| CTAS Budget Detail Worksheet FY17 |

| Worksheet Instructions |

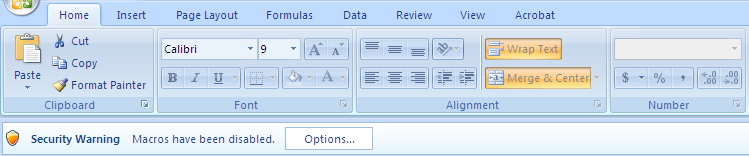

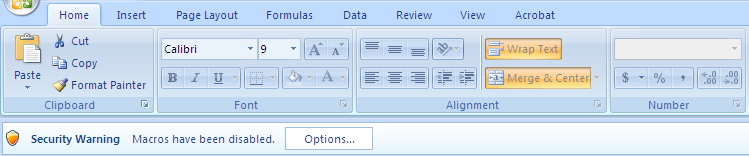

Note: This document requires macros be enabled to work properly. Please ensure that macros are enabled before entering any data. You may be able to enable macros by choosing the "Enable this content" option from the Security Warning Ribbon above.

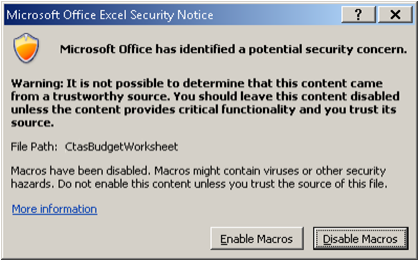

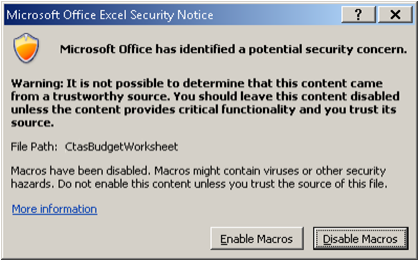

If the ribbon is not visible you may have been prompted to enable macros when you opened he document as pictured here. If you elected to disable macros,

|

|

please close the document and reopen it with macros enabled. |

| Purpose: |

| The Budget Detail Worksheet is provided for your use in the preparation of the budget and budget narrative. All required information (including the budget narrative) must be provided. Funds may not be budgeted in the shaded categories under each purpose area. Indicate any non-federal (matching) amount in the appropriate category, if applicable. |

| How to use this Workbook: |

This workbook has been made available to CTAS applicants so that they can provide budgetary information for each Purpose Area they are applying for. It is a required document and must be completed and uploaded to the Grant Management System (GMS) as an attachment to your application. The workbook includes three different worksheets. The first worksheet (this one) is an instruction sheet; the second worksheet includes the Purpose Area specific budget detail worksheet and narrative and each must be filled out if the applicant is applying for that specific Purpose Area. If an application is not being submitted for a particular Purpose Area, no action on the budget worksheet is required. The last worksheet is a Budget Summary. It compiles all of the relevant budget information for all Purpose Areas into a single location and should be reviewed for correctness before the workbook is uploaded to the GMS application.

Step by Step Usage:

1. Please read and print this instruction page. It can be used as a reference while completing the rest of the document.

2. A purpose area index for this workbook has been created for your convenience. Clicking on the link for each Purpose Area will take you directly to that tab in this document.

3. Complete this document by selecting the relevant Purpose Area tabs for which funds are being requested and entering the budget detail information in the boxes.

4. None of the purpose areas in this solicitation require a match. However, if a successful application proposes a voluntary match amount, and DOJ approves the budget, the total match amount incorporated into the approved budget becomes mandatory and subject to audit.

5. A budget narrative section is provided to you for each category within the worksheet. This is where your justification and/or linkages to the program narrative may be entered.

6. A Budget Summary is automatically calculated for you on the last worksheet. Note: Any errors detected on this page should be fixed on the Purpose Area specific tab.

Note regarding “Subawards (Subgrants)/Procurement Contracts” category (formerly labeled “Consultants/Contracts”): DOJ has designated this budget category, starting with the FY 16 CTAS, to enable applicants to identify proposed costs for subawards (see “Subaward” definition at 2 CFR 200.92) and distinguish those costs from costs for procurement contracts (see “Contract” definition at 2 CFR 200.22) the applicant proposes to fund with Federal award funds. For more information, see item IV. “Budget Detail Worksheet and Budget Narrative including Demographic Form” under Section D. What an Application Should Include in the solicitation and the response to the CTAS FY 2016 FAQ entitled, “What do I need to know before entering data and information under the ‘Subawards (Subgrants)/Procurement Contracts’ budget category in the CTAS Budget Worksheet?”

Contact Information

Technical Assistance: For technical assistance with submitting an application, contact the Grants Management System Support Hotline at 1–888–549–9901, option 3, or via e-mail to [email protected]. The GMS Support Hotline is available Monday–Friday (except U.S. federal government holidays) from 6:00 a.m. to 12:00 midnight, Eastern Time.

