Regulatory Impact Analysis

2725ria02.docx

Accidental Release Prevention Requirements: Risk Management Programs Under the Clean Air Act; Safer Communities by Chemical Accident Prevention (Final Rule)

Regulatory Impact Analysis

OMB: 2050-0226

*** E.O. 12866 Review – Draft – Do Not Cite, Quote, or Release During Review***

Clean Air Act Risk Management Program Regulations Final Rule RIA 20230920_EO 12866 Initiated

Regulatory Impact Analysis

Safer Communities by Chemical Accident Prevention

Final Rule

U.S. Environmental Protection Agency (EPA)

Office of Land and Emergency Management (OLEM)

Office of Emergency Management (OEM)

1200 Pennsylvania Avenue, NW (Mail Code 5104A)

Washington, D.C. 20460 USA

August 30, 2023

CHAPTER 1: Introduction and Background 15

1.1 History and Need for the Rule 15

1.2 Organization of the Analysis 20

CHAPTER 2: Final Rule Provisions 21

2.1 Summary of Provisions and Applicability to Private Sector Facilities 21

2.2 Applicability to Government-owned Facilities and Entities 25

2.3 Changes in the Final Rule RIA from the Proposed Rule RIA 25

CHAPTER 3: Universe of RMP Facilities and 26

3.1 Universe of RMP Facilities 26

3.2 Number and Costs of Baseline Accidents 34

CHAPTER 4: Costs of Final Rule Revisions 51

4.4 Prevention Program Provisions 53

4.7 Information Availability 63

CHAPTER 5: Total Estimated Costs of the Final Rule 66

5.3 Prevention Program Rule Provisions 68

5.6 Information Availability to the Public 74

5.7 Important Cost Uncertainties and Indirect Costs Associated with Prevention Program Provisions 75

CHAPTER 6: Total Benefits of the Final Rule 80

6.2 Benefit Categories Associated with Accident Prevention and Mitigation 87

6.3 Avoided Accident Impacts: Breakeven Analysis 93

CHAPTER 7: Regulatory Alternatives Considered 98

7.1 Lower-cost Regulatory Alternative 98

7.2 Higher Cost Regulatory Alternative 101

7.3 Summary of Regulatory Alternatives 103

CHAPTER 8: Small Entity Analysis 106

8.2 Estimating the Number of Small Entities 107

8.3 Economic Impact on Small Entities 110

CHAPTER 9: Communities with Environmental Justice Concerns 119

9.3 Results Characterizing Baseline Conditions 123

9.5 Climate Change Impacts 132

CHAPTER 10: Limitations and Conclusions 135

10.1 Limitations and Conclusions 135

CHAPTER 11: Analyses Required Under Applicable Statutes and Executive Orders 138

11.2 Unfunded Mandates Reform Act 138

11.5 Paperwork Reduction Act of 1995 142

11.6 National Technology Transfer and Advancement Act 143

11.7 Consultation and Coordination with Indian Tribal Governments 143

APPENDIX A: Cost Estimates of HF Alkylation Conversion 145

APPENDIX B: Property and Business Losses in the Petrochemical Sector 147

APPENDIX C: Small Entity Analysis Data Comparison 149

C.1 Proposed Rule Data Comparison 149

C.2 Final Rule Data Comparison 154

Acronyms

Acronym Definition

AFPM American Fuel & Petrochemical Manufacturers

API American Petroleum Institute

ASEC Annual Social and Economic Supplement

ASM Annual Survey of Manufacturers

AWWA American Water Works Association

BEA Bureau of Economic Analysis

BLS Bureau of Labor Statistics

CAA Clean Air Act

CBP County Business Patterns

CSAG Chemical Safety Advocacy Group

CSB U.S. Chemical Safety Board

DUNS Data universal numbering system

D.C. District of Columbia

E.O. Executive Order

EPA U.S. Environmental Protection Agency

EPCRA Emergency Planning and Community Right to Know Act

GDP Gross Domestic Product

FTE Full-time employee

HF Hydrofluoric acid

HHS U.S. Department of Health & Human Services

ICR Information Collection Request

ISD Inherently safer design

IST Inherently safer technology

IPAWS Integrated Public Alert and Warning System

LEPC Local Emergency Planning Committee

NAICS North American Industrial Classification System

NIPA National Income and Product Accounts

NPRM Notice of Proposed Rulemaking

NTTAA National Technology Transfer and Advancement Act

OCA Offsite Consequences Analysis

OEM Office of Emergency Management

OEWS Occupational Employment and Wage Statistics

OSWER Office of Solid Waste and Emergency Response

OLEM Office of Land and Emergency Management

OMB Office of Management and Budget

OSHA Occupational Safety & Health Administration

PHA Process Hazard Analysis

PSM Process Safety Management

RAGAGEP Recognized and Generally Accepted Good Engineering Practices

RFA Regulatory Flexibility Act

RFI Request for Information

RIA Regulatory Impact Analysis

RMP Risk Management Program

SBA Small Business Administration

SDS Safety Data Sheet

STAA Safer Technology and Alternatives Analysis

TRI Toxic Release Inventory

TQ Threshold quantity

U.S. United States

VSL Value of a statistical life

WTP Willingness to pay

Executive Summary

Introduction

To bolster resilience to the impacts of climate change and prioritize environmental justice through environmental policy and regulation in the United States, President Biden issued Executive Order (E.O.) 13990, Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis. The E.O. directs Federal agencies to review current regulations and take action to address these issues. To support these priorities, EPA reviewed and proposed revisions to the current Risk Management Program (RMP)1 regulation.

The purpose of the final Safer Communities by Chemical Accident Prevention (SCCAP) final rule is to make changes to the current RMP rule in order to improve safety at facilities that use and distribute hazardous chemicals. EPA believes that the RMP regulations have been effective in preventing and mitigating chemical accidents in the U.S. However, because major RMP accidents continue to occur, EPA in this final rule is taking further steps to help protect human health and the environment from chemical hazards. The final rule revisions, by giving special consideration to concerns about climate change and environmental justice and building on lessons learned from the current regulatory program, will further protect human health and the environment from chemical hazards through advancement of process safety. These revisions are informed by EPA’s review of the current RMP rule and data, information collected by EPA through oral testimonies from the summer 2021 listening sessions on June 16 and July 8, 2021, written public comments submitted in response to a request for comment published by EPA prior to the development of the proposed rule (86 FR 28828; May 28, 2021), as well as the proposal’s open written comment period and September 2022 public hearings.

The final rule revisions seek to improve chemical process safety, assist in planning, preparing for, and responding to RMP accidents, and improve public awareness of chemical hazards at regulated sources. To accomplish this, these final rule provisions include several changes to the accident prevention program requirements, enhancements to the emergency preparedness requirements, changes to increase public availability of chemical hazard information, and changes or clarifications to certain regulatory definitions or issues. Some final rule provisions target facilities in close proximity to certain other facilities and/or facilities that have had recent accidents and/or facilities using a certain hazardous process (HF alkylation).

Provisions Analyzed in this RIA

This Regulatory Impact Analysis (RIA) analyzes the following new requirements and revisions to current requirements.

Prevention Program

Safer Technology and Alternatives Analysis (STAA)— (Revisions apply to §68.3 and §68.67)

The current RMP rule does not require facilities to conduct a STAA. The final rule STAA requirement includes two parts: the initial evaluation to identify alternatives and a practicability assessment to determine the costs and assess the reasonableness of implementing technology alternatives. Under the final rule, all facilities with Program 3 processes in North American Industrial Classification System (NAICS) code 324 and 325 are required to conduct the initial evaluation. Of those facilities, facilities that have had an accident since their most recent Process Hazard Analysis (PHA) or are located within one mile of another facility with a process in NAICS code 324 or 325, also are required to conduct a practicability assessment.2 The final rule also requires that all facilities in NAICS 324 using hydrofluoric acid (HF) in an alkylation unit (approximately 45 facilities) conduct a practicability assessment to assess inherently safer alternatives to HF alkylation, regardless of accident history or proximity to another NAICS 324- or 325-regulated facility.

STAA Implementation— (Revisions apply to §68.3 and §68.67)

Under the final rule, all facilities required to conduct a STAA practicability assessment (i.e., Program 3 NAICS 324 and 325 facilities that have had an accident since their most recent PHA, with an HF unit in a NAICS 324 process, or are located within one mile of another facility with a NAICS 324 or 325 process) also are required to implement at least one passive measure at the facility, or an inherently safer technology or design, or a combination of active and procedural measures causing equivalent to or greater than the risk reduction of a passive measure. EPA is providing facilities with flexibility to choose either one or a combination of inherently safer technology (IST) or inherently safer design (ISD), passive, active, or procedural measures, provided it reduces risk at least as much as a practicable passive measure would achieve.

