Project and Expenditure Report User Guide

Coronavirus State and Local Fiscal Recovery Funds Program

2022.01.04 PE Report User Guide_DRAFT (CLEAN) v2

Project and Expenditure Report User Guide

OMB: 1505-0271

edata dress with r

January

XX, 2022 Version

1

XXX Version:

1.0

August

9, 2021 Version:

1.0

Table of Contents

Section I. Reporting Basics 1

Section II. Navigation and Logistics 3

Section III. Reporting Requirements 9

Section IV. Project and Expenditure Report 12

Appendix A – Designating SLFRF Points of Contact by SLFRF Account Administrators 40

Appendix B – Bulk File Upload Overview 47

Appendix C – Expenditure Categories and Template Mapping 61

Appendix D – SLFRF Expenditure Category Programmatic Data and Other Information 64

List of Figures

Figure 3- Sample Bulk Upload Icon 4

Figure 4- Successful Bulk Upload Example 5

Figure 5- Unsuccessful Bulk Upload 5

Figure 6- Invalid Bulk Upload Error 6

Figure 7- Duplicative Value Upload Error 7

Figure 8- Manual Entry Text Box 7

Figure 9 Sidebar indicating Unsubmit Button 8

Figure 10 Relationship between Expenditure Categories and Multiple Projects 12

Figure 11 Recipient Information 13

Figure 12 Point of Contact List 13

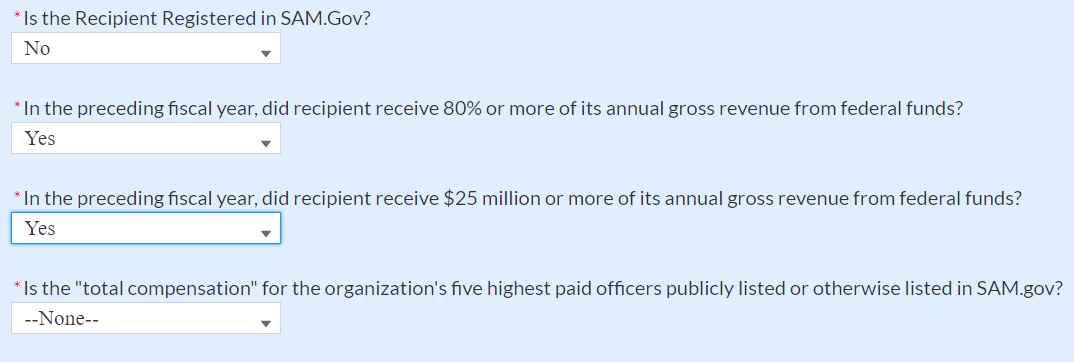

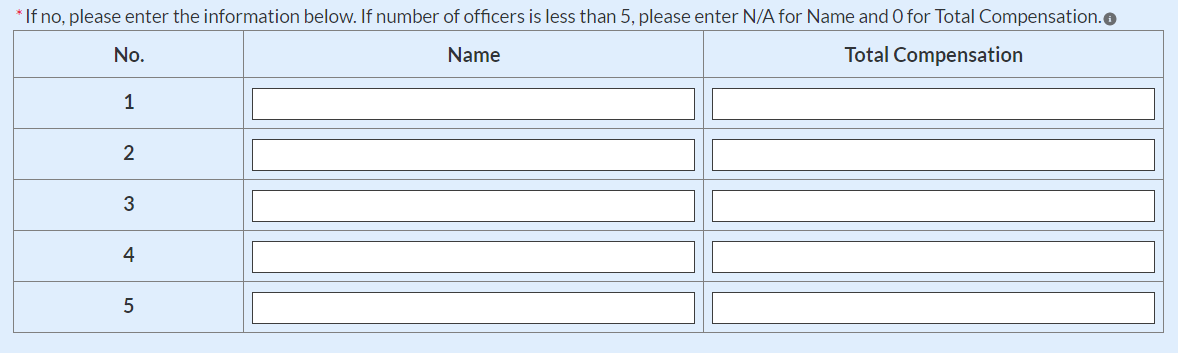

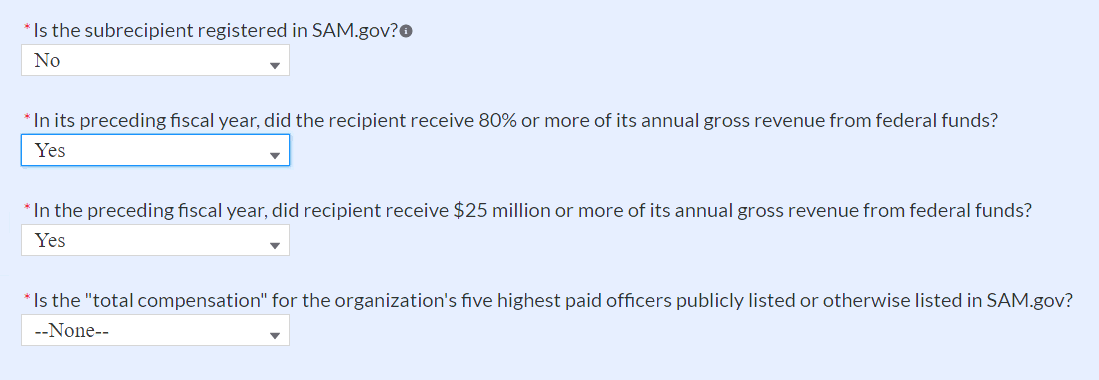

Figure 14 Additional SAM.gov questions (1) 14

Figure 15 Additional SAM.gov questions (2) 15

Figure 16 Record of Highest Paid Officer 15

Figure 17 My Projects Screen Example 17

Figure 18 Project Expenditure Category Group 18

Figure 19 Project Expenditure Category 18

Figure 20 Bulk Upload for EC 1.1 18

Figure 21 Project Entry Screen 19

Figure 22 Manual Entry for EC 1.9 20

Figure 23 Programmatic Data for EC 1.9 20

Figure 24 Edit Project Screen 21

Figure 25 Premium Pay Screen 22

Figure 26 Programmatic Data for Infrastructure Projects 24

Figure 27 Davis Bacon Certification 25

Figure 28 Additional Questions if Response to Davis Bacon Certification is "No" 25

Figure 29 Certification for Labor Agreements 26

Figure 30 Additional Questions if response is "No" 26

Figure 31 Revenue Replacement Screen 28

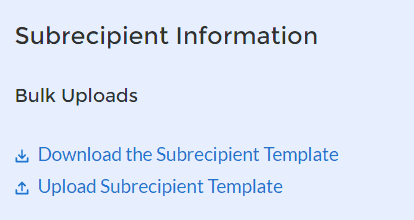

Figure 32 Subrecipient Bulk Upload Icon 29

Figure 33 Manually Create a Subrecipient 30

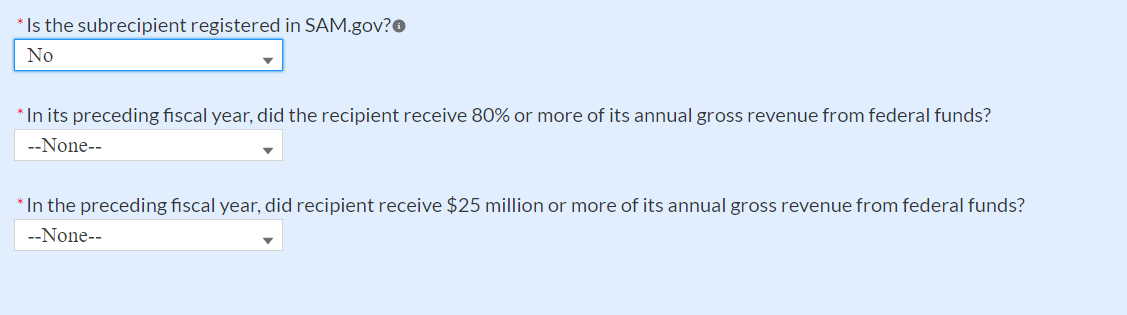

Figure 34 Sam.gov Questions for Subrecipients 30

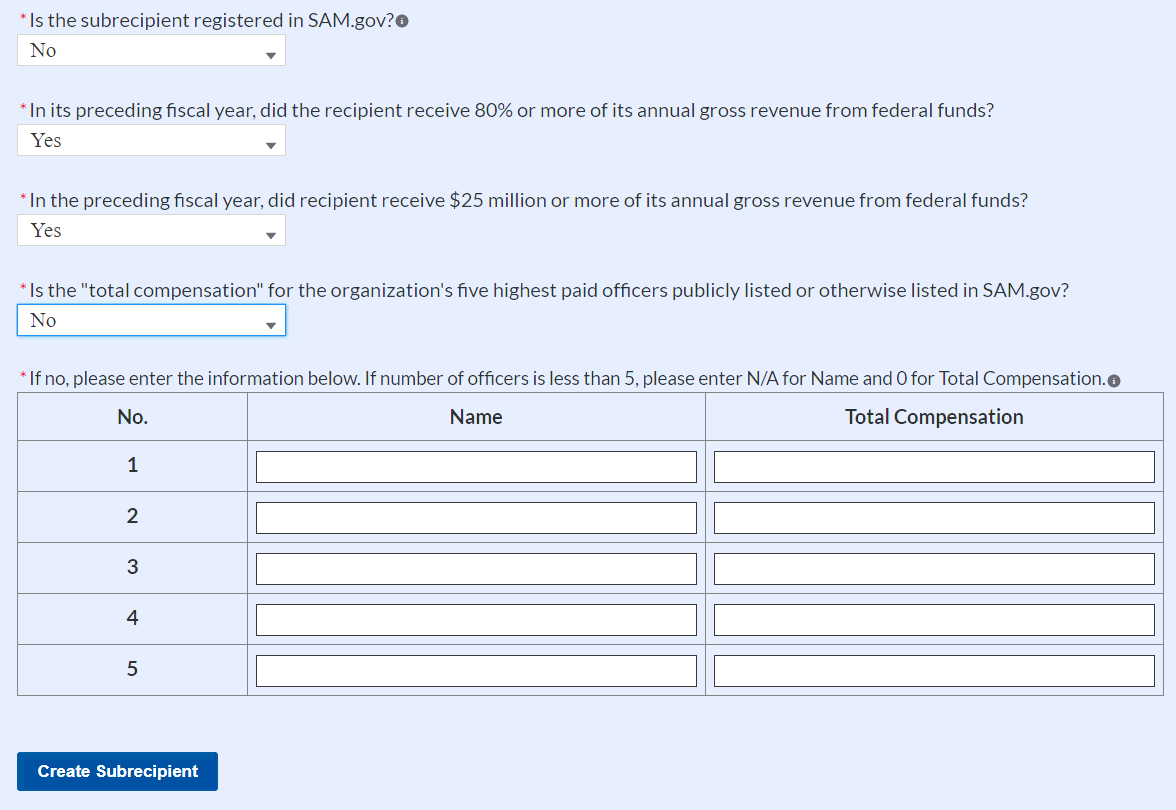

Figure 35 Additional SAM.gov questions for Subrecipients 31

Figure 36 Five Highest Paid Officers for Subrecipients 31

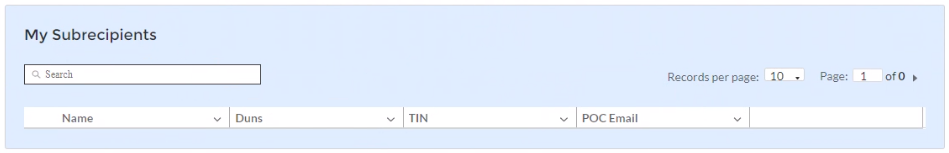

Figure 37 Subrecipients Entered 32

Figure 38 Subaward Bulk Upload (1) 32

Figure 39 Subaward Reporting 34

Figure 41 Expenditures >$50,000 35

Figure 42 Aggregated Expenditures <$50,000 36

Figure 43 Payments to Individuals 37

Figure 44 Tax Offset Provision Screen 37

Figure 45 Official Certification 38

Overview

This document provides information on using Treasury’s Portal to submit the required Coronavirus State and Local Fiscal Recovery Funds (SLFRF) Project and Expenditure (P&E) reports. It is a supplement to the Compliance and Reporting Guidance (Reporting Guidance), which contains relevant information and guidance on the reporting requirements.

Additionally, you should visit Treasury’s SLFRF home page for the latest guidance and updates on programmatic and reporting topics, as well as information on Treasury’s Interim Final Rule (IFR).

Each SLFRF recipient is required to submit periodic reports with current performance and financial information including background information about the SLFRF projects that are the subjects of the reports; and financial information with details about obligations, expenditures, direct payments, and subawards.

What is Covered in this User Guide?

This User Guide contains detailed guidance and instructions for SLFRF recipients in using Treasury’s Portal for submitting the Project and Expenditure reports. All recipients must submit the required reports via Treasury’s Portal. This guide is not comprehensive and is meant to be used in conjunction with the documents mentioned above.

This User Guide provides detailed instructions to help recipients enter and submit the following:

Project data

Subrecipient data

Subaward data

Expenditure data

Project and Expenditure Bulk Upload Templates

Designating Staff for Key Roles in Managing SLFRF Reports User Designations

SLFRF recipients are required to designate staff or officials for the following three roles in managing reports for their SLFRF award. Recipients must make the required designations prior to accessing Treasury’s Portal. The required roles are as follows:

Account Administrator for the SLFRF award has the administrative role of maintaining the names and contact information of the designated individuals for SLFRF reporting. The Account Administrator is also responsible for working within your organization to determine its designees for the roles of Point of Contact for Reporting and Authorized Representative for Reporting and providing their names and contact information via Treasury’s Portal. Finally, the Account Administrator is responsible for making any changes or updates to the user roles as needed over the award period. We recommend that the Account Administrator identify an individual to serve in his/her place in the event of staff changes.

Point of Contact for Reporting is the primary contact for receiving official Treasury notifications about reporting on the SLFRF award, including alerts about upcoming reporting, requirements, and deadlines. The Point of Contact for Reporting is responsible for completing the SLFRF reports.

Authorized Representative for Reporting or ARR is responsible for certifying and submitting official reports on behalf of the SLFRF recipient. Treasury will accept reports or other official communications only when submitted by the Authorized Representative for Reporting. The Authorized Representative for Reporting is also responsible for communications with Treasury on such matters as extension requests and amendments of previously submitted reports. The official reports may include special reports, quarterly or annual reports, interim reports, and final reports.

Some key items to note:

Each designated individual must register with ID.me or Login.gov for gaining access to Treasury’s Portal.

Users who have previously registered through ID.me may continue to access Treasury’s Portal through that method. This link includes further instructions.

If you have not previously registered with ID.me, you should register through Login.gov following this link. The following links provide additional information:

An individual may be designated for multiple roles. For example, the individual designated as the Point of Contact for Reporting may also be designated as the Authorized Representative for Reporting.

The recipient may designate one individual for all three roles.

Multiple individuals can be designated for each role.

An organization may make changes and updates to the list of designation individuals whenever needed. These changes must be processed by the Account Administrator.

Refer to Appendix A for guidance on designating individuals for the three roles.

The designated individuals’ names and contact information will be pre-populated in the “Recipient Profile” portion of the recipient’s SLFRF reports, and recipients will be able to update the information, if necessary.

Please contact [email protected] for additional information on procedures for registering with ID.me or Login.gov.

Questions?

If you have any questions about the SLFRF program’s reporting requirements, please contact us by email via [email protected].

Figure

1- Landing Page

From the landing page, select Go to Your Reports or Submissions & Compliance Forms on the left side panel to be taken to a list of options for the programs you have access to under the Report Selection section.

At this time, you may select the Project and Expenditures report.

Each listed report constitutes a link to that specific report’s online forms. Selecting a report from the landing page will open the first in a series of screens.

To begin completing a specific report, click on Provide Information for the given report. Refer to the Reporting Guidance for details about each type of required report for submittal.

The Navigation Bar (see Figure 2) on the left of Treasury’s Portal will allow you to freely move between screens.

Treasury’s Portal leads you through a series of online forms that, when completed, will fulfill your reporting obligations. While navigating through Treasury’s Portal and submitting required information, users will have the option of manually entering data directly into Treasury’s Portal or providing information via a bulk upload file that includes all relevant information in a Treasury approved process and format.

Bulk File Upload Files

Recipients can use the bulk upload function for providing required information for the modules listed here:

Project Overview

Subrecipients

Subawards

Expenditures

When using the bulk upload, recipients must provide the required information in specified formats and use the Treasury approved templates for each respective bulk upload. Recipients must download each of the templates separately from within the relevant Treasury’s Portal module.

Please see Appendix B – Bulk File Upload Overview for complete guidance on using this important function.

Modules accepting bulk upload files are clearly marked in Treasury’s Portal and identified in later sections of this User Guide. The template for each upload file is available in the relevant module for download (see Figure 3).

Figure 3- Sample Bulk Upload Icon

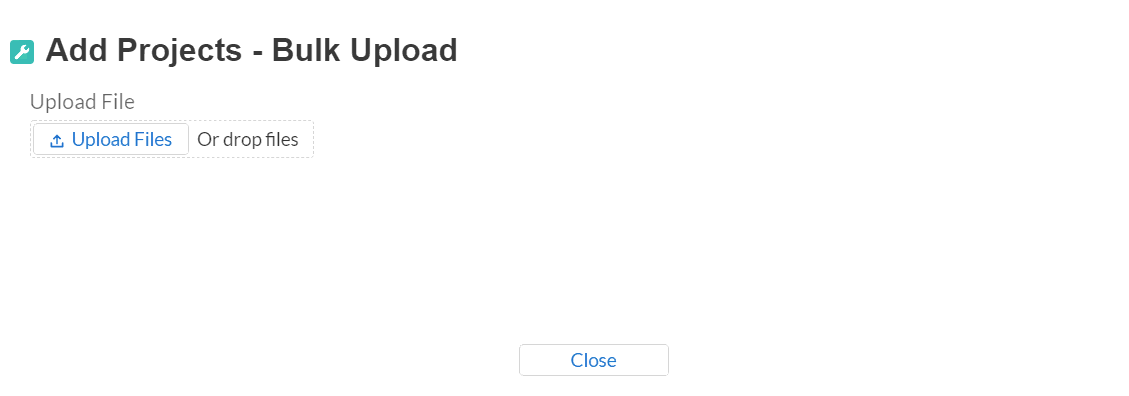

All bulk file templates download in the .xls format, but these files must be converted to .csv format to properly upload. When you click the upload button you will be directed to an upload screen. You can either choose to add files or drag and drop files to initiate the bulk upload (see Figure 4).

