Surety Bond Guarantee Fee Reduction Study Survey

Surety Bond Guarantee Fee Reduction Study Survey

3245-– Surety Firm Survey Appendix B.1 1-29-2020

Surety Bond Guarantee Fee Reduction Study Survey

OMB: 3245-0411

Appendix B

Appendix B.1 – Surety Firm Survey (Hard Copy and Web-based Versions)

Appendix B.1.a Hard Copy of Surety Bond Guarantee Program Impacts on the Fee Reduction Survey for Surety Firms

The U.S. Small Business Administration’s (SBA) Surety Bond Guarantee (SBG) Program guarantees bid, payment, and performance bonds for small and emerging businesses that cannot obtain surety bonds through traditional commercial channels. Beginning in October 2018, SBA temporarily reduced the fees it charges surety firms and small businesses participating in the SBG Program. The fee charged to participating surety firms and agents to guarantee bonds was reduced from 26 percent to 20 percent of the bond premium, while the fee charged to small businesses was reduced from $7.29 per $1,000.00 of the contract to $6.00 per $1,000.00. SBA has contracted with 2M Research, to evaluate the effects of these fee reductions on your participation in and perceptions of the SBG Program.

As part of this evaluation, we would like to ask you a few questions about your experience with the SBG Program under the reduced fee structure. Your participation is voluntary; however, your participation in this study will help SBA to effectively manage and improve the SBG program. The survey has two sections and is designed for you to complete online in approximately 15 minutes.

Please answer as openly and honestly as possible. Your answers will be kept confidential, no one at SBA will know how you answered the questions, and only aggregated results will be provided to or published by SBA. If you have any questions or concerns about completing the survey, please do not hesitate to contact the help desk at [email protected] or call 1-202-205-6540. We thank you for your willingness to answer this online questionnaire.

Section 1. Effects of the Fee Reduction on Your Surety Firm

This first section asks about your firm’s initial perceptions of the fee reductions and the actual effects of the reductions on your firm. The second section will ask about how possible changes to the fees might impact your firm over the next 2 years.

For purposes of this survey, a “guaranteed bond” under the SBG Program will be referred to as a “bond”. Survey questions will ask about the fees associated with bonds that are submitted to the SBG Program for approval.

Throughout the survey, please provide answers based on your recollection and experience. Should your firm not require SBA approval to issue bonds, please answer the following questions to the best of your ability. Please do not reference additional documentation as you complete the survey.

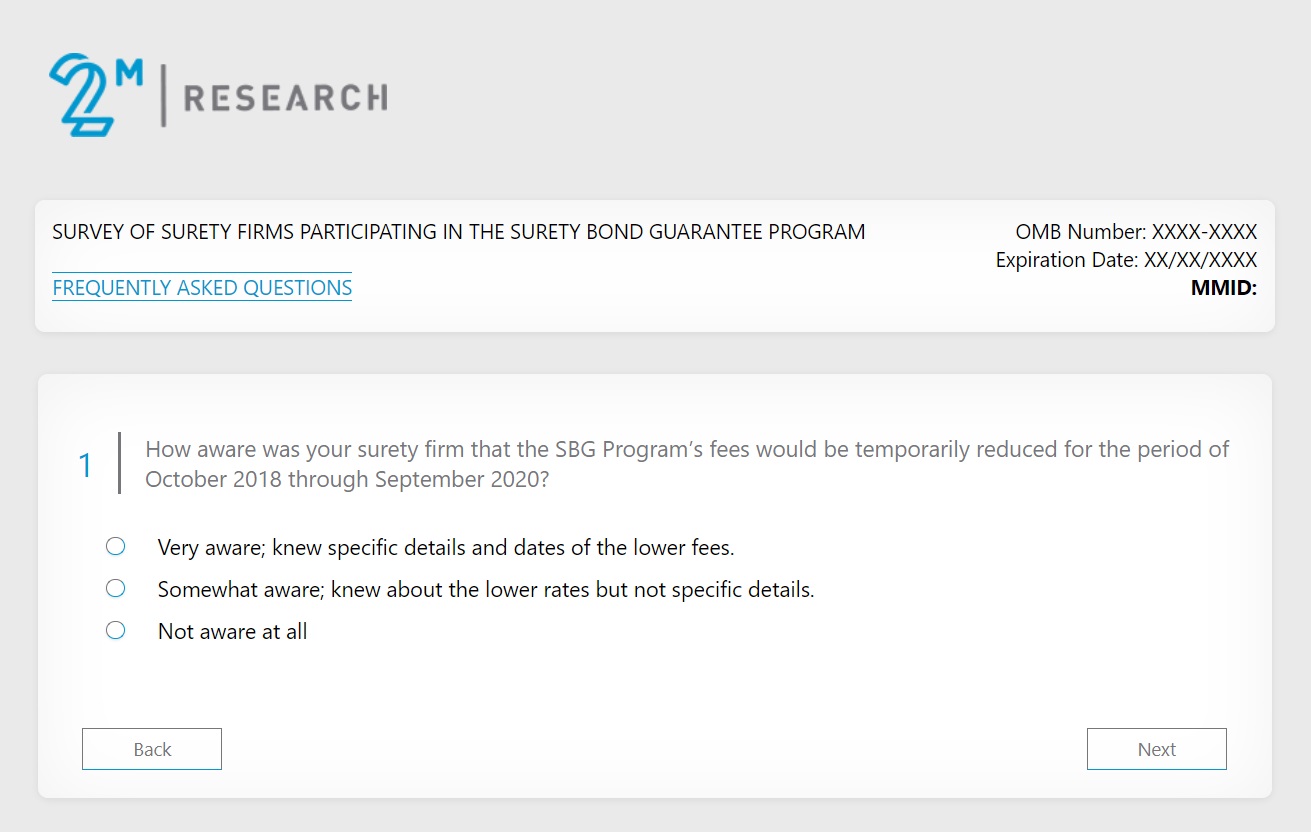

1. How aware was your surety firm that the SBG Program’s fees would be temporarily reduced for the period of October 2018 through September 2020?

Very aware; knew specific details and dates of the lower fees.

Somewhat aware; knew about the lower rates but not specific details.

Not aware at all [Skip to Q4].

In the next questions, we will ask about the effects your firm expected from the fee reductions.

For these questions, the term “bond applications” references applications sent to surety firms that may or may not have been approved to be bonded under the SBG Program.

