Supporting Statement, Appendix B

5. Supporting Statement, Appendix B 5-22-19.docx

H-2A Temporary Agricultural Labor Certification Program

Supporting Statement, Appendix B

OMB: 1205-0466

H-2A Temporary Agricultural Labor Certification Program

OMB Control No. 1205-0466

April 2019

APPENDIX B

SUPPORTING STATEMENT

H-2A Temporary Agricultural Labor Certification Program

OMB Control Number 1205-0466

Public Comment Responses

This is an appendix to the Office of Management and Budget’s (OMB) Supporting Statement for the collection of information under the H-2A H-2A Temporary Agricultural Labor Certification Program, OMB Control Number 1205-0466, which includes application forms and general instructions. This document is to be reviewed in conjunction with in Question 8 of the Supporting Statement. This appendix includes a summary of all public comments received in response to the 60-day Federal Register Notice (FRN) the Department of Labor’s (Department) Employment and Training Administration (ETA), Office of Foreign Labor Certification (OFLC) published in the Federal Register on October 25, 2018 (83 FR 53911). The Department received 17 responses to its solicitation of comments in the 60-day FRN, many of which included several consolidated comments. One of these responses was submitted by a group of 13 agricultural advocacy organizations, hereinafter referred to as “the combined worker advocacy organizations.” Two of the comments received discussed issues that are outside the scope of this ICR. Other commenters made specific suggestions on topics related to this ICR, but the suggestions would require rulemaking and, therefore, are beyond the scope of this ICR. The comments have been considered, summarized, and addressed in this document.

Support for the Department’s Proposed Revisions

Some of the commenters expressed general support for the Department’s proposed revisions, while others expressed support for specific proposals. Two commenters noted that they “supported efforts to streamline information collections and eliminate redundancy.” One of the commenters expressed appreciation for the Department’s elimination of “redundancy in the filings with the State Workforce Agencies [SWAs].” The other commenter stated that the proposals constitute “a much-appreciated effort to modernize, streamline, and generally improve the application filing process” by eliminating the “repetition and redundancy of submitting information, particularly on non-compatible forms, requiring manual entry of the same information two or more times.” Several other commenters expressed support for proposals in specific sections or fields of the forms.

The Department appreciates the commenters’ acknowledgement of the reorganized information collection to aid the Department in its administration of the H-2A program. As mentioned in its 60-Day FRN, the Department is proposing to streamline its current collection of information, and better clarify existing employer obligations required by the Department’s 2010 H-2A Final Rule.1 See 20 Code of Federal Regulations (CFR) 655, Subpart B. The proposed form revisions provide standardized formats for the collection of information required by the Department’s H-2A regulations at 20 CFR 655, Subpart B, to reduce employer time and burden preparing applications, and promote greater efficiency and transparency in OFLC’s review and issuance of temporary labor certification decisions under the H-2A visa program. The Department emphasizes that these proposed revisions do not create new obligations for employers; rather, they reiterate and support compliance with existing regulatory requirements. As a result, the Department has determined that it will retain the majority of its proposed revisions. However, the Department has made some modifications to its original proposal in response to public comments requesting clarifications to the proposed information collection. This document discusses in detail the Department’s decisions with respect to the modifications made to its proposed collections.

One commenter commended the Department’s efforts to streamline and modernize the forms, but recommended the Department further reduce information collections to ensure collection of only the information required by the Immigration and Nationality Act (INA). The Department appreciates the comment, but it has determined that the proposed and revised forms collect from H-2A employers only the minimally required information to determine program eligibility and allow OFLC to administer the H-2A labor certification program.

Burden Imposed by the Department’s Proposed Revisions

Two commenters expressed concerns with the Department’s estimates of the burden these Information Collection Request (ICR) proposals will impose on an employer. One of the commenters stated that the “projected estimated number of applications does not reflect the actual, or expected increases in the number of applications being filed.” This commenter also stated that the “estimated time for completion also does not reflect total time involved in generating the information to complete the form,” and that “most employers hire additional help for form completion, legal review… (averages $250.00/ application), and to track the application throughout the process to secure approval by the 4 government agencies.” The other commenter suggested the Department project application increases of 10 to 20 percent due to “unemployment rates at all-time lows within the ‘normal’ agricultural workforce, an aging U.S. farmworker population, and robust immigration related enforcement strategies.” This commenter was also concerned that the time burdens estimated by the Department are too low, stating that the 5.96 hour figure “does not appear to include” Notice of Deficiency (NOD) “response time” and may not account for the time required to develop the application. Finally, this commenter suggested “an estimate should be included for” Agricultural Recruitment System (ARS) “Clearance Order applications in addition to ‘H-2A submissions.’”

The Department explained in the 60-Day FRN Supporting Statement its methodology for estimating the number of applications, which was based on actual program filing data, compiled for the past three years. The Department also thoroughly assessed the overall burden associated with filing the Forms ETA-790/790A, including its addenda (i.e., ARS Clearance Order), and ETA-9142A, including its appendix, and employers responses to NODs, and provided a detailed breakdown of the estimated burden associated with each. The burden estimates represent an average of all responses based on OFLC’s experience processing applications, including both simple and complex applications and both first filings using the collection and recurring filings in subsequent years. Regarding the burden of completing the proposed forms, the Department's electronic filing system will continue to allow for re-use of data entered in prior applications, which significantly reduces the time burden associated with employers completing more complex applications (e.g., applications with large numbers of worksites, crop activities, or wages) that are typically reused in subsequent filings.

Several other commenters expressed concerns about the data entry burden associated with completing the proposed Form ETA-790A addenda (e.g., worksite, crop activity, and wage information), which the Department addresses in the specific sections below. However, these commenters did not provide specific input for the Department to consider regarding the current burden and cost estimates. The Department has revised the burden figures, as appropriate, to accommodate changes made in response to comments received for the 60-Day FRN. During the 30-day comment period, the public may submit further comments about the burden estimates to the attention of OMB as instructed by the Federal Register notice.

The Department’s Authority to Revise the H-2A Forms

Three commenters asserted that the Department’s proposed collection of information is not legally required or does not reflect statutory or regulatory language, and should not be collected unless the Department engages in rulemaking. The Department respectfully disagrees with the commenters and maintains that its proposed changes do not alter employers’ substantive legal obligations under the INA and the Department’s accompanying regulations. Therefore, neither regulatory nor statutory amendments are necessary, as the revisions contained in this ICR are within the Department’s existing authority to administer the H-2A temporary labor certification process. Form changes under the Department’s existing authority do not require the Department to engage in rulemaking under the Administrative Procedure Act (APA) and its associated notice and comment process. Rather, the Department has made available its proposed revisions for public inspection, as mandated by and in compliance with the PRA and its notice and comment process. The Department’s proposal better organizes the collection of information in more usable and efficient formats, and codifies information it currently receives from employers as paper-based attachments into new standardized forms and associated appendices. The Department believes its proposed revisions, in response to all public comments received, will facilitate a proper disclosure of the material terms and conditions of employment, reduce employer confusion about H-2A regulatory requirements, and improve the accuracy, completeness, and quality of information received.

Two commenters asserted that the Department exceeded its authority because it failed to provide sufficient space in the proposed Form ETA-790/790A or permit adequate upload functionality for attachments, which impedes the employer’s ability to describe the terms and conditions of employment fully and accurately. The commenters claimed that these limitations effectively result in the Department proscribing terms and conditions that make the job “more attractive to U.S. workers.” One of these commenters recommended the Department “allow employers . . . to provide details regarding material job requirements and duties.”

As discussed in response to the comments above, the Department proposes a new Addendum C, which will allow employers to disclose, fully and completely, additional information concerning the material terms and conditions of the job offer. The Department also reminds the commenters that this ICR relates to an employer’s request for nonimmigrant workers, as well as the materials terms and conditions of employment, including those relating to wages, working conditions, and other benefits, that facilitate the recruitment of U.S. workers and issuance of temporary labor certifications under the H-2A program. To that end, the Department’s proposed Form ETA-790/790A is designed to collect the material terms and conditions in a more uniform and electronic format that can most effectively advertise the employer’s job offer to prospective U.S. workers within a multi-state region of traditional or expected labor supply, as required by the INA.

