GFE/Information Booklet

Real Estate Settlement Procedures Act (Regulation X) 12 CFR 1024

Forms from RESPA

GFE/Information Booklet

OMB: 3170-0016

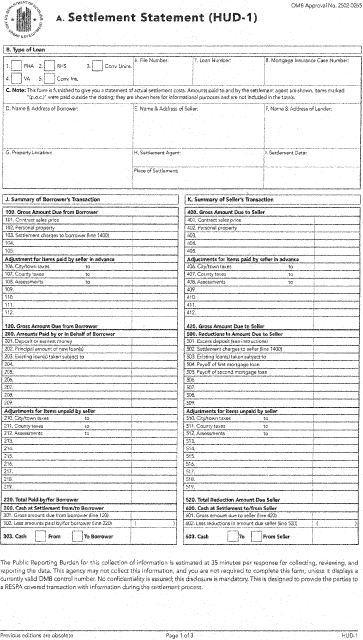

Appendix A to Part 1024—Instructions for Completing HUD-1 and HUD-1a Settlement Statements; Sample HUD-1 and HUD-1a Statements

The following are instructions for completing the HUD-1 settlement statement, required under Section 4 of RESPA and 12 CFR Part 1024 (Regulation X) of the Bureau of Consumer Financial Protection (Bureau) regulations. This form is to be used as a statement of actual charges and adjustments paid by the borrower and the seller, to be given to the parties in connection with the settlement. The instructions for completion of the HUD-1 are primarily for the benefit of the settlement agents who prepare the statements and need not be transmitted to the parties as an integral part of the HUD-1. There is no objection to the use of the HUD-1 in transactions in which its use is not legally required. Refer to the definitions section of the regulations (12 CFR 1024.2) for specific definitions of many of the terms that are used in these instructions.

General Instructions

Information and amounts may be filled in by typewriter, hand printing, computer printing, or any other method producing clear and legible results. Refer to the Bureau’s regulations (Regulation X) regarding rules applicable to reproduction of the HUD-1 for the purpose of including customary recitals and information used locally in settlements; for example, a breakdown of payoff figures, a breakdown of the Borrower’s total monthly mortgage payments, check disbursements, a statement indicating receipt of funds, applicable special stipulations between Borrower and Seller, and the date funds are transferred.

The settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement. Charges for loan origination and title services should not be itemized except as provided in these instructions. For each separately identified settlement service in connection with the transaction, the name of the person ultimately receiving the payment must be shown together with the total amount paid to such person. Items paid to and retained by a loan originator are disclosed as required in the instructions for lines in the 800-series of the HUD-1 (and for per diem interest, in the 900-series of the HUD-1).

As a general rule, charges that are paid for by the seller must be shown in the seller's column on page 2 of the HUD-1 (unless paid outside closing), and charges that are paid for by the borrower must be shown in the borrower’s column (unless paid outside closing). However, in order to promote comparability between the charges on the GFE and the charges on the HUD-1, if a seller pays for a charge that was included on the GFE, the charge should be listed in the borrower’s column on page 2 of the HUD-1. That charge should also be offset by listing a credit in that amount to the borrower on lines 204-209 on page 1 of the HUD-1, and by a charge to the seller in lines 506-509 on page 1 of the HUD-1. If a loan originator (other than for no-cost loans), real estate agent, other settlement service provider, or other person pays for a charge that was included on the GFE, the charge should be listed in the borrower’s column on page 2 of the HUD-1, with an offsetting credit reported on page 1 of the HUD-1, identifying the party paying the charge.

Charges paid outside of settlement by the borrower, seller, loan originator, real estate agent, or any other person, must be included on the HUD-1 but marked “P.O.C.” for “Paid Outside of Closing” (settlement) and must not be included in computing totals. However, indirect payments from a lender to a mortgage broker may not be disclosed as P.O.C., and must be included as a credit on Line 802. P.O.C. items must not be placed in the Borrower or Seller columns, but rather on the appropriate line outside the columns. The settlement agent must indicate whether P.O.C. items are paid for by the Borrower, Seller, or some other party by marking the items paid for by whoever made the payment as “P.O.C.” with the party making the payment identified in parentheses, such as “P.O.C. (borrower)” or “P.O.C. (seller)”.

In the case of “no cost” loans where “no cost” encompasses third party fees as well as the upfront payment to the loan originator, the third party services covered by the “no cost” provisions must be itemized and listed in the borrower’s column on the HUD-1/1A with the charge for the third party service. These itemized charges must be offset with a negative adjusted origination charge on Line 803 and recorded in the columns.

Blank lines are provided in Section L for any additional settlement charges. Blank lines are also provided for additional insertions in Sections J and K. The names of the recipients of the settlement charges in Section L and the names of the recipients of adjustments described in Section J or K should be included on the blank lines.

Lines and columns in Section J which relate to the Borrower’s transaction may be left blank on the copy of the HUD-1 which will be furnished to the Seller. Lines and columns in Section K which relate to the Seller’s transaction may be left blank on the copy of the HUD-1 which will be furnished to the Borrower.

Line Item Instructions

Instructions for completing the individual items on the HUD-1 follow.

Section A. This section requires no entry of information.

Section B. Check appropriate loan type and complete the remaining items as applicable.

Section C. This section provides a notice regarding settlement costs and requires no additional entry of information.

Sections D and E. Fill in the names and current mailing addresses and zip codes of the Borrower and the Seller. Where there is more than one Borrower or Seller, the name and address of each one is required. Use a supplementary page if needed to list multiple Borrowers or Sellers.

Section F. Fill in the name, current mailing address and zip code of the Lender.

Section G. The street address of the property being sold should be listed. If there is no street address, a brief legal description or other location of the property should be inserted. In all cases give the zip code of the property.

Section H. Fill in name, address, zip code and telephone number of settlement agent, and address and zip code of “place of settlement.”

Section I. Fill in date of settlement.

Section J. Summary of Borrower’s Transaction. Line 101 is for the contract sales price of the property being sold, excluding the price of any items of tangible personal property if Borrower and Seller have agreed to a separate price for such items.

Line 102 is for the sales price of any items of tangible personal property excluded from Line 101. Personal property could include such items as carpets, drapes, stoves, refrigerators, etc. What constitutes personal property varies from state to state. Manufactured homes are not considered personal property for this purpose.

Line 103 is used to record the total charges to Borrower detailed in Section L and totaled on Line 1400.

Lines 104 and 105 are for additional amounts owed by the Borrower, such as charges that were not listed on the GFE or items paid by the Seller prior to settlement but reimbursed by the Borrower at settlement. For example, the balance in the Seller’s reserve account held in connection with an existing loan, if assigned to the Borrower in a loan assumption case, will be entered here. These lines will also be used when a tenant in the property being sold has not yet paid the rent, which the Borrower will collect, for a period of time prior to the settlement. The lines will also be used to indicate the treatment for any tenant security deposit. The Seller will be credited on Lines 404-405.

Lines 106 through 112 are for items which the Seller had paid in advance, and for which the Borrower must therefore reimburse the Seller. Examples of items for which adjustments will be made may include taxes and assessments paid in advance for an entire year or other period, when settlement occurs prior to the expiration of the year or other period for which they were paid. Additional examples include flood and hazard insurance premiums, if the Borrower is being substituted as an insured under the same policy; mortgage insurance in loan assumption cases; planned unit development or condominium association assessments paid in advance; fuel or other supplies on hand, purchased by the Seller, which the Borrower will use when Borrower takes possession of the property; and ground rent paid in advance.

Line 120 is for the total of Lines 101 through 112.

Line 201 is for any amount paid against the sales price prior to settlement.

Line 202 is for the amount of the new loan made by the Lender when a loan to finance construction of a new structure constructed for sale is used as or converted to a loan to finance purchase. Line 202 should also be used for the amount of the first user loan, when a loan to purchase a manufactured home for resale is converted to a loan to finance purchase by the first user. For other loans covered by 12 CFR Part 1024 (Regulation X) which finance construction of a new structure or purchase of a manufactured home, list the sales price of the land on Line 104, the construction cost or purchase price of manufactured home on Line 105 (Line 101 would be left blank in this instance) and amount of the loan on Line 202. The remainder of the form should be completed taking into account adjustments and charges related to the temporary financing and permanent financing and which are known at the date of settlement.

