CDFI Program and NMTC Program Annual Report

CDFI Program Awardee and NMTC Allocatee Annual Report

NMTCAllocateeTLRGuidance_Proposed_FinalVersion_NoRedline_Final_Approved

CDFI Program and NMTC Program Annual Report

OMB: 1559-0027

U.S. Department of Treasury

Community Development Financial Institutions Fund

Allocatee (CDE)

Transaction Level Report Data Point Guidance for

AMIS

(July 2023)

Table of Contents

What’s New in the NMTC Allocatee TLR Guidance? 22

Understanding the Data Point Boxes 27

CDE Transaction Level Report – Data Point Guidance 31

TLR Projects Tab 59

Getting Started

Transaction Level Reports are now in the CDFI Fund’s Awards Management Information System (AMIS). For an overview of the data field changes made, review the “CIIS to AMIS Crosswalk NMTC TLR” guide.

AMIS provides two ways users can create their Transaction Level Report (TLR):

Manual entry of your Transaction Level Report (TLR) through the AMIS User Interface (UI)

Upload of multiple TLR records through either a CSV file template or an XML schema

Disclosure

The CDFI Fund may upon request provide information collected and any associated reporting submitted by the Allocatee to an appropriate federal, state, tribal, local, international, or foreign law enforcement agency or other appropriate authority charged with investigating or prosecuting a violation or enforcing or implementing a law, rule, regulation, or order.

Manual Entry

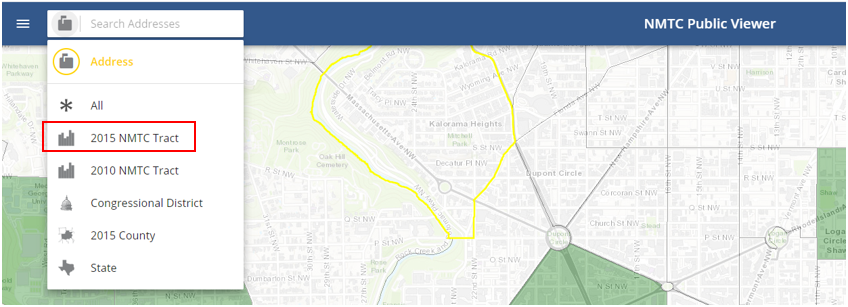

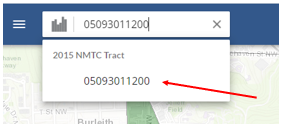

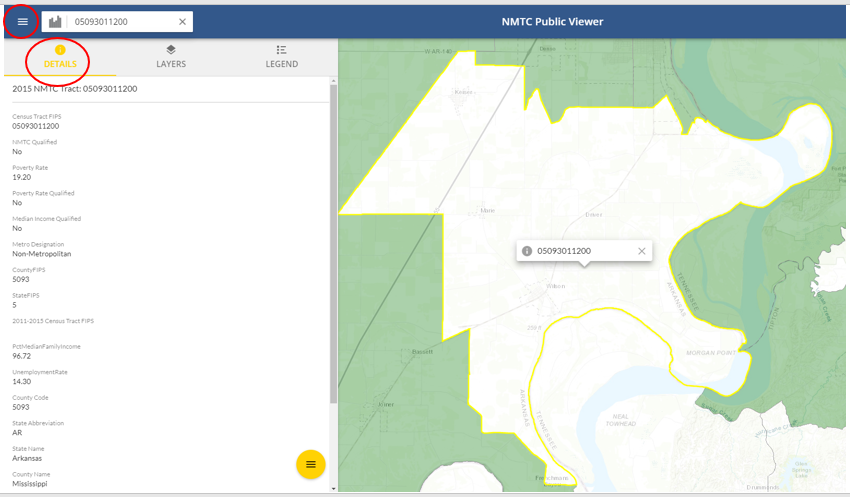

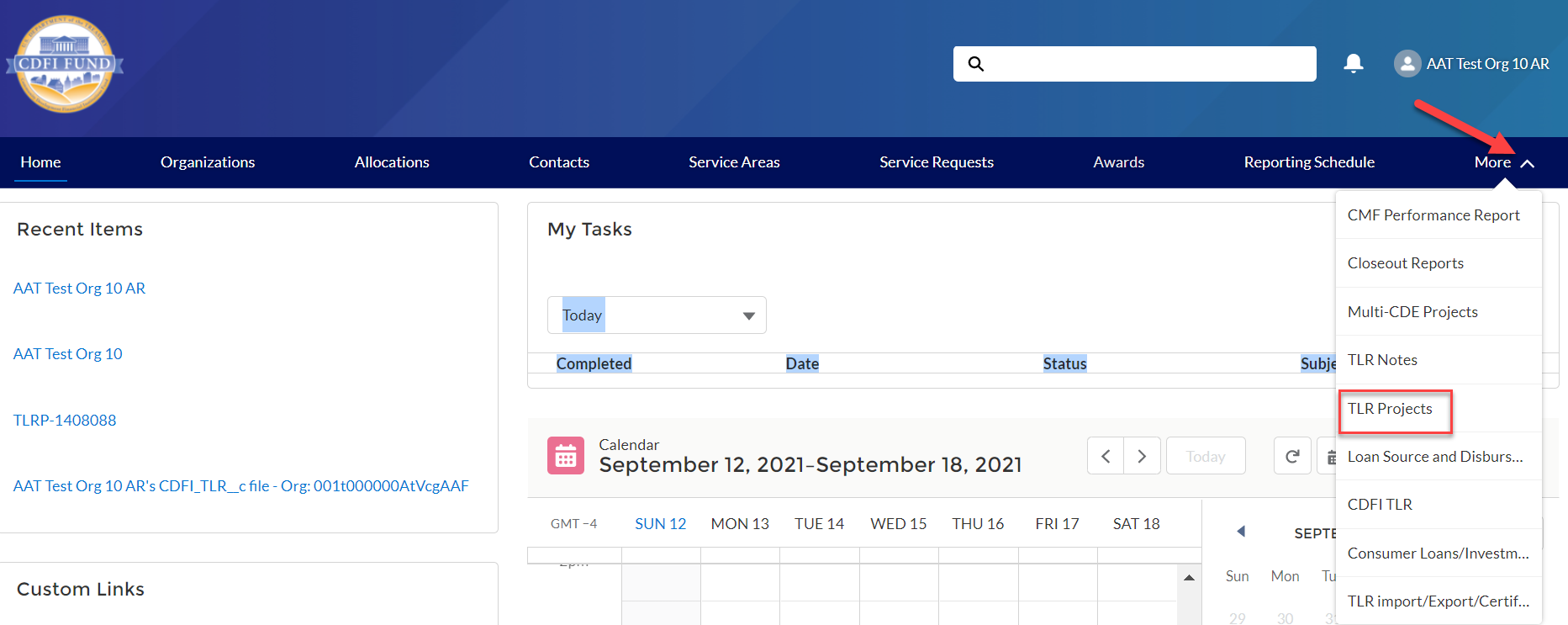

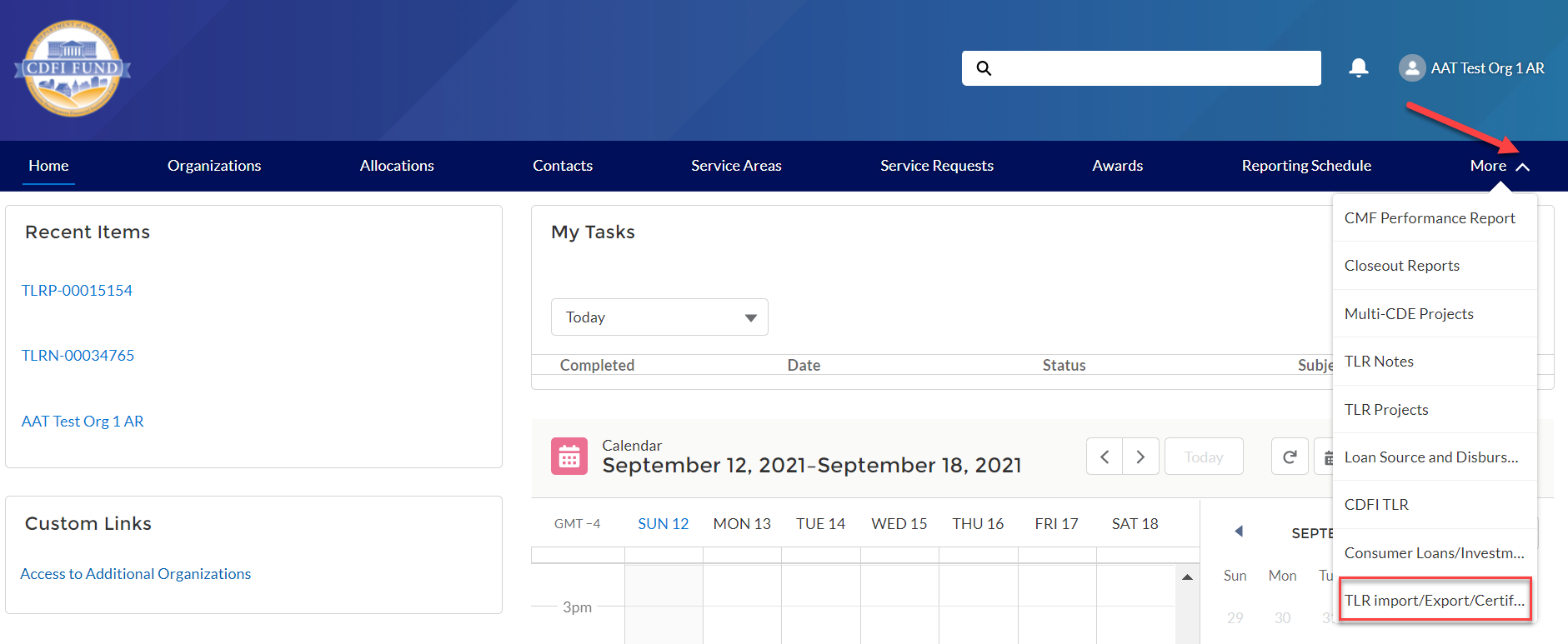

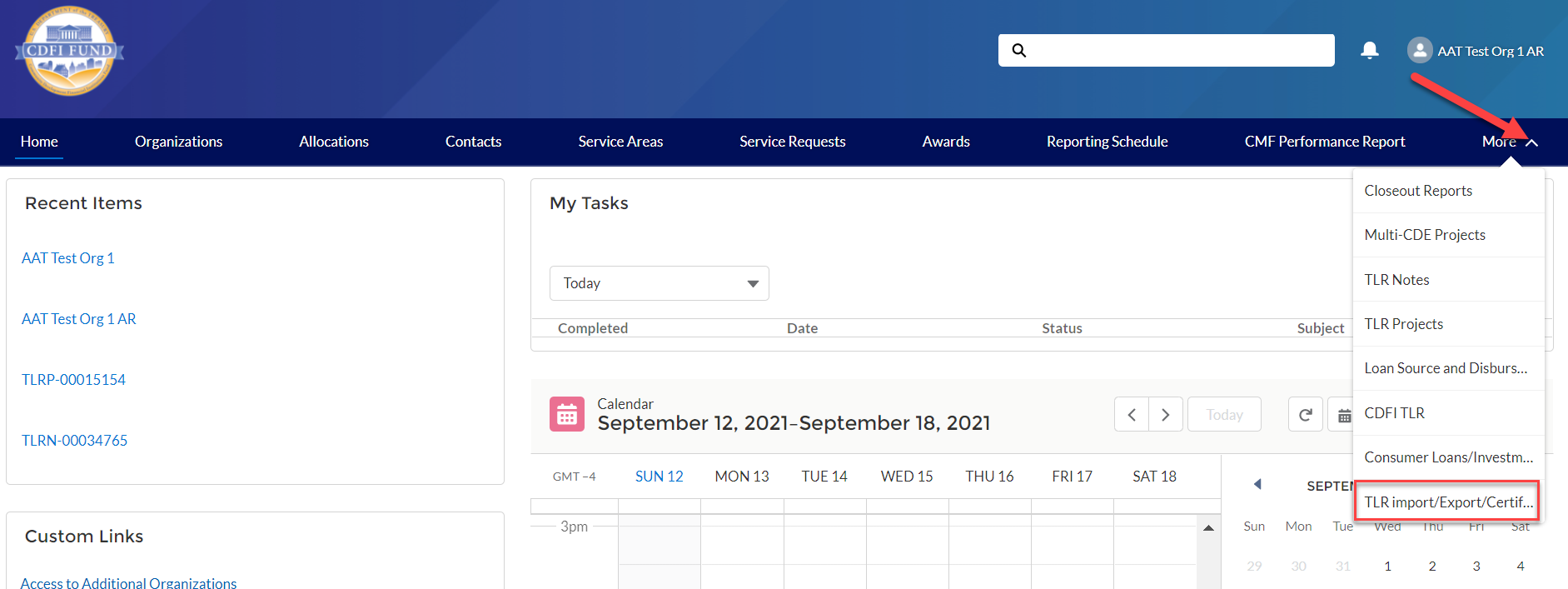

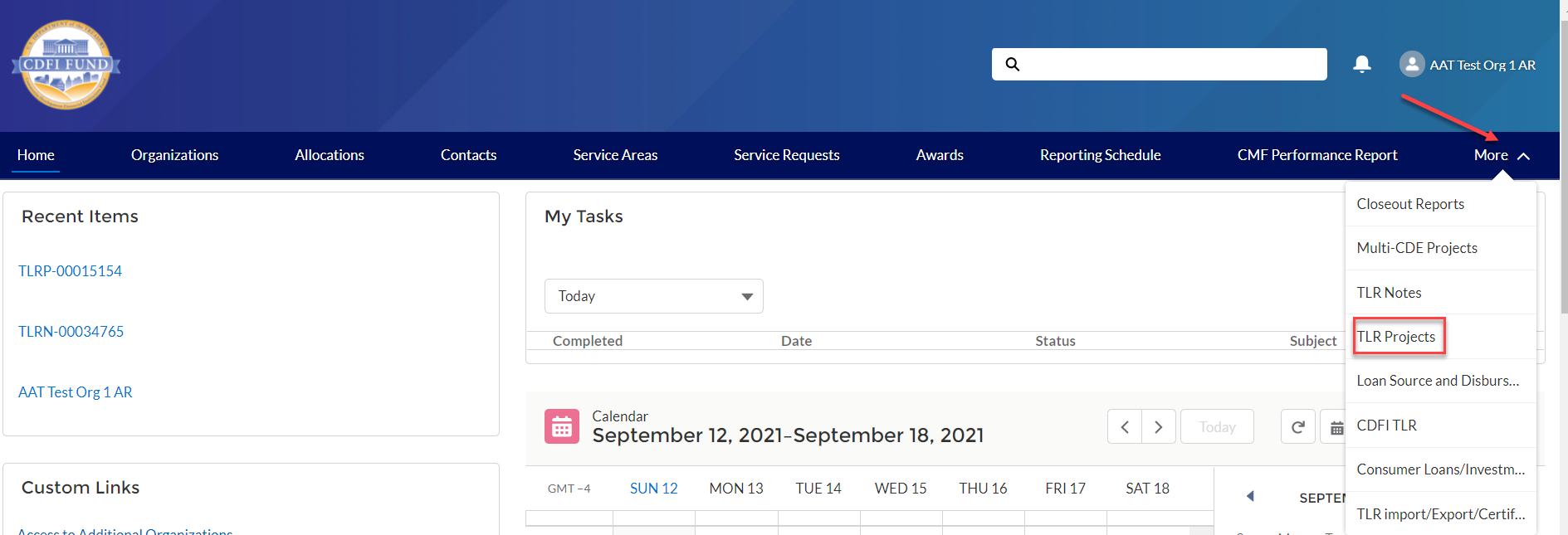

To manually begin your Transaction Level Report (TLR), log into AMIS and click on the TLR Projects tab located in the “More” dropdown.

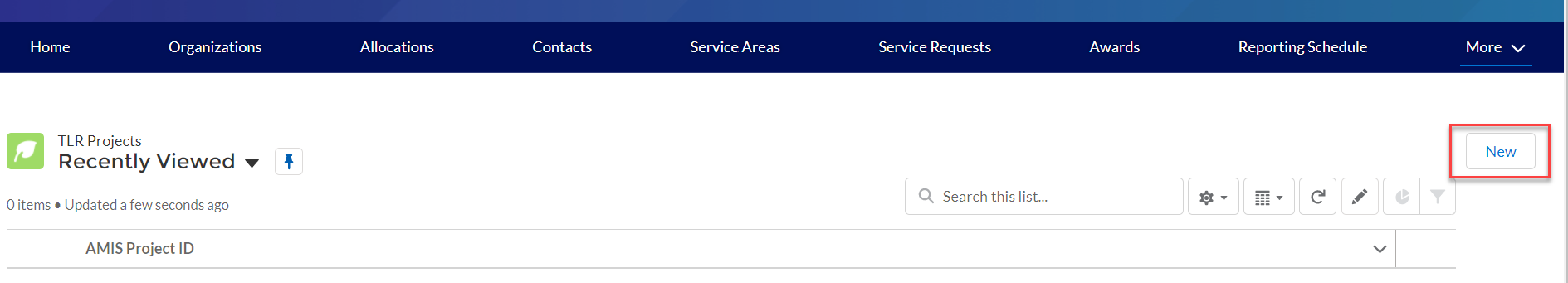

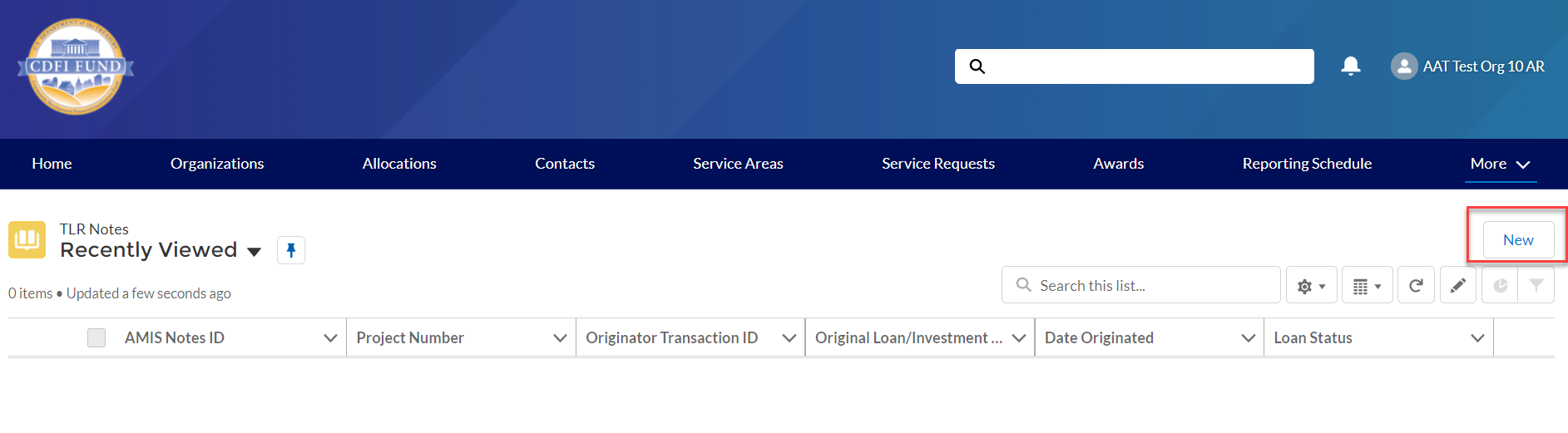

Once on the TLR Projects Tab, click the “New” button.