The Department’s Proposed Changes to the Form ETA-9142A and General Instructions

General Comments

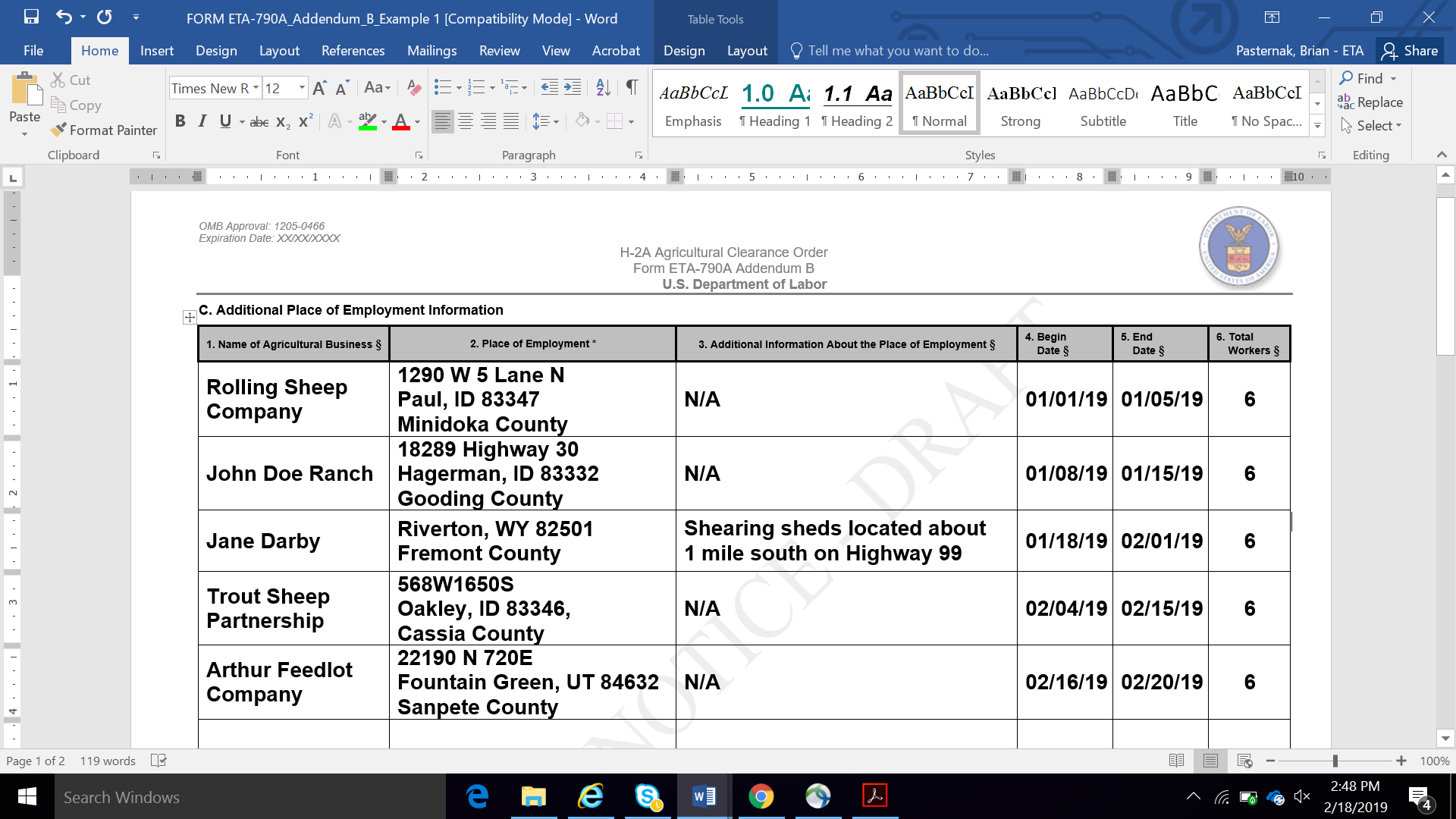

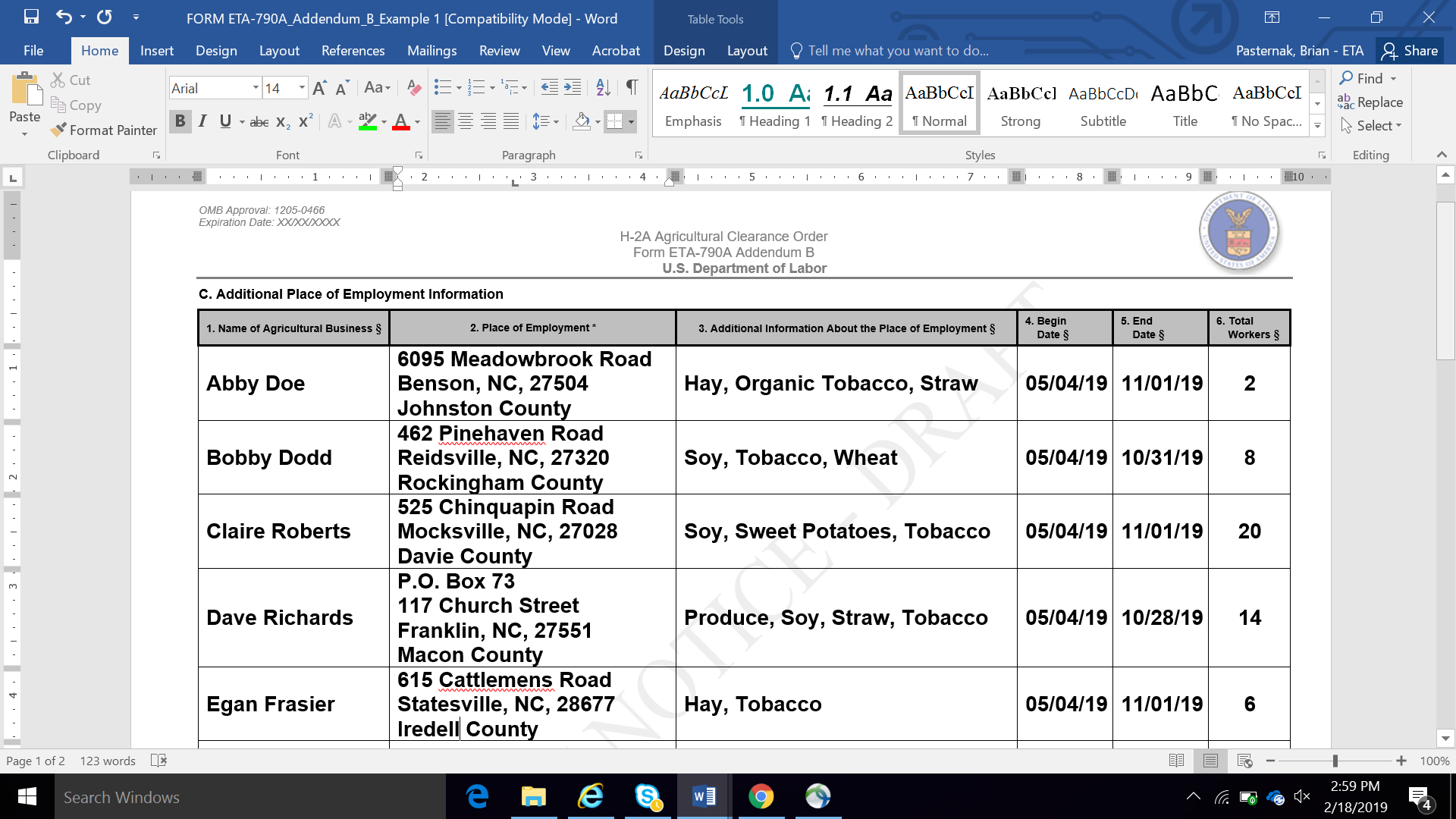

One commenter commended the Department for “accommodat[ing] joint employers,” but expressed a concern that the Form ETA-9142A does not appear to include a section in which all employers seeking to jointly employ a worker can be identified. The commenter recommended the Department propose an additional addendum to collect joint employer information. The Department appreciates the comment, but declines to make the requested modification. This application filing situation arises when two or more individual employers, who are operating in the same area of intended employment, have a shared need for the worker(s) to perform the same agricultural labor or services during the same period of employment, but each employer cannot guarantee full-time employment for the worker(s) during each workweek. In this situation, any one of the joint employers may file the Form ETA-9142A by marking “Joint Employer” in Field A.1 and then completing the employer information (Section B) and employer point of contact information (Section C) sections. To identify the other employers who will jointly employ the worker(s), the employer will mark “Yes” in Field C.7 on the Form ETA-790A and complete all applicable fields on the Addendum B to identify the other employer(s) that seek to jointly employ the worker(s). The collection of this information, coupled with the signed ETA-9142A, Appendix A, from each employer provides sufficient information for the Department to identify and review applications from joint employers.

One commenter recommended the Department include on the Form ETA-9142A additional fields or spaces for an employer to “enter a statement of temporary need as well as other details … [like] a small employer’s request for exemption to the ‘50% rule’…” The Department appreciates the commenter’s concern, but declines to make the requested modification. Employers seeking a small farm exemption to the 50 percent rule, as permitted by the INA at 8 U.S.C. 1188(c)(3)(B)(ii), can disclose their requests directly on the Form ETA-790A by using the new Addendum C. The Form ETA-790A is the most appropriate form to collect this request because the SWAs use this form to facilitate the interstate recruitment U.S. workers through the ARS, as required by the INA. No additional form or attachments are necessary for employers to identify a small farm exemption to the 50 percent rule.

The combined worker advocacy organizations recommended the Department add a question on the Form ETA-9142A “that require[s] the employer, or its attorney or agent . . . to provide the identity and address of any recruiter or agent” that it “hired, who has received compensation, and/or who is reasonably known . . . to be helping in efforts to identify, recruit, or hire” foreign workers. The commenters also recommended the Department include a question that collects information on “the identity and location of all persons and entities hired by, working for, or reasonably known . . . to be helping the recruiter or agent, and any agents or employees of those persons and entities, to identify, recruit, or hire” foreign workers. The commenters also recommended the Department “affirmatively require[e]” attorneys and agents to confirm “that they, or any persons used by them to recruit H-2A workers, have complied with the no-fees requirements of [20] CFR § 655.135(j) and (k).” The commenters stated that this information “is necessary to protect H-2A workers from unlawful fees” and to “ensure that DOL is fulfilling its statutory responsibilities in the H-2A certification process . . . .” More specifically, they stated the information is necessary to “enforcement of [the] prohibition against recruitment fees” and they note that “illegal fees is a common problem in the H-2A program . . . .”

The Department understands the commenters’ concerns, but declines to make the requested modifications. The proposed Form ETA-9142A, Appendix A, already includes the assurances about prohibited fees, payments, etc., required by regulation. Appendix A, Items B.11 and B.12 reflect the regulatory language at 20 CFR 655.135(j) and (k). See Form ETA-9142A, Appendix A, Assurance Items B.11 and B.12. To collect specific, detailed information about foreign recruiters, or to expand the B.11 and/or B.12 assurance language, would require rulemaking and is beyond the scope of this ICR.

Section A – Nature of H-2A Application

One commenter expressed concern that Field A.4 is “ambiguous and certain to lead to considerable confusion.” The commenter stated that it does not make sense for the Department to remove the Statement of Temporary Need field from this section and instead require this information in a separate attachment, given the Department is proposing to prohibit submission of attachments in response to the collection of most other information on the forms. The commenter stated that the instructions for completing the field also are ambiguous and confusing because they appear to indicate that an employer need not include a Statement of Temporary Need if “the nature of the employer’s need is clearly seasonal,” but do not indicate what might qualify as “clearly seasonal.” The commenter recommended the Department “promulgate specific guidelines explaining how and why such employers are entitled to such deference to the exclusion of others.” More specifically, the commenter recommended the Department “clearly specify its criteria and methodology in the instructions so that employers are apprised as to when it will require a statement of temporary need.” The commenter also stated that an exclusion of some employers from the requirement to describe temporary need would be “entirely unfair and inequitable” because it would “treat some industries as ‘clearly’ seasonal while imposing additional burdens of proof on other industries . . . .” The commenter concluded that such a proposal would be “contrary to law” and would constitute “de facto rulemaking that requires public notice and comment . . . .”

The commenter is correct that the Department proposes to eliminate certain attachments in this ICR. However, the Department’s prohibition on employer submissions of free-form attachments is limited to the Form ETA-790A, as it serves to collect all essential job-related information in a standardized format for circulation within the ARS, as discussed in greater detail below. In contrast, the Department has not proposed eliminating all attachments to the Form ETA-9142A. The Department’s proposed Form ETA-9142A permits employers to submit attachments to justify responses to certain collection fields on the form, such as supporting documentation required by regulation for H-2ALCs or copies of agreements for agents authorized to represent employers identified on the form. Like the other attachments to the Form ETA-9142A, a statement of temporary need attachment may be necessary for an employer to show that its application for temporary employment certification meets all statutory and regulatory criteria for certification.

Although the Department disagrees with the commenter’s assertion that the ICR impermissibly exempts a certain class of employers from showing their need qualifies as seasonal or temporary under the regulatory standard, the Department is proposing minor modifications to the General Instructions, Form ETA-9142A, to clarify the proposed collection of temporary need information. OFLC will continue to review an employer’s temporary or seasonal need for workers as part of the labor certification review. However, the vast majority of employers using the H-2A visa program do so on a predictable and recurring seasonal agricultural growing cycle, and many of these job opportunities were previously granted labor certification and do not employ workers to perform the services or labor in other months or seasons of the calendar year. Thus, the nature of the need for the services or labor to be performed has been and may continue to be determined temporary due to the unique nature of the agricultural industry.

Further, much of the information that is reviewed by OFLC to determine temporary need, such as a description of the employer’s business, period of employment, number of workers needed, and the temporary services required, is already collected on other parts of the Forms ETA-9142A and ETA-790/790A without the need for additional explanation or supporting documentation. Generally, such information will be consistent with OFLC’s experience related to that agricultural crop or commodity’s recurring growing cycle in that local or regional area and the employer’s recent filing history. Requiring all employers to enter additional information in the form of a statement of seasonal or temporary need would be unnecessary for OFLC’s determination in many cases. However, for employers who have a need for workers other than seasonal (e.g., one-time occurrence based on extraordinary circumstance), OFLC’s experience demonstrates that additional documentation submitted with the Form ETA-9142A, at the time of filing, is necessary to better determine whether the nature of the employer’s need is temporary. The Department will clarify in the General Instructions, Form ETA-9142A, that where information about the employer’s job opportunity or the nature of its seasonal or temporary need changes or is unclear and requires further explanation, OFLC will continue to issue a NOD requesting an additional explanation or supporting documentation during application review. The proposed General Instructions were intended to permit employers to initially omit a statement of seasonal or temporary need if the employer believes it would provide redundant information; they were not intended to exempt any employer from demonstrating a seasonal or temporary need.