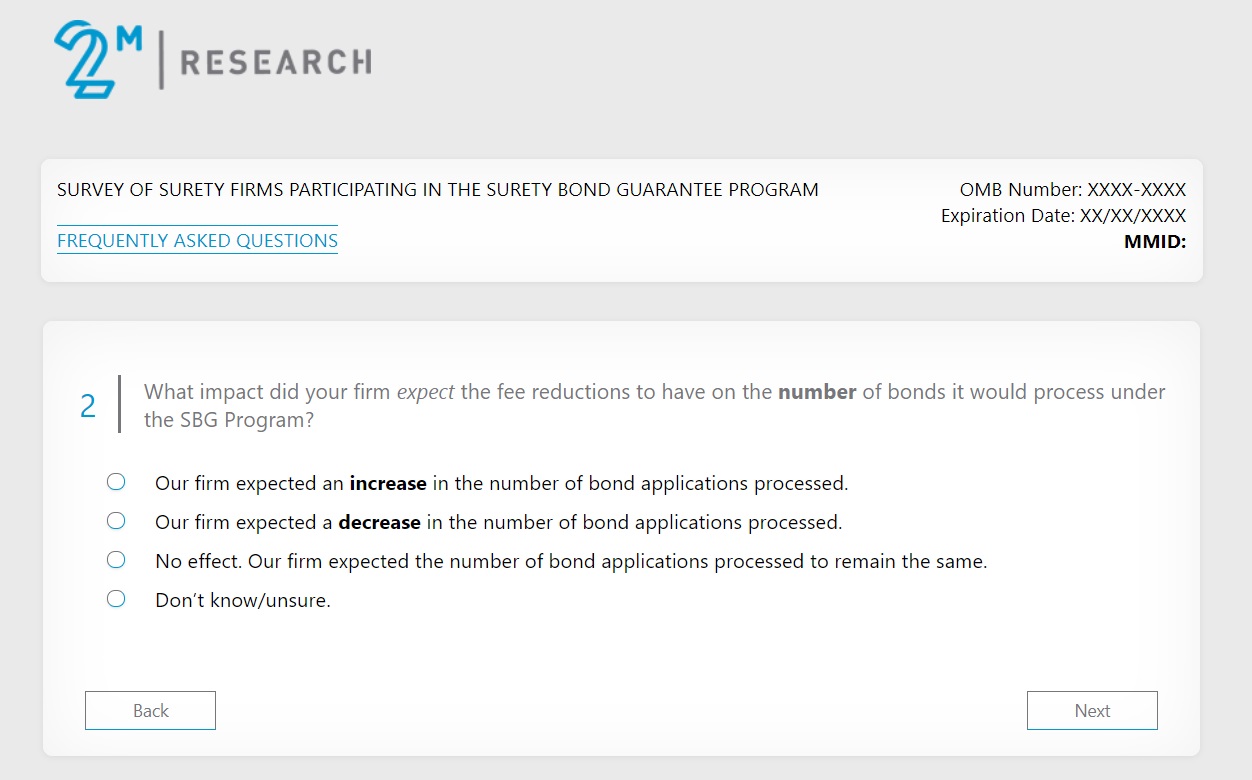

2. What impact did your firm expect the fee reductions to have on the number of bond applications it would process under the SBG Program?

Our firm expected an increase in the number of bond applications processed.

Our firm expected a decrease in the number of bond applications processed.

No effect. Our firm expected the number of bond applications processed to remain the same.

Don’t know/unsure.

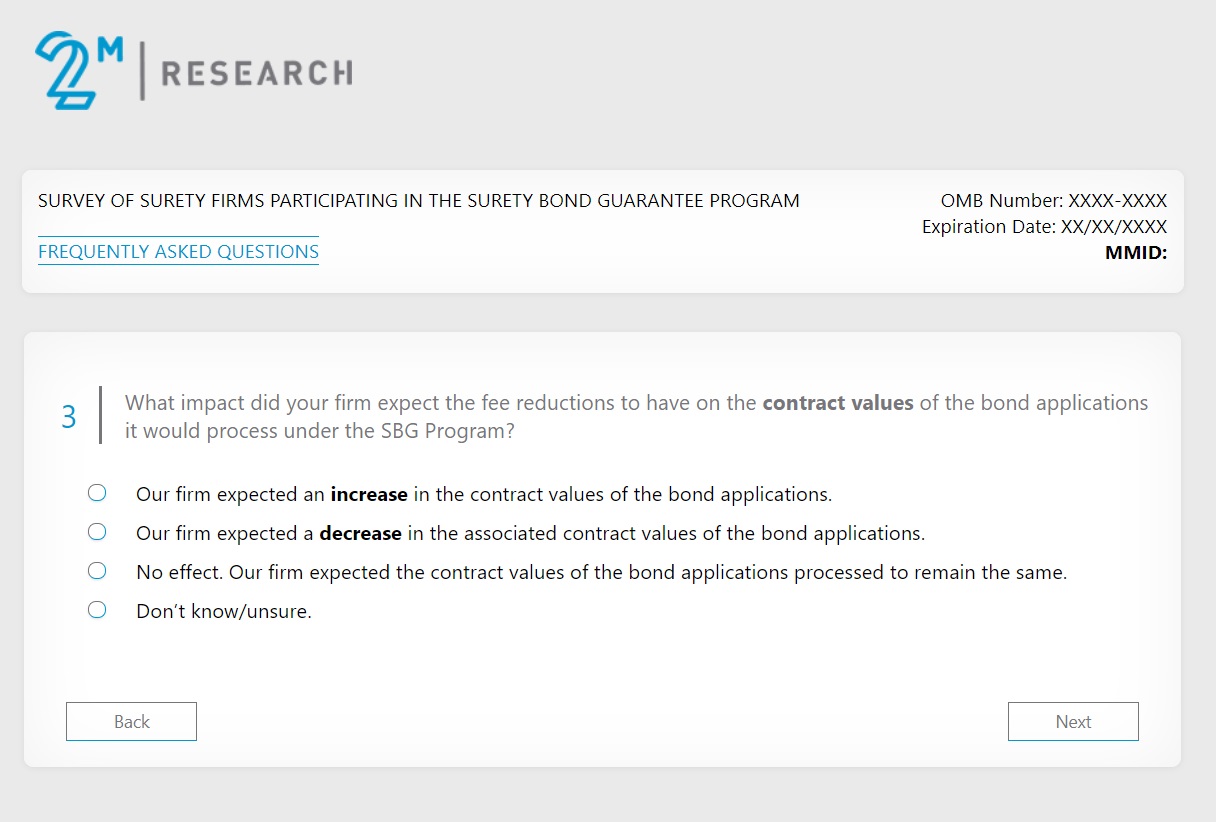

3. What impact did your firm expect the fee reductions to have on the contract values of the bond applications it would process under the SBG Program?

Our firm expected an increase in the contract values of the bond applications.

Our firm expected a decrease in the associated contract values of the bond applications.

No effect. Our firm expected the contract values of the bond applications processed to remain the same.

In the next questions, we will ask about the effects your firm experienced from the fee reductions. Please provide answers based on your recollection and experience; please do not reference additional documentation.

For these questions, the term “bond applications” references applications sent to surety firms that may or may not have been approved to be bonded under the SBG Program.