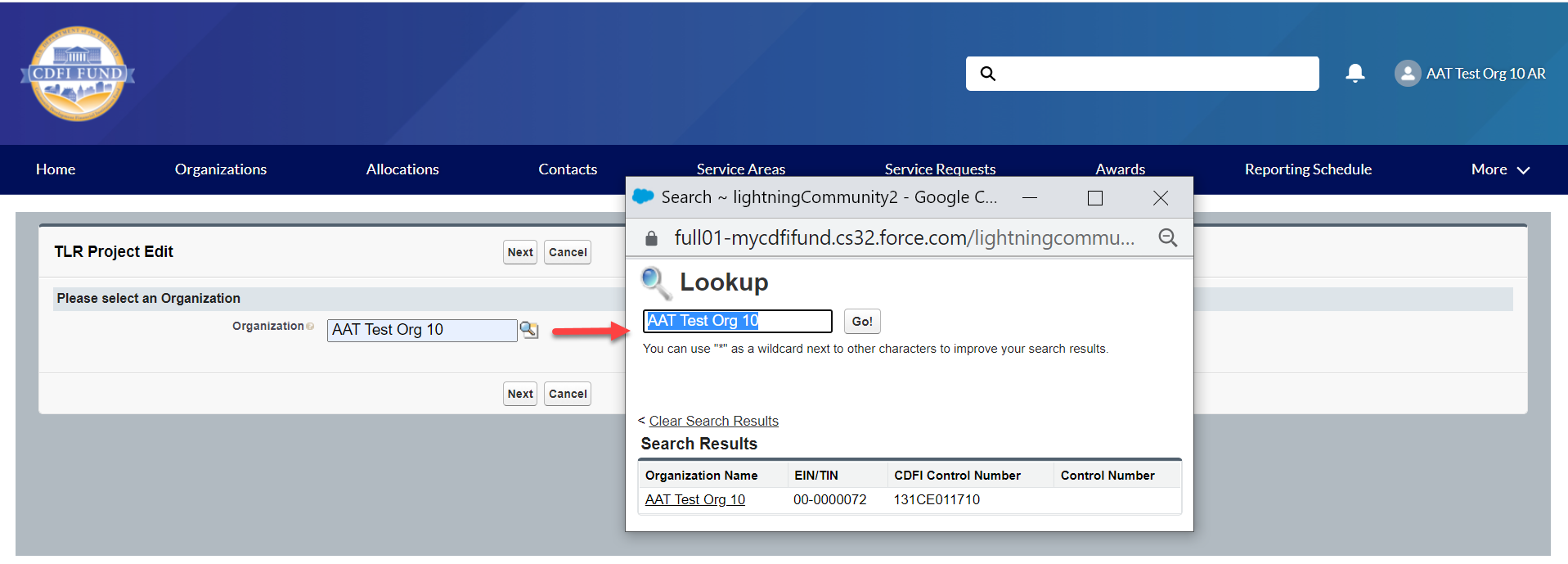

Enter the name of your organization in the “Organization” field and click “Next” to go to the TLR Project detail page to fill out the information based on the Data Points listed in the guide. You can click the search icon to search the list of organizations you are permitted to access.

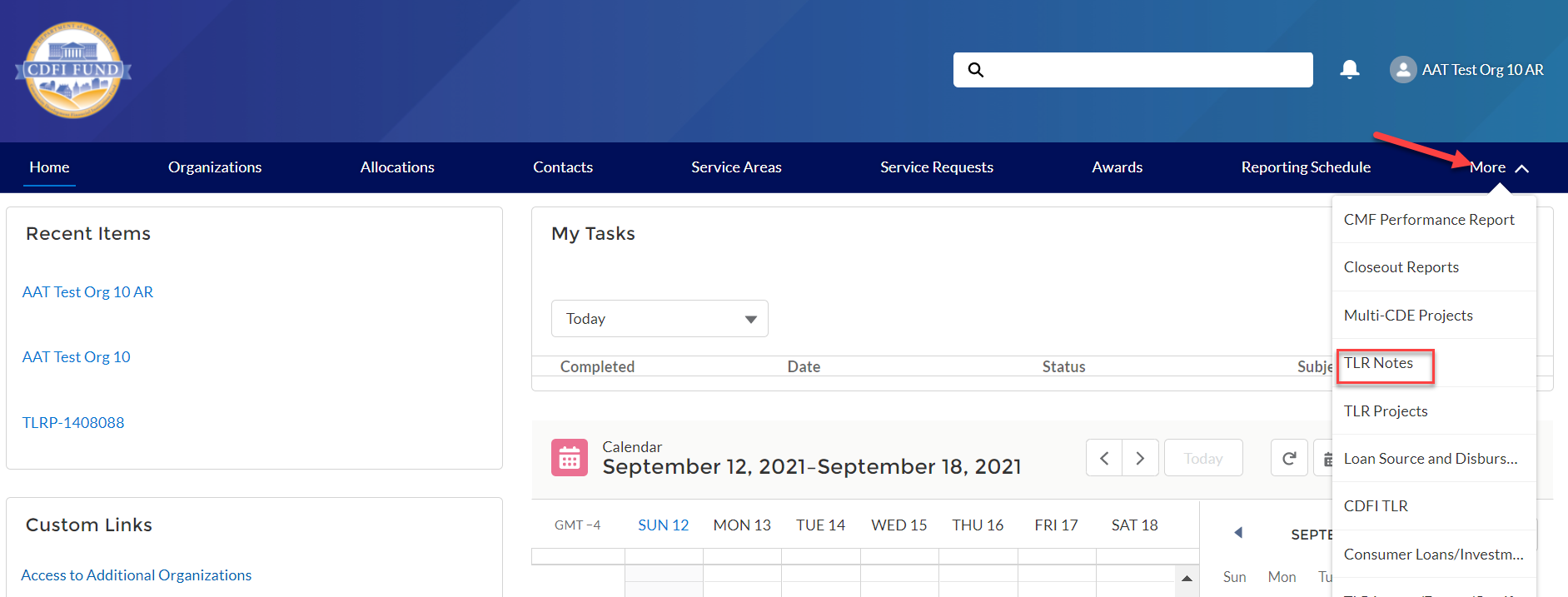

Once you have completed and saved your TLR Project record, click on the TLR Notes Tab located in the “More” dropdown.

Click the “New” button. Fill out the information based on the Data Points listed in the guide.

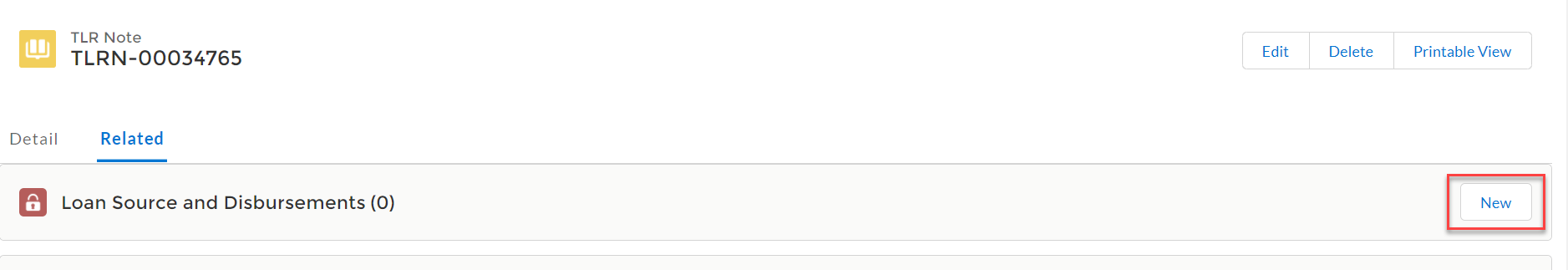

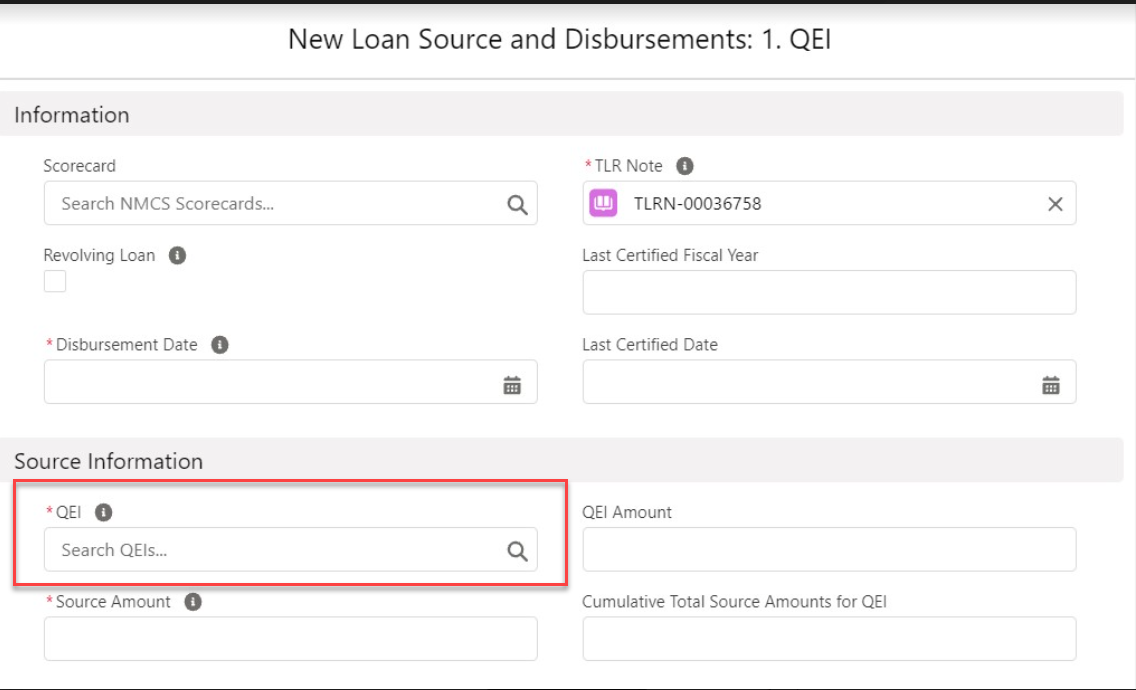

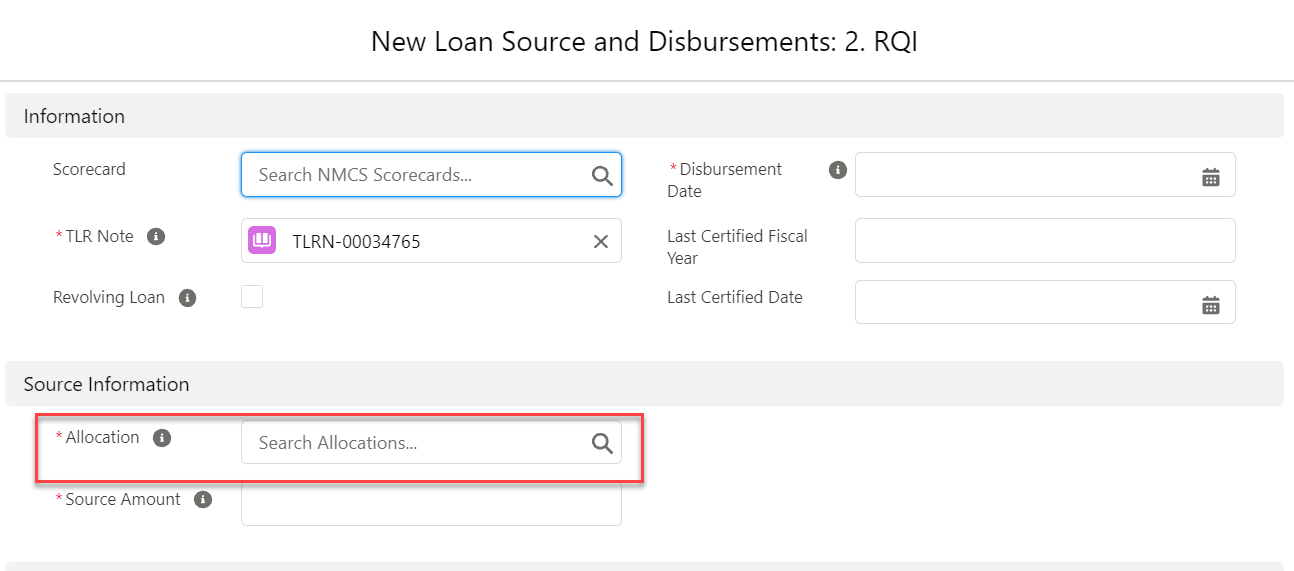

Once you have finished filling out and saving your TLR Note record, scroll down the page to the Loan Source and Disbursements related list (located on the TLR Note record – Related Tab). Click the “New” button. Fill out the information based on the Data Points listed in the guide.

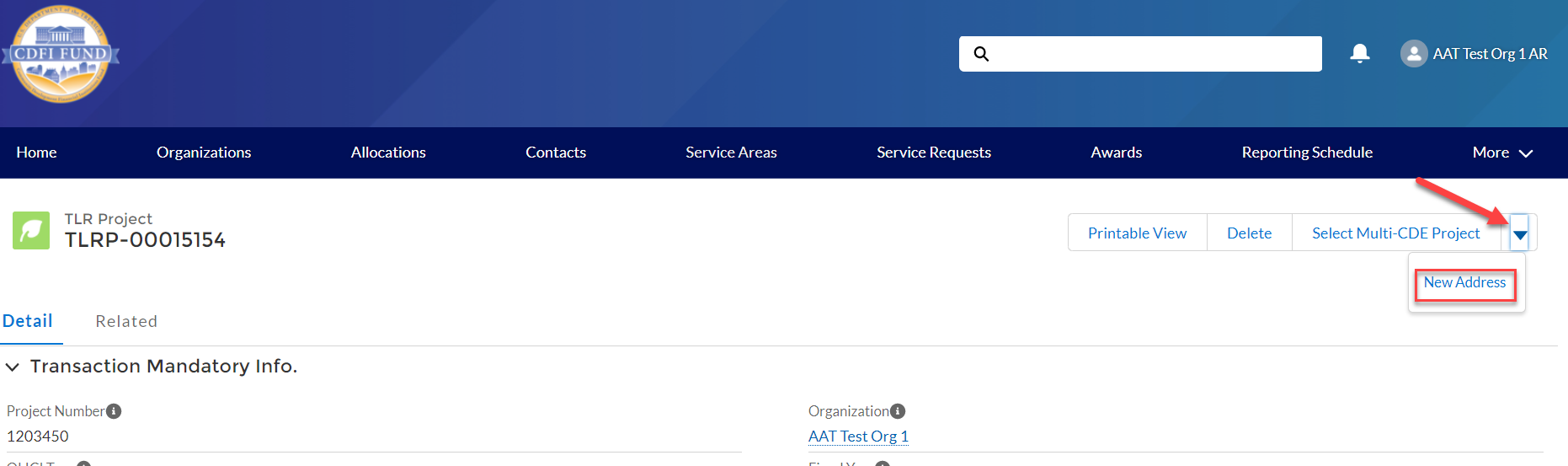

Once you have completed and saved your Loan Source record, click on the TLR Projects Tab again, click on the new record you created and then click on the “New Address” button. Fill out the information based on the Data Points listed in the guide.

CSV File Upload

To create multiple TLR records at one time, AMIS allows users to upload CSV files to load via a file import graphic interface. Click on the "TLR Import/Export/Certify" tab in the menu bar to get started.

Note: Please use the “General” cell formatting for CSV file uploads.

Note: Since templates change from time to time, it is always best practice to download new templates before beginning a file upload process.

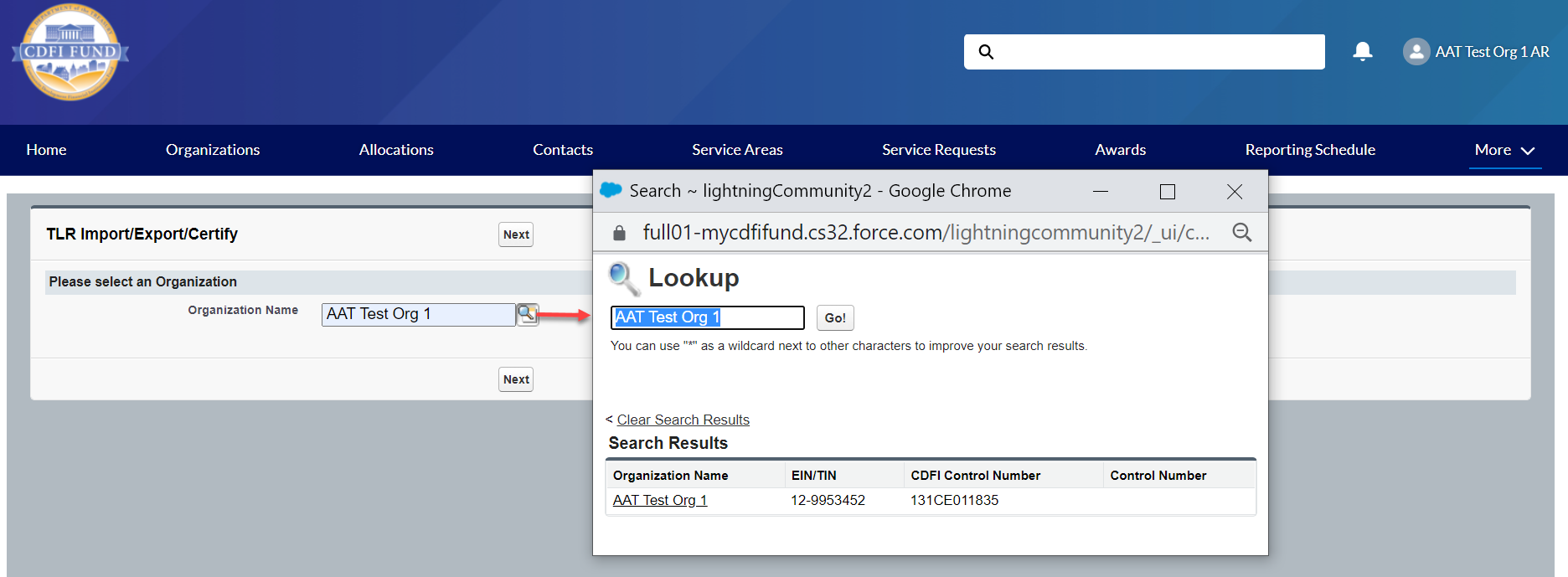

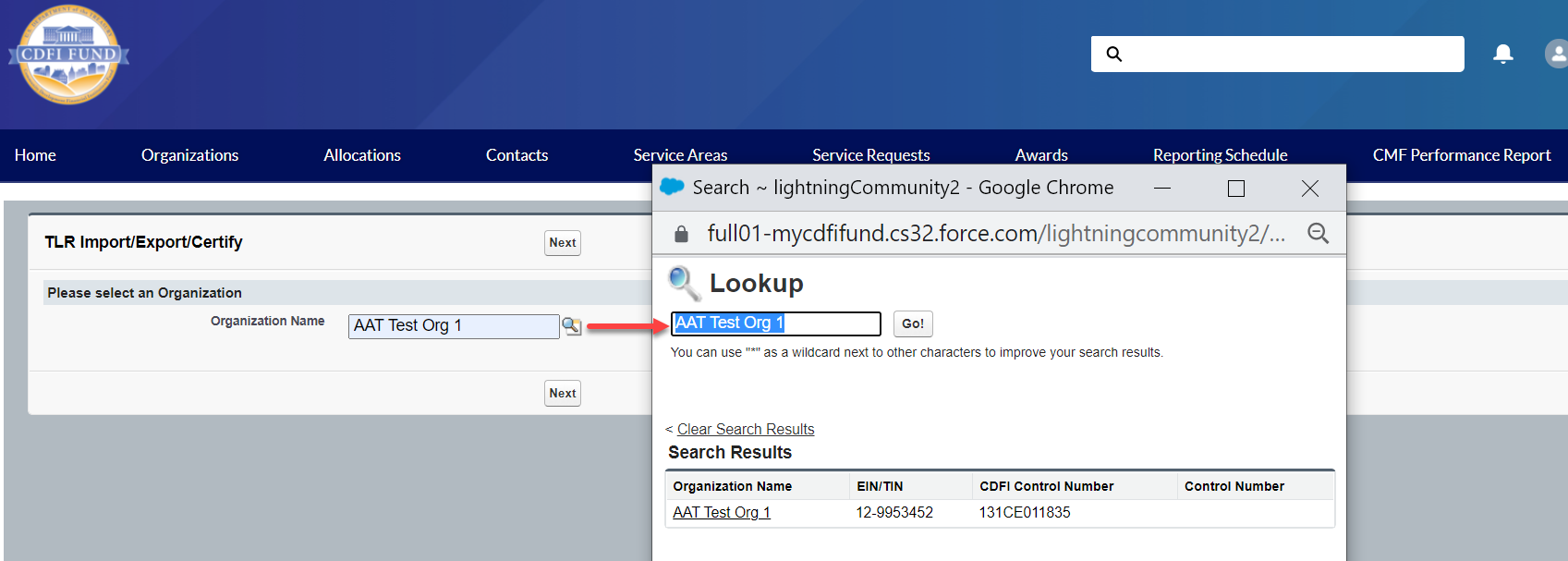

Use the "Organization Name" field to enter the organization’s name to create the TLR records. Click the search icon to see a list of the organizations to which you are associated.

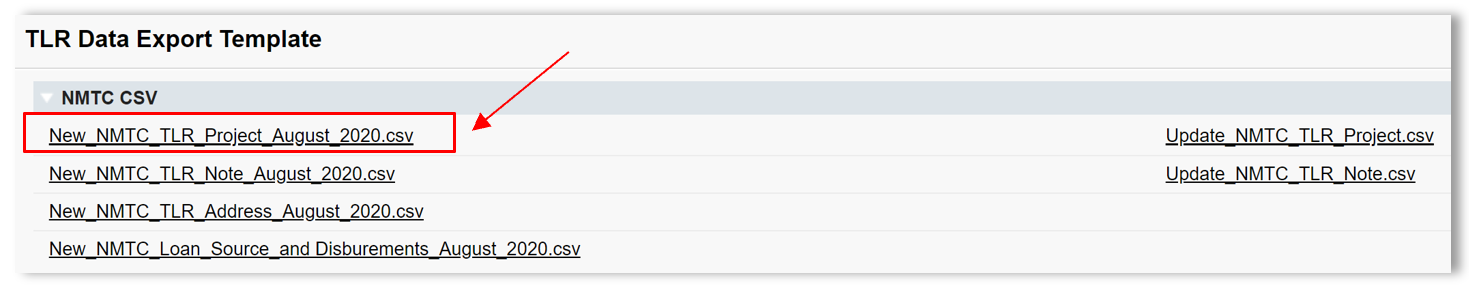

Click the "New_NMTC_TLR_Project.CSV" link to download the template.

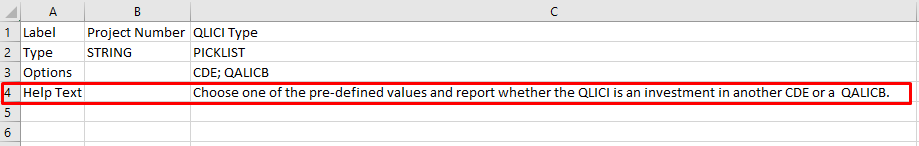

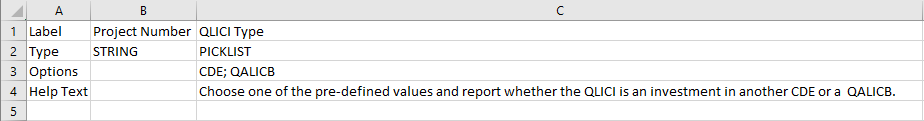

Open the CSV file and take a moment to review what each row represents:

Row

1 = Field label

Row 2 = Field type

Row 3 = Options to

choose from when filling out the cells, if applicable.

Row 4 =

Help Text

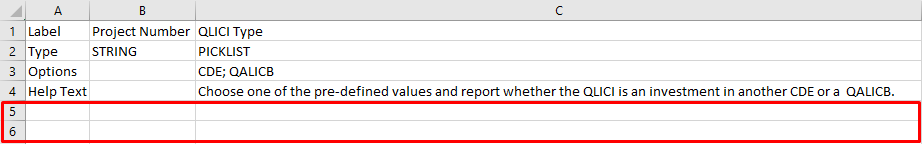

Use row 5 and on in the CSV file to fill out your answers for the labels (fields) in row 1.

Use the Help Text on the CSV sheet in row 4 as needed to fill out your data.

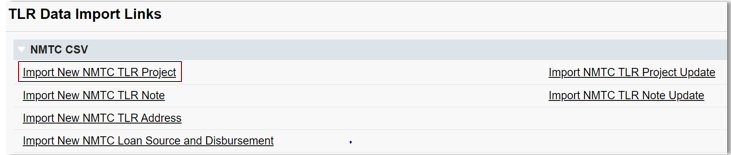

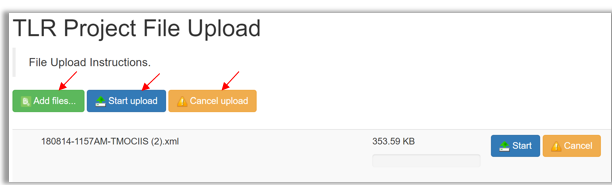

After you save the file, return to the AMIS portal and click the "Import New TLR Project" Link.

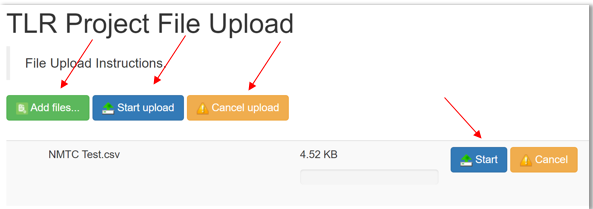

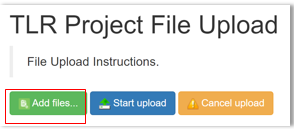

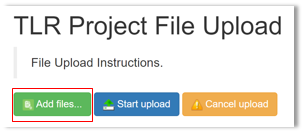

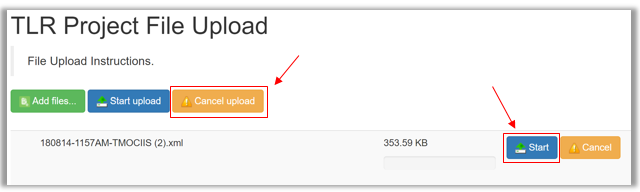

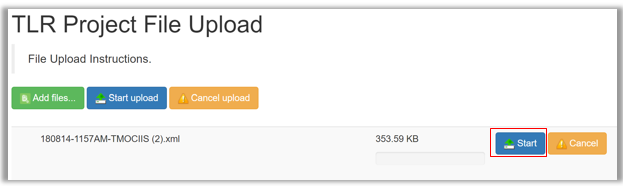

Click on “Add Files” and select the document to be uploaded.

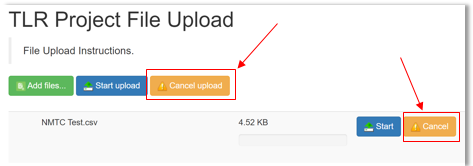

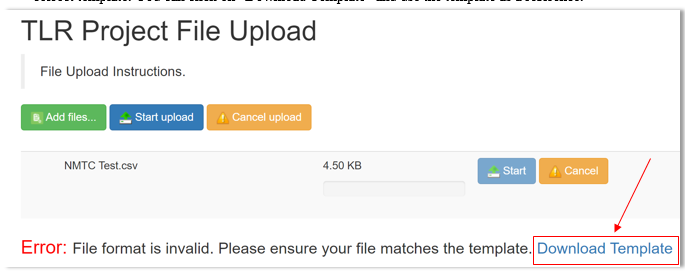

The upload document must be formatted in Microsoft Excel Comma Separated Values File (.csv). If the wrong file is selected in error, click on “Cancel Upload.”

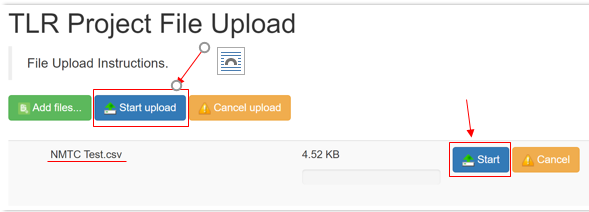

Once the correctly formatted document is selected, click on “Start Upload”

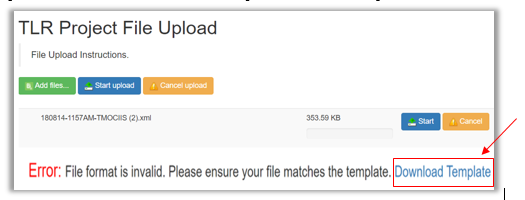

If the uploaded file is in the wrong format or uses an outdated template, AMIS will automatically generate an error message and provide the user with the correct template. Click on “Download Template,” transfer TLR data on to the new template and resume the upload process.

The correct template can also be found by navigating to Import/Export/Certify tab and clicking on “New_NMTC_TLR_Project_August_2020.csv.”

To cancel an upload mid-progress, click on “Cancel Upload.” This will delete any document already selected. To start a new upload, click on “Add Files,” select the correct upload document and click “Start Upload.”

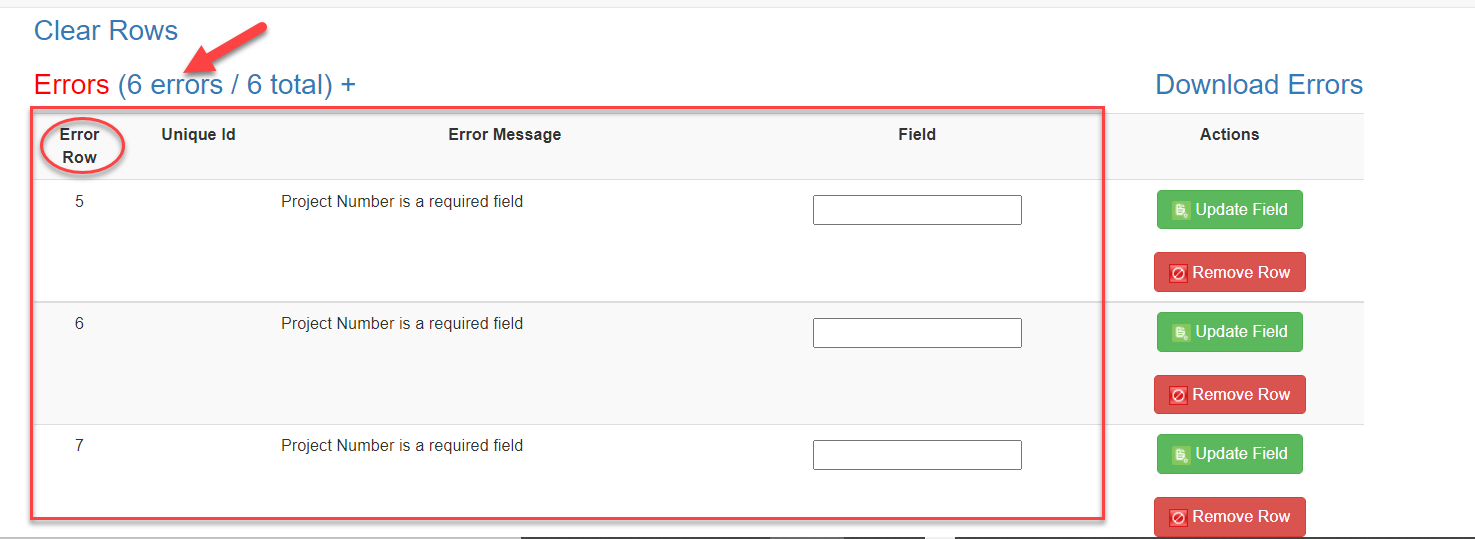

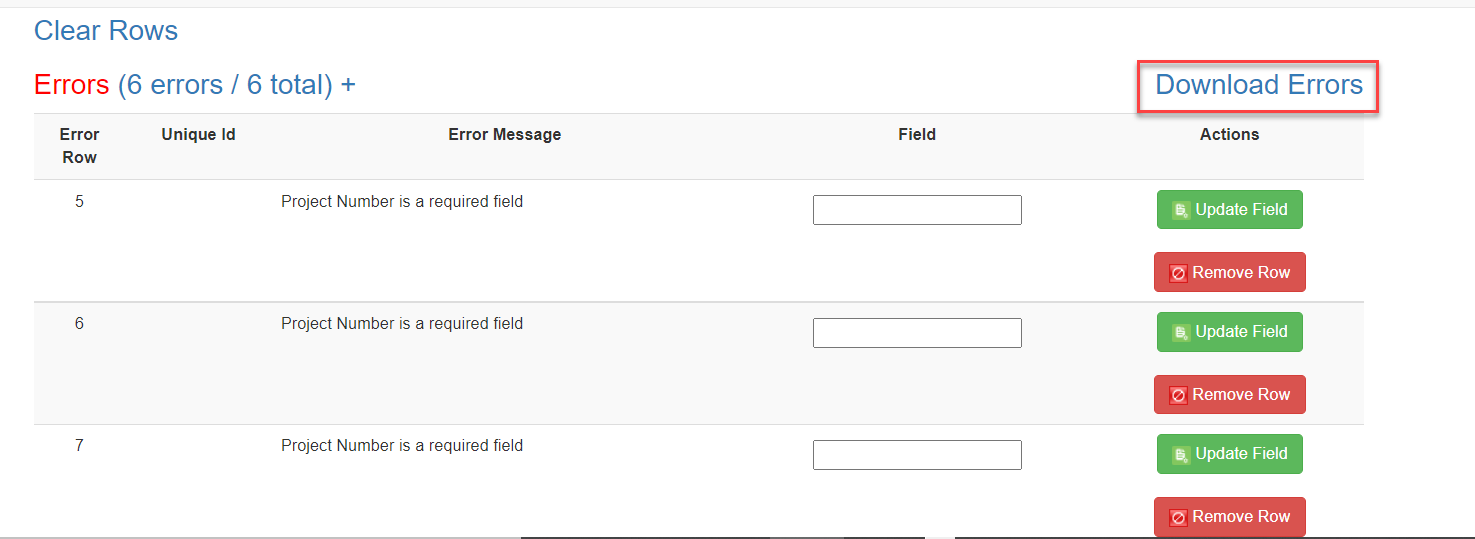

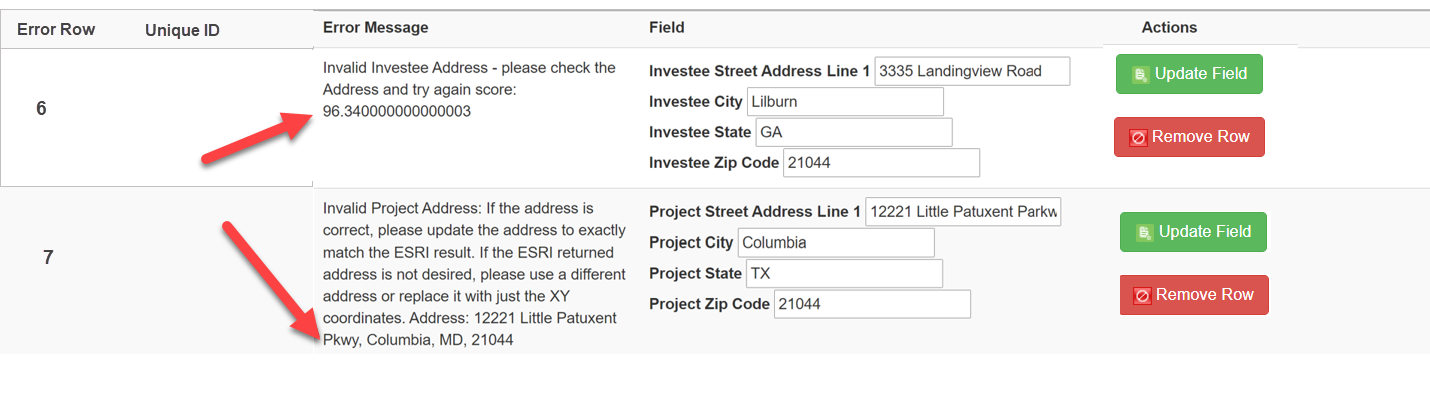

Once the document is uploaded into the AMIS, the user will see a list of errors found in uploaded data. The number of error messages will be displayed along with the Error Message, Error Row and Field name where the error was found.

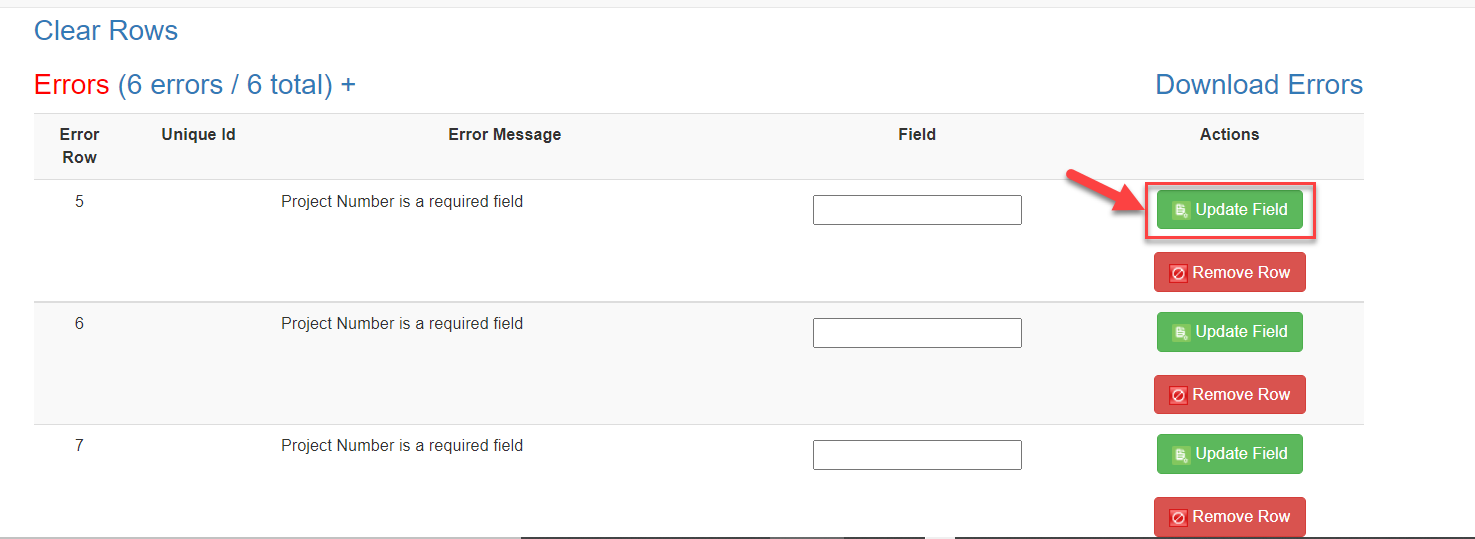

Users can update incorrect data on the page by entering the correct data and then clicking “Update Field.” If AMIS accepts the new entry, the error will go away. If the newly entered data is still incorrect, AMIS will not save the row and the error will remain on the screen.

Note: If you receive an error on the Project Number field that indicates that the Project Number already exists, please contact the AMIS Help Desk at [email protected] for help.

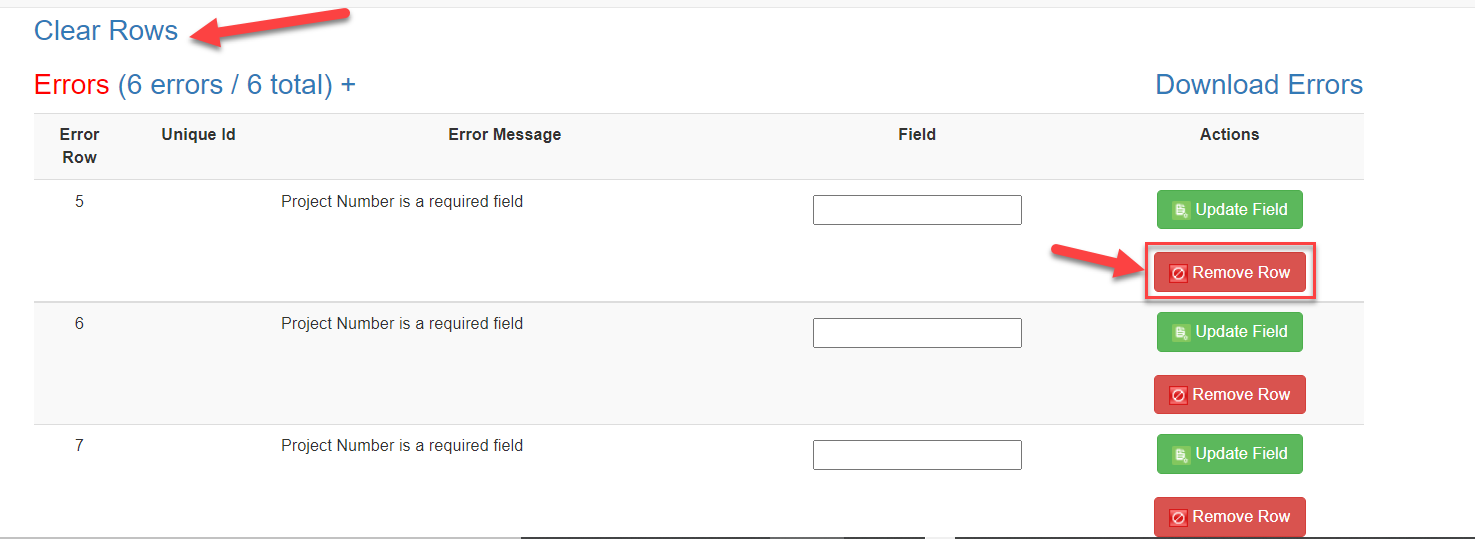

If the user decides not to upload a specific row, the row may be removed by clicking the red “Remove Row” button. If the user decides not to upload any of the rows, all rows may be removed by clicking “Clear Rows.”

Alternatively, users can fix errors in their upload data by clicking “Download Errors” and downloading a file containing uploaded data and corresponding error message. The error file can be used to make changes in the original upload file.

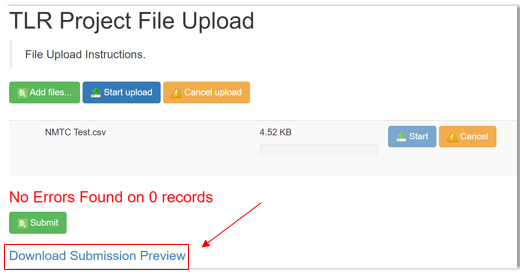

Once all the incorrect entries have been fixed and the data is uploaded again, users will see a message indicating that no errors were found. To view a file containing all the data that will be successfully uploaded into AMIS, users can click on “Download Submission Preview.”

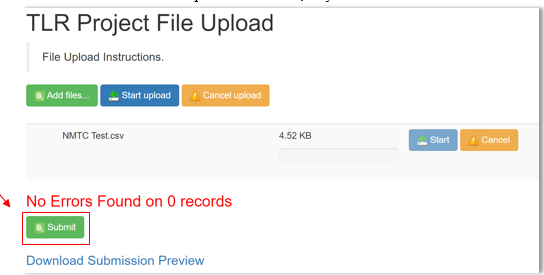

To submit the finalized data, click “Submit.”

XML File Upload

To create multiple TLR records at one time, AMIS allows users to upload files using an XML schema. To get started click on the "TLR Import/Export/Certify" tab located in the “More” dropdown.

Use the "Organization Name" field to enter the name of the organization for which you are submitting TLR records. You may also select the Organization Name from a list by clicking on the search icon next to the “Organization Name” field and choosing from a list of organizations you are permitted to access.

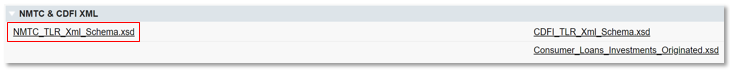

Click the "NMTC_TLR_Xml_Schema.xsd" link to download the XML Schema to use when generating an XML file. XML attribute names contain no spaces, but are otherwise identical to the corresponding data guidance field name.

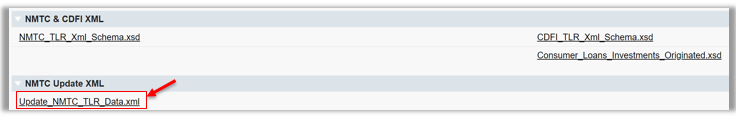

To submit updates to existing projects, click the “Update_NMTC_TLR_Data.xml” link to download an XML file of current project data already in AMIS. The update template will contain a list of existing TLR Projects that are within the 7-year update window along with their annually updatable fields. Please note that only fields marked as “Annual Update Required” in the Allocatee TLR Data Point Guidance document, are required or allowed to be updated.

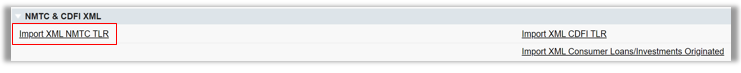

After you fill out and save the file, back on the AMIS portal, click the "Import_XML_NMTC_TLR” link.

Click on “Add Files” and select the document to be uploaded.

The upload document must be formatted in Extensible Markup Language (.xml). If the wrong file is selected in error, click on “Cancel Upload.”

Once the correctly formatted document is selected, click on “Start Upload”

If the uploaded file is in the wrong format or uses an outdated template, AMIS will automatically generate an error message and provide the user with the correct template. Click on “Download Template,” transfer TLR data on to the new template and resume the upload process.

The correct template can also be found by navigating to Import/Export/Certify tab and clicking on “New_NMTC_TLR_XML_Schema.xsd.”

![]()

Follow the steps 4 through 10 outlined above in the CSV File Upload section.

Certifying TLRs

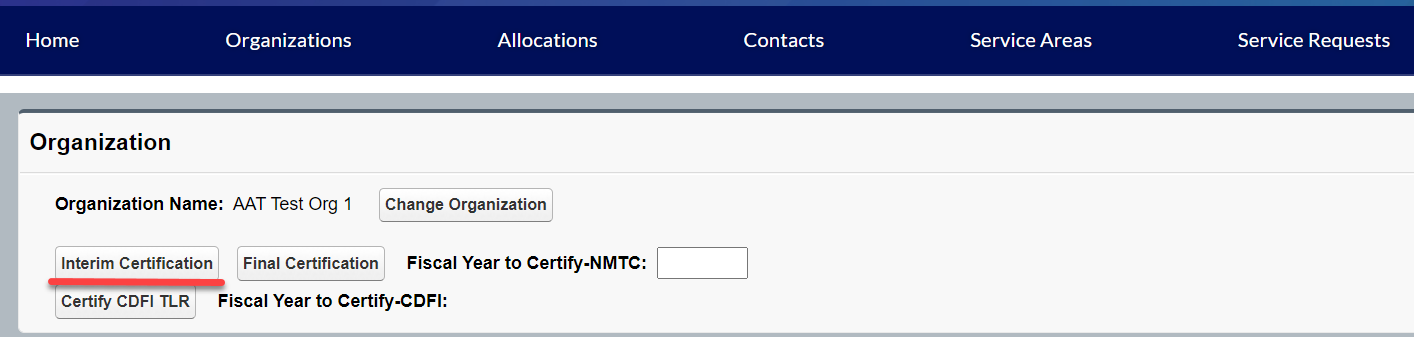

To certify your TLRs, navigate to the “TLR Import/Export/Certify” tab and enter the name of your organization. The earliest Fiscal Year available for certification will be displayed next to the Certification buttons.

Starting August 2020, users have the option to certify data when the data is available -- prior to the reporting due date -- by using the “Interim Certification” button. Once all TLR records for a fiscal year are Interim Certified, users are required to close out the certification window for that fiscal by using the “Final Certification” button.

Interim Certification

To certify records as you go throughout the fiscal year, use the “Interim Certification” button. Users can continue to add records after Interim Certification.

Please Note:

Each TLR Project must have an active Note to be considered for Interim Certification.

Each TLR Project must have at least one Address to be considered for Interim Certification

Each TLR Note must have at least one Loan Source and Disbursement.

If a Project or Note record is missing any of these requirements, AMIS will not certify the records.

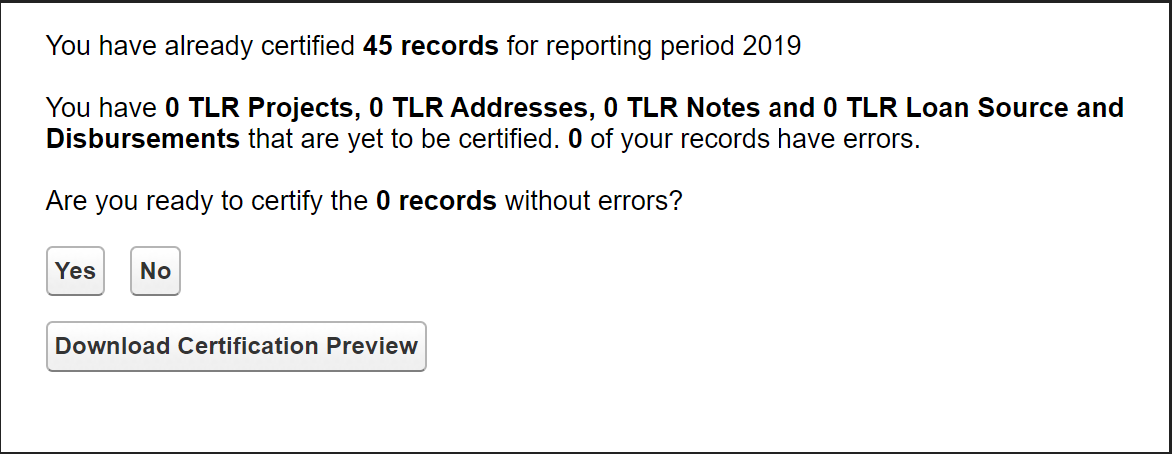

Upon clicking the “Interim Certification” button, AMIS pulls all the records that meet the prescribed criteria and runs a final check on the data to ensure that all records meet the data validation rules.

The system counts the following:

The number of records that have been Interim Certified for that reporting period;

The number of records that have been submitted but not Interim Certified;

The number of records that have been submitted but did not pass the validation check (records with errors); and

The number of records that will be Interim Certified if the user decides to proceed with certification (records without errors).

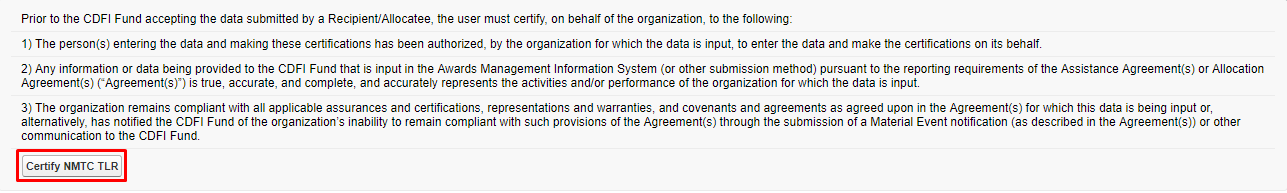

Users have the option of previewing the data compiled by AMIS before certification by clicking “Download Certification Preview.” The first column of the preview file shows the status of a given record. If a record failed a validation, the file shows the data field that caused the record to fail and the validation rule that was not met. To proceed with Interim Certification, click “Yes” when asked if you are ready to submit the records without errors. Users will then be directed to the certification statement page and once they click “Certify NMTC TLR” all submitted TLRs that passed the validation check (all submitted records without errors) will be Interim Certified.

