Initial Supplemental Report

Emergency Capital Investment Program Reporting

5. ECIP Reporting ISR instructions Banks and HoldCos - final 3.30.2022

Initial Supplemental Report

OMB: 1505-0275

U.S. Department of the Treasury |

Emergency Capital Investment Program |

Instructions for the Initial Supplemental Report for Insured Depository Institutions, Bank Holding Companies, and Savings and Loan Holding Companies |

Contents

I. General Instructions 2

A. Who Must Report on Which Forms 2

B. Definitions and Rules of Practice 2

C. Organization of These Instructions 2

D. Submission of the Report: Schedule A–Baseline Qualified Lending Calculation 2

E. Submission of the Report: Schedule B–Disaggregated Data on Qualified Lending and Deep Impact Lending 4

F. Lending Activity 5

G. Qualified Lending 6

II. Schedule A–Baseline Qualified Lending Calculation 7

A. General Instructions for Schedule A–Baseline Qualified Lending Calculation 7

B. Line Item Instructions for Schedule A–Baseline Qualified Lending Calculation 7

III. Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending 9

A. General Instructions for Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending 9

B. Line Item Instructions For Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending 10

IV. Glossary 11

Every institution (Applicant) seeking to participate in the Emergency Capital Investment Program (ECIP) of the U.S. Department of the Treasury (Treasury) is required to submit an Initial Supplemental Report no later than 10 business days before the closing date of its ECIP investment. For example, if an Applicant’s ECIP closing date is Tuesday, May 24, 2022, then the Applicant must submit this report by Tuesday, May 10, 2022.

The purpose of the Initial Supplemental Report is to establish the baseline amount of Qualified Lending, as defined in the Glossary, by an Applicant, which will be used to measure increases in Qualified Lending in subsequent years during the ECIP investment period. The baseline is established by measuring the amount of Qualified Lending during the baseline year, which is the one-year period ending on September 30, 2020. For Applicants that are bank holding companies or savings and loan holding companies, the baseline is established by measuring the aggregate amount of Qualified Lending by the bank holding company or savings and loan holding company’s insured depository institution subsidiaries during the baseline year.

Insured depository institutions, bank holding companies, and savings and loan holding companies should use these instructions to complete the Initial Supplemental Report. Credit unions should use the Instructions for the Initial Supplemental Report for Credit Unions, not this document. Applicants must prepare and file the Initial Supplemental Report in accordance with these instructions.

The Initial Supplemental Report has two schedules. Schedule A–Baseline Qualified Lending Calculation is used to calculate the baseline amount of Qualified Lending, subject to a floor and ceiling as described below. Schedule B–Disaggregated Data on Qualified Lending and Deep Impact Lending is used to present further detail on the composition of the Applicant’s Qualified Lending. Both schedules must be completed using a spreadsheet template, available on the ECIP website, and uploaded to the ECIP Portal, as described below.

If you have general questions regarding this form, please contact the Emergency Capital Investment Program at [email protected].

Unless otherwise stated, the Initial Supplemental Report and the Instructions for the Initial Supplemental Report incorporate the definitions and general rules of practice embodied in the Consolidated Reports of Condition and Income for Banks (Call Report), as well as the instructions pertaining thereto, or the Call Report of the bank holding company or savings and loan holding company’s insured depository institution subsidiaries.

These instructions are divided into three sections:

General Instructions describing overall reporting requirements.

General Instructions and Line-Item Instructions for Schedule A–Baseline Qualified Lending Calculation and Schedule B–Disaggregated Data on Qualified Lending and Deep Impact Lending

A Glossary of terms.

Each Applicant seeking to participate in the ECIP must file its Schedule A–Baseline Qualified Lending Calculation through the ECIP Portal using the following steps:

The person filling out the report must have a sign-on account with ID.me to validate his or her identity prior to accessing the ECIP Portal. Instructions for registering for an ID.me account can be found here: ID.me registration instructions.

Download the Baseline Qualified Lending Summary Template corresponding to your institution type from the ECIP Portal. There are separate templates for credit unions and banks or holding companies. Do not change any formatting, add rows or columns, or make any other alteration to the template. Once filled out, the template must be uploaded in a .csv format.

Prepare your Qualified Lending data in accordance with these instructions and fill out the template. Do not enter commas, decimal points, dollar signs, letters, or symbols. Applicants are strongly encouraged to enter zeros in any column or row for which the Applicant does not have origination data to report. Blank cells will be treated as zeros. All fields must be completed. Please double-check all figures before submitting a report. Save the completed template as a local file on your computer or your network.

