1545-0074 Supporting Statement 2021-01-11

1545-0074 Supporting Statement 2021-01-11.docx

U.S. Individual Income Tax Return

OMB: 1545-0074

SUPPORTING STATEMENT

Internal Revenue Service

U.S. Income Tax Return for Individual Taxpayers

OMB Control Number 1545-0074

1. CIRCUMSTANCES NECESSITATING COLLECTION OF INFORMATION

Sections 6011 & 6012 of the Internal Revenue Code (IRC), require individuals to prepare and file income tax returns annually. These forms and related schedules are used by individuals to report their income subject to tax and compute their correct tax liability.

Regulations section 1.6011-1explains that every person subject to any tax, or required to collect any tax, under Subtitle A of the Code, shall make such returns or statements as are required by the regulations. The return or statement shall include therein the information required by the applicable regulations or forms. Section 1.6012-1 explains the general guidelines for individuals required to make returns of income.

Copies of the prescribed return forms are so far as possible furnished to taxpayers by the IRS. A taxpayer will not be excused from making a return, however, by the fact that no return form has been furnished to him. Taxpayers not supplied with the proper forms should make application therefor to the district director in ample time to have their returns prepared, verified, and filed on or before the due date with the internal revenue office where such returns are required to be filed. Each taxpayer should carefully prepare his return and set forth fully and clearly the information required to be included therein. Returns which have not been so prepared will not be accepted as meeting the requirements of the Code. In the absence of a prescribed form, a statement made by a taxpayer disclosing his gross income and the deductions therefrom may be accepted as a tentative return, and, if filed within the prescribed time, the statement so made will relieve the taxpayer from liability for the addition to tax imposed for the delinquent filing of the return, provided that without unnecessary delay such a tentative return is supplemented by a return made on the proper form.

This information collection request (ICR), covers the actual reporting burden associated with preparing and submitting the prescribed return forms (attached), by individuals required to file Form 1040 and any of its’ affiliated forms.

2. USE OF DATA

The data on Form 1040 and its schedules will be used in computing the tax liability and in determining that the items claimed are properly allowable. It is also used for general statistical use.

3. USE OF IMPROVED INFORMATION TECHNOLOGY TO REDUCE BURDEN

We are currently offering electronic filing for these forms and schedules.

4. EFFORTS TO IDENTIFY DUPLICATION

The information obtained through this collection is unique and is not already available for use or adaptation from another source.

5. METHODS TO MINIMIZE BURDEN ON SMALL BUSINESSES OR OTHER SMALL ENTITIES

It has been determined that the regulations related to this form are not a significant regulatory action as defined in Executive Order 12866. Therefore, a regulatory assessment is not required. It has also been determined that section 553(b) of the Administrative Procedure Act (5 U.S.C. chapter 5) does not apply to these regulations. It is hereby certified that the collection of information in these regulations will not have a significant economic impact on a substantial number of small entities. This certification is based on the fact that most of the material advisors affected by these regulations are not small entities and for those material advisors that are small entities most of the information is already required under the current regulations. Any additional recordkeeping burdens on material advisors that result from this regulation are insubstantial.

6. CONSEQUENCES OF LESS FREQUENT COLLECTION ON FEDERAL PROGRAMS OR POLICY ACTIVITIES

Consequences of less frequent collection on federal programs or policy activities could consist of a decrease in the amount of taxes collected by the Service, inaccurate and untimely filing of tax returns, and an increase in tax violations.

7. SPECIAL CIRCUMSTANCES REQUIRING DATA COLLECTION TO BE INCONSISTENT WITH GUIDELINES IN 5 CFR 1320.5(d)(2)

There are no special circumstances requiring data collection to be inconsistent with guidelines in 5 CFR 1320.5(d)(2).

8. CONSULTATION WITH INDIVIDUALS OUTSIDE OF THE AGENCY ON AVAILABILITY OF DATA, FREQUENCY OF COLLECTION, CLARITY OF INSTRUCTIONS AND FORMS, AND DATA ELEMENTS

In response to the Federal register notice dated October 30, 2020 (85 FR 68956), we received two comments during the comment period regarding the burden associated with this collection of information. The first comment letter related to the filing requirements of Form 1040-NR and its relationship to foreign trusts and estates. The comment letter recommended that such taxpayers “…be permitted to file their returns on Form 1041…”. The second comment letter provided support for “…the continued collection of data by the Internal Revenue Service (IRS) for Form 1040 and its related schedules.”

