332-600 Usmca Automotive Rules Of Origin Motor Vehicle Producer

The USMCA Automotive Rules of Origin Motor Vehicle Producer Questionnaire

USMCAAutoROOs -- Questionnaire

OMB: 3117-0235

The USMCA AUTOMOTIVE RULES OF ORIGIN MOTOR vehicle Producer questionnaire

U.S. INTERNATIONAL TRADE COMMISSION

You are receiving this questionnaire because the U.S. International Trade Commission (Commission or USITC) has identified your firm as a motor vehicle producer in the United States (see “motor vehicle production” in the Definitions/Glossary, which begins on page 5). Your response will be treated as confidential and will be referenced only if we can ensure anonymity.

The information requested by this questionnaire is for use by the Commission in the report its required to prepare under section 202A(g)(2) of the United States-Mexico-Canada Agreement Implementation Act (19 U.S.C. § 4532(g)(2)) (the Act). The Act requires the Commission to prepare a series of five biennial reports on the economic impact of the automotive rules of origin (ROOs) in the United States-Mexico-Canada Agreement (USMCA), and to provide those reports to the President, the House Committee on Ways and Means, and the Senate Committee on Finance. The first of the reports was delivered on June 30, 2023, with four additional reports due in 2025, 2027, 2029, and 2031. Under 202A(g)(4)(A) of the Act, the Commission shall “solicit information relating to matters that will be addressed in the report.” The Commission is conducting a survey of U.S. motor vehicle producers for the 2025 report.

Answers to this questionnaire will provide information about motor vehicle producers that will assist the Commission in preparing its report in its factfinding investigation on the economic impact of the USMCA automotive ROOs (Inv. No. 332-600). You can learn more about this investigation at the following website: http://www.usitc.gov/USMCAAutoROO.

Your firm is required by law to respond to this questionnaire.

Please read all instructions and submit your response

to the web-based questionnaire no later than xxx.

OMB number: XXX; Expiration date: XX/XX/XXXX

No response is required if a currently valid OMB control number is not displayed.

The Commission is requesting this information under the authority of section 332(g) of the Tariff Act of 1930 (19 U.S.C. § 1332(g)). Completing the questionnaire is mandatory, and failure to reply as directed can result in a subpoena or other order to compel the submission of records or information in your possession (19 U.S.C. § 1333(a)).

For more information on this questionnaire, contact the project team at [email protected].

Confidentiality

The Commission has designated the information you provide in response to this questionnaire as “confidential business information,” unless such information is otherwise available to the public. The Commission may aggregate the information you provide with information from other questionnaire responses. The Commission will not publish information obtained from your questionnaire response or an aggregation of your and other questionnaire responses in a manner that would identify your firm or reveal the operations of your firm. Section 332(g) of the Tariff Act of 1930 (19 U.S.C. § 1332(g)) provides that the Commission may not release information which it considers to be confidential business information unless the party submitting such information had notice, at the time of submission, that such information would be released by the Commission, or such party subsequently consents to the release of the information.

Instructions

Accessing and completing the questionnaire. To provide your firm’s response to this questionnaire, use the secure interactive website version, accessible at this link:

For the purposes of viewing the full questionnaire, a PDF version is available at this link: xx.

We sent your firm a notification letter that includes a website link and a 10-digit questionnaire token. Type the website link in an internet browser and access the questionnaire for online completion using your 10-digit questionnaire token. If you have issues with your token or accessing the questionnaire, please email [email protected] for assistance.

Entering information. Answer each question that applies to your firm. Some questions require you to answer by using the provided checkboxes, while others require you to type a response into entry areas. You will have an opportunity to review your responses, edit them, and download a copy before submitting.

Entering numeric data. Enter data for revenue/sales, employees, etc. in actual units, not in thousands, millions, or other multiples of units. For example, for $123.4 million, enter "123400000," not "123400" or "123.4." (Do not add commas between digits; they will appear automatically after you enter the numbers.)

Questionnaire structure. This questionnaire is composed of six sections. First, read and respond to section 1 questions carefully. Your responses in section 1 will determine whether you must complete every section that follows.

Submitting the questionnaire. After you have completed all applicable sections, you may download a copy before submitting. Select the “submit” button to send your final response.

How to report information about your firm

Coordinating your firm's response. Only one questionnaire per firm may be submitted. If individuals or departments within your firm will share responsibility for completing this questionnaire, please coordinate and combine their responses. This will minimize our need to contact your firm for clarification.

Relationship to corporate structure. Provide a single response for your firm's activities and experiences and, to the extent possible, the experiences of its subsidiaries and affiliates.

If

your firm is a holding company without operations, please contact the

project team at [email protected]

for further instruction.

For

U.S. affiliates of foreign companies, please respond as if the

affiliate were an independent firm operating in the United States.

For example, for an affiliate in the United States, report estimated

total U.S. and North American costs for the affiliate and not for the

foreign parent company.

Definitions/Glossary

Advanced battery – a battery of a kind used as the primary source for the generation of electric power for electrically powered vehicles. Components include cells, modules/arrays, and assembled packs, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

Axle – a drive-axle with differential, whether or not provided with other transmission components, and non-driving axles. Components include axle shafts, axle housings, axle hubs, carriers, and differentials, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

Body and chassis – Major stampings that form the “body in white” or chassis frame. Components include major body panels, secondary panels, structural panels, and frames, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

Complementary part – a motor vehicle part that is subject to USMCA automotive ROOs (e.g., small electric motor, headlight, and wiring set) that is not a core part or principal part. The HS 2012 subheadings and descriptions for complementary parts are included in the USMCA, Appendix to Annex 4-B, Complementary Parts for Passenger Vehicles and Light Trucks, table C and Complementary Parts for Heavy Trucks, table E.