Programmatic Assistance: For programmatic and general assistance with the requirements of this solicitation, contact the Response Center at 1–800–421–6770 or by e-mail at [email protected]. The Response Center’s hours of operation are Monday–Friday (except U.S. federal government holidays) from 9:00 a.m. to 5:00 p.m. Eastern Time. The Response Center will remain open on the solicitation closing date until 9:00 p.m. Eastern Time.

|

| Budget Point of Contact Information: |

| Contact Name: |

Last: |

|

First: |

|

Middle: |

|

| Contact Phone: |

|

Contact Fax: |

|

Contact Email: |

|

| Purpose Area Index: |

| PA (#) |

Name |

|

|

|

|

|

|

|

Program Office |

CFDA # |

| Demographics Form |

CTAS Demographic Form |

|

|

| 1 |

Public Safety and Community Policing |

COPS |

16.710 |

| 2 |

Comprehensive Tribal Justice Systems Strategic Planning |

|

16.608 |

| 3 |

Justice Systems and Alcohol and Substance Abuse |

BJA |

16.608 |

| 4 |

Tribal Justice System Infrastructure Program |

BJA |

16.596 |

| 5 |

Office on Violence Against Women Tribal Governments Program |

OVW |

16.587 |

| 6 |

Children’s Justice Act Partnerships for Indian Communities |

OVC |

16.582 |

| 7 |

Comprehensive Tribal Victim Assistance Program |

OVC |

16.582 |

| 8 |

Tribal Juvenile Healing To Wellness Courts |

OJJDP |

16.585 |

| 9 |

Tribal Youth Program |

OJJDP |

16.731 |

|

Budget Summary |

|

|

| Budget Category Descriptions: |

| Personnel |

List each position by title and name of employee, if available. Show the annual salary rate and the percentage of time to be devoted to the project. Compensation paid for employees engaged in grant activities must be consistent with that paid for similar work within the applicant organization. In the budget narrative, include a description of the responsibilities and duties of each position in relationship to fulfilling the project goals and objectives. All requested information must be included in the budget detail worksheet and budget narrative.

|

| Fringe Benefits |

Fringe benefits should be based on actual known costs or an approved negotiated rate by a Federal agency. If not based on an approved negotiated rate, list the composition of the fringe benefit package. Fringe benefits are for the personnel listed in the budget category (A) and only for the percentage of time devoted to the project. All requested information must be included in the budget detail worksheet and budget narrative. |

| Travel |

Itemize travel expenses of staff personnel (e.g. staff to training, field interviews, advisory group meeting, etc.). Describe the purpose of each travel expenditure in reference to the project objectives. Show the basis of computation (e.g., six people to 3-day training at $X airfare, $X lodging, $X subsistence). In training projects, travel and meals for trainees should be listed separately. Show the number of trainees and the unit costs involved. Identify the location of travel, if known; or if unknown, indicate "location to be determined." Indicate whether applicant's formal written travel policy or the Federal Travel Regulations are followed. Note: Travel expenses for consultants should be included in the “Consultant Travel” data fields under the “Subawards (Subgrants)/Procurement Contracts” category. For each Purpose Area applied for, the budget should include the estimated cost for travel and accommodations for two staff to attend two three-day long meetings, with one in Washington D.C. and one in their region, with the exception of Purpose Area 1, which should budget for one meeting in Washington D.C, and Purpose Areas 6 and 7, which should budget for 3 meetings within a 3 year period, with 2 in Washington D.C, and 1 within their region. All requested information must be included in the budget detail worksheet and budget narrative. |

| Equipment |

List non-expendable items that are to be purchased (Note: Organization's own capitalization policy for classification of equipment should be used). Expendable items should be included in the "Supplies" category. Applicants should analyze the cost benefits of purchasing versus leasing equipment, especially high cost items and those subject to rapid technological advances. Rented or leased equipment costs should be listed in the “Contracts” data fields under the “Subawards (Subgrants)/Procurement Contracts" category. In the budget narrative, explain how the equipment is necessary for the success of the project, and describe the procurement method to be used. All requested information must be included in the budget detail worksheet and budget narrative. |

| Supplies |

List items by type (office supplies, postage, training materials, copy paper, and expendable equipment items costing less than $5,000, such as books, hand held tape recorders) and show the basis for computation. Generally, supplies include any materials that are expendable or consumed during the course of the project. All requested information must be included in the budget detail worksheet and budget narrative. |

| Construction |

Provide a description of the construction project and an estimate of the costs. Construction costs are only allowed for Purpose Area #4. Minor repairs or renovations may be allowable in other Purpose Areas and should be classified in the “Other” category. Consult with the program office before budgeting funds in this category. All requested information must be included in the budget detail worksheet and budget narrative. |

| Subawards (Subgrants) / Procurement Contracts |

Procurement contracts (see “Contract” definition at 2 CFR 200.22): Provide a description of the product or service to be procured by contract and an estimate of the cost. Indicate whether the applicant’s formal, written Procurement Policy or the Federal Acquisition Regulation is followed. Applicants are encouraged to promote free and open competition in awarding procurement contracts. A separate justification must be provided for sole source procurements in excess of the Simplified Acquisition Threshold set in accordance with 41 U.S.C. 1908 (currently set at $150,000).

Consultant Fees: For each consultant enter the name, if known, service to be provided, hourly or daily fee (8-hour day), and estimated time on the project. Consultant fees in excess of the DOJ grant-making component’s maximum rate for an 8-hour day (currently $650 for OJP and OVW, and $550 for the COPS Office) require additional justification and prior approval from the respective DOJ grant-making component. All requested information must be included in the budget detail worksheet and budget narrative.