Both comment letters have been forwarded to the appropriate office for review and consideration. There was no final determination on any recommendation’s made in these letters at the time this request package was created. Any changes to the filing requirements of estates and trusts will need to be thoroughly vetted prior to any potential processing updates.

9. EXPLANATION OF DECISION TO PROVIDE ANY PAYMENT OR GIFT TO RESPONDENTS

No payment or gift has been provided to any respondents.

10. ASSURANCE OF CONFIDENTIALITY OF RESPONSES

Generally, tax returns and tax return information are confidential as required by 26 USC 6103.

11. JUSTIFICATION OF SENSITIVE QUESTIONS

In accordance with the Privacy Act of 1974, Treasury has published its complete Privacy Act systems of records notices, which include all maintained records systems as of January 2, 2014; six systems have been amended, altered, or added since April 20, 2010, when the complete notices were last published. See 79 F.R. 209-261 and 79 F.R. 183-206, which was published on January 2, 2014.

A privacy impact assessment (PIA) has been conducted for information collected under this request as part of the “Individual Master File (IMF)” system and a Privacy Act System of Records notice (SORN) has been issued for this system under IRS 24.030--Customer Account Data Engine Individual Master File, formerly Individual Master File, and IRS 34.037--IRS Audit Trail and Security Records System. The Internal Revenue Service PIAs can be found at http://www.treasury.gov/privacy/PIAs/Pages/default.aspx.

Title 26 USC 6109 requires inclusion of identifying numbers in returns, statements, or other documents for securing proper identification of persons required to make such returns, statements, or documents and is the authority for social security numbers (SSNs) in IRS systems.

12. ESTIMATED BURDEN OF INFORMATION COLLECTION

PRA Approval of Forms Used by Individual Taxpayers

Under the PRA, OMB assigns a control number to each ''collection of information'' that it reviews and approves for use by an agency. The PRA also requires agencies to estimate the burden for each collection of information. Burden estimates for each control number are displayed in (1) PRA notices that accompany collections of information, (2) Federal Register notices such as this one, and (3) OMB's database of approved information collections.

