PLUS Credit Counseling

PLUS Adverse Credit Reconsideration Loan Counseling

Text Baseline PLUS Credit Counseling 2020 60D

PLUS Credit Counseling

OMB: 1845-0129

Your Loans & Their Impact

English Text |

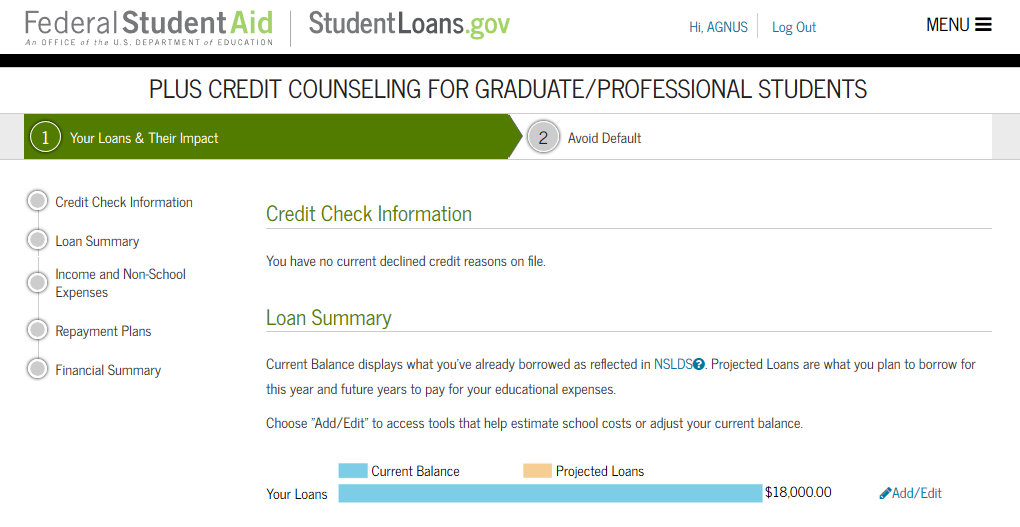

PLUS CREDIT COUNSELING FOR GRADUATE/PROFESSIONAL STUDENTS |

Credit Check Information |

Loan Summary |

Income and Non-School Expenses |

Repayment Plans |

Financial Summary |

Credit Check Information [Does not display unless user has a declined credit reason] |

[If a borrower has a declined credit reason, the following text is displayed] Based on the information we received from {0}, we were unable to approve your request for a Direct PLUS Loan for the following reason(s): |

You may still be eligible to receive a Direct PLUS Loan. In order to become eligible you must take one of the following actions: |

|

or |

|

Loan Summary |

Current Balance displays what you've already borrowed as reflected in NSLDS [tooltip]. Projected Loans are what you plan to borrow for this year and future years to pay for your educational expenses. Tooltip: The central database for student aid. NSLDS receives data from schools, guaranty agencies, and other Department of Education databases.

|

Choose "Add/Edit" to access tools that help estimate school costs or adjust your current balance. |

Current Balance |

Projected Loans |

Your Loans |

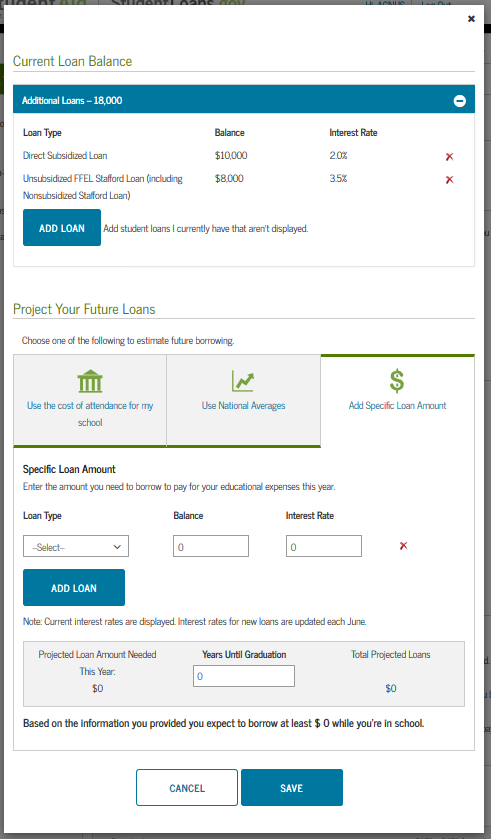

Add Loan – Add Specific Loan Amount

English Text |

Current Loan Balance |

Loan Type |

Balance |

Interest Rate |

ADD LOAN |

Add student loans I currently have that aren't displayed. |

Project Your Future Loans |

Choose one of the following to estimate future borrowing. |

Specific Loan Amount |

Enter the amount you need to borrow to pay for your educational expenses this year. |