Figure 4- Successful Bulk Upload Example

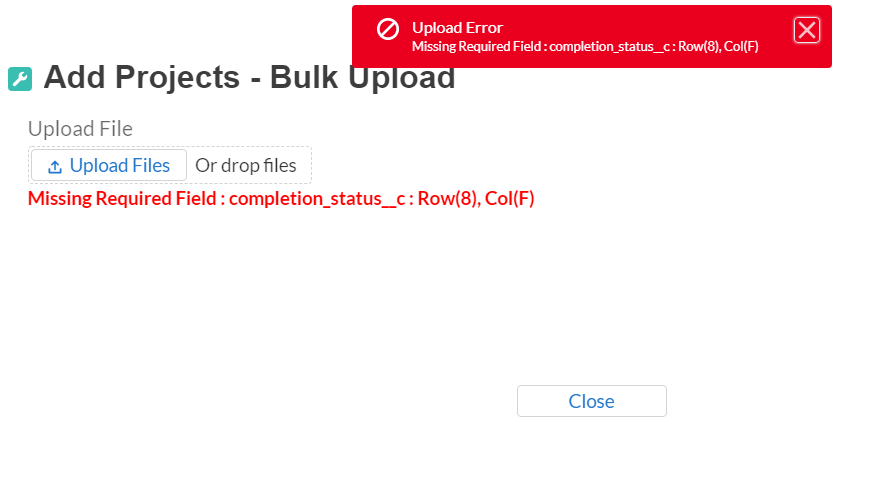

Treasury’s Portal will reject the file if an incorrect template, data format, or file format other than .csv is used for upload (see Figure 5). Treasury’s Portal will display an error message on screen if the bulk data upload file contains errors. If you receive an error message, you will need to correct the errors in the bulk upload file and re-submit the corrected version.

Recipients should review the upload file carefully, as current system functionality will only show the first error found in a bulk file. Multiple field errors will necessitate multiple fix and upload attempts.

When a bulk upload error occurs, the system stops scanning the file and immediately reports the first error found in the document. Once you correct the error, you should ensure you have not made the same error in each consecutive row below where the first error was identified prior to re-submitting the corrected bulk upload file.

There are three common Bulk File Upload errors as described below:

Blank Data (see Figure 5): When a required field is left blank within your bulk upload file, the specific bulk upload file row and cell number will be provided on the screen. In the example below, the user made an error pertaining to the “Completion Status” and the error is located in Column F, Row 8.

Figure 5- Unsuccessful Bulk Upload

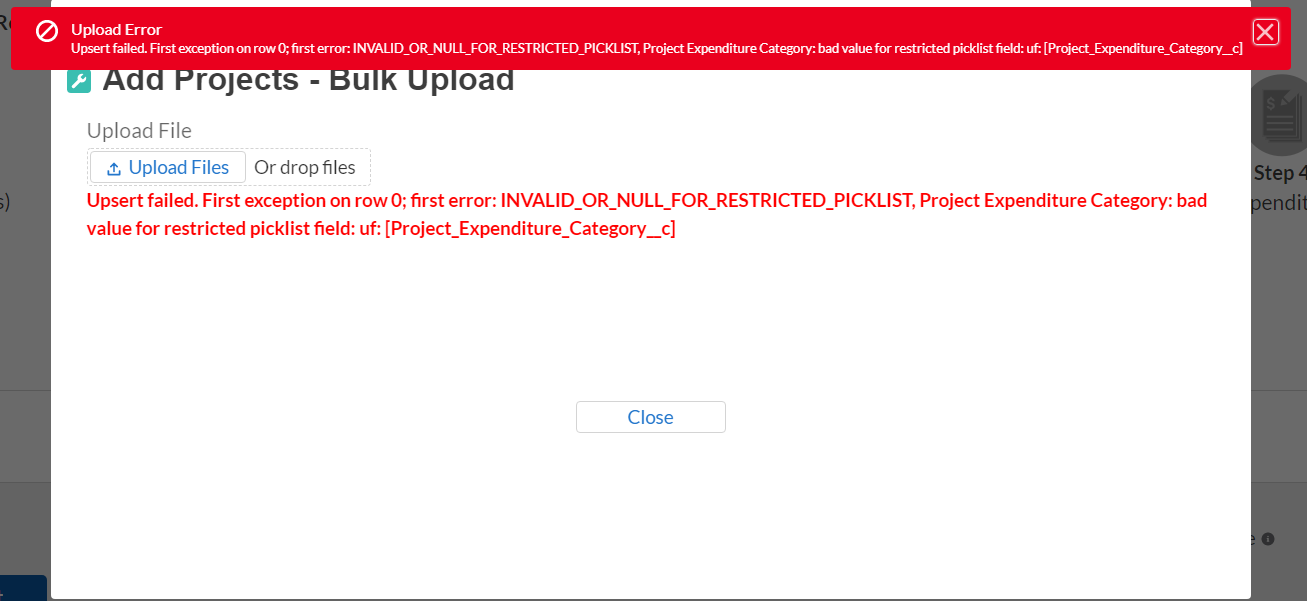

Invalid Data (see Figure 6): Invalid data includes any type of data (numeric or text) that does not meet the requirements set forth in the Help Text within each bulk upload template. When invalid data is found in a cell, the error message uses Row Zero logic. When the system scans for and finds invalid data, the error message treats the first row containing your entered data (typically Row 8) as Row “0”.

For example, if your bulk upload file contains an error in Row 8, and the first line of your data entry is in Row 8, then the error message will report the mistake in Row 0 (8 minus the starting point of 8) as shown in Figure 6.

The error message will also show the required field that was incorrect, such as “Project and Expenditure Category” shown in Figure 6.

Figure 6- Invalid Bulk Upload Error

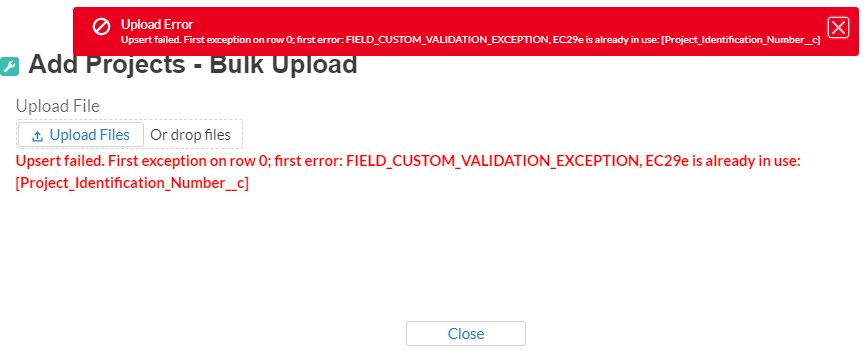

Duplicate Data (see Figure 7): Duplicate data includes any type of data (numeric or text) that is repeated in the same column when the Help Text within a bulk upload template requires a unique entry. For example, unique numbers should be provided for the project identification number. When duplicate data is found in a cell, the error message uses Row Zero logic. When the system scans for and finds invalid data, the error message treats the first row containing your entered data (typically Row 8) as Row “0.”

For example, if your Bulk Upload file contains an error in Row 8, and the first line of your data entry is in Row 8, then the error message will report the mistake in Row 0 (8 minus the starting point of 8) as shown in Figure 7.

The error message will also show the required field that was incorrect, such as “Project Identification Number” shown in Figure 7.

Figure 7- Duplicative Value Upload Error

Manual Data Entry

Manual data entry requires you to provide inputs as instructed on the screen. Manual inputs are described in detail below for each section of this user guide.

Note: An asterisk ( * ) indicates a required field. Entry into the field is required before you can save or proceed to the next screen.

Your inputs will be subject to validation by Treasury’s Portal to ensure that the data provided is consistent with expected format or description (e.g., entering “one hundred” instead of 100). If a given data entry fails a validation rule, Treasury’s Portal will display an error for you to address.

You will not be able to submit manually entered data that does not satisfy the data validation rules.

Narrative Boxes

When filling out detailed narratives, you are encouraged to type out responses in a word processing application (such as Microsoft Word) to minimize grammatical errors, track word count, and concisely answer all required narrative details. You can then copy and paste the final written narratives directly into the text boxes.

The text boxes (see Figure 8) can be expanded by clicking and dragging the icon in the bottom-right corner.

Figure 8- Manual Entry Text Box

Corrections and Resubmissions

In the event a file is uploaded, or information is entered into Treasury’s Portal, the information will be accepted by Treasury’s Portal as a record. Changes to information that has been bulk uploaded are currently not permitted.

After a recipient’s submission has been certified and submitted in the system by the ARR, it can be corrected in the Portal by selecting the Unsubmit button. Recipients may unsubmit, then resubmit their Project and expenditure Report any time before the reporting deadline (see Figure 9).

Figure 9 Sidebar indicating Unsubmit Button

Reporting Requirements by Recipient

For the SLFRF program, reporting requirements vary by recipient type, as shown in the table below. Detailed instructions for completion and submission of each report are covered in Part 2 of the Reporting Guidance.

Tier |

Recipient |

Interim Report |

Project and Expenditure Report |

Recovery Plan Performance Report |

1 |

States, U.S. territories, metropolitan cities and counties with a population that exceeds 250,000 residents |

By August 31, 2021 or 60 days after receiving funding if funding was received by October 15, with expenditures by category |

By January 31, 2022, and then 30 days after the end of each quarter thereafter1 |

By August 31, 2021 or 60 days after receiving funding, and annually thereafter by July 312 |

2 |

Metropolitan cities and counties with a population below 250,000 residents which received more than $10 million in SLFRF funding |

Not required |

||

3 |

Tribal Governments which received more than $30 million in SLFRF funding |

|||

4 |

Tribal Governments which received less than $30 million in SLFRF funding |

By April 30, 2022, and then annually thereafter3

|

||

5 |

Metropolitan cities and counties with a population below 250,000 residents which received less than $10 million in SLFRF funding |

|||

6 |

NEUs |

Not required |

Project and Expenditure Report Requirements

Quarterly Reporting

The following recipients are required to submit quarterly Project and Expenditure Reports:

States, and U.S. territories

Metropolitan cities and counties with population that exceeds 250,000 residents

Metropolitan cities and counties with a population below 250,000 residents which received more than $10 million in SLFRF funding

Tribal Governments that received more than $30 million in SLFRF funding

For these recipients, the initial quarterly Project and Expenditure Report will cover the period from March 3, 2021 to December 31, 2021 and must be submitted to Treasury by January 31, 2022. The subsequent quarterly reports will cover one calendar quarter and must be submitted to Treasury within 30 calendar days after the end of each calendar quarter

States and territories should continue to submit the monthly NEU/Non-UGLG distribution information through the separate module in Treasury’s Portal.

Annual Reporting

The following recipients are required to submit annual Project and Expenditure Reports:

Tribal Governments that received less than $30 million in SLFRF funding

Metropolitan cities and counties with a population below 250,000 residents which received less than $10 million in SLFRF funding

Non-Entitlement Units of Local Government (NEU). To facilitate reporting, each NEU will need a NEU Recipient Number. This is a unique identification code for each NEU assigned by the State or U.S. Territory to the NEU as part of its request for funding.

For these recipients, the initial Project and Expenditure Report will cover from March 3, 2021 to March 31, 2022 and must be submitted to Treasury by April 30, 2022. The subsequent annual reports will cover one calendar year and must be submitted to Treasury by April 30 each year.

Key Concepts for Reporting

The following concept structure applies to all report types:

Expenditure Categories

Each recipient is required to report the obligations and expenditures by project according to the corresponding Expenditure Category (EC). As noted in the Reporting Guidance, there are a wide range of eligible uses of the SLFRF funds, and Treasury must be able to track how funds are used by recipients for oversight and transparency purposes. In addition, States, U.S. territories and metropolitan cities and counties with a population over 250,000 also need to provide the adopted budget for each project.

An obligation is an order placed – such as a contract – and similar transactions that require payment.

An expenditure is when the service has been rendered or the good has been delivered to the entity, and payment is due.

The adopted budget is the budget adopted for each project by a recipient associated with SLFRF funds. Recipients will enter the Adopted Budget based on information that exists currently in the recipient’s financial systems and the recipient’s established budget process. Treasury understands that recipients may use different budget processes. For example, a recipient may consider a project budgeted once a legislature has appropriated funds; whereas another recipient may consider a project budgeted at the moment when the funds have been obligated. Note that Treasury is not approving or pre-approving projects or budgets. Treasury will use this information to better understand the intended impact, identify opportunities for technical assistance, and understand the recipient’s progress in program implementation. Treasury is also collecting additional descriptive information about the budget process in order to better understand the context of recipients’ budget processes.

For each project, the recipient will be asked to select the appropriate Expenditure Category based on the scope of the project (as described in Appendix 1 of the Reporting Guidance). Projects should be scoped to align to a single Expenditure Category.

The Expenditure Categories are important not only for tracking projects and expenditures, but also because for certain Expenditure Categories you will need to provide additional programmatic data. You will see them referred to regularly throughout the Reporting Guidance and in this User Guide with “EC” followed by a number.

Appendix C includes the full list of the 66 Expenditure Categories4, which refers to the detailed level. For instance, 1.1 is the EC related to Public Health: 1.1 COVID-19 Vaccination.

While 66 Expenditure Categories are identified, they are a very broad categorization – each Expenditure Category could include many different programs and activities.

Project

A project is defined as a grouping of closely related activities that together are intended to achieve a specific goal or directed toward a common purpose.

These activities can include new or existing services, funded in whole or in part by the SLFRF award.

Within this broad definition, recipients have flexibility to define their projects in a way that provides the greatest clarity on the work which will be performed.

Each project must align to one Expenditure Category. Projects break down an Expenditure Category into more detail.

You are required to define projects at a sufficient level of granularity to be able to do any programmatic reporting that is required.

For each Expenditure Category you use funding for, you will have one or more projects.

For each project, you will need to track obligations and expenditures, as well as any subawards made.

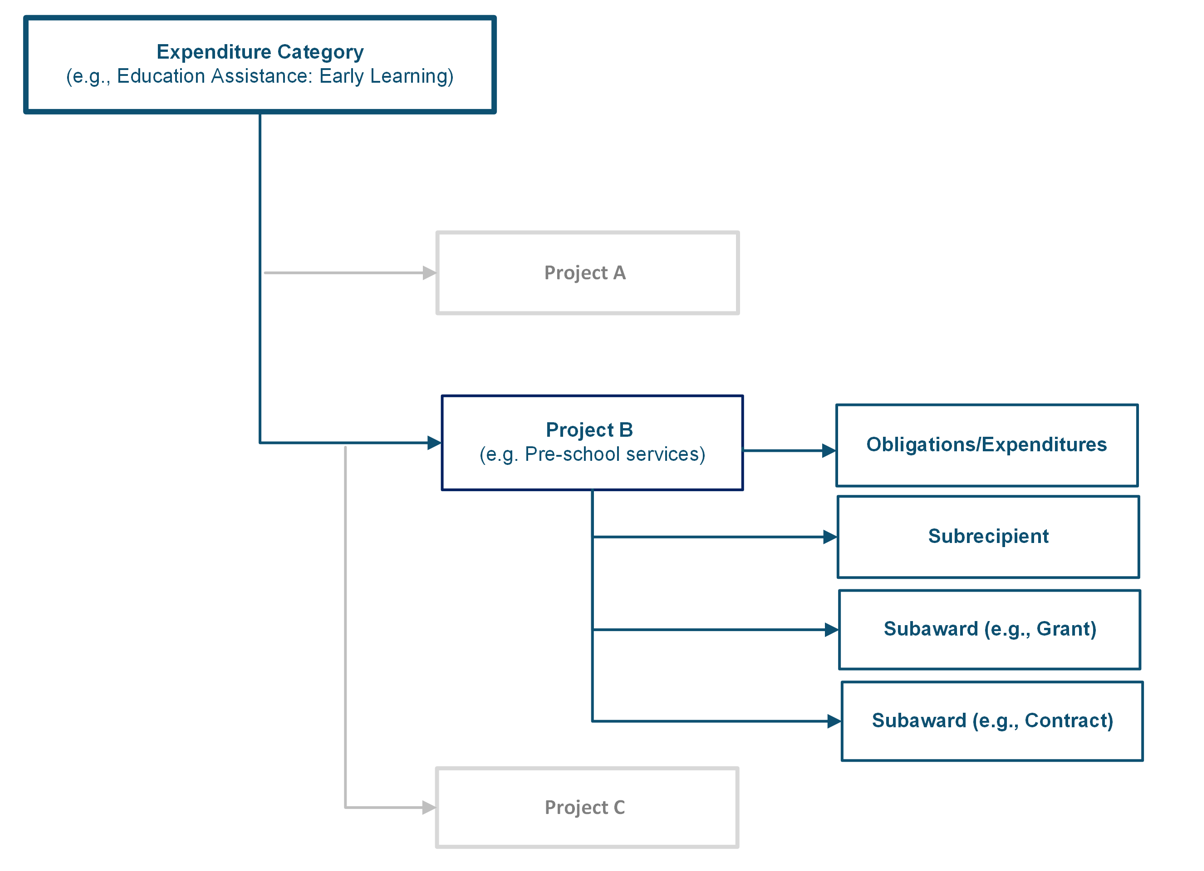

Figure 10 depicts the relationship between EC and multiple projects.

Figure 10 Relationship between Expenditure Categories and Multiple Projects

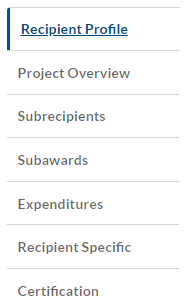

The Project and Expenditure Report provides information on projects funded, expenditures, and contracts and subawards over $50,000, and other information required from recipients. Multiple modules or “screens” will help navigate recipients through the Project and Expenditure Report in Treasury’s Portal as follows:

Recipient Profile

Project Overview

Subrecipients

Subawards

Expenditures

Recipient Specific

Certification

The following sections describe the reporting steps and information to be collected in each module.

Recipient Profile

Upon login, you will be directed to the recipient information page, which is intended to verify relevant information in Treasury’s Portal. On this screen, you will review and confirm key information on your organization, and input information required for the Project and Expenditure Report. Recipient Profile information will be pre-populated from your SLFRF Application file (see Figure 10). If you have previously entered a DUNS (+4) number, it will appear here.

Review and confirm your Recipient Profile prepopulated from your SLFRF Application file (see Figure 11).

If you have a Recipient DUNS (+4) number and the field is not populated, update as necessary.

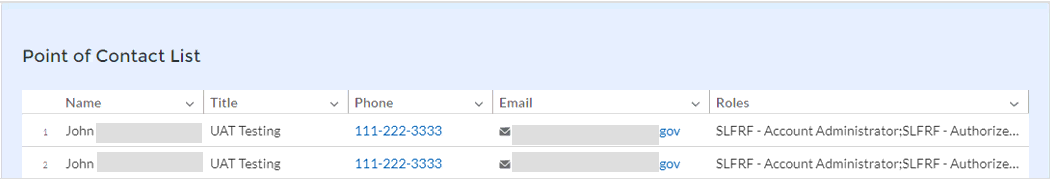

Verify the names and contact information for individuals the recipient has designated for key reporting roles for the SLFRF program displayed on the screen (see Figure 12).