Taxpayer Burden Model

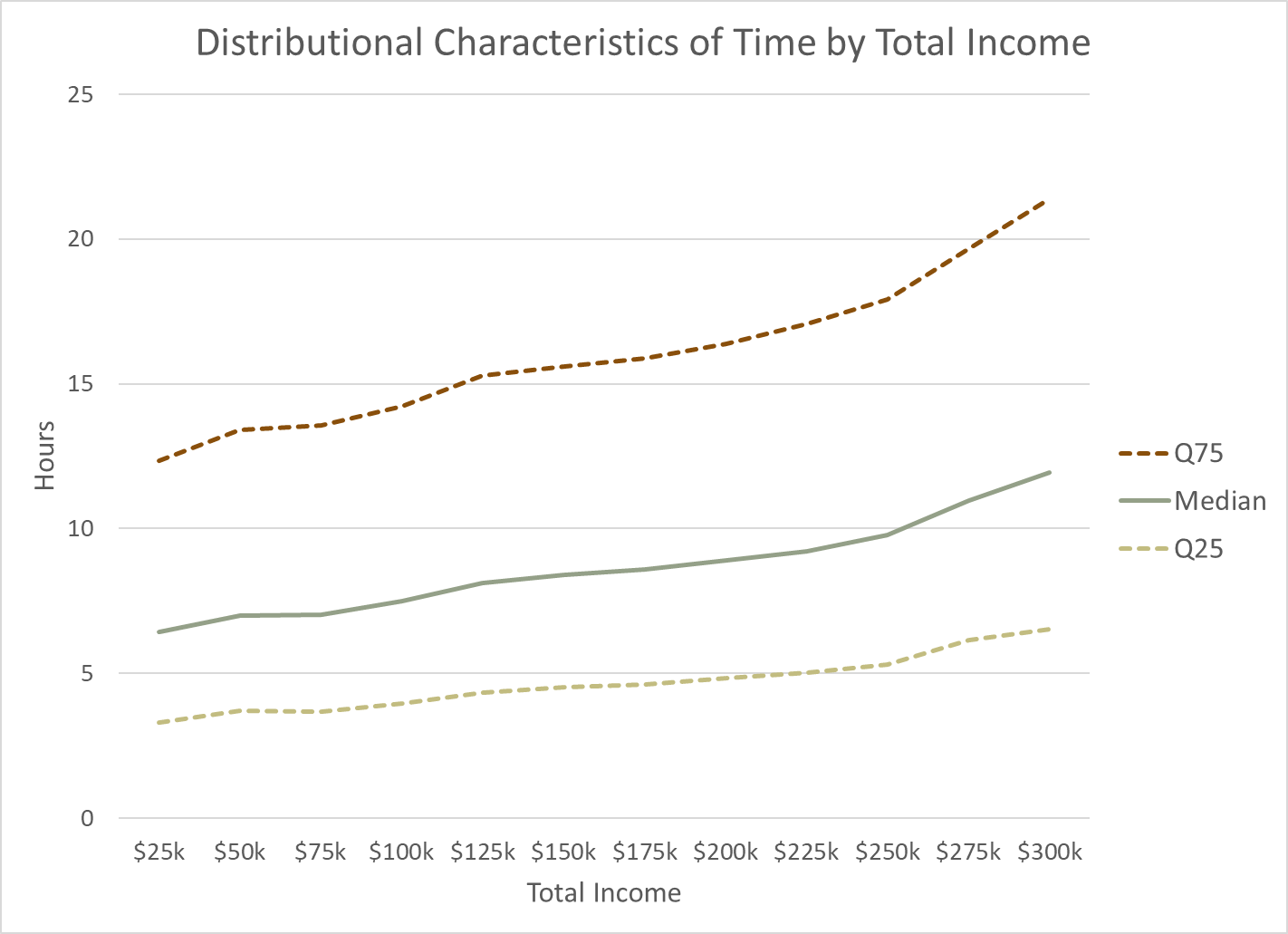

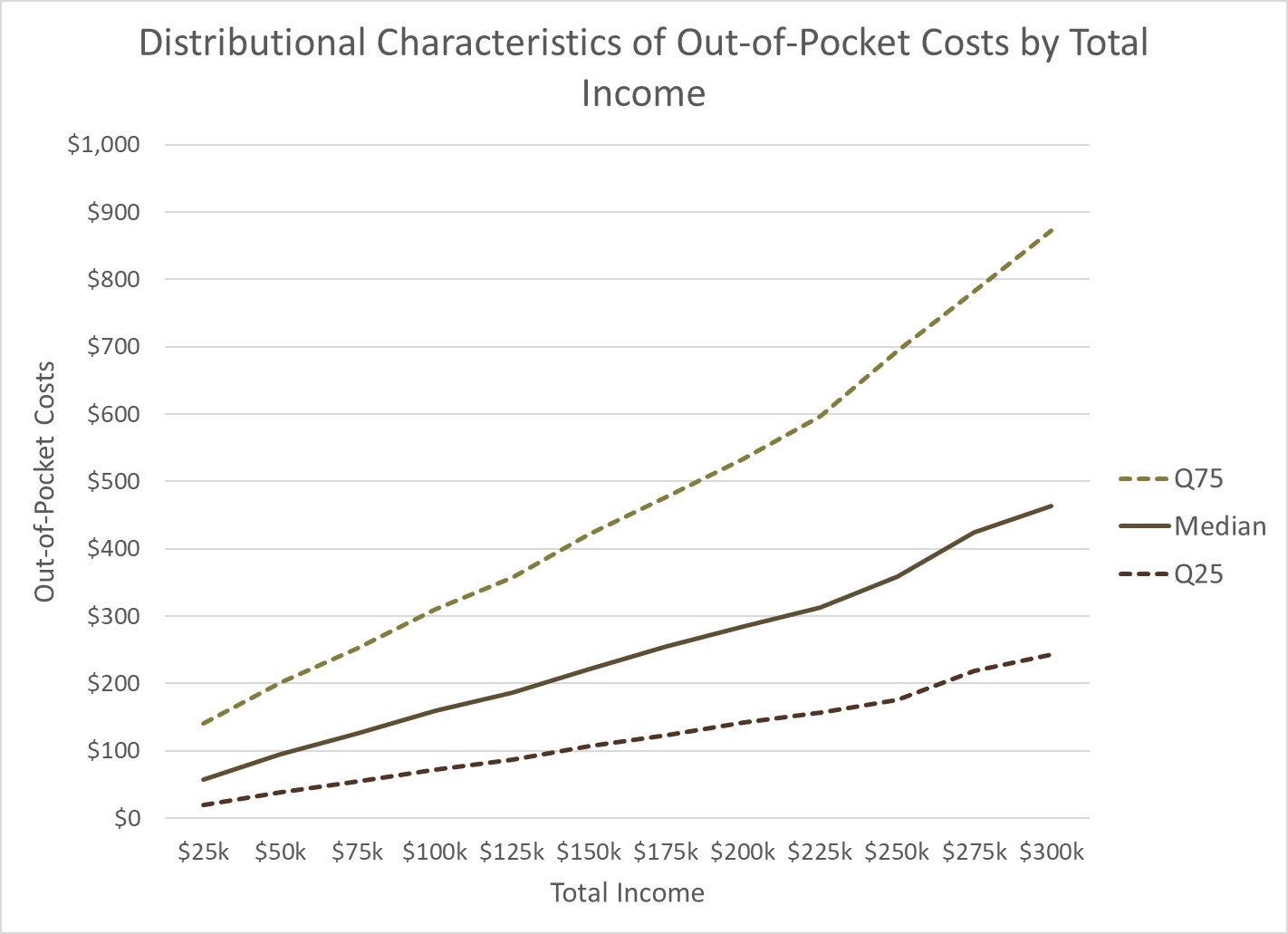

The IRS uses the Individual Taxpayer Burden Model (ITBM) to estimate the burden experienced by individual taxpayers when complying with Federal tax laws. The model was developed using a survey of tax year 2018 individual taxpayers that was fielded in 2019 and 2020. The approach to measuring burden focuses on the characteristics and activities undertaken by individual taxpayers in meeting their tax return filing obligations.

Burden is defined as the time and out-of-pocket costs incurred by taxpayers in complying with the Federal tax system. Out-of-pocket costs include any expenses incurred by taxpayers to prepare and submit their tax returns. Examples include tax return preparation fees, the purchase price of tax preparation software, submission fees, photocopying costs, postage, and phone calls (if not toll-free).

The methodology distinguishes among preparation method, taxpayer activities, taxpayer type, filing method, and income level. Indicators of tax law and administrative complexity, as reflected in the tax forms and instructions, are incorporated into the model.

Preparation methods reflected in the model are as follows:

• Self-prepared without software,

• Self-prepared with software, and

• Use of a paid preparer or tax professional.

Types of taxpayer activities reflected in the model are as follows:

• Recordkeeping,

• Tax planning,

• Gathering tax materials,

• Use of services (IRS and other),

• Form completion, and

• Form submission.

Taxpayer Burden Estimates

