2019–20 National Postsecondary Student Aid Study (NPSAS:20)

2019–20 National Postsecondary Student Aid Study (NPSAS:20)

Appendix H NPSAS 2020 Student Records Instrument

2019–20 National Postsecondary Student Aid Study (NPSAS:20)

OMB: 1850-0666

2019–20 NATIONAL POSTSECONDARY STUDENT AID STUDY (NPSAS:20)

Appendix H

Student Records Instrument

OMB # 1850-0666 v. 29

Submitted by

National Center for Education Statistics

U.S. Department of Education

August 2019

second revision April 2020

This appendix provides the 2019–20 National Postsecondary Student Aid Study (NPSAS:20) student records data collection instrument. The NPSAS:20 instrument remains largely unchanged from the instrument approved for NPSAS:20 qualitative testing [OMB# 1850-0803 v.243 & 247]. The changes noted below were developed based on the results of this qualitative testing1 and based on the 2017-18 NPSAS Administrative Collection (NPSAS:18-AC) and are intended to improve data quality while also reducing respondent burden.

Table 1 lists all instrument items in this appendix and indicates any changes to the content of the instrument when compared to the instrument approved for NPSAS:20 qualitative testing. The table includes color coding to indicate whether items have remained the same (black), were revised (purple), removed (red), or added (green) when compared to the NPSAS:20 qualitative testing instrument.

Contents

Log in Screen for Postsecondary Data Portal H-5

Mock-up of Login Screen H-6

Eligibility H-12

BELIG H-12

BELIGRSN H-12

General Student Information H-13

FNAME H-13

MNAME H-13

LNAME H-13

SUFFIX H-13

SOCIAL H-13

ASTHDOB H-14

ASGENDER H-14

AMARITAL H-14

AMAIDEN H-14

SPOUSEFN H-14

SPOUSEMN H-14

SPOUSELN H-14

ACITIZEN H-14

AVETERAN H-14

AHIGHSCH H-15

AHIGHYR H-15

SUBSCTION: RACE & ETHNICITY H-15

Enrollment H-20

BEERDTMY H-20

BELEDTMY H-20

BETRANSFER H-20

BREMEVER H-20

BEFSTTM H-20

BERECVBA H-21

BEBADATE H-21

BEACTENG H-21

BEACTMAT H-21

BEACTRDG H-21

BEACTSCI H-21

BEACTCOM H-22

BESATCR H-22

BESATMAT H-22

BESATWRT H-22

BENLADEG H-22

BENADTYP H-23

BENLALVL H-23

BEDEGDATE H-24

BEEXPDEG H-24

BENNFGPA H-24

BECURMAJ1 H-24

BECIPMAJ1 H-25

BECURMAJ2 H-25

BECIPMAJ2 H-25

BEUNDECL H-25

BECLKHRS H-25

BECLKCOMP H-25

BECRDHRS H-26

BECRDCOMP H-26

BTUITOT H-26

BTUIREF (NEW) H-26

BROOMREF (NEW) H-27

BTUNJURI H-27

BTMST[01-12] H-27

BTMHR H-28

Budget H-28

CNPERIOD H-28

CNFULLYR (NEW) H-29

CNLCLRES H-29

CTUITION H-29

CNESBOOK H-29

CNESROOM H-30

CNETRANS H-30

CNESCOMP H-30

CNEHLTH H-30

CNEOTHER H-30

CTOTLCOA H-30

Financial Aid H-30

CFAWARN H-30

CFAPROB H-30

CFAINELG H-31

SUBSECTION: FEDERAL AID H-31

SUBSECTION: STATE AID H-32

SUBSECTION: INSTITUTION AID H-36

SUBSECTION: PRIVATE AID OR OTHER GOVERNMENT AID H-39

Tables

Table 1. Student records instrument for NPSAS:20 student records collection H-7

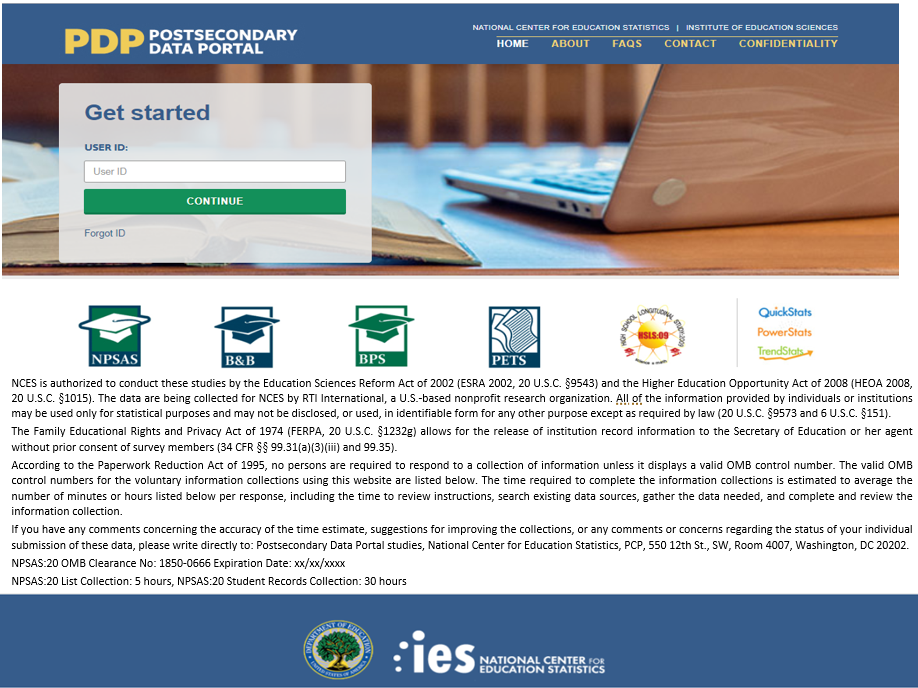

Log in Screen for Postsecondary Data Portal

Login Area

Get Started

USERID __________

Forgot ID? Click Send User ID below to have your user ID sent to the e-mail address that you enter. Otherwise, click Cancel.

E-mail Address: __________________________________

PRA Statement

[The following statement will appear on the Postsecondary Data Portal log in screen:]

NCES is authorized to conduct these studies by the Education Sciences Reform Act of 2002 (ESRA 2002, 20 U.S.C. §9543) and the Higher Education Opportunity Act of 2008 (HEOA 2008, 20 U.S.C. §1015). The data are being collected for NCES by RTI International, a U.S.-based nonprofit research organization. All of the information provided by individuals or institutions may be used only for statistical purposes and may not be disclosed, or used, in identifiable form for any other purpose except as required by law (20 U.S.C. §9573 and 6 U.S.C. §151).

The Family Educational Rights and Privacy Act of 1974 (FERPA, 20 U.S.C. §1232g) allows for the release of institution record information to the Secretary of Education or her agent without prior consent of survey members (34 CFR §§ 99.31(a)(3)(iii) and 99.35).

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control numbers for the voluntary information collections using this website are listed below. The time required to complete the information collections is estimated to average the number of minutes or hours listed below per response, including the time to review instructions, search existing data sources, gather the data needed, and complete and review the information collection.

If you have any comments concerning the accuracy of the time estimate, suggestions for improving the collections, or any comments or concerns regarding the status of your individual submission of these data, please write directly to: Postsecondary Data Portal studies, National Center for Education Statistics, PCP, 550 12th St., SW, Room 4007, Washington, DC 20202.