Finally, the Department reminds the commenter that USCIS collects substantially similar information regarding temporary or seasonal need at the time the employer files the petition. The DHS regulations and the Department regulations use the same definition of temporary or seasonal need. See 8 CFR 214.2(h)(5)(iv)(A); 20 CFR 655.103(d). Unlike other aspects of the Department’s H-2A labor certification, DHS does not treat the Department’s temporary need determination as final.2 Rather, the DHS regulations provide that the Department’s finding that an employer’s need is temporary or seasonal “is normally sufficient” for the purpose of an H-2A Petition but goes on to state that notwithstanding the Department’s finding, DHS will find employment:

not to be temporary or seasonal where an application for permanent labor certification has been filed for the same alien, or for another alien to be employed in the same position, by the same employer or by its parent, subsidiary or affiliate. This can only be overcome by the petitioner’s demonstration that there will be at least a 6-month interruption of employment in the United States after H-2A status ends. Also, eligibility will not be found, notwithstanding the issuance of a temporary agricultural labor certification, where there is substantial evidence that the employment is not temporary or seasonal. 8 CFR 214.2(h)(5)(iv)(B).

Thus, even in situations where OFLC grants temporary labor certification, USCIS retains independent authority to review temporary need, as required by the INA, and to deny the employer’s petition based on this issue.

Section B – Employer Information

The combined worker advocacy organizations expressed concern that Fields B.1 and B.2 are insufficient to protect workers’ rights because “too many employers operate under dissolved, inactive, or defunct corporations, limited liability corporations, and limited liability partnerships . . . .” The commenters explained that these entities often “lack[] income and assets sufficient to pay wages owed to workers, back wages or civil monetary penalties assessed by the Department, or judgments obtained by the workers in civil litigation.” The commenters recommended the Department add a checkbox to Section B that requires the employer to indicate the entity form and attest that the business is in good standing. The Department understands the commenters’ concerns, but declines to make the requested changes because the corporate form is often apparent in the entity’s name and adding a checkbox to collect an employer's attestation would not accomplish the commenters’ goal of verifying an entity is in good standing. Furthermore, OFLC does not have the regulatory authority to collect, or expertise to review, information regarding an employer’s good standing or ability to pay, or the effect of such limited liability corporations or partnerships in the temporary labor certification process.

Section C – Employer Point of Contact Information

One commenter expressed concern that Section C does not permit an employer to provide multiple phone numbers and recommended the Department expand its collection to permit employers to disclose multiple phone numbers. The Department appreciates the commenter's concern, but declines to make the requested modification to the Form ETA-9142A. The employer point of contacted listed in Section C should be the person most familiar with the content of the Forms ETA-9142A and ETA-790/790A and able to receive and engage in regular communications with the OFLC and SWA, as appropriate. The phone number listed in Section C should be the one primarily used by the employer’s point of contact for its normal business operations. Permitting multiple contact phone numbers on the Form ETA-9142A may lead to confusing and potentially duplicative communications among the employer, SWA, and OFLC.

The combined worker advocacy organizations expressed concern about the Department’s proposed elimination of the following fields currently collected in Section C of the Form ETA-9142A: the number of non-family full-time equivalent employees, annual gross revenue, and year [the business was] established. The commenters stated that this information “would be material for DOL Wage and Hour enforcement, including jurisdiction under the FLSA” and that “[t]he year the business was established . . . helps to verify the employer is an established business.” The commenters urged the Department to continue the collection of these items on the proposed Form ETA-9142A. The Department appreciates the comments but declines to make additional modifications to its proposal. With respect to the three fields noted above, the Department removed these fields because of its assessment that they do not provide practical utility, and any use of this information to profile certain employers for potential non-compliance issues would be speculative. During an OFLC audit or an investigation by WHD, the Department can and does request additional information.

One commenter recommended the Department change Field C.14 from mandatory to conditional because some employers, such as “small agricultural businesses,” may “not have email addresses or utilize the internet.” Another commenter noted that some employers do not use email due to religious beliefs. A third commenter recommended the Department alter Field C.14 to allow an employer to include an association or agent email in the limited situation where an employer does not have or use an email address. Alternatively, the third commenter recommended the Department permit employers to use “some alternative means of communication.” The Department appreciates the commenters’ concern that some small agricultural businesses may not possess an email address and some may have limited or no access to the internet, which would inhibit them from obtaining an email account and address. To address this concern, the Department is proposing minor changes to the Form ETA-9142A, General Instructions, to better align with the General Instructions for this same collection item on the Form ETA-790A. Specifically, the Department will clarify that the email entered in Field C.14 on the Form ETA-9142A must be the same as the one regularly used by the employer’s point of contact for its business operations and must be capable of sending and receiving electronic communications from OFLC regarding the processing of this temporary labor certification application. If the employer’s point of contact does not possess a business email address, an entry of “N/A” in Field C.14 will be acceptable as a signifier that the collection item is “Not Applicable” for employers who do not have a business email address. Finally, it is not acceptable for the email address of the employer’s agent or attorney to be included in Field C.14, because that email address is already collected in Field D.14 of the Form ETA-9142A.

Section D – Attorney or Agent Information

One commenter commended the Department’s “decision to differentiate between agents and attorneys,” but states the “form incorrectly assumes that the agent is a natural person” and “is not designed to contemplate a corporation or other legal business entity serving as the agent.” This commenter expressed a concern that Fields D.1 to D.4 include collection of an individual’s name, as the agent may be an entity, not an individual working for that entity. In addition, this commenter further stated that collecting the individual’s name may conflict with Field D.20 because “the ‘agreement’ between the employer and the agent that authorizes the agent to act on the employer's behalf will be executed naming the entity as the agent, not the individual listed in [Fields D.1 to D.4].” This commenter recommended the Department permit entry of “a business entity in lieu of the agent’s last name, first name, and middle initial” in Fields D.2, D.3, and D.4. Alternatively, this commenter recommended the Department clarify in the instructions that “the individual listed as the ‘agent’ is merely serving as the lawful representative of the entity . . . .” The Department appreciates the comment, but respectfully declines to modify Fields D.2, D.3, and D.4 because the proposed collection of this information is not a change from the current collection. The Department collects the agent’s business entity name, if applicable, in Field D.15. Collecting both the entity’s name and the individual’s name enables the Department to communicate appropriately with the representative the employer has authorized to engage with the Department on its behalf in the filing and processing of the Form ETA-9142A. Further, the agent’s agreement will clarify, rather than conflict with, the information provided in Fields D.2, D.3, D.4, and D.15 and enable the Department to understand the type of agent involved (i.e., entity and/or person) and the nature of the agent’s relationship with the employer. To the extent the concern originated in the General Instructions for the Form ETA-9142A, Appendix A, the Department will revise those instructions for clarity.

The above commenter also recommended the Department permit entry of an association or agency “general email address” in Field D.14, instead of the email address of an individual. The Department agrees with the commenter and will propose a minor clarification to the General Instructions for completing Field D.14, by adding the word “business” to modify “email” (“Enter the business email of the attorney/agent . . . .”) to clarify the collection does not explicitly require a specific person’s email address.

The combined worker advocacy organizations expressed a concern that Field D.21 requires only an H-2A agent, not an attorney, to attach a Foreign Labor Contractor (FLC) Certificate of Registration that identifies FLC activities the agent is authorized to perform. The commenters noted that “[m]any, if not all . . . attorneys engage in [FLC] activities.” The commenters recommended the Department require attorneys to “attach a copy of their FLC certificate of registration to the Form ETA-9142A.” The Department understands the commenters’ concerns, but respectfully declines to require a response to D.21 from all attorneys. However, the Department proposes revisions to the Form ETA-9142A, General Instructions, to remove “Attorney only” and “Agent only” text introducing D.17 to D.19 and D.20 to D.21 and replace it with language that is not mutually exclusive. For example, rather than “Agent Only” introducing D.20 and D.21, the Department will revise the introductory language to state: “Questions 20 and 21 in this section must be answered when “Agent” is selected in response to question D.1.” These changes better reflect the Department’s current application of 20 CFR 655.133 and collect the minimal information necessary to reach a determination. With this revision, if “Agent” is indicated in question D.1, a response to D.21 continues to be required in all cases. If “Attorney” is indicated in D.1, the attorney is not relieved of the obligation to obtain an FLC certificate of registration if required by MSPA and the attorney may respond to D.21; however, the Department will not require a response to D.21. The Department collects the information essential to pursue compliance with responsibilities and obligations from licensed attorneys through D.17 to D.19.

Section E – Job Opportunity & Supporting Documentation

The combined worker advocacy organizations commended the Department for proposing a new Section E of the Form ETA-9142A, which the commenters stated “is helpful to both H-2ALCs and DOL officials as it reminds them of the additional responsibilities of H-2ALCs.” These commenters specifically commended the Department for including fields such as Field E.4 that “prompts the employer to affirm that where the application is an application by joint employers, that the Form ETA-790A includes the name, address, total number of workers needed, and crops and agricultural work for each employer that will employ workers” and Fields E.5 through E.9 that clarify additional requirements for H-2ALCs.

Regarding Field E.4, one commenter “presumes . . . DOL intends employers to list joint employers on the SWA job order rather than the ETA-9142A,” but expresses concern that “it is unclear . . . where such listing must occur” on the Form ETA-790/790A. The commenter also anticipates confusion between joint employers and FLC client businesses, if the Department intends to use Addendum B to collect names and locations for both of those types of entities. The commenter recommended the Department add a “section that would allow employers to list joint employers directly on the ETA-9142A rather than outsourcing this task to the ETA-790/790A.” Alternatively, the commenter recommended the Department “create a clear and obvious place where such information is intended to go” and “furnish appropriate instructions for doing so.” The Department appreciates the comment, but declines to make the requested modifications. The Form ETA-790A is the most appropriate place to collect the information because the locations where work will be performed, including the name and addresses of the joint employers, are material terms and conditions of the job offered. Because the employer will submit the Form ETA-790/790A and Addenda to OFLC with the Form ETA-9142A, to collect the same information on the Form ETA-9142A would be redundant.