Log into the ECIP Portal online, click on the “Initial Supplemental Report” tab, and upload your template using the “file upload” option.

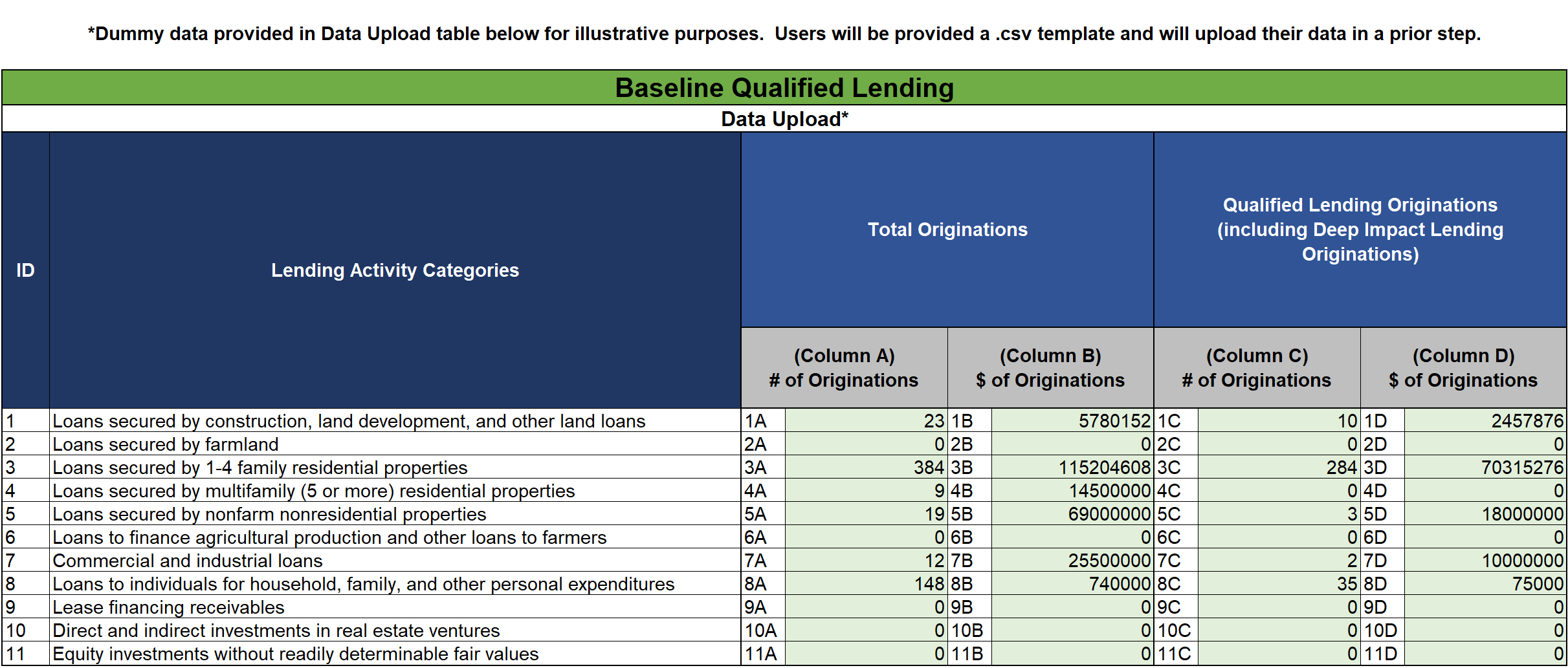

Once uploaded, the “Baseline Qualified Lending” tab will generate an output report based on the data entered in the template, which will look similar to the example table below. Review the output report and confirm that the data is presented accurately. If any data is incorrect, make changes to your .csv file and repeat the steps to upload the corrected report.

You will be presented with a Data Output table and Data Reference table. The Data Output table, like the example below, will display the Total Originations and Total Qualified Lending calculated based on the data reported in your .csv file. Please see the Line-Item Instructions for Schedule A–Baseline Qualified Lending Calculation (Section II.B) in these instructions for more information on how items 12A and 12B are calculated. Review items 12A and 12B for accuracy. If the results do not match your expected results, please review the .csv file for any errors and upload a corrected version.