NPSAS:20 OMB Clearance No: 1850-0666 Expiration Date: xx/xx/xxxx

NPSAS:20 List Collection: 5 hours, NPSAS:20 Student Records Collection: 30 hours

Mock-up of Login Screen

Table 1. Student records instrument for NPSAS:20 student records collection

Item Name |

Item Description |

Change Removed (X), Added (A), Revised (R) |

Revision from NPSAS:20 Student Records Instrument for Qualitative Testing (OMB# 1850-0803 v. 243) |

Institution Information |

|||

BENRTYPE |

Report Enrollment Status |

X |

Items moved to the Registration Page, which was included in the NPSAS:20 enrollment list clearance package (OMB# 1850-0666 v.23). |

BTMNAME[01-12] |

Term name [1-12] |

X |

|

BTMBEG[01-12] |

Term start date [1-12] |

X |

|

BTMEND[01-12] |

Term end date [1-12] |

X |

|

CRSUNIT |

Standard Academic Course Credit |

X |

|

Eligibility |

|||

BELIG |

Student eligible for NPSAS:20? |

R |

Help text revised for clarity and to provide instructions for students impacted by COVID-19. |

BELIGRSN |

Ineligible reason |

R |

Help text revised for clarity and to provide instructions for students impacted by COVID-19. |

General Student Information |

|||

FNAME |

First name |

|

No change |

MNAME |

Middle name |

|

No change |

LNAME |

Last name |

|

No change |

SUFFIX |

Suffix |

|

No change |

SOCIAL |

Social Security Number |

R |

Context note added to help text to explain the purpose of collecting this item. |

ASTHDOB |

Date of birth |

R |

Earliest valid response option updated from 1920 to 1930. The latest valid response option updated from 2014 to 2004. |

ASGENDER |

Sex |

R |

New response option added for “Other” sex. |

AMARITAL |

Marital status |

R |

Context note added to help text to explain the purpose of collecting this item. |

AMAIDEN |

Maiden name |

|

No change |

SPOUSEFN |

Spouse first name |

|

No change |

SPOUSEMN |

Spouse middle name |

|

No change |

SPOUSELN |

Spouse last name |

|

No change |

ACITIZEN |

Citizenship status |

R |

Recoded response option values to match Student Records Codebook. |

AVETERAN |

Veteran status |

|

No change |

AHIGHSCH |

High school completion type |

|

No change |

ASHIGHYR |

High school completion year |

R |

Earliest valid response option updated from 1920 to 1940. |

ASHISPAN |

Ethnicity |

R |

Help text revised to specify that item is critical. |

ASTWHITE |

Race: White |

R |

New response option added for “Unknown” race. Help text revised to include instructions for using new Unknown option. |

ASTBLACK |

Race: Black |

R |

|

ASTASIAN |

Race: Asian |

R |

|

ASINDIAN |

Race: American Indian or Alaska Native |

R |

|

ASISLAND |

Race: Native Hawaiian or Other Pacific Islander |

R |

|

PERMAD1L |

Permanent address line 1 |

|

No change |

PERMAD2L |

Permanent address line 2 |

|

No change |

PERMCITY |

Permanent city |

|

No change |

PERMSTAT |

Permanent state |

|

No change |

PERMZIP |

Permanent ZIP |

|

No change |

PRMCNTRY |

Permanent country |

|

No change |

SCHSTRES |

Permanent resident of [institution state] |

|

No change |

LOCAD1L |

Local address line 1 |

|

No change |

LOCAD2L |

Local address line 2 |

|

No change |

LOCCITY |

Local city |

|

No change |

LOCSTAT |

Local state |

|

No change |

LOCZIP |

Local ZIP |

|

No change |

PHONE1 |

Phone |

|

No change |

PHONE1TYPE |

Type |

|

No change |

PHONE2 |

Phone |

|

No change |

PHONE2TYPE |

Type |

|

No change |

PRSEMAIL |

E-mail address |

|

No change |

CAMEMAIL |

Campus e-mail address |

|

No change |

PARFRST |

Parent first name |

|

No change |

PARMID |

Parent middle name |

|

No change |

PARLAST |

Parent last name |

|

No change |

PARSUF |

Parent suffix |

|

No change |

PARAD1L |

Parent address line 1 |

|

No change |

PARAD2L |

Parent address line 2 |

|

No change |

PARCITY |

Parent city |

|

No change |

PARSTAT |

Parent state |

|

No change |

PARZIP |

Parent ZIP |

|

No change |

PARCNTRY |

Parent country |

|

No change |

PAREMAIL |

Parent e-mail |

|

No change |

PARTEL |

Parent phone |

|

No change |

PARCELL |

Parent cell phone |

|

No change |

PARPITL |

Parent international phone |

|

No change |

OTHFRST |

Other contact first name |

|

No change |

OTHMID |

Other contact middle name |

|

No change |

OTHLAST |

Other contact last name |

|

No change |

OTHSUF |

Other contact suffix |

|

No change |

OTHREL |

Relationship of other contact to student |

|

No change |

OTHAD1L |

Other contact address line 1 |

|

No change |

OTHAD2L |

Other contact address line 2 |

|

No change |

OTHCITY |

Other contact city |

|

No change |

OTHSTAT |

Other contact state |

|

No change |

OTHZIP |

Other contact ZIP |

|

No change |

OTHCNTRY |

Other contact country |

|

No change |

OTHEMAIL |

Other contact e-mail |

|

No change |

OTHTEL |

Other contact phone |

|

No change |

OTHCELL |

Other contact cell phone |

|

No change |

Enrollment |

|||

BEERDTMY |

First enrolled at this institution date |

R |

Help text revised for clarity. Earliest valid response option updated from 1920 to 1940. |

BELEDTMY |

Last enrolled at this institution date |

R |

Help text revised to state that item should be left blank for still enrolled students. Earliest valid response option updated from 1920 to 1940. |

BETRANSFER |

Accepted transfer credit |

|

No change |

BREMEVER |

Ever taken a remedial course |

R |

Help text revised for clarity and to specify how institutions should report students who took co-requisite courses. |

BEFSTTM |

First-time beginning student |

|

No change |

BERECVBA |

Received bachelor’s degree |

R |

Help text revised to remove reference to graduate students. |

BEBADATE |

Date bachelor’s degree received |

R |

Help text revised to remove reference to graduate students. Earliest valid response option updated from 1920 to 1940. |

BEACTENG |

ACT English score |

|

No change |

BEACTMAT |

ACT Mathematics score |

|

No change |

BEACTRDG |

ACT Reading score |

|

No change |

BEACTSCI |

ACT Science score |

|

No change |

BEACTCOM |

ACT Composite score |

|

No change |

BESATCR |

SAT Evidence-Based Reading and Writing score |

R |

Item revised to match new SAT test. |

BESATMAT |

SAT Math score |

R |

Item revised to match new SAT test. |

BESATWRT |

SAT Essay score |

R |

Item revised to match new SAT test. |

BENLADEG |

Program/Degree |

R |

Help text revised to provide instructions for students impacted by COVID-19. |

BENADTYP |

Graduate Degree Type |

R |

Help text revised to specify that item only applies to graduate students and to provide instructions for students impacted by COVID-19. |

BENLALVL |

Class level |

R |

Help text revised to provide instructions for students impacted by COVID-19. |

BEDEGDATE |

Degree completion date |

|

No change |

BEEXPDEG |

Expected to complete degree requirements by [date] |

R |

Help text revised to clarify when this item should be left blank. |

BENNFGPA |

Cumulative (unweighted) GPA |

R |

Help text revised to provide example of correct data format. |

BECURMAJR1 |

First major |

R |

Help text revised to provide instructions for students impacted by COVID-19. |

BECIPMAJ1 |

CIP code for first major |

R |

Help text revised to include link to CIP program website. |

BECURMAJ2 |

Second major |

R |

Help text revised to provide instructions for students impacted by COVID-19. |

BECIPMAJ2 |

CIP code for second major |

R |

Help text revised to include link to CIP program website. |

BEUNDECL |

Major undeclared |

|

No change |

BECRDHRS |

Required credit hours in program |

R |

Help text revised to specify that item should be left blank when it does not apply. |

BECRDCOMP |

Cumulative credit hours completed |

R |

|

BECLKHRS |

Required clock hours in program |

R |

|

BECLKCOMP |

Cumulative clock hours completed |

R |

|

BTTUITOT |

Total tuition and required fees charged |

R |

Wording revised to specify that tuition should be reported for specific academic terms and to provide instructions for students impacted by COVID-19. |

BTUIREF |

Tuition and fees refunded for COVID-19 |

A |

New item added to capture tuition refunds due to COVID-19. |

BROOMREF |

Room and board refunded for COVID-19 |

A |

New item added to capture room and board refunds due to COVID-19. |

BTUNJURI |

Residency for Tuition Purposes |

|

No change |

BTMST[01-12] |

Enrollment status [term 1-12] |

R |

Help text revised to provide instructions for students impacted by COVID-19. |

BTMHR[01-12] |

Units for credit enrolled [term 1-12] |

R |

Help text revised to specify that item is critical and to provide instructions for students impacted by COVID-19. |

Budget |

|||

CNPERIOD |

Budget Period |

R |

Help text revised for clarity and to provide instructions for students impacted by COVID-19. |