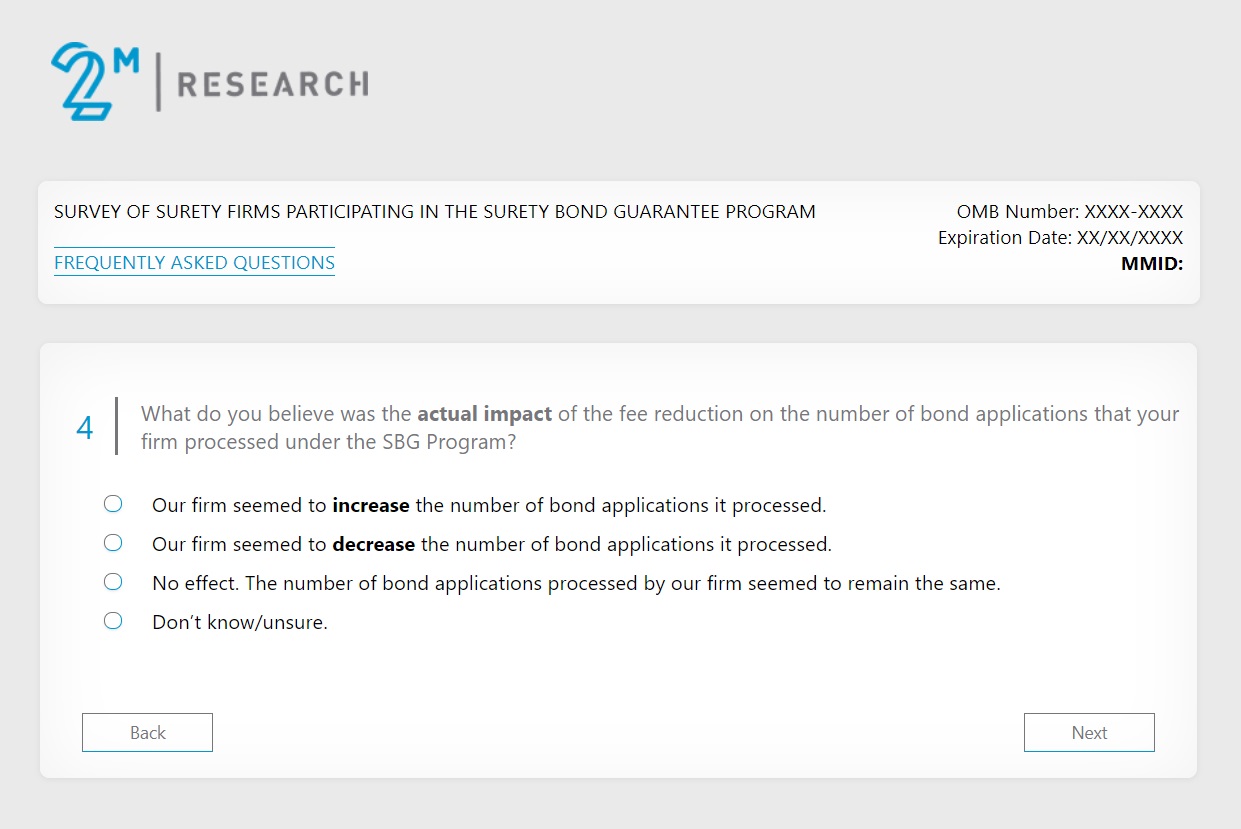

4. What do you believe was the actual impact of the fee reduction on the number of bond applications that your firm processed under the SBG Program?

Our firm seemed to increase the number of bond applications it processed.

Our firm seemed to decrease the number of bond applications it processed.

No effect. The number of bond applications processed by our firm seemed to remain the same.

Don’t know/unsure.

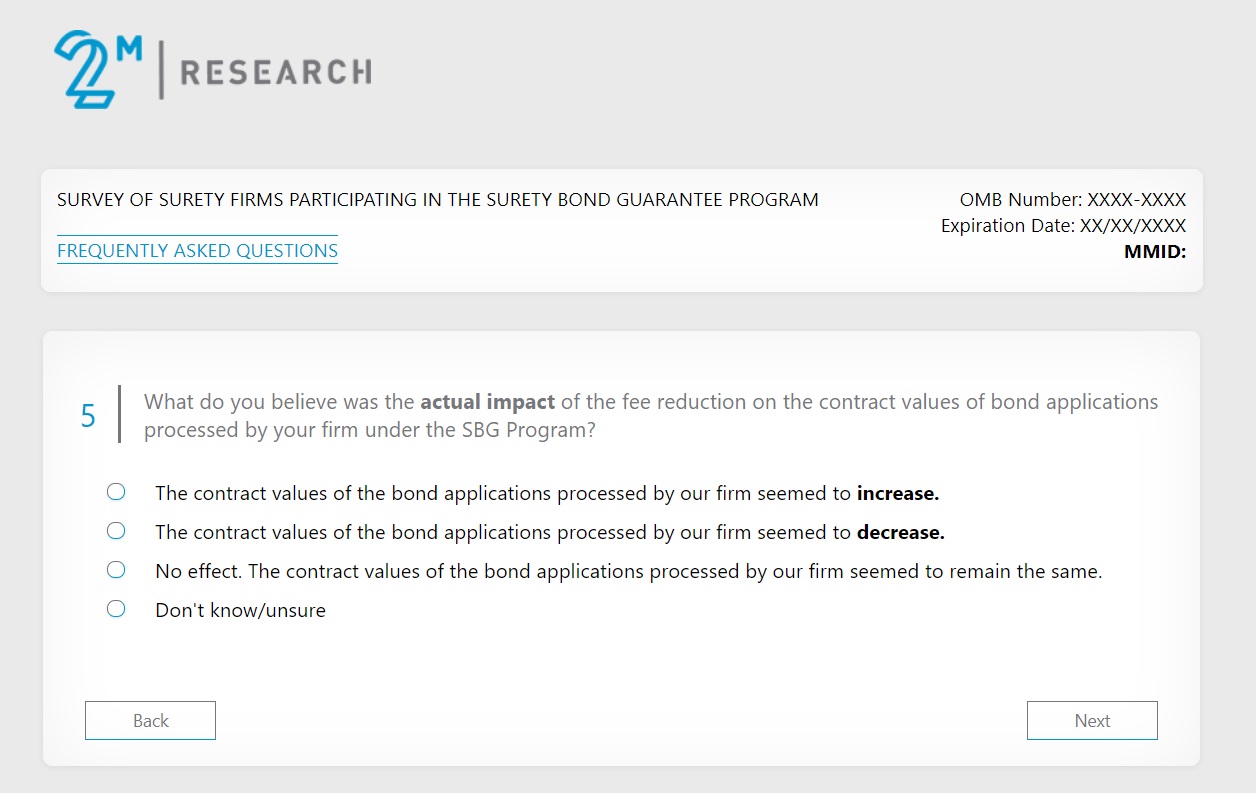

5. What do you believe was the actual impact of the fee reduction on the contract values of bond applications processed by your firm under the SBG Program?

The contract values of the bond applications processed by our firm seemed to increase.

The contract values of the bond applications processed by our firm seemed to decrease.

No effect. The contract values of the bond applications processed by our firm seemed to remain the same.

Don’t know/unsure.