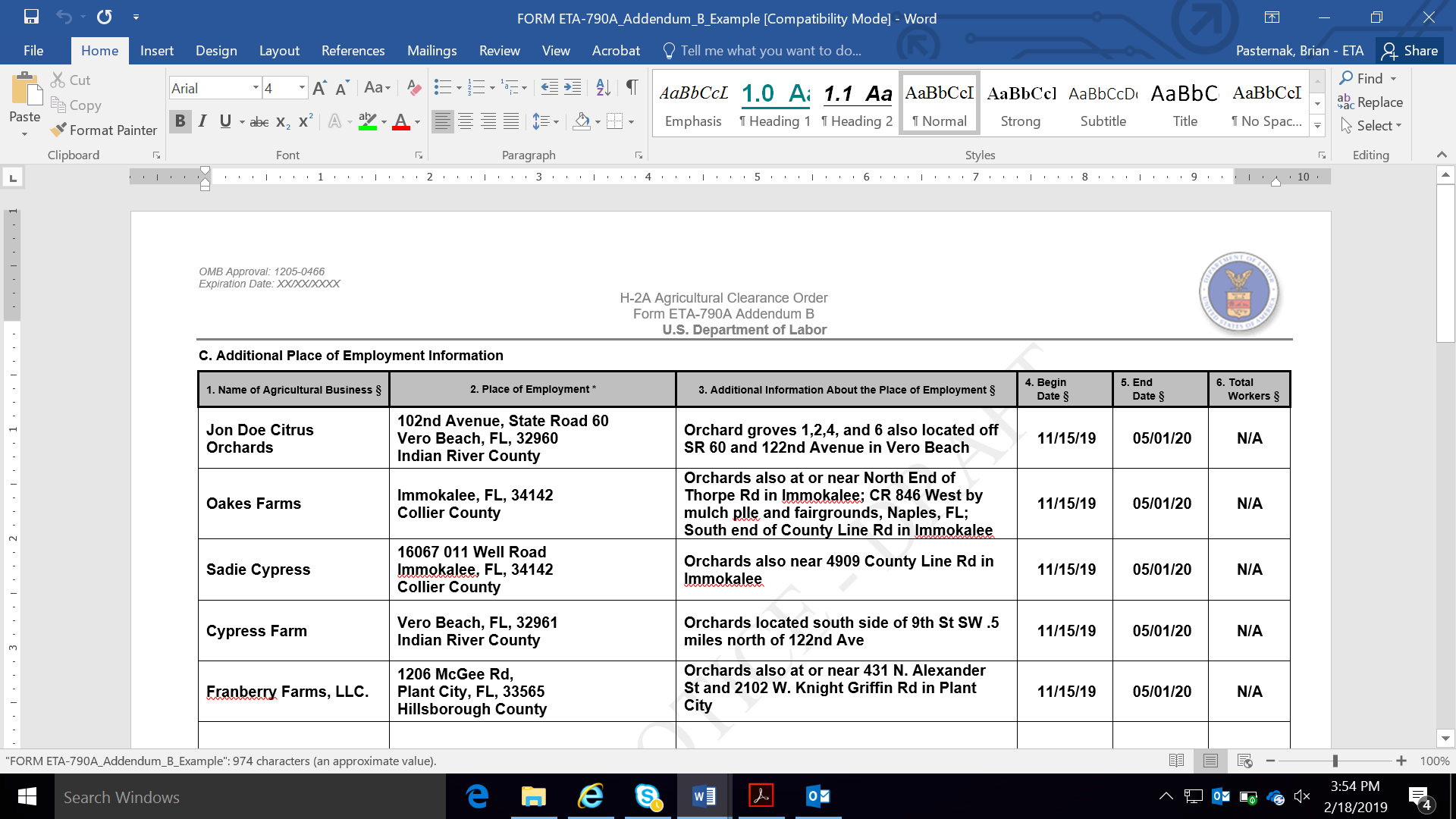

As previously stated, any one of the joint employers may file the Form ETA-9142A by marking “Joint Employer” in Field A.1 and then completing the employer information (Section B) and employer point of contact information (Section C) sections. The employer will mark “Yes” in Field C.7 on the Form ETA-790A and complete all applicable fields on the Addendum B to identify the other employer(s) that seek to jointly employ the worker(s). The collection of this information, coupled with the signed ETA-9142A, Appendix A, from each employer provides sufficient information for the Department to identify and review applications from joint employers. The Department does not anticipate confusion in understanding the nature of the businesses listed on the Addendum B. For a joint employer application, the employer information listed in Addendum B will be the participating joint employers. For an H-2ALC application, the place(s) of employment listed in Addendum B will be the employer’s clients. Unlike a joint employer application, an H-2ALC application will be accompanied by contracts for each business listed on Addendum B.

One commenter recommended the Department add the option “N/A” to Field E.8 because “some special procedures exempt this requirement for certain FLCs.” The Department agrees with the commenter and is modifying its proposed collection for the Form ETA-9142A, Section E, Field E.8, and General Instructions to include an option for employers to select "N/A" where the requirement to obtain a FLC Certificate of Registration does not apply. This proposed modification will also achieve consistency with a similar question asked of authorized agents representing the employer under Section D, Field 21.

Section F – Declaration of Employer and Attorney/Agent

The combined worker advocacy organizations commended the Department’s proposed Section F declaration language that requires each joint employer to sign Appendix A to confirm each employer has reviewed, and agrees with, all applicable terms, assurances, and obligations.

Section G – Preparer

The Department did not receive any comments on Section G.

General Instructions

Two commenters expressed concern about the “note” in the General Instructions for the Form ETA-9142A, Field A.1, that presents the regulatory definition of an “agricultural association.” These commenters stated that many associations filing H-2A applications on behalf of their members would not “fit [the] narrow definition of Agricultural Association” that is “limit[ed] to ‘any nonprofit or cooperative association of farms . . . that recruits, solicits, hires, employs, furnishes, houses, or transports any worker that is subject to 8 U.S.C. 1188.” One of the commenters asserted that “[t]he terms ‘recruits,’ ‘solicits,’ and ‘furnishes’ are perhaps misleading in this context, as opposed to [the Migrant and Seasonal Agricultural Worker Protection Act] MSPA or other settings.” The Department appreciates the comments, but declines to change the proposed language. The definition of an agricultural association is included in the Department’s regulation at 20 CFR 655.103(b) and citations to that term in the Form ETA-9142A, General Instructions, are included for reference. Therefore, to change the “note” as the commenters suggest would require rulemaking and is beyond the scope of this ICR.

One commenter recommended the Department remove language proposed in the introduction of the instructions for Appendix A that states the agent agreement must include “a statement appointing a specific person as agent for the employer.” The commenter stated, first, that in the case of association filers, multiple employees of the association may be involved in completing the Form ETA-9142A and it is the association, not any one of its employees, acting as the employer’s agent. Second, the commenter expressed a concern that “placing a specific name in the application could expose an individual to unwanted and unnecessary attention from individual activists who oppose use of the H-2A program.”

In response to the commenter’s concerns about the requirement to include a statement appointing a specific person as agent for the employer, the Department will propose minor clarifications to the Form ETA-9142A, General Instructions, for the Appendix A to better align with existing regulatory requirements. Specifically, the Department will provide the following clarification:

If “Attorney” or “Agent” is checked in Question D.1, the Attorney or Agent must complete Section A of the Appendix A, Form ETA-9142A. In accordance with 20 CFR 655.133(a), an agent filing an Application for Temporary Employment Certification on behalf of an employer must provide a copy of the agent agreement or other document demonstrating the agent’s authority to represent the employer. For more information concerning the definitions of an attorney and agent, please read the Department’s regulation at 20 CFR 655.103(b).

In response to the commenter’s concern regarding unwanted attention from individual activists due to disclosure of a person’s name on the Appendix A, the Department notes that the proposed information collection is not a change from the current collection. The Form ETA-9142A, Section D, and the Appendix A both collect the name of the attorney or agent and the name of the law firm or business that employs the attorney or agent. This information is necessary to confirm the person(s) the employer has designated to act on its behalf in connection with the filing and processing of the Form ETA-9142A and the nature of the agent’s relationship with the employer.

The Department’s Proposed Changes to the Form ETA-9142A, Appendix A

The Department’s regulations at 20 CFR 655.130(a) and (d) and 655.135 require an employer and, if applicable, the employer’s attorney or agent to submit a completed Appendix A attesting to compliance with all terms, assurance, and obligations required for the employer to obtain an H-2A temporary labor certification. The Department’s proposed revisions to Appendix A better align information collection requirements with the Department’s current regulatory framework, provide greater clarity to employers on regulatory requirements, and promote greater transparency in OFLC’s review and issuance of temporary labor certification decisions under the H-2A program.

Section A – Attorney or Agent Declaration

One commenter objected to the language of the declaration that requires the attorney/agent to certify that it has provided to the employer the Form ETA-9142A, ETA-790/790A, and all supporting documentation for review. The commenter asserted that there is no “basis for this requirement in the regulations or the statute.” A second commenter recommended the elimination of this declaration, stating it is “unnecessary and duplicative” because “[i]f the employer has approved the ETA-790/790A then that approval should extend to the same information on the ETA-9142A.” The Department disagrees with the commenter that there is no legal basis for the attorney or agent to assure that it has provided the Form ETA-9142A, ETA-790/790A, and all supporting documentation to the employer for review. By signing Section A of the Appendix A, the attorney or agent is assuring that it has been designated by the employer to act on its behalf in connection with the H-2A application. The attorney or agent is not preparing the required forms and supporting documentation on its own, but rather is performing these activities in conjunction with its employer-client, who concurrently assures the Department that it has read and reviewed every page of the required forms and supporting documentation. The Department reminds the commenter that regardless of whether the employer is represented by an attorney or agent, the employer is required to sign the Form ETA-9142A, Appendix A, Form ETA-790/790A, and review all supporting documentation submitted to the SWA and the Department. This proposed language will strengthen program integrity by ensuring that employers that designate attorneys or agents to act on their behalf have full knowledge of the information and disclosures that are prepared on their behalf prior to the filing of the required forms and all documentation with the Department. The Department also believes this change will guard against the shifting of culpability between employers and attorneys or agents during the course of administrative or investigative proceedings where program violations are discovered.

The combined worker advocacy organizations recommended the Department add an assurance from attorney/agents “that they, or any persons used by them to recruit H-2A workers, have complied with the no-fees requirements of [20] CFR § 655.135(j) and (k)” and collect information about foreign labor recruiters on the form. The Department understands the commenters’ concerns. The proposed Form ETA-9142A includes the assurances about prohibited fees, payments, etc., required by regulation in Appendix A. Items B.11 and B.12 in Appendix A reflect the regulatory language at 20 CFR 655.135(j) and (k). To collect specific, detailed information about foreign recruiters, or to require the assurance directly from the agent/attorney, would require rulemaking and is beyond the scope of this ICR. See 20 CFR 655.135(k).

Two commenters recommended the Department modify Appendix A, Fields A.1, A.2, and A.3 to permit entry of “the name of a business entity in lieu of the agent’s last name, first name, and middle initial.” Alternatively, one of the commenters recommended the Department clarify in the form or its General Instructions that “the individual listed as the ‘agent’ is merely serving as the lawful representative of the entity . . . .” The Department appreciates the commenters’ suggestions, but notes that this proposed information collection is not a change from the current collection. As previously discussed, the Form ETA-9142A, Section D, and the Appendix A both collect the name of the attorney or agent and the name of the law firm or business that employs the attorney or agent. This information is necessary to confirm the person(s) the employer has designated to act on its behalf in connection with the filing and processing of the Form ETA-9142A.

Two commenters noted that the instructions to Appendix A, Field A.5 instruct the attorney/agent to enter its email address, but this field actually requests the attorney/agent signature. One of these commenters also noted that the instructions to Field A.6 instruct the attorney/agent to sign the form, but the space provided on the form requests the “Date Signed.” The Department agrees with the commenters and will propose modifications to the Form ETA-9142A, General Instructions, for the Appendix A to remove instructions related to the collection of an email address and adjust the numbering so that the General Instructions correlate to the Fields A.5 and A.6.

Finally, one commenter noted that the final sentence of the first paragraph includes the phrase “then I have attached an agency agreement” and the commenter believed the Department should replace the word “agency” with “agent.” The Department agrees with the commenter, and will make a minor modification to the Form ETA-9142A, Appendix A, Attorney or Agent Declaration, to better align with the language used in the regulation at 20 CFR 655.133(a). The proposed language for the first paragraph under the Attorney or Agent Declaration will read as follows:

I hereby declare under penalty of perjury that I am an attorney for the employer, or that I am an employee of, or hired by, the employer listed in Section B of the Form ETA-9142A, and that I have been designated by that employer in accordance with 20 CFR 655.133 to act on its behalf in connection with this application, as evidenced by the attached agent agreement.

Finally, in completing the Appendix A, the Department proposed that the attorney or agent acknowledge “to knowingly furnish materially false information in the preparation of this form and any supplement thereto or to aid, abet, or counsel another to do so is a federal offense punishable by fines, imprisonment, or both (18 U.S.C. 2, 1001, 1546, 1621).” However, in reviewing this proposed language, the Department noticed an inaccuracy in the legal standard under 18 U.S.C. Section 2, 1001, 1546, and 1621. Therefore, the Department proposes a modification to this declaration to state “to knowingly and/or willfully furnish materially false information” [emphasis added] in order to more accurately reflect the legal standard in 18 U.S.C. Section 2, 1001, 1546, and 1621.

