see section II.B ) .

CGF Workflow

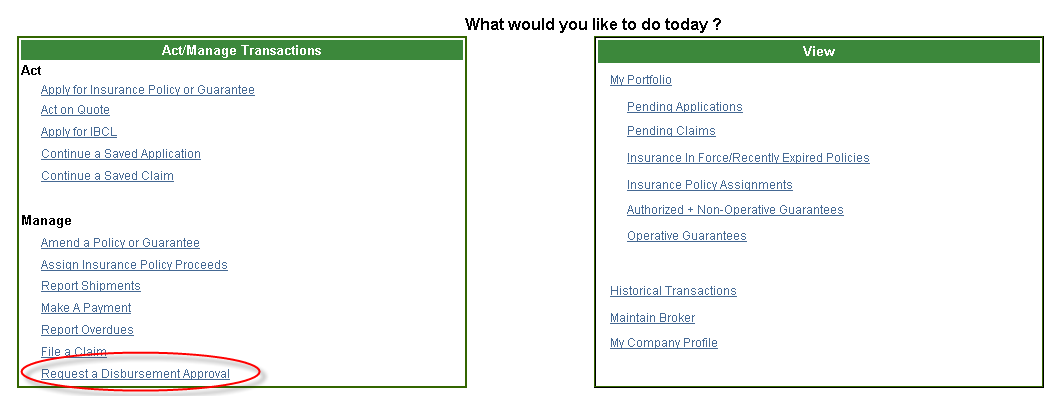

Once logged into ExIm Online, the System will present the Lender with a menu of options asking the Lender, “What do you want to do today?” On the left hand side, the Lender will select “Manage – Request a Disbursement Approval” (see below).

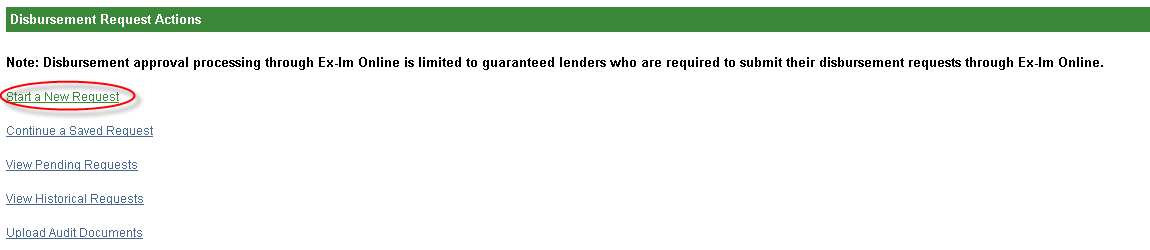

From this screen, the System will ask the Lender what action they want to take and the Lender will select to “Start a New Request”.

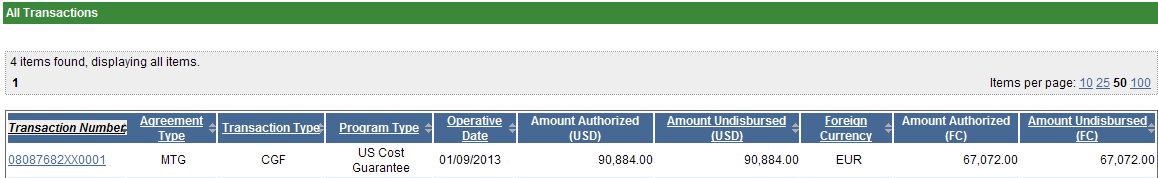

Once this option is selected, the System will display a listing of transactions associated to the Lender. Based on the transaction selected, the System will display the appropriate disbursement request screens which are included in Section III of this document.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Lauren Kirsch |

| File Modified | 0000-00-00 |

| File Created | 2021-01-29 |

© 2026 OMB.report | Privacy Policy