CNFULLYR |

Full-year Budget |

A |

New item added to collect whether “full-year” budgets include summer sessions. |

CNLCLRES |

Student residence for budget |

R |

Help text revised for clarity. |

CTUITION |

Budgeted tuition/fees |

R |

Help text revised for clarity. |

CNESBOOK |

Budgeted books/supplies |

|

No change |

CNESROOM |

Budgeted room and board |

|

No change |

CNETRANS |

Budgeted transportation |

|

No change |

CNESCOMP |

Budgeted computer/technology |

|

No change |

CNEHLTH |

Budgeted health insurance |

|

No change |

CNEOTHER |

Budgeted all other expenses |

R |

Help text revised for clarity. |

CTOTLCOA |

Total budgeted cost of attendance |

R |

Help text revised for clarity. |

Financial Aid |

|||

CFAWARN |

Placed on financial aid warning |

R |

Help text revised for clarity and to include contextual information about Satisfactory Academic Progress policies. |

CFAPROB |

Placed on financial aid probation |

R |

|

CFAINELG |

Ineligible to receive Title IV financial aid |

R |

|

CFAFEDAID |

Student had federal aid |

R |

Wording revised to specify that aid should be reported for specific academic terms and that institutions should report aid disbursed; also to provide instructions for students impacted by COVID-19. |

CFADPELL |

Pell Grant amount |

|

No change |

CFASSTAF |

Subsidized Stafford/Direct Loan amount |

|

No change |

CFAUSTAF |

Unsubsidized Stafford/Direct Loan amount |

|

No change |

CFADPLUS |

Parent PLUS Loan amount |

|

No change |

CFAGPLUS |

Graduate PLUS Loan amount |

|

No change |

CFATEACH |

Federal TEACH Grant amount |

|

No change |

CPERKINS |

Perkins Loan amount |

|

No change |

CFAFSEOG |

Federal SEOG Grant amount |

|

No change |

CFATDFWS |

Federal work study awarded amount |

R |

Help text revised to specify that this item should report aid awarded. |

CFAIRAQ |

Iraq & Afghanistan Service Grant amount |

|

No change |

CFATVET |

Veteran’s benefits amount |

R |

Help text revised to specify that benefits for active duty military should not be included. |

CFASTATAID |

Student had state aid |

R |

Wording revised to specify that aid should be reported for specific academic terms and that institutions should report aid disbursed; also to provide instructions for students impacted by COVID-19. |

CFSTATE[01-03] |

State aid program [1-3] name |

R |

Context note added to help text to explain the purpose of collecting this item. |

CFSTTYP[01-03] |

State aid program [1-3] type |

R |

Help text revised to clarify definition for merit and need-based aid and to provide instructions for students impacted by COVID-19. New response option added for COVID-19 aid. |

CSTAMT[01-03] |

State aid program [1-3] amount |

|

No change |

CFAINSTAID |

Student had institution aid |

R |

Wording revised to specify that aid should be reported for specific academic terms and that institutions should report aid disbursed; also to provide instructions for students impacted by COVID-19. |

CFAINS[01-03] |

Institution aid program [1-3] name |

R |

Context note added to help text to explain the purpose of collecting this item. |

CFAITYP[01-03] |

Institution aid program [1-3] type |

R |

Help text revised to clarify definition for merit and need-based aid and to provide instructions for students impacted by COVID-19. New response option added for COVID-19 aid. |

CFAIAMT[01-03] |

Institution aid program [1-3] amount |

|

No change |

CFAOTHGOV |

Student had private aid or other gov’t aid |

R |

Wording revised to specify that aid should be reported for specific academic terms and that institutions should report aid disbursed; also to provide instructions for students impacted by COVID-19. |

CFAOTHGOV[01-03] |

Private aid or other gov’t aid program [1-3] name |

R |

Context note added to help text to explain the purpose of collecting this item. |

CFAGOVTYP[01-03] |

Private aid or other gov’t aid program [1-3] type |

R |

Help text revised to clarify definition for merit and need-based aid and to provide instructions for students impacted by COVID-19. New response option added for COVID-19 aid. |

CFAGOVSRC[01-03] |

Private aid or other gov’t aid program [1-3] source |

A |

Added to aid in review and coding of financial aid data. |

CFAGOVAMT[01-03] |

Private aid or other gov’t aid program [1-3] amount |

|

No change |

CFAOTHAID |

Student had other aid |

R |

Wording revised to specify that aid should be reported for specific academic terms and that institutions should report aid disbursed; also to provide instructions for students impacted by COVID-19. |

CFAOTHNAM[01-03] |

Other aid program [1-3] name |

R |

Context note added to help text to explain the purpose of collecting this item. |

CFAOTHTYP[01-03] |

Other aid program [1-3] type |

R |

Help text revised to clarify definition for merit and need-based aid and to provide instructions for students impacted by COVID-19. New response option added for COVID-19 aid. |

CFAOTHSRC[01-03] |

Other aid program [1-3] source |

|

No change |

CFAOTHAMT[01-03] |

Other aid program [1-3] amount |

|

No change |

Eligibility

BELIG

Student is eligible for NPSAS:20?

Note [Web and Excel mode]: this item defaults to Yes unless you change the selection.

Note [CSV mode]: if you leave this item blank, the student will be treated as eligible for NPSAS:20.

If you think that this student is ineligible for NPSAS:20, change the response to No and select a reason that the student is ineligible. If more than one reason applies, choose the reason that appears first on the list. You do not need to provide any other data for ineligible students.

Note about students ineligible due to a tuition refund: students who attended your institution in spring of 2020 and then received a full tuition refund solely due to COVID-19-related interruptions of study should be marked as eligible. These students should only be marked as ineligible if one of the other ineligible reasons applies (e.g., student was enrolled in a high school completion program, etc.).

The student is ineligible for NPSAS:20 if he or she meets any of the following conditions:

Not enrolled at institution: Student was not enrolled at this institution at any time from July 1, 2019 to June 30, 2020.

Tuition refund: Student was enrolled at one time but received a full tuition refund for all terms in study period from July 1, 2019 to June 30, 2020. If the student received a full tuition refund solely because of a COVID-19-related interruption of study but would otherwise be eligible for NPSAS:20, the student should be marked as eligible.

Pays tuition to another institution: Student attends this institution under joint arrangements with another institution and pays tuition solely to the other institution.

Length of program: Student was enrolled in an occupational/technical program of study less than 3 months or 300 clock/contact hours of instruction.

Non-credit program: Student was enrolled, but not in at least one course that could be applied toward fulfilling requirements for an academic degree, a certificate or diploma program, or in a term for credit that could be transferred to another school.

Completing high school: Student was still completing high school requirements as of the last term enrolled in the July 1, 2019 - June 30, 2020 academic year.

GED or high school completion program: Student was enrolled solely in a GED or high school completion program as of the last term enrolled in the July 1, 2019 - June 30, 2020 academic year.

Adult basic education program: Student was enrolled solely in an adult basic education program (e.g., ESL, literacy) as of the last term enrolled in the July 1, 2019 - June 30, 2020 academic year.

1=Yes

0=No

BELIGRSN

Ineligible reason

Select the reason that the student is not eligible for NPSAS:20.

Note about students ineligible due to a tuition refund: students who attended your institution in spring of 2020 and then received a full tuition refund solely due to COVID-19-related interruptions of study should be marked as eligible. These students should only be marked as ineligible if one of the other ineligible reasons applies (e.g., student was enrolled in a high school completion program, etc.).

1=Student was not enrolled at this institution at any time from July 1, 2019 to June 30, 2020.

2=Student was enrolled at one time but received a full tuition refund for all terms in study period from July 1, 2019 to June 30, 2020. If the student received a full tuition refund solely because of a COVID-19-related interruption of study but would otherwise be eligible for NPSAS:20, the student should be marked as eligible.

3=Student attends this institution under joint arrangements with another institution and pays tuition solely to the other institution.

4=Student was enrolled in an occupational/technical program of study less than 3 months or 300 clock/contact hours of instruction.

5=Student was enrolled, but not in at least one course that could be applied toward fulfilling requirements for an academic degree, a certificate or diploma program, or in a term for credit that could be transferred to another school.

6=Student was still completing High School requirements (for the last term enrolled).

7=Student was enrolled solely in a GED or High School completion program (for the last term enrolled).

8=Student was enrolled solely in an adult basic education program (i.e., ESL, literacy) (for the last term enrolled).