Section B – Employer Declaration

One commenter recommended the Department remove the attestations listed in Appendix A, Section B, stating that their “inclusion is inappropriate” because “[t]he attestations serve no purpose not already served by the regulations themselves.” Citing Matter of Island Holdings, 2013-PWD-00002 (Dec. 3, 2013), the commenter added that “[i]f the attestations differ[] from the regulations, they are nullities and may not be lawfully imposed by DOL.” Finally, the commenter stated that “even a set of attestations that exactly matches the regulations raises an issue” because “several federal crimes address providing materially false information to federal officers” so a violation of the attestations would “attach[] criminal penalties to civil administrative violations, something that DOL does not have the authority to do . . . .”

The Department respectfully disagrees with the commenter’s assertions and declines to modify the proposed Appendix A to remove the listed attestations. The Department has the authority to determine the manner in which employers, who choose to use the H-2A program, assure compliance with all assurances, obligations, and conditions of employment applicable to hiring H-2A workers and/or U.S. workers in corresponding employment for job opportunities under the Forms ETA-9142A and ETA-790/790A. Section I of the Form ETA-790A summarizes the regulatory requirements to which the agricultural job order is subject under ARS interstate clearance and the H-2A program. Section B of the Form ETA-9142A, Appendix A, summarizes the additional statutory and regulatory requirements to which the H-2A employer is subject, beyond the agricultural job order, in a succinct manner that helps employers better understand their obligations and responsibilities for deciding to participate in the H-2A program. These assurances, obligations, and conditions of employment do not create any no new legal obligations.

One commenter asserted that the declaration at B.9.iv “incorrectly states the law” at 20 CFR 655.122(e) and “imposes an additional requirement not required by the regulations.” The commenter expressed a concern that the proposed declaration expressly requires the employer to provide workers’ compensation insurance coverage at no charge to the worker, but the Department’s regulation uses the phrase “without charge to the worker” only in the clause pertaining to circumstances in which “the type of employment for which the certification is sought is not covered by or is exempt from the State’s workers’ compensation law.” The commenter recommended the Department reword the declaration to mirror the language at 20 CFR 655.122(e).

The Department agrees with the commenter and proposes modifications to the Form ETA-9142A, Appendix A, Item B.9(iv) that will more accurately reflect the statutory and regulatory requirement for employers to provide workers’ compensation insurance coverage. Specifically, the Department will modify the declaration to state the following:

Will provide workers’ compensation insurance coverage in compliance with State law covering injury and disease arising out of and in the course of the worker’s employment. If the type of employment for which the certification is sought is not covered by or is exempt from the State’s workers’ compensation law, the employer will provide, at no cost to the worker, insurance coverage with benefits at least equal to those provided under the State workers’ compensation law for other comparable employment.

The combined worker advocacy organizations expressed concerns that the declaration at B.15 “oversimplifies a worker’s duty to return to his country of origin when his employment ends and, thus, of the employer’s duty to so inform the worker” because it “does not sufficiently account for grace periods that workers may have to depart the country.” The commenters recommended the Department “consult with the [DHS] to craft simple, but accurate language” to prevent employers from calling Immigration and Customs Enforcement immediately for workers to be detained and deported. The Department understands the commenters’ concerns, but respectfully declines to make the requested modification. The proposed language under declaration B.15 accurately reflects the regulatory requirement at 20 CFR 655.135(i), which requires employers to notify workers of their duty depart the United States when their employment ends, unless they have been sponsored for subsequent employment in the United States. Any additional guidance or interpretation of an H-2A employer’s obligation to notify workers of this duty to depart the United States is beyond the scope of the ICR.

Those combined worker advocacy organizations also recommended the Department add a new declaration, applicable to all employers, that mirrors declaration B.17.iii, which requires an H-2ALC to certify that it “is able to provide proof of its ability to discharge financial obligations . . . .” The commenters interpret this language as an attestation that the employer has enough funds to pay the offered wages under the temporary labor certification. The Department respectfully declines to add the requested declaration for all non-H-2ALC employers similar to the one at B.17.iii, because it is not an existing regulatory requirement and is beyond the scope of this ICR. Declaration B.17.iii reflects the regulatory requirement at 20 CFR 655.132(b)(3) that an employer meeting the definition of an H-2ALC must submit an original surety bond with its application. This is not a regulatory requirement for all employers filing an H-2A application.

These commenters also suggested modifying the Appendix A to include the following declaration: (1) that the employer has paid all wages due to workers in the past years, and (2) that “[i]n compliance with the William Wilberforce Trafficking Victims Protection Reauthorization Act, the employer will not hold or confiscate workers’ passports, visas, or other immigration documents. 20 CFR 655.135(e).” In response to these comments, the Department respectfully declines to add the requested declaration that the employer has paid all wages due in the past years, because such a declaration is not an existing regulatory requirement and is beyond the scope of this ICR. Regarding the second declaration, the Department maintains that the existing language under declaration B.9(i) is sufficient to ensure employer compliance with applicable Federal, State, and local employment-related laws and regulations, including the William Wilberforce Trafficking Victims Protection Reauthorization Act. Furthermore, the prohibition against holding workers’ passports or other immigration documents is disclosed by the employer to all workers using a worker rights poster developed by the Department’s Wage Hour Division, which is already covered by declaration B.16 in the Appendix A.

Additionally, the combined worker advocacy organizations expressed a concern that the language in declaration B.9((ii) does not accurately reflect an employer’s “obligation to provide housing to all H-2A workers as required under the H-2A regulations.” The commenters recommended the Department modify the language to clarify that an employer must provide housing to all H-2A workers and that the phrase “who are not reasonably able to return to their residence within the same day” applies only to corresponding workers. The Department agrees with the commenters’ suggestion and is proposing revised language for the Form ETA-9142A, Appendix A, Section B.9((ii) that more clearly reflects the employer’s housing obligation under 20 CFR 655.122(d). Specifically, the Department will modify the declaration at B.9(ii) to state the following: “Will provide or secure housing at no cost to the H-2A workers and those workers in corresponding employment who are not reasonably able to return to their residence within the same day. The housing provided or secured for workers complies with the applicable local, State, or Federal standards and guidelines for housing.”

Finally, the combined worker advocacy organizations recommended the Department include a new declaration, preferably at Section B.9(i), stating that the employer will comply with “employment-related EEO law.” The commenters stated this is necessary because employers often impermissibly seek to hire only foreign workers who are “young single men without family in the United States” and discriminate against female workers, older workers, or those “who otherwise don’t fit into the ‘ideal’ demographic . . . .” The Department understands the commenters’ concerns, but respectfully declines to make the change the commenters recommend because expansion of the employer’s obligation to foreign worker recruitment abroad would require rulemaking and is beyond the scope of this ICR. However, the Department notes that the declaration under Section B.3 in the proposed Form ETA-9142A, Appendix A, already includes the “non-discriminatory hiring practices” assurance required of employers by 20 CFR 655.135(a). Therefore, the Department maintains this language is sufficient to cover discriminatory behavior in the recruitment of U.S. workers.

In completing the Appendix A, the Department proposed that the employer acknowledge “to knowingly furnish materially false information in the preparation of this form and any supplement thereto or to aid, abet, or counsel another to do so is a federal offense punishable by fines, imprisonment, or both (18 U.S.C. 2, 1001, 1546, 1621).” However, in reviewing this proposed language, the Department noticed an inaccuracy in the legal standard under 18 U.S.C. Section 2, 1001, 1546, and 1621. Therefore, the Department proposes a modification to this declaration to state “to knowingly and/or willfully furnish materially false information” [emphasis added] in order to more accurately reflect the legal standard in 18 U.S.C. Section 2, 1001, 1546, and 1621.

The Department’s Proposed Form ETA-9142A, H-2A Approval Final Determination

The Department is proposing to eliminate the issuance of paper-based labor certification decisions by creating a one-page Form ETA-9142A, Final Determination: H-2A Temporary Labor Certification Approval (Final Determination Notice), which OFLC will issue electronically to employers. This one-page Final Determination form will provide the Department’s official certification that it did not identify a sufficient number of available, qualified U.S. workers for the job opportunity and that employment of the foreign worker(s) will not adversely affect the wages and working conditions of U.S. workers similarly employed. The Department believes this proposed form will promote greater efficiency in issuing temporary labor certification decisions and minimize delays in employers filing H-2A petitions with the DHS’s United States Citizenship and Immigration Services (USCIS).

Three commenters expressed support for the Department’s proposed Final Determination Notice, stating that “[t]he elimination of paper-based labor certification decisions will increase the efficiency of the process, reduce costs for both agencies and stakeholders, and contribute to more streamlined document retention.” One of these commenters asked how OFLC will transmit this document to an employer that does not have an email address or otherwise cannot receive the new form electronically. The Department appreciates the commenters’ support of the proposal to promote greater efficiency in issuing temporary labor certification decisions, generate savings by eliminating the issuance of certifications on expensive security paper, and minimize delays associated with employers filing H-2A petitions with USCIS.

In response to the question posed by one of the commenters, the new Final Determination Notice will contain succinct, essential information about the certified application and will be issued in a secure Adobe PDF format electronically. In circumstances where the employer or, if applicable, its authorized attorney or agent, is not able to receive the temporary labor certification documents electronically, the Final Determination Notice will be issued on standard paper in a manner that ensures next day delivery. The Department will also issue a copy of the certified Forms ETA-9142A and ETA-790A, including all applicable appendices and addenda, to the employer or, if applicable, its authorized attorney or agent, using the same delivery methods. The Department has extensive experience processing electronic applications, and routinely receives and sends official communications (e.g., Notices of Acceptance and Deficiency) using email addresses disclosed on the Form ETA-9142A as a standard practice. In circumstances where electronic documents are not received by email, including this new form, the employer and, if applicable, its authorized attorney or agent will continue to contact OFLC’s Chicago National Processing Center helpdesk at [email protected] to request the documents.

One commenter asked how USCIS will be apprised of all the information contained in the certified H-2A application, which the commenter stated is important to avoiding Requests for Evidence (RFE). As stated in the Department’s proposal, the employer will use the Final Determination Notice, as well as any other required documentation, to support the filing of an I-129 petition with USCIS. The Department is working collaboratively with USCIS to share information, which may affect the I-129 petition documentation in the future. However, the Department reminds the commenter that USCIS has authority to determine what minimum information and documentation are required to support the I-129 petition. The employer must comply with the filing requirements set by USCIS, including any requirement that employers submit a full copy of the certified Form ETA-9142A, the new Form ETA-790A, including all applicable addenda and appendices, in addition to the one-page Final Determination Notice and the Appendix A.

The Department’s Proposed Changes to the Form ETA-790 and General Instructions

The Form ETA-790/790A collects information about the material terms, wages, and working conditions of employment that employers will use when recruiting U.S. workers. When necessary, the Department also uses this information in post-adjudication audit examinations, investigations, and/or program integrity proceedings (e.g., revocation or debarment actions). The Form ETA-790 is a one-page coversheet designed to facilitate the SWA’s receipt and processing of the job order through its intrastate system and the ARS, and for the employer seeking to employ workers in agricultural employment to designate that the job order will be used in connection with a future Form ETA-9142A for H-2A workers.

Comments Related to the Proposed Elimination of Attachments

Several commenters expressed general concerns with the Department’s proposal to collect all program information on the forms and to no longer permit separate, free-form attachments. One commenter explained that “[n]o one text field can capture the specifics of every job order” and stated that this was particularly true in sections that require demonstration of seasonal need, information on additional worksites or housing locations, explanation of crops to be handled or piece-rates to be paid, and work rules that must be disclosed. This commenter recommended the Department “continue to accept uploaded attachments from employers where necessary.” Several commenters expressed general concerns with space limitations on many of the form fields, which they argued may compromise an employer’s ability to express the details of its job opportunity fully and completely, and also expressed concern about the burden associated with entering narrative text into the fields on the proposed forms that employers currently include on these free-form attachments.