Final Certification

Final Certification for the NMTC TLR is due 180 days after the end of an Organization’s Fiscal Year. Final Certified TLR records will be locked from any editing. The status of the TLR Report as reflected in the AMIS Reporting Schedule (i.e., “Submitted,” “Pending Receipt”, “Submitted-Overdue” etc.) is determined on the date the user runs the “Final Certification” process. The “Final Certification” process closes out the Fiscal Year for any further certification.

Final Certification involves both the reporting of new transactions and changes to the “Annual Update Fields” for “active” transactions that were reported in the prior year.

Note: Once Final Certification has been processed, users can no longer submit/certify records for a given Fiscal Year.

Annual Update Fields

At the beginning of an Organization’s fiscal year, the TLR records that were entered and certified in previous fiscal years will be unlocked so that the user can update “Annual Update” fields (these are the only fields the user will be able to successfully edit). Once users have made the appropriate annual updates to their TLR records, they will be able to proceed with Interim Certification and Final Certification of the TLR. Again, after Final Certification, all the records will be locked from editing until the next fiscal year.

Object |

Annual Update Fields |

TLR Project |

-Actual Jobs Created (Construction) -Actual Jobs Created (Financed) -Actual Jobs Created (Tenant) -Annual Gross Revenue (Reporting Period) |

TLR Note |

-Amount Charged Off -Amount Recovered -Days Delinquent -Loan Status -Number of 60 Days or More Delinquent -Number of Times the Loan Restructured -Original Loan/Investment Amount -Principle Balance Outstanding -Term -QLICI Level |

There are three ways to update existing records.

Manually update each record from the User Interface (UI).

Use the CSV file upload functionality. See below for directions.

Use the XML file upload functionality. See below for directions.

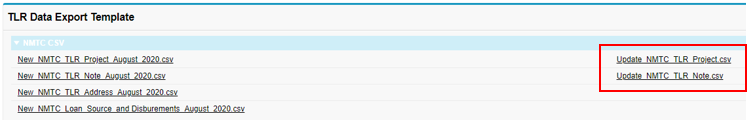

CSV Upload Functionality

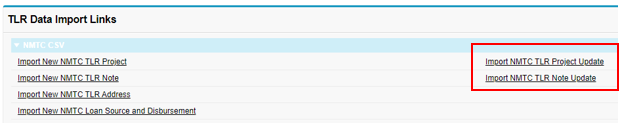

Go to the TLR Import/Export/Certify Page.

Search for the organization you are associated with and download the two update templates called Update_NMTC_TLR_Project.csv and Update_NMTC_TLR_Note.csv.

Make any necessary modifications to the records on each template.

Upload your updates using the import NMTC TLR Project Update and Import NMTC TLR Note Update import data links. The rest of the process follows the regular CSV File Upload process.

XML Upload Functionality

Updates are also possible through the XML File Upload process on the TLR Import/Export/Certify Page, using the Update NMTC TLR Data.XML template and the Import XML NMTC TLR link

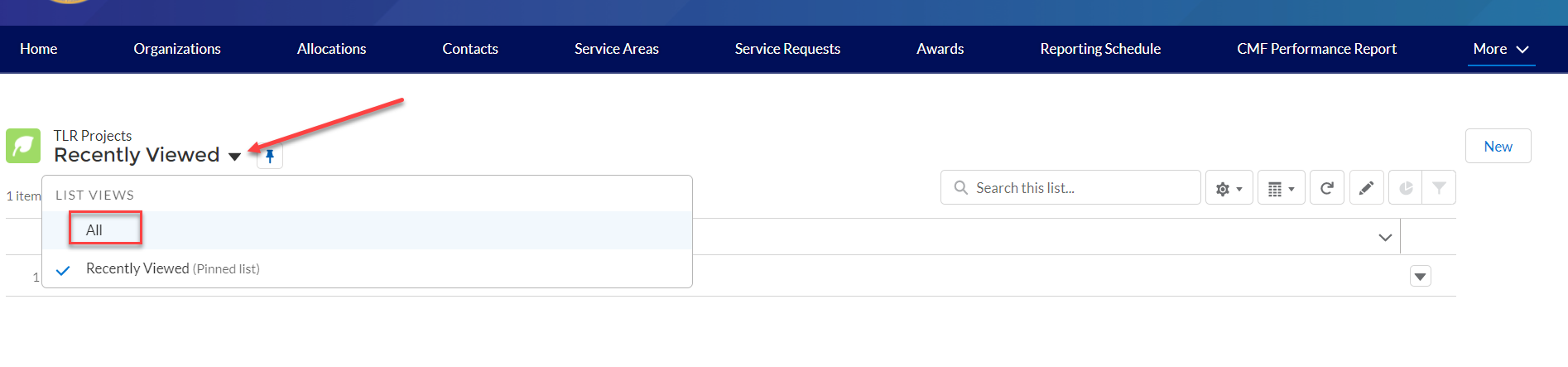

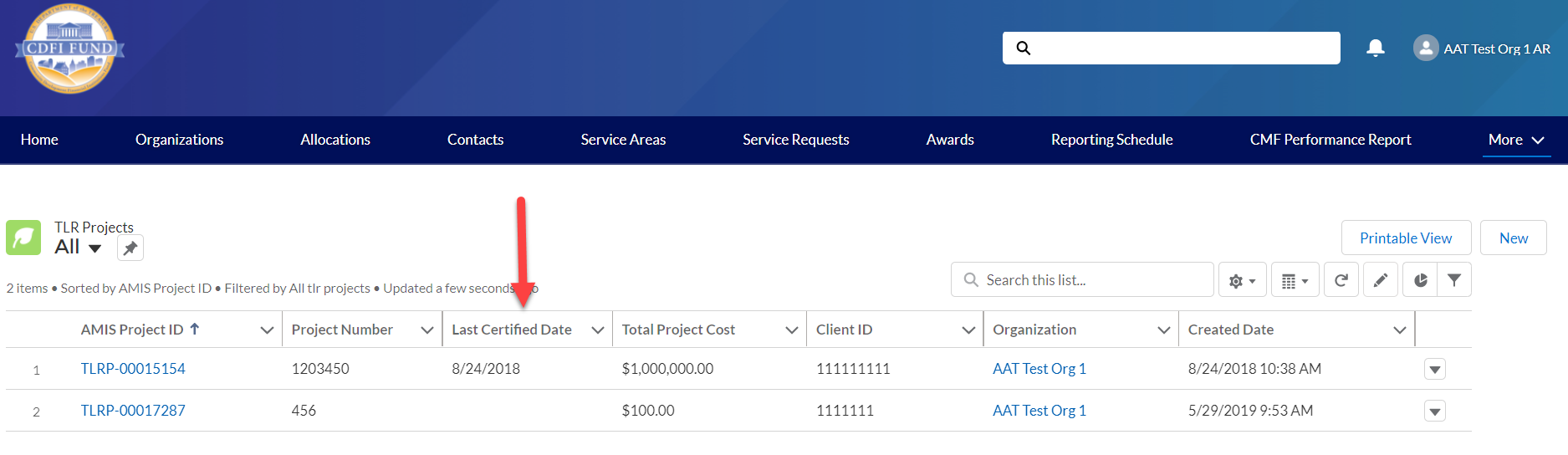

To check whether a TLR Project has successfully been certified (i.e. has undergone Final Certification), navigate to the “TLR Projects” tab located in the “More” dropdown.

Select “All” from the “View” list.

All TLR Project that have successfully passed through Final Certification will have a date displayed under “Last Certified Date.”

Note: If you happen to have performed Final Certification in error (i.e. you have additional records you need to submit), please contact the AMIS Help Desk at [email protected] for further assistance.

What’s New in the NMTC Allocatee TLR Guidance?

New Data Points

There are several new data points which have been added to the Project Level report. They are described below based on topic.

Depth of Public Subsidy Data Points

To better measure the depth of public subsidy for NMTC transactions, a new data point is added to the NMTC Allocatee TLR:

Estimated Annual Net Operating Income

Community Outcomes Data Points

The new additions to the community outcome reporting in the NMTC Allocatee TLR include:

Projected Full-Time Equivalent (FTE) Permanent Jobs to Be Created and/or Retained at Businesses Financed

Actual Full-Time Equivalent (FTE) Permanent Jobs Created and/or Retained at Businesses Financed

Job Quality Measures (Measure of Job Quality)

Number of Quality Jobs

Identify Accessible Jobs Measure (Measure of Job Accessibility)

Number of Accessible Jobs

Type of Business Loan

Native American-Owned or Controlled Businesses

Number of People Served by Commercial Goods or Services

Number of People Served by Community Goods or Services

Number of Households Served by Infrastructure Services

Identify Environmental Restoration and/or Sustainability Outcome Measure

Quantify Environmental Restoration and/or Sustainability Outcome

Allocation Agreement Compliance Data Points

To enhance the Fund’s ability to assess certain provisions of the Allocation Agreement when QLICIs are originated, the CDFI Fund will collect the following new data points:

Below Market Interest Rate at Origination

Blended Interest Rate at Origination

Comparable Blended Interest Rate at Origination

What is Interest Rate Comparable at Origination?

Interest Rate Comparable at Origination – Other

Changes to Existing Data Points

There are several existing data points at the Project Level report which have either been revised or deleted. They are described below based on topic.

General

The revisions to existing data fields:

Estimated Annual Net Operating Income

Fees and Transaction Costs

Data fields on fees and transaction costs have been revised to ensure that they are mutually exclusive. In addition, all data points will be reported as actual dollar amounts. Three data points related to fees and transaction costs have been deleted due to lack of usage.

Revised fields:

Total QEI Proceeds Retained by the CDE or CDE Affiliate

Upfront Fees to the CDE or CDE Affiliate

Upfront Fees to Investors or Investor Affiliates

Upfront Fees to Unaffiliated Third Parties

Upfront Transaction Costs

Ongoing Fees to the CDE or CDE Affiliate

Ongoing Fees Paid to Investors or Investor Affiliates

Ongoing Fees to Unaffiliated Third Parties

Ongoing Transaction Costs

Back-end Fees to CDE or CDE Affiliates

Back-end Fees to Investors or Investor Affiliates

Back-end Fees to Unaffiliated Third Parties

Back-end Transaction Costs

Deleted fields:

Other Sources of Compensation and Profits Charged to Investors

Other Sources of Compensation and Profits Charged to Borrowers/Investees

Other Sources of Compensation and Profits Charged to Other Entities

Depth of Public Subsidy Data Points

For “Total Project Cost Public Sources,” the revised guidance shown in italics states that Allocatees must “include federal, state, and local government funds, including funding derived from other tax credits (state and federal) used to directly finance the NMTC project and that were not part of the leverage structure.”

Community Outcomes Data Points

The revisions to existing data fields community outcome reporting in the NMTC Allocatee TLR include:

Minority-Owned or Controlled Businesses

Women Owned or Controlled

Low-Income Owned or Controlled

Race

Hispanic Origin

Projected Full-time Equivalent (FTE) Jobs to Be Created – Construction

Projected Full-time Equivalent (FTE) Permanent Jobs to Be Created and/or Retained at Tenant Businesses

Actual Full-time Equivalent (FTE) Jobs Created (Construction)

Actual Full-time Equivalent (FTE) Permanent Jobs Created and/or Retained at Tenant Businesses

Square Feet of Real Estate – Industrial/Manufacturing

Square Feet of Real Estate – Office

Square Feet of Real Estate – Retail

Housing Units – Sale

Housing Units – Rental

Affordable Housing Units – Sale

Affordable Housing Units – Rental

Deleted fields:

Type of Jobs Reported

Allocation Agreement Compliance Data Points

In addition, the CDFI Fund has eliminated the following data points that are no longer relevant in assessing compliance, given that they relate to data points after origination:

Below Market Interest Rate the end of the reporting period

Blended Interest Rate the end of the reporting period

Comparable Blended Interest Rate the end of the reporting period

Below Market Interest Rates or Flexible Terms Required under Allocation Agreement

Below Market Interest Rate at the end of the reporting period

What is Interest Rate Comparable at the end of the reporting period?

Interest Rate Comparable -- Other

Interest Rate Financial Note Terms at the end of the reporting period

Notes-Investments

The revisions to existing data fields:

Projected Residual Value of QLICI that May be Obtained by the QALICB and/or QALICB Affiliate

Type of Business Loan

New User Features

There are no new user features at this time.

New Disclosure

The CDFI Fund may upon request provide information collected and any associated reporting submitted by the Allocatee to an appropriate federal, state, tribal, local, international, or foreign law enforcement agency or other appropriate authority charged with investigating or prosecuting a violation or enforcing or implementing a law, rule, regulation, or order.

Generating NMTC Reports

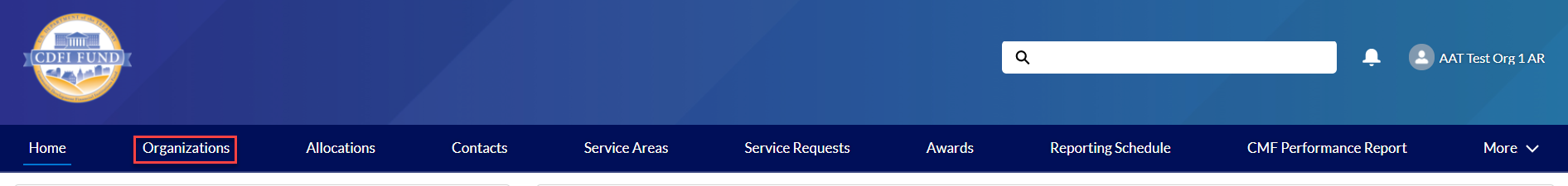

To generate TLR Reports, log into the CDFI Fund’s Awards Management Information System (AMIS) and click on the “Organizations” tab.

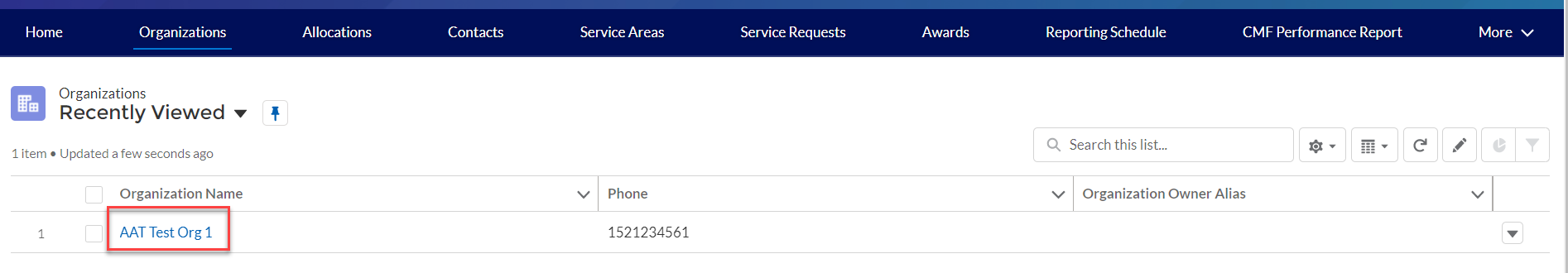

Find the Organization whose reports you want to view and click on the link.

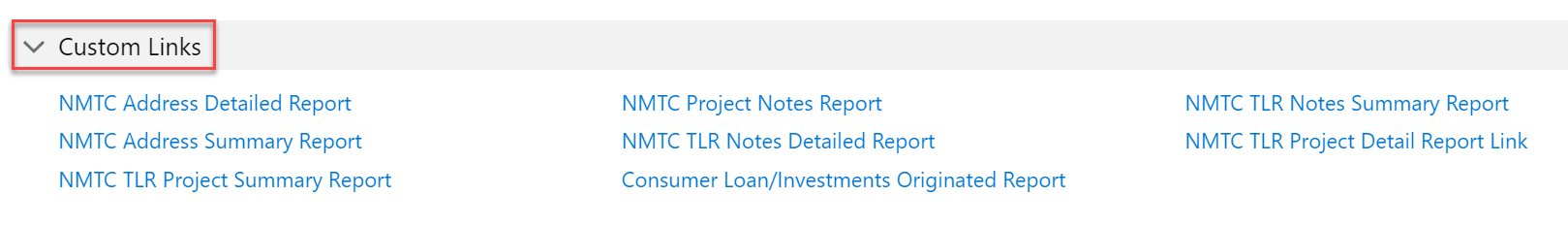

Once on the Organization page, scroll to the bottom of the details and locate the ‘Custom Links’ section. Links to available reports will be listed in the section.

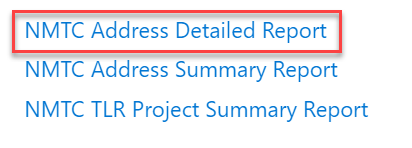

Left click on the report you would like to generate.

The report generates in a new window with all records that meet the report’s built-in criteria. Customization is not possible at this point.