Figure 11 Recipient Information

Figure 12 Point of Contact List

If changes are needed to the information displayed on the screen, use the textbox (see Figure 11). Please refer to the instructions in Appendix A if the updates are associated with reporting roles, or contact [email protected].

For States, U.S. territories, and metropolitan cities and counties over a population over 250,000, provide the answers to the following two questions:

Who approves the budget in your jurisdiction? Select from the pick-list as follows: Legislature; Executive; Legislature & Executive; Other.

If other, specify who approves the budget. Please include information about the role or function, not an individual’s name.

Is your budget considered executed at the point of obligation? Select “Y” or “N”. Please note that if you select Y and your budget is considered executed at the point of obligation, then your adopted budget and total dollar value of obligations for each project would be the same.

Treasury is requiring descriptive information about budget processes to support analysis of adopted budget information. Treasury is collecting adopted budget information to better understand the intended impact of recipient projects and help tell the story of how these funds are used, identify opportunities for technical assistance, and understand the recipient’s progress in program implementation. Treasury is requesting this descriptive information to inform these efforts.

Treasury is not approving or pre-approving projects or budgets. Treasury also recognizes that recipients may adjust project budgets over time, and recipients will have the ability to reflect these changes in future reporting.

Complete the SAM.gov Registration and Executive Compensation information.

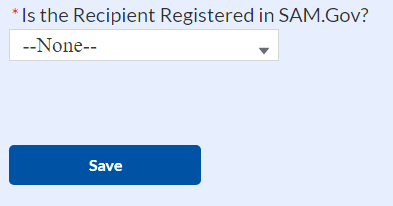

Use the dropdown (see Figure 13) to confirm your entity’s SAM.gov status and Executive Compensation reporting eligibility questions.

If you are registered in SAM.gov, select “Yes” from the picklist and move on to Step 7 below.

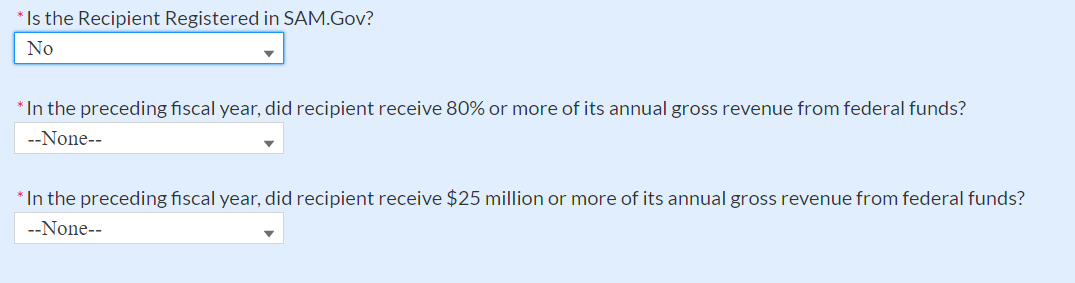

If you are not registered in SAM.gov, select “No” from the picklist. Two additional questions will populate the space below (see Figure 14).

Figure 14 Additional SAM.gov questions (1)

If the recipient received 80% or more of its annual gross revenue from federal funds AND the recipient received $25 million or more of its annual gross revenue from federal funds, an additional question will appear (see Figure 15). If the answer is “No” to any of these two questions, move on to step 7 below.

Figure 15 Additional SAM.gov questions (2)

Select “Yes” if the total compensation for the organization’s five highest paid officers is publicly listed or otherwise listed in SAM.gov and move on to Step 7 below.

Select “No” if the total compensation for the organization’s five highest paid officers is not publicly listed or otherwise listed in SAM.gov. Enter the name(s) of the officer(s) in the chart that will appear (see Figure 16) and the total compensation received by each. If fewer than five (5) officers exist, enter “N/A” and $0 in the empty field(s).

Figure 16 Record of Highest Paid Officer

Once all fields have been reviewed and verified, click the Save button to save your progress, then click the Next button to proceed to the following screen.

Project Overview

Recipients are required to enter all projects funded through SLFRF funds as part of their Project and Expenditure Report. Once projects are entered, they are viewable on the Project Overview screen and can be updated in future reporting periods.

There are a couple of things to keep in mind when planning and executing your project inventory entry:

Manual versus Bulk Upload Entry: There are two ways to enter project information – manual data entry and bulk upload. Bulk upload templates are specific to the project’s expenditure category group. Recipients may upload information for multiple projects within the same expenditure category group template simultaneously. Appendix B provides step by step instructions for using the bulk upload option.

Due to the different data collected across expenditure categories, you should not use the same bulk upload template from one expenditure category group to another.

Non-Infrastructure and Infrastructure Projects Programmatic Data: Treasury requests various programmatic data or impact measures for projects in several non-infrastructure (i.e., projects in EC 1 – 4) and infrastructure projects (i.e., projects in EC 5.1 – 5.17). The programmatic data can be provided via manual project entry or via bulk upload templates. Appendix B provides step by step instructions for using the bulk upload option for projects with programmatic data. Appendix D provides additional detail on the programmatic data requested by EC. Treasury recognizes that some programmatic data may not be available until a project starts.

Infrastructure Projects with expected total cost over $10M: Information for infrastructure projects with expected total cost over $10 million must be entered manually at this time in Treasury’s Portal. Appendix D provides additional detail on the programmatic data requested by EC.

When creating infrastructure projects via bulk upload, it is important to re-open those project records to manually complete fields related to costs over $10M.

Transfers to NEUs (EC 7.4) (only applicable to States and U.S. territories): States and U.S. territories should report any transfers to NEUs as part of the separate NEU/Non-UGLG module. A project cannot be added under EC 7.4.

Recipients should refer to Appendix C when planning your project inventory entry, as it includes a table identifying which ECs require the programmatic data. The table also maps each EC to its appropriate bulk upload template.

All projects, regardless of Expenditure Category, require a set of “standard” data fields. Some of these fields, such as project name and project ID, are static and do not change across reporting periods. Other fields, such as status of completion and total obligations, will change across reporting periods.

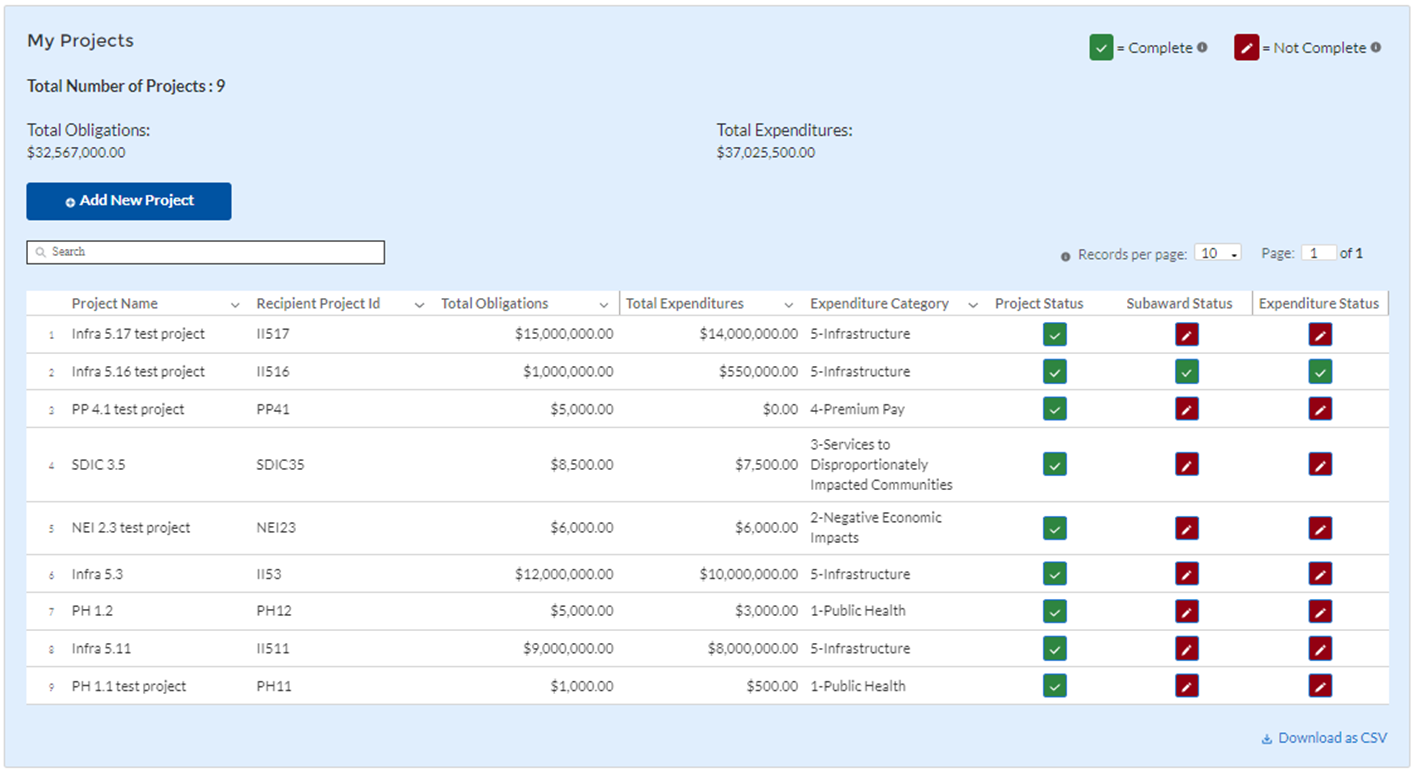

On the Project Overview Screen, recipients can view previously established projects and enter new projects (see Figure 17). The screen displays the total number of projects and total obligations for the recipient. The screen also displays the following for each project entered: project name, project ID, adopted budget (if applicable), total obligations, total expenditures, expenditure category, project status, subaward status, and expenditure status. To go directly to a project to edit or add information, click the colored green or red status button for that project.

![]() For Project Status, the green check icon indicates all required

fields have been answered. For Subaward Status and Expenditure

Status, this indicates that at least one subaward or expenditure

entry has been made.

For Project Status, the green check icon indicates all required

fields have been answered. For Subaward Status and Expenditure

Status, this indicates that at least one subaward or expenditure

entry has been made.

![]() For Project Status, the red pencil icon indicates that not all

required fields have been answered. For Subaward Status and

Expenditure Status, this indicates that no subaward or expenditure

entry has been made.

For Project Status, the red pencil icon indicates that not all

required fields have been answered. For Subaward Status and

Expenditure Status, this indicates that no subaward or expenditure

entry has been made.

To add a new project from this screen, click the Add New Project button. You may need to refresh your browser screen to see your previous new entries.

Figure 17 My Projects Screen Example

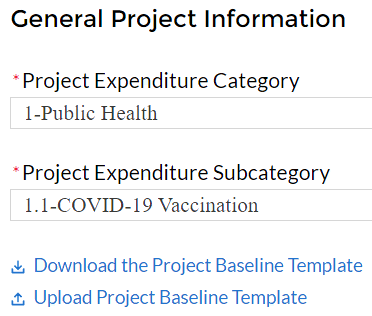

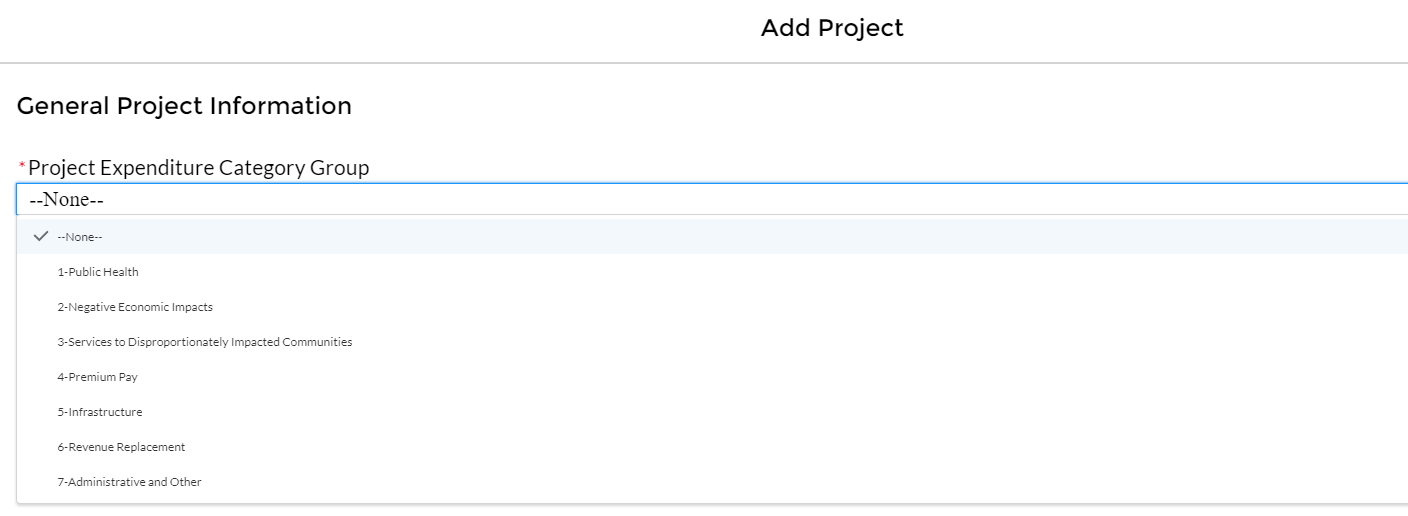

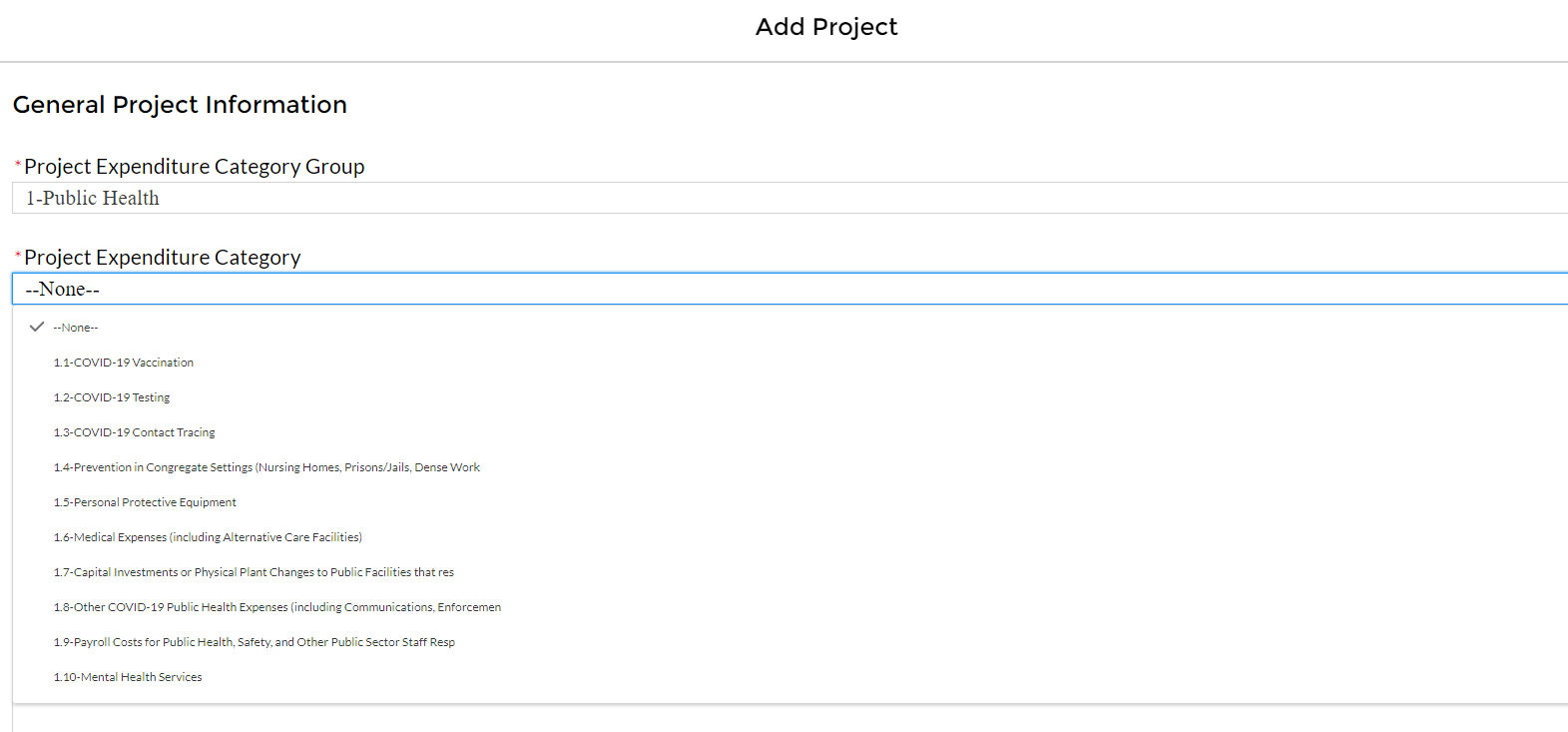

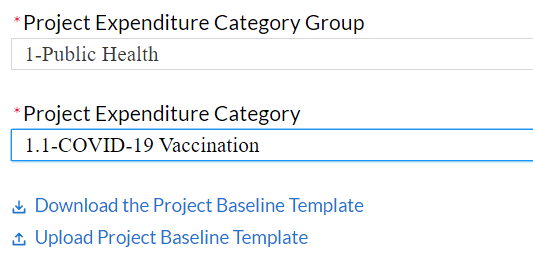

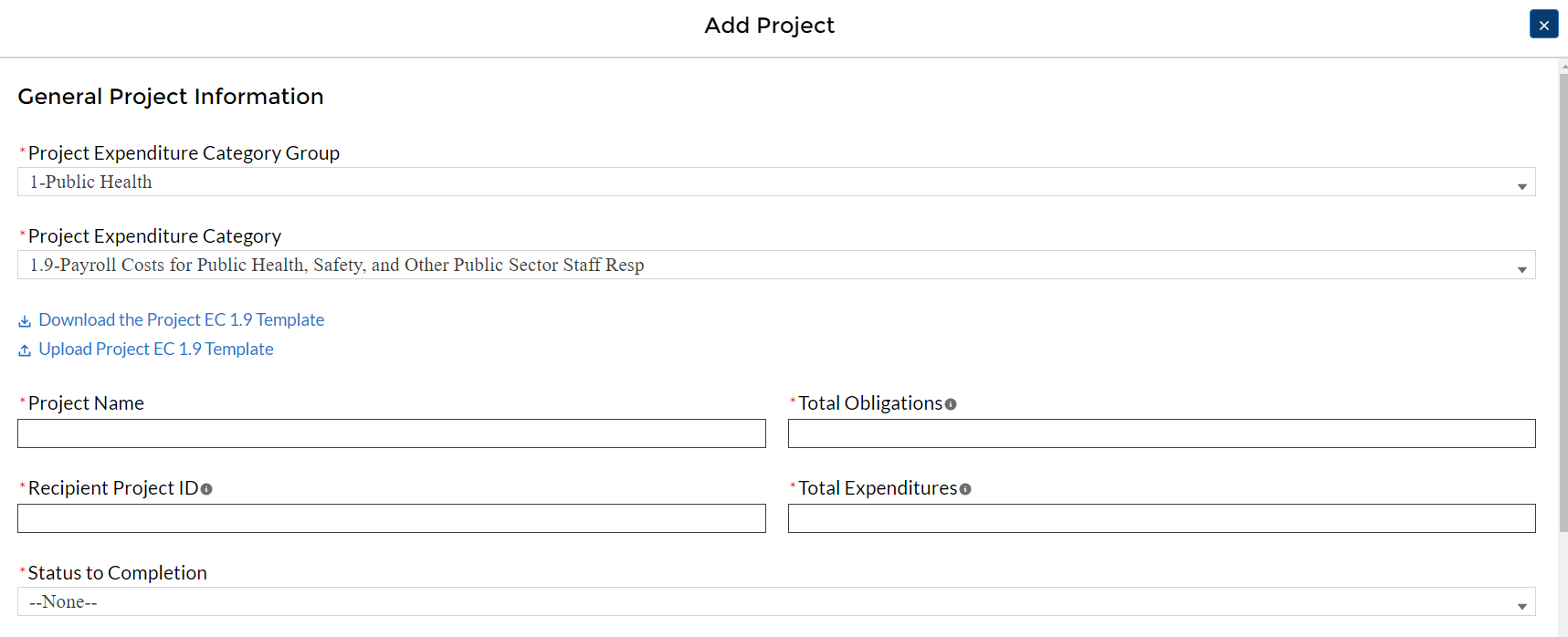

Select the Project Expenditure Category Group and Project Expenditure Category from the picklists. Selection of Expenditure Category drives the template by which you will manually enter the project data (see Figures 18 through 21). To view all of the ECs, scrolling may be necessary.