![]()

The Data Reference table, like the example below, provides several reference points which will be calculated by the system to assist you in determining whether your determination of Baseline Qualified Lending is within the anticipated range. Please see the Line-Item Instructions for Schedule A–Baseline Qualified Lending Calculation (Section II.B) in these instructions for more information on how items 13A, 13B and 13C are calculated.

![]()

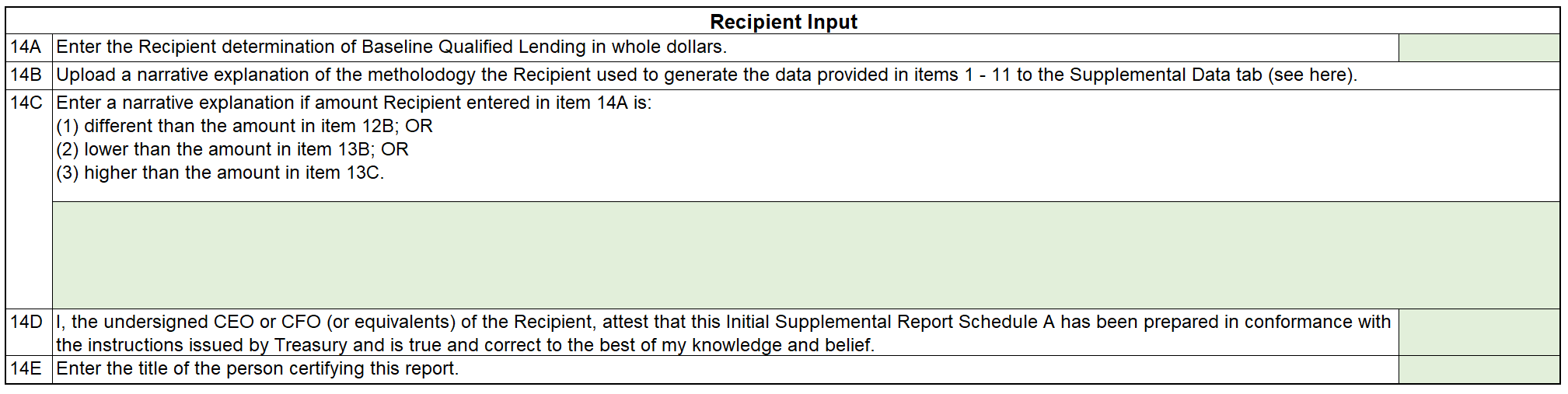

You will be presented with Recipient Input fields, like the example below. Report your Baseline Qualified Lending in item 14A. Please see the Line-Item Instructions for Schedule A–Baseline Qualified Lending Calculation (Section II.B) in these instructions for more information on how to determine Baseline Qualified Lending. You will be required to attach a narrative explanation if the Applicant reports an amount in item 14A that is either: (i) different than the amount listed in item 12B; (ii) lower than the amount in item 13B; or (iii) higher than the amount listed in item 13C.

Either the CEO or CFO of the Applicant must print their name in item 14D to sign the report, certifying that all of the amounts listed in the report are complete and accurate. Print the title of the person certifying the report in item 14E.

Attach a narrative explanation of the methodology the Applicant used to generate the data in lines 1-11, to enable Treasury to assess consistency with ECIP program requirements.1 Provide a level of detail in the narrative that would allow your organization to reproduce the report at a later point in time. If there are specific systems or datasets that were used to produce the report, it may be helpful to provide specific references to those sources (e.g., a report out of system X was used to calculate Y). Upload the narrative explanation as a PDF file, using the “file upload” option under the “Baseline Qualified Lending Methodology” heading in the ECIP Portal.

Once the required fields are completed and the narrative uploaded, click “Save.”

Submission of the Report: Schedule B–Disaggregated Data on Qualified Lending and Deep Impact Lending

The person filling out the report must have a sign-on account with ID.me to validate his or her identity prior to accessing the ECIP Portal.

Download the Disaggregated Data template corresponding to your institution type from the ECIP Portal. There are separate templates for credit unions and banks or holding companies. Do not change any formatting, add rows or columns, or make any other alteration to the template. Once filled out, the template must be uploaded in a .csv format.

Prepare your disaggregated data in accordance with these instructions and fill out the template. Do not enter commas, decimal points, dollar signs, letters, or symbols. Applicants are strongly encouraged to enter zeros in any column or row for which the Applicant does not have origination data to report. Blank cells will be treated as zeros. All fields must be completed. Please double-check all figures before submitting a report. Save the completed template as a local file on your computer or your network.