Summary level results from fiscal year 2021 using this methodology are presented below. The data shown were the best forward-looking estimates available for income tax returns filed for tax year 2020.

The burden estimates were based on statutory requirements as of October 1, 2020 for taxpayers filing a 2020 Form 1040 tax return. Time spent and out-of-pocket costs are presented separately. Time burden is broken out by taxpayer activity, with record keeping representing the largest component. Out-of-pocket costs include any expenses incurred by taxpayers to prepare and submit their tax returns. Examples include tax return preparation and submission fees, postage and photocopying costs, and tax preparation software costs.

Reported time and cost burdens are national averages and do not necessarily reflect a “typical” case. Most taxpayers experience lower than average burden, with taxpayer burden varying considerably by taxpayer type. For instance, the estimated average time burden for all taxpayers filing a Form 1040 is 12 hours, with an average cost of $230 per return. This average includes all associated forms and schedules, across all preparation methods and taxpayer activities.

There is significant variation in taxpayer activity across different taxpayer groups. For example, non-business taxpayers are expected to have an average burden of about 8 hours and $140, while business taxpayers are expected to have an average burden of about 21 hours and $430. Similarly, tax preparation fees and other out-of-pocket costs vary extensively depending on the tax situation of the taxpayer, the type of software or professional preparer used, and the geographic location.