HS

2012 subheading |

Description |

4009.12 |

Tubes, pipes and hoses of vulcanised rubber other than hard rubber, not reinforced or otherwise combined with other materials, with fittings |

4009.22 |

Tubes, pipes and hoses of vulcanised rubber other than hard rubber, reinforced or otherwise combined only with metal, with fittings |

4009.32 |

Tubes, pipes and hoses of vulcanised rubber other than hard rubber, reinforced or otherwise combined only with textile materials, with fittings |

4009.42 |

Tubes, pipes and hoses of vulcanised rubber other than hard rubber, reinforced or otherwise combined with other materials, with fittings |

8301.20 |

Locks of a kind used for motor vehicles |

Ex 8421.39 |

Catalytic converters |

8481.20 |

Valves for oleohydraulic or pneumatic transmissions |

8481.30 Check |

Check (nonreturn) valves |

8481.80 |

Other taps, cocks, valves and similar appliances, including pressure-reducing valves and thermostatically controlled valves |

8501.10 |

Electric motors of an output not exceeding 37.5 W |

8501.20 |

Universal AC/DC motors of an output exceeding 37.5 W 8501.31 Other DC motors and generators of an output not exceeding 750 W |

Ex 8507.20 |

Other lead-acid batteries of a kind used for the propulsion of motor vehicles of Chapter 87 |

Ex 8507.30 |

Nickel-cadmium batteries of a kind used for the propulsion of motor vehicles of Chapter 87 |

Ex 8507.40 |

Nickel-iron batteries of a kind used for the propulsion of motor vehicles of Chapter 87 |

Ex 8507.80 |

Other batteries of a kind used for the propulsion of motor vehicles of Chapter 87 |

8511.30 |

Distributors; ignition coils 8512.20 Other lighting or visual signalling equipment |

8512.40 |

Windshield wipers, defrosters and demisters |

Ex 8519.81 |

Cassette decks 8536.50 Other electrical switches, for a voltage not exceeding 1,000 V |

Ex 8536.90 |

Junction boxes |

8539.10 |

Sealed beam lamp units |

8539.21 |

Tungsten halogen filament lamp |

8544.30 |

Ignition wiring sets and other wiring sets of a kind used in motor vehicles |

9031.80 |

Other measuring and checking instruments, appliances & machines |

9032.89 |

Other automatic regulating or controlling instruments and apparatus |

Note: ‘Ex’ denotes that only a subset of the HS subheading is covered by the USMCA automotive ROOs.

HS

2012 subheading |

Description |

8413.50 |

Other reciprocating positive displacement pumps |

Ex 8479.89 |

Electronic brake systems, including ABS and ESC systems |

8482.10 |

Ball bearings |

8482.20 |

Tapered roller bearings, including cone and tapered roller assemblies |

8482.30 |

Spherical roller bearings |

8482.40 |

Needle roller bearings |

8482.50 |

Other cylindrical roller bearings |

8483.20 |

Bearing housings, incorporating ball or roller bearings |

8483.30 |

Bearing housings, not incorporating ball or roller bearings; plain shaft bearings |

8483.60 |

Clutches and shaft couplings (including universal joints) |

8505.20 |

Electro-magnetic couplings, clutches and brakes |

8505.90 |

Other electro-magnets; electro-magnetic or permanent magnet chucks, clamps and similar holding devices; electro-magnetic lifting heads; including parts |

Note: ‘Ex’ denotes that only a subset of the HS subheading is covered by the USMCA automotive ROOs.

Core part – an engine, transmission, body and chassis, axle, suspensions system, steering system, or advanced battery for passenger vehicles and light trucks, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2. There is no list of core parts for heavy trucks. The HS 2012 subheadings and descriptions for core parts for passenger vehicle and light trucks are included in the USMCA, Appendix to Annex 4-B, Core Parts for Passenger Vehicles and Light Trucks, table A.1, and are:

HS 2012 subheading |

Description |

8407.31 |

Reciprocating piston engines of a kind used for the propulsion of passenger vehicles of Chapter 87, of a cylinder capacity not exceeding 50 cc |

8407.32 |

Reciprocating piston engines of a kind used for the propulsion of vehicles of Chapter 87, of a cylinder capacity exceeding 50 cc but not exceeding 250 cc |

8407.33 |

Reciprocating piston engines of a kind used for the propulsion of vehicles of Chapter 87, of a cylinder capacity exceeding 250 cc but not exceeding 1,000 cc |

8407.34 |

Reciprocating piston engines of a kind used for the propulsion of vehicles of Chapter 87, of a cylinder capacity exceeding 1,000 cc |

Ex 8408.20 |

Compression-ignition internal combustion piston engines of a kind used for the propulsion of vehicles of subheading 8704.21 or 8704.31 |

8409.91 |

Parts suitable for use solely or principally with the engines of heading 8407 or 8408, suitable for use solely or principally with spark-ignition internal combustion piston engines |

8409.99 |

Parts suitable for use solely or principally with the engines of heading 8407 or 8408, other |

8507.60 |

Lithium-ion batteries |

8706.00 |

Chassis fitted with engines, for the motor vehicles of heading 8703 or subheading 8704.21 or 8704.31 |

8707.10 |

Bodies for the vehicles of heading 8703 |

8707.90 |

Bodies for the vehicles of subheading 8704.21 or 8704.31 |

Ex 8708.29 |

Body stampings |

8708.40 |

Gear boxes and parts thereof |

8708.50 |

Drive axles with differential, whether or not provided with other transmission components, and non-driving axles; parts thereof |

8708.80 |

Suspension systems and parts thereof (including shock absorbers) |

8708.94 |

Steering wheels, steering columns, and steering boxes; parts thereof |

Ex 8708.99 |

Chassis frames |

Note: ‘Ex’ denotes that only a subset of the HS subheading is covered by the USMCA automotive ROOs.

Engine – spark-ignition reciprocating or rotary internal combustion piston engine and compression-ignition internal combustion engine (diesel or semi-diesel engine). Components include heads, blocks, crankshafts, crankcases, pistons, rods, and head subassemblies, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

Entry into force – the date that the USMCA took effect: July 1, 2020.

Heavy truck – a motor vehicle of HS 2012 subheading 8701.20, 8704.22, 8704.23, 8704.32, 8704.90, or heading 8706,1 except for a motor vehicle that is solely or principally for off-road use.2

Ingot – a block of relatively pure metal.

