Declaration Submission Form for Critical Technology Pilot Program

Regulations Pertaining to Mergers, Acquisitions and Takeovers by Foreign Persons

Declaration Submission Form Guidelines 11.5.18

Declaration Submission Form for Critical Technology Pilot Program

OMB: 1505-0121

Guidelines for Completing the Declaration Submission Form for

Critical Technology Pilot Program

Any party filing a declaration pursuant to 31 CFR 801.401 must submit the declaration in accordance with the instructions below.

Technical Submission Instructions

The party or parties must respond to each item on the Declaration Submission Form, which is available at: https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius, by typing the relevant information. As specified on the Declaration Submission Form, parties are required to submit certain attachments. Technical instructions for attaching documents are provided below. With respect to the certification required pursuant to 31 CFR § 801.403, parties must print and sign the form, which is available at: https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius, and attach a scanned copy prior to submitting the Declaration Submission Form. All Declaration Submission Forms must be submitted by email to CFIUS at: [email protected].

How to Attach Files to a PDF in Adobe Acrobat:

Adobe Acrobat Pro 2017:

Newer versions of Adobe Acrobat provide the ability to attach files within a PDF. There are two options to attach files to a PDF utilizing Acrobat Pro 2017.

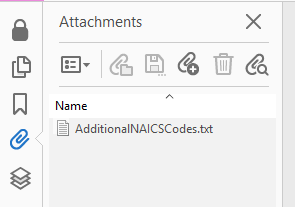

Use the Attachments panel to add, delete, or view attachments.

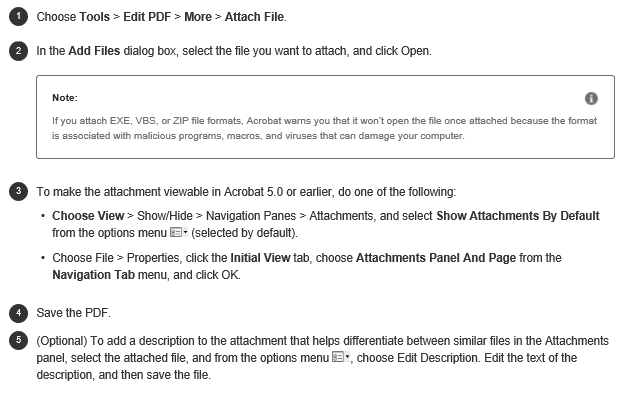

Follow these steps to add attachments.

Other versions of Adobe Acrobat:

For other versions of Adobe Acrobat, including Acrobat Reader DC, the ability to embed attachments within a PDF is not available. Attach additional files as you normally would to an email submission.

To download a free version of Acrobat Reader DC, click here. https://get.adobe.com/reader/

To learn more about Acrobat Reader DC, click here. https://helpx.adobe.com/acrobat/user-guide.html

For Adobe Acrobat Frequently Asked Questions, click here. https://helpx.adobe.com/reader/faq.html

NOTE: The following office macro-enabled extensions are blocked by Adobe and cannot be attached to the Declarations template.

.xlsm, .xlsb, .xlm, .xltm, .xla, .xlam,.xll // Excel macro enabled extensions

.docm, .dotm, .docb // Word macro enabled extensions

.pptm, .potm, .ppam, .ppsm, .sldm // Power Point

.accde, .accdr // Access

Guidance for Responding to the Declaration Submission Form Questions

The guidance below may be helpful for parties in completing the Declaration Submission Form:

1. Parties must list the full business names or legal person names of all parties to the transaction, separated by semicolons.

2. Parties should only respond “yes” if all parties to the transaction are submitting the declaration jointly and are certifying that the information contained in the declaration is consistent with § 800.202. Note that if the response to Question 2 is “no,” per § 801.403(b), the Committee may, at its discretion, request that the parties to the transaction file a written notice of the transaction under § 801.501, if the Staff Chairperson determines that the information provided by the submitting party in the declaration is insufficient for CFIUS to assess the transaction.