Table 1 shows the preliminary burden estimates for individual taxpayers filing 2020 Form 1040, Form 1040NR, Form 1040NR–EZ, Form 1040X, 1040–SR tax return.

*The projected number of tax filers was derived based on trends in the number of filers per Publication 6292.

ICB Estimates for the 1040/SR/NR/NR-EZ/X series of returns and supporting forms and schedules |

||||||

FY2021 |

||||||

|

FY20 |

Program Change due to Adjustment In Agency Estimates |

Program Change due to New Legislation |

Program Change due to Agency Discretion |

FY21 |

|

|

|

|

|

|

|

|

Number of Taxpayers |

159,300,000 |

5,200,000 |

- |

- |

164,500,000 |

|

Burden in Hours |

1,717,000,000 |

278,000,000 |

- |

- |

1,995,000,000 |

|

Burden in Dollars |

33,267,000,000 |

4,694,000,000 |

- |

(1,000,000) |

37,960,000,000 |

|

Monetized Total Burden |

60,997,000,000 |

10,950,000,000 |

- |

(4,000,000) |

71,943,000,000 |

|

|

|

|

|

|

|

|

Detail may not add to total due to rounding. Source RAAS:KDA (10-28-2020)

|

|

|

|

|

||

Estimated Average Taxpayer Burden for Individuals Filing a 1040 by Activity |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||

Primary Form Filed or Type of Taxpayer |

Time Burden |

Money Burden |

||||||||||

|

Percentage of Returns |

Average Time Burden (Hours)*** |

Average Cost (Dollars) |

Total Monetized Burden (Dollars) |

||||||||

Total Time |

Record Keeping |

Tax Planning |

Form Completion and Submission |

All Other |

||||||||

All Taxpayers |

100% |

12 |

5 |

2 |

4 |

1 |

$230 |

$440 |

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

Type of Taxpayer |

|

|

|

|

|

|

|

|

||||

Nonbusiness** |

70% |

8 |

3 |

1 |

3 |

1 |

$140 |

$270 |

||||

Business** |

30% |

21 |

11 |

3 |

5 |

2 |

$440 |

$840 |

||||

|

|

|

|

|

|

|

|

|

|

|||

Note: This table does not include 1040NR, 1040NR-EZ, and 1040X filers. Detail may not add to total due to rounding. Dollars rounded to the nearest $10. ** A ‘‘business’’ filer files one or more of the following with Form 1040: Schedule C, C–EZ, E, F, Form 2106, or 2106–EZ. A ‘‘non-business’’ filer does not file any of these schedules or forms with Form 1040. *** Times are rounded to nearest hour.

|

||||||||||||

Taxpayer Burden Statistics by Total Positive Income Quintile |

|||

All Filers |

|||

Total Positive Income Quintiles |

Average Time |

Average Out-of-Pocket Costs |

Average Total Monetized Burden |

0 to 20 |

7.0 |

$75 |

$130 |

20 to 40 |

10.5 |

$125 |

$215 |

40 to 60 |

11.0 |

$160 |

$290 |

60 to 80 |

12.5 |

$220 |

$420 |

80 to 100 |

19.5 |

$580 |

$1,135 |

Wage and Investment Filers |

|||

Total Income Decile |

Average Time |

Average Out-of-Pocket Costs |

Average Total Monetized Burden |

0 to 20 |

6.5 |

$65 |

$115 |

20 to 40 |

8.5 |

$110 |

$190 |

40 to 60 |

8.5 |

$135 |

$245 |

60 to 80 |

8.5 |

$180 |

$340 |

80 to 100 |

10.0 |

$310 |

$615 |

Self Employed Filers |

|||

Total Income Decile |

Average Time |

Average Out-of-Pocket Costs |

Average Total Monetized Burden |

0 to 20 |

11.5 |

$120 |

$210 |

20 to 40 |

17.5 |

$180 |

$325 |

40 to 60 |

19.5 |

$230 |

$430 |

60 to 80 |

20.5 |

$300 |

$585 |

80 to 100 |

27.0 |

$790 |

$1,540 |

We are asking for continued approval of these regulations that are associated with Form 1040. Please continue to assign OMB number 1545-0074 to these regulations.