Log into the ECIP Portal online, click on the “Initial Supplemental Report” tab, and upload your template using the “file upload” option.

Once uploaded, the “Disaggregated Qualified Lending” tab will generate an output report based on the data entered in the template. Review the output report and confirm that the data is presented accurately. If any data is incorrect, make changes to your .csv file and repeat the steps to upload the corrected report.

Attach a narrative explanation of the methodology the Applicant used to generate the data in lines 1-11, to enable Treasury to assess consistency with ECIP program requirements.2 Provide a level of detail in the narrative that would allow your organization to reproduce the report at a later point in time. If there are specific systems or datasets that were used to produce the report, it may be helpful to provide specific references to those sources (e.g., A report out of system X was used to calculate Y). Upload the narrative explanation as a PDF file, using the “file upload” option under the “Baseline Qualified Lending Methodology” heading in the ECIP Portal.

Either the CEO or CFO of the Applicant must print their name to submit the report. Print the title of the person submitting the report.

Click “Save” to complete submission of Schedule B.

The Applicant must report all Qualified Lending, as defined in the Glossary, for the period from October 1, 2019 to September 30, 2020. Qualified Lending is a subset of Lending Activity, as defined in the Glossary and in this section of these instructions, and thus, an Applicant should first identify its Lending Activity. Only Lending Activity that can be verified as meeting the definition of Qualified Lending should be included in the Initial Supplemental Report.

Applicants that are bank holding companies or savings and loan holding companies should aggregate data for all of the holding company’s insured depository institution subsidiaries.

Components of Lending Activity. For purposes of the baseline, Lending Activity includes:

all new extensions of credit that would be reportable during the baseline year in the Call Report or equivalent regulatory report;

loans originated and sold during the baseline year, even if not reportable in the Call Report or equivalent regulatory report due to such sale;

purchases of or participations in loans during the baseline year made by non-depository CDFI loan funds that were originated within one year of purchase by the institution;

open-ended extensions of credit if the credit was originated during the baseline year; and

direct and indirect investments during the baseline year in real estate ventures and equity investments without readily determinable fair values.

Exclusions. Notwithstanding anything to the contrary in these instructions, Lending Activity excludes:

for banking organizations, any loans made under the Paycheck Protection Program;

the portion of any loan for which, on the date of origination, a third party other than the U.S. government assumed the credit risk of the loan; and

any loan that is an extension or renewal of any existing loan unless it involves an increase of 20% or more in the principal amount of the loan, in which case the entire loan amount, including the increase, is eligible for inclusion.

Originations. Report new loans and extensions of credit completed during the reporting period. Report loans originated and sold during the baseline year as long as the loan was not sold on the day of origination.

Lines of Credit. Report the full amount authorized (the maximum credit limit) for an open-ended extension of credit if the credit was established during the baseline year. For example, if the Applicant established a $2 million line of credit during the baseline year, include $2 million in Lending Activity. A line of credit that is an extension or renewal of an existing line of credit is excluded from Lending Activity unless it involves an increase of 20% or more in the principal amount of the line of credit, in which case the entire authorized amount, including the increase, is eligible for inclusion. Funds drawn on a line of credit that was established before the baseline year must not be included in Lending Activity.

Loan Purchases. Report the purchase price for purchases of or participations in loans during the baseline year made by non-depository CDFI loan funds that were originated within one year of purchase by the institution.

Investments. Direct and indirect investments in real estate and equity investments without readily determinable fair values should be calculated on a cash basis. These investment categories include equity investments that are public welfare investments and community development investments. Do not report unfunded investment commitments.

Lending Activity Categories. The Lending Activity categories are defined based on the instructions to the Call Report. For example, Lending Activity reportable on Line 1 in Schedule A–Baseline Qualified Lending Calculation is originations of loans that would be classified as “Loans secured by construction, land development, and other land loans” on the Call Report or equivalent regulatory report. The Initial Supplemental Report measures loan originations, not loan balances. Do not report balances from the Call Report Schedule RC.

Mergers, Acquisitions or Business Combinations. If the Applicant has completed a merger, acquisition, or other business combination with another institution prior to the date of closing of the ECIP investment, include the Lending Activity of the acquired institution for the entire baseline year in your report.