One commenter stated that the “ability to manipulate a word document to show piece rates, housing sites, or work sites is far superior [to] the ETA-790.” Another commenter believed the “inability to utilize attachments would cripple an employer’s ability to thoroughly describe all of the terms and conditions associated with the position being offered,” noting that it is much easier to provide all of the material terms and conditions in languages other than English in a separate free-form attachment. A third commenter stated the Department cannot use “the guise of being more efficient or streamlined” as pre-text to “deny employers their prerogatives to set employment terms and conditions, including housing and job performance rules consistent with their statutory rights, as interpreted by binding case law analyses and . . . 8 U.S.C. §1188(a)(1)(B).” This commenter also expressed a general concern that elimination of attachments violates “the principles and requirements of Federalism,” because the Department has “undertaken to interpret and enforce state-created rights . . . [of H-2A employers] that are imperiled by adoption of the planned ETA 790 and ETA 790A forms with restrictions on the attachment of material terms of the job for which there is no room on the forms.” Finally, one commenter asked the Department to clarify if the statement “[s]eparate attachments will not be accepted” applies only to the fields where it is specifically mentioned in the forms or instructions (e.g., in Form ETA-790A, Field A.7b), or if it is a general prohibition applying to every field in the collection. This commenter recommended the Department clarify whether it intends to reject all attachments or only attachments submitted in response to fields for which the Department explicitly instructed the employer not to submit an attachment.

The Department appreciates the commenters’ concerns, but declines to modify the proposed information collection to allow submission of free-form attachments. The Department is proposing to replace the existing paper-based Form ETA-790 with a new Form ETA-790/790A, H-2A Agricultural Clearance Order, which will be attached to Form ETA-9142A to eliminate redundant data collection and promote a more efficient means for employers to file the required job order with ETA and the SWA serving the area of intended employment. Based on many years of program experience, the Department has determined that paper-based submissions and free-form attachments to the current Form ETA-790 are more resource-intensive to review and costly for OFLC to handle. The current paper-based collection requires manual data entry of information contained in the required documents, as well as manual uploading of scanned copies of these free-form attachments into OFLC’s electronic case documents repository. The current process also results in misplaced or lost documentation, unnecessary communication delays between employers and the Government, and missed opportunities to resolve minor deficiencies quickly in the application process. Proposing an electronically fillable and fileable Form ETA-790/790A will reduce data entry burden and eliminate the need for manual corrections of errors and other deficiencies; improve the speed with which job order information can be reviewed, retrieved and shared with the SWAs and OFLC staff; reduce OFLC staff review time and storage costs; reduce document storage costs; improve document security; and improve the efficiency of posting and maintaining approved job orders on the Department’s electronic job registry.

In response to the commenters’ concerns regarding the use of free-form attachments and space limitations on specific form fields, the Department is modifying the Form ETA-790A and General Instructions to propose a new Addendum C. The Addendum C will provide an employer with greater flexibility to fully complete the response to any field on the proposed form, or disclose additional material terms or conditions of employment based on the unique specifications of the job opportunity that are not specifically addressed in a particular Form ETA-790A field. The Department proposes to replace the limited free-text space for additional material terms and conditions of employment contained in Section H with “yes” or “no” checkboxes where the employer may indicate it has attached an Addendum C that includes additional information about the terms and conditions of the job opportunity. Further, the Department will revise the instructions to Section H to clarify that the new Addendum C will be used to disclose additional material terms and conditions of the job offer.