-

1.23-5

1.307-2

1.1385-1

1.31.2

1.333-1

1.1402(a)-2,5,11,15

1.37-2 and 3

1.351-3

161.1402(c)-2

1.41-4

1.383-1

1.1402(e)-(2)-1

1.41-4A

1.442-1

1.1402(f)-1

1.43-2

1.446-1

1.6001-1

1.44A-3

1.451-5 thru 7

1.6060-1

1.6072-1

1.52-4

1.454-1

1.61-15

1.461-1

1.6107-1

1.63-1

1.466-1

1.6109-1 and 2

1.64(c)6

1.551-4

1.6011-1

1.71-1

1.612-4

1.6012-1

1.72

1.642(c)-5 and 6

1.6013-1, 6, 7

1.79-2 and 3

1.702-1

1.6017-1

1.83-2 thru 5

1.706-1

1.6060-1

1.105

1.736-1

1.6072-1

1.151-1

1.743-1

1.6107-1

1.152-4 and 4T

1.751-1

1.6109-1

1.162-24

1.852-7 and 9

1.6151-1

1.163-10T

1.861-4

1.6695-1

1.166-10

1.931-1

1.6696-1

1.17

1.935-1

1.9100-1

1.170A

1.1012-1

5c.0

1.172

1.1041-1T

7

1.180-2

1.1081-11

16A.126-2

1.182-6

1.1101-4

18.1-7

1.190-3

1.1211-1

31.6011(a)-1 and 7

1.213-1

1.1212-1

301.6110-3 and 5

1.215-1

1.1231-2

301.6316-4 thru 6

1.254-1

1.1232-3

301.6361-1 and 3

1.265-1

1.1248-7

301.6501

1.274-5T and 6T

1.1251-2

301.6501(d)

1.280A-3

1.1254-1 and 3

301.6905-1

1.280F-3T

1.1304-1 thru 5

301.7216-2

1.302-4

1.1311(a)-1

1.1383-1

ESTIMATED TOTAL ANNUAL COST BURDEN TO RESPONDENTS

The total estimated time and out-of-pocket costs, as estimated by the IRS ITBM, represent the federal income tax compliance burden for the estimated 164.5 million individual taxpayers that filed a Tax Year 2020 federal income tax return. The time and out-of-pockets costs per respondent shown were also estimated using the IRS ITBM. Due to rounding, the per respondent burden calculated using the total amounts above will be different. As a result, estimates of the cost burdens were calculated at $231 per taxpayer, with a combined estimate total of $37,960,000,000.

14. ESTIMATED ANNUALIZED COST TO THE FEDERAL GOVERNMENT

To ensure more accuracy and consistency across its information collections, IRS is currently in the process of revising the methodology it uses to estimate burden and costs. Once this methodology is complete, IRS will update this information collection to reflect a more precise estimate of burden and costs. At the present time, the IRS estimates an annual government cost to be $ 13,659,428.

-

Product

Labor & Downstream Impact Costs

Print & Shipping Costs

Government Cost Estimate per Product

All Forms attached

$ 9,504,743

$ 4,154,685

$ 13,659,428

Grand Total

$ 9,504,743

$ 4,154,685

$ 13,659,428

*See supplementary document for cost per form and instructions.

15. REASONS FOR CHANGE IN BURDEN

P.L. 116-136 (H.R. 748, Coronavirus Aid, Relief and Economic Security (CARES) Act) - signed by the President on March 27, 2020, established a 2020 recovery rebate for individuals (the Economic Impact Payment (EIP). As a result, IRS issued EIPs to help Americans during this crisis. The issuance of these EIPs created a one-time burden increase during the 2020 calendar year to account for the temporary tax compliance requirements. With the completed issuance of all EIPs, this burden is being removed.

|

Change in Filers |

Change in Time |

Change in Dollars |

Change in Monetized Burden |

IRS issued EIPs to help Americans during this crisis |

22,750,000 |

4,229,167 |

- |

- |

Change in Burden due to P.L. 116-136 (H.R. 748, Coronavirus Aid, Relief and Economic Security (CARES) Act) |

||||||

March – June 2020 |

||||||

|

Original FY20 Approved Burden |

Temporary Change due to EIPs |

Total Approved Burden Including 2020 CARES Act |

Completion of Temporary EIPs |

Post CARES Act FY20 Baseline |

|

|

|

|

|

|

|

|

Number of Taxpayers |

159,300,000 |

22,750,000 |

182,050,000 |

(22,750,000) |

159,300,000 |

|

Burden in Hours |

1,717,000,000 |

4,229,167 |

1,721,229,167 |

(4,229,167) |

1,717,000,000 |

|

Burden in Dollars |

33,267,000,000 |

- |

- |

- |

33,267,000,000 |

|

|

|

|

|

|

|

|

The year-over-year change in burden is analyzed and reported by technical adjustments, legislative adjustments, and agency adjustments.