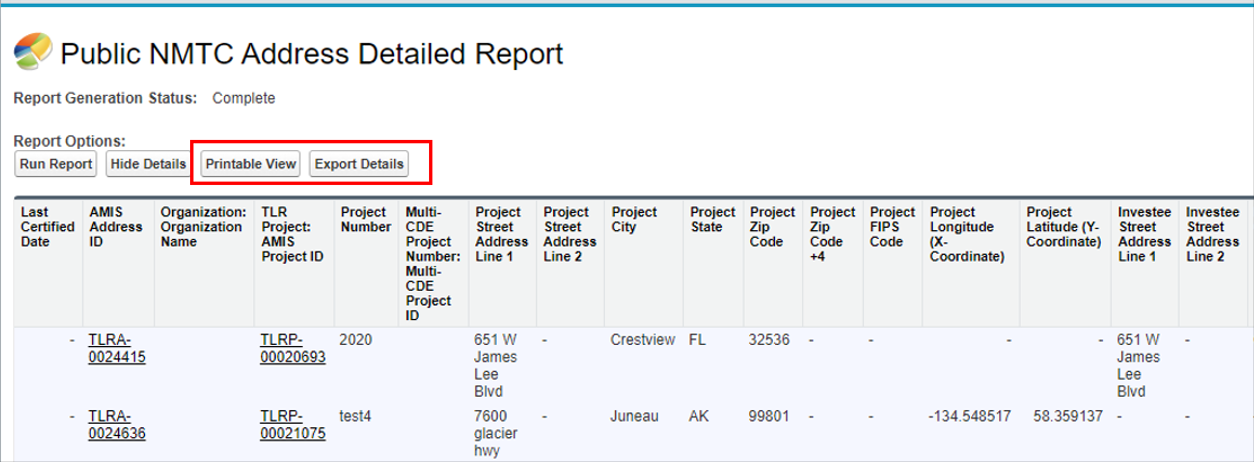

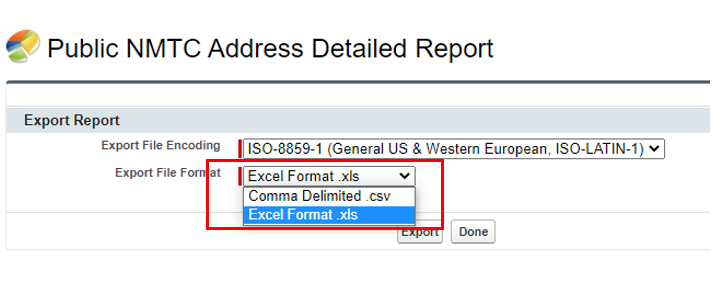

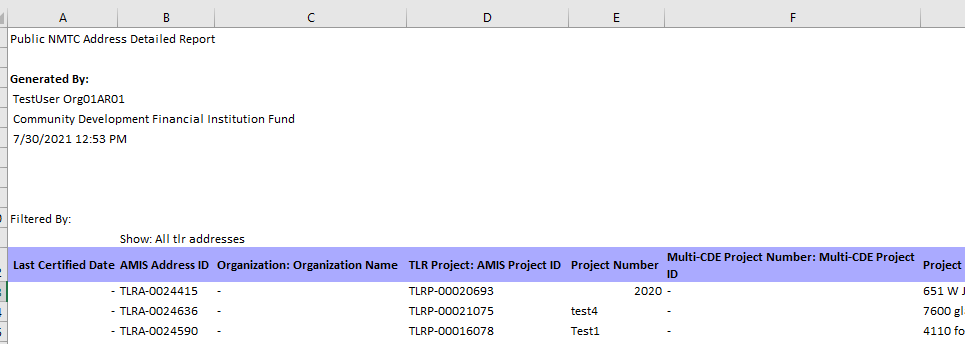

The report provides a Printable View button and an Export Details button

The Printable View button creates a formatted Excel spreadsheet of the report, suitable for presentation.

The Export Details button creates either an unformatted Excel or CSV spreadsheet of the report suitable for analysis, data manipulation (such as filtering) and import into other systems

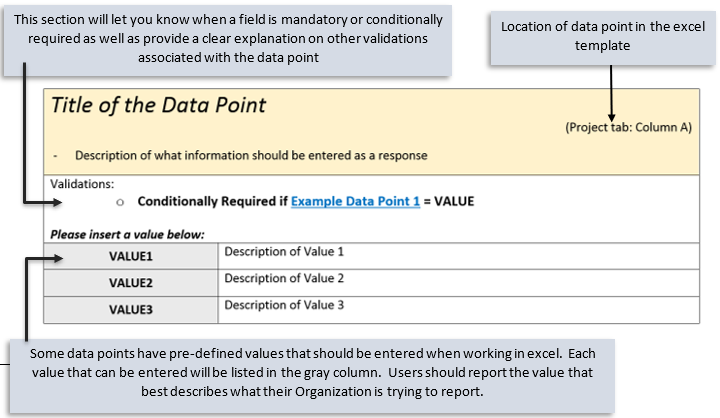

Understanding the Data Point Boxes

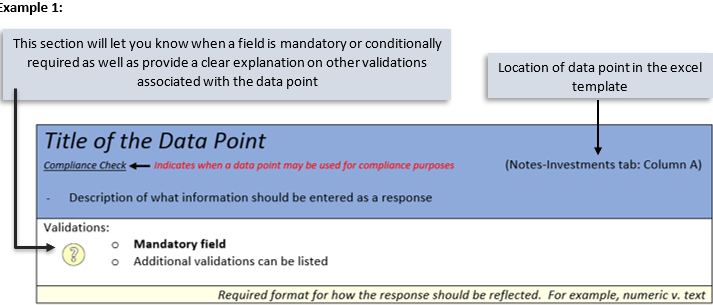

Below is a diagram of how to read and understand the data point boxes listed in the section CDE Transaction Level Report – Data Point Guidance.

Each data point is color-coded according to its related requirements.

|

Purpose of Color Coding |

|

Mandatory – A response must be provided or the TLR will not be accepted. |

|

Conditionally Required – This field will become enabled and require an answer based on a response in a previous field. |

|

Optional – Not required to provide a response although it is recommended. |

|

AMIS System Generated – User response is not allowed. |

Example 1:

Example 2:

Who to contact for help

If you are experiencing any difficulties with the data entry portion of your report, including document errors, system errors, and basic questions, please contact the AMIS Helpdesk. The most effective means of requesting support is submitting a Service Request. From the AMIS Service Request tab, select the “Create New Service Request” button. Select “Continue” to accept the default record type of “General Inquiry.” Ensure that “NMTC-AMIS technical problem” is selected for the Type drop-down field.

Alternatively, the Allocatee may send an email to [email protected]. Please type, “NMTC: TLR Assistance Needed” in the subject line of the email. A technical support staff person will generally reply within 24 hours on weekdays. Allocatees may also phone the CDFI Fund IT Help Desk at (202) 653-0422. If a technical support staff person is unavailable to immediately assist, please leave a message and a staff person will return the call within 36 hours on weekdays.

CDE Transaction Level Report – Data Point Guidance

Notes-Investments

Note: For the crosswalk guide on the NMTC TLR field level changes from the previous round refer to the “CIIS to AMIS Crosswalk NMTC TLR”.

Project Number Transaction Mandatory Info (Column B) TLR Project is used to link a Financial Note(s) to a distinct Project and to track Projects across reporting periods. This field is also used for navigational purposes. This field is automatically generated for the user by the system and is used to link a Financial Note(s) to a distinct Project and to track Projects across reporting periods. |

Validations:

|

Response must be numeric - up to 8 digits |

Originator Transaction ID Transaction Mandatory Info (Column C) Assign a unique Originator Transaction ID to track Financial Note. |

Validations:

|

Response must be text - up to 20 characters |

Last Certified Date Transaction Mandatory Info AMIS will populate this field with the date the TLR object was certified. |

Validations:

|

Format of mm/dd/yyyy |

Purpose Transaction Mandatory Info (Column D) Choose one of the pre-defined values below and identify the primary purpose of the financial note if there are multiple purposes (for example, a loan funding both the purchase of a fixed asset and a facility improvement), select the purpose with the largest percentage of the transaction. |

Validations:

Please select one of the following: |

BUSINESS |

Non-Real Estate Business: Financing to for-profit and nonprofit businesses with more than five employees or in an amount greater than $50,000 for a purpose that is not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate. |

MICRO |

Non- Real Estate Microenterprise: Financing to a for-profit or non-profit enterprise that has five or fewer employees (including the proprietor) with an amount no more than $50,000 for a purpose that is not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate. |

RECOCOM |

Real Estate – Construction/Permanent/Acquisition w/o Rehab – Commercial: Financial Note is for predevelopment financing, construction or permanent financing, or acquisition without rehabilitation of office, retail, manufacturing, or community facility space. Include mixed-use real estate that combines both commercial and residential use. |

RECOMULTI |

Real Estate – Construction–Housing-Multi Family: Financial Note is for predevelopment financing, or construction of multifamily housing. |

RECOSINGLE |

Real Estate – Construction–Housing-Single Family: Financial Note is for predevelopment financing, or construction of single-family housing. |

RERHCOM |

Real

Estate–Rehabilitation–Commercial: Financing is to

rehabilitate office, retail, |

RERHMULTI |

Real Estate – Rehabilitation – Housing – Multi Family: Financing is to rehabilitate or acquire single family housing. |

RERHSINGLE |

Real Estate – Rehabilitation – Housing – Single-Family: Financing is to rehabilitate or acquire single family housing. |

OTHER |

Other: Financial note purpose does not match any of the purposes defined above. |

Transaction Type Transaction Mandatory Info (Column E) Report the type of transaction for the financial note by choosing one of the options below. |

Validations:

Please select one of the following: |

TERM |

Term Loan |

EQTYINV |

Equity Investment |

LOC |

Line of Credit |

DEBTEQTY |

Debt with Equity |

OTHER |

Other |

Loan Status Transaction Mandatory Info (Column F) Annual Update Field Report the status of the loan/investment amount at the reporting period end. Loans that were “modified” (i.e. increase in principal) must be reported as RESTRUCT and the modified loan also reported as a new transaction. |

Validations:

Please select one of the following: |

ACTIVE |

Active – the financial note was open, on-the-books, and/or had some sort of activity during the reporting year. |

ACTIVE END |

Active but the financial note has reached the end of its seven-year compliance reporting period. |

CLOSED |

Closed in good standing – a loan or line of credit that is paid in full (not refinanced) or an equity investment that has been exited. |

SOLD |

Sold – the financial note is off-the-books but not paid in full. |

CHARGEDOFF |

Charged off - the financial note is off-the-books but not paid in full. |

REFIN |

Refinanced - the financial note has been paid in full and the remaining principal amount has been refinanced by another lender. |

RESTRUCT |

Restructured with a charge off or modified. |

Date Originated Financial Note Term (Column G) Report the date that a legally binding note has been signed by the borrower/investee in favor of the lender/investor. |

Validations:

|

The response must be in the format of mm/dd/yyyy |

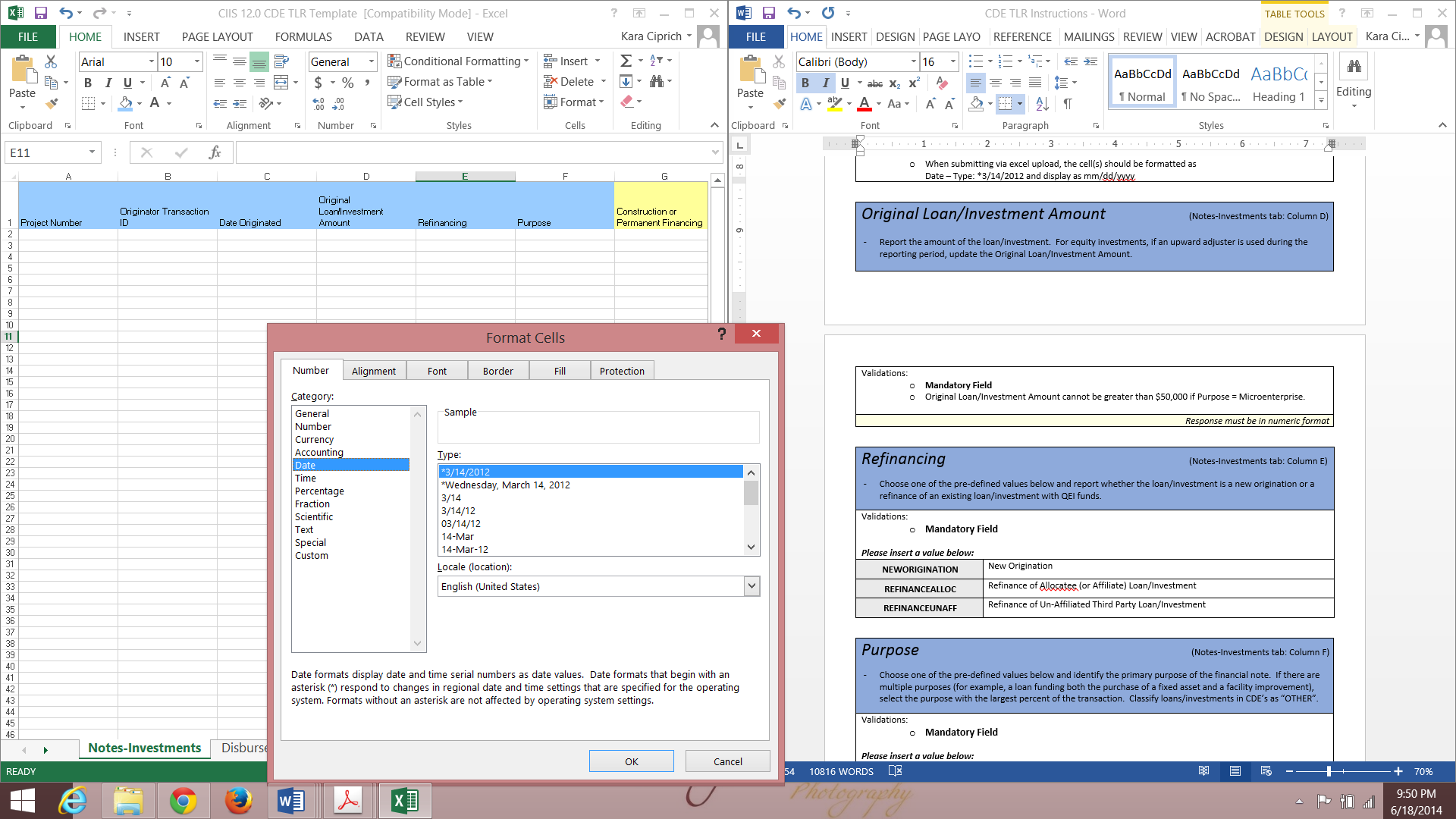

Common Question: I have uploaded my file, but it says that I have not provided a response for this date column/date column is in the incorrect format. I see my date entered, how do I fix it?

The most common fix is to make sure the date column is formatted correctly. When entering an answer into a cell that requires a date, make sure to format the cell as below. This can be done by right clicking on the cell(s). Although it may not fully appear as if it is in the correct format (March 3, 2014 will appear as 3/3/2014 as opposed to 03/3/2014), rest assured, this is correct.

Original Loan/Investment Amount Financial Note Term (Column H) Annual Update Required Report the amount of the loan/investment. |

Validations:

|

Response must be in numeric format |

Refinancing Financial Note Terms (Column I) Report whether the loan/investment is a new origination or a refinance of an existing loan/investment with QEI funds. |

Validations:

Please select one of the following: |

NEWORIGINATION |

New Origination |

REFINANCEALLOC |

Refinance of Allocatee (or Affiliate) Loan/Investment |

REFINANCEUNAFF |

Refinance of Un-Affiliated Third-Party Loan/Investment |

Construction or Permanent Financing Financial Note Terms (Column J) Report whether the loan/investment is for construction or permanent financing. |

Validations:

Please select one of the following: |

CONSTRUCTION |

Construction |

PERMANENT |

Permanent |

BOTH |

Both construction and permanent |

Take-out or Acquisition Financing Financial Note Terms (Column K) Report whether the loan/investment is for take-out or acquisition financing. |

Validations:

Please select one of the following: |

TAKEOUT |

Take-out financing |

ACQUISITION |

Acquisition without rehabilitation |

Acquisition or Rehabilitation Financial Note Terms (Column L) Report whether the loan/investment includes financing for the acquisition of the property. |

Validations:

Please select one of the following: |

ACQUISITIONREHAB |

Acquisition and rehabilitation |

REHABILITATION |

Rehabilitation only |

Rehabilitation Amount Financial Note Terms (Column M) Report the portion of the Original Loan/Investment Amount that was used for the rehabilitation. |

Validations:

|

Response must be in numeric format |

Loan Origination Fees Financial Note Terms (Column N) Report the total loan origination fees, including processing, credit report, and other fees. |

Validations:

|

Response must be in dollars up to 2 decimal places |

Interest Rate at Origination Financial Note Terms (Column O) Report the interest rate in effect at the origination of the loan. |

Validations:

|

The response must be in numeric format up to 3 decimal places |

Interest Type Financial Note Terms (Column Q) Choose one of the pre-defined values below and report the type of interest. |

Validations:

Please select one of the following: |

FIXED |

Fixed |

ADJ |

Adjustable |

Points Financial Note Terms (Column R) Report the points charged to the borrower at origination. |

Validations:

|

Response must be in numeric format up to 3 decimal places |

Amortization Type Financial Note Terms (Column S) Choose one of the pre-defined values below and report how the financial note is amortized. |

Validations:

Please select one of the following: |

FULLAMORT |

Fully Amortized – Amortization schedule includes both interest and principal payments throughout the life of the loan. |

PARTAMORT |

Partially Amortized – The amortization schedule includes some principal payments throughout the life of the loan, with a larger principal payment at maturity. |

NONAMORT |

Non-Amortizing – Amortization schedule includes interest only payments with a single principal payment at maturity. |

OTHER |

Other |

Length of Amortization Period (in months) Financial Note Terms (Column T) Report the length of the amortization period. |

Validations:

|

Response must be in numeric format |

Period of Interest Only Payments (in months) Financial Note Terms (Column U) Report the number of interest only payments at the time of origination. |

Validations:

|

Response must be in numeric format |

Term (in months) Financial Note Terms (Column V) Annual Update Required For each loan and line of credit, report the full term in months. Report the full term, not the remaining term. |

Validations:

|

Response must be in numeric format |

Guarantee Financial Note Terms (Column W) If any portion of the loan is guaranteed, choose one of the pre-defined values below and report the source. |

Validations:

Please select one of the following: |

SBA |

Small Business Administration (SBA) |

USDA |

US Department of Agriculture (USDA) |

OTHERGOV |

Other Federal Government Source |

PERSONAL |

Personal Guarantee |

OTHER |

Other |

NONE |

None |

Lien Position Financial Note Terms (Column X) Choose one of the pre-defined values below and report the CDE’s lien position. |

Validations:

Please select one of the following: |

FIRST |

First |

SECOND |

Second |

UNSECURED |

Unsecured Debt |

OTHER |

Other |

Collateral Type Financial Note Terms (Column Y) Choose one of the pre-defined values below and report the type of collateral pledged for the loan/investment. |

Validations:

Please select one of the following: |

RE |

Real Estate |

REOTHER |

Other Real Estate |

VEH |

Vehicle |

EQUIP |

Equipment |

INVENTORY |

Inventory |

REC |

Receivables |

HOMEEQTY |

Home Equity |

OTHER |

Other |

NONE |

None |

Collateral Value at Origination Financial Note Terms (Column Z) Estimate and report the fair value of the collateral at the time of origination. |

Validations:

|

Response must be in numeric format |

Equity-Like Features Financial Note Terms (Column AA) Choose one of the pre-defined values below and report the type of equity-like feature. |

Validations:

Please select one of the following: |

CONVDEBT |

Convertible Debt – Loan agreement specifies an option to convert all or part of the loan amount to equity |

PERFINT |

Performance Based Interest Rate – Loan’s interest rate adjusts based on the borrower’s performance. |

ROYALTIES |

Royalties – Loan has a royalty participation that gives the investor the right to a percentage of the borrower’s sales or profits. |

WARRANTS |

Warrants – Loan agreement gives the investor the right to purchase the portfolio company’s stock at a later date at a pre-negotiated price. |

OTHER |

Other – Loan Agreement specifies an equity-like feature not described above. |

Equity Injection Amount Financial Note Terms (Column AB) Equity injection is an underwriting mechanism used to help borrowers who lack collateral to qualify for a loan. The equity injection measures the amount of the borrower's own assets invested in the business. Report the equity injection amount provided by the investee/borrower (i.e. down payment for a purchase mortgage or the value of machinery the borrower purchased for the financed project). |

Validations:

|

Response must be in numeric format |

Advanced Purchase Commitment (Column AC) Report whether the loan/investment is an advance purchase commitment. |

Validations:

|

Response must be YES or NO |

Seller Organization (Column AD) Report the seller organization. |

Validations:

|

Response must be text |

Equity Product (Column AE) Compliance Check Report whether the financial note is an equity product. |

Validations:

|

Response must be YES or NO |

Equity-Equivalent Terms & Conditions (Column AF) Compliance Check Report whether the financial note has equity-equivalent terms and conditions. |

Validations:

|

Response must be YES or NO |

Debt with Equity Features (Column AG) Compliance Check Report whether the financial note has debt with equity features. |

Validations:

|

Response must be YES or NO |

Subordinated Debt (Column AH) Compliance Check Report whether the financial note is subordinated debt. |

Validations:

|

Response must be YES or NO |

Below Market Interest Rate at Origination (Column AI) |

Compliance Check Report whether the financial note had below market interest rate at origination. |

Validations:

|

Response must be YES, NO, or NA |

Comparable Interest Rate at Origination (Column AJ) Report the comparable market interest rate at origination that the Allocatee used to determine that the financial note had a below market interest rate. |

Validations:

|

Response must be in numeric format up to 3 decimal places |

What is Interest Rate Comparable at Origination? (Column #) Choose one of the pre-defined values below and report the interest rate comparable at origination. |

Validations:

Please select one of the following: |

NONNMTC |

CDE’s Non-NMTC Transaction |

PARENT |

CDE’s Parent/Affiliate |

BANKS |

Banks |

OTHER |

Other |

Interest Rate Comparable at Origination – Other (Column #) Provide further explanation for what the interest rate is comparable to at origination. |

Validations:

|

Response must be text |

Lower than Standard Origination Fees (Financial Note) (Column AO) Lower than Standard Origination Fees Compliance Check Report whether the financial note has lower than standard origination fees. |

Validations:

|

Response must be YES or NO |

Standard Origination Fees (Column AP) Report the comparable market origination fees that the Allocatee used as a benchmark to determine that the financial note has lower than standard origination fees. |

Validations:

|

Response must be numeric up to 2 decimal places |

Longer than Standard Period of Interest Only Payments (Column AQ) Compliance Check Report whether the financial note has longer than standard period of interest only payments. |

Validations:

|

Response must be YES, NO, or NA |

Standard Period of Interest Only Payments (Column AR) Report the comparable market period of interest only payments. Provide the benchmark period, in months, that the Allocatee used to determine that the financial note has a longer than standard period of interest only payments. |

Validations:

|

Response must be numeric |

Longer than Standard Amortization Period (Column AS) Compliance Check Report whether the financial note has a longer than standard amortization period. |

Validations:

|

Response must be YES, NO, or NA |

Standard Amortization Period (Column AT) Report the comparable market amortization period. Provide the benchmark period, in months, that the Allocatee used to determine that the financial note has a longer than standard amortization period. |

Validations:

|

Response must be numeric |

What is Standard Amortization Period Comparable? (Column AU) Standard Amortization Period Comparable? Choose one of the pre-defined values below and report the standard amortization period comparable. |

Validations:

Please select one of the following: |

NONNMTC |

CDE’s Non-NMTC Transaction |

PARENT |

CDE’s Parent/Affiliate |

BANKS |

Banks |

OTHER |

Other |

Standard Amortization Period Comparable – Other (Column AV) Provide further explanation for what the standard amortization period is comparable to. |

Validations:

|

Response must be text |

Nontraditional Forms of Collateral (Column AW) Compliance Check Report whether the financial note has a nontraditional form of collateral. |

Validations:

|

Response must be YES or NO |

Traditional Form of Collateral (Column AX) Choose one of the pre-defined values below and report the comparable market form of collateral that the Allocatee used as a benchmark to determine that the financial note has a nontraditional form of collateral. |

Validations:

Please select one of the following: |

RE |

Real Estate |

REOTHER |

Other Real Estate |

VEH |

Vehicle |

EQUIP |

Equipment |

INVENTORY |

Inventory |

REC |

Receivables |

HOMEEQTY |

Home Equity |

OTHER |

Other |

NONE |

None |

What is Traditional Forms of Collateral Comparable? (Column AY) Traditional Collateral Comparable? Choose one of the pre-defined values below and report the traditional form of collateral comparable. |

Validations:

Please select one of the following: |

NONNMTC |

CDE’s Non-NMTC Transaction |

PARENT |

CDE’s Parent/Affiliate |

BANKS |

Banks |

OTHER |

Other |

Traditional Form of Collateral Comparable – Other (Column AZ) Traditional Collateral Comparable Other Provide further explanation for what traditional form of collateral is comparable. |

Validations:

|

Response must be text |

QLICI Level (Column BA) Annual Update Required Compliance Check Report whether the financial note was funded with original QEI funds (QEI funds invested for the first time), a reinvestment of repaid QLICI(s), or both by choosing an option below. |

|

Validations:

Please select one of the following: |

|

ORIG |

Original QEI funds |

REINVST |

Reinvestment or repaid QLICI’s |

ORIGREIN |

Both |

Principal Balance Outstanding (Column BB) Annual Update Required Report the principal balance outstanding at the end of the reporting period. |

Validations:

|

Response must be numeric |

Dollar Amount Used to Finance Non-Real Estate Activities NRE Activities Finance Amount (Column BC) Report, in dollars, the portion of proceeds of the financial notes provided by the CDE that financed non-real estate uses. Non-real estate uses include working capital, inventory, equipment, or any other activity not connected to the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), acquisition, management, or leasing of real estate. |

Validations:

|

Response must be numeric up to 2 decimal places |

New Originator Transaction ID of Restructured Loan (Column BD) New Restructured Loan Transaction ID Report the new Originator Transaction ID for each financial note that was restructured. |

Validations:

|

Response must be text |

Days Delinquent (Column BE) Annual Update Required Report the number of days that the required loan payment is past due at the reporting period end. If a borrower made a partial payment on the due date but still owes any part of the payment, report that payment as past due. |

Validations:

|

Response must be numeric |

Number of Times 60 Days or More Delinquent (Column BF) Number of 60 Days or More Delinquent Annual Update Required Report the number of times the loan has been 60 days or more delinquent during the life of the loan. |

Validations:

|

Response must be numeric |

Number of Times the Loan was Restructured (Column BG) Number of Times the Loan Restructured Annual Update Required Report the number of times the loan was restructured during the life of the loan. |

Validations:

|

Response must be numeric |

Amount Charged Off (Column BH) Annual Update Required Report the amount charged off during the life of the loan. |

Validations:

|

Response must be numeric |

Amount Recovered (Column BI) Annual Update Required Report the amount recovered as of the reporting period end date. |

Validations:

|

Response must be numeric |

Actual Rate of Return (Column BJ) Report the investor’s internal rate of return at the end of the reporting period. |

Validations:

|

Response must be numeric format up to 3 decimals |

Projected Residual Value of QLICI that May be Obtained by the QALICB and/or QALICB Affiliate Projected Residual Value of QLICI (Column BK) Report the amount of any equity or debt investment which may be acquired by the QALICB and/or QALICB Affiliate as the result of a put/call option or other arrangement. |

|

Validations:

|

|

Response must be numeric |

|

Type of Business LoanChoose one of the pre-defined types below that best describes the type of business loan provided to the QALICB. This is a conditionally required response when the user selects the loan “Purpose” field for either “Business” or “Micro” which then requires the recipient to select one of three broad categories of business loans or investments: Business Working Capital; Business Fixed Capital; and Business Expansion or Business Startup. |

|

Validation:

Select one of the measures below: |

|

Business Working Capital |

A loan or investment that will be used to cover any ongoing operating expenses of a business such as payroll, inventory, rent or utility expenses. |

Business Fixed Assets |

A loan or investment that will be used to pay for any tangible property used in the operation of a business, but which is not expected to be consumed or converted into cash in the ordinary course of events. Commonly financed fixed assets include machinery and equipment, furniture and fixtures, and leasehold improvements. |

Business Expansion or Startup |

A loan to support the expansion or startup of a business or develop a new product line or service which may include a mix of investments in equipment, salaries, materials, etc., to support the business startup or expansion. |

TLR Projects Tab

Project Number (Column B) Assign a unique identifier to each Project. |

Validations:

|

Response must be numeric |

QLICI Type (Column C) Compliance Check Choose one of the pre-defined values below and report whether the QLICI is an investment in another CDE or a QALICB. |

Validations:

Please select one of the following: |

CDE |

CDE |

QALICB |

QALICB |

Investee Type (Column D) Choose one of the pre-defined values below and report whether the project is an investment in a business or another CDE. |

Validations:

Please select one of the following: |

BUS |

Business |

CDE |

CDE |

Multi-CDE Project ID (Column E) Multi-CDE Project Number Report the Multi-CDE Project Number that was assigned to the Multi-CDE Project. Use the lookup function to identify and report the Multi-CDE Project ID associated with the project. |

Validations:

|

Response must be text |

Project Results from Investment CDE (Column F) Is this project a result of a secondary loan from an investment made to a CDE? Report if the project results from funds provided as investments in, or loans to, another CDE. |

Validations:

|

|

Associated Project (Column G)

If the project results from an investment in a CDE, enter the AMIS project ID. This field links the secondary loans or investments resulting from investments in, or loans to, another CDE. |

Validations: Conditionally Required if Project Results from Investment CDE = Yes; and QLICI Type = QALICB |

|

Fiscal Year (Column H)

Choose one of the pre-defined values. The system will auto-populate the current and previous Fiscal Year of the TLR Project available. |

Validations:

|

|

Last Certified Date AMIS will populate this field with the date the TLR object was certified. |

Validations:

|

format of mm/dd/yyyy |

Total Project Cost (Column I) Report the total cost of the project being funded. |

Validations:

|

Response must be numeric |

Total Project Cost Public Sources (Column J) Report the portion of the Total Project Cost provided by public sources excluding any amount(s) reported in Other Tax Credit Amount and Public Subsidy Used to Fund Leveraged Loan. |

Validations:

Guidance: If public sources are being bridged by other types of capital, then those must be included in the dollar amount if the public source is known at the time of closing. |

Response must be numeric |

Total Project Cost Other CDE’s (Column K) Report the portion of the total QLICI investments made by other CDE’s into the project from QEI proceeds. |

Validations:

|

Response must be numeric |

Total Project Cost Private Investment (Column L) Report the portion of the private investment in the project (i.e. CDE’s using non-QEI proceeds, direct bank loans, direct equity, and other investments). |

Validations:

|

Response must be numeric |

Estimated Annual Net Operating Income (Column #) In the case of a for-profit entity, report the Estimated Annual Net Operating Income, which is the annual revenue less operating costs of the project. In the case of a non-profit entity, report the Change in Net Assets or the Addition to Net Assets. |

Validations:

|

Response must be numeric |

Loan-to-Value Ratio (Column M) Report the loan-to-value ratio at origination for the total project. |

Validations:

|

Response must be numeric up to 3 decimal places OR NA |

Projected Debt Service Coverage Ratio (Column N) Report the projected debt service coverage ratio at origination for the total project. |

Validations:

|

Response must be numeric up to 3 decimal places OR NA |

Loan Loss Reserve Requirement (Column O) Report the loan loss reserve requirement for the total project. |

|

Response must be numeric up to 3 decimal places OR NA |

Investee (Borrower) Guidance

• If the QALICB is a real estate developer, the Investee is the developer.

• If the QALICB is an operating business (non-real estate), the Investee is the business.

• If the QALICB is a single-purpose entity (SPE) created by an operating business to lease back property to that parent business, the Investee is the parent business

Client ID (Column P) Report a unique identifier to each client (investee/borrower). The Client ID is used to track the investee/borrower across Projects. Please do not use any names, social security numbers or any other personal identifying information in formulating the Client ID. |

Validations:

|

Response must be text up to 20 characters |

Investee TIN (Column Q) Report the Tax Identification Number (TIN) of the CDE investee/borrower. |

Validations:

|

Response must be numeric |

Investee CDE Certification Number (Column R) If the Project is an investment in another CDE, report the Certification Number of the CDE investee/borrower. |

Validations:

|

Response must be numeric |

Date Business Established (Column S) Report the date formal papers were filed to establish the investee’s/borrower’s business or the date the first sales occurred. |

Validations:

|

Response must in the format of mm/dd/yyyy |

Entity Structure (Column T) Choose one of the pre-defined values below and report the investee’s/borrower’s business or government structure. |

Validations:

Please select one of the following: |

NONPROFIT |

Non-Profit or Not-for-Profit – Based on the IRS categorization for tax purposes |

FORPROFIT |

For-Profit – Based on the IRS categorization for tax purposes |

TRIBAL |

Tribal or Village Government – Entity is a tribal or village government, whether or not it has been federally recognized |

OTHER |

Other – All other structures that do not fit the descriptions above, such as a government or quasi-government entity (i.e. a water authority) |

Minority-Owned or Controlled Businesses (Column U) Report whether the investee/borrower is at least 51% owned or controlled by one or more individuals that identify themselves as American Indian or Alaskan Native, Asian, Black or African American, Hispanic or Latino, Native Hawaiian or Other Pacific Islander. |

Validations:

|

Response must be YES or NO |

Native American-Owned or Controlled Businesses Report whether the investee/borrower is at least 51% owned or controlled by one or more individuals who are members of Tribal entities recognized by the Bureau of Indian Affairs (BIA) or by individuals having origins in any of the original peoples of Hawaii. |

Validations:

|

Response must be YES or NO |

Women Owned or Controlled (Column V) Report whether the investee/borrower is at least 51% owned or controlled by one or more women. |

Validations:

|

Response must be YES or NO |

Low-Income Owned or Controlled (Column W) Report whether the investee/borrower is at least 51% owned or controlled by one or more Low-Income Person |

Validations:

|

Response must be YES or NO |

Race (Column X) Choose one of the pre-defined values below and report the race of the primary investee(s)/borrower(s) |

Validations:

Please select one of the following: |

AMIND |

American Indian |

ALASKAN |

Alaskan Native |

ASIAN |

Asian |

BLACK |

Black or African American |

HAWAIIAN |

Native Hawaiian |

PACIFIC |

Other Pacific Islander |

WHITE |

White |

OTHER |

Other |

NG |

Not Given |

NA |

Not Applicable |

Hispanic Origin (Column Y) Choose one of the pre-defined values below and report whether the primary investee/borrower is Hispanic or Latino. |

Validations:

Please select one of the following: |

YES |

Yes |

NO |

No |

NG |

Not Given |

NA |

Not Applicable |

Business Description – Primary (Column Z) Choose one of the pre-defined values below and report the primary description of the business of the QALICB. |

Validations:

Please select one of the following: |

FOOD |

Includes groceries, bakeries, food wholesalers, and farmers’ markets |

OFFICE |

Financial, professional, scientific, management, business, or other office space |

INDUSTRIAL |

Industrial, manufacturing, transportation, logistics, or warehousing space |

HOUSING |

Housing |

HEALTH |

Health, human, and social service facilities |

COMMUNITY |

Education and community facilities |

ARTS |

Facilities or space for the performing arts, cultural, entertainment, or other amenities |

RETAIL |

Retail |

HOTEL |

Hotel |

MIXED |

Includes combinations of office/retail, housing, and community spaces. |

OTHER |

Other |

Business Description – Narrative (Column AA) Provide an additional description of the type of business that is being financed (e.g. grocery store, Federally Qualified Health Center, charter school, a manufacturing company, etc.) and of the products or services provided by the operating business (e.g. manufacture of farm equipment, early childhood education, primary healthcare, etc.). |

Validations:

|

The response must be text |

NAICS (Column AB) Report the 6-digit North American Industry Classification (NAICS) Code of the QALICB. |

Validations:

Guidance:

|

Response must be numeric |

Annual Gross Revenue from Business Operations at Time of Loan/Investment Annual Gross Revenue (Loan/Investment) (Column AC) For business Projects, report the investee’s/borrower’s annual gross business revenue during the most recent 12-month period prior to Project origination for which the information is available. If the QALICB is a single-purpose entity (SPE), report the revenue of the parent business. |

Validations:

|

Response must be numeric |

Annual Gross Revenue from Business Operations Reported During the Reporting Period (Column AD) Annual Gross Revenue (Reporting Period) Annual Update Required For business Projects, report the investee’s/borrower’s annual gross business revenue during the most recent 12-month period for which the information is available. If the QALICB is a single-purpose entity (SPE), report revenue for the parent business |

Validations:

|

Response must be numeric |

Guidance for Reporting Jobs Projected/Actual Created or Maintained Currently in AMIS, values must be entered for either the three Projected Jobs fields or the three Actual Job fields in the Project - Outcomes section. The Actual Job fields can be left blank and filled out in the future if the 3 Projected job fields have been completed. Once filled out, the Actual Job fields can only be updated via service request. The type of jobs reported on must all be DIRECT jobs. |

Full-Time Equivalent Jobs

- One FTE is a 35-hour or more

work week.

Part-Time

employees - When calculating

FTE’s, part-time employees

should be combined (i.e. 2 part-time employees that each work 17.5

hours equals one FTE)

Jobs at Time of Loan/Investment (Column AF) Report the number of full-time equivalent (FTE) jobs in the business at the time the project was originated. |

Validations:

|

Response must be numeric |

Projected Full-time Equivalent (FTE) Jobs to Be Created - Construction (Column AH) Projected Jobs (Construction) Report the number of full-time equivalent (FTE) construction jobs projected to be created due to this financing. |

Validations:

|

Response must be numeric |

Projected Full-time Equivalent (FTE) Permanent Jobs to Be Created and/or Retained at Businesses Financed Projected Permanent Jobs (Financed) (Column AG) Report the number of permanent full-time equivalent (FTE) jobs projected (at date originated) to be created and/or retained in the business due to this financing. |

Validations:

|

Response must be numeric |

Projected Full-time Equivalent (FTE) Permanent Jobs to Be Created and/or Retained at Tenant Businesses Projected Permanent Jobs (Tenant) (Column AI) Report the number of permanent full-time equivalent (FTE) jobs projected to be created and/or retained in businesses located at the property financed. |

Validations:

Guidance: Include owner-occupied businesses. |

Response must be numeric |

Actual Full-time Equivalent (FTE) Permanent Jobs Created and/or Retained at Businesses Financed (Column AJ) Actual Jobs Created (Financed) Report the cumulative number of permanent full-time equivalent (FTE) jobs created and/or retained in the business due to this financing. |

Validations:

|

Response must be numeric |

Actual Full-time Equivalent (FTE) Jobs Created (Construction) (Column AK) Report the cumulative number of full-time equivalent (FTE) construction jobs created due to this financing. |

Validations:

|

Response must be numeric |

Actual Full-time Equivalent (FTE) Permanent Jobs Created and/or Retained at Tenant Businesses (Column AL) Actual Jobs Created (Tenant) Report the cumulative number of permanent full-time equivalent (FTE) jobs created and/or retained in businesses located at the property financed. |

Validations:

Guidance: Include owner-occupied businesses. |

Response must be numeric |

Source of Job Estimates (Column AM) Choose one of the pre-defined values below and report the source of the job estimates reported. |

Validations:

|

NEWFINANCING |

New hires that the project business expects to be able to make as a result of the new financing |

WAGEDATA |

Estimates based on state or local wage data and projected wage and salary expenditures attributable to project financing |

ECONOMICIMPACT |

Estimates based on economic impact modeling systems such as IMPLAN, RIMSII, or REMI |

RULEOFTHUMB |

Estimates based on developers “rules of thumb” about jobs created by type of business and square-footage built. |

OTHER |

Other – Please provide further explanation in Source of Job Estimates – Other |

NA |

Not Applicable |

Response must be text |

Source of Job Estimates – Other (Column AN) Provide further explanation for what the source of job estimates is. |

Validations:

|

Response must be text |

Square Feet of Real Estate – Industrial/Manufacturing (Column AO) Square Feet of Real Estate – Industrial/Manufacturing Report the total number of gross square feet of industrial/manufacturing space that are expected to be constructed, rehabilitated, and/or acquired with funding from the transaction. |

Validations:

|

Response must be numeric |

Square Feet of Real Estate – Office (Column AP) Report the total number of gross square feet of office space that are expected to be constructed, rehabilitated, and/or acquired with funding from the transaction. |

Validations:

|

Response must be numeric |

Square Feet of Real Estate – Retail (Column AQ) Report the total number of gross square feet of retail space that are expected to be constructed, rehabilitated, and/or acquired with funding from the transaction. |

Validations:

|

Response must be numeric |

Housing Units – Sale (Column AR) Compliance Check Report the number of for-sale housing units to be constructed, rehabilitated, and/or acquired with funding from the transaction. |

Validations:

|

Response must be numeric |

Housing Units – Rental (Column AS) Compliance Check Report the number of rental housing units to be constructed, rehabilitated, and/or acquired with funding from the transaction. |

Validations:

|

Response must be numeric |

Affordable Housing Units – Sale (Column AT) Compliance Check Of the total Housing Units - Sale to be constructed, rehabilitated, and/or acquired with funding from the transaction, report the number that are projected to be affordable housing units |

Validations:

|

Response must be numeric |

Affordable Housing Units – Rental (Column AU) Compliance Check Of the total Housing Units – Rental to be constructed, rehabilitated, and/or acquired with funding from the transaction, report the number that are projected to be affordable housing units. |

Validations:

|

Response must be numeric |

Community Facility (Column AV) Report whether the project financed is a community facility. |

Validations:

|

Response must be YES, NO, or Don’t Know |

Capacity of Educational Community Facility (Column AW) Capacity of Educational Community If the project financed includes an educational facility, report the number of student seats available in the school. If not, report 0. |

Validations:

|

Response must be numeric |

Capacity of Childcare Community Facility (Column AX) If the project financed includes a childcare facility, report the number of childcare slots available. If not, report 0. |

Validations:

|

Response must be numeric |

Capacity of Healthcare Community Facility (Column AY) Capacity of Healthcare Community If the project financed includes a healthcare facility, report the projected number of visits per year. If not, report 0. |

Validations:

|

Response must be numeric |

Capacity of Arts Center Community Facility (Column AZ) Capacity of Arts Center Community If the project financed includes an arts center, report the capacity of the arts center (i.e. if the project is a theater, report the seating capacity). If not, report 0. |

Validations:

|

Response must be numeric |

Number of People Served by Commercial Goods or ServicesReport the number of people (e.g. customers, clients, patients, students, etc.) served by commercial goods or services as a result of NMTC financing per year. Include investments that provide access to retail, grocery stores, farmer’s markets, entertainment, pharmacies, etc. |

Validations:

Guidance: Follow generally accepted practices for counting people or use the methodology that was described in the NMTC Allocation Application.

Do not exclude Multi-CDEs – for reporting across CDEs, aim to coordinate responses and avoid data issues to best of your ability. |

Response must be numeric |

Number of People Served by Community Goods or ServicesReport the number of people (e.g. clients, patients, students, visitors, attendees, etc.) served by community goods or services as a result of NMTC financing per year. Include investments in community goods or services such as food pantries, healthcare, social services, educational, cultural, etc. |

Validations:

Guidance: Follow generally accepted practices for counting people or use the methodology that was described in the NMTC Allocation Application.

Do not exclude Multi-CDEs – for reporting across CDEs, aim to coordinate responses and avoid data issues to best of your ability. |

Response must be numeric |

QALICB Type (Column BA) Compliance Check Choose one of the pre-defined values below and report the QALICB type that describes the investee/borrower. |

Validations:

Please select one of the following: |

RE |

Real Estate QALICB |

NRE |

Non-Real Estate QALICB |

SPE |

Special Purpose Entity QALICB |

QALICB TYPE GUIDANCE Real Estate QALICB: Financing provided to a Real Estate QALICB refers to entities whose predominant business activity (e.g. more than 50 percent of gross income) is the development (including construction of new facilities and rehabilitation/enhancement of existing facilities), management, or leasing of real estate that will be sold or leased to third partities.

Non-Real Estate QALICB: Transactions with QALICBs whos predominant business activity includes all other types of business activities other than those listed above must be classified as Non-Real Estate QALICBs regardless of: 1) how the business intends to use the proceeds of the transaction; or 2) whether the business intends to use any real estate owned as collateral for a loan.

Special Purpose Entity QALICB: Loans or investments made to a special purpose entity that is controlled by or under common control with an Operating Business, and that was set up specifically to lease the property back to the Operating Business such that the Operating Business is the principal user of the property, must be classified as a Special Purpose Entity QALICB. An Operating Business is considered the principal user of the QALICB’s property if it is the occupant of a majority (i.e., greater than 50%) of the rentable square footage of the QALICB’s property. The QALICB may lease the balance of its property to one or more third parties. The term “Operating Business” is defined in the glossary of the NMTC Allocation Application. |

|

NMTC Eligibility Criteria (Column BB) Compliance Check Choose one of the pre-defined values below and report which geographic criteria qualifies this transaction as a NMTC eligible transaction. |

Validations:

Please select one of the following: |

TARGETAREA |

CDFI Fund approved target area or other area (can only be selected if Date Originated is prior to 12/31/2012) |

TARGETPOP |

Targeted Population |

TRACTS |

Tracts with low population |

HIGHMIGRATION |

High migration rural county |

2006-2010ACS |

American Community Survey 2006-2010 – May apply to QLICIs closed between May 1, 2012 and October 31, 2018. |

2011-2015ACS |

American Community Survey 2011-2015 – May apply to QLICIs closed between and including October 31, 2017 and October 31, 2018. Exclusively applies to QLICIs closed on or after November 1, 2018. |

Related Entity (Column BC) Compliance Check Report whether the investee (entity receiving the financing) is a related entity as defined under the applicable allocation agreement. |

Validations:

|

Response must be YES or NO |

Guidance for Reporting Fees and Transaction Costs

|

Upfront Fees to Investors or Investor Affiliates (Column BD) Report the dollar amount of upfront sources of compensation and fees paid to investors or investor Affiliates. |

Validations:

Guidance: This question is applicable to all CDEs participating in an NMTC project. For Multi-CDE projects, in which upfront fees to investors or investor affiliates are not directly traceable to a specific CDE, the amount of the fees must be pro-rated to the amount of the QEI. |

Response must be numeric |

Upfront Fees to the CDE or CDE Affiliate (Column BE)

Report the dollar amount of upfront sources of compensation and fees paid to CDE or CDE Affiliates. |

Validations:

Guidance: If a CDE or a CDE Affiliate charges a fee for services provided that would normally be considered a project cost (e.g., real estate development consulting, financial consulting by a CDE or a CDE Affiliate, etc.), then such a fee must be reported under this data point.

Fees must be reported as an estimate at origination.

Do not double-count fees; base the entered dollar amount on who it was paid to initially. |

Response must be numeric |

Upfront Fees to Unaffiliated Third Parties (Column BF) Report the dollar amount of upfront sources of compensation and fees paid to unaffiliated third parties. |

Validations:

Guidance: Fees must be reported as an estimate at origination.

Do not double-count fees; base the entered dollar amount on who it was paid to initially. |

Response must be numeric |

Ongoing Fees Paid to Investors or Investor Affiliates (Column BG) Report the dollar amount of ongoing sources of compensation and fees paid to investor or investor Affiliates. |

Validations:

|

Response must be numeric |

Ongoing Fees to the CDE or CDE Affiliate (Column BH) Report the dollar amount of ongoing sources of compensation and fees paid to the CDE or CDE Affiliate. |

Validations:

|

Response must be numeric |

Ongoing Fees to Unaffiliated Third Parties (Column BI) Report the dollar amount of ongoing sources of compensation and fees paid to unaffiliated third parties. |

Validations:

|

Response must be numeric |

Total QEI Proceeds Retained by the CDE or CDE Affiliate (Column BJ) Report the total dollar amount of the QEI proceeds retained by the CDE prior to the QLICI being made. |

Validations:

Guidance: Amounts withheld for Loan Loss Reserves of future QLICIs must NOT be included in this dollar amount. Loan Loss Reserves are collected in another data field. |

Response must be numeric |

Back-end Fees to Investors or Investor Affiliates (Column BK) Report the amount of back-end sources of compensation and fees paid to investors or investor Affiliates. |

Validations:

|

Response must be numeric |

Back-end to CDE or CDE Affiliates (Column BL) Report the dollar amount of back-end sources of compensation and fees paid to CDE or CDE Affiliates. |

Validations:

|

Response must be numeric |

Back-end Fees to Unaffiliated Third Parties (Column BM)

Report the dollar amount of back-end sources of compensation and fees paid to unaffiliated third parties. |

Validations:

|

Response must be numeric |

Upfront Transaction Costs (Column BN) Report the dollar amount of upfront transaction costs.. |

Validations:

|

Response must be numeric |

Ongoing Transaction Costs (Column BO) Report the dollar amount of ongoing transaction costs. |

Validations:

Guidance: Fees and expenses paid from QLICI interest must NOT be reported in this data field. |

Response must be numeric |

Back-end Transaction Costs (Column BP) Report the dollar amount of back-end transaction costs. |

Validations:

Guidance: Back-end transaction costs must be reported as an estimate at origination. |

Response must be numeric |

Below Market Interest Rate at Origination (Column #) Compliance Check Report whether the project had a below market interest rate at origination. |

Validations:

|

Response must be YES or NO or NA |

Blended Interest Rate at Origination (Column #) Compliance Check Report the blended interest rate in effect at origination. |

Validations:

|

Response must be numeric up to 3 decimal places |

Comparable Blended Interest Rate at Origination (Column #) Report the comparable market rate at origination that the Allocatee used as a benchmark to determine that the project has a below market interest rate. |

Validations:

|

Response must be numeric up to 3 decimal places |

Lower than Standard Origination Fees (Column BT) Compliance Check Report whether the project has lower than standard origination fees. |

Validations:

|

Response must be YES or NO |

Standard Origination Fees (Project) (Column BU) Report the comparable market origination fees that the Allocatee used as benchmark to determine that the project has lower than standard origination fees. |

Validations:

|

Response must be in dollars up to 3 decimal places |

Higher than Standard Loan to Value Ratio (Column BV) Compliance Check Report whether the project has a higher than standard loan to value ratio. |

Validations:

|

Response must be YES or NO |

Standard Loan to Value Ratio (Column BW) Report the comparable market loan to value ratio that the Allocatee used as benchmark to determine that the project has higher than standard loan to value ratio. |

Validations:

|

Response must be numeric up to 3 decimal places |

More Flexible Borrower Credit Standards (Column BX) Compliance Check Report whether the project has more flexible borrower credit standards. |

Validations:

|

Response must be YES or NO |

Lower than Standard Debt Service Coverage Ratio (Column BY) Lower than Standard Debt Service Ratio Compliance Check Report whether the project has a lower than standard debt service coverage ratio. |

Validations:

|

Response must be YES or NO |

Standard Debt Service Coverage Ratio (Column BZ) Report the comparable market debt service coverage ratio that the Allocatee used as benchmark to determine that the project has a lower than standard debt service coverage ratio. |

Validations:

|

Response must be numeric up to 3 decimal places |

Lower than Standard Loan Loss Reserve Requirement Lower than Standard Loan Loss Req (Column CA) Compliance Check Report whether the project has a lower than standard loan loss reserve requirement. |

Validations:

|

Response must be YES or NO |

Standard Loan Loss Reserve Requirement (Column CB) Report the comparable standard loan loss reserve requirement that the Allocatee used as benchmark to determine that the project has a lower than standard debt service coverage ratio. |

Validations:

|

Response must be numeric up to 3 decimal places |

Poverty Rates Greater than 25% but less than or equal to 30% Poverty Rates Greater > 25% and < 30% (Column CC) Compliance Check Poverty Rates Greater than 25% but less than or equal to 30%. |

Validations:

|

Response must be YES, NO or NA |

Poverty Rates Greater than 30% (Column CD) Compliance Check Poverty Rates Greater than 30% |

Validations:

|

Response must be YES, NO or NA |

Median Income Less than or Equal to 60% of Area Median Income Median Income Rates ≤ 60% of Area Median Income (Column CE) Compliance Check If located within a Non-Metropolitan area, median family income does not exceed 60% of statewide median family income or if located within a Metropolitan Area, median family income does not exceed 60% of the statewide median family income or the metropolitan area median family income. |

Validations:

|

Response must be YES, NO or NA |

Median Income Greater than 60% of Area Median Income but less than 70% Median Income 60-70% Area Median Income (Column CF) Compliance Check If located within a non-metropolitan area, median family income is greater than 60% but less than 70% of statewide median family income or if located within a metropolitan area, median family income greater than 60% but less than or equal to 70% of the statewide median family income or the metropolitan area median family income. |

Validations:

|

Response must be YES, NO or NA |

Unemployment rates equal to or greater than 1.25 but less than 1.5 times the national average Unemployment rates 1.25 – 1.5 Nation AVG (Column CG) Compliance Check Unemployment rates equal to or greater than 1.25 but less than 1.5 times the national average. |

Validations:

|

Response must be YES, NO or NA |

Unemployment rates at least 1.5 times the national average Unemployment rates equal 1.5X national average (Column CH) Compliance Check Unemployment rates at least 1.5 times the national average. |

Validations:

|

Response must be YES, NO or NA |

Designated for Redevelopment (Column CI) Compliance Check Designated for redevelopment by a governmental agency. |

Validations:

|

Response must be YES, NO or NA |

Designated EZ, EC, or RC (Column CJ) Compliance Check Federally designated Empowerment Zone, Enterprise Communities, or Renewal Communities. |

Validations:

|

Response must be YES, NO or NA |

SBA Designated HUB Zone (Column CK) Compliance Check U.S. Small Business Administration (SBA) designated HUB Zones, to the extent that the QLICI’s will support businesses that obtain HUB Zone certification from the SBA. |

Validations:

|