Figure 18 Project Expenditure Category Group

Figure 19 Project Expenditure Category

Note that once you select values from the Project Expenditure Category Group and the Project Expenditure Category picklists, the bulk download and upload links will appear (see Figure 20). As you are entering the information manually, go to step 3.

Figure 20 Bulk Upload for EC 1.1

Enter the project name.

Enter the unique project identification number you assigned to the project. Do not use duplicate project numbers for multiple projects.

Select the completion status of the project from the drop-down list. Options are:

Not started

Completed less than 50%

Completed 50% or more

Completed

For States, U.S territories and metropolitan cities and counties with population over 250,000, enter the adopted budget for the project.

Enter the total dollar value of obligations for this project. If funds have not been obligated, enter "0".

Enter the total dollar value of expenditures for this project. If expenditures have yet to be made, enter "0".

Note – Recipients should ensure that Total Expenditures are less than or equal to Total Obligations for each project. Treasury’s Portal will otherwise return an error.

Provide a description for the project between 50 to 250 words. Treasury encourages recipients to include a description of the population they are serving, the desired impact, and how this impact will be measured.

For projects reported

under the Project Expenditure Categories EC1: Public Health, EC2:

Negative Economic Impact and EC3: Services to Disproportionately

Impacted Communities, provide answers to the questions “Does

this project include a capital expenditure”? If “Yes”,

what is the total expected cost of the capital expenditure, including

pre-development costs? If the answer is “No”, include a

zero for the expected total cost of the capital expenditure.

If the project earns income or has expended that income, enter the total dollar value of program income earned and Program income expended in the fields of the same name, respectively.

If the project is in an EC which requires additional programmatic data, additional fields will display on the screen. Please see Section IV.b.2 below for more information on providing programmatic data and Appendix D for more information on the programmatic indicators themselves.

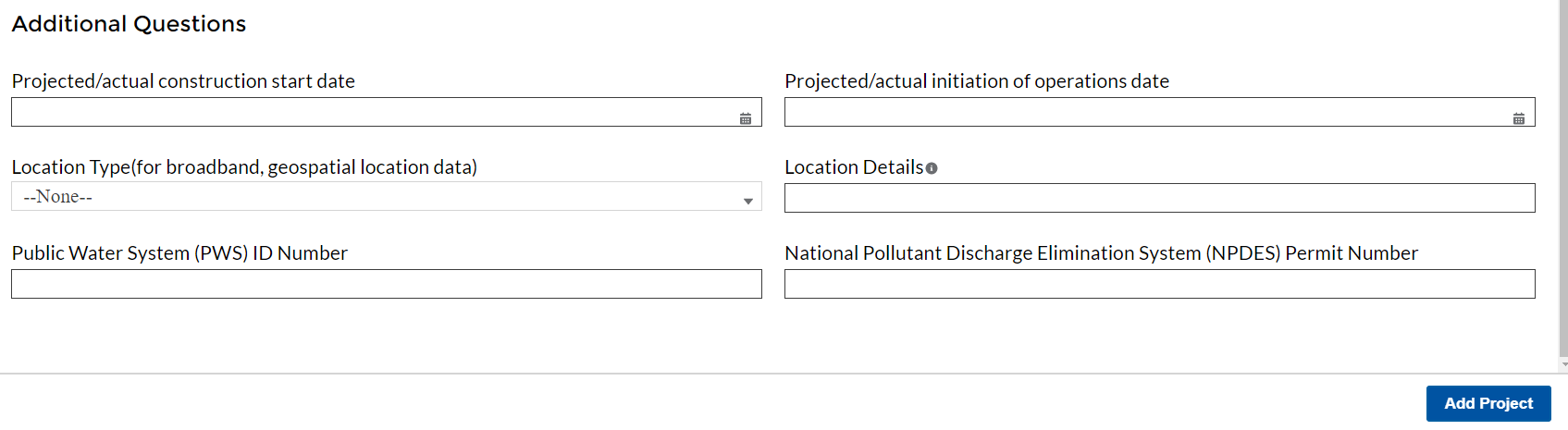

Figure 21 Project Entry Screen

Once all of the above information is entered, click the Add Project button, then click the Next button to proceed to the following screen or you can stay on this screen and continue adding projects to your project inventory. Refer to Figure 21.

As noted above, projects in several ECs require programmatic data in addition to the standard project information covered above and as described in Part B.3.i and B.3.j of the Reporting Guidance. Appendix D provides additional detail on the measures and information required, by Expenditure Category. This information should be provided at the project-level (e.g., disaggregated by project if the recipient has multiple projects in a single EC).

Programmatic data can be provided via the manual project entry process described above, or in some cases via bulk upload using the Expenditure Category-specific templates, described in Section IV.b.4 and Appendix B.

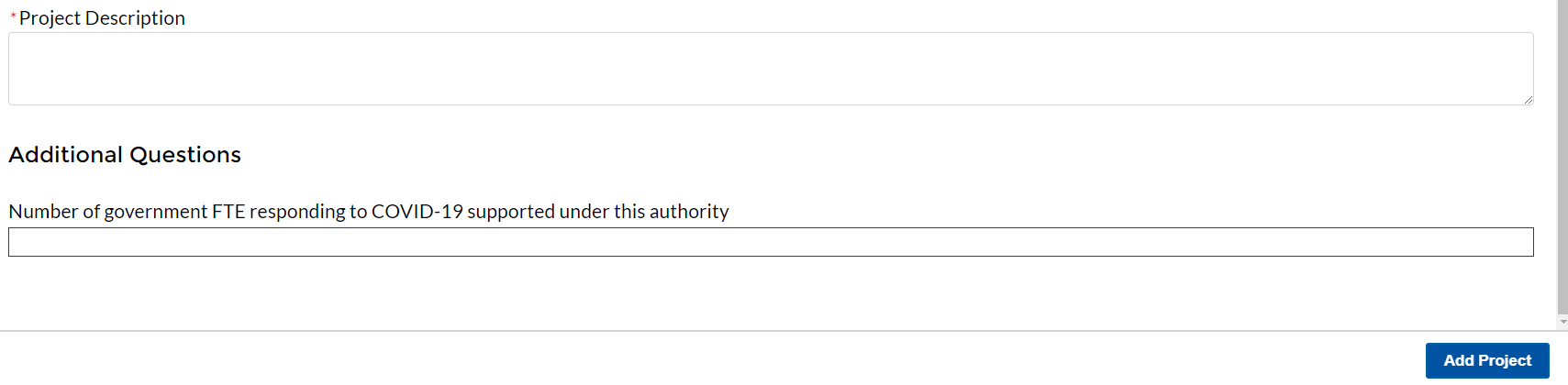

For example, to manually enter a new project in Expenditure Category 1.9 (see Figure 22) Payroll Cost for Public Health, Safety, and other Public Sector Staff Resp, the recipient should:

Follow steps 1 – 11 in Section IV.b.1 above.

Populate the programmatic data field for “Number of government FTEs responding to COVID-19 supported under this authority” (see Figure 23).

Once all of the above information is entered, click Add Project.

Click the Next button to proceed to the following screen.

Figure 22 Manual Entry for EC 1.9

Figure 23 Programmatic Data for EC 1.9

If entering projects via bulk upload, recipients should populate the programmatic data columns contained in the appropriate EC’s bulk upload template.

Refer to Appendix D for a full listing of project Expenditure Categories with detail on the additional information needed for specific categories. Appendix C provides a helpful table mapping each Expenditure Category to the bulk upload template recipients should use if inputting or updating projects via the bulk upload method.

Projects entered into the system can be edited or deleted before final submission. To edit a project, open the project from the My Projects screen. To delete a project, use the Delete Project Button. If a report is already submitted, users will need to un-submit to edit or delete a project record. See Figure 24.

Premium Pay (EC 4.1 and EC 4.2)

If EC 4.1 or 4.2 is selected as the project expenditure category, recipients will need to provide additional data.

In addition, recipients need to provide additional information in regard to Premium Pay, as reflected in Figure 25.

Note - Recipients that are either creating or supporting a Premium Pay program may only provide premium pay to eligible workers, e.g., workers needed to maintain continuity of operations of essential critical infrastructure sectors (see sector list below), for essential work, e.g., work that is not performed while teleworking from a residence; and involves either:

regular, in-person interactions with patients, the public, or coworkers of the individual that is performing the work; or

regular physical handling of items that were handled by, or are to be handled by, patients, the public, or coworkers of the individual that is performing the work.

Sectors designated as essential critical infrastructure sectors: Recipients should refer to the list of sectors below when providing information for this question. Recipients may also refer to this list of sectors on the Subaward screens (see section IV.g) to answer the question: Employer sector for all subawards to third-party employers (i.e., employers other than the State, local, or Tribal government).

Sectors Designated as Essential Critical Infrastructure Sectors |

Any work performed by an employee of a State, local, or Tribal government |

Behavioral health |

Biomedical Research |

Critical clinical research, development, and testing necessary for COVID-19 response |

Dental care work |

Educational work, school nutrition work, and other work required to operate a school facility |

Elections work |

Emergency response |

Family or childcare |

Grocery stores, restaurants, food production, and food delivery |

Health care |

Home- and community-based health care or assistance with activities of daily living |

Laundry work |

Maintenance work |

Medical testing and diagnostics |

Mortuary work |

Pharmacy |

Public health work |

Sanitation, disinfection, and cleaning work |

Social services work |

Solid waste or hazardous materials management, response, and cleanup work |

Transportation and warehousing |

Vital services to Tribes |

Work at hotel and commercial lodging facilities that are used for COVID-19 mitigation and containment |

Work requiring physical interaction with patients |

Other |

Beyond this list, the chief executive (or equivalent) of a recipient government may designate additional non-public sectors as critical so long as doing so is necessary to protecting the health and wellbeing of the residents of such jurisdictions.

Premium Pay Narrative: Premium pay must be responsive to eligible workers performing essential work during the public health emergency. For groups of workers that do not meet one of the two criteria below, Recipients must submit a written justification to Treasury describing how the premium pay or grant is responsive to workers performing essential work during the public health emergency:

Eligible worker receiving premium pay is earning (with the premium included) below 150 percent of their residing state or county’s average annual wage for all occupations, as defined by the Bureau of Labor Statistics Occupational Employment and Wage Statistics,5 whichever is higher, on an annual basis; or

Eligible worker receiving premium pay is not exempt from the Fair Labor Standards Act overtime provisions.

Infrastructure Projects Programmatic Data (EC 5)

Programmatic data is requested for Infrastructure projects in addition to data uploaded by bulk template. That additional programmatic data can only be entered manually at this time in Treasury’s Portal.

If adding an infrastructure project via the bulk upload method, recipients will be asked to provide additional data in Treasury’s Portal screens (see Figure 26), consistent with the Reporting Guidance. Alternatively, recipients can enter all infrastructure project information manually. Please see Appendix D and the Reporting Guidance for more information on the additional programmatic data requested for infrastructure projects.

Figure 26 Programmatic Data for Infrastructure Projects

Infrastructure Projects with total expected costs over $10M

Recipients entering infrastructure projects with total expected costs over $10 million are required to respond to two questions manually. If you expect a project to exceed $10 million over its lifetime, it is strongly recommended to complete the certifications in advance to avoid future retroactive reporting burden and project-associated expenses.

Recipients are required to provide the following two certifications, or provide additional information:

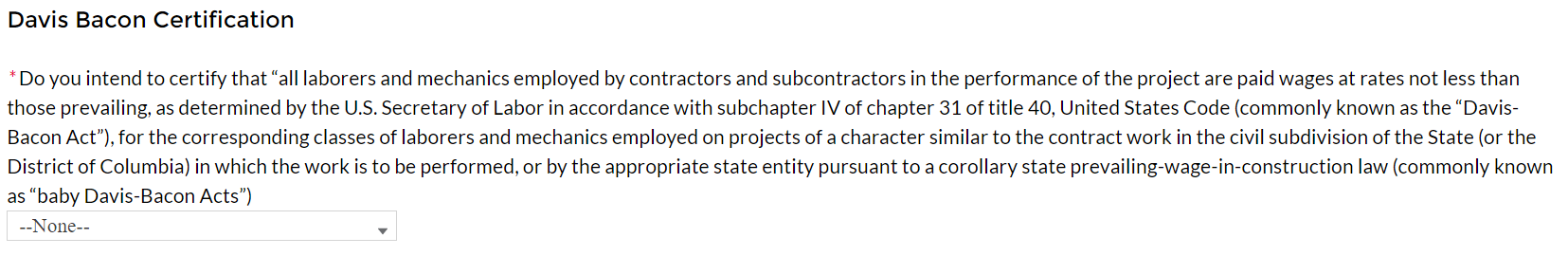

Davis Bacon Act Certification (see Figures 27 and 28):

Select “Yes” or “No” response to Certification question for compliance with Davis-Bacon Act: Do you intend to certify that “all laborers and mechanics employed by contractors and subcontractors in the performance of the project are paid wages at rates not less than those prevailing, as determined by the U.S. Secretary of Labor in accordance with subchapter IV of chapter 31 of title 40, United States Code (commonly known as the “Davis-Bacon Act”), for the corresponding classes of laborers and mechanics employed on projects of a character similar to the contract work in the civil subdivision of the State (or the District of Columbia) in which the work is to be performed, or by the appropriate state entity pursuant to a corollary state prevailing-wage-in-construction law (commonly known as “baby Davis-Bacon Acts”)?

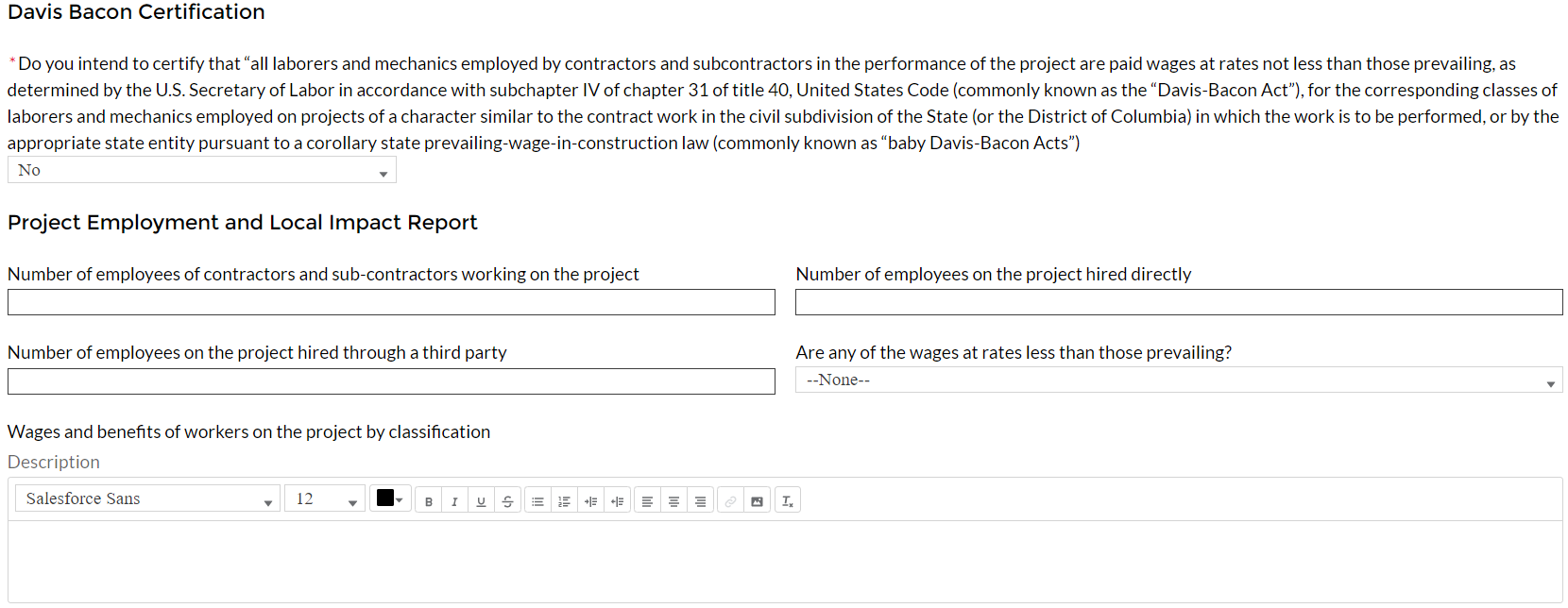

If response is “No”, enter the following information in the pop-up window:

The number of employees of contractors and sub-contractors working on the project;

The number of employees on the project hired directly and hired through a third party; and

The wages and benefits of workers on the project by classification; and

Whether those wages are at rates less than those prevailing6.

PLEASE NOTE: Selecting "Yes" to 1(a) means that you intend to certify that all contractors and subcontractors are paying prevailing wages and fringe benefits to all laborers and mechanics on the project.