Labor value content (LVC) – the share of the value of a motor vehicle or motor vehicle production that is comprised of qualifying labor and other qualifying expenditures, expressed as a percentage. Qualifying labor and LVC requirements in the USMCA automotive ROOs are found in the USMCA, Appendix to Annex 4-B, Provisions Related to the Product-Specific Rules of Origin for Automotive Goods, Article 7.

Light truck – a motor vehicle of subheading 8704.21 or 8704.31, except for a motor vehicle that is solely or principally for off-road use.

Model line – a group of motor vehicles having the same platform or model name.

Motor vehicle – a passenger vehicle, light truck, or heavy truck (on-road vehicles from subheadings 8701.10 through 8701.90,3 8702.10, 8702.90, 8703.21 through 8703.90, 8704.10, 8704.21, 8704.22, 8704.23, 8704.31, 8704.32, 8704.90, or heading 8705 or 8706).4

Motor vehicle assembly – the process of combining separate constituent parts into a finished motor vehicle, usually along an assembly line.

Motor vehicle production – the manufacturing and assembly of motor vehicles.

Non-originating good or non-originating material – a good or material that does not qualify for duty-free treatment under the USMCA.

Nontraditional motor vehicle input – an input that is historically not uniquely associated with motor vehicles, such as electronic components or electrical inputs, but is still frequently part of the finished motor vehicle.

Overhead cost – a cost that generally does not increase with the number of vehicles produced, also referred to as a fixed cost.

Originating good or originating material – a good or material that qualifies as originating under the USMCA.

Passenger vehicle – a motor vehicle of any subheading from 8703.21 through 8703.90.

Party – Canada, Mexico, or the United States.

Platform – a consolidated group of components and systems shared across multiple models (e.g., powertrain, underbody, seat structure, thermal system, etc.).

Principal part – a significant motor vehicle part not included in core parts, including such parts as air conditioners, seats, air bags, and major components of core parts (e.g., transmission shafts, electronic brake systems, and clutches). The HS 2012 subheadings and descriptions for principal parts are included in the USMCA, Appendix to Annex 4-B, Principal Parts for Passenger Vehicles and Light Trucks, table B and Principal Parts for Heavy Trucks, table D, and are:

HS

2012 subheading |

Description |

8413.30 |

Fuel, lubricating or cooling medium pumps for internal combustion piston engines |

8413.50 |

Other reciprocating positive displacement pumps |

8414.59 |

Other fans |

8414.80 |

Other air or gas pumps, compressors and fans |

8415.20 |

Air conditioning machines, comprising a motor-driven fan and elements for changing the temperature and humidity, including those machines in which humidity cannot be separately regulated, of a kind used for persons, in motor vehicles |

Ex 8479.89 |

Electronic brake systems, including ABS and ESC systems |

8482.10 |

Ball bearings |

8484.20 |

Tapered roller bearings, including cone and tapered roller assemblies |

8482.30 |

Spherical roller bearings |

8482.40 |

Needle roller bearings |

8482.50 |

Other cylindrical roller bearings |

8482.80 |

Other ball or roller bearings, including combined ball/roller bearings |

8483.10 |

Transmission shafts (including cam shafts and crank shafts) and cranks |

8483.20 |

Bearing housings, incorporating ball or roller bearings |

8483.30 |

Bearing housings, not incorporating ball or roller bearings; plain shaft bearings |

8483.40 |

Gears and gearing, other than toothed wheels, chain sprockets and other transmission elements presented separately; ball or roller screws; gear boxes and other speed changers, including torque converters |

8483.50 |

Flywheels and pulleys, including pulley blocks |

8483.60 |

Clutches and shaft couplings (including universal joints) |

8501.32 |

Other DC motors and generators of an output exceeding 750W but not exceeding 75 kW |

8501.33 |

Other DC motors and generators of an output exceeding 75 kW but not exceeding 375 kW |

8505.20 |

Electro-magnetic couplings, clutches and brakes |

8505.90 |

Other electro-magnets; electro-magnetic or permanent magnet chucks, clamps and similar holding devices; electro-magnetic lifting heads; including parts |

8511.40 |

Starter motors and dual purpose starter-generators of a kind used for spark ignition or compression-ignition internal combustion engines |

8511.50 |

Other generators |

8511.80 |

Other electrical ignition or starting equipment of a kind used for spark-ignition or compression-ignition internal combustion engines |

Ex 8511.90 |

Parts of electrical ignition or starting equipment of a kind used for spark-ignition or compression-ignition internal combustion engines |

8537.10 |

Electric controls for a voltage not exceeding 1,000 V |

8708.10 |

Bumpers and parts thereof |

8708.21 |

Safety seat belts |

Ex 8708.29 |

Other parts and accessories of bodies (including cabs) of motor vehicles (excluding body stampings) |

8708.30 |

Brakes and servo-brakes; parts thereof |

8708.70 |

Road wheels and parts and accessories thereof |

8708.91 |

Radiators and parts thereof |

8708.92 |

Silencers (mufflers) and exhaust pipes; parts thereof |

8708.93 |

Clutches and parts thereof |

8708.95 |

Safety airbags with inflator system; parts thereof |

8708.99 |

Other parts and accessories of motor vehicles of headings 8701 to 8705 (excluding chassis frames) |

9401.20 |

Seats of a kind used for motor vehicles |

Note: ‘Ex’ denotes that only a subset of the HS subheading is covered by the USMCA automotive ROOs.

