Supporting Statement 10_5_2016

Supporting Statement 10_5_2016.docx

Loan Guarantee for Projects that Employ Innovative Technologies

OMB: 1910-5134

U.S. Department of Energy

Supporting Statement

Loan Programs Office

OMB Control Number: 1910-5134

10 CFR Part 690

“Loan Guarantees for Projects That Employ Innovative Technologies”

This supporting statement provides additional information regarding the Department of

Energy (DOE) request for extension of a previously approved information collection by the Loan Programs Office (LPO).

1. Explain the circumstances that make the collection of information necessary.

Identify any legal or administrative requirements that necessitate the collection.

Attach a copy of the appropriate section of each statute and regulation mandating

or authorizing the collection of information.

Approval of this Information Collection Request (ICR) is being requested to effectively manage LPO funds and ensure the Department meets public transparency and accountability standards.

Title XVII of the Energy Policy Act of 2005 (EPAct 2005) (42 U.S.C. 16511-16514) authorizes the Secretary of Energy, after consultation with the Secretary of the Treasury, to make loan guarantees for specified projects. This information is needed to obtain from applicants the information that needs to be included in their applications for a loan guarantee.

This information collection is also necessitated by requirements and requests for timely information on program activities to the Office of Management and Budget (OMB), Congress and the public.

2. Indicate how, by whom, and for what purpose the information is to be used.

Except for a new collection, indicate the actual use the agency has made of the

information received from the current collection.

The information collected will be and has been used by DOE to plan, manage, and evaluate its loan guarantee program. The information will be and has been used to answer congressional, budget and public inquiries. Additionally, the collection helps the LPO to manage its funds and make projections as to risks.

The information collected will be and has been used to determine applicant eligibility for loan guarantees, to evaluate applications received, and to protect the government’s financial interests.

3. Describe whether, and to what extent, the collection of information involves the

use of automated, electronic, mechanical, or other technological collection

techniques or other forms of information technology, e.g., permitting electronic

submission of responses, and the basis for the decision for adopting this means of

collection. Also describe any consideration of using information technology to

reduce burden.

LPO requires that applications be submitted in electronic format through LPO’s electronic application portal, which can be found at http://apps.loanprograms.energy.gov. Information that was formerly collected using an agency form (DOE Form No. 540.2) will be collected by text fields. Other information will be collected by uploading it electronically through the application portal. This means of collecting information was adopted to make submitting, retrieving, and using the information easier and cheaper, reducing the hour burden and the cost burden.

4. Describe efforts to identify duplication. Show specifically why any similar

information already available cannot be used or modified for use for the purposes described in Item 2 above.

DOE does not collect similar information for any projects to which it provides financial support. Companies that sponsor projects that may be eligible for loan guarantees will develop similar information as they seek debt financing and equity investment. These companies will be able to use much of this information in preparing Applications, thus reducing the burden on respondents.

5. If the collection of information impacts small businesses or other small entities

(Item 5 of OMB Form 83-I), describe any methods used to minimize burden.

Most eligible projects will be larger than those that small businesses usually undertake. Nevertheless, LPO has taken steps to increase the attractiveness of the program to smaller businesses. The process of requiring a two-part application is designed, in part, to enable LPO to screen interested projects and provide an early indication of projects’ eligibility for a loan guarantee under this program. LPO substantially reduced the Part I fee from the level of fee previously required (in the hundreds of thousands of dollars) to $50,000 to make it more economical for smaller businesses to apply. LPO will use Part I of the application to screen for project eligibility and readiness to proceed, before inviting an applicant to submit Part II of the application. Thus, by allowing LPO to engage in an initial review of project proposals, the two-part application may reduce the paperwork burden for small and larger businesses alike, or at least lessen the burden of a subsequent full application. Additionally, LPO substantially reduced the Part II fee from the level of fee previously required ($925,000) to a variable fee based on the dollar amount of the financing. Applicants requesting an amount that does not exceed $150,000,000 as the principal amount of the Guaranteed Obligation pay $100,000. Applicants requesting an amount that exceeds $150,000,000 as the principal amount of the Guaranteed Obligation pay $350,000. In order to allow newer entities, or even start-ups, to participate in the program, LPO allows applicants that are not able to provide a description of two full years of their experience in projects of similar scope to provide evidence of their expertise in an alternative description.

6. Describe the consequence to Federal program or policy activities if the collection

is not conducted or is conducted less frequently, as well as any technical or legal

obstacles to reducing burden.

If the information is not collected, DOE will be unable to implement Title XVII of the Energy Policy Act of 2005 (42 U.S.C. 16511-16514).

Additionally, if the information is not collected, DOE will be unable to effectively respond to congressional, budget and general public inquiries about LPO program activity.

7. Explain any special circumstances that require the collection to be conducted in a manner inconsistent with OMB guidelines. (a) requiring respondents to report information to the agency more often than quarterly; (b) requiring respondents to prepare a written response to a collection of information in fewer than 30 days after receipt of it; (c) requiring respondents to submit more than an original and two copies of any document; (d) requiring respondents to retain records, other than health, medical government contract, grant-in-aid, or tax records, for more than three years; (e) in connection with a statistical survey, that is not designed to product valid and reliable results that can be generalized to the universe of study; (f) requiring the use of statistical data classification that has not been reviewed and approved by OMB; (g) that includes a pledge of confidentially that is not supported by authority established in stature of regulation, that is not supported by disclosure and data security policies that are consistent with the pledge, or which unnecessarily impedes sharing of data with other agencies for compatible confidential use; (h) requiring respondents to submit proprietary trade secrets, or other confidential information unless the agency can demonstrate that it has instituted procedures to protect the information’s confidentiality to the extent permitted by law.

There are no special circumstances that require the collection to be conducted in a manner inconsistent with OMB guidelines. The collection is consistent with OMB guidelines.

LPO notes that because the projects seeking loan guarantees become eligible only if they employ new or innovative technologies, the applicants may submit proprietary trade secrets from time to time in order to justify the extension of a loan guarantee by DOE. LPO can demonstrate that it has instituted procedures to protect the information’s confidentiality to the extent permitted by law.

8. If applicable, provide a copy and identify the date and page number of

publication in the Federal Register of the agency's notice, required by 5 CFR

1320.8(d), soliciting comments on the information collection prior to submission to

OMB. Summarize public comments received in response to that notice and describe

actions taken by the agency in response to these comments. Specifically address

comments received on cost and hour burden. Describe efforts to consult with

persons outside the agency to obtain their views on the availability of data,

frequency of collection, the clarity of instructions and recordkeeping, disclosure, or

reporting format (if any), and on the data elements to be recorded, disclosed, or

reported. Consultation with representatives of those from whom information is to

be obtained or those who must compile records should occur at least once every 3

years - even if the collection of information activity is the same as in prior periods. There may be circumstances that may preclude consultation in a specific situation.

These circumstances should be explained.

The Department published a 60-day notice in the Federal Register on July 6, 2016, at page number 44010 (Vol. 81, No. 129) soliciting comments on the extension for three years of the information collection prior to submission to OMB. No comments related to the information collection were received.

9. Explain any decision to provide any payment or gift to respondents, other than

reenumeration of contractors or grantees.

No payment or gift to respondents is being proposed under this information collection.

10. Describe any assurance of confidentiality provided to respondents and the basis

for the assurance in statute, regulation, or agency policy.

The information and materials DOE requirements from an applicant for the applicant to demonstrate compliance with the information collection requirements of 10 CFR Part 609 do not include and request for personally identifiable information.

This information collection provides the following assurance of confidentiality to respondents, under the Freedom of Information Act (5 U.S.C. 552):

“Patentable ideas, trade secrets, proprietary and confidential commercial or financial information, disclosure of which may harm the Applicant, should be included in an Application only to the extent that such information is necessary to convey an understanding of the proposed project or facility. The use and disclosure of such data may be restricted, provided the Applicant specifically identifies and marks such data in accordance with 10 CFR 600.15 described below:

1. Upload the following legend on a separate page in response to Section B of Part I and/or Section A of Part II of the Application, respectively (be sure to specify the section number(s) from the Application that contain(s) such data): “Applicant hereby certifies that Section(s) [___] of this Application may contain trade secrets or commercial or financial information that is privileged or confidential and is exempt from public disclosure. Such information shall be used or disclosed only for evaluation purposes or in accordance the loan guarantee agreement, if any, entered in response to this Application. If this Applicant is issued a loan guarantee under Title XVII of the Energy Policy Act of 2005, as amended, as a result of, or in connection with, the submission of this Application, DOE shall have the right to use or disclose the data contained herein, other than such data that have been properly declared in the loan guarantee agreement to be trade secrets or commercial or financial information that is privileged or confidential and is exempt from public disclosure.”

2. Include the following legend on the first or cover page of each document or electronic file submitted that contains such data (be sure to specify the page numbers from such document or electronic file that contains such data): “Notice of Restriction on Disclosure and Use of Data Pages [___] of this document may contain trade secrets or commercial or financial information that is privileged or confidential and is exempt from public disclosure. Such information shall be used or disclosed only for evaluation purposes or in accordance with a financial assistance or loan agreement between the submitter and the Government. The Government may use or disclose any information that is not appropriately marked or otherwise restricted, regardless of source.”

3. Include the following legend on each page containing trade secrets or commercial or financial information that is privileged or confidential: “May contain trade secrets or commercial or financial information that is privileged or confidential and exempt from public disclosure.”

4. In addition, each line or paragraph containing trade secrets or commercial or financial information that is privileged or confidential must be marked with brackets or other clear identification, such as highlighting.”

11. Provide additional justification for any questions of a sensitive nature, such as

sexual behavior and attitudes, religious beliefs, and other matters that are

commonly considered private. This justification should include the reasons why the

agency considers the questions necessary, the specific uses to be made of the

information, the explanation to be given to persons from whom the information is

requested, and any steps to be taken to obtain their consent.

No questions of a personally sensitive nature, such as sexual behavior and attitudes, religious beliefs, and other matters that are commonly considered private are included in this information collection. The information collected is of a programmatic, technical, and financial nature. As a condition of the receipt of program assistance, respondents must provide total disclosure of income data, debts, and assets, and history of business dealings that may be considered sensitive. Respondents interviewed indicated no problems or concerns with providing the information requested by this collection. They understand the necessity due to the nature of the assistance and realize this is standard practice when requesting credit assistance. Disclosure is governed by the Privacy Act and the Freedom of Information Act.

12. Provide estimates of the hour burden of the collection of information.

The responses that are required in this information collection include quite complex technical and financial information, including information regarding innovative technologies and financial models. Accordingly, the estimate of hour burden of the information collection is as follows:

Total number of unduplicated respondents: 100

Reports filed per person: 1

Total annual responses: 100

Total annual burden hours: 13,000 hours

Average Burden

Per Collection: 130 hours

Per Applicant: 130 hours

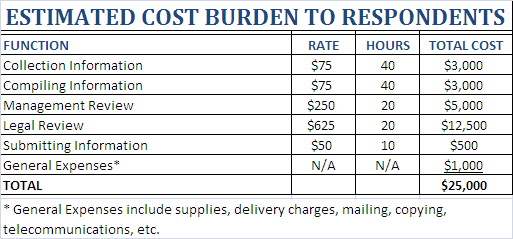

13. Provide an estimate for the total annual cost burden to respondents or

recordkeepers resulting from the collection of information. (Do not include the cost

of any hour burden shown in Items 12 and 14).

The estimate of cost for the hour burden of the information collection is $25,000 per respondent. DOE estimates that there will be 100 annual responses per year so the estimated burden for the collection is $2.5 million for the hourly burden. A breakout estimating the various components of this estimated cost (e.g. collecting data, compiling information, reviewing, submitting, legal review), which takes into account the assumed salaries of the positions that would be required to prepare the application (e.g. clerical, engineer, legal)is:

In addition, as detailed below in item 14, there is a fee of $50,000, payable to DOE when the pre-application is submitted, and an additional application fee of $350,000 for applicants requesting an amount that exceeds $150,000,000, payable to DOE when the full application is submitted, for a total application fee of $400,000. Other than the hour burden and the fee payable to DOE (which include an estimated amount for general expenses such as the cost of the CDs, if the applicant copies the application onto CDs, and express mailing, etc.), it should not be necessary for the respondent to incur any costs for capital, start-up, total operation, maintenance or purchase of services other than what is usual and customary for normal business operations.

14. Provide estimates of annualized costs to the Federal government.

The estimated net annual cost to the Federal government of this information collection is zero dollars. The estimated cost incurred by LPO of a full application is estimated to be between $150,000 and $400,000, based on the cost of employees that process the applications, including the average employee salary, benefits, and miscellaneous expenses as determined by the LPO Director for Strategic Initiatives. This amount is offset by the $150,000 or $400,000, as applicable, fee for filing a full application, which is required by Title XVII to cover the costs incurred by LPO. The fee estimate was produced by reference to the most recent LPO application process, the LPO administrative budget required to administer Section 1703. LPO applied the administrative budget across the applications received, with applications weighted more heavily as they moved forward in the review, underwriting, and closing process. LPO’s expectation and assumption, supported by its administrative budget analysis, was that the Part I review takes less time than Part II review process, which, in turn, takes less time than the continued due diligence/term sheet negotiation, document drafting, and closing.

15. Explain the reasons for any program changes or adjustments reported in Items

13 or 14 of the OMB Form 83-I.

The Loan Program Office’s current estimate of the annual reporting and recordkeeping cost burden to the applicant is based on LPO’s experience with actual prior collections, which were completed pursuant to the Paperwork Reduction Act under the OMB control number 1910-5134. The increase in the annual reporting and recordkeeping cost burden to the applicant is a more accurate estimate of the annual reporting and recordkeeping cost burden. After receiving and working on approximately 400 applications with applicants that responded to the actual prior collections, the Loan Programs Office reviewed the costs based on actual experience and determined that the revised annual cost of $25,000 is its best estimate of what it will cost applicants for reporting and recordkeeping.

16. For collections of information whose results will be published, outline plans for

tabulation and publication. Address any complex analytical techniques that will be

used. Provide the time schedule for the entire project, including beginning and

ending dates of the collection of information, completion of report, publication

dates, and other actions.

There will be no collections of information whose results will be published for statistical use. The information collected is not intended to be published. No complex analytical techniques will be employed. There will not be a report on the information LPO collects, other than quarterly and annual reporting on the progress of the loan guarantee program as a whole. DOE could commence issuing loan guarantees under the program at some unspecified date during FY 2016. Loan guarantees issued under the program will be in effect as long as the debt they support continues to be in effect, which could be 15 years or more.

17. If seeking approval to not display the expiration date for OMB approval of the

information collection, explain the reasons that display would be inappropriate.

The OMB control number, OMB expiration date, and burden disclosure statement will be included on all forms and instructions, including the electronic forms found on DOE’s application portal.

18. Explain each exception to the certification statement identified in Item 19,

"Certification for Paperwork Reduction Act Submissions," of OMB Form 83-I.

There are no exceptions to the certification statement in item 19.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | leongal |

| File Modified | 0000-00-00 |

| File Created | 2021-01-23 |

© 2026 OMB.report | Privacy Policy