1=Not enrolled at institution

2=Tuition refund

3=Pays tuition to another institution

4=Length of program

5=Non-credit program

6=Completing high school

7=GED or high school completion program

8=Adult basic education program

General Student Information

FNAME

First Name ___________________

MNAME

Middle Name ___________________

LNAME

Last Name ___________________

SUFFIX

Suffix ___________________

SOCIAL

Social Security Number/SSN ___________________

We will use SSNs to match students to the U.S. Department of Education's Central Processing System (CPS) database, which contains information from the Free Application for Federal Student Aid (FAFSA), the National Student Loan Data System (NSLDS), and other databases prior to selecting the student sample. Matching to these databases prior to sampling will help us to select a representative sample of students.

ASTHDOB

Month: January - December

Date: 01-31

Year: 1930 - 2004

ASGENDER

Sex

0=Male

1=Female

2=Other

-1=Unknown

AMARITAL

Marital Status

Note: This item is critical because it contributes to determining students’ dependency status. If you do not know this student’s marital status, please select Unknown.

0=Not married (single, windowed, divorced)

1=Married

2=Separated

-1=Unknown

AMAIDEN

Maiden Name ___________________

SPOUSEFN

Spouse First Name ___________________

SPOUSEMN

Spouse Middle Name ___________________

SPOUSELN

Spouse Last Name ___________________

ACITIZEN

Citizenship Status

Please indicate the student's citizenship status using one of the response options provided. Do not provide the student's country of origin.

1 = US citizen or US national

2 = Resident alien, permanent resident, or other eligible non-citizen

3 = Foreign/International student with student visa

-1 = Unknown

AVETERAN

Veteran or Active Duty Military Status

Please indicate whether the sample member is a veteran of the U.S. Armed Forces or is serving on active duty (not whether the sample member is receiving veteran’s benefits).

0 = No

1 = Yes, veteran

2 = Yes, active duty military

-1 = Unknown

AHIGHSCH

High School Completion Type

1 = High School Diploma

2 = GED or other equivalency

3 = High school completion certificate

4 = Foreign high school

5 = Home schooled

6 = No high school degree/certificate

-1 = Unknown

AHIGHYR

High School Completion Year

Year: 1940 - 2020

SUBSCTION: RACE & ETHNICITY

Instruction: Note that these items are critical, and you will receive an error message for leaving them blank. If you do not know a student’s ethnicity or race, please select Unknown.

Note that these race and ethnicity categories differ from those reported to IPEDS, but are consistent with IPEDS requirements for the collection of race and ethnicity.

For more information about IPEDS requirements for the collection and reporting of race and ethnicity, visit https://surveys.nces.ed.gov/ipeds/visfaq_re.aspx#1.

ASHISPAN

Ethnicity

0=Not Hispanic or Latino

1=Hispanic or Latino

-1=Unknown

ASTWHITE

Race: White

You will receive an error message if you (a) leave all race items blank, or (b) select No for all race items. To resolve the error message, you may either select Yes for at least one race item or select Unknown for all race items.

0 = No

1 = Yes

-1 = Unknown

ASTBLACK

Race: Black or African American

You will receive an error message if you (a) leave all race items blank, or (b) select No for all race items. To resolve the error message, you may either select Yes for at least one race item or select Unknown for all race items.

0 = No

1 = Yes

-1 = Unknown

ASTASIAN

Race: Asian

You will receive an error message if you (a) leave all race items blank, or (b) select No for all race items. To resolve the error message, you may either select Yes for at least one race item or select Unknown for all race items.

0 = No

1 = Yes

-1 = Unknown

ASINDIAN

Race: American Indian or Alaska Native

You will receive an error message if you (a) leave all race items blank, or (b) select No for all race items. To resolve the error message, you may either select Yes for at least one race item or select Unknown for all race items.

0 = No

1 = Yes

-1 = Unknown

ASISLAND

Race: Native Hawaiian or Other Pacific Islander

You will receive an error message if you (a) leave all race items blank, or (b) select No for all race items. To resolve the error message, you may either select Yes for at least one race item or select Unknown for all race items.

0 = No

1 = Yes

-1 = Unknown

PERMAD1L

Permanent Address Line 1 ___________________

PERMAD2L

Permanent Address Line 2 ___________________

PERMCITY

Permanent Address City ___________________

PERMSTAT

Permanent Address State: -Select-

PERMZIP

Permanent Address ZIP ___________________

PERMCNTRY

Permanent Address Country (if not USA) ___________________

SCHSTRES

Is the student a permanent resident of [the state in which the institution is located]?

0 = No

1 = Yes

-1 = Unknown

LOCAD1L

Local Address Line 1 ___________________

LOCAD2L

Local Address Line 2 ___________________

LOCCITY

Local Address City ___________________

LOCSTAT

Local Address State: -Select-

LOCZIP

Local Address ZIP ___________________

PHONE1

Phone 1 ___________________

PHONE1TYPE

Phone 1 Type

1 = Home

2 = Mobile

3 = Other

PHONE2

Phone 1 ___________________

PHONE2TYPE

Phone 2 Type

1 = Home

2 = Mobile

3 = Other

PRSEMAIL

Personal Email ___________________

CAMEMAIL

Campus Email ___________________

PARFRST

Parent First Name ___________________

PARMID

Parent Middle Name ___________________

PARLAST

Parent Last Name ___________________

PARSUF

Parent Suffix ___________________

PARAD1L

Parent Address Line 1 ___________________

PARAD2L

Parent Address Line 2 ___________________

PARCITY

Parent Address City ___________________

PARSTAT

Parent Address State: -Select-

PARZIP

Parent Address ZIP ___________________

PARCNTRY

Parent Address Country (if not USA) ___________________

PAREMAIL

Parent Email ___________________

PARTEL

Parent Phone ___________________

PARCELL

Parent Cell Phone ___________________

PARPITL

Parent International Phone ___________________

OTHFRST

Other Contact First Name ___________________

OTHMID

Other Contact Middle Name ___________________

OTHLAST

Other Contact Last Name ___________________

OTHSUF

Other Contact Suffix ___________________

OTHREL

Relationship of Other Contact to Student

1 = Parent

2 = Guardian

3 = Sibling

4 = Aunt

5 = Uncle

6 = Grandparent

7 = Spouse

8 = Friend

9 = Colleague

10 = Other

-1 = Unknown

OTHAD1L

Other Contact Address Line 1 ___________________

OTHAD2L

Other Contact Address Line 2 ___________________

OTHCITY

Other Contact Address City ___________________

OTHSTAT

Other Contact Address State: -Select-

OTHZIP

Other Contact Address ZIP ___________________

OTHCNTRY

Other Contact Address Country (if not USA) ___________________

OTHEMAIL

Other Contact Email ___________________

OTHTEL

Other Contact Phone ___________________

OTHCELL

Other Contact Cell Phone ___________________

Enrollment

BEERDTMY

Date first enrolled at this institution

Enter the date the student enrolled at this institution for the first time, even if this date occurred prior to this academic year.

Month: January - December

Date: 01 - 31

Year: 1940-2020

BELEDTMY

Date last enrolled at this institution

If the student is no longer enrolled at this institution, enter the student’s last date of enrollment. If the student is still enrolled at the institution, leave this item blank.

Month: January - December

Date: 01 - 31

Year: 1940-2020

BETRANSFER

Accepted transfer credit

Indicate whether your institution accepted transfer credits for this student from another postsecondary institution. Please exclude remedial or developmental courses.

0 = No

1 = Yes

BREMEVER

Ever taken a remedial course

Since completing high school, has the student taken any remedial/developmental courses to improve their basic skills in English, math, reading, or writing? If possible, answer Yes if your records indicate that the student took any remedial courses since high school, even if they were not taken at your institution.

Please answer Yes if the student took co-requisite developmental courses (sometimes known as gateway courses), in which the student was enrolled in a course that included both developmental and post-development content.

0 = No

1 = Yes

BEFSTTM

First time Beginning Student?

A student is considered a first-time beginner (FTB) for NPSAS:20 if he or she is as an undergraduate student who enrolled in college for the first time at this institution between July 1, 2019 and June 30, 2020.

Students are NOT FTBs if they were enrolled in a postsecondary class for credit at this or any other postsecondary institution prior to July 1, 2019, unless the credit was advanced placement (AP) credit, international baccalaureate (IB) credit, or any other postsecondary credit or formal award earned while the student was still completing high school.