Root Cause Analysis— (Revisions apply to §§68.60 and 68.81)

Under the current RMP rule, facilities are required to conduct an incident investigation following an incident which resulted or reasonably could have resulted in a catastrophic release. The final rule requires facilities to conduct a root cause analysis as part of an incident investigation following an RMP-reportable accident. A root cause analysis is a formal process to identify underlying reasons for failures that led to accidental releases. These analyses require staff knowledgeable in selection and use of root cause analysis techniques. The incident investigation revisions apply to all facilities with Program 2 and 3 processes that experience an RMP-reportable accident. There are approximately 100 accidents with RMP-reportable impacts per year in the baseline (see Exhibit 3-11).

Third-Party Audits— (Revisions apply to §§68.58 and 68.79 and new §§68.59 and 68.80)

The current RMP rule requires facilities to conduct a compliance audit of Program 2 and Program 3 processes at least once every three years. This final rule, also applicable to Program 2 and Program 3 processes, requires the next required compliance audit to be a third-party audit when any one of the following conditions applies:

The facility has had an RMP-reportable accident; or

An implementing agency requires a third-party audit either due to conditions at the facility that could lead to an accidental release of a regulated substance, or due to a previous third-party audit that failed to meet the competency or independence criteria of §68.80(c).

Employee Participation— (Provisions apply to §68.83)

Under the current RMP rule, Program 3 process facilities’ employee participation plans require the owner or operator to consult with employees and their representatives on the conduct and development of process hazards analyses and on the development of the other elements of process safety management (PSM). The owner or operator must provide employees and their representatives access to process hazard analyses and to all other information required to be developed under the current rule.

The final rule revises §68.83 and other aspects of employee participation to require six new components:

Program 2 facilities must develop written employee participation plans of action, which detail employee roles in using reasonable judgment and communication procedures to identify, raise, and address safety concerns. Facilities must also develop and implement a process for employees to report on hazards and noncompliance and must provide employees and their representatives access to hazard reviews and all other information required to be developed under the rule.

The Program 3 employee participation plan must include the consultation of employees and their representatives regarding how to address, correct, resolve, document, and implement recommendations of process hazard analyses, incident investigations, and compliance audits.

The Program 3 employee participation plan must include and ensure that effective methods are in place so that employees knowledgeable in the process and their representatives have specific stop work authorities based on a potential for a catastrophic release. The specific authorities must include:

Recommending to the operator in charge of a unit that an operation or process be shut down, partially or completely, based on the potential for a catastrophic release;

Allowing a qualified operator in charge of a unit to shut down, partially or completely, an operation or process based on the potential for a catastrophic release.

Program 3 employee participation plans must include a process for employees to report on hazards and noncompliance.

Program 2 and Program 3 facilities must provide an annual written or electronic notice to employees indicating RMP information is available.

Program 2 and Program 3 facilities must provide training to inform employees, their representatives, and management involved in the process of the details of the written employee participation plan.

Backup Power for Perimeter Monitors— (Revisions apply to §§68.50 and 68.67)

The final rule requires air control or monitoring equipment associated with prevention and detection of accidental releases from RMP-regulated processes where power loss has been identified as a major hazard to have standby or backup power.

RMP Justification Hazard Evaluation Amplifications— (Revisions apply to §§68.50 and 68.67)

The final rule requires that hazard evaluations explicitly address natural hazards and the risk of power failure. EPA believes that because natural hazards and power loss continue to be factors in RMP accidents and present growing threats to process safety at RMP facilities, a requirement to evaluate and control natural hazards and power loss risks should be explicitly stated in the RMP regulation. Hazard evaluations also must explicitly define stationary source siting as inclusive of processes, equipment, buildings within the stationary source, hazards posed by proximate stationary sources, and accidental release consequences posed by proximity to the public and public receptors. The final rule requires that risk management plans explicitly include declined natural hazard, power loss, and siting evaluation recommendations and their associated justifications.

RAGAGEP gap analysis— (Revisions apply to §§68.69 and 68.175)

The final rule requires that risk management plans explicitly include declined PHA recommendations associated with adopting practices from the most recent version of RAGAGEP and their associated justifications.

Emergency Response

Community Notification of RMP Accidents— (Previsions apply to §§68.90 and 68.95)

The final rule adds a requirement to RMP facility owners and operators who designate themselves as a non-responding facility to develop and implement, as necessary, procedures for informing the public and the appropriate emergency response agencies about accidental releases of RMP-regulated substances. EPA is also requiring that responding and non-responding facilities ensure that:

A community notification system is in place;

The public is promptly notified of an RMP accident release; and

The notification provides appropriate, timely data and information to local responders with the current understanding and best estimates of the nature of the release.

Information Availability

Information Availability— (revisions apply to §68.210)

The final rule requires all facilities to disclose certain chemical hazard information to the public residing, working, or spending significant time within 6 miles3 of the facility in the language (either English or one of two other major languages used in the community) requested by the requester.4 These are new information availability requirements, not currently required. EPA is requiring owners and operators to maintain a record of requesters. The facility or its parent company, if applicable, also must provide ongoing notification through publicly accessible means regarding what information is available upon request for those members of the public, how to request that information, and where to access information on community preparedness.

Regulatory Alternatives to the Final Rule

The RIA analyzed several regulatory alternatives to the final rule. EPA considered one regulatory alternative with lower costs than the final rule costs and one with higher costs. The lower cost regulatory alternative is the same as the final rule except that it considers alternatives for three provisions: root cause analysis, third-party audits, and employee participation. The higher cost alternative applies the STAA and third-party audit provisions to a broader set of facilities but is otherwise the same as the final rule. See Chapter 7 for a description of each regulatory alternative EPA considered, estimates of the incremental costs of the alternatives relative to a baseline of no new rulemaking and breakeven analyses of those alternatives.

Universe of RMP Facilities

Recent data show that 11,740 facilities have filed current risk management plans with EPA and are potentially affected by the final rule. These facilities range from petroleum refineries and large chemical manufacturers to water and wastewater treatment systems; chemical and petroleum wholesalers and terminals; food manufacturers, packing plants, and other cold storage facilities with ammonia refrigeration systems; agricultural chemical distributors; midstream gas plants; and a limited number of other sources that use RMP-regulated substances. A table of the number of affected facilities by sector and NAICS code can be found in Exhibit 3-1.

Summary of Estimated Costs of the Final Rule

Exhibit ES-1 presents a summary of the total undiscounted, discounted, and annualized costs of the final rule. In total, EPA estimates annualized costs of $256.9 million at a 3 percent discount rate and $296.9 million at a 7 percent discount rate over a 10-year period. The provisions associated with the largest annualized cost at a 3 percent discount rate are STAA implementation ($168.7 million), STAA practicability assessment ($27.0 million), and STAA initial evaluation ($18.5 million), followed by information availability ($12.8 million), employee participation plan ($11.5 million), third-party audits ($7.5 million), rule familiarization ($5.8 million), and a community notification system ($4.0 million). The remaining provisions impose annualized costs of less than $1 million, including root cause analysis ($0.7 million), emergency backup power for perimeter monitors used to detect RMP-regulated substances ($0.3 million), and RMP justifications ($0.1 million).

Exhibit ES‑1. Summary of Estimated Costs (millions, 2022 dollars).