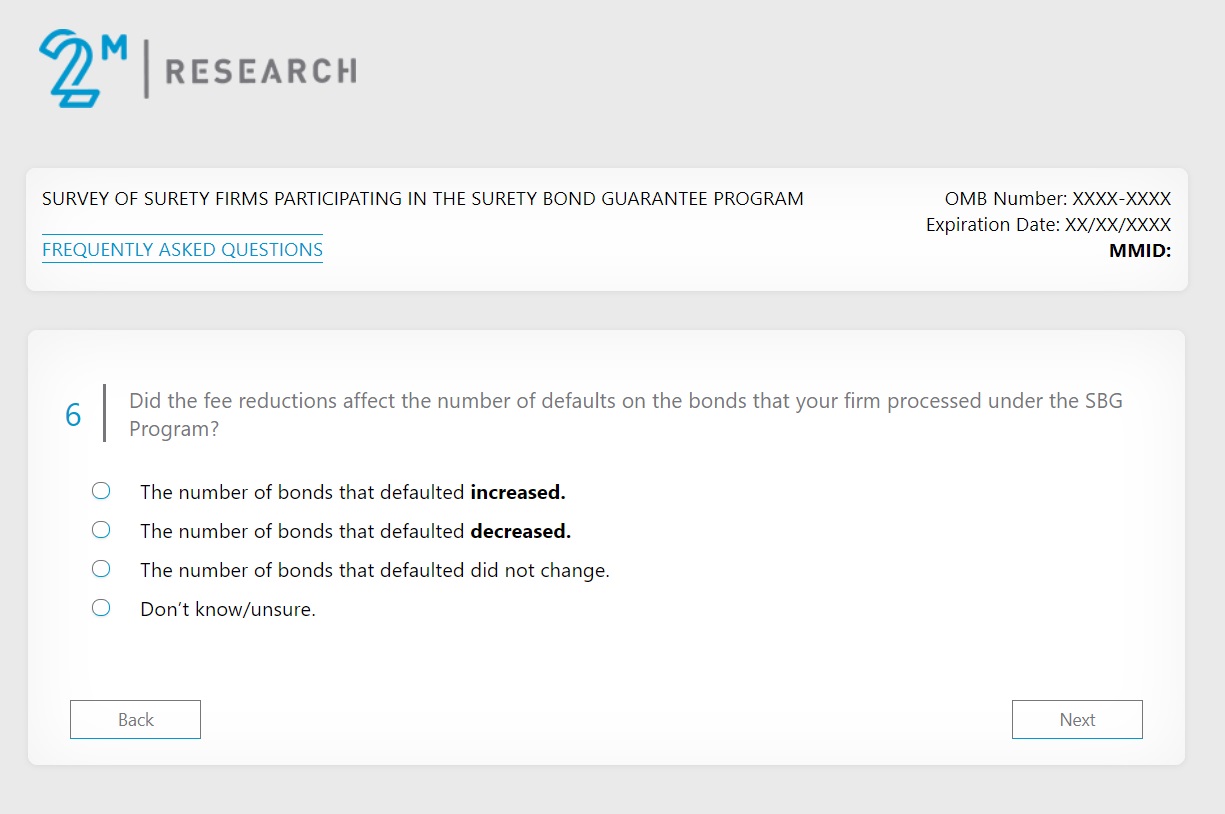

6. Did the fee reductions affect the number of defaults on the bonds that your firm processed under the SBG Program?

The number of bonds that defaulted increased.

The number of bonds that defaulted decreased.

The number of bonds that defaulted did not change.

Don’t know/unsure.

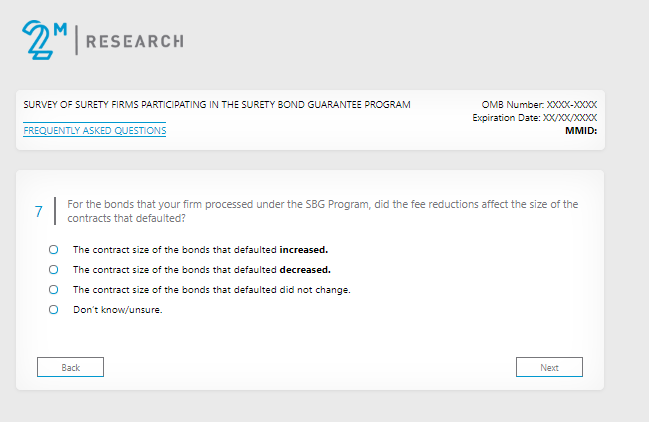

7. For the bonds that your firm processed under the SBG Program, did the fee reductions affect the size of the contracts that defaulted?

The contract size of the bonds that defaulted increased.

The contract size of the bonds that defaulted decreased.

The contract size of the bonds that defaulted did not change.

Don’t know/unsure.

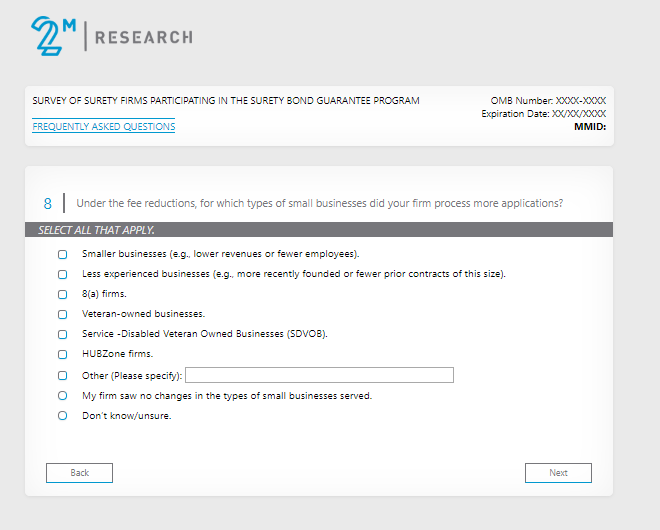

8. Under the fee reductions, for which types of small businesses did your firm process more applications? SELECT ALL THAT APPLY.

□ Smaller businesses (e.g., lower revenues or fewer employees).

□ Less experienced businesses (e.g., more recently founded or fewer prior contracts of this size).

□ 8(a) firms.

□ Veteran-owned businesses.

□ Service -Disabled Veteran Owned Businesses (SDVOB).

□ HUBZone firms.

□ Other (Please specify):________________

○ My firm saw no changes in the types of small businesses served.

○ Don’t know/unsure.

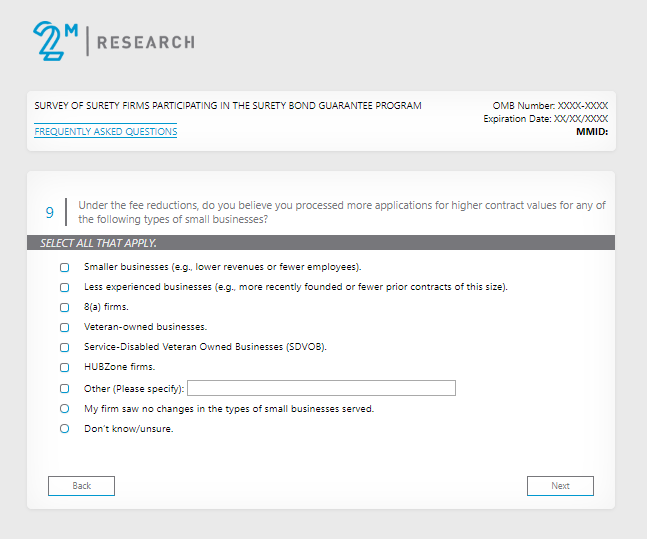

9. Under the fee reductions, do you believe you processed more applications for higher contract values for any of the following types of small businesses? SELECT ALL THAT APPLY.

□ Smaller businesses (e.g., lower revenues or fewer employees).

□ Less experienced businesses (e.g., more recently founded or fewer prior contracts of this size).

□ 8(a) firms.

□ Veteran-owned businesses.

□ Service -Disabled Veteran Owned Businesses (SDVOB).

□ HUBZone firms.

□ Other (Please specify):_________________

○ My firm saw no changes in the types of small businesses served.

○ Don’t know/unsure.

Section 2. Expected Effects of Changes to the SBG Program Fees on Your Surety Firm

This next section asks for your perceptions of how possible changes to the SBG Program surety fees might impact your firm over the next 2 years.

