Consolidated Annual Report for the Carl D. Perkins Career and Technical Act of 2006

Consolidated Annual Report (CAR) for the Carl D. Perkins Career and Technical Education Act of 2006

CAR_User_Guide_072017

Consolidated Annual Report for the Carl D. Perkins Career and Technical Act of 2006

OMB: 1830-0569

Consolidated

Annual Report (CAR) Submission Information

2013

CAR Submission Information

KEY DATES

TBD

CAR Training Session 1

TBD

CAR Training Session 2

TBD

CAR Reporting BeginsTBD

Deadline to submit secondary performance data to the EDFACTS Submission SystemDecember 31

CAR Reporting Ends

GETTING HELP

CAR

Reporting Ends

For general assistance, please contact Sharon Head, OCTAE, at: [email protected].

ACCESSING THE PERKINS WEB PORTAL

For technical assistance, please contact: [email protected].

Perkins Web Portal URL: https://perkins.ed.gov/

Important Notes:

Account information will be sent separately.

New users must activate their account and create a password before logging in to the Perkins Web Portal.

Table

of Contents

Activate Your Account and Create a Password |

4 |

Log in to the Perkins Web Portal |

5 |

Navigating the Perkins Web Portal |

6 |

Submit Your Report |

7 |

Report Workspace |

8 |

Consolidated Annual Report (CAR) Steps: |

|

Step 1. Cover Page |

9-10 |

Step 2. Reporting Information |

11 |

Step 3. Use of Funds |

12 |

Step 4. Technical Skill Attainment (Not required) |

13 |

Step 5a. Interim Financial Status Report |

14-17 |

Step 5b. Final Financial Status Report |

18-21 |

Step 6. Enrollment Data |

22 |

Step 6a. Enrollment Data for CTE Participants |

23-25 |

Step 6b. Enrollment Data for CTE Concentrators |

26 |

Step 7. Performance Data |

27-30 |

Step 8. Program Improvement Plans |

31 |

Step 9. Review & Certification |

32-35 |

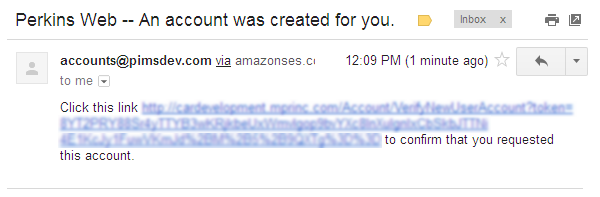

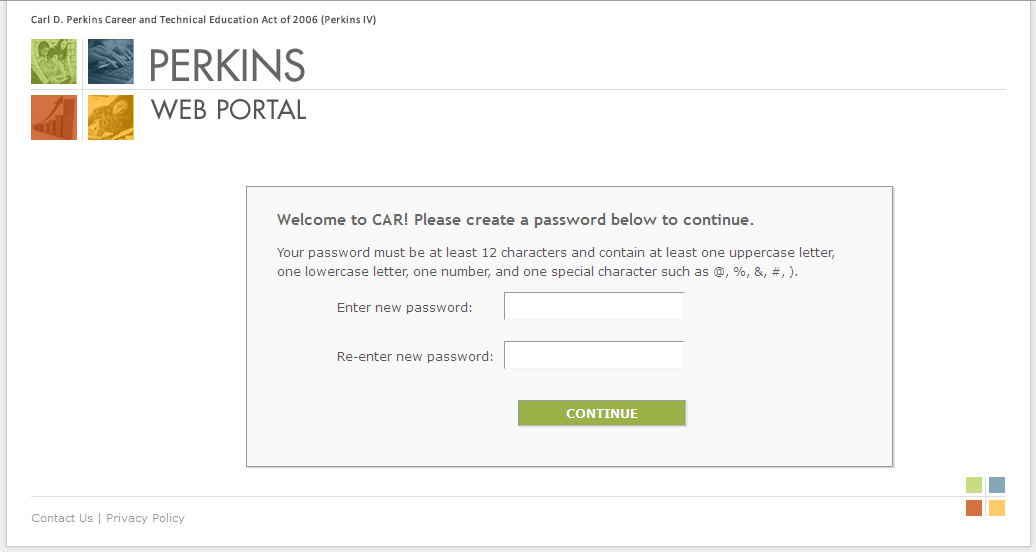

Activate

Your Account and Create a Password

Activate

Your Account and Create a Password

Instructions: Click

the link provided in the email with subject line “Perkins Web

– An account was created for you”. Create

a password. Passwords must meet the following security requirements: At

least 12 characters in length Contain

at least one uppercase letter Contain

at least one lowercase letter Contain

at least one number Contain

at least one special character

For example: mustLuvD0gs!

1

1

2

2

Log

in to the Perkins Web Portal

Log

in to the Perkins Web Portal

Instructions: Enter

your email and the password you created and click Login. Note You

can reset your password by clicking Forgot

Password on

the log in page. Passwords may be changed once every 24 hours.

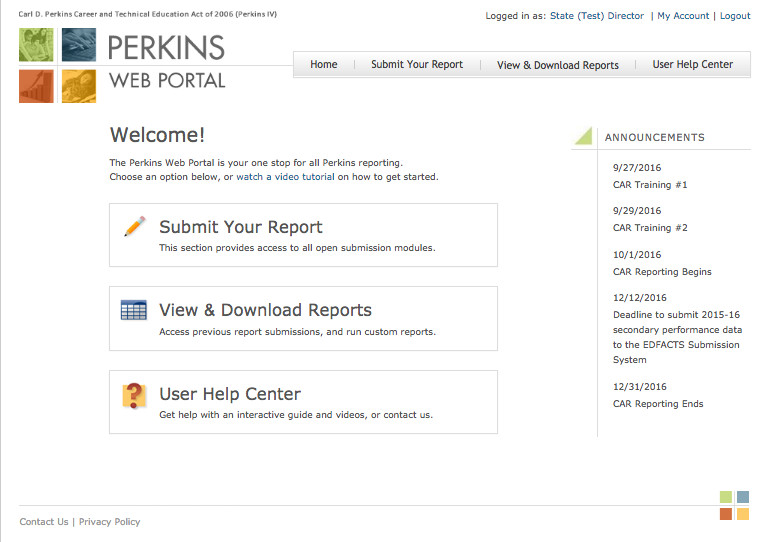

Navigating

the Perkins Web Portal

Navigating

the Perkins Web Portal

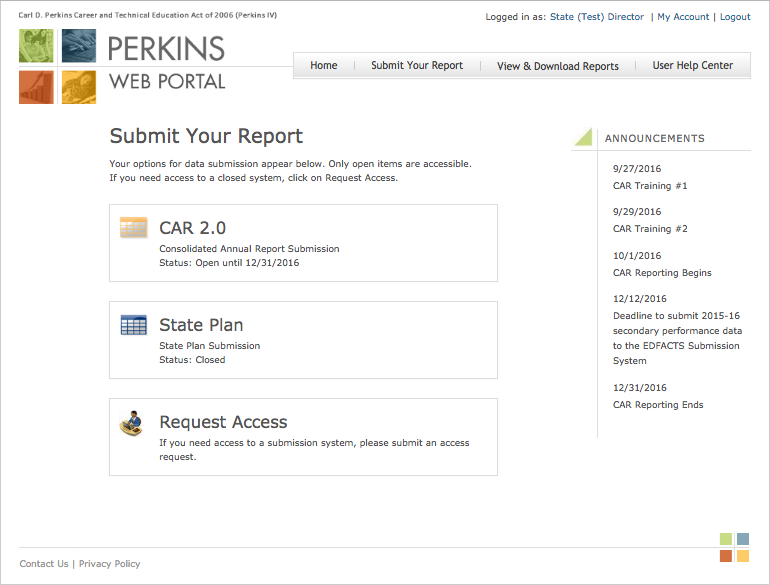

Instructions: Access

the main sections of the Perkins Web Portal from the home page: Submit

Your Report Access

the submission portals. See page 7 for more information. View

& Download Reports See

previous report submissions. Download report packages. User

Help Center View

instructions for report submissions, and watch recorded training

sessions.

The

main sections can also be accessed using the navigation links at

the top of the page. Click

My Account

to view and update your account information. Click

Logout to end

your session.

Key

dates are displayed under Announcements.

3

1

2

4

1

2

4

3

Submit

Your Report

Submit

Your Report

Instructions: To

access CAR, click Submit

Your Report on

the Perkins Web Portal homepage. From

the Submit Your Report page, click CAR

2.0. You

can also access CAR using the navigation provided at the top of the

page.

Click Request

Access if you

think you should have access to a report that is closed or not shown

on the Submit Your Report page, or if you need to request accounts

for other members of your team who help complete the report. Note Only

State Directors may submit access requests.

