AIES Supporting Statement B

AIES Supporting Statement B.docx

Annual Integrated Economic Survey

OMB: 0607-1024

SUPPORTING STATEMENT

U.S. Department of Commerce

U.S. Census Bureau

Annual Integrated Economic Survey (AIES)

OMB Control No. 0607-1024

PART B: Collections of Information Employing Statistical Methods

This revision request documents the modifications that transpired between February and October 2024.

1. Universe and Respondent Selection

The target population of the AIES covers all domestic, private sector, non-farm employer businesses in the United States (50 states and the District of Columbia) as defined by the 2017 North American Industry Classification System (NAICS). Exclusions are foreign operations of U.S. businesses headquartered in the U.S. territories and most government operations (including the U.S. Postal Service), agricultural production companies and private households.

The Annual Integrated Economic Survey (AIES) is selected from a frame of approximately 5.4 million employer companies constructed from the Business Register, which is the Census Bureau’s master business list. In the AIES, the company is the ultimate sampling unit (USU). Approximately 385,940 companies will be included in the sample. Of the sampled companies, approximately 37,500 are self-representing (included with probability = 1), based on the diversity of their operations. The remaining companies on the frame are stratified within sector by geographic category within 3-digit industry (NAICS) classification. This is an unequal probability sample, with company inclusion probabilities accounting for contribution(s) to both national and subnational estimates of annual payroll.

The measure-of-size (MOS) variable used for the AIES sample design is based on the administrative annual payroll, which is available for the majority of establishments on the AIES sampling frame and is generally positively correlated with the AIES key data items. The company-level MOS is determined by summing the establishment values within the company. Each company on the frame is assigned to a single sampling stratum and has a single sampling MOS. Each non-self-representing company on the sampling frame has a sampling industry, defined as its most detailed unique NAICS code.

To minimize erroneous industry classifications in the sample design, in-scope companies are classified as certainty using the complexity criteria described in the following table:

Table 1: AIES Designation of Initial Certainty Stratum by Complexity

Company operates in |

Number of Sectors |

Number of Industries* |

Number of States |

Certainty |

2 or more |

2 or more |

Not considered |

1 |

3 or more |

Not considered |

|

1 |

2 |

2+ |

|

1 |

2 |

1 |

|

Noncertainty |

1 |

2** |

1 |

1 |

1 |

1+ |

* 4-digit NAICS industry

**Sectors 44-45, 62 (selected pairs of industries)

To determine the initial sector allocations of companies in each sector frame, let

=

total number of companies on the AIES frame that are eligible for

sampling (noncertainty)

=

total number of companies on the AIES frame that are eligible for

sampling (noncertainty)

=

total number of companies in sector s

on

the AIES frame

=

total number of companies in sector s

on

the AIES frame

that are eligible for sampling

that are eligible for sampling

=

total number of eligible agriculture sector companies in

=

total number of eligible agriculture sector companies in

=

total number of eligible mining,

quarrying, & oil & gas extraction

sector companies in

=

total number of eligible mining,

quarrying, & oil & gas extraction

sector companies in

=

total number of eligible construction sector companies in

=

total number of eligible construction sector companies in

=

total number of eligible manufacturing sector companies in

=

total number of eligible manufacturing sector companies in

=

total number of eligible management

of companies & enterprises

sector companies in

=

total number of eligible management

of companies & enterprises

sector companies in

=

initial total number of companies to be sampled in the AIES excluding

those in sectors 11, 21, 23, 31-33, and 55.

=

initial total number of companies to be sampled in the AIES excluding

those in sectors 11, 21, 23, 31-33, and 55.

The initial allocations of companies in the agriculture (11), mining, quarrying, & oil & gas extraction (21), construction (23), manufacturing (31-33), and management (55) sectors are

=

250

=

250

=

850

=

850

=

3,500

=

3,500

=

30,000

=

30,000

=

100

=

100

The values for allocations in agriculture (11), mining (21), construction (23), and management of companies & enterprises (55) sectors are their respective sample sizes from the Annual Capital Expenditures Survey (ACES). Historically, the Annual Survey of Manufactures (ASM) has published state level estimates for manufacturing (31-33) sector. The relatively large allocation for this sector should yield domain estimates of comparable – or higher – reliability for the AIES than their ASM counterparts, while also accounting for the elimination of the previous survey’s non-mail component.