Total Originations. In Schedule A and Schedule B, applicants should report their total Lending Activity for the baseline year in the columns that ask for “Total Originations,” including Lending Activity that is not Qualified Lending or Deep Impact Lending. In Schedule A–Baseline Qualified Lending Calculation, “Total Originations” are reported in columns A and B. In Schedule B–Disaggregated Data on Qualified Lending and Deep Impact Lending, “Total Originations” are reported in column A. Activity that is excluded from Lending Activity, such as loan extensions or renewals unless there is an increase of 20% or more in the principal amount of the loan, must not be included in “Total Originations.”

Target Communities. Qualified Lending is a subset of Lending Activity. Lending Activity is considered Qualified Lending or Deep Impact Lending if it is made to one of the Target Communities in the table below. Refer to the Glossary to these instructions for further information on the categories of Target Communities.

Place-based Categories of Target Communities. To determine whether a loan is made to a place-based Target Community in the table below (for example, whether a loan is made to a Rural Community), use the address of the real property for loans collateralized by real property, and the address of the borrower for all other lending.

Purchases of Loans Made by Non-depository CDFI Loan Funds. As noted above, Lending Activity includes purchases of or participations in loans during the baseline year made by non-depository CDFI loan funds that were originated within one year of purchase by the institution. These purchases or participations are only eligible to qualify as Qualified Lending or Deep Impact Lending if the underlying loan is made to a Target Community listed in the table below.

TABLE 1–TARGET COMMUNITIES

Qualified Lending and Deep Impact Lending. For the purposes of the baseline, Qualified Lending and Deep Impact Lending count equally. Report Deep Impact Lending as part of Qualified Lending in Schedule A–Baseline Qualified Lending Calculation.

Loans to Multiple Target Communities. A loan or investment may be to more than one target community. For example, a loan may be made to a Low-income Borrower in a Persistent Poverty County. In Schedule A–Baseline Qualified Lending Calculation, each loan must only be counted towards Qualified Lending once. That is, a loan should be counted towards Qualified Lending if it is made to any of the target communities outlined above.

Baseline Lending Floor. An institution’s Qualified Lending baseline will be subject to a floor determined based on the lending reported by the institution for fiscal year 2020 in Question 1(a) in the institution’s Emergency Investment Lending Plan. The Line-Item Instructions for items 13A and 13B in Schedule A–Baseline Qualified Lending Calculation provide more information on how the floor is calculated. Treasury expects that an institution’s Qualified Lending baseline will generally be higher than the calculated floor because the scope of lending activity that would be considered Qualified Lending is broader than the scope of lending activity that was reportable in Question 1(a) in the Emergency Investment Lending Plan.

Narrative Explanation. Applicants may determine which of their Lending Activity meets the definitions of Qualified Lending by: (i) geocoding their loans against the Place-based categories of Target Communities; (ii) using Home Mortgage Disclosure Act data; and (iii) any other methodology or data which reasonably identifies Qualified Lending. The narrative should describe which methodology, or combination of methodologies, applicants used to identify their Qualified Lending.

1 - 11. For each of lines 1 through 11, report originations of the loans or investments described in the line number. For example, in line 1, report originations of loans that would be classified as “Loans secured by construction, land development, and other land loans” on the Call Report or equivalent regulatory report. In column A, report the total number of loan originations or investments. In column B, report the dollar value of total loan originations or investments. In column C, report the number of loan originations or investments that meet the definition of Qualified Lending. In column D, report the dollar value of originations or investments that meet the definition of Qualified Lending.

12A. Total Originations. This is the sum of all Lending Activity by the Applicant for the baseline year. This amount should equal the sum of column B (items 1B through 11B).

12B. Total Qualified Lending. This is the sum of all Qualified Lending (including Deep Impact Lending) reported by the Applicant for the baseline year. This amount should equal the sum of column D (items 1D through 11D).

13A. % 2020 LMI and OTP Lending. Item 13A is calculated using data reported in Question 1(a) of the Emergency Investment Lending Plan (EILP Question 1(a)) that was submitted to Treasury as part of the Applicant’s ECIP application. The table below shows part of EILP Question 1(a).

Where “Lending by the Applicant to LMI and Other Targeted Populations” is the sum of (a) lending made directly to LMI borrowers (item 2 of EILP Question 1(a)); (b) lending made directly to Other Targeted Populations not included in item 2 (item 3 of EILP Question 1(a)); (c) lending made to borrowers or projects that create direct benefits for LMI populations not already included in items 2 and 3 (item 4 of EILP Question 1(a)); and (d) lending made to borrowers in census tracts that are majority Other Targeted Populations not already included in items 2, 3, and 4 (item 5 of EILP Question 1(a)). “Loans originated during FY 2020” is total loans (item 1 of EILP Question 1(a)).