Please note that this is not the same as the first-time full-time designation reported to IPEDS.

0 = No

1 = Yes

BERECVBA

Received bachelor’s degree

Select Yes if the student has already obtained a bachelor’s degree, even if it was not awarded by this institution.

0 = No

1 = Yes

BEBADATE

Date bachelor’s degree received

If the student has obtained a bachelor’s degree, enter the date the degree was received. If the student has not yet received a bachelor’s degree, leave this item blank.

Month: January - December

Date: 01 - 31

Year: 1940-2020

BEACTENG

ACT English ___________________

Enter the student’s ACT English score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy.

BEACTMAT

ACT Mathematics ___________________

Enter the student’s ACT Mathematics score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy.

BEACTRDG

ACT Reading ___________________

Enter the student’s ACT Reading score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy.

BEACTSCI

ACT Science ___________________

Enter the student’s ACT Science score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy.

BEACTCOM

ACT Composite ___________________

Enter the student’s ACT Composite score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy.

BESATCR

SAT Evidence-Based Reading and Writing ___________________

Enter the student’s SAT Evidence-Based Reading and Writing score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy. For students who took the SAT test prior to March 2016, please report the Critical Reading score in this field.

BESATMAT

SAT Math ___________________

Enter the student’s SAT Math score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy. For students who took the SAT test prior to March 2016, please report the Mathematics score in this field.

BESATWRT

SAT Essay ___________________

Enter the student’s SAT Essay score. If this student has multiple scores on record, enter the score that is used according to your institution’s admissions policy. If the student did not take the Essay portion of the SAT, please leave this field blank. For students who took the SAT test prior to March 2016, please report the Writing score in this field.

BENLADEG

Program/Degree

In what degree program was this student enrolled on June 30, 2020? If the student was no longer enrolled on June 30, 2020, report the degree program for his or her last term enrolled between July 1, 2019 and June 30, 2020. If the student’s last term enrolled was suspended due to COVID-19, report the student’s degree program as of the last day of classes.

If the student was enrolled in more than one program, enter the highest degree program. If the student was enrolled in a dual degree program in which both degrees are the same level (such as a dual MD/PhD or dual MA/MBA), select the student’s primary degree program.

1=Enrolled in undergraduate courses, not in a degree program

2=Undergraduate certificate or diploma (occupational or technical program)

3=Associate's degree

4=Bachelor's degree

5=Enrolled in graduate courses, not in a degree program

6=Post-baccalaureate certificate program

7=Dual bachelor's/master's degree

8=Master's degree program

9=Post-master's certificate

10=Doctoral degree - research/scholarship

11=Doctoral degree - professional practice

12=Doctoral degree - other

-1=Unknown

BENADTYP

Graduate Degree Type

1 = Master of Science (MS)

2 = Master of Arts (MA)

3 = Master of Education (M.Ed) or Teaching (MAT)

4 = Master of Business Administration (MBA)

5 = Master of Public Administration (MPA)

6 = Master of Social Work (MSW)

7 = Master of Fine Arts (MFA)

8 = Master of Public Health (MPH)

9 = Master of Divinity (M.Div)

10 = Other master's degree program not listed

11 = Doctor of Philosophy (PhD)

12 = Doctor of Education (EdD)

13 = Doctor of Science or Engineering

14 = Doctor of Psychology (PsyD)

15 = Doctor of Business or Public Admin (DBA, DPA)

16 = Doctor of Fine Arts (DFA)

17 = Doctor of Theology (ThD)

18 = Law (JD, LLB)

19 = Medicine or Osteopathic Medicine (MD, DO)

20 = Dentistry (DDS, DMD)

21 = Chiropractic (DC, DCM)

22 = Pharmacy (PharmD)

23 = Optometry (OD)

24 = Podiatry (DPM, DP, PodD)

25 = Veterinary medicine (DVM)

26 = Other doctoral degree not listed

In what type of graduate degree program was this student enrolled on June 30, 2020? If the student was no longer enrolled on June 30, 2020, report the graduate degree program type for his or her last term enrolled between July 1, 2019 and June 30, 2020. If the student’s last term enrolled was suspended due to COVID-19, report the student’s graduate degree program type as of the last day of classes.

This item applies to graduate students only; for all other students, leave this item blank.

BENLALVL

Class Level

Enter the student's class level as of June 30, 2020. If the student was no longer enrolled on June 30, provide the student’s class level during his or her last term enrolled between July 1, 2019 and June 30, 2020. If the student’s last term enrolled was suspended due to COVID-19, report the student’s class level as of the last day of classes.

If class level was used to determine financial aid eligibility, report that class level for this item. Otherwise, report the class level as defined by your institution.

Institutions typically define class level based on the number of earned credits. An example of a commonly used classification:

0-29 earned credit hours for first-year/freshman

30-59 earned credit hours for sophomore

60-89 earned credit hours for junior

90+ earned credit hours for senior

1 = 1st Year/Freshman

2 = Sophomore

3 = Junior

4 = Senior

5 = 5th Year or Higher Undergraduate

6 = Undergraduate (unclassified)

7 = Student with bachelor's or advanced degree taking undergraduate courses

8 = 1st year Graduate

9 = Beyond 1st year Graduate

10 = Graduate (unclassified)

-1 = Unknown

BEDEGDATE

Date Completed

If the student completed the degree program, enter the date the degree was received.

Month: January - December

Date: 01 - 31

Year: 1920-2020

BEEXPDEG

Expected to complete degree requirements by June 30, 2020?

Is the student expected to have completed the requirements for their current degree program on or before June 30, 2020? Completion of the requirements means all required classes have been taken and passed and sufficient credit or clock hours have been earned. Some students may not yet have been awarded their degree or certificate by the institution, even though the requirements have been completed.

Leave this item blank if any of the following apply:

You are completing this request after June 30, 2020.

The student has completed his or her degree (completed degrees are collected separately in this section).

The student is no longer enrolled in this institution.

BENNFGPA

Cumulative (Unweighted) GPA___________________

Please provide the student’s cumulative GPA as of June 30, 2020. If your institution uses a 4point scale, please enter GPA with two decimal places (x.xx). If your institution uses a 100 point scale, enter the grade with one decimal place (xx.x).

BECURMAJ1

First Major ___________________

BECIPMAJ1

First Major CIP Code___________________

Please provide the CIP code for this student’s first major as of June 30, 2020. If the student was no longer enrolled on June 30, provide the student’s major during his or her last term enrolled between July 1, 2019 and June 30, 2020. If the student’s last term enrolled was suspended due to COVID-19, report the student’s first major as of the last day of classes.

CIP (Classification of Instructional Programs) codes are used by the National Center for Education Statistics (NCES) for major or field of study reporting, assessment, and tracking. For more information about the Classification of Instructional Programs, see https://nces.ed.gov/ipeds/cipcode/.

If you cannot report the major CIP code, please leave this column blank and enter the student's current or most recent first major or field of study in the First Major item in this section. If the student has not yet declared a major, please leave this item blank and select "Yes" for the "undeclared" item in this section.

BECURMAJ2

Second Major ___________________

BECIPMAJ2

Second Major CIP Code___________________

Please provide the CIP code for this student’s second major as of June 30, 2020. If the student was no longer enrolled on June 30, provide the student’s major during his or her last term enrolled between July 1, 2019 and June 30, 2020. If the student’s last term enrolled was suspended due to COVID-19, report the student’s second major as of the last day of classes.

CIP (Classification of Instructional Programs) codes are used by the National Center for Education Statistics (NCES) for major or field of study reporting, assessment, and tracking. For more information about the Classification of Instructional Programs, see https://nces.ed.gov/ipeds/cipcode/.

If you cannot report the major CIP code, please leave this column blank and enter the student's current or most recent second major or field of study in the Second Major item in this section. If the student has not yet declared a major, please leave this item blank and select "Yes" for the "undeclared" item in this section.

BEUNDECL

Major Undeclared

0 = No

1 = Yes

BECLKHRS

Total Number of Clock Hours in Program___________________

If this student is enrolled in a clock hour program, what is the total length of the program in clock/contact hours? If the student is not enrolled in a clock hour program, leave this item blank.

BECLKCOMP

Cumulative Clock Hours Completed___________________

Please provide the total cumulative clock hours earned by this student as of June 30, 2020. Include all clock hours earned, even if they do not count toward the student’s degree/program requirements. If the student is not enrolled in a clock hour program, leave this item blank.