Subawards (see “Subaward” definition at 2 CFR 200.92): Provide a description of the Federal award activities proposed to be carried out by any subrecipient and an estimate of the cost (include the cost per subrecipient, to the extent known prior to application submission). For each subrecipient, enter the subrecipient entity name, if known. Please indicate any subaward information included under budget category G. Subawards (Subgrants)/Procurement Contracts by including the label “(subaward)” with each subaward entry. |

| Other Costs |

List items (e.g., rent, reproduction, telephone, janitorial or security services, and investigative or confidential funds) by type and the basis of the computation. For example, provide the square footage and the cost per square foot for rent, or provide a monthly rental cost and how many months to rent. All requested information must be included in the budget detail worksheet and budget narrative. |

| Indirect Costs |

Indirect costs are allowed only if: a) the applicant has a current, federally approved indirect cost rate; or b) the applicant is eligible to use and elects to use the “de minimis” indirect cost rate described in 2 C.F.R. 200.414(f). (See paragraph D.1.b. in Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals for a description of entities that may not elect to use the “de minimis” rate.) An applicant with a current, federally approved indirect cost rate must attach a A copy of the rate approval, (a fully-executed, negotiated agreement. If the applicant does not have an approved rate, one can be requested by contacting the applicant’s cognizant Federal agency, which will review all documentation and approve a rate for the applicant organization, or if the applicant’s accounting system permits, costs may be allocated in the direct costs categories. (Applicant Indian tribal governments, in particular, should review Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals regarding submission and documentation of indirect cost proposals.) Narrative for any indirect costs should clearly state which direct costs the indirect cost agreement is being applied to. All requested information must be included in the budget detail worksheet and budget narrative.

In order to use the “de minimis” indirect rate an applicant would need to attach written documentation to the application that advises DOJ of both the applicant’s eligibility (to use the “de minimis” rate) and its election. If the applicant elects the de minimis method, costs must be consistently charged as either indirect or direct costs, but may not be double charged or inconsistently charged as both. In addition, if this method is chosen then it must be used consistently for all federal awards until such time as the applicant entity chooses to negotiate a federally approved indirect cost rate.

|

| Demographic Form |

|

Please fill out this form in its entirety. Note that each subsection has individual instructions. Please read them carefully before filling out this form. If you are applying as a consortium please aggregate the data for all the Tribes represented in your application. |

|

| I. Tribe Information |

|

|

|

|

|

|

|

1. The name of each federally-recognized Indian Tribe that will be served by the proposed project(s): |

|

|

Name(s) |

|

The name(s) of your tribe and represented tribes. |

|

|

|

|

|

|

|

|

|

|

|

|

BIA Region(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. What is the Tribe's current enrollment, including members living both on and off the reservation? |

|

|

|

|

|

|

|

|

|

3. What is the Tribe's juvenile population, including members living both on and off the reservation? |

|

|

|

|

|

|

|

|

|

4. Of your current enrollment, what is the Tribe's total number of unemployed 18 years and over? |

|

|

|

|

|

|

|

|

|

5. Of your current enrollment, what is the Tribe's total number of under-employed (below the poverty line) 18 years and over? |

|

|

|

|

|

|

|

|

|

6. Of your current enrollment, what is the Tribe's total number of employed 18 years and over? |

|

|

|

|

|

|

|

|

|

7. What is the current local population base? |

|

|

|

|

|

|

|

|

|

8. Please enter the approximate square mileage of the reservation/jurisdiction to be served: (sq. miles) |

|

|

|

|

|

|

|

|

|

9. Please check the crime victim population area(s) that best describe the services the Tribe typically supports. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Have you applied for a CTAS grant before? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, what year? |

|

|

|

|

|

|

|

|

|

11. Please provide your status as an applicant (check all that apply): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. If you selected Tribal Coalition or Tribal Consortia please list the tribes you represent: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. If you selected Non-profit organization describe the nature of you services and whom you provide them. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Please indicate if you agree with the following statement: The tribe(s)submitting this application consider themselves to be remotely located with respect to availability of justice or other relevant community services.

|

|

|

If you selected “Yes”, please provide a brief statement that explains your selection. Examples might include “For a majority of our tribal community, law enforcement resource centers are greater than 1 hour’s drive away.” Or “Our tribal community has no resident medical facilities and the nearest public health center is operated by the City/Town of XXX which is not within tribal lands and not easily reached.” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| II. Property/Violent Crime |

|

|

|

|

|

|

|

Using the most recent available data and to the best of your ability using the UCR crime definitions, enter the actual number of incidents reported to your Tribe for the following crime types. Note that only those incidents for which your Tribe had primary response authority should be provided. |

|

|

|

|

|

|

|

|

|

|

|

|

|

UCR Data * |

|

|

|

Year |

|

|

|

|

Criminal Homicide |

|

|

|

|

Forcible Rape |

|

|

|

|

Robbery |

|

|

|

|

Aggravated Assault |

|

|

|

|

Burglary |

|

|

|

|

Larceny (except motor vehicle theft) |

|

|

|

|

Motor Vehicle Theft |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Note: If your Tribe is not using UCR data or reports to NIBRS, please explain the source or methods used to report your crime data. If you do not report crime incidents at all please explain why you are unable to provide such data. If instructions are needed on converting your data to UCR Summary Data style please view the COPS Application Guide of the FBI's UCR Handbook (www.fbi.gov/ucr/handbook/ucrhandbook04.pdf) for more information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The FBI is retiring the current Summary Reporting System (SRS) and will transition to an all-NIBRS data collection system within the next five years. The transition to NIBRS will provide a more complete and accurate picture of crime at the tribal, national, state, and local level. As of 2021, the FBI will no longer collect summary data and will only accept data in the NIBRS format and COPS Office awards will be based on submitted NIBRS data. Transitioning all law enforcement agencies to NIBRS is the first step in gathering more comprehensive crime data. Tribal, state, and local COPS grantees are encouraged to expedite the transition to NIBRS in their jurisdictions so that they will remain eligible to receive COPS Office awards. |

|

|

|

|

|

|

|

|

|

|

|

| III. Tribal Law Enforcement Information |

|

|

|

|

|

|

|

|

|

|

Please answer the following questions. NOTE: If you choose "none" for question 1 you are finished completing this section and do not need to answer 1a or 1b. |

|

|

1. What law enforcement agency or departments does your Tribe operate? (check all that apply): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. What is the actual population your department serves as the primary law enforcement agency entity? |