Figure 27 Davis Bacon Certification

Figure 28 Additional Questions if Response to Davis Bacon Certification is "No"

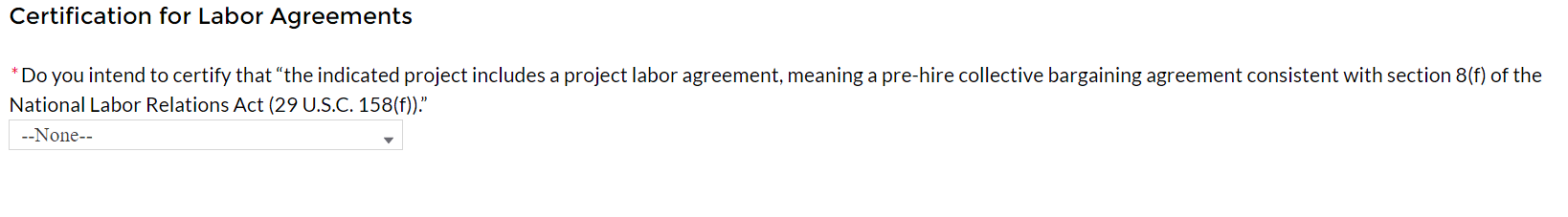

Project Labor Agreement Certification (Figures 29 and 30):

Select “Yes” or “No” response to Certification question for existence of project labor agreement: Do you intend to certify that “the indicated project includes a project labor agreement, meaning a pre-hire collective bargaining agreement consistent with section 8(f) of the National Labor Relations Act (29 U.S.C. 158(f))?

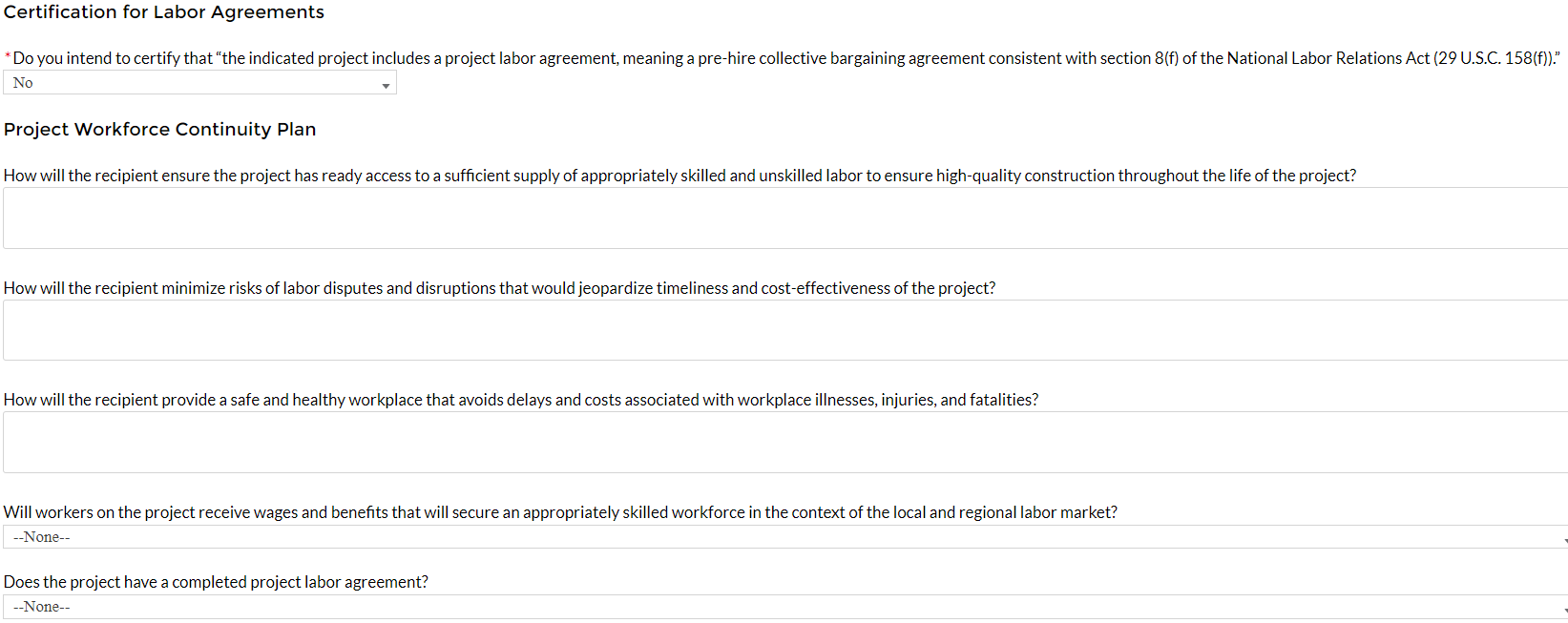

If response is “No”, enter the following information about a project continuity plan in the pop-up window:

How the recipient will ensure the project has ready access to a sufficient supply of appropriately skilled and unskilled labor to ensure high-quality construction throughout the life of the project, including a description of any required professional certifications and/or in-house training;

How the recipient will minimize risks of labor disputes and disruptions that would jeopardize timeliness and cost-effectiveness of the project;

How the recipient will provide a safe and healthy workplace that avoids delays and costs associated with workplace illnesses, injuries, and fatalities, including descriptions of safety training, certification, and/or licensure requirements for all relevant workers (e.g., OSHA 10, OSHA 30);

Whether workers on the project will receive wages and benefits that will secure an appropriately skilled workforce in the context of the local or regional labor market; and

Whether the project has completed a project labor agreement.

PLEASE NOTE: Selecting "Yes" to 2(a) means that you intend to or are using an 8(f) pre-hire agreement on your project.

Figure 29 Certification for Labor Agreements

Figure 30 Additional Questions if response is "No"

Once all of the above information is entered, click Add Project. Click the Next button to proceed to the following screen.

Water and sewer projects (EC 5.1-5.15)

Recipients will provide information associated with water and sewer projects, under EC 5.1 through 5.15 when the project starts. Recipients are not required to provide the information if the project has not started. When the “Status of Completion” field is marked “Not Started, the additional questions required for water and sewer projects will not populate.

Revenue Replacement

Recipients will have the option to update or provide information associated with revenue replacement not previously provided as part of prior submissions. Information previously provided as part of the Interim Report (if provided) will display in this screen. Depending on your answer to the question, “is your jurisdiction electing to use the standard allowance of up to $10 million for identifying the revenue loss?” you will be asked conditional questions. Refer to Figure 31.

As outlined in the Final Rule, Recipients will have the option to make a one-time decision to calculate revenue loss according to the formula outlined in the Final Rule or elect a “Standard Allowance” of up to $10 million, not to exceed the award allocation, to spend on government services throughout the period of performance.

For recipients calculating revenue loss according to the formula, note that the Final Rule permits recipients are permitted to choose whether to use calendar or fiscal year calculation dates. Recipients must use the same calculation time frame (calendar or fiscal year) throughout the award period.

For recipients electing the “Standard Allowance,” Treasury will presume that up to $10 million, not to exceed the award allocation, in revenue has been lost due to the public health emergency and recipients are permitted to use that amount to fund “government services.” Please note that electing the standard allowance does not change a recipient’s total allocation.

Treasury’s Portal will allow all recipients to elect to use this standard allowance instead of calculating lost revenue using the formula. Refer to Figure 31. The following question will display in the screen for all recipients, including those with total allocations of $10 million or less:

Is your jurisdiction electing to use the standard allowance of up to $10 million, not to exceed your total award allocation, for identifying revenue loss? Yes/No (Please note electing the standard allowance does not change your total allocation).

Based on the recipient’s election, certain information will display in Treasury’s Portal which the recipient will need to complete, as noted in the table below:

Data |

Standard Allowance – Yes |

Standard Allowance- No |

Base Year Revenue |

N/A |

Required |

Fiscal Year End Date |

N/A |

Required |

Growth Adjustment Used |

N/A |

Required |

Actual General Revenue as of 12 months ended December 31, 2020 |

N/A |

Required |

Estimated Revenue Loss |

N/A |

Required |

Select whether Fiscal Recovery Funds were used to a make a deposit into a pension fund. Please note that no recipients except for Tribal governments may use Fiscal Recovery Funds to make a deposit to a pension fund |

Required |

Required |

Provide an explanation of how revenue replacement funds were allocated to government services: Please provide an explanation |

Required |

Required |

Figure 31 Revenue Replacement Screen

Recipients have the option to provide project information via bulk upload, in lieu of manual entry for some or all of their projects. Please note, bulk upload templates are specific to the EC the project best aligns to. The table in Appendix C provides a mapping of project ECs to their appropriate bulk upload template.

Fill the downloaded template with information specific to each project’s EC, as follows. Projects within the same EC or set of ECs covered by a given template can be uploaded together. For example, all projects in EC 2.1 to 2.5 (Negative Economic Impacts) can be entered together on the Project Bulk Upload for Project EC 2.1-2.5 Template. Optional fields are denoted by (*). “Column” below refers to the applicable area in the bulk upload file.

Column B: Select the Project Expenditure Group

Column C: Select the Expenditure Category

Column D: Enter the Project Name

Column E: Enter the unique project identification number assigned by the State or U.S. Territory to the project. Do not use duplicate project numbers for multiple projects

Column F: Select the completion status of the project

Column G: Enter the total dollar value of the adopted budget for this project * (only applicable to States, U.S. Territories, and metropolitan cities and counties with population over 250,000)

Column H: Enter the total dollar value of obligations for this project. If no amounts are obligated, enter “0”

Column I: Enter the total dollar value of expenditures for this project. If no expenditures have been incurred, enter “0”

Column J: For projects in EC 1, EC 2, or EC 3, enter a yes or no response to the question, does this project include a capital expenditure?

Column K: If yes, what is the total expected cost of the capital expenditure?

Column L: Enter a description of the project

Column M: Enter a brief description of the structure and objectives of assistance program(s) (e.g., nutrition assistance for ow income households)

Column N: Enter the number of households served (by program if recipient establishes multiple separate household assistance programs)

Column O: Enter a brief description of recipient’s approach to ensuring that aid to households responds to a negative economic impact of Covid-19.

Upload the Project Entry and Status template, in this case the template for EC 2.1-2.5, separately as a .csv file by using the respective Upload button on the screen or dropping the files in this view.

Once all of the above information is entered, click Add Project. Click the Next button to proceed to the following screen.

Refer to Appendix B for additional information related to the bulk file upload process

The Subrecipients or Beneficiaries Profile documents the information about each subrecipient or beneficiary that has received at least one Subaward or Direct Payment of federal funding greater than $50,000 to execute projects supporting the SLFRF program. Please note that projects entered under EC 6.1 Provision of Government Services are not required to enter Subrecipient, Subaward, or Expenditures (for a subaward) information for the January reporting cycle. The Subrecipients or Beneficiaries module allows users to enter data manually or leverage the bulk file upload capability. For bulk-upload instructions specific to this submodule, see Appendix B. You can download the bulk file template for use in submitting the required data via bulk upload. When ready to submit the data, use the upload button (see Figure 32).

Figure 32 Subrecipient Bulk Upload Icon

Note: When using the bulk file upload capability, the Subrecipient bulk upload must be completed prior to beginning the data entry for the Subawards module.

If you choose to individually enter records, follow the instructions below.

Enter the relevant Subrecipient or Beneficiary information in each of the required fields (see Figure 33). Recipients must enter at least one of the following three identifiers for a subrecipient: UEI (Unique Entity Identifier), DUNS, or TIN.

Figure 33 Manually Create a Subrecipient or Beneficiary

If the subrecipient or beneficiary is not registered in SAM.Gov, select “No” from the picklist. Two additional questions will populate the space below (see Figure 34).

Figure 34 Sam.gov Questions for Subrecipients

If the recipient received 80% or more of its annual gross revenue from federal funds AND the recipient received $25 million or more of its annual gross revenue from federal funds, an additional question will appear (see Figure 35).

Figure 35 Additional SAM.gov questions for Subrecipients

Select “Yes” if the total compensation for the organization’s five highest paid officers is publicly listed or otherwise listed in SAM.Gov and move on to step 6 below.

Select “No” if the total compensation for the organization’s five highest paid officers is not publicly listed or otherwise listed in SAM.Gov. Enter the name(s) of the officer(s) in the chart that will appear (see Figure 36) and the total compensation received by each. If fewer than five (5) officers exist, enter “N/A” and $0 in the empty field(s).

Figure 36 Five Highest Paid Officers for Subrecipients or Beneficiaries

At the bottom of the page, click the Create Subrecipient icon to complete the Subrecipient record and return to Subrecipient screen.

Subrecipient or Beneficiaries entered into the system are shown at the bottom portion of the screen (see Figure 37).

Figure 37 Subrecipients Entered

Subawards or Direct Payments

The Subawards or Direct Payments section allows recipients to enter the required information regarding Subawards or Direct Payment of federal funding greater than $50,000 for all direct payments, subawards, and contracts made by your organization under SLFRF. Please note that projects entered under EC 6.1 Provision of Government Services are not required to enter Subrecipient, Subaward, or Expenditures (for a subaward) information for the January reporting cycle.

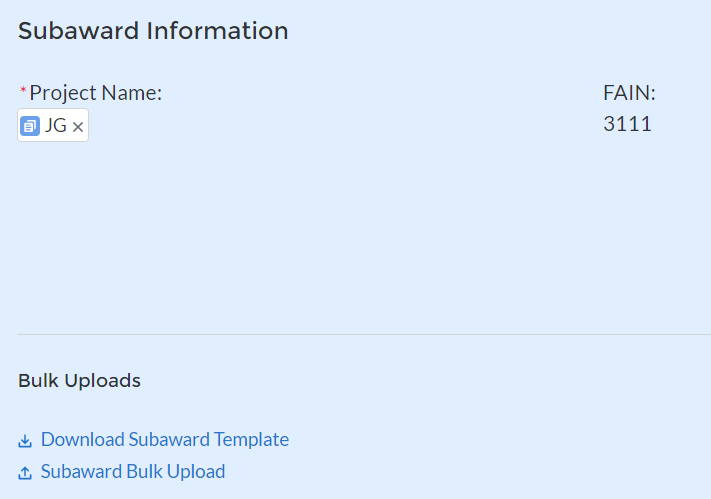

The Subawards or Direct Payments module allows users to enter data manually or leverage the bulk file upload capability. For bulk-upload instructions specific to this submodule, see Appendix B. You can download the bulk template using the provided link in Treasury’s Portal before using the upload button (see Figure 38).

Figure 38 Subaward Bulk Upload (1)

Figure 38 Subaward Bulk Upload (2)

Note: Subaward bulk upload can only be completed after Subrecipient bulk upload is completed.

If you choose to individually enter records, follow the instructions below.

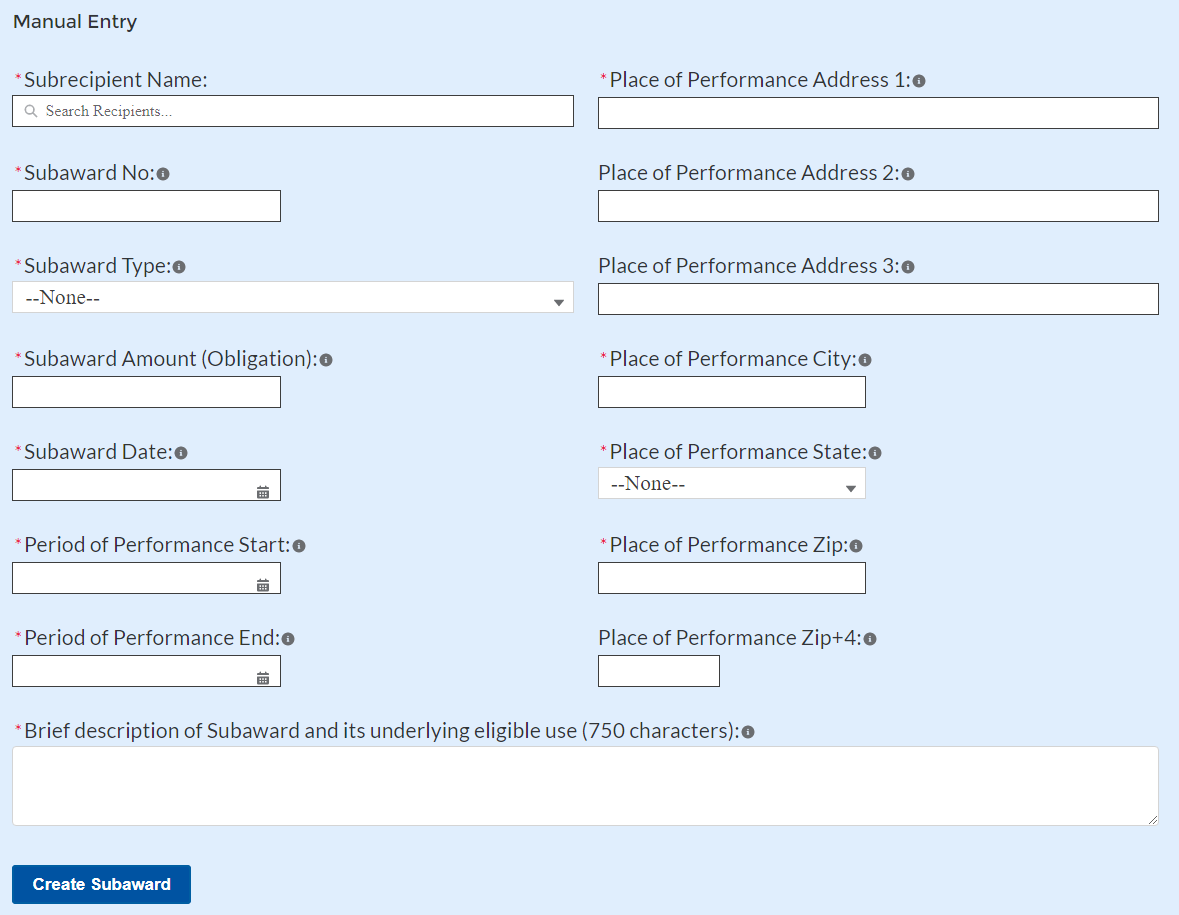

Enter the following fields pertaining to the Subawards or Direct Payments (see Figure 39):

Subrecipient or Direct Payment Recipient Name from the picklist

Subaward Number

Subaward Amount (Obligation)

Subaward Date

Period of Performance Start

Period of Performance End

Place of Performance Address, City, State, Zip, Zip+4

Select the Subaward Type from the drop-down picklist:

Contract: Purchase order

Contract: Delivery order

Contract: Blanket Purchase Agreement

Contract: Definitive contract

Grant: Lump sum Payment(s)

Grant: Reimbursable

Loan - Maturity prior to 12/31/26 with planned forgiveness (please see note below on use of loans)

Loan - Maturity prior to 12/31/26 without planned forgiveness (please see note below on use of loans)

Loan - Maturity past 12/31/26 with planned forgiveness (please see note below on use of loans)

Loan - Maturity past 12/31/26 without planned forgiveness (please see note below on use of loans)

Direct Payment

Transfer: Lump Sum Payment(s)

Transfer: Reimbursable

Click Create Subaward to establish the Subaward record. Repeat Steps 1 through 3 to create additional Subaward records.