1

2

1

3

4

4

3

2

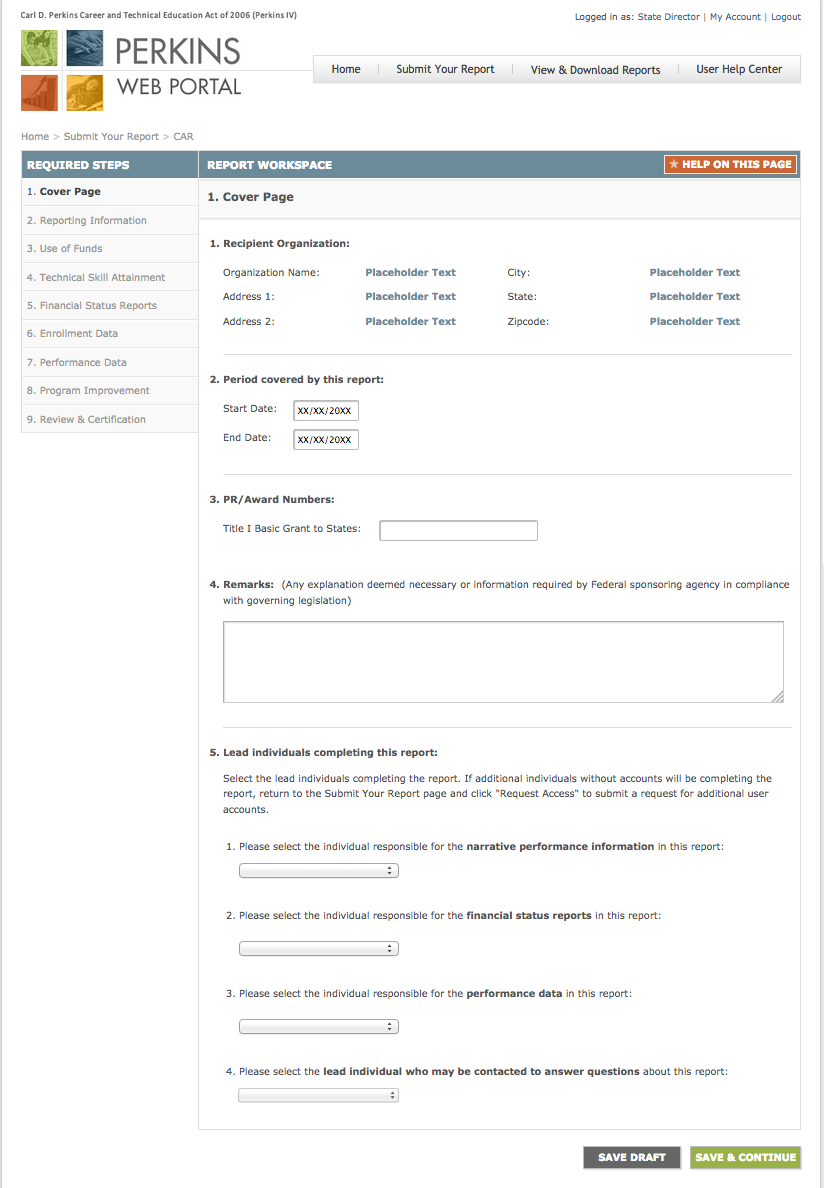

Report

Workspace

Report

Workspace

Instructions: Links

to the required steps are shown to the left of the Report Workspace. Click

Help on this

page to view

instructions and tips for completing each step. Enter

the requested data in the web form located in the Report Workspace. Save

your progress by clicking Save

Draft. Click

Save &

Continue to

save your work and move on to the next step.

Note Use

the links on the left-hand side of the page to return to a step to

make changes. Do not use the browser’s Back

button.

1

2

2

1

3

3

4

4

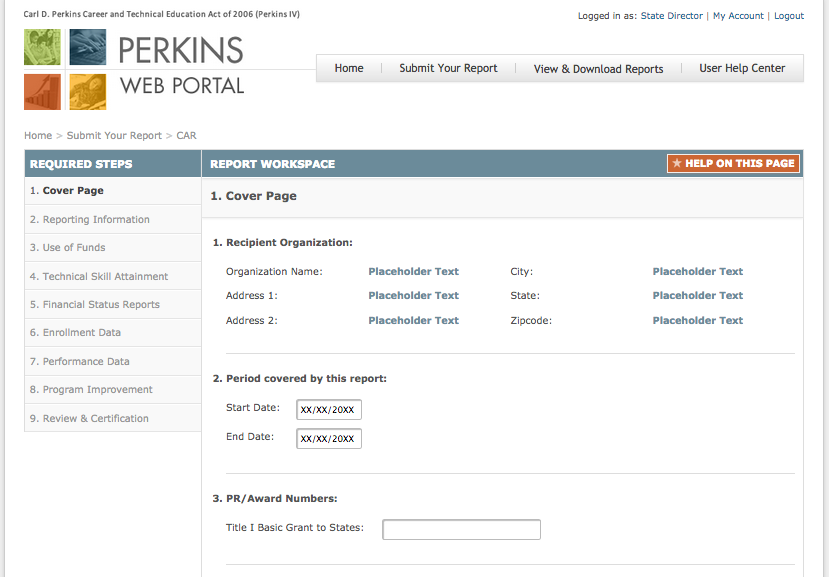

CAR

– Step 1. Cover Page

CAR

– Step 1. Cover Page

Instructions: Confirm

the Recipient Organization contact information. If the information

is incorrect contact your Regional Accountability Specialist. Confirm

the program year covered in the report, e.g. July 1, 2015 through

June 30, 2016.

Enter

PR/Award number as indicated in Block 5 of the Grant Award

Notifications for the Basic Grant to States.

Continues on next page

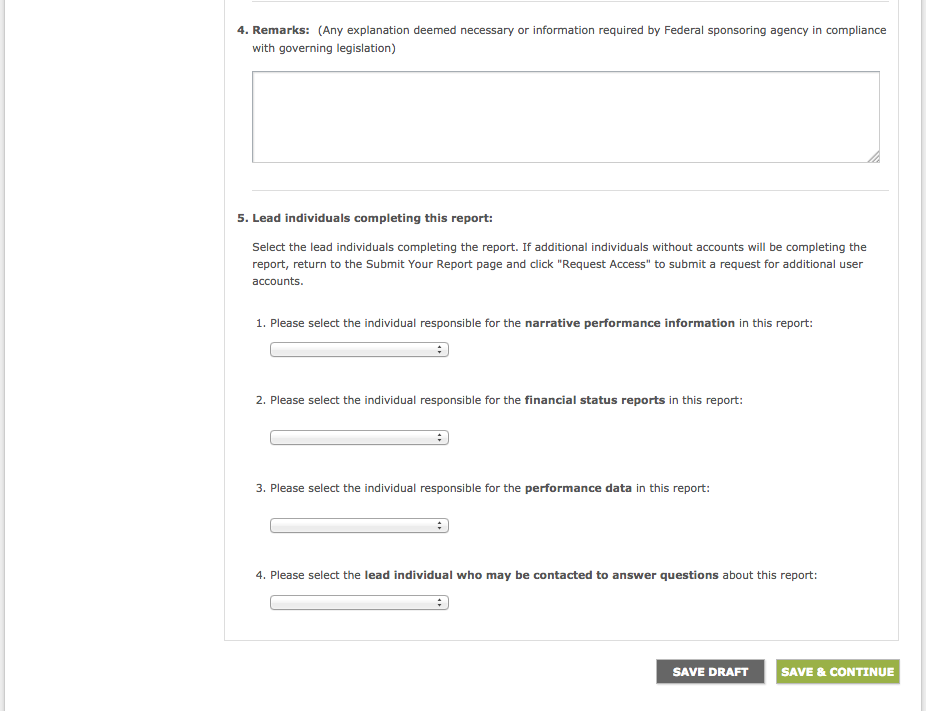

CAR

– Step 1. Cover Page (Continued)

CAR

– Step 1. Cover Page (Continued)

Instructions: Include

any remarks that are necessary to explain any specifics in the

report or information required by the Department of Education.

Select

the lead individuals completing the report. If additional

individuals without accounts will be completing the report, return

to the Submit

Your Report page

and click

Request Access

to submit a request for additional user accounts.

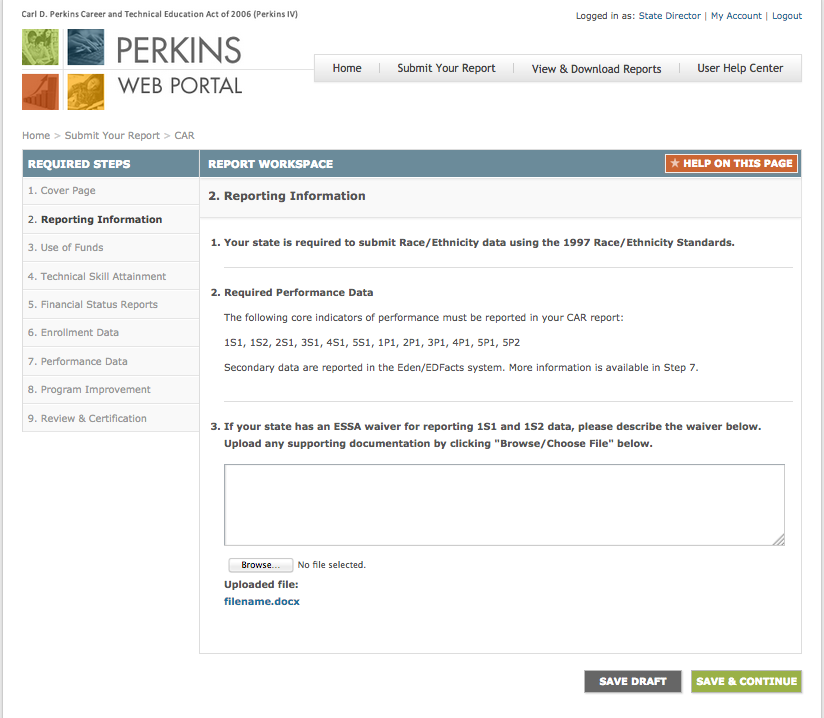

CAR

– Step 2. Reporting Information

CAR

– Step 2. Reporting Information

Instructions: This

page indicates your state’s reporting requirements. If any

information listed in questions 1 and 2 is incorrect, please contact

your Regional Accountability Specialist. If

your state has an ESSA waiver for reporting 1S1 and 1S2 data, please

describe the waiver in the text box provided. Upload any supporting

documentation by clicking Browse/Choose

File.

CAR

– Step 3. Use of Funds

CAR

– Step 3. Use of Funds

Instructions: Section

124(b) of Perkins IV describes the required and permissive uses of

State leadership funds.

Provide

a summary of your State’s major initiatives and activities

for each of the required use of funds questions. Click “Save

Draft” at the bottom of the screen to save your work in

progress. For

permissive use of funds questions, choose Yes or No. If you choose

Yes, enter your answer in the textbox provided. Upload

supporting documentation in the space provided and provide a

description for each file. Supporting documentation is optional.

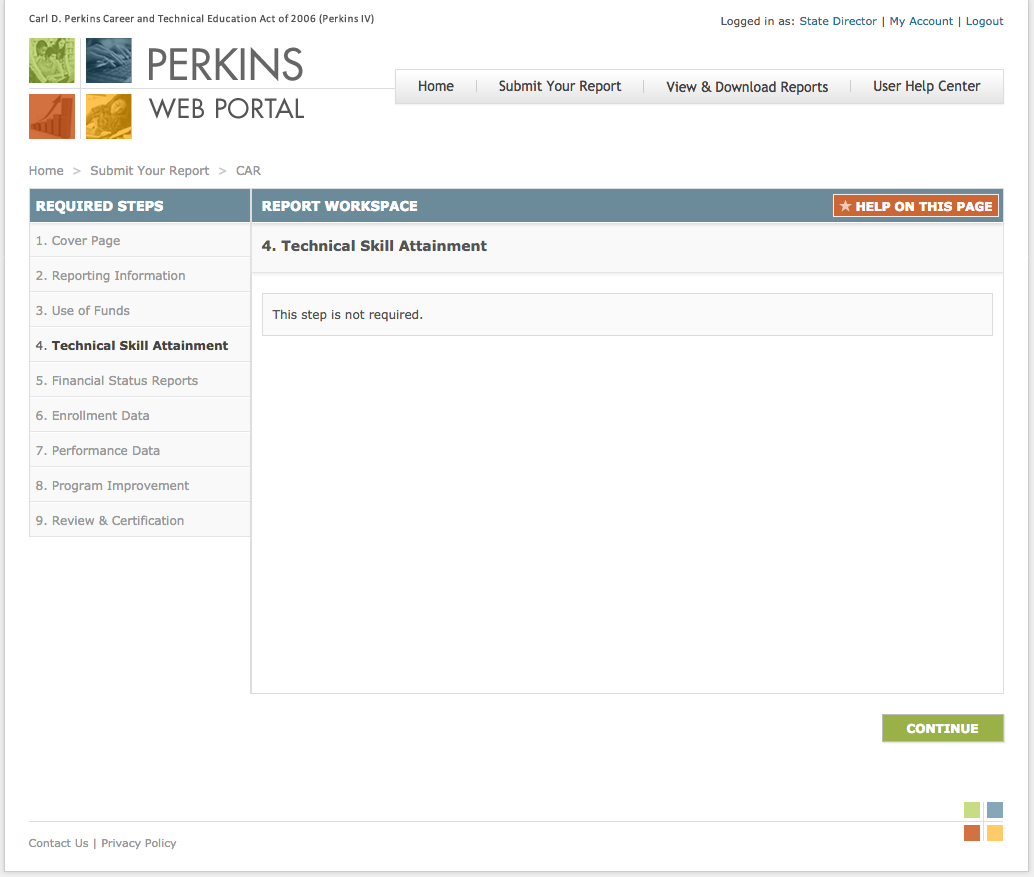

CAR

– Step 4. Technical Skill Attainment

CAR

– Step 4. Technical Skill Attainment

Instructions:

This

step is not required. Click Continue

to proceed to the next step.

CAR

– Step 5a. Interim Financial Status Report

CAR

– Step 5a. Interim Financial Status Report

Instructions: The

FSR form must be completed and certified by the State’s

Financial Auditor. Confirm

the name of the State submitting the interim FSR. If the

information is incorrect, contact your Regional Accountability

Specialist. Enter

the start and end dates of the 15-month federal funding period for

the Title I award. Enter

the start and end dates of the reporting period covered by the

interim FSR. The dates for the interim FSR report may span up to a

15-month period. Select

the accounting method used by the State to track program

expenditures: Cash or Accrual. Enter

the grant award number for the Title I grant. Enter

the amount of the State’s Title I grant award as indicated on

the grant award notification (GAN). Check

the box if the State is filing an amended interim FSR and enter the

date in the adjacent box.

Continues on next page

CAR

– Step 5a. Interim Financial Status Report (Continued)

CAR

– Step 5a. Interim Financial Status Report (Continued)

See pages 16-17 for

instructions on completing the interim FSR matrix.

CAR – Step 5a. Interim Financial Status Report (Continued)

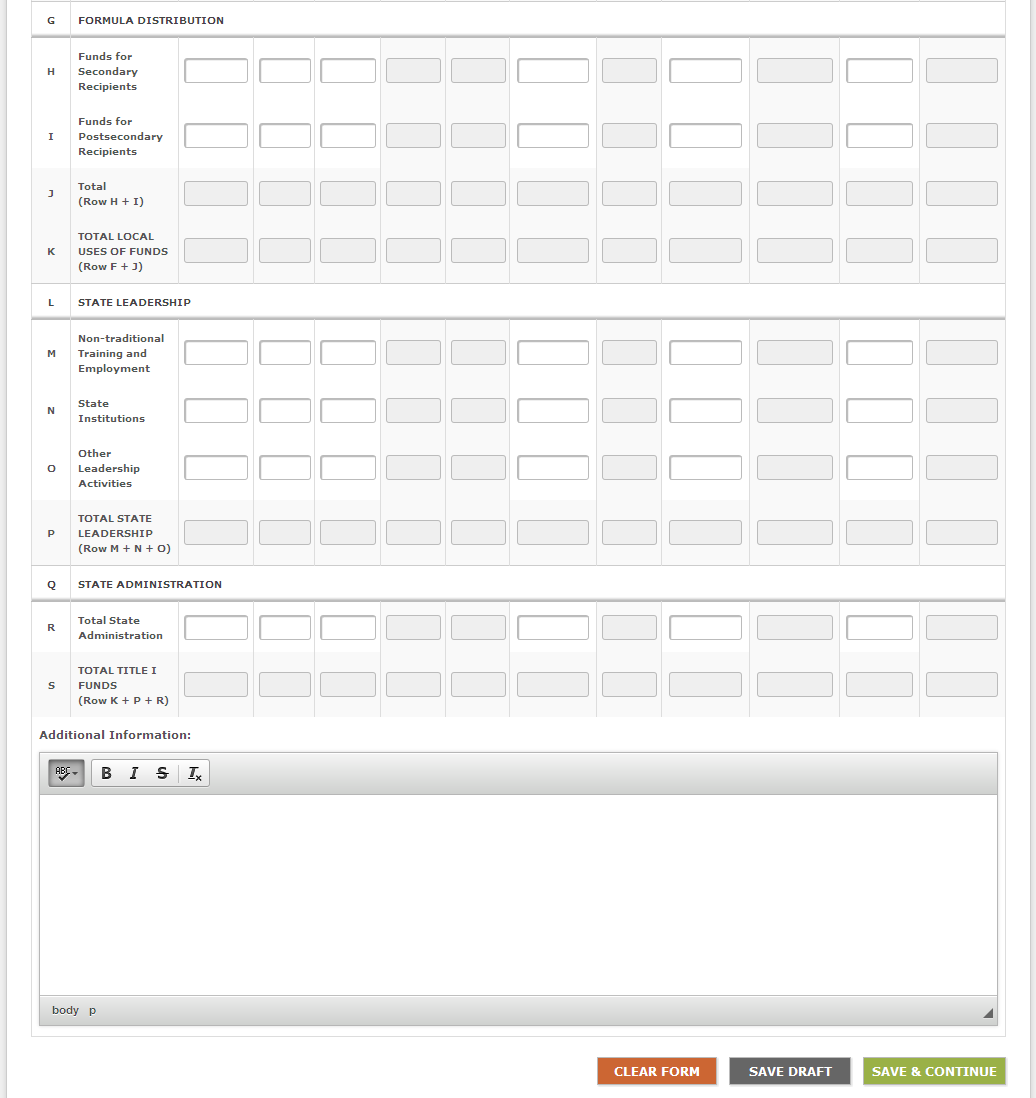

Instructions for completing the interim FSR matrix:

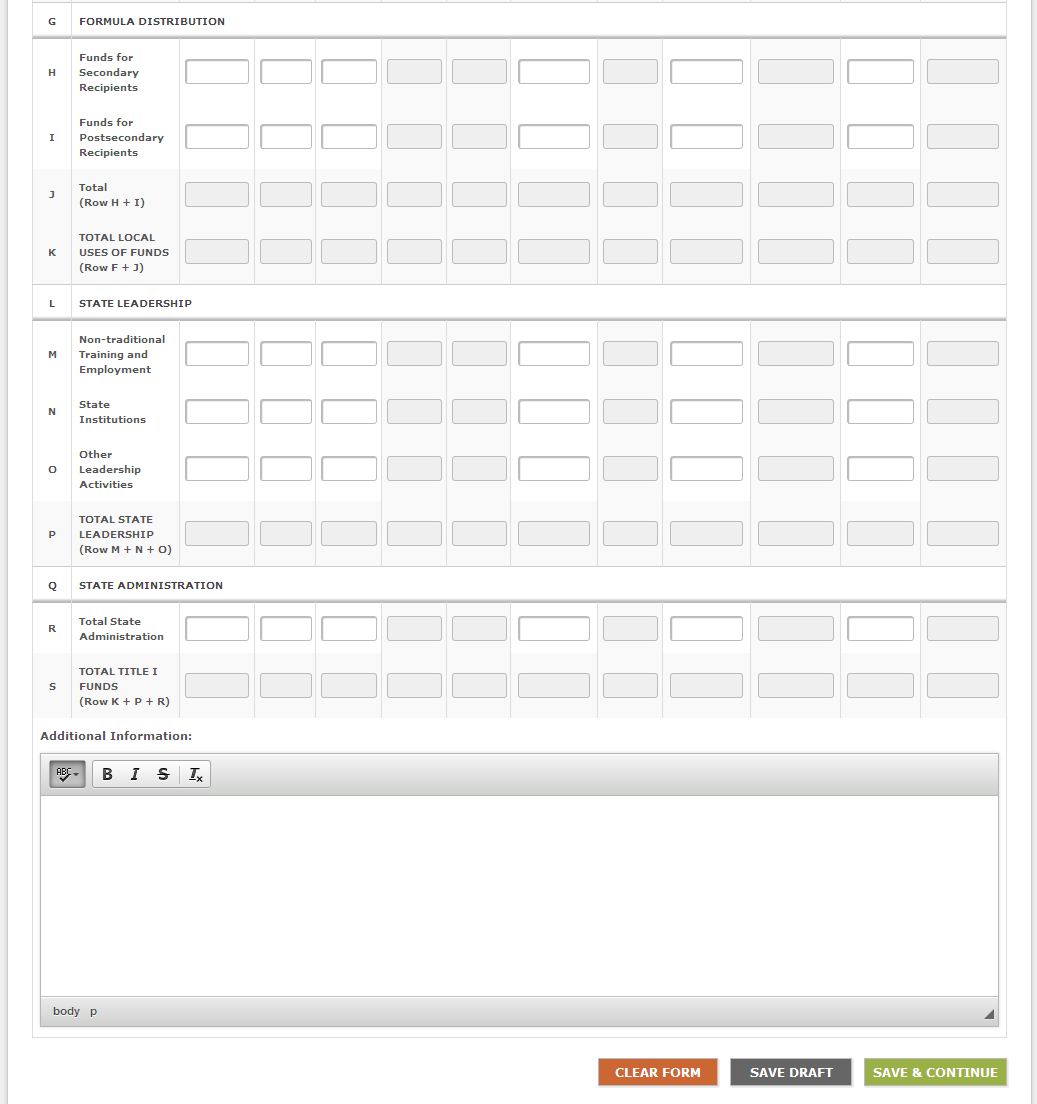

Rows

Below are row headings that appear on the interim FSR matrix, listed in the order they appear from top to bottom on the interim FSR. Unless otherwise specified, a State must provide information for each row category in each of the interim FSR columns.

Total Title I Funds— No information needs to be entered for this row. The total amount of the grant award made to the eligible agency under Sec. 111 of Title I of Perkins IV for the funding period covered by the interim FSR.

Local Uses of Funds— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency distributes to eligible recipients. This amount shall not be less than 85 percent of the total Title I allocation.

Reserve— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency makes available as a reserve for eligible recipients under Sec. 112(c) of Perkins IV. This amount shall not be more than ten percent of the funds made available for distribution to eligible recipients.

Funds for Secondary Recipients— Enter the amounts of reserve funds made available to secondary recipients. Do not enter information in Columns 4, 5, 7, 9, or 11.

Funds for Postsecondary Recipients— Enter the amounts of reserve funds made available to postsecondary recipients. Do not enter information in Columns 4, 5, 7, 9, or 11.

Total— Do not enter information in row F. The total amount of reserve funds made available to secondary and postsecondary recipients will be automatically calculated for each column by adding rows D and E.

Formula Distribution— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency distributes by formula under Sec. 131 and 132 of Perkins IV to eligible secondary and postsecondary recipients, respectively, after subtracting any funds to be distributed under a reserve.

Funds for Secondary Recipients— Enter the amounts of funds distributed by formula to secondary recipients. Do not enter information in Columns 4, 5, 7, 9, and 11.

Funds for Postsecondary Recipients— Enter the amounts of funds distributed by formula to postsecondary recipients. Do not enter information in Columns 4, 5, 7, 9, and 11.

Total— Do not enter information in row J. The total amount of funds distributed by formula to eligible recipients will be automatically calculated for each column by adding rows H and I.

Total Local Uses of Funds— Do not enter information in row K. The total amount of Title I funds that the eligible agency distributes under the reserve and by formula to eligible recipients will be automatically calculated for each column by adding rows F and J.

State Leadership— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency uses to carry out the State leadership activities described in Sec. 124 of Perkins IV. This amount shall not be more than ten percent of the eligible agency's total Title I funds.

Nontraditional Training and Employment— Enter the amounts of State leadership funds made available for services that prepare individuals for non-traditional fields. This amount shall not be less than $60,000 and not be more than $150,000. Do not enter information in Columns 4, 5, 7, 9, and 11.

State Institutions— Enter the amounts of State leadership funds made available to serve individuals in State institutions, such as State correctional institutions and institutions that serve individuals with disabilities. This amount shall not be more than one percent of the eligible agency's total Title I funds. Do not enter information in Columns 4, 5, 7, 9, and 11.

Other Leadership Activities— Enter the amounts of other State leadership funds made available. Do not enter information in Columns 4, 5, 7, 9, and 11.

Total State Leadership— Do not enter information in row P. The total amount of Title I funds for State leadership activities will be automatically calculated for each column by adding rows M, N, and O.

State Administration— No information needs to be entered for this row. The total amount of Title I funds that the eligible agency uses to carry out the State administration activities described in Sec. 121 of Perkins IV. This amount shall not be more than five percent, or $250,000, whichever is greater of the eligible agency's total Title I funds.

Total State Administration— Enter the amounts of Title I funds for State administration activities. Do not enter information in Columns 4, 5, 7, 9, and 11.

Total Title I Funds— Do not enter information in row S. The total amount of funds that the eligible agency uses to carry out activities under Title I of Perkins IV will be automatically calculated for each column by adding rows K, P, and R. This amount includes funds for local uses, State leadership, and State administration.

CAR – Step 5a. Interim Financial Status Report (Continued)

Instructions for completing the interim FSR matrix:

Columns

Below are column headings on the interim FSR matrix, listed in the order they appear from left to right on the interim FSR. The column headings on the interim FSR matrix are used to track expenditures for each of the rows.

Net Outlays Previously Reported— Do not enter information in column 1 for the interim FSR.

Total Outlays This Report Period— Report first-year expenditures for the interim report. Include any program income and non-Federal outlays made during the reporting period.

Program Income Credits— Report program income. Refer to Uniform Guidance at 2 CFR 200.307 for more information and details. This column will be blank in most instances.

Net Outlays This Report Period— Do not enter information in column 4. The net outlays will be automatically calculated by subtracting program income credits from total outlays (column 2 - column 3).

Net Outlays To Date— Do not enter information in column 5. For the interim report, column 5 will be automatically populated with the amounts from column 4.