Loan Type |

Balance |

Interest Rate |

ADD LOAN |

Note: Current interest rates are displayed. Interest rates for new loans are updated each June. |

Projected Loan Amount Needed This Year: |

Years Until Graduation |

Total Projected Loans |

Based on the information you provided you expect to borrow at least |

while you're in school. |

CANCEL |

SAVE |

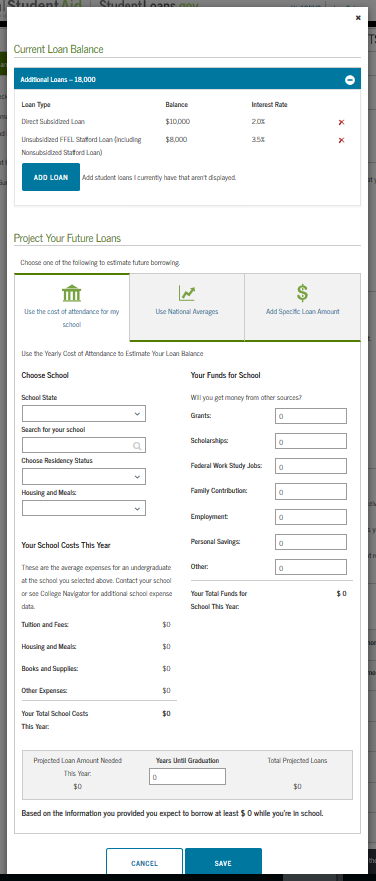

Add Loan – Use the cost of attendance for my school

English Text |

Use the Yearly Cost of Attendance to Estimate Your Loan Balance |

Choose School |

School State |

Search for your school |

Choose Residency Status |

In-State |

Out-of-State |

Housing and Meals: |

On-Campus |

Off-Campus |

Your School Costs This Year |

These are the average expenses for an undergraduate at the school you selected above. Contact your school or see College Navigator for additional school expense data. |

Tuition and Fees: |

Housing and Meals: |

Books and Supplies: |

Other Expenses: |

Your Total School Costs This Year: |

Your Funds for School |

Will you get money from other sources? |

Grants: |

Scholarships: |

Federal Work Study Jobs: |

Family Contribution: |

Employment: |

Personal Savings: |

Other: |

Your Total Funds for School This Year: |

Projected Loan Amount Needed This Year: |

Years Until Graduation |

Total Projected Loans |

Based on the information you provided you expect to borrow at least |

while you're in school. |

CANCEL |

SAVE |

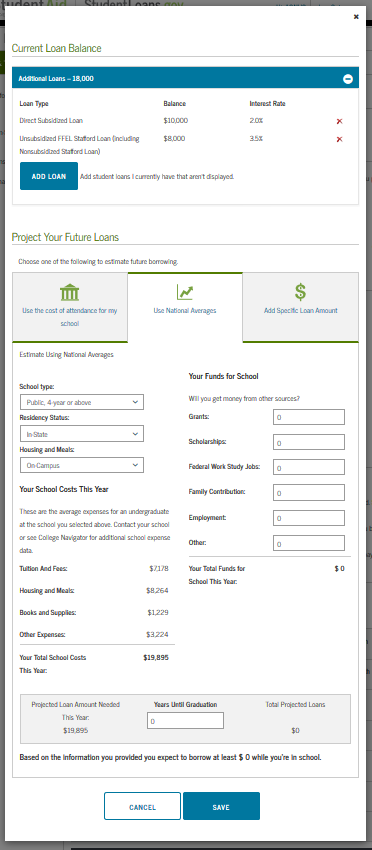

Add Loan – Use National Averages

English Text |

Estimate Using National Averages |

School type: |

Residency Status: |

In-State |

Out-of-State |

Housing and Meals: |

On-Campus |

Off-Campus |

Your School Costs This Year |

These are the average expenses for an undergraduate at the school you selected above. Contact your school or see College Navigator for additional school expense data. |