That

is,

13B. Floor for Baseline Qualified Lending. Item 13B is the floor for the Baseline Qualified Lending for the Applicant. Item 13B is calculated by multiplying total originations (item 12A) by the percentage of lending to LMI and Other Targeted Populations (item 13A).

13C. Ceiling for Baseline Qualified Lending. Item 13C is the ceiling for the Baseline Qualified Lending for the Applicant. The baseline ceiling is total originations (item 12A). Baseline Qualified Lending may not be more than total originations.

14A. Baseline Qualified Lending. Report the Baseline Qualified Lending for the Applicant, which should be calculated using the following steps:

Is total Qualified Lending in item 12B higher than the floor for Baseline Qualified Lending in item 13B AND lower than the ceiling for Baseline Qualified Lending in item 13C?

If yes: The Baseline Qualified Lending is equal to total Qualified Lending in item 12B.

If no: Continue to (ii)

Is total Qualified Lending in item 12B lower than the floor for Baseline Qualified Lending in item 13B?

If yes: The Baseline Qualified Lending is equal to the floor for Baseline Qualified Lending in item 13B.

If no: Continue to (iii)

Is total Qualified Lending in item 12B higher than the ceiling for Baseline Qualified Lending in item 13C?

If yes: The Baseline Qualified Lending is equal to the ceiling for Baseline Qualified Lending in item 13C.

If no: Please confirm your inputs are accurate.

Treasury will use the value reported in item 14A, subject to Treasury review as necessary, as the Applicant’s Baseline Qualified Lending for purposes of calculating the dividend or interest rate payable on the ECIP instruments issued by the Applicant in accordance with the terms of the instruments.

14B. Narrative Explanation for Schedule A. Attach a narrative explanation of the methodology the Applicant used to generate the data in lines 1-11.

14C. Narrative Explanation for Baseline Qualified Lending. Enter a narrative explanation if the amount entered in item 14A is either (i) different than the amount in item 12B; (ii) lower than the amount in item 13B; or (iii) higher than the amount in item 13C.

14D. CEO or CFO Certification. Either the CEO or CFO (or persons performing equivalent functions) of the Applicant must electronically certify the accuracy of Schedule A by typing their name in item 14D.

14E. CEO or CFO Title. Identify whether the certification in item 14D was provided by the CEO or CFO (or equivalent) of the Applicant.

General Instructions for Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending

Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending collects Lending Activity by Qualified Lending or Deep Impact Lending category. Since Schedule B collects historical data based on demographic or other borrower characteristics Applicants may not have access to, Applicants should report data in Schedule B on a best-efforts basis using data that is reasonably available to the Applicant. Applicants are not required to collect demographic or other borrower characteristics that they do not already have access to solely for the purpose of completing Schedule B.

Loans to Multiple Target Communities. A loan or investment may be to more than one target community. For example, a loan may be made to a Low-income Borrower in a Persistent Poverty County. In Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending, report each loan in each applicable target community category. For example, a loan made to a Low-income Borrower in a Persistent Poverty County must be included in both columns D and J. The same loan or investment may be included in both Qualified Lending and Deep Impact Lending. Since a single loan may be reported in more than one column, Treasury expects that aggregating lending activity across columns (such as adding together items 2B through 2S) will not equal values reported in Schedule A-Baseline Qualified Lending Calculation and will not provide useful data points.

Purchases of Loans Made by Non-depository CDFI Loan Funds. As noted above, Lending Activity includes purchases of or participations in loans during the baseline year made by non-depository CDFI loan funds that were originated within one year of purchase by the institution. In Schedule B, include as Deep Impact Lending purchases of or participations in loans during the baseline year made by non-profit non-depository CDFI loan funds that were originated within one year of purchase by the institution AND that were made to a Target Community listed under Deep Impact Lending in the table above (e.g., Persistent Poverty Counties). Purchases of or participations in loans during the baseline year made by for-profit non-depository CDFI loan funds may only be included as Qualified Lending and not Deep Impact Lending even if they were made to a Target Community listed under Deep Impact Lending in the table above.