Non-Federal Share of Outlays— Enter non-Federal outlays, including State expenditures to meet the matching and hold-harmless requirements of sections 112(b) and 323(a) of Perkins IV.

Total Federal Share of Outlays— Do not enter information in column 7. The total amount of Federal outlays will be automatically calculated by subtracting non-Federal outlays from net outlays to date (column 5 - column 6).

Federal Share of Unliquidated Obligations— Enter the amounts of the Federal share of unliquidated obligations.

Federal Share of Outlays and Unliquidated Obligations— Do not enter information in column 9. The total amount Federal outlays made and the Federal share of unliquidated obligations outstanding will be automatically calculated by adding column 7 and column 8.

Federal Funds Authorized— Enter the amounts of available resources from the total Title I grant funds earmarked for the specific purposes on each row.

Balance of Federal Funds— Do not enter information in column 11. The total amounts of unobligated funds available for the carry-over year for the interim report will be automatically calculated by subtracting column 9 from column 10.

CAR

– Step 5b. Final Financial Status Report

CAR

– Step 5b. Final Financial Status Report

Instructions: The

FSR form must be completed and certified by the State’s

Financial Auditor. Confirm

the name of the State submitting the final FSR. If the information

is incorrect, contact your Regional Accountability Specialist. Enter

the start and end dates of the 15-month federal funding period for

the Title I award. Enter

the start and end dates of the reporting period covered by the

final FSR. The dates for the final FSR report may span up to a

27-month period. Select

the accounting method used by the State to track program

expenditures: Cash or Accrual. Enter

the grant award number for the Title I grant. Enter

the amount of the State’s Title I grant award as indicated

on the grant award notification (GAN). Check

the box if the State is filing an amended final FSR and enter the

date in the adjacent box.

Continues on next page

CAR

– Step 5b. Final Financial Status Report (Continued)

CAR

– Step 5b. Final Financial Status Report (Continued)

See pages 20-21 for

instructions on completing the final FSR matrix.

CAR – Step 5b. Final Financial Status Report (Continued)

Instructions for completing the final FSR matrix:

Rows

Below are row headings that appear on the final FSR matrix, listed in the order they appear from top to bottom on the final FSR. Unless otherwise specified, a State must provide information for each row category in each of the final FSR columns.

Total Title I Funds— No information needs to be entered for this row. The total amount of the grant award made to the eligible agency under Sec. 111 of Title I of Perkins IV for the funding period covered by the interim FSR.

Local Uses of Funds— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency distributes to eligible recipients. This amount shall not be less than 85 percent of the total Title I allocation.

Reserve— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency makes available as a reserve for eligible recipients under Sec. 112(c) of Perkins IV. This amount shall not be more than ten percent of the funds made available for distribution to eligible recipients.

Funds for Secondary Recipients— Enter the amounts of reserve funds made available to secondary recipients. Do not enter information in Columns 4, 5, 7, 9, or 11.

Funds for Postsecondary Recipients— Enter the amounts of reserve funds made available to postsecondary recipients. Do not enter information in Columns 4, 5, 7, 9, or 11.

Total— Do not enter information in row F. The total amount of reserve funds made available to secondary and postsecondary recipients will be automatically calculated for each column by adding rows D and E.

Formula Distribution— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency distributes by formula under Sec. 131 and 132 of Perkins IV to eligible secondary and postsecondary recipients, respectively, after subtracting ay funds to be distributed under a reserve.

Funds for Secondary Recipients— Enter the amounts of funds distributed by formula to secondary recipients. Do not enter information in Columns 4, 5, 7, 9, and 11.

Funds for Postsecondary Recipients— Enter the amounts of funds distributed by formula to postsecondary recipients. Do not enter information in Columns 4, 5, 7, 9, and 11.

Total— Do not enter information in row J. The total amount of funds distributed by formula to eligible recipients will be automatically calculated for each column by adding rows H and I.

Total Local Uses of Funds— Do not enter information in row K. The total amount of Title I funds that the eligible agency distributes under the reserve and by formula to eligible recipients will be automatically calculated for each column by adding rows F and J.

State Leadership— No information needs to be entered for this row. The total amount of funds under Title I of Perkins IV that the eligible agency uses to carry out the State leadership activities described in Sec. 124 of Perkins IV. This amount shall not be more than ten percent of the eligible agency's total Title I funds.

Nontraditional Training and Employment— Enter the amounts of State leadership funds made available for services that prepare individuals for non-traditional fields. This amount shall not be less than $60,000 and not be more than $150,000. Do not enter information in Columns 4, 5, 7, 9, and 11.

State Institutions— Enter the amounts of State leadership funds made available to serve individuals in State institutions, such as State correctional institutions and institutions that serve individuals with disabilities. This amount shall not be more than one percent of the eligible agency's total Title I funds. Do not enter information in Columns 4, 5, 7, 9, and 11.

Other Leadership Activities— Enter the amounts of other State leadership funds made available. Do not enter information in Columns 4, 5, 7, 9, and 11.

Total State Leadership— Do not enter information in row P. The total amount of Title I funds for State leadership activities will be automatically calculated for each column by adding rows M, N, and O.

State Administration— No information needs to be entered for this row. The total amount of Title I funds that the eligible agency uses to carry out the State administration activities described in Sec. 121 of Perkins IV. This amount shall not be more than five percent, or $250,000, whichever is greater of the eligible agency's total Title I funds.

Total State Administration— Enter the amounts of Title I funds for State administration activities. Do not enter information in Columns 4, 5, 7, 9, and 11.

Total Title I Funds— Do not enter information in row S. The total amount of funds that the eligible agency uses to carry out activities under Title I of Perkins IV will be automatically calculated for each column by adding rows K, P, and R. This amount includes funds for local uses, State leadership, and State administration.

CAR – Step 5b. Final Financial Status Report (Continued)

Instructions for completing the final FSR matrix:

Columns

Below are column headings on the final FSR matrix, listed in the order they appear from left to right on the final FSR. The column headings on the final FSR matrix are used to track expenditures for each of the rows.

Net Outlays Previously Reported— Enter expenditures from column 5 (Net Outlays To Date) from the interim financial report for this grant.

Total Outlays This Report Period— Report carry-over expenditures for the final report. Include any program income and non-Federal outlays made during the reporting period.

Program Income Credits— Report program income. Refer to Uniform Guidance at 2 CFR 200.307 for more information and details. This column will be blank in most instances.

Net Outlays This Report Period— Do not enter information in column 4. The net outlays will be automatically calculated by subtracting program income credits from total outlays (column 2 - column 3).

Net Outlays To Date— Do not enter information in column 5. For the final report, column 5 will be automatically populated with the amounts from column 4.

Non-Federal Share of Outlays— Enter non-Federal outlays, including State expenditures to meet the matching and hold-harmless requirements of sections 112(b) and 323(a) of Perkins IV.

Total Federal Share of Outlays— Do not enter information in column 7. The total amount of Federal outlays will be automatically calculated by subtracting non-Federal outlays from net outlays to date (column 5 - column 6).

Federal Share of Unliquidated Obligations— Enter the amounts of the Federal share of unliquidated obligations.

Federal Share of Outlays and Unliquidated Obligations— Do not enter information in column 9. The total amount Federal outlays made and the Federal share of unliquidated obligations outstanding will be automatically calculated by adding column 7 and column 8.

Federal Funds Authorized— Enter the amounts of available resources from the total Title I grant funds earmarked for the specific purposes on each row.

Balance of Federal Funds— Do not enter information in column 11. The total amounts of unobligated funds will be automatically calculated by subtracting column 9 from column 10. These are lapsed funds that the State will be returning to the Federal Treasury.

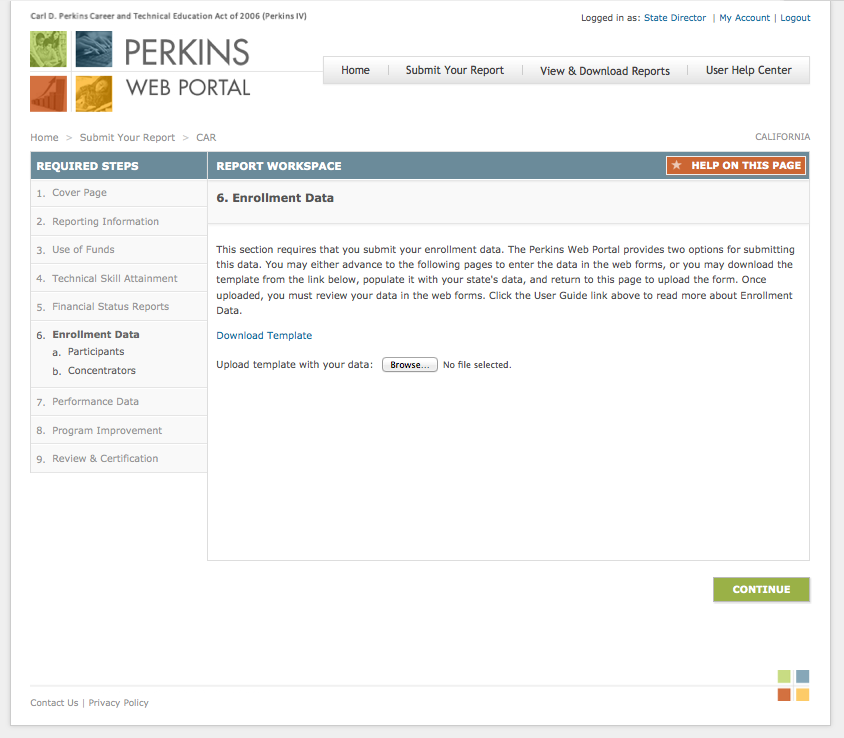

CAR

– Step 6. Enrollment Data

CAR

– Step 6. Enrollment Data

Instructions:

States

must provide enrollment data for students who are considered CTE

Participants and those who are considered CTE Concentrators.