Tuition And Fees: |

Housing and Meals: |

Books and Supplies: |

Other Expenses: |

Your Total School Costs This Year: |

Your Funds for School |

Will you get money from other sources? |

Grants: |

Scholarships: |

Federal Work Study Jobs: |

Family Contribution: |

Employment: |

Other: |

Your Total Funds for School This Year: |

Projected Loan Amount Needed This Year: |

Years Until Graduation |

Total Projected Loans |

Based on the information you provided you expect to borrow at least |

while you're in school. |

CANCEL |

SAVE |

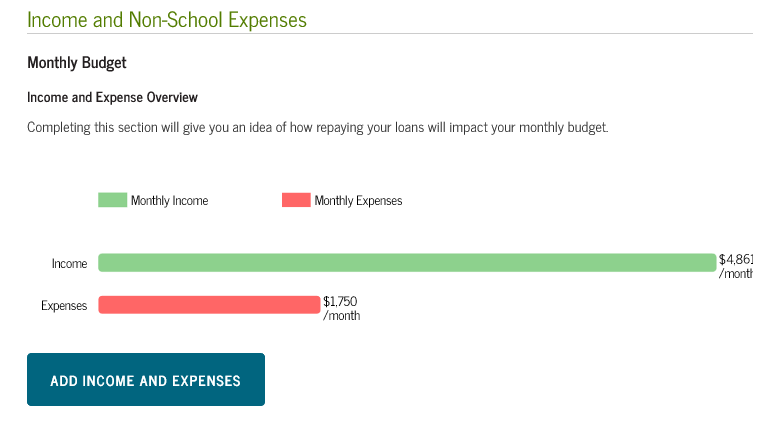

Income and Non-School Expenses

English Text |

Income and Non-School Expenses |

Monthly Budget |

Income and Expense Overview |

Completing this section will give you an idea of how repaying your loans will impact your monthly budget. |

Monthly Income |

/month |

Monthly Expenses |

/month |

ADD INCOME AND EXPENSES |

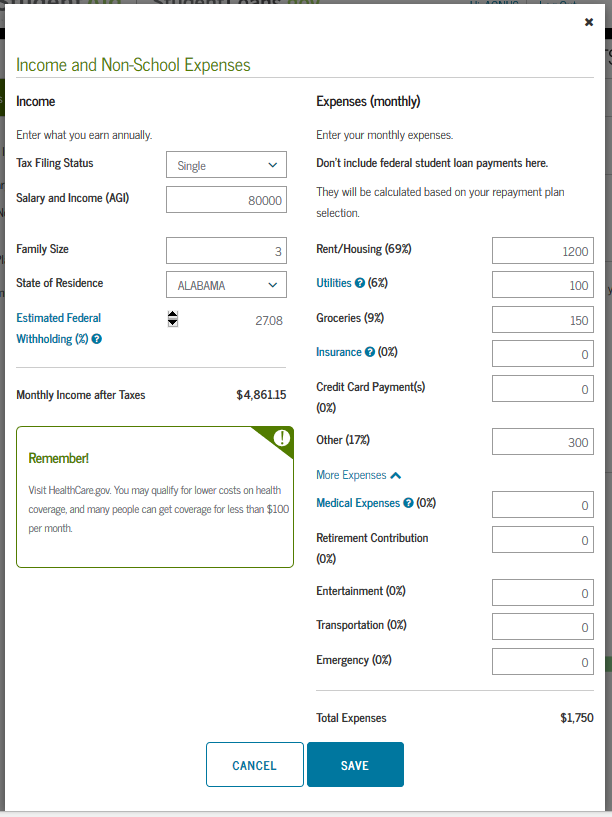

Add Income and Expenses

English Text |

Income and Non-School Expenses |

Income |

Enter what you earn annually. |

Tax Filing Status |

Single |

Married Filing Jointly |

Married Filing Separately |

Head of Household |

Salary and Income (AGI) |

Family Size |

State of Residence |

Federal Income Taxes |

Social Security |

Medicare |

Monthly Income after Taxes |

Expenses (monthly) |

Enter your monthly expenses. Don't include federal student loan payments here. They will be calculated based on your repayment plan selection. |