Line 203 is used for cases in which the Borrower is assuming or taking title subject to an existing loan or lien on the property.

Lines 204-209 are used for other items paid by or on behalf of the Borrower. Lines 204-209 should be used to indicate any financing arrangements or other new loan not listed in Line 202. For example, if the Borrower is using a second mortgage or note to finance part of the purchase price, whether from the same lender, another lender or the Seller, insert the principal amount of the loan with a brief explanation on Lines 204-209. Lines 204-209 should also be used where the Borrower receives a credit from the Seller for closing costs, including seller-paid GFE charges. They may also be used in cases in which a Seller (typically a builder) is making an “allowance” to the Borrower for items that the Borrower is to purchase separately.

Lines 210 through 219 are for items which have not yet been paid, and which the Borrower is expected to pay, but which are attributable in part to a period of time prior to the settlement. In jurisdictions in which taxes are paid late in the tax year, most cases will show the proration of taxes in these lines. Other examples include utilities used but not paid for by the Seller, rent collected in advance by the Seller from a tenant for a period extending beyond the settlement date, and interest on loan assumptions.

Line 220 is for the total of Lines 201 through 219.

Lines 301 and 302 are summary lines for the Borrower. Enter total in Line 120 on Line 301. Enter total in Line 220 on Line 302.

Line 303 must indicate either the cash required from the Borrower at settlement (the usual case in a purchase transaction), or cash payable to the Borrower at settlement (if, for example, the Borrower’s earnest money exceeds the Borrower’s cash obligations in the transaction or there is a cash-out refinance). Subtract Line 302 from Line 301 and enter the amount of cash due to or from the Borrower at settlement on Line 303. The appropriate box should be checked. If the Borrower’s earnest money is applied toward the charge for a settlement service, the amount so applied should not be included on Line 303 but instead should be shown on the appropriate line for the settlement service, marked “P.O.C. (Borrower)”, and must not be included in computing totals.

Section K. Summary of Seller’s Transaction. Instructions for the use of Lines 101 and 102 and 104-112 above, apply also to Lines 401-412. Line 420 is for the total of Lines 401 through 412.

Line 501 is used if the Seller’s real estate broker or other party who is not the settlement agent has received and holds a deposit against the sales price (earnest money) which exceeds the fee or commission owed to that party. If that party will render the excess deposit directly to the Seller, rather than through the settlement agent, the amount of excess deposit should be entered on Line 501 and the amount of the total deposit (including commissions) should be entered on Line 201.

Line 502 is used to record the total charges to the Seller detailed in Section L and totaled on Line 1400.

Line 503 is used if the Borrower is assuming or taking title subject to existing liens which are to be deducted from sales price.

Lines 504 and 505 are used for the amounts (including any accrued interest) of any first and/or second loans which will be paid as part of the settlement.

Line 506 is used for deposits paid by the Borrower to the Seller or other party who is not the settlement agent. Enter the amount of the deposit in Line 201 on Line 506 unless Line 501 is used or the party who is not the settlement agent transfers all or part of the deposit to the settlement agent, in which case the settlement agent will note in parentheses on Line 507 the amount of the deposit that is being disbursed as proceeds and enter in the column for Line 506 the amount retained by the above-described party for settlement services. If the settlement agent holds the deposit, insert a note in Line 507 which indicates that the deposit is being disbursed as proceeds.

Lines 506 through 509 may be used to list additional liens which must be paid off through the settlement to clear title to the property. Other Seller obligations should be shown on Lines 506-509, including charges that were disclosed on the GFE but that are actually being paid for by the Seller. These Lines may also be used to indicate funds to be held by the settlement agent for the payment of either repairs, or water, fuel, or other utility bills that cannot be prorated between the parties at settlement because the amounts used by the Seller prior to settlement are not yet known. Subsequent disclosure of the actual amount of these post-settlement items to be paid from settlement funds is optional. Any amounts entered on Lines 204-209 including Seller financing arrangements should also be entered on Lines 506-509.

Instructions for the use of Lines 510 through 519 are the same as those for Lines 210 to 219 above.

Line 520 is for the total of Lines 501 through 519.

Lines 601 and 602 are summary lines for the Seller. Enter the total in Line 420 on Line 601. Enter the total in Line 520 on Line 602.

Line 603 must indicate either the cash required to be paid to the Seller at settlement (the usual case in a purchase transaction), or the cash payable by the Seller at settlement. Subtract Line 602 from Line 601 and enter the amount of cash due to or from the Seller at settlement on Line 603. The appropriate box should be checked.

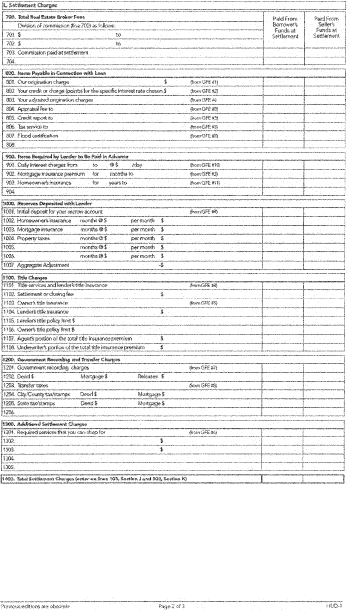

Section L. Settlement Charges.

Line 700 is used to enter the sales commission charged by the sales agent or real estate broker.

Lines 701-702 are to be used to state the split of the commission where the settlement agent disburses portions of the commission to two or more sales agents or real estate brokers.

Line 703 is used to enter the amount of sales commission disbursed at settlement. If the sales agent or real estate broker is retaining a part of the deposit against the sales price (earnest money) to apply towards the sales agent’s or real estate broker’s commission, include in Line 703 only that part of the commission being disbursed at settlement and insert a note on Line 704 indicating the amount the sales agent or real estate broker is retaining as a “P.O.C.” item.

Line 704 may be used for additional charges made by the sales agent or real estate broker, or for a sales commission charged to the Borrower, which will be disbursed by the settlement agent.

Line 801 is used to record “Our origination charge,” which includes all charges received by the loan originator, except any charge for the specific interest rate chosen (points). This number must not be listed in either the buyer’s or seller’s column. The amount shown in Line 801 must include any amounts received for origination services, including administrative and processing services, performed by or on behalf of the loan originator.

Line 802 is used to record “Your credit or charge (points) for the specific interest rate chosen,” which states the charge or credit adjustment as applied to “Our origination charge,” if applicable. This number must not be listed in either column or shown on page one of the HUD-1.

For a mortgage broker originating a loan in its own name, the amount shown on Line 802 will be the difference between the initial loan amount and the total payment to the mortgage broker from the lender. The total payment to the mortgage broker will be the sum of the price paid for the loan by the lender and any other payments to the mortgage broker from the lender, including any payments based on the loan amount or loan terms, and any flat rate payments. For a mortgage broker originating a loan in another entity’s name, the amount shown on Line 802 will be the sum of all payments to the mortgage broker from the lender, including any payments based on the loan amount or loan terms, and any flat rate payments.

In either case, when the amount paid to the mortgage broker exceeds the initial loan amount, there is a credit to the borrower and it is entered as a negative amount. When the initial loan amount exceeds the amount paid to the mortgage broker, there is a charge to the borrower and it is entered as a positive amount. For a lender, the amount shown on Line 802 may include any credit or charge (points) to the Borrower.

Line 803 is used to record “Your adjusted origination charges,” which states the net amount of the loan origination charges, the sum of the amounts shown in Lines 801 and 802. This amount must be listed in the columns as either a positive number (for example, where the origination charge shown in Line 801 exceeds any credit for the interest rate shown in Line 802 or where there is an origination charge in Line 801 and a charge for the interest rate (points) is shown on Line 802) or as a negative number (for example, where the credit for the interest rate shown in Line 802 exceeds the origination charges shown in Line 801).

In the case of “no cost” loans, where “no cost” refers only to the loan originator’s fees, the amounts shown in Lines 801 and 802 should offset, so that the charge shown on Line 803 is zero. Where “no cost” includes third party settlement services, the credit shown in Line 802 will more than offset the amount shown in Line 801. The amount shown in Line 803 will be a negative number to offset the settlement charges paid indirectly through the loan originator.

Lines 804-808 may be used to record each of the “Required services that we select.” Each settlement service provider must be identified by name and the amount paid recorded either inside the columns or as paid to the provider outside closing (“P.O.C.”), as described in the General Instructions.

Line 804 is used to record the appraisal fee.

Line 805 is used to record the fee for all credit reports.

Line 806 is used to record the fee for any tax service.

Line 807 is used to record any flood certification fee.

Lines 808 and additional sequentially numbered lines, as needed, are used to record other third party services required by the loan originator. These Lines may also be used to record other required disclosures from the loan originator. Any such disclosures must be listed outside the columns.

Lines 901-904. This series is used to record the items which the Lender requires to be paid at the time of settlement, but which are not necessarily paid to the lender (e.g., FHA mortgage insurance premium), other than reserves collected by the Lender and recorded in the 1000-series.

Line 901 is used if interest is collected at settlement for a part of a month or other period between settlement and the date from which interest will be collected with the first regular monthly payment. Enter that amount here and include the per diem charges. If such interest is not collected until the first regular monthly payment, no entry should be made on Line 901.

Line 902 is used for mortgage insurance premiums due and payable at settlement, including any monthly amounts due at settlement and any upfront mortgage insurance premium, but not including any reserves collected by the Lender and recorded in the 1000-series. If a lump sum mortgage insurance premium paid at settlement is included on Line 902, a note should indicate that the premium is for the life of the loan.

Line 903 is used for homeowner’s insurance premiums that the Lender requires to be paid at the time of settlement, except reserves collected by the Lender and recorded in the 1000-series.

Lines 904 and additional sequentially numbered lines are used to list additional items required by the Lender (except for reserves collected by the Lender and recorded in the 1000-series), including premiums for flood or other insurance. These lines are also used to list amounts paid at settlement for insurance not required by the Lender.

Lines 1000-1007. This series is used for amounts collected by the Lender from the Borrower and held in an account for the future payment of the obligations listed as they fall due. Include the time period (number of months) and the monthly assessment. In many jurisdictions this is referred to as an “escrow”, “impound”, or “trust” account. In addition to the property taxes and insurance listed, some Lenders may require reserves for flood insurance, condominium owners’ association assessments, etc. The amount in line 1001 must be listed in the columns, and the itemizations in lines 1002 through 1007 must be listed outside the columns.

After itemizing individual deposits in the 1000 series, the servicer shall make an adjustment based on aggregate accounting. This adjustment equals the difference between the deposit required under aggregate accounting and the sum of the itemized deposits. The computation steps for aggregate accounting are set out in 12 CFR 1024.17(d). The adjustment will always be a negative number or zero (-0-), except for amounts due to rounding. The settlement agent shall enter the aggregate adjustment amount outside the columns on a final line of the 1000 series of the HUD-1 or HUD-1A statement. Appendix E to this part sets out an example of aggregate analysis.

Lines 1100-1108. This series covers title charges and charges by attorneys and closing or settlement agents. The title charges include a variety of services performed by title companies or others, and include fees directly related to the transfer of title (title examination, title search, document preparation), fees for title insurance, and fees for conducting the closing. The legal charges include fees for attorneys representing the lender, seller, or borrower, and any attorney preparing title work. The series also includes any settlement, notary, and delivery fees related to the services covered in this series. Disbursements to third parties must be broken out in the appropriate lines or in blank lines in the series, and amounts paid to these third parties must be shown outside of the columns if included in Line 1101. Charges not included in Line 1101 must be listed in the columns.

Line 1101 is used to record the total for the category of “Title services and lender’s title insurance.” This amount must be listed in the columns.

Line 1102 is used to record the settlement or closing fee.

Line 1103 is used to record the charges for the owner’s title insurance and related endorsements. This amount must be listed in the columns.

Line 1104 is used to record the lender’s title insurance premium and related endorsements.

Line 1105 is used to record the amount of the lender’s title policy limit. This amount is recorded outside of the columns.

Line 1106 is used to record the amount of the owner’s title policy limit. This amount is recorded outside of the columns.

Line 1107 is used to record the amount of the total title insurance premium, including endorsements, that is retained by the title agent. This amount is recorded outside of the columns.

Line 1108 used to record the amount of the total title insurance premium, including endorsements, that is retained by the title underwriter. This amount is recorded outside of the columns.

Additional sequentially numbered lines in the 1100-series may be used to itemize title charges paid to other third parties, as identified by name and type of service provided.

Lines 1200-1206. This series covers government recording and transfer charges. Charges paid by the borrower must be listed in the columns as described for lines 1201 and 1203, with itemizations shown outside the columns. Any amounts that are charged to the seller and that were not included on the Good Faith Estimate must be listed in the columns.

Line 1201 is used to record the total “Government recording charges,” and the amount must be listed in the columns.

Line 1202 is used to record, outside of the columns, the itemized recording charges.

Line 1203 is used to record the transfer taxes, and the amount must be listed in the columns.

Line 1204 is used to record, outside of the columns, the amounts for local transfer taxes and stamps.

Line 1205 is used to record, outside of the columns, the amounts for State transfer taxes and stamps.

Line 1206 and additional sequentially numbered lines may be used to record specific itemized third party charges for government recording and transfer services, but the amounts must be listed outside the columns.

Line 1301 and additional sequentially numbered lines must be used to record required services that the borrower can shop for, such as fees for survey, pest inspection, or other similar inspections. These lines may also be used to record additional itemized settlement charges that are not included in a specific category, such as fees for structural and environmental inspections; pre-sale inspections of heating, plumbing or electrical equipment; or insurance or warranty coverage. The amounts must be listed in either the borrower’s or seller’s column.

Line 1400 must state the total settlement charges as calculated by adding the amounts within each column.

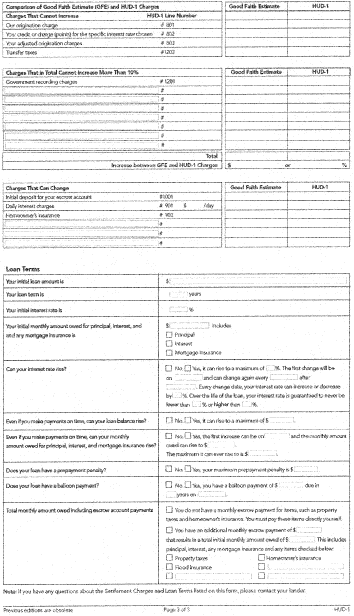

Page 3

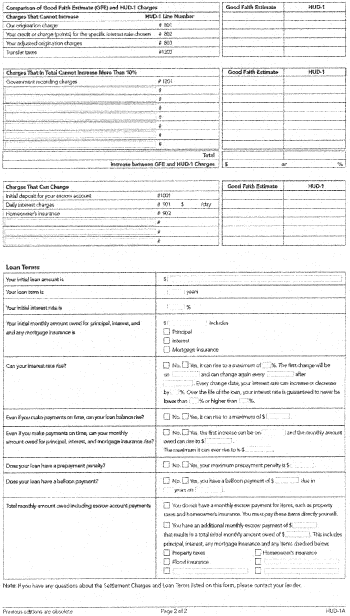

Comparison of Good Faith Estimate (GFE) and HUD-1/1A Charges

The HUD-1/1-A is a statement of actual charges and adjustments. The comparison chart on page 3 of the HUD-1 must be prepared using the exact information and amounts for the services that were purchased or provided as part of the transaction, as that information and those amounts are shown on the GFE and in the HUD-1. If a service that was listed on the GFE was not obtained in connection with the transaction, pages 1 and 2 of the HUD-1 should not include any amount for that service, and the estimate on the GFE of the charge for the service should not be included in any amounts shown on the comparison chart on Page 3 of the HUD-1. The comparison chart is comprised of three sections: “Charges That Cannot Increase”, “Charges That Cannot Increase More Than 10%”, and “Charges That Can Change”.

“Charges That Cannot Increase”. The amounts shown in Blocks 1 and 2, in Line A, and in Block 8 on the borrower’s GFE must be entered in the appropriate line in the Good Faith Estimate column. The amounts shown on Lines 801, 802, 803 and 1203 of the HUD-1/1A must be entered in the corresponding line in the HUD-1/1A column. The HUD-1/1A column must include any amounts shown on page 2 of the HUD-1 in the column as paid for by the borrower, plus any amounts that are shown as P.O.C. by or on behalf of the borrower. If there is a credit in Block 2 of the GFE or Line 802 of the HUD-1/1A, the credit should be entered as a negative number.

“Charges That Cannot Increase More Than 10%”. A description of each charge included in Blocks 3 and 7 on the borrower’s GFE must be entered on separate lines in this section, with the amount shown on the borrower’s GFE for each charge entered in the corresponding line in the Good Faith Estimate column. For each charge included in Blocks 4, 5 and 6 on the borrower’s GFE for which the loan originator selected the provider or for which the borrower selected a provider identified by the loan originator, a description must be entered on a separate line in this section, with the amount shown on the borrower’s GFE for each charge entered in the corresponding line in the Good Faith Estimate column. The loan originator must identify any third party settlement services for which the borrower selected a provider other than one identified by the loan originator so that the settlement agent can include those charges in the appropriate category. Additional lines may be added if necessary. The amounts shown on the HUD-1/1A for each line must be entered in the HUD-1/1A column next to the corresponding charge from the GFE, along with the appropriate HUD-1/1A line number. The HUD-1/1A column must include any amounts shown on page 2 of the HUD-1 in the column as paid for by the borrower, plus any amounts that are shown as P.O.C. by or on behalf of the borrower.

The amounts shown in the Good Faith Estimate and HUD-1/1A columns for this section must be separately totaled and entered in the designated line. If the total for the HUD-1/1A column is greater than the total for the Good Faith Estimate column, then the amount of the increase must be entered both as a dollar amount and as a percentage increase in the appropriate line.

“Charges That Can Change”. The amounts shown in Blocks 9, 10 and 11 on the borrower’s GFE must be entered in the appropriate lines in the Good Faith Estimate column. Any third party settlement services for which the borrower selected a provider other than one identified by the loan originator must also be included in this section. The amounts shown on the HUD-1/1A for each charge in this section must be entered in the corresponding line in the HUD-1/1A column, along with the appropriate HUD-1/1A line number. The HUD-1/1A column must include any amounts shown on page 2 of the HUD-1 in the column as paid for by the borrower, plus any amounts that are shown as P.O.C. by or on behalf of the borrower. Additional lines may be added if necessary.

Loan Terms

This section must be completed in accordance with the information and instructions provided by the lender. The lender must provide this information in a format that permits the settlement agent to simply enter the necessary information in the appropriate spaces, without the settlement agent having to refer to the loan documents themselves.

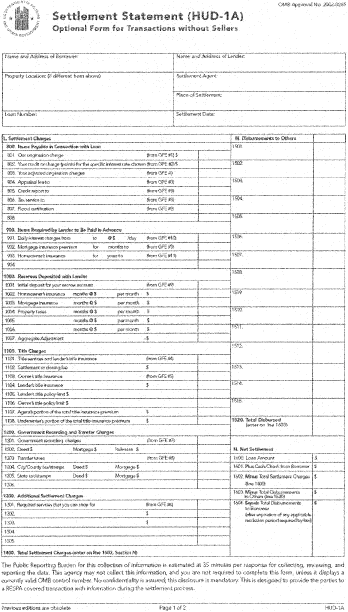

Instructions for Completing HUD-1A

Note: The HUD-1A is an optional form that may be used for refinancing and subordinate-lien federally related mortgage loans, as well as for any other one-party transaction that does not involve the transfer of title to residential real property. The HUD-1 form may also be used for such transactions, by utilizing the borrower’s side of the HUD-1 and following the relevant parts of the instructions as set forth above. The use of either the HUD-1 or HUD-1A is not mandatory for open-end lines of credit (home-equity plans), as long as the provisions of Regulation Z are followed.

Background

The HUD-1A settlement statement is to be used as a statement of actual charges and adjustments to be given to the borrower at settlement, as defined in this part. The instructions for completion of the HUD-1A are for the benefit of the settlement agent who prepares the statement; the instructions are not a part of the statement and need not be transmitted to the borrower. There is no objection to using the HUD-1A in transactions in which it is not required, and its use in open-end lines of credit transactions (home-equity plans) is encouraged. It may not be used as a substitute for a HUD-1 in any transaction that has a seller.

Refer to the “definitions” section (§ 1024.2) of 12 CFR Part 1024 (Regulation X) for specific definitions of terms used in these instructions.

General Instructions

Information and amounts may be filled in by typewriter, hand printing, computer printing, or any other method producing clear and legible results. Refer to 12 CFR 1024.9 regarding rules for reproduction of the HUD-1A. Additional pages may be attached to the HUD-1A for the inclusion of customary recitals and information used locally for settlements or if there are insufficient lines on the HUD-1A. The settlement agent shall complete the HUD-1A in accordance with the instructions for the HUD-1 to the extent possible, including the instructions for disclosing items paid outside closing and for no cost loans.

Blank lines are provided in Section L for any additional settlement charges. Blank lines are also provided in Section M for recipients of all or portions of the loan proceeds. The names of the recipients of the settlement charges in Section L and the names of the recipients of the loan proceeds in Section M should be set forth on the blank lines.

Line-Item Instructions

Page 1

The identification information at the top of the HUD-1A should be completed as follows: The borrower’s name and address is entered in the space provided. If the property securing the loan is different from the borrower’s address, the address or other location information on the property should be entered in the space provided. The loan number is the lender’s identification number for the loan. The settlement date is the date of settlement in accordance with 12 CFR 1024.2, not the end of any applicable rescission period. The name and address of the lender should be entered in the space provided.

Section L. Settlement Charges. This section of the HUD-1A is similar to Section L of the HUD-1, with minor changes or omissions, including deletion of lines 700 through 704, relating to real estate broker commissions. The instructions for Section L in the HUD-1 should be followed insofar as possible. Inapplicable charges should be ignored, as should any instructions regarding seller items.

Line 1400 in the HUD-1A is for the total settlement charges charged to the borrower. Enter this total on line 1601. This total should include Section L amounts from additional pages, if any are attached to this HUD-1A.

Section M. Disbursement to Others. This section is used to list payees, other than the borrower, of all or portions of the loan proceeds (including the lender, if the loan is paying off a prior loan made by the same lender), when the payee will be paid directly out of the settlement proceeds. It is not used to list payees of settlement charges, nor to list funds disbursed directly to the borrower, even if the lender knows the borrower’s intended use of the funds.

For example, in a refinancing transaction, the loan proceeds are used to pay off an existing loan. The name of the lender for the loan being paid off and the pay-off balance would be entered in Section M. In a home improvement transaction when the proceeds are to be paid to the home improvement contractor, the name of the contractor and the amount paid to the contractor would be entered in Section M. In a consolidation loan, or when part of the loan proceeds is used to pay off other creditors, the name of each creditor and the amount paid to that creditor would be entered in Section M. If the proceeds are to be given directly to the borrower and the borrower will use the proceeds to pay off existing obligations, this would not be reflected in Section M.

Section N. Net Settlement. Line 1600 normally sets forth the principal amount of the loan as it appears on the related note for this loan. In the event this form is used for an open-ended home equity line whose approved amount is greater than the initial amount advanced at settlement, the amount shown on Line 1600 will be the loan amount advanced at settlement. Line 1601 is used for all settlement charges that both are included in the totals for lines 1400 and 1602, and are not financed as part of the principal amount of the loan. This is the amount normally received by the lender from the borrower at settlement, which would occur when some or all of the settlement charges were paid in cash by the borrower at settlement, instead of being financed as part of the principal amount of the loan. Failure to include any such amount in line 1601 will result in an error in the amount calculated on line 1604. Items paid outside of closing (P.O.C.) should not be included in Line 1601.

Line 1602 is the total amount from line 1400.

Line 1603 is the total amount from line 1520.

Line 1604 is the amount disbursed to the borrower. This is determined by adding together the amounts for lines 1600 and 1601, and then subtracting any amounts listed on lines 1602 and 1603.

Page 2

This section of the HUD-1A is similar to page 3 of the HUD-1. The instructions for page 3 of the HUD-1 should be followed insofar as possible. The HUD-1/1A Column should include any amounts shown on page 1 of the HUD-1A in the column as paid for by the borrower, plus any amounts that are shown as P.O.C. by the borrower. Inapplicable charges should be ignored.

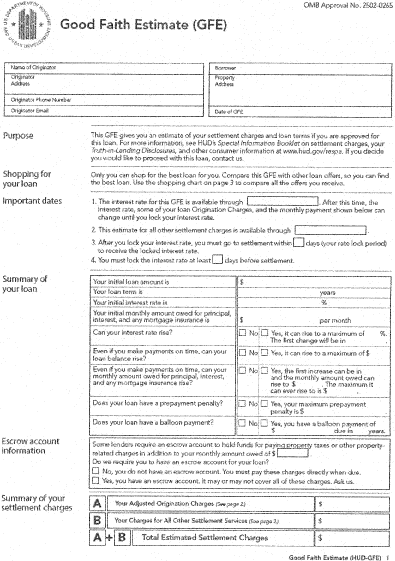

Appendix C to Part 1024—Instructions for Completing Good Faith Estimate (GFE) Form

The following are instructions for completing the GFE required under Section 5 of RESPA and 12 CFR 1024.7 of the Bureau regulations. The standardized form set forth in this Appendix is the required GFE form and must be provided exactly as specified; provided, however, preparers may replace HUD’s OMB approval number listed on the form with the Bureau’s OMB approval number when they reproduce the GFE form. The instructions for completion of the GFE are primarily for the benefit of the loan originator who prepares the form and need not be transmitted to the borrower(s) as an integral part of the GFE. The required standardized GFE form must be prepared completely and accurately. A separate GFE must be provided for each loan where a transaction will involve more than one mortgage loan.

General Instructions

The loan originator preparing the GFE may fill in information and amounts on the form by typewriter, hand printing, computer printing, or any other method producing clear and legible results. Under these instructions, the “form” refers to the required standardized GFE form. Although the standardized GFE is a prescribed form, Blocks 3, 6, and 11 on page 2 may be adapted for use in particular loan situations, so that additional lines may be inserted there, and unused lines may be deleted.

All fees for categories of charges shall be disclosed in U.S. dollar and cent amounts.

Specific Instructions

Page 1

Top of the Form—The loan originator must enter its name, business address, telephone number, and email address, if any, on the top of the form, along with the applicant’s name, the address or location of the property for which financing is sought, and the date of the GFE.

“Purpose.”—This section describes the general purpose of the GFE as well as additional information available to the applicant.

“Shopping for your loan.”—This section requires no loan originator action.

“Important dates.”—This section briefly states important deadlines after which the loan terms that are the subject of the GFE may not be available to the applicant. In Line 1, the loan originator must state the date and, if necessary, time until which the interest rate for the GFE will be available. In Line 2, the loan originator must state the date until which the estimate of all other settlement charges for the GFE will be available. This date must be at least 10 business days from the date of the GFE. In Line 3, the loan originator must state how many calendar days within which the applicant must go to settlement once the interest rate is locked. In Line 4, the loan originator must state how many calendar days prior to settlement the interest rate would have to be locked, if applicable.

“Summary of your loan ”—In this section, for all loans the loan originator must fill in, where indicated:

(i) The initial loan amount;

(ii) The loan term; and

(iii) The initial interest rate.

The loan originator must fill in the initial monthly amount owed for principal, interest, and any mortgage insurance. The amount shown must be the greater of: (1) The required monthly payment for principal and interest for the first regularly scheduled payment, plus any monthly mortgage insurance payment; or (2) the accrued interest for the first regularly scheduled payment, plus any monthly mortgage insurance payment.

The loan originator must indicate whether the interest rate can rise, and, if it can, must insert the maximum rate to which it can rise over the life of the loan. The loan originator must also indicate the period of time after which the interest rate can first change.

The loan originator must indicate whether the loan balance can rise even if the borrower makes payments on time, for example in the case of a loan with negative amortization. If it can, the loan originator must insert the maximum amount to which the loan balance can rise over the life of the loan. For federal, state, local, or tribal housing programs that provide payment assistance, any repayment of such program assistance should be excluded from consideration in completing this item. If the loan balance will increase only because escrow items are being paid through the loan balance, the loan originator is not required to check the box indicating that the loan balance can rise.

The loan originator must indicate whether the monthly amount owed for principal, interest, and any mortgage insurance can rise even if the borrower makes payments on time. If the monthly amount owed can rise even if the borrower makes payments on time, the loan originator must indicate the period of time after which the monthly amount owed can first change, the maximum amount to which the monthly amount owed can rise at the time of the first change, and the maximum amount to which the monthly amount owed can rise over the life of the loan. The amount used for the monthly amount owed must be the greater of: (1) The required monthly payment for principal and interest for that month, plus any monthly mortgage insurance payment; or (2) the accrued interest for that month, plus any monthly mortgage insurance payment.

The loan originator must indicate whether the loan includes a prepayment penalty, and, if so, the maximum amount that it could be.

The loan originator must indicate whether the loan requires a balloon payment and, if so, the amount of the payment and in how many years it will be due.

“Escrow account information.”—The loan originator must indicate whether the loan includes an escrow account for property taxes and other financial obligations. The amount shown in the “Summary of your loan” section for “Your initial monthly amount owed for principal, interest, and any mortgage insurance” must be entered in the space for the monthly amount owed in this section.

“Summary of your settlement charges.”—On this line, the loan originator must state the Adjusted Origination Charges from subtotal A of page 2, the Charges for All Other Settlement Services from subtotal B of page 2, and the Total Estimated Settlement Charges from the bottom of page 2.

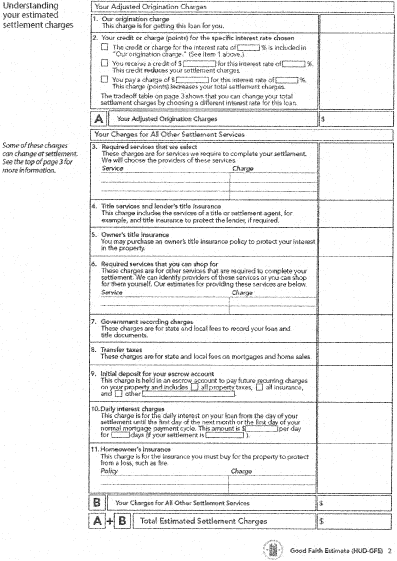

Page 2

“Understanding your estimated settlement charges.”—This section details 11 settlement cost categories and amounts associated with the mortgage loan. For purposes of determining whether a tolerance has been met, the amount on the GFE should be compared with the total of any amounts shown on the HUD-1 in the borrower’s column and any amounts paid outside closing by or on behalf of the borrower.

Your Adjusted Origination Charges”

Block 1, “Our origination charge.”—The loan originator must state here all charges that all loan originators involved in this transaction will receive, except for any charge for the specific interest rate chosen (points). A loan originator may not separately charge any additional fees for getting this loan, including for application, processing, or underwriting. The amount stated in Block 1 is subject to zero tolerance, i.e., the amount may not increase at settlement.

Block 2, “Your credit or charge (points) for the specific interest rate chosen.”—For transactions involving mortgage brokers, the mortgage broker must indicate through check boxes whether there is a credit to the borrower for the interest rate chosen on the loan, the interest rate, and the amount of the credit, or whether there is an additional charge (points) to the borrower for the interest rate chosen on the loan, the interest rate, and the amount of that charge. Only one of the boxes may be checked; a credit and charge cannot occur together in the same transaction.

For transactions without a mortgage broker, the lender may choose not to separately disclose in this block any credit or charge for the interest rate chosen on the loan; however, if this block does not include any positive or negative figure, the lender must check the first box to indicate that “The credit or charge for the interest rate you have chosen” is included in “Our origination charge” above (see Block 1 instructions above), must insert the interest rate, and must also insert “0” in Block 2. Only one of the boxes may be checked; a credit and charge cannot occur together in the same transaction.

For a mortgage broker, the credit or charge for the specific interest rate chosen is the net payment to the mortgage broker from the lender (i.e., the sum of all payments to the mortgage broker from the lender, including payments based on the loan amount, a flat rate, or any other computation, and in a table funded transaction, the loan amount less the price paid for the loan by the lender). When the net payment to the mortgage broker from the lender is positive, there is a credit to the borrower and it is entered as a negative amount in Block 2 of the GFE. When the net payment to the mortgage broker from the lender is negative, there is a charge to the borrower and it is entered as a positive amount in Block 2 of the GFE. If there is no net payment (i.e., the credit or charge for the specific interest rate chosen is zero), the mortgage broker must insert “0” in Block 2 and may check either the box indicating there is a credit of “0” or the box indicating there is a charge of “0”.

The amount stated in Block 2 is subject to zero tolerance while the interest rate is locked, i.e., any credit for the interest rate chosen cannot decrease in absolute value terms and any charge for the interest rate chosen cannot increase. (Note: An increase in the credit is allowed since this increase is a reduction in cost to the borrower. A decrease in the credit is not allowed since it is an increase in cost to the borrower.)

Line A, “Your Adjusted Origination Charges.”—The loan originator must add the numbers in Blocks 1 and 2 and enter this subtotal at highlighted Line A. The subtotal at Line A will be a negative number if there is a credit in Block 2 that exceeds the charge in Block 1. The amount stated in Line A is subject to zero tolerance while the interest rate is locked.

In the case of “no cost” loans, where “no cost” refers only to the loan originator’s fees, Line A must show a zero charge as the adjusted origination charge. In the case of “no cost” loans where “no cost” encompasses third party fees as well as the upfront payment to the loan originator, all of the third party fees listed in Block 3 through Block 11 to be paid for by the loan originator (or borrower, if any) must be itemized and listed on the GFE. The credit for the interest rate chosen must be large enough that the total for Line A will result in a negative number to cover the third party fees.

“Your Charges for All Other Settlement Services”

There is a 10 percent tolerance applied to the sum of the prices of each service listed in Block 3, Block 4, Block 5, Block 6, and Block 7, where the loan originator requires the use of a particular provider or the borrower uses a provider selected or identified by the loan originator. Any services in Block 4, Block 5, or Block 6 for which the borrower selects a provider other than one identified by the loan originator are not subject to any tolerance and, at settlement, would not be included in the sum of the charges on which the 10 percent tolerance is based. Where a loan originator permits a borrower to shop for third party settlement services, the loan originator must provide the borrower with a written list of settlement services providers at the time of the GFE, on a separate sheet of paper.

Block 3, “Required services that we select.”—In this block, the loan originator must identify each third party settlement service required and selected by the loan originator (excluding title services), along with the estimated price to be paid to the provider of each service. Examples of such third party settlement services might include provision of credit reports, appraisals, flood checks, tax services, and any upfront mortgage insurance premium. The loan originator must identify the specific required services and provide an estimate of the price of each service. Loan originators are also required to add the individual charges disclosed in this block and place that total in the column of this block. The charge shown in this block is subject to an overall 10 percent tolerance as described above.

Block 4, “Title services and lender’s title insurance.”—In this block, the loan originator must state the estimated total charge for third party settlement service providers for all closing services, regardless of whether the providers are selected or paid for by the borrower, seller, or loan originator. The loan originator must also include any lender’s title insurance premiums, when required, regardless of whether the provider is selected or paid for by the borrower, seller, or loan originator. All fees for title searches, examinations, and endorsements, for example, would be included in this total. The charge shown in this block is subject to an overall 10 percent tolerance as described above.

Block 5, “Owner’s title insurance.”—In this block, for all purchase transactions the loan originator must provide an estimate of the charge for the owner’s title insurance and related endorsements, regardless of whether the providers are selected or paid for by the borrower, seller, or loan originator. For non-purchase transactions, the loan originator may enter “NA” or “Not Applicable” in this Block. The charge shown in this block is subject to an overall 10 percent tolerance as described above.

Block 6, “Required services that you can shop for.”—In this block, the loan originator must identify each third party settlement service required by the loan originator where the borrower is permitted to shop for and select the settlement service provider (excluding title services), along with the estimated charge to be paid to the provider of each service. The loan originator must identify the specific required services (e.g., survey, pest inspection) and provide an estimate of the charge of each service. The loan originator must also add the individual charges disclosed in this block and place the total in the column of this block. The charge shown in this block is subject to an overall 10 percent tolerance as described above.

Block 7, “Government recording charge .”—In this block, the loan originator must estimate the state and local government fees for recording the loan and title documents that can be expected to be charged at settlement. The charge shown in this block is subject to an overall 10 percent tolerance as described above.

Block 8, “Transfer taxes.”—In this block, the loan originator must estimate the sum of all state and local government fees on mortgages and home sales that can be expected to be charged at settlement, based upon the proposed loan amount or sales price and on the property address. A zero tolerance applies to the sum of these estimated fees.

Block 9, “Initial deposit for your escrow account.”—In this block, the loan originator must estimate the amount that it will require the borrower to place into a reserve or escrow account at settlement to be applied to recurring charges for property taxes, homeowner’s and other similar insurance, mortgage insurance, and other periodic charges. The loan originator must indicate through check boxes if the reserve or escrow account will cover future payments for all tax, all hazard insurance, and other obligations that the loan originator requires to be paid as they fall due. If the reserve or escrow account includes some, but not all, property taxes or hazard insurance, or if it includes mortgage insurance, the loan originator should check “other” and then list the items included.

Block 10, “Daily interest charges.”—In this block, the loan originator must estimate the total amount that will be due at settlement for the daily interest on the loan from the date of settlement until the first day of the first period covered by scheduled mortgage payments. The loan originator must also indicate how this total amount is calculated by providing the amount of the interest charges per day and the number of days used in the calculation, based on a stated projected closing date.

Block 11, “Homeowner's insurance.”—The loan originator must estimate in this block the total amount of the premiums for any hazard insurance policy and other similar insurance, such as fire or flood insurance that must be purchased at or before settlement to meet the loan originator’s requirements. The loan originator must also separately indicate the nature of each type of insurance required along with the charges. To the extent a loan originator requires that such insurance be part of an escrow account, the amount of the initial escrow deposit must be included in Block 9.

Line B, “Your Charges for All Other Settlement Services.”—The loan originator must add the numbers in Blocks 3 through 11 and enter this subtotal in the column at highlighted Line B.

Line A+B, “Total Estimated Settlement Charges.”—The loan originator must add the subtotals in the right-hand column at highlighted Lines A and B and enter this total in the column at highlighted Line A+B.