The

initial sector level allocations for the other sectors ( are obtained with proportional allocation, with

are obtained with proportional allocation, with

,

where

,

where

Initial allocations may be further increased as needed to attain

targeted coefficient of variations (CV) of 2% or lower on the frame

analysis variables for each national tabulation industry level and

targeted CV’s of 15% or lower for geographic industry

estimates.

Initial allocations may be further increased as needed to attain

targeted coefficient of variations (CV) of 2% or lower on the frame

analysis variables for each national tabulation industry level and

targeted CV’s of 15% or lower for geographic industry

estimates.

Let

be the set of companies on the AIES frame that are included in the

initial certainty complexity stratum, so that

be the set of companies on the AIES frame that are included in the

initial certainty complexity stratum, so that

is comprised of the remaining companies on the AIES frame. The

remaining companies are split into 19 separate sector (2-digit NAICS)

frames (

is comprised of the remaining companies on the AIES frame. The

remaining companies are split into 19 separate sector (2-digit NAICS)

frames ( from the companies in

from the companies in

.

.

The within-sector stratification procedure is applied to all sectors except agriculture (11), mining (21), construction (23), and management of companies and enterprises (55). As these sectors do not have geographic publication requirements, their initial strata are defined by 3-digit NAICS.

For the remaining sectors, the noncertainty USUs (companies) are stratified into:

A single diverse company stratum (1) comprising companies that operate in two different 4-digit NAICS industries and one state (sectors 44-45 and 62 only)

One multi-state stratum per 3-digit NAICS industry1 comprising companies that operate in one 3-digit NAICS industry and 2 or more states

Twenty-seven geographic substrata per 3-digit NAICS industry comprising companies that solely operate in the identified 3-digit NAICS industry and the geographic substratum: see table 2.

Table 2: Geographic Strata for the AIES Sampling Design1, 2, 3

Region |

Total States |

Direct Use States |

States Included in Balance of Region |

Northeast |

9 |

Massachusetts, New York, New Jersey, Pennsylvania |

Connecticut, Maine, New Hampshire, Rhode Island, Vermont |

Midwest |

12 |

Illinois, Indiana, Michigan, Minnesota, Missouri, Ohio, Wisconsin |

Iowa, Kansas, Nebraska, North Dakota, South Dakota |

South |

16 |

Florida, Georgia, Maryland, North Carolina, Tennessee, Texas, Virginia |

Alabama, Arkansas, Delaware, District of Columbia, Kentucky, Louisiana, Mississippi, Oklahoma, South Carolina, West Virginia |

West |

13 |

Arizona, California, Colorado, Oregon, Washington |

Alaska, Hawaii, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming |

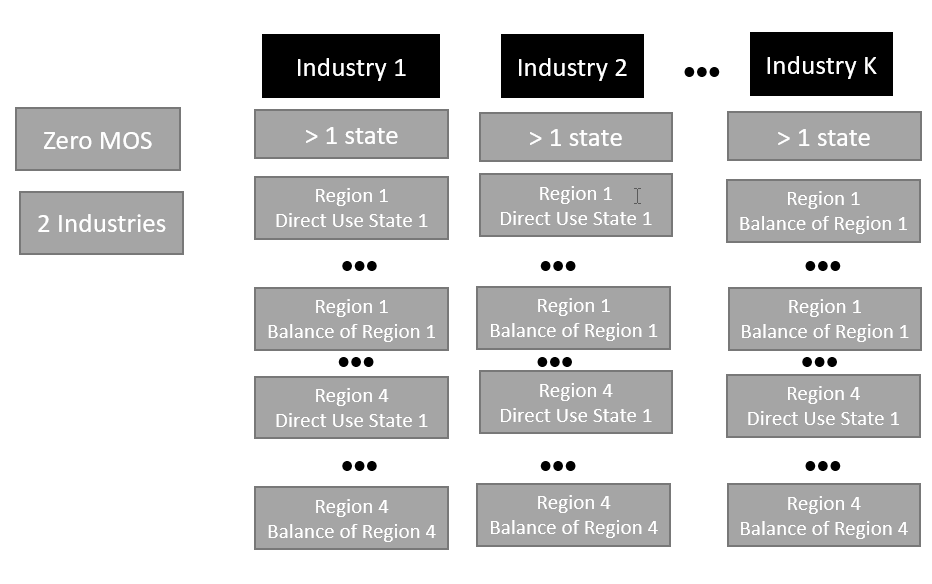

Figure 1 illustrates the initial stratification procedure.

Figure

1: AIES Stratification Within Sector for all sectors but agriculture

(11), mining (21), construction (23), and management (55). The Zero

MOS contains all companies in the sector with a MOS value of zero.

There are 28 geographic strata corresponding to each broad stratum: a

single multi-state stratum (labeled >1 state) and 27 single

geographic area strata. The 2 industries stratum is used only in

retail (44-45) and health care (62).

Figure

1: AIES Stratification Within Sector for all sectors but agriculture

(11), mining (21), construction (23), and management (55). The Zero

MOS contains all companies in the sector with a MOS value of zero.

There are 28 geographic strata corresponding to each broad stratum: a

single multi-state stratum (labeled >1 state) and 27 single

geographic area strata. The 2 industries stratum is used only in

retail (44-45) and health care (62).

Because the AIES is ultimately a multipurpose sample, it is not possible to optimize for a single data item. Instead, the AIES utilizes stratified sequential sampling, also known as Chromy’s method, which is available from PROC SURVEYSELECT in SAS®.

Stratified sequential sampling is a without-replacement PPS sampling method that allows for a within-strata sort. Within each AIES sampling stratum, the USUs (companies) are sorted by national industry tabulation NAICS (4-digit, 5-digit, or 6-digit) and state, providing implicit stratification. Because the USU probabilities of selection are a monotonically increasing function, the AIES sampling procedure includes a second-level sort on the USU annual payroll, which should help insure a representative sample in terms of unit size within stratum.

An approximation of the 2024 AIES sample size is presented in Table 3:

Table 3 AIES Allocation

Sector |

Total |

Complex Certainties |

37,500 |

11/21/23/55 |

5,140 |

22 |

950 |

31-33 |

33,100 |

42 |

17,800 |

44-45 |

38,700 |

48-49 |

13,000 |

51 |

5,200 |

52 |

15,000 |

53 |

20,500 |

54 |

50,300 |

56 |

21,000 |

61 |

5,650 |

62 |

40,300 |

71 |

8,200 |

72 |

34,200 |

81 |

39,400 |

Total |

385,940 |

The 2024 AIES sample includes approximately 1,000 large, multiunit companies (primarily covering out-of-scope enterprises) which are necessary to update and maintain a centralized, multipurpose Business Register (BR). In an effort to reduce burden, a subset of smaller single-unit companies will not receive an AIES questionnaire. Approximately 80,000 small, single-unit companies that were previously included in the 2023 AIES sample will not be mailed a questionnaire.

The Census Bureau will obtain data for these AIES non-mailed companies using information from the administrative records of the IRS and the Social Security Administration. These administrative records include information on business characteristics, including employment, total revenue, payroll, operating status, organization change, ownership information, and classification. This administrative information was obtained under conditions which safeguard the confidentiality of both tax and census records. Other sources may be utilized to gather additional data on these non-mailed companies. When administrative or other source data is not available, methods for handling missing data are applied. These companies have been accounted for in the burden tables in Supporting Statement A and Attachment V – AIES Sample Size and Burden Estimates.

An approximation of the 2024 AIES Collection Counts is presented in Table 4: |

|

Table 4 2024 AIES Collection Counts |

|

Sector |

Total |

Complex Certainties |

37,500 |

11/21/23/55 |

3,940 |

22 |

950 |

31-33 |

22,900 |

42 |

17,800 |

44-45 |

31,300 |

48-49 |

9,900 |

51 |

4,500 |

52 |

11,800 |

53 |

11,100 |

54 |

39,000 |

56 |

14,900 |

61 |

4,450 |

62 |

28,300 |

71 |

6,800 |

72 |

29,000 |

81 |

31,200 |

Total |

305,340 |

Response Rates

This survey is designed to replace a suite of seven independently designed surveys. The survey unit response rate is expected to fall in the range of those surveys of approximately 50 – 70%. The reporting unit response rate (URR) is the ratio of the number of active, in-scope companies that provided sufficient data to be considered a respondent to the total number of active, in-scope businesses in the sample, times 100 percent. The URR assesses the risk of nonresponse bias. Similar metrics about nonresponse bias are the total quantity response rate (TQRR) and/or the imputation rate (IR). These metrics measure the proportion of the total estimate coming from reported or imputed, sample-weight-adjusted data values. A separate metric can be computed for each item collected in AIES, whereas there is only one unit response rate for the survey. TQRR/IR can be used to gain insight into the quality of item-level estimates versus the overall URR.