Rent/Housing ( %) |

Utilities [tooltip] ( %) |

Groceries ( %) |

Insurance [tooltip] ( %) |

Credit Card Payment(s) ( %) |

Other ( %) |

More Expenses |

Medical Expenses [tooltip] ( %) |

Retirement Contribution ( %) |

Entertainment ( %) |

Transportation ( %) |

Emergency ( %) |

Total Expenses |

Remember! |

Visit HealthCare.gov. You may qualify for lower costs on health coverage, and many people can get coverage for less than $100 per month. |

CANCEL |

SAVE |

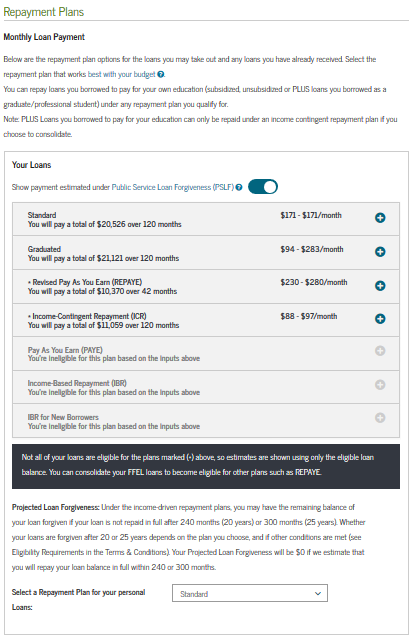

Repayment Plans

English Text |

Repayment Plans |

Monthly Loan Payment |

Below are the repayment plan options for the loans you may take out and any loans you have already received. |

Select the repayment plan that works best with your budget [tooltip]. |

You can repay loans you borrowed to pay for your own education (subsidized, unsubsidized or PLUS loans you borrowed as a graduate/professional student) under any repayment plan you qualify for. Note: PLUS Loans you borrowed to pay for your education can only be repaid under an income contingent repayment plan if you choose to consolidate. [tooltip text] |

Your Loans |

Show payment estimated under Public Service Loan Forgiveness (PSLF) [tooltip] |

You’re ineligible for this plan based on the inputs above [Displayed conditionally] |

You will pay a total of {0} over {0} months |

First Monthly Payment |

Last Monthly Payment |

Total Amount Paid |

Projected Loan Forgiveness |

Public Service Loan Forgiveness |

Repayment Period |

months |

More Information [link will open Repayment Plan pop-up, see Shared Page Components text baseline] |

Not all of your loans are eligible for the plans marked (*) above, so estimates are shown using only the eligible loan balance. You can consolidate your FFEL loans to become eligible for other plans such as REPAYE. [appears when user has a combination of DL and FFEL loans] |

Consolidation Repayment Plans: |

Projected Loan Forgiveness: Under the income-driven repayment plans, you may have the remaining balance of your loan forgiven if your loan is not repaid in full after 240 months (20 years) or 300 months (25 years). Whether your loans are forgiven after 20 or 25 years depends on the plan you choose, and if other conditions are met (see Eligibility Requirements in the Terms & Conditions). Your Projected Loan Forgiveness will be $0 if we estimate that you will repay your loan balance in full within 240 or 300 months. |

Repayment Plan selection is only available if your loan information is retrieved from NSLDS [tooltip] or you manually entered it. |