Cost Elements |

Total Undiscounted |

Total Discounted (3%) |

Total Discounted (7%) |

Annualized (3%) |

Annualized (7%) |

Rule Familiarization |

$50.9 |

$49.5 |

$47.6 |

$5.8 |

$6.8 |

Safer Technology Alternatives Analysis (STAA) |

|||||

Initial Evaluation |

$176.49 |

$158.2 |

$138.3 |

$18.5 |

$19.7 |

Practicability Assessment |

$256.9 |

$230.2 |

$201.0 |

$27.0 |

$28.6 |

Implementation |

$1,700.4 |

$1,438.9 |

$1,172.6 |

$168.7 |

$204.9 |

Root Cause Analysis |

$7.3 |

$6.2 |

$5.1 |

$0.7 |

$0.7 |

Third-party Audits |

$75.2 |

$64.2 |

$52.8 |

$7.5 |

$7.5 |

Employee Participation Plan |

$114.7 |

$97.9 |

$80.6 |

$11.5 |

$11.5 |

Backup Power for Perimeter Monitors |

$3.3 |

$2.8 |

$2.3 |

$0.3 |

$0.3 |

RMP Justifications |

|||||

No Backup Power |

$.2 |

$0.1 |

$0.1 |

$0.0** |

$0.0** |

Natural Hazards |

$.4 |

$0.4 |

$0.3 |

$0.0** |

$0.0** |

Facility Siting |

$.4 |

$0.4 |

$0.3 |

$0.0** |

$0.0** |

RAGAGEP |

$.3 |

$0.2 |

$0.2 |

$0.0** |

$0.0** |

Community Notification System |

$39.7 |

$33.9 |

$27.9 |

$4.0 |

$4.0 |

Information Availability |

$127.6 |

$108.8 |

$89.6 |

$12.8 |

$12.8 |

Total Cost* |

$2,554.0 |

$2,191.7 |

$1,818.9 |

$256.9 |

|

*Totals may not sum due to rounding.

** Costs are zero due to rounding. Unrounded costs are $15,798 for No Backup Power, $42,307 for Natural Hazards and Facility Siting, and $27,582 for RAGAGEP.

Exhibit ES-2 provides undiscounted yearly costs for the final rule provisions, for Years 1-10. Rule familiarization costs are incurred only in Year 1, and therefore are $0 in subsequent years.

Exhibit ES‑2. Summary of Estimated Undiscounted Yearly Costs (millions, 2022 dollars).

Cost Elements |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

Year 7 |

Year 8 |

Year 9 |

Year 10 |

Rule Familiarization |

$50.9 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

STAA |

||||||||||

Initial Evaluation |

$29.9 |

$29.9 |

$29.9 |

$29.9 |

$29.9 |

$5.4 |

$5.4 |

$5.4 |

$5.4 |

$5.4 |

Practicability Assessment |

$43.2 |

$43.2 |

$43.2 |

$43.2 |

$43.2 |

$8.2 |

$8.2 |

$8.2 |

$8.2 |

$8.2 |

Implementation |

$145.0 |

$150.5 |

$156.1 |

$161.7 |

$167.3 |

$172.8 |

$178.4 |

$184.0 |

$189.6 |

$195.1 |

Root Cause Analysis |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

$0.8 |

Third-party Audits |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

$7.5 |

Employee Participation Plan |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

$11.5 |

Backup Power for Perimeter Monitors |

$0.3 |

$0.3 |

$0.3 |

$0.3 |

$0.4 |

$0.4 |

$0.4 |

$0.4 |

$0.4 |

$0.4 |

Justifications** |

||||||||||

No Backup Power |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

Natural Hazards |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

Facility Siting |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

RAGAGEP |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

$0.0 |

Community Notification System |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

$4.0 |

Information Availability |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

$12.8 |

Total Cost* |

$305.8 |

$260.5 |

$266.1 |

$271.7 |

$277.3 |

$223.4 |

$229.0 |

$234.5 |

$240.1 |

$245.7 |

*Totals may not sum due to rounding.

** Costs are zero due to rounding. Unrounded costs are $15,798 for No Backup Power, $42,307 for Natural Hazards and Facility Siting, and $27,582 for RAGAGEP.

Baseline Damages

Accidents and releases from RMP facilities occur every year, involving toxic vapors, fires, and explosions, and resulting in fatalities, injuries, property damage, evacuations, and more. Using data on facility-reported accident impacts from the RMP Accident Database, EPA summarizes the damages that were caused by RMP-reportable accidents during each of the five years from 2016 to 2020, the most recent five-year period for which RMP program data is available. Exhibit ES-3 summarizes reported RMP accident impacts and, when possible, monetizes them.5 During this timeframe, 488 RMP accidents with either or both onsite and offsite damages occurred at RMP facilities. The reported impacts in the RIA correspond to program requirements (40 CFR 68.42 and 68.168), but many additional accident impacts are not required to be reported and thus are not reflected in EPA’s monetized estimates.

Exhibit ES‑3. Summary of Quantified Baseline Damages 2016-2020 (millions, 2022 dollars).

|

Unit Value |

5-Year Total |

Average/Year |

Average/Accident |

Median /Accident |

Onsite |

|||||

Fatalities |

$10.4 |

$187.9 |

$37.57 |

$0.38 |

$0.00 |

Injuries |

$0.05 |

$28.75 |

$5.75 |

$0.06 |

$0.05 |

Property Damage |

|

$2,273 |

$454.58 |

$4.66 |

$0.00 |

Onsite Total |

|

$2,489.49 |

$497.90 |

$5.10 |

$0.05 |

Offsite |

|||||

Fatalities |

$10.4 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

Hospitalizations |

$0.045 |

$1.40 |

$0.28 |

$0.00 |

$0.00 |

Medical Treatment |

$0.001 |

$0.13 |

$0.03 |

$0.00 |

$0.00 |

Evacuations* |

$0.000 |

$18.99 |

$3.80 |

$0.04 |

$0.00 |

Sheltering in Place* |

$0.000 |

$12.58 |

$2.52 |

$0.03 |

$0.00 |

Property Damage |

|

$178.55 |

$35.71 |

$0.37 |

$0.00 |

Offsite Total |

|

$211.66 |

$42.33 |

$0.43 |

$0.00 |

Total** |

|

$2,701.14 |

$540.23 |

$5.54 |

$0.05 |

* The unit value is $293 for evacuations and $147 for sheltering-in place, so when expressed in rounded millions, the value represented in the table is zero.

**Totals may not sum due to rounding.

EPA monetized reported onsite and offsite damages when possible. EPA estimated total average annual onsite damages of $497.9 million. The largest monetized, average annual, onsite damage category was property damage, which resulted in average annual damage of approximately $454.58 million. The next largest impact was onsite fatalities ($37.57 million) and injuries ($5.75 million).

Again, reflecting reported impacts, EPA estimated total average annual offsite damages of $42.33 million. The largest monetized, average annual, offsite damage category was property damage, which resulted in average annual damage of approximately $35.71 million. The next largest impact was from evacuations ($3.80 million), sheltering in place ($2.52 million), hospitalizations ($0.28 million), and medical treatment ($0.03 million). In total, EPA estimated monetized damages from RMP facility accidents over the five-year period of $540.23 million per year.6

Overall, monetized damages from reported accident impacts in the RMP Accident Database from 2016 through 2020 ranged from a low of $100 to a high of $700 million, with a median accident value of $50,000 for the 488 RMP impact accidents. Median values were zero in all damage categories except for onsite (worker) injuries. While an important objective of the final rule is to reduce the probability of a major catastrophe, the baseline damages in Exhibit ES-3 do not reflect the full costs of a catastrophe. However, the baseline damages shed light on the nature and extent of existing costs from RMP facility accidents. EPA has determined that the final rule provisions will help mitigate these costs.

In addition to the monetized baseline accident damages reflecting impacts required to be reported by RMP facilities, there are many additional RMP accident impacts that EPA was unable to quantify or monetize due to a lack of data. Unquantified baseline damages include potential health risks from exposure to toxic chemicals, lost productivity, responder costs, transaction costs, negative impacts on property values, environmental damages, unquantified evacuation and shelter-in-place costs, and damages related to catastrophic releases. In some cases, these damages could be even more detrimental to society than those damages that can be quantified. These categories are discussed in detail in Chapter 6.

Summary of Benefits

EPA expects the final rule to reduce accident risks across the spectrum of RMP facilities and accident categories. The rule requirements are targeted at reducing both the probability and the magnitude of the full range of accident types regulated by the RMP program including fires, explosions, and releases of toxic vapors. Accident risks posed by the variety of RMP facilities in numerous industries (listed in Exhibit 3-1) should decrease, with larger impacts expected for P3 facilities and especially petroleum refineries and chemical manufacturers that meet the three conditions for the STAA practicability and implementation requirements. Avoided accident damages include those that are required to be reported by RMP facilities such as fatalities, injuries, property damage, hospitalizations, medical treatment, evacuations, sheltering-in-place and others. EPA also expects that the final rule provisions will reduce baseline damages that are not required to be reported such as taxpayer-funded responder costs, transaction costs for parties affected by the accident, property value reductions in neighborhoods nearby, unmonetized costs of evacuations and sheltering-in-place, the costs of potential health risks from exposure to toxic chemicals, lost productivity, and more. In addition, information benefits will be experienced due to several final rule provisions such as the community notification requirements and the back-up power for monitoring equipment. Finally, the rule will reduce the likelihood of major catastrophes. Although EPA was unable to quantify the reductions in damages that may result from the final rule provisions, EPA expects that a substantial portion of future damages will be prevented by the final rule.