HS

2012 subheading |

Description |

8407.31 |

Reciprocating piston engines of a kind used for the propulsion of passenger vehicles of Chapter 87, of a cylinder capacity not exceeding 50 cc |

8407.32 |

Reciprocating piston engines of a kind used for the propulsion of vehicles of Chapter 87, of a cylinder capacity exceeding 50 cc but not exceeding 250 cc |

8407.33 |

Reciprocating piston engines of a kind used for the propulsion of vehicles of Chapter 87, of a cylinder capacity exceeding 250 cc but not exceeding 1,000 cc |

8407.34 |

Reciprocating piston engines of a kind used for the propulsion of vehicles of Chapter 87, of a cylinder capacity exceeding 1,000 cc |

8408.20 |

Compression-ignition internal combustion piston engines of a kind used for the propulsion of vehicles of Chapter 87 |

8409.91 |

Parts suitable for use solely or principally with the engines of heading 8407 or 8408, suitable for use solely or principally with spark-ignition internal combustion piston engines |

8409.99 |

Parts suitable for use solely or principally with the engines of heading 8407 or 8408, other |

8413.30 |

Fuel, lubricating or cooling medium pumps for internal combustion piston engines |

Ex 8414.59 |

Turbochargers and superchargers |

8414.80 |

Other air or gas pumps, compressors and fans |

8415.20 |

Air conditioning machines, comprising a motor-driven fan and elements for changing the temperature and humidity, including those machines in which humidity cannot be separately regulated, of a kind used for persons, in motor vehicles |

8483.10 |

Transmission shafts (including cam shafts and crank shafts) and cranks |

8483.40 |

Gears and gearing, other than toothed wheels, chain sprockets and other transmission elements presented separately; ball or roller screws; gear boxes and other speed changers, including torque converters |

8483.50 |

Flywheels and pulleys, including pulley blocks |

Ex 8501.32 |

Other DC motors and generators of an output exceeding 750W but not exceeding 75 kW, of a kind used for the propulsion of motor vehicles of Chapter 87 |

8511.40 |

Starter motors and dual purpose starter-generators of a kind used for spark ignition or compression-ignition internal combustion engines |

8511.50 |

Other generators |

8537.10 |

Electric controls for a voltage not exceeding 1,000 V |

8706.00 |

Chassis fitted with engines, for the motor vehicles of heading 8701 through 8705 |

8707.90 |

Bodies for the vehicles of heading 8701, 8702, 8704 or 8705 |

8708.10 |

Bumpers and parts thereof |

8708.21 |

Safety seat belts |

8708.29 |

Other parts and accessories of bodies (including cabs) of motor vehicles |

8708.30 |

Brakes and servo-brakes; parts thereof |

8708.40 |

Gear boxes and parts thereof |

8708.50 |

Drive axles with differential, whether or not provided with other transmission components, and non-driving axles; and parts thereof |

8708.70 |

Road wheels and parts and accessories thereof |

8708.80 |

Suspension systems and parts thereof (including shock absorbers) |

8708.91 |

Radiators and parts thereof |

8708.92 |

Silencers (mufflers) and exhaust pipes; parts thereof |

8708.93 |

Clutches and parts thereof |

8708.94 |

Steering wheels, steering columns and steering boxes; parts thereof |

8708.95 |

Safety airbags with inflator system; parts thereof |

8708.99 |

Other parts and accessories of motor vehicles of headings 87.01 to 87.05 |

9401.20 |

Seats of a kind used for motor vehicles |

Note: ‘Ex’ denotes that only a subset of the HS subheading is covered by the USMCA automotive ROOs.

Production motor vehicle – a mass-produced motor vehicle that is offered for sale to the public.

Regional value content (RVC) – the share of the motor vehicle value based on its transaction value or net cost that is made up of originating material, expressed as a percentage. RVC requirements in the USMCA automotive ROOs are found in the USMCA, Appendix to Annex 4-B, Provisions Related to the Product-Specific Rules of Origin for Automotive Goods, Articles 3, 4, and 10.

Rules of origin (ROOs) – the USMCA automotive ROOs as defined in 19 C.F.R. Appendix A to part 182; USMCA, Appendix to Annex 4-B, 4-B-1-1 through 4-B-1-47.

Steering system – the system that controls the movement of a motor vehicle along its vertical axis. Components tracked for USMCA include steering columns, steering gear/racks, and control units, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

Suspension system – the system that connects a motor vehicle to its wheels, allowing for relative motion between the two. Components tracked for USMCA include shock absorbers, struts, control arms, sway bars, knuckles, coil springs, and leaf springs, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

Tariff classification – the determination of which subheading and/or statistical reporting number a specific good is provided for in the Harmonized System (HS) or Harmonized Tariff Schedule (HTS)

Territory of a party – as defined in Chapter 1, Section C: Country-Specific Definitions of the USMCA:

for Canada,

the land territory, air space, internal waters, and territorial sea of Canada,

the exclusive economic zone of Canada, and

the continental shelf of Canada, as determined by its domestic law and consistent with international law,

for Mexico,

the land territory, including the states of the Federation and Mexico City,

the air space, and

the internal waters, territorial sea, and any areas beyond the territorial seas of Mexico within which Mexico may exercise sovereign rights and jurisdiction, as determined by its domestic law, consistent with the United Nations Convention on the Law of the Sea, done at Montego Bay on December 10, 1982; and

for the United States,

the customs territory of the United States, which includes the 50 states, the District of Columbia, and Puerto Rico,

the foreign trade zones located in the United States and Puerto Rico, and

the territorial sea and air space of the United States and any area beyond the territorial sea within which, in accordance with the customary international law as reflected in the United Nations Convention on the Law of the Sea, the United States may exercise sovereign rights or jurisdiction.

Transmission – a gear box. Components include transmission cases, torque converters, torque converter housings, gears and gear blanks, clutches, and valve body assemblies, according to the USMCA, Appendix to Annex 4-B, Parts and Components for Determining the Origin of Passenger Vehicles and Light Trucks Under Article 3 of This Appendix, table A.2.

USMCA – the United States-Mexico-Canada Agreement.

Variable cost of production – a cost that changes based on the number of vehicles produced.

SECTION 1. Firm Information

Enter the 10-digit questionnaire token that was in the notification letter we sent to your firm. This will allow the project team to track your response. If you do not know this token, contact the project team at [email protected].

Questionnaire token: __________________

Enter your firm’s U.S. headquarters' address and the name of a person that we may contact if we have any questions regarding your response.

|

||||

Business name |

||||

|

||||

Address |

||||

|

|

|

|

|

City |

State |

Zip code |

Website address |

|

|

|

|||

Contact person’s name |

Contact person’s job title |

|||

|

|

|||

Contact person’s telephone number |

Contact person’s email |

|||

List your firm’s full-time equivalent (FTE) employment, including non-production workers and contractors, at manufacturing and assembly facilities in the United States for 2018 through 2023.