Enrollment data are collected for secondary, postsecondary, and

adult students.

The

Perkins Web Portal provides two options for submitting this data:

You

may either advance to the following pages to enter the data in the

web forms; or

You

may download the template from the link provide, populate it with

your state's data, and return to this page to upload the form. Once

uploaded, you must review your data in the web forms.

1

2

2

Continues on next page

1

CAR

– Step 6a. Enrollment Data for CTE Participants

CAR

– Step 6a. Enrollment Data for CTE Participants

Instructions:

Each

cell on the student enrollment form must contain only one of the

following four options: a whole number, "0" (zero),

negative one "-1" (data not provided), or negative nine

"-9" (program not offered).

0

indicates that there are no students in the cell.

-1

means that the State attempted, but was unable, to obtain data from

its eligible recipients. "-1" will be counted as a "0"

in aggregated totals. All cells with "-1" must be

explained in the Additional Information block at the bottom of the

form.

-9

means the State does not offer the program. See

pages 24-25 for instructions on completing this form.

CAR – Step 6a. Enrollment Data for CTE Participants (Continued)

Instructions for completing this form:

Grand Total— Do not enter information in row 1. The grand total for each category of students will be automatically calculated by adding row 3 and row 4.

Gender— No information needs to be entered for this row. The gender count of participants enrolled in one or more State CTE approved courses.

Male— Enter unduplicated counts of male students enrolled in one or more State CTE approved courses for columns A–E.

Female— Enter unduplicated counts of female students enrolled in one or more State CTE approved courses for columns A–E.

Race/ethnicity (1997 Revised Standards)— No information needs to be entered for this row. The ethnicity count of the students enrolled in one or more State CTE approved course. States must use the 1997 standards for race and ethnicity.

Rows 6-13: Enter ethnicity counts for students enrolled in one or more State CTE approved courses for columns A–E. May contain a duplicated student enrollment count.American Indian or Alaskan Native— A person having origins in any of the original peoples of North and South America (including Central America), and who maintains a tribal affiliation or community attachment.

Asian— A person having origins in any of the original peoples of the Far East, East, Southeast Asia, or the Indian subcontinent including, for example, Cambodia, China, India, Japan, Korea, Malaysia, Pakistan, the Philippine Islands, Thailand, and Vietnam.

Black or African American— A person having origins in any of the Black racial groups of Africa.

Hispanic/Latino— A person of Cuban, Mexican, Puerto Rican, South or Central American, or other Spanish culture or origin.

Native Hawaiian or Other Pacific Islander— A person having origins in any of the original peoples of Hawaii, Guam, Samoa, or other Pacific Islands.

White— A person having origins in any of the original peoples of Europe, the Middle East, or North Africa.

Two or More Races— A person belonging to two or more racial groups.

Unknown (Postsecondary only)— A postsecondary student who does not self-identify a race and/or ethnicity on a local information collection.

Special Population and Other Student Categories— No information needs to be entered for this row. The special population count of the students enrolled in one or more State CTE approved courses. Unless otherwise noted, the following categories and definitions are described in section 3 of Perkins IV.

Rows 15–23: Enter

special population counts for students enrolled in one or more State

CTE approved courses. These rows may contain a duplicated student

enrollment count; for example, a student may be both "limited

English proficient" and "economically disadvantaged.”

CAR – Step 6a. Enrollment Data for CTE Participants (Continued)

Individual With Disabilities (ADA) (Postsecondary and adult only)— Individuals with any disability as defined in section 3 of the Americans with Disabilities Act of 1990 (ADA). Under section 3(2) of the ADA, the term "disability" means, with respect to an individual

a physical or mental impairment that substantially limits one or more of the major life activities of such individual;

a record of such an impairment; or

being regarded as having such impairment. (as described in paragraph ((3))

Disability Status (ESEA/IDEA) (Secondary only) – The term “disability status” as used in section 1111(h)(1)(C)(i) of ESEA refers to a “child with a disability,” which under section 9101 of ESEA has the same meaning as the term in section 1401 of the Individuals With Disabilities Education Act. Under section 1401(3) of the IDEA, the term “child with disability” means a child

with intellectual disabilities, hearing impairments (including deafness), speech or language impairments, visual impairments (including blindness), serious emotional disturbance (referred to in this chapter as “emotional disturbance”), orthopedic impairments, autism, traumatic brain injury, other health impairments, or specific learning disabilities; and

who, by reason thereof, needs special education and related services.

Economically Disadvantaged— Individuals from economically disadvantaged families, including foster children.

Single Parents— The term "single parents" includes single pregnant women.

Displaced Homemakers— Individuals who

have worked primarily without remuneration to care for a home and family and for that reason has diminished marketable skills; (ii) have been dependent on the income of another family member but is no longer supported by that income; or (iii) are a parent whose youngest dependent child will become ineligible to receive assistance under part A of title IV of the Social Security Act (42 U.S.C. 601 et seq.) not later than 2 years after the date on which the parent applies for assistance under this title; and

are unemployed or underemployed and are experiencing difficulty in obtaining or upgrading employment.

Limited English Proficient— Secondary school students, adults, or out-of-school youth who have limited ability in speaking, reading, writing, or understanding the English language, and

whose native language is a language other than English; or

who live in a family or community environment in which a language other than English is the dominant language.

Migrant Status— The term “migrant status” as used in section 1111(h)(1)(C)(i) of the ESEA is not defined; however, the Department strongly encourages a State to use the same definition of “migrant status” as a State uses in its annual State report card and as approved in its Consolidated State Accountability Workbook.

Nontraditional Enrollees— Occupations or fields of work, including careers in computer science, technology, and other current and emerging high skill occupations, for which individuals from one gender comprise less than 25 percent of the individuals employed in each such occupation or field of work.

Instructions: Each

cell on the student enrollment form must contain only one of the

following four options: a whole number, "0" (zero),

negative one "-1" (data not provided), or negative nine

"-9" (program not offered). 0

indicates that there are no students in the cell. -1

means that the State attempted, but was unable, to obtain data from

its eligible recipients. "-1" will be counted as a "0"

in aggregated totals. All cells with "-1" must be

explained in the Additional Information block at the bottom of the

form. -9

means the State does not offer the program.

Instructions

for completing this form: States

must provide an unduplicated count of CTE concentrators using the

16 career cluster categories recognized by OVAE and the National

Association for State Directors for Career and Technical Education

Consortium (NASDCTEc). The

most updated definitions of these areas and the Classification of

Instructional Programs (CIP) codes crosswalk can be found on the

Perkins Collaborative Resource Network (PCRN) web site at

http://cte.ed.gov/accountability/perkins-iv-crosswalks.

If

a program area or sequence of courses recognized by the State is

broader than one of the 16 career cluster areas or cuts across more

than one career cluster area, then the State must select the most

appropriate cluster in which to place the student. If the State

does not offer programs in one or more of the 16 career clusters,

please insert “-9” (program not offered) in that

column. If the State has a different name for a cluster, the State

should find the closest applicable of the 16 clusters in which to

place the student.

Prior

to Entering Data Into the Table

Assign the State CTE program

to the most appropriate career cluster. If a State CTE approved

program/sequence crosswalks to more than one career cluster, then

do one of the following:

identify

the most appropriate career cluster area for the program/sequence

of courses, or divide

the program/sequence of courses into different program sub areas

and assign each program sub area to its most appropriate career

cluster area; and Report

each student in only one career cluster area. If a student's

pro-gram/sequence of courses includes more than one career cluster

area the student should be included in the career cluster area for

which that program is most closely affiliated using the suggested

crosswalks.