Changes Due to Technical Adjustments to Agency Estimates: The overall year-over-year change is due almost entirely to technical adjustments. The table provided below breaks down the major changes by technical adjustment type. It is important to note that the updated tax return and survey data are both from TY18 so the data and the survey incorporate activity and taxpayer experience post implementation of the Tax Cuts and Jobs Act (TCJA). The TY18 survey results indicate that out-of-pocket costs appear to have increased on the margin. Reported time amounts also increased but to a lesser extent. The increased time and money burden for these taxpayers are primarily responsible for the increase in burden. It is still unclear whether this increase is temporary or permanent. Anecdotal evidence suggests that this may be a temporary increase since many taxpayers may have collected and entered the same information compared to the prior year even though it was no longer optimal for their situation. Specifically, filers who previously itemized may have been more likely to collect and enter their itemization activity even though they ultimately claimed the standard deduction. Survey data for TY19 will be available at the end of FY21 and should insight into the permanence of these changes.

|

Change in Filers |

Change in Time |

Change in Dollars |

Change in Burden |

Updated FY20 Baseline |

4,300,000 |

73,500,000 |

445,000,000 |

1,671,000,000 |

Updated Tax Return Data |

- |

(118,000,000) |

(1,015,000,000) |

(396,000,000) |

Updated Survey Data |

- |

313,500,000 |

4,830,000,000 |

8,767,000,000 |

FY21 Population Estimates |

900,000 |

9,000,000 |

434,000,000 |

908,000,000 |

|

|

|

|

|

Total |

5,200,000 |

278,000,000 |

4,694,000,000 |

10,950,000,000 |

Program Changes Due to New Statutes: There were no significant year-over-year legislative changes impacting this collection.

Program Changes Due to Agency Discretion: The only material administrative change is the roll out of Form 1040-X e-filing. Approximately 1.5 million filers are expected to e-file a Form 1040-X in FY21. Form 1040-X e-filing is estimated to decrease time burden by approximately 150,000 hours and decrease out-of-pocket costs by approximately $4,000,000.

Because of the temporary EIP burden, the ICR summary of burden will be reflected in ROCIS as follows:

|

Previously Approved |

Change Due to New Statute |

Change Due to Agency Discretion |

Change Due to Adjustment in Estimate |

Change Due to Potential Violation of the PRA |

Total Requested |

Annual Number of Responses |

182,050,000 |

0 |

0 |

(17,550,000) |

0 |

164,500,000 |

Annual Time Burden (Hr) |

1,721,229,167 |

0 |

(150,000) |

273,920,833 |

0 |

1,995,000,000 |

Annual Cost Burden ($) |

33,267,000,000 |

0 |

(4,000,000) |

4,695,000,000 |

0 |

37,960,000,000 |

16. PLANS FOR TABULATION, STATISTICAL ANALYSIS AND PUBLICATION

The intent of this collection is to collect data in areas of income, gains, losses, deductions, credits, and to figure the income tax liability of a business taxpayer.

17. REASONS WHY DISPLAYING THE OMB EXPIRATION DATE IS INAPPROPRIATE

We believe that displaying the OMB expiration date is inappropriate because it could cause confusion by leading taxpayers to believe that the forms sunset as of the expiration date. Taxpayers are not likely to be aware that the Service intends to request renewal of the OMB approval and obtain a new expiration date before the old one expires.

18. EXCEPTIONS TO THE CERTIFICATION STATEMENT

There are no exceptions to the certification statement.

Note: The following paragraph applies to all the collections of information in this submission:

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the collection of information displays a valid OMB control number. Books or records relating to a collection of information must be retained if their contents may become material in the administration of any internal revenue law. Generally, tax returns and tax return information are confidential, as required by 26 U.S.C. 6103.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 2021-01-12 |

© 2026 OMB.report | Privacy Policy