-

2018

2019

2020

2021

2022

2023

FTE employment

Does your firm produce motor vehicles in North America?

Yes

No

[If yes to 1.3a] In which countries does your firm produce motor vehicles (select all that apply)?

Canada

Mexico

United States

-

[If yes to 1.3a] Provide the list of subsidiaries or affiliates that will be included in your firm’s responses.

-

Subsidiary or Affiliate Name

Country

[If ‘yes’ to 1.3a] Are there any motor vehicles that your firm produced in North America that qualified for duty-free treatment under the USMCA between July 1, 2020 and July 1, 2024?

Yes

No

[If no to 1.5a] If no, please explain: ___________________

-

Are there any motor vehicles that your firm plans to produce in North America (but does not yet) for which it will attempt to qualify for duty-free treatment under the USMCA?

Yes

No

Please explain: ___________________

1.7

a. [If no to 1.5a and 1.6a] Since January 1, 2018, the beginning of the year in which the USMCA draft text was released, did your firm make any changes to its North American supply chain in an attempt to qualify for duty-free treatment under the USMCA?

Yes, and did qualify

Yes, but did not qualify

No

Please explain: ___________________

[If ‘no’ to 1.3a and ‘no’ to 1.5a, 1.6a, and 1.7a, skip to Section 5]

SECTION 2. Sourcing Changes

This section asks about decisions and changes made to motor vehicle assembly and motor vehicle parts sourcing since January 1, 2018, and the extent to which the USMCA automotive ROOs led to the change. For each question below, to the extent possible, describe the impact of changes by model line of motor vehicle. Only include changes that have already been made, and do not include planned future changes.

USMCA automotive ROOs effects on existing supply chains and production

This section asks about the impact of USMCA automotive ROOs on existing assembly locations and supply chains for motor vehicles that have been in place since January 1, 2018. The questions below are for model lines of motor vehicles that were sold in the North American market beginning before the USMCA entered into force on July 1, 2020. Effects of the ROOs on new model lines that were introduced after July 1, 2020, should be included in section 2.3.

2.1.1

a. Were there any assembly relocation decisions in which the USMCA automotive ROOs led your firm to continue assembly in North America instead of moving assembly outside of North America?

Yes

No

[If ‘yes’ to 2.1.1a] List and describe the assembly relocation decisions in which the USMCA automotive ROOs led your firm to continue assembly in North America in the table below. For each assembly relocation decision, provide a brief explanation of the decision, the impacted model line of motor vehicle, select the attribution to ROOs, indicate whether the decision was attributed to the RVC, LVC, or both, and list any non-USMCA factors which may have contributed to the decision. Note: full attribution to the ROOs is appropriate if the assembly relocation decision was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the assembly relocation decision was made in part to meet the ROOs, in addition to influences from other factors.

Describe the assembly relocation decision (e.g., firm would have shifted assembly relocation from United States to South Korea) |

Provide a brief explanation for the assembly relocation decision |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs [dropdown: full, partial] |

Indicate if the assembly relocation decision is attributable to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 4] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

|

2.1.2

a. Were there any sourcing decisions in which the USMCA automotive ROOs contributed to your firm deciding to continue sourcing motor vehicle core parts or materials from a plant or supplier located in North America instead of switching to a non-North American supplier?

Yes

No

[If ‘yes’ to 2.1.2a] List the sourcing decisions in which the USMCA automotive ROOs led your firm to continue sourcing core parts or materials from North America in the table below. Provide a brief explanation of the decisions, select the core part or material impacted, provide the impacted model line of motor vehicle, select the attribution of the decision to the ROOs, indicate whether the decision was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the decision. Note: full attribution to the ROOs is appropriate if the sourcing decision was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing decision was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing decision (e.g., firm would have shifted sourcing of aluminum from United States to South Korea) |

Provide a brief explanation for the sourcing decision |

Core part or material impacted [dropdown: engine, transmission, body and chassis, axle, suspension system, steering system, advanced battery, steel, aluminum] |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs [dropdown: full, partial] |

Indicate if assembly location decision is attributable to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 5] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

|

|

Changes to motor vehicle assembly and parts and materials sourcing

This section asks about changes made to motor vehicle assembly and motor vehicle parts and materials sourcing to meet the USMCA automotive ROOs.5 The questions below are for model lines of motor vehicles that were sold in the North American market beginning before the USMCA entered into force on July 1, 2020. Effects of the ROOs on new model lines that were introduced after July 1, 2020, should be included in section 2.3.

The intent of this section is to collect vehicle-specific information about changes made to motor vehicle assembly and parts and materials sourcing. Only include sourcing changes that were made to meet the USMCA automotive ROOs, not a complete list of all sourcing changes. Additionally, only include a sourcing change of the listed core part and not components of the core part. To the extent possible, include all sourcing changes that resulted in a change to country location to, from, or within North America (Canada, Mexico, and the United States).

2.2.1

Since January 1, 2018, has your firm relocated assembly of a model line of motor vehicle to North America (either from outside North America or between North American countries) to meet the USMCA automotive ROOs? An assembly relocation may be a relocation of an entire factory, or a partial shift in output from one factory to another.

Yes

No

[If yes to 2.2.1a] List and describe the assembly relocations in which the USMCA automotive ROOs led your firm to relocate assembly in the table below. For each assembly relocation, provide the impacted model line of motor vehicle, select the attribution of the relocation to the ROOs, indicate whether the decision was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the decision. Note: full attribution to the ROOs is appropriate if the assembly relocation was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the assembly relocation was made in part to meet the ROOs, in addition to influences from other factors.

Describe the assembly relocation (e.g., from city, state, country to city, state, country) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs [dropdown: full, partial] |

Indicate if the assembly relocation can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

[If yes to 2.2.1a] For each assembly relocation attributed to the USMCA automotive ROOs, provide a brief explanation, the month and year of the assembly relocation, and a percentage of the model line impacted by the assembly relocation.

