30689 Q_IRS Mobile 30689 Q_IRS Mobile V5_12062021_DOT (1)

E-Government Website Customer Satisfaction Surveys

30689 Q_IRS Mobile V5_12062021_DOT (1).xlsx

OMB: 1090-0008

⚠️ Notice: This form may be outdated. More recent filings and information on OMB 1090-0008 can be found here:

Document [xlsx]

Download: xlsx | pdf

Model Questions

Custom Questions

CQs (10-01-2021)

Attributes

Overview

Welcome and Thank You TextModel Questions

Custom Questions

CQs (10-01-2021)

Attributes

Sheet 1: Welcome and Thank You Text

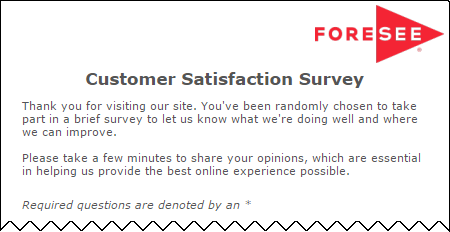

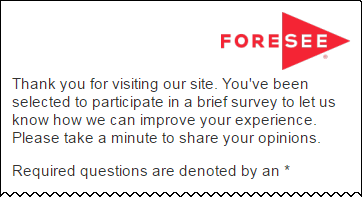

| The text you see here will appear at the top and bottom of your survey, examples below. | |||||

| Default text is included and you may modify this text as needed. | |||||

| Welcome and Thank You Text | |||||

| Welcome Text | Welcome Text - Tablet / Phone | ||||

| Thank you for visiting. You've been randomly chosen to take part in a brief survey to let us know what we're doing well and where we can improve. Please take a few minutes to share your opinions, which are essential in helping us provide the best online experience possible. |

Thank you for visiting. You've been selected to participate in a brief survey to let us know how we can improve your experience. Please take a minute to share your opinions. | ||||

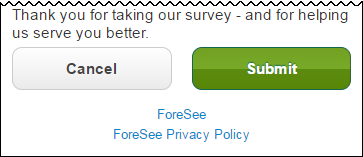

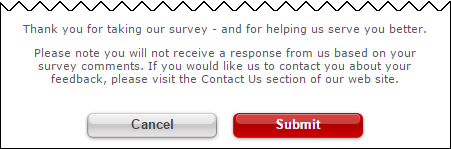

| Thank You Text | Thank You Text - Tablet / Phone | ||||

| Thank you for taking our survey - and for helping us serve you better. Please note you will not receive a response from us based on your survey comments. If you would like us to contact you about your feedback, please visit the Contact Us section of our website. |

Thank you for taking our survey - and for helping us serve you better. We appreciate your input! |

||||

| Example Desktop | Example Mobile | ||||

|

|||||

|

|||||

|

|||||

|

|||||

Sheet 2: Model Questions

| Model Name | IRS Mobile v5 | |||||||

| Model ID | M5tYsVQZUoI4NdAVVtBEUw4C | Underlined & Italicized: Re-order | ||||||

| Partitioned | No | Pink: Addition | ||||||

| Date | ||||||||

| Model Version | NA | Blue: Reword | ||||||

| Label | Element Questions | Label | Satisfaction Questions | Label | Future Behaviors | |||

Sheet 3: Custom Questions

| Model Name | IRS Mobile v5 | |||||||||

| Model ID | M5tYsVQZUoI4NdAVVtBEUw4C | Underlined & Italicized: Re-order | ||||||||

| Partitioned | No | Pink: Addition | ||||||||

| Date | Blue: Reword | |||||||||

| QID | AP Question Tag | Skip From | Question Text | Answer Choices | Skip To | AP Answer Tag | Required Y/N |

Type | Special Instructions | CQ Label |

| PAT0504952 | Please rate your agreement with the following statements about your visit to IRS.gov today: This interaction increased my trust in the IRS. |

