Appendix 2: Review Choice Demonstration Home Health Design

CMS-10599 - Appendix 2 - Review Choice Demonstration HHS Design - 30-day.docx

Pre-Claim Review Demonstration For Home Health Services (CMS-10599)

Appendix 2: Review Choice Demonstration Home Health Design

OMB: 0938-1311

Appendix 2: Review Choice Demonstration for Home Health Services Design

Authority:

Section 402(a)(1)(J) of the Social Security Amendments of 1967 (42 U.S.C. 1395b-1(a)(1)(J)) authorizes the Secretary to develop demonstration projects that "develop or demonstrate improved methods for the investigation and prosecution of fraud in the provision of care or services under the health programs established by the Social Security Act” (the Act). Under this authority, CMS will implement a Medicare demonstration that establishes a review choice process for home health agencies (HHAs) to assist in developing improved procedures for the identification, investigation, and prosecution of Medicare fraud occurring among HHAs providing services to Medicare beneficiaries.

Background:

This demonstration will evaluate a review choice method that may assist with the investigation and prosecution of fraud in order to protect the Medicare Trust Funds from fraudulent actions and improper payments. CMS believes that this demonstration will-- (1) test the level of resources needed to implement a permanent review choice program for home health services; (2) determine the feasibility of performing the different claim review types to prevent payment for services that have historically had a high incidence of fraud; and (3) determine the return on investment of review choices for home health claims. This demonstration will support the program integrity strategy of moving toward a more effective, proactive strategy that identifies potential improper payments while offering providers greater choice and flexibility. CMS will analyze data from the demonstration to evaluate the impact on fraud in the demonstration states, which we believe will help assist in developing improved procedures for the identification, investigation, and prosecution of Medicare fraud occurring among HHAs providing services to Medicare beneficiaries and may consider if a more focused, risk based approach to pre-claim review is warranted in the future.

Design:

This demonstration will implement a 5-year review choice process for home health services in Illinois, Ohio, North Carolina, Florida, and Texas. It will begin in Illinois no earlier than December 10, 2018 and will be phased into the other states with at least 60 days’ notice before implementation. CMS and Palmetto GBA, the Medicare Administrative Contractor (MAC) for the demonstration states, will notify providers in each state prior to the start of the demonstration in the state.