Describe the assembly relocation (e.g., from city, state, country to city, state, country) |

Model line of motor vehicle impacted |

Provide a brief explanation for the assembly relocation |

Month and year of the assembly relocation |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above } |

{carried forward from above } |

|

|

|

|

|

|

|

|

|

|

[If yes to 2.2.1a] For each assembly relocation attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs due to assembly relocation?

Description of the assembly relocation |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of assembly (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

Select the motor vehicle parts and materials for which your firm has made sourcing changes to meet the USMCA automotive ROOs since January 1, 2018, for its North American production (select all that apply).6

Engines

Transmissions

Bodies and chassis

Axles

Suspension systems

Steering systems

Advanced batteries

Steel

Aluminum

[If ‘engines’ is selected in 2.2.2]

Engines

2.2.3

List the engine sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of engines from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each engine sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each engine sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘transmissions’ is selected in 2.2.2]

Transmissions

2.2.4

List the transmission sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of transmissions from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each transmission sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each transmission sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘bodies and chassis’ is selected in 2.2.2]

Bodies and chassis

2.2.5

List the bodies and chassis sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of bodies and chassis from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each body and chassis sourcing change attributed to the USMCA automotive ROOs In the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each body and chassis sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘axles’ is selected in 2.2.2]

Axles

2.2.6

List the axle sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of axles from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each axle sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each axle sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘suspension systems’ is selected in 2.2.2]

Suspension systems

2.2.7

List the suspension system sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of suspension systems from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each suspension system sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each suspension system sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘steering systems’ is selected in 2.2.2]

Steering systems

2.2.8

List the steering system sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of steering systems from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each steering system sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each steering system sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘advanced batteries’ is selected in 2.2.2]

Advanced batteries

2.2.9

List the advanced battery sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors. Indicate the level of attribution to the ROOs and attribution to regional value content (RVC) requirements and labor value content (LVC) requirements in the table below.

Describe the sourcing change (e.g., shifted sourcing of advanced batteries from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each advanced battery sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each advanced battery sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘steel’ is selected in 2.2.2]

Steel

2.2.10

List the steel sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: Full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of steel from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each steel sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each steel sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

[If ‘aluminum’ is selected in 2.2.2]

Aluminum

2.2.11

List the aluminum sourcing changes that were made to meet the USMCA automotive ROOs in the table below. For each sourcing change, provide the impacted model line of motor vehicle, select the attribution of the change to the ROOs, indicate whether the change was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the change. Note: full attribution to the ROOs is appropriate if the sourcing change was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing change was made in part to meet the ROOs, in addition to influences from other factors.

Describe the sourcing change (e.g., shifted sourcing of aluminum from South Korea to United States) |

Model line of motor vehicle impacted |

Attribution to the USMCA automotive ROOs ([dropdown: full, partial]) |

Indicate if the sourcing change can be attributed to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 3] List any non-ROOs factors contributing to the sourcing change |

|

|

|

|

|

Provide additional information about each aluminum sourcing change attributed to the USMCA automotive ROOs in the table below.

Description of the sourcing change |

Model line of motor vehicle impacted |

Provide a brief explanation for the sourcing change |

Month and year of the sourcing change |

Percent of model line of motor vehicle impacted |

[If <100 percent in column 5] Provide a brief explanation if less than 100 percent of the model line of motor vehicle was impacted |

{carried forward from above} |

{carried forward from above} |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For each aluminum sourcing change attributed to the USMCA automotive ROOs, what was the change in per-motor vehicle variable costs of production and one-time overhead costs?

Description of the sourcing change |

Model line of motor vehicle impacted |

Change in per-motor vehicle variable costs of production (in dollars, use minus sign for a decrease in costs) |

Change in overhead costs (in dollars, use minus sign for a decrease in costs) |

{carried forward from above} |

{carried forward from above} |

|

|

USMCA automotive ROOs effects on new production

This section asks about the effects of the USMCA automotive ROOs on new model lines of motor vehicles that were introduced to the North American market after the USMCA entered into force on July 1, 2020. For model lines of motor vehicles that were sold in the North American market beginning before the USMCA entered into force, responses should be included in sections 2.1 and 2.2.

2.3.1

Since the USMCA entered into force on July 1, 2020, did your firm sell any new model lines of motor vehicles?

Yes

No

[If ‘yes’ to 2.3.1a] Did the USMCA automotive ROOs affect decisions about the location of assembly for new model lines of motor vehicles?

Yes

No

[If ‘yes’ to 2.3.1b] List the model line(s) of motor vehicles whose assembly location decision was affected by the USMCA automotive ROOs in the table below. For each model line of motor vehicle, provide the assembly location decision, select the attribution of the decision to the ROOs, indicate whether the decision was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the decision. Note: full attribution to the ROOs is appropriate if the assembly location decision was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the assembly location decision was made in part to meet the ROOs, in addition to influences from other factors.

Model line of motor vehicle impacted |

Assembly location decision ([dropdown: Assemble within North America, Assemble outside North America) |

Attribution to the USMCA automotive ROOs [dropdown: full, partial] |

Indicate if assembly location decision is attributable to RVC, LVC, or both [dropdown: RVC, LVC, both] |

List any non-ROOs factors contributing to the assembly location decision |

|

|

|

|

|

2.3.2

[If ‘yes’ to 2.3.1a] Did the USMCA automotive ROOs affect decisions about the sourcing of parts or materials when the new model lines of motor vehicle were brought into production?

Yes

No

[If yes to 2.3.2a] List the new model line(s) of motor vehicles that were sold since July 1, 2020 for which the USMCA automotive ROOs affected sourcing decisions in the table below. For each model line of motor vehicle, provide the first sales date and country of vehicle assembly, select the attribution of the decision to the ROOs, indicate whether the decision was attributed to the RVC, LVC, or both, and list any non-ROOs factors which may have contributed to the decision. Note: full attribution to the ROOs is appropriate if the sourcing decision was only made to meet the ROOs. Partial attribution to the ROOs is appropriate if the sourcing decision was made in part to meet the ROOs, in addition to influences from other factors.