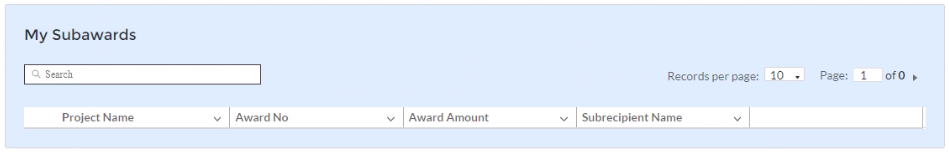

Subawards entered into the system are shown at the bottom portion of the screen (see Figure 40).

Expenditures

In the Expenditures tab, recipients will provide information for each contract, grant, loan, transfer, or direct payment greater than $50,000. Additionally, aggregate reporting is required for contracts, grants, transfers made to other government entities, loans, direct payments, and payments to individuals that are less than $50,000. If aggregated expenditures linked to a project equal the total Expenditures reported for that project, the Subaward status box on the My Projects screen is changed to ‘Complete’. Please note that projects entered under EC 6.1 Provision of Government Services are not required to enter Subrecipient, Subaward, or Expenditures (for a subaward) information for the January reporting cycle.

The Expenditures reporting module allows users to enter data manually or leverage the bulk file upload capability. For bulk-upload instructions specific to this submodule, see Appendix B.

If you do not use the bulk upload function, follow the steps listed below.

To report new expenditures under a specific subaward, enter the subaward number. The Project Name associated with the subaward will auto populate.

Enter the following:

Expenditure Start Date

Expenditure End Date

Expenditure Amount

Enter narrative for Administrative Costs, if applicable.

If Subaward Type is a grant, verify the Subrecipient’s compliance with the conditions of the grant through the drop-down picklist. If the Subrecipient is non-compliant, provide a brief explanation regarding non-compliance.

Click the Create Expenditure button to submit the record. Repeat Steps 1 through 6 to report additional sub-award expenditures. Proceed to the next segment once all sub-award expenditures are reported.

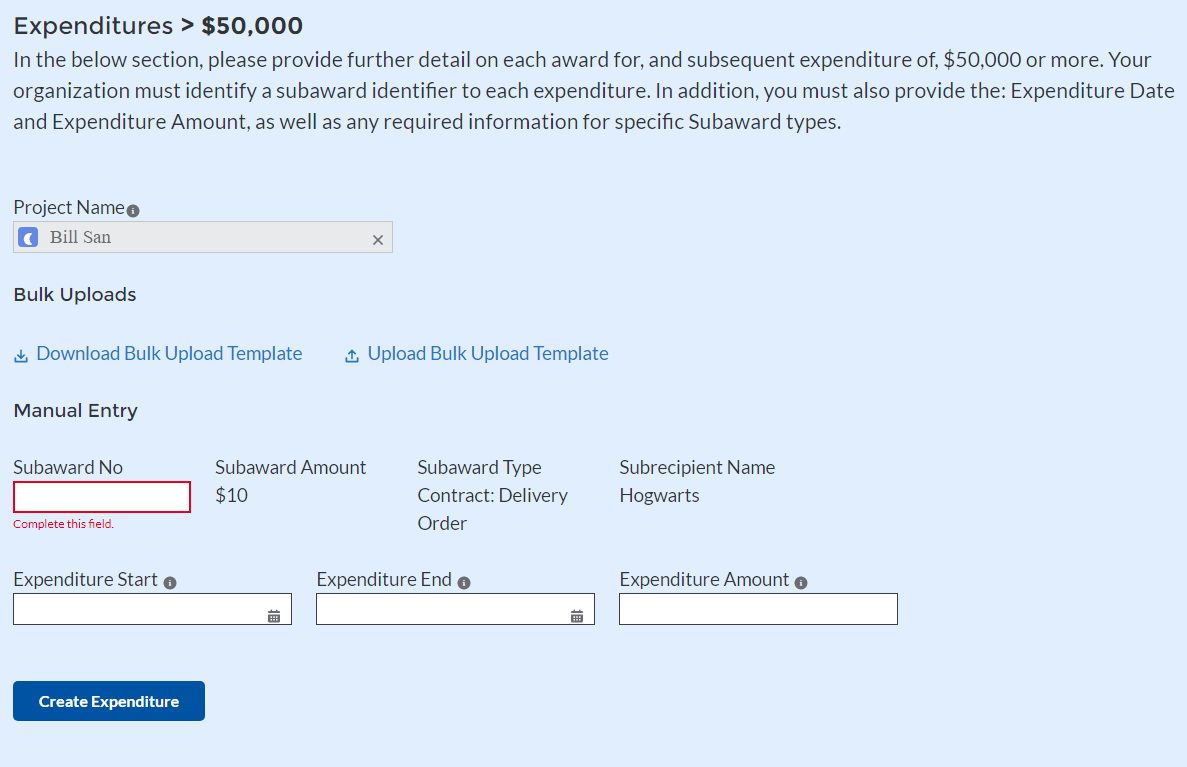

Expenditures Greater than $50,000

For expenditures for awards greater than $50,000, fill out the “Expenditures for Awards> $50,000” box (see Figure 41). Project name and subaward will be selected to link each expenditure to the appropriate entries. Note that the Project name is automatically identified based on the associated Subaward No. entered. Once the information has been entered, click the Create Expenditure button on the bottom left of the box.

Figure 41 Expenditures >$50,000

Alternatively, the Expenditures for Awards greater than $50,000 bulk upload template (Figure 40) may be used and uploaded with the relevant information.

Expenditures Less than $50,000

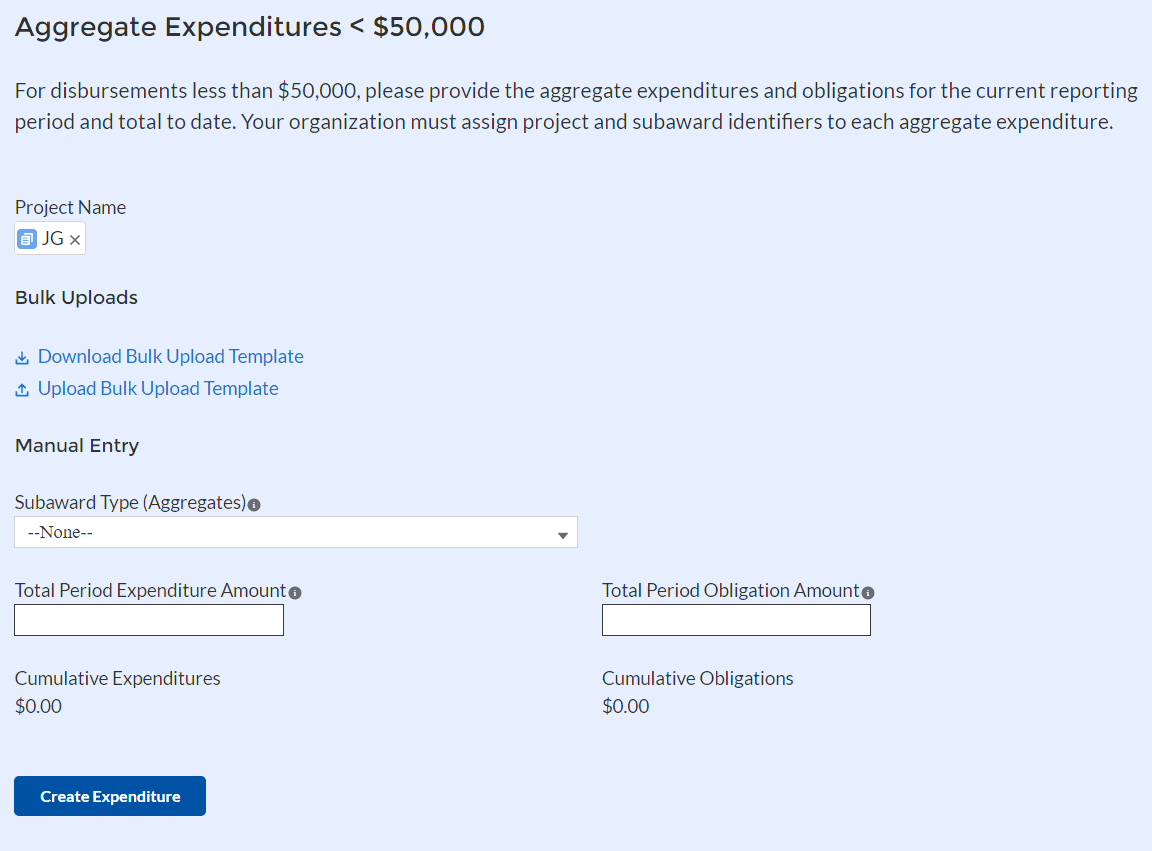

For expenditures for awards less than $50,000 fill out the “Aggregate Expenditures < $50,000” box (see Figure 42). Once the information has been entered, click the Create Expenditure button on the bottom left of the box. Note the need to manually identify the Project Name as no Subaward is necessary for Aggregate Expenditures less than $50,000.

Figure 42 Aggregated Expenditures <$50,000

Aggregate subaward types available for selection are as follows.

Aggregate of Contracts Awarded

Aggregate of Grants Awarded

Aggregate of Loans Issued

Aggregate of Transfers

Aggregate of Direct Payments

Alternatively, the Aggregate Expenditures less than $50,000 bulk upload template may be used and uploaded with the relevant information.

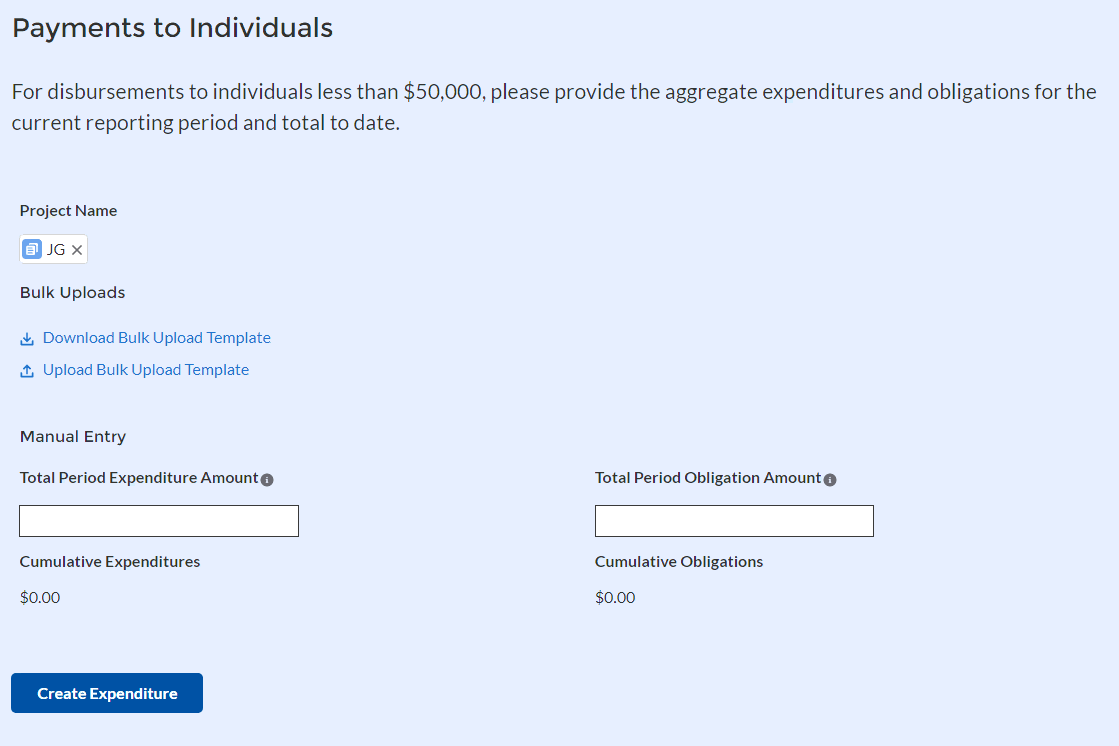

Payments to Individuals

For disbursements to individuals less than $50,000, recipients should complete the “Payments to Individuals” box (see Figure 43) with expenditure information. Once this information has been entered, click the Create Expenditure button on the bottom left of the box.

Figure 43 Payments to Individuals

Alternatively, the Payments to Individuals bulk upload template (Figure 43) may be used and uploaded with the relevant information. Note the need to manually identify the Project Name as no Subaward is necessary for Payments to Individuals less than $50,000.

Once entries are complete, click the Next button on the bottom right of the page. This will bring recipients to the Report tab.

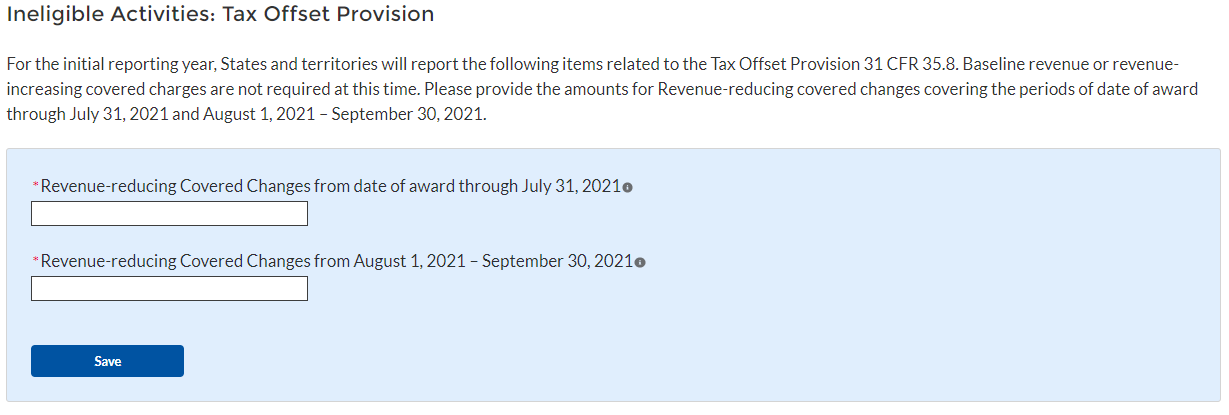

Tax Offset Provision (Only for States and U.S. Territories)

Baseline revenue or revenue-increasing covered charges information are not required at this time. State and U.S territory recipients should provide the amount of revenue-reducing covered changes covering the periods of date of award through July 31, 2021 and separately, August 1, 2021 through December 31, 2021. (See Figure 44).

See Section C (11) of the Reporting Guidance for additional information.

Additional guidance will be forthcoming for additional reporting requirements regarding the tax offset provision.

Figure 44 Tax Offset Provision Screen

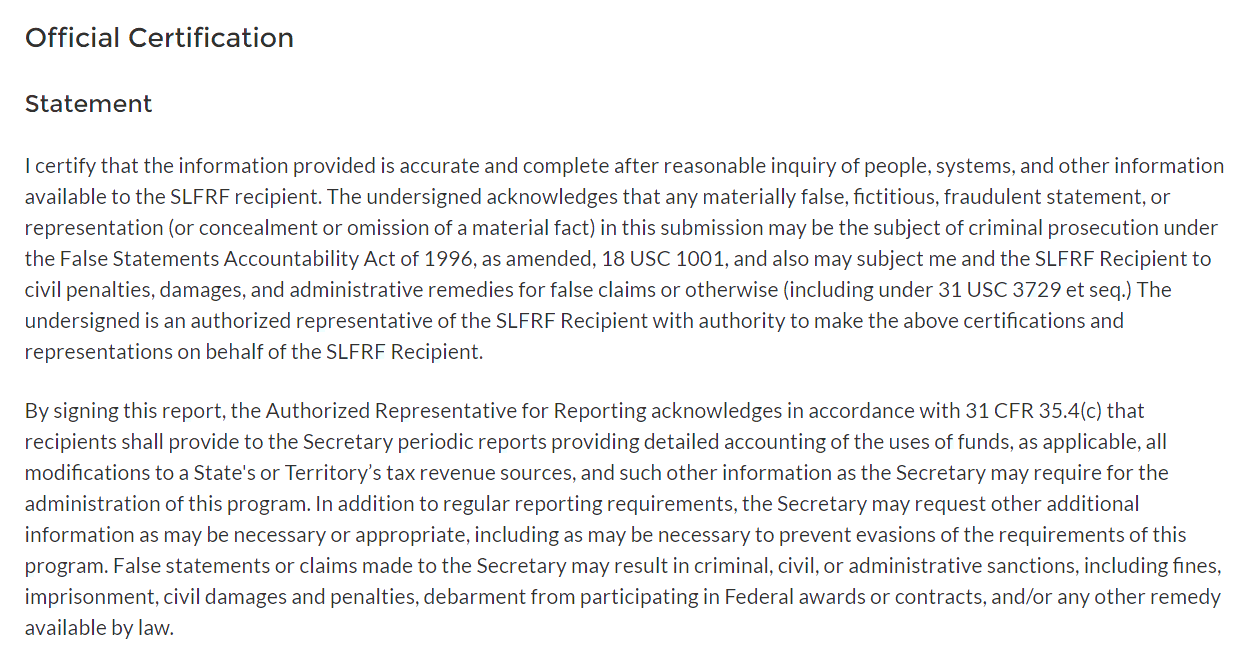

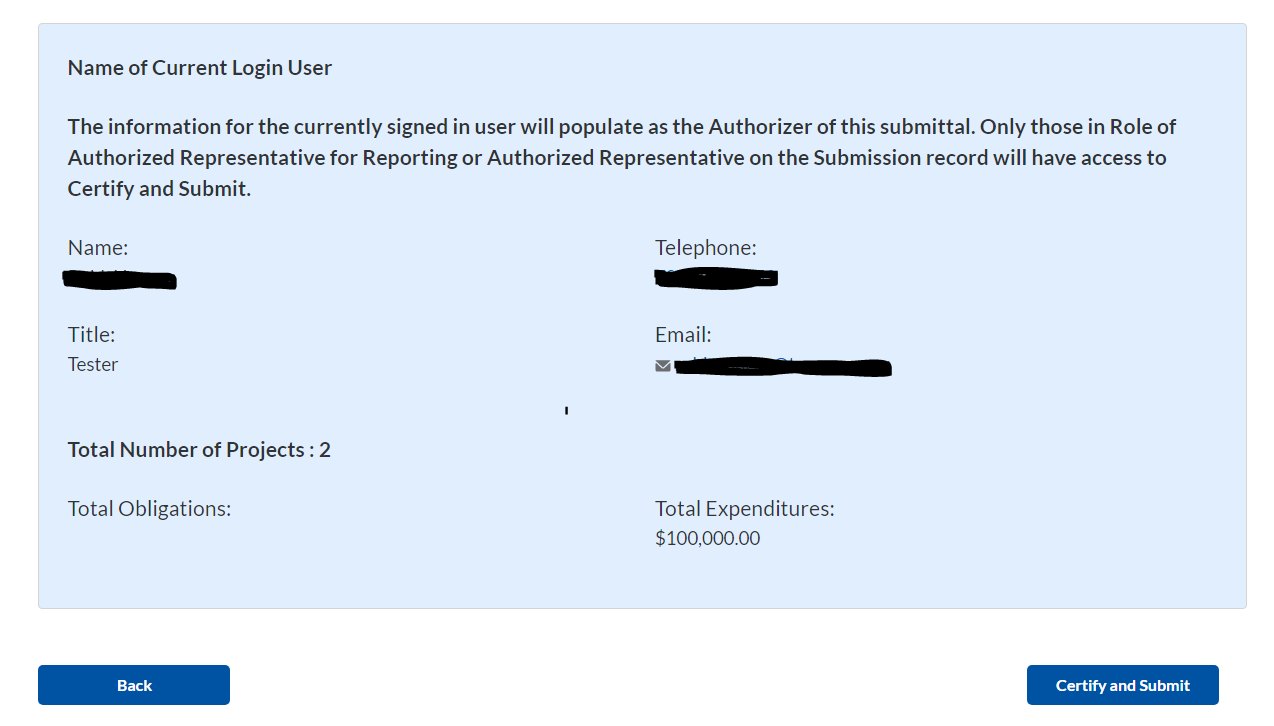

Official Certification

On this screen, the Authorized Representative for Reporting (ARR) will be asked to certify information pertaining to the Project and Expenditure. By certifying this submission, the ARR is confirming that all reported information is accurate and approved for submission (see Figures 45 and 46).