Non-Response and Estimation

Data are imputed using survey data and administrative data as input for unit non-response, item non-response, and for responses that fail computer or analyst edits.

For the non-mailed AIES companies, imputation or weight adjustments are performed to account for missing data items that could not be obtained through administrative data or other sources.

Totals are computed as the sum of weighted data (reported and imputed) for all selected sampling units, including the non-mailed companies, that meet the sample canvass and tabulation criteria given above. The sampling weight for a given sampling unit is the reciprocal of its probability of inclusion into the sample. Measures of variation will be provided in the form of coefficients of variation and standard errors.

Benchmarking

Published estimates from the AIES will be benchmarked to the Economic Census.

NAICS Classification Research

On its last approval of the AIES, OMB remarked that, “In light of the Census Bureau’s finding in Supporting Statement Part B “that NAICS classifications can be unnatural or challenging for some businesses,” the Census Bureau shall carry out additional research to estimate the percentage of AIES respondents that select an incorrect NAICS code; estimate the extent to which differences in NAICS code assignments by the Census Bureau and the Bureau of Labor Statistics for the same establishments are due to misclassifications in the Census Business Register; and indicate to OMB within one year of ICR approval the Census Bureau’s plans for achieving a significant reduction in NAICS misclassification”. The Census Bureau supports additional research and identifying opportunities to reduce NAICS misclassification. However, this effort should be conducted on a larger-scale and not confined to the AIES. NAICS classification for companies selected in the AIES is driven by the Economic Census and the Census Bureau’s Business Register (BR). Discussions are underway regarding a “data synchronization” effort between multiple Federal statistical agencies. A plan for significantly reducing NAICS misclassification is included as Attachment P.

2. Procedures for Collecting Information

In the past, the Census Bureau conducted numerous annual surveys that were often differentiated by type of business (i.e., retail, service, wholesale). In Survey Year 2023 (SY23/Year 1), we integrated seven existing annual business surveys into one streamlined single survey called the Annual Integrated Economic Survey (AIES). In Survey Year 2022 (SY22/Year 0), conducted a Dress Rehearsal to test and refine our methods prior to the full implementation in SY23. The AIES survey request replaced requests that respondents would have been asked to participate in for the following surveys:

Annual Capital Expenditures Survey (ACES)

Annual Retail Trade Survey (ARTS)

Annual Survey of Manufactures (ASM)

Annual Wholesale Trade Survey (AWTS)

Manufacturers' Unfilled Orders Survey (M3UFO)

Report of Organization (COS)

Service Annual Survey (SAS)

Survey Year 2021 (SY21) was the final collection for the Report of Organization and ASM. Survey Year 2022 (with data collection during calendar year 2023) was the final collection for the other five surveys (ARTS, AWTS, SAS, ACES, and M3UFO). During calendar year 2023, we conducted the 2022 Economic Census and the AIES Dress Rehearsal. Coordinating SY22 collection activities with messaging to increase awareness of the AIES was vital to successfully communicating this significant change to how we collect our data without negatively affecting the collections for the legacy surveys or the 2022 Economic Census.

The table below shows the number of firms for the AIES Dress Rehearsal in SY22 (Year 0), the full implementation in SY23 (Year 1), and SY24 (Year 2).

-

SY22/

Year 0

SY23

Year 1

SY24

8,470

385,940

305,340

The initial letter to firms identifies the survey name, due date, instructions for accessing the electronic survey instrument, authority for collection, and burden estimate. It also provides a website with information for respondents and a telephone number for those needing assistance. When we have an email address for the respondent, we will also send out the initial survey request by email. We will periodically follow-up with nonrespondents via mail, email, and phone.

Electronic reporting will be the only advertised reporting option. Nevertheless, the Census Bureau will accept data submitted through other methods. For example, if a firm does not have access to the Internet, we can arrange for the business to provide data to an analyst via phone.

3. Methods to Maximize Response

Our intention is for the redesigned survey to be easier to complete (reducing respondent burden), resulting in better and more timely data, and allowing the Census Bureau to operate more efficiently to reduce costs.