Select a Repayment Plan for your personal loans: |

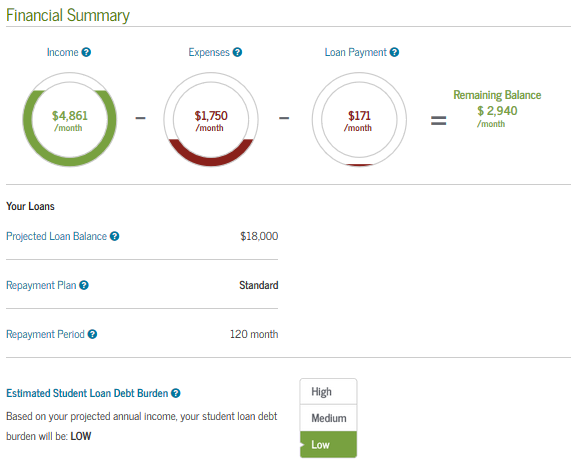

Financial Summary

English Text |

Financial Summary |

Income [tooltip] |

/month |

Expenses [tooltip] |

/month |

Loan Payment [tooltip] |

/month |

Remaining Balance |

/month |

Your Loans |

Projected Loan Balance [tooltip] |

Repayment Plan [tooltip] |

Repayment Period [tooltip] |

Estimated Student Loan Debt Burden [tooltip] |

Based on your projected annual income, your student loan debt burden will be: |

High |

Medium |

Low |

EXIT |

CONTINUE |

All Borrower Types - Avoid Default (Step 2)

English Text |

You're currently not logged in! [if unauthenticated] |

Log in to view your federal student loan data, notify schools of counseling completion, and save proof of counseling completion. If you are not logged in, you cannot meet requirements for completing counseling. [if unauthenticated] |

LOG IN [if unauthenticated] |

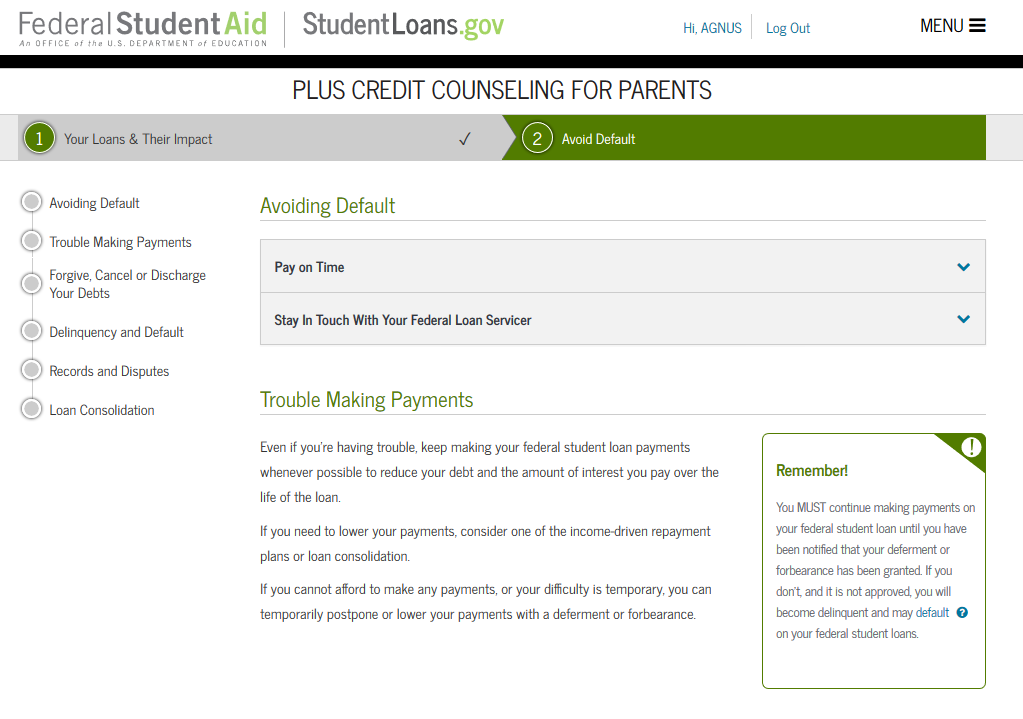

Avoiding Default |

Finish Your Program and Graduate [appears for Grad only] |

Graduation is the first step to successfully repaying your federal student loans.