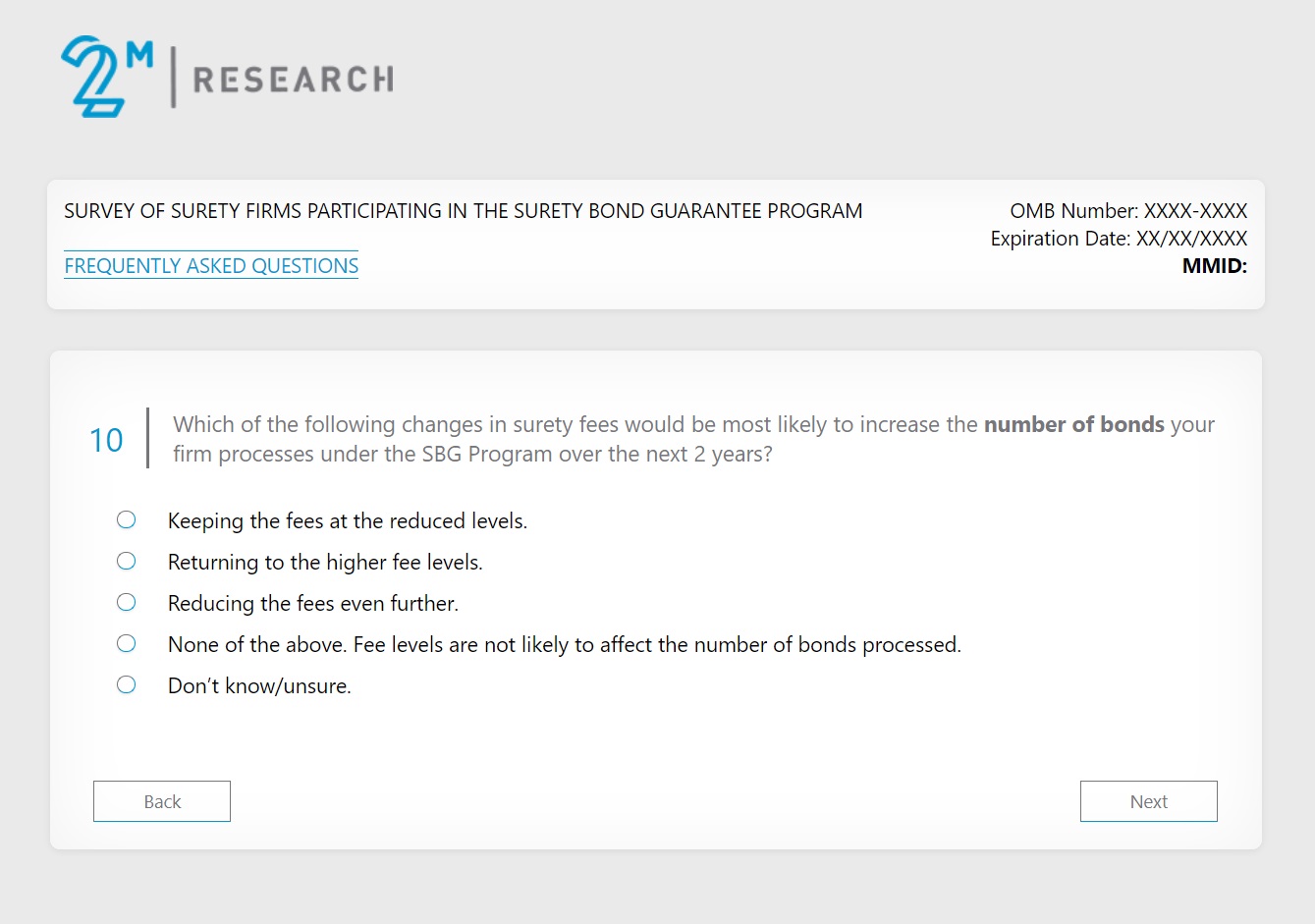

10. Which of the following changes in surety fees would be most likely to increase the number of bonds your firm processes under the SBG Program over the next 2 years?

Keeping the fees at the reduced levels.

Returning to the higher fee levels.

Reducing the fees even further.

None of the above. Fee levels are not likely to affect the number of bonds processed.

Don’t know/unsure.

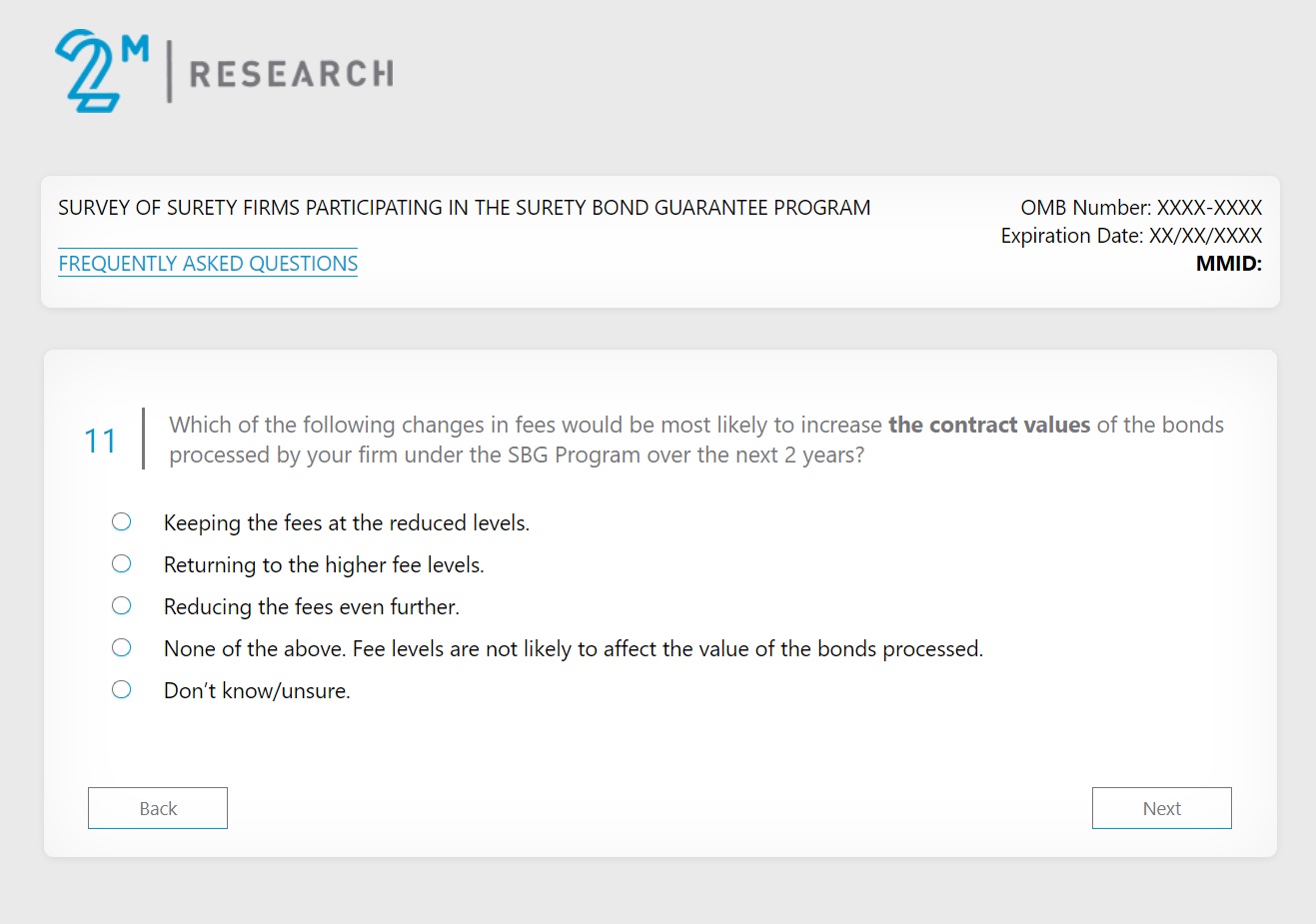

11. Which of the following changes in fees would be most likely to increase the contract values of the bonds processed by your firm under the SBG Program over the next 2 years?

Keeping the fees at the reduced levels.

Returning to the higher fee levels.

Reducing the fees even further.

None of the above. Fee levels are not likely to affect the value of the bonds processed.

Don’t know/unsure.