Costs Relative to Benefits: A Limited Breakeven Analysis

EPA is unable to estimate quantitative benefits for the final rule because EPA has no data to project the specific contribution of each final rule provision to reductions in the frequency or severity of future accidents. As shown by accident trends, accident frequency and severity are difficult to predict. In addition, EPA does not have data to estimate the value of all categories of baseline damages that will be reduced by the final rule, nor is there data to estimate the value of improved information due to the final rule. Therefore, the incremental impact on the risk of an RMP facility release resulting from each of the revised RMP rule provisions is uncertain and the full value of reduced risks is unknown. These unknowns prevent EPA from conducting a standard benefit cost analysis.

Instead, to provide insight into the trade-off between the costs and benefits of the final rule provisions, this RIA presents a breakeven analysis limited by incomplete information. The results of this analysis should be viewed with caution. It consists of a simple comparison between the estimated annualized costs of the rule and the limited set of monetized baseline accident impacts. The annualized costs of the final rule (at a 3 percent discount rate) are estimated as $257 million, while average annual monetized accident impacts based on self-reported RMP facility data are estimated as $540 million. The many baseline accident impacts that are not reflected in the $540 million baseline accident cost estimate, yet are expected to be avoided as a benefit of the final provisions, include responder costs, transaction costs, property value reductions, unmonetized costs of evacuations and sheltering-in-place, the costs of potential health risks from exposure to toxic chemicals, and productivity losses, among others. The $540 million estimate also does not reflect the full set of baseline inefficiencies that will be improved due to the improved information offered by several of the final provisions such as the community notification requirements and the back-up power for monitors. Finally, as explained above, the baseline estimate of costs does not include major catastrophic losses. In light of these numerous unmonetized impacts, the estimate of baseline costs potentially reduced by the final rule is only partial and is a conservative estimate.

The limited breakeven analysis suggests that the final rule will need to reduce damages valued at approximately $2 billion over any number of future accidents to achieve breakeven. Alternatively, on an annual basis, given estimated annualized costs of approximately $257 million (3% discount rate) and an estimated number of annual accidents of about 100, fewer than approximately 47 accidents, each with average monetized damages of approximately $5.5 million as estimated for the most recent five-year baseline period, will need to be prevented annually by the final rule to breakeven. Breaking even with fewer than 47 will depend on whether high magnitude accidents are prevented and also on the value of the unquantified accident damages that will be avoided. As the range of monetized accident impacts suggests (from $100 to $700 million for 2016 to 2020), the variation in monetized damages is substantial. Preventing a single high cost accident annually would offset annual rule costs. In sum, when considering the rule’s likely benefits of avoiding some portion of the monetized accident impacts, as well as the additional unmonetized benefits, EPA believes the costs of the rule are reasonable in comparison to its expected benefits. When assessing the reasonableness of the benefits and burdens of various regulatory options, EPA must place weight on both preventing more common accidental releases captured in the accident history portion of the RMP database while also placing weight on less quantifiable potential catastrophic events. The Agency’s judgment as to what regulations are “reasonable” is informed by both quantifiable and unquantifiable burdens and benefits.

CHAPTER 1: Introduction and Background

1.1 History and Need for the Rule

1.1.1 Overview of the Risk Management Program

Serious chemical accidents occurring in the 1970s and 1980s, including accidents in Bhopal, India; Seveso, Italy; and Pasadena, Texas, led to a series of legislative reforms relating to chemical safety in industrialized countries.7,8 In the United States,, the Emergency Planning and Community Right to Know Act (EPCRA) was enacted in 1986 to promote community emergency planning and preparedness and provide local responders and the public with information about the chemical hazards in their community (42 U.S.C. 11002 et seq.). In 1990, sections 112(r) and 304 of the Clean Air Act (CAA) were enacted to help prevent severe chemical facility accidents. Section 304 required the Occupational Safety & Health Administration (OSHA) to publish a chemical process safety standard (Process Safety Management, or PSM standard) to prevent accidental releases of chemicals that could pose a threat to employees. Section 112(r) required the Environmental Protection Agency (EPA) to publish Accidental Release Prevention Program regulations to detect and prevent or minimize chemical releases and their consequences if they occur.

CAA section 112(r) required EPA to develop a list of at least 100 regulated substances known to cause or that may reasonably be anticipated to cause death, injury, or serious adverse effects to human health or the environment (42 U.S.C 7412(r)). EPA was also required to establish threshold quantities (TQs) for these substances that determine the applicability of rules to prevent accidental releases of these substances. Section 112(r)(7)(B) required EPA to promulgate reasonable regulations and appropriate guidance to provide, to the greatest extent practicable, for the prevention and detection of accidental releases of regulated substances and for response to such releases by the owners or operators of the sources of such releases. The section mandates that the regulations require the owner or operator of a facility “to prepare and implement a risk management plan to detect and prevent or minimize accidental releases of such substances from the facility, and to provide a prompt emergency response to any such releases in order to protect human health and the environment.” The section further mandates that the plan include:

A hazard assessment to assess the potential effects of an accidental release of any regulated substance. This assessment must include an estimate of potential release quantities and a determination of downwind effects, including potential exposures to affected populations. Such assessment must include a previous release history of the past five years, including the size, concentration, and duration of releases, and must include an evaluation of worst-case accidental releases.

A program for preventing accidental releases of regulated substances, including safety precautions and maintenance, monitoring and employee training measures to be used at the source.

A response program providing for specific actions to be taken in response to an accidental release of a regulated substance to protect human health and the environment, including procedures for informing the public and local agencies responsible for responding to accidental releases, emergency health care, and employee training measures.

Finally, section 112(r) requires the owner or operator of an affected facility to develop and file a Risk Management Plan with EPA, the U.S. Chemical Safety Board (CSB) (also established under the section), and State, and local response agencies.

OSHA adopted its PSM standard (codified at 29 CFR 1910.119) in 1992 (57 FR 6403, Feb. 24, 1992). The PSM standard requires facilities to develop and implement an integrated approach to chemical process safety and include the following elements: accurate, up-to-date diagrams of all process equipment; an analysis of the process hazards; standard operating procedures; training; maintenance; pre-startup reviews; management of change; compliance audits; incident investigation; employee participation; hot-work9 permits; contractor training; and emergency response. The applicability of the PSM standard is driven by the presence of specific chemicals in quantities above thresholds set in the standard.

EPA published its section 112(r) regulations in two stages − a list of regulated substances and TQs in 1994 (59 FR 4478, January 31, 1994), and the RMP requirements in 1996 (61 FR 31731, June 20, 1996); both are codified at 40 CFR part 68. As required by section 112(r), part 68 includes several major requirements that were not covered by the PSM standard. These include a hazard assessment consisting of an offsite consequences analysis (OCA) and five-year accident history, and the development and submission of a risk management plan that summarizes a source’s RMP. EPA also required stationary sources to develop a management system to oversee the program and included emergency response program requirements beyond those contained in the PSM standard. RMPs were first submitted to EPA in June 1999 and must be updated at least every five years. EPA has amended the rule over time to modify the list of substances, revise data requirements, and to address other issues. The primary requirements adopted in 1996, however, remain in place.

The RMP rule establishes three program levels and requires facility owners or operators to conduct hazard assessments and submit RMPs regardless of the program level. Program 1 requirements apply to processes that will not affect the public in the case of a worst-case release and with no accidents with specific offsite consequences within the past five years. Program 1 provisions impose limited hazard assessment requirements and emergency response requirements.

Program 2 provisions apply to processes not eligible for Program 1 or subject to Program 3, and impose streamlined prevention program requirements, including safety information, hazard review, operating procedures, training, maintenance, compliance audits, and incident investigation elements. Program 2 provisions also impose hazard assessment, management, and emergency response requirements. Program 2 processes are primarily agricultural chemical distributors, chemical wholesalers, and chlorine use at publicly owned water and wastewater facilities in States without OSHA-approved State Plans. To further reduce the burden on facilities with Program 2 processes, EPA developed and published several industry-specific guidance documents10 and an OCA guidance document.