Line Item Instructions For Schedule B – Disaggregated Data on Qualified Lending and Deep Impact Lending

1 – 11. For each of lines 1 through 11, report originations of the loans or investments described in the line number. For example, in line 1, report originations of loans that would be classified as “Loans secured by construction, land development, and other land loans” on the Call Report or equivalent regulatory report. In column A, report the dollar value of total loan originations or investments. In columns B through S, report the dollar value of originations or investments that can be identified as having been made to the Target Community in the column heading, as defined in the Glossary. For example, in column B, report originations or investments that were made to LMI Borrowers, as defined in the Glossary. In column P, report originations or investments that are Public Welfare and Community Development Investments, as defined in the Glossary, if they primarily benefit LMI Borrowers or communities. In column S, report originations or investments that are Public Welfare and Community Development Investments, as defined in the Glossary, if they primarily benefit Low-Income Borrowers, Minority borrowers, or Minority Businesses.

12. Total. Report the total for each column (lines 1 through 11).

13A. CEO or CFO Certification. Either the CEO or CFO (or persons performing equivalent functions) of the Applicant must electronically submit Schedule B by typing their name in item 13A.

13B. CEO or CFO Title. Identify whether the confirmation in item 13A was provided by the CEO or CFO (or equivalent) of the Applicant.

The following definitions apply to the Initial Supplemental Report and these instructions.

“Affordable Housing” means financing for any affordable housing development project that has received a funding allocation under a state’s Low-Income Housing Tax Credit (LIHTC) program (9% or 4% credits) or from a U.S. Department of Housing and Urban Development grantee utilizing HOME or Housing Trust Fund grant funds.

“Area Median Income” means the estimated median family income as defined in the “Census and Federal Financial Institutions Examining Council Estimated MSA/MD Median Family Income for 2020 CRA/HMDA Reports” file located at: https://www.ffiec.gov/Medianincome.htm.

“Community Service Facility” means financing of a facility that is a “community service facility” as defined in 26 USC § 42(d)(4)(C)(iii) and that is underwritten on the basis of primarily serving Low-Income Borrowers or Other Targeted Populations or are sponsored by a unit of government to serve Low-Income Borrowers or Other Targeted Populations.

“Deep Impact Lending” is a subset of Qualified Lending. Lending Activity is considered Deep Impact Lending if it is made to one of the Target Communities listed in the “Deep Impact Lending” column in Table 1–Target Communities in these instructions.

“Deeply Affordable Housing” means financing for any (1) affordable housing units restricted to households earning below 30% of area median income3 for a period not less than 10 years, prorated based on the percentage that such units make up of the total number of housing units; or (2) Affordable Housing in a “high opportunity area” as defined by the Federal Housing Finance Agency in 12 C.F.R. § 1282.1(b).

“Indian Reservations and Native Hawaiian Homelands” means (1) an “Indian Reservation” as defined in the CDFI Fund regulations at 12 C.F.R § 1805.104 (i.e., any geographic area that meets the requirements of section 4(10) of the Indian Child Welfare Act of 1978 (25 U.S.C. 1903(10)), and shall include: land held by incorporated Native groups, regional corporations, and village corporations, as defined in or established pursuant to the Alaska Native Claims Settlement Act (43 U.S.C. 1602); public domain Indian allotments; and former Indian reservations in the State of Oklahoma); or (2) Hawaiian Home Lands.

“Lending Activity” means loan originations, investments or other activity that is eligible to be included in the Initial Supplemental Report, as explained further in the section of the General Instructions titled “Lending Activity.”

“LMI Borrower” means having an income of not more than: (1) for borrowers in Metropolitan Areas, 120 percent of the area median income; and (2) for borrowers in Non-Metropolitan Areas, the greater of 120 percent of the area median income; or 120 percent of the statewide Non-Metropolitan area median income.

“Low-income Borrower” means having an income of not more than: (1) for borrowers in Metropolitan Areas, 80 percent of the area median income; and (2) for borrowers in Non-Metropolitan Areas, the greater of 80 percent of the area median income; or 80 percent of the statewide Non-Metropolitan area median income.

“Metropolitan Area” means an area designated as such by the Office of Management and Budget pursuant to 44 U.S.C. 3504(e) and 31 U.S.C. 1104(d) and Executive Order 10253 (3 C.F.R., 1949–1953 Comp., p. 758), as amended. For the Initial Supplemental Report, Applicants must use the list of Metropolitan Areas posted to the ECIP website.