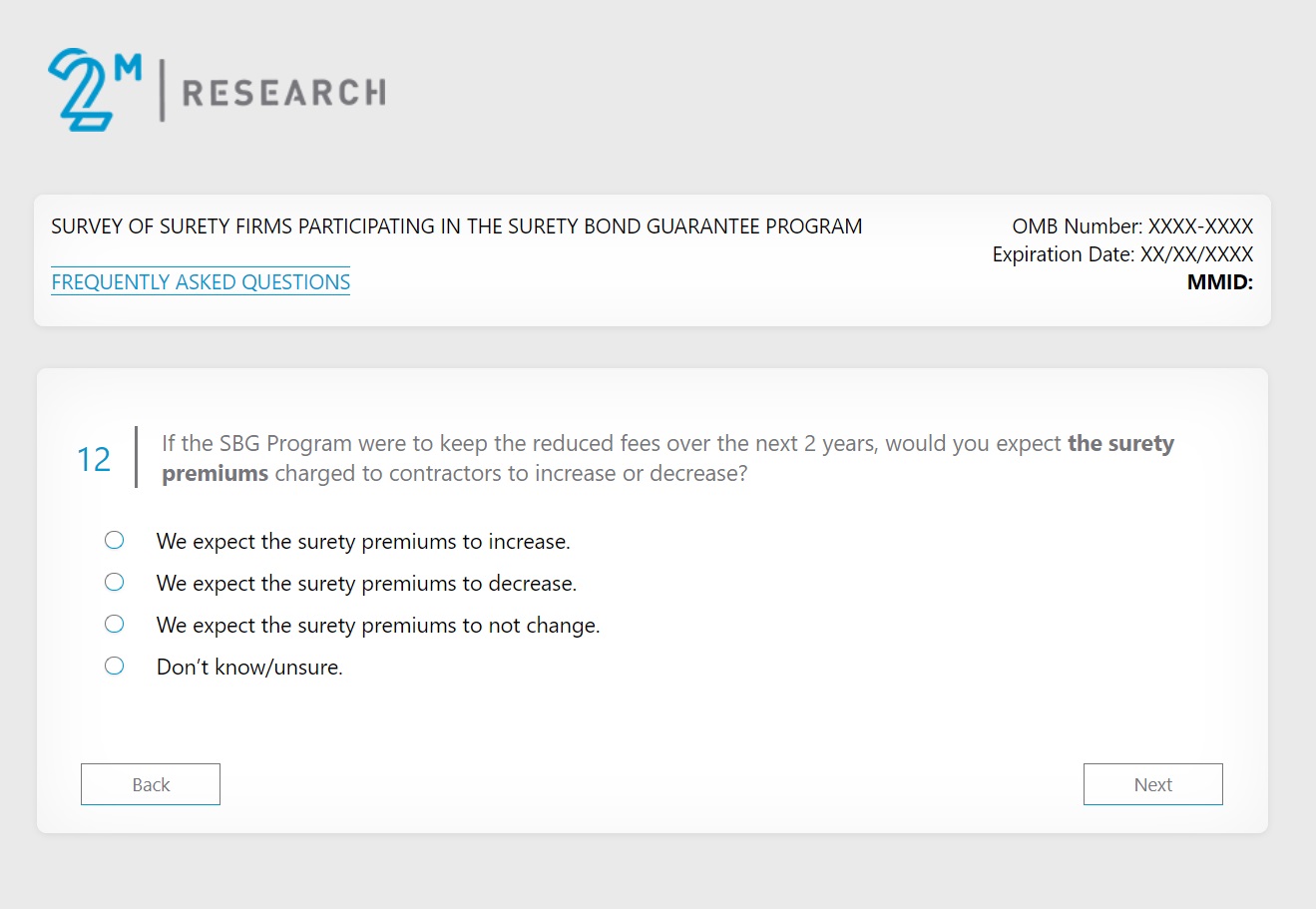

12. If the SBG Program were to keep the reduced fees over the next 2 years, would you expect the surety premiums charged to contractors to increase or decrease?

We expect the surety premiums to increase.

We expect the surety premiums to decrease.

We expect the surety premiums to not change.

Don’t know/unsure.

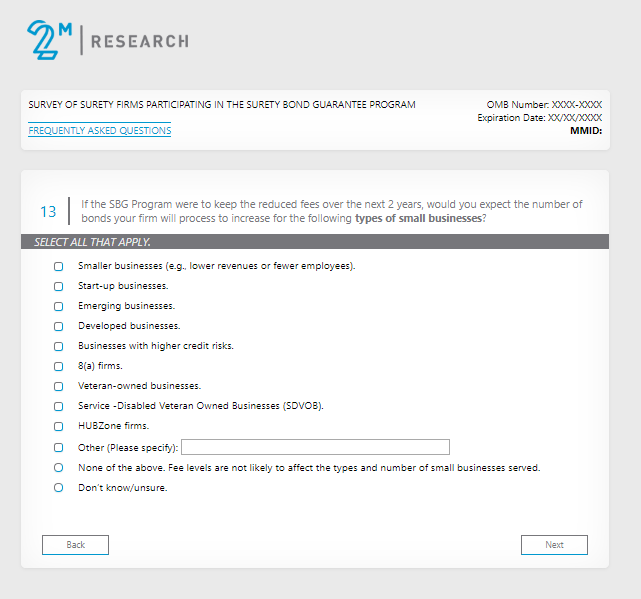

13. If the SBG Program were to keep the reduced fees over the next 2 years, would you expect the number of bonds your firm will process to increase for the following types of small businesses?

SELECT ALL THAT APPLY.

□ Smaller businesses (e.g., lower revenues or fewer employees).

□ Start-up businesses.

□ Emerging businesses.

□ Developed businesses.

□ Businesses with higher credit risks.

□ 8(a) firms.

□ Veteran-owned businesses.

□ Service -Disabled Veteran Owned Businesses (SDVOB).

□ HUBZone firms.

□ Other (Please specify): _________________

None of the above. Fee levels are not likely to affect the types and number of small businesses served.

○ Don’t know/unsure.

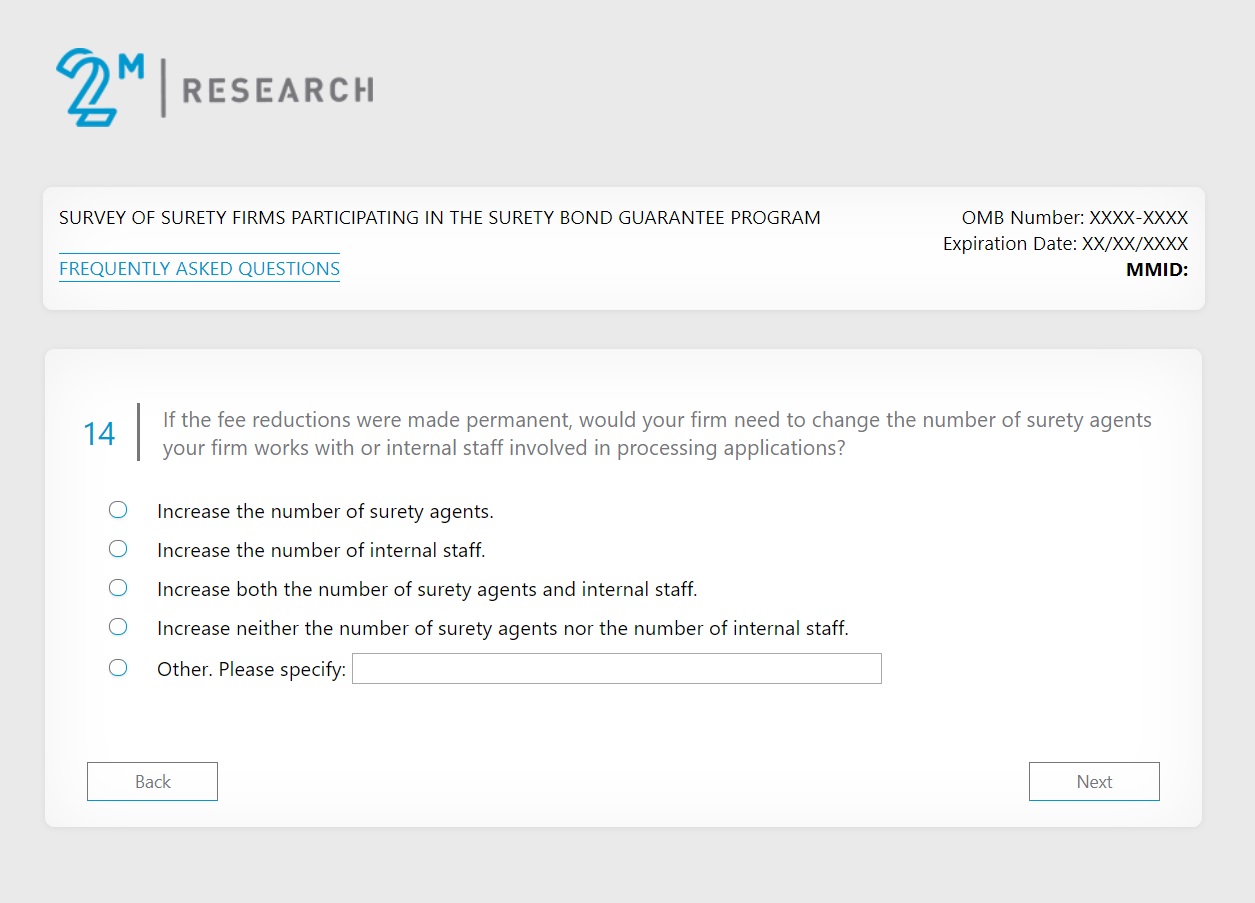

14. If the fee reductions were made permanent, would your firm need to change the number of surety agents your firm works with or internal staff involved in processing applications?

○ Increase the number of surety agents.

○ Increase the number of internal staff.

○ Increase both the number of surety agents and internal staff.

○ Increase neither the number of surety agents nor the number of internal staff.

○ Other. Please specify: ___________________.

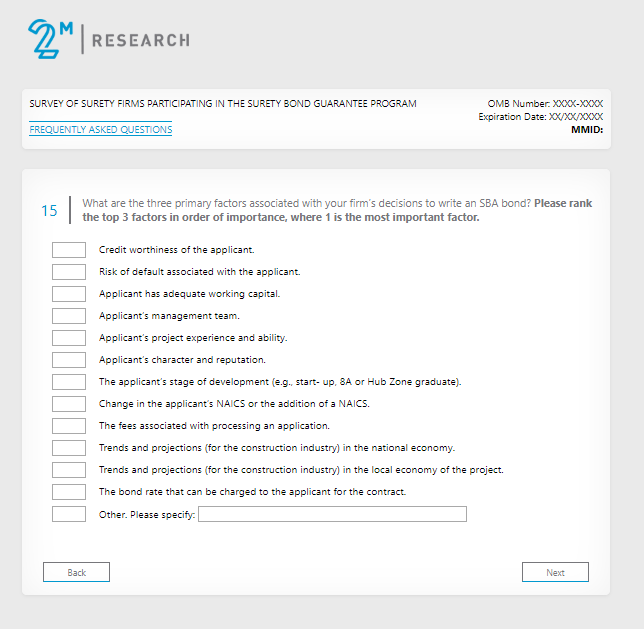

15. What are the three primary factors associated with your firm’s decisions to write an SBA bond? Please rank the top 3 factors in order of importance, where 1 is the most important factor.

____ Creditworthiness of the applicant.

____ Risk of default associated with the applicant.

____ Applicant has adequate working capital.

____ Applicant’s management team.

____ Applicant’s project experience and ability.

____ Applicant’s character and reputation.

____ The applicant’s stage of development (e.g., start-up, 8(a) or HUBZone graduate).

____ Change in the applicant’s NAICS or the addition of a NAICS.

____ The fees associated with processing an application.

____ Trends and projections (for the construction industry) in the national economy.

____ Trends and projections (for the construction industry) in the local economy of the

project.

____ The bond rate that can be charged to the applicant for the contract.

____ Other. Please specify: ___________________.

Now, we are going to ask you a few questions about the surety fee and your firm’s likelihood of processing SBG Program bonds. As a reminder, the surety fee charged by SBA for 2006 through 2018 was 26% and was temporarily reduced to 20% on October 1, 2018.

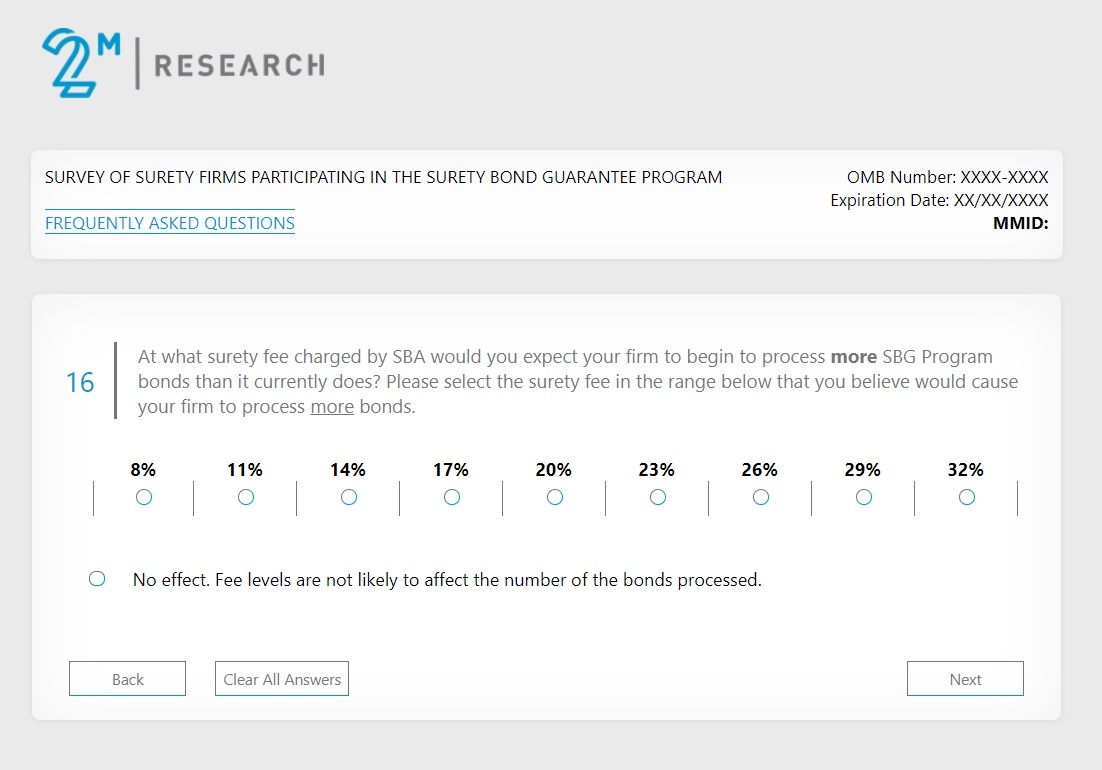

16. At what surety fee charged by SBA would you expect your firm to begin to process more SBG Program bonds than it currently does? Please select the surety fee in the range below that you believe would cause your firm to process more bonds.

8% 11% 14% 17% 20% 23% 26% 29% 32%

|_____|____|_____|_____|_____|_____|_____|______|

□ □ □ □ □ □ □ □ □

□ No effect. Fee levels are not likely to affect the number of the bonds processed.

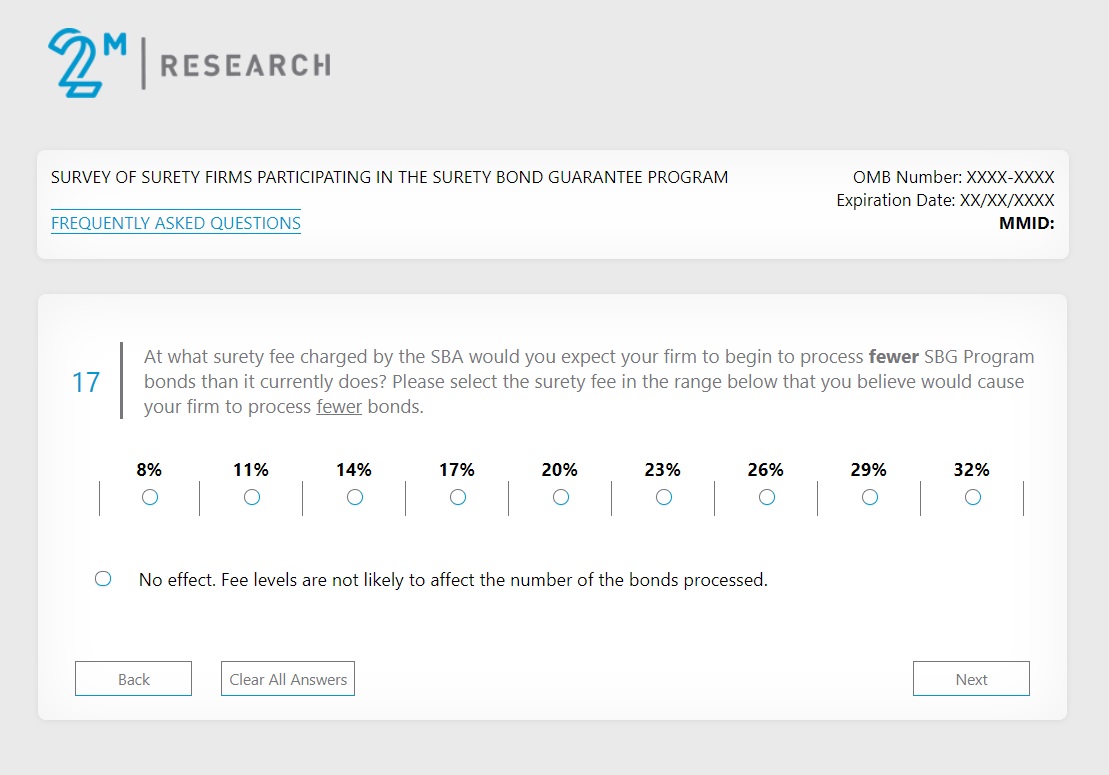

17. At what surety fee charged by the SBA would you expect your firm to begin to process fewer SBG Program bonds than it currently does? Please select the surety fee in the range below that you believe would cause your firm to process fewer bonds.

8% 11% 14% 17% 20% 23% 26% 29% 32%

|_____|____|_____|_____|_____|_____|_____|______|

□ □ □ □ □ □ □ □ □

□ No effect. Fee levels are not likely to affect the number of the bonds processed.

The next question asks about your broader perspective as a participant in the SBG Program, as opposed to the narrower perspective of your surety firm.

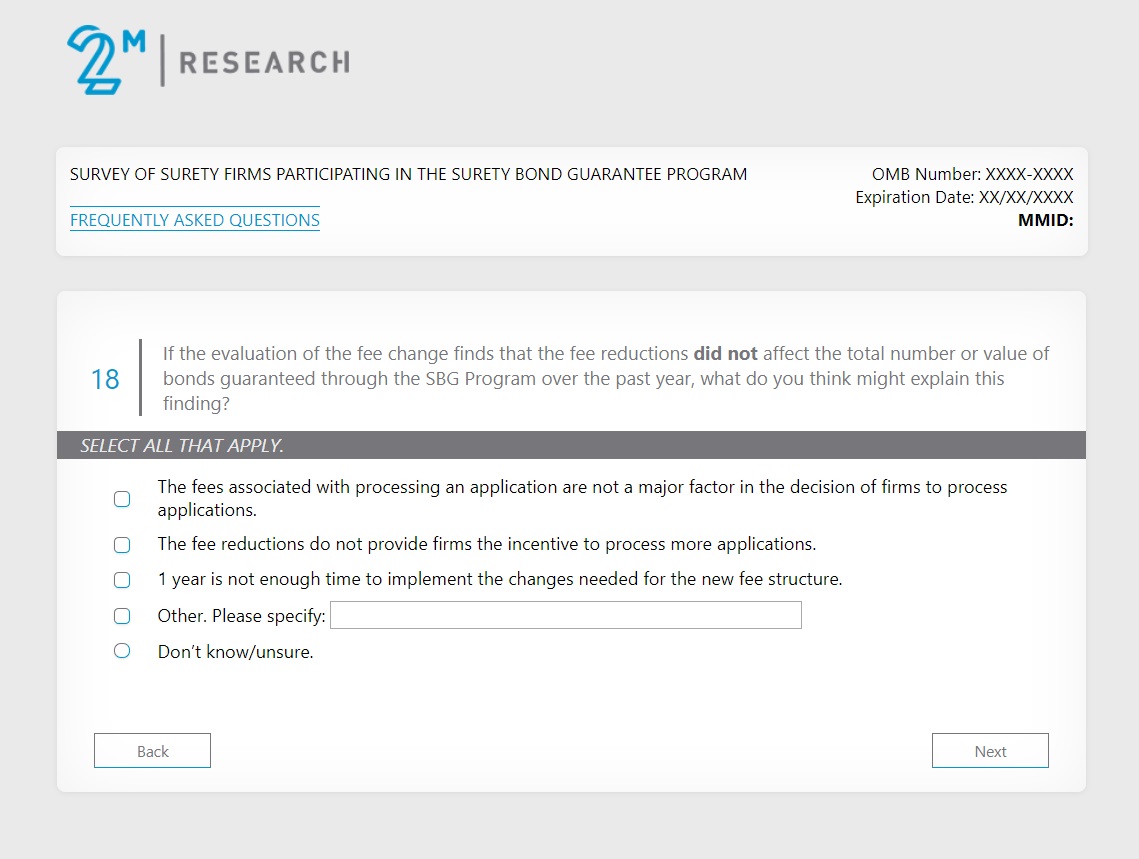

18. If the evaluation of the fee change finds that the fee reductions did not affect the total number or value of bonds guaranteed through the SBG Program over the past year, what do you think might explain this finding? SELECT ALL THAT APPLY.

□ The fees associated with processing an application are not a major factor in the decision of firms to process applications.

□ The fee reductions do not provide firms the incentive to process more applications.

□ 1 year is not enough time to implement the changes needed for the new fee structure.

□ Other. Please specify: ___________________.

□ Don’t know/unsure.

19. Is there anything else you would like to share regarding your surety firm’s participation in the SBG Program?

[Enter open-ended text here.]

Thank you for participating in this survey. Your survey has been submitted. If you have any questions about this survey, please email [email protected].

Appendix B.1.b Screenshots of Web-based Surety Bond Guarantee Program Impacts on the Fee Reduction Survey for Surety Firms (Web-based)

This section displays how the survey of Surety Firms Participating in the Surety Bond Guarantee will be presented to participating surety firms on a web-based platform. The programmed survey includes branching logic for Question 1 which skips to Question 4 if survey respondents select “Not aware at all.” For review purposes, response option types (single-select, multiple-select, and ranking) are indicated with the following symbols:

This symbol indicates that respondents can only select one response

□ This symbol indicates that respondents can select multiple responses

__ This symbol indicates that respondents can insert ranking values (e.g., 1, 2, 3)

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Borg, Brittany J. |

| File Modified | 0000-00-00 |

| File Created | 2021-01-14 |

© 2026 OMB.report | Privacy Policy