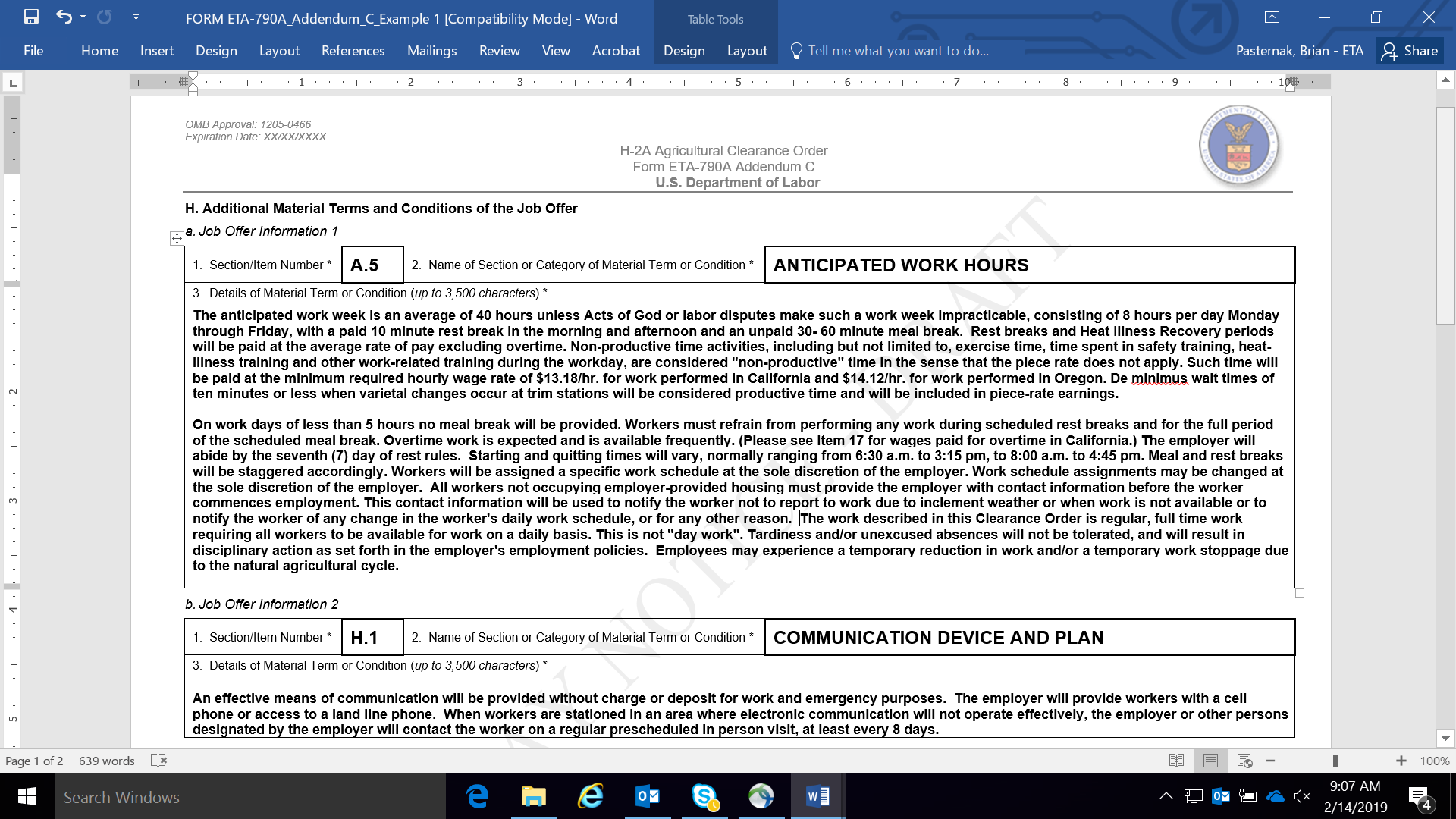

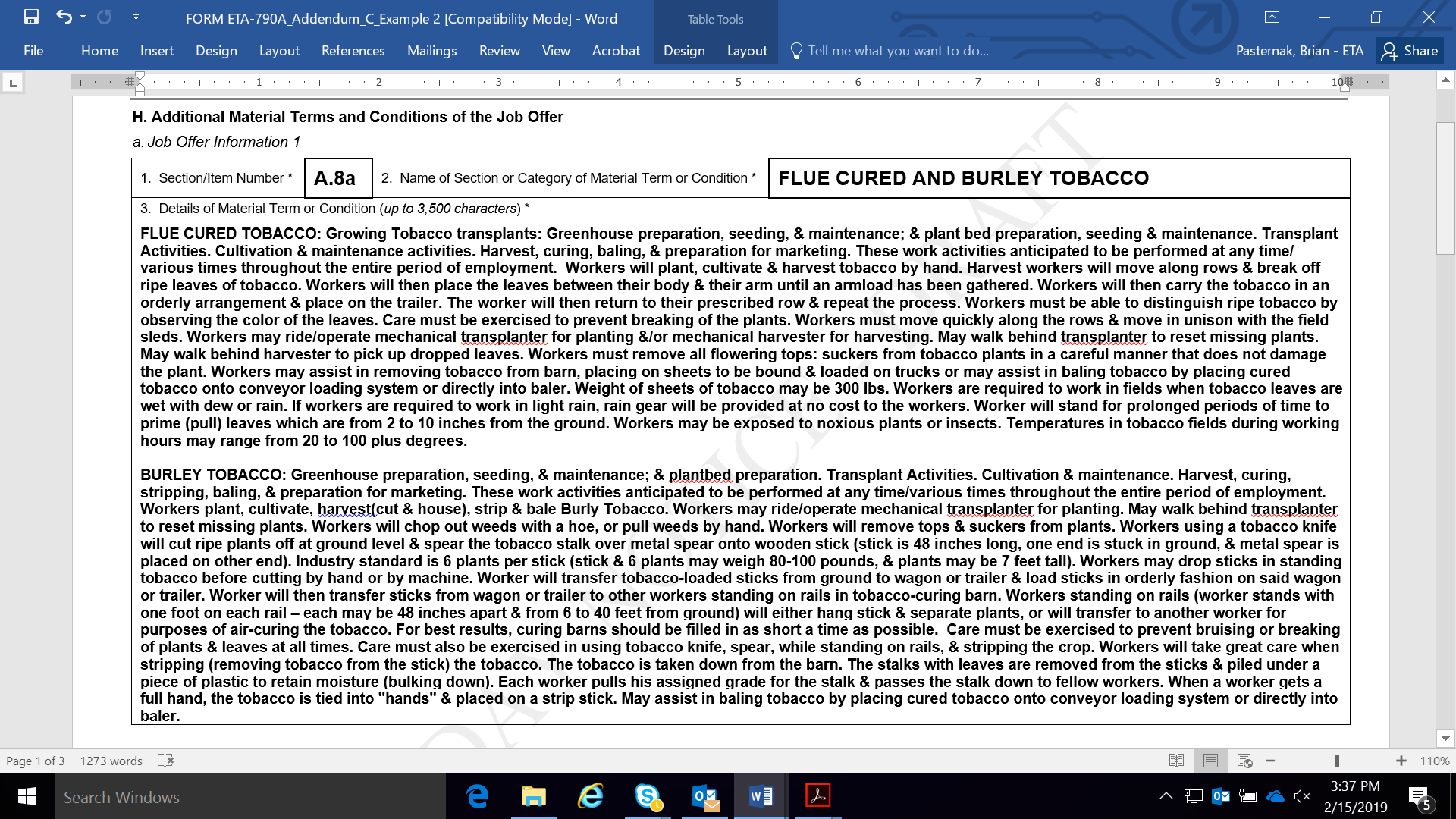

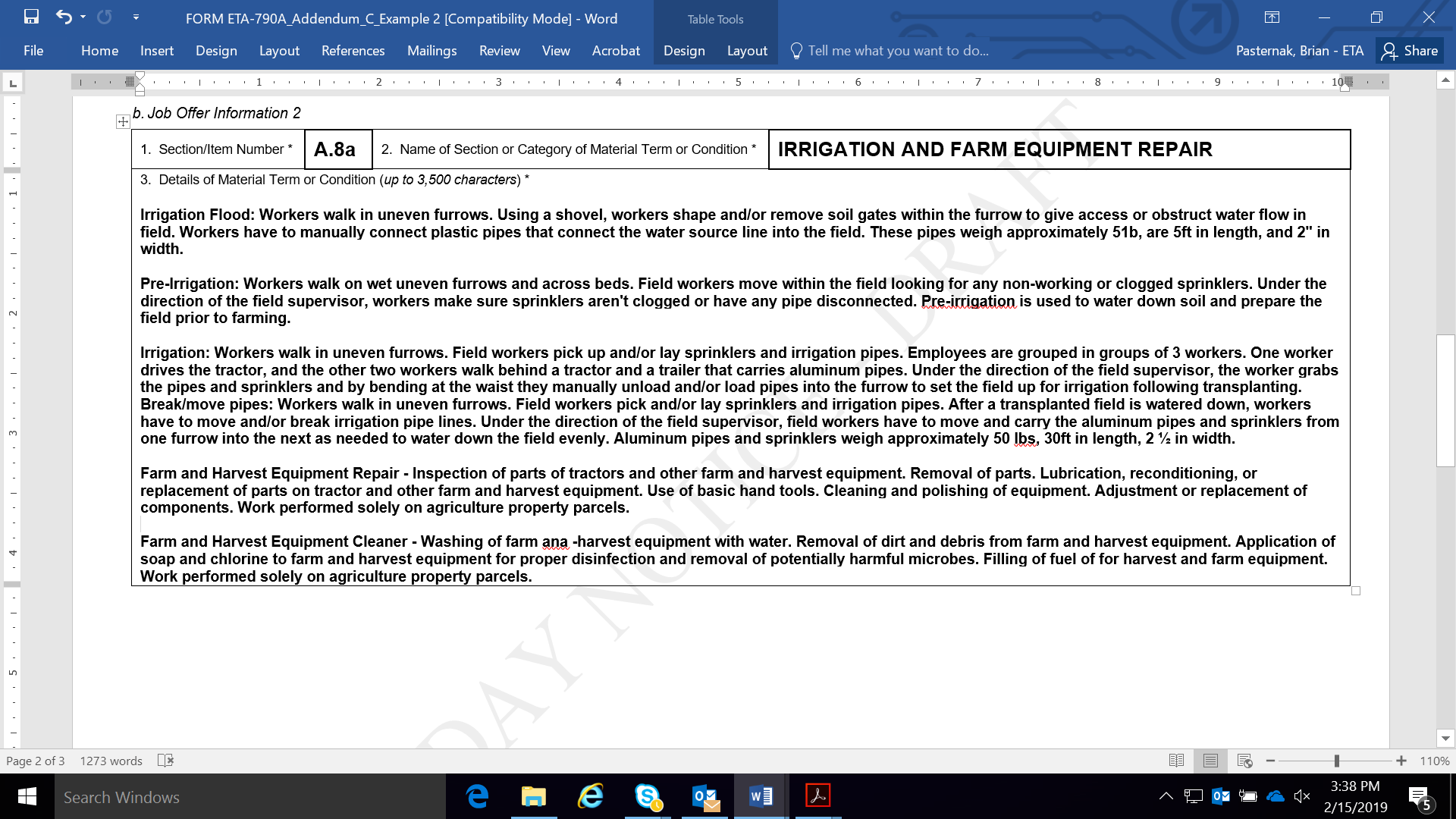

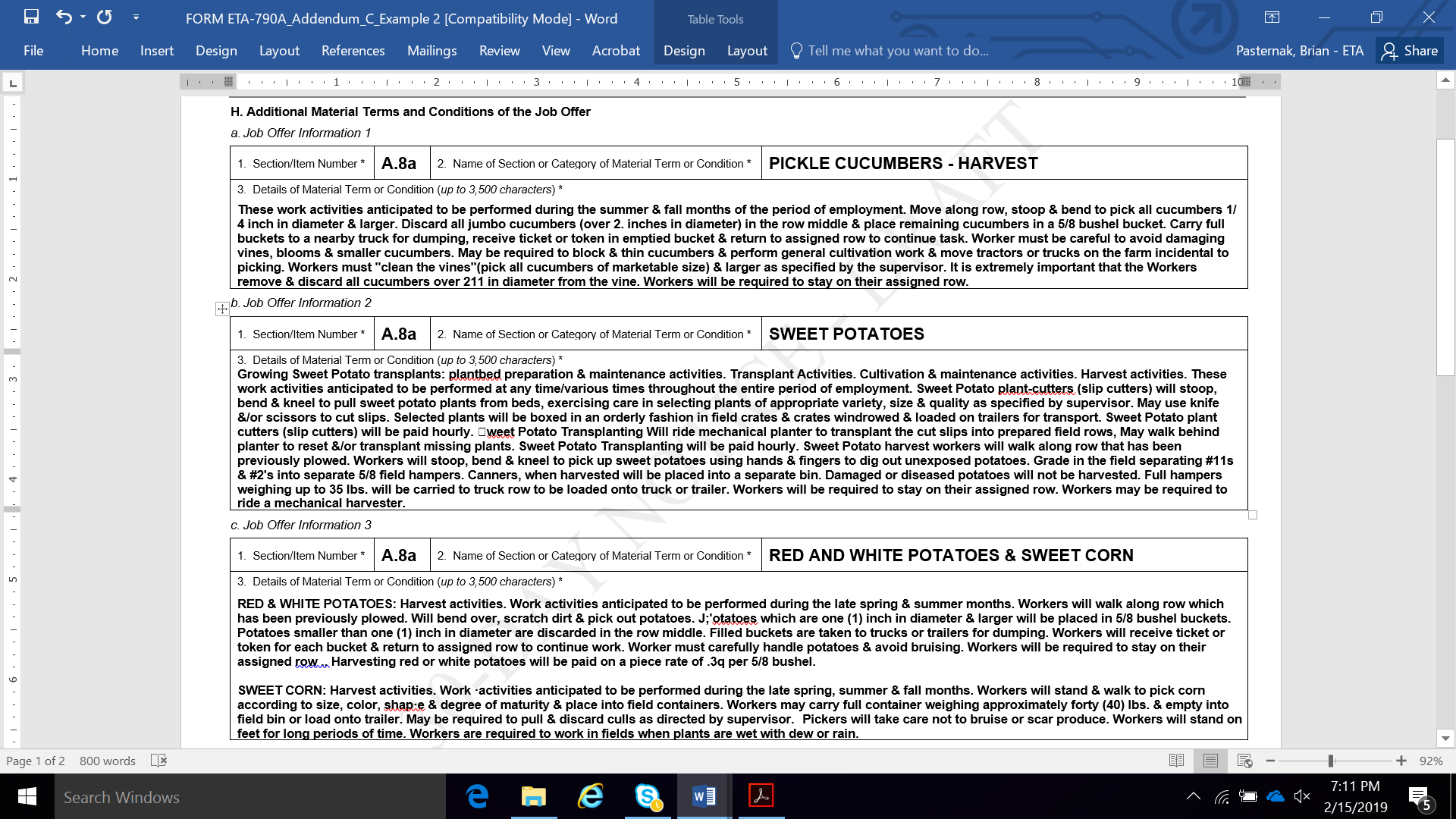

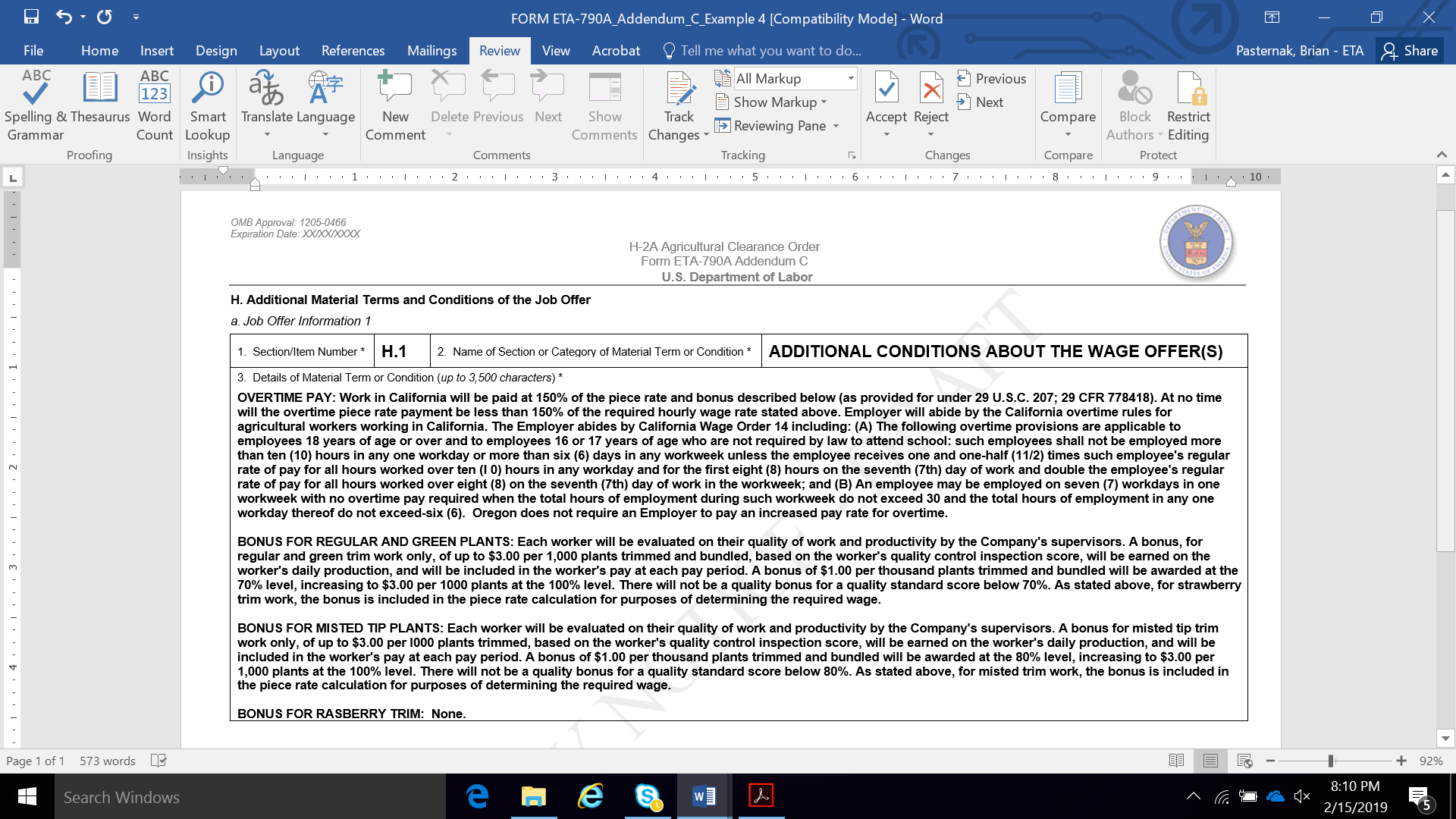

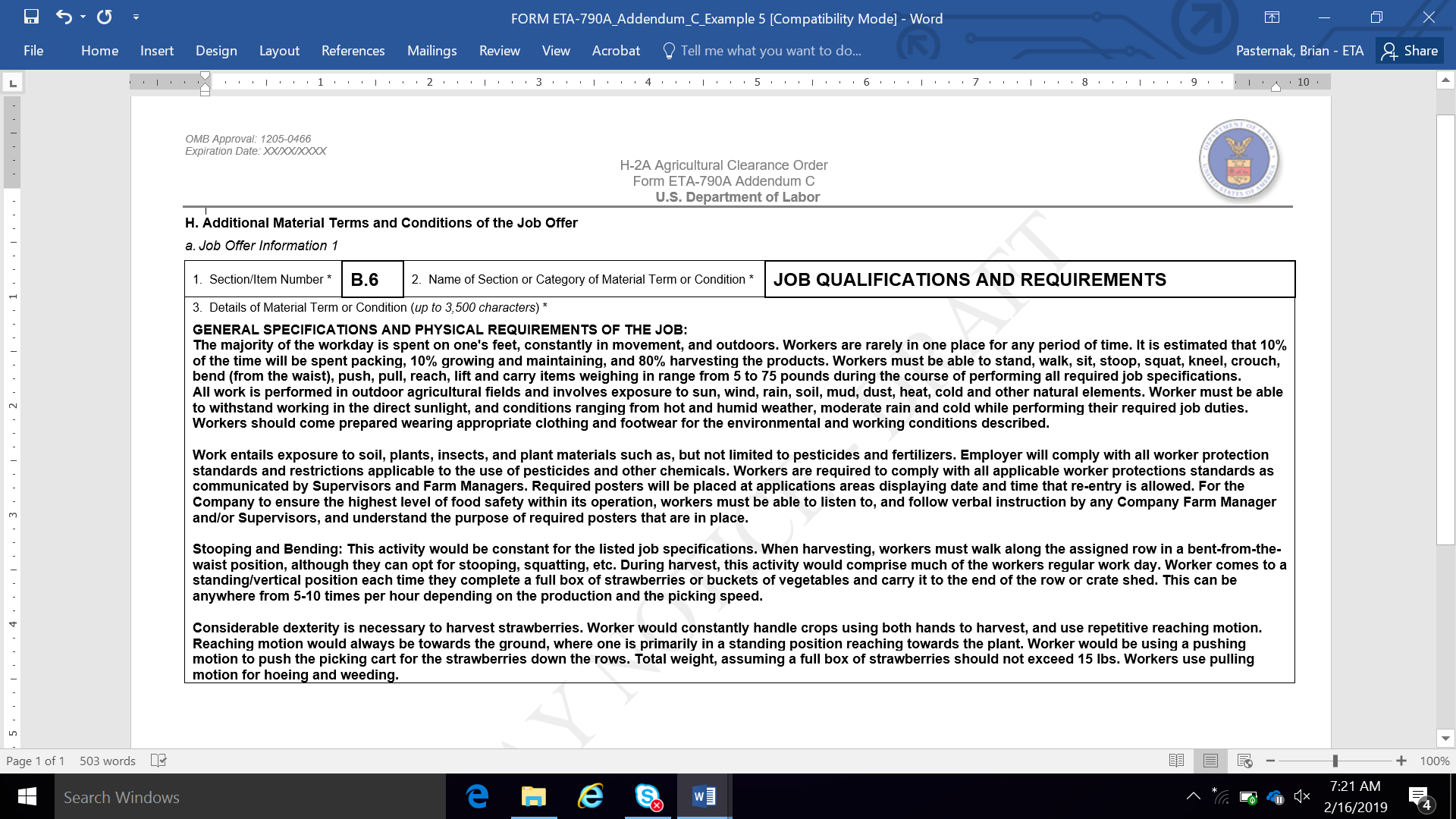

To ensure each response is clearly identified and effectively organized for the Department’s review, the Addendum C requires the employer to identify the section/item number as well as the name of the section or category for each material term or condition disclosed. For example, if additional space is required to fully disclose conditions of the wage offer on the Form ETA-790A, the employer would enter “A.10” in Item 1 and “Job Offer Information” in Item 2. For additional job information not related to a specific field, the employer would enter the letter “H,” followed by a sequential number in Item 1, and then the name of the category for the material term or condition in Item 2. For example, using a commenter’s example, if an employer needs to disclose material terms or conditions related to provision of a communication device for a worker engaged in the herding or production of livestock on the range, the employer will enter “H.1” in Item 1 and “Communication Device and Plan” in Item 2. Item 3 of the proposed Addendum C provides the employer with additional space to specify the details of the identified material term or condition of the job offer. If the same employer needed additional space to disclose terms and conditions related to the anticipated hours of work, the employer would enter “A.5” in Item 1 and “Anticipated Work Hours” in Item 2. In Item 3, the employer would provide the specific information necessary to disclose fully the terms of employment related to work hours each day. The Department provides below an illustration of how the Addendum C can be completed for this example.

T

his

approach will capture essential information in a standardized format

that will facilitate a more consistent and effective review of the

material terms and conditions of the job offer, not only for the SWA

and OFLC, but also for workers recruited in connection with the job

opportunity. Each entry on the Addendum C may include up to

3,500 characters, which is the equivalent of approximately 570 words

and slightly more than one page of text, and the employer may

complete as many additional “job offer” information

sections on the Addendum C as are necessary to disclose fully

all material terms and conditions of the job offer. Employers who

retain material terms and conditions of their job offers in other

free-form attachments can easily “cut-and-paste” text

into this more standardized format, or use the Department’s

electronic system to create, maintain, and reuse one or more entries

on the Addendum C for subsequent application filings. The

Department is exploring the possibility of including in its

electronic filing system an option to use a digital service to

translate the text of form entries into a language other than

English, thereby reducing the burden for employers to create and

maintain separate language translations of the form entries.

his

approach will capture essential information in a standardized format

that will facilitate a more consistent and effective review of the

material terms and conditions of the job offer, not only for the SWA

and OFLC, but also for workers recruited in connection with the job

opportunity. Each entry on the Addendum C may include up to

3,500 characters, which is the equivalent of approximately 570 words

and slightly more than one page of text, and the employer may

complete as many additional “job offer” information

sections on the Addendum C as are necessary to disclose fully

all material terms and conditions of the job offer. Employers who

retain material terms and conditions of their job offers in other

free-form attachments can easily “cut-and-paste” text

into this more standardized format, or use the Department’s

electronic system to create, maintain, and reuse one or more entries

on the Addendum C for subsequent application filings. The

Department is exploring the possibility of including in its

electronic filing system an option to use a digital service to

translate the text of form entries into a language other than

English, thereby reducing the burden for employers to create and

maintain separate language translations of the form entries.

Comments Related to H-2A Assurances, Obligations, and Requirements

One commenter commended the Department for the proposed Form ETA-790A, stating the proposed revision “is a vast improvement to the Form ETA-790” and expressed particular appreciation for the proposed sections that include conditions of employment and assurance for agricultural clearance orders.” Another commenter commended the Department for “offer[ing] the Forms 790 and 790A as ‘fillable’ PDF files” and eliminating “redundancy in the filings with the [SWAs] and OFLC,” which it stated is “one of employers’ top sources of frustration with the application filing process . . . particularly on non-compatible forms, requiring manual entry of the same information two or more times.”