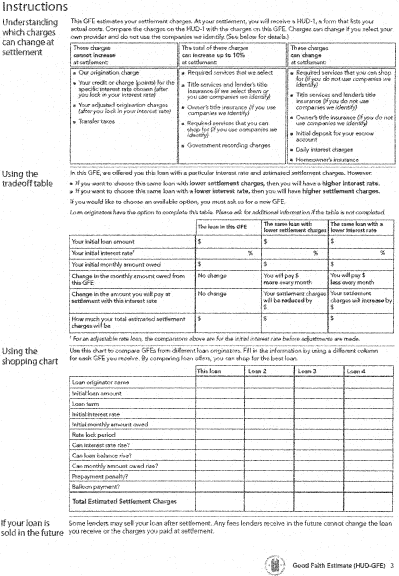

Page 3

“Instructions”

“Understanding which charges can change at settlement.”—This section informs the applicant about which categories of settlement charges can increase at closing, and by how much, and which categories of settlement charges cannot increase at closing. This section requires no loan originator action.

“Using the tradeoff table.”—This section is designed to make borrowers aware of the relationship between their total estimated settlement charges on one hand, and the interest rate and resulting monthly payment on the other hand. The loan originator must complete the left hand column using the loan amount, interest rate, monthly payment figure, and the total estimated settlement charges from page 1 of the GFE. The loan originator, at its option, may provide the borrower with the same information for two alternative loans, one with a higher interest rate, if available, and one with a lower interest rate, if available, from the loan originator. The loan originator should list in the tradeoff table only alternative loans for which it would presently issue a GFE based on the same information the loan originator considered in issuing this GFE. The alternative loans must use the same loan amount and be otherwise identical to the loan in the GFE. The alternative loans must have, for example, the identical number of payment periods; the same margin, index, and adjustment schedule if the loans are adjustable rate mortgages; and the same requirements for prepayment penalty and balloon payments. If the loan originator fills in the tradeoff table, the loan originator must show the borrower the loan amount, alternative interest rate, alternative monthly payment, the change in the monthly payment from the loan in this GFE to the alternative loan, the change in the total settlement charges from the loan in this GFE to the alternative loan, and the total settlement charges for the alternative loan. If these options are available, an applicant may request a new GFE, and a new GFE must be provided by the loan originator.

“Using the shopping chart.”—This chart is a shopping tool to be provided by the loan originator for the borrower to complete, in order to compare GFEs.

“If your loan is sold in the future.”—This section requires no loan originator action.

APPENDIX D TO PART 1024

Affiliated Business Arrangement Disclosure Statement Format Notice

To: __________________________ Property: _____________________

From: ________________________ Date: _________________________

(Entity Making Statement)

This is to give you notice that [referring party] has a business relationship with _[settlement services providers (s) ]_____. [Describe the nature of the relationship between the referring party and the provider(s), including percentage of ownership interest, if applicable.] Because of this relationship, this referral may provide [referring party] a financial or other benefit.

[A.] Set forth below is the estimated charge or range of charges for the settlement services listed. You are NOT required to use the listed provider(s) as a condition for [settlement of your loan on] [or] [purchase, sale, or refinance of] the subject property. THERE ARE FREQUENTLY OTHER SETTLEMENT SERVICE PROVIDERS AVAILABLE WITH SIMILAR SERVICES. YOU ARE FREE TO SHOP AROUND TO DETERMINE THAT YOU ARE RECEIVING THE BEST SERVICES AND THE BEST RATE FOR THESE SERVICES.

_[provider and settlement service]___ _[charge or range of charges]______

_______________________________ ______________________________

_______________________________ ______________________________

[B.] Set forth below is the estimated charge or range of charges for the settlement services of an attorney, credit reporting agency, or real estate appraiser that we, as your lender, will require you to use, as a condition of your loan on this property, to represent our interests in the transaction.

_[provider and settlement service]_____ _[charge or range of charges]________

________________________________ _______________________________

________________________________ _______________________________

ACKNOWLEDMENT

I/we have read this disclosure form, and understand that referring party is referring me/us to purchase the above-described settlement service(s) and may receive a financial or other benefit as the result of this referral.

____________________________________

Signature

[INSTRUCTIONS TO PREPARER:] [Use paragraph A for referrals other than those by a lender to an attorney, a credit reporting agency, or a real estate appraiser that a lender is requiring a borrower to use to represent the lender’s interests in the transaction. Use paragraph B for those referrals to an attorney, credit reporting agency, or real estate appraiser that a lender is requiring a borrower to use to represent the lender’s interests in the transaction. When applicable, use both paragraphs. Specific timing rules for delivery of the affiliated business disclosure statement are set forth in 12 CFR 1024.15(b)(1) of Regulation X). These INSTRUCTIONS TO PREPARER should not appear on the statement.]

Appendix E to Part 1024—Arithmetic Steps

I. Example Illustrating Aggregate Analysis:

ASSUMPTIONS:

Disbursements:

$360 for school taxes disbursed on September 20

$1,200 for county property taxes:

$500 disbursed on July 25

$700 disbursed on December 10

Cushion: One-sixth of estimated annual disbursements

Settlement: May 15

First Payment: July 1

Step 1—Initial Trial Balance

|

Aggregate |

||

pmt |

disb |

bal |

|

Jun |

0 |

0 |

0 |

Jul |

130 |

500 |

−370 |

Aug |

130 |

0 |

−240 |

Sep |

130 |

360 |

−470 |

Oct |

130 |

0 |

−340 |

Nov |

130 |

0 |

−210 |

Dec |

130 |

700 |

−780 |

Jan |

130 |

0 |

−650 |

Feb |

130 |

0 |

−520 |

Mar |

130 |

0 |

−390 |

Apr |

130 |

0 |

−260 |

May |

130 |

0 |

−130 |

Jun |

130 |

0 |

0 |

Step 2—Adjusted Trial Balance

[Increase monthly balances to eliminate negative balances]

|

Aggregate |

||

pmt |

disb |

bal |

|

Jun |

0 |

0 |

780 |

Jul |

130 |

500 |

410 |

Aug |

130 |

0 |

540 |

Sep |

130 |

360 |

310 |

Oct |

130 |

0 |

440 |

Nov |

130 |

0 |

570 |

Dec |

130 |

700 |

0 |

Jan |

130 |

0 |

130 |

Feb |

130 |

0 |

260 |

Mar |

130 |

0 |

390 |

Apr |

130 |

0 |

520 |

May |

130 |

0 |

650 |

Jun |

130 |

0 |

780 |

Step 3—Trial Balance With Cushion

|

Aggregate |

||

pmt |

disb |

bal |

|

Jun |

0 |

0 |

1040 |

Jul |

130 |

500 |

670 |

Aug |

130 |

0 |

800 |

Sep |

130 |

360 |

570 |

Oct |

130 |

0 |

700 |

Nov |

130 |

0 |

830 |

Dec |

130 |

700 |

260 |

Jan |

130 |

0 |

390 |

Feb |

130 |

0 |

520 |

Mar |

130 |

0 |

650 |

Apr |

130 |

0 |

780 |

May |

130 |

0 |

910 |

Jun |

130 |

0 |

1040 |

II. Example Illustrating Single-Item Analysis

ASSUMPTIONS:

Disbursements:

$360 for school taxes disbursed on September 20

$1,200 for county property taxes:

$500 disbursed on July 25

$700 disbursed on December 10

Cushion: One-sixth of estimated annual disbursements

Settlement: May 15

First Payment: July 1

Step 1—Initial Trial Balance

|

Single-item |

|||||

Taxes |

School taxes |

|||||

pmt |

disb |

bal |

pmt |

disb |

bal |

|

June |

0 |

0 |

0 |

0 |

0 |

0 |

July |

100 |

500 |

−400 |

30 |

0 |

30 |

August |

100 |

0 |

−300 |

30 |

0 |

60 |

September |

100 |

0 |

−200 |

30 |

360 |

−270 |

October |

100 |

0 |

−100 |

30 |

0 |

−240 |

November |

100 |

0 |

0 |

30 |

0 |

−210 |

December |

100 |

700 |

−600 |

30 |

0 |

−180 |

January |

100 |

0 |

−500 |

30 |

0 |

−150 |

February |

100 |

0 |

−400 |

30 |

0 |

−120 |

March |

100 |

0 |

−300 |

30 |

0 |

−90 |

April |

100 |

0 |

−200 |

30 |

0 |

−60 |

May |

100 |

0 |

−100 |

30 |

0 |

−30 |

June |

100 |

0 |

0 |

30 |

0 |

0 |

Step 2—Adjusted Trial Balance (Increase Monthly Balances To Eliminate Negative Balances)

|

Single-item |

|||||

Taxes |

School taxes |

|||||

pmt |

disb |

bal |

pmt |

disb |

bal |

|

Jun |

0 |

0 |

600 |

0 |

0 |

270 |

Jul |

100 |

500 |

200 |

30 |

0 |

300 |

Aug |

100 |

0 |

300 |

30 |

0 |

330 |

Sep |

100 |

0 |

400 |

30 |

360 |

0 |

Oct |

100 |

0 |

500 |

30 |

0 |

30 |

Nov |

100 |

0 |

600 |

30 |

0 |

60 |

Dec |

100 |

700 |

0 |

30 |

0 |

90 |

Jan |

100 |

0 |

100 |

30 |

0 |

120 |

Feb |

100 |

0 |

200 |

30 |

0 |

150 |

Mar |

100 |

0 |

300 |

30 |

0 |

180 |

Apr |

100 |

0 |

400 |

30 |

0 |

210 |

May |

100 |

0 |

500 |

30 |

0 |

240 |

Jun |

100 |

0 |

600 |

30 |

0 |

270 |

Step 3—Trial Balance With Cushion

|

Single-Item |

|||||

Taxes |

School taxes |

|||||

pmt |

disb |

bal |

pmt |

disb |

bal |

|

Jun |

0 |

0 |

800 |

0 |

0 |

330 |

Jul |

100 |

500 |

400 |

30 |

0 |

360 |

Aug |

100 |

0 |

500 |

30 |

0 |

390 |

Sep |

100 |

0 |

600 |

30 |

360 |

60 |

Oct |

100 |

0 |

700 |

30 |

0 |

90 |

Nov |

100 |

0 |

800 |

30 |

0 |

120 |

Dec |

100 |

700 |

200 |

30 |

0 |

150 |

Jan |

100 |

0 |

300 |

30 |

0 |

180 |

Feb |

100 |

0 |

400 |

30 |

0 |

210 |

Mar |

100 |

0 |

500 |

30 |

0 |

240 |

Apr |

100 |

0 |

600 |

30 |

0 |

270 |

May |

100 |

0 |

700 |

30 |

0 |

300 |

Jun |

100 |

0 |

800 |

30 |

0 |

330 |

Appendix MS-1 to Part 1024

[Sample language; use business stationery or similar heading]

[Date]

SERVICING DISCLOSURE STATEMENT NOTICE TO FIRST LIEN MORTGAGE LOAN APPLICANTS: THE RIGHT TO COLLECT YOUR MORTGAGE LOAN PAYMENTS MAY BE TRANSFERRED

You are applying for a mortgage loan covered by the Real Estate Settlement Procedures Act (RESPA) (12 U.S.C. 2601 et seq.). RESPA gives you certain rights under Federal law. This statement describes whether the servicing for this loan may be transferred to a different loan servicer. “Servicing” refers to collecting your principal, interest, and escrow payments, if any, as well as sending any monthly or annual statements, tracking account balances, and handling other aspects of your loan. You will be given advance notice before a transfer occurs.

Servicing Transfer Information

[We may assign, sell, or transfer the servicing of your loan while the loan is outstanding.]

[or]

[We do not service mortgage loans of the type for which you applied. We intend to assign, sell, or transfer the servicing of your mortgage loan before the first payment is due.]

[or]

[The loan for which you have applied will be serviced at this financial institution and we do not intend to sell, transfer, or assign the servicing of the loan.]

[INSTRUCTIONS TO PREPARER: Insert the date and select the appropriate language under “Servicing Transfer Information.” The model format may be annotated with further information that clarifies or enhances the model language.]

APPENDIX MS-2 to PART 1024

[Sample language; use business stationery or similar heading]

NOTICE OF ASSIGNMENT, SALE, OR TRANSFER

OF SERVICING RIGHTS

You are hereby notified that the servicing of your mortgage loan, that is, the right to collect payments from you, is being assigned, sold or transferred from _______________ to ____________________, effective _______________________.

The assignment, sale or transfer of the servicing of the mortgage loan does not affect any term or condition of the mortgage instruments, other than terms directly related to the servicing of your loan.

Except in limited circumstances, the law requires that your present servicer send you this notice at least 15 days before the effective date of transfer, or at closing. Your new servicer must also send you this notice no later than 15 days after this effective date or at closing. [In this case, all necessary information is combined in this one notice].

Your present servicer is _____________________________. If you have any question relating to the transfer of servicing from your present servicer call ______________________ [enter the name of an individual or department here] between ____________ a.m. and ___________ p.m. on the following days _______________________.

This is a [toll-free] or [collect call] number.

Your new servicer will be _______________________________.

The business address for your new servicer is:

__________________________________________________________________________________________________________________.

The [toll-free] [collect call] telephone number of your new servicer is ___________________. If you have any question relating to the transfer of servicing to your new servicer call ________________________ [enter the name of an individual or department here] at _____________ [toll free or collect call telephone number] between __________ a.m. and _______ p.m. on the following days ______________________________.

The date that your present servicer will stop accepting payments form you is ________________. The date that your new servicer will start accepting payments from you is ______________________. Send all payments due on or after that date to your new servicer.

[Use the paragraph if appropriate; otherwise omit.] The transfer of servicing rights may affect the term of or the continued availability of mortgage life or disability insurance or any other type of optional insurance in the following manner:

________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

and you should take the following action to maintain coverage:

____________________________________________________________________________________________________________________________________________________________________________.

You should also be aware of the following information, which is set out in more detail in Section 6 of the Real Estate Settlement Procedures Act (RESPA) (12 U.S.C. 2605):

During the 60-day period following the effective date of the transfer of the loan servicing, a loan payment received by your old servicer before its due date may not be treated by the new loan servicer as late, and a late fee may not be imposed on you.

Section 6 of RESPA (12 U.S.C. 2605) gives you certain consumer rights. If you send a “qualified written request” to your loan servicer concerning the servicing of your loan, your servicer must provide you with a written acknowledgment within 20 Business Days of receipt of your request. A “qualified written request” is a written correspondence, other than notice on a payment coupon or other payment medium supplied by the servicer, which includes your name and account number, and your reasons for the request. [If you want to send a “qualified written request” regarding the servicing of your loan, it must be sent to this address:

___________________________________________________________________________________________________________________________________________________________]

Not later than 60 Business Days after receiving your request, your servicer must make any appropriate corrections to your account, and must provide you with a written clarification regarding any dispute. During this 60-Business Day period, your servicer may not provide information to a consumer reporting agency concerning any overdue payment related to such period or qualified written request. However, this does not prevent the servicer from initiating foreclosure if proper grounds exist under the mortgage documents.

A Business Day is a day on which the offices of the business entity are open to the public for carrying on substantially all of its business functions.

Section 6 of RESPA also provides for damages and costs for individuals or classes of individuals in circumstances where servicers are shown to have violated the requirements of that Section. You should seek legal advice if you believe your rights have been violated.

[INSTRUCTIONS TO PREPARER: Delivery means placing the notice in the mail, first class postage prepaid, prior to 15 days before the effective date of transfer (transferor) or prior to 15 days after the effective date of transfer (transferee). However, this notice may be sent not more than 30 days after the effective date of the transfer of servicing rights if certain emergency business situations occur. See 12 CFR § 1024.21(d)(1)(ii). “Lender” may be substituted for “present servicer” where appropriate. These instructions should not appear on the format.]

___________________________________________ __________________

PRESENT SERVICER [Signature not required] Date

[and][or]

___________________________________________ ___________________

FUTURE SERVICER [Signature not required] Date

| File Type | application/msword |

| File Modified | 2011-10-27 |

| File Created | 2011-10-27 |

© 2026 OMB.report | Privacy Policy