Model line of motor vehicle added |

Month and year of first sale |

Country of vehicle assembly |

Attribution of sourcing decision to the USMCA automotive ROOs [dropdown: full, partial] |

Indicate if sourcing decision is attributable to RVC, LVC, or both [dropdown: RVC, LVC, both] |

[If ‘partial’ from column 4] List any non-ROOs factors contributing to the sourcing decisions |

|

|

|

|

|

|

SECTION 3. Effects of the USMCA automotive ROOs

3.1

a. Provide the USMCA automotive RVC and LVC, in percent, for all models for which your firm calculated RVC and LVC pursuant to the USMCA between 2020 and 2023. In answering this question, first indicate whether you will provide this information for all models at once or use the aggregations that you reported to U.S. Customs and Border Protection (CBP).

All models

Use aggregations reported to CBP

For question 3.1, indicate if your firm will be providing information on a calendar year basis or fiscal year basis.

Calendar year

Fiscal year

[If ‘fiscal year’ is selected in 3.1b] c. Indicate the starting month of your firm’s fiscal year. ______________

[if ‘all models’ is selected in 3.1a provide table below] d. Provide the aggregate USMCA automotive RVC and LVC, in percent, for all models for which your firm calculated RVC and LVC pursuant to the USMCA for 2020 through 2023.

-

2020

2021

2022

2023

RVC (%)

LVC (%)

[if ‘use aggregations reported to CBP’ is selected in 3.1a] d. For the purposes of calculating USMCA automotive RVC and LVC, how many aggregations did you report to CBP? _________ [max of 50]

[If ‘use aggregations reported to CBP’ is selected in 3.1a] e. For each aggregation listed in 3.1d, include the amount of production, list the model lines of motor vehicles included in the aggregation, and the RVC and LVC, in percent, for 2020 through 2023.

List

[One table for each aggregation listed in 3.1b]

-

Metric

2020

2021

2022

2023

Production (in units)

Included model lines of motor vehicles

RVC (%)

LVC (%)

Provide your firm-level percent of steel and aluminum (by value) that was sourced from North America between 2020 and 2023.

-

2020

2021

2022

2023

Steel

Aluminum

3.2

Has your firm increased wages at any of its North American parts or assembly plants so that they qualify for LVC certification?

Yes

No, raised wages for reasons other than LVC

No, did not raise wages

[If ‘yes’ to 3.2a] Please explain: ___________________

3.3

a. How have production changes made to meet USMCA labor value content requirements (and any related labor cost changes) changed your firm’s use of automation in the production process?

Increased use of automation

Minimal change in use of automation

Decreased use of automation

Not applicable

Please explain: ___________________

3.4

How have the USMCA automotive ROOs affected innovation at your firm (e.g., resulted in changes to R&D investment, increased or decreased ability to bring new products to market, changes in design or production processes, etc.)?

Increased innovation

Minimal change in innovation

Decreased innovation

Not applicable

Please explain: ____________________

3.5 Resilience

3.5.1

Have the changes that your firm made to its supply chain in response to the USMCA automotive ROOs affected your firm’s ability to maintain motor vehicle production operations when facing non-North American supply chain disruptions (for example, if a non-North American supplier is temporarily unable to supply at the expected level)?

Our firm is better able to maintain motor vehicle production because of the changes it made to its supply chain in response to the USMCA automotive ROOs.

Our firm is less able to maintain motor vehicle production because of the changes it made to its supply chain in response to the USMCA automotive ROOs.

No change in ability to maintain motor vehicle production operations.

Unclear due to complexity of supply chain.

Please explain: ___________________

3.5.2

Have the changes your firm made to its supply chain in response to the USMCA automotive ROOs affected your firm’s ability to maintain motor vehicle production operations when facing North American supply chain disruptions (for example, if a North American supplier is temporarily unable to supply at the expected level)?

Our firm is better able to maintain motor vehicle production because of the changes it made to its supply chain in response to the USMCA automotive ROOs.

Our firm is less able to maintain motor vehicle production because changes it made to its supply chain in response to the of the USMCA automotive ROOs.

No change in ability to maintain motor vehicle production operations.

Unclear due to complexity of supply chain.

Please explain: ___________________

3.6 Trade

3.6.1

a. Have the USMCA automotive ROOs affected your firm’s U.S. exports since entry into force of the USMCA?

Yes

No

b. [If ‘yes’ to 3.6.1a] How have the USMCA automotive ROOs affected your firm’s U.S. exports since entry into force of the USMCA?

-

Export market

Effect of the USMCA automotive ROOs on exports [dropdown: decrease in exports of greater than 5 percent, decrease in exports of 0 to 5 percent, no effect in exports, increase in exports of 0 to 5 percent, increase in exports of greater than 5 percent]

Exports to Canada and Mexico

Exports to other countries

3.6.2

Since the USMCA entered into force, did your firm pay the most-favored-nation rate of duty for passenger vehicles, light trucks, or heavy trucks when importing production motor vehicles into Canada, Mexico, or the United States from a USMCA partner country rather than meet the USMCA automotive ROOs?

Yes

No

[If yes to 3.6.2a] Provide the following information by model line of motor vehicle:

Model line of motor vehicle for which duty was paid |

Importing country [dropdown: Canada, Mexico, United States] |

Year(s) additional duty paid |

Number of vehicles |

|

|

|

|

[if yes to 3.6.2a] Please explain:______________

3.6.3

Since the USMCA entered into force, did your firm pay the most-favored-nation rate of duty for those parts listed in section 2.2 (i.e., those listed in Table A.1 of the agreement) when importing those parts into Canada, Mexico, or the United States from a USMCA partner country rather than meet the USMCA automotive ROOs?

Yes

No

[If yes to 3.6.3a] Provide the following information by part and model line of motor vehicle:

Part for which duty was paid [dropdown: engine, transmission, body and chassis, axle, suspension system, steering system, advanced battery] |

Model line of motor vehicle impacted |

Importing country [dropdown: Canada, Mexico, United States] |

Year(s) additional duty paid |

Number of parts |

|

|

|

|

|

[if yes to 3.6.3a] Please explain:______________

SECTION 4. Technological Changes

This section asks about the extent to which the USMCA automotive ROOs remain relevant in light of technological changes occurring in the automotive industry. Section 4 is broken up into two subsections; the first asks about the five technological changes that the Commission examined in its 2023 report, while the second asks for information related to any additional technological changes that may impact the continued relevancy of the USMCA automotive ROOs.