Program 3 requirements apply to processes not eligible for Program 1 and that are either subject to OSHA's PSM standard, under Federal or State OSHA programs, or classified in one of ten specified NAICS codes (1997 version) listed at 40 CFR 68.10(d)(1). The ten NAICS codes are:

32211 (pulp mills)

32411 (petroleum refineries)

32511 (petrochemical manufacturing)

325181 (alkali and chlorine manufacturing)

325188 (all other basic inorganic chemical manufacturing)

325192 (cyclic crude and intermediate manufacturing)

325199 (all other basic organic chemical manufacturing)

325211 (plastics material and resin manufacturing)

325311 (nitrogenous fertilizer manufacturing)

32532 (pesticide and other agricultural chemical manufacturing)

Program 3 requirements impose elements nearly identical to those in OSHA’s PSM standard. The Program 3 prevention program includes requirements relating to the following:

Process safety information

PHA

Operating procedures

Training

Mechanical integrity

Management of change

Pre-startup review

Compliance audits

Incident investigations

Employee participation

Hot-work permits, and

Contractors.

Program 3 provisions also impose the same hazard assessment, management, and emergency response requirements that are required for Program 2.

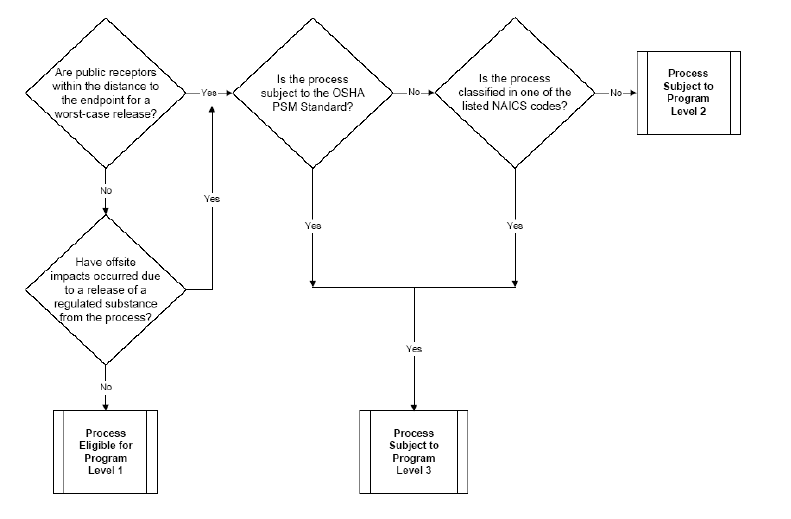

The following flow chart demonstrates how facilities determine the program level to which they are subject:11

Facilities that are exempt from the OSHA PSM standard may be subject to EPA requirements under the RMP rule. This can occur for several reasons. First, the lists of substances regulated are not identical; for example, EPA lists aqueous ammonia in any solution that is 20 percent ammonia or more while OSHA covers aqueous ammonia only at concentrations of 44 percent or more. Second, because OSHA has no authority over State and local government employees, the OSHA PSM standard does not apply to publicly-owned facilities (mainly water and wastewater treatment systems) in States where OSHA implements and enforces the standard (about half the States). States with OSHA-approved workplace safety and health programs (referred to as State-Plans) must implement and enforce standards that are at least as effective as federal OSHA standards for protecting workers, and must also provide equivalent protection to State and local government employees as a condition of OSHA approval. Last, regulatory exemptions are not identical; for example, the OSHA PSM standard exempts normally unoccupied remote facilities, but the RMP rule does not.

1.1.2 Other Recent Rulemakings and Related Actions

In response to catastrophic chemical facility accidents such as the 2013 explosion at the West Texas Fertilizer Company in West, Texas and others,12 in 2013, President Obama issued E.O. 13650, entitled Improving Chemical Facility Safety and Security.13 This E.O. requires EPA and OSHA to consider whether and how to update and modernize the RMP rule and PSM standard, among other requirements. Both EPA and OSHA conducted public listening sessions14 and issued requests for information (RFIs) to seek input from the public and the regulated community on potential revisions to the rules.15 Based on feedback received from the RFIs and public listening sessions, EPA subsequently published a Notice of Proposed Rulemaking (NPRM) on March 14, 2016 (81 FR 13637). The 2017 amendments rule (Accidental Release Prevention Requirements: Risk Management Programs Under the Clean Air Act) was the result of EPA’s consideration of the public comments received on the RFI and NPRM, recommendations from the CSB, comments received during E.O. 13650 listening sessions, and information gained by EPA through inspection of RMP facilities and enforcement of the rule over the previous 17 years. The final amendments rule was published in the Federal Register on January 13, 2017 (82 FR 4594, hereafter referred to as the “2017 amendments rule”).

In response to the 2017 amendments rule, EPA received three petitions for reconsideration from stakeholders,16,17,18 expressing concerns and requesting a delay or stay in the rule’s implementation. On May 30, 2018, EPA published a proposed rule reconsidering the 2017 amendments rule. The final reconsideration rule (Accidental Release Prevention Requirements: Risk Management Programs Under the Clean Air Act) was published in the Federal Register on December 19, 2019 (84 FR 69834, hereafter referred to as the “2019 reconsideration rule”).

1.1.3 Recent Events and Rationale Leading to the Final Rule

On January 20, 2021, President Biden issued E.O. 13990, Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis.19 E.O. 13990 directed Federal agencies to review current regulations and take action to address priorities established by the current Administration, including bolstering resilience to the impacts of climate change and prioritizing environmental justice. The E.O. did not direct the Agency to publish a solicitation for information from the public. However, on May 28, 2021 EPA issued a notice of virtual public listening sessions and request for public comment to obtain information on the adequacy of prior revisions to the RMP regulations including the 2017 amendments and 2019 reconsideration rules. The virtual listening sessions were held on June 16 and July 8, 2021 and were attended by OSHA to foster continued coordination with EPA. Commenters discussed revisions and updates to the prevention program, emergency response requirements, information availability requirements, and regulated chemicals. Commenters also discussed the importance of incorporating climate changes risks and impacts into the RMP regulations and expanding the application of environmental justice.

The RMP regulations have contributed to the prevention and mitigation of chemical accidents in the United States. Accident histories submitted with RMPs have shown a reduction in the frequency of accidents since the beginning of the program. However, serious chemical releases from RMP-regulated processes have continued. RMP data for 2011 through 2020, the most recent 10-year period with complete information, show that each year an average124 accidents occurred with RMP-reportable impacts. RMP data for 2016 through 2020, the most recent five-year period with complete information, averaged an annual 98 accidents with RMP-reportable impacts. RMP-reportable accidents remain a significant concern to communities, particularly those located near the perimeter of the facilities, and impose significant social costs annually. EPA believes that the revisions to the RMP in this final rule will further protect human health and the environment from chemical hazards through advancement of enhanced PSM.

Facilities subject to the RMP regulation pose significant risks to the public and the environment because of the types and quantities of hazardous substances they store and use in chemical processes. These risks stem from potential accidental chemical releases which can cause fires, explosions, and harmful vapor clouds. Chemical accidents and their resulting impacts not only kill and injure people but can cause significant damage to property, goods produced, plant equipment and structures; and nearby industrial, commercial, and residential buildings, equipment, and furnishings. Damage can also occur to the natural environment and negatively affect nearby ecosystems and wildlife. Resources, such as emergency personnel and equipment, are diverted to address the fire, explosion, or vapor cloud. Residents living nearby may need to shelter-in-place or evacuate. Properties located near the accident may lose value because of the perceived risks posed by proximity to a facility that has had an accident.

EPA expects the benefits of the final rule to include reductions in the numbers of people killed, injured, and evacuated or otherwise inconvenienced by sheltering-in-place; reductions in the damage caused to property onsite and offsite including product, equipment, and buildings; reductions in damages to the environment and ecosystems; and reductions in emergency response and other resources diverted to protect people, extinguish fires, and clean up affected areas. The final rule will also provide other benefits, such as increased public information, leading to more efficient decisions in nearby property markets and regarding emergency response preparedness. The final rule provisions reduce the probability of a catastrophic release. By reducing the chance of an accidental release, the final rule also avoids expenditures on lawsuits and other transactions to address resulting accidental harms.

Some of the final rule provisions target RMP facilities in close proximity to certain other RMP facilities and/or RMP facilities that have had recent accidents. Both types of facilities increase the likelihood of exposures to nearby communities to a future accident’s offsite impacts. Because communities with environmental justice concerns are over-represented in these nearby communities, the final rule provisions will provide proportionately greater relief to historically marginalized fenceline communities than to the general population.