1=Strongly Disagree | Y | Radio button, scale, no don't know | Trust | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| PAT0504953 | I am satisfied with the service I received from IRS.gov. | 1=Strongly Disagree | Y | Radio button, scale, no don't know | Satisfaction | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| PAT0504954 | My need was addressed. | 1=Strongly Disagree | 3.1 | Y | Radio button, scale, no don't know | Skip Logic Group* | Quality | |||

| 2 | 3.1 | |||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| SBD9358Q004 | 3.1 | Why was your need not addressed? Please do NOT provide any personal information (name, Social Security number, etc.) in your response. |

N | Text area, no char limit | Skip Logic Group* | OE_Need | ||||

| PAT0504955 | It was easy to complete what I needed to do. | 1=Strongly Disagree | Y | Radio button, scale, no don't know | Ease | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| PAT0504956 | It took a reasonable amount of time to do what I needed to do. | 1=Strongly Disagree | Y | Radio button, scale, no don't know | Efficiency | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| SBD9358Q007 | Who are you visiting IRS.gov today as? (Select all that apply.) | Myself (individual) or on behalf of others (example: family member, spouse or client) | 6.1 | Y | Checkbox, one-up vertical | Skip Logic Group* | Role | |||

| Business (example: corporation, partnership, small business or my employer) | ||||||||||

| Charity or non-profit organization (example: tax exempt entity or government entity) | ||||||||||

| Tax professional (example: accountant, attorney, bank trust officer, enrolled agent, tax consultant or tax preparer) | ||||||||||

| Other | ||||||||||

| SBD9358Q008 | 6.1 | Which situation best describes who you’re helping? (Select all that apply.) | Non-filer of a federal income tax return | N | Checkbox, one-up vertical | Skip Logic Group* | Situation | |||

| First-time federal income tax return filer | ||||||||||

| Employee earning a wage or salary (Standard 1040 Filer) | ||||||||||

| Retiree | ||||||||||

| Earns self-employment income | ||||||||||

| Someone who has employees | ||||||||||

| Foreign national living in the United States | ||||||||||

| US taxpayer living abroad | ||||||||||

| Parent acting on behalf of a child | ||||||||||

| Active duty member of the military | ||||||||||

| Estate administrator acting on behalf of a deceased person and/or their estate | ||||||||||

| Receives disability benefits | ||||||||||

| SBD9358Q009 | What was your reason for visiting IRS.gov today? (Select all that apply.) | Economic impact payment information | Y | Checkbox, one-up vertical | Skip Logic Group* | Primary Reason | ||||

| Refund status | ||||||||||

| Tax forms, publications, or instructions | ||||||||||

| Child tax credit payment information | 7.2 | |||||||||

| Filing or filing information | ||||||||||

| Payments, payment plans or balance information | 7.1 | |||||||||

| Tax records (tax transcript, account transcript, etc.) | ||||||||||

| Tools for tax professionals (e.g., e-services) | ||||||||||

| Free File information | ||||||||||

| Tax Identification Number (EIN, PTIN, ITIN, etc.) | ||||||||||

| Penalties | ||||||||||

| Credits and deduction information | ||||||||||

| Amended tax return status or information | ||||||||||

| Identity theft, fraud, or scams | ||||||||||

| General tax information | ||||||||||

| Seek contact information | ||||||||||

| Other | ||||||||||

| SBD9358Q010 | 7.1 | Please indicate which specific payment tasks describe your visit today. (Select all that apply.) | Make an online payment | N | Checkbox, one-up vertical | Skip Logic Group* | Payment Tasks | |||

| Seek information about payment options | ||||||||||

| Set up an installment agreement or online payment agreement | ||||||||||

| Look-up, modify, or cancel an existing payment | ||||||||||

| Look-up, modify, or cancel an existing payment agreement | ||||||||||

| Check my account balance | ||||||||||

| View my payment history | ||||||||||

| Seek contact information | ||||||||||

| Other | ||||||||||

| SBD9358Q011 | 7.2 | Please indicate which specific child tax credit payment tasks describe your visit today. (Select all that apply.) | Check eligibility status | N | Checkbox, one-up vertical | Skip Logic Group* | Child Tax Credit Tasks | |||