To increase awareness of the AIES both during and shortly after the legacy surveys concluded collection for SY22, we contacted respondents and non-respondents for each of the legacy surveys to inform them that the legacy survey will be discontinued and communicated the upcoming AIES via email (respondents only) and paper (both respondents and nonrespondents). For the AIES Dress Rehearsal, an advance notice was sent to the contacts from the legacy surveys to introduce changes in our data collection and inform firms that they will receive the new AIES survey instead of the SY22 legacy annual surveys.

After the AIES initial letter, firms are given at least 45 business days to respond and are given extension dates upon request. Approximately a week before the AIES due date, respondents will receive a due date reminder. Shortly after the due date, we will periodically follow-up with delinquent cases via mail, email, or phone.

We provide a website with information for respondents and a telephone number and secure messaging for those needing assistance. For selected large and complex companies, account managers provide tailored customer service and work with companies to ensure timely and accurate reporting.

4. Tests of Procedures or Methods

Record Keeping Study

A first step in respondent-centered research in support of the development of the AIES was a series of 29 interviews with medium-sized companies across various industries exploring their record keeping practices. These interviews explored the link between financial records and company organizational and management practices. First, researchers asked respondents to describe in their own words what their business does or makes, and then to indicate the North American Industry Classification System (NAICS) most appropriate for their business. Next, researchers explored companies’ reporting of four key variables (sales/receipts/revenues; inventory; expenses, focusing on payroll and employment; and capital expenditures); in some cases, respondents were shown specific questionnaires from the annual surveys they had received – and to which they had responded. They were asked to explain their general response process, how they gathered data from multiple sources, and whether they needed to manipulate the data in order to provide answers to what they thought the questions were asking. Researchers probed apparent discrepancies between respondents’ reporting practices and the question’s intent.

Major findings from the Record Keeping Study shed light on how companies’ practices translate into response processes for Census Bureau surveys. This includes three major findings: first, industry classification is challenging and unnatural for respondents, and companies can struggle to fit within the NAICS classification system. Second, businesses varied in their operating units, and this impacted the level and detail at which they keep their records, which can negatively or positively impact response. Finally, consolidated financial records are a mainstay for businesses, and act as an ‘anchor’ for most detailed information that respondents provide.

Data Accessibility Study

Following the Record Keeping Study, Census Bureau researchers engaged in an additional 30 in-depth interviews with medium sized businesses across various industries about the accessibility of their data at various levels of the business. These interviews first established definitions and equivalencies of response units (for example, what is the company term that means the same as ‘establishment’?). Then, respondents were asked about ‘general’ and ‘specific’ industry classifications (akin to the four- and six-digit NAICS classifications). Finally, respondents were asked to use a four-point color coded scale ranging from green (very accessible) to red (not at all accessible) to categorize data for specific topics (e.g., revenue, expenses, and payroll) at specific levels (e.g., company-wide, by establishment, or at the general and specific industry levels).

This set of interviewing further detailed what data are available at what levels. Respondents still struggled with their NAICS classification, noting that the categories could be too broad or, conversely, not encompassing enough to accurately describe the company as a whole. At the same time, researchers noted that company-level data are the most accessible regardless of size and sector of the business, and that more granular levels of data can be increasingly challenging to report, with respondents struggling most to report information by industry. Note that this interviewing also asked about the availability of data at the state level, and that many respondents indicated that to provide response by state, they would first have to output data by establishment and sum up to the state level.

Coordinated Collection Respondent and Non-Respondent Debriefings

In preparation for the integrated survey, staff at the Census Bureau began a program of consolidating company contacts across the disparate current annual surveys to identify one primary contact for the AIES. To better understand how contact consolidation might impact response processes, researchers conducted two rounds of debriefing interviews. The first was 35 interviews with responding companies across various sizes and industries, during which Census Bureau researchers asked questions about communication materials and challenges. The second round was 19 interviews with non-responding companies of various sizes and industries to understand where response may have broken down.

From the respondent debriefing interviews, several major findings informed the contact strategy for the AIES. Researchers noted that many respondents did not receive – or do not remember receiving – many of the communications that the Census Bureau sent in support of consolidating contacts. Some of this may be related to the COVID-19 global pandemic, both because respondents may have been working remotely and not received the contact, or because of the general inconsistencies in mail delivery during the pandemic. Researchers also noted that respondents generally received Census Bureau communications positively (especially the online Respondent Portal that they use to complete surveys), but that respondents’ experiences with reaching out for support from the Census Bureau can be mixed. Non-respondent debriefings identified barriers to response, including company-related issues like staffing shortages and data being decentralized, surveys that do not reflect current company structure, and communication shortfalls from the Census Bureau.

Survey Structure Interviewing

To start to build out the survey flow for the AIES, Census Bureau researchers conducted 39 interviews with companies across various industries focused on preliminary ‘mock ups’ of survey screens designed to give respondents an overview of each module and the survey at large. Respondents were asked about their record keeping practices and preferences for reporting (e.g., using a spreadsheet or the traditional page-by-page response). Finally, respondents were asked to reflect on the concept of the AIES as a whole, their thoughts about the overall design, and their thoughts on its effect on their burden.

For this interviewing, Census Bureau researchers noted that the AIES introduces complexities for response both at the units of collection (company, establishment, and industry) and by the various topics mixed into one survey. Again, the issue of NAICS classification ‘fitting’ a business generally – and more specifically the classification of specific industries – was noted as a space where respondents sometimes struggled. Most respondents indicated wanting to use the downloadable spreadsheet option, to gather their data first and then enter it into the survey, and to submit data across all survey sections at one time, instead of section by section. Respondents also stressed their reliance on others within the company to complete the survey, and that they were open to using survey previews (as PDFs or otherwise) to make a plan for data collection and/or to email to other departments or locations for response.

AIES Pilot Phase I

With this qualitative research in mind, Census Bureau researchers determined that the next research step was to induce independent response from the field for the integrated survey. 78 companies from across the country in various industries were invited to participate in Phase I of the AIES Pilot, and from that, 62 companies (79 percent) provided at least some response data to the survey. In addition to the online survey, 10 companies participated in debriefing interviews asking about response processes for the integrated instrument, 15 companies completed a Response Analysis Survey (a short survey with questions centered on real and perceived response burden), and 11 companies called while 52 companies wrote emails requesting additional information, asking questions, or otherwise reaching out for support.

Major findings for the first phase of the pilot were focused on response process and resultant data. For response process, researchers noted that respondents used a hybrid response process whereby the most accessible data (company-wide) were reported using a traditional page-by-page online survey, but establishment and industry data were reported using a respond-by-spreadsheet survey. Many respondents mentioned the benefits to responding by spreadsheet, but that the spreadsheet must be designed to capture data holistically across the company. Finally, investigations into response burden for the collection instrument were mixed, with some respondents saying it took about the same amount of time or resources or less than the current annual surveys and others saying it took them more time or resources to complete the pilot survey.

AIES Pilot Phase II

With the richness of the data from Phase I of the AIES Pilot, Census Bureau researchers determined that the next step would be to reproduce the pilot, with more and larger businesses, and updated with findings from all of the preceding research. This research seeks to reengage the 62 businesses that provided any response data to the phase I pilot as well as an additional 827 companies from across the country, varying in size and industry. As in Phase I, the Phase II pilot features an updated respond-by-spreadsheet design that reflects the need for holistic collection across the company, as well as debriefing interviews, a repeat of the Response Analysis Survey, and cataloguing contact from the field as an additional source of feedback on the harmonized survey.

The AIES Pilot Phase II research field period began data collection in February 2023 and ran through April 17, 2023. Note that close out was late September, meaning that data will still be accepted through that date, but will not be considered for research findings.

Findings from this round of research are categorized into three topics. First, the Phase II pilot tested specific features of the response spreadsheet, finding that respondents reacted positively to having all locations displayed in one list, the inclusion of auto summing between units reduced item missingness, and giving a choice between location and industry reporting needs additional refinement. Second, the Phase II pilot provided additional information about respondent burden, finding that the scope and length of the survey continues to be challenging, and that burden will be negatively impacted by respondent learning curve as they adjust to the new survey. Finally, the Phase II pilot further explored responded messaging, finding that respondents are using the available response support materials and that contact strategies need additional refining.

Usability Testing

Once the 2023 online survey instrument was programmed and internally tested, Census Bureau researchers engaged in usability testing with companies varying in size, industry classification, and complexity. This research was conducted under the Census Bureau’s Generic Clearance for Census Bureau Questionnaire Pretesting Research (OMB Control Number 0607-0725) and included interviews with 28 companies. This testing focused on three aspects of survey response, including: response support materials like help screens and survey previews; interaction with the online respond-by-spreadsheet design; and the survey flow, including content and logic checks, submission, and other aspects of response. This research began in fall 2023 and concluded with enough time to consider findings for the 2024 production survey design, as well as inform research considerations for post-launch instrument refinement.