BECRDHRS

Total Number of Credit Hours in Program___________________

If this student is enrolled in a credit hour program, what is the total length of the program in credit hours? If the student is not enrolled in a credit hour program, leave this item blank.

BECRDCOMP

Cumulative Credit Hours Completed___________________

Please provide the total cumulative credit hours earned by this student as of June 30, 2020. Include all credit hours earned, even if they do not count toward the student’s degree/program requirements. If the student is not enrolled in a credit hour program, leave this item blank.

BTUITOT

Total Tuition and Required Fees Charged ___________________

[FOR TERM-BASED INSTITUTIONS: Report the total tuition and required fees charged to this student for [term1, term2, term3,...], prior to any aid, discounts, or waivers.] These are the terms your institution reported for the 2019-20 academic year on the NPSAS:20 Registration Page. If you have questions about these terms, please contact the Help Desk.

[FOR CONTINUOUS ENROLLMENT INSTITUTIONS: Report the total tuition and required fees charged to this student for the period July 1, 2019 to June 30, 2020, prior to any aid, discounts, or waivers.]

Please report the tuition and required fees charged prior to any refunds or reimbursements due to COVID-19. If any part of the student’s tuition was refunded or reimbursed, please report that amount separately under “Tuition Refund for COVID-19.”

Required fees include all fixed sum charges that are required of such a large proportion of all students that the student who does not pay the charges is an exception.

Include any out-of-state/out-of-district fees for applicable students.

Please enter the specific amount charged for this student (typically obtained from the business or bursar's office), not the budgeted tuition amount or the average tuition amount charged for students.

BTUIREF (NEW)

Tuition and Fees Refunded for COVID-19 ___________________

Please report the amount of tuition or fees refunded or reimbursed to the student due to COVID-19. If the student did not receive a tuition or fees refund or reimbursement due to COVID-19, leave this item blank.

This item is only for reporting tuition or fees refunds or reimbursements due to COVID-19. Tuition waivers for other reasons should be reported as aid in the financial aid section. Do not report tuition refunds or reimbursements for COVID-19 as financial aid.

BROOMREF (NEW)

Indicate whether your institution refunded any portion of the student’s room and board fees for the July 1, 2019 to June 30, 2020 academic year due to COVID-19.

0 = No

1 = Yes

2 = Institution does not offer room and board.

-1 = Unknown

BTUNJURI

Residency for Tuition Purposes

Please indicate the student’s tuition classification for the 2019-2020 academic year.

An in-district student is a student who is a legal resident of the locality in which he/she attends school and thus is entitled to reduced tuition charges if offered by the institution.

An in-state student is a student who is a legal resident of the state in which he/she attends school.

A student may receive in-state or reduced tuition even if he/she is not a legal resident of the state, such as through programs that offer in-state tuition to veterans or through tuition reciprocity agreements with adjacent states. Report these students as “in-state tuition for other reason,” even if the reduced tuition is higher than in-state tuition.

An out-of-state student is a student who is not a legal resident of the state in which he/she attends school.

1 = In-district

2 = In-state tuition based on legal residence

3 = In-state tuition for other reason (e.g., veteran status)

4 = Out-of-state

5 = No differential tuition based on residency

-1 = Unknown

BTMST[01-12]

Enrollment Status for [Term 01-12]

Enter the student’s enrollment status in [term 1-12].

For institutions with interruptions of study related to COVID-19: If the student’s enrollment status changed due to COVID-19 (e.g., for institution closure or a partial cancellation of a student’s course load), please report the student’s most recent enrollment status. For example, a student who was enrolled full time in spring 2020 but dropped to half-time status due to COVID-19-related course cancellations should be reported as half-time.

For institutions without interruptions of study related to COVID-19: If enrollment status was used to determine financial aid eligibility, report that enrollment status for this item. Otherwise, report the enrollment status as defined by your institution.

Institutions typically define enrollment status based on the number of credit or clock hours attempted. For example, students who are enrolled as a full-time student typically carry at least

12 semester or quarter hours per term at the undergraduate level or 9 credit hours per term at the graduate level.

24 semester hours or 36 quarter hours per academic year for an educational program using credit hours for a program of less than one academic year.

24 clock hours per week for an education program using clock hours.

0 = Not enrolled

1 = Full-time

2 = 3/4-time

3 = Half-time

4 = Less than half-time

BTMHR

Number of Credits or Clock Hours Enrolled in [Term 01-12] ___________________

Enter the number of credits or clock hours this student attempted for this term. If the student’s credit or clock hours attempted changed due to COVID-19 (e.g., for institution closure or a partial cancellation of a student’s course load), please report the student’s most recent credit or clock hours attempted. For example, a student who was enrolled for 12 credit hours in spring 2020 but dropped to 6 credit hours due to COVID-19-related course cancellations should be reported as 6 credit hours. If you were not able to provide an enrollment status for this term, the number of credits or clock hours is critical for determining this student’s enrollment intensity.

Budget

Please provide budgeted costs of attendance for the 2019-2020 academic year (July 1, 2019 to June 30, 2020). If possible, please provide a full-time/full-year budget for each student, even if the student was not enrolled full-time for the entire academic year. The budget costs should match the student’s program and residence (e.g., on-campus, off-campus with parents, off-campus not with parents).

CNPERIOD

Budget Period

Select the budget period that matches the budgeted costs of attendance you will provide for this student.

If possible, please provide the full-time, full-year budget that matches this student’s program and residence, even if the student was not enrolled full-time for the entire year. (Below you will be asked to indicate whether the full-year budget includes costs for summer terms.)

For guidance on reporting budgeted costs of attendance for students impacted by COVID-19, please see the Student Records Handbook on the Resources page of the PDP or contact the Help Desk.

If a full-time, full-year budget is not available, you can use Pell guidelines to prorate the amount to reflect the costs for a full-time student enrolled for a full academic year in the student’s academic program. Click here for definitions and more information about prorating costs of attendance.

If a full-time, full-year budget is not available, and you cannot provide a prorated amount, you may provide budgeted costs of attendance for other budget periods. For additional guidance and examples, please see the NPSAS:20 Student Records Handbook (available on the Resources page of the PDP).

Please provide budgeted costs of attendance for a full-time student enrolled for a full academic year.

Academic year: An academic year must include at least 30 weeks of instructional time for credit-hour based programs, or 26 weeks of instructional time for clock-hour based programs.

At a semester-based institution, the academic year typically includes fall and spring terms. At a trimester-based institution, the academic year typically includes fall, spring, and summer terms.

For more information about defining an academic year, visit [link]. A link to the FSA Handbook is also available on the Resources page of the PDP.

Full-time: The following minimum coursework standards are for undergraduate students enrolled full-time in the academic year:

- For credit-hour programs, at least 24 semester or trimester credit hours, or 36 quarter credit hours; or

- For clock-hour programs, at least 900 clock hours.

Adjusting budgeted costs of attendance: If your program costs are not for full-time, full-year enrollment, use the Pell guidelines to adjust your costs of attendance to report a full-time, full-year budget.

For more information about prorating costs of attendance for Pell, visit [link]. A link to the FSA Handbook is also available on the Resources page of the PDP.

1 = Full-time, full-year

2 = Full-time, one term

3 = 3/4-time, full-year

4 = 3/4-time, one term

5 = Half-time, full-year

6 = Half-time, one term

7 = Less than half-time, full-year

8 = Less than half-time, one term

9 = Other

CNFULLYR (NEW)

Full-year Budget

If you provided a full-year budget for this student (Budget Period = 1, 3, 5, or 7), please indicate whether the budgeted costs of attendance include summer terms. If you provided a one term budget, leave this item blank.

1 = Yes, the full-year budget includes summer term(s)

0 = No, the full-year budget does NOT include summer term(s)

CNLCLRES

Student Residence

For purposes of determining the student’s budgeted cost of attendance for the 2019-20 academic year, what was the student’s housing/residence status?

1 = On-campus or school-owned housing

2 = Off-campus without parents

3 = Off-campus with parents

-1 = Unknown

CTUITION

Tuition & Fees ___________________

For the budget period you specified for this student, enter the BUDGETED cost for tuition and fees for this student. This amount may differ from the total tuition and fees CHARGED (requested in the enrollment section), and is typically obtained from the financial aid office.

CNESBOOK

Books & Supplies ___________________

CNESROOM

Room & Board ___________________

CNETRANS

Transportation ___________________

CNESCOMP

Computer Technology ___________________

For example: a reasonable cost, as determined by your institution, for the rental or purchase of a personal computer that the student will use for study for budget period you specified for this student.

CNEHLTH

Health Insurance ___________________

CNEOTHER

All Other ___________________

For the budget period you specified for this student, enter the total budgeted cost of attendance not included in any of the previous budget categories.

CTOTLCOA

Budgeted Total Cost of Attendance ___________________

For the budget period you specified for this student, enter the total budgeted cost of attendance.

Financial Aid

CFAWARN

Financial Aid Warning

Based on your institution's Satisfactory Academic Progress policy, at any time during the July 1, 2019 to June 30, 2020 financial aid year, was the student placed on financial aid warning?

For information about Satisfactory Academic Progress, see the FSA Handbook at [link]. A link to the FSA Handbook is also available on the Resources page of the PDP.

0 = No

1 = Yes

CFAPROB

Financial Aid Probation

Based on your institution's Satisfactory Academic Progress policy, at any time during the July 1, 2019 to June 30, 2020 financial aid year, was the student placed on financial aid probation?

For information about Satisfactory Academic Progress, see the FSA Handbook at [link]. A link to the FSA Handbook is also available on the Resources page of the PDP.

0 = No

1 = Yes

CFAINELG

Ineligible to Receive Title IV Aid

Based on your institution's Satisfactory Academic Progress policy, at any time during the July 1, 2019 to June 30, 2020 financial aid year, was the student ineligible to receive Title IV financial aid?

For information about Satisfactory Academic Progress, see the FSA Handbook at [link]. A link to the FSA Handbook is also available on the Resources page of the PDP.

0 = No

1 = Yes

SUBSECTION: FEDERAL AID

[FOR TERM-BASED INSTITUTIONS: For each of the federal aid programs below, report the total whole dollar amount disbursed for [term1, term2, term3,...]. These are the terms your institution reported for the 2019-20 academic year on the NPSAS:20 Registration Page. If you have questions about these terms, please contact the Help Desk.

Report the total amount disbursed for these terms combined, not separate amounts for each term. If the student has aid for this period that has not yet been disbursed, include the whole dollar amount that you expect to be disbursed. For example, if you need to report aid for the Summer 2020 term but the aid has not yet been disbursed, include the amount awarded that you expect to be disbursed.]

[FOR CONTINUOUS ENROLLMENT INSTITUTIONS: For each federal aid award received by the student, report the total whole dollar amount disbursed for the 2019-2020 financial aid year (July 1, 2019 to June 30, 2020). If the student has aid for this period that has not yet been disbursed, include the whole dollar amount awarded that you expect to be disbursed.]

For additional guidance and examples, please see the NPSAS:20 Student Records Handbook, which is available on the Resources page of the PDP. If the student was awarded a type of federal financial aid not listed here, you will have an opportunity to enter the name, type, and amount awarded in ‘Other Aid’ at the end of this section.

For guidance on reporting financial aid for students impacted by COVID-19, please see the Student Records Handbook on the Resources page of the PDP or contact the Help Desk.

CFAFEDAID

Student had federal aid for the 2019-20 financial aid year?

0 = No

1 = Yes

CFADPELL

Pell Grant Amount ___________________

CFASSTAF

Subsidized Direct/Stafford Loan Amount ___________________

CFAUSTAF

Unsubsidized Direct/Stafford Loan Amount ___________________

CFADPLUS

Parent PLUS Loan Amount ___________________

CFAGPLUS

Graduate PLUS Loan Amount ___________________

CFATEACH

Federal TEACH Grant Amount ___________________

CPERKINS

Perkins Loan Amount ___________________

CFAFSEOG

Federal SEOG Grant Amount ___________________

CFATDFWS

Federal Work Study AWARDED ___________________

Federal Work-Study awarded refers to the maximum amount the student could earn through the Work-Study Program over the course of the academic year. For example, if the student was awarded $1000 and actually earned $500, enter $1000 for this item.

Note: For this item only, please report the amount awarded. For all other financial aid awards, report the amount disbursed/expected to be disbursed.

CFAIRAQ

Iraq & Afghanistan Service Grant ___________________

CFATVET

Veterans Benefits ___________________

Veterans’ education benefits include programs administered by the U.S. Department of Veterans Affairs, including such programs as the GI Bill (for example, Post-9/11 GI Bill, Montgomery GI Bill), the Reserve Educational Assistance Program (REAP), and Dependents’ Educational Assistance program (DEA).

Department of Defense (DOD) Armed Forces Grants and other benefits for active duty military should not be reported as veterans benefits. For help categorizing aid awards, see the Financial Aid Type Cheat Sheet on the Resources page of the PDP, or contact the Help Desk.

SUBSECTION: STATE AID

[FOR TERM-BASED INSTITUTIONS: For each state aid award received by the student, report the total whole dollar amount disbursed for [term1, term2, term3,...]. These are the terms your institution reported for the 2019-20 academic year on the NPSAS:20 Registration Page. If you have questions about these terms, please contact the Help Desk.

Report the total amount disbursed for these terms combined, not separate amounts for each term. If the student has aid for this period that has not yet been disbursed, include the whole dollar amount that you expect to be disbursed. For example, if you need to report aid for the Summer 2020 term but the aid has not yet been disbursed, include the amount awarded that you expect to be disbursed.]

[FOR CONTINUOUS ENROLLMENT INSTITUTIONS: For each state aid award received by the student, report the total whole dollar amount disbursed for the 2019-2020 financial aid year (July 1, 2019 to June 30, 2020). If the student has aid for this period that has not yet been disbursed, include the whole dollar amount awarded that you expect to be disbursed.]

For additional guidance and examples, please see the NPSAS:20 Student Records Handbook, which is available on the Resources page of the PDP.

You may report up to 3 state awards per student in this section. If the student was awarded more than three state aid awards, you can report the award in "Other Aid" at the end of this section.

For guidance on reporting financial aid for students impacted by COVID-19, please see the Student Records Handbook on the Resources page of the PDP or contact the Help Desk.

CFASTATAID

Student had state aid for the 2019-2020 financial aid year?

0 = No

1 = Yes

CFSTATE01

State Aid Program Name 1 ___________________

Aid program names will not be released with the final data. This information will be used to data quality review, such as to verify that reported amounts fall within statutory limits and ensure that the financial aid type and source are correctly coded.

CFSTTYP01

State Aid Program Type 1

Need-based aid is awarded based on an applicant's financial resources. Merit-based aid is awarded based on an applicant's academic achievement. Merit aid that was awarded without consideration of financial resources should be considered merit aid. However, if any part of the awarding criteria includes a student's financial resources, the aid is considered either “need-based” or “both need and merit-based.” Aid based on neither need nor merit may include an applicant's non-academic talents, demographic, or other characteristics as the awarding criteria.

For help categorizing aid awards, see the Financial Aid Type Cheat Sheet on the Resources page of the PDP, or contact the Help Desk. Special financial aid awards for students impacted by COVID-19 should be reported as Aid for COVID-19 (type = 20). Refunds of tuition or fees due to COVID-19 should not be reported as financial aid; instead, they should be reported as “Tuition and Fees Refunded for COVID-19” in the Enrollment section.

1=Grant/scholarship, need-based

2=Grant/scholarship, merit-based

3=Grant/scholarship, both need and merit

4=Grant/scholarship, neither need nor merit

5=Grant/scholarship, unknown

6=Tuition Waiver, non-faculty/staff

7=Loan

8=Work-study

9=Athletic scholarship

10=Tuition waiver, faculty/staff

11=Teaching assistantship/stipend

12=Research assistantship/stipend

13=Other assistantship/stipend

14=Traineeship

15=ROTC/Armed Forces Grants

16=Veterans benefits

17=Resident advisor/assistant (RA) benefits

18=WIA/Job training/Vocational Rehabilitation

19=Employer aid

20=Aid for COVID-19

CFSTAMT01

State Aid Program Amount 1 ___________________

CFSTATE02

State Aid Program Name 2 ___________________

Aid program names will not be released with the final data. This information will be used to data quality review, such as to verify that reported amounts fall within statutory limits and ensure that the financial aid type and source are correctly coded.

CFSTTYP02

State Aid Program Type 2

Need-based aid is awarded based on an applicant's financial resources. Merit-based aid is awarded based on an applicant's academic achievement. Merit aid that was awarded without consideration of financial resources should be considered merit aid. However, if any part of the awarding criteria includes a student's financial resources, the aid is considered either “need-based” or “both need and merit-based.” Aid based on neither need nor merit may include an applicant's non-academic talents, demographic, or other characteristics as the awarding criteria.

For help categorizing aid awards, see the Financial Aid Type Cheat Sheet on the Resources page of the PDP, or contact the Help Desk. Special financial aid awards for students impacted by COVID-19 should be reported as Aid for COVID-19 (type = 20). Refunds of tuition or fees due to COVID-19 should not be reported as financial aid; instead, they should be reported as “Tuition and Fees Refunded for COVID-19” in the Enrollment section.

1=Grant/scholarship, need-based

2=Grant/scholarship, merit-based

3=Grant/scholarship, both need and merit

4=Grant/scholarship, neither need nor merit

5=Grant/scholarship, unknown

6=Tuition Waiver, non-faculty/staff

7=Loan

8=Work-study

9=Athletic scholarship

10=Tuition waiver, faculty/staff

11=Teaching assistantship/stipend

12=Research assistantship/stipend

13=Other assistantship/stipend

14=Traineeship

15=ROTC/Armed Forces Grants

16=Veterans benefits

17=Resident advisor/assistant (RA) benefits

18=WIA/Job training/Vocational Rehabilitation

19=Employer aid

20=Aid for COVID-19

CFSTAMT02

State Aid Program Amount 2 ___________________

CFSTATE03

State Aid Program Name 3 ___________________

Aid program names will not be released with the final data. This information will be used to data quality review, such as to verify that reported amounts fall within statutory limits and ensure that the financial aid type and source are correctly coded.

CFSTTYP03

State Aid Program Type 3

Need-based aid is awarded based on an applicant's financial resources. Merit-based aid is awarded based on an applicant's academic achievement. Merit aid that was awarded without consideration of financial resources should be considered merit aid. However, if any part of the awarding criteria includes a student's financial resources, the aid is considered either “need-based” or “both need and merit-based.” Aid based on neither need nor merit may include an applicant's non-academic talents, demographic, or other characteristics as the awarding criteria.

For help categorizing aid awards, see the Financial Aid Type Cheat Sheet on the Resources page of the PDP, or contact the Help Desk. Special financial aid awards for students impacted by COVID-19 should be reported as Aid for COVID-19 (type = 20). Refunds of tuition or fees due to COVID-19 should not be reported as financial aid; instead, they should be reported as “Tuition and Fees Refunded for COVID-19” in the Enrollment section.

1=Grant/scholarship, need-based

2=Grant/scholarship, merit-based

3=Grant/scholarship, both need and merit

4=Grant/scholarship, neither need nor merit

5=Grant/scholarship, unknown

6=Tuition Waiver, non-faculty/staff

7=Loan

8=Work-study

9=Athletic scholarship

10=Tuition waiver, faculty/staff

11=Teaching assistantship/stipend

12=Research assistantship/stipend

13=Other assistantship/stipend

14=Traineeship

15=ROTC/Armed Forces Grants

16=Veterans benefits

17=Resident advisor/assistant (RA) benefits

18=WIA/Job training/Vocational Rehabilitation

19=Employer aid

20=Aid for COVID-19

CFSTAMT03

State Aid Program Amount 3 ___________________

SUBSECTION: INSTITUTION AID

[FOR TERM-BASED INSTITUTIONS: For each institution aid award received by the student, report the total whole dollar amount disbursed for [term1, term2, term3,...]. These are the terms your institution reported for the 2019-20 academic year on the NPSAS:20 Registration Page. If you have questions about these terms, please contact the Help Desk.

Report the total amount disbursed for these terms combined, not separate amounts for each term. If the student has aid for this period that has not yet been disbursed, include the whole dollar amount that you expect to be disbursed. For example, if you need to report aid for the Summer 2020 term but the aid has not yet been disbursed, include the amount awarded that you expect to be disbursed.]

[FOR CONTINUOUS ENROLLMENT INSTITUTIONS: For each state aid award received by the student, report the total whole dollar amount disbursed for the 2019-2020 financial aid year (July 1, 2019 to June 30, 2020). If the student has aid for this period that has not yet been disbursed, include the whole dollar amount awarded that you expect to be disbursed.]

For additional guidance and examples, please see the NPSAS:20 Student Records Handbook, which is available on the Resources page of the PDP.

You may report up to 3 institution awards per student in this section. If the student was awarded more than three institution aid awards, you can report the award in "Other Aid" at the end of this section.

For guidance on reporting financial aid for students impacted by COVID-19, please see the Student Records Handbook on the Resources page of the PDP or contact the Help Desk.

CFAINSTAID

Student had institution aid for the 2019-2020 financial aid year?

0 = No

1 = Yes

CFAINS01

Institution Aid Program Name 1 ___________________

Aid program names will not be released with the final data. This information will be used to data quality review, such as to verify that reported amounts fall within statutory limits and ensure that the financial aid type and source are correctly coded.

CFAITYP01

Institution Aid Program Type 1

Need-based aid is awarded based on an applicant's financial resources. Merit-based aid is awarded based on an applicant's academic achievement. Merit aid that was awarded without consideration of financial resources should be considered merit aid. However, if any part of the awarding criteria includes a student's financial resources, the aid is considered either “need-based” or “both need and merit-based.” Aid based on neither need nor merit may include an applicant's non-academic talents, demographic, or other characteristics as the awarding criteria.

For help categorizing aid awards, see the Financial Aid Type Cheat Sheet on the Resources page of the PDP, or contact the Help Desk. Special financial aid awards for students impacted by COVID-19 should be reported as Aid for COVID-19 (type = 20). Refunds of tuition or fees due to COVID-19 should not be reported as financial aid; instead, they should be reported as “Tuition and Fees Refunded for COVID-19” in the Enrollment section.1=Grant/scholarship, need-based

2=Grant/scholarship, merit-based

3=Grant/scholarship, both need and merit

4=Grant/scholarship, neither need nor merit

5=Grant/scholarship, unknown

6=Tuition Waiver, non-faculty/staff

7=Loan

8=Work-study

9=Athletic scholarship

10=Tuition waiver, faculty/staff

11=Teaching assistantship/stipend

12=Research assistantship/stipend

13=Other assistantship/stipend

14=Traineeship

15=ROTC/Armed Forces Grants

16=Veterans benefits

17=Resident advisor/assistant (RA) benefits

18=WIA/Job training/Vocational Rehabilitation

19=Employer aid

20=Aid for COVID-19

CFAIAMT01

Institution Aid Program Amount 1 ___________________

CFAINS02

Institution Aid Program Name 2 ___________________

Aid program names will not be released with the final data. This information will be used to data quality review, such as to verify that reported amounts fall within statutory limits and ensure that the financial aid type and source are correctly coded.

CFAITYP02

Institution Aid Program Type 2

Need-based aid is awarded based on an applicant's financial resources. Merit-based aid is awarded based on an applicant's academic achievement. Merit aid that was awarded without consideration of financial resources should be considered merit aid. However, if any part of the awarding criteria includes a student's financial resources, the aid is considered either “need-based” or “both need and merit-based.” Aid based on neither need nor merit may include an applicant's non-academic talents, demographic, or other characteristics as the awarding criteria.

For help categorizing aid awards, see the Financial Aid Type Cheat Sheet on the Resources page of the PDP, or contact the Help Desk. Special financial aid awards for students impacted by COVID-19 should be reported as Aid for COVID-19 (type = 20). Refunds of tuition or fees due to COVID-19 should not be reported as financial aid; instead, they should be reported as “Tuition and Fees Refunded for COVID-19” in the Enrollment section.1=Grant/scholarship, need-based

2=Grant/scholarship, merit-based

3=Grant/scholarship, both need and merit

4=Grant/scholarship, neither need nor merit

5=Grant/scholarship, unknown

6=Tuition Waiver, non-faculty/staff

7=Loan

8=Work-study

9=Athletic scholarship

10=Tuition waiver, faculty/staff

11=Teaching assistantship/stipend

12=Research assistantship/stipend

13=Other assistantship/stipend

14=Traineeship

15=ROTC/Armed Forces Grants

16=Veterans benefits

17=Resident advisor/assistant (RA) benefits

18=WIA/Job training/Vocational Rehabilitation

19=Employer aid

20=Aid for COVID-19

CFAIAMT02