| View payment history | ||||||||||

| Update payment information | ||||||||||

| Update mailing address | ||||||||||

| Unenroll from payments | ||||||||||

| Re-enroll in payments | ||||||||||

| Find general information about the credit | ||||||||||

| SBD9358Q012 | Prior to this visit, what contact have you had with the IRS about your main reason for visiting? (Select all that apply.) | Have not been in contact with the IRS for this reason | Y | Checkbox, one-up vertical | Prior Contact | |||||

| Received a notice or letter from the IRS | ||||||||||

| Called the IRS and spoke to a customer service representative | ||||||||||

| Called the IRS and used the automated phone system to get information | ||||||||||

| Visited an IRS office (Taxpayer Assistance Center) | ||||||||||

| Used the IRS2Go Mobile App | ||||||||||

| Visited IRS.gov | ||||||||||

| SBD9358Q013 | Were you able to log in to (or create an account for) any IRS online tool today? | I did not have to log in or create an account | Y | Radio button, one-up vertical | Log In | |||||

| I successfully logged in or created an account | ||||||||||

| I was unable to log in or create an account | ||||||||||

| SBD9358Q014 | What suggestions do you have to improve existing IRS.gov services? Please do NOT provide any personal information (name, Social Security number, etc.) in your response. |

N | Text area, no char limit | OE_Improve |

Sheet 4: CQs (10-01-2021)

| Model Name | IRS Mobile v5 | |||||||||

| Model ID | M5tYsVQZUoI4NdAVVtBEUw4C | Underlined & Italicized: Re-order | ||||||||

| Partitioned | No | Pink: Addition | ||||||||

| Date | Blue: Reword | |||||||||

| QID | AP Question Tag | Skip From | Question Text | Answer Choices | Skip To | AP Answer Tag | Required Y/N |

Type | Special Instructions | CQ Label |

This interaction increased my trust in the IRS. |

||||||||||

| NEW | Please rate your agreement with the following statements about your visit to IRS.gov today: This interaction increased my trust in the IRS. |

1=Strongly Disagree | Y | Radio button, scale, no don't know | Trust | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| NEW | I am satisfied with the service I received from IRS.gov. | 1=Strongly Disagree | Y | Radio button, scale, no don't know | Satisfaction | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| NEW | My need was addressed. | 1=Strongly Disagree | 3.1 | Y | Radio button, scale, no don't know | Skip Logic Group* | Quality | |||

| 2 | 3.1 | |||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| SBD9358Q004 | 3.1 | Why was your need not addressed? Please do NOT provide any personal information (name, Social Security number, etc.) in your response. |

N | Text area, no char limit | Skip Logic Group* | OE_Need | ||||

| NEW | It was easy to complete what I needed to do. | 1=Strongly Disagree | Y | Radio button, scale, no don't know | Ease | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| NEW | It took a reasonable amount of time to do what I needed to do. | 1=Strongly Disagree | Y | Radio button, scale, no don't know | Efficiency | |||||

| 2 | ||||||||||

| 3 | ||||||||||

| 4 | ||||||||||

| Strongly Agree=5 | ||||||||||

| SBD9358Q007 | Who are you visiting IRS.gov today as? (Select all that apply.) | Myself (individual) or on behalf of others (example: family member, spouse or client) | 6.1 | Y | Checkbox, one-up vertical | Skip Logic Group* | Role | |||

| Business (example: corporation, partnership, small business or my employer) | ||||||||||

| Charity or non-profit organization (example: tax exempt entity or government entity) | ||||||||||

| Tax professional (example: accountant, attorney, bank trust officer, enrolled agent, tax consultant or tax preparer) | ||||||||||

| Other | ||||||||||

| SBD9358Q008 | 6.1 | Which situation best describes who you’re helping? (Select all that apply.) | Non-filer of a federal income tax return | N | Checkbox, one-up vertical | Skip Logic Group* | Situation | |||