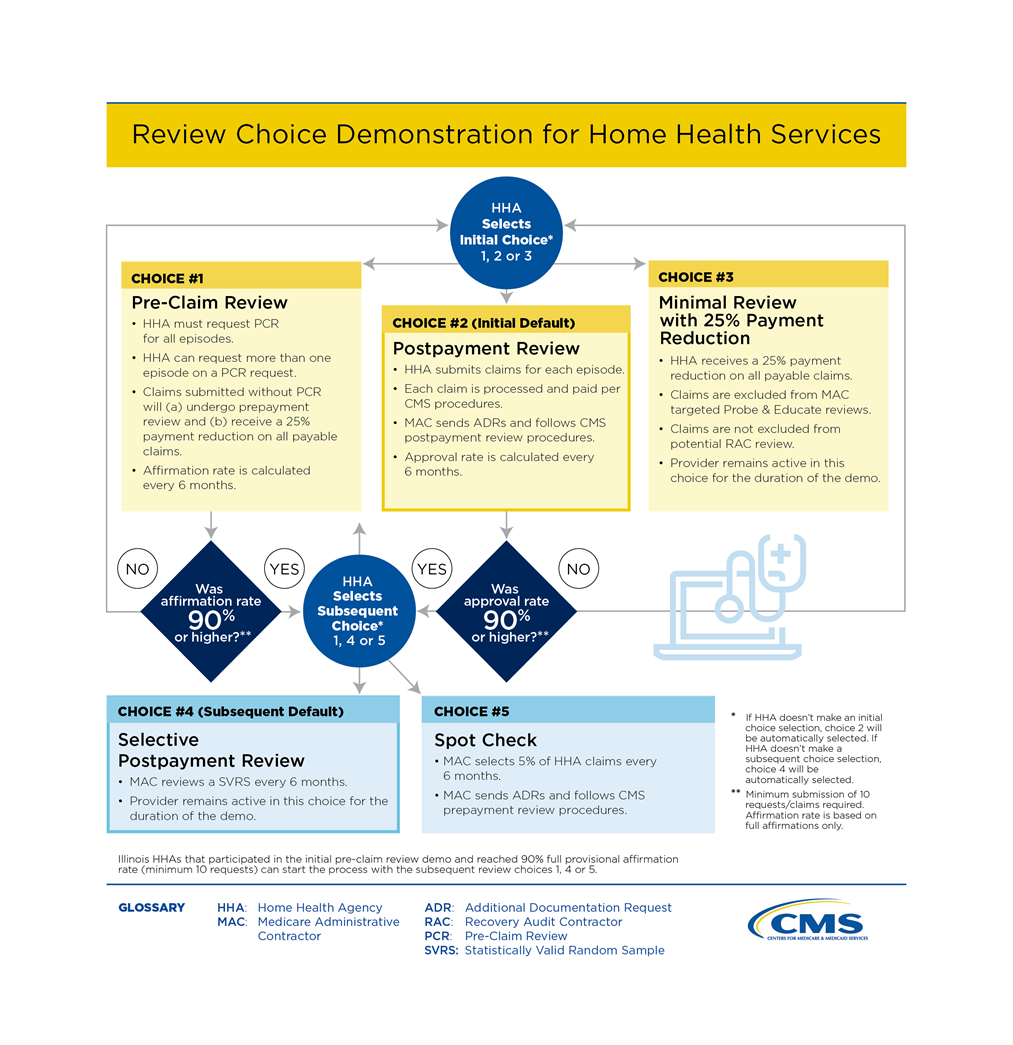

This demonstration will not create new clinical documentation requirements; rather, it only requires submission of the same information HHAs are already required to maintain. This will help guarantee that all relevant coverage and clinical documentation requirements are met. HHAs will have increased flexibility as they are able to choose their path to demonstrate compliance (see Attachment A for a flowchart of the different demonstration choices).

Under this demonstration HHAs will initially choose between three review options:

Choice 1: Pre-Claim Review,

Choice 2: Postpayment Review, or

Choice 3: Minimal review with a 25% payment reduction. (HHAs that choose this option will remain in this option for the duration of the demonstration regardless of their claim approval rate.)

CMS and Palmetto GBA will issue guidance on how HHAs can select their review choice. HHAs who do not actively choose one of the initial three review options will be automatically assigned to participate in the postpayment review option.

An HHA’s compliance determines their next step. Every 6 months, the provider’s pre-claim review affirmation rate or postpayment review approval rate will be calculated. If the provider’s rate is 90% or greater (based on a 10 request/claim minimum), the provider may choose from one of the three subsequent review options:

Choice 1: Pre-Claim Review,

Choice 4: Selective Postpayment Review, or

Choice 5: Spot Check Review.

HHA’s that do not actively choose one of the subsequent review options will automatically be assigned to participate in the selective postpayment review option, and will remain there for the duration of the demonstration.

If the provider’s rate is less than 90% or they have not submitted at least 10 requests/claims, the provider must again choose from one of the initial three options.

Illinois providers who previously participated in the Pre-Claim Review demonstration and have already reached the 90% target provisional affirmation rate (based on a minimum 10 requests submitted) can also choose from the three subsequent review options, and do not need to start in one of the initial three review options.

Initial Choices:

Choice 1: Pre-claim Review

If an HHA chooses to participate in pre-claim review, the HHA or the beneficiary initiates the pre-claim review process by submitting a pre-claim review request to the MAC with all relevant documentation based on applicable Medicare rules and policy requirements. The pre-claim review request may specify a specific number of episodes for the beneficiary.

The MAC will review the pre-claim review request to determine whether the home health service for the beneficiary complies with applicable Medicare coverage and clinical documentation requirements. The MAC will communicate a decision that provisionally affirms or non-affirms the request for approval for the services to both the HHA and the beneficiary. The MAC can affirm for the number of episodes requested by the HHA, or for a lesser number of episodes. For the initial submission of a pre-claim review request, the MAC will make all reasonable efforts to make and communicate a decision within 10 business days.

If a second pre-claim review request is resubmitted after a non-affirmative decision on an initial pre-claim review request, the MAC will have 20 business days to conduct a complex medical review and communicate a decision on whether the beneficiary meets all of the requirements for a provisional affirmative pre-claim review decision. The timeframes are consistent with other CMS prior authorization programs, and meeting these timeframes will become part of the MAC’s performance metrics.

Claims for which there is an associated provisional affirmative pre-claim review decision will be paid in full, so long as the home health claim was billed and submitted correctly. Absent evidence of possible fraud or gaming, claims will not be subjected to postpayment review by a MAC, Recovery Auditor Contractor (RAC), or the Supplemental Medical Review Contractor. Claims could still be selected for review based on potential fraud or for purposes of measuring the Medicare improper payment rate. Claims with an associated non-affirmative pre-claim review decision will be denied. Denied claims are afforded full appeal rights. Claims submitted without first receiving a pre-claim review decision will automatically be subjected to prepayment medical review. The claims will also be subject to a 25 percent payment reduction of the full claim amount if determined to be payable but where there is no associated pre-claim review request. Therefore, CMS recommends that HHAs submit claims for which there is an associated provisional affirmative pre-claim review decision with the unique tracking number (UTN) assigned by the MAC, or the HHA will run the risk of CMS denying the claim or the HHA incurring a payment reduction for that claim.

HHAs who choose this option will participate for 6 months, after which the HHA’s affirmation rate is calculated. The HHA’s compliance will determine their next step, as described above.

Choice 2: Postpayment Review

If the HHA chooses postpayment review of all of their claims, the HHA will follow its standard intake, service, and billing procedures, and the claims will pay according to normal claim processes. The MAC will conduct complex medical review on the claims submitted during a 6-month interval to determine whether the home health service for the beneficiary complied with applicable Medicare coverage and clinical documentation requirements. The MAC will send the HHA an additional documentation request (ADR) letter following receipt of the claim for payment.

HHAs who choose this option will participate for 6 months, after which the HHA’s approval rate is calculated. The HHA’s compliance will determine their next step, as described above.

Choice 3: Minimal Review with 25% Payment Reduction

If a HHA chooses minimal review with a 25% payment reduction, they will submit claims according to the normal claims process. Claims falling under this option will be excluded from regular MAC targeted probe and educate reviews, but may be subject to potential RAC review, in accordance with their regular review processes. The claims may also be subject to Unified Program Integrity Contractor (UPIC) review if fraud is suspected. Any denied claims will retain all normal appeal rights. HHAs will receive an automatic 25% reduction on all payable home health claims. The 25% payment reduction is non-transferrable to the beneficiary and is not subject to appeal. If a HHA chooses this option, they will remain in this option for the duration of the demonstration and will not have an opportunity to pick a different option later. This will allow for operational consistency amongst the review and payment of the provider’s claims.

Subsequent Choices:

Choice 1: Pre-Claim Review

The HHA may choose to begin or continue with pre-claim review, as described above.

Choice 4: Selective Postpayment Review

If the HHA chooses selective postpayment review, the claims will pay according to normal claim processes. The MAC will review a statistically valid random sample every 6 months. The MAC will send the HHA an ADR letter for claims being reviewed. The HHA will remain in this option for the remainder of the demonstration and will not have an opportunity to pick a different option later.

Choice 5: Spot Check Review

If the HHA chooses a spot check review, the MAC will randomly select 5% of claims for prepayment review every 6 months. The HHA may remain with this choice for the remainder of the demonstration as long as the spot check shows the HHA is compliant with Medicare coverage rules and policy. If the HHA is not in compliance, the HHA must again choose from one of the initial three review options.

Providers in all options will be subject to continued monitoring of their billing by the MAC. For example, the MAC will monitor the number of Requests for Anticipated Payments (RAPs) that are submitted and subsequently cancelled. These cancellations should be rare. The MAC will monitor those rates and if a HHA has a high cancellation rate, the MAC will suppress payment on their RAPs. The MAC will also conduct data analysis of the HHA’s billing behavior, and if they notice billing anomalies, the MAC can conduct additional educational with the provider. If the MAC suspects that an HHA in any of the demonstration choices is engaging in fraudulent behavior, the MAC will refer the provider to the UPIC.

Additional Information:

Additional information about the implementation of the review choice demonstration is available on the CMS website at: home health demonstration website. Questions regarding the demonstration should be sent to [email protected].

Attachment A:

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | DANIELLE CHESTANG |

| File Modified | 0000-00-00 |

| File Created | 2021-01-20 |

© 2026 OMB.report | Privacy Policy