3. Parties should provide contact information for the pilot program U.S. business for purposes of communicating directly with CFIUS. In many cases this will be the name of legal counsel representing the pilot program U.S. business for the purposes of this declaration. Parties may also list the email address for a secondary point of contact if desired.

4. Parties should provide contact information for the foreign person for purposes of communicating directly with CFIUS, including receiving letters from CFIUS. In many cases this will be the name of legal counsel representing the foreign person for the purposes of this declaration. Parties may also list the email address for a secondary point of contact, if desired. If this contact is the same as for the pilot program U.S. business, the information should be repeated in this section.

5. Parties should provide a one- or two-word description of the structure of the transaction, such as “share purchase,” “merger,” or “asset purchase.”

6. Parties should provide the total percentage of voting interest acquired by the foreign person of the pilot program U.S. business as a result of the transaction.

7. Parties should provide the total percentage of economic interest acquired by the foreign person of the pilot program U.S. business as a result of the transaction.

8. Parties should respond “yes” if there are multiple classes of ownership, irrespective of whether all classes have voting rights.

9. Parties should provide the total transaction value of the particular transaction notified in this declaration in U.S. dollars.

10. Parties should provide the expected completion date, as defined in § 801.202.

11. Parties should describe the nature of the transaction, including any details necessary to understand the roles of the parties, transaction structure, and its purpose and scope.

12. Parties should include all sources of debt or equity financing for the transaction, including banking institutions, government financing, or other sources.

13. Parties may stipulate that the transaction is a pilot program covered transaction by selecting “yes.” Selecting “no” indicates that the parties are not stipulating one way or the other, or that the parties do not agree among themselves to the stipulation.

14. Parties may stipulate that the transaction could result in control of a pilot program U.S. business by a foreign person by selecting “yes.” Selecting “no” indicates that the parties are not stipulating one way or the other, or that the parties do not agree among themselves to the stipulation.

15. Parties may stipulate that the transaction is a foreign government-controlled transaction by selecting “yes.” Selecting “no” indicates that the parties are not stipulating one way or the other, or that the parties do not agree among themselves to the stipulation.

16. If the parties respond “yes” to any of Questions 13-15, the parties must provide an explanation of the basis for each stipulation made. If one or more, but not all, parties to the transaction provide a stipulation in Questions 13-15, please provide an explanation. If the parties respond “no” to all of the Questions 13-15 parties must explain why they are submitting a declaration pursuant to § 801.401(a).

17. Parties must select “yes” or “no” with respect to whether the foreign person will acquire the rights listed in Question 17.

18. If the parties respond “yes” to acquiring any of the rights listed in Question 17, the parties must provide an explanation for each affirmative response. If the parties respond “no” to all the subparts of Question 17, parties must explain here why they are submitting a declaration pursuant to § 801.401(a).

19. Parties should provide only the primary Web site address for the pilot program U.S. business. If the pilot program U.S. business does not have a Web site address, indicate “N/A” in response to 19(a). The responses to 19(c) and 19(d) may be the same in some cases. Each response should each include only one address. Please see Treasury’s Web site at: https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius for the template for submitting information required in 19(e).

20. Parties should provide a brief summary of the business activities of the pilot program U.S. business and its subsidiaries as typically described in annual reports, and the product or service categories of each with applicable six-digit NAICS codes. A “subsidiary” of a pilot program U.S. business is any entity with respect to which the U.S. pilot program business is a “parent” as defined in § 800.219.

21. Parties must list at Question 21 all critical technologies of the pilot program U.S. business as defined in § 801.204. The name of the critical technology in the first column should be a descriptive term or terms for reference. In the second column, parties must provide the corresponding classification or categorization for each critical technology under the relevant authority listed at § 801.204 (for example, the Export Control Classification Number, U.S. Munitions List category, identification as a select agent or toxin, etc.). Parties must also provide, in the third column, one or more six-digit NAICS code(s) for each critical technology per § 801.213. For pilot program U.S. businesses with more than three critical technologies, the additional responses to this question must be provided in a separate template available on Treasury’s Web site at: https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius.