|

|

|

This may or may not be the same as the population reported in the U.S. Census, the Tribe's current enrollment or the local population base. A Tribe with primary law enforcement authority is defined as having first responder responsibility to calls for service for all types of criminal incidents within its jurisdiction. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Enter the current Fiscal Year Actual Sworn Force Strength as of the date of this application: |

|

|

|

The actual number of sworn officer positions is the actual number of sworn positions employed by your Tribe as of the date of this application. Do not include funded but currently vacant positions or unpaid positions. NOTE: For Tribes with multiple component law enforcement departments (e.g. Department of Public Safety and Fish and Wildlife Department), please report cumulative, full- and part-time sworn-force strength number for all law enforcement departments in your Tribe which would receive funding through this request if awarded. |

|

|

|

Full-Time: |

|

Part-Time: |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. On average how many hours of IN-SERVICE (non-recruit) training (e.g. FTO, continuing professional education, roll call, standard) are required annually for each of your agency’s officers/deputies in the following categories (if none, please indicate 0 hours)? |

|

|

|

|

|

|

|

|

|

|

|

|

Use of Force: |

|

De-escalation of conflict: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Racial and ethnic bias that includes elements of implicit/unconscious bias: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender bias in response to domestic violence and sexual assault: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bias towards lesbian, gay, bisexual, and transgender (LGBT) individuals: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community engagement (e.g., community policing and problem solving): |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Does your agency administer a police training academy? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. How many total hours of basic/recruit ACADEMY training are required for each of your agency’s officer/deputy recruits in the following categories (if none, please indicate 0 hours)? |

|

|

|

|

|

|

|

|

|

|

|

|

Use of Force: |

|

De-escalation of conflict: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Racial and ethnic bias that includes elements of implicit/unconscious bias: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender bias in response to domestic violence and sexual assault: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bias towards lesbian, gay, bisexual, and transgender (LGBT) individuals: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community engagement (e.g., community policing and problem solving): |

|

|

|

|

|

|

|

|

|

|

|

|

| IV. Tribal Facilities, Capacities and Capabilities |

|

|

|

|

|

|

|

|

|

|

1. Telecommunications and Technology |

|

|

|

|

|

|

|

|

|

a. Describe your Internet Access: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. What types of communication services are generally available to the tribe at large and/or the tribe's justice components? (check all that apply) |

|

|

|

|

|

|

|

|

|

|

Tribe |

Justice |

|

|

|

i. Land Line (telephone, dial-up service) |

|

|

|

|

|

|

|

|

|

ii. Cellular (telephone, data, etc.) |

|

|

|

|

|

|

|

iii. Satellite - Receive only (broadcasting services) |

|

|

|

|

|

|

|

iv. Satellite - 2-way (2-way voice and data and well as broadcasting) |

|

|

|

|

|

|

|

v. Radio services - (HF, VHF, UHF) |

|

|

|

|

|

|

|

vi. Point to Point Microwave |

|

|

|

|

|

|

|

vii. Other (please describe) |

|

|

|

|

|

|

|

|

Tribal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Justice Comp. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Facilities and Services (check all that apply) |

|

|

|

|

|

|

|

|

|

Applicants should check and provide data for all the facilities and services located within the reservation/jurisdiction described in question 8 above. |

|

|

|

|

|

|

|

|

# of beds |

|

|

|

|

|

|

# of facilities |

|

|

|

|

# of facilities |

|

|

|

|

# of facilities |

|

|

|

|

# of facilities |

|

|

|

|

# of beds |

|

|

|

|

# of beds |

|

|

|

|

# of facilities |

|

|

|

|

# of facilities |

|

|

|

|

# of facilities |

|

|

|

|

# of facilities |

|

|

|

|

|

|

|

|

| Public Safety and Community Policing |

|

Purpose Area (1) |

|

|

| Program Office |

|

|

|

|

COPS |

16.710 |

|

|

|

|

|

|

|

|

|

|

|

| Note: Non-Federal match is not required for this purpose area but can be provided if desired. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List each position by title and name of employee, if available. Show the annual salary rate and the percentage of time to be devoted to the project. Compensation paid for employees engaged in grant avtivities must be consistent with that paid for similar work within the applicant organization. In the budget narrative, include a description of the responsibilities and duties of each position in relationship to fulfilling the project goals and objectives. All requested information must be included in the budget detail worksheet and budget narrative.

A. Personnel, B. Fringe Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cost |

|

|

| Personnel Salary Total |

$0 |

$0 |

$0 |

|

|

| Personnel Fringe Total |

$0 |

$0 |

$0 |

|

|

| Personnel Grand Total |

$0 |

$0 |

$0 |

|

|

|

Itemize travel expenses of staff personnel (e.g. staff to training, field interviews, advisory group meeting, etc.). Describe the purpose of each travel expenditure in reference to the project objectives. Show the basis of computation (e.g., six people to 3-day training at $X airfare, $X lodging, $X subsistence). In training projects, travel and meals for trainees should be listed separately. Show the number of trainees and the unit costs involved. Identify the location of travel, if known; or if unknown, indicate "location to be determined." Indicate whether applicant's formal written travel policy or the Federal Travel Regulations are followed.

Note: Travel expenses for consultants should be included in the “Consultant Travel” data fields under the “Subawards (Subgrants)/Procurement Contracts” category. For each Purpose Area applied for, the budget should include the estimated cost for travel and accommodations for two staff to attend two three-day long meetings, with one in Washington D.C. and one in their region, with the exception of Purpose Area 1, which should budget for one meeting in Washington D.C, and Purpose Areas 6 and 7, which should budget for 3 meetings within a 3 year period, with 2 in Washington D.C, and 1 within their region. All requested information must be included in the budget detail worksheet and budget narrative.