1.2 Organization of the Analysis

This RIA is organized as follows:

Chapter 2 describes RMP provisions that EPA is adding or revising.

Chapter 3 discusses the universe of regulated entities and the various divisions used in the analysis.

Chapter 4 discusses the basis for cost estimates for each of the provisions and alternatives and presents the unit costs.

Chapter 5 presents the total estimated costs for each provision and for all provisions combined.

Chapter 6 discusses the social benefits of the rule.

Chapter 7 discusses the regulatory alternatives analyzed.

Chapter 8 presents the small entity impacts analysis.

Chapter 9 presents the environmental justice analysis.

Chapter 10 discusses limitations of the analysis and conclusions.

Chapter 11 discusses other analyses required under applicable statutes and E.Os.

CHAPTER 2: Final Rule Provisions

This chapter presents a summary of the provisions in the final rule that EPA has determined impose new costs. Total benefits of the final rule are addressed in Chapter 6. The final provisions include additions and revisions to existing RMP requirements.

2.1 Summary of Provisions and Applicability to Private Sector Facilities

The RIA analyzed the following new requirements and revisions to current requirements:

2.1.1 New Prevention Program Provisions

New prevention program provisions include requirements for STAA, root cause analysis, third-party audits, employee participation, and backup power for perimeter monitors.

The current RMP regulations do not require facilities to conduct a STAA. The STAA requirement in the final rule includes multiple components: the initial evaluation to identify alternatives, a practicability assessment to determine the costs and assess the reasonableness of implementing technology alternatives, and in some cases, implementation of safer measures. The former two components are discussed under 2.1.1.1 and the implementation component is discussed under 2.1.1.2.

2.1.1.1 STAA— (Revisions apply to §68.3 and §68.67)

Under the final rule, all facilities with Program 3 processes in NAICS codes 324 and 325 will be required to conduct an initial evaluation of safer technologies and alternatives. Of those facilities, facilities that have had an accident since their most recent process hazard analysis or that are located within one mile of another facility with a covered process in NAICS code 324 or 325, will be required to also conduct a practicability assessment.20 The final rule also requires that all facilities in NAICS 324 using HF in an alkylation unit (approximately 45 facilities) conduct a practicability assessment to assess inherently safer alternatives to HF alkylation, regardless of accident history or proximity to another NAICS 324- or 325-regulated facility. Because EPA is requiring STAA only in sectors with the most frequent and severe documented and continuing accidents, EPA expects the total burden of the STAA provision to be lower than the total burden that would have been imposed by the 2017 amendments rule’s proposed STAA provision (but removed in the 2019 reconsideration rule), which would have applied more broadly.

2.1.1.2 STAA Implementation— (Revisions apply to §68.3 and §68.67)

Under the final rule, all facilities required to conduct a STAA practicability assessment (i.e., Program 3 NAICS 324 and 325 facilities that have had an accident since their most recent process hazard analysis, with an HF unit in a NAICS 324 process, or located within one mile of another facility with a NAICS 324 or 325 process) are required to implement at least one passive measure at the facility, or an inherently safer technology or design, or a combination of active and procedural measures equivalent to or greater than the risk reduction of a passive measure. EPA is providing facilities with flexibility to choose either one or a combination of IST/ISD, passive, active, or procedural measures, provided the choice reduces risk at least as much as a practicable passive measure would achieve.

2.1.1.3 Root Cause Analysis— (Revisions apply to §§68.60 and 68.81)

A root cause analysis is a formal process to identify underlying reasons for failures that lead to accidental releases. These analyses usually require staff trained in the technique. Under the current RMP rule, facilities are required to conduct an incident investigation following an incident that resulted or reasonably could have resulted in a catastrophic release. The final rule requires facilities to conduct a root cause analysis as part of an incident investigation following an RMP-reportable accident. The new requirement will apply to all facilities with Program 2 and 3 processes that experience an RMP-reportable accident. There are approximately 100 accidents with onsite impacts per year in the baseline (see Exhibit 3-11).

2.1.1.4 Third-Party Audits— (Revisions apply to §§68.58 and 68.79 and new §§68.59 and 68.80)

The current RMP rule requires facilities to conduct a compliance audit of Program 2 and Program 3 processes at least once every three years. The final rule, also applicable to Program 2 and Program 3 processes, requires the next required compliance audit to be a third-party audit when any one of the following conditions applies:

The facility has had an RMP-reportable accident; or

An implementing agency requires a third-party audit either due to conditions at the stationary source that could lead to an accidental release of a regulated substance, or due to a previous third-party audit that failed to meet the competency or independence criteria of §68.80(c).

EPA believes that these third-party audit provisions will help ensure that owners and operators of RMP facilities objectively and adequately explore all opportunities to prevent or minimize accidental releases of regulated substances to protect human health and the environment. EPA estimates that only a small number of facilities will be subject to the third-party audit requirement each year.

2.1.1.5 Employee Participation— (Provisions apply to §68.83)

Under the current RMP rule, Program 3 process facilities’ employee participation plans require the owner or operator to consult with employees and their representatives on the conduct and development of process hazards analyses and on the development of the other elements of PSM. The owner or operator must provide employees and their representatives access to PHAs and to all other information required to be developed under this rule.

The final rule revises §68.83 and other aspects of employee participation to require six new components:

Program 2 process facilities must develop written employee participation plans of action, which detail employee roles in using reasonable judgment and communication procedures to identify, raise, and address safety concerns. Facilities must also develop and implement a process for employees to report on hazards and noncompliance and must provide employees and their representatives access to hazard reviews and all other information required to be developed under this rule.

The Program 3 employee participation plan must include the consultation of employees and their representatives regarding how to address, correct, resolve, document, and implement recommendations of process hazard analyses, incident investigations, and compliance audits.

The Program 3 employee participation plan must include and ensure that effective methods are in place so that employees knowledgeable in the process and their representatives have specific stop work authorities based on a potential for a catastrophic release. The specific authorities must include:

Recommending to the operator in charge of a unit that an operation or process be shut down, partially or completely, based on the potential for a catastrophic release.

Allowing a qualified operator in charge of a unit to shut down, partially or completely, an operation or process, based on the potential for a catastrophic release.

Program 3 employee participation plans must include a process for employees to report on hazards and noncompliance.

Program 2 and Program 3 process facilities must provide an annual written or electronic notice to employees indicating RMP information is available.

Program 2 and Program 3 process facilities must provide training to inform employees, their representatives, and management involved in the process of the details of the written employee participation plan.

These employee participation provisions will ensure that owners and operators who have not fully developed employee participation programs have additional measures in place to prevent and minimize accidental releases of RMP-regulated substances. These new provisions will not impose a burden on facilities that already have robust employee participation programs in place.

2.1.1.6 Backup Power for Perimeter Monitors— (Revisions apply to §§68.50 and 68.67)

Currently, many facilities voluntarily have backup power installed for perimeter monitors. The final rule requires those facilities that have air control or monitoring equipment associated with prevention and detection of accidental releases from RMP-regulated processes and that have identified power loss as a major hazard, to install standby or backup power. EPA believes this will help ensure continuous monitoring so that potential exposure to chemical substances can be measured during and following a natural disaster.

2.1.2 RMP Justifications

The final rule clarifies requirements for hazard evaluations to consider natural hazards and power systems. It also requires justifications when facilities choose to decline certain recommendations.

2.1.2.1 Hazard Evaluation Amplifications— (Revisions apply to §§68.50 and 68.67)

The final rule requires that hazard evaluations explicitly address natural hazards and the risk of power failure and standby or emergency power systems. EPA believes that because natural hazards and power loss continue to be factors in RMP accidents and due to climate change present growing threats to process safety at RMP facilities, a requirement to evaluate and control natural hazards should be explicitly stated in the RMP regulation. Hazard evaluations will also have to explicitly define stationary source siting as inclusive of processes, equipment, buildings within the stationary source, hazards posed by proximate stationary sources, and accidental release consequences posed by proximity to the public and public receptors. The final rule will require that RMPs explicitly include declined natural hazard, power loss, and siting evaluation recommendations and their associated justifications.

2.1.2.2 Recognized and Generally Accepted Good Engineering Practices (RAGAGEP) gap analysis— (Revisions apply to §§68.69 and 68.175)

The final rule requires that RMPs explicitly include declined PHA recommendations associated with adopting practices from the most recent version of RAGAGEP and their associated justifications.

