Exempt Organizations Card Sorting Study

Collection of Qualitative Feedback on Agency Service Delivery

Exempt Organizations Card Sorting Study

Exempt Organizations Card Sorting Study

OMB: 1545-2256

Exempt Organizations Card Sorting Study

Phase 1 – Moderated Study

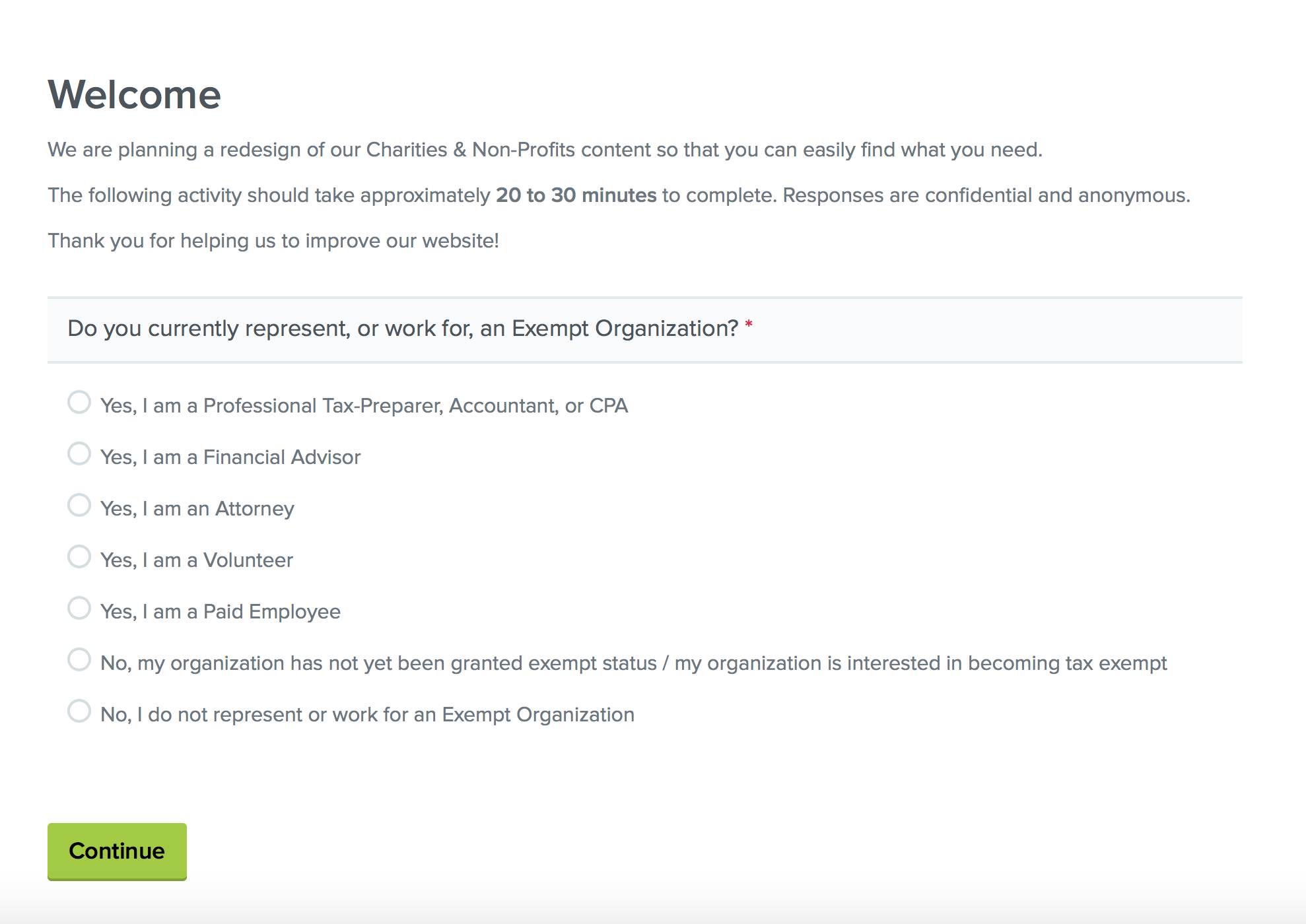

Survey Screener

Do you currently represent, or work for, an Exempt Organization?

Yes, I am a Professional Tax-Preparer, Accountant, or CPA

Yes, I am a Financial Advisor

Yes, I am an Attorney

Yes, I am a Volunteer

Yes, I am a Paid Employee

No, my organization has not yet been granted exempt status / my organization is interested in becoming tax exempt

No, I do not represent or work for an Exempt Organization

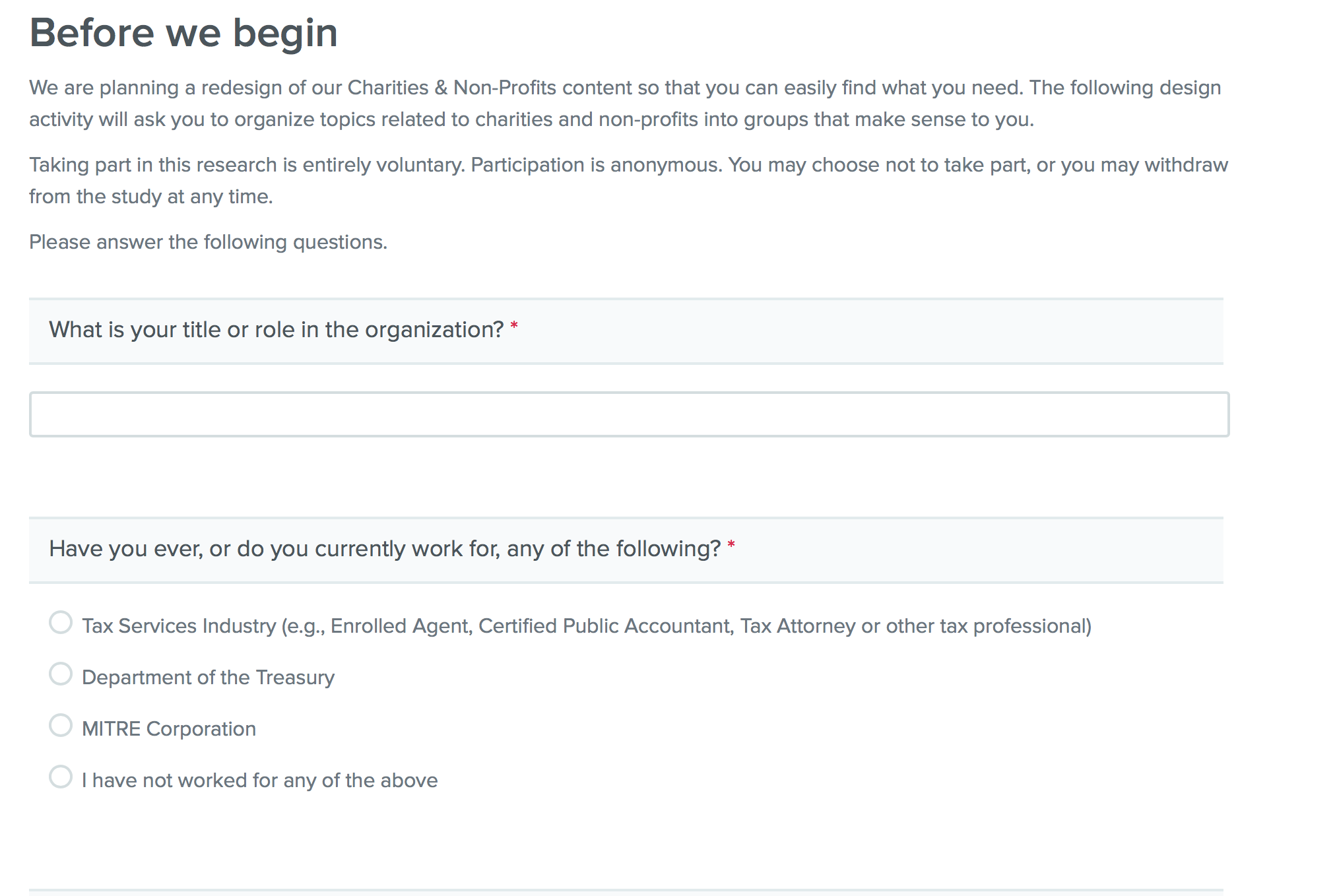

What is your title or role in the organization? *

_______________________

Have you ever, or do you currently work for any of the following?

Tax Services Industry (e.g., Enrolled Agent, Certified Public Accountant, Tax Attorney or other tax professional)

Department of the Treasury

MITRE Corporation

I have not worked for any of the above

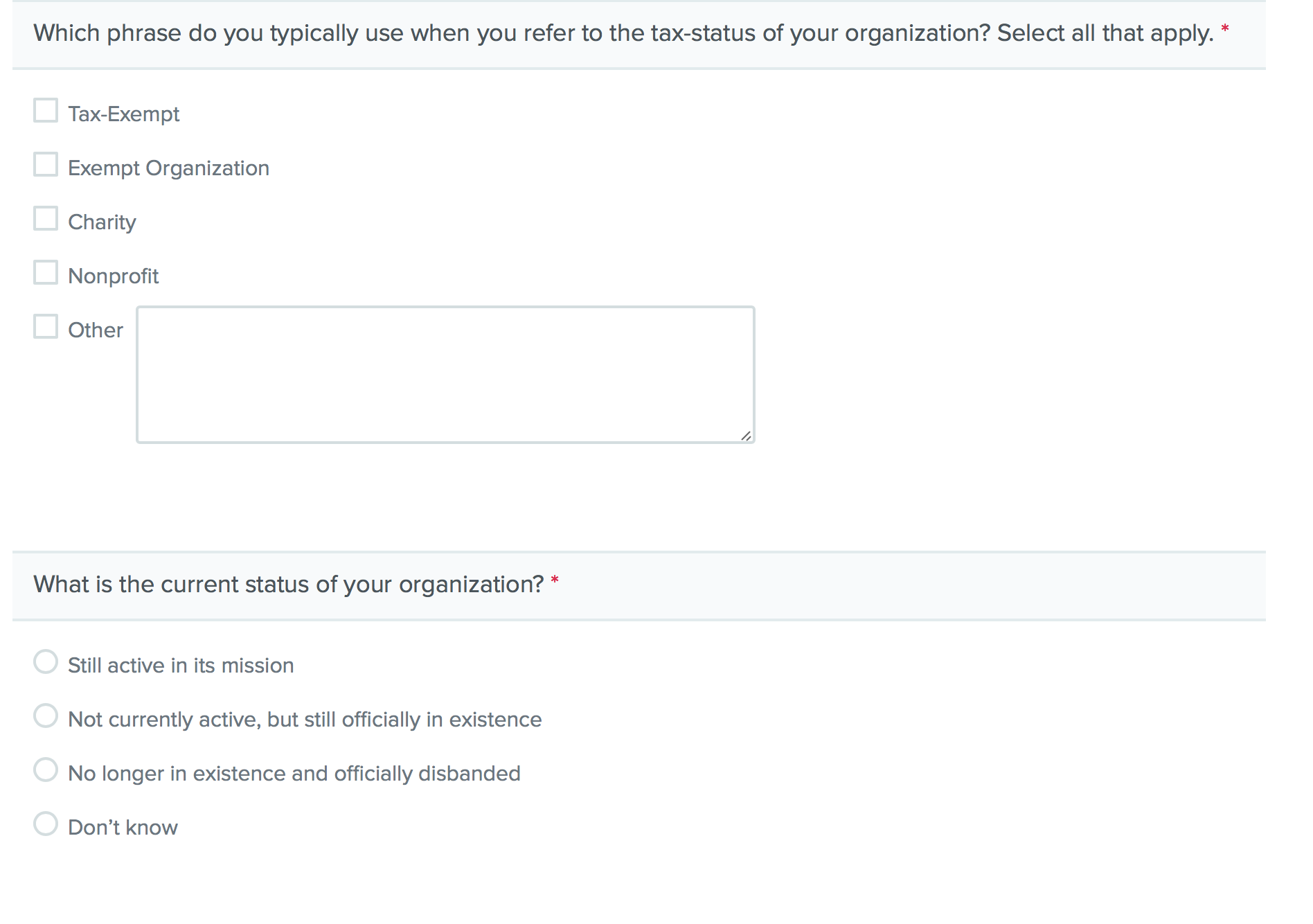

Which phrase do you typically use when you refer to the tax-status of your organization? Select all that apply.

Exempt Organization

Tax-Exempt

Nonprofit

Charity

What is the current status of your organization? *

Still active in its mission

Not currently active, but still officially in existence

No longer in existence and officially disbanded

Don’t know

Other: _________

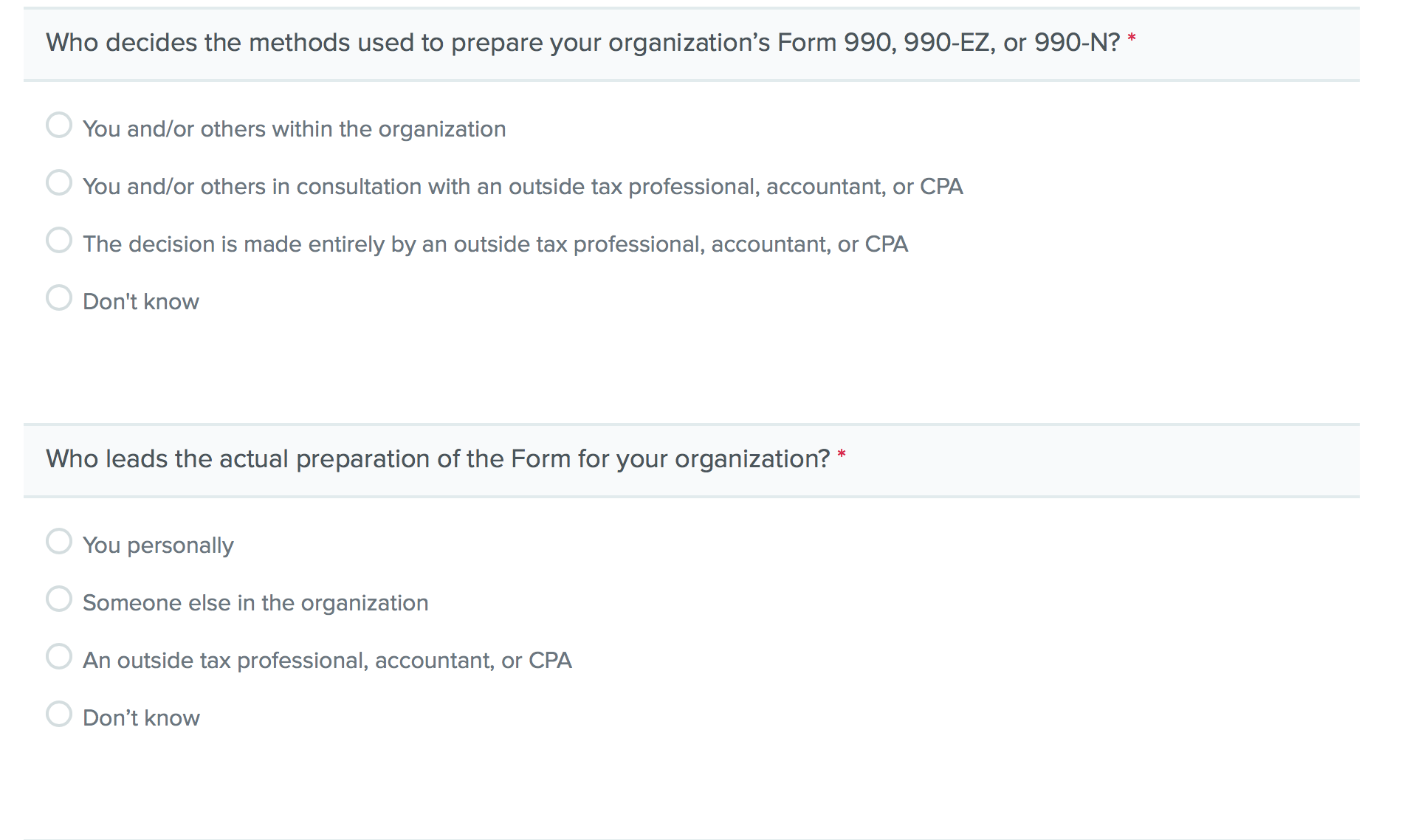

Who decides the methods used to prepare your organization’s Form 990, 990-EZ, or 990-N? *

You and/or others within the organization

You and/or others in consultation with an outside tax professional, accountant, or CPA

The decision is made entirely by an outside tax professional, accountant, or CPA.