C. Travel |

|

|

|

|

|

|

|

|

|

|

| Event Title |

Location |

Type of Expense |

Computation |

|

|

| Indicate the purpose of each trip or type of trip (training, advisory group meeting) |

Indicate the location of the event |

Registration, Hotel, airfare, per diem |

Compute the cost of each type of expense X the number of people traveling. |

|

|

|

Location |

Type of Expense |

Cost |

Duration or Distance |

# of Staff |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Travel Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List non-expendable items that are to be purchased (Note: Organization's own capitalization policy for classification of equipment should be used).

Expendable items should be included in the "Supplies" category. Applicants should analyze the cost benefits of purchasing versus leasing equipment, especially high cost items and those subject to rapid technological advances.

Rented or leased equipment costs should be listed in the “Contracts” data fields under the “Subawards (Subgrants)/Procurement Contracts” category.

In the budget narrative, explain how the equipment is necessary for the success of the project, and describe the procurement method to be used. All requested information must be included in the budget detail worksheet and budget narrative.

D. Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item |

Computation |

|

|

| List and describe each item of equipment that will be purchased |

Compute the cost (e.g., the number of each item to be purchased X the cost per item) |

|

|

|

Enter the total number of items to be purchased.

# of Items |

Enter the cost of each equipment item.

Cost |

Total cost is the calculated value of the data provided and should match the total amount to be paid for equipment item.

Total Cost = # of Items x Cost

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Equipment Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List items by type (office supplies, postage, training materials, copy paper, and expendable equipment items costing less than $5,000, such as books, hand held tape recorders) and show the basis for computation. Generally, supplies include any materials that are expendable or consumed during the course of the project. All requested information must be included in the budget detail worksheet and budget narrative.

E. Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supply Items |

Computation |

|

|

| Provide a list of the types of items to be purchased with grant funds. |

Describe the item and the compute the costs. Computation: The number of each item to be purchased X the cost per item. |

|

|

|

Enter the total number of items to be purchased.

# of Items |

Cost |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Supplies Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provide a description of the construction project and an estimate of the costs. Construction costs are only allowed for Purpose Area #4. Minor repairs or renovations may be allowable in other Purpose Areas and should be classified in the “Other” category. Consult with the program office before budgeting funds in this category. All requested information must be included in the budget detail worksheet and budget narrative.

F. Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subawards (see “Subaward” definition at 2 CFR 200.92): Provide a description of the Federal award activities proposed to be carried out by any subrecipient and an estimate of the cost (include the cost per subrecipient, to the extent known prior to application submission). For each subrecipient, enter the subrecipient entity name, if known. Please indicate any subaward information included under budget category G. Subawards (Subgrants)/Procurement Contracts by including the label “(subaward)” with each subaward entry.

G. Subawards (Subgrants) |

|

|

|

|

|

|

|

|

|

|

|

|

| Subawards (Subgrants) |

|

|

| Subawards (Subgrants): Provide a cost estimate for activities to be carried out by subrecipients. |

|

|

| Description |

Purpose |

Consultant? |

Computation |

|

|

| Subawards (Subgrants): Provide a description of the activities to be carried out by subrecipients |

Describe the purpose of the subaward (subgrant) |

Is the subaward for a consultant? If yes, use the section below to explain associated travel expenses included in the cost. |

Compute the cost (e.g Cost-Non-Federal Contribution) |

|

|

|

Total cost is the value or cost of the procurement contract (or consultant) or of the subaward, as applicable.

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Subaward Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consultant Travel (if necessary) |

|

|

| List all travel-related expenses to be paid from the grant to the individual consultants (e.g., transportation, meals, lodging) separate from their consultant fees. |

|

|

| Purpose of Travel |

Location |

Type of Expense |

Computation |

|

|

| Indicate the purpose of each trip or type of trip (training, advisory group meeting) |

Indicate the location of the event |

Hotel, airfare, per diem |

Compute the cost of each type of expense X the number of people traveling. |

|

|

|

|

|

Cost |

Duration or Distance |

# of Staff |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

Procurement contracts (see “Contract” definition at 2 CFR 200.22): Provide a description of the product or service to be procured by contract and an estimate of the cost. Indicate whether the applicant’s formal, written Procurement Policy or the Federal Acquisition Regulation is followed. Applicants are encouraged to promote free and open competition in awarding procurement contracts. A separate justification must be provided for sole source procurements in excess of the Simplified Acquisition Threshold set in accordance with 41 U.S.C. 1908 (currently set at $150,000). Consultant Fees: For each consultant enter the name, if known, service to be provided, hourly or daily fee (8-hour day), and estimated time on the project. Consultant fees in excess of the DOJ grant-making component’s maximum rate for an 8-hour day (currently $650 for OJP and OVW, and $550 for the COPS Office). All requested information must be included in the budget detail worksheet and budget narrative.

H. Procurement Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

| Procurement Contracts |

|

|

| Procurement contracts: Provide a cost estimate for the product or service to be procured by contract |

|

|

| Description |

Purpose |

Consultant? |

Computation |

|

|

| Provide a description of the products or services to be procured by contract and an estimate of the costs. Applicants are encouraged to promote free and open competition in awarding contracts. A separate justification must be provided for sole source procurements in excess of the Simplified Acquisition Threshold (currently $150,000). |

Describe the purpose of the procurement contract |

Is the procurement contract for a consultant? If yes, use the section below to explain associated travel expenses included in the cost. |

Compute the cost (e.g Cost-Non-Federal Contribution) |

|

|

|

Total cost is the value or cost of the procurement contract (or consultant) or of the subaward, as applicable.

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

| Total |

$0 |

$0 |

$0 |

|

|

| Procurement Contract Narrative |

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consultant Travel (if necessary) |

|

|

| List all travel-related expenses to be paid from the grant to the individual consultants (e.g., transportation, meals, lodging) separate from their consultant fees. |

|

|

| Purpose of Travel |

Location |

Type of Expense |

Computation |

|

|

| Indicate the purpose of each trip or type of trip (training, advisory group meeting) |

Indicate the location of the event |

Hotel, airfare, per diem |

Compute the cost of each type of expense X the number of people traveling. |

|

|

|

|

|

Cost |

Duration or Distance |

# of Staff |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

List items (e.g., rent, reproduction, telephone, janitorial or security services, and investigative or confidential funds) by type and the basis of the computation. For example, provide the square footage and the cost per square foot for rent, or provide a monthly rental cost and how many months to rent. All requested information must be included in the budget detail worksheet and budget narrative.

I. Other Costs |

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

| List and describe items that will be paid with grants funds. |

|

|

|

Total cost is the value or cost of the other cost.

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

$0 |

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Other Costs Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indirect costs are allowed only if: a) the applicant has a current, federally approved indirect cost rate; or b) the applicant is eligible to use and elects to use the “de minimis” indirect cost rate described in 2 C.F.R. 200.414(f). (See paragraph D.1.b. in Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals for a description of entities that may not elect to use the “de minimis” rate.) An applicant with a current, federally approved indirect cost rate must attach a copy of the rate approval, (a fully-executed, negotiated agreement). If the applicant does not have an approved rate, one can be requested by contacting the applicant’s cognizant Federal agency, which will review all documentation and approve a rate for the applicant organization, or if the applicant’s accounting system permits, costs may be allocated in the direct costs categories. (Applicant Indian tribal governments, in particular, should review Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals regarding submission and documentation of indirect cost proposals.) All requested information must be included in the budget detail worksheet and budget narrative.

In order to use the “de minimis” indirect rate an applicant would need to attach written documentation to the application that advises DOJ of both the applicant’s eligibility (to use the “de minimis” rate) and its election. If the applicant elects the de minimis method, costs must be consistently charged as either indirect or direct costs, but may not be double charged or inconsistently charged as both. In addition, if this method is chosen then it must be used consistently for all federal awards until such time as the applicant entity chooses to negotiate a federally approved indirect cost rate.

J. Indirect Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

Computation |

|

|

| Describe what the approved rate is and how it is applied. |

|

|

|

Compute the indirect costs for those portions of the program which allow such costs. |

|

|

|

Cost is the value of the indirect cost.

Base |

The approved cost rate for this indirect cost.

Indirect Cost Rate |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

| $0 |

$0 |

$0 |

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Indirect Costs Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive Tribal Justice Systems Strategic Planning |

|

Purpose Area (2) |

|

|

|

| Program Office |

|

|

|

|

16.608 |

|

|

|

|

|

|

|

|

|

|

|

|

| Note: Non-Federal match is not required for this purpose area but can be provided if desired. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List each position by title and name of employee, if available. Show the annual salary rate and the percentage of time to be devoted to the project. Compensation paid for employees engaged in grant avtivities must be consistent with that paid for similar work within the applicant organization. In the budget narrative, include a description of the responsibilities and duties of each position in relationship to fulfilling the project goals and objectives. All requested information must be included in the budget detail worksheet and budget narrative.

A. Personnel |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name/Position |

Computation |

|

|

|

| List each position and name, if known. New positions may be grouped by type. |

Show annual salary rate & amount of time devoted to the project for each name/position. |

|

|

|

|

Enter the total number of positions for type.

# of Positions |

Enter the employee’s salary. This value can be entered as hourly, daily, weekly or yearly rates.

Salary |

Enter the rate classification for this employee’s salary. Possible values are “hourly, daily, weekly, yearly.” This column is not used by the calculation and is only for annotative purposes.

Rate |

Enter the number of hours, days, weeks, or years the employee will be working on the project. This column should be the total calendar time. The employee’s actual allocation/availability should be reflected in the “%” column.

Time Worked

(# of hours, days, months, years) |

Enter the percentage the individual will be working on the proposed project. If the employee is full-time enter 100%.

% |

Total cost is the calculated value of the data provided and should match the total amount to be paid to this employee over the life of the program.

Total Cost = Salary x Time Worked x %

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

$0 |

|

|

|

| Total(s) |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fringe benefits should be based on actual known costs or an approved negotiated rate by a Federal agency. If not based on an approved negotiated rate, list the composition of the fringe benefit package. Fringe benefits are for the personnel listed in the budget category (A) and only for the percentage of time devoted to the project. All requested information must be included in the budget detail worksheet and budget narrative.

B. Fringe Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Type of Benefit |

Computation |

|

|

|

| List each grant-support fringe benefit that is provided to the grant-funded position. |

Show the basis for computation. |

|

|

|

|

Enter the cost base for each employee listed in section “A. Personnel” that will receive fringe benefits as part of working on this grant. The salary value may be the Total Cost value calculated for the specific employee.

Base |

Enter the percentage of the employee’s salary that is paid as fringe benefits.

Rate |

Total cost is the calculated value of the data provided and should match the total amount to be paid to this employee as fringe benefits over the life of the sponsored program.

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

$0 |

|

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Itemize travel expenses of staff personnel (e.g. staff to training, field interviews, advisory group meeting, etc.). Describe the purpose of each travel expenditure in reference to the project objectives. Show the basis of computation (e.g., six people to 3-day training at $X airfare, $X lodging, $X subsistence). In training projects, travel and meals for trainees should be listed separately. Show the number of trainees and the unit costs involved. Identify the location of travel, if known; or if unknown, indicate "location to be determined." Indicate whether applicant's formal written travel policy or the Federal Travel Regulations are followed.

Note: Travel expenses for consultants should be included in the “Consultant Travel” data fields under the “Subawards (Subgrants)/Procurement Contracts” category. For each Purpose Area applied for, the budget should include the estimated cost for travel and accommodations for two staff to attend two three-day long meetings, with one in Washington D.C. and one in their region, with the exception of Purpose Area 1, which should budget for one meeting in Washington D.C, and Purpose Areas 6 and 7, which should budget for 3 meetings within a 3 year period, with 2 in Washington D.C, and 1 within their region. All requested information must be included in the budget detail worksheet and budget narrative.

C. Travel |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purpose of Travel |

Location |

Type of Expense |

Computation |

|

|

|

| Indicate the purpose of each trip or type of trip (training, advisory group meeting) |

Indicate the travel destination. |

Hotel, airfare, per diem |

Compute the cost of each type of expense X the number of people traveling. |

|

|

|

|

Enter the cost of the travel item. For example, the total cost of a single round trip airline ticket, the reimbursement cost of a mile of car travel, or the per night cost of a hotel stay.

Cost |

Enter the distance traveled or the duration of the stay. For example, the number of nights staying in a hotel, the number of days that per diem will be claimed for or the number of miles traveled by car.

Duration or Distance |

Enter the number of staff that will be claiming travel expenses. For example, the number of employees staying in a hotel, or the number of employees being reimbursed for car travel.

# of Staff |

Total cost is the calculated value of the data provided and should match the total amount to be paid for travel reimbursement.

Total Cost = Cost x Duration or Distance x # of Staff

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List non-expendable items that are to be purchased (Note: Organization's own capitalization policy for classification of equipment should be used). Expendable items should be included in the "Supplies" category. Applicants should analyze the cost benefits of purchasing versus leasing equipment, especially high cost items and those subject to rapid technological advances. Rented or leased equipment costs should be listed in the “Contracts” data fields under the “Subawards (Subgrants)/Procurement Contracts” category. In the budget narrative, explain how the equipment is necessary for the success of the project, and describe the procurement method to be used. All requested information must be included in the budget detail worksheet and budget narrative.

D. Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item |

Computation |

|

|

|

| List and describe each item of equipment that will be purchased |

Compute the cost (e.g., the number of each item to be purchased X the cost per item) |

|

|

|

|

Enter the total number of items to be purchased.

# of Items |

Enter the cost of each equipment item.

Cost |

Total cost is the calculated value of the data provided and should match the total amount to be paid for equipment item.

Total Cost = # of Items x Cost

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

$0 |

|

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List items by type (office supplies, postage, training materials, copy paper, and expendable equipment items costing less than $5,000, such as books, hand held tape recorders) and show the basis for computation. Generally, supplies include any materials that are expendable or consumed during the course of the project. All requested information must be included in the budget detail worksheet and budget narrative.

E. Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supply Items |

Computation |

|

|

|

| Provide a list of the types of items to be purchased with grant funds. |

Describe the item and the compute the costs. Computation: The number of each item to be purchased X the cost per item. |

|

|

|

|

Enter the total number of items to be purchased.

# of Items |

Enter the cost of each supply item, for example, $11 for printer ink or $110 for office supplies.

Cost |

Total cost is the calculated value of the data provided and should match the total amount to be paid for supply item.

Total Cost = # of Items x Cost

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

$0 |

|

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provide a description of the construction project and an estimate of the costs. Construction costs are only allowed for Purpose Area #4. Minor repairs or renovations may be allowable in other Purpose Areas and should be classified in the “Other” category. Consult with the program office before budgeting funds in this category. All requested information must be included in the budget detail worksheet and budget narrative.

F. Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

| List of Construction Activities |

Computation |

|

|

|

| List and describe each item that is part of construction. |

Compute the costs (e.g., the number of each item to be purchased X the cost per item) |

|

|

|

Construction costs are not permitted by this Purpose Area.

|

Enter the total number of items to be purchased.

# of Items |

Enter the cost of each construction task.

Cost |

Total cost is the calculated value of the data provided and should match the total amount to be paid for construction task.

Total Cost = # of Items x Cost

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

| N/A |

|

|

$0 |

|

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subawards (see “Subaward” definition at 2 CFR 200.92): Provide a description of the Federal award activities proposed to be carried out by any subrecipient and an estimate of the cost (include the cost per subrecipient, to the extent known prior to application submission). For each subrecipient, enter the subrecipient entity name, if known. Please indicate any subaward information included under budget category G. Subawards (Subgrants)/Procurement Contracts by including the label “(subaward)” with each subaward entry.

G. Subawards (Subgrants) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subawards (Subgrants) |

|

|

|

| Subawards (Subgrants): Provide a cost estimate for activities to be carried out by subrecipients. |

|

|

|

| Description |

Purpose |

Consultant? |

Computation |

|

|

|

| Subawards (Subgrants): Provide a description of the activities to be carried out by subrecipients |

Describe the purpose of the subaward (subgrant) |

Is the subaward for a consultant? If yes, use the section below to explain associated travel expenses included in the cost. |

Compute the cost (e.g Cost-Non-Federal Contribution) |

|

|

|

|

|

|

|

|

|

|

Total cost is the value or cost of the procurement contract (or consultant) or of the subaward, as applicable.

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Subaward Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consultant Travel (if necessary) |

|

|

|

| List all travel-related expenses to be paid from the grant to the individual consultants (e.g., transportation, meals, lodging) separate from their consultant fees. |

|

|

|

| Purpose of Travel |

Location |

Type of Expense |

Computation |

|

|

|

| Indicate the purpose of each trip or type of trip (training, advisory group meeting) |

Indicate the location of the event |

Hotel, airfare, per diem |

Compute the cost of each type of expense X the number of people traveling. |

|

|

|

|

|

Cost |

Duration or Distance |

# of Staff |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Procurement contracts (see “Contract” definition at 2 CFR 200.22): Provide a description of the product or service to be procured by contract and an estimate of the cost. Indicate whether the applicant’s formal, written Procurement Policy or the Federal Acquisition Regulation is followed. Applicants are encouraged to promote free and open competition in awarding procurement contracts. A separate justification must be provided for sole source procurements in excess of the Simplified Acquisition Threshold set in accordance with 41 U.S.C. 1908 (currently set at $150,000). Consultant Fees: For each consultant enter the name, if known, service to be provided, hourly or daily fee (8-hour day), and estimated time on the project. Consultant fees in excess of the DOJ grant-making component’s maximum rate for an 8-hour day (currently $650 for OJP and OVW, and $550 for the COPS Office). All requested information must be included in the budget detail worksheet and budget narrative.

H. Procurement Contracts |

|

|

|

|

|

|

|

|

|

|

| Procurement Contracts |

|

|

|

| Procurement contracts: Provide a cost estimate for the product or service to be procured by contract |

|

|

|

| Description |

Purpose |

Consultant? |

Computation |

|

|

|

| Provide a description of the products or services to be procured by contract and an estimate of the costs. Applicants are encouraged to promote free and open competition in awarding contracts. A separate justification must be provided for sole source procurements in excess of the Simplified Acquisition Threshold (currently $150,000). |

Describe the purpose of the procurement contract |

Is the procurement contract for a consultant? If yes, use the section below to explain associated travel expenses included in the cost. |

Compute the cost (e.g Cost-Non-Federal Contribution) |

|

|

|

|

Total cost is the value or cost of the procurement contract (or consultant) or of the subaward, as applicable.

Total Cost |

Non-Federal Contribution is the dollar amount not requested from the sponsoring Program Office. This value should be $0 if all funds are to be requested from the Program Office.

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

| Procurement Contract Narrative |

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consultant Travel (if necessary) |

|

|

|

| List all travel-related expenses to be paid from the grant to the individual consultants (e.g., transportation, meals, lodging) separate from their consultant fees. |

|

|

|

| Purpose of Travel |

Location |

Type of Expense |

Computation |

|

|

|

| Indicate the purpose of each trip or type of trip (training, advisory group meeting) |

Indicate the location of the event |

Hotel, airfare, per diem |

Compute the cost of each type of expense X the number of people traveling. |

|

|

|

|

|

Cost |

Duration or Distance |

# of Staff |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

List items (e.g., rent, reproduction, telephone, janitorial or security services, and investigative or confidential funds) by type and the basis of the computation. For example, provide the square footage and the cost per square foot for rent, or provide a monthly rental cost and how many months to rent. All requested information must be included in the budget detail worksheet and budget narrative.

I. Other Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

|

|

| List and describe items that will be paid with grants funds. |

|

|

|

|

|

|

|

|

|

Total cost is the value or cost of the other cost.

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Other Costs Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indirect costs are allowed only if: a) the applicant has a current, federally approved indirect cost rate; or b) the applicant is eligible to use and elects to use the “de minimis” indirect cost rate described in 2 C.F.R. 200.414(f). (See paragraph D.1.b. in Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals for a description of entities that may not elect to use the “de minimis” rate.) An applicant with a current, federally approved indirect cost rate must attach a copy of the rate approval, (a fully-executed, negotiated agreement). If the applicant does not have an approved rate, one can be requested by contacting the applicant’s cognizant Federal agency, which will review all documentation and approve a rate for the applicant organization, or if the applicant’s accounting system permits, costs may be allocated in the direct costs categories. (Applicant Indian tribal governments, in particular, should review Appendix VII to Part 200—States and Local Government and Indian Tribe Indirect Cost Proposals regarding submission and documentation of indirect cost proposals.) All requested information must be included in the budget detail worksheet and budget narrative.

In order to use the “de minimis” indirect rate an applicant would need to attach written documentation to the application that advises DOJ of both the applicant’s eligibility (to use the “de minimis” rate) and its election. If the applicant elects the de minimis method, costs must be consistently charged as either indirect or direct costs, but may not be double charged or inconsistently charged as both. In addition, if this method is chosen then it must be used consistently for all federal awards until such time as the applicant entity chooses to negotiate a federally approved indirect cost rate.

J. Indirect Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

Computation |

|

|

|

| Describe what the approved rate is and how it is applied. |

Compute the indirect costs for those portions of the program which allow such costs. |

|

|

|

|

Cost is the value of the indirect cost.

Base |

The approved cost rate for this indirect cost.

Indirect Cost Rate |

Total Cost |

Non-Federal Contribution |

The amount requested from the sponsoring Program Office.

Federal Request |

|

|

|

|

|

$0 |

$0 |

$0 |

|

|

|

| Total |

$0 |

$0 |

$0 |

|

|

|

|

Enter a text description explaining how the numbers provided in this section were generated, as well as any explanation of the proposed personnel’s roles and qualifications.

Indirect Costs Narrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Justice Systems and Alcohol and Substance Abuse |

|

Purpose Area (3) |

|

|

|

| Program Office |

|

|

|

BJA |

16.608 |

|

|

|

|

|

|

|

|

|

|

|

|

| Note: Non-Federal match is not required for this purpose area but can be provided if desired. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|