| First-time federal income tax return filer | ||||||||||

| Employee earning a wage or salary (Standard 1040 Filer) | ||||||||||

| Retiree | ||||||||||

| Earns self-employment income | ||||||||||

| Someone who has employees | ||||||||||

| Foreign national living in the United States | ||||||||||

| US taxpayer living abroad | ||||||||||

| Parent acting on behalf of a child | ||||||||||

| Active duty member of the military | ||||||||||

| Estate administrator acting on behalf of a deceased person and/or their estate | ||||||||||

| Receives disability benefits | ||||||||||

| SBD9358Q009 | What was your reason for visiting IRS.gov today? (Select all that apply.) | Economic impact payment information | Y | Checkbox, one-up vertical | Skip Logic Group* | Primary Reason | ||||

| Refund status | ||||||||||

| Tax forms, publications, or instructions | ||||||||||

| Child tax credit payment information | 7.2 | |||||||||

| Filing or filing information | ||||||||||

| Payments, payment plans or balance information | 7.1 | |||||||||

| Tax records (tax transcript, account transcript, etc.) | ||||||||||

| Tools for tax professionals (e.g., e-services) | ||||||||||

| Free File information | ||||||||||

| Tax Identification Number (EIN, PTIN, ITIN, etc.) | ||||||||||

| Penalties | ||||||||||

| Credits and deduction information | ||||||||||

| Amended tax return status or information | ||||||||||

| Identity theft, fraud, or scams | ||||||||||

| General tax information | ||||||||||

| Seek contact information | ||||||||||

| Other | ||||||||||

| SBD9358Q010 | 7.1 | Please indicate which specific payment tasks describe your visit today. (Select all that apply.) | Make an online payment | N | Checkbox, one-up vertical | Skip Logic Group* | Payment Tasks | |||

| Seek information about payment options | ||||||||||

| Set up an installment agreement or online payment agreement | ||||||||||

| Look-up, modify, or cancel an existing payment | ||||||||||

| Look-up, modify, or cancel an existing payment agreement | ||||||||||

| Check my account balance | ||||||||||

| View my payment history | ||||||||||

| Seek contact information | ||||||||||

| Other | ||||||||||

| SBD9358Q011 | 7.2 | Please indicate which specific child tax credit payment tasks describe your visit today. (Select all that apply.) | Check eligibility status | N | Checkbox, one-up vertical | Skip Logic Group* | Child Tax Credit Tasks | |||

| View payment history | ||||||||||

| Update payment information | ||||||||||

| Update mailing address | ||||||||||

| Unenroll from payments | ||||||||||

| Re-enroll in payments | ||||||||||

| Find general information about the credit | ||||||||||

| SBD9358Q012 | Prior to this visit, what contact have you had with the IRS about your main reason for visiting? (Select all that apply.) | Have not been in contact with the IRS for this reason | Y | Checkbox, one-up vertical | Prior Contact | |||||

| Received a notice or letter from the IRS | ||||||||||

| Called the IRS and spoke to a customer service representative | ||||||||||

| Called the IRS and used the automated phone system to get information | ||||||||||

| Visited an IRS office (Taxpayer Assistance Center) | ||||||||||

| Used the IRS2Go Mobile App | ||||||||||

| Visited IRS.gov | ||||||||||

| SBD9358Q013 | Were you able to log in to (or create an account for) any IRS online tool today? | I did not have to log in or create an account | Y | Radio button, one-up vertical | Log In | |||||

| I successfully logged in or created an account | ||||||||||

| I was unable to log in or create an account | ||||||||||

| SBD9358Q014 | What suggestions do you have to improve existing IRS.gov services? Please do NOT provide any personal information (name, Social Security number, etc.) in your response. |

N | Text area, no char limit | OE_Improve |

Sheet 5: Attributes

| Attribute | Value |

| Channel | Mobile |

| Touchpoint Name | Browse |

| Hierarchy | No |

| Model Type | NonModel |

| Journey Phase | Consideration |

| Touchpoint Type | Standard |

| Partner Involved | No |

| Replay | No |

| Version Number of Model Template | NA |

| Survey Type | NONMODEL |

| Look and Feel | Single Page |

| Theme Color | #000000 |

| File Type | application/vnd.openxmlformats-officedocument.spreadsheetml.sheet |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy