Non-substantive Change for 2023 ARMS 3

0275 - ARMS 3 - Non-substantive Change Request - 2023 Surveys - September 22, 2023.docx

Agricultural Resource Management Phase 3 Economic Surveys

Non-substantive Change for 2023 ARMS 3

OMB: 0535-0275

September 22, 2023

Non-substantive Change Request

0535-0275 – Agricultural Resource Management Survey (ARMS) Phase III

Cost and Returns Report

Oats Cost and Returns Report

Peanuts Cost and Returns Report

Soybeans Cost and Returns Report

Following a review of the ARMS 3 questionnaires that were recently approved by OMB, the USDA Economic Research Service, with consultation with NASS updated the question text and enumerator instruction based on further consultation. The changes are described below. Almost all changes are wording changes to clarify what is needed from the respondent. Changes will be documented by each version separately.

Cost and Returns Report

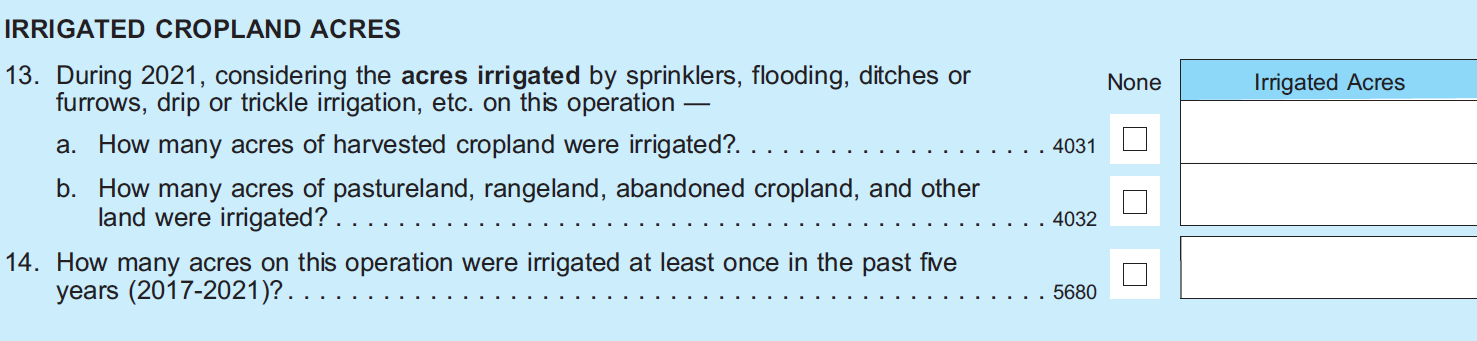

Section A, Items 13 and 14 – Removed from approved version

Section A, Item 15 – from “Has this operation ever received financial assistance from EQIP or CSP?” to “Has this operation ever received financial assistance from Environmental Quality Incentives Program (EQIP) or the Conservation Stewardship Program (CSP)?”

Section A, Item 16 – from “Has this operation ever received technical assistance from NRCS?.” to “Has this operation ever received technical assistance from Natural Resources Conservation Service (NRCS)?.”

Section A, Item 17 – from “For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local program and provided financial assistance to help defray the cost of practice adoption.)” to For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local programs. They provide financial assistance to help defray the cost of practice adoption.)

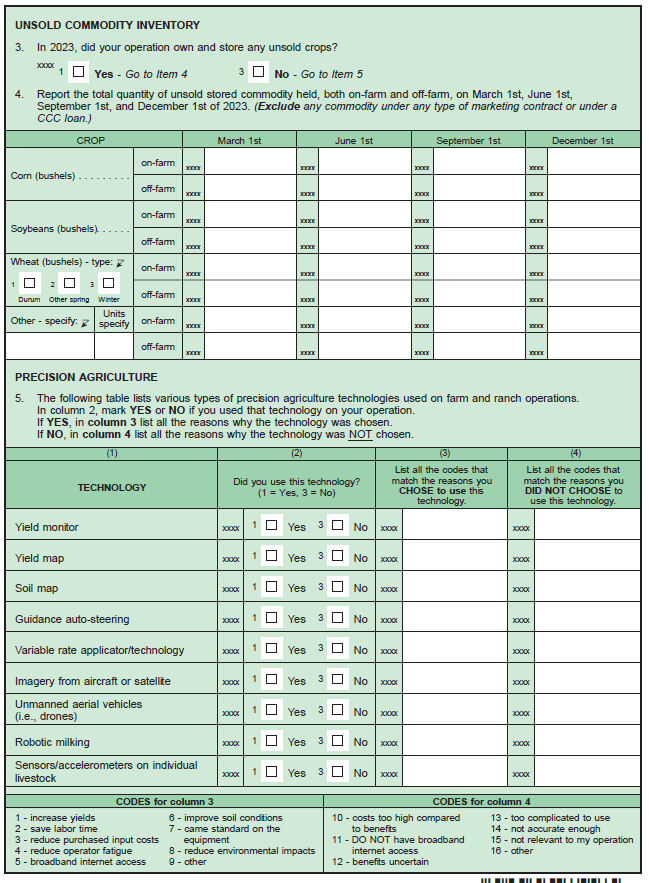

Section B, New questions after question 2 table:

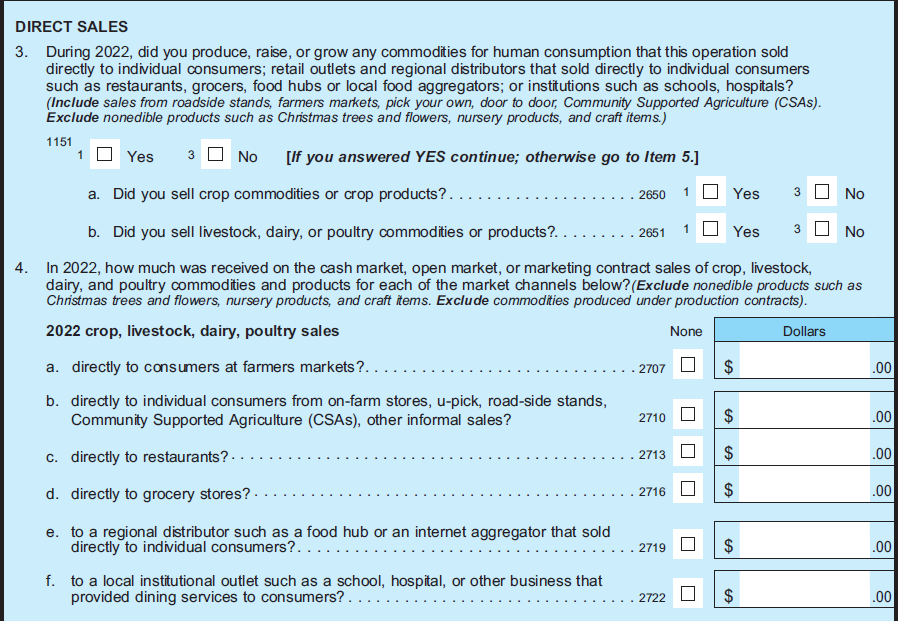

Section E, Items 3 and 4 – Removed.

Section E, Item 5 – “Did your buyers (including cooperatives) require or encourage you to use sustainable livestock or crop production practices such as cover crops or reduced fertilizer application rates, or changes to livestock diets or feed additives through any of the following methods? Exclude certified-organic production.

Section E, Item 4 After the –“INCENTIVES FROM COMMODITY BUYERS” section there is a new question:

“If any of the {Incentives from Commodity Buyers} are marked YES, is the arrangement related to carbon sequestration or GHG emission reductions? (Y/N)”

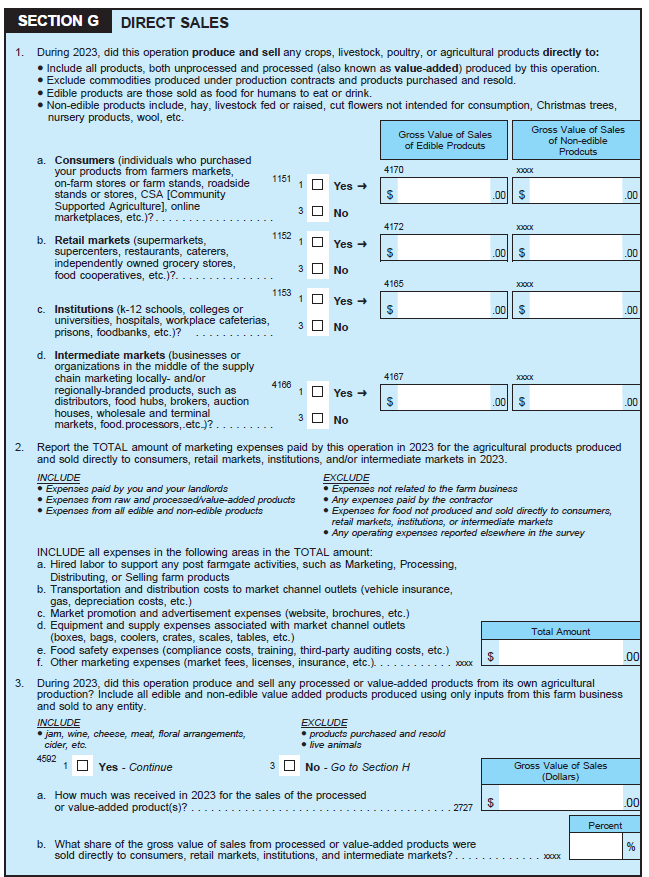

NEW SECTION AFTER SECTION F – ACCOUNTS RECEIVABLE & DEFERRED PAYMENTS

Section G (Government Payments & Other Farm Related Income), Item 2 – “In 2023, did this operation receive Federal, State or local farm program payments? (Include government payments received through a cooperative and forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments.)”

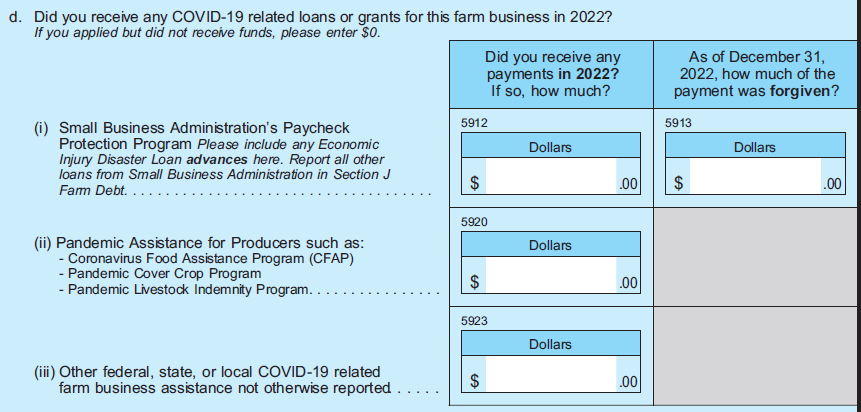

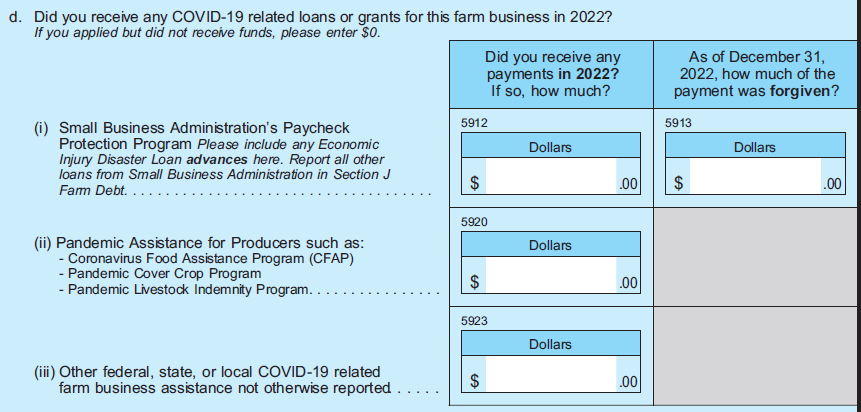

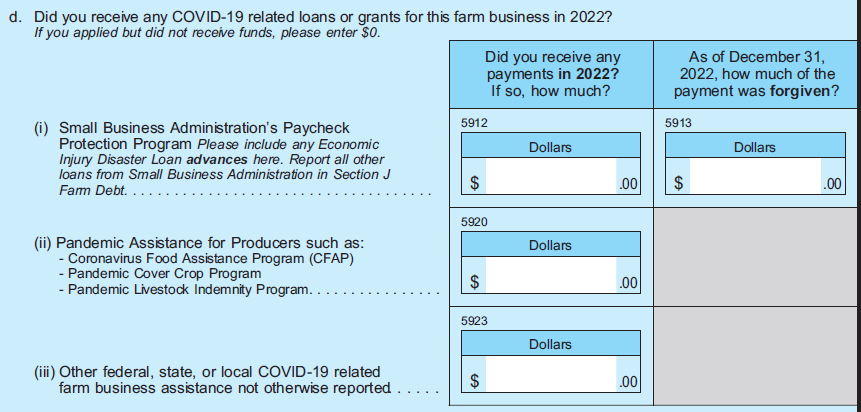

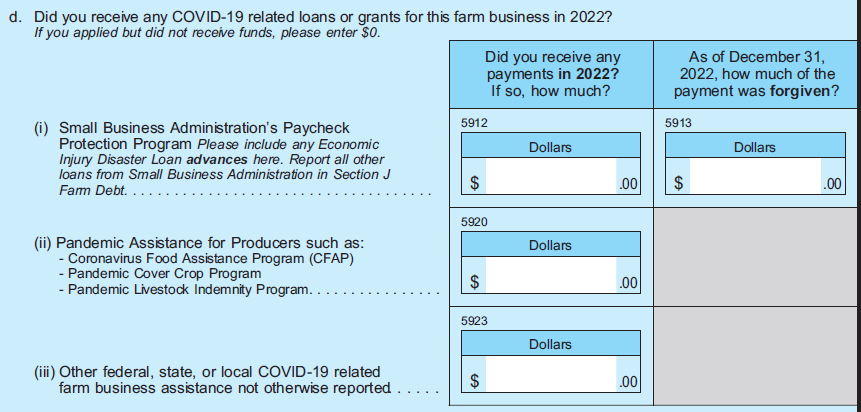

Section G, Item 2d – Removed:

Section G, Items 5, 6, 7 – Removed.

Section I, Item 2b – From “tractors, machinery, tools, equipment, and implements owned by the operation” to “tractors, machinery, tools, equipment, and implements owned by the operation (including ATVs and UTVs)”.

Section I, Item 4a – New question “Do you have any liquid holdings over $250,000 at a single banking institution? Include both farm business bank accounts and personal accounts.”

Section J, Item 3 (Include/exclude) – from “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes. Exclude PPP loans or grants and instead report those in Section G, question 2di on page 9.” to “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes.”

Section J, Items 5-8 – New questions after Item 4

Section K, Items 14, 15, 16, 17, 18, 19, 20 – Removed.

Section L, Item 1 (Goto statements after responses) – Yes – Go to Item 1a; No – Go to Item 2.

Section L, Item 1a – New question “Is the principal operator a member of the family who owns more than 50 percent of this operation? (Yes/No)”

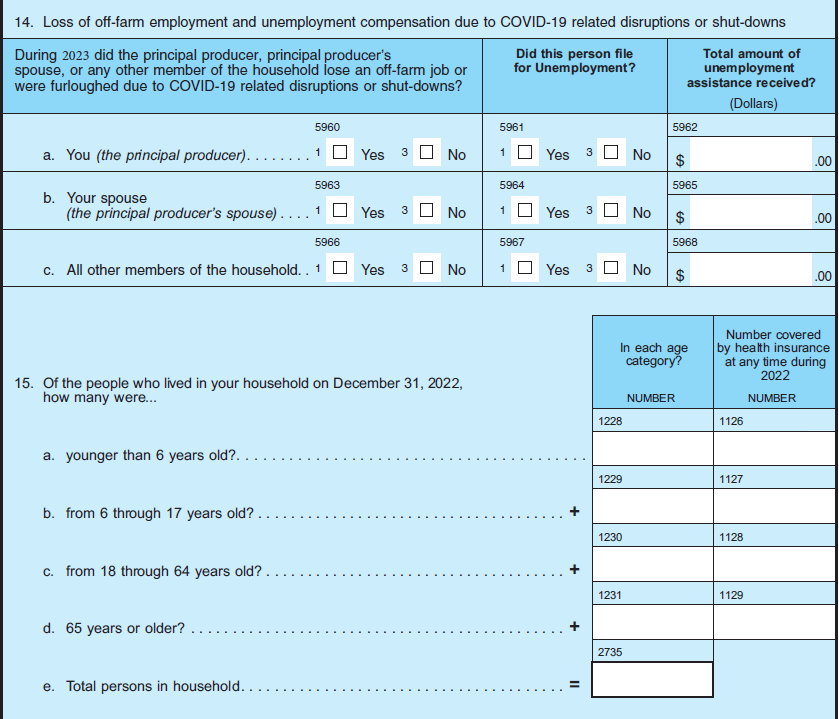

Section M, Item 1i Include/Exclude Statement – From “Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance including COVID-19 related unemployment. Exclude government COVID-19 related stimulus payments” to Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance.”

Section M, Item 1j – Removed “income from COVID-19 related Economic Impact Payments also known as stimulus payments/check”.

Oat Cost and Returns Report

Section A, Item 13 – from “Has this operation ever received financial assistance from EQIP or CSP?” to “Has this operation ever received financial assistance from Environmental Quality Incentives Program (EQIP) or the Conservation Stewardship Program (CSP)?”

Section A, Item 14 – from “Has this operation ever received technical assistance from NRCS?.” to “Has this operation ever received technical assistance from Natural Resources Conservation Service (NRCS)?.”

Section A, Item 15 – from “For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local program and provided financial assistance to help defray the cost of practice adoption.)” to For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local programs. They provide financial assistance to help defray the cost of practice adoption.)

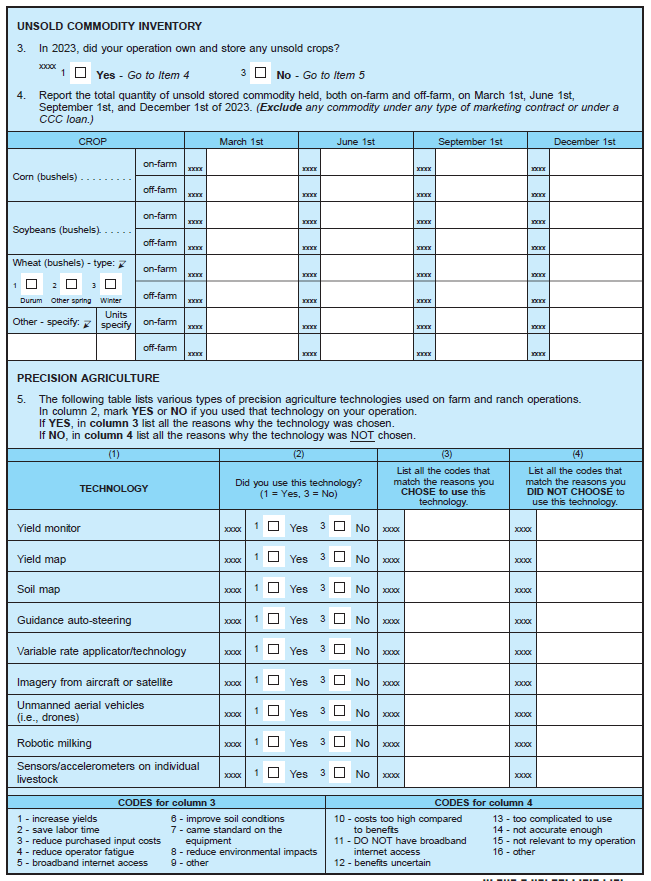

Section B, New questions after question 2 table:

Section C, Item 1 – From “Did you or anyone else have any livestock or poultry on this operation in 2023 (regardless of ownership), or did this operation receive any income from livestock, poultry, or livestock products in 2023? (Include your landlord’s share & livestock/poultry grown for others on a contract basis. Exclude livestock/poultry grown or fed by someone else on a custom or contractual basis.)” to “Were there any livestock or poultry on this operation for which you made day to day decisions in 2023 (regardless of ownership) or did this operation receive any income from livestock, poultry, or livestock products in 2023? (Include your landlord’s share & livestock/poultry grown for others on a contract basis. Exclude livestock/poultry grown or fed by someone else on a custom or contractual basis.)”

Section E, Item 3 – From “Did your buyers (including cooperatives) require or encourage you to use sustainable production practices such as cover crops or reduced fertilizer application rates through any of the following methods? Exclude certified-organic production.” to “Did your buyers of ANY crop (including cooperatives) require or encourage you to use sustainable production practices such as cover crops or reduced fertilizer application rates through any of the following methods? Exclude certified-organic production.”

Section E, Item 4 After the –“INCENTIVES FROM COMMODITY BUYERS” section there is a new question:

“If any of the {Incentives from Commodity Buyers} are marked YES, is the arrangement related to carbon sequestration or GHG emission reductions? (Y/N)”

Section G, Item 2 – From “In 2023, did this operation received Federal, State, or local farm program payments? (Include government program payments received through a cooperative as well as any forgivable Small Business Administration Paycheck Protection Program (PPP) loans and forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments” to “In 2023, did this operation received Federal, State, or local farm program payments? (Include government program payments received through a cooperative as well as forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments”

Section G, Item 2d – Removed:

Section H, Overall Instruction – From “Report total production expenses paid by this operation in 2023. (Include only expenses related to this operation. Exclude expenses NOT related to this farm/ranch; expenses of performing custom work FOR others, if this is a separate business; and expenses on land rented to others.)” to “In 2023, how much was spent for each item by the PRODUCER(S) and PARTNER(S): (Include only expenses related to this operation. Exclude expenses NOT related to this farm/ranch; expenses of performing custom work FOR others, if this is a separate business; and expenses on land rented to others.)”

Section I, Item 2b – From “tractors, machinery, tools, equipment, and implements owned by the operation” to “tractors, machinery, tools, equipment, and implements owned by the operation (including ATVs and UTVs)”.

Section J, Item 3 (Include/exclude) – from “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes. Exclude PPP loans or grants and instead report those in Section G, question 2di on page 9.” to “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes.”

Section K, Item 13 – From “Over the past year, how many hours per week did each of the following people spend working outside of this farm or ranch? (Include time spent working for a wage or salary, or for a non-farm business. Exclude time spent working at another farm/ranch and time spent commuting.)” to “Over the past year, how many hours per week did each of the following people spend working outside of this farm or ranch? (Include time spent working for a wage or salary, or for a non-farm business. Exclude time spent commuting.)”

Section K, Item 13a – From “The principal producer” to “You (the principal producer)”

Section K, Item 13b – From “The principal producer’s spouse” to “Your spouse (the principal producer’s spouse)”

Section K, Item 14 – Removed.

Section L – Farm Producer Household – Income, Asset, and Debt is now Section M.

Section L (Now M), Item 1i Include/Exclude Statement – From “Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance including COVID-19 related unemployment. Exclude government COVID-19 related stimulus payments” to Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance.”

Section L (Now M), Item 1j – Removed “income from COVID-19 related Economic Impact Payments also known as stimulus payments/check”.

Section M – Type of Organization is now Section L

Section N – Non-GMO/GE Crop – Removed.

Section P – Irrigation – Removed.

Peanuts Cost and Returns Report

Section A, Item 13 – from “Has this operation ever received financial assistance from EQIP or CSP?” to “Has this operation ever received financial assistance from Environmental Quality Incentives Program (EQIP) or the Conservation Stewardship Program (CSP)?”

Section A, Item 14 – from “Has this operation ever received technical assistance from NRCS?.” to “Has this operation ever received technical assistance from Natural Resources Conservation Service (NRCS)?.”

Section A, Item 15 – from “For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local program and provided financial assistance to help defray the cost of practice adoption.)” to For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local programs. They provide financial assistance to help defray the cost of practice adoption.)

Section B, New questions after question 2 table:

Section C, Item 1 – From “Did you or anyone else have any livestock or poultry on this operation in 2023 (regardless of ownership), or did this operation receive any income from livestock, poultry, or livestock products in 2023? (Include your landlord’s share & livestock/poultry grown for others on a contract basis. Exclude livestock/poultry grown or fed by someone else on a custom or contractual basis.)” to “Were there any livestock or poultry on this operation for which you made day to day decisions in 2023 (regardless of ownership) or did this operation receive any income from livestock, poultry, or livestock products in 2023? (Include your landlord’s share & livestock/poultry grown for others on a contract basis. Exclude livestock/poultry grown or fed by someone else on a custom or contractual basis.)”

Section E, Item 3 – From “Did your buyers (including cooperatives) require or encourage you to use sustainable production practices such as cover crops or reduced fertilizer application rates through any of the following methods? Exclude certified-organic production.” to “Did your buyers of ANY crop (including cooperatives) require or encourage you to use sustainable production practices such as cover crops or reduced fertilizer application rates through any of the following methods? Exclude certified-organic production.”

Section E, Item 4 After the –“INCENTIVES FROM COMMODITY BUYERS” section there is a new question:

“If any of the {Incentives from Commodity Buyers} are marked YES, is the arrangement related to carbon sequestration or GHG emission reductions? (Y/N)”

Section G, Item 2 – From “In 2023, did this operation received Federal, State, or local farm program payments? (Include government program payments received through a cooperative as well as any forgivable Small Business Administration Paycheck Protection Program (PPP) loans and forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments” to “In 2023, did this operation received Federal, State, or local farm program payments? (Include government program payments received through a cooperative as well as forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments”

Section G, Item 2d – Removed:

Section H, Overall Instruction – From “Report total production expenses paid by this operation in 2023. (Include only expenses related to this operation. Exclude expenses NOT related to this farm/ranch; expenses of performing custom work FOR others, if this is a separate business; and expenses on land rented to others.)” to “In 2023, how much was spent for each item by the PRODUCER(S) and PARTNER(S): (Include only expenses related to this operation. Exclude expenses NOT related to this farm/ranch; expenses of performing custom work FOR others, if this is a separate business; and expenses on land rented to others.)”

Section I, Item 2b – From “tractors, machinery, tools, equipment, and implements owned by the operation” to “tractors, machinery, tools, equipment, and implements owned by the operation (including ATVs and UTVs)”.

Section J, Item 3 (Include/exclude) – from “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes. Exclude PPP loans or grants and instead report those in Section G, question 2di on page 9.” to “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes.”

Section K, Item 13 – From “Over the past year, how many hours per week did each of the following people spend working outside of this farm or ranch? (Include time spent working for a wage or salary, or for a non-farm business. Exclude time spent working at another farm/ranch and time spent commuting.)” to “Over the past year, how many hours per week did each of the following people spend working outside of this farm or ranch? (Include time spent working for a wage or salary, or for a non-farm business. Exclude time spent commuting.)”

Section K, Item 13a – From “The principal producer” to “You (the principal producer)”

Section K, Item 13b – From “The principal producer’s spouse” to “Your spouse (the principal producer’s spouse)”

Section K, Item 14 – Removed.

Section L – Farm Producer Household – Income, Asset, and Debt is now Section M.

Section L (Now M), Item 1i Include/Exclude Statement – From “Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance including COVID-19 related unemployment. Exclude government COVID-19 related stimulus payments” to Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance.”

Section L (Now M), Item 1j – Removed “income from COVID-19 related Economic Impact Payments also known as stimulus payments/check”.

Section M – Type of Organization is now Section L

Section N – Non-GMO/GE Crop – Removed.

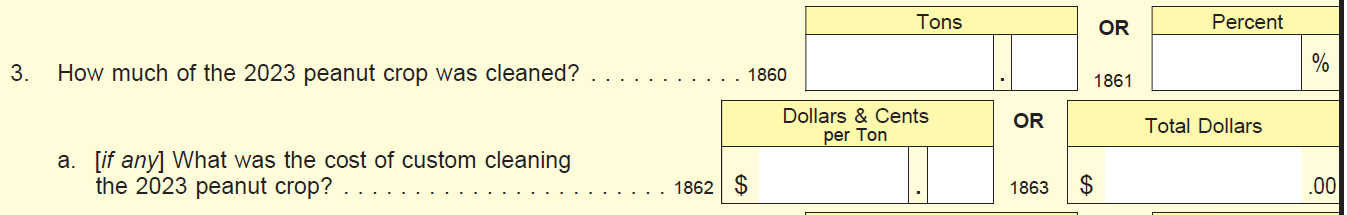

Section O – Added a new question after question 2 as peanuts need to be cleaned after harvest:

Section O, Item 3b – from “dried by this operation?” to “dried other than custom dried (such as on-farm drying in trailers/wagons)?”

Section O, Item 4 – from “How much was spent for custom drying the 2023 peanut crop?” to “What was the cost of custom drying the 2023 peanut crop?”

Section O, Item 6 – Removed.

Section O, Item 7a – From “Paid and unpaid producers, partners, and family members, and other unpaid workers?” to “Operator, partners, family members and other unpaid workers”.

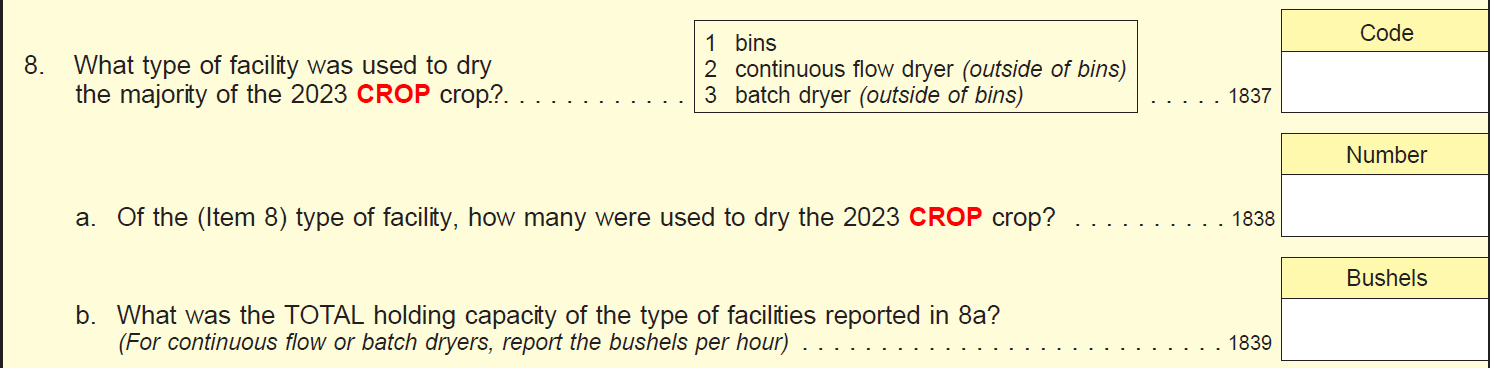

Section O, Item 8 – Changed due to the difference in peanut drying from grains. From

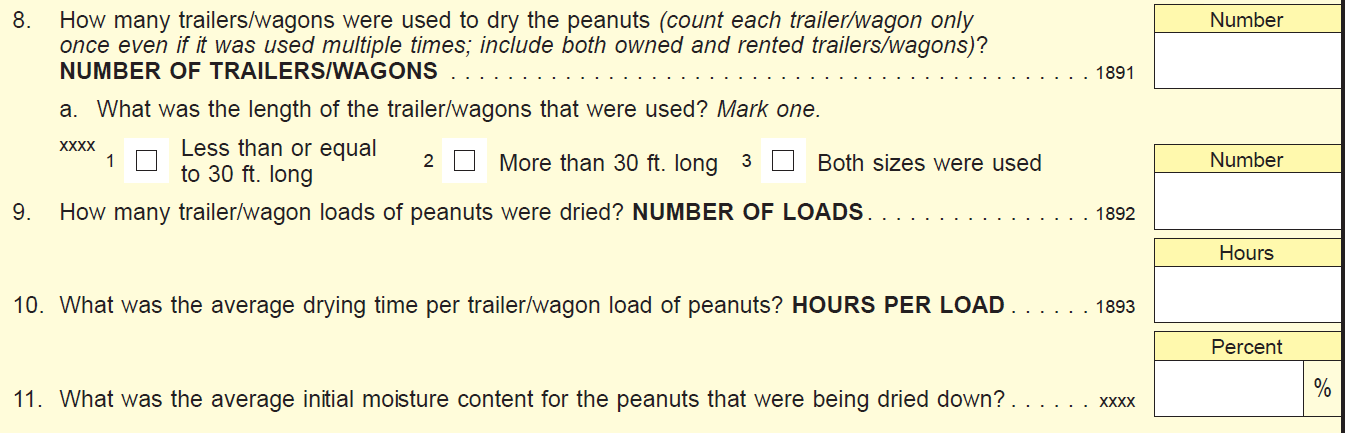

To

Section P – Irrigation – Removed.

Soybeans Cost and Returns Report

Section A, Item 13 – from “Has this operation ever received financial assistance from EQIP or CSP?” to “Has this operation ever received financial assistance from Environmental Quality Incentives Program (EQIP) or the Conservation Stewardship Program (CSP)?”

Section A, Item 14 – from “Has this operation ever received technical assistance from NRCS?.” to “Has this operation ever received technical assistance from Natural Resources Conservation Service (NRCS)?.”

Section A, Item 15 – from “For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local program and provided financial assistance to help defray the cost of practice adoption.)” to For each of the conservation management practices listed below, report the total acres on this operation using this practice in 2023 in Column 1. Report those acres that were using the practice AND received a cost share or financial assistance payment in Column 2 (Conservation program payments are provided by USDA programs such as EQIP or CSP or similarly structures State or local programs. They provide financial assistance to help defray the cost of practice adoption.)

Section B, New questions after question 2 table:

Section C, Item 1 – From “Did you or anyone else have any livestock or poultry on this operation in 2023 (regardless of ownership), or did this operation receive any income from livestock, poultry, or livestock products in 2023? (Include your landlord’s share & livestock/poultry grown for others on a contract basis. Exclude livestock/poultry grown or fed by someone else on a custom or contractual basis.)” to “Were there any livestock or poultry on this operation for which you made day to day decisions in 2023 (regardless of ownership) or did this operation receive any income from livestock, poultry, or livestock products in 2023? (Include your landlord’s share & livestock/poultry grown for others on a contract basis. Exclude livestock/poultry grown or fed by someone else on a custom or contractual basis.)”

Section E, Item 3 – From “Did your buyers (including cooperatives) require or encourage you to use sustainable production practices such as cover crops or reduced fertilizer application rates through any of the following methods? Exclude certified-organic production.” to “Did your buyers of ANY crop (including cooperatives) require or encourage you to use sustainable production practices such as cover crops or reduced fertilizer application rates through any of the following methods? Exclude certified-organic production.”

Section E, Item 4 After the –“INCENTIVES FROM COMMODITY BUYERS” section there is a new question:

“If any of the {Incentives from Commodity Buyers} are marked YES, is the arrangement related to carbon sequestration or GHG emission reductions? (Y/N)”

Section G, Item 2 – From “In 2023, did this operation received Federal, State, or local farm program payments? (Include government program payments received through a cooperative as well as any forgivable Small Business Administration Paycheck Protection Program (PPP) loans and forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments” to “In 2023, did this operation received Federal, State, or local farm program payments? (Include government program payments received through a cooperative as well as forgivable ‘advances’ from the Economic Injury Disaster Assistance program. Exclude CCC loan payments”

Section G, Item 2d – Removed:

Section H, Overall Instruction – From “Report total production expenses paid by this operation in 2023. (Include only expenses related to this operation. Exclude expenses NOT related to this farm/ranch; expenses of performing custom work FOR others, if this is a separate business; and expenses on land rented to others.)” to “In 2023, how much was spent for each item by the PRODUCER(S) and PARTNER(S): (Include only expenses related to this operation. Exclude expenses NOT related to this farm/ranch; expenses of performing custom work FOR others, if this is a separate business; and expenses on land rented to others.)”

Section I, Item 2b – From “tractors, machinery, tools, equipment, and implements owned by the operation” to “tractors, machinery, tools, equipment, and implements owned by the operation (including ATVs and UTVs)”.

Section J, Item 3 (Include/exclude) – from “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes. Exclude PPP loans or grants and instead report those in Section G, question 2di on page 9.” to “Include farm/ranch loans, debt on the producer’s house if owned by the operation, Economic Injury Disaster Loans (EIDL), and multi-purpose loans used for both farm and non-farm purposes. Exclude CCC commodity loans and any loans used exclusively for non-farm purposes.”

Section K, Item 13 – From “Over the past year, how many hours per week did each of the following people spend working outside of this farm or ranch? (Include time spent working for a wage or salary, or for a non-farm business. Exclude time spent working at another farm/ranch and time spent commuting.)” to “Over the past year, how many hours per week did each of the following people spend working outside of this farm or ranch? (Include time spent working for a wage or salary, or for a non-farm business. Exclude time spent commuting.)”

Section K, Item 13a – From “The principal producer” to “You (the principal producer)”

Section K, Item 13b – From “The principal producer’s spouse” to “Your spouse (the principal producer’s spouse)”

Section K, Item 14 – Removed.

Section L – Farm Producer Household – Income, Asset, and Debt is now Section M.

Section L (Now M), Item 1i Include/Exclude Statement – From “Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance including COVID-19 related unemployment. Exclude government COVID-19 related stimulus payments” to Include Social Security, military, and other public retirement, veteran’s benefits, public disability, unemployment, or other public assistance.”

Section L (Now M), Item 1j – Removed “income from COVID-19 related Economic Impact Payments also known as stimulus payments/check”.

Section M – Type of Organization is now Section L

Section N – Non-GMO/GE Crop – Removed.

Section P – Irrigation – Removed.

These changes will not impact the current sample size or respondent burden.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | hancda |

| File Modified | 0000-00-00 |

| File Created | 2023-09-26 |

© 2026 OMB.report | Privacy Policy