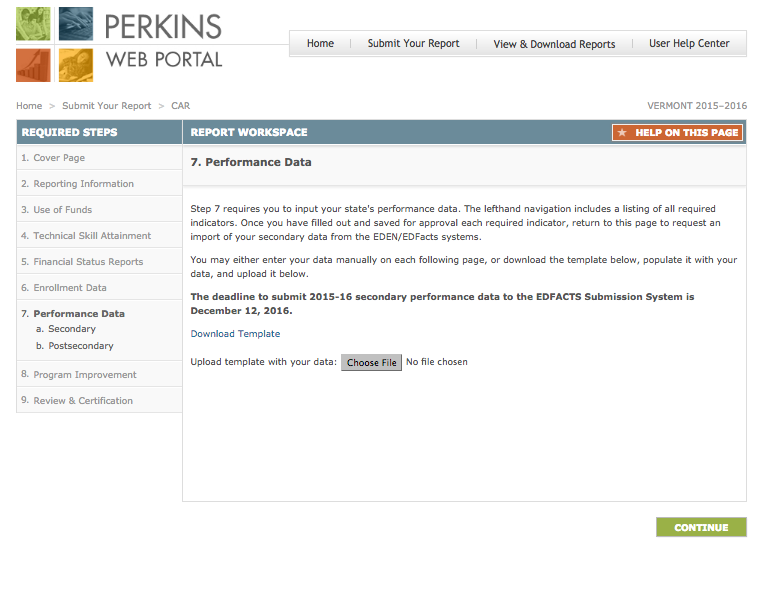

CAR

– Step 7. Performance Data

CAR

– Step 7. Performance Data

Instructions:

States

must provide performance data for the preceding program year. The

required indicators are displayed in the Step 7 navigation under

the applicable level (i.e. Postsecondary, Adult).

The

Perkins Web Portal provides two options for submitting this data:

You

may either advance to the following pages to enter the data in the

web forms; or

You

may download the template from the link provide, populate it with

your state's data, and return to this page to upload the form. Once

uploaded, you must review your data in the web forms.

Once

you have filled out and saved for approval each required indicator,

return to this page to request an import of your secondary data

from the EDEN/EDFacts system.

1

2

2

1

Continues on next page

CAR

– Step 7. Performance Data (Continued)

CAR

– Step 7. Performance Data (Continued)

Instructions: Each

cell on the student enrollment form must contain only one of the

following four options: a whole number, "0" (zero),

negative one "-1" (data not provided), or negative nine

"-9" (program not offered).

0

indicates that there are no students in the cell.

-1

means that the State attempted, but was unable, to obtain data from

its eligible recipients. "-1" will be counted as a "0"

in aggregated totals. All cells with "-1" must be

explained in the Additional Information block at the bottom of the

form.

-9

means the State does not offer the program. See

pages 29-30 for instructions on completing this form.

CAR – Step 7. Performance Data (Continued)

Instructions for completing this form:

Columns

Number of Students in the Numerator— Enter the total number of secondary career and technical education concentrators meeting the State's numerator definition for each population row.

Number of Students in the Denominator— Enter the total number of secondary career and technical education concentrators meeting the State's denominator definition for each population row.

State Adjusted Level of Performance— Do not enter data in column C. The State adjusted levels of performance will be automatically populated in the matrix.

Actual Level of Performance— Do not enter data in column D. The actual levels of performance will be automatically calculated.

Adjusted Versus Actual Level of Performance— Do not enter data in column E. The actual levels of performance will be automatically calculated by subtracting column D from column E.

Met 90 Percent of Adjusted Level of Performance— Do not enter data in column F. The column will automatically calculate and display a “Y” if at least 90 percent of the adjusted level of performance was met and an “N” if it was not met.

Rows

Grand Total— Do not enter information in third row. The grand total for each category of students will be automatically calculated.

Gender— No information needs to be entered for this row. The gender count of participants enrolled in one or more State CTE approved courses.

Male— Enter unduplicated counts of male students enrolled in one or more State CTE approved courses for columns A–E.

Female— Enter unduplicated counts of female students enrolled in one or more State CTE approved courses for columns A–E.

Race/ethnicity (1997 Revised Standards)— No information needs to be entered for this row. The ethnicity count of the students enrolled in one or more State CTE approved course. States must use the 1997 standards for race and ethnicity.

American Indian or Alaskan Native— A person having origins in any of the original peoples of North and South America (including Central America), and who maintains a tribal affiliation or community attachment.

Asian— A person having origins in any of the original peoples of the Far East, East, Southeast Asia, or the Indian subcontinent including, for example, Cambodia, China, India, Japan, Korea, Malaysia, Pakistan, the Philippine Islands, Thailand, and Vietnam.

Black or African American— A person having origins in any of the Black racial groups of Africa.

Hispanic/Latino— A person of Cuban, Mexican, Puerto Rican, South or Central American, or other Spanish culture or origin.

Native Hawaiian or Other Pacific Islander— A person having origins in any of the original peoples of Hawaii, Guam, Samoa, or other Pacific Islands.

White— A person having origins in any of the original peoples of Europe, the Middle East, or North Africa.

Two or More Races— A person belonging to two or more racial groups.

Unknown (Postsecondary only)— A postsecondary student who does not self-identify a race and/or ethnicity on a local information collection.

CAR – Step 7. Performance Data (Continued)

Special Population and Other Student Categories— No information needs to be entered for this row. The special population count of the students enrolled in one or more State CTE approved courses. Unless otherwise noted, the following categories and definitions are described in section 3 of Perkins IV.

Enter special population counts for students enrolled in one or more State CTE approved courses. These rows may contain a duplicated student enrollment count; for example, a student may be both "limited English proficient" and "economically disadvantaged.”

Individual With Disabilities (ADA) (Postsecondary and adult only)— Individuals with any disability as defined in section 3 of the Americans with Disabilities Act of 1990 (ADA). Under section 3(2) of the ADA, the term "disability" means, with respect to an individual

a physical or mental impairment that substantially limits one or more of the major life activities of such individual;

a record of such an impairment; or

being regarded as having such impairment.

Economically Disadvantaged— Individuals from economically disadvantaged families, including foster children.

Single Parents— The term "single parents" includes single pregnant women.

Displaced Homemakers— Individuals who

have worked primarily without remuneration to care for a home and family and for that reason has diminished marketable skills; (ii) have been dependent on the income of another family member but is no longer supported by that income; or (iii) are a parent whose youngest dependent child will become ineligible to receive assistance under part A of title IV of the Social Security Act (42 U.S.C. 601 et seq.) not later than 2 years after the date on which the parent applies for assistance under this title; and

are unemployed or underemployed and are experiencing difficulty in obtaining or upgrading employment.

Limited English Proficient— Secondary school students, adults, or out-of-school youth who have limited ability in speaking, reading, writing, or understanding the English language, and

whose native language is a language other than English; or

who live in a family or community environment in which a language other than English is the dominant language.

Nontraditional Enrollees— Occupations or fields of work, including careers in computer science, technology, and other current and emerging high skill occupations, for which individuals from one gender comprise less than 25 percent of the individuals employed in each such occupation or field of work.

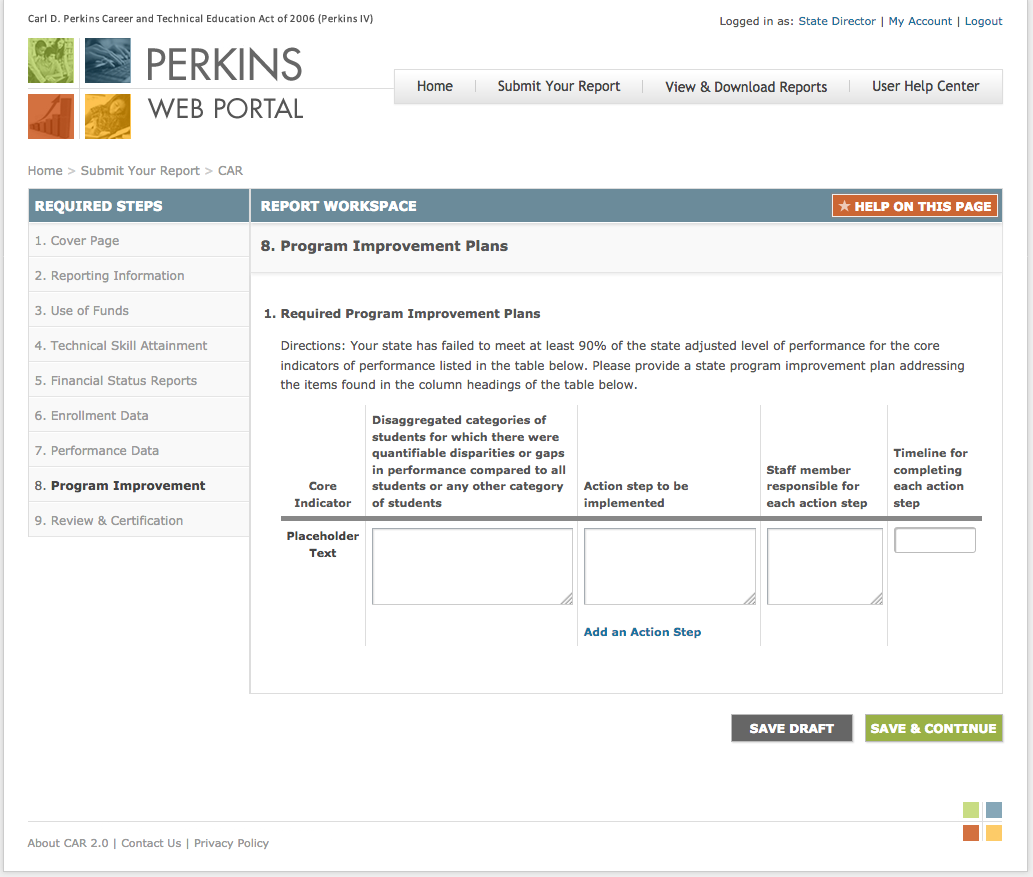

CAR

– Step 8. Program Improvement Plans

CAR

– Step 8. Program Improvement Plans

Instructions: If

your State failed to meet at least 90 percent of a State-adjusted

level of performance for any of the core indicators of

performance, this form will populate with the missed indicators.