One commenter stated that the “draft 790/790A . . . appears to require all employers using the Agricultural Recruitment System (ARS) to follow the requirements of the H-2A foreign labor program,” but non-H-2A employers do not need to follow these requirements. For example, the commenter noted that non-H-2A employers using the ARS are not required to complete Sections D and F of the Form ETA-790A, and recommended the Department clearly indicate that these sections apply only to H-2A employer. The commenter recommended the Department clarify in the instructions to the forms that there is a distinction between requirements for H-2A employers and the requirements for non-H-2A agricultural employers. In response to the commenter’s recommendation, the Department is proposing a minor modification to the General Instructions for the Form ETA-790, Item III.1, clarifying that employer seeking to employ only U.S. workers in agricultural employment should select the option entitled "790B (non-H-2A clearance order)" and proceed to complete that form, which is not for use in the H-2A program and is covered under ICR 1205-0134.

This commenter also expressed concern that the proposed Form ETA-790A includes H-2A requirements that belong on the Form ETA-9142A, and recommended the Department ensure the Form ETA-790A “follow[s] the requirements of § 653.501(c)(1)(iv),” as the INA requires. The Department appreciates the comment, but reminds the commenter that any job order submitted by an employer, which will be used in connection with a future Form ETA-9142A for H-2A workers, must meet the regulatory requirements for agricultural clearance orders in 20 CFR part 653, subpart F and the requirements set forth in 20 CFR 655.122.

Further, the commenter recommended the Department conduct “a review of statutory/regulatory data authorization for each data point during this process . . . to assure only required information is mandated on the Forms.” The commenter noted that “[t]o expand a statutory or regulatory requirement[] through an [ICR] is contrary to the express requirement of the PRA.” In response to this comment, the Department has conducted a thorough review of the language and determined that all language proposed in this ICR is consistent with applicable laws and regulations, and the Department is proposing to collect only the minimum information necessary for it to carry out its temporary labor certification role.

The combined worker advocacy organizations, along with one more commenter, opposed the Department’s proposed elimination of Fields 20 through 25 on the current Form ETA-790. Field 20 asks whether it is prevailing practice to use FLCs to recruit, supervise, transport, house and/or pay workers for these crop activities and if so, the FLC wage for each activity. The commenters believed that this question is “the most prominent notification to potential H-2A employers of their obligation to offer FLCs a competitive override [where] the use of FLCs is the prevailing practice.” The commenters expressed concern that removal of this question will hinder many farmworkers’ ability to “accept H-2A jobs [because] local farmworkers depend on [FLCs] to transport them to and from” work sites and will “make it difficult, if not impossible, for the [SWA] or the OFLC to determine what, if any, override is being offered by the potential H-2A employer.”

Fields 21 to 25 on the current Form ETA-790 collect information on the following: unemployment and workers’ compensation coverage; provision of tools, supplies, and equipment at no charge to workers; anticipated range of hours for different seasonal activities; whether collect calls are accepted; commission or benefits for sale arrangements made to workers; and whether there is any strike, work stoppage, slowdown, or interruption of operation at any worksites. The combined worker advocacy organizations noted the proposed declarations and assurance in the Forms ETA-9142A, Appendix A, and ETA-790A cover some, but not all of these issues. The commenters urged the Department to retain Fields 21 to 25 to ensure “that all of these specific questions and benefits will be uniformly addressed by employers for potential applicants.”

The Department appreciates the comments, but declines to make the requested modifications. The Department has the authority to determine the manner in which employers, who choose to use the H-2A program, assure compliance with all assurances, obligations, and conditions of employment applicable to hiring H-2A workers and/or U.S. workers for job opportunities under the Form ETA-790A. The Department proposes to retain the assurances, obligations, and conditions of employment applicable to all H-2A job opportunities (e.g., workers’ compensation coverage, employer provided tools and equipment, and no strike, lockout, or work stoppage) as standardized statements listed in Section I, which the employer must read and accept before signing the form. Section I summarizes the regulatory requirements to which the job order is subject in a manner that permits the employers to succinctly understand their obligations and responsibilities for deciding to participate in the H-2A program. Further, the Department recognizes that the Form ETA-790A communicates the terms and conditions of employment to workers who may be interested in the job opportunity. Rather than requiring employers to copy assurances into free-text fields or risk misstating a requirement, Section I presents these terms in uniform, understandable language that mirrors the regulation. The standardized statements in Section I also serve to protect workers employed under the Form ETA-790A from employers who are unaware of regulatory requirements or who seek to abuse the H-2A program. However, for variable terms and conditions of employment, which may or may not be applicable and require more detailed explanations based on the unique circumstances of the employer’s job opportunity (e.g., anticipated range of hours for different seasonal activities, whether collect calls are accepted, commission or benefits for sale arrangements made to workers), the Form ETA-790A contains both free-text fields and a new Addendum C through which this information may be disclosed.