EPA assumes the clarifying amplifications will not impose a burden on facilities. EPA believes including these declined recommendations and associated justifications will provide useful information about potential hazards associated with a facility and will impose only a nominal burden on owners or operators.

2.1.3 Emergency Response

2.1.3.1 Community Notification of RMP Accidents— (Provisions apply to §§68.90 and 68.95)

The

final rule will add a requirement that RMP facility owners and

operators who designate themselves as a non-responding facility,

develop and implement, as necessary, procedures for informing the

public and the appropriate emergency response agencies about

accidental releases of RMP-regulated substances. Responding

facilities should already have mechanisms and procedures in place in

the baseline to notify the public through emergency response programs

or plans.

EPA is also requiring that responding and non-responding facilities ensure that:

A community notification system is in place.

The public is promptly notified of an RMP accident release.

The notification provides appropriate timely data and information to local responders with the current understanding and best estimates of the nature of the release.

EPA expects that these provisions, in combination with the currently required annual emergency coordination meetings and notification exercises, will enhance coordinated notification to the public, improve documented accountability for the notification process, and help ensure timely decisions about notification of releases, particularly those with offsite impacts. The emergency response provisions apply to facilities with Program 2 or 3 processes.

2.1.4 Information Availability

2.1.4.1 Information Availability— (revisions apply to §68.210)

The final rule requires all facilities to disclose certain chemical hazard information to the public residing, working, or spending significant time within 6 miles21 of the facility in the language (either English or one of two other major languages) used in the community as specified by the requester.22 These are new information availability requirements. EPA is requiring owners and operators to maintain a record of requestors. The facility or its parent company, if applicable, will also be required to provide ongoing notification through publicly accessible means on three items:

1) The information that is available upon request for those members of the public,

2) How to request that information, and

3) Where to access information on community preparedness.

Facilities could provide this notification on a company website, at public libraries, in local papers, or via other means appropriate for particular communities and facilities.

The information to be disclosed includes:

Names of regulated substances at the facility.

Safety Data Sheets (SDS) for all regulated substances at the facility.

Accident history information.

Declined recommendations and the justifications for declining them.

Emergency response program information.

List of scheduled exercises.

Local Emergency Planning Committee (LEPC) or local response agency contact information.

EPA believes these revised information availability provisions will improve information sharing within communities, allow affected communities to obtain information from RMP facilities, and ensure information availability in areas without LEPCs.

2.2 Applicability to Government-owned Facilities and Entities

The final rule is applicable to local governments that own and operate RMP facilities (primarily water and wastewater systems, but also some swimming pools23), to delegated agencies that implement the final rule, and to LEPCs that coordinate with facilities.

2.3 Changes in the Final Rule RIA from the Proposed Rule RIA

The final rule RIA makes several changes from the proposed rule RIA in response to more recent data availability, public comments, and differences between proposed and final regulatory requirements. The final rule RIA updates all wage and other monetary assumptions, including monetized benefits, to use the more recently available sources and presents results in 2022 dollars. The universe of facilities examined in the final rule RIA remains the same as the universe in the proposed rule RIA. The final rule RIA updates or adds costs for several provisions:

Rule familiarization costs: updated assumptions on the number of hours required for Delegating Implementing Agencies and most facilities to be consistent with LEPCs in response to public comments.

Third-party audits: Costs updated to reflect a change in the provision requiring third-party audits after any accident.

Initial Evaluation and Practicability Assessment: costs updated to reflect changes to the provision requiring STAA initial evaluation for more facilities and the practicability assessment for certain facilities that experience an accident since their most recent process hazard analysis. Updated cost estimates to account for less effort required the second time a STAA analysis is completed.

STAA Implementation: New cost for the provision now requiring certain facilities to implement one or more measures that has up-to passive measure risk reduction.

Public Disclosure: New cost added to capture translation and ID verification requirements.

Justifications: New costs added to capture four justification requirements in RMP submissions for RAGAGEP, Facility Siting, Natural Hazards, and Emergency Backup Power, which were not previously costed in the proposed rule RIA.

Emergency Backup Power for Perimeter Monitors: Updated generator cost assumptions and added recurring operation and maintenance costs in response to public comments.

Employee Participation Plan: Added a cost for training requirements in response to public comments.

CHAPTER 3: Universe of RMP Facilities and

Recent data show that 11,740 facilities have filed current RMPs with EPA and are potentially affected by the final rule. These facilities range from petroleum refineries and large chemical manufacturers to water and wastewater treatment systems; chemical and petroleum wholesalers and terminals; food manufacturers, packing plants, and other cold storage facilities with ammonia refrigeration systems; agricultural chemical distributors; midstream gas plants; and a limited number of other sources that use RMP-regulated substances. This chapter describes these facilities and how they are categorized for the purposes of the economic analysis.

3.1 Universe of RMP Facilities

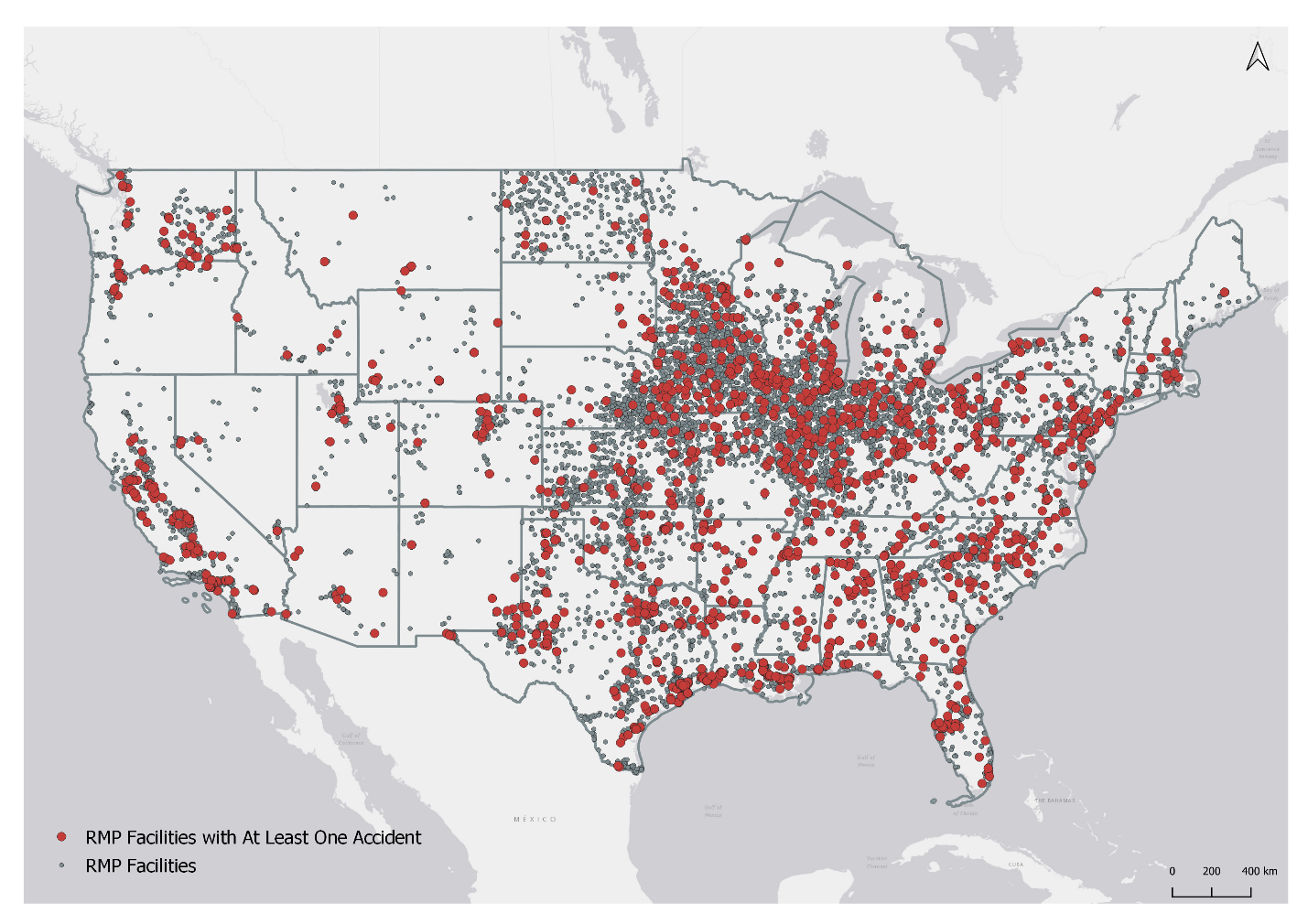

Exhibit 3-1 presents the numbers of facilities according to RMP reporting as of December 31, 2020, by industrial sector and chemical use. Exhibit 3-2 presents the number of facilities in each sector in the form of a bar chart.