Users who are not designated as an ARR will not be presented with the screen.

The ARR’s Name, Title, Telephone Number, and E-Mail Address will be presented on screen for review.

Allow the Certifying Official to review all prior screens and entries to verify accuracy of the inputted record.

Figure 45 Official Certification

Verify information included in Figure 46 and confirm that the values presented are as expected based on the information included or uploaded in previous screens.

Figure 46 Summary of Reported Information

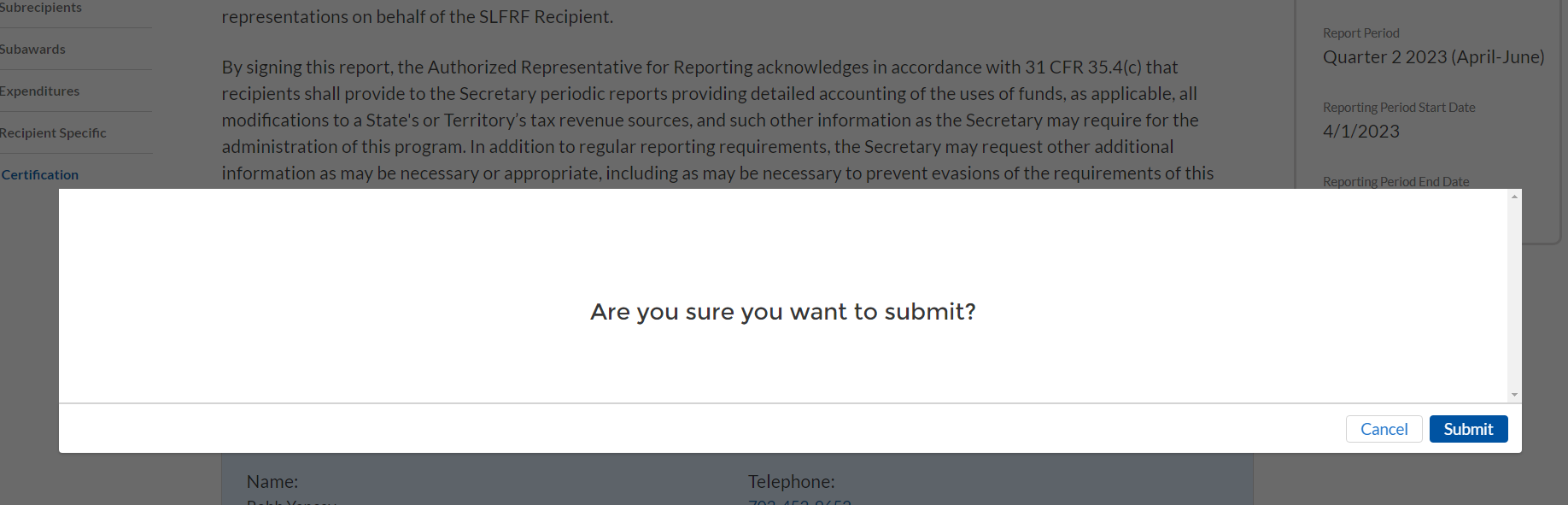

When certifying and submitting the report, a confirmation box will appear asking if the recipient is sure it wants to submit (see Figure 47).

Figure 47 Submission Verification

Once all of the information is validated, click the Submit button to complete the entry.

Appendix A – Designating SLFRF Points of Contact by SLFRF Account Administrators

This section provides a brief instruction for SLFRF Account Administrators on accessing Treasury’s Portal to provide the names and contact information of officials to be designated as your organization’s points of contact for the SLFRF award(s). The following pages provide step-by-step guidance. See FAQ Section B for commonly asked questions/answers on this topic.

Note- the screens noted below may be subject to change.

Section A: Instructions

Step

1

You must be registered in the ID.me or Login.gov system to

access Treasury’s Portal. If you have questions about

registering in ID.me or Login.gov, please email [email protected].

Step

2

Once you are registered in ID.me or Login.gov, click on

the link in the email you received requesting the POC designations.

If you do not have the email link, please email us via

[email protected] and we will provide the link.

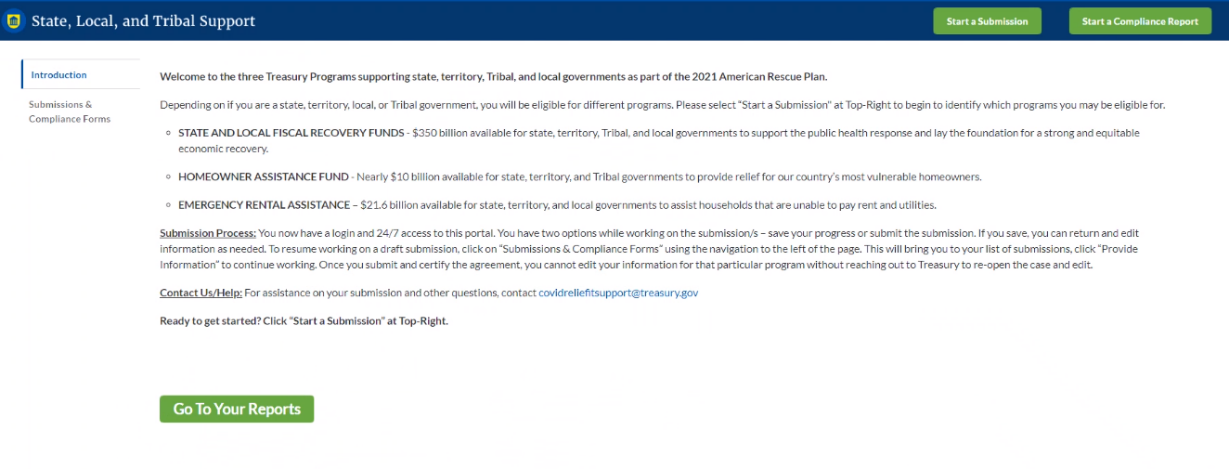

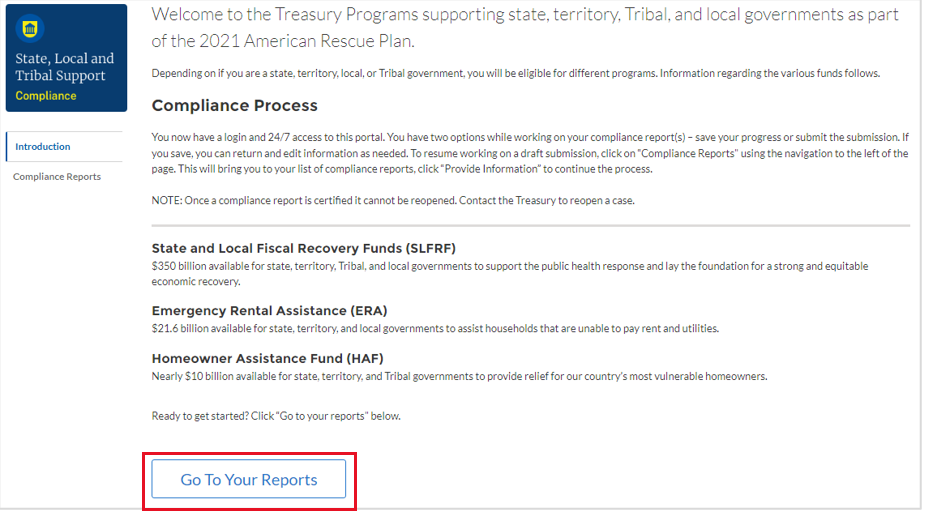

Step

3

The link will take you to the Treasury Portal “State,

Local, and Tribal Support” landing page as shown below. Once

on that page, click on the Go to Your Reports button at the

bottom left of the screen, as indicated in by the red box below.

Figure 48- State, Local, and Tribal Support Landing Page

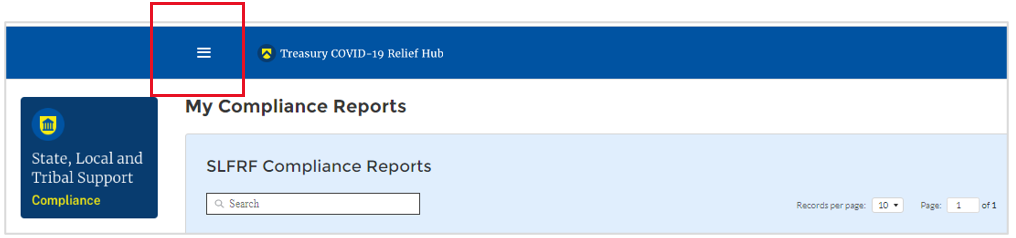

Step

4

The green Go to Your Report button will take you to

the Submissions and Compliance page as shown below. Once on that

page, click on the three-line navigation icon at the top left of the

screen. The red box indicates the icon.

Figure 49- My Compliance Reports

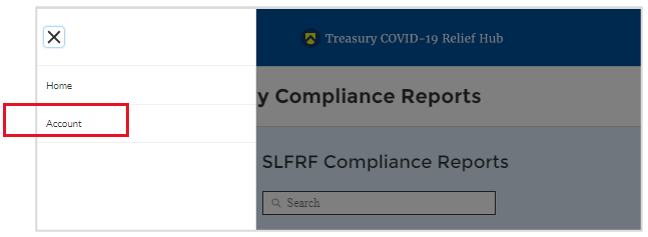

Step

5

After clicking on the three-line navigation icon, a

drop-down menu will appear on the top left of the screen as shown

below. Please click on “Account” from the drop-down

menu, as shown by the red box below.

Figure 50- Account

Step

6

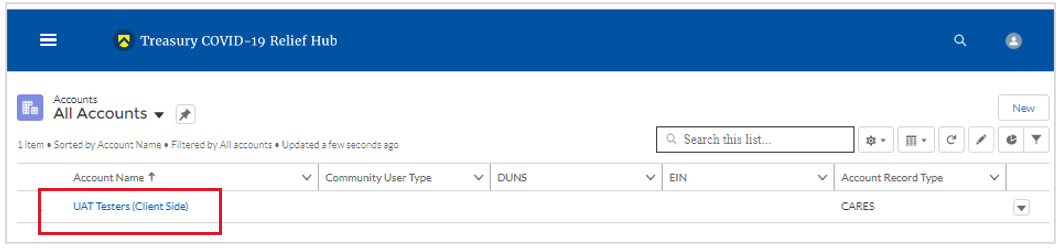

Next you will see the screen below. Under the “Account

Name” heading, click on the name of your organization (as shown

by the red box).

Figure 51 – Account Name

Step

7

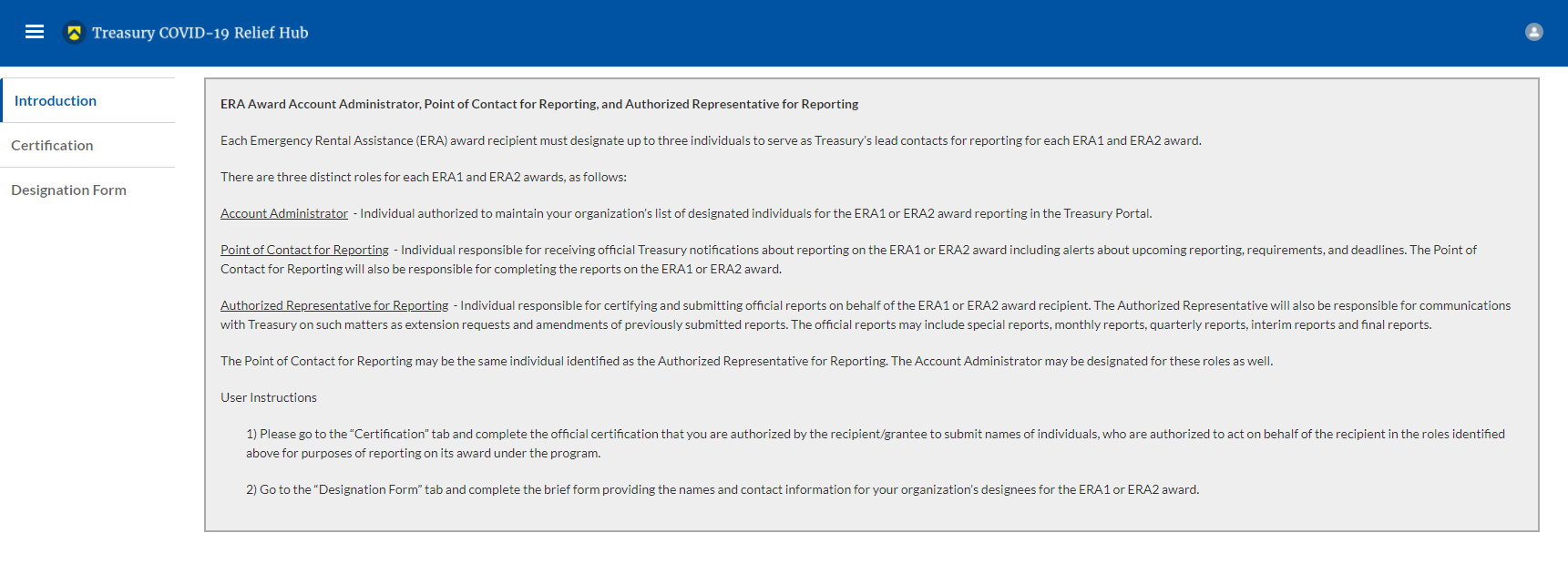

By clicking the name of your organization, Treasury’s

portal will open to allow you to provide names and contact

information on your organization’s designees for the SLFRF

reports, as shown below. The landing page provides basic information

about the designations. Please see section B for more details about

the roles and responsibilities for each or the three roles.

Figure 52 – Landing Page

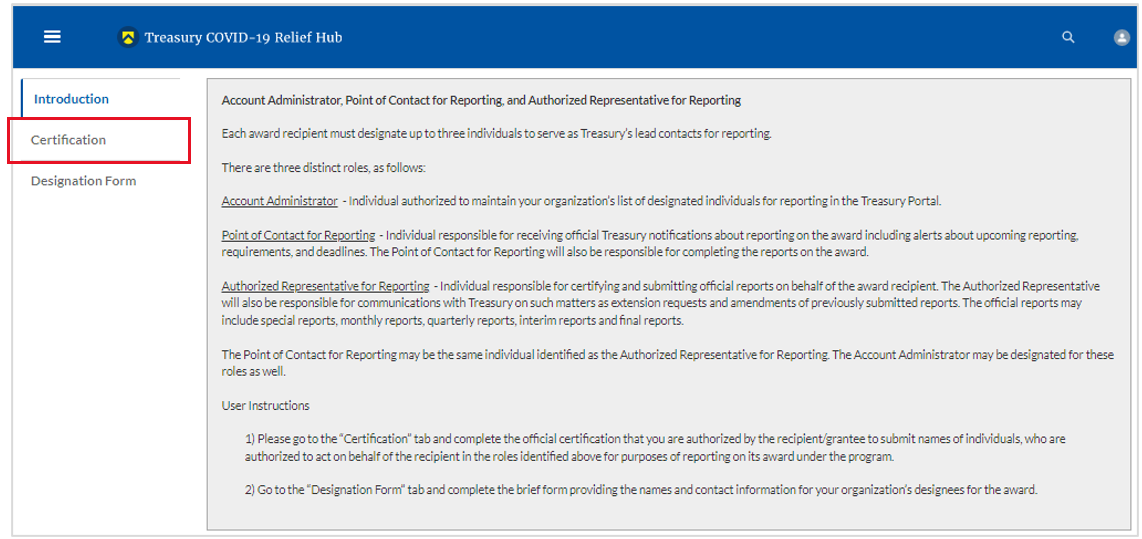

Step

8

When you are ready to key in the names of the designated

individuals, click on the Certification button on the left

navigation bar, as noted in the red box shown below.