Additional detail regarding the Census Bureau’s respondent-centered formative research is provided in Attachment H, unit harmonization studies for the AIES in Attachment L, and AIES usability testing in Attachment S.

AIES Dress Rehearsal

The 2022 AIES Dress Rehearsal was a continuation of the research conducted in Phases I and II of the AIES Pilot surveys. Approximately, 8,500 companies received an invitation to respond to the Dress Rehearsal. The Dress Rehearsal represented the largest and last of the research collections in support of the 2023 AIES scheduled to mail in March of 2024.

The AIES Dress Rehearsal research field period began data collection on September 7, 2023, and closed on December 1, 2023. It was the first iteration that was fielded using a new Centurion instrument and other new Census Bureau infrastructure. In addition to survey response data, additional research modalities included paradata, a Response Analysis Survey (RAS), respondent debriefing and usability interviews, and cataloging contact from the field.

Preliminary findings from this round of research are categorized into four topics which include testing the flow of the survey; testing key elements of the spreadsheet design; evaluating burden; and testing additional respondent communications materials. Through Dress Rehearsal research, the Census Bureau was able to identify areas of improvement needed in the collection instrument. There were several improvements implemented prior to the 2023 AIES collection. First, it was determined that improvements were needed to the survey flow. The Census Bureau found that that the linear design needed to be abandoned and additional supports for the three-step layout put in place. Next, the Census Bureau tested key elements of the spreadsheet design and found that respondents need the ability navigate forward and backward through the survey and additional functionality such as providing a download/upload feature for establishment listings, the ability to freeze columns and rows to help orient respondents in the spreadsheet, and updates are necessary to the ways that industries are displayed. While evaluating research on response burden, the Census Bureau found that error checking functionality needed some additional development and that respondents rely on a survey preview to support reporting. Finally, researchers learned that respondents rely heavily on the materials the Census Bureau provides when they are accessible, and that each piece of communications serves a particular function to support the response process.

Additional details regarding the AIES Dress Rehearsal Preliminary Findings and Recommendations can be found in Attachment N.

5. Contacts for Statistical Aspects and Data Collection

For questions regarding the planning and implementation of this survey, please contact Edward Watkins, Assistant Division Chief, Economy Wide Statistics Division, U.S. Census Bureau) at 301-763-4750 or [email protected]

For inquiries about the methodology for this survey, please contact James Hunt, Methodology Director (Economic Statistical Methods Division, U.S. Census Bureau) at 301-763-6599 or [email protected]

LIST OF ATTACHMENTS

Legal Citation – Title 13 U.S.C

Electronic Instrument Selected Screen Shots for the Dress Rehearsal

Dress Rehearsal Debriefing Protocol

Letters for the Dress Rehearsal

Summary of the AIES Content

2023 AIES Draft Content

Consultations with Key Federal Stakeholders

Respondent-Centered Formative Research Overview

Dress Rehearsal Sample Size and Burden Estimates

AIES Sample Size and Burden Estimates

30-Day Notice Comments Received

Unit Harmonization Studies for the Annual Integrated Economic Survey

2023 AIES Letters

AIES Dress Rehearsal Preliminary Findings and Recommendation

Electronic Instrument Selected Screen Shot for the 2023 AIES

Census Bureau NAICS Implementation Action Plan for OMB

AIES Content Changes Between the 2023 and 2024 AIES

2024 AIES Content Summary

AIES Usability Testing Findings and Recommendations

2024 AIES Letters

60-Day Notice Comments Received

2024 AIES Sample Size and Burden Estimates

1 Services industries incorporate taxable and tax-exempt categories into the strata definitions, essentially doubling the number of strata for these industries. Wholesale trade industries incorporate type of operation category into the strata definitions, essentially tripling the number of strata for these industries.

2 Each Direct Use state defines a separate geographic substrata. The combined Balance of Region states for each region define one geographic substrata.

3 Substrata determined after analysis of (1) Business register establishment counts, (2) 2020 decennial census population counts, and (3) Annual Business Survey cell suppression counts.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | James W Hunt (CENSUS/ESMD FED) |

| File Modified | 0000-00-00 |

| File Created | 2024-11-14 |

© 2026 OMB.report | Privacy Policy