Impact on the overall continued relevancy of the USMCA automotive ROOs

In its first report, the Commission identified technological changes in the U.S. automotive industry that have occurred since the negotiation of the USMCA, or are in the process of occurring, and evaluated the extent to which these technological changes affect the application of the USMCA automotive ROOs in the U.S. automotive industry.7 For each of these five topics below, indicate the extent to which the specified technological change has any impact on the overall continued relevancy of the USMCA automotive ROOs, as those changes pertain to your firm.8

The tariff classification of electric vehicles (EV) and hybrid light trucks:

Brief description of the technological change and the potential impact on the relevancy of the USMCA automotive ROOs: The production of EV and hybrid pickup trucks and work vans has increased significantly since the negotiation of the USMCA. However, there is a divergence in the tariff classification of these vehicles compared to internal combustion engine counterparts. The USMCA was written in HS 2012 nomenclature, and HS subheading 8704.90 was classified as a heavy truck under the USMCA. HS subheading 8704.90, in HS 2012 nomenclature, is where EV and hybrid trucks are classified, regardless of their size. This means that EV and hybrid trucks under five tons (those classified under 8704.41, 8704.51, and 8704.60 in more recent HS nomenclature), which most would consider light trucks, are classified as heavy trucks under the USMCA. 9 This results in a different set of ROOs for EV and hybrid trucks compared to light trucks with internal combustion engines. As the volume of EV and hybrid pickup trucks and work vans continues to increase, this means that the share of trucks weighing less than five tons treated as heavy trucks will continue to increase.10

Does your firm currently produce any EV or hybrid light trucks (e.g., a hybrid or electric pickup truck or work van) in North America that are classified as a heavy truck under the USMCA?

Yes

No

Has your firm publicly announced future plans to produce any EV or hybrid light trucks in North America that will be classified as a heavy truck under the USMCA?

Yes

No

[If ‘yes’ to 4.1.1a or 4.1.1b] List those model line(s) of motor vehicle: __________________

[If ‘yes’ to 4.1.1a or 4.1.1b] How impactful is the increase in production of EV and hybrid pickup trucks and work vans and their classification as heavy trucks on the continued relevancy of the USMCA automotive ROOs related to these goods?

Factor |

No impact |

Minimal impact |

Some impact |

Large impact |

Classification of EV and hybrid pickup trucks and work vans as a heavy truck |

|

|

|

|

[If ‘yes’ to 4.1.1a or 4.1.1.b] Please explain: ____________________

Differences between tariff-shift rules for stamped vs. cast aluminum motor vehicle body parts

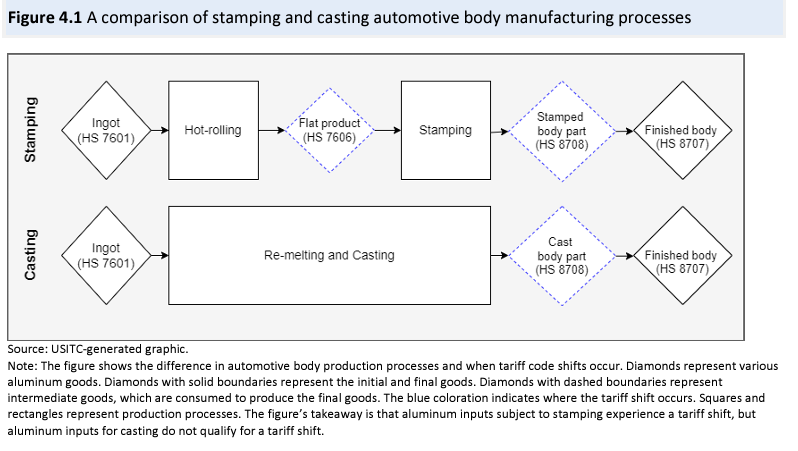

Brief description of the technological change and the potential impact on the relevancy of the USMCA automotive ROOs: Aluminum automotive bodies were traditionally made from stamped aluminum body parts, but aluminum casting is increasingly becoming an alternative method of production for automotive bodies, and offers certain advantages compared to stamping. The USMCA automotive ROOs for aluminum are such that stamped aluminum motor vehicle body parts can qualify as originating if certain intermediate production steps are performed within the USMCA region, even if the process uses non-originating aluminum ingots. However, since the casting production process does not have an equivalent intermediate production step, producers cannot qualify comparable cast body parts as originating, unless the ingot itself was originating (see figure below).11

Source: USITC, USMCA Automotive Rules of Origin: Economic Impact and Operation, 2023 Report, June 2023, 92.

4.1.2

Does your firm cast aluminum body parts for production of motor vehicles in North America?

Yes

No

[If ‘no’ to 4.1.2a] Does your firm currently have plans to cast aluminum body parts for the production of motor vehicles in North American by December 31, 2025?

Yes

No

[If ‘yes’ to 4.1.2a or 4.1.2b] Please explain the extent to which your firm casts aluminum body parts or plans to do so in the future (e.g., use in a few vehicle models, most vehicles, etc.): ____________________

[If ‘yes’ to 4.1.2a or 4.1.2b] How impactful is the use of cast versus stamped aluminum body parts on the continued relevancy of the USMCA automotive ROOs related to these goods?

Factor |

No impact |

Minimal impact |

Some impact |

Large impact |

Differences between tariff-shift rules for stamped vs. cast aluminum body parts |

|

|

|

|

[If ‘yes’ to 4.1.2a or 4.1.2b] Please explain: ____________________

The increasing importance of nontraditional motor vehicle inputs

Brief description of the technological change and the potential impact on the relevancy of the USMCA automotive ROOs: The value of nontraditional motor vehicle inputs in the motor vehicle supply chain continues to rise, as does the share of the final motor vehicle cost encompassed by these inputs. However, these inputs are typically not classified as motor vehicle parts in the Harmonized System and are typically not subject to any product-specific automotive rules of origin under the USMCA. Examples of these inputs include semiconductors, sensors, cameras, and touch screens.12

4.1.3