Figure 53- Certification

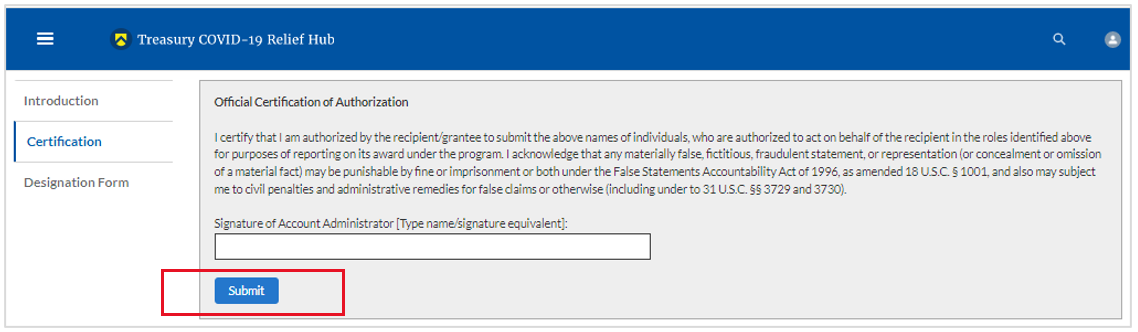

Step

9

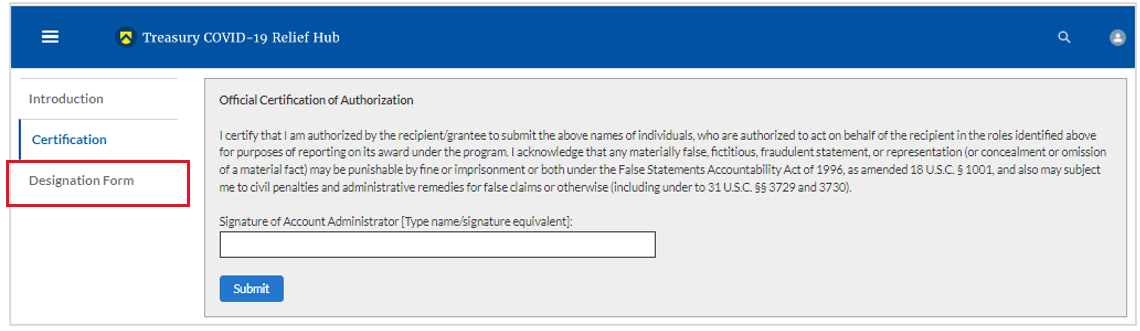

On the “Official Certification of Authorization”

screen, you should type in your name to indicate you are authorized

to submit the names of the designated individuals. Once you enter

your name, click on the Submit button.

Figure 54- Official Certification of Authorization

Step

10

Next, click on the Designation Form button on the

left navigation bar, as noted by the red box shown below.

Figure 55- Designation Form

Step

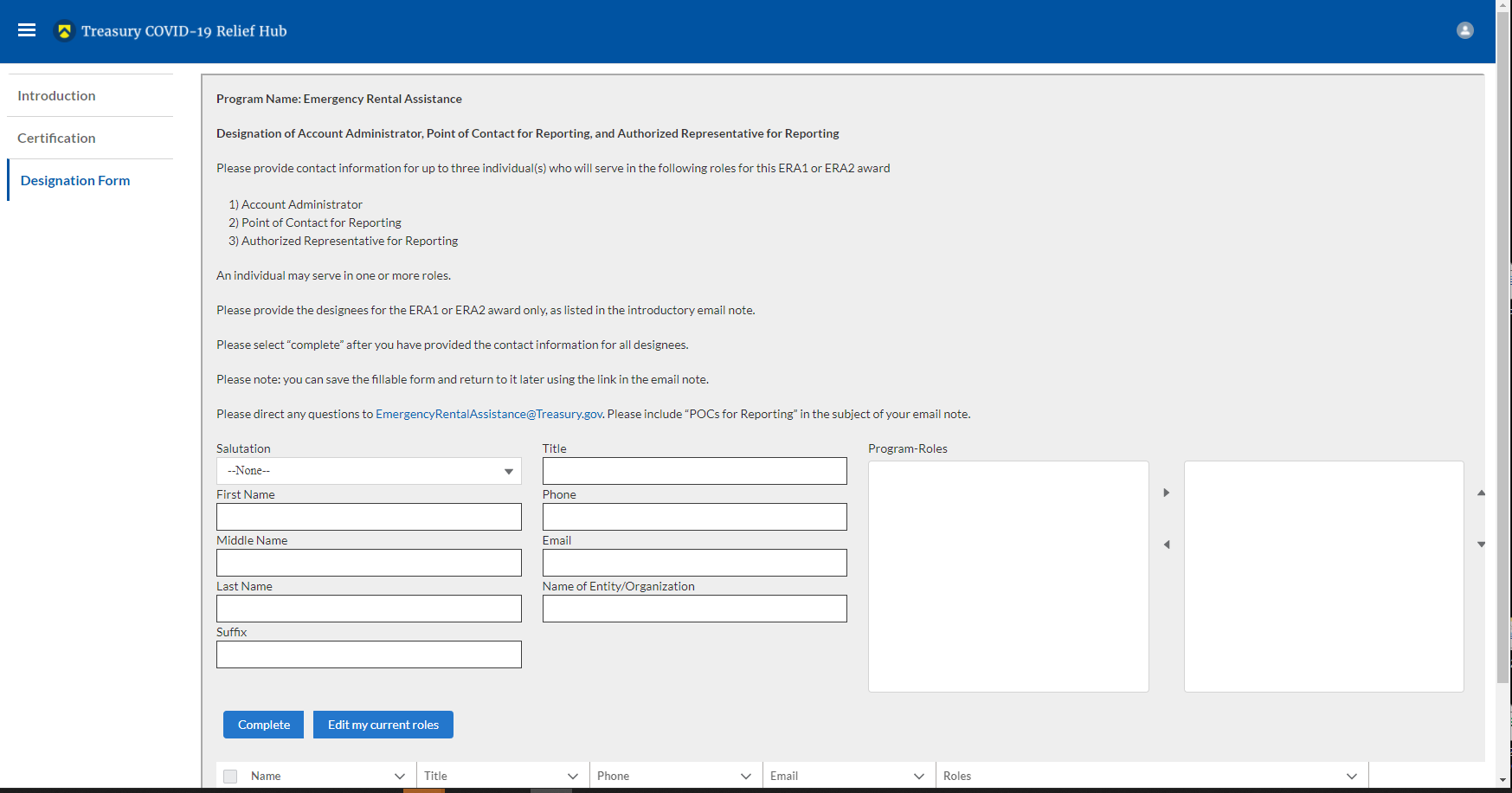

11

Clicking on the Designation Form button will open

the “Designation of Account Administrator, Point of Contact for

Reporting, and Authorized Representative for Reporting” screen

shown below.

Figure 56- Designation of Account Administrator, Point of Contact for Reporting, and Authorized Representative for Reporting

You can use the Designation Form to enter the names and contact information for each of the three designations for each of you SLFRF allocations.

The roles for the SLFRF allocations are displayed as follows:

SLFRF – Account Administrator

SLFRF – Point of Contact for Reporting

SLFRF – Authorized Representative for Reporting

The Designation Form screen shows nine data fields for entering key information about the individual being designated. These include:

Salutation (optional)

First Name

Middle Name (optional)

Last Name

Suffix (optional)

Title

Phone

Email

Name of Entity/Organization (Recipient entity)

Note: The screen will display a list at the bottom of the screen with the names and contact information of individuals (if any) who have previously been designated for any of the three roles. This list will be important in maintaining and updating your organization’s designees in the future.

Designation of the Account Administrator

Remember, we have temporarily authorized you as the SLFRF – Account Administrator. There is no need to re-enter your name and contact information if you plan to continue in that role. If you need to designate someone else as the SLFRF Account Administrator,

Find your name at the bottom of the screen.

Hit the blue Edit button located to right of your name.

Enter the name and contact information of the new SLFRF Account Administrator.

Hit the blue Complete button.

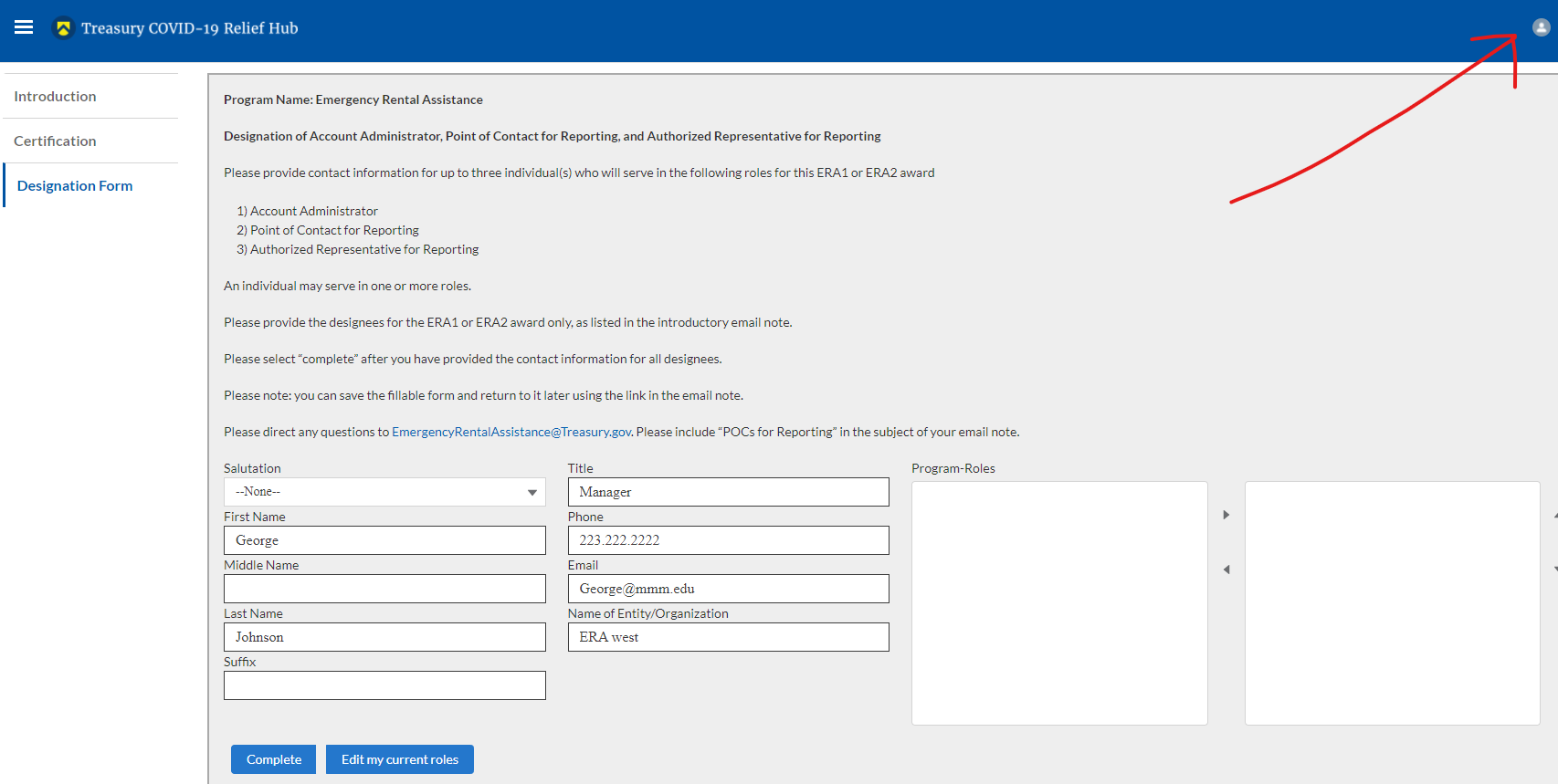

Designation of Point of Contact for Reporting and Authorized Representative for Reporting

Enter the next designee’s name and contact information.

After entering their name and required contact information, select the Program Role(s) for which he/she is being designated.

Once the role is selected, click on the small arrow to the right of the role, which will move the role to the box on the right.

Click on the Complete button at the bottom of the screen.

Follow the same process for each of the remaining designees.

When you have entered all three designations, please press the Complete button.

As a final step, go to the icon on the upper right of the screen as shown below to exit the system.

Figure 57- Designation Form

Section B: Questions and Answers

Who is authorized to designate the Account Administrator, the Point of Contact for Reporting, and the Authorized Representative for Reporting for my organization’s SLFRF’s award?

Treasury requests that each SLFRF should follow its own decision-making procedures in making the three designations for each award.

What is the deadline for making the designation?

Treasury requests that users of Treasury’s portal make the three designations as soon as possible to enable your organization to submit its Interim Report and Recovery Plan Performance Report (if applicable).

What are the responsibilities for each of the three designated roles?

The required roles are as follows:

Account Administrator for the SLFRF award has the administrative role of maintaining the names and contact information of the designated individuals for SLFRF reporting. The Account Administrator is also responsible for working within your organization to determine its designees for the roles of Point of Contact for Reporting and Authorized Representative for Reporting and providing their names and contact information via Treasury’s Portal. The Account Administrator can also view and submit reports. Finally, the Account Administrator is responsible for making any changes or updates as needed over the award period. We recommend that the Account Administrator identify an individual to serve in his/her place in the event of staff changes.

Point of Contact for Reporting is the primary contact for receiving official Treasury notifications about reporting on the SLFRF award, including alerts about upcoming reporting, requirements, and deadlines. The Point of Contact for Reporting is responsible for completing the SLFRF reports but cannot certify and submit these reports.

Authorized Representative for Reporting is responsible for certifying and submitting official reports on behalf of the SLFRF award recipient. Treasury will accept reports or other official communications only when submitted by the Authorized Representative for Reporting. The Authorized Representative for Reporting is also responsible for communications with Treasury on such matters as extension requests and amendments of previously submitted reports. The official reports may include special reports, monthly reports, quarterly reports, interim reports, and final reports.

May

my organization designate one individual for multiple roles?

Yes,

an individual may be designated for multiple roles. For example, the

individual designated as the Account Administrator can also be

designated as the Authorized Representative for Reporting or Point of

Contact for Reporting. It is also acceptable for an organization to

designate one individual for all three roles however it should also

adhere to any applicable rules on personnel checks and balances.

May

my organization designate more than one individual per role?

Yes,

you may designate more than one person per each role but are

encouraged to limit the number of users assigned to each role.

May

my organization change the designations from time to time?

Yes,

an organization may make changes and updates to the list of

designation individuals whenever needed.

Must

each of the designated individuals register for using Treasury’s

Portal?

Yes, everyone designated for any of the roles must

register with ID.me or Login.gov before they will be given access to

Treasury’s portal. Please contact us at the email address

below for more information and guidance on registering with ID.me or

Login.gov. If you are already registered with ID.me, you do not have

to register to Login.gov to access your reports.

Additional

Questions or Additional Assistance?

If you have

additional questions about accessing or using Treasury’s portal

to provide the designees’ names and contact information, please

send us an email via [email protected].

Appendix B – Bulk File Upload Overview

Purpose

This Appendix provides an overview of the SLFRF bulk file upload process. The six (6) bulk file upload templates listed below are presented in the order in which they should be populated and submitted to the SLFRF Treasury Portal. The data requirements for each template can be found in subsequent sections of this Appendix. The templates can be downloaded directly from the State and Local Fiscal Recovery Fund Treasury Portal.

Project Baseline Template (Note: This template will be used for Expenditure Categories (1.1-1.8, 1.10-1.12, 2.6-2.13, 3.6-3.16, 7.1-7.3)

Subrecipient Template

Subaward Template

Expenditures GT $50,000 Template

Aggregate Expenditures LT $50,000 Template

Payments to Individuals LT $50,000 Template

Expenditure Category (EC) Templates

Expenditure Categories (EC) which require additional programmatic data and other information are listed below. The reporting requirements for each EC can be found in Appendix D. .

Project Baseline Template

Project EC 1.9 Template

Project EC 2.1 - 2.5 Template

Project EC 2.14 Template

Project EC 3.1 - 3.5 Template

Project EC 4.1 - 4.2 Template

Project EC 5 Template

Template Description

Each of the bulk file upload templates contains instructions on how to populate the respective fields within each file. When adding content to each template, please follow the “Help” text, which will provide what is and isn’t permitted for each cell. Each Module in the web application provides a link to download the template. All templates have the same structure as described below:

Row 1: Template Version

Row 2: Template Name

Row 3: Instructions: Brief description of the template constraints.

Row 4: Field IDs: Column identifiers

Row 5: Required or Optional: This field specifies if the field is optional or required. When the column is required, and a recipient does not provide the required data, the system will not accept any record or allow the file to be uploaded.

Row 6: Field Name: Brief description of each Field or Column

Row 7: Field Help Text: Provides a description of the column. There are 2 types of fields, 1). an open value either text or numbers and 2). A predefined list of pick list values:

Open Value: Any text or number. Text for State name or a Number that represents amounts. Most text types are free formats, the only expectation is for Dates, each column that represents a date describes the accepted format. For any number field, it is not required to add “,” to represent thousands or it is not required to add “$” to represent currency. Only add decimal “.” when needed.

Pick List: A Predefined list of values that is accepted by the system. When the column is a pick list, row 7 provides the list of options that the system accepts. End users should “copy and paste” the valid value for each record. If the respondent provides a value that is not in the predefined pick list, the system will not accept the file. Responses should not contain double quotes

Row 8: Data that Recipient submits. Row 8 is where recipients insert specific data to submit. The system accepts 1 or many rows.

The following is special guidance for each row or set of rows:

Do not change the content of rows 1 to 7.

Rows 4 to 7 provide metadata of each data element or column of the information that respondents will provide.

Add your data beginning in row 8, column B.

Bulk Upload Process

The upload process includes the following steps:

Download the template from the link provided in the web application section of the module.

Open the template in Microsoft Excel.

Save the template as a .CSV file and change the name of the file as needed.

Add your data starting with row 8, column B of the applicable template.

When you finish adding your data repeat step 4.

Upload the new file to the portal. The system will provide a message if the upload was successful or unsuccessful.

Reuse the same file if the upload process fails. Reconcile the issues that the system indicated and repeat step 7 until all issues are corrected.

Bulk Upload Creation Steps

The collective bulk file upload process is contingent upon end-users following the below steps to ensure successful submission

Note: All data submitted via the bulk upload functionality must be submitted as a .CSV file.

CSV Guidance

Refer to the following link for descriptions of the CSV format.

https://en.wikipedia.org/wiki/Comma-separated_values

Specific CSV characteristics

The date format is: MM/DD/YYYY. Example:

06/22/2021

All currency values are numeric. It is not required to add “,” for thousand or millions.

All currency values should not contain a “$” sign. The file will be rejected if a “$” is included in the data entry.

Once you’ve saved the excel spreadsheet as a .csv file, do not re-open the file. Re-opening the file will cause excel to possible revert to an .xls type file and leading zeros or other issues may occur,

Upload Template Description

Each data element and/or column in the CSV files is described below:

Index No: Reference number for the data element. For internal use only.

Defined term: Column Short description.

Definition: Column long description or definition.

CSV Column Name: The column header name that must be used in the CSV file.

Required: Indicates if the column is required or not required.

List Value: The content of the column is from a list of predefined values. This is valid for some of the columns. The list is provided for all cases. Most of the cases is N/A which means that the type is ether String or Numeric.

Data type: Specify the data type of the column. The options are: Numeric, Text, Date and Pick List.

Max Length: Indicates the maximum length in characters that is allowed for each column.

Project Baseline Template

The downloadable templates provide all information required to create the upload files. The following table highlights the data elements required to complete the Project Baseline Template. Expenditure categories not covered by the Project Baseline Template have a devoted template as described in Appendix C.

Defined Term |

Definition |

Required/ Optional |

List Values |

Data Type |

Max

|

Project Expenditure Category Group

|

Per guidance, this field represents the predefined project expenditure category |