“Minority” means any Black American, Native American, Hispanic American, Asian American, Native Alaskan, Native Hawaiian, or Pacific Islander.

“Minority Business” means a business that is 51% or more owned by a Minority.

“Minority Communities” means a census tract where the majority of the population consists of Minorities. For the Initial Supplemental Report, Applicants must use the list of Minority Communities posted to the ECIP website.

“Other Targeted Populations” means Minorities and, solely for CDFIs, populations designated as Other Targeted Populations for that CDFI pursuant to any regulation issued by the CDFI Fund.

“Persistent Poverty Counties” means any county, including county equivalent areas in Puerto Rico, that has had 20% or more of its population living in poverty over the past 30 years, as measured by the 1990 and 2000 decennial censuses and the 2011–2015 5- year data series available from the American Community Survey of the Bureau of the Census or any other territory or possession of the United States that has had 20% or more of its population living in poverty over the past 30 years, as measured by the 1990, 2000 and 2010 Island Areas Decennial Censuses, or equivalent data, of the Bureau of the Census. For the Initial Supplemental Report, Applicants must use the list of Persistent Poverty Counties posted to the ECIP website.

“Public Welfare and Community Development Investments” means Public Welfare Investments made pursuant to 12 U.S.C. 24(eleventh) or 12 U.S.C. 338a as reported to an Applicant’s primary federal financial regulator.

“Qualified Lending” is a subset of Lending Activity. Lending Activity is considered Qualified Lending if it is made to one of the Target Communities listed in Table 1–Target Communities in these instructions.

“Rural Communities” means areas within a county not contained within a Metropolitan Statistical Area, as defined in OMB Bulletin No. 15-01 and applied using 2010 census tracts. For the Initial Supplemental Report, Applicants must use the list of Rural Communities posted to the ECIP website.

“Small Businesses or Farms” means a business or farm with gross annual revenues of $1 million or less at the time of underwriting.

“Underserved Communities” means a local community, neighborhood, or rural district that is an “investment area” as defined in the CDFI Fund regulations at 12 CFR § 1805.201(b)(3)(ii). For the Initial Supplemental Report, Applicants must use the list of Underserved Communities posted to the ECIP website.

“Underserved Small Business” means a business with gross annual revenues that do not exceed $100,000 or that is majority owned by individual(s) who are Low-Income Borrowers or Other Targeted Populations.

“Urban Low-Income Communities” means a local community, neighborhood, or rural district in which the median family income (MFI) does not exceed (1) with respect to a census tract or block numbering area located within a Metropolitan Area, 80% of the Metropolitan Area MFI or the national Metropolitan Area MFI, whichever is greater, or (2) with respect to a census tract or block numbering area located outside of a Metropolitan Area, 80% of the statewide Non-Metropolitan Area MFI or the national Non- Metropolitan Area MFI, whichever is greater. For the Initial Supplemental Report, Applicants must use the list of Urban Low-Income Communities posted to the ECIP website.

“U.S. Territories” means Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands.

Paperwork Reduction Act Notice.

OMB Approval No.

Expiration Date: September 30, 2022

The

information collected will be used for the U.S. Government to process

requests for support. The estimated burden associated with this

collection of information is 160 hours per response. Comments

concerning the accuracy of this burden estimate and suggestions for

reducing this burden should be directed to the Office of Privacy,

Transparency and Records, Department of the Treasury, 1500

Pennsylvania Ave., N.W., Washington, D.C. 20220. DO NOT send the form

to this address. An agency may not conduct or sponsor, and a person

is not required to respond to, a collection of information unless it

displays a valid control number assigned by OMB.

1 Treasury requires the Applicant to provide a methodology narrative for Schedules A and B. The Applicant may combine these explanations into a single document and upload this document only once. Applicants also have the option to provide and upload narratives for each schedule separately.

2 See footnote above.

3 For the purposes of defining “Deeply Affordable Housing” only, “area median income” refers to the definition used in the restricting covenant or contract or by the developer of the housing unit. That is, if an affordable housing developer restricts units to households earning below 30% of area median income for a period not less than 10 years, those units would be considered “Deeply Affordable Housing.”

ECIP Instructions for Initial Supplemental Report for IDIs, BHCs and SLHCs |

||

OMB Number: ####-####, Version #1 |

|

|

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Alexander, David (Detailee) |

| File Modified | 0000-00-00 |

| File Created | 2022-06-29 |

© 2026 OMB.report | Privacy Policy