[appears for Grad only] |

Did you know? [appears for Grad only] |

It's important to graduate! According to U.S. Census Bureau Data, the average college graduate from a 4-year degree program earns almost $1,000,000 more over a lifetime than a high school graduate. [appears for Grad only] |

Pay on Time |

It is very important that you make your federal student loan payments on time. If you are having trouble making your monthly payment, you should immediately contact your federal loan servicer for assistance. |

Stay In Touch With Your Federal Loan Servicer |

Open all your mail and read everything pertaining to your federal student loans. Signing up for electronic correspondence can help you ensure that you never miss a letter or bill. |

Contact your loan servicer [tooltip] BEFORE you miss a payment on your federal student loan. They can help review and advise you of your repayment options. If you are unable to make your Perkins loan payment, contact your schools financial aid office. |

Trouble Making Payments |

Even if you're having trouble, keep making your federal student loan payments whenever possible to reduce your debt and the amount of interest you pay over the life of the loan. |

If you need to lower your payments, consider one of the income-driven repayment plans or loan consolidation. |

If you cannot afford to make any payments, or your difficulty is temporary, you can temporarily postpone or lower your payments with a deferment or forbearance. |

Remember! |

You MUST continue making payments on your federal student loan until you have been notified that your deferment or forbearance has been granted. If you don't, and it is not approved, you will become delinquent and may default [tooltip] on your federal student loans. |

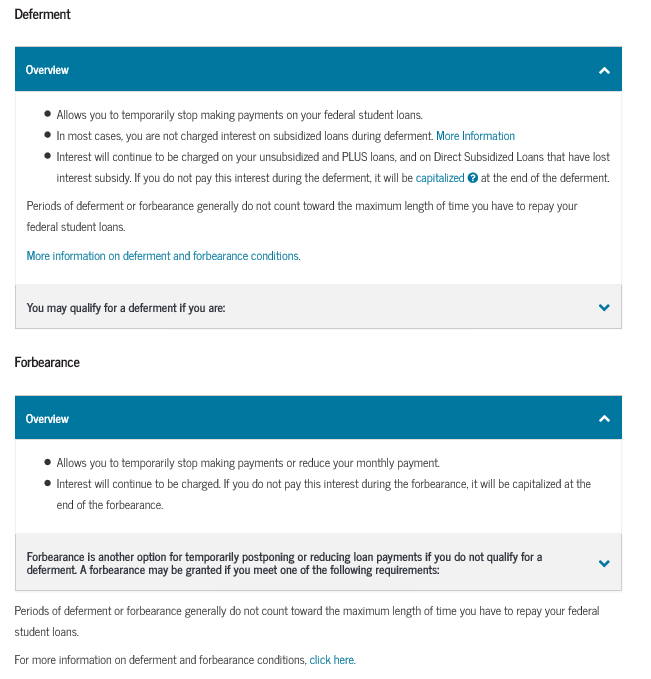

Deferment |

Overview

Periods of deferment or forbearance generally do not count toward the maximum length of time you have to repay your federal student loans. |

You may qualify for a deferment if you are: |

|

Forbearance |

Overview

|

Forbearance is another option for temporarily postponing or reducing loan payments if you do not qualify for a deferment. A forbearance may be granted if you meet one of the following requirements: |

|

Periods of deferment or forbearance generally do not count toward the maximum length of time you have to repay your federal student loans. |

Forgive, Cancel or Discharge Your Debts |

Under certain circumstances, you may have all or part of your federal student loans forgiven or discharged. Contact your federal loan servicer for details. For a full list of the conditions for forgiveness and discharge/cancellation, see the loan cancellation and discharge summary chart. |

Remember! |

Federal student loans are not generally eliminated as part of personal bankruptcy. Contact your federal loan servicer to discuss your federal student loan repayment options. |

Forgiveness

[Forgiveness section appears for grad only] |

Teacher

Loan Forgiveness |

If you teach full-time at certain elementary or secondary schools or educational service agencies that serve low-income students. |

Forgives up to $5,000 (up to $17,500 for teachers in certain subject areas) of your Direct Loans, except for Direct PLUS Loans, provided you teach for five consecutive years as a highly-qualified teacher or as a highly-qualified teacher in certain subjects. |

Public

Service Loan Forgiveness |

If you work full-time for a qualifying public service organization while making 120 qualifying monthly payments. |

Forgives all of your remaining Direct Loan debt after you have made the 120 qualifying payments. |

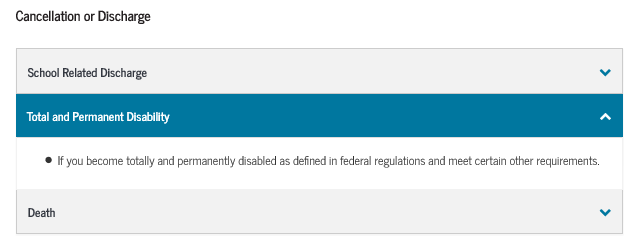

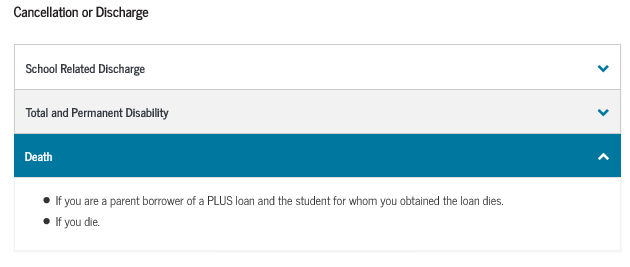

Cancellation or Discharge |

School Related Discharge |

If your school:

Or if:

|

Total

and Permanent Disability |

|

Death |

|

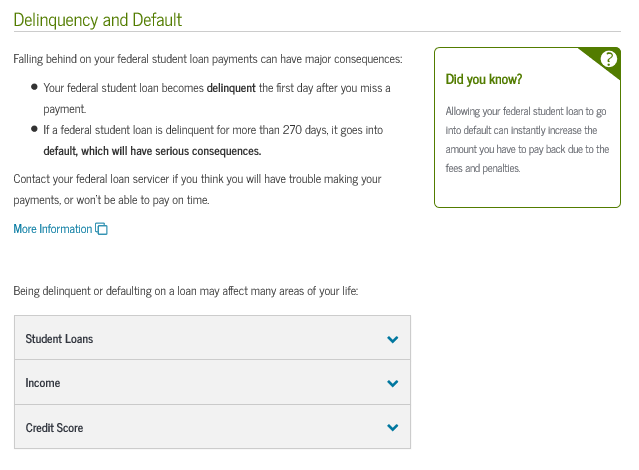

Delinquency and Default |

Falling behind on your federal student loan payments can have major consequences:

Contact your federal loan servicer if you think you will have trouble making your payments, or won't be able to pay on time.

|

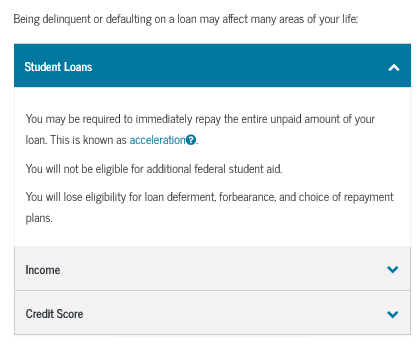

Being delinquent or defaulting on a loan may affect many areas of your life: |

Student Loans |

You may be required to immediately repay the entire unpaid amount of your loan. This is known as acceleration [tooltip]. You will not be eligible for additional federal student aid. You will lose eligibility for loan deferment, forbearance, and choice of repayment plans.

|

Future Income |

Your loans may be turned over to a collection agency and you will have to pay additional charges, late fees, and collection costs. You may have part of your income withheld by the Federal government. This is known as wage garnishment. Your Federal and State income tax refunds may be withheld. This is known as a tax offset.

|

Credit Score |

Your credit score will be damaged. You may have difficulty qualifying for credit cards, car loans, or mortgages, and may be charged much higher interest rates. You may have difficulty signing up for utilities, getting car or home owner's insurance, or getting a cell phone plan. You may have difficulty getting approval to rent an apartment (credit checks may be required).

|

Did you know? |

Allowing your federal student loan to go into default can instantly increase the amount you have to pay back due to the fees and penalties. |

Alert! |

Although your credit history is not taken into account for Direct Subsidized Loans and Direct Unsubsidized Loans, your credit history will be affected if you do not repay your federal student loans under the repayment plan you agree to when you enter repayment. |

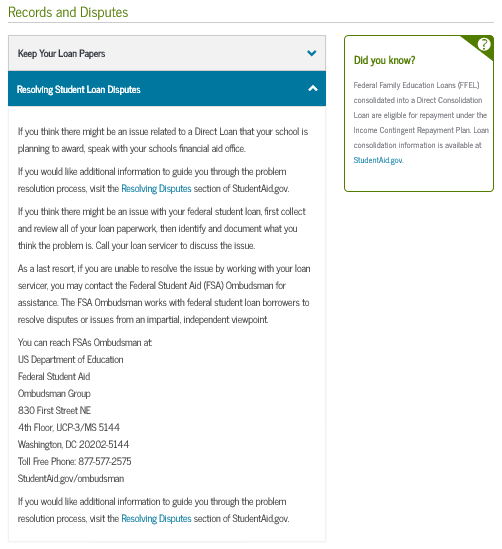

Records and Disputes |

Keep Your Loan Papers |

Keep your loan paperwork in a safe place, including your promissory note, disclosure notices, and billing statements.

|

Resolving Student Loan Disputes |

If you think there might be an issue related to a Direct Loan that your school is planning to award, speak with your schools financial aid office. If you would like additional information to guide you through the problem resolution process, visit the Resolving Disputes section of StudentAid.gov. If you think there might be an issue with your federal student loan, first collect and review all of your loan paperwork, then identify and document what you think the problem is. Call your loan servicer to discuss the issue. As a last resort, if you are unable to resolve the issue by working with your loan servicer, you may contact the Federal Student Aid (FSA) Ombudsman for assistance. The FSA Ombudsman works with federal student loan borrowers to resolve disputes or issues from an impartial, independent viewpoint.

You

can reach FSAs Ombudsman at: If you would like additional information to guide you through the problem resolution process, visit the Resolving Disputes section of StudentAid.gov.

|

Did you Know? |

Federal Family Education Loans (FFEL) consolidated into a Direct Consolidation Loan are eligible for repayment under the Pay As You Earn and ICR plans. Loan consolidation information is available at StudentAid.gov. |

Loan Consolidation |

More Information |

CONSOLIDATION LOANS |

A consolidation loan may help make payments more manageable by combining several federal student loans into one loan with one monthly payment. You need to apply for loan consolidation and choose a repayment plan. Depending on the amount of your debt and the repayment plan that you choose, the repayment period for a Direct Consolidation Loan may range from 10 to 30 years. The interest rate for a Direct Consolidation Loan is a fixed rate. The fixed rate is the weighted average of the interest rates on all of the loans you consolidate, rounded up to the nearest one-eighth of one percent. How can consolidation help me manage my debt? Loan consolidation can offer you benefits to help manage your education debt. You will:

As with other loan types, you may prepay a consolidation loan without penalty and may change repayment plans if you find that your current plan no longer meets your needs. Is there a downside to consolidation? Although consolidation can help many students manage their monthly payments, there are some cases when consolidation may not be right for you.

CLOSE |

EXIT |

SUBMIT COUNSELING |

All Borrower Types - Summary

English Text |

You're currently not logged in!

[if unauthenticated] |

Log in to view your federal student loan data, notify schools of counseling completion, and save proof of counseling completion. If you are not logged in, you cannot meet requirements for completing counseling.

[if unauthenticated] |

LOG IN

[if unauthenticated] |

PLUS CREDIT COUNSELING FOR GRADUATE/PROFESSIONAL STUDENTS |

[User’s Name], you have successfully completed PLUS Credit Counseling! [if authenticated] |

The following is a summary of the information you entered during this session and future actions you can take. |

Financial Summary |

/month |

/month |

/month |

Remaining Balance /month |

Repayment Plan Details |

Financial Takeaway |

Debt Burden [tooltip] Based on your projected annual income, your student loan debt burden will be: |

High |

Medium |

Low |

Additional Resources |

College Planning |

Career Planning |

Financial Planning |

Check out our Youtube Playlist: |

Export your budget and repayment information. |

E-mail a summary of your budget and repayment information. |

Print a summary of your counseling session. |

Tweet |

Tweet about completing your counseling session. |

Next Steps |

View/Print Borrower's Rights & Responsibilities for Direct PLUS Loans |

Complete Direct Consolidation Loan Application and Promissory Note |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Tamburelli, Laura |

| File Modified | 0000-00-00 |

| File Created | 2021-01-13 |

© 2026 OMB.report | Privacy Policy