Exhibit 3-1: Number of Affected Facilities by Sector as of December 31, 2020.

Sector |

NAICS Codes |

Number of facilities |

Chemical Uses |

Administration of environmental quality programs (i.e., governments) |

92 |

10 |

Use chlorine and other chemicals for water treatment |

Water/sewage/other systems (i.e., government-owned water) |

2213 (Government-owned) |

1,439 |

Use chlorine and other chemicals for water treatment |

Agricultural chemical distributors/wholesalers |

11, 424 (except 4246, 4247) |

3,315 |

Store ammonia for sale; some in NAICS 111 and 115 use ammonia as a refrigerant |

Chemical manufacturing |

325 |

1,502 |

Manufacture, process, store |

Chemical wholesalers |

4246 |

317 |

Store for sale |

Food and beverage manufacturing |

311, 312 |

1,571 |

Use (mostly ammonia) as a refrigerant |

Oil and gas extraction |

211 |

719 |

Intermediate processing (mostly regulated flammable substances and flammable mixtures) |

Other |

21 (except 211), 23, 44, 45, 48, 491, 54, 55, 56, 61, 62, 71, 72, 81, 99 |

246 |

Use chemicals for wastewater treatment, refrigeration, store chemicals for sale |

Other manufacturing |

313, 314, 315, 326, 327, 33 |

375 |

Use various chemicals in manufacturing process, waste treatment |

Other wholesale |

421, 422, 423 |

39 |

Use (mostly ammonia) as a refrigerant |

Paper manufacturing |

321, 322 |

55 |

Use various chemicals in pulp and paper manufacturing |

Petroleum and coal products manufacturing |

324 |

156 |

Manufacture, process, store (mostly regulated flammable substances and flammable mixtures) |

Petroleum wholesalers |

4247 |

367 |

Store for sale (mostly regulated flammable substances and flammable mixtures) |

Utilities/water/wastewater |

221 (Non- government-owned water) |

519 |

Use chlorine (mostly for water treatment) and other chemicals |

Warehousing and storage |

493 |

1,110 |

Use (mostly ammonia) as a refrigerant |

Total |

|

11,740 |

|

Exhibit 3-2: Chart of Affected Facilities by Sector (2020).

*Governments means NAICS 92 facilities involved in administration of environmental quality programs. Government-owned water means government-owned NAICS 2213 facilities involved in water, sewage, and other systems. Utilities/water/wastewater means NAICS 221 facilities (including utilities, water, and wastewater) except government-owned water.

The RMP rule applies to processes at facilities with regulated substances above threshold quantities. Processes are activities involving regulated substances including any use, storage, manufacturing, handling, or onsite movement of such substances, or combination of these activities. In general, the cost of implementing the rule provisions varies primarily by the complexity of the processes involved. Chemical manufacturers and petroleum refineries have more covered processes per facility and more complex issues to consider when evaluating hazards, designing exercises, conducting audits, investigating incidents, and explaining information to employees, responders, and the public compared to facilities that simply store or use chemicals in simple processes (e.g., refrigeration systems and water and waste treatment systems). For the purposes of the cost analysis, therefore, all facilities with NAICS 324 or 325 (petroleum and coal products manufacturing and chemical manufacturing) processes are considered complex; all other facilities are considered simple.

3.1.1 RMP Data

The facility universe analyzed in the RIA is based on the RMP Database as of August 1, 2021 and includes facilities active as of December 31, 2020.24 EPA used Microsoft Access queries and R code to pull and analyze the data. The RMP Database includes information from each RMP submission, and identifies the facility, its processes and their respective NAICS sectors and programs, any RMP-reportable accidents, as well as other information reported in the RMP.

To create the dataset of the universe of affected facilities, EPA selected from among the rows in the Facility ID table for each EPA Facility ID, the row with the highest Facility ID without a deregistration date and with a receipt date prior to 2021. This dataset was merged by Facility ID with the Processes table. To assign each facility a NAICS sector and program level, EPA matched each facility to a process corresponding to that facility, first from among the facility’s complex processes (NAICS 324 or 325) and then by its highest program level. So, if a facility has any complex processes, the facility was classified by the sector of one of those processes. Each facility was assigned the highest program level of any of its processes. So, if a facility has any Program 3 processes, the facility was classified as Program 3.

3.1.2 Manual Adjustments

While both government-owned and non-government-owned NAICS 2213 facilities perform the same functions, EPA expects that government-owned facilities will incur different burden hours than similar private facilities. Therefore, to better assess the impacts on government-owned versus non-government-owned NAICS 2213 facilities, EPA reviewed all facilities categorized as NAICS 2213 to distinguish between private and government ownership. EPA includes a category for government-owned NAICS 2213 facilities, which is separate from the category for facilities that report as NAICS 92 government administration.

For this final rule, EPA explored alternative data sources to classify NAICS 2213 facilities as private or government owned. EPA used its Facility Registry System (FRS) to crosswalk the data universal numbering system (DUNS) numbers (unique nine-digit business identifiers) reported by facilities in their RMP with their Water System ID for identification in EPA’s Safe Drinking Water Information System (SDWIS) dataset. SDWIS has information on registered water facilities and their ownership, so this crosswalk will allow EPA an alternative dataset to establish ownership type for water facilities in RMP. Completing this exercise only identified 731 facilities in SDWIS, a count that is lower than the number of facilities that identify as NAICS 2231 in their RMPs regardless of ownership. Reasons for the lower count could include DUNS numbers that are inaccurately reported in RMPs, not all DUNS numbers having matches to Water System IDs in FRS, and NAICS codes inaccurately reported in RMP submissions. Therefore, EPA relied on the manual adjustments performed during the proposed rule stage to more accurately identify the facilities that are NAICS 2213 privately-owned versus government-owned because searches using facility names provided a more accurate match.

3.1.2 Breakdowns Used in the Analysis

As explained in Section 1.1.1 Overview of the Risk Management Program, the RMP rule imposes different requirements on facilities based on program levels of the facility’s processes. Program 3 processes are those that are not eligible for Program 1 and are subject to the OSHA PSM standard or are in certain NAICS codes (refineries, a limited number of chemical manufacturers and pulp mills). Of the 4,769 processes in those NAICS codes, 4,595 processes were at facilities that self-reported that they are subject to OSHA PSM.

Exhibit 3-3: Number of Facilities by Program Level.

A portion of Program 2 facilities (765 of 3,975) are publicly-owned water/wastewater treatment facilities in States where OSHA (rather than the State) enforces OSHA rules.25 Because these facilities are publicly- owned, their processes are considered Program 2. This contrasts with those not under public ownership (which are Program 3), even though the processes are the same. The remaining Program 2 facilities are agricultural distribution facilities that store anhydrous ammonia, utilities that use aqueous ammonia and other facilities that store or use chemicals not subject to OSHA PSM.26

Exhibit 3-4 presents the number of facilities by sector and program level; publicly-owned water/wastewater treatment systems (NAICS 2213) are listed as government-owned water, other government facilities (NAICS 92) are listed as governments, and privately-owned and operated systems (NAICS 2213) are listed under utilities/water (NAICS 221).

Exhibit 3-4: Number of Facilities by Sector and Program Level (2020).

Sector |

NAICS Codes |

P1 |

P2 |

P3 |

Total |

Administration of environmental quality programs (i.e., governments) |

92 |

4 |

1 |

5 |

10 |

Water/sewage/other systems (i.e., government-owned water) |

2213 (Gov’t-owned) |

6 |

786 |

647 |

1,439 |

Agricultural chemical distributors/wholesalers |

11, 424 (except 4246, 4247) |

3 |

2,635 |

677 |

3,315 |

Chemical manufacturing |

325 |

54 |

63 |

1,385 |

1,502 |

Chemical wholesalers |

4246 |

8 |

86 |

223 |

317 |

Food and beverage manufacturing |

311, 312 |

3 |

3 |

1,565 |

1,571 |

Oil and gas extraction |

211 |

300 |

31 |