Who leads the actual preparation of the Form for your organization? *

You personally

Someone else in the organization

An outside tax professional, accountant, or CPA

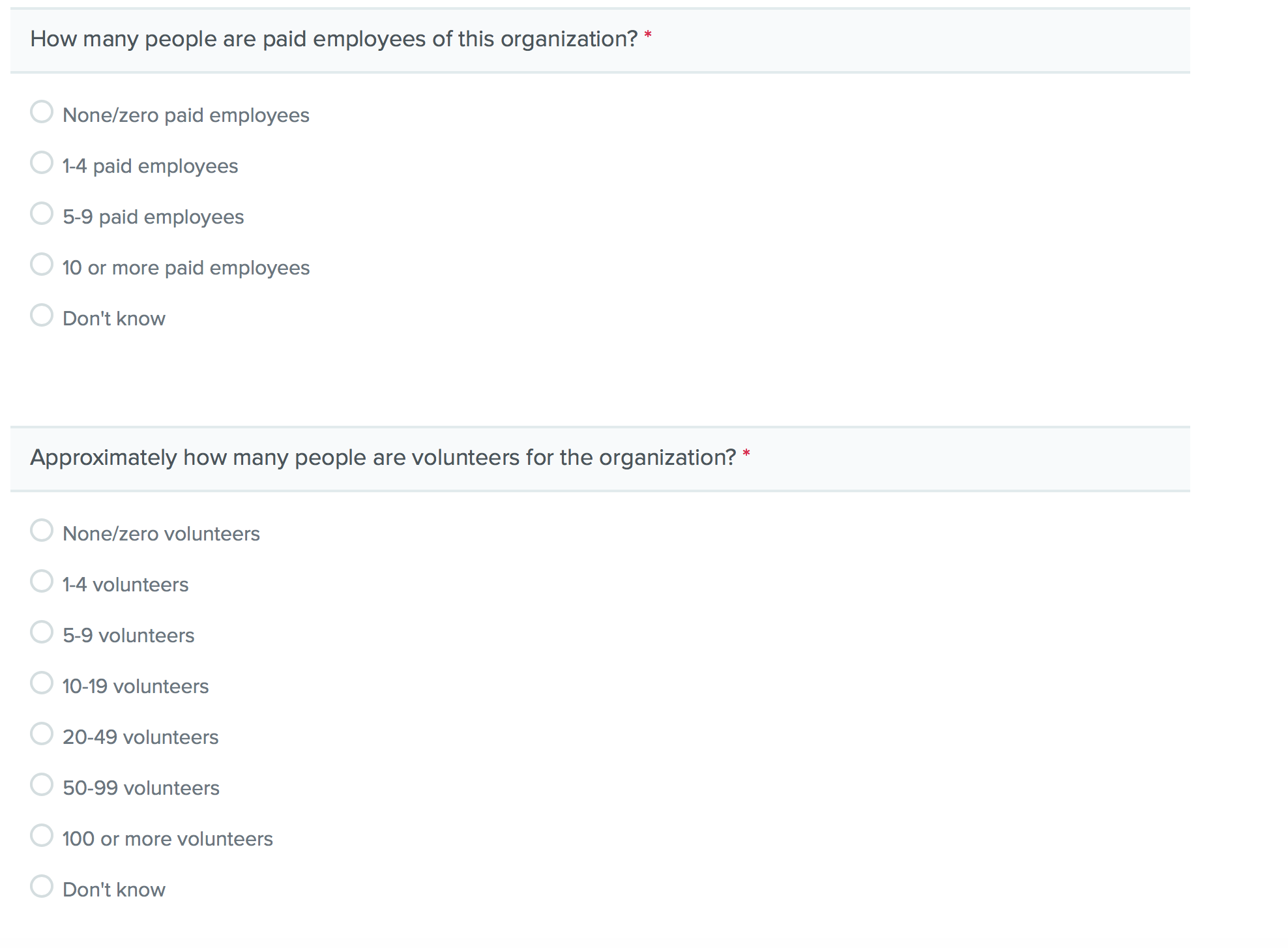

How many people are paid employees of this organization? *

None/zero paid employees

1-4 paid employees

5-9 paid employees

10 or more paid employees

Approximately how many people are volunteers for the organization? *

None/zero paid employees

1-4 volunteers

5-9 volunteers

10-19 volunteers

20-49 volunteers

50-99 volunteers

100 or more volunteers

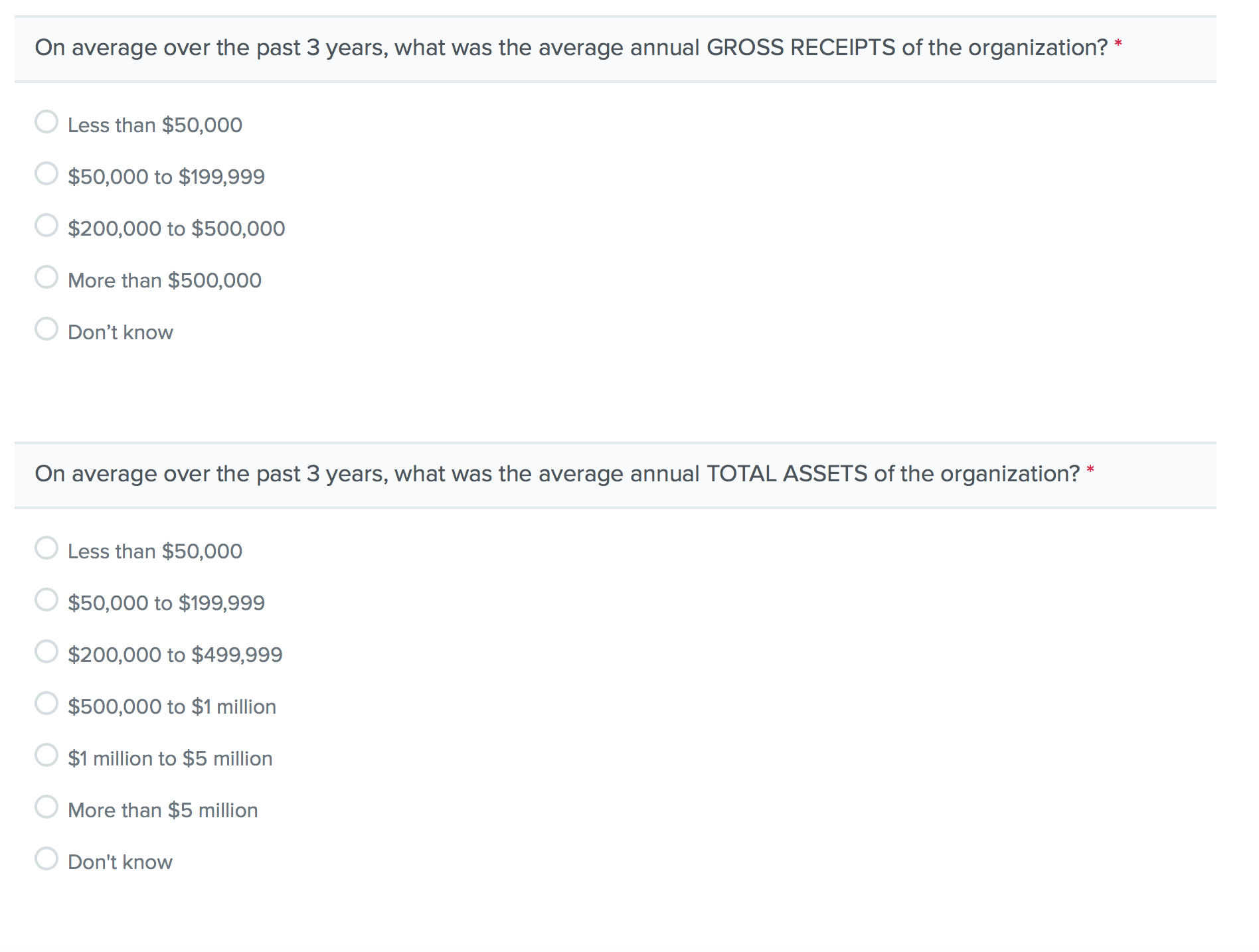

On average over the past 3 years, what was the average annual GROSS RECEIPTS of the organization? *

Less than $50,000 very small exempt organization, include

$50,000 to $199,999 small exempt organization, include

$200,000 to $500,000 medium exempt organization, include

More than $500,000 large, do not include in in-person study

Don’t know review other answers to determine eligibility

On average over the past 3 years, what was the average annual TOTAL ASSETS of the organization? *

Less than $50,000

$50,000 to $199,999

$200,000 to $499,999

$500,000 to $1 million

$1 million to $5 million

More than $5 million

Don’t know

Would you like to participate in PAID study to help inform a redesign of IRS.gov?

Yes

No

If yes, please provide your email address so we may contact you to schedule a paid session.

_____________________________________

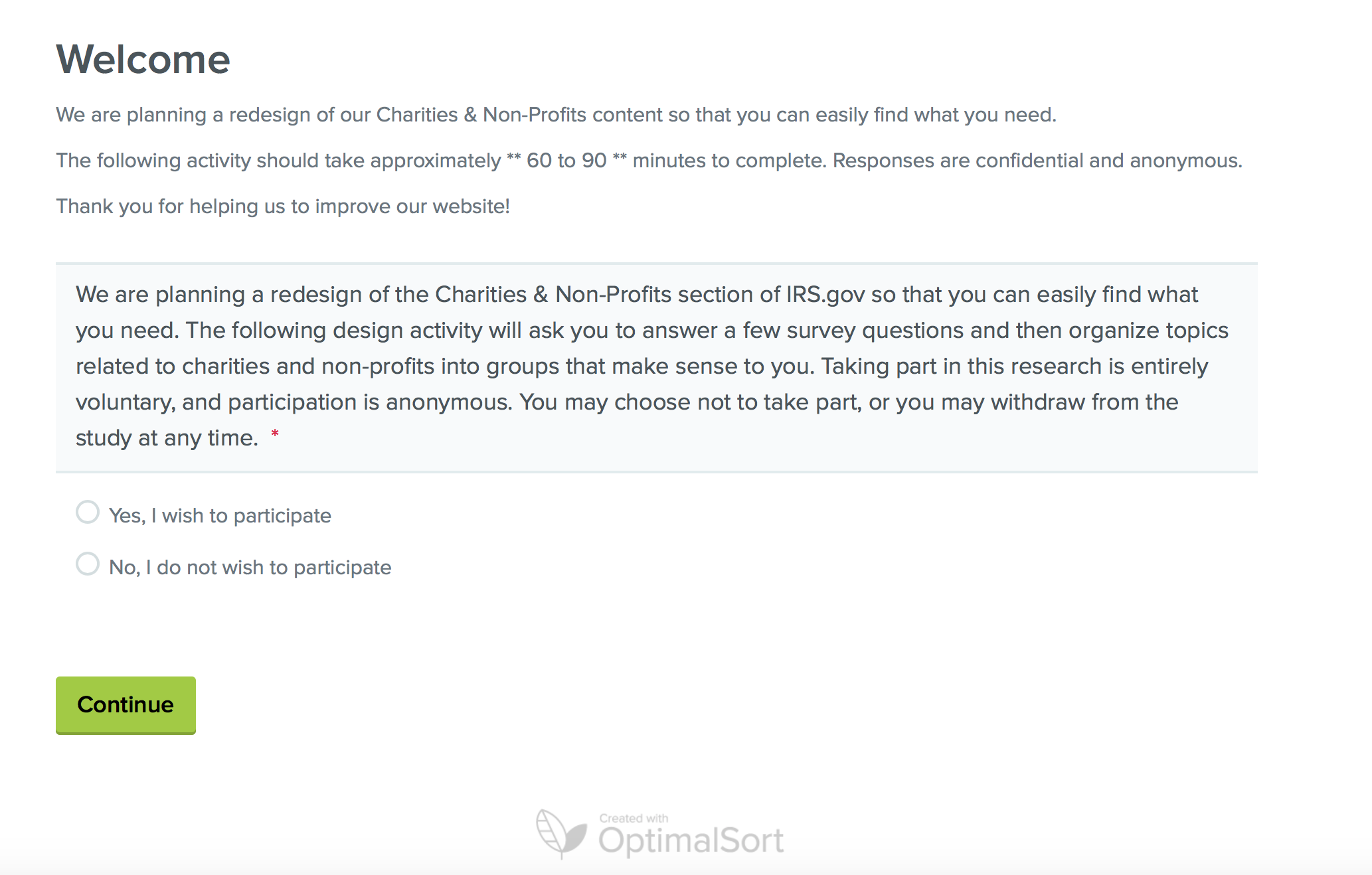

Pre-Study Questions

We are planning a redesign of the Charities & Non-Profits section of IRS.gov so that you can easily find what you need. The following design activity will ask you to answer a few survey questions and then organize topics related to charities and non-profits into groups that make sense to you. Taking part in this research is entirely voluntary, and participation is anonymous. You may choose not to take part, or you may withdraw from the study at any time.

Yes, I wish to participate

No, I do not wish to participate Reject

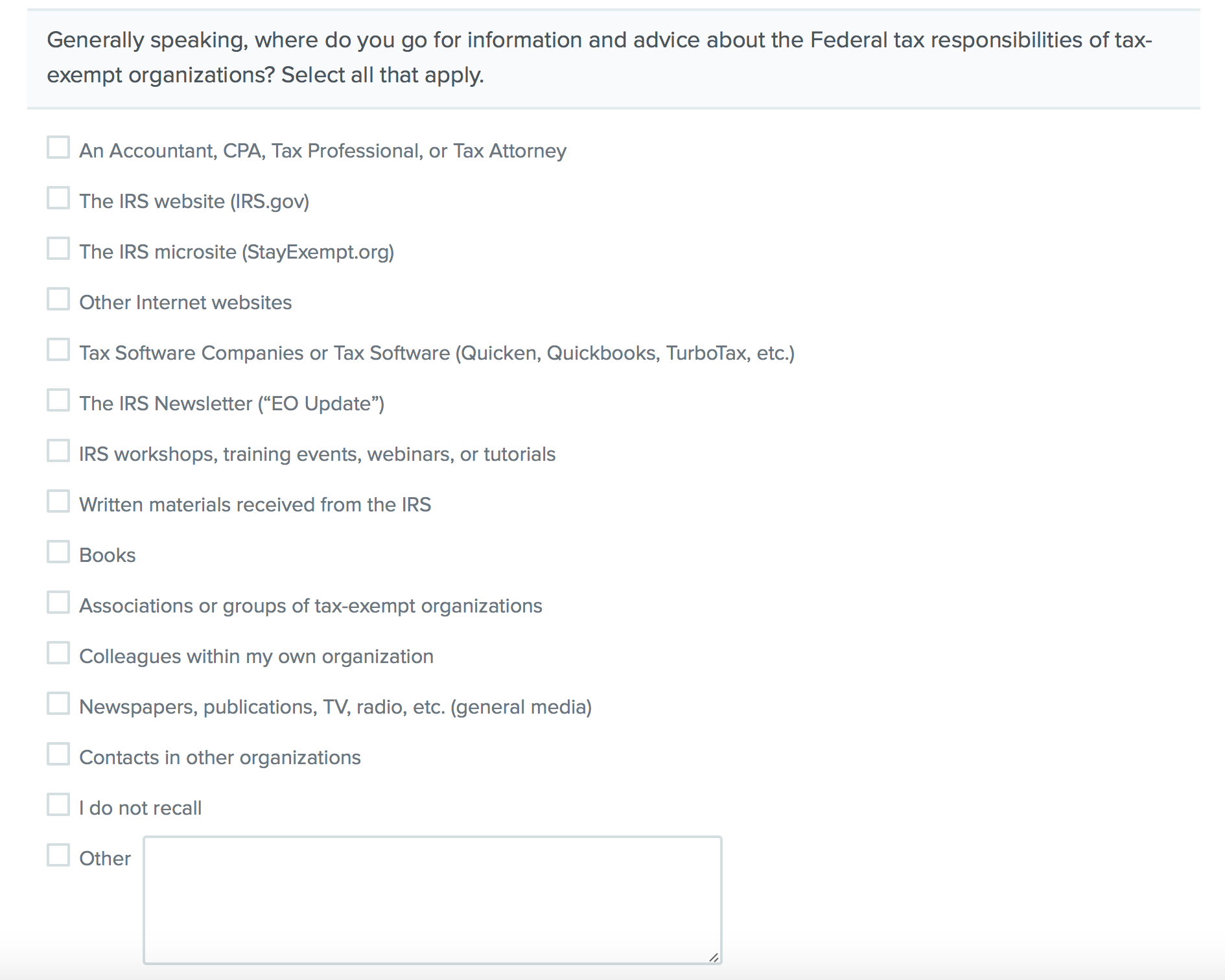

Generally speaking, where do you go for information and advice about the Federal tax responsibilities of tax-exempt organizations? Select all that apply.

An Accountant, CPA, Tax Professional, or Tax Attorney

The IRS website (IRS.gov)

The IRS microsite (StayExempt.org)

Other Internet websites

Tax Software Companies or Tax Software (Quicken, Quickbooks, TurboTax, etc.)

The IRS Newsletter (“EO Update”)

IRS workshops, training events, webinars, or tutorials

Written materials received from the IRS

Books

Associations or groups of tax-exempt organizations

Colleagues within my own organization

Newspapers, publications, TV, radio, etc. (general media)

Contacts in other organizations

I do not recall

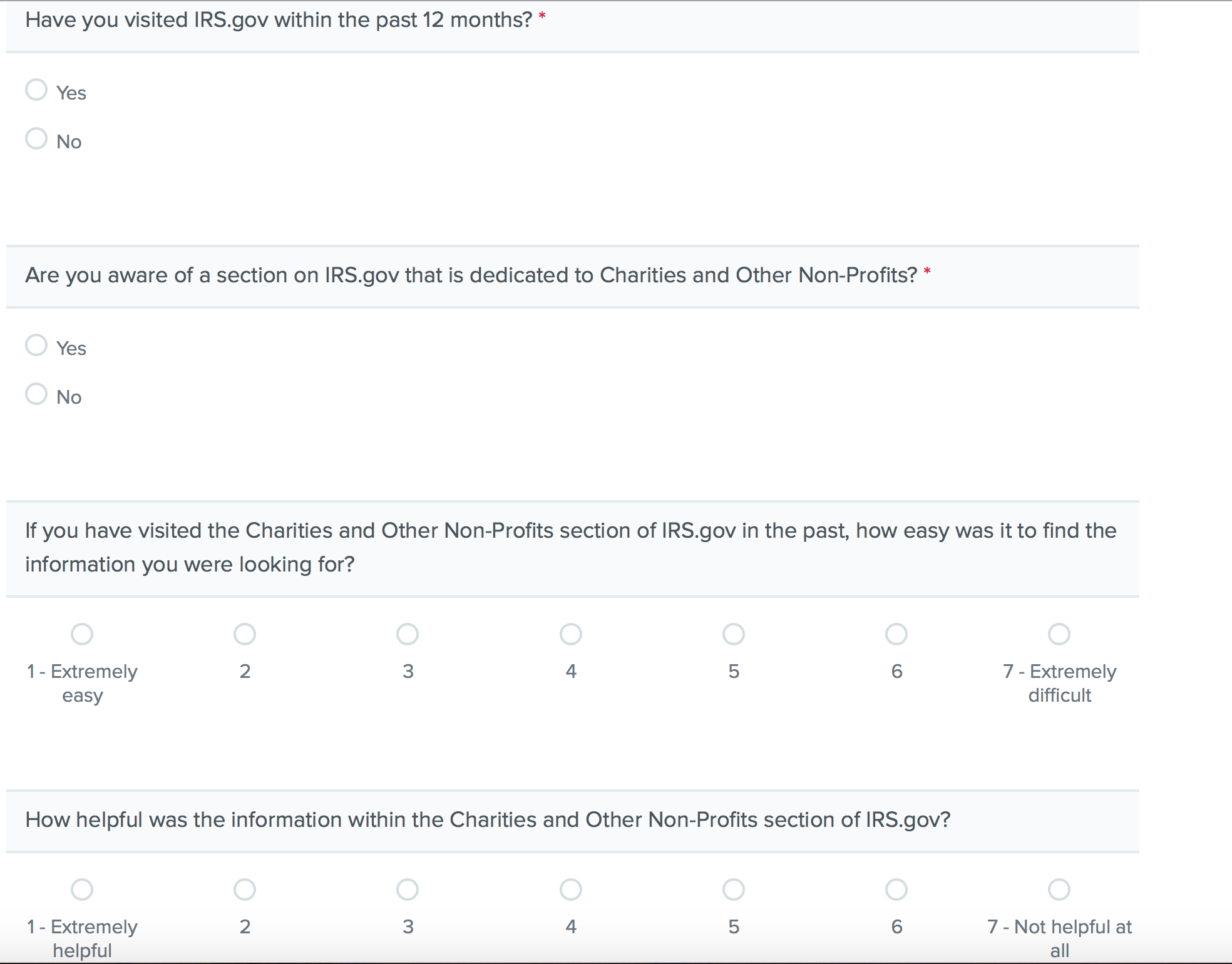

Have you visited IRS.gov within the past 12 months?

Yes

No

Are you aware of a section on IRS.gov that is dedicated to Charities and Other Non-Profits?

Yes

No

If you have visited the Charities and Other Non-Profits section of IRS.gov in the past, how easy was it to find the information you were looking for?

1 – Extremely easy

2

3

4

5

6

7 – Extremely difficult

How helpful was the information within the Charities and Other Non-Profits section of IRS.gov?

1 – Extremely helpful

2

3

4

5

6

7 – Not helpful at all

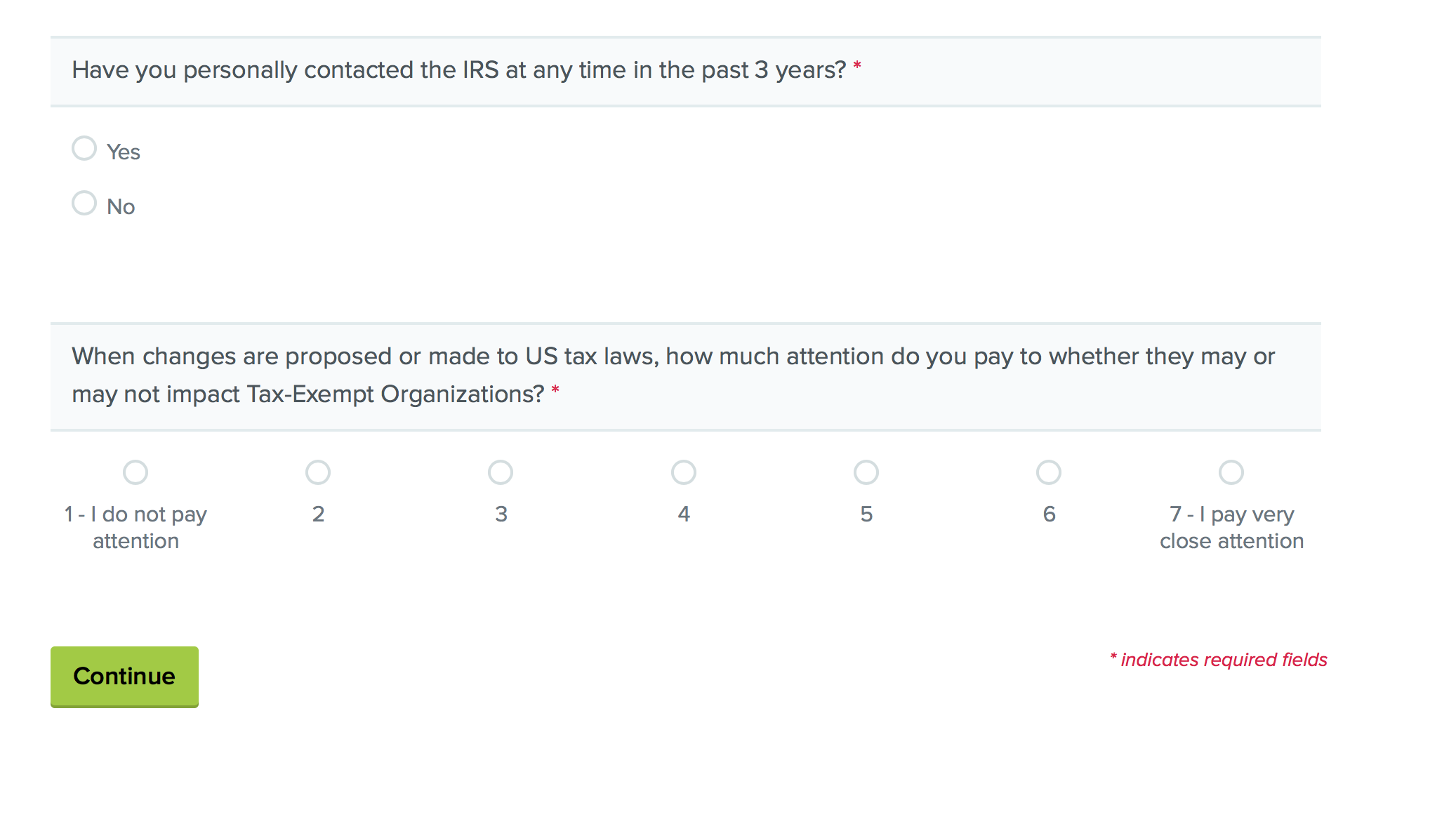

Have you personally contacted the IRS at any time in the past 3 years?

Yes

No

When changes are proposed or made to US tax laws, how much attention do you pay to whether they may or may not impact Tax-Exempt Organizations?

1 – I do not pay attention

2

3

4

5

6

7 – I pay very close attention

Please wait for further instruction before continuing.

Ok

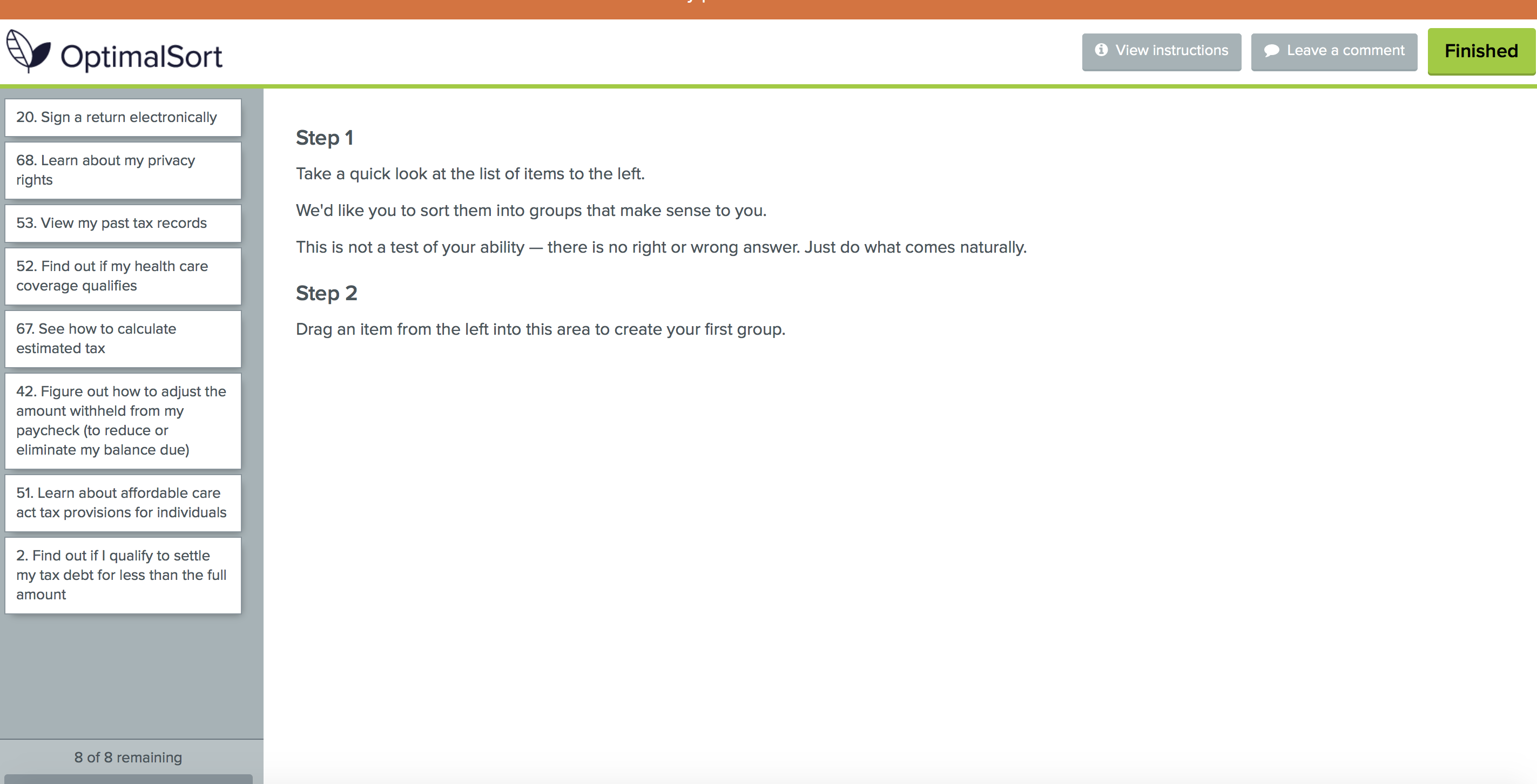

OptimalSort Screen Shots

Interview Protocol

Begin (5 mins)

Hi [participant’s name], my name is _________________ and on the phone with us is [note taker] who will be taking notes on our session today [note taker says hello]. We work for the MITRE Corporation, which is a nonprofit that runs federally funded research and development centers for federal agencies, including the IRS.

The IRS is looking for feedback from its website users on how to improve the content and navigation on IRS.gov. Today we’re looking for feedback from representatives of non-profit organizations on the charities and non-profits section of the website.

During our session, we’ll observe you organize a list of tasks related to exempt organizations and discuss your choices. We will combine our findings and will not attribute comments to any specific individuals or organizations in our reporting to the IRS.

We will spend roughly 60-90 minutes today. Your participation is voluntary, and you may leave at any time. On completion, we will send you a gift card for $40 for your time. If you must leave the session prior to completing our two activities today you will forfeit the $40 incentive.

Do you have any questions before we get started?

(Participant asks any questions, then states they are ready to begin).

We will go ahead and begin if you are ready.

Pre-Survey (5 mins)

I am sending you a link that will appear in the Skype chat area, let me know when you have opened the link.

(Send Optimal Sort link to participant)

(Troubleshoot as needed)

(Participant indicates the link is open)

I will read the consent statement on your screen aloud as you read along:

We are planning a redesign of the Charities & Non-Profits section of IRS.gov so that you can easily find what you need. The following design activity will ask you to answer a few survey questions and then organize topics related to charities and non-profits into groups that make sense to you.

Taking part in this research is entirely voluntary, and participation is anonymous. You may choose not to take part, or you may withdraw from the study at any time.

Please click to participate, and then select “Continue.”

(Participant indicates they have reached the notice telling them to wait for instruction).

Thank you.

Before we get started, I’d like to learn a little more about your experience with IRS.gov.

Approximately how many times have you visited IRS.gov for information related to Exempt Organizations in the past month?

(Moderator takes notes and asks for clarification when needed)

In the past year?

(Moderator takes notes and asks for clarification when needed)

What do you consider yourself when it comes to your knowledge regarding creating, managing and reporting for an Exempt Organization? (NIH Proficiency Scale)

Not applicable (no experience)

Basic knowledge

Limited experience

Intermediate (practical experience)

Advanced

Expert

(Moderator takes notes and asks for clarification when needed)

Thank you, now we’ll set up for our next activity.

Share Screen (1-2 mins)

Before we continue, I need you to share your screen with me for the remainder of the session.

If you click on the Skype tab on your web browser, there is a row of 4 circular buttons at the bottom of the screen. Click the one that looks like a small computer screen (the third one from the left) and select, “Present Desktop.” Some options should have popped up – click “Present” to share your screen. [Include any additional technical details.]

(Participant shares their screen)

Now that I can see your screen, please click “Continue” to open the exercise.

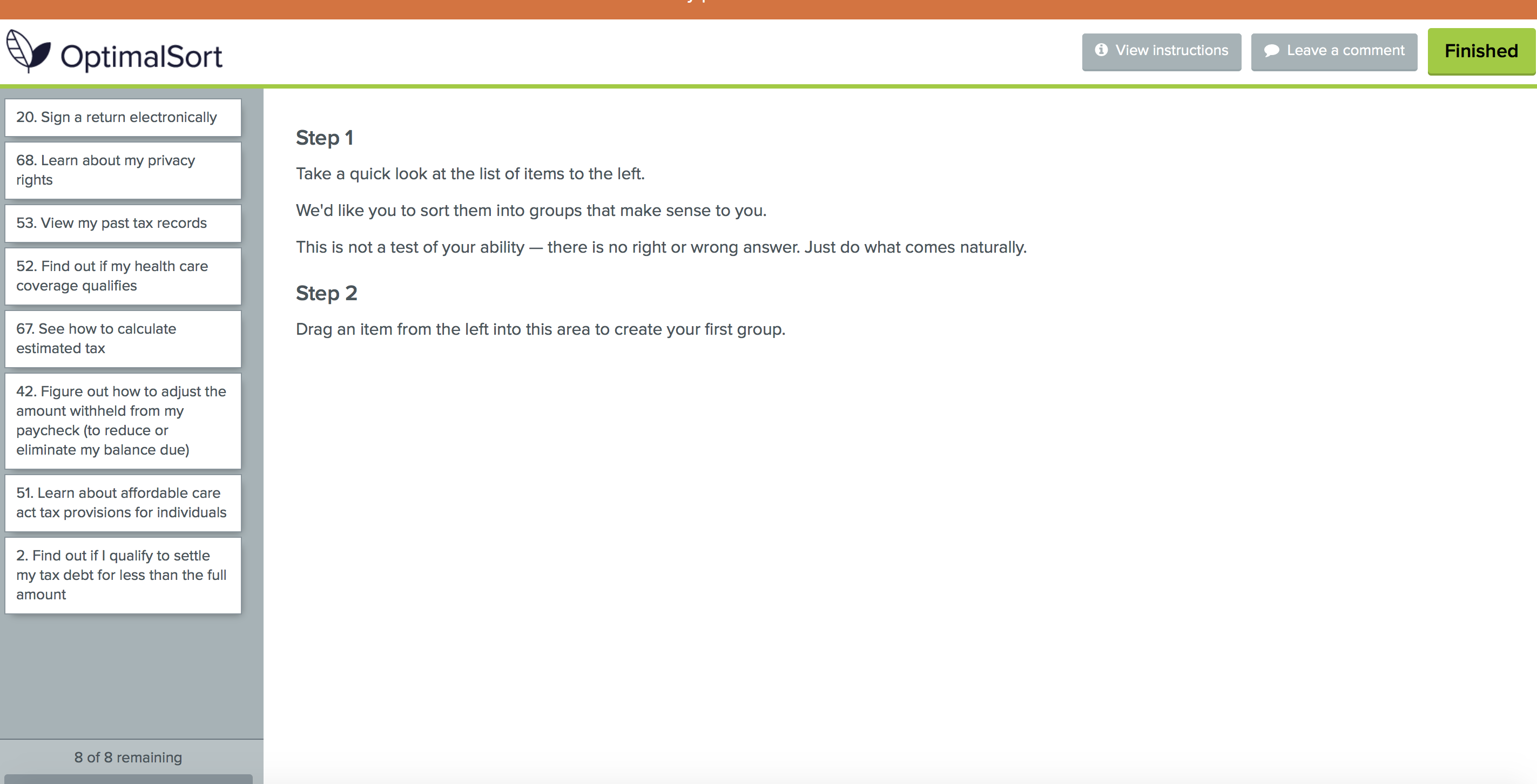

Card Sort (30 mins)

This part of the study is an information sorting exercise. I will read through the instructions as you follow along:

Step 1

Take a quick look at the list of items to the left.

We'd like you to sort them into groups that make sense to you.

There is no right or wrong answer. Just do what comes naturally.

Feel free to think aloud as you sort, and ask any questions along the way.

Step 2

Drag an item from the left into this area to create your first group.

(Participant asks questions / begins the card sort)

(Moderator takes notes and asks for clarification when needed)

(Participant indicates they have finished the card sort)

(Moderator gains clarification on groupings if necessary)

Now that you have finished this portion, please click the “Finished” button at the top right (green button).

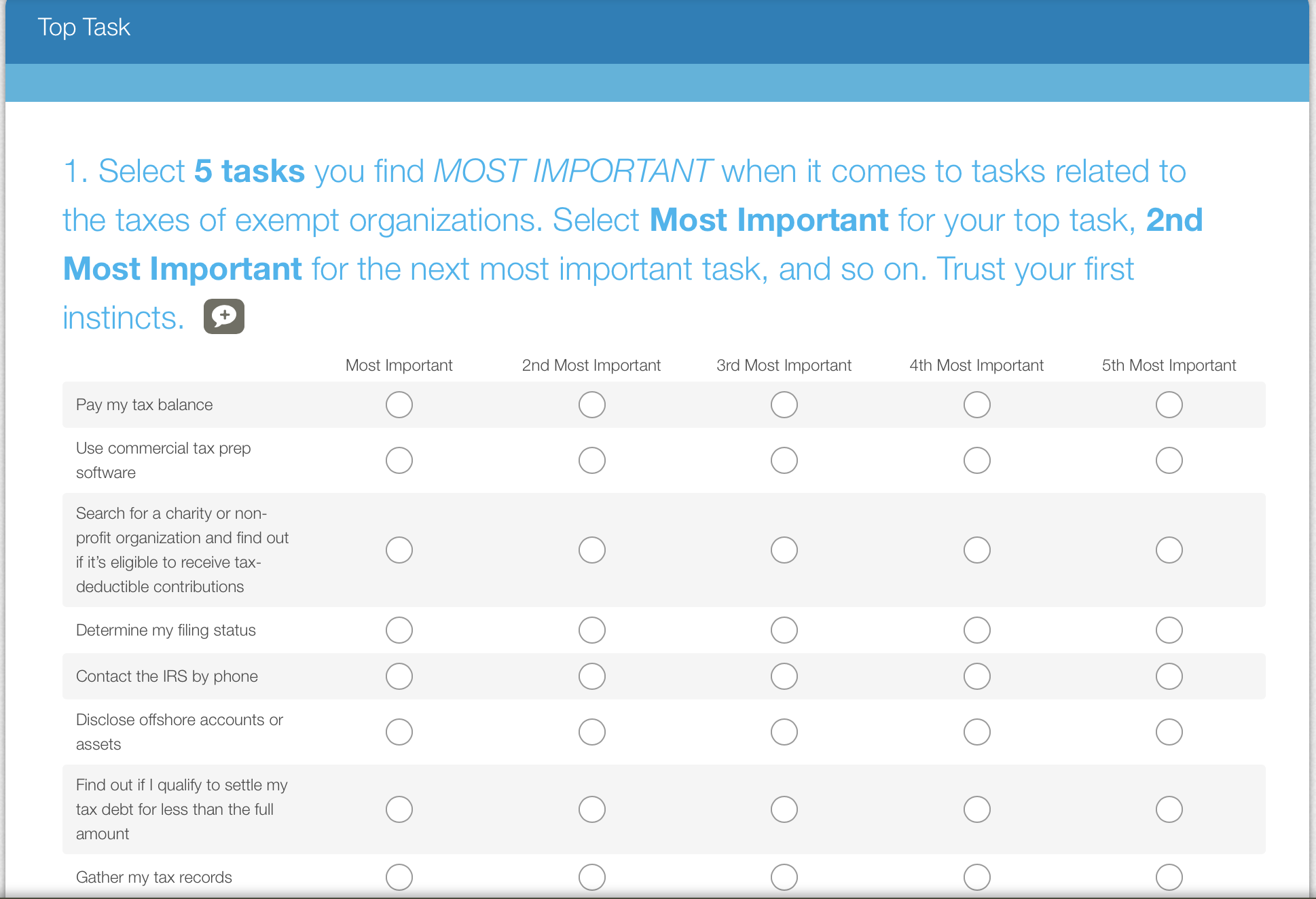

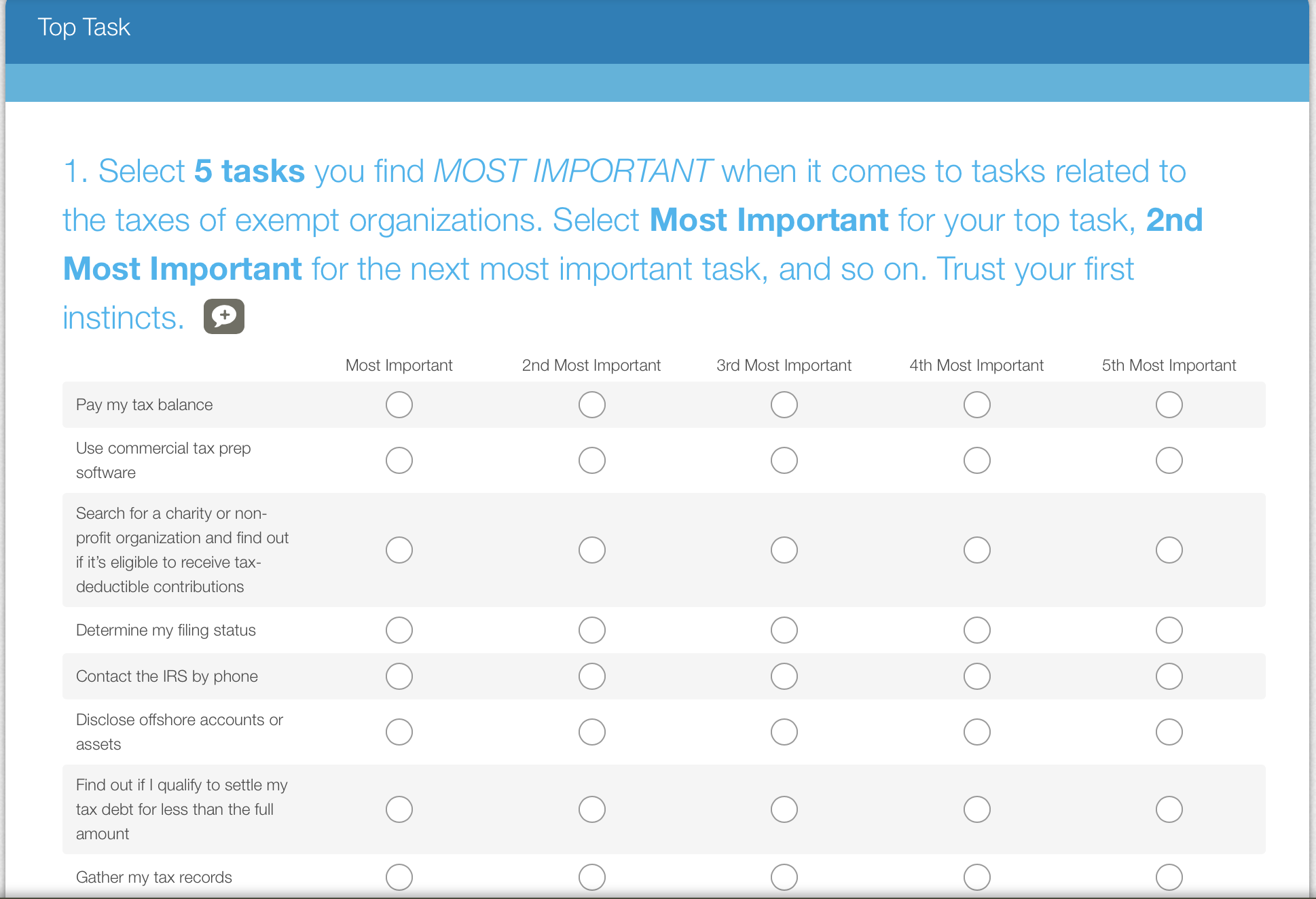

Top Task (5 mins)

For our second activity; I will give you five minutes to look through this list and choose your TOP 5 tasks that are most important to you as they relate to exempt organizations. Choose “Most Important” for your top task, “2nd Most Important” for your second task, and so on. Trust your first instincts. I will let you know when time is up.

(Participant asks any questions, then begins)

Please click “Done” at the bottom of the page.

Exit Interview (10-15 mins)

Now that you have completed all the activities, I have a few follow-up questions before we end the session. This won’t take long.

How easy or difficult was it for you to group all of the items into categories? I’ll read you your response options.

- Very difficult

- Difficult

- Neutral

- Easy

- Very easy

What were some of the most important items and categories from the activity today?

Were there any topics that you did not completely understand?

Were any important topics missing?

How would you characterize the way you organized the items?

If there was one way the IRS.gov website could serve your organization better, what would that be?

That concludes the session. Thank you for taking the time to help us improve the charities and non-profits section of the IRS.gov website. Your compensation of $40 will be emailed to you shortly. If you have any questions about the results of this study or receiving your compensation, feel free to reach out to me by email.

Phase 2 – Unmoderated Study

Optimal Sort Screen Shots

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Microsoft Office User |

| File Modified | 0000-00-00 |

| File Created | 2021-01-22 |

© 2026 OMB.report | Privacy Policy