22. Parties must select “yes” if the pilot program U.S. business has any contracts (including any subcontracts, if known) that are currently in effect or were in effect within the past three years with any U.S. Government agency or component, or in the past 10 years if the contract included access to personally identifiable information of U.S. Government personnel.

23. Parties must select “yes” if the pilot program U.S. business has any contracts (including any subcontracts, if known) that are currently in effect or were in effect within the past five years involving information, technology, or data that is classified under Executive Order 12958, as amended.

24. Parties must select “yes” if the pilot program U.S. business has received any grant or other funding from the Department of Defense or the Department of Energy, or participated in or collaborated on any defense or energy program or product involving one or more critical technologies or pilot program industries within the past five years.

25. Parties must select “yes” if the pilot program U.S. business participated in a Defense Production Act Title III Program (50 U.S.C. 4501 et seq.) within the past seven years.

26. Parties must select “yes” if the pilot program U.S. business has received or placed priority rated contracts or orders under the Defense Priorities and Allocations System (DPAS) regulation (15 CFR part 700) within the past three years.

27. If the parties responded “yes” to Question 26, list the levels of the priority rated contracts or orders.

28. Parties must provide the full legal name of the ultimate parent of the foreign person, as the term “parent” is defined in § 800.219. Provide the name of the foreign person that is a party to this transaction if no entity or person is a parent of the foreign person within the meaning of § 800. 219.

29. The organizational chart must include, without limitation, information that identifies the name, principal place of business and place of incorporation or other legal organization (for entities), and nationality (for individuals) for each of the following: (i) the immediate parent, the ultimate parent, and each intermediate parent, if any, of each foreign person that is a party to the transaction; (ii) where the ultimate parent is a private company, the ultimate owner(s) of such parent; and (iii) where the ultimate parent is a public company, any shareholder with an interest of greater than five percent in such parent.

30. Parties must respond “yes” for any direct or indirect ownership interests and/or rights of any foreign government in the foreign person’s ownership structure.

31. If the parties responded “yes” to Question 30, provide as an attachment information regarding all foreign government ownership in the foreign person’s ownership structure, including nationality and percentage of ownership, as well as any rights that a foreign government holds, directly or indirectly, with respect to the foreign person.

32. Parties should provide a brief summary of the business activities of the foreign person and any of its parents, as applicable, as typically described in annual reports.

33. Parties should respond “yes” if any party to the transaction has previously been a party to another transaction previously notified or submitted to the Committee, even if the case or declaration was withdrawn and abandoned.

34. If the parties responded “yes” to Question 33, the parties should list all case or declaration numbers assigned by the Committee for all prior transactions.

35. The parties should respond “yes” if the pilot program U.S. business, the foreign person, or any parent or subsidiary of the foreign person has been convicted in the last ten years of a crime in any jurisdiction, including foreign jurisdictions. A “subsidiary” of a foreign person is any entity with respect to which the foreign person is a “parent” as defined in § 800.219.

36. If the parties responded “yes” to Question 35, the parties should identify the person convicted of the crime and provide an explanation, including the relevant jurisdiction and criminal case law number or legal citation.

37. Parties must respond “yes” to certifying that the information is consistent with § 800.202, in accordance with the requirements of § 801.403(d), in order to submit a complete declaration.

38. Each party to a transaction filing a declaration must provide a certification of the information contained in the declaration consistent with § 800.202. The certification must be signed by the chief executive officer or other duly authorized designee of each party to a transaction filing a declaration. Sample certifications may be found on Treasury’s Web site at: https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Joseloff, Benjamin |

| File Modified | 0000-00-00 |

| File Created | 2021-01-20 |

© 2026 OMB.report | Privacy Policy