Fill out the following fields:

Disaggregated

Categories—

List the disaggregated categories of students for which there

were quantifiable disparities or gaps in performance compared to

all students or any other category of students. Action

Steps—

Describe in detail the action steps that the State will

implement, beginning in the current program year, to improve the

State's performance on the core indicator overall and for the

categories of students for which disparities or gaps in

performance were identified. Staff

Responsible—

Provide the name of the staff member(s) in the State responsible

for each

action step. Timeline—

Enter a date for completion of each action step.

1

1

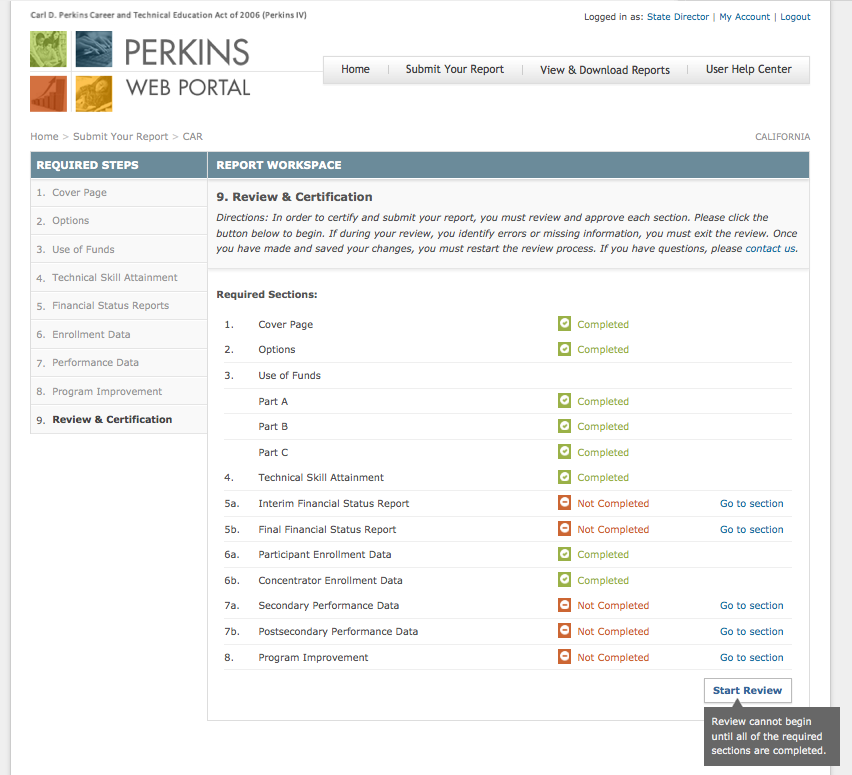

CAR

– Step 9. Review & Certification

CAR

– Step 9. Review & Certification

Instructions:

The

State Director must review and approve each section before the CAR

may be certified and submitted to OCTAE for review.

The

required sections and completion status are displayed on this page.

Click

Go

to section

to continue working on a section.

Review

cannot begin until all of the required sections are completed.

1

2

1

3

2

3

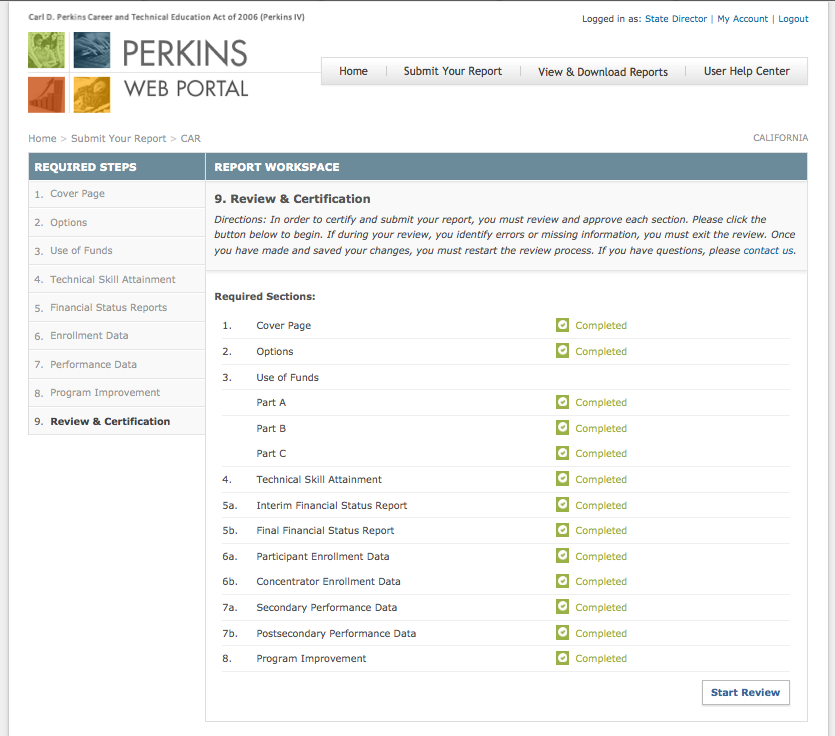

CAR

– Step 9. Review & Certification (Continued)

CAR

– Step 9. Review & Certification (Continued)

Instructions:

Click

Start

Review

once all of the required steps have been completed.

CAR

– Step 9. Review & Certification (Continued)

CAR

– Step 9. Review & Certification (Continued)

Instructions: Review

the information entered in each section.

If

during your review, you identify errors or missing information, you

must exit the review. Once you have made and saved your changes,

click Start

Review

to continue the review process.

If

complete and accurate information have been provided, click Approve

Section.

1

2

2

1

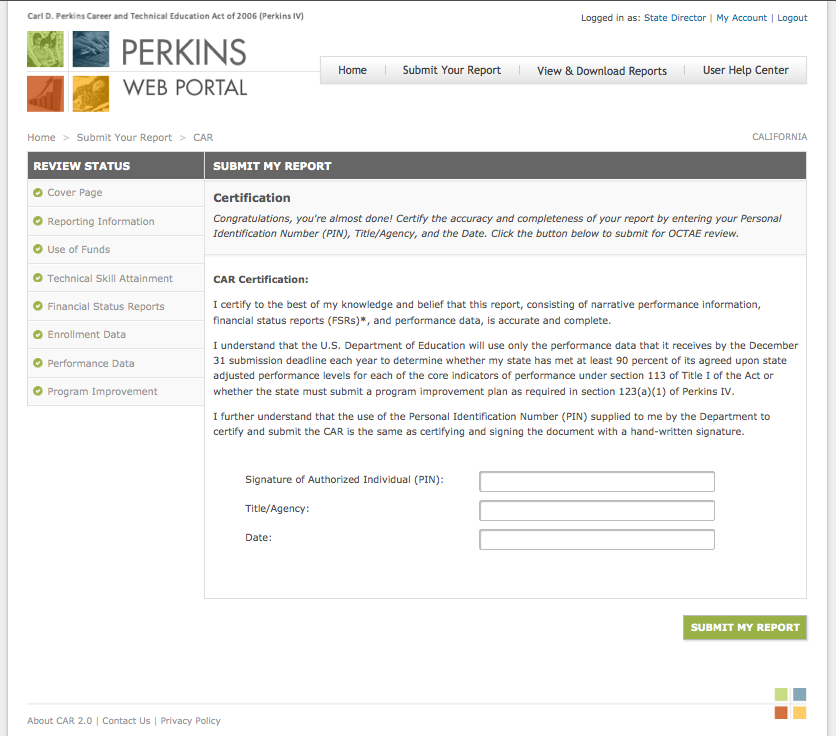

CAR

– Step 9. Review & Certification (Continued)

CAR

– Step 9. Review & Certification (Continued)

Instructions: Once

all of the required steps have been reviewed and approved, the

State Director must certify this form. Instructions

for obtaining a Personal Identification Number (PIN) will be

provided to State Directors separately. Click

Submit My

Report to

submit the report for OCTAE review.

The

report will become read-only once it has been submitted for OCTAE

review. During

OCTAE review, requests for revision may be emailed to the State

Director. At that time the steps requiring revision will be

available for editing.

Note

1

2

1

2

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Janell Scott |

| File Modified | 0000-00-00 |

| File Created | 2021-01-22 |